Financial Results Third Quarter 2025 .2

Forward-Looking Statements & Non-GAAP Financial Measures This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the financial condition, results of operations, trends in lending policies and loan programs, plans and prospective business partnerships, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “believe,” “continue,” “could,” “decline,” “drive,” “enhance,” “estimate,” “expanding,” “expect,” “grow,” “growth,” “improve,” “increase,” “looking ahead,” “may,” “pending,” “plan,” “position,” “preliminary,” “remain,” “rising,” “should,” “slow,” “stable,” “strategy,” “well-positioned,” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward-looking statements. Such statements are subject to certain risks and uncertainties including: our business and operations and the business and operations of our vendors and customers; general economic conditions, whether national or regional, and conditions in the lending markets in which we participate may have an adverse effect on the demand for our loans and other products; our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that is the collateral for our loans. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial and industrial, construction and SBA loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; the impacts of inflation and rising interest rates on the general economy; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. This presentation contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible book value per common share, tangible common equity to tangible assets, total interest income – FTE, net interest income – FTE, net interest margin – FTE, adjusted revenue, pre-tax, pre-provision (loss) income, adjusted pre-tax, pre-provision income, adjusted noninterest income, adjusted income (loss) before income taxes, adjusted income tax provision (benefit), adjusted net (loss) income, adjusted diluted earnings per share, adjusted return on average assets, adjusted return on average shareholders’ equity, adjusted return on average tangible common equity, adjusted tangible common equity, adjusted tangible assets and adjusted tangible common equity to adjusted tangible assets are used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the table at the end of this presentation under the caption “Reconciliation of Non-GAAP Financial Measures.” 2

Key Business Highlights Strategic Balance Sheet Optimization – Completed the sale of single tenant lease financing loans and repositioned deposits to enhance capital ratios and balance sheet flexibility for future growth Solid Revenue Momentum – Adjusted revenue up 30% with 8th consecutive quarter of net interest income growth driven by higher yields and operational efficiency Strong Loan Pipelines – Pipelines remain strong; seeing continued opportunities in construction/investor commercial real estate, single tenant lease financing and commercial & industrial Improving Asset Quality – Proactive credit related measures in small business lending and franchise finance yielding positive results with delinquencies improving sequentially BaaS Model Drives Strong Liquidity – Significant fintech deposit growth delivers robust balance sheet liquidity with a favorable loans-to-deposits ratio supporting future expansion Increased Management Conviction in Long-term Outlook – Dedicated and experienced team, proactive approach and strong liquidity position the Company for long-term profitable growth 3

Credit & Lending Update – 3Q25 Building a Stronger Financial Foundation Proactive Credit Management – Increased reserves and resolved problem loans in small business and franchise finance portfolios – Cleaner credit profile sets the stage for future growth Franchise Finance Progress – Delinquencies reduced by 79% this quarter – Successful recovery strategies with over 90% recovery on certain loans – Fewer new delinquencies and only three loans on deferral Small Business Lending Improvements – Over $1.9 billion in loans originated since 2020 – Enhanced approval processes and advanced analytics to spot issues earlier – Delinquencies dropped by over 50% Positive SBA Loan Sale Momentum – Secondary market sales normalized – $142.5 million in loans sold and $10.6 million in gain on sale revenue—both up sharply from 2Q25 Bottom Line: Proactive approach is driving meaningful improvements in asset quality, reducing delinquencies, and strengthening our financial performance. We remain committed to supporting our customers and delivering positive results for all stakeholders. 4

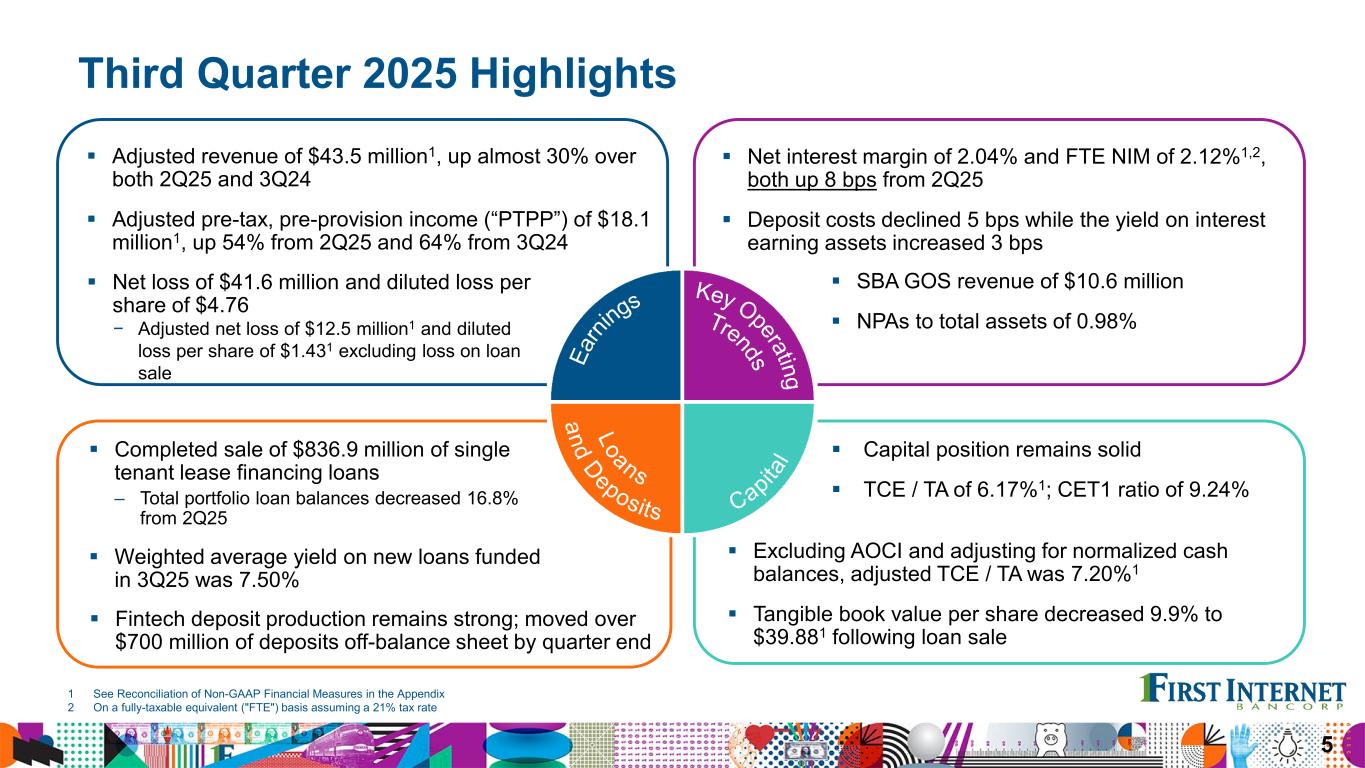

Third Quarter 2025 Highlights Adjusted revenue of $43.5 million1, up almost 30% over both 2Q25 and 3Q24 Adjusted pre-tax, pre-provision income (“PTPP”) of $18.1 million1, up 54% from 2Q25 and 64% from 3Q24 5 Net interest margin of 2.04% and FTE NIM of 2.12%1,2, both up 8 bps from 2Q25 Deposit costs declined 5 bps while the yield on interest earning assets increased 3 bps SBA GOS revenue of $10.6 million NPAs to total assets of 0.98% Excluding AOCI and adjusting for normalized cash balances, adjusted TCE / TA was 7.20%1 Tangible book value per share decreased 9.9% to $39.881 following loan sale 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix 2 On a fully-taxable equivalent ("FTE") basis assuming a 21% tax rate Net loss of $41.6 million and diluted loss per share of $4.76 − Adjusted net loss of $12.5 million1 and diluted loss per share of $1.431 excluding loss on loan sale Completed sale of $836.9 million of single tenant lease financing loans – Total portfolio loan balances decreased 16.8% from 2Q25 Weighted average yield on new loans funded in 3Q25 was 7.50% Fintech deposit production remains strong; moved over $700 million of deposits off-balance sheet by quarter end Capital position remains solid TCE / TA of 6.17%1; CET1 ratio of 9.24%

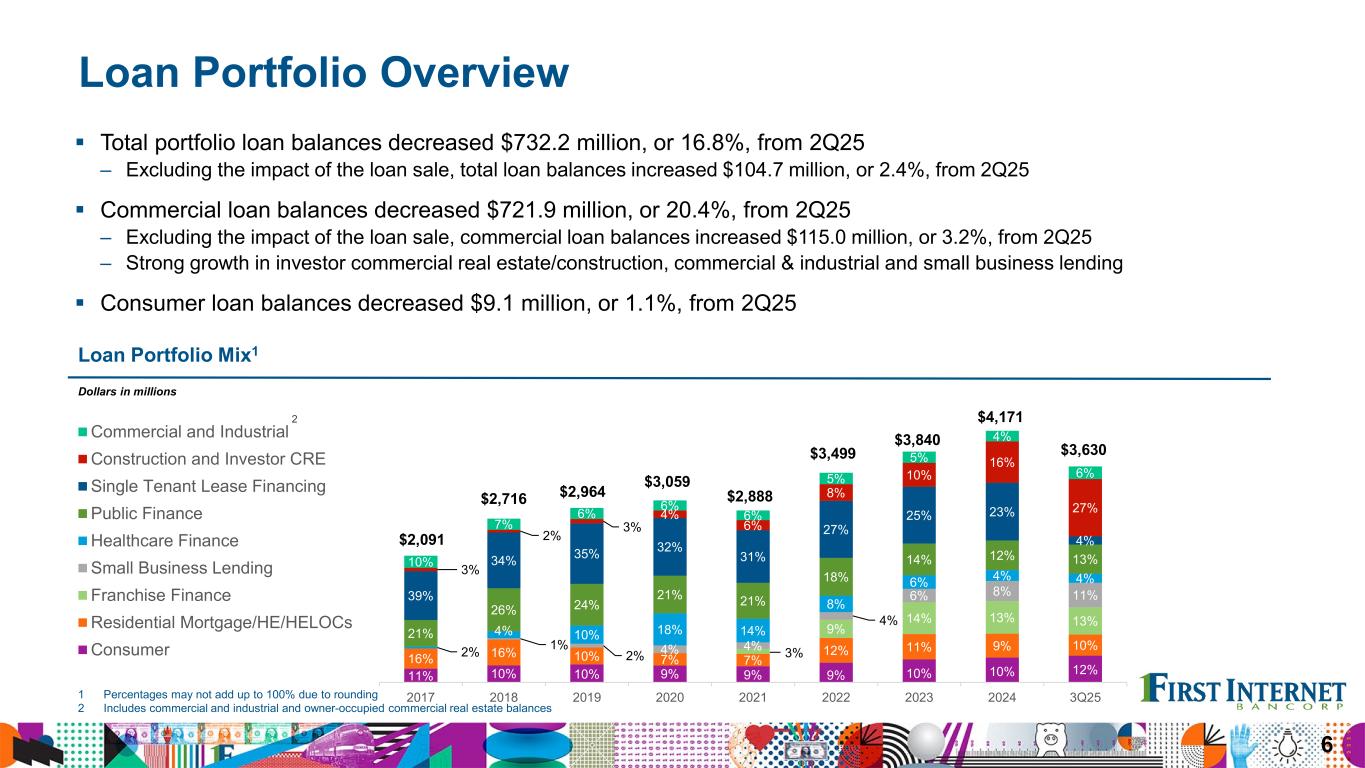

Loan Portfolio Overview Total portfolio loan balances decreased $732.2 million, or 16.8%, from 2Q25 – Excluding the impact of the loan sale, total loan balances increased $104.7 million, or 2.4%, from 2Q25 Commercial loan balances decreased $721.9 million, or 20.4%, from 2Q25 – Excluding the impact of the loan sale, commercial loan balances increased $115.0 million, or 3.2%, from 2Q25 – Strong growth in investor commercial real estate/construction, commercial & industrial and small business lending Consumer loan balances decreased $9.1 million, or 1.1%, from 2Q25 6 Loan Portfolio Mix1 1 Percentages may not add up to 100% due to rounding 2 Includes commercial and industrial and owner-occupied commercial real estate balances Dollars in millions 2 11% 10% 10% 9% 9% 9% 10% 10% 12% 16% 16% 10% 7% 7% 12% 11% 9% 10%3% 9% 14% 13% 13% 1% 2% 4% 4% 4% 6% 8% 11% 2% 4% 10% 18% 14% 8% 6% 4% 4% 21% 26% 24% 21% 21% 18% 14% 12% 13% 39% 34% 35% 32% 31% 27% 25% 23% 4% 3% 2% 3% 4% 6% 8% 10% 16% 27% 10% 7% 6% 6% 6% 5% 5% 4% 6% $2,091 $2,716 $2,964 $3,059 $2,888 $3,499 $3,840 $4,171 $3,630 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 Commercial and Industrial Construction and Investor CRE Single Tenant Lease Financing Public Finance Healthcare Finance Small Business Lending Franchise Finance Residential Mortgage/HE/HELOCs Consumer

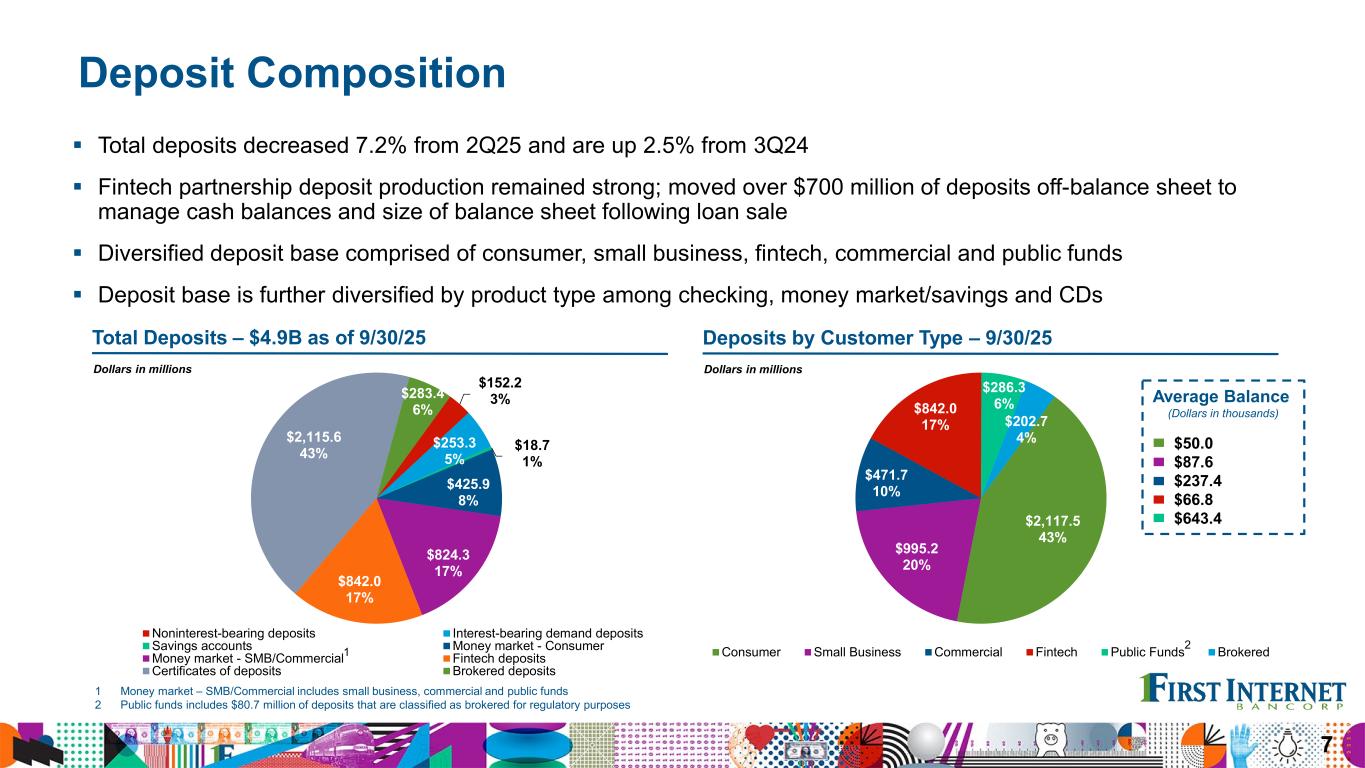

$2,117.5 43% $995.2 20% $471.7 10% $842.0 17% $286.3 6% $202.7 4% Consumer Small Business Commercial Fintech Public Funds Brokered2 $152.2 3% $253.3 5% $18.7 1% $425.9 8% $824.3 17%$842.0 17% $2,115.6 43% $283.4 6% Noninterest-bearing deposits Interest-bearing demand deposits Savings accounts Money market - Consumer Money market - SMB/Commercial Fintech deposits Certificates of deposits Brokered deposits Deposit Composition 7 Total deposits decreased 7.2% from 2Q25 and are up 2.5% from 3Q24 Fintech partnership deposit production remained strong; moved over $700 million of deposits off-balance sheet to manage cash balances and size of balance sheet following loan sale Diversified deposit base comprised of consumer, small business, fintech, commercial and public funds Deposit base is further diversified by product type among checking, money market/savings and CDs 1 Money market – SMB/Commercial includes small business, commercial and public funds 2 Public funds includes $80.7 million of deposits that are classified as brokered for regulatory purposes 1 Deposits by Customer Type – 9/30/25 Dollars in millions Total Deposits – $4.9B as of 9/30/25 Dollars in millions Average Balance (Dollars in thousands) $50.0 $87.6 $237.4 $66.8 $643.4

Liquidity and 3Q25 Deposit Update 8 Cash and unused borrowing capacity totaled $2.9 billion as of September 30, 2025 – Currently represents 180% of total uninsured deposits and 216% of adjusted uninsured deposits – Off-balance sheet deposits can easily be moved back onto the balance sheet to support growth and/or liquidity needs Deposit production and on-balance sheet liquidity used to fund loan growth as well as pay down higher-cost FHLB advances and brokered deposits Loans to deposits ratio remains favorable at 73.9% 1 Money market – SMB/Commercial includes small business, commercial and public funds Cost of Funds by Deposit TypeTotal Deposits by Quarter Dollars in millions 2% 2% 3% 2% 3% 5% 6% 5% 5% 5%1% 0% 0% 0% 0%9% 9% 9% 8% 9% 16% 15% 17% 15% 17% 11% 13% 18% 23% 17% 56% 55% 48% 47% 49% 3Q24 4Q24 1Q25 2Q25 3Q25 Noninterest-bearing deposits Interest-bearing demand deposits Savings accounts Money market - Consumer Money market - SMB/Commercial Fintech deposits Certificates and brokered deposits 1 $4,797.7 $4,933.2 3Q24 4Q24 1Q25 2Q25 3Q25 Interest-bearing demand deposits 2.62% 2.55% 2.96% 3.19% 3.33% Savings accounts 0.84% 0.85% 0.85% 0.85% 0.83% Money market accounts 4.22% 3.96% 3.77% 3.74% 3.73% Certificates of deposits 4.75% 4.71% 4.55% 4.41% 4.27% Brokered deposits 4.98% 4.68% 4.45% 4.39% 4.38% Total interest-bearing deposits 4.30% 4.13% 4.01% 3.92% 3.87% $5,298.8$4,945.6 $4,915.4

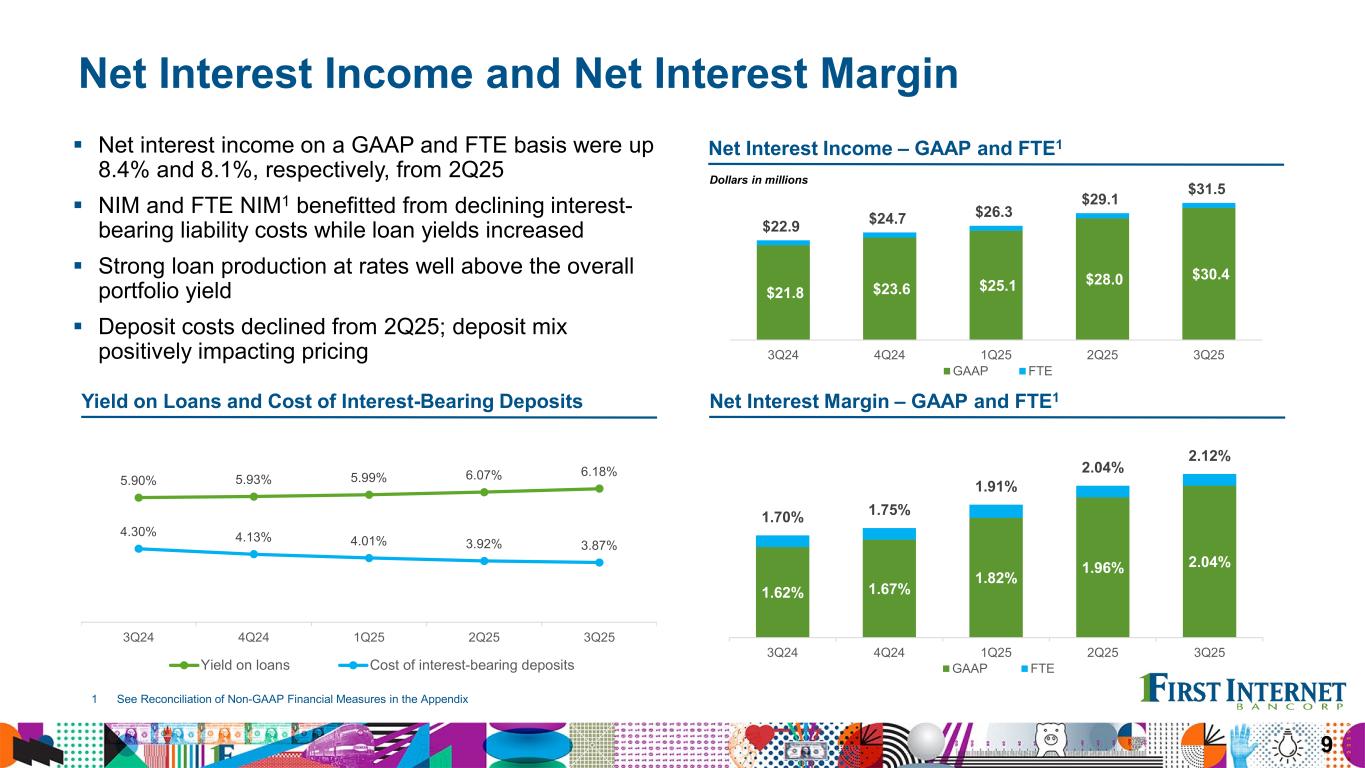

Net Interest Income and Net Interest Margin Net interest income on a GAAP and FTE basis were up 8.4% and 8.1%, respectively, from 2Q25 NIM and FTE NIM1 benefitted from declining interest- bearing liability costs while loan yields increased Strong loan production at rates well above the overall portfolio yield Deposit costs declined from 2Q25; deposit mix positively impacting pricing 9 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix Yield on Loans and Cost of Interest-Bearing Deposits Net Interest Margin – GAAP and FTE1 5.90% 5.93% 5.99% 6.07% 6.18% 4.30% 4.13% 4.01% 3.92% 3.87% 3Q24 4Q24 1Q25 2Q25 3Q25 Yield on loans Cost of interest-bearing deposits $21.8 $23.6 $25.1 $28.0 $30.4 $22.9 $24.7 $26.3 $29.1 $31.5 3Q24 4Q24 1Q25 2Q25 3Q25 GAAP FTE 1.62% 1.67% 1.82% 1.96% 2.04% 1.70% 1.75% 1.91% 2.04% 2.12% 3Q24 4Q24 1Q25 2Q25 3Q25 GAAP FTE Net Interest Income – GAAP and FTE1 Dollars in millions

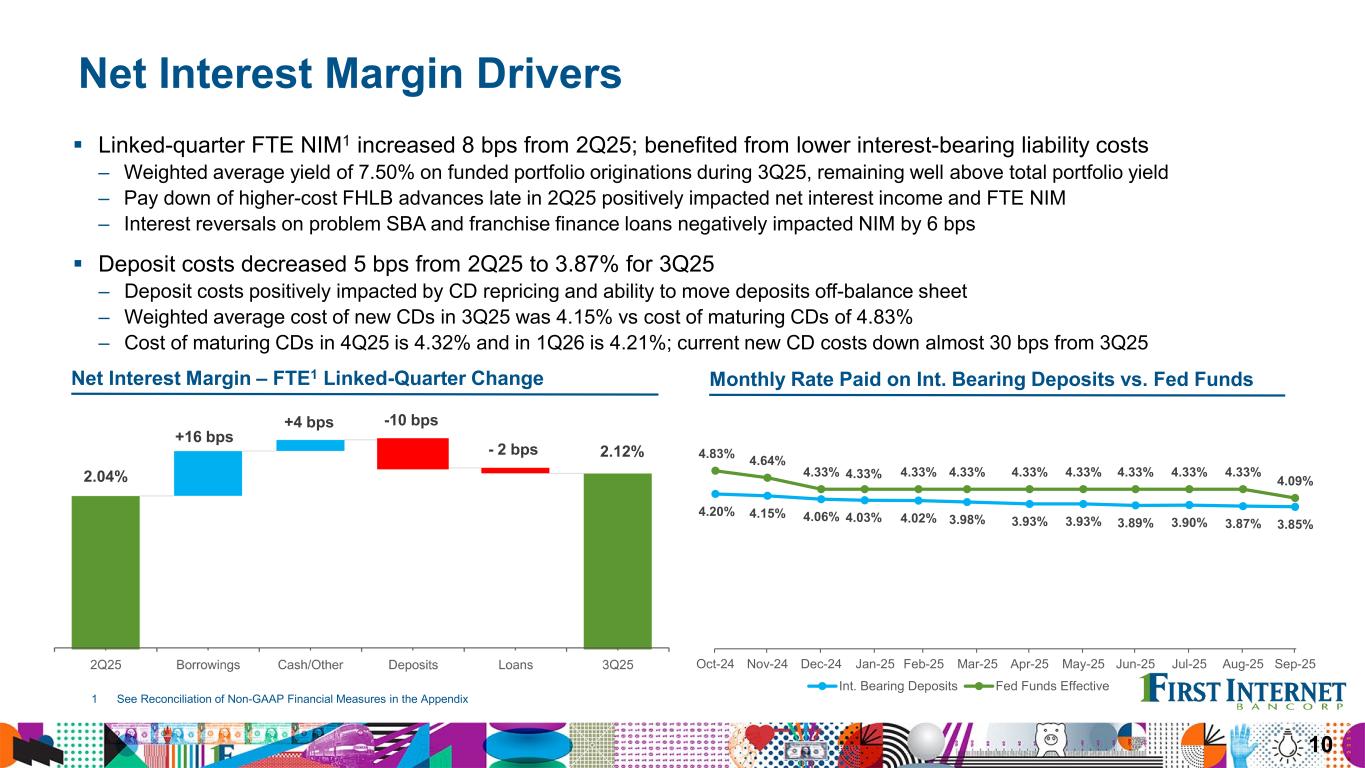

Net Interest Margin Drivers 10 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix Net Interest Margin – FTE1 Linked-Quarter Change Monthly Rate Paid on Int. Bearing Deposits vs. Fed Funds Linked-quarter FTE NIM1 increased 8 bps from 2Q25; benefited from lower interest-bearing liability costs – Weighted average yield of 7.50% on funded portfolio originations during 3Q25, remaining well above total portfolio yield – Pay down of higher-cost FHLB advances late in 2Q25 positively impacted net interest income and FTE NIM – Interest reversals on problem SBA and franchise finance loans negatively impacted NIM by 6 bps Deposit costs decreased 5 bps from 2Q25 to 3.87% for 3Q25 – Deposit costs positively impacted by CD repricing and ability to move deposits off-balance sheet – Weighted average cost of new CDs in 3Q25 was 4.15% vs cost of maturing CDs of 4.83% – Cost of maturing CDs in 4Q25 is 4.32% and in 1Q26 is 4.21%; current new CD costs down almost 30 bps from 3Q25 +16 bps - 2 bps -10 bps 2.04% 2.12% +4 bps 4.20% 4.15% 4.06% 4.03% 4.02% 3.98% 3.93% 3.93% 3.89% 3.90% 3.87% 3.85% 4.83% 4.64% 4.33% 4.33% 4.33% 4.33% 4.33% 4.33% 4.33% 4.33% 4.33% 4.09% Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Int. Bearing Deposits Fed Funds Effective

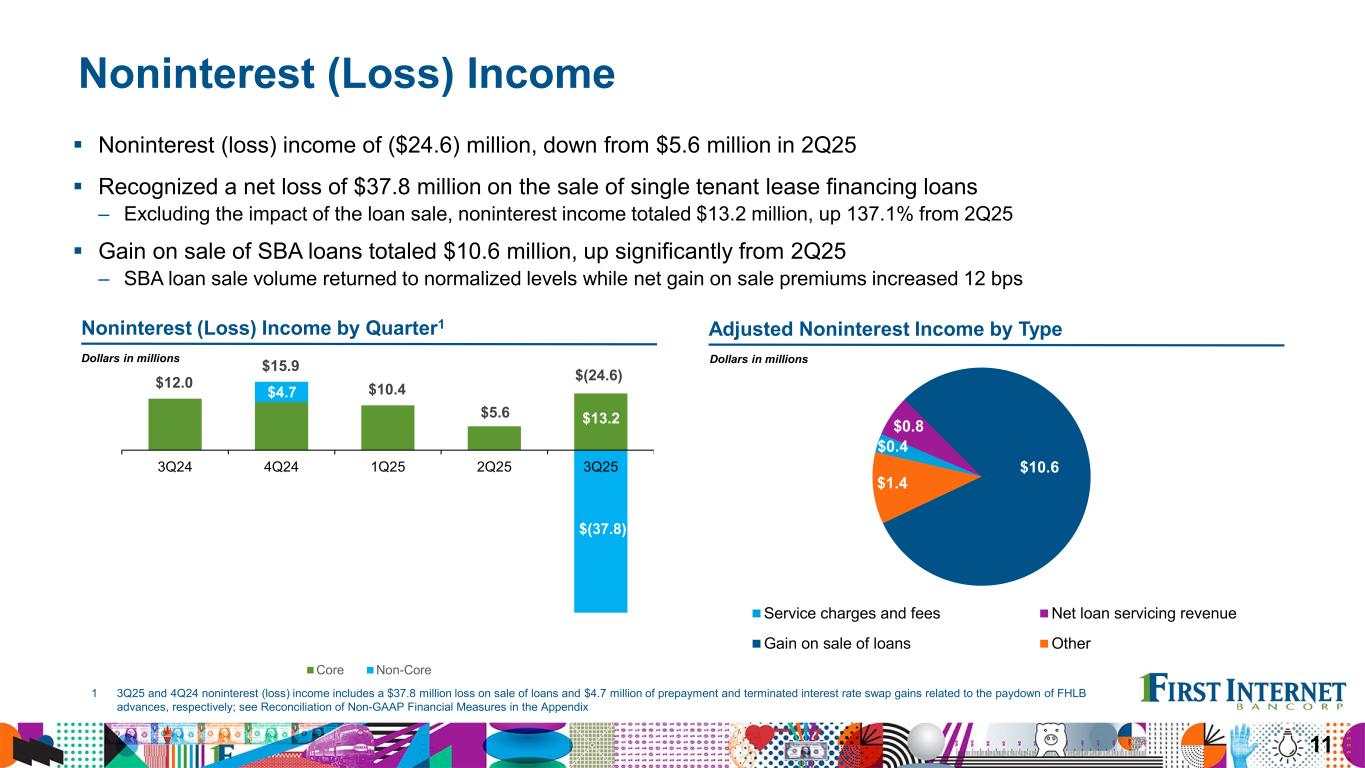

Noninterest (Loss) Income 11 Dollars in millions Adjusted Noninterest Income by Type Dollars in millions Noninterest (Loss) Income by Quarter1 Noninterest (loss) income of ($24.6) million, down from $5.6 million in 2Q25 Recognized a net loss of $37.8 million on the sale of single tenant lease financing loans – Excluding the impact of the loan sale, noninterest income totaled $13.2 million, up 137.1% from 2Q25 Gain on sale of SBA loans totaled $10.6 million, up significantly from 2Q25 – SBA loan sale volume returned to normalized levels while net gain on sale premiums increased 12 bps $0.4 $0.8 $10.6 $1.4 Service charges and fees Net loan servicing revenue Gain on sale of loans Other $4.7 $(37.8) $12.0 $15.9 $10.4 $5.6 $13.2 3Q24 4Q24 1Q25 2Q25 3Q25 Core Non-Core $(24.6) $11.2 1 3Q25 and 4Q24 noninterest (loss) income includes a $37.8 million loss on sale of loans and $4.7 million of prepayment and terminated interest rate swap gains related to the paydown of FHLB advances, respectively; see Reconciliation of Non-GAAP Financial Measures in the Appendix

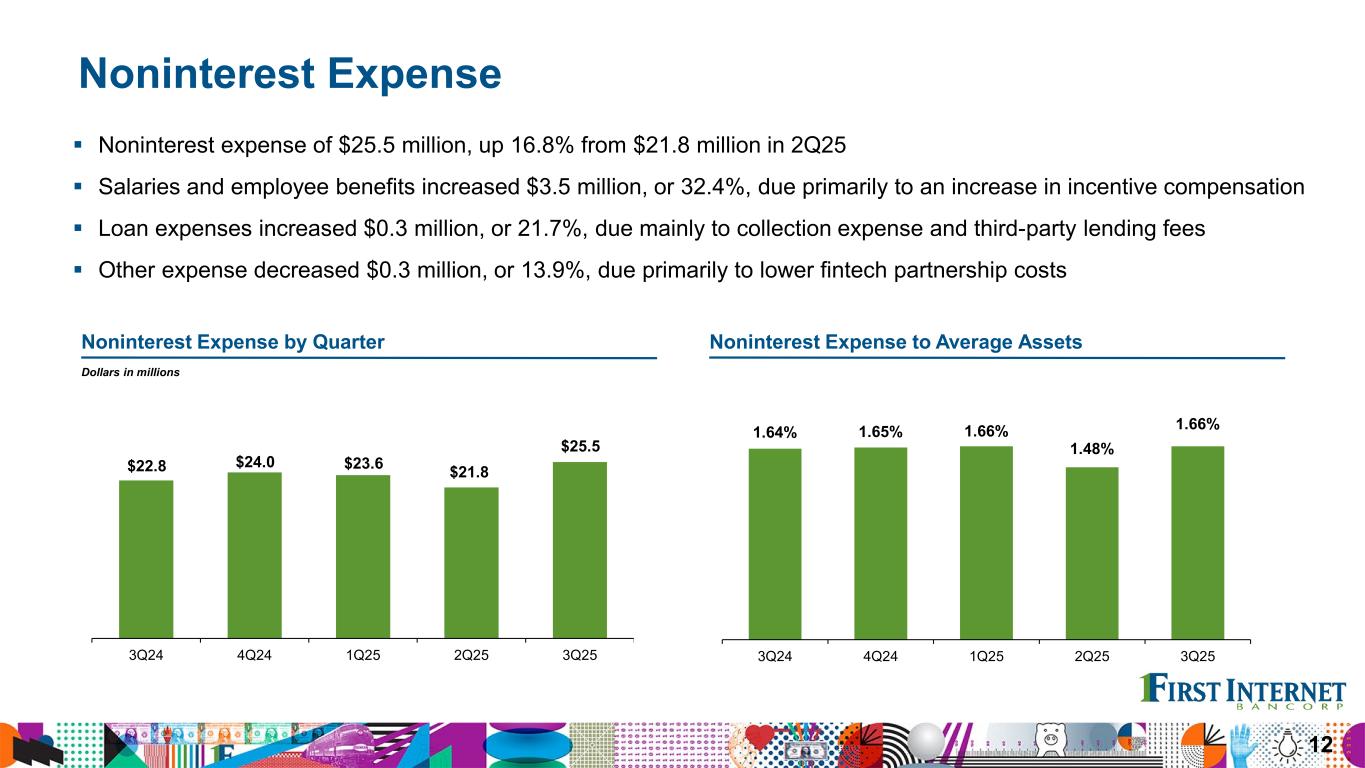

Noninterest Expense Dollars in millions Noninterest Expense by Quarter Noninterest Expense to Average Assets 1.73%1.71% 1.55% 1.64% 1.65% 1.66% 1.48% 1.66% 3Q24 4Q24 1Q25 2Q25 3Q25 $22.8 $24.0 $23.6 $21.8 $25.5 3Q24 4Q24 1Q25 2Q25 3Q25 Noninterest expense of $25.5 million, up 16.8% from $21.8 million in 2Q25 Salaries and employee benefits increased $3.5 million, or 32.4%, due primarily to an increase in incentive compensation Loan expenses increased $0.3 million, or 21.7%, due mainly to collection expense and third-party lending fees Other expense decreased $0.3 million, or 13.9%, due primarily to lower fintech partnership costs 12

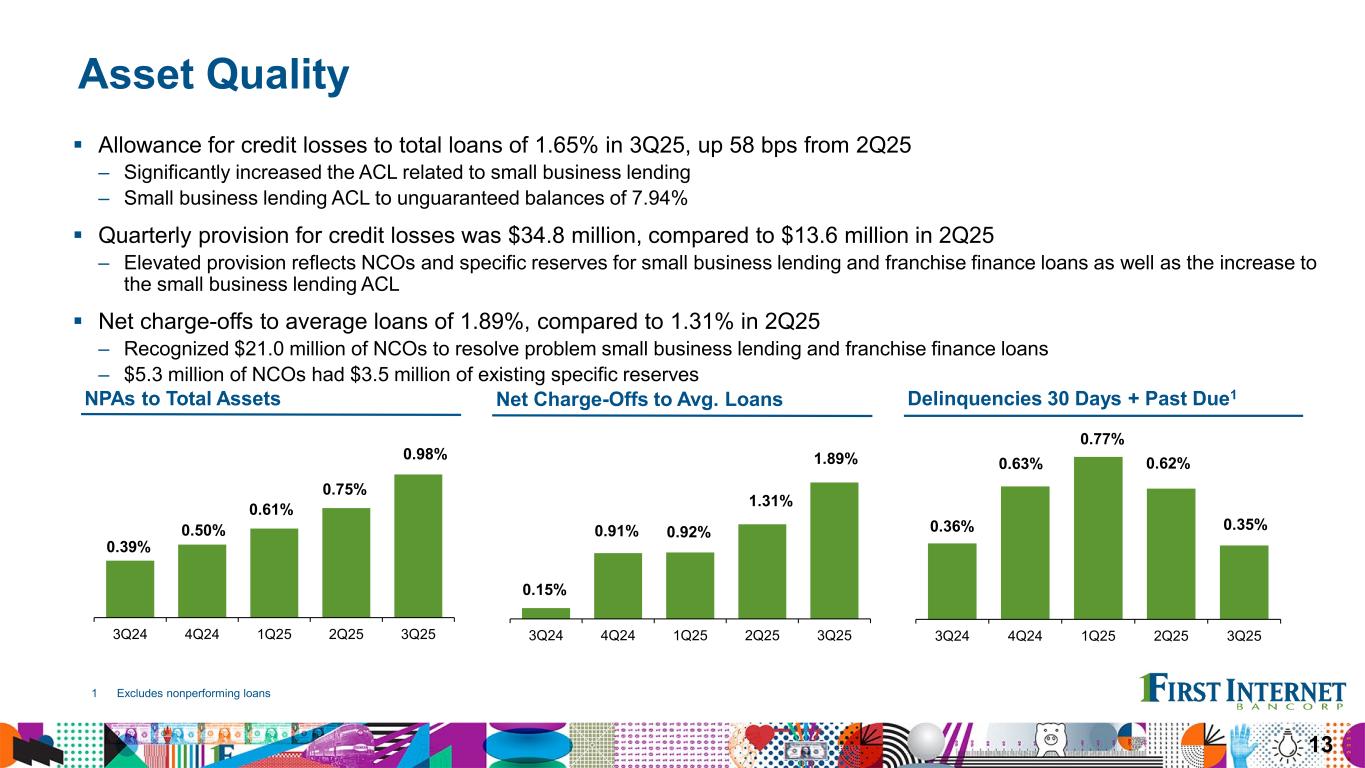

Asset Quality Allowance for credit losses to total loans of 1.65% in 3Q25, up 58 bps from 2Q25 – Significantly increased the ACL related to small business lending – Small business lending ACL to unguaranteed balances of 7.94% Quarterly provision for credit losses was $34.8 million, compared to $13.6 million in 2Q25 – Elevated provision reflects NCOs and specific reserves for small business lending and franchise finance loans as well as the increase to the small business lending ACL Net charge-offs to average loans of 1.89%, compared to 1.31% in 2Q25 – Recognized $21.0 million of NCOs to resolve problem small business lending and franchise finance loans – $5.3 million of NCOs had $3.5 million of existing specific reserves 13 0.39% 0.50% 0.61% 0.75% 0.98% 3Q24 4Q24 1Q25 2Q25 3Q25 0.15% 0.91% 0.92% 1.31% 1.89% 3Q24 4Q24 1Q25 2Q25 3Q25 NPAs to Total Assets Net Charge-Offs to Avg. Loans Delinquencies 30 Days + Past Due1 0.36% 0.63% 0.77% 0.62% 0.35% 3Q24 4Q24 1Q25 2Q25 3Q25 1 Excludes nonperforming loans

Capital Tangible common equity to tangible assets decreased 18 bps from 2Q25 to 6.17%1 Tangible book value per share of $39.881, down 9.9% from 2Q25 and down 9.1% from 3Q24 Regulatory capital ratios benefited from the sale of single tenant lease financing loans Tier 1 leverage ratio expected to increase significantly in 4Q25 as average assets reset following the loan sale 14 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix 2 Regulatory capital ratios are preliminary pending filing of the Company’s and Bank’s regulatory reports Company Bank Total shareholders' equity to assets 6.25% 7.48% Tangible common equity to tangible assets1 6.17% 7.40% Tier 1 leverage ratio 5.69% 6.89% Common equity tier 1 capital ratio 9.24% 11.21% Tier 1 capital ratio 9.24% 11.21% Total risk-based capital ratio 13.11% 12.46% $30.82 $33.29 $38.51 $39.74 $41.43 $43.77 $39.88 2019 2020 2021 2022 2023 2024 3Q25 Tangible Book Value Per Share1 Regulatory Capital Ratios – September 30, 20252

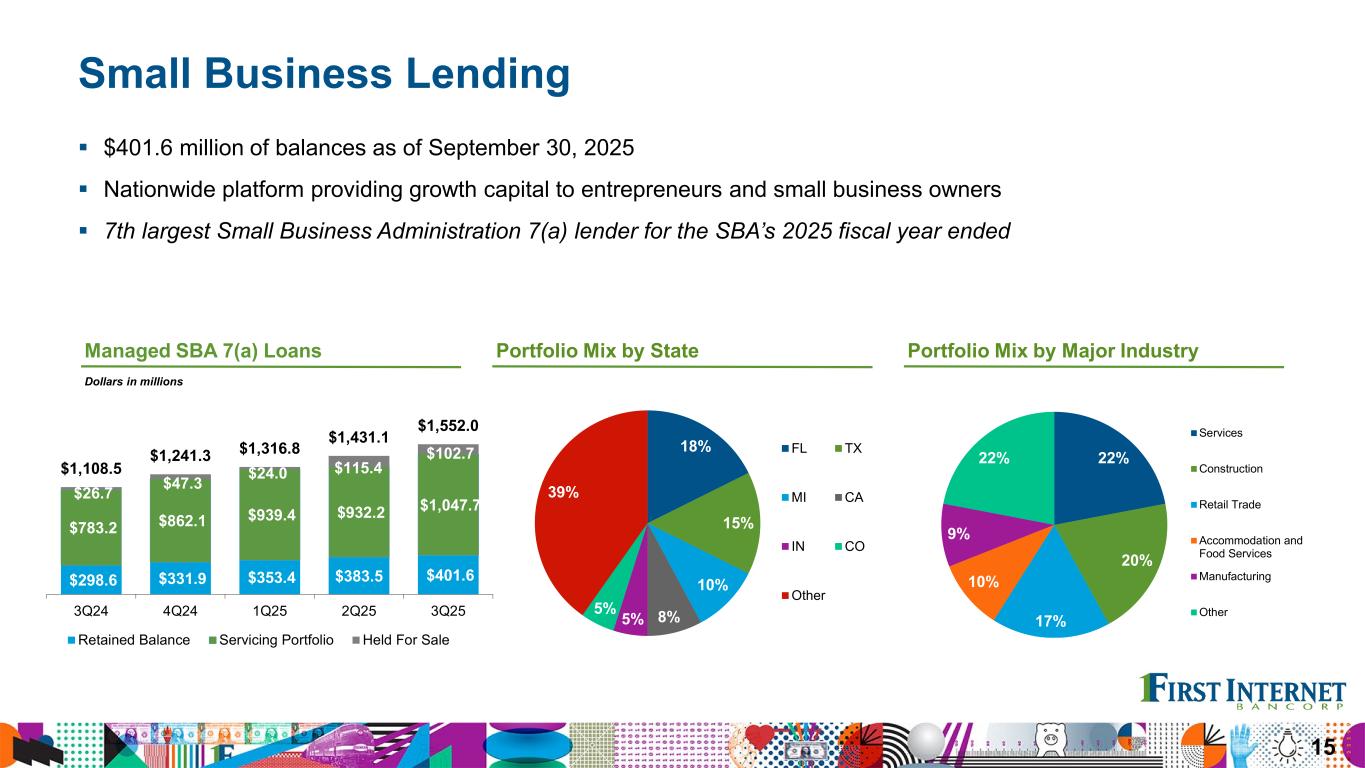

Small Business Lending $401.6 million of balances as of September 30, 2025 Nationwide platform providing growth capital to entrepreneurs and small business owners 7th largest Small Business Administration 7(a) lender for the SBA’s 2025 fiscal year ended 1315 Managed SBA 7(a) Loans Portfolio Mix by State Portfolio Mix by Major Industry 18% 15% 10% 8%5%5% 39% FL TX MI CA IN CO Other 22% 20% 17% 10% 9% 22% Services Construction Retail Trade Accommodation and Food Services Manufacturing Other $298.6 $331.9 $353.4 $383.5 $401.6 $783.2 $862.1 $939.4 $932.2 $1,047.7 $26.7 $47.3 $24.0 $115.4 $102.7 $1,108.5 $1,241.3 $1,316.8 $1,431.1 $1,552.0 3Q24 4Q24 1Q25 2Q25 3Q25 Retained Balance Servicing Portfolio Held For Sale Dollars in millions

Construction and Investor Commercial Real Estate $944.5 million of combined balances as of September 30, 2025 Average current loan balance of $16.5 million for investor CRE Average commitment sizes for construction – Commercial construction/development: $20.8 million – Residential construction/development: $1.8 million 16 Portfolio by Loan Type Portfolio Mix by State Portfolio Mix by Major Industry 3Q25 unfunded commitment balances – Commercial construction/development: $352.5 million – Residential construction/development: $49.4 million Minimal office exposure; 1.5% of combined balances consisting of suburban and medical office space 68% 29% 3% Investor Commercial Real Estate Commercial Construction/ Development Residential Construction/ Development 48% 22% 16% 4% 10% Multifamily/Mixed Use Industrial Warehouse Hospitality Residential Land Development Other 45% 16% 8% 6% 6% 19% IN AZ CA FL SC Other

Single Tenant Lease Financing $135.0 million of balances as of September 30, 2025 Long-term financing of single tenant properties occupied by historically strong national and regional tenants Weighted-average portfolio LTV of 49% Average loan size of $1.4 million 17 Portfolio Mix by Major Vertical Portfolio Mix by Major Tenant Portfolio Mix by Geography Strong historical credit performance No delinquencies in this portfolio Completed sale of $836.9 million of loans in 3Q25 – Expected to significantly improve net interest margin – Improves interest rate risk management – Accelerates optimization of interest-earning assets 21% 9% 18%22% 6% 4% 5% 15% Quick Service Restaurants Auto Parts/ Repair/Car Wash Full Service Restaurants Convenience/Fuel Pharmacies Dollar Stores Specialty Retailer Other 5% 5% 5% 4% 4% 4% 3% 3%67% Davita Burger King 7-Eleven Red Lobster Applebee's Walgreens Albertsons Caliber Collision Other 12% 19% 21% 39% 9%

2% 13% 11% 6% 16% 9% 7%1% 0% 35% AAA/Aaa AA+/Aa1 AA/Aa2 AA-/Aa3 A+/A1 A/A2 A-/A3 BBB+/Baa1 BBB/Baa2 Non-Rated 30% 12% 12% 11% 9% 6% 6% 4% 2% 1% 7% General Obligation Lease rental revenue Essential use equipment loans Short term cash flow financing (BAN) Water & sewer revenue Private Higher Education Tax Incremental Financing (TIF) districts Public higher education facilities Income Tax supported loans Municipally owned healthcare facilities Other 66%6% 4% 4% 4% 3% 3% 3% 7% IN OK IA MO OH MI GA WA Other Public Finance $480.1 million of balances as of September 30, 2025 Provides a range of credit solutions for government and not-for-profit entities Borrowers’ needs include short-term financing, debt refinancing, infrastructure improvements, economic development and equipment financing 18 No delinquencies or losses since inception Portfolio Mix by Repayment Source Borrower Mix by Credit Rating Portfolio Mix by State

C&I and Owner-Occupied Commercial Real Estate $256.3 million of combined balances as of September 30, 2025 Current C&I LOC utilization of 56% Average loan sizes C&I: $699,000 Owner-occupied CRE: $894,000 19 Portfolio by Loan Type Portfolio Mix by State Portfolio Mix by Major Industry 19 53% 27% 20% C&I - Term Loans C&I - Lines of Credit Owner Occupied CRE 28% 18% 11% 8% 4% 31% IN CA AZ IL FL Other Minimal office exposure; 0.4% of combined loan balances consisting of suburban office space 26% 14% 9%9% 8% 34% Wealth Advisory Services Equipment Finance Manufacturing Construction Other

Franchise Finance $450.3 million of balances as of September 30, 2025 Focused on providing growth financing to franchisees in a variety of industry segments Diversified by industry, geography and brand Average loan size of $723,000 20 Portfolio Mix by Borrower Use Portfolio Mix by State Portfolio Mix by Brand 132 10% 7% 7% 6% 5% 5% 60% Urban Air Adventure Park Scooter's Coffee My Salon Suite Goldfish Swim School Restore Hyper Wellness Jersey Mike's Other 20% 16% 15%13% 10% 6% 20% Limited-Service Restaurants Indoor Recreation Beauty Salons Snacks and Nonalcoholic Beverages Fitness and Recreational Sports Centers Other Personal Care Services Other 14% 12% 6% 5% 4% 4%3% 52% TX CA FL GA MI PA KY Other

Healthcare Finance $150.5 million of balances as of September 30, 2025 Average loan size of $361,000 Borrower’s needs include practice finance or acquisition, acquiring or refinancing owner-occupied commercial real estate, equipment purchases and project loans Strong historical credit performance to date 21 Portfolio Mix by Borrower Use Portfolio Mix by Borrower Portfolio Mix by State 21 87% 10% 3% Dentists Veterinarians Other 31% 11% 5%5%4%4% 4% 36% CA TX FL NY AZ WA IL Other 74% 21% 5% Practice Refi or Acquisition Owner Occupied CRE Project

Residential Mortgage $365.1 million of balances as of September 30, 2025 (includes home equity balances) Historically direct-to-consumer originations centrally located at corporate headquarters Focused on high quality borrowers – Average loan size of $197,000 – Average credit score at origination of 742 – Average LTV at origination of 80% Strong historical credit performance 22 Concentration by State Concentration by Loan TypeNational Portfolio with Midwest Concentration 15% 2% 74% 4% 5% 22 73% 12% 2% 2% 1% 10% IN CA NY FL TX All other states 94% 4%1% 1% Single Family Residential Home Equity – LOC Home Equity – Closed End SFR Construction to Permanent

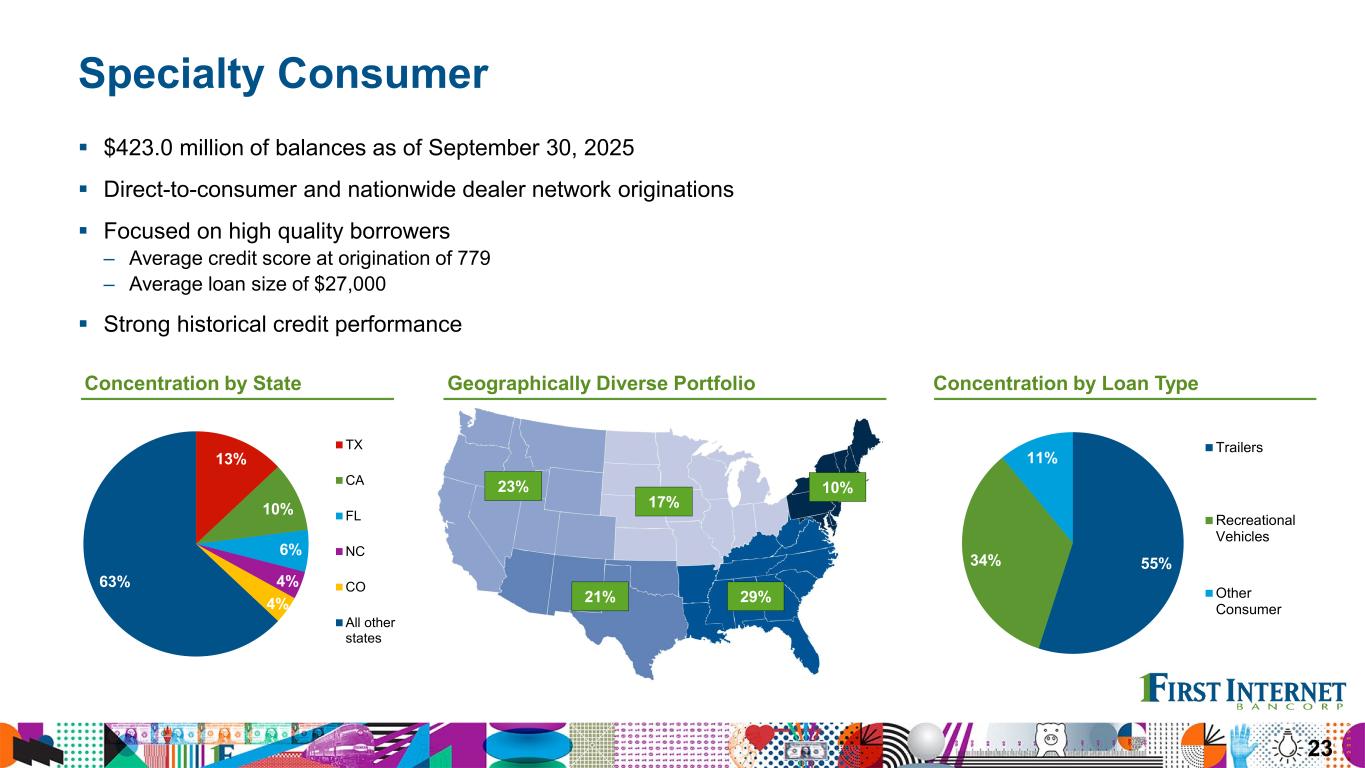

23% 21% 17% 29% 10% Specialty Consumer $423.0 million of balances as of September 30, 2025 Direct-to-consumer and nationwide dealer network originations Focused on high quality borrowers – Average credit score at origination of 779 – Average loan size of $27,000 Strong historical credit performance Concentration by State Concentration by Loan TypeGeographically Diverse Portfolio 231 13% 10% 6% 4% 4% 63% TX CA FL NC CO All other states 55%34% 11% Trailers Recreational Vehicles Other Consumer

24 Appendix

Loan Portfolio Composition 25 1 Includes carrying value adjustments of $20.2 million, $21.2 million, $22.1 million, $22.9 million, $27.8 million and $32.5 million associated with public finance loans as of September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024, December 31, 2023 and December 31, 2022, respectively. Dollars in thousands 2022 2023 2024 1Q25 2Q25 3Q25 Commercial loans Commercial and industrial 126,108$ 129,349$ 120,175$ 140,239$ 174,475$ 206,301$ Owner-occupied commercial real estate 61,836 57,286 53,591 49,954 50,096 50,046 Investor commercial real estate 93,121 132,077 269,431 297,874 513,411 644,184 Construction 181,966 261,750 413,523 471,082 332,658 300,291 Single tenant lease financing 939,240 936,616 949,748 950,814 970,042 135,025 Public finance 621,032 521,764 485,867 482,558 476,339 480,119 Healthcare finance 272,461 222,793 181,427 171,430 160,073 150,522 Small business lending 123,750 218,506 331,914 353,408 383,455 401,628 Franchise finance 299,835 525,783 536,909 514,700 479,757 450,340 Total commercial loans 2,719,349 3,005,924 3,342,585 3,432,059 3,540,306 2,818,456 Consumer loans Residential mortgage 383,948 395,648 375,160 367,722 358,922 349,275 Home equity 24,712 23,669 18,274 17,421 16,668 15,806 Trailers 167,326 188,763 210,575 220,012 228,786 232,006 Recreational vehicles 121,808 145,558 149,342 145,690 144,476 142,245 Other consumer loans 35,464 43,293 48,030 46,851 48,319 48,753 Total consumer loans 733,258 796,931 801,381 797,696 797,171 788,085 Net def. loan fees, prem., disc. and other 1 46,794 37,365 26,680 24,657 25,085 23,844 Total loans 3,499,401$ 3,840,220$ 4,170,646$ 4,254,412$ 4,362,562$ 3,630,385$

Reconciliation of Non-GAAP Financial Measures 26 Dollars in thousands, except for per share data 2019 2020 2021 2022 2023 2024 3Q25 Total equity - GAAP $304,913 $330,944 $380,338 $364,974 $362,795 $384,063 $352,168 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $300,226 $326,257 $375,651 $360,287 $358,108 $379,376 $347,481 Common shares outstanding 9,741,800 9,800,569 9,754,455 9,065,883 8,644,451 8,667,894 8,713,094 Book value per common share $31.30 $33.77 $38.99 $40.26 $41.97 $44.31 $40.42 Effect of goodwill (0.48) (0.48) (0.48) (0.52) (0.54) (0.54) (0.54) Tangible book value per common share $30.82 $33.29 $38.51 $39.74 $41.43 $43.77 $39.88

Reconciliation of Non-GAAP Financial Measures 27 1 Assuming a 21% tax rate Dollars in thousands, except for per share data 3Q24 4Q24 1Q25 2Q25 3Q25 Total equity - GAAP $385,129 $384,063 $387,747 $390,239 $352,168 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $380,442 $379,376 $383,060 $385,552 $347,481 Total assets - GAAP $5,823,259 $5,737,859 $5,851,608 $6,072,573 $5,639,174 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) Tangible assets $5,818,572 $5,733,172 $5,846,921 $6,067,886 $5,634,487 Common shares outstanding 8,667,894 8,667,894 8,697,085 8,713,094 8,713,094 Book value per common share $44.43 $44.31 $44.58 $44.79 $40.42 Effect of goodwill (0.54) (0.54) (0.54) (0.54) (0.54) Tangible book value per common share $43.89 $43.77 $44.04 $44.25 $39.88 Total shareholders' equity to assets 6.61% 6.69% 6.63% 6.43% 6.25% Effect of goodwill (0.07%) (0.07%) (0.08%) (0.08%) (0.08%) Tangible common equity to tangible assets 6.54% 6.62% 6.55% 6.35% 6.17% Total interest income $74,990 $77,771 $76,829 $80,886 $84,388 Adjustments: Fully-taxable equivalent adjustments 1 1,133 1,152 1,169 1,157 1,158 Total interest income - FTE $76,123 $78,923 $77,998 $82,043 $85,546 Net interest income $21,765 $23,551 $25,096 $27,990 $30,352 Adjustments: Fully-taxable equivalent adjustments 1 1,133 1,152 1,169 1,157 1,158 Net interest income - FTE $22,898 $24,703 $26,265 $29,147 $31,510 Net interest margin 1.62% 1.67% 1.82% 1.96% 2.04% Adjustments: Effect of fully-taxable equivalent adjustments 1 0.08% 0.08% 0.09% 0.08% 0.08% Net interest margin - FTE 1.70% 1.75% 1.91% 2.04% 2.12%

Reconciliation of Non-GAAP Financial Measures 28 1 Assuming a 21% tax rate Dollars in thousands, except for per share data 3Q24 4Q24 1Q25 2Q25 3Q25 Total revenue - GAAP $33,794 $39,487 $35,523 $33,547 $5,705 Adjustments: Loss on sale of loans - - - - 37,823 Gain on prepayment of FHLB advance - (1,829) - - - Gain on termination of swaps - (2,904) - - - Adjusted revenue $33,794 $34,754 $35,523 $33,547 $43,528 Net income - GAAP 6,990$ 7,330$ 943$ 193$ (41,593)$ Adjustments:1 Provision for credit losses 3,390 7,201 11,933 13,608 34,789 Income tax (benefit) provision 620 999 (909) (2,054) (12,950) Pre-tax, pre-provision (loss) income $11,000 $15,530 $11,967 $11,747 (19,754)$ Pre-tax, pre-provision income 11,000$ 15,530$ 11,967$ 11,747$ (19,754)$ Adjustments: Loss on sale of loans - - - - 37,823 Adjusted pre-tax, pre-provision income $11,000 $15,530 $11,967 $11,747 18,069$ Pre-tax, pre-provision (loss) income $11,000 $15,530 $11,967 $11,747 (19,754)$ Adjustments: Loss on sale of loans - - - - 37,823 Gain on prepayment of FHLB advances - (1,829) - - - Gain on termination of swaps - (2,904) - - - Adjusted pre-tax, pre-provision income $11,000 $10,797 $11,967 $11,747 18,069$ Noninterest (loss) income $12,029 $15,936 $10,427 $5,557 (24,647)$ Adjustments: Loss on sale of loans - - - - 37,823 Gain on prepayment of FHLB advance - (1,829) - - - Gain on termination of swaps - (2,904) - - - Adjusted noninterest income $12,029 $11,203 $10,427 $5,557 $13,176

Reconciliation of Non-GAAP Financial Measures 29 1 Assuming a 21% tax rate Dollars in thousands, except for per share data 3Q24 4Q24 1Q25 2Q25 3Q25 Income (loss) before income taxes - GAAP 7,610$ 8,329$ 34$ (1,861)$ (54,543)$ Adjustments: Loss on sale of loans - - - - 37,823 Gain on prepayment of FHLB advance - (1,829) - - - Gain on termination of swaps - (2,904) - - - Adjusted income (loss) before income taxes $7,610 $3,596 $34 ($1,861) ($16,720) Income tax provision (benefit) - GAAP 620$ 999$ (909)$ (2,054)$ (12,950)$ Adjustments:1 Loss on sale of loans - - - - 8,699 Gain on prepayment of FHLB advance - (384) - - - Gain on termination of swaps - (610) - - - Adjusted income tax provision (benefit) 620$ 5$ (909)$ (2,054)$ (4,251)$ Net income (loss) - GAAP 6,990$ 7,330$ 943$ 193$ (41,593)$ Adjustments: Loss on sale of loans - - - - 29,124 Gain on prepayment of FHLB advance - (1,445) - - - Gain on termination of swaps - (2,294) - - - Adjusted net income (loss) $6,990 $3,591 $943 $193 ($12,469)

Reconciliation of Non-GAAP Financial Measures 30 Dollars in thousands, except for per share data 3Q24 4Q24 1Q25 2Q25 3Q25 Diluted average common shares outstanding 8,768,731 8,788,793 8,784,970 8,760,374 8,742,052 Diluted earnings per share - GAAP 0.80$ 0.83$ 0.11$ 0.02$ (4.76)$ Adjustments: Effect of loss on sale of loans - - - - 3.33 Effect of gain on prepayment of FHLB advance - (0.16) - - - Effect of gain on termination of swaps - (0.26) - - - Adjusted diluted earnings per share $0.80 $0.41 $0.11 $0.02 (1.43)$ Return on average assets 0.50% 0.50% 0.07% 0.01% (2.71%) Effect of loss on sale of loans 0.00% 0.00% 0.00% 0.00% 1.90% Effect of gain on prepayment of FHLB advance 0.00% (0.10%) 0.00% 0.00% 0.00% Effect of gain on termination of swaps 0.00% (0.16%) 0.00% 0.00% 0.00% Adjusted return on average assets 0.50% 0.24% 0.07% 0.01% (0.81%) Return on average shareholders' equity 7.32% 7.49% 0.98% 0.20% (42.11%) Effect of loss on sale of loans 0.00% 0.00% 0.00% 0.00% 29.48% Effect of gain on prepayment of FHLB advance 0.00% (1.48%) 0.00% 0.00% 0.00% Effect of gain on termination of swaps 0.00% (2.34%) 0.00% 0.00% 0.00% Adjusted return on average shareholders' equity 7.32% 3.67% 0.98% 0.20% (12.63%) Return on average tangible common equity 7.41% 7.58% 0.99% 0.20% (42.62%) Effect of loss on sale of loans 0.00% 0.00% 0.00% 0.00% 29.84% Effect of gain on prepayment of FHLB advance 0.00% (1.49%) 0.00% 0.00% 0.00% Effect of gain on termination of swaps 0.00% (2.37%) 0.00% 0.00% 0.00% Adjusted return on average tangible common equity 7.41% 3.72% 0.99% 0.20% (12.78%)

Reconciliation of Non-GAAP Financial Measures 31 Dollars in thousands 3Q25 Tangible common equity $347,481 Adjustments: Accumulated other comprehensive loss 23,004 Adjusted tangible common equity $370,485 Tangible assets $5,634,487 Adjustments: Cash in excess of $300 million (487,661) Adjusted tangible assets $5,146,826 Adjusted tangible common equity $370,485 Adjusted tangible assets $5,146,826 Adjusted tangible common equity to adjusted tangible assets 7.20%