Certain information identified by [***] has been excluded from this exhibit because it is both (i) not material and (ii) of the type that the registrant treats as private or confidential. SHARE PURCHASE AGREEMENT entered into by and between EVERTEC BRASIL INFORMÁTICA S.A. as Buyer and TOTVS S.A. as Seller as intervening and consenting party: DIMENSA S.A. and, as guarantor: EVERTEC GROUP, LLC Dated February 2, 2026.

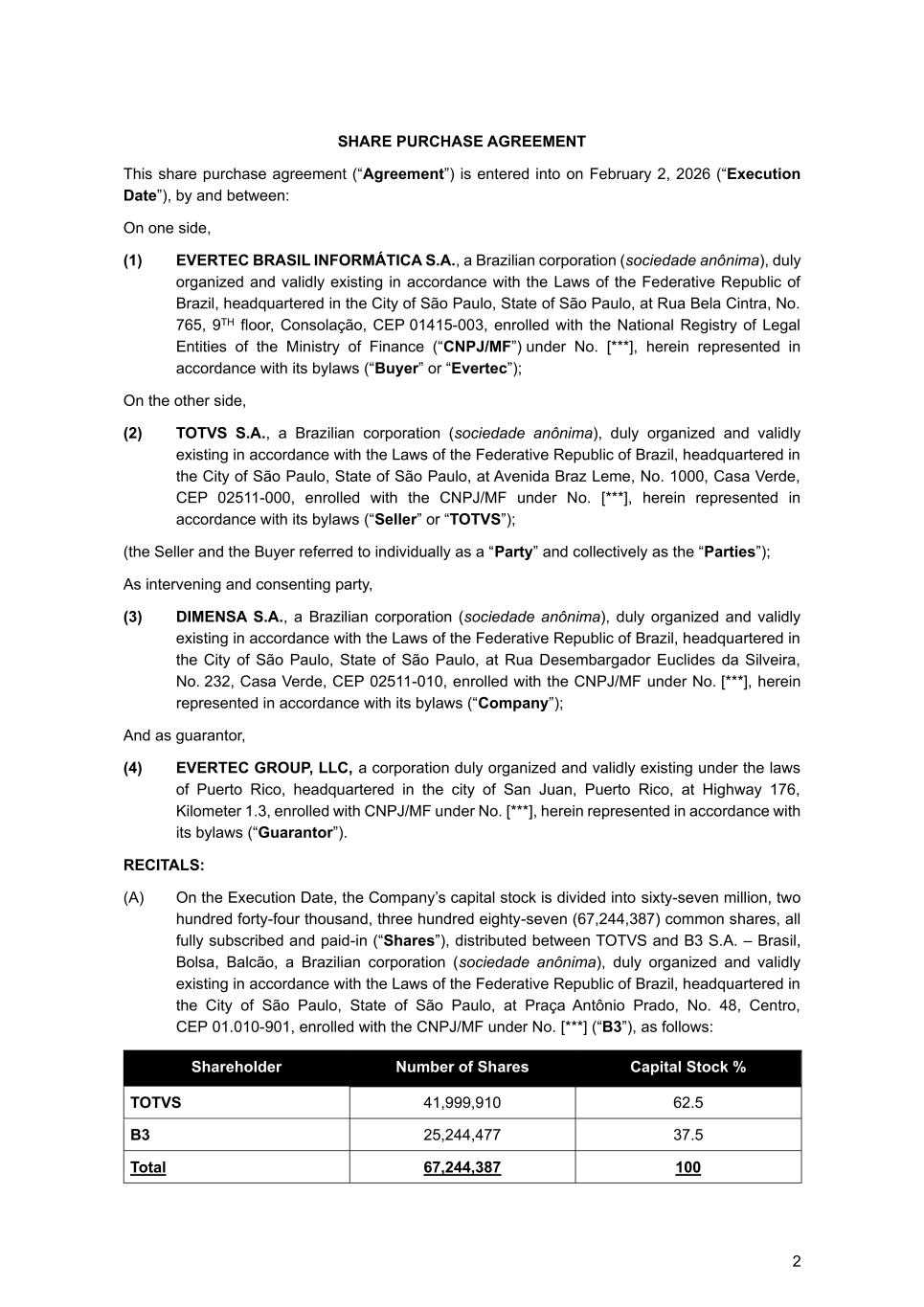

2 SHARE PURCHASE AGREEMENT This share purchase agreement (“Agreement”) is entered into on February 2, 2026 (“Execution Date”), by and between: On one side, (1) EVERTEC BRASIL INFORMÁTICA S.A., a Brazilian corporation (sociedade anônima), duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of São Paulo, State of São Paulo, at Rua Bela Cintra, No. 765, 9TH floor, Consolação, CEP 01415-003, enrolled with the National Registry of Legal Entities of the Ministry of Finance (“CNPJ/MF”) under No. [***], herein represented in accordance with its bylaws (“Buyer” or “Evertec”); On the other side, (2) TOTVS S.A., a Brazilian corporation (sociedade anônima), duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of São Paulo, State of São Paulo, at Avenida Braz Leme, No. 1000, Casa Verde, CEP 02511-000, enrolled with the CNPJ/MF under No. [***], herein represented in accordance with its bylaws (“Seller” or “TOTVS”); (the Seller and the Buyer referred to individually as a “Party” and collectively as the “Parties”); As intervening and consenting party, (3) DIMENSA S.A., a Brazilian corporation (sociedade anônima), duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of São Paulo, State of São Paulo, at Rua Desembargador Euclides da Silveira, No. 232, Casa Verde, CEP 02511-010, enrolled with the CNPJ/MF under No. [***], herein represented in accordance with its bylaws (“Company”); And as guarantor, (4) EVERTEC GROUP, LLC, a corporation duly organized and validly existing under the laws of Puerto Rico, headquartered in the city of San Juan, Puerto Rico, at Highway 176, Kilometer 1.3, enrolled with CNPJ/MF under No. [***], herein represented in accordance with its bylaws (“Guarantor”). RECITALS: (A) On the Execution Date, the Company’s capital stock is divided into sixty-seven million, two hundred forty-four thousand, three hundred eighty-seven (67,244,387) common shares, all fully subscribed and paid-in (“Shares”), distributed between TOTVS and B3 S.A. – Brasil, Bolsa, Balcão, a Brazilian corporation (sociedade anônima), duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of São Paulo, State of São Paulo, at Praça Antônio Prado, No. 48, Centro, CEP 01.010-901, enrolled with the CNPJ/MF under No. [***] (“B3”), as follows: Shareholder Number of Shares Capital Stock % TOTVS 41,999,910 62.5 B3 25,244,477 37.5 Total 67,244,387 100

3 (B) Pursuant to the share purchase agreement entered into by and between TOTVS and B3 on February 2, 2026 (“B3 SPA”), TOTVS undertook to acquire all twenty-five million, two hundred forty-four thousand, four hundred seventy-seven (25,244,477) shares B3 holds in the Company’s capital stock (“B3 Shares”) and B3 undertook to sell all B3 Shares to TOTVS (“B3 Transaction”), subject to the satisfaction (or waiver, if applicable) of certain conditions precedent set forth therein; (C) Failure by the Parties to consummate the Transaction (as defined below) is a condition subsequent under the B3 SPA and, if such condition is verified, the B3 SPA shall be terminated and the B3 Transaction unwound; (D) As a result of the consummation of B3 Transaction, TOTVS shall become the sole shareholder of the Company, holding the Shares representing one hundred percent (100%) of the Company’s capital stock; and (E) Subject to the terms and conditions set forth in this Agreement, including the consummation of the B3 Transaction, the Seller wishes to sell to the Buyer, and the Buyer wishes to buy from the Seller, all the Shares (“Transaction”). NOW, THEREFORE, in consideration of the foregoing and the mutual covenants contained herein, the Parties resolve to enter into this Agreement, which shall be governed by the following terms: 1 Definitions; Interpretation Rules 1.1 Definitions Capitalized terms, both in the singular and plural form, as the case may be, as used in this Agreement shall have the following meanings: “Affiliates” means, in relation to a certain Person, any other Person who, directly or indirectly, Controls, is Controlled by, or is under common Control with such Person, provided that any Person over which the Seller and/or the Buyer do not have effective Control or which is co‑controlled, i.e., in which a fifty percent (50%) equity interest is held and which does not grant sufficient powers to effectively Control such Person (including [***], and its direct or indirect subsidiaries or controlled companies), shall not be deemed an Affiliate, so long as the Seller and/or the Buyer do not have Control over such Person. “Anti-Corruption Law” means all anti-corruption, anti-bribery, fraud, kickback, anti- money laundering, anti-boycott, electoral, public bids and government contracts, conflict of interests in government or anti-terrorist-financing Laws, regulations or orders, in Brazil and in any other relevant jurisdictions applicable to the Seller, the Company and their Affiliates, including, without limitation, Decree-Law No. 2,848/1940, Law No. 9,504/1997, Law No. 8,429/1992 as amended by Law No. 14,230/2021, Law No. 12,850/2013, Law No. 12,846/2013, Decree-Law No. 8,420/2015, Law No. 12,813/2013 and Law No. 8,666/1993 as amended by

4 Law No. 14,230/2021 of the Federative Republic of Brazil, as any of the foregoing may be amended from time to time. “Base Date” means July 31, 2025. “BRL” means Brazilian Reais, the official currency in Brazil. “Business” means the business conducted by the Company and the Subsidiaries, as a whole, as of the Execution Date, which consists of consulting, advisory and software development services, licensing and use of proprietary and third-party software, data processing services and commercial representation activities. “Business Day” means any day, except for Saturdays, Sundays, holidays or any other day on which commercial banks are authorized by Law to remain closed in the City of São Paulo, State of São Paulo. “CADE” means the Administrative Council for Economic Defense of Brazil (Conselho Administrativo de Defesa Econômica). “Cash” means, as of a certain reference date, the consolidated amount of cash, cash equivalents and short-term financial investments of liquidity within ninety (90) days of the Company and all its Subsidiaries and any positive mark-to- market value related derivative, swap, or hedging transactions. “CDI Rate” means the daily average rate of interbank deposits, based on a year of two hundred and fifty-two (252) Business Days, calculated and disclosed daily by B3, or another reference rate of the Brazilian national financial system that may replace it. “Civil Code” means Law No. 10,406, of January 10, 2002, as amended. “Claim” means any claim, lawsuit, litigation, dispute, action, defense, appeal, suit, condemnation, audit, infraction notice, charge, complaint, demand (whether arbitral, civil, criminal, administrative, judicial, or otherwise) commenced, brought or conducted, by or before or with any Governmental Authority, Third-Party, arbitrator or other body. “Closing Cash” means the Cash as of the Closing Date. “Closing Debt” means the Debt as of the Closing Date. “Closing Working Capital” means the Working Capital as of the Closing Date. “Code of Civil Procedure” means Law No. 13,105, of March 16, 2015, as amended. “Control” means, in relation to a Person, the ownership, whether by

5 ownership of securities, contract or otherwise, of rights that assures, directly or indirectly: (i) the majority of the votes in the resolutions of such Person and (ii) the power to appoint the majority of the managers or directors of such Person, and the related terms “Controlled by”, “Controlling” or “under common Control with” shall be read accordingly. “Corporate Law” means Law No. 6,404, of December 15, 1976, as amended. “Cost Sharing Agreements” means (i) the “Contrato de Compartilhamento de Custos, Despesas e Outras Avenças”, entered into by and between the Company and TOTVS on July 30, 2021, (ii) the “Contrato de Compartilhamento de Custos e Outras Avenças” to be executed by and between the Seller and Quiver Desenvolvimento e Tecnologia Ltda. and Quiver Soluções de Tecnologia Ltda., with retroactive effect as of November 1st, 2024, substantially in accordance with the draft sent by email from the Seller to the Buyer on the Execution Date; and (iii) the “Contrato de Compartilhamento de Custos e Outras Avenças” to be executed by and between the Seller and RBM WEB - Sistemas Inteligentes Ltda., with retroactive effect as of February 1st, 2024, substantially in accordance with the draft sent by email from the Seller to the Buyer on the Execution Date. “CVM” means the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários). “Debt” means, as of a certain reference date, the consolidated and aggregate amount of (i) all outstanding principal, whether overdue or to mature, together with accrued interest, fines, penalties, and monetary adjustments and any other amounts due under financial indebtedness or debt securities or obligations arising under derivative, swap, or hedging transactions, which should be recorded at an amount equal to their negative mark-to-market value; (ii) all amounts payable under M&A transactions involving the Company and all its Subsidiaries, including, but not limited to, purchase price (and any installments thereof), deferred payments, bonuses, and any and all other outstanding obligations, net of any values, retained amounts, Escrow Accounts’ balances or guarantees related to these transactions; (iii) any acknowledgment of debt or confession; (iv) dividends, interest on equity, or other profit distributions or declared payments to shareholders or partners that have not been paid; (v) any amount related to retention/award of employees (including employees, officers, and service providers, such as extraordinary bonuses) due to the Transaction, including related expenses and taxes; and (vi) any obligations, whether contingent or not, that become

6 due as a result of the execution of this Agreement, the (or in order to ensure the) contracting or implementation of the Transaction and the obligations provided for herein or the performance of this Agreement, including, if applicable, any fines, fees, tariffs, waiver fees, or other amounts due to prepayment or early maturity as a result of the change of Control of the Company or of the Subsidiaries, as well as any Liens, Taxes, or resulting penalties and amounts owed to financial, legal, or any other advisors related to the Transaction. The items considered for the purposes of calculating the Debt shall not be considered for the purposes of calculating Working Capital, and vice versa. Exhibit 2.3.1 contains calculation of the Company’s and all its Subsidiaries’ Debt on the Base Date. “Employee” means all persons hired by the Company and/or its Subsidiaries under the employment regime governed by Brazilian Labor Law (Consolidação das Leis do Trabalho – CLT), enacted by Decree-Law No. 5,452, dated May 1, 1943, as amended. “Escrow Accounts” means the existing escrow accounts held by the Company, and any other escrows accounts to be opened by the Company between the Execution Date and the Closing Date, to cover Company’s obligations payable to Third- Parties related to potential earn-out payments and other deferred purchase price amounts, either in the event of the prepayment set forth in Section 5.1.5 or upon the timely payment of the M&A payables as provided in the relevant M&A agreements as applicable, in the context of the acquisition of equity interests by the Company in [***], which balances are indicated in Exhibit 7.9. Exhibit 7.9 shall be updated at the Closing Date to indicate any new escrow accounts opened by the Company between Execution Date and the Closing Date, and to indicate the balances of such escrow accounts at the Closing Date. “Financial Statement” means (i) the consolidated audited financial statements of the Company for the period ended December 31, 2024 and the related audited consolidated statements of operations and comprehensive loss, income, cash flows and changes in shareholders’ equity for the fiscal years then ended, including any related notes, schedules and other supplementary information attached thereto, and (ii) the consolidated unaudited interim financial statements of the Company for the period ended on the Base Date. “Fundamental Reps and Warranties” means the representations and warranties made by the Seller in Sections 6.1.1, 6.1.2, 6.1.3, 6.1.4 and 6.1.5, and the representations and warranties regarding the Company and

7 its Subsidiaries pursuant to Sections 6.2.1, 6.2.2, 6.2.3, 6.2.4, 6.2.5, 6.2.6, 6.2.14, 6.2.28, 6.2.29 and 6.2.31. “Governmental Authority” means any (i) government, federal, state, district, province, city, municipality or other political subdivision thereof in Brazil or any foreign jurisdiction having authority, (ii) entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, (iii) governmental authority, agency, department, board, tribunal, commission or instrumentality, state-owned or partially state-owned companies of Brazil or any foreign jurisdiction having authority, (iv) court, tribunal or arbitrator(s), and any governmental self-regulatory organization, including stock exchanges exercising authority, agency or authority in Brazil or any foreign jurisdiction, (v) diplomatic office or representation of Brazil or any jurisdiction, and (vi) public international organizations. “Governmental Official” means any Person who, even if temporarily or without compensation, holds a position, employment or function in any Governmental Authority, in Brazilian or foreign diplomatic representations, as well as in companies or other legal entities controlled, directly or indirectly, by the Brazilian government or of a foreign country, who is engaged in the public affairs of an international/inter-governmental organization, as well as any director or officer of public party, labor union, publicly held or funded foundation or association and political candidates, or is a candidate for public office or a leader of a political party, labor union, or professional council. “Indemnified Party” means either a Buyer's Indemnified Party or a Seller's Indemnified Party, as the case may be. “IFRS” means the International Financial Reporting Standards, as applied in Brazil, pursuant to the Corporate Law, the regulations of CVM, B3 and the Brazilian Board of Accountants (Comitê de Pronunciamentos Contábeis – CPC). “Independent Auditor” means any of the following accounting firms: EY Auditores Independentes, Deloitte Touche Tohmatsu Auditores Independentes, Grant Thornton Auditores Independentes and BDO RCS Auditores Independentes. “Intellectual Property Rights” means all rights, titles and interests, whether registered or unregistered, in and to: (i) patents, inventions, utility models and industrial designs; (ii) trademarks, service marks, trade names, trade dress, logos, domain names and other source identifiers, together with the goodwill associated therewith; (iii) copyrights and neighboring rights, including rights in

8 computer software (including all rights in Proprietary Systems), databases and other works of authorship; (iv) trade secrets, know-how, confidential information, technical information and proprietary processes; (v) applications, registrations, renewals and extensions relating to any of the foregoing; and (vi) any other intellectual or industrial property rights recognized under applicable Law, in each case in Brazil. “IPCA” means Extended Consumer Price Index, as released by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística – IBGE). “Knowledge” means, with respect to any representation or warranty made to the “Knowledge” of a Person: (i) such Person shall be considered to have “knowledge” of a fact or other matter, if such Person is actually aware of such fact or other matter; and (ii) if such Person is a legal entity, such Person shall be considered to have “knowledge” of a fact or other matter, if any individual who is serving as its chief executive officer, chief financial officer, chief human resources officer and/or general counsel is actually and demonstrably of the knowledge or should have been of the knowledge due to their attributions and liabilities in such Person, after due inquiry. “Law” or “Legislation” means any and all federal, statutes, rules, regulations, codes, ordinances, treaties, policies or other written guidance, judgments, injunctions, decrees, orders, franchise, guidelines, conditions or other directional requirement of a Governmental Authority having jurisdiction over the assets or the property of the applicable Person or the operations thereof. “Liens” means, with respect to any property or asset, any mortgage, charge, pledge, lien, option, lease, right of pre- emption or any other encumbrance or security interest of any kind or any other type of title transfer or retention arrangement having similar effect. “Loss” means any direct losses and damages of a definitive nature involving cash disbursement, actually suffered and all charges and reasonably incurred and actually disbursed expenses (including reasonably incurred costs of enforcement and reasonably incurred legal costs and expenses), being excluded indirect losses, moral, incidental, exemplary, special or punitive losses, loss of profit, loss of opportunity or multiple damages as well as business reputational harm, except if payable to a Third-

9 Party in connection with a Third-Party Claim. “Material Adverse Event” means a change in the Business, in the condition (financial or otherwise) or in the results of operations of the Company or the Subsidiaries, taken as a whole; in any such case that have resulted or are reasonably expected to result in: (a) the filing of new Claims (except for Claims in respect of which there is a right of recourse against Third-Parties) involving [***], provided that any judicial Claim deemed by a written legal opinion issued by any of the Brazilian law firms listed in Exhibit A as frivolous, manifestly unfounded, or brought in bad faith, shall be disregarded for purposes of the calculation provided for in this item; or (b) condemnation in ongoing Claims (except for Claims in respect of which there is a right of recourse against Third- Parties) involving [***]; or (c) adverse impacts or that is reasonably expected to impact the Business in [***], provided that any such change resulting from the following facts, occurrences or events shall not constitute a “Material Adverse Event”: (i) general global, national or regional business, political, market, regulatory or social conditions (or changes therein), including in respect to interest or currency rates or the financial or capital markets, (ii) any act of terrorism, war (whether declared or not declared), military action or the escalation or worsening thereof, act of God, earthquakes, hurricanes, tornadoes or other natural disaster, pandemic, epidemic, or disease outbreaks, similar calamity or other force majeure event, (iii) any adoption, implementation, change or proposed change in Law (or interpretations thereof) after the date hereof, (iv) any change in the economic, business, financial, regulatory or legal enforcement environment generally affecting the Business in which the Company operates, (v) changes in applicable accounting principles or any applicable regulatory accounting rules (or the enforcement, implementation or interpretation thereof) after the date hereof, (vi) government shutdown or other events of force majeure involving Brazil, (vii) any action taken (or omitted to be taken) by the Seller or the Company at the written request of the Buyer, (viii) any action taken by the Seller or the Company that is expressly required under this Agreement, and (ix) the public announcement of this Agreement, the identity of (or any actions taken by) the Buyer or the pendency or consummation of the transactions contemplated hereby, including any effect arising out of actions of competitors, customers, suppliers, distributors, joint venture partners, employees (including losses of employees) or labor unions in connection therewith, and (x) the refusal of any client to continue or renew, or termination by any client of, a contractual

10 relationship with a client primarily due to the Buyer having entered into a contract to become or becoming the beneficial owner of the Company. “Order” means any order, writ, decree, judgement, award, injunction, settlement or stipulation issued, promulgated, made, rendered or entered into by or with any Governmental Authority (in each case, whether temporary, preliminary or permanent). “Ordinary Course of Business” means, in relation to the Company and the Subsidiaries, taken as a whole, the conduct of its activities in a manner that is consistent in nature, scope and magnitude with past practices and is related to its day-to-day operations, provided that in accordance with the Law. “Person” means any individual or entity, including companies, corporations, associations, consortiums, joint ventures, trusts, funds, estates, partnerships, international or multilateral organization or other public, private or private and public entity, including entities without legal status or other corporate entities, or any Governmental Authority, as well as their successors and assignees. “Purchase Price” means the Base Purchase Price, as adjusted by the Base Purchase Price Adjustment, pursuant to Section 2.2 and Section 2.3. “Related Party” means (a) with respect to the Company, the Seller and/or any Affiliate of the Company or the Seller (other than the Company), or any director or officer, or any other legal entity in which any of the above parties holds direct or indirect Control, and (b) with respect to any other Person, any Affiliate and respective officers or directors. “Representatives” means, with respect to a Person, its officers, directors, Employees, agents or any other professional adviser. “Shares” means the definition set forth in Recitals (A), provided that the number of Shares corresponding to the total number of shares into which the Company’s capital stock is divided may be reduced prior to the Closing in the event contemplated in Section 3.1.8. “Shareholders’ Agreement” means the shareholders’ agreement entered into by and between TOTVS and B3 on October 1st, 2021, as amended on April 5, 2022, April 25, 2022, February 23, 2023, June 21, 2023, and June 6, 2025. “Subsidiaries” means (i) Agger S.A., a corporation duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of

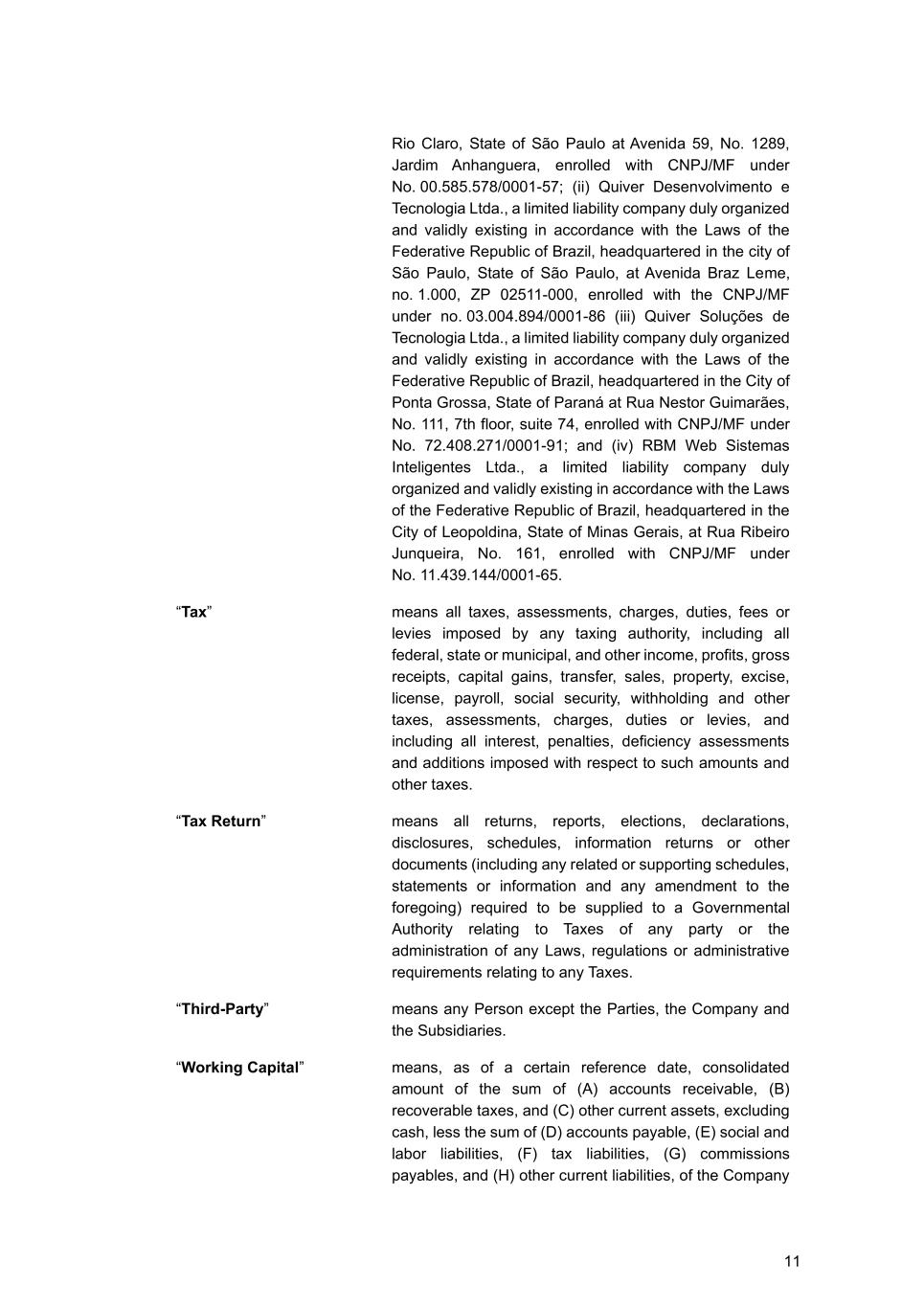

11 Rio Claro, State of São Paulo at Avenida 59, No. 1289, Jardim Anhanguera, enrolled with CNPJ/MF under No. 00.585.578/0001-57; (ii) Quiver Desenvolvimento e Tecnologia Ltda., a limited liability company duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the city of São Paulo, State of São Paulo, at Avenida Braz Leme, no. 1.000, ZP 02511-000, enrolled with the CNPJ/MF under no. 03.004.894/0001-86 (iii) Quiver Soluções de Tecnologia Ltda., a limited liability company duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of Ponta Grossa, State of Paraná at Rua Nestor Guimarães, No. 111, 7th floor, suite 74, enrolled with CNPJ/MF under No. 72.408.271/0001-91; and (iv) RBM Web Sistemas Inteligentes Ltda., a limited liability company duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, headquartered in the City of Leopoldina, State of Minas Gerais, at Rua Ribeiro Junqueira, No. 161, enrolled with CNPJ/MF under No. 11.439.144/0001-65. “Tax” means all taxes, assessments, charges, duties, fees or levies imposed by any taxing authority, including all federal, state or municipal, and other income, profits, gross receipts, capital gains, transfer, sales, property, excise, license, payroll, social security, withholding and other taxes, assessments, charges, duties or levies, and including all interest, penalties, deficiency assessments and additions imposed with respect to such amounts and other taxes. “Tax Return” means all returns, reports, elections, declarations, disclosures, schedules, information returns or other documents (including any related or supporting schedules, statements or information and any amendment to the foregoing) required to be supplied to a Governmental Authority relating to Taxes of any party or the administration of any Laws, regulations or administrative requirements relating to any Taxes. “Third-Party” means any Person except the Parties, the Company and the Subsidiaries. “Working Capital” means, as of a certain reference date, consolidated amount of the sum of (A) accounts receivable, (B) recoverable taxes, and (C) other current assets, excluding cash, less the sum of (D) accounts payable, (E) social and labor liabilities, (F) tax liabilities, (G) commissions payables, and (H) other current liabilities, of the Company

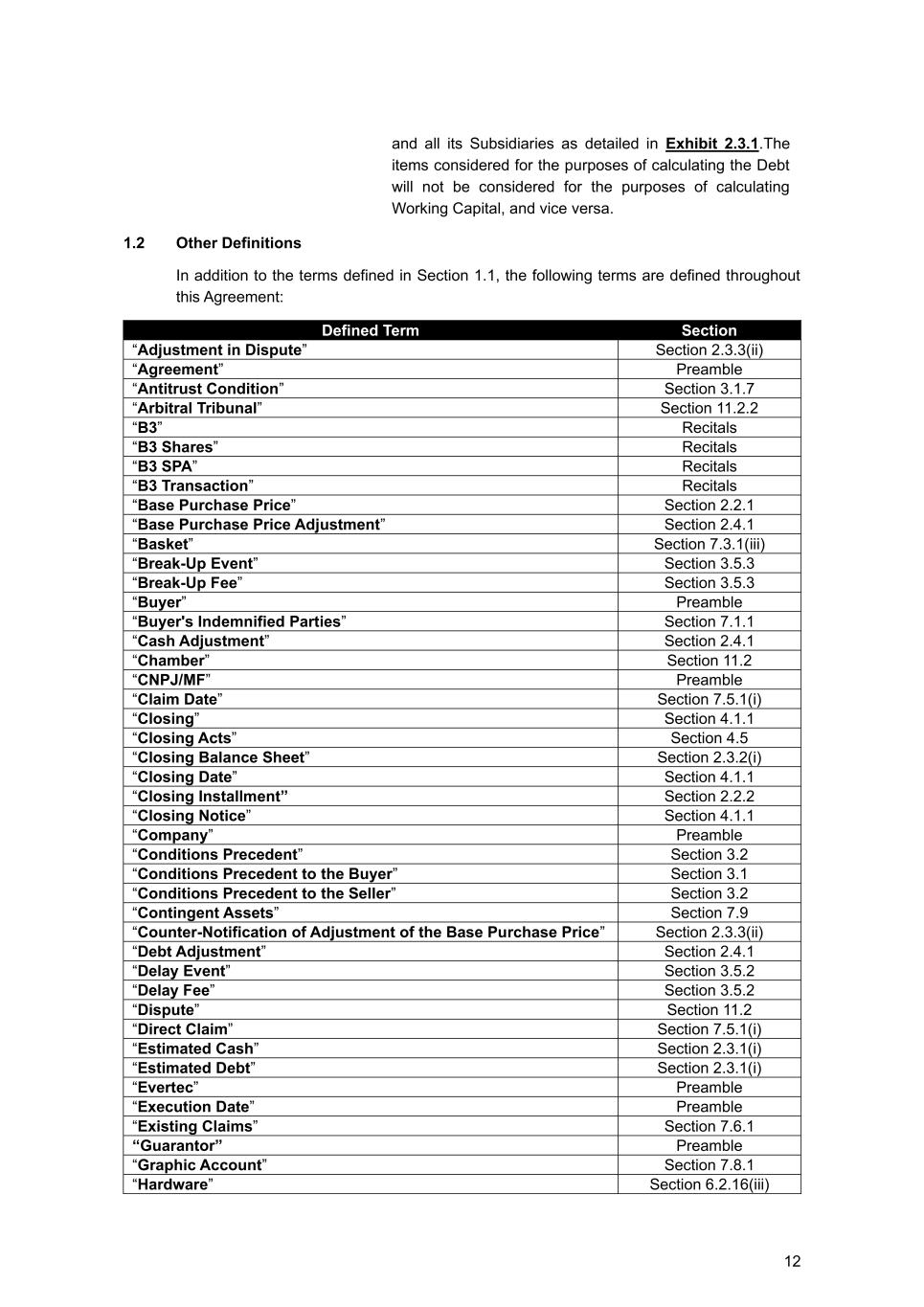

12 and all its Subsidiaries as detailed in Exhibit 2.3.1.The items considered for the purposes of calculating the Debt will not be considered for the purposes of calculating Working Capital, and vice versa. 1.2 Other Definitions In addition to the terms defined in Section 1.1, the following terms are defined throughout this Agreement: Defined Term Section “Adjustment in Dispute” Section 2.3.3(ii) “Agreement” Preamble “Antitrust Condition” Section 3.1.7 “Arbitral Tribunal” Section 11.2.2 “B3” Recitals “B3 Shares” Recitals “B3 SPA” Recitals “B3 Transaction” Recitals “Base Purchase Price” Section 2.2.1 “Base Purchase Price Adjustment” Section 2.4.1 “Basket” Section 7.3.1(iii) “Break-Up Event” Section 3.5.3 “Break-Up Fee” Section 3.5.3 “Buyer” Preamble “Buyer's Indemnified Parties” Section 7.1.1 “Cash Adjustment” Section 2.4.1 “Chamber” Section 11.2 “CNPJ/MF” Preamble “Claim Date” Section 7.5.1(i) “Closing” Section 4.1.1 “Closing Acts” Section 4.5 “Closing Balance Sheet” Section 2.3.2(i) “Closing Date” Section 4.1.1 “Closing Installment” Section 2.2.2 “Closing Notice” Section 4.1.1 “Company” Preamble “Conditions Precedent” Section 3.2 “Conditions Precedent to the Buyer” Section 3.1 “Conditions Precedent to the Seller” Section 3.2 “Contingent Assets” Section 7.9 “Counter-Notification of Adjustment of the Base Purchase Price” Section 2.3.3(ii) “Debt Adjustment” Section 2.4.1 “Delay Event” Section 3.5.2 “Delay Fee” Section 3.5.2 “Dispute” Section 11.2 “Direct Claim” Section 7.5.1(i) “Estimated Cash” Section 2.3.1(i) “Estimated Debt” Section 2.3.1(i) “Evertec” Preamble “Execution Date” Preamble “Existing Claims” Section 7.6.1 “Guarantor” Preamble “Graphic Account” Section 7.8.1 “Hardware” Section 6.2.16(iii)

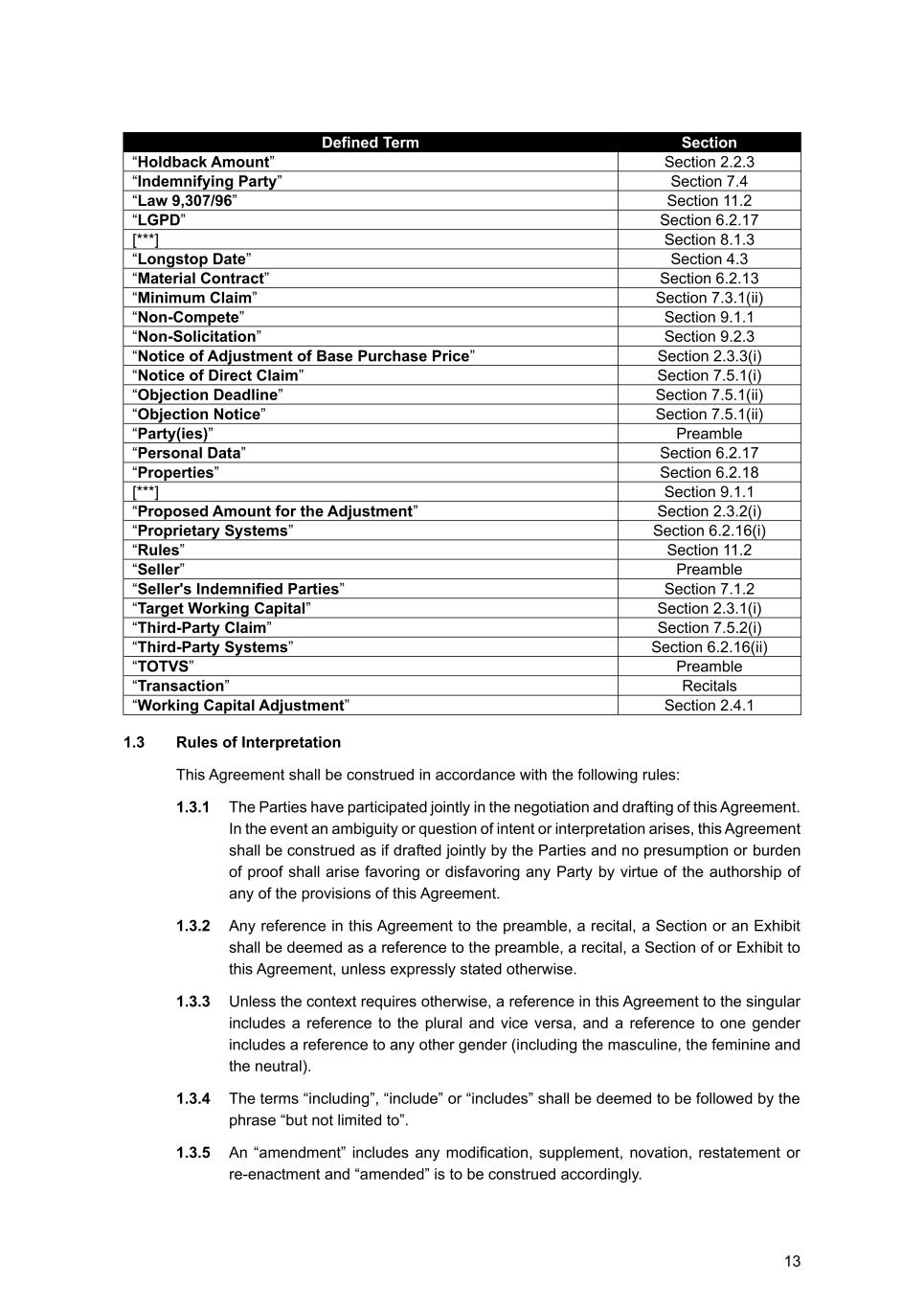

13 Defined Term Section “Holdback Amount” Section 2.2.3 “Indemnifying Party” Section 7.4 “Law 9,307/96” Section 11.2 “LGPD” Section 6.2.17 [***] Section 8.1.3 “Longstop Date” Section 4.3 “Material Contract” Section 6.2.13 “Minimum Claim” Section 7.3.1(ii) “Non-Compete” Section 9.1.1 “Non-Solicitation” Section 9.2.3 “Notice of Adjustment of Base Purchase Price” Section 2.3.3(i) “Notice of Direct Claim” Section 7.5.1(i) “Objection Deadline” Section 7.5.1(ii) “Objection Notice” Section 7.5.1(ii) “Party(ies)” Preamble “Personal Data” Section 6.2.17 “Properties” Section 6.2.18 [***] Section 9.1.1 “Proposed Amount for the Adjustment” Section 2.3.2(i) “Proprietary Systems” Section 6.2.16(i) “Rules” Section 11.2 “Seller” Preamble “Seller's Indemnified Parties” Section 7.1.2 “Target Working Capital” Section 2.3.1(i) “Third-Party Claim” Section 7.5.2(i) “Third-Party Systems” Section 6.2.16(ii) “TOTVS” Preamble “Transaction” Recitals “Working Capital Adjustment” Section 2.4.1 1.3 Rules of Interpretation This Agreement shall be construed in accordance with the following rules: 1.3.1 The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any of the provisions of this Agreement. 1.3.2 Any reference in this Agreement to the preamble, a recital, a Section or an Exhibit shall be deemed as a reference to the preamble, a recital, a Section of or Exhibit to this Agreement, unless expressly stated otherwise. 1.3.3 Unless the context requires otherwise, a reference in this Agreement to the singular includes a reference to the plural and vice versa, and a reference to one gender includes a reference to any other gender (including the masculine, the feminine and the neutral). 1.3.4 The terms “including”, “include” or “includes” shall be deemed to be followed by the phrase “but not limited to”. 1.3.5 An “amendment” includes any modification, supplement, novation, restatement or re-enactment and “amended” is to be construed accordingly.

14 1.3.6 Any agreement, document or Law set out or referred to in this Agreement or any document referred to in this Agreement means such agreement, document or Law as amended, modified or supplemented from time to time, including (in the case of agreements or documents) by reason of waiver or consent and (in the case of Legislation) by subsequent Legislation relating to the same subject matter 1.3.7 References to any of the Parties hereto include their permitted successors and assigns and vice versa. 1.3.8 Any and all terms hereunder shall be counted in calendar days, except when expressly stated to be counted in Business Days. Whenever the expiration of a term falls on a day that is not a Business Day the term shall be automatically extended to the subsequent Business Day. For all purposes of this Agreement, any and all time periods shall be counted excluding the first day and including the last day. 1.3.9 The words “hereof”, “herein”, “hereunder” and similar words refer to this Agreement as a whole and not to any particular provision of this Agreement. 1.3.10 The table of contents and the headings in this Agreement are for convenience only and shall be ignored in the interpretation of this Agreement. 1.3.11 Where the term "best efforts" or "commercially reasonable efforts" are used, such efforts shall not include any obligation to incur substantial or extraordinary expenses or liabilities. 1.3.12 Any fact or item disclosed in any Exhibit hereof shall not by reason only of such inclusion be deemed to be material and shall not be employed as a point of reference in determining any standard of materiality under this Agreement. All Exhibits annexed hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth in full herein. 1.3.13 Any capitalized terms used in any Exhibit but not otherwise defined therein, shall have the meaning as defined in this Agreement. 1.3.14 For purposes of Article 110 of the Civil Code, each Party declares that it has no knowledge of any mental reservation of any other Party. 2 Sale and Purchase of the Shares and Purchase Price 2.1 Sale and Purchase of the Shares Subject to the terms and conditions set forth in this Agreement, including the consummation of the B3 Transaction, the Buyer undertakes to acquire from the Seller, and the Seller undertakes to sell and transfer to the Buyer, on an irrevocable and irreversible basis, all of the Shares, free and clear of any and all Liens and together with all rights inherent thereto in consideration of the Purchase Price. 2.2 Purchase Price 2.2.1 Base Purchase Price In consideration of the acquisition of the Shares, the Buyer shall pay to the Seller on the Closing Date an amount equal to nine hundred and fifty million Brazilian

15 Reais (BRL 950,000,000.00), to be adjusted according to Section 2.3.1 and according to the monthly positive variation of the IPCA accrued in the period between October 31, 2025 and the Closing Date (“Base Purchase Price”), and subject to the additional adjustments set forth below. The foregoing adjustment shall be calculated on a pro rata temporis basis, considering the actual number of days elapsed. 2.2.2 Payment of the Base Purchase Price Subject to the terms and conditions set forth in this Agreement, on the Closing Date, the Buyer shall pay the Base Purchase Price minus the Holdback Amount, to the Seller (“Closing Installment”) by wire transfer, in immediately available funds, to the bank account held by the Seller set forth in Exhibit 2.2.2. 2.2.3 An amount of [***] shall be retained by the Buyer for purposes of securing any adjustment to the Base Purchase Price Adjustment, provided that such amount shall be held and released in accordance with Section 2.3 and 2.5 below (“Holdback Amount”). 2.3 Base Purchase Price Adjustment 2.3.1 Base Purchase Price Calculation Assumptions (i) The Parties acknowledge that the Base Purchase Price has been agreed upon by the Parties based on the assumption that, on the Closing Date: (a) the amount of the Debt shall be zero Brazilian Reais (BRL 0.00) (“Estimated Debt”); (b) the sum of the Cash shall be zero Brazilian Reais (BRL 0.00) (“Estimated Cash”); and (c) the Working Capital shall be a negative amount of seven million, two hundred seventy two thousand, seven hundred fifty four Brazilian Reais and forty five cents (negative BRL 7,272,754.45) (“Target Working Capital”). The amounts provided for in this Section 2.3.1 were calculated in accordance with the spreadsheet attached to this Agreement as Exhibit 2.3.1 and pursuant to IFRS. (ii) No later than ten (10) Business Days before the Closing Date, the Seller shall deliver to the Buyer an unaudited balance sheet and an updated projection of the Estimated Debt, of the Estimated Cash and of the Target Working Capital at the Closing Date in accordance with Exhibit 2.3.1. The reviewed Base Purchase Price is binding for the Buyer (without prejudice of the Closing Balance Sheet and Base Purchase Price Adjustment to be carried out in accordance with Sections 2.3.2 and 2.4 below). 2.3.2 Closing Balance Sheet and Proposed Amount for the Adjustment (i) Within thirty (30) Business Days from the Closing Date, the Buyer shall (a) deliver to the Seller a consolidated unaudited balance sheet of the Company (“Closing Balance Sheet”) setting forth the Buyer’s determination of the actual amounts of Closing Debt, Closing Cash and Closing Working Capital, calculated in accordance with Exhibit 2.3.2 and pursuant to IFRS, consistent with the methodologies, assumptions and using the same financial accounts (rubricas) used for the calculation of the Estimated Debt, the Estimated Cash and the Target Working Capital; (b) inform the Seller of any adjustment to the Base Purchase Price that it deems appropriate (“Proposed Amount for the Adjustment”); and (c) provide

16 reasonably detailed supporting documentation (including those data and information reasonably requested by the Seller) to support the calculation set forth therein. (ii) Within fifteen (15) Business Days from the date of delivery by the Buyer of the Closing Balance Sheet, the Seller shall evaluate and confirm the Proposed Amount for the Adjustment and the amounts of the Closing Debt, the Closing Cash and the Closing Working Capital. (iii) If the Seller agrees to the Proposed Amount for the Adjustment and the amounts of the Closing Debt, the Closing Cash and the Closing Working Capital as determined by the Buyer, the Seller shall express its agreement to the Buyer within the time period referred to in Section 2.3.2(ii), and the Proposed Amount for the Adjustment shall be adopted as the Base Purchase Price Adjustment for all purposes of this Agreement, to be paid by one Party to the other Party pursuant to Section 2.4. 2.3.3 Seller's Disagreement (i) If the Seller disagrees with the Proposed Amount for the Adjustment or the Closing Debt, the Closing Cash and the Closing Working Capital as determined by the Buyer, the Seller shall deliver written notice to the Buyer within the period of fifteen (15) Business Days, as provided by Section 2.3.2(ii) informing the Buyer of such disagreement and providing reasonably detailed supporting documentation to support the calculation set forth therein (“Notice of Adjustment of Base Purchase Price”). Failure by the Seller to timely deliver a complete Notice of Adjustment of Base Purchase Price shall be construed as the Seller’s agreement to the Proposed Amount for the Adjustment, which shall then be considered final and definitive by the Parties. (ii) Upon receipt of the Notice of Adjustment of Base Purchase Price, the Buyer shall have a period of up to ten (10) Business Days from receipt of the Notice of Adjustment of Base Purchase Price to respond to the Seller, in writing, as to whether or not the Buyer agrees with the amounts of the Closing Debt, the Closing Cash and the Closing Working Capital (“Adjustment in Dispute”) set forth in the Notice of Adjustment of Base Purchase Price (“Counter- Notification of Adjustment of the Base Purchase Price”). Failure by the Buyer to timely deliver the Counter-Notification of Adjustment of the Base Purchase Price, pursuant to this Section, shall be construed as the agreement of the Buyer as to the amounts of the Closing Debt, the Closing Cash and the Closing Working Capital set forth in the Notice of Adjustment of Base Purchase Price, which shall then be deemed final and definitive by the Parties. (iii) If the Buyer and the Seller disagree on the amount of the Closing Debt, the Closing Cash and/or the Closing Working Capital, thus constituting an Adjustment in Dispute, the Parties shall have a period of fifteen (15) Business Days, counted from the receipt of the Counter-Notification of Adjustment to the Base Purchase Price to negotiate and attempt to reach an agreement as to the Adjustment in Dispute. (iv) In the event that the Buyer and the Seller fail to reach an agreement within

17 the fifteen (15) Business Days period set forth in Section 2.3.3(iii), then the Parties shall have up to thirty (30) Business Days to engage a mutually chosen Independent Auditor to evaluate the Adjustment in Dispute and prepare the final and binding calculation of the Base Purchase Price Adjustment, provided that, if the Parties do not agree on an Independent Auditor within such period, the Independent Auditor that has submitted the lowest fee proposal shall be appointed. The Independent Auditor shall (a) at the time of engagement, declare that it is an independent auditing firm in relation to the Parties and the Company, (b) declare that it must comply with the criteria set forth in this Agreement, as well as (c) act as a specialized auditing firm (and not as an arbitrator) and submit, within thirty (30) days, counted from the date of its engagement, its evaluation of the Adjustment in Dispute. Any failure by the Independent Auditor to comply with such deadline shall not invalidate the procedure established by this Section. The results presented by the Independent Auditor shall be final and binding on the Parties, except in the case of manifest error, provided that the Independent Auditor shall be engaged to act as an expert and not an arbitrator. Either Party shall have a period of fifteen (15) days to submit questions and request any clarifications from the Independent Auditor, in writing. If no questions or requests are presented, or once the auditor's report is modified to include such answers and clarifications as it deems appropriate, then the Independent Auditor's report shall become final and binding on the Parties for all purposes, except in the event of a manifest error. The indication of manifest error must be submitted to the Independent Auditor within five (5) Business Days from its verification by the Party, with a copy to the other Party, which will have five (5) Business Days from the receipt of the correspondence, to comment on the indication of manifest error. The Independent Auditor shall respond within five (5) Business Days of receipt of the other Party's response. For clarification purposes, the Independent Auditor shall not give an opinion on any other item and/or amount that does not involve the Adjustment in Dispute. (v) The costs of hiring the Independent Auditor shall be initially borne 50% (fifty percent) by the Seller and fifty percent (50%) by the Buyer. Such costs shall ultimately be paid (or reimbursed, as the case may be) by the Party whose amount of the Base Purchase Price Adjustment indicated by it has presented the greater difference in relation to the Base Price Adjustment determined by the Independent Auditor. (vi) The Buyer, the Seller and the Company shall cooperate with each other and the Independent Auditor (if applicable) by providing them with access to any document, information, director, officer, Employee, service provider, auditor or any legal or accounting advisor of the Company for all purposes of this Section 2.3, to the extent that such access does not impair the regular operation of the Company. 2.4 Calculation and Payment of the Base Purchase Price Adjustment 2.4.1 In the event (i) the Closing Debt is lower than the Estimated Debt, then the Base Purchase Price shall be increased by the exact amount of such difference; on the other hand, if the Closing Debt is greater than the Estimated Debt, then the Base

18 Purchase Price shall be reduced by the exact amount of such difference (“Debt Adjustment”); (ii) the Closing Cash is lower than the Estimated Cash, then the Base Purchase Price shall be reduced by the exact amount of such difference; on the other hand, if the Closing Cash is greater than the Estimated Cash, then the Base Purchase Price shall be increased by the exact amount of such difference (“Cash Adjustment”); and (iii) the Closing Working Capital is lower than the Target Working Capital, then the Base Purchase Price shall be reduced by the exact amount of such difference; on the other hand, in the event that the Closing Working Capital is greater than the Target Working Capital, then the Base Purchase Price shall be increased by the exact amount of such difference (“Working Capital Adjustment” and, together with the Debt Adjustment and the Cash Adjustment, the “Base Purchase Price Adjustment”). Exhibit 2.4.1 contains a non-binding example of the calculation of the Base Purchase Price Adjustment, for reference purposes only. 2.4.2 Subject to the provisions of Section 2.4.3 below, the Base Purchase Price Adjustment amount, calculated in accordance with the provisions of Section 2.4.1, based on the final amounts of the Closing Debt, the Closing Cash and the Closing Working Capital calculated pursuant to Section 2.3 shall be paid (i.e., retained or released from the Holdback Amount, pursuant Section 2.5.2) by the Seller to the Buyer or by the Buyer to the Seller, as the case may be, within ten (10) days, counted from the date of final and definitive determination of the Base Purchase Price Adjustment, in accordance with the procedure provided for in Section 2.3. 2.4.3 If, once the procedures set forth in Section 2.3 have been concluded, the Party responsible for paying the amounts arising from the Base Purchase Price Adjustment fails to comply with its obligation to make the respective payment timely, such defaulting Party shall be subject to the following penalties: (i) a non-compensatory fine in the amount corresponding to [***]; (ii) default interest of [***]; and (iii) monetary adjustment according to the accumulated positive variation of the CDI Rate, calculated from the date on which the payment of the Base Purchase Price was due until the date of its effective payment. 2.5 Holdback 2.5.1 Subject to the provisions of Section 2.2.3, the Holdback Amount shall be used by the Parties exclusively to satisfy the Base Purchase Price Adjustment and shall be adjusted by the positive variation of the CDI Rate, accrued from the Closing Date until the date of its effective release, as applicable. 2.5.2 Upon final determination of the Base Purchase Price Adjustment, pursuant to Section 2.4, the payment shall be made by the Seller to the Buyer or by the Buyer to the Seller, as applicable, according to the following procedures: (i) If the Base Purchase Price Adjustment is found to be due by the Seller to the Buyer, the Buyer shall retain the corresponding amount of the Base Purchase Price Adjustment from the Holdback Amount. If the Holdback Amount is insufficient to cover the Base Purchase Price Adjustment due to the Buyer, then the Seller shall pay the shortfall to the Buyer by wire transfer, in immediately available funds, to the Bank Account No.: [***], Bank Branch: [***], Bank: [***], held by the Buyer, within five (5) Business Days after the definitive determination of the Base Purchase Price Adjustment; or (ii) If the Base Purchase Price Adjustment is found to be due by the Buyer to the

19 Seller, the Buyer shall release the full Holdback Amount increased by the difference between the Base Purchase Price Adjustment Amount and the Holdback Amount (if any), and transfer it to the Seller by wire transfer, in immediately available funds, to the bank account held by the Seller indicated in Exhibit 2.2.2, within five (5) Business Days after the definitive determination of the Base Purchase Price Adjustment. (iii) Subject to Section 2.4.3, the remaining balance of the Holdback Amount (if any), after the deduction set forth in Section 2.5.2(i), shall be released to the Seller, in immediately available funds, to the bank account indicated in Section 2.2.2, within ten (10) days counted from the date of final and definitive determination of the Base Purchase Price Adjustment, in accordance with the procedure provided for in Section 2.3. 2.6 Release The Seller and the Buyer acknowledge that the effective receipt of the wire transfers of immediately available funds related to (i) the payment of the Base Purchase Price by the Buyer to the Seller shall imply the irrevocable and irreversible release by the Seller to the Buyer with respect to the obligation to pay the Base Purchase Price; and (ii) payment of the Base Purchase Price Adjustment by the Seller to the Buyer or by the Buyer to the Seller, as the case may be, shall imply the irrevocable and irreversible release by the Buyer to the Seller or by the Seller to the Buyer, as the case may be, with respect to the obligation to pay the Base Purchase Price Adjustment. 2.7 Taxes Each Party shall be solely responsible for the timely payment of any applicable Taxes that are charged to such Party arising out of or in connection with the Transaction contemplated hereby. 3 Conditions Precedent 3.1 Conditions Precedent to the Buyer The obligation of the Buyer to consummate the Transaction is subject to the satisfaction or written waiver by the Buyer, in whole or part (to the extent such condition can be waived, in its sole discretion), at Closing, of each of the following conditions (“Conditions Precedent to the Buyer”): 3.1.1 Representation and Warranties Each of the representations and warranties made by the Seller pursuant to Section 6.1 and Section 6.2 shall be, true, accurate and correct as of the date hereof and as of the Closing Date (other than any representations and warranties that expressly relate to a particular date, which shall be true and correct as of such date), provided that in case any agreement that is not a Material Contract is not listed in Exhibit 6.2.4, such misrepresentation shall not prevent the Closing, as long as all other Conditions Precedent to the Buyer are satisfied or waived, as applicable. For the avoidance of doubt, any misrepresentation of such Fundamental Rep and Warranty shall remain subject to full indemnification for Losses, subject to the limitations set forth in Section 7 (Indemnification). 3.1.2 Covenants

20 The Seller shall have complied in all respects with all covenants, obligations and agreements contained in Section 4.5 and Chapter 8 (Antitrust Condition) to the extent applicable to Seller expressly required to be complied with by it on or prior to the Closing Date. 3.1.3 No Material Adverse Event Since the Execution Date, there shall not have occurred a Material Adverse Event. 3.1.4 No Law or Order No Governmental Authority shall have issued, enacted, entered into, promulgated or enforced any Law or Order making illegal or prohibiting (other than for conditions or other restraints that may be imposed by CADE that must be addressed by the Buyer pursuant to Chapter 8 (Antitrust Condition)) the consummation of the Transaction. 3.1.5 Termination of the Shareholders’ Agreement The Seller shall deliver to the Buyer evidence that the Shareholders’ Agreement has been terminated, except as specifically set forth in the B3 SPA. 3.1.6 Consummation of the B3 Transaction The B3 Transaction shall have been consummated, and the Buyer shall have become the sole shareholder of the Company, holding all the Shares, on a fully diluted basis, free and clear of any liens; and the Company’s Share Transfer Register Book and Share Register Book shall have been duly updated to reflect the Seller as the sole legal and beneficial owner of one hundred percent (100%) of the Shares. As part of the B3 Transaction, B3 shall undertake in favor of the Company a non- solicitation obligation, in accordance with non-solicitation obligation set forth in the B3 SPA, the terms of which are set forth in Exhibit 3.1.6. 3.1.7 Antitrust Condition Subject to Chapter 8 (Antitrust Condition), CADE shall have approved the Transaction contemplated by this Agreement, and no change shall have been made to such approval within the 15-day period beginning on the date of the publication of such CADE approval in the Official Gazette (Diário Oficial da União) in case of approval by the general superintendent office of CADE (the “Antitrust Condition”). For such purposes, CADE shall have issued a certificate attesting that no appeals or requests for further review were lodged and that such approval is final (for certainty, the condition set forth in this Section shall not be considered fulfilled until receipt of such clearance certificate). 3.1.8 Cash Distribution Seller shall have held a Shareholders General Meeting to approve, in accordance with applicable Law, a distribution of Cash by the Company to Seller (whether through dividend distribution or redemption of shares) and Company shall have transferred to the Seller the Cash corresponding to such distribution, so that the Company shall not have, at Closing, more than [***] in Cash. If the distribution is carried out, in whole or in part, through a redemption of shares, the Seller shall cause the Company to update the Share Register Book to reflect the relevant cancellation of such shares. 3.2 Conditions Precedent to the Seller

21 The obligation of the Seller to consummate the Transaction is subject to the satisfaction or written waiver by the Seller, in whole or part (to the extent such condition can be waived, in its sole discretion), at Closing, of each of the following conditions (“Conditions Precedent to the Seller” and, jointly with the Conditions Precedent to the Buyer, “Conditions Precedent”): 3.2.1 Representation and Warranties Each of the representations and warranties made by the Buyer pursuant to Section 6.3 shall be true, accurate and correct as of the date hereof and as of the Closing Date (other than any representations and warranties that expressly relate to a particular date, which shall be true and correct as of such date). 3.2.2 Covenants The Buyer shall have complied in all respects with all covenants, obligations and agreements contained in this Agreement expressly required to be complied by it on or prior to the Closing Date. 3.2.3 No Law or Order No Governmental Authority shall have issued, enacted, entered into, promulgated or enforced any Law or Order making illegal or prohibiting (other than for conditions or other restraints that may be imposed by CADE that must be addressed by the Buyer pursuant to Chapter 8 (Antitrust Condition)) the consummation of Transaction. 3.2.4 Consummation of the B3 Transaction The B3 Transaction shall have been consummated as provided in Section 3.1.6. 3.2.5 Antitrust Condition The Antitrust Condition shall have been met as provided in Section 3.1.7. 3.3 Waiver of Conditions Precedent Except for the Conditions Precedent set forth in Section 3.1.4, 3.1.7, 3.2.3 and 3.2.5, which are not subject to waiver, any Party may waive, in whole or in part, the satisfaction of one or more of its respective Conditions Precedent. 3.4 Commitment of the Parties 3.4.1 The Parties undertake to perform all acts reasonably necessary for the satisfaction of the Conditions Precedent. 3.4.2 The Parties further undertake, if at any time after the Closing Date, any other act is reasonably necessary to facilitate the performance of the provisions of this Agreement (including, but not limited to, the execution of other documents), to cooperate with each other for the purpose of facilitating the performance of such act, to the extent reasonable and provided that it complies with the Law. 3.4.3 The responsibility for the satisfaction and implementation of the Conditions Precedent set forth in (a) the Section 3.2 shall be the responsibility of the Buyer; and (b) the Section 3.1 shall be the responsibility of the Seller, including with respect to the costs, expenses or Taxes related to or necessary for such implementation or occurrence, except for the Conditions Precedent provided in the Section 3.1.7 and 3.2.5, which satisfaction and implementation shall comply with the provisions of

22 Chapter 8 (Antitrust Condition). 3.5 Failure to Satisfy Conditions Precedent 3.5.1 If the Conditions Precedent have not been satisfied or waived by the applicable Party by the Longstop Date, this Agreement may be terminated pursuant to Chapter 11 (Governing Law and Dispute Resolution). In this case, no amount shall be due to any Party by way of fine, indemnity, reimbursement of costs or expenses or any other title, except as described in the Section 3.5.2 or 3.5.3, as the case may be. 3.5.2 Without prejudice to Section 4.1.1 below, in the event that the Conditions Precedent to the Buyer and the Conditions Precedent to the Seller have been satisfied or waived until the Longstop Date and either the Buyer or the Seller, delays to consummate the Transaction for any unjustifiable reason, or with willful misconduct or negligence (“Delay Event”), the defaulting Party shall pay to the non-defaulting Party a non-compensatory fine in an amount corresponding to [***], plus a default interest at the rate of [***], calculated over the Base Purchase Price from the date of the Delay Event and until the effective consummation of the Transaction, limited to the amount corresponding to [***] (“Delay Fee”). The occurrence of a Delay Event shall not release or exempt either Party from its obligation to consummate the Transaction, and the jeopardized Party shall be entitled to enforce the consummation of the Transaction, as well as request indemnification for Losses suffered due to the Delay Event. Any Delay Fee must be paid within ten (10) Business Days of the effective Closing Date from the date such Delay Fee reaches the limit above, whichever occurs first. 3.5.3 In the event that (i) the Buyer refuses to comply with the restrictions imposed by CADE [***] in order to satisfy the Antitrust Condition, or (ii) the Conditions Precedent set forth in Sections 3.1.6 (Consummation of the B3 Transaction) and 3.2.4 (Consummation of the B3 Transaction) have not been satisfied until the Longstop Date, or in case B3 exercises its right of first refusal provided for in Section 8.1 of the Shareholders’ Agreement (“Break-Up Event”), then the Buyer or the Seller, as the case may be, shall pay to the other Party a compensatory fine [***] (“Break-Up Fee”). The Break-Up Fee shall be paid within ten (10) Business Days of the occurrence of the Break-Up Event and shall constitute the exclusive monetary remedy of the Buyer or the Seller, as the case may be, under applicable Law and this Agreement, for any Losses incurred thereby in connection with the Transaction and its termination. 4 Closing 4.1 Closing 4.1.1 Subject to the terms and conditions set forth in this Agreement, the consummation of the Transaction (“Closing”) shall occur (i) on the last Business Day of a given month, if the last Condition Precedent (except for the conditions precedent set forth in Sections 3.1.5, 3.1.6, 3.1.8, and 3.2.4, which may be satisfied on the Closing Date, in any case before Closing) has been satisfied or waived (as the case may be) until the fifteenth (15th) day of the same month; (ii) on the last Business Day of the following month, if the last Condition Precedent has been satisfied or waived (as the case may be) (except for the conditions precedent set forth in Sections 3.1.5, 3.1.6, 3.1.8, and 3.2.4, which shall be satisfied on the Closing Date) between the sixteenth

23 (16th) day and the last Business Day of a given month; or (iii) on any other date mutually agreed upon by the Parties, but in any case Closing shall not take place before April 1st, 2026. The day on which the Closing occurs will be considered the “Closing Date”. Upon satisfaction (or waiver) of the last Conditions Precedent (except for the conditions precedent set forth in Sections 3.1.5, 3.1.6, 3.1.8, and 3.2.4, which shall be satisfied on the Closing Date), any Party may notify the other Party of such satisfaction and provide evidence thereof (“Closing Notice”). The Closing Notice shall state the Closing Date subject to the provisions of this Chapter 4 (Closing) and be accompanied by any updates to the Exhibits to this Agreement, and full documentation supporting such updates, subject to Section 4.7. 4.1.2 The other Party may respond to the Closing Notice within five (5) Business Days from the date of receipt, stating its agreement or disagreement with respect to the satisfaction (or waiver) of the Conditions Precedent. The failure to send the notice referred to in this Section shall mean full agreement with the contents of the Closing Notice, and the obligation to demonstrate satisfaction with the Conditions Precedent of Section 3.2 shall remain. 4.1.3 In the event of disagreement regarding the satisfaction of the Conditions Precedent, the Parties shall negotiate in good faith a solution to the disagreement. If no agreement is reached within ten (10) Business Days of delivery of the foregoing notice, either Party may initiate a Dispute resolution proceeding pursuant to Section 11.2. 4.2 Closing Location The acts related to the Closing shall be carried out in person, at Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados’ office, located at Avenida Brig. Faria Lima, No. 4100, 6th floor, Itaim Bibi, in the City of São Paulo, State of São Paulo, Zip Code 04538-132, or any other location to be mutually agreed upon by Parties. Parties may also agree to have the Closing documents signed by means of electronic signature, pursuant to Section 13.14. 4.3 Longstop Date All Conditions Precedent must be satisfied (or waived) within one hundred and eighty (180) days from the Execution Date (“Longstop Date”). In the event that the Conditions Precedent are not satisfied (or waived) by the Longstop Date, Section 12.2 shall apply. Notwithstanding, the Parties may, by mutual agreement and in writing, extend the Longstop Date. 4.4 Binding Obligation The satisfaction or waiver under the terms of this Agreement (to the extent such condition can be waived), as applicable, of all Conditions Precedent prior to or at Closing shall result in the irrevocable and irreversible binding obligation of the Parties to consummate the Transaction. 4.5 Closing Acts Without prejudice to other actions reasonably required to consummate the Transaction, the Parties and, as the case may be, the Company undertake to perform the acts described below on (or up to) the Closing Date (unless waived in writing by both Parties by mutual agreement) (“Closing Acts”): 4.5.1 Closing Certificate

24 The Parties shall enter into a closing certificate whereby the Parties: (i) acknowledge satisfaction (or waiver, as the case may be and to the extent waiver is permitted by Law or this Agreement) of the Conditions Precedent, followed, as applicable, by documentation evidencing their satisfaction or waiver; (ii) confirm that the representations and warranties made under this Agreement continue to be true, correct and accurate in all material aspects (or, with respect to representations and warranties already qualified by materiality or by Knowledge, true, correct and accurate in all respects as so qualified) as of the Closing Date as if they were made on such date (other than any representations and warranties that expressly relate to a particular date, which shall be true and correct as of such date); and (iii) confirm the performance of the acts of the Closing Acts listed in this Section 4.5 and the completion of the Closing. 4.5.2 Transfer of the Company's Shares The Buyer and the Seller shall execute the respective deed of transfer of the Shares in the Share Transfer Register Book of the Company to formalize the transfer of the Shares to the Buyer and the management of the Company shall make the necessary annotations and update the relevant entry in the Share Register Book of the Company. 4.5.3 Transitional Services Agreement The Company and the Seller shall enter into a transitional services agreement in order to ensure the continuity of the Company’s operations during a transitional period of up to six (6) months following the Closing Date, in accordance with the draft attached hereto as Exhibit 4.5.3. Upon the expiration of the periods set forth in the transitional services agreement, Buyer may request the extension of the services indicated in the Exhibit 4.5.3, provided that (a) in any event, the extension shall not exceed three (3) months from the original term, and (b) the costs to be paid by the Buyer to the Seller for the services will be increased by [***] from the first month after the original expiration term and the effective termination of each of the services. 4.5.4 Payment of the Closing Installment The Buyer shall pay the Closing Installment to the Seller pursuant to Section 2.2. 4.5.5 Power of Attorney The Company shall grant a power of attorney, pursuant to the draft of Exhibit 4.5.5, with specific powers for certain Persons to be appointed by the Buyer at the Closing Date. 4.6 Simultaneous Acts All actions, acts and obligations listed in Section 4.5 shall be deemed simultaneous, provided that no action, act and/or obligation shall be deemed to have been effectively carried out until all the other acts and/or obligations have been taken, performed, complied or completed, except if the Parties agree otherwise in writing. 4.7 Updated Exhibits Subject to the provisions of Section 3.1.1, prior to the Closing Date, the Seller may update the Exhibits hereto so that the representations and warranties contained in Section 6.2 be true and accurate in all material aspects (or, with respect to representations and warranties

25 already qualified by materiality or by Knowledge, true, correct and accurate in all respects as so qualified) as of the Closing Date, as long as such updates (i) are not made to Exhibits to Fundamental Reps and Warranties; (ii) derive exclusively from new facts taken place after the Execution Date; (iii) do not derive from facts resulting from a breach to the obligations and covenants herein; and/or (iv) do not represent, in aggregate and combined with any other events or circumstances hereunder, a Material Adverse Event. 4.8 Further Assurances Each of the Parties and the Company: (i) shall execute, or shall cause to be executed, such documents and shall take, or shall cause to be taken, such further actions as may be reasonably required to carry out the provisions of this Agreement and give effect to the Transaction and (ii) shall refrain from taking any actions that would reasonably be expected to impair, delay or prevent the Closing. 5 Conduct of Business 5.1 Conduct of Business 5.1.1 From the Execution Date until the Closing Date, the Seller, without the prior written consent of the Buyer (which shall not be unreasonably withheld, conditioned or delayed), shall not and shall cause the Company and the Subsidiaries not to take (or undertake or promise to take) any of the following actions: (i) create, allot or issue any shares of the Company or agree, arrange or undertake to do any of those actions; (ii) reduce the Company’s capital stock; (iii) split, reclassify, group, any shares of the Company's capital stock, or other security or voting rights in the Company; (iv) grant or agree to grant any option, right to acquire or call (whether by conversion, subscription or otherwise) in respect of any shares of the Company, except for the Seller’s obligations provided for in the Company’s Shareholder’s Agreement; (v) acquire or dispose of, or agree to acquire or dispose of, any assets or businesses in an amount exceeding [***]; (vi) assume or incur, or agree to assume or incur, any material liability, obligation or expense in an amount [***]; (vii) incur Debt in an amount [***]; (viii) enter into any transaction with any Related Party other than at arm’s length, except in the Ordinary Course of Business such as the Cost Sharing Agreements; (ix) enter into or agree to enter into any merger, merger of shares (incorporação de ações), spin-off, acquisition or consolidation with any Person or adopt any plan of complete or partial liquidation, dissolution, restructuring, recapitalization or other reorganization; (x) make any loans, advances or capital contributions to, or investments in, any other Person (including any Affiliate) in an amount exceeding [***];

26 (xi) sign, modify, cancel, terminate or amend any Material Contract that would fit into items (vi) to (ix) of Section 6.2.13, except for (a) any contract relating to the acquisition or disposal of any business or equity interests (whether by way of merger or incorporation, sale of quotas, sale of assets or otherwise) for the specific purpose of Section 5.1.5, (b) termination at the initiative of the other party in the relevant Material Contract, or (c) any modification or amendment to a Material Contract that would fit into item (ix) of Section 6.2.13, provided that such modification or amendment does not result in the creation, expansion or increase of any non-compete, non- solicitation or exclusivity obligations, or any other restriction on the business or activities of the Company as currently conducted, or that restricts the Company’s freedom to compete in any line of business; (xii) increase the compensation payable (including payments, wages, compensation, bonuses, incentives, deferred compensation, profit sharing, pension or any other compensation or benefits) to any current or former director, manager, Employee, service provider or agent of the Company, outside the Ordinary Course of Business; (xiii) make any payment, distribution or arrangement of bonuses, profit sharing, pension, retirement, insurance, or benefit, to or with any director, manager, Employee or service provider, outside the Ordinary Course of Business; (xiv) establish, adopt, or terminate any Employee benefit plan or any collective bargaining, compensation or other arrangement, fund, policy, or arrangement, for the benefit of any directors, managers, Employees, or service providers; (xv) make any change in accounting method, accounting practice, or auditing practice, except if due to a mandatory legal provision; and (xvi) have any of its assets materially necessary for the Ordinary Course of Business subject to any Lien or given in rem or personal guarantee, for the benefit of any Person. 5.1.2 The provisions set forth exclusively in items (v), (vi), (vii), (x) or (xiv) of Section 5.1.1 above do not apply in respect of and shall not operate to restrict or prevent the following, provided that Seller informs the Buyer within five (5) Business Days after taking such action (and, in any case, before Closing) and makes available a complete copy of all applicable documents: (i) any matter reasonably undertaken in an emergency or disaster situation with the intention of and only to the extent of those matters required with a view to minimizing any adverse effect of such situation; (ii) completing or performing any obligations undertaken pursuant to any contract, agreement or arrangement entered into prior to the date of this Agreement; or (iii) any matter to the extent required by Law or any Governmental Authority. 5.1.3 Failure by the Buyer to respond to the Seller’s notice requesting to take any of the actions listed in Section 5.1.1 within ten (10) days as from receipt thereof, shall be construed as the Buyer’s consent to Seller’s request.

27 5.1.4 Section 5.1.1. does not prevent, or limit in any way, the Company’s ability to pre-pay any of its outstanding Debts. 5.1.5 From the Execution Date until the Closing Date, the Company shall be permitted to modify or amend any of the contracts listed in Exhibit 6.2.5(ii), relating to the acquisition or disposal of any business or equity interests (whether by way of merger or incorporation, sale of quotas, sale of assets or otherwise) to which it is a party, solely for the purposes of allowing the prepayment of any amounts payable thereunder. 5.1.6 For the avoidance of doubt, the restrictions set forth in item (xi) of Section 5.1.1. above shall not prevent or limit, in any way, the Seller’s ability to modify, cancel, terminate or amend any of the umbrella agreements to which the Seller is a party and under which the Company also benefits from the services provided thereunder, provided that any amendments thereto shall not aim to cause any disproportional negative impact to the Company’s interests. 5.1.7 Seller shall notify the Buyer within five (5) Business Days after modifying, canceling, terminating or amending any umbrella agreement pursuant to Section 5.1.6, providing the Seller with a summary of the modifications and amendments thereto to the extent they impact the Company. 5.1.8 Except for the treatment in relation to the umbrella agreements referred to in Section 5.1.7 above, Seller shall inform Buyer within five (5) Business Days after taking such action (and, in any case, before Closing) and make available a complete copy of all applicable documents (if necessary, through a clean team), in case of termination, modification or amendment to Material Contracts pursuant to Section 5.1.1(xi) above. 6 Representations and Warranties 6.1 Representations and Warranties of the Seller The Seller hereby represents and warrants to the Buyer that the following representations and warranties are true, complete, accurate, correct, and not misleading as of the date hereof, and shall continue to be true, complete, accurate, correct, and not misleading on the Closing Date (or, if made expressly in relation to a specific date, as of such date): 6.1.1 Organization and Regularity The Seller is a Brazilian corporation (sociedade anônima) validly existing and legally and duly incorporated, and in good standing, under the Laws of the Federative Republic of Brazil. The Seller has full capacity and legitimacy and is legally entitled to conduct their business as currently conducted, as well as to hold and use all of their assets and properties. 6.1.2 Power, Capacity and Authorization The Seller has full power, capacity and authority to: (i) enter into this Agreement and all other documents and instruments necessary for the completion of the Transaction; (ii) comply with the obligations undertaken in this Agreement and in all documents necessary for the completion of the Transaction; and (iii) consummate the Transaction, having taken all necessary measures and obtained all necessary approvals to authorize the conclusion and execution of the Transaction.

28 6.1.3 Enforceability This Agreement has been signed by the Seller and constitutes a legal, valid and binding obligations, enforceable against it, in accordance with its terms, except insofar as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally or by principles governing the availability of equitable remedies. Each of the Transaction documents to be signed prior to and/or on the Closing Date constitutes and shall constitute a valid and enforceable obligation of each of its Parties in accordance with their respective terms. 6.1.4 Consents The execution and performance of this Agreement by the Seller, as well as the execution of the other Transaction documents and the consummation of the Transaction: (i) do not violate or contradict any constitutive or corporate document of Seller and/or any corporate resolutions of its partners; and (ii) do not violate or contradict any Law, regulation, order, Decision or judgment issued by any Governmental Authority, applicable to the Seller. All or any consents, permissions, approvals and agreements from, and other notices to, Third-Parties which are necessary for the Seller to obtain in order to enter and perform its obligations under this Agreement, in accordance with its terms, have been, or at Closing will have been (as the case may be), unconditionally obtained or waived in writing. 6.1.5 No Brokerage Fees Except for lawyers, investment bankers, financial advisors and other professional advisors hired by the Seller to assist it in the implementation of the Transaction (which costs and expenses shall be borne and paid fully and exclusively by the Seller without any contribution or payment to be made by the Company or any Subsidiary in connection therewith), no broker, finder, investment banker or similar agent: (i) has been retained or employed by or on behalf of the Seller in connection with the Transaction; (ii) is authorized to act on behalf of the Seller within the scope of the Transaction; or (iii) is or might be entitled to any fee, legal fees, commission or payment from the Seller in connection with the preparation, negotiation and execution of this Agreement or the consummation of the Transaction. 6.2 Representations and Warranties regarding the Company and the Subsidiaries The Seller hereby represents and warrants to the Buyer with respect to the Company that the following representations and warranties are true and accurate on the date hereof and shall be true and accurate on the Closing Date (or, if made expressly in relation to a specific date, as of such date), it being expressly agreed that all representations and statements below comprehend the Company and all Subsidiaries, taken as a whole, even if any such statements mention solely the Company: 6.2.1 Organization and Regularity The Company is a Brazilian corporation (sociedade anônima), validly existing and legally and duly incorporated under the Laws of the Federative Republic of Brazil.

29 The Subsidiaries are companies validly existing and legally and duly incorporated under the Laws of the Federative Republic of Brazil. The Company and the Subsidiaries have full capacity and legitimacy and is legally entitled to conduct their business as currently conducted, as well as to hold and use all of their assets and properties. 6.2.2 Power, Capacity and Authorization The Company has full power, capacity and authority to: (i) enter into this Agreement and all other documents and instruments necessary for the completion of the Transaction; (ii) comply with the obligations undertaken in this Agreement and in all documents necessary for the completion of the Transaction; and (iii) consummate the Transaction, having taken all necessary measures and obtained all necessary approvals to authorize the conclusion and execution of the Transaction. 6.2.3 Enforceability This Agreement constitutes a legal, valid and binding obligations, enforceable against the Company, in accordance with its terms, except insofar as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally or by principles governing the availability of equitable remedies. Each of the Transaction documents to be signed prior to and/or on the Closing Date constitutes and shall constitute a valid and enforceable obligation of each of its Parties in accordance with their respective terms. 6.2.4 No Conflicts; Consents Except for the consents listed in Exhibit 6.2.4, and the approval from CADE, all or any consents, permissions, approvals or agreements from Third-Parties which are necessary for the Company to obtain in order to enter and perform its obligations under this Agreement, in accordance with its terms, have been, or at Closing will have been (as the case may be), unconditionally obtained or made in writing. The execution and performance of this Agreement by the Company, as well as the execution of the other Transaction documents and the consummation of the Transaction: (i) do not violate, contradict or cause the breach, non-compliance, non- observance, early termination, loss of relevant rights or termination of (a) any constitutive or corporate document of the Company, and (b) any contract, commitment, obligation, understanding, agreement or restriction of any nature whatsoever to which Seller and/or the Company are parties or to which they are subject, or by which their respective assets or properties are bound, except for those listed in Exhibit 6.2.4; (ii) do not violate or contradict any Law, regulation, order, Decision or judgment issued by any Governmental Authority, applicable to the Company, the Seller and/or their respective assets or property; and (iii) do not create any Lien on any assets or property of the Company or on its shares, other than the obligations contained in this Agreement and in the other documents of the Transaction. 6.2.5 Ownership Interest in other Persons