January 2026 FINANCIAL RESULTS FOURTH QUARTER 2025 Investor Presentation NASDAQ: INBK .2

2 Forward-Looking Statements & Non-GAAP Financial Measures This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the financial condition, results of operations, trends in lending policies and loan programs, plans and prospective business partnerships, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “believe,” “continue,” “could,” “decline,” “drive,” “enhance,” “estimate,” “expanding,” “expect,” “grow,” “growth,” “improve,” “increase,” “looking ahead,” “may,” “pending,” “plan,” “position,” “preliminary,” “remain,” “rising,” “should,” “slow,” “stable,” “strategy,” “well-positioned,” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward- looking statements. Such statements are subject to certain risks and uncertainties including: our business and operations and the business and operations of our vendors and customers; general economic conditions, whether national or regional, and conditions in the lending markets in which we participate may have an adverse effect on the demand for our loans and other products; our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that is the collateral for our loans. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial and industrial, construction and SBA loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; the impacts of inflation and rising interest rates on the general economy; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. This presentation contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible book value per common share, tangible common equity to tangible assets, total interest income – FTE, net interest income – FTE, net interest margin – FTE, adjusted revenue, pre-provision net revenue (loss), adjusted pre-provision net revenue, adjusted noninterest income, adjusted income (loss) before income taxes, adjusted income tax provision (benefit), adjusted net income (loss), adjusted diluted earnings per share, adjusted return on average assets, adjusted return on average shareholders’ equity, adjusted return on average tangible common equity, adjusted tangible common equity, adjusted tangible assets and adjusted tangible common equity to adjusted tangible assets are used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the table at the end of this presentation under the caption “Reconciliation of Non-GAAP Financial Measures.”

3 Our Founding Thesis • Founded in 1999, based on a revolutionary idea that challenged the entire banking industry - create America's first state-chartered, FDIC-insured institution to operate entirely online • 25+ Year Legacy: From kitchen table startup to industry transformer, maintaining the same entrepreneurial spirit that empowers customers to "bank on their own ideas" • Core Guiding Principles: ▪ Personal Connections: Despite being digital- first, we believe in the power of personal relationships built on trust and understanding ▪ Customer-Centric: Taking time to know each customer and provide tailored solutions for every financial need ▪ Innovation-Driven: Staying true to our roots as trailblazers who transformed an entire industry "Like most start-ups, our early days were challenging. But we built our success — and transformed the banking industry — by staying true to our roots as innovators and trailblazers. Today, we bring the same passion and creativity to every interaction you have with First Internet Bank — we want to empower you to bank on your own ideas.” CHAIRMAN AND CEO DAVID B. BECKER:

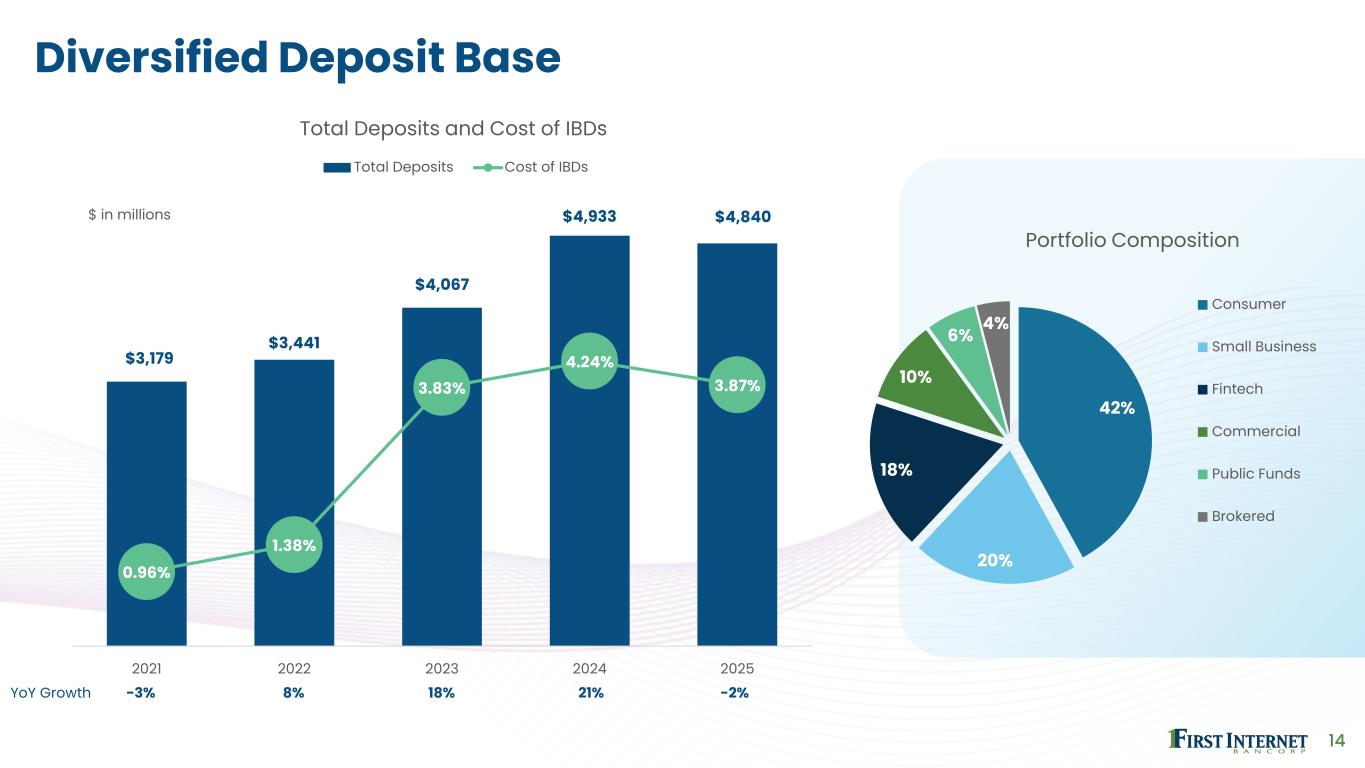

4 Strategic Update LENDING • Strong originations throughout 2025 in construction / investor CRE, C&I and small business lending • Strong commercial lending pipelines heading into 2026 set the stage for continued net interest income growth • Emerging verticals include growing and expanding wealth advisory lending, equipment finance and lending partnerships with fintechs • Secondary market sales from leading SBA platform propel noninterest income DEPOSITS • Commercial, small business and consumer deposit relationships sourced nationally • 4Q25 cost of interest-bearing deposits declined 45 bps vs 4Q24 • $1.5 billion in deposits indexed to Fed Funds rate • $859 million of CDs mature 1H26 with a WAC of 4.15%; current WAC of new CDs is 3.65% (-50 bp) • Small business checking product is a 3-time recipient of the Best in Biz award for its cash flow insights, payments through Zelle, and cash management capabilities – with no monthly fee BaaS / FINTECH • As a sponsor bank, we support deposit programs, payment processing, and lending programs • $1.9 billion in partnerships deposits drive strong liquidity and balance sheet flexibility • $165 billion in annual payments volume; accelerating quarterly • 2025 co-recipient of the award for Payments Innovation of the Year from American Banker for our work with Increase to deliver High- fidelity ACH – a solution bringing greater reliability and insight to high-volume ACH transactions

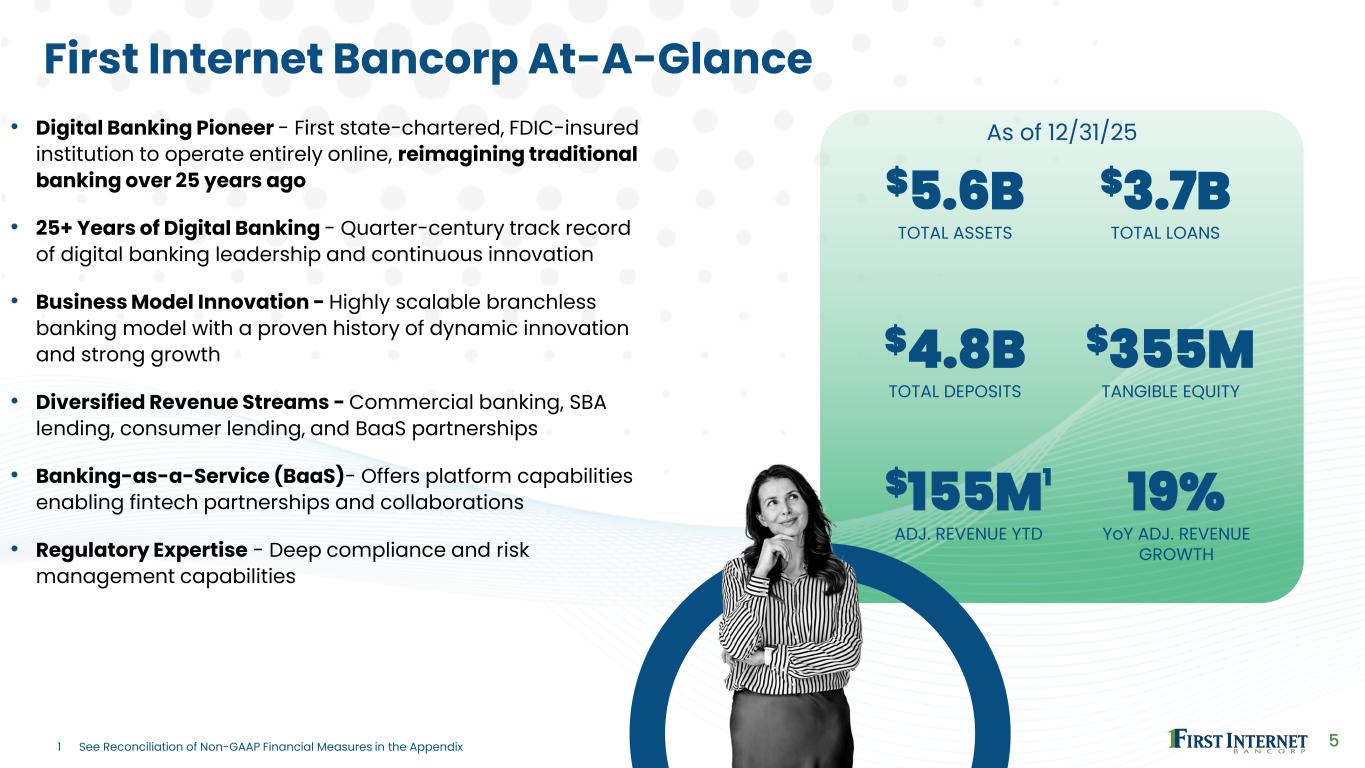

5 First Internet Bancorp At-A-Glance • Digital Banking Pioneer - First state-chartered, FDIC-insured institution to operate entirely online, reimagining traditional banking over 25 years ago • 25+ Years of Digital Banking - Quarter-century track record of digital banking leadership and continuous innovation • Business Model Innovation - Highly scalable branchless banking model with a proven history of dynamic innovation and strong growth • Diversified Revenue Streams - Commercial banking, SBA lending, consumer lending, and BaaS partnerships • Banking-as-a-Service (BaaS)- Offers platform capabilities enabling fintech partnerships and collaborations • Regulatory Expertise - Deep compliance and risk management capabilities $5.6B TOTAL ASSETS 19% YoY ADJ. REVENUE GROWTH $155M1 ADJ. REVENUE YTD $3.7B TOTAL LOANS $4.8B TOTAL DEPOSITS $355M TANGIBLE EQUITY As of 12/31/25 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix

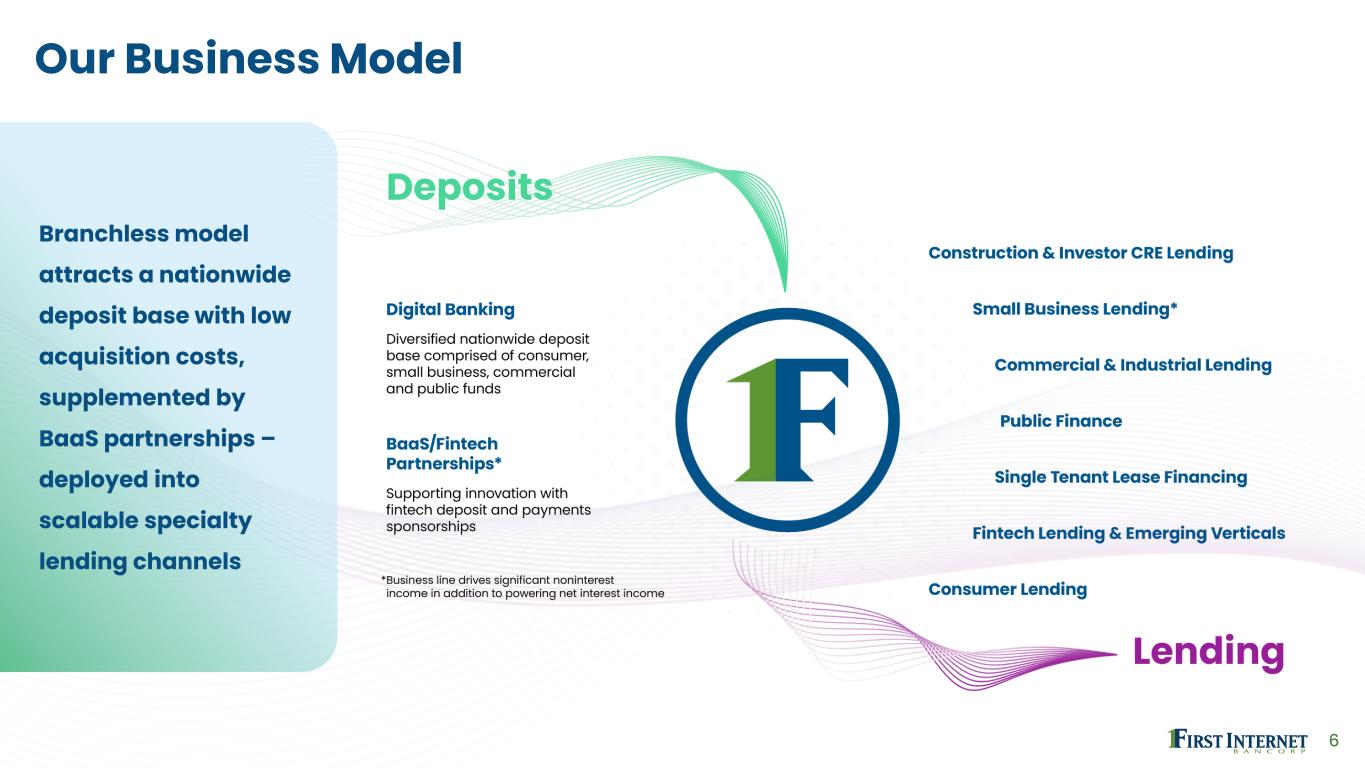

6 Our Business Model Branchless model attracts a nationwide deposit base with low acquisition costs, supplemented by BaaS partnerships – deployed into scalable specialty lending channels

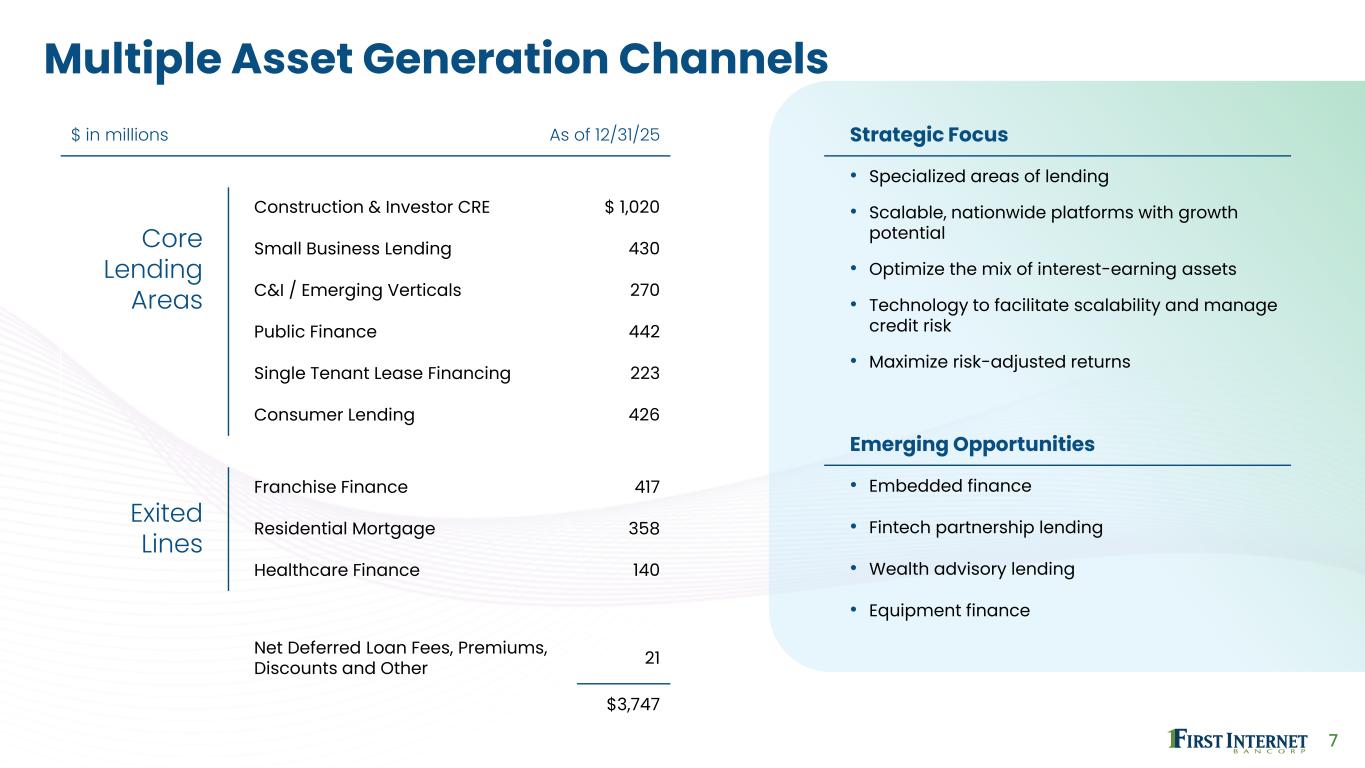

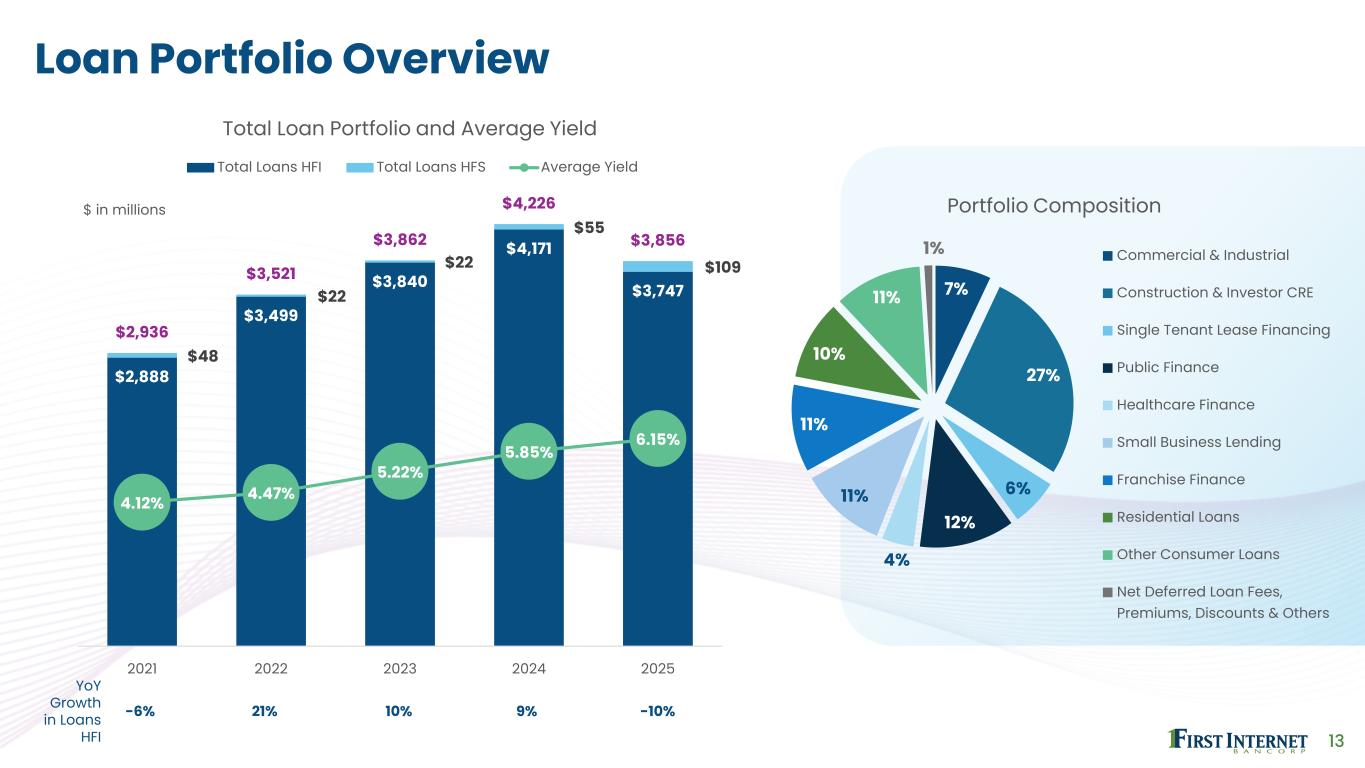

7 Multiple Asset Generation Channels $ in millions As of 12/31/25 Core Lending Areas Construction & Investor CRE $ 1,020 Small Business Lending 430 C&I / Emerging Verticals 270 Public Finance 442 Single Tenant Lease Financing 223 Consumer Lending 426 Exited Lines Franchise Finance 417 Residential Mortgage 358 Healthcare Finance 140 Net Deferred Loan Fees, Premiums, Discounts and Other 21 $3,747 Strategic Focus • Specialized areas of lending • Scalable, nationwide platforms with growth potential • Optimize the mix of interest-earning assets • Technology to facilitate scalability and manage credit risk • Maximize risk-adjusted returns Emerging Opportunities • Embedded finance • Fintech partnership lending • Wealth advisory lending • Equipment finance

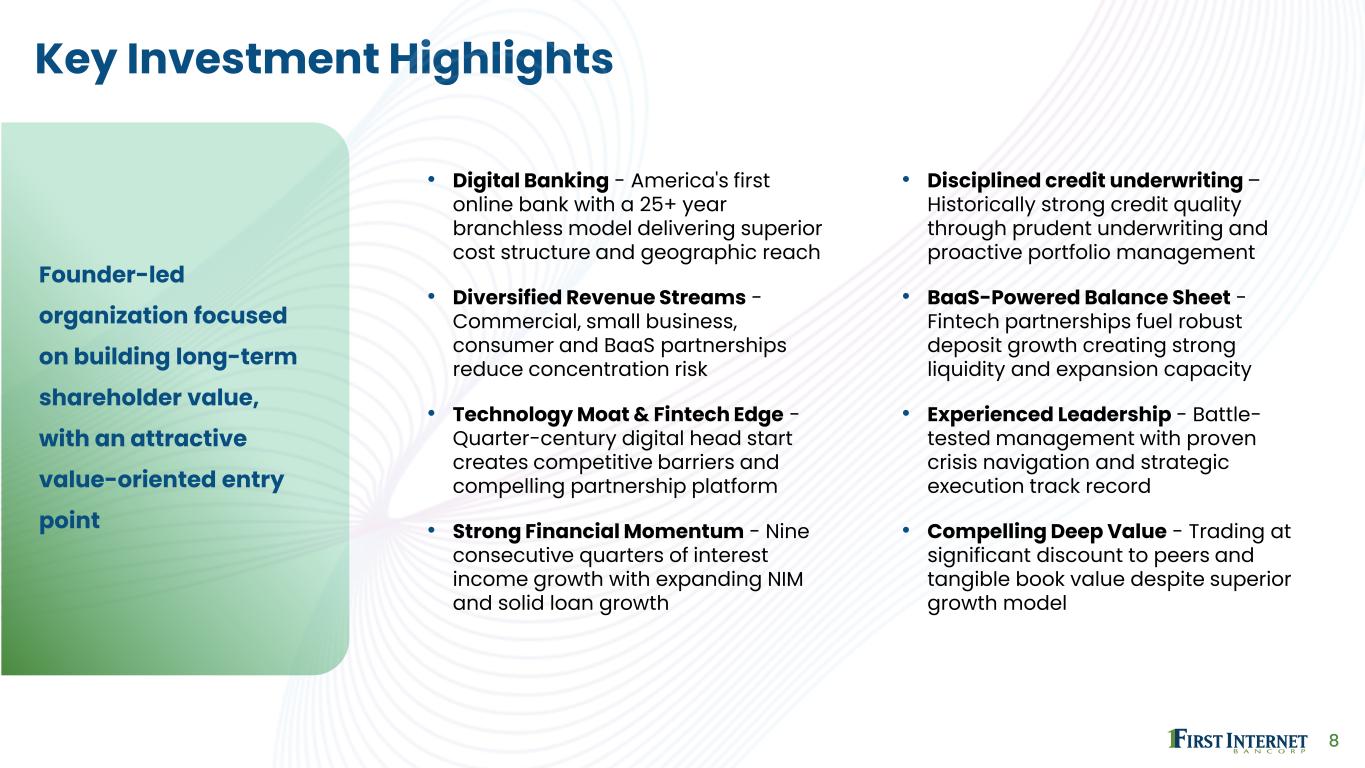

8 Key Investment Highlights • Digital Banking - America's first online bank with a 25+ year branchless model delivering superior cost structure and geographic reach • Diversified Revenue Streams - Commercial, small business, consumer and BaaS partnerships reduce concentration risk • Technology Moat & Fintech Edge - Quarter-century digital head start creates competitive barriers and compelling partnership platform • Strong Financial Momentum - Nine consecutive quarters of interest income growth with expanding NIM and solid loan growth • Disciplined credit underwriting – Historically strong credit quality through prudent underwriting and proactive portfolio management • BaaS-Powered Balance Sheet - Fintech partnerships fuel robust deposit growth creating strong liquidity and expansion capacity • Experienced Leadership - Battle- tested management with proven crisis navigation and strategic execution track record • Compelling Deep Value - Trading at significant discount to peers and tangible book value despite superior growth model Founder-led organization focused on building long-term shareholder value, with an attractive value-oriented entry point

9 Experienced Leadership • Founder of the first state-chartered, FDIC-insured bank to operate entirely online 25+ years ago • 40-year career in fintech/SaaS with 5 successful Inc. 500 company exits • Founding Board Chair of TechPoint and active in multiple Indiana economic development and education initiatives • Ernst & Young Entrepreneur of the Year (2001), Indiana Banking Excellence Award (2021), and Mickey Maurer Entrepreneur of the Year (2025) • Appointed president in July 2021 • 25 years with the Company in various leadership roles, including COO • Fintech background prior to joining INBK • Active on advisory boards for Indianapolis Neighborhood Housing Partnership and Hamilton County Community Foundation • Brings 30+ years of financial services experience • Banking Industry Veteran - Previously SVP of Investor Relations & Corporate Development at First Financial Bancorp (publicly traded bank holding company) • Former investment banker specializing in financial services sector • Began career at Price Waterhouse LLP DAVID B. BECKER Chairman and CEO NICOLE S. LORCH President, COO and Corporate Secretary KENNETH J. LOVIK EVP & CFO

Financial Review

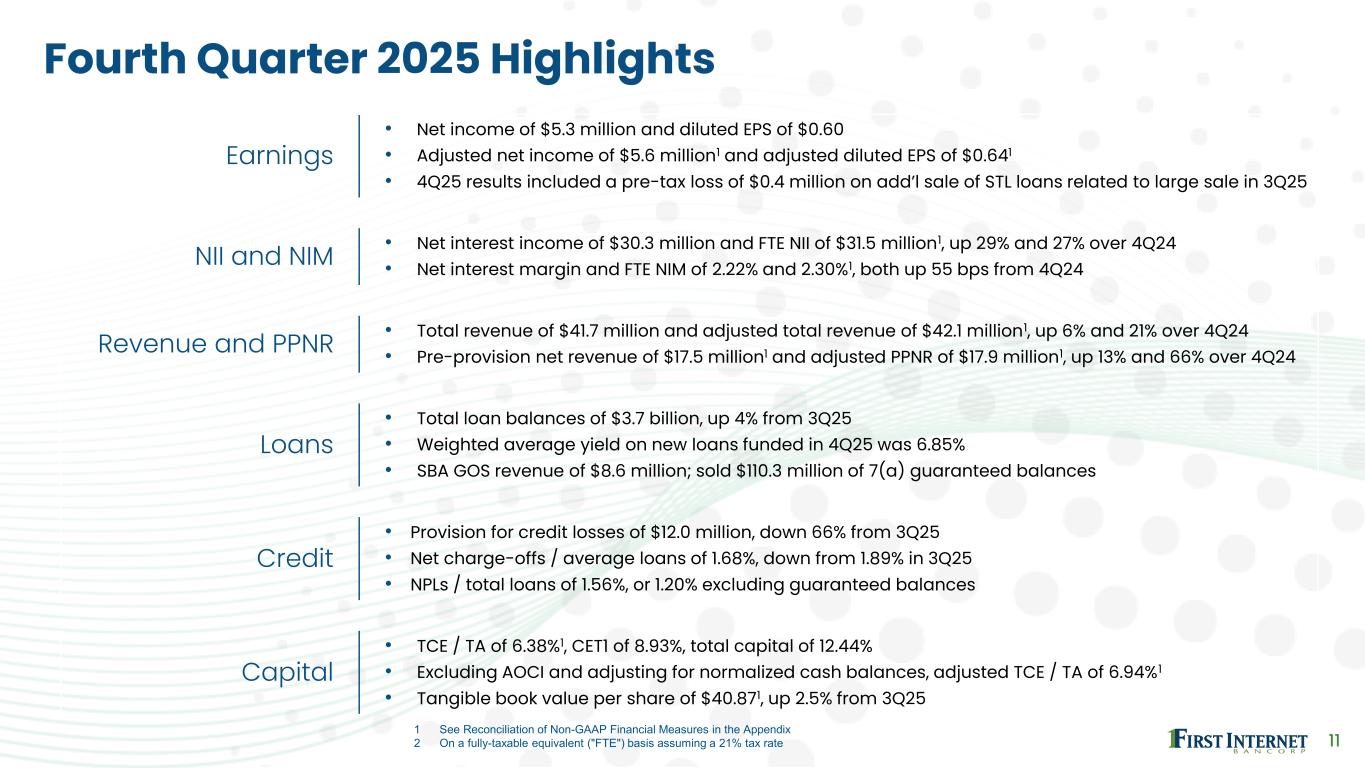

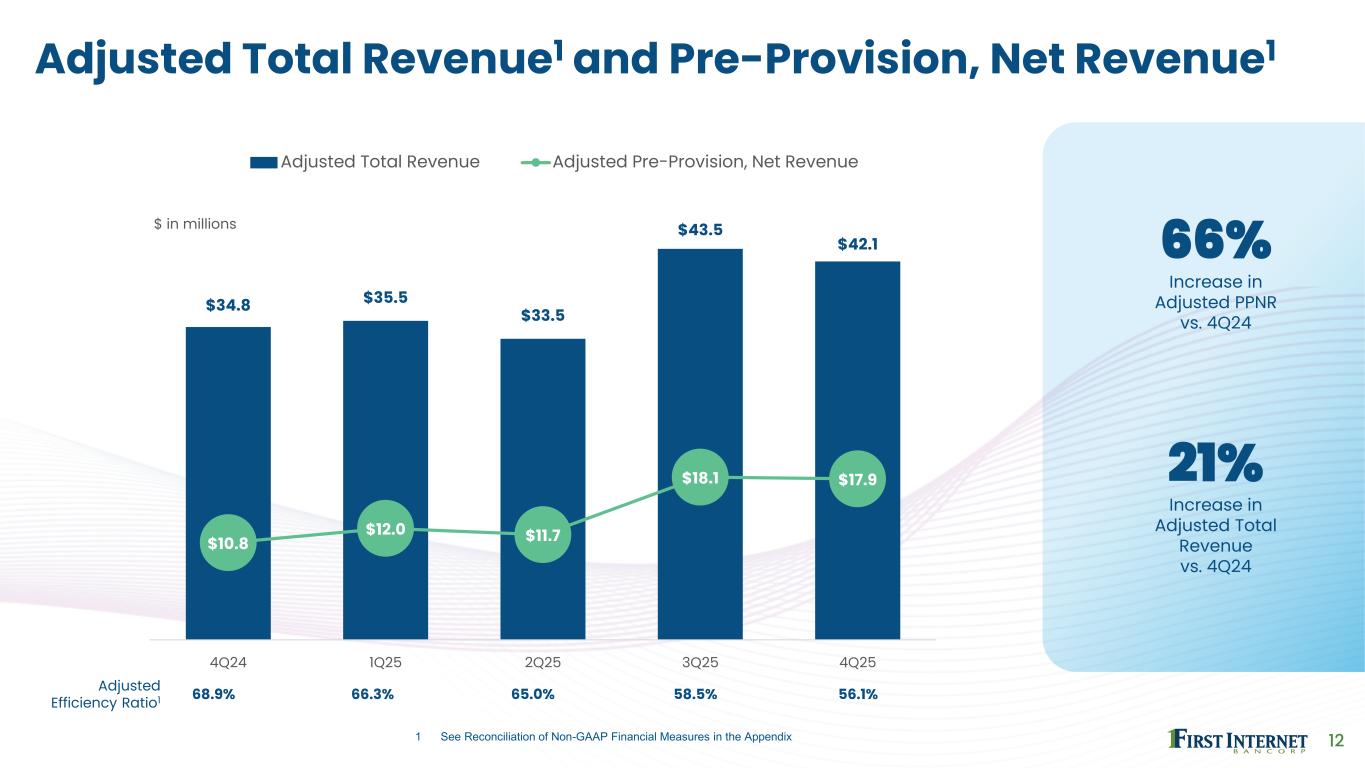

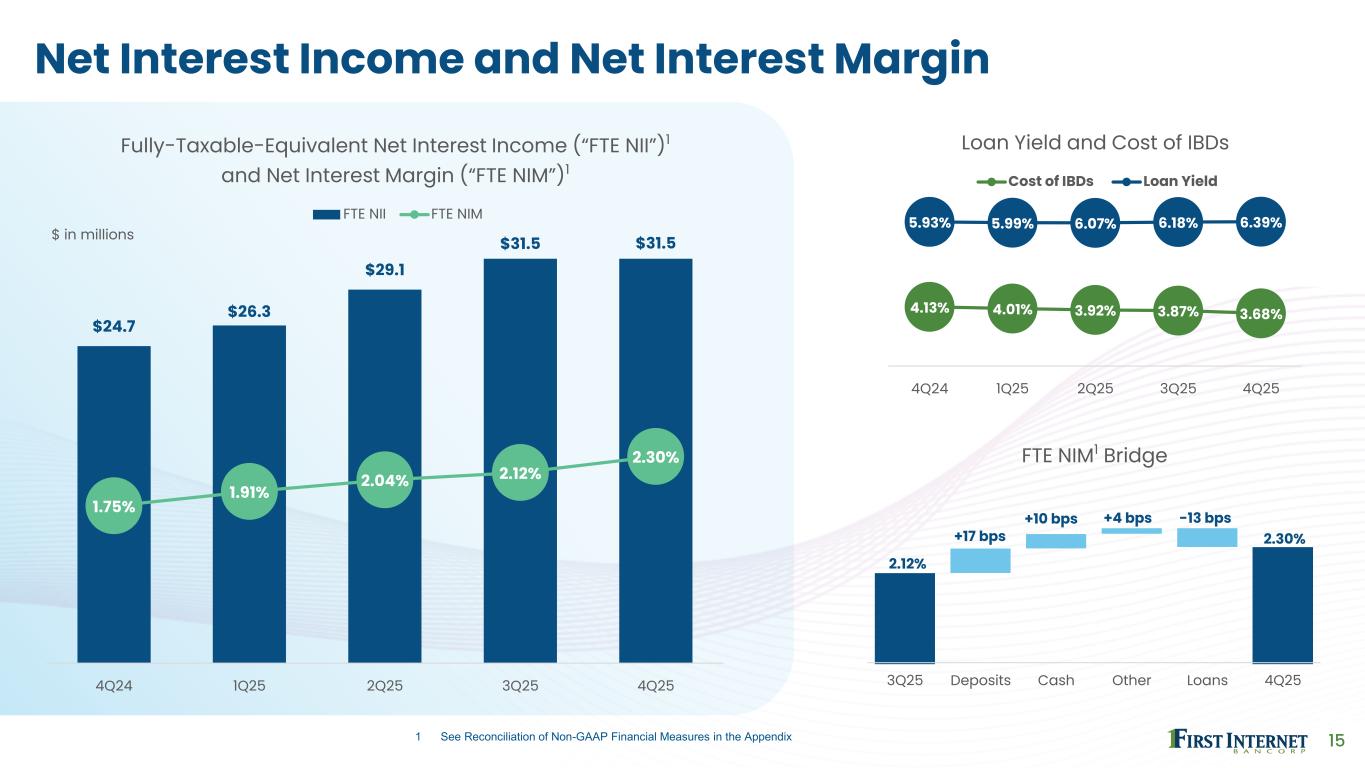

11 Fourth Quarter 2025 Highlights Earnings • Net income of $5.3 million and diluted EPS of $0.60 • Adjusted net income of $5.6 million1 and adjusted diluted EPS of $0.641 • 4Q25 results included a pre-tax loss of $0.4 million on add’l sale of STL loans related to large sale in 3Q25 NII and NIM • Net interest income of $30.3 million and FTE NII of $31.5 million1, up 29% and 27% over 4Q24 • Net interest margin and FTE NIM of 2.22% and 2.30%1, both up 55 bps from 4Q24 Revenue and PPNR • Total revenue of $41.7 million and adjusted total revenue of $42.1 million1, up 6% and 21% over 4Q24 • Pre-provision net revenue of $17.5 million1 and adjusted PPNR of $17.9 million1, up 13% and 66% over 4Q24 Loans • Total loan balances of $3.7 billion, up 4% from 3Q25 • Weighted average yield on new loans funded in 4Q25 was 6.85% • SBA GOS revenue of $8.6 million; sold $110.3 million of 7(a) guaranteed balances Credit • Provision for credit losses of $12.0 million, down 66% from 3Q25 • Net charge-offs / average loans of 1.68%, down from 1.89% in 3Q25 • NPLs / total loans of 1.56%, or 1.20% excluding guaranteed balances Capital • TCE / TA of 6.38%1, CET1 of 8.93%, total capital of 12.44% • Excluding AOCI and adjusting for normalized cash balances, adjusted TCE / TA of 6.94%1 • Tangible book value per share of $40.871, up 2.5% from 3Q25 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix 2 On a fully-taxable equivalent ("FTE") basis assuming a 21% tax rate

12 Adjusted Total Revenue1 and Pre-Provision, Net Revenue1 $34.8 $35.5 $33.5 $43.5 $42.1 $10.8 $12.0 $11.7 $18.1 $17.9 4Q24 1Q25 2Q25 3Q25 4Q25 Adjusted Total Revenue Adjusted Pre-Provision, Net Revenue Adjusted Efficiency Ratio1 68.9% 66.3% 65.0% 58.5% 56.1% 66% Increase in Adjusted PPNR vs. 4Q24 21% Increase in Adjusted Total Revenue vs. 4Q24 $ in millions 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix

13 Loan Portfolio Overview $2,888 $3,499 $3,840 $4,171 $3,747 $48 $22 $22 $55 $109 $2,936 $3,521 $3,862 $4,226 $3,856 4.12% 4.47% 5.22% 5.85% 6.15% 2021 2022 2023 2024 2025 Total Loan Portfolio and Average Yield Total Loans HFI Total Loans HFS Average Yield 7% 27% 6% 12% 4% 11% 11% 10% 11% 1% Portfolio Composition Commercial & Industrial Construction & Investor CRE Single Tenant Lease Financing Public Finance Healthcare Finance Small Business Lending Franchise Finance Residential Loans Other Consumer Loans Net Deferred Loan Fees, Premiums, Discounts & Others YoY Growth in Loans HFI -6% 21% 10% 9% -10% $ in millions

14 Diversified Deposit Base YoY Growth -3% 8% 18% 21% -2% $3,179 $3,441 $4,067 $4,933 $4,840 0.96% 1.38% 3.83% 4.24% 3.87% 2021 2022 2023 2024 2025 Total Deposits and Cost of IBDs Total Deposits Cost of IBDs 42% 20% 18% 10% 6% 4% Portfolio Composition Consumer Small Business Fintech Commercial Public Funds Brokered $ in millions

15 $24.7 $26.3 $29.1 $31.5 $31.5 1.75% 1.91% 2.04% 2.12% 2.30% 4Q24 1Q25 2Q25 3Q25 4Q25 Fully-Taxable-Equivalent Net Interest Income (“FTE NII”)1 and Net Interest Margin (“FTE NIM”)1 FTE NII FTE NIM 4.13% 4.01% 3.92% 3.87% 3.68% 5.93% 5.99% 6.07% 6.18% 6.39% 4Q24 1Q25 2Q25 3Q25 4Q25 Loan Yield and Cost of IBDs Cost of IBDs Loan Yield 3Q25 Deposits Cash Other Loans 4Q25 Net Interest Income and Net Interest Margin 2.12% +10 bps +4 bps -13 bps 2.30%+17 bps FTE NIM1 Bridge $ in millions 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix

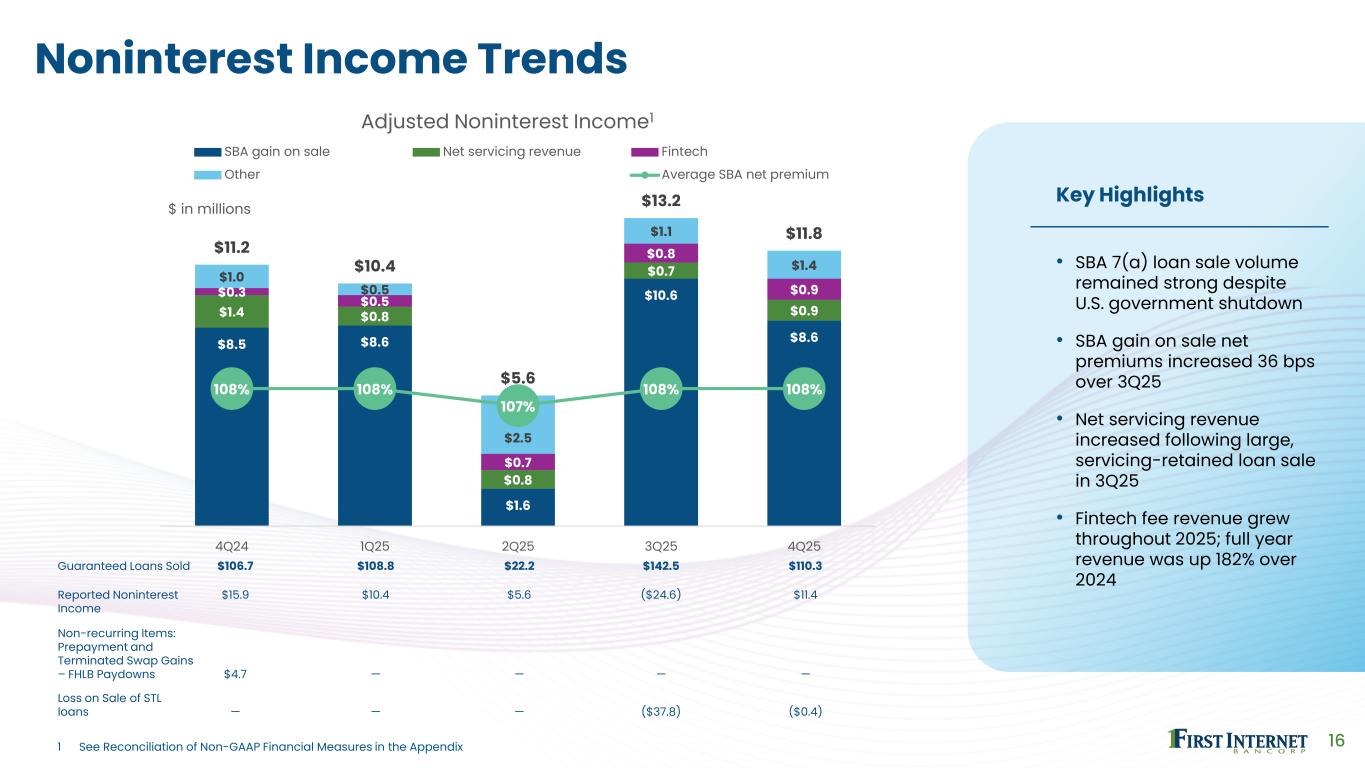

16 Noninterest Income Trends Guaranteed Loans Sold $106.7 $108.8 $22.2 $142.5 $110.3 Reported Noninterest Income $15.9 $10.4 $5.6 ($24.6) $11.4 Non-recurring Items: Prepayment and Terminated Swap Gains – FHLB Paydowns $4.7 — — — — Loss on Sale of STL loans — — — ($37.8) ($0.4) Key Highlights • SBA 7(a) loan sale volume remained strong despite U.S. government shutdown • SBA gain on sale net premiums increased 36 bps over 3Q25 • Net servicing revenue increased following large, servicing-retained loan sale in 3Q25 • Fintech fee revenue grew throughout 2025; full year revenue was up 182% over 2024 $8.5 $8.6 $1.6 $10.6 $8.6 $1.4 $0.8 $0.8 $0.7 $0.9 $0.3 $0.5 $0.7 $0.8 $0.9 $1.0 $0.5 $2.5 $1.1 $1.4 $11.2 $10.4 $5.6 $13.2 $11.8 108% 108% 107% 108% 108% 4Q24 1Q25 2Q25 3Q25 4Q25 Adjusted Noninterest Income1 SBA gain on sale Net servicing revenue Fintech Other Average SBA net premium 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix $ in millions

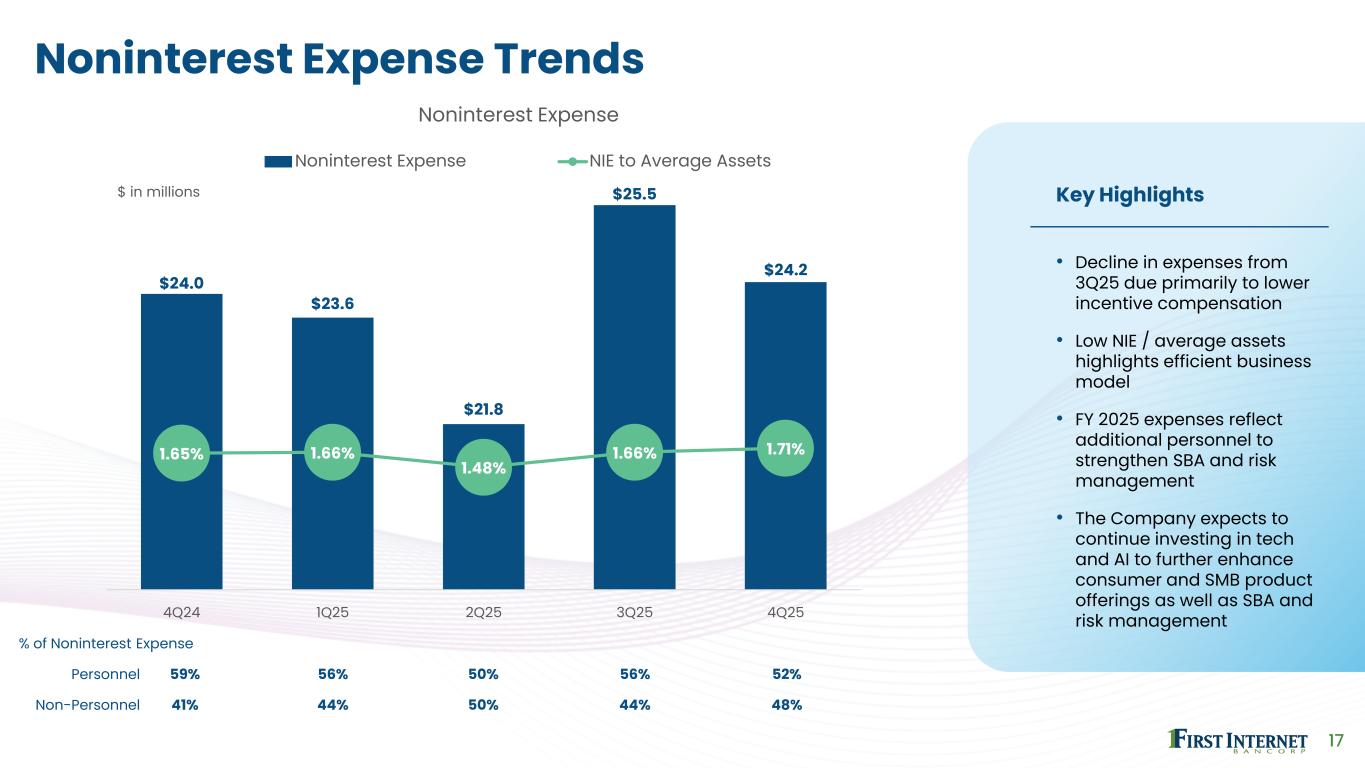

17 Noninterest Expense Trends $24.0 $23.6 $21.8 $25.5 $24.2 1.65% 1.66% 1.48% 1.66% 1.71% 4Q24 1Q25 2Q25 3Q25 4Q25 Noninterest Expense Noninterest Expense NIE to Average Assets % of Noninterest Expense Personnel 59% 56% 50% 56% 52% Non-Personnel 41% 44% 50% 44% 48% $ in millions Key Highlights • Decline in expenses from 3Q25 due primarily to lower incentive compensation • Low NIE / average assets highlights efficient business model • FY 2025 expenses reflect additional personnel to strengthen SBA and risk management • The Company expects to continue investing in tech and AI to further enhance consumer and SMB product offerings as well as SBA and risk management

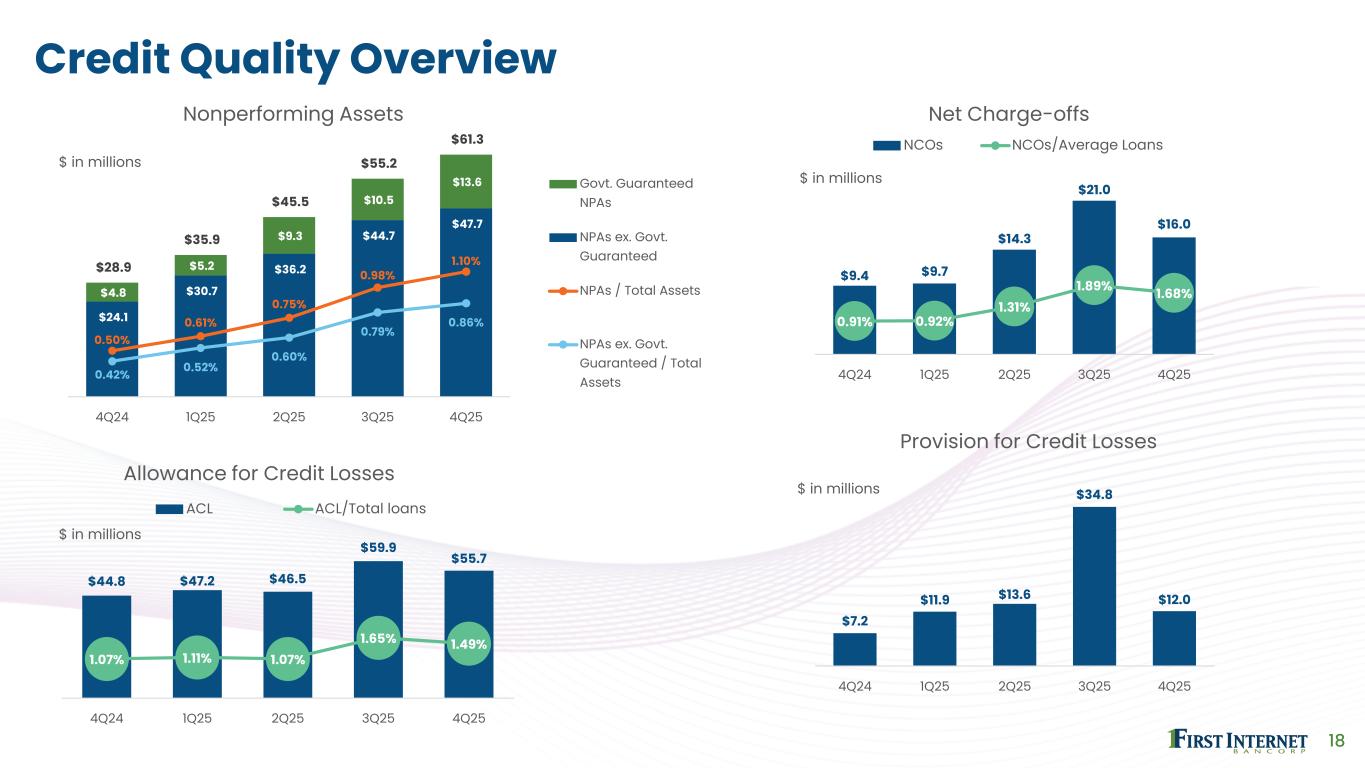

18 Credit Quality Overview $44.8 $47.2 $46.5 $59.9 $55.7 1.07% 1.11% 1.07% 1.65% 1.49% 4Q24 1Q25 2Q25 3Q25 4Q25 Allowance for Credit Losses ACL ACL/Total loans $ in millions $9.4 $9.7 $14.3 $21.0 $16.0 0.91% 0.92% 1.31% 1.89% 1.68% 4Q24 1Q25 2Q25 3Q25 4Q25 Net Charge-offs NCOs NCOs/Average Loans $ in millions $7.2 $11.9 $13.6 $34.8 $12.0 4Q24 1Q25 2Q25 3Q25 4Q25 Provision for Credit Losses $ in millions $24.1 $30.7 $36.2 $44.7 $47.7 $4.8 $5.2 $9.3 $10.5 $13.6 $28.9 $35.9 $45.5 $55.2 $61.3 0.50% 0.61% 0.75% 0.98% 1.10% 0.42% 0.52% 0.60% 0.79% 0.86% 4Q24 1Q25 2Q25 3Q25 4Q25 Nonperforming Assets Govt. Guaranteed NPAs NPAs ex. Govt. Guaranteed NPAs / Total Assets NPAs ex. Govt. Guaranteed / Total Assets $ in millions

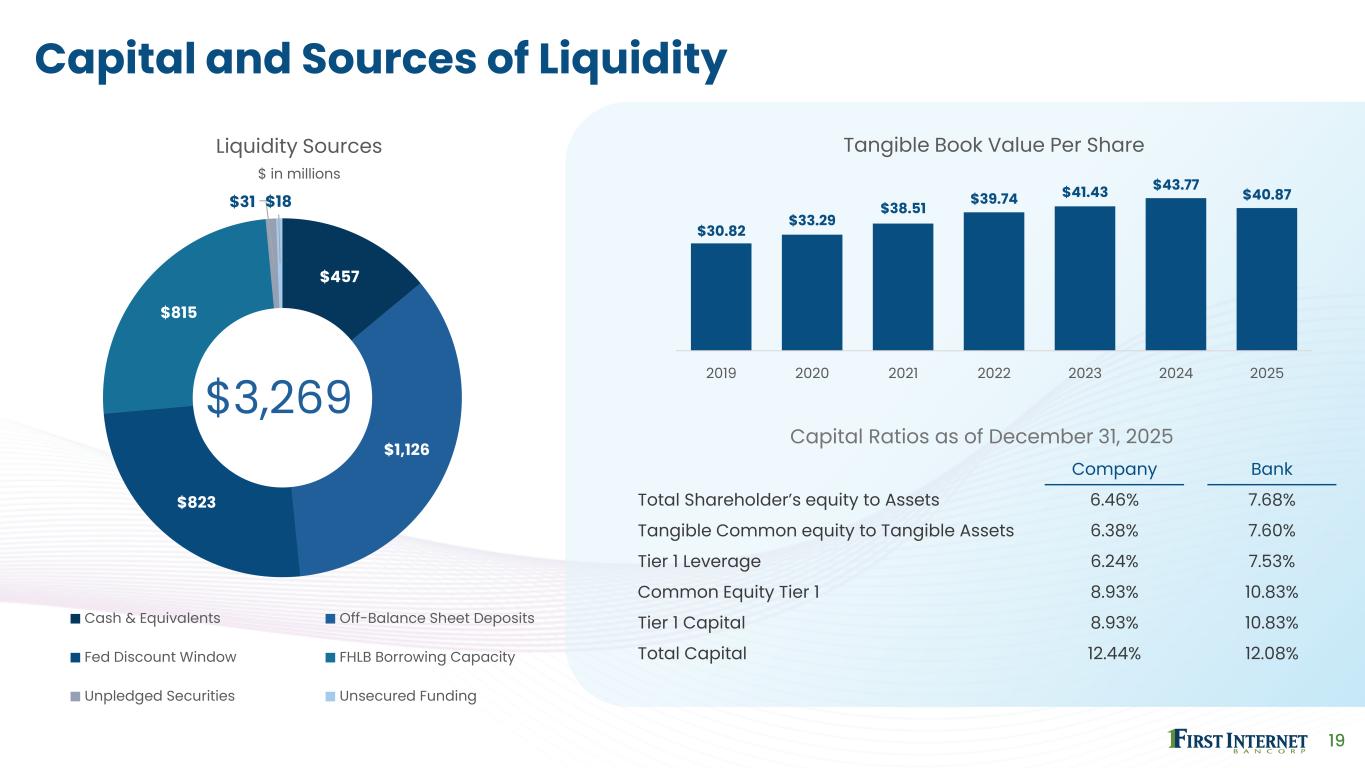

19 Capital and Sources of Liquidity $457 $1,126 $823 $815 $31 $18 Liquidity Sources $ in millions Cash & Equivalents Off-Balance Sheet Deposits Fed Discount Window FHLB Borrowing Capacity Unpledged Securities Unsecured Funding $30.82 $33.29 $38.51 $39.74 $41.43 $43.77 $40.87 2019 2020 2021 2022 2023 2024 2025 Tangible Book Value Per Share Capital Ratios as of December 31, 2025 Company Bank Total Shareholder’s equity to Assets 6.46% 7.68% Tangible Common equity to Tangible Assets 6.38% 7.60% Tier 1 Leverage 6.24% 7.53% Common Equity Tier 1 8.93% 10.83% Tier 1 Capital 8.93% 10.83% Total Capital 12.44% 12.08% $3,269

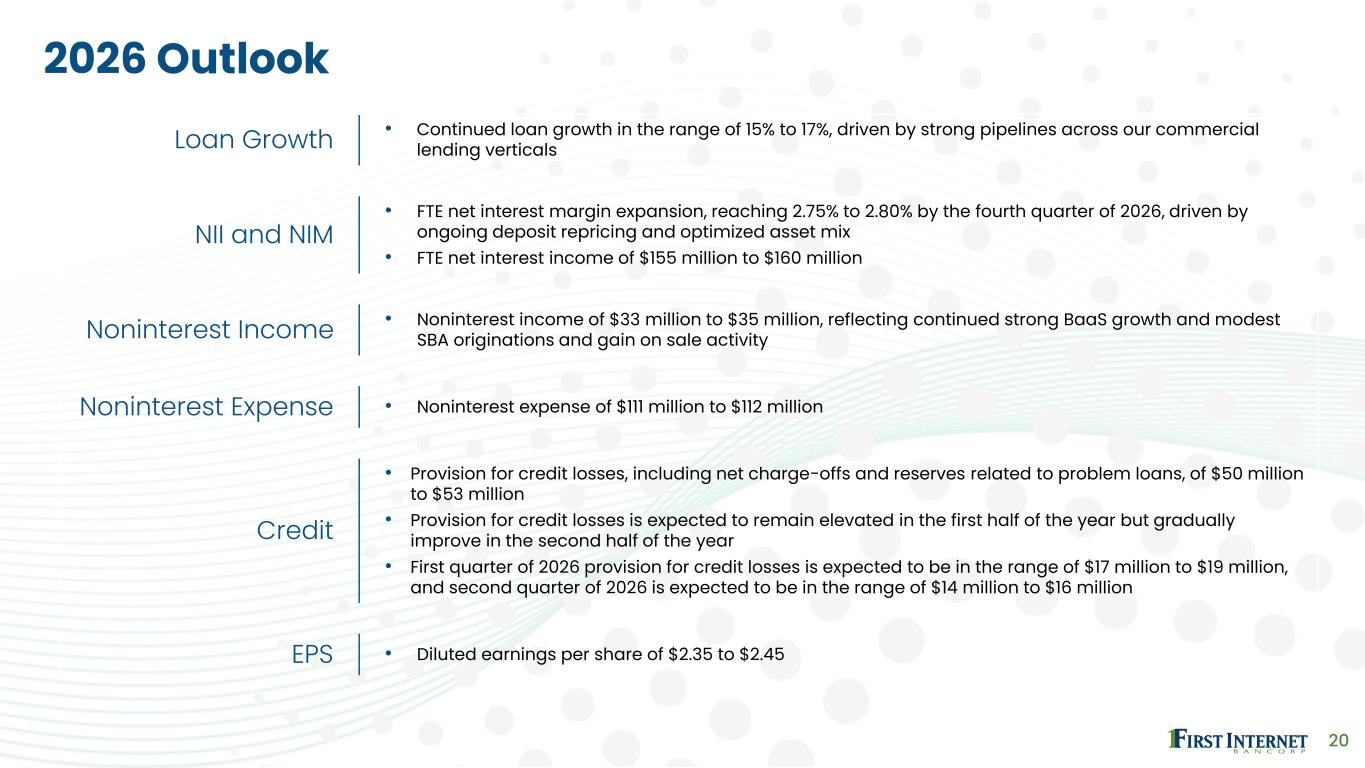

20 2026 Outlook Loan Growth • Continued loan growth in the range of 15% to 17%, driven by strong pipelines across our commercial lending verticals NII and NIM • FTE net interest margin expansion, reaching 2.75% to 2.80% by the fourth quarter of 2026, driven by ongoing deposit repricing and optimized asset mix • FTE net interest income of $155 million to $160 million Noninterest Income • Noninterest income of $33 million to $35 million, reflecting continued strong BaaS growth and modest SBA originations and gain on sale activity Noninterest Expense • Noninterest expense of $111 million to $112 million Credit • Provision for credit losses, including net charge-offs and reserves related to problem loans, of $50 million to $53 million • Provision for credit losses is expected to remain elevated in the first half of the year but gradually improve in the second half of the year • First quarter of 2026 provision for credit losses is expected to be in the range of $17 million to $19 million, and second quarter of 2026 is expected to be in the range of $14 million to $16 million EPS • Diluted earnings per share of $2.35 to $2.45

Appendix

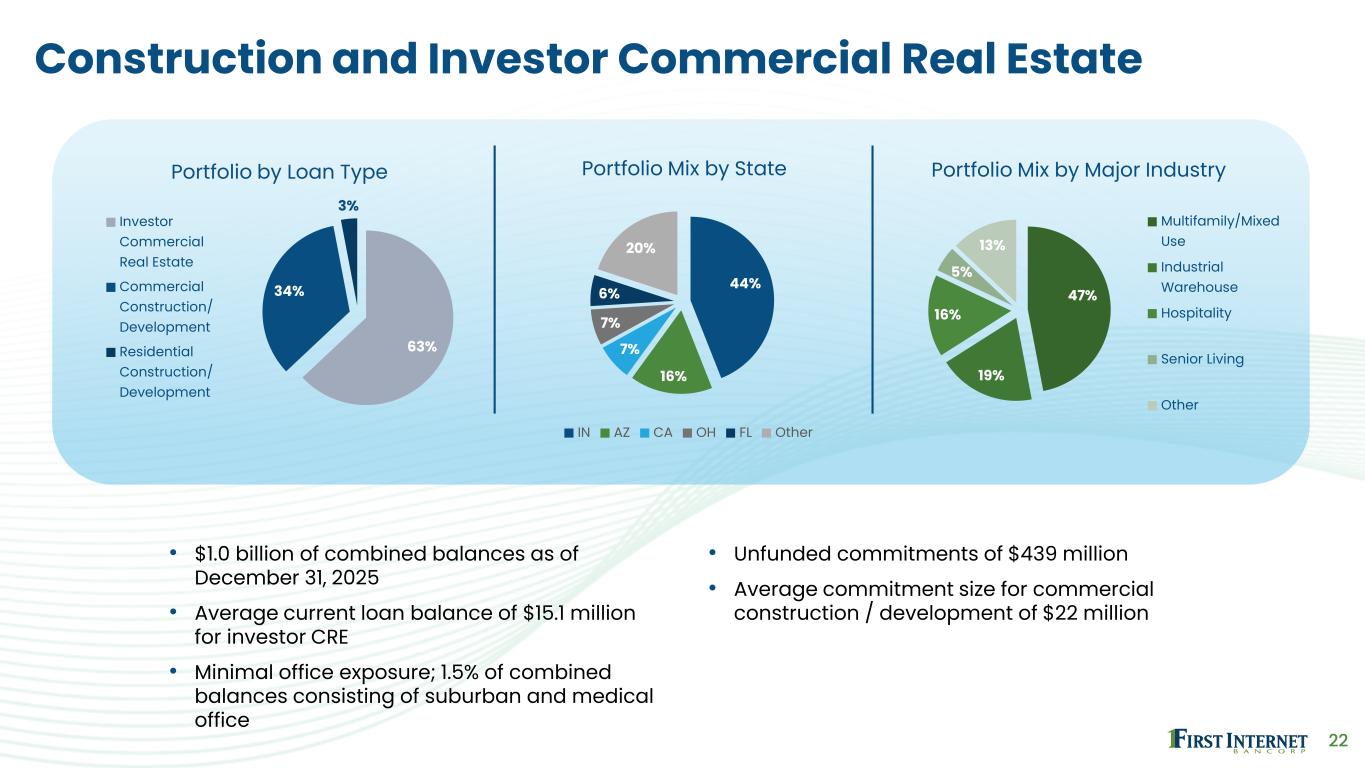

22 Construction and Investor Commercial Real Estate • $1.0 billion of combined balances as of December 31, 2025 • Average current loan balance of $15.1 million for investor CRE • Minimal office exposure; 1.5% of combined balances consisting of suburban and medical office • Unfunded commitments of $439 million • Average commitment size for commercial construction / development of $22 million 63% 34% 3% Portfolio by Loan Type Investor Commercial Real Estate Commercial Construction/ Development Residential Construction/ Development 47% 19% 16% 5% 13% Portfolio Mix by Major Industry Multifamily/Mixed Use Industrial Warehouse Hospitality Senior Living Other 44% 16% 7% 7% 6% 20% Portfolio Mix by State IN AZ CA OH FL Other

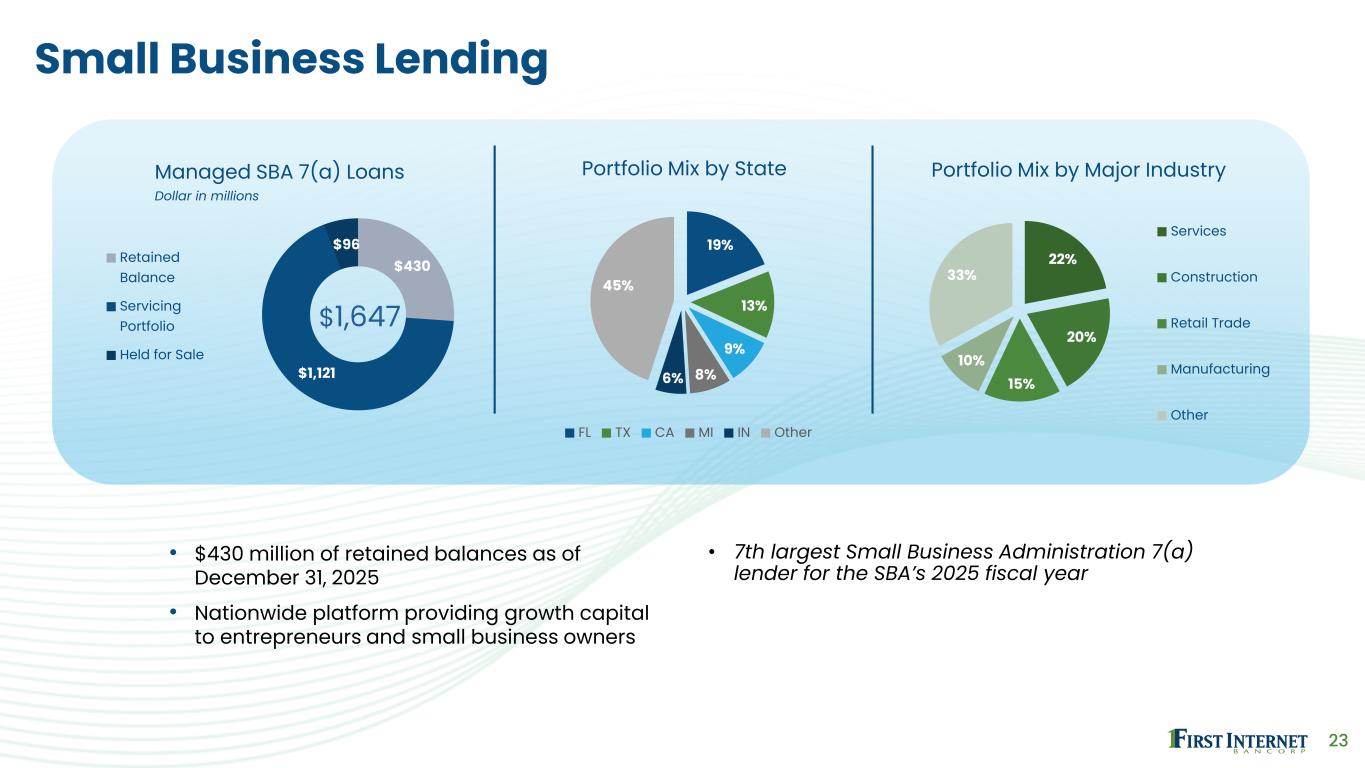

23 Small Business Lending • $430 million of retained balances as of December 31, 2025 • Nationwide platform providing growth capital to entrepreneurs and small business owners • 7th largest Small Business Administration 7(a) lender for the SBA’s 2025 fiscal year $430 $1,121 $96 Managed SBA 7(a) Loans Dollar in millions Retained Balance Servicing Portfolio Held for Sale 22% 20% 15% 10% 33% Portfolio Mix by Major Industry Services Construction Retail Trade Manufacturing Other 19% 13% 9% 8%6% 45% Portfolio Mix by State FL TX CA MI IN Other $1,647

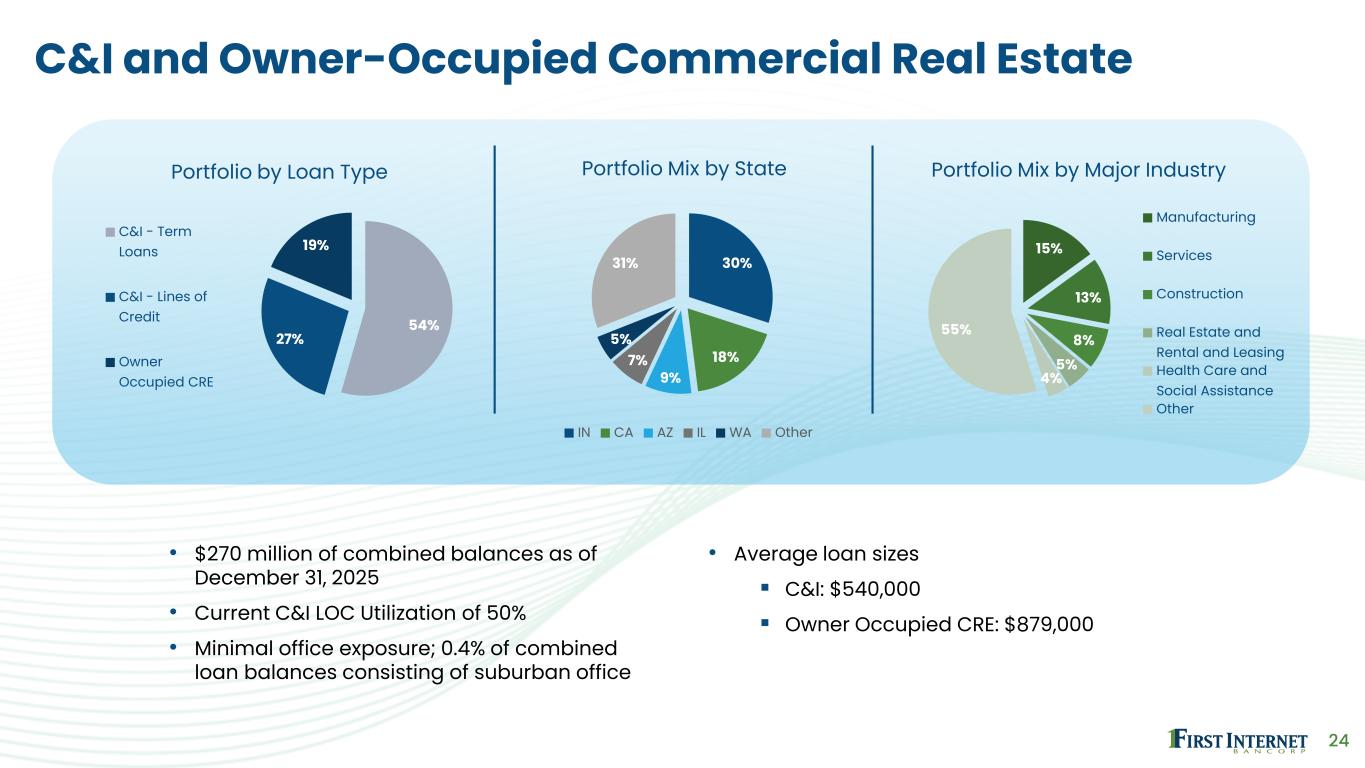

24 C&I and Owner-Occupied Commercial Real Estate • $270 million of combined balances as of December 31, 2025 • Current C&I LOC Utilization of 50% • Minimal office exposure; 0.4% of combined loan balances consisting of suburban office • Average loan sizes ▪ C&I: $540,000 ▪ Owner Occupied CRE: $879,000 54% 27% 19% Portfolio by Loan Type C&I - Term Loans C&I - Lines of Credit Owner Occupied CRE 15% 13% 8% 5% 4% 55% Portfolio Mix by Major Industry Manufacturing Services Construction Real Estate and Rental and Leasing Health Care and Social Assistance Other 30% 18% 9% 7% 5% 31% Portfolio Mix by State IN CA AZ IL WA Other

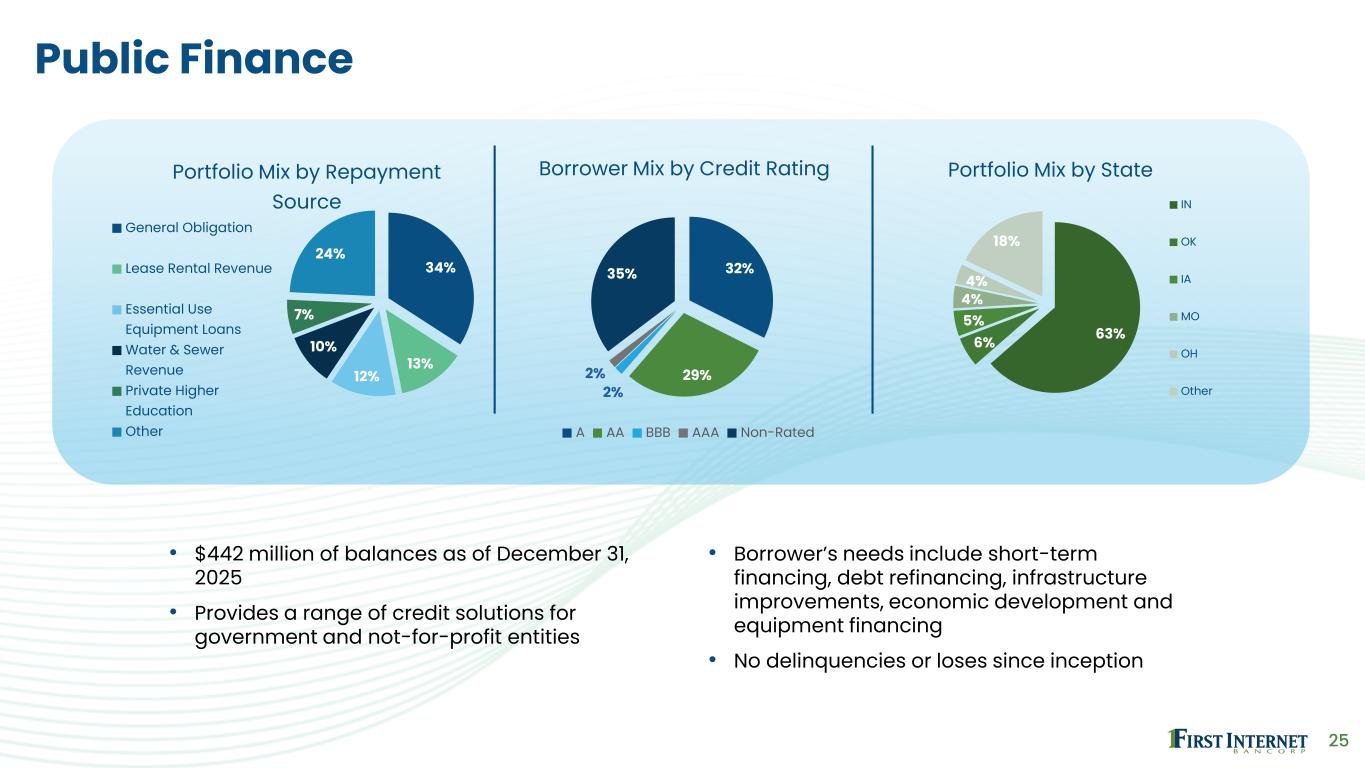

25 Public Finance 34% 13% 12% 10% 7% 24% Portfolio Mix by Repayment Source General Obligation Lease Rental Revenue Essential Use Equipment Loans Water & Sewer Revenue Private Higher Education Other 63%6% 5% 4% 4% 18% Portfolio Mix by State IN OK IA MO OH Other 32% 29% 2% 2% 35% Borrower Mix by Credit Rating A AA BBB AAA Non-Rated • $442 million of balances as of December 31, 2025 • Provides a range of credit solutions for government and not-for-profit entities • Borrower’s needs include short-term financing, debt refinancing, infrastructure improvements, economic development and equipment financing • No delinquencies or loses since inception

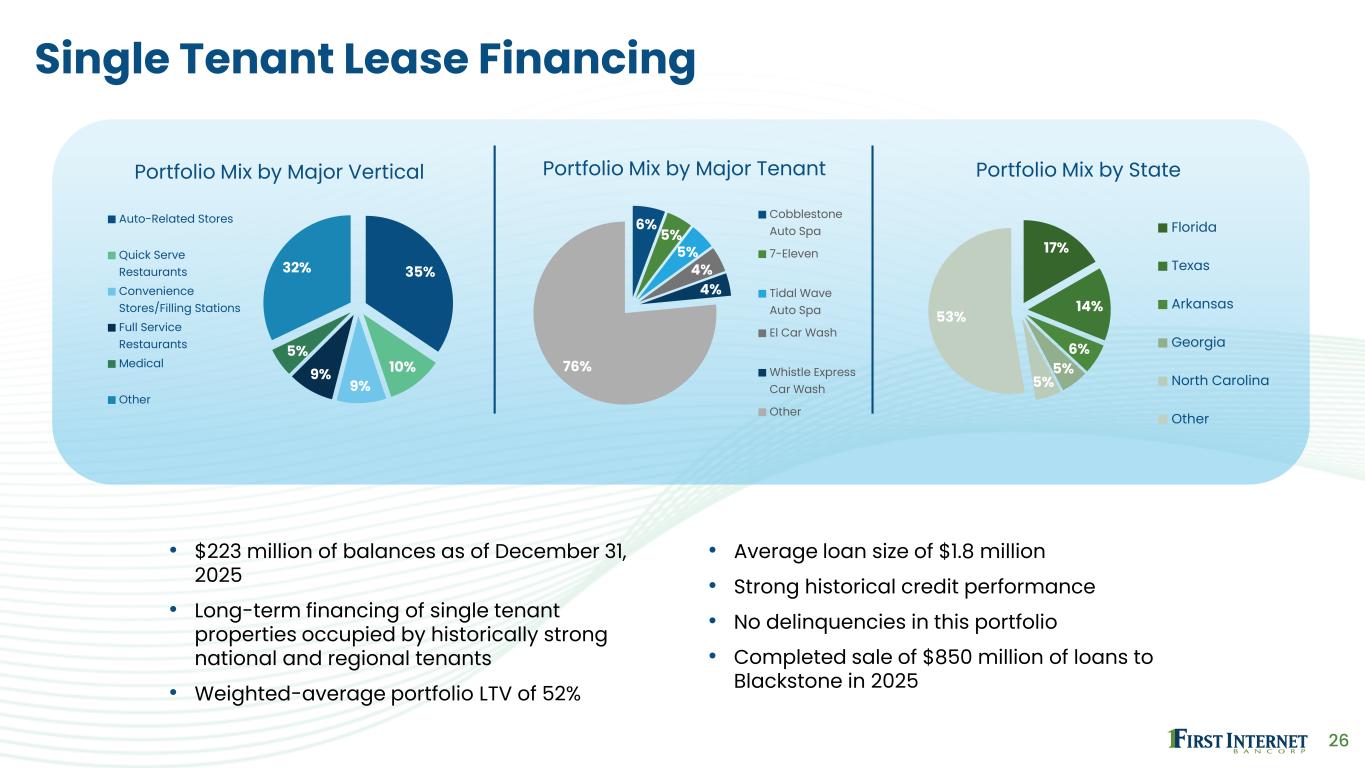

26 Single Tenant Lease Financing 35% 10% 9% 9% 5% 32% Portfolio Mix by Major Vertical Auto-Related Stores Quick Serve Restaurants Convenience Stores/Filling Stations Full Service Restaurants Medical Other 17% 14% 6% 5% 5% 53% Portfolio Mix by State Florida Texas Arkansas Georgia North Carolina Other 6% 5% 5% 4% 4% 76% Portfolio Mix by Major Tenant Cobblestone Auto Spa 7-Eleven Tidal Wave Auto Spa El Car Wash Whistle Express Car Wash Other • $223 million of balances as of December 31, 2025 • Long-term financing of single tenant properties occupied by historically strong national and regional tenants • Weighted-average portfolio LTV of 52% • Average loan size of $1.8 million • Strong historical credit performance • No delinquencies in this portfolio • Completed sale of $850 million of loans to Blackstone in 2025

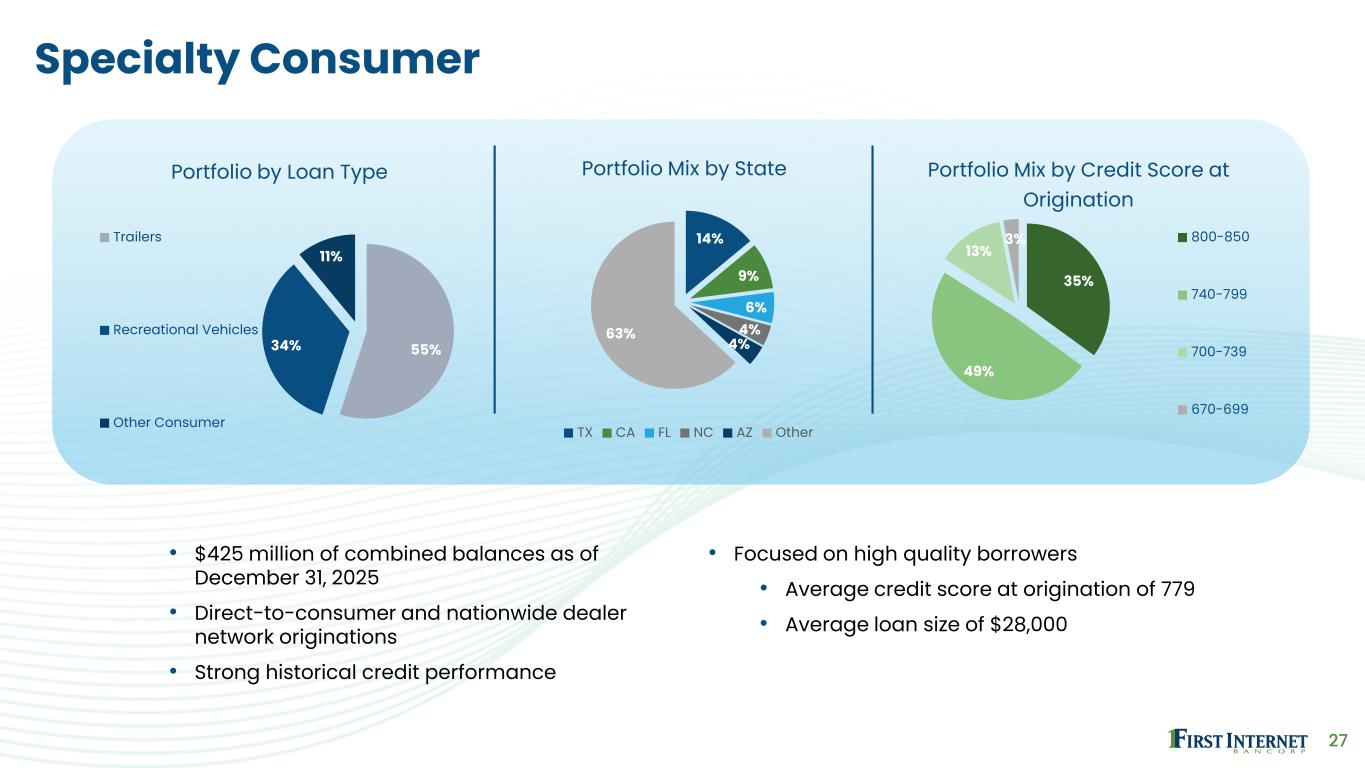

27 Specialty Consumer • $425 million of combined balances as of December 31, 2025 • Direct-to-consumer and nationwide dealer network originations • Strong historical credit performance • Focused on high quality borrowers • Average credit score at origination of 779 • Average loan size of $28,000 55%34% 11% Portfolio by Loan Type Trailers Recreational Vehicles Other Consumer 14% 9% 6% 4% 4% 63% Portfolio Mix by State TX CA FL NC AZ Other 35% 49% 13% 3% Portfolio Mix by Credit Score at Origination 800-850 740-799 700-739 670-699

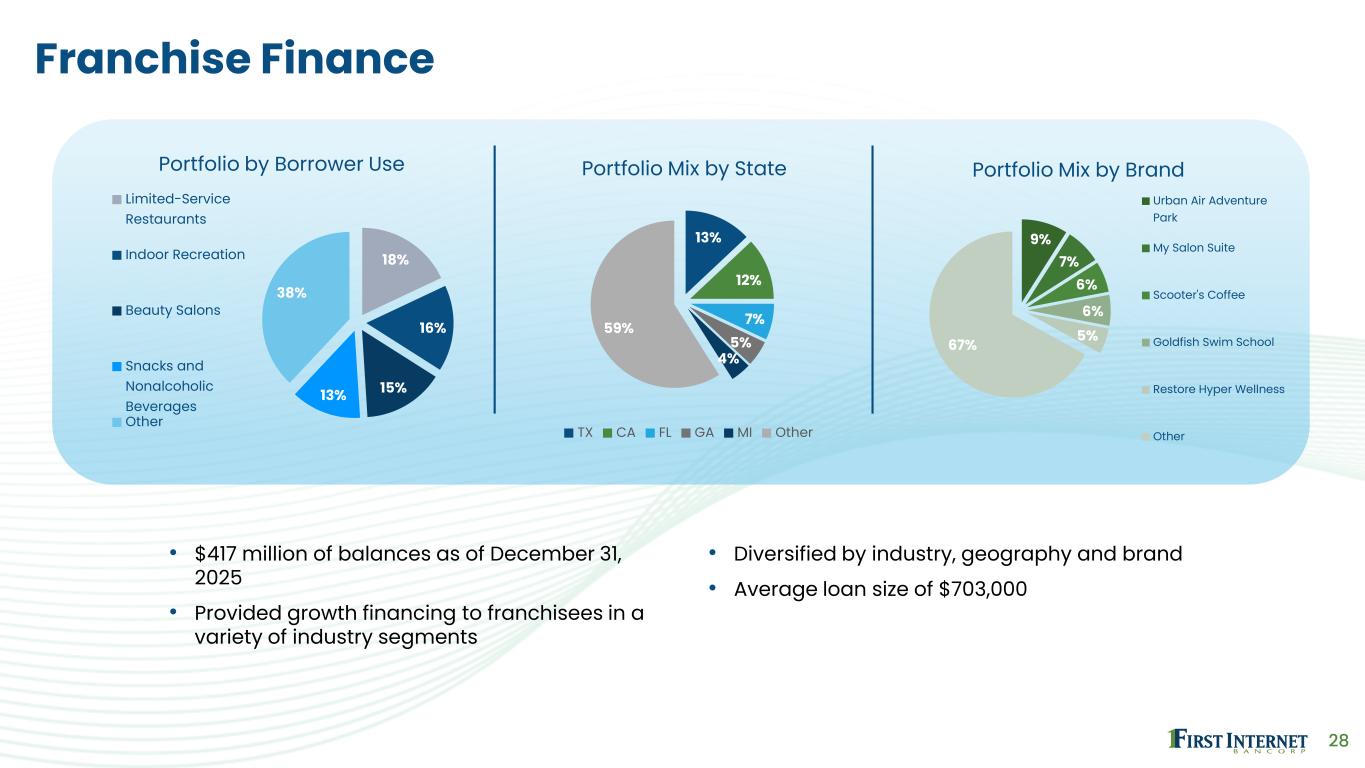

28 Franchise Finance • $417 million of balances as of December 31, 2025 • Provided growth financing to franchisees in a variety of industry segments • Diversified by industry, geography and brand • Average loan size of $703,000 18% 16% 15%13% 38% Portfolio by Borrower Use Limited-Service Restaurants Indoor Recreation Beauty Salons Snacks and Nonalcoholic Beverages Other 9% 7% 6% 6% 5%67% Portfolio Mix by Brand Urban Air Adventure Park My Salon Suite Scooter's Coffee Goldfish Swim School Restore Hyper Wellness Other 13% 12% 7% 5% 4% 59% Portfolio Mix by State TX CA FL GA MI Other

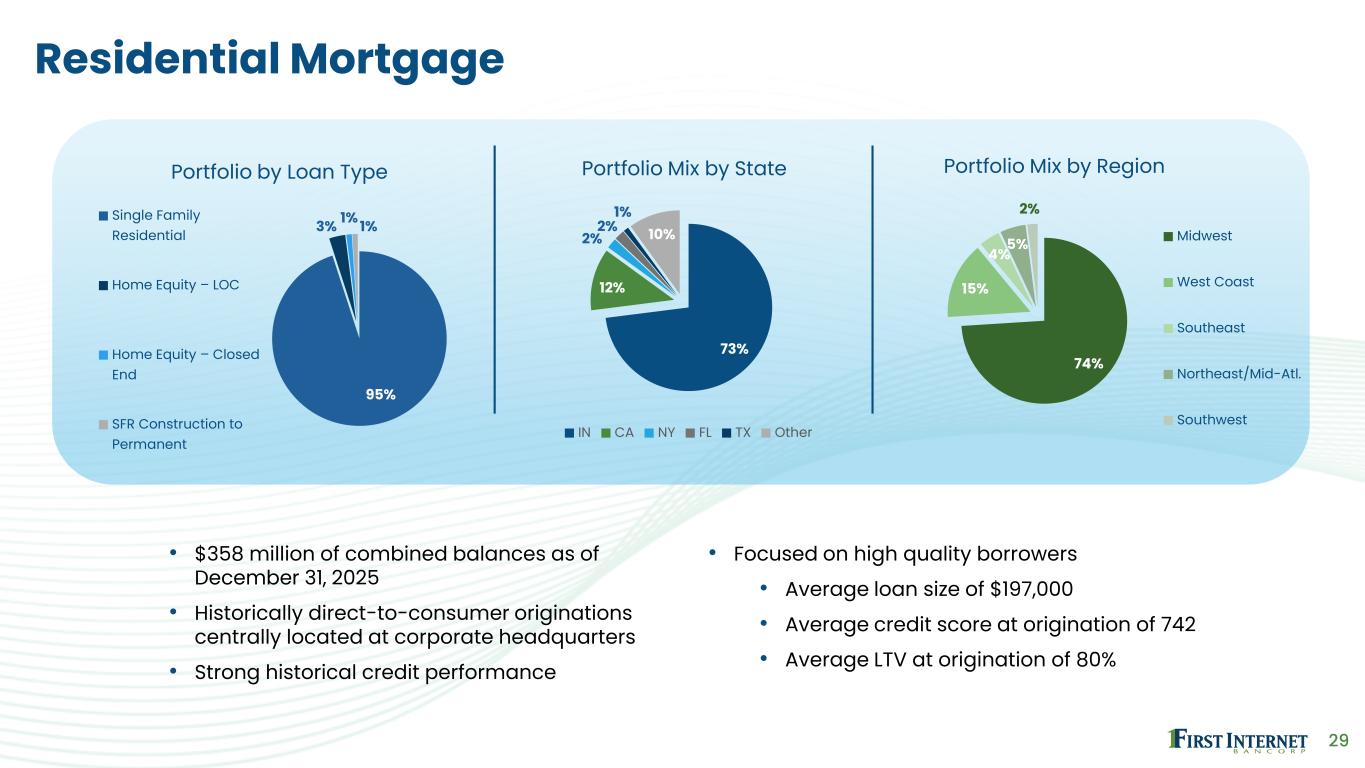

29 Residential Mortgage • $358 million of combined balances as of December 31, 2025 • Historically direct-to-consumer originations centrally located at corporate headquarters • Strong historical credit performance • Focused on high quality borrowers • Average loan size of $197,000 • Average credit score at origination of 742 • Average LTV at origination of 80% 95% 3% 1% 1% Portfolio by Loan Type Single Family Residential Home Equity – LOC Home Equity – Closed End SFR Construction to Permanent 73% 12% 2% 2% 1% 10% Portfolio Mix by State IN CA NY FL TX Other 74% 15% 4% 5% 2% Portfolio Mix by Region Midwest West Coast Southeast Northeast/Mid-Atl. Southwest

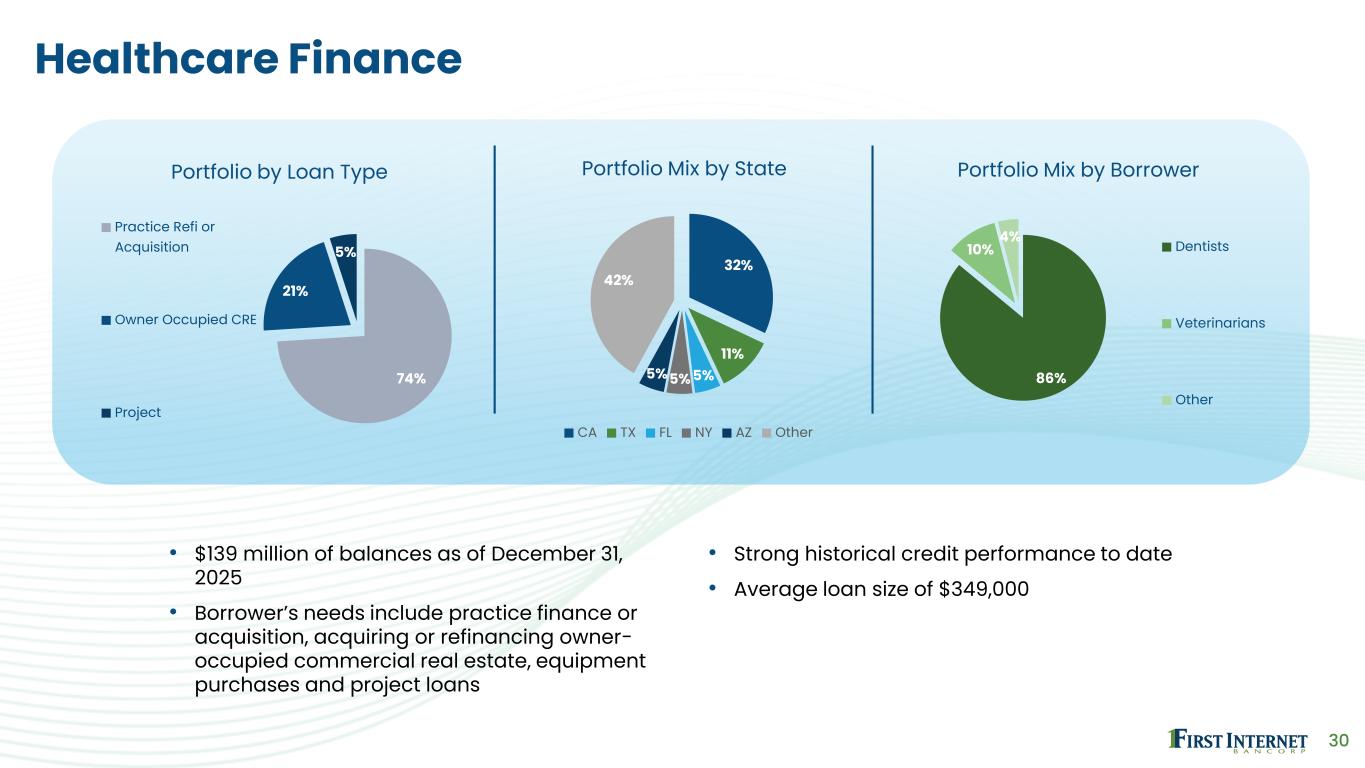

30 Healthcare Finance • $139 million of balances as of December 31, 2025 • Borrower’s needs include practice finance or acquisition, acquiring or refinancing owner- occupied commercial real estate, equipment purchases and project loans • Strong historical credit performance to date • Average loan size of $349,000 74% 21% 5% Portfolio by Loan Type Practice Refi or Acquisition Owner Occupied CRE Project 86% 10% 4% Portfolio Mix by Borrower Dentists Veterinarians Other 32% 11% 5%5%5% 42% Portfolio Mix by State CA TX FL NY AZ Other

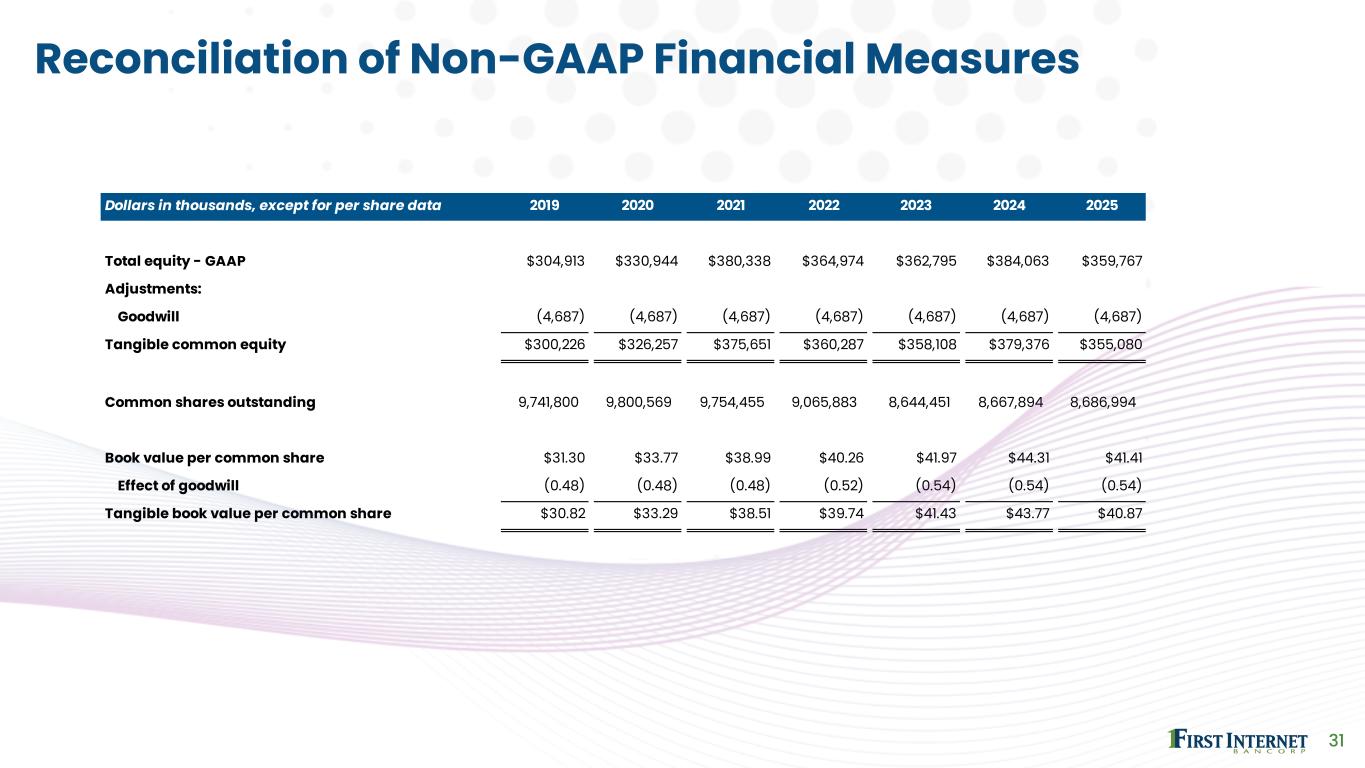

Dollars in thousands, except for per share data 2019 2020 2021 2022 2023 2024 2025 Total equity - GAAP $304,913 $330,944 $380,338 $364,974 $362,795 $384,063 $359,767 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $300,226 $326,257 $375,651 $360,287 $358,108 $379,376 $355,080 Common shares outstanding 9,741,800 9,800,569 9,754,455 9,065,883 8,644,451 8,667,894 8,686,994 Book value per common share $31.30 $33.77 $38.99 $40.26 $41.97 $44.31 $41.41 Effect of goodwill (0.48) (0.48) (0.48) (0.52) (0.54) (0.54) (0.54) Tangible book value per common share $30.82 $33.29 $38.51 $39.74 $41.43 $43.77 $40.87 31 Reconciliation of Non-GAAP Financial Measures

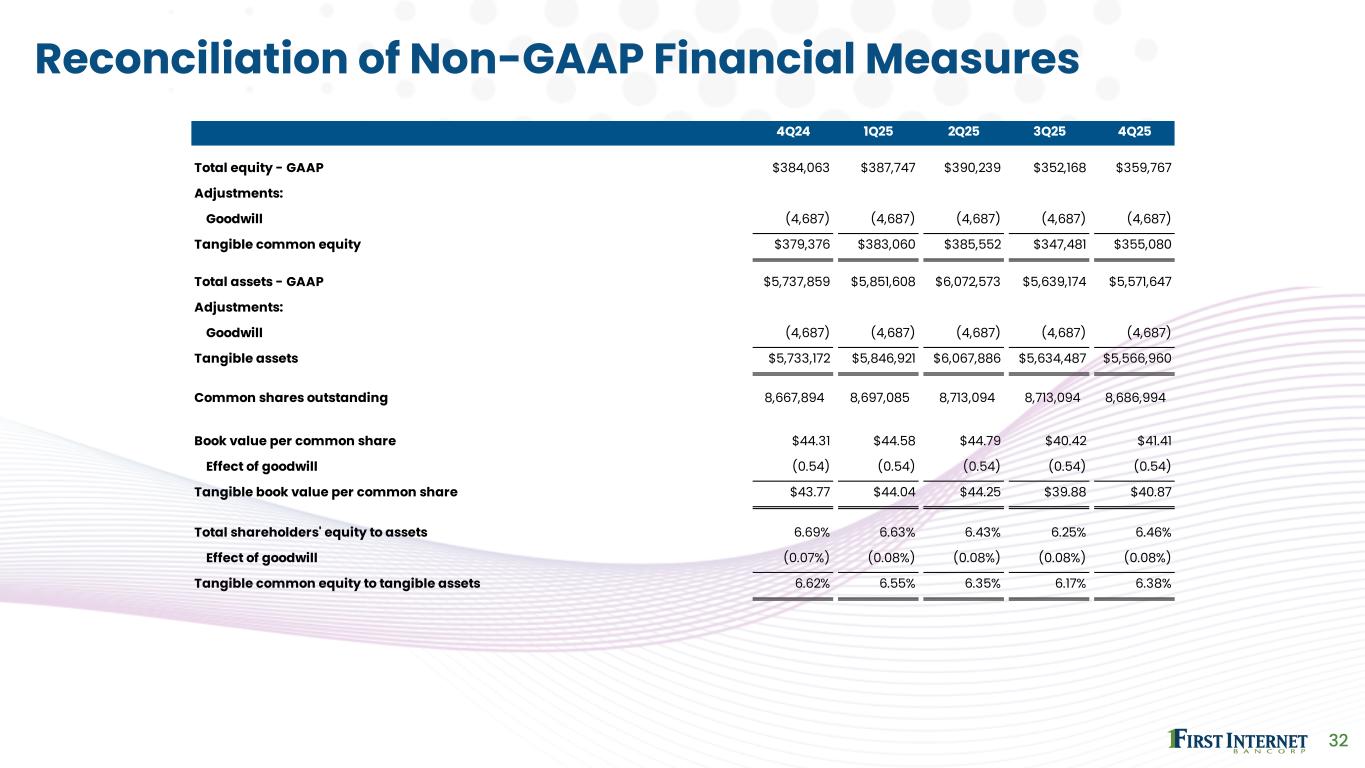

4Q24 1Q25 2Q25 3Q25 4Q25 Total equity - GAAP $384,063 $387,747 $390,239 $352,168 $359,767 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $379,376 $383,060 $385,552 $347,481 $355,080 Total assets - GAAP $5,737,859 $5,851,608 $6,072,573 $5,639,174 $5,571,647 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) Tangible assets $5,733,172 $5,846,921 $6,067,886 $5,634,487 $5,566,960 Common shares outstanding 8,667,894 8,697,085 8,713,094 8,713,094 8,686,994 Book value per common share $44.31 $44.58 $44.79 $40.42 $41.41 Effect of goodwill (0.54) (0.54) (0.54) (0.54) (0.54) Tangible book value per common share $43.77 $44.04 $44.25 $39.88 $40.87 Total shareholders' equity to assets 6.69% 6.63% 6.43% 6.25% 6.46% Effect of goodwill (0.07%) (0.08%) (0.08%) (0.08%) (0.08%) Tangible common equity to tangible assets 6.62% 6.55% 6.35% 6.17% 6.38% 32 Reconciliation of Non-GAAP Financial Measures

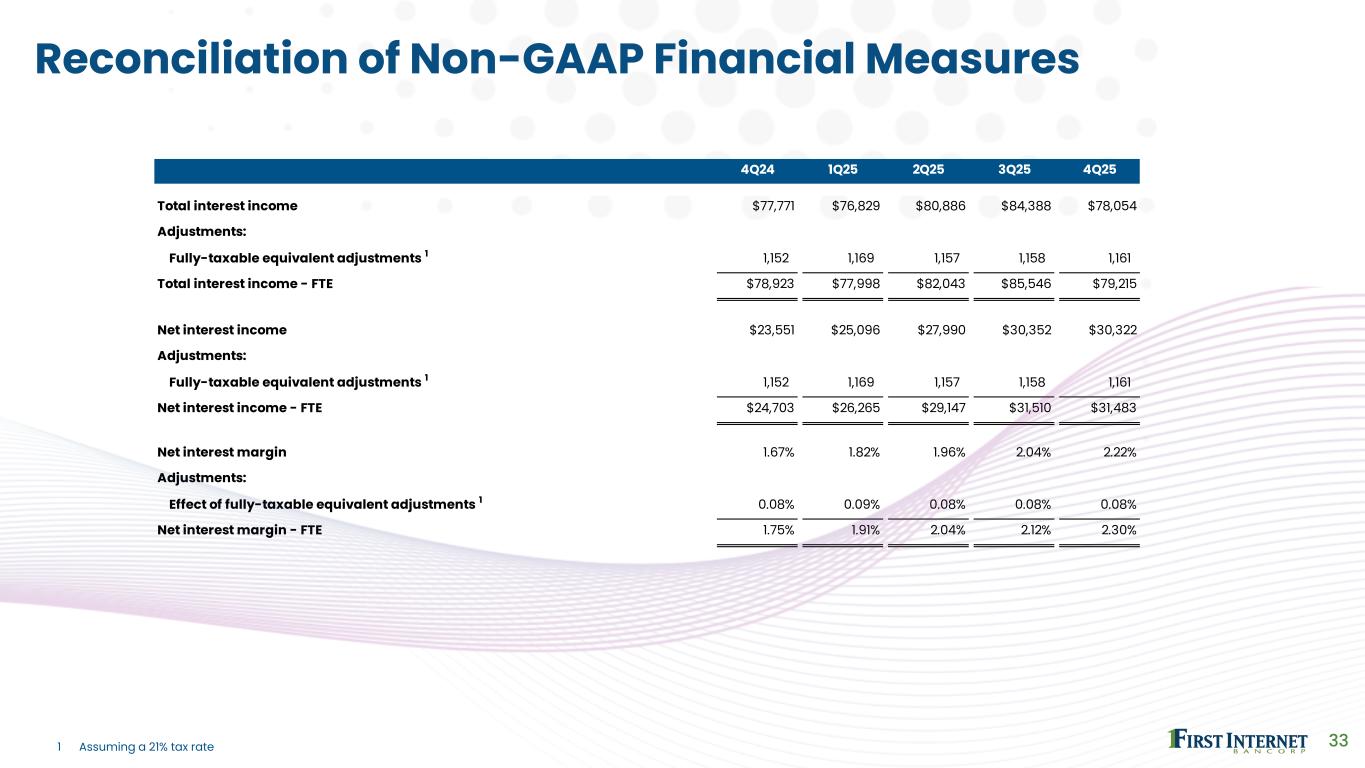

4Q24 1Q25 2Q25 3Q25 4Q25 Total interest income $77,771 $76,829 $80,886 $84,388 $78,054 Adjustments: Fully-taxable equivalent adjustments 1 1,152 1,169 1,157 1,158 1,161 Total interest income - FTE $78,923 $77,998 $82,043 $85,546 $79,215 Net interest income $23,551 $25,096 $27,990 $30,352 $30,322 Adjustments: Fully-taxable equivalent adjustments 1 1,152 1,169 1,157 1,158 1,161 Net interest income - FTE $24,703 $26,265 $29,147 $31,510 $31,483 Net interest margin 1.67% 1.82% 1.96% 2.04% 2.22% Adjustments: Effect of fully-taxable equivalent adjustments 1 0.08% 0.09% 0.08% 0.08% 0.08% Net interest margin - FTE 1.75% 1.91% 2.04% 2.12% 2.30% 33 Reconciliation of Non-GAAP Financial Measures 1 Assuming a 21% tax rate

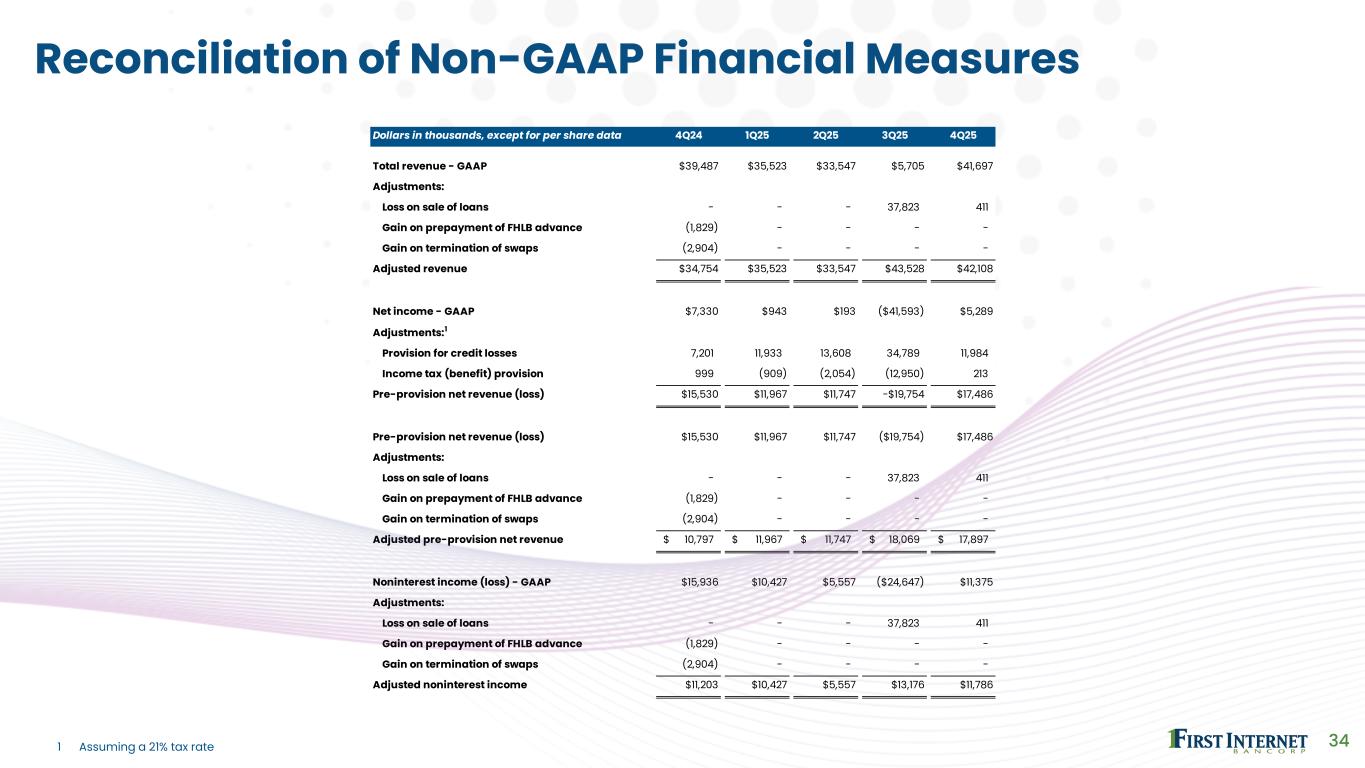

Dollars in thousands, except for per share data 4Q24 1Q25 2Q25 3Q25 4Q25 Total revenue - GAAP $39,487 $35,523 $33,547 $5,705 $41,697 Adjustments: Loss on sale of loans - - - 37,823 411 Gain on prepayment of FHLB advance (1,829) - - - - Gain on termination of swaps (2,904) - - - - Adjusted revenue $34,754 $35,523 $33,547 $43,528 $42,108 Net income - GAAP $7,330 $943 $193 ($41,593) $5,289 Adjustments:1 Provision for credit losses 7,201 11,933 13,608 34,789 11,984 Income tax (benefit) provision 999 (909) (2,054) (12,950) 213 Pre-provision net revenue (loss) $15,530 $11,967 $11,747 -$19,754 $17,486 Pre-provision net revenue (loss) $15,530 $11,967 $11,747 ($19,754) $17,486 Adjustments: Loss on sale of loans - - - 37,823 411 Gain on prepayment of FHLB advance (1,829) - - - - Gain on termination of swaps (2,904) - - - - Adjusted pre-provision net revenue 10,797$ 11,967$ 11,747$ 18,069$ 17,897$ Noninterest income (loss) - GAAP $15,936 $10,427 $5,557 ($24,647) $11,375 Adjustments: Loss on sale of loans - - - 37,823 411 Gain on prepayment of FHLB advance (1,829) - - - - Gain on termination of swaps (2,904) - - - - Adjusted noninterest income $11,203 $10,427 $5,557 $13,176 $11,786 34 Reconciliation of Non-GAAP Financial Measures 1 Assuming a 21% tax rate

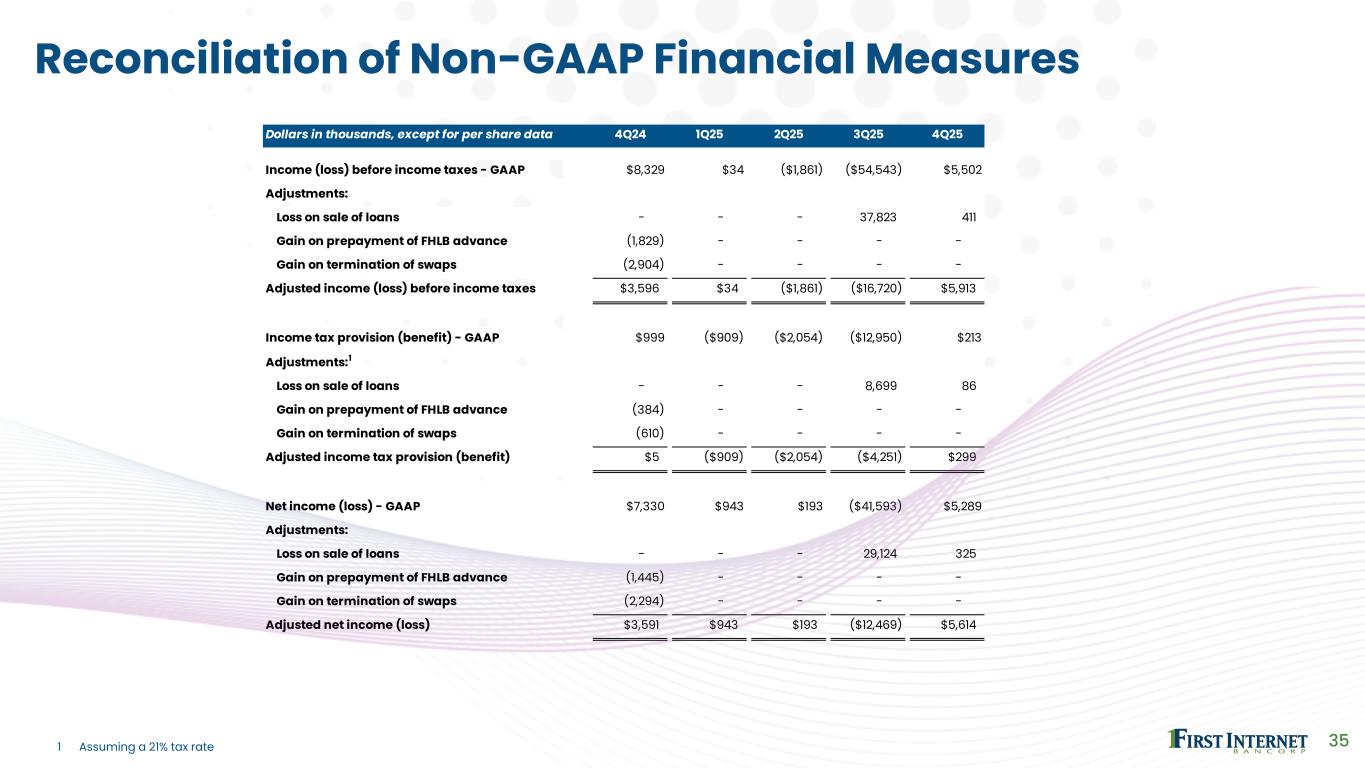

Dollars in thousands, except for per share data 4Q24 1Q25 2Q25 3Q25 4Q25 Income (loss) before income taxes - GAAP $8,329 $34 ($1,861) ($54,543) $5,502 Adjustments: Loss on sale of loans - - - 37,823 411 Gain on prepayment of FHLB advance (1,829) - - - - Gain on termination of swaps (2,904) - - - - Adjusted income (loss) before income taxes $3,596 $34 ($1,861) ($16,720) $5,913 Income tax provision (benefit) - GAAP $999 ($909) ($2,054) ($12,950) $213 Adjustments:1 Loss on sale of loans - - - 8,699 86 Gain on prepayment of FHLB advance (384) - - - - Gain on termination of swaps (610) - - - - Adjusted income tax provision (benefit) $5 ($909) ($2,054) ($4,251) $299 Net income (loss) - GAAP $7,330 $943 $193 ($41,593) $5,289 Adjustments: Loss on sale of loans - - - 29,124 325 Gain on prepayment of FHLB advance (1,445) - - - - Gain on termination of swaps (2,294) - - - - Adjusted net income (loss) $3,591 $943 $193 ($12,469) $5,614 35 Reconciliation of Non-GAAP Financial Measures 1 Assuming a 21% tax rate

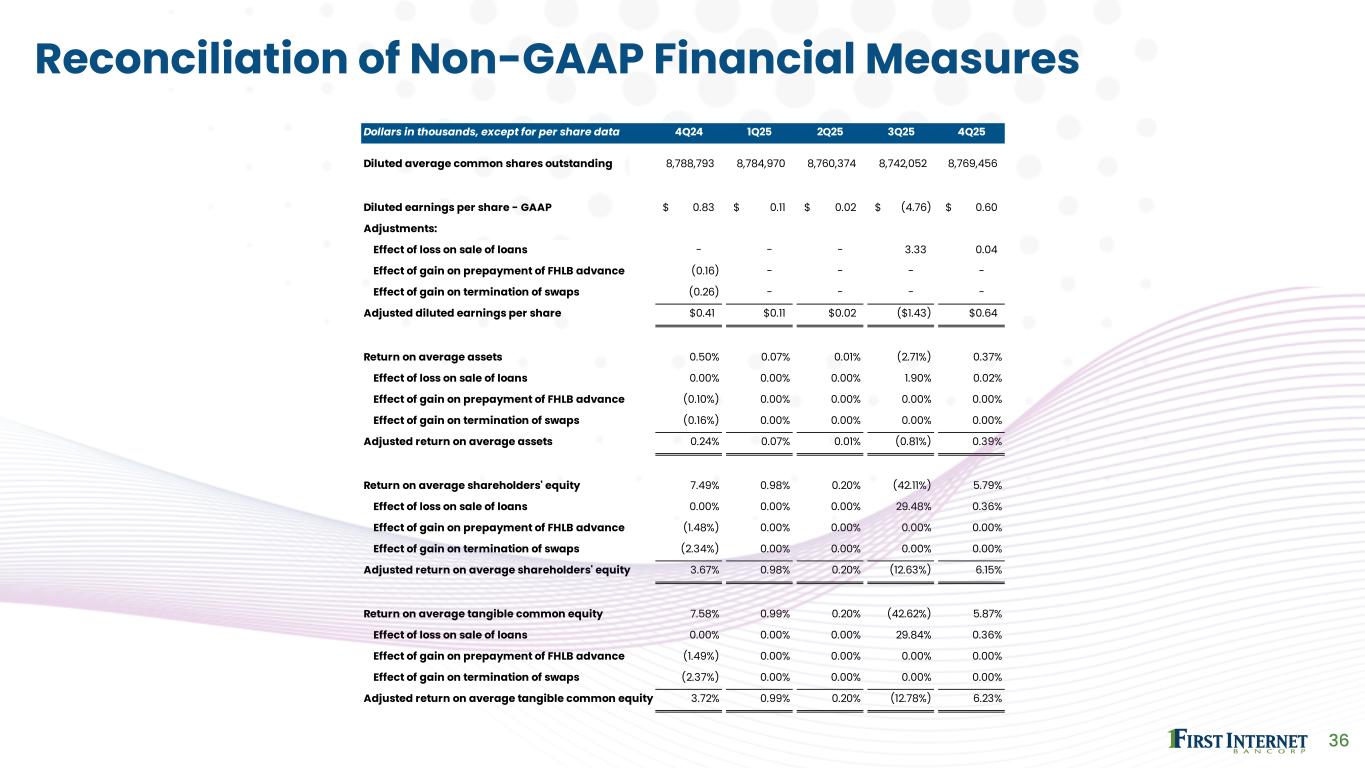

Dollars in thousands, except for per share data 4Q24 1Q25 2Q25 3Q25 4Q25 Diluted average common shares outstanding 8,788,793 8,784,970 8,760,374 8,742,052 8,769,456 Diluted earnings per share - GAAP 0.83$ 0.11$ 0.02$ (4.76)$ 0.60$ Adjustments: Effect of loss on sale of loans - - - 3.33 0.04 Effect of gain on prepayment of FHLB advance (0.16) - - - - Effect of gain on termination of swaps (0.26) - - - - Adjusted diluted earnings per share $0.41 $0.11 $0.02 ($1.43) $0.64 Return on average assets 0.50% 0.07% 0.01% (2.71%) 0.37% Effect of loss on sale of loans 0.00% 0.00% 0.00% 1.90% 0.02% Effect of gain on prepayment of FHLB advance (0.10%) 0.00% 0.00% 0.00% 0.00% Effect of gain on termination of swaps (0.16%) 0.00% 0.00% 0.00% 0.00% Adjusted return on average assets 0.24% 0.07% 0.01% (0.81%) 0.39% Return on average shareholders' equity 7.49% 0.98% 0.20% (42.11%) 5.79% Effect of loss on sale of loans 0.00% 0.00% 0.00% 29.48% 0.36% Effect of gain on prepayment of FHLB advance (1.48%) 0.00% 0.00% 0.00% 0.00% Effect of gain on termination of swaps (2.34%) 0.00% 0.00% 0.00% 0.00% Adjusted return on average shareholders' equity 3.67% 0.98% 0.20% (12.63%) 6.15% Return on average tangible common equity 7.58% 0.99% 0.20% (42.62%) 5.87% Effect of loss on sale of loans 0.00% 0.00% 0.00% 29.84% 0.36% Effect of gain on prepayment of FHLB advance (1.49%) 0.00% 0.00% 0.00% 0.00% Effect of gain on termination of swaps (2.37%) 0.00% 0.00% 0.00% 0.00% Adjusted return on average tangible common equity 3.72% 0.99% 0.20% (12.78%) 6.23% 36 Reconciliation of Non-GAAP Financial Measures

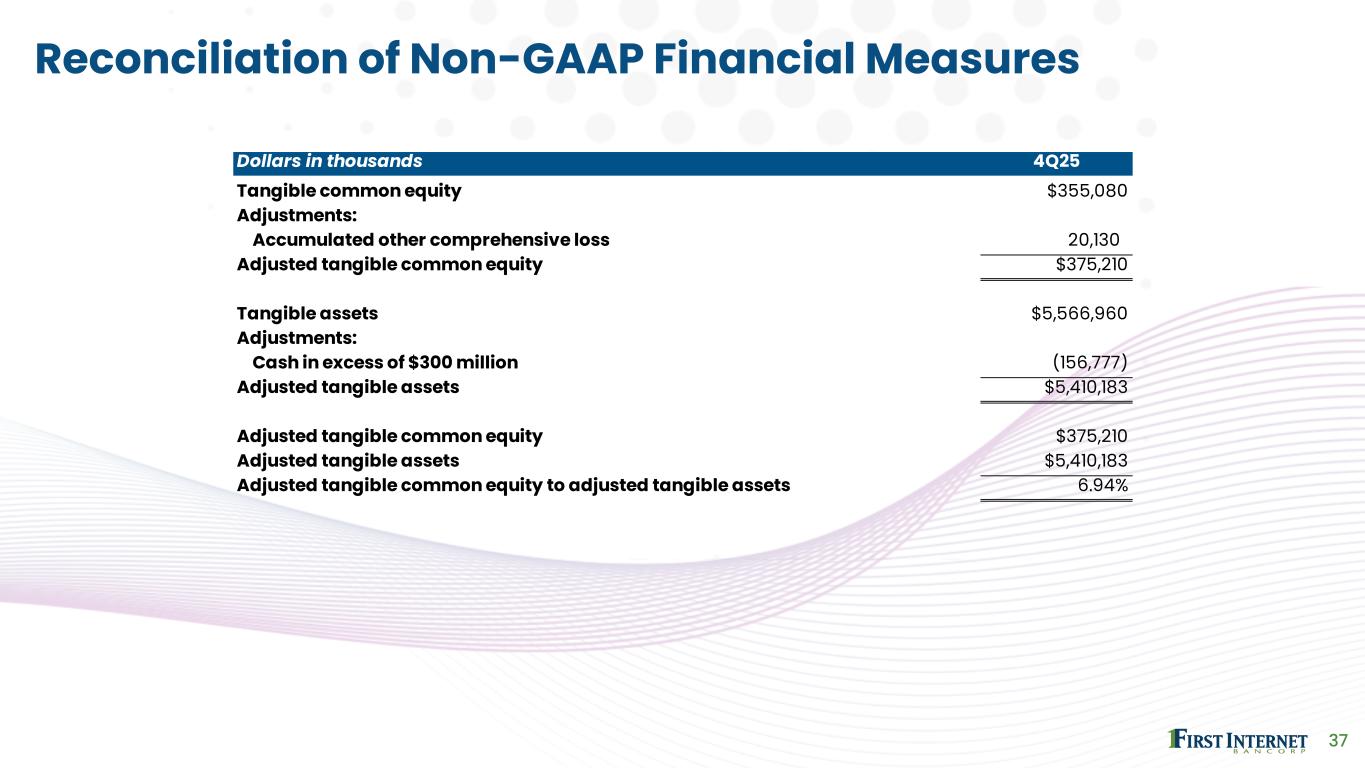

Dollars in thousands 4Q25 Tangible common equity $355,080 Adjustments: Accumulated other comprehensive loss 20,130 Adjusted tangible common equity $375,210 Tangible assets $5,566,960 Adjustments: Cash in excess of $300 million (156,777) Adjusted tangible assets $5,410,183 Adjusted tangible common equity $375,210 Adjusted tangible assets $5,410,183 Adjusted tangible common equity to adjusted tangible assets 6.94% 37 Reconciliation of Non-GAAP Financial Measures