Franklin BSP Realty Trust Fourth Quarter 2025 Supplemental Information

B E N E F I T S T R E E T P A R T N E R S 2 Important Information The information herein relates to the Company’s business and financial information as of December 31, 2025 and does not reflect subsequent developments. Risk Factors Investing in and owning our common stock involves a high degree of risk. For a discussion of these risks, see the section entitled “Risk Factors” in our Annual Report on Form 10- K filed with the SEC on February 26, 2025, and the risk disclosures in our subsequent periodic reports filed with the SEC. Forward-Looking Statements Certain statements included in this presentation are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of Franklin BSP Realty Trust, Inc. (“FBRT” or the “Company”) and may include the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause actual outcomes to differ materially from our forward-looking statements include macroeconomic factors in the United States including inflation, changing interest rates and economic contraction, impairments in the value of real estate property securing our loans or that we own, the extent of any recoveries on delinquent loans, and the financial stability of our borrowers, and the other factors set forth in the risk factors section of our most recent Form 10-K and Form 10-Q. The extent to which these factors impact us and our borrowers will depend on future developments, which are highly uncertain and cannot be predicted with confidence. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law. Additional Important Information The summary information provided in this presentation does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with us or any of our affiliated funds. There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations. Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances. The information contained herein is qualified in its entirety by reference to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. You may obtain a copy of the most recent Annual Report or Quarterly Report by calling (844) 785-4393 and/or visiting www.fbrtreit.com. This presentation contains information regarding FBRT’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Distributable Earnings. Please refer to the appendix for the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures. PAST PERFORMANCE IS NOT A GUARANTEE OR INDICATIVE OF FUTURE RESULTS. INVESTMENTS INVOLVE SIGNIFICANT RISKS, INCLUDING LOSS OF THE ENTIRE INVESTMENT. There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of the Company’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objective of the Company will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Please refer to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for a more complete list of risk factors. The following slides contain summaries of certain financial information about the Company. The information contained in this presentation is summary information that is intended to be considered in the context of our filings with the Securities and Exchange Commission and other public announcements that we may make, by press release or otherwise, from time to time.

FBRT 4Q 2025 Financial Update

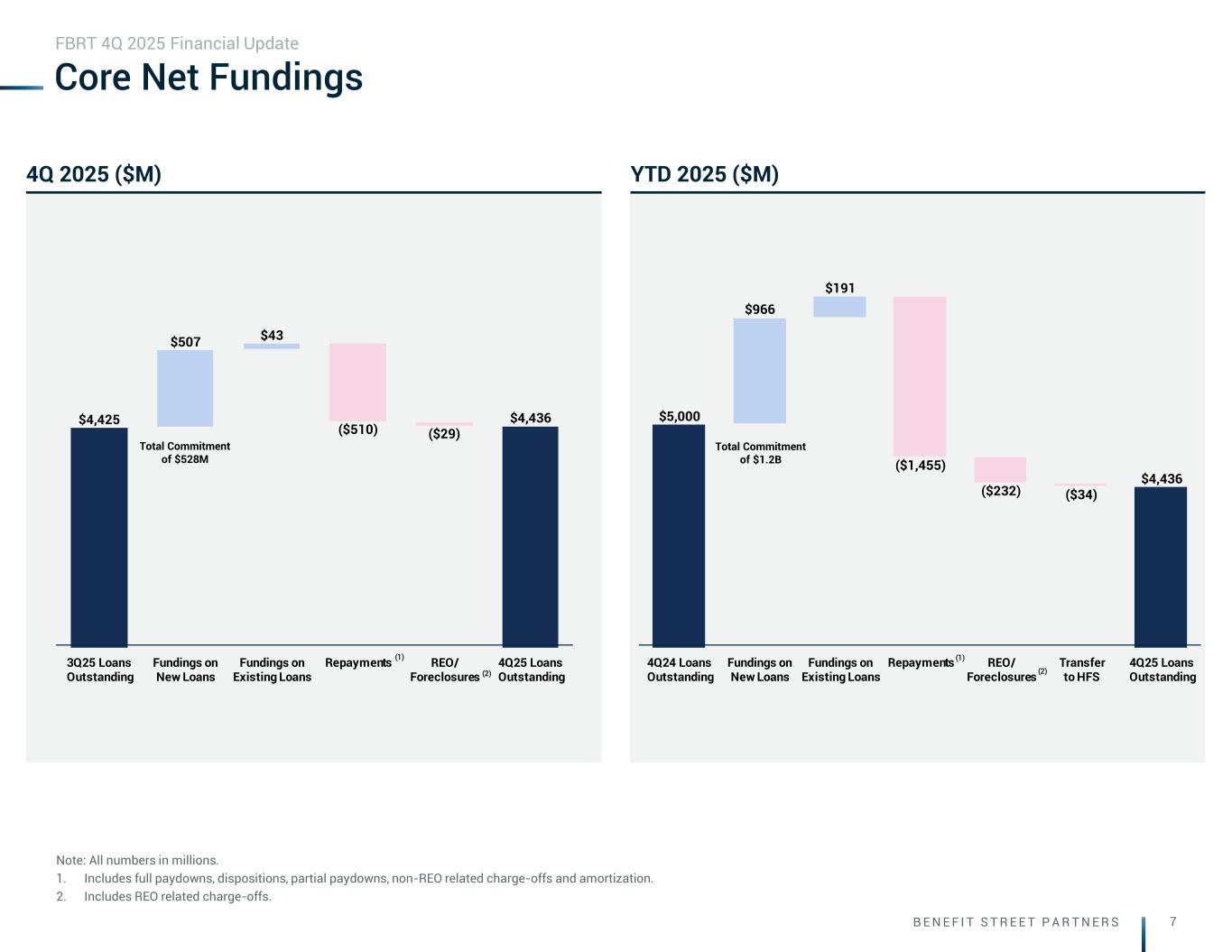

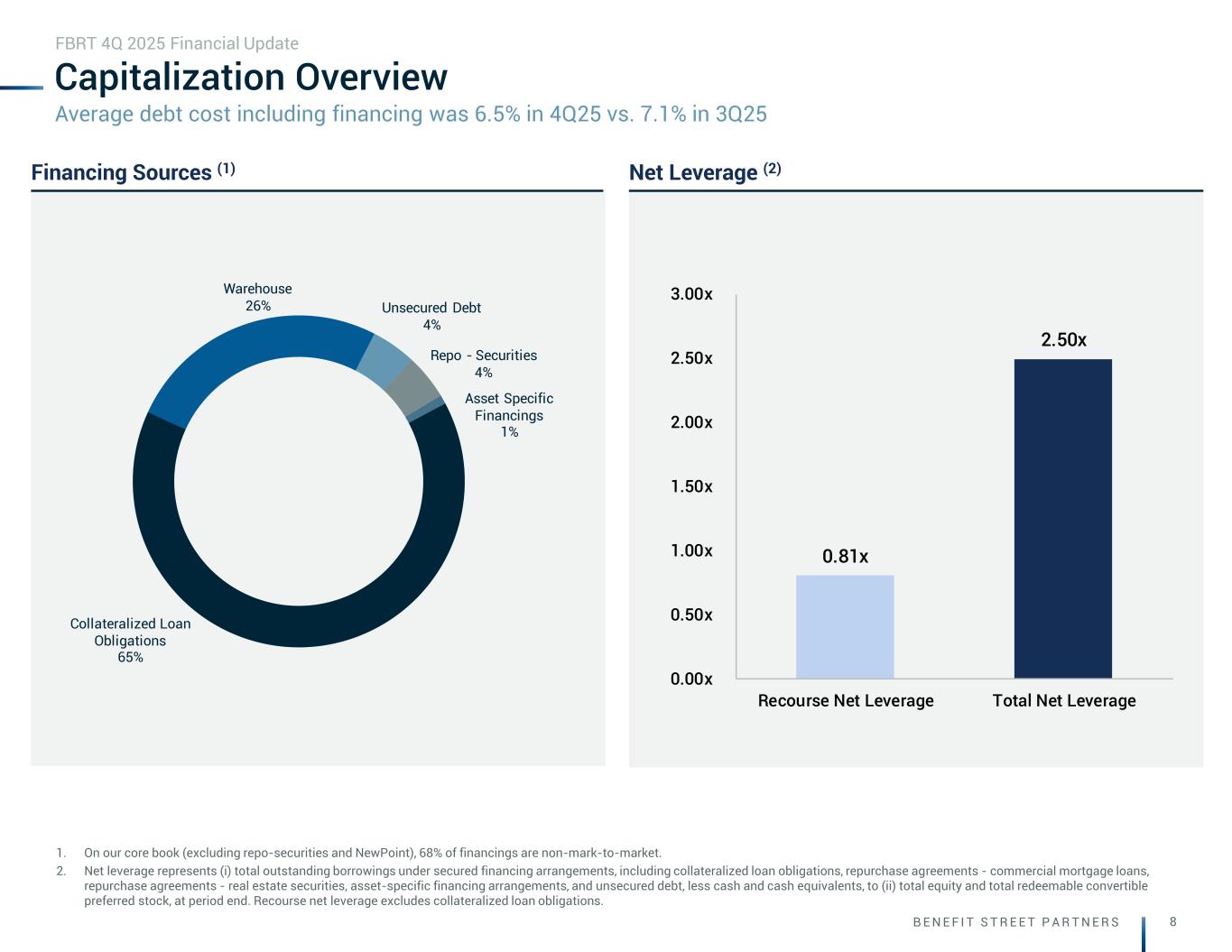

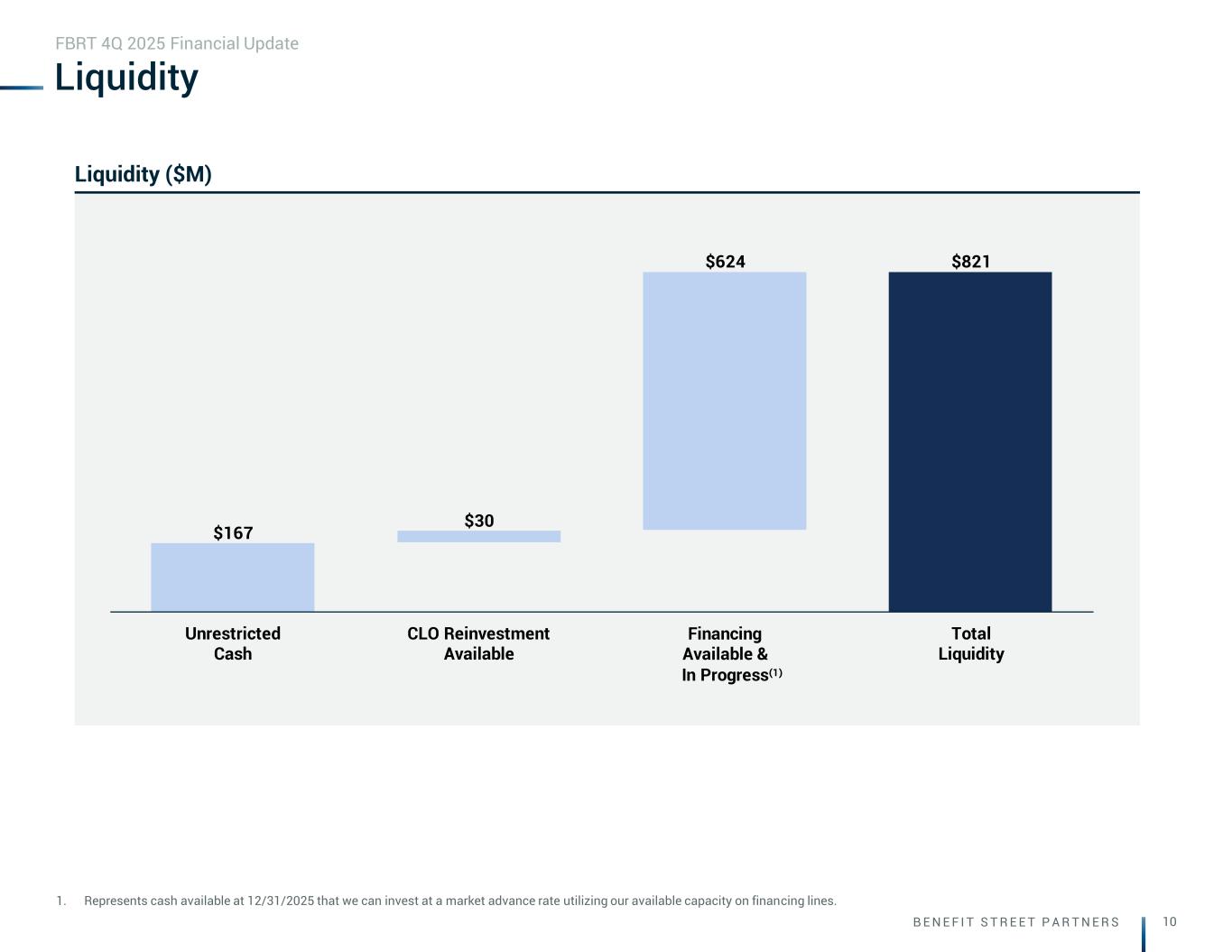

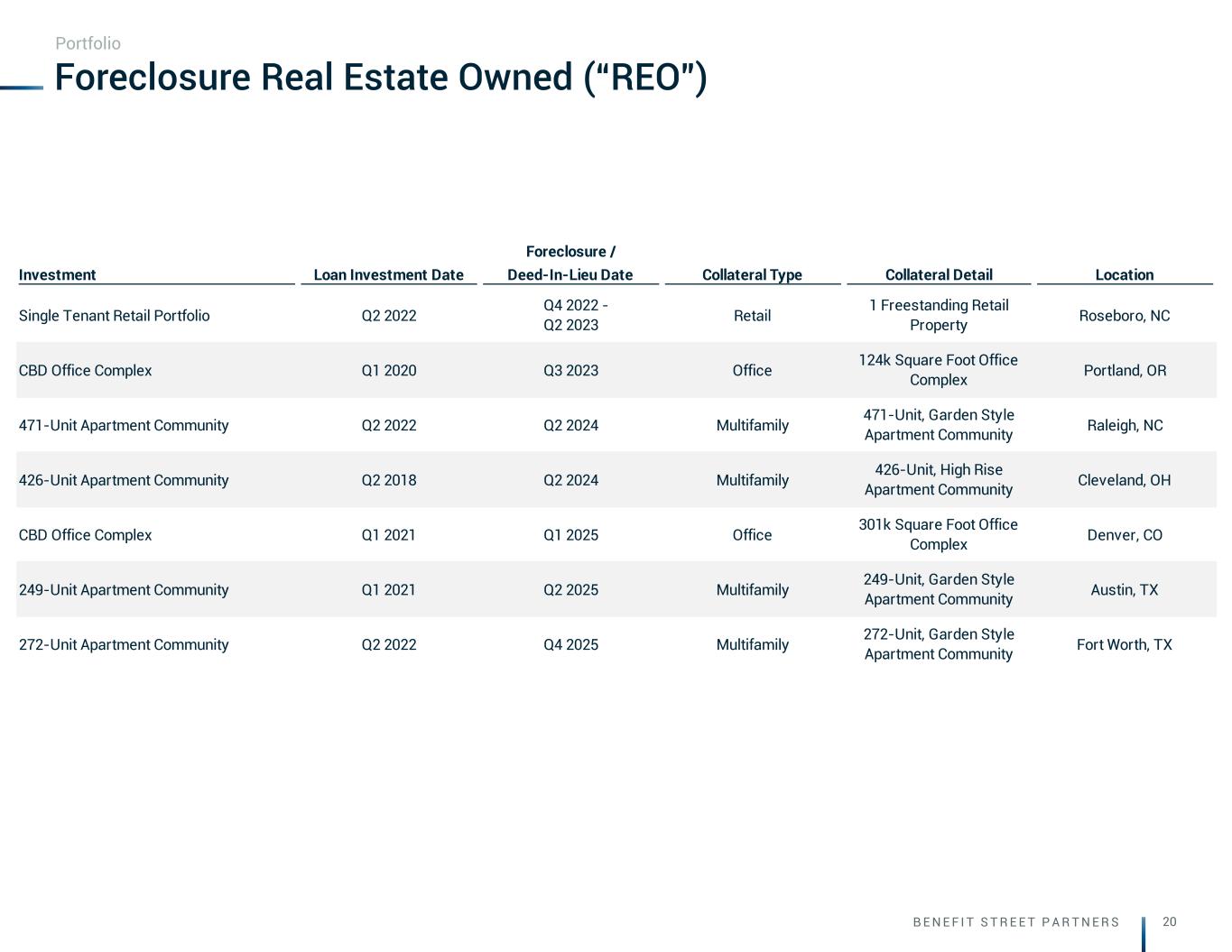

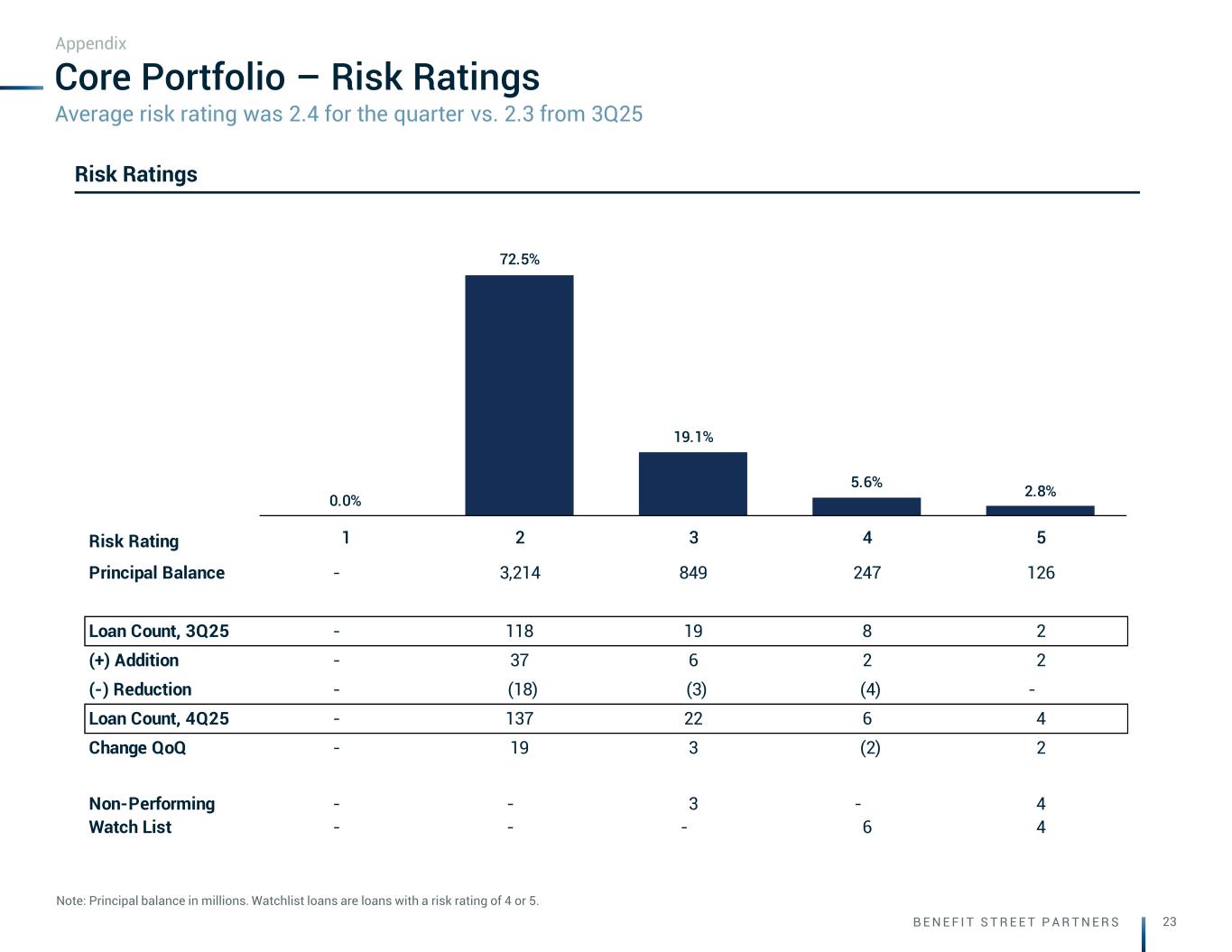

B E N E F I T S T R E E T P A R T N E R S 4 Highlights FBRT 4Q 2025 Financial Update • Fully-converted book value per share is $14.15 vs. $14.29 in Q3 2025 (1). Undepreciated fully-converted book value per share is $14.34 vs. $14.46 in Q3 2025 (1) (3) • Net debt to equity is 2.5x; recourse net debt to equity is 0.8x • 68% of financing sources are non-mark-to-market on our core book • $821 million of liquidity of which $167 million is cash and $30 million is CLO reinvest/ramp available (4) • Repurchased $14.4 million of common stock, which resulted in $0.05 of accretion to fully-converted book value per share (1) • Core Portfolio: Principal balance increased by $11 million in the quarter. Closed $528 million of new loan commitments and funded $550 million of principal balance including future funding on existing loans. Received loan repayments of $510 million • Agency Business: Originated $1.1 billion of new loan commitments under programs with Fannie Mae, Freddie Mac, and HUD • Core Portfolio of 169 CRE loans and $4.4 billion of principal balance, average size of $26 million and 77% multifamily. Two assets were removed from the watch list. Ten assets remain on the watch list, four of which are risk rated a five and six of which are risk rated a four • REO portfolio of seven foreclosure positions [vs. nine in Q3 2025] totaling $214 million and one investment real estate owned position of $118 million Capitalization Investments Portfolio Earnings • GAAP Net Income of $18.4 million or $0.13 per diluted common share or $0.13 per fully converted share (1) • Distributable Earnings before realized losses (2) of $27.7 million or $0.22 per fully converted share (1) • Distributable Earnings (2) of $17.9 million or $0.12 per fully converted share (1). Distributable Earnings includes $9.8 million of realized losses within the quarter, $7.7 million of which is related to debt extinguishment • Declared a Q4 2025 cash dividend of $0.355 per share, representing an annualized yield of 10.0% on fully-converted book value per share (1) 1. Fully Converted assumes conversion of our series of convertible preferred stock and Class A units in FBRT OP LLC, our operating partnership (“OP Units”), along with full vesting of our outstanding equity compensation awards. 2. Please see appendix for GAAP net income to Distributable Earnings calculation. 3. Adjusted for accumulated depreciation and amortization of real property of $17.5 million and $16.4 million at 12/31/25 and 9/30/25, respectively. 4. Cash excludes restricted cash. Total liquidity amount includes the cash available we can invest at a market advance rate utilizing our available capacity on financing lines.

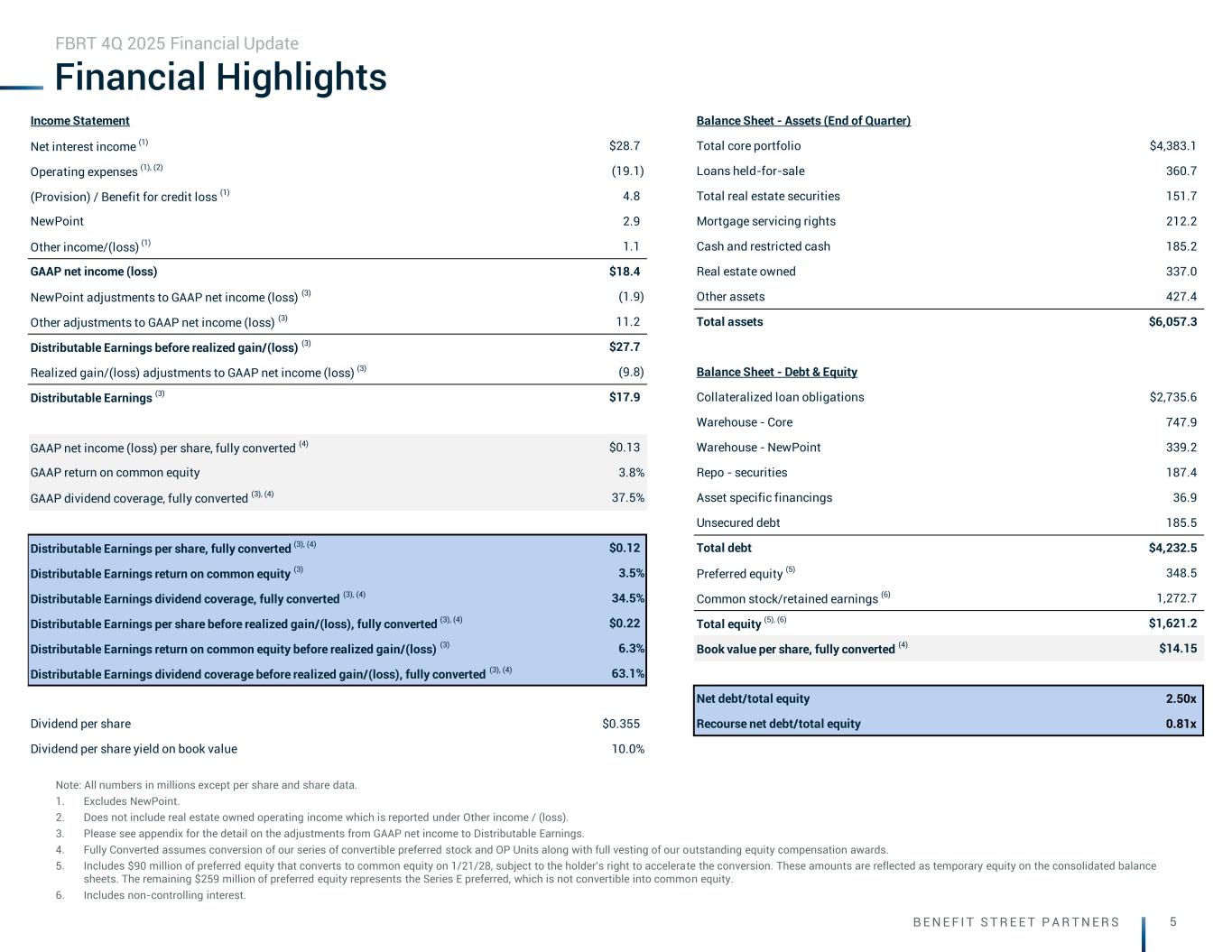

B E N E F I T S T R E E T P A R T N E R S 5 Income Statement Balance Sheet - Assets (End of Quarter) Net interest income (1) $28.7 Total core portfolio $4,383.1 Operating expenses (1), (2) (19.1) Loans held-for-sale 360.7 (Provision) / Benefit for credit loss (1) 4.8 Total real estate securities 151.7 NewPoint 2.9 Mortgage servicing rights 212.2 Other income/(loss) (1) 1.1 Cash and restricted cash 185.2 GAAP net income (loss) $18.4 Real estate owned 337.0 NewPoint adjustments to GAAP net income (loss) (3) (1.9) Other assets 427.4 Other adjustments to GAAP net income (loss) (3) 11.2 Total assets $6,057.3 Distributable Earnings before realized gain/(loss) (3) $27.7 Realized gain/(loss) adjustments to GAAP net income (loss) (3) (9.8) Balance Sheet - Debt & Equity Distributable Earnings (3) $17.9 Collateralized loan obligations $2,735.6 Warehouse - Core 747.9 GAAP net income (loss) per share, fully converted (4) $0.13 Warehouse - NewPoint 339.2 GAAP return on common equity 3.8% Repo - securities 187.4 GAAP dividend coverage, fully converted (3), (4) 37.5% Asset specific financings 36.9 Unsecured debt 185.5 Distributable Earnings per share, fully converted (3), (4) $0.12 Total debt $4,232.5 Distributable Earnings return on common equity (3) 3.5% Preferred equity (5) 348.5 Distributable Earnings dividend coverage, fully converted (3), (4) 34.5% Common stock/retained earnings (6) 1,272.7 Distributable Earnings per share before realized gain/(loss), fully converted (3), (4) $0.22 Total equity (5), (6) $1,621.2 Distributable Earnings return on common equity before realized gain/(loss) (3) 6.3% Book value per share, fully converted (4) $14.15 Distributable Earnings dividend coverage before realized gain/(loss), fully converted (3), (4) 63.1% Net debt/total equity 2.50x Dividend per share $0.355 Recourse net debt/total equity 0.81x Dividend per share yield on book value 10.0% Financial Highlights Note: All numbers in millions except per share and share data. 1. Excludes NewPoint. 2. Does not include real estate owned operating income which is reported under Other income / (loss). 3. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 4. Fully Converted assumes conversion of our series of convertible preferred stock and OP Units along with full vesting of our outstanding equity compensation awards. 5. Includes $90 million of preferred equity that converts to common equity on 1/21/28, subject to the holder's right to accelerate the conversion. These amounts are reflected as temporary equity on the consolidated balance sheets. The remaining $259 million of preferred equity represents the Series E preferred, which is not convertible into common equity. 6. Includes non-controlling interest. FBRT 4Q 2025 Financial Update

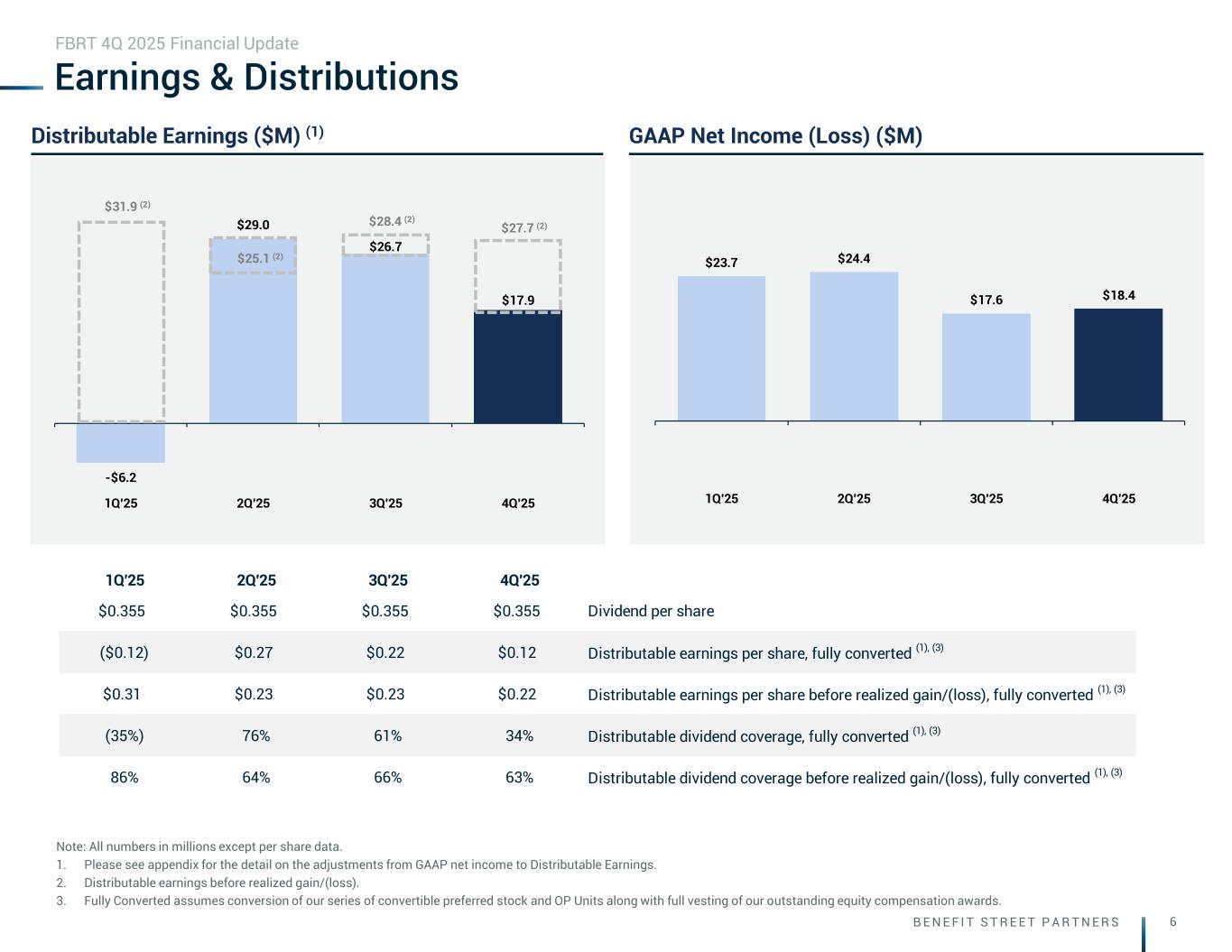

B E N E F I T S T R E E T P A R T N E R S 6 -$6.2 $29.0 $26.7 $17.9 1Q'25 2Q'25 3Q'25 4Q'25 $31.9 (2) $28.4 (2) $27.7 (2) $25.1 (2) $23.7 $24.4 $17.6 $18.4 1Q'25 2Q'25 3Q'25 4Q'25 1Q'25 2Q'25 3Q'25 4Q'25 $0.355 $0.355 $0.355 $0.355 Dividend per share ($0.12) $0.27 $0.22 $0.12 Distributable earnings per share, fully converted (1), (3) $0.31 $0.23 $0.23 $0.22 Distributable earnings per share before realized gain/(loss), fully converted (1), (3) (35%) 76% 61% 34% Distributable dividend coverage, fully converted (1), (3) 86% 64% 66% 63% Distributable dividend coverage before realized gain/(loss), fully converted (1), (3) Earnings & Distributions Note: All numbers in millions except per share data. 1. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 2. Distributable earnings before realized gain/(loss). 3. Fully Converted assumes conversion of our series of convertible preferred stock and OP Units along with full vesting of our outstanding equity compensation awards. FBRT 4Q 2025 Financial Update Distributable Earnings ($M) (1) GAAP Net Income (Loss) ($M)

B E N E F I T S T R E E T P A R T N E R S 7 $4,425 $507 $43 ($510) ($29) $4,436 3Q25 Loans Outstanding Fundings on New Loans Fundings on Existing Loans Repayments REO/ Foreclosures 4Q25 Loans Outstanding $5,000 $966 $191 ($1,455) ($232) ($34) $4,436 4Q24 Loans Outstanding Fundings on New Loans Fundings on Existing Loans Repayments REO/ Foreclosures Transfer to HFS 4Q25 Loans Outstanding (1) (1) (2) (2) Note: All numbers in millions. 1. Includes full paydowns, dispositions, partial paydowns, non-REO related charge-offs and amortization. 2. Includes REO related charge-offs. Core Net Fundings FBRT 4Q 2025 Financial Update 4Q 2025 ($M) YTD 2025 ($M) Total Commitment of $528M Total Commitment of $1.2B

B E N E F I T S T R E E T P A R T N E R S 8 Capitalization Overview 1. On our core book (excluding repo-securities and NewPoint), 68% of financings are non-mark-to-market. 2. Net leverage represents (i) total outstanding borrowings under secured financing arrangements, including collateralized loan obligations, repurchase agreements - commercial mortgage loans, repurchase agreements - real estate securities, asset-specific financing arrangements, and unsecured debt, less cash and cash equivalents, to (ii) total equity and total redeemable convertible preferred stock, at period end. Recourse net leverage excludes collateralized loan obligations. FBRT 4Q 2025 Financial Update Financing Sources (1) Net Leverage (2) Average debt cost including financing was 6.5% in 4Q25 vs. 7.1% in 3Q25 Collateralized Loan Obligations 65% Warehouse 26% Unsecured Debt 4% Repo - Securities 4% Asset Specific Financings 1% 0.81x 2.50x 0.00x 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x Recourse Net Leverage Total Net Leverage

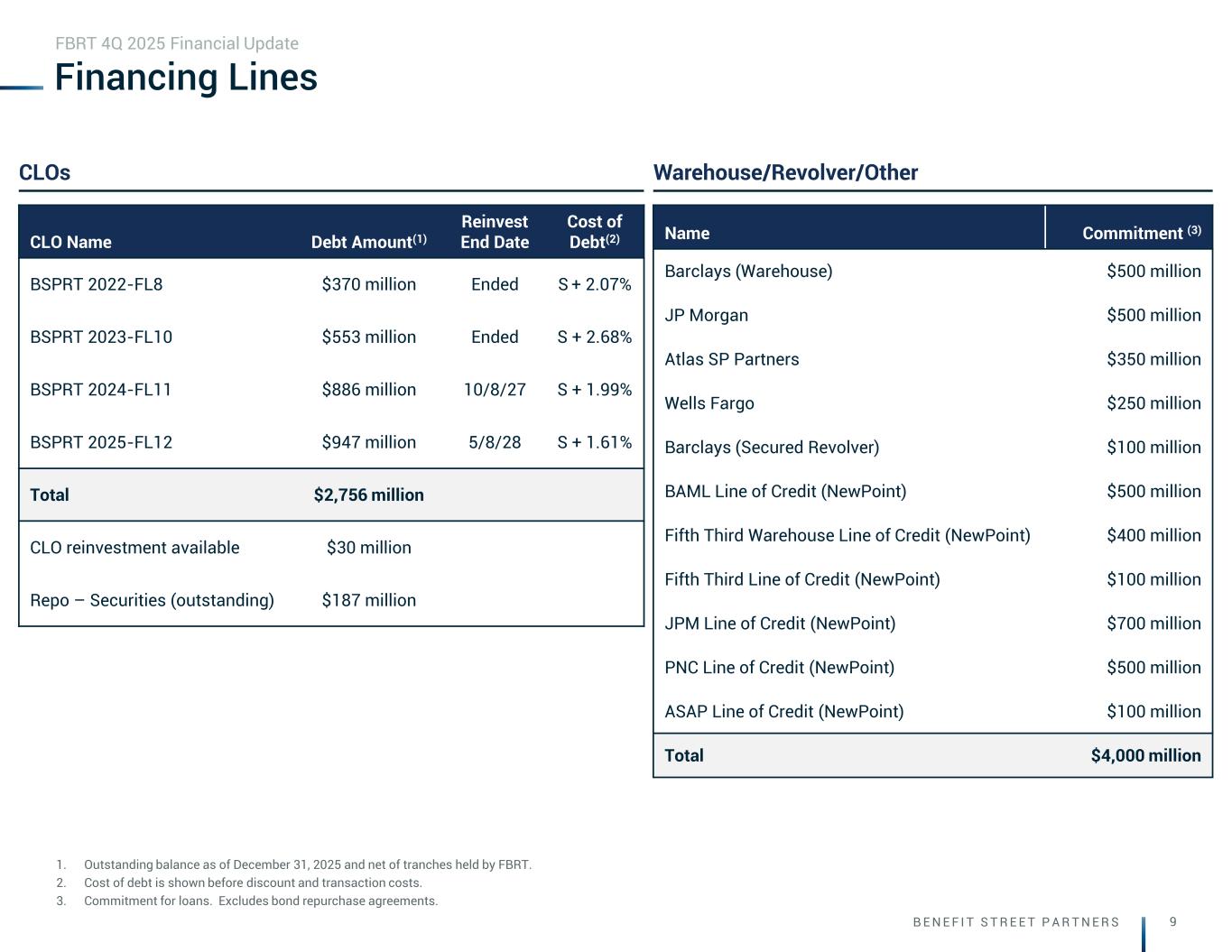

B E N E F I T S T R E E T P A R T N E R S 9 Financing Lines 1. Outstanding balance as of December 31, 2025 and net of tranches held by FBRT. 2. Cost of debt is shown before discount and transaction costs. 3. Commitment for loans. Excludes bond repurchase agreements. FBRT 4Q 2025 Financial Update CLOs Warehouse/Revolver/Other CLO Name Debt Amount(1) Reinvest End Date Cost of Debt(2) BSPRT 2022-FL8 $370 million Ended S + 2.07% BSPRT 2023-FL10 $553 million Ended S + 2.68% BSPRT 2024-FL11 $886 million 10/8/27 S + 1.99% BSPRT 2025-FL12 $947 million 5/8/28 S + 1.61% Total $2,756 million CLO reinvestment available $30 million Repo – Securities (outstanding) $187 million Name Commitment (3) Barclays (Warehouse) $500 million JP Morgan $500 million Atlas SP Partners $350 million Wells Fargo $250 million Barclays (Secured Revolver) $100 million BAML Line of Credit (NewPoint) $500 million Fifth Third Warehouse Line of Credit (NewPoint) $400 million Fifth Third Line of Credit (NewPoint) $100 million JPM Line of Credit (NewPoint) $700 million PNC Line of Credit (NewPoint) $500 million ASAP Line of Credit (NewPoint) $100 million Total $4,000 million

B E N E F I T S T R E E T P A R T N E R S 10 $30 $624 $821 $167 Unrestricted Cash CLO Reinvestment Available Financing Available & In Progress Total Liquidity (1) Liquidity 1. Represents cash available at 12/31/2025 that we can invest at a market advance rate utilizing our available capacity on financing lines. FBRT 4Q 2025 Financial Update Liquidity ($M)

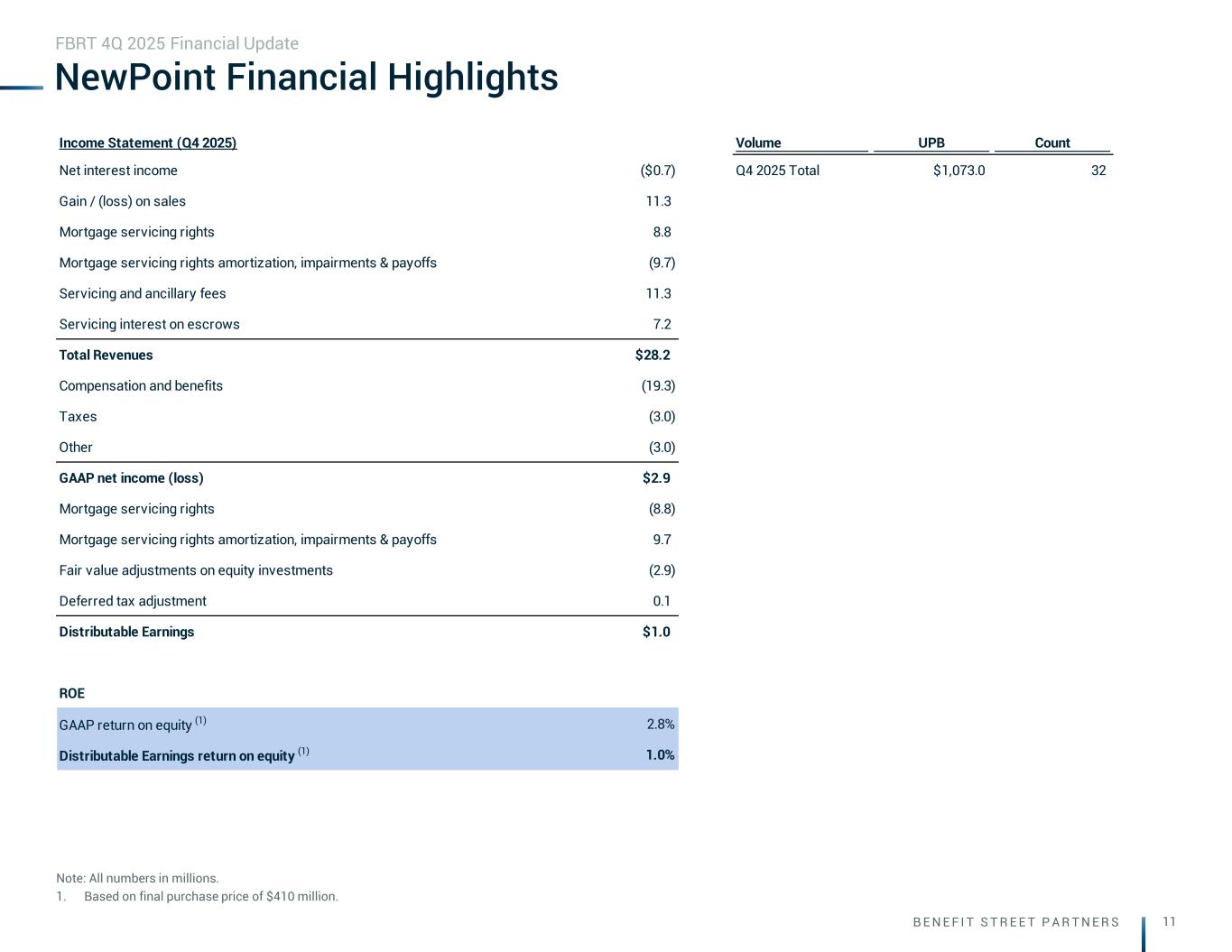

B E N E F I T S T R E E T P A R T N E R S 11 NewPoint Financial Highlights Note: All numbers in millions. 1. Based on final purchase price of $410 million. FBRT 4Q 2025 Financial Update Income Statement (Q4 2025) Volume UPB Count Net interest income ($0.7) Q4 2025 Total $1,073.0 32 Gain / (loss) on sales 11.3 Mortgage servicing rights 8.8 Mortgage servicing rights amortization, impairments & payoffs (9.7) Servicing and ancillary fees 11.3 Servicing interest on escrows 7.2 Total Revenues $28.2 Compensation and benefits (19.3) Taxes (3.0) Other (3.0) GAAP net income (loss) $2.9 Mortgage servicing rights (8.8) Mortgage servicing rights amortization, impairments & payoffs 9.7 Fair value adjustments on equity investments (2.9) Deferred tax adjustment 0.1 Distributable Earnings $1.0 ROE GAAP return on equity (1) 2.8% Distributable Earnings return on equity (1) 1.0%

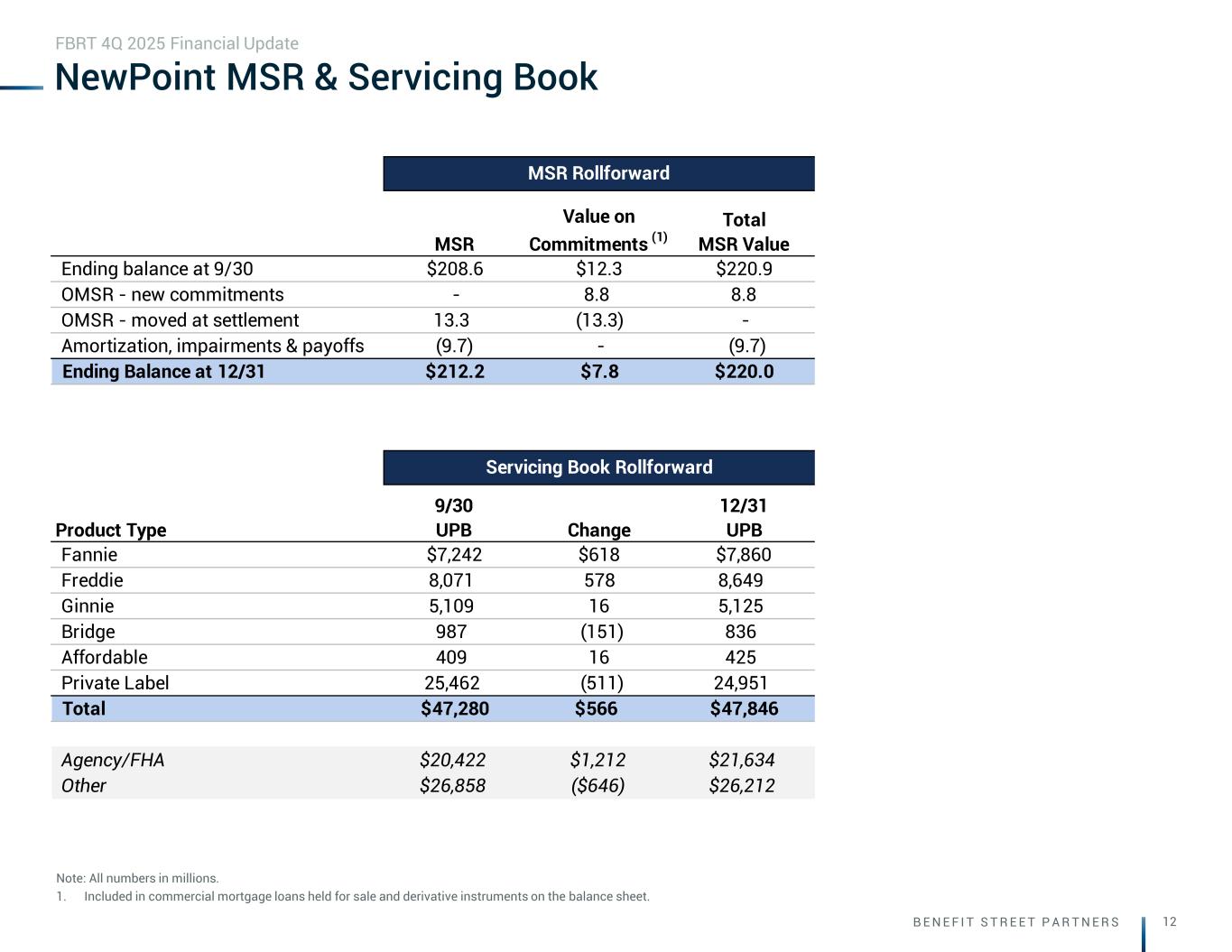

B E N E F I T S T R E E T P A R T N E R S 12 NewPoint MSR & Servicing Book Note: All numbers in millions. 1. Included in commercial mortgage loans held for sale and derivative instruments on the balance sheet. FBRT 4Q 2025 Financial Update MSR Value on Commitments (1) Total MSR Value Ending balance at 9/30 $208.6 $12.3 $220.9 OMSR - new commitments - 8.8 8.8 OMSR - moved at settlement 13.3 (13.3) - Amortization, impairments & payoffs (9.7) - (9.7) Ending Balance at 12/31 $212.2 $7.8 $220.0 Product Type 9/30 UPB Change 12/31 UPB Fannie $7,242 $618 $7,860 Freddie 8,071 578 8,649 Ginnie 5,109 16 5,125 Bridge 987 (151) 836 Affordable 409 16 425 Private Label 25,462 (511) 24,951 Total $47,280 $566 $47,846 Agency/FHA $20,422 $1,212 $21,634 Other $26,858 ($646) $26,212 Servicing Book Rollforward MSR Rollforward

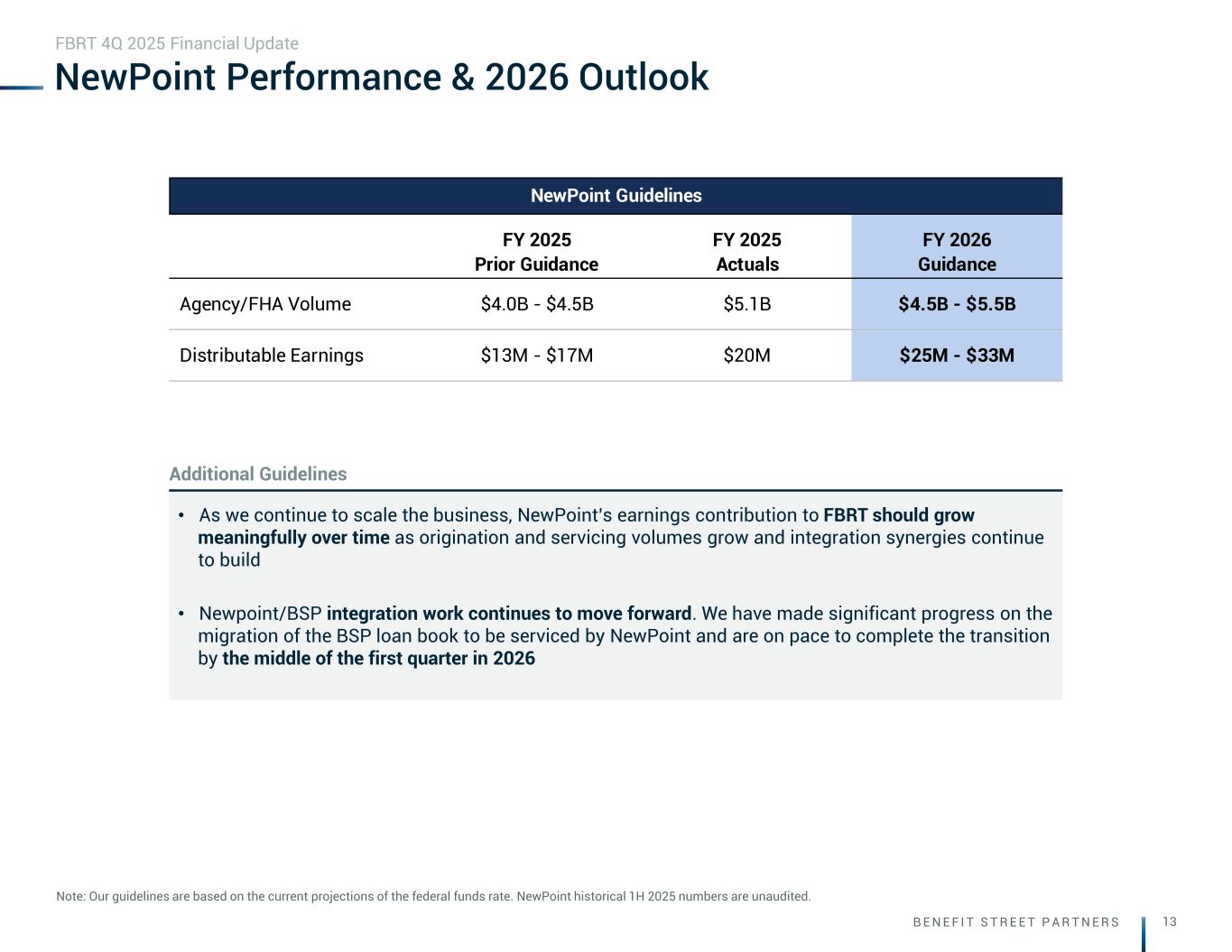

B E N E F I T S T R E E T P A R T N E R S 13 NewPoint Performance & 2026 Outlook Note: Our guidelines are based on the current projections of the federal funds rate. NewPoint historical 1H 2025 numbers are unaudited. FBRT 4Q 2025 Financial Update • As we continue to scale the business, NewPoint’s earnings contribution to FBRT should grow meaningfully over time as origination and servicing volumes grow and integration synergies continue to build • Newpoint/BSP integration work continues to move forward. We have made significant progress on the migration of the BSP loan book to be serviced by NewPoint and are on pace to complete the transition by the middle of the first quarter in 2026 FY 2025 Prior Guidance FY 2025 Actuals FY 2026 Guidance Agency/FHA Volume $4.0B - $4.5B $5.1B $4.5B - $5.5B Distributable Earnings $13M - $17M $20M $25M - $33M NewPoint Guidelines Additional Guidelines

Portfolio

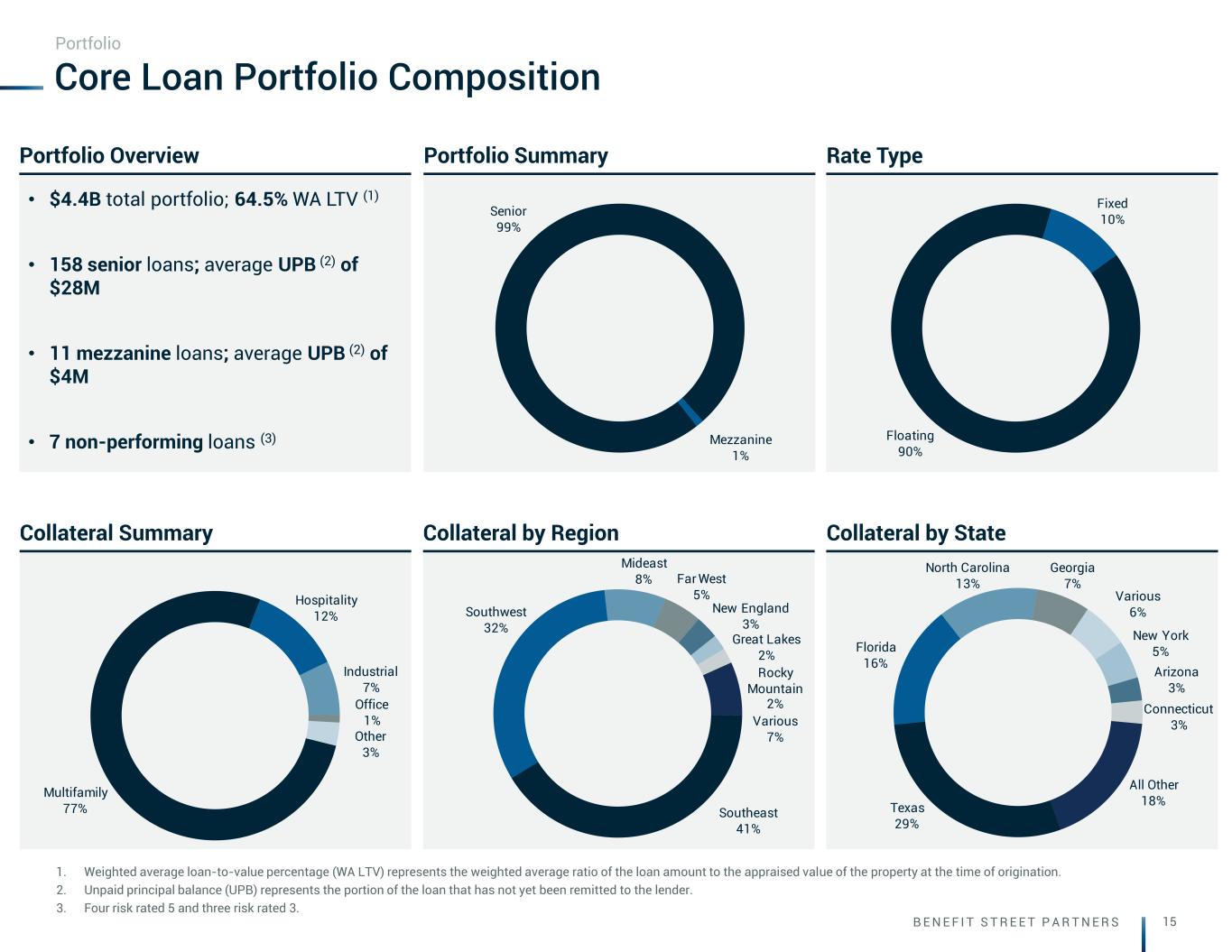

B E N E F I T S T R E E T P A R T N E R S 15 Collateral by Region Texas 29% Florida 16% North Carolina 13% Georgia 7% Various 6% New York 5% Arizona 3% Connecticut 3% All Other 18% Core Loan Portfolio Composition 1. Weighted average loan-to-value percentage (WA LTV) represents the weighted average ratio of the loan amount to the appraised value of the property at the time of origination. 2. Unpaid principal balance (UPB) represents the portion of the loan that has not yet been remitted to the lender. 3. Four risk rated 5 and three risk rated 3. Portfolio Rate TypePortfolio Summary Collateral by StateCollateral Summary • $4.4B total portfolio; 64.5% WA LTV (1) • 158 senior loans; average UPB (2) of $28M • 11 mezzanine loans; average UPB (2) of $4M • 7 non-performing loans (3) Portfolio Overview Southeast 41% Southwest 32% Mideast 8% Far West 5% New England 3% Great Lakes 2% Rocky Mountain 2% Various 7% Floating 90% Fixed 10% Senior 99% Mezzanine 1% Multifamily 77% Hospitality 12% Industrial 7% Office 1% Other 3%

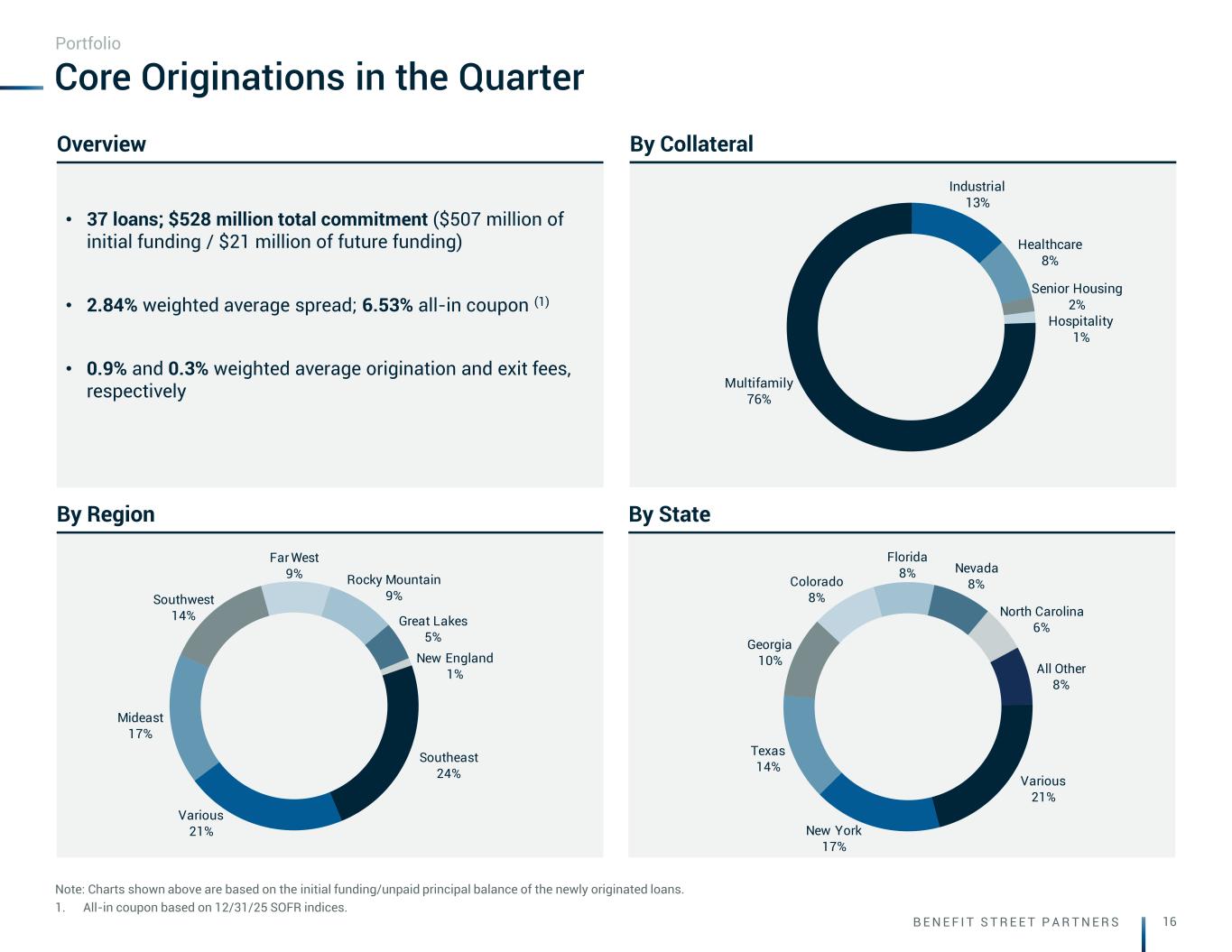

B E N E F I T S T R E E T P A R T N E R S 16 By State By Collateral By Region Core Originations in the Quarter Note: Charts shown above are based on the initial funding/unpaid principal balance of the newly originated loans. 1. All-in coupon based on 12/31/25 SOFR indices. Portfolio • 37 loans; $528 million total commitment ($507 million of initial funding / $21 million of future funding) • 2.84% weighted average spread; 6.53% all-in coupon (1) • 0.9% and 0.3% weighted average origination and exit fees, respectively Overview Southeast 24% Various 21% Mideast 17% Southwest 14% Far West 9% Rocky Mountain 9% Great Lakes 5% New England 1% Various 21% New York 17% Texas 14% Georgia 10% Colorado 8% Florida 8% Nevada 8% North Carolina 6% All Other 8% Multifamily 76% Industrial 13% Healthcare 8% Senior Housing 2% Hospitality 1%

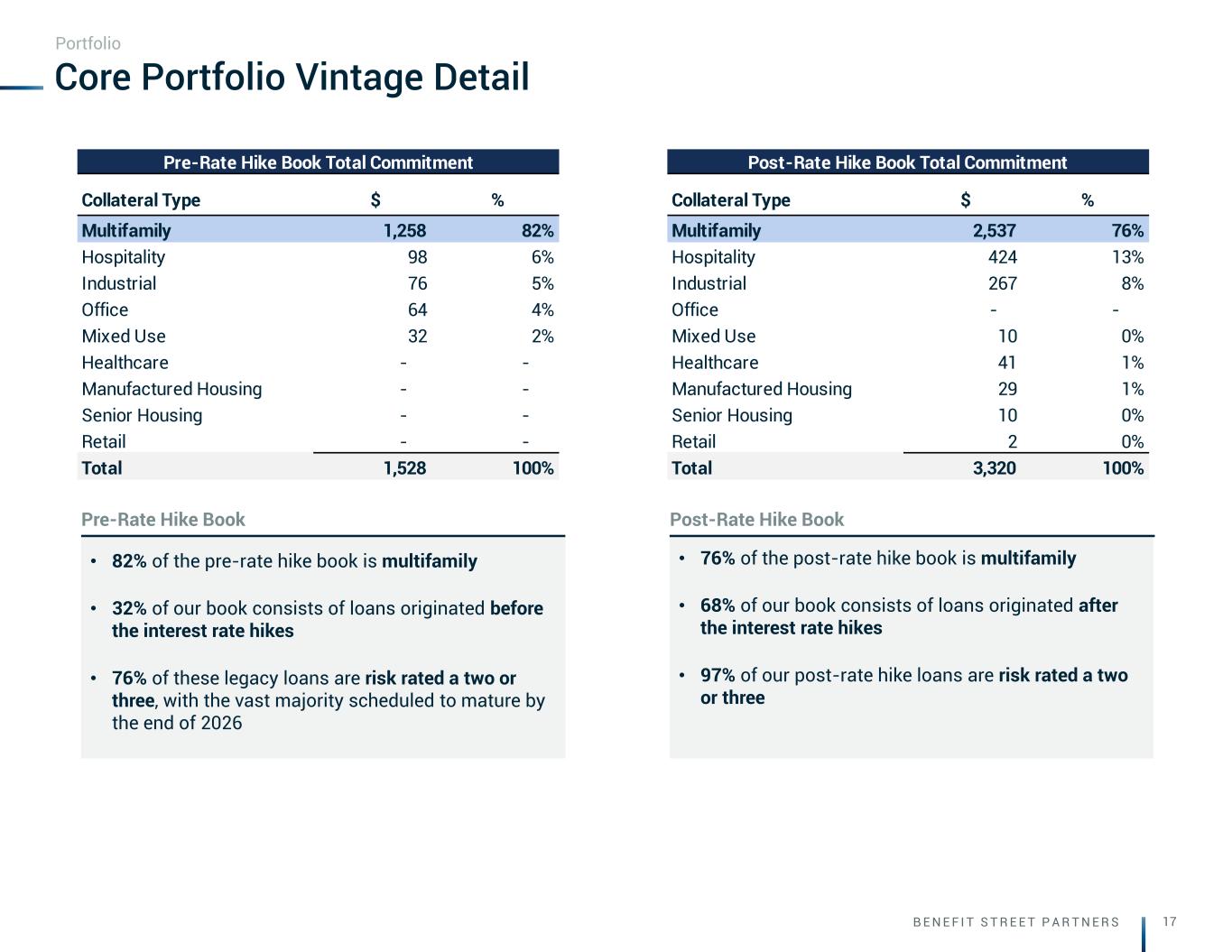

B E N E F I T S T R E E T P A R T N E R S 17 Pre-Rate Hike Book Total Commitment Post-Rate Hike Book Total Commitment Risk Ratings by Commitment Collateral Type $ % Collateral Type $ % Multifamily 1,258 82% Multifamily 2,537 76% Hospitality 98 6% Hospitality 424 13% Industrial 76 5% Industrial 267 8% Office 64 4% Office - - Mixed Use 32 2% Mixed Use 10 0% Healthcare - - Healthcare 41 1% Manufactured Housing - - Manufactured Housing 29 1% Senior Housing - - Senior Housing 10 0% Retail - - Retail 2 0% Total 1,528 100% Total 3,320 100% Core Portfolio Vintage Detail Portfolio • 76% of the post-rate hike book is multifamily • 68% of our book consists of loans originated after the interest rate hikes • 97% of our post-rate hike loans are risk rated a two or three • 82% of the pre-rate hike book is multifamily • 32% of our book consists of loans originated before the interest rate hikes • 76% of these legacy loans are risk rated a two or three, with the vast majority scheduled to mature by the end of 2026 Pre-Rate Hike Book Post-Rate Hike Book

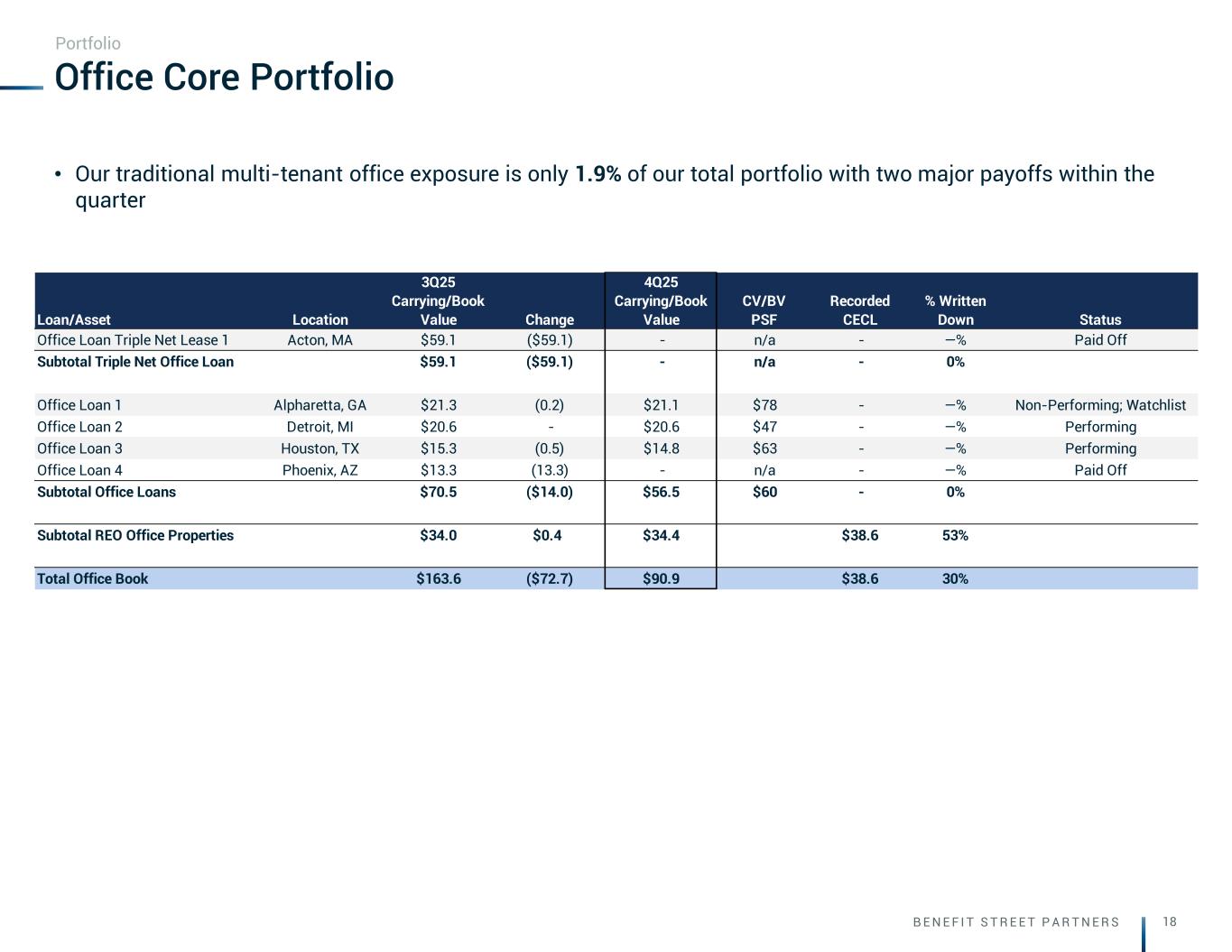

B E N E F I T S T R E E T P A R T N E R S 18 • Our traditional multi-tenant office exposure is only 1.9% of our total portfolio with two major payoffs within the quarter Office Core Portfolio Portfolio Loan/Asset Location 3Q25 Carrying/Book Value Change 4Q25 Carrying/Book Value CV/BV PSF Recorded CECL % Written Down Status Office Loan Triple Net Lease 1 Acton, MA $59.1 ($59.1) - n/a - —% Paid Off Subtotal Triple Net Office Loan $59.1 ($59.1) - n/a - 0% Office Loan 1 Alpharetta, GA $21.3 (0.2) $21.1 $78 - —% Non-Performing; Watchlist Office Loan 2 Detroit, MI $20.6 - $20.6 $47 - —% Performing Office Loan 3 Houston, TX $15.3 (0.5) $14.8 $63 - —% Performing Office Loan 4 Phoenix, AZ $13.3 (13.3) - n/a - —% Paid Off Subtotal Office Loans $70.5 ($14.0) $56.5 $60 - 0% Subtotal REO Office Properties $34.0 $0.4 $34.4 $38.6 53% Total Office Book $163.6 ($72.7) $90.9 $38.6 30%

B E N E F I T S T R E E T P A R T N E R S 19 Investment Loan Type Investment Date Default Date Non-Performing Collateral Loan Purpose Location Loan Risk Rating 276-Unit Apartment Community Floating Rate Senior Loan Q2 2022 None Yes Multifamily Acquisition Charlotte, NC 5 184-Unit Apartment Community Floating Rate Senior Loan Q4 2021 None Yes Multifamily Acquisition Glendale, AZ 5 Suburban Office Park Floating Rate Senior Loan Q4 2019 None Yes Office Acquisition Alpharetta, GA 5 77-Unit Apartment Community Floating Rate Senior Loan Q4 2021 Q3 2025 Yes Multifamily Acquisition Philadelphia, PA 5 848-Unit Apartment Community Floating Rate Senior Loan Q1 2021 None No Multifamily Acquisition Garland, TX 4 307-Unit Student Housing Community Floating Rate Senior Loan Q2 2022 None No Multifamily Acquisition Norfolk, VA 4 344-Unit Apartment Community Floating Rate Senior Loan Q4 2022 None No Multifamily Acquisition San Antonio, TX 4 176-Unit Apartment Community Floating Rate Senior Loan Q2 2022 None No Multifamily Acquisition Fort Worth, TX 4 172-Unit Apartment Community Floating Rate Senior Loan Q1 2022 None No Multifamily Acquisition Tempe, AZ 4 476-Unit Apartment Community Floating Rate Senior Loan Q1 2021 None No Multifamily Acquisition Austin, TX 4 Core Portfolio - Watch List Loans (Risk Rating 4&5) Note: Watchlist loans are loans with a risk rating of 4 or 5. All numbers in millions. Portfolio

B E N E F I T S T R E E T P A R T N E R S 20 Investment Loan Investment Date Foreclosure / Deed-In-Lieu Date Collateral Type Collateral Detail Location Single Tenant Retail Portfolio Q2 2022 Q4 2022 - Q2 2023 Retail 1 Freestanding Retail Property Roseboro, NC CBD Office Complex Q1 2020 Q3 2023 Office 124k Square Foot Office Complex Portland, OR 471-Unit Apartment Community Q2 2022 Q2 2024 Multifamily 471-Unit, Garden Style Apartment Community Raleigh, NC 426-Unit Apartment Community Q2 2018 Q2 2024 Multifamily 426-Unit, High Rise Apartment Community Cleveland, OH CBD Office Complex Q1 2021 Q1 2025 Office 301k Square Foot Office Complex Denver, CO 249-Unit Apartment Community Q1 2021 Q2 2025 Multifamily 249-Unit, Garden Style Apartment Community Austin, TX 272-Unit Apartment Community Q2 2022 Q4 2025 Multifamily 272-Unit, Garden Style Apartment Community Fort Worth, TX Foreclosure Real Estate Owned (“REO”) Portfolio

Appendix

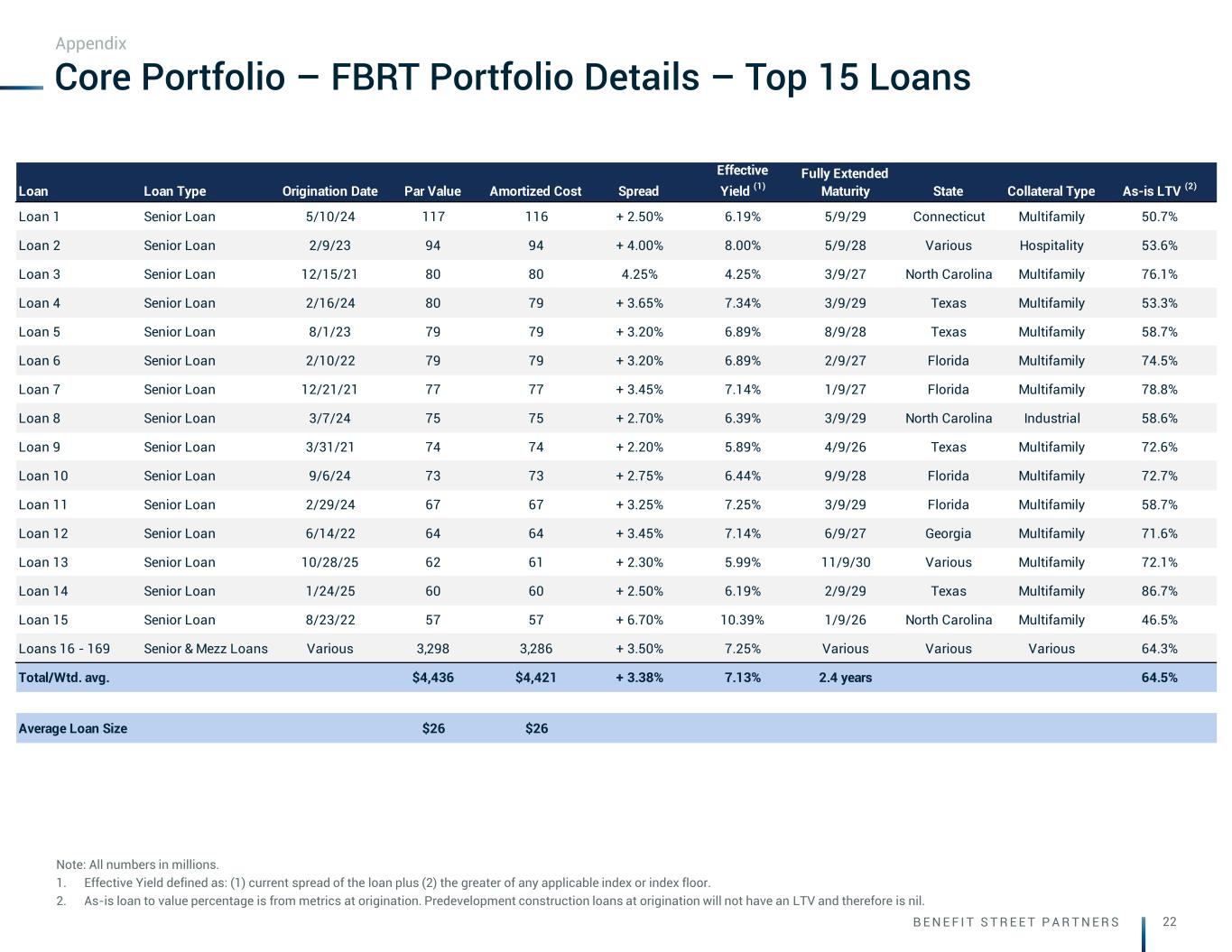

B E N E F I T S T R E E T P A R T N E R S 22 Core Portfolio – FBRT Portfolio Details – Top 15 Loans Note: All numbers in millions. 1. Effective Yield defined as: (1) current spread of the loan plus (2) the greater of any applicable index or index floor. 2. As-is loan to value percentage is from metrics at origination. Predevelopment construction loans at origination will not have an LTV and therefore is nil. Appendix Loan Loan Type Origination Date Par Value Amortized Cost Spread Effective Yield (1) Fully Extended Maturity State Collateral Type As-is LTV (2) Loan 1 Senior Loan 5/10/24 117 116 + 2.50% 6.19% 5/9/29 Connecticut Multifamily 50.7% Loan 2 Senior Loan 2/9/23 94 94 + 4.00% 8.00% 5/9/28 Various Hospitality 53.6% Loan 3 Senior Loan 12/15/21 80 80 4.25% 4.25% 3/9/27 North Carolina Multifamily 76.1% Loan 4 Senior Loan 2/16/24 80 79 + 3.65% 7.34% 3/9/29 Texas Multifamily 53.3% Loan 5 Senior Loan 8/1/23 79 79 + 3.20% 6.89% 8/9/28 Texas Multifamily 58.7% Loan 6 Senior Loan 2/10/22 79 79 + 3.20% 6.89% 2/9/27 Florida Multifamily 74.5% Loan 7 Senior Loan 12/21/21 77 77 + 3.45% 7.14% 1/9/27 Florida Multifamily 78.8% Loan 8 Senior Loan 3/7/24 75 75 + 2.70% 6.39% 3/9/29 North Carolina Industrial 58.6% Loan 9 Senior Loan 3/31/21 74 74 + 2.20% 5.89% 4/9/26 Texas Multifamily 72.6% Loan 10 Senior Loan 9/6/24 73 73 + 2.75% 6.44% 9/9/28 Florida Multifamily 72.7% Loan 11 Senior Loan 2/29/24 67 67 + 3.25% 7.25% 3/9/29 Florida Multifamily 58.7% Loan 12 Senior Loan 6/14/22 64 64 + 3.45% 7.14% 6/9/27 Georgia Multifamily 71.6% Loan 13 Senior Loan 10/28/25 62 61 + 2.30% 5.99% 11/9/30 Various Multifamily 72.1% Loan 14 Senior Loan 1/24/25 60 60 + 2.50% 6.19% 2/9/29 Texas Multifamily 86.7% Loan 15 Senior Loan 8/23/22 57 57 + 6.70% 10.39% 1/9/26 North Carolina Multifamily 46.5% Loans 16 - 169 Senior & Mezz Loans Various 3,298 3,286 + 3.50% 7.25% Various Various Various 64.3% Total/Wtd. avg. $4,436 $4,421 + 3.38% 7.13% 2.4 years 64.5% Average Loan Size $26 $26

B E N E F I T S T R E E T P A R T N E R S 23 Risk Rating Principal Balance - 3,214 849 247 126 Loan Count, 3Q25 - 118 19 8 2 (+) Addition - 37 6 2 2 (-) Reduction - (18) (3) (4) - Loan Count, 4Q25 - 137 22 6 4 Change QoQ - 19 3 (2) 2 Non-Performing - - 3 - 4 Watch List - - - 6 4 0.0% 72.5% 19.1% 5.6% 2.8% 1 2 3 4 5 Core Portfolio – Risk Ratings Note: Principal balance in millions. Watchlist loans are loans with a risk rating of 4 or 5. Appendix Risk Ratings Average risk rating was 2.4 for the quarter vs. 2.3 from 3Q25

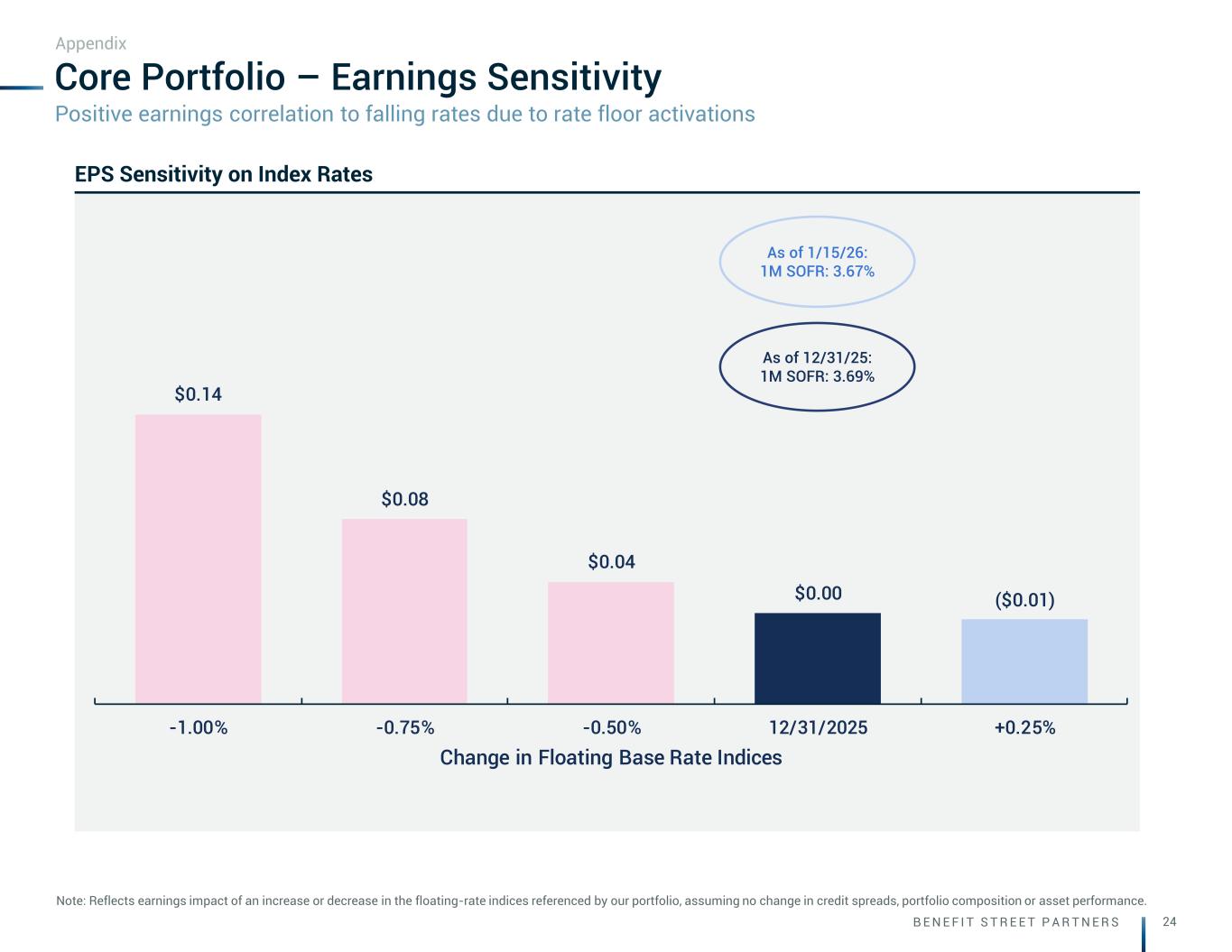

B E N E F I T S T R E E T P A R T N E R S 24 $0.14 $0.08 $0.04 $0.00 ($0.01) -1.00% -0.75% -0.50% 12/31/2025 +0.25% Change in Floating Base Rate Indices Core Portfolio – Earnings Sensitivity Note: Reflects earnings impact of an increase or decrease in the floating-rate indices referenced by our portfolio, assuming no change in credit spreads, portfolio composition or asset performance. Appendix EPS Sensitivity on Index Rates Positive earnings correlation to falling rates due to rate floor activations As of 1/15/26: 1M SOFR: 3.67% As of 12/31/25: 1M SOFR: 3.69%

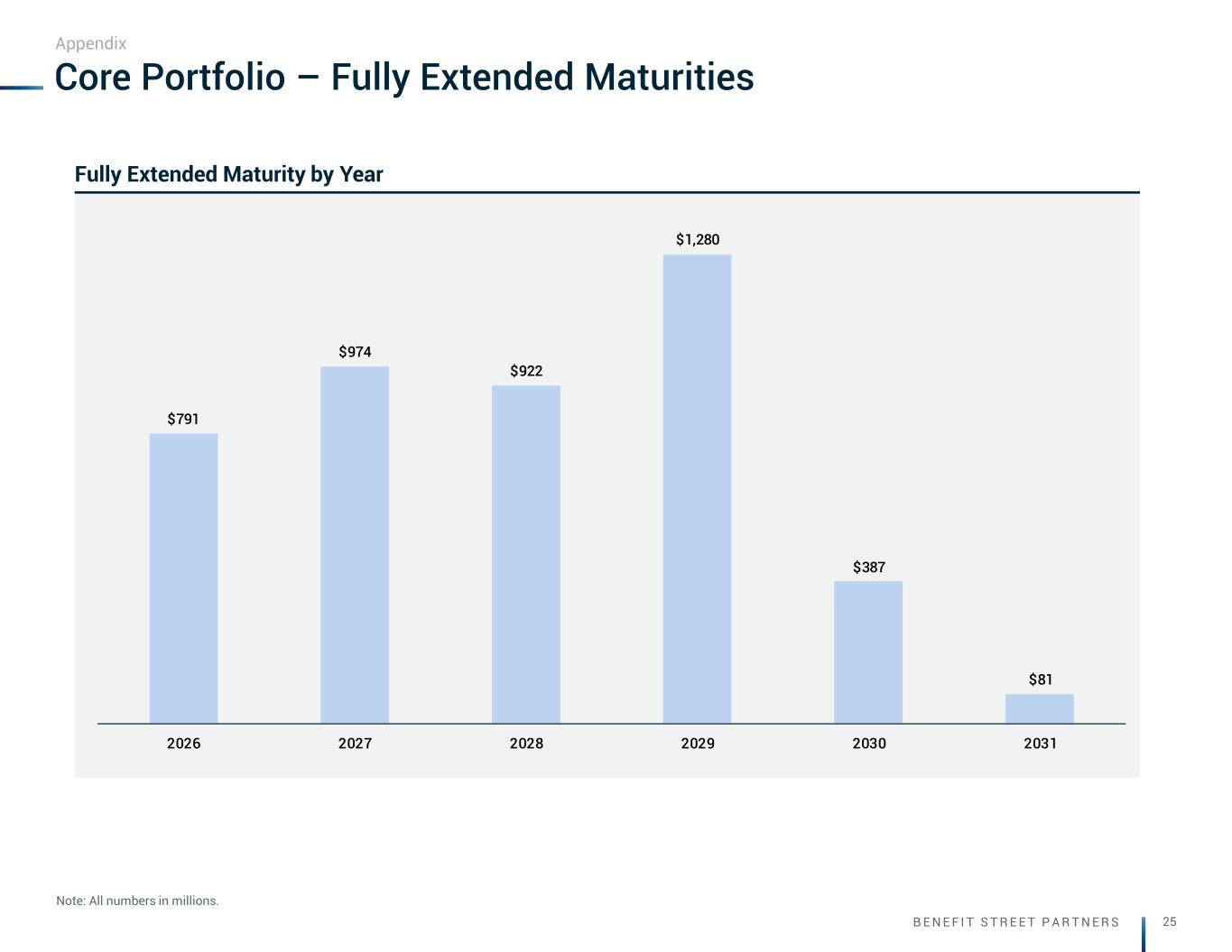

B E N E F I T S T R E E T P A R T N E R S 25 $791 $974 $922 $1,280 $387 $81 2026 2027 2028 2029 2030 2031 Core Portfolio – Fully Extended Maturities Note: All numbers in millions. Appendix Fully Extended Maturity by Year

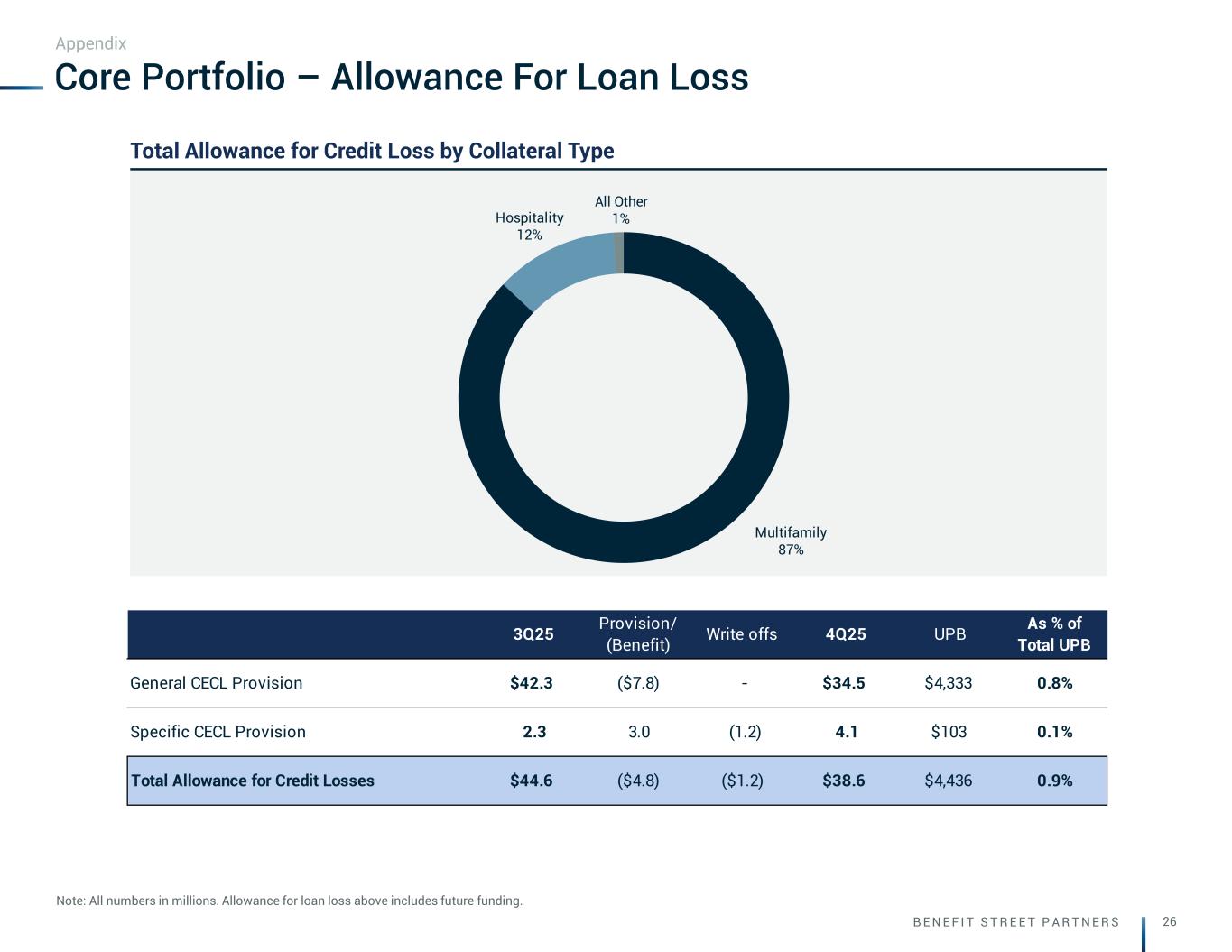

B E N E F I T S T R E E T P A R T N E R S 26 Multifamily 87% Hospitality 12% All Other 1% 3Q25 Provision/ (Benefit) Write offs 4Q25 UPB As % of Total UPB General CECL Provision $42.3 ($7.8) - $34.5 $4,333 0.8% Specific CECL Provision 2.3 3.0 (1.2) 4.1 $103 0.1% Total Allowance for Credit Losses $44.6 ($4.8) ($1.2) $38.6 $4,436 0.9% Core Portfolio – Allowance For Loan Loss Note: All numbers in millions. Allowance for loan loss above includes future funding. Appendix Total Allowance for Credit Loss by Collateral Type

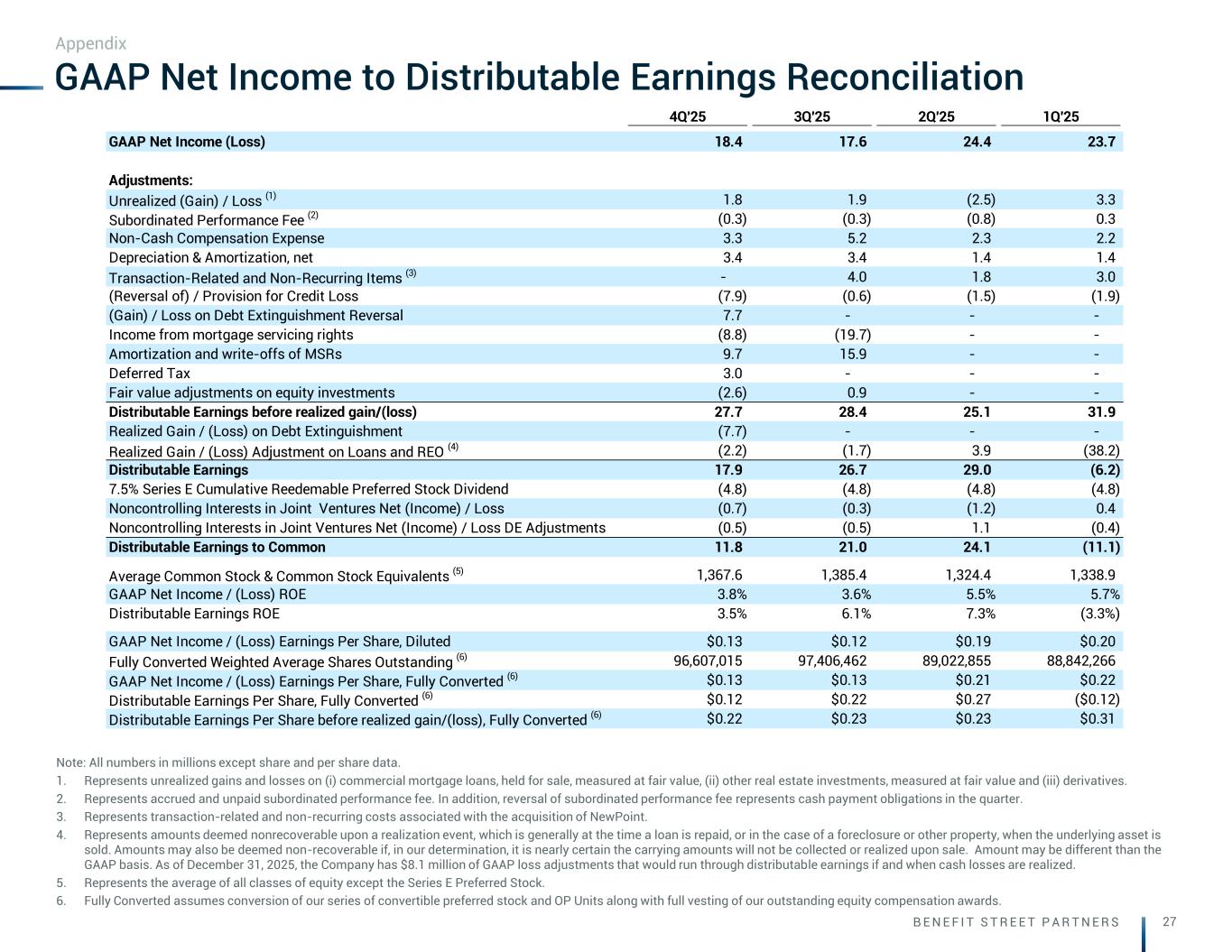

B E N E F I T S T R E E T P A R T N E R S 27 GAAP Net Income to Distributable Earnings Reconciliation Note: All numbers in millions except share and per share data. 1. Represents unrealized gains and losses on (i) commercial mortgage loans, held for sale, measured at fair value, (ii) other real estate investments, measured at fair value and (iii) derivatives. 2. Represents accrued and unpaid subordinated performance fee. In addition, reversal of subordinated performance fee represents cash payment obligations in the quarter. 3. Represents transaction-related and non-recurring costs associated with the acquisition of NewPoint. 4. Represents amounts deemed nonrecoverable upon a realization event, which is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized upon sale. Amount may be different than the GAAP basis. As of December 31, 2025, the Company has $8.1 million of GAAP loss adjustments that would run through distributable earnings if and when cash losses are realized. 5. Represents the average of all classes of equity except the Series E Preferred Stock. 6. Fully Converted assumes conversion of our series of convertible preferred stock and OP Units along with full vesting of our outstanding equity compensation awards. Appendix 4Q'25 3Q'25 2Q'25 1Q'25 GAAP Net Income (Loss) 18.4 17.6 24.4 23.7 Adjustments: Unrealized (Gain) / Loss (1) 1.8 1.9 (2.5) 3.3 Subordinated Performance Fee (2) (0.3) (0.3) (0.8) 0.3 Non-Cash Compensation Expense 3.3 5.2 2.3 2.2 Depreciation & Amortization, net 3.4 3.4 1.4 1.4 Transaction-Related and Non-Recurring Items (3) - 4.0 1.8 3.0 (Reversal of) / Provision for Credit Loss (7.9) (0.6) (1.5) (1.9) (Gain) / Loss on Debt Extinguishment Reversal 7.7 - - - Income from mortgage servicing rights (8.8) (19.7) - - Amortization and write-offs of MSRs 9.7 15.9 - - Deferred Tax 3.0 - - - Fair value adjustments on equity investments (2.6) 0.9 - - Distributable Earnings before realized gain/(loss) 27.7 28.4 25.1 31.9 Realized Gain / (Loss) on Debt Extinguishment (7.7) - - - Realized Gain / (Loss) Adjustment on Loans and REO (4) (2.2) (1.7) 3.9 (38.2) Distributable Earnings 17.9 26.7 29.0 (6.2) 7.5% Series E Cumulative Reedemable Preferred Stock Dividend (4.8) (4.8) (4.8) (4.8) Noncontrolling Interests in Joint Ventures Net (Income) / Loss (0.7) (0.3) (1.2) 0.4 Noncontrolling Interests in Joint Ventures Net (Income) / Loss DE Adjustments (0.5) (0.5) 1.1 (0.4) Distributable Earnings to Common 11.8 21.0 24.1 (11.1) Average Common Stock & Common Stock Equivalents (5) 1,367.6 1,385.4 1,324.4 1,338.9 GAAP Net Income / (Loss) ROE 3.8% 3.6% 5.5% 5.7% Distributable Earnings ROE 3.5% 6.1% 7.3% (3.3%) GAAP Net Income / (Loss) Earnings Per Share, Diluted $0.13 $0.12 $0.19 $0.20 Fully Converted Weighted Average Shares Outstanding (6) 96,607,015 97,406,462 89,022,855 88,842,266 GAAP Net Income / (Loss) Earnings Per Share, Fully Converted (6) $0.13 $0.13 $0.21 $0.22 Distributable Earnings Per Share, Fully Converted (6) $0.12 $0.22 $0.27 ($0.12) Distributable Earnings Per Share before realized gain/(loss), Fully Converted (6) $0.22 $0.23 $0.23 $0.31

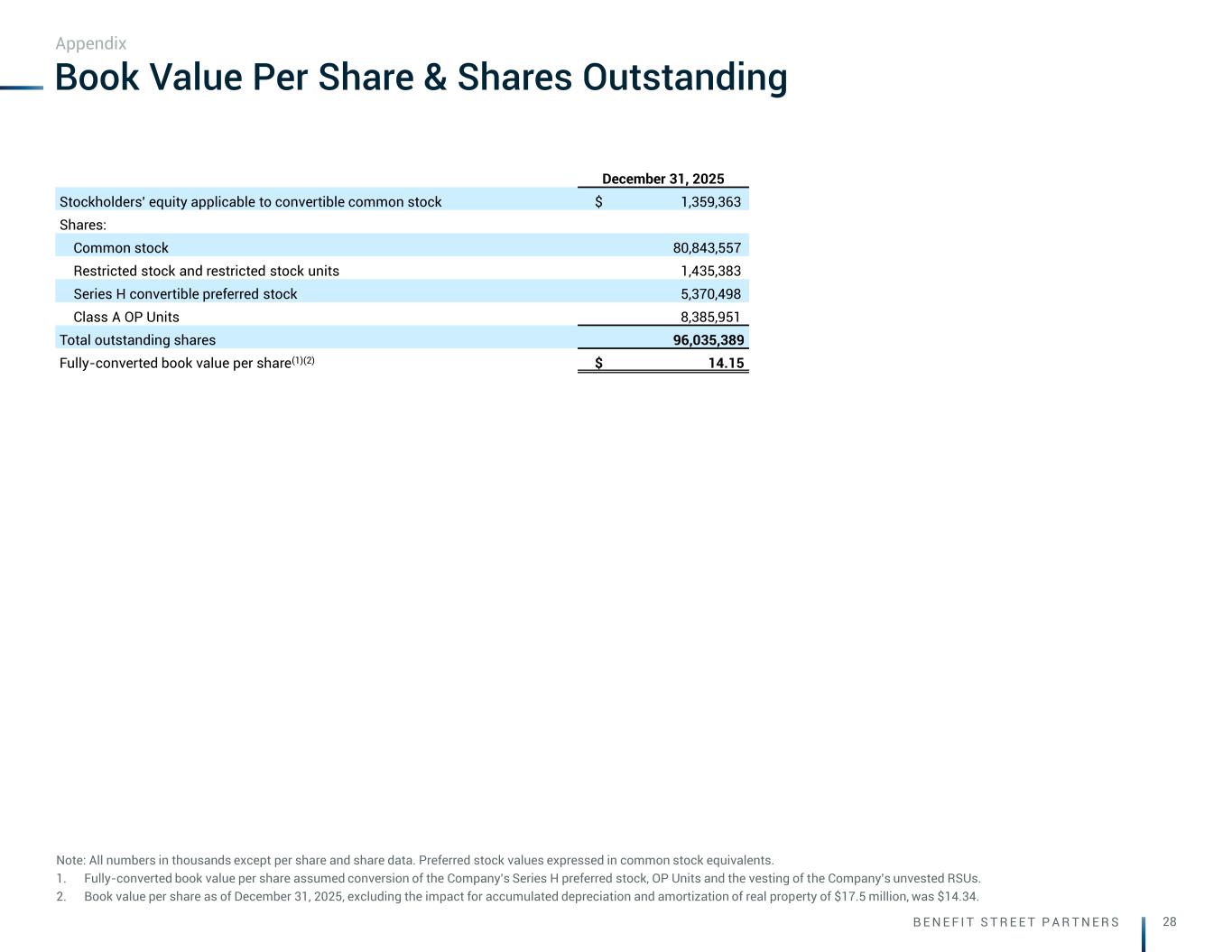

B E N E F I T S T R E E T P A R T N E R S 28 December 31, 2025 Stockholders' equity applicable to convertible common stock $ 1,359,363 Shares: Common stock 80,843,557 Restricted stock and restricted stock units 1,435,383 Series H convertible preferred stock 5,370,498 Class A OP Units 8,385,951 Total outstanding shares 96,035,389 Fully-converted book value per share(1)(2) $ 14.15 Book Value Per Share & Shares Outstanding Appendix Note: All numbers in thousands except per share and share data. Preferred stock values expressed in common stock equivalents. 1. Fully-converted book value per share assumed conversion of the Company's Series H preferred stock, OP Units and the vesting of the Company's unvested RSUs. 2. Book value per share as of December 31, 2025, excluding the impact for accumulated depreciation and amortization of real property of $17.5 million, was $14.34.

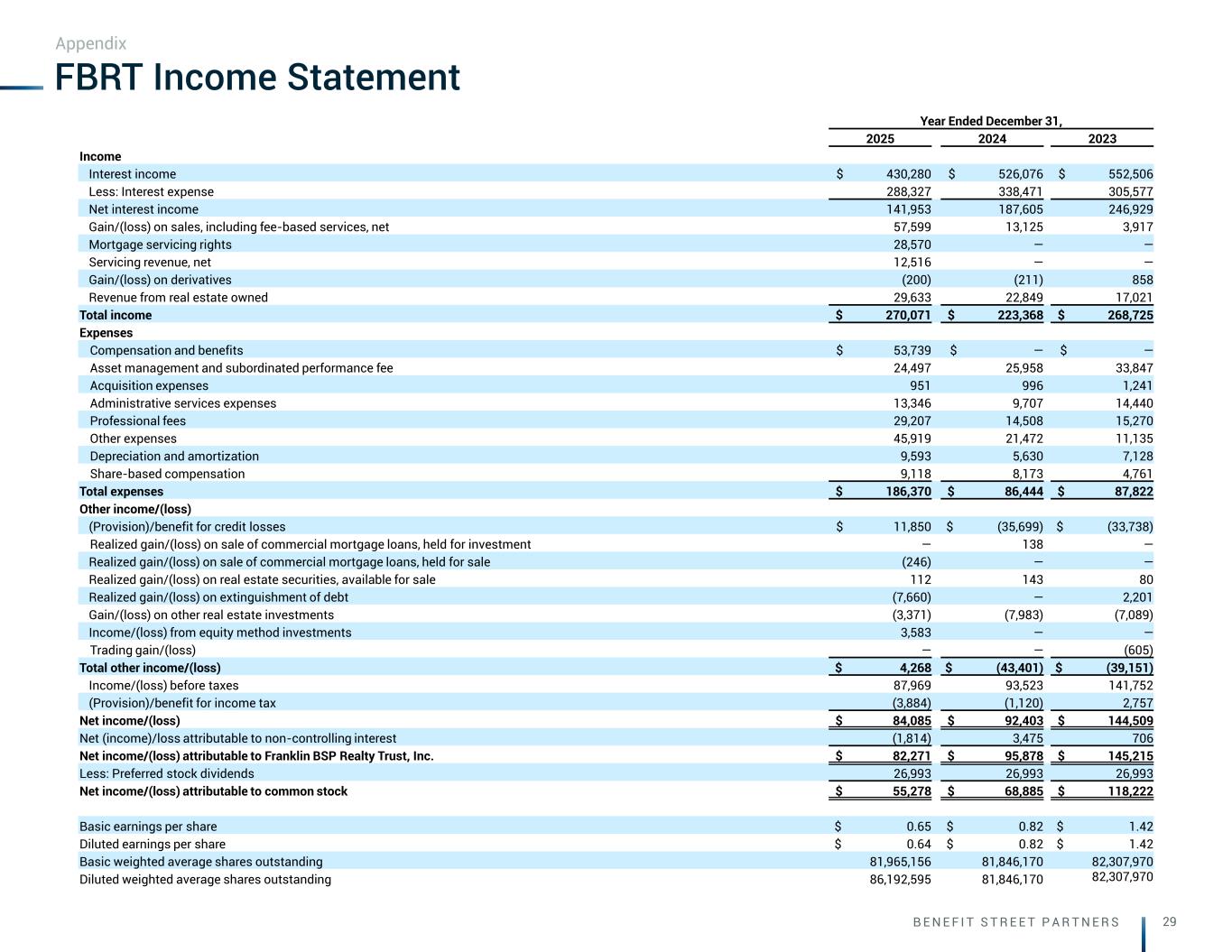

B E N E F I T S T R E E T P A R T N E R S 29 FBRT Income Statement Appendix Year Ended December 31, 2025 2024 2023 Income Interest income $ 430,280 $ 526,076 $ 552,506 Less: Interest expense 288,327 338,471 305,577 Net interest income 141,953 187,605 246,929 Gain/(loss) on sales, including fee-based services, net 57,599 13,125 3,917 Mortgage servicing rights 28,570 — — Servicing revenue, net 12,516 — — Gain/(loss) on derivatives (200) (211) 858 Revenue from real estate owned 29,633 22,849 17,021 Total income $ 270,071 $ 223,368 $ 268,725 Expenses Compensation and benefits $ 53,739 $ — $ — Asset management and subordinated performance fee 24,497 25,958 33,847 Acquisition expenses 951 996 1,241 Administrative services expenses 13,346 9,707 14,440 Professional fees 29,207 14,508 15,270 Other expenses 45,919 21,472 11,135 Depreciation and amortization 9,593 5,630 7,128 Share-based compensation 9,118 8,173 4,761 Total expenses $ 186,370 $ 86,444 $ 87,822 Other income/(loss) (Provision)/benefit for credit losses $ 11,850 $ (35,699) $ (33,738) Realized gain/(loss) on sale of commercial mortgage loans, held for investment — 138 — Realized gain/(loss) on sale of commercial mortgage loans, held for sale (246) — — Realized gain/(loss) on real estate securities, available for sale 112 143 80 Realized gain/(loss) on extinguishment of debt (7,660) — 2,201 Gain/(loss) on other real estate investments (3,371) (7,983) (7,089) Income/(loss) from equity method investments 3,583 — — Trading gain/(loss) — — (605) Total other income/(loss) $ 4,268 $ (43,401) $ (39,151) Income/(loss) before taxes 87,969 93,523 141,752 (Provision)/benefit for income tax (3,884) (1,120) 2,757 Net income/(loss) $ 84,085 $ 92,403 $ 144,509 Net (income)/loss attributable to non-controlling interest (1,814) 3,475 706 Net income/(loss) attributable to Franklin BSP Realty Trust, Inc. $ 82,271 $ 95,878 $ 145,215 Less: Preferred stock dividends 26,993 26,993 26,993 Net income/(loss) attributable to common stock $ 55,278 $ 68,885 $ 118,222 Basic earnings per share $ 0.65 $ 0.82 $ 1.42 Diluted earnings per share $ 0.64 $ 0.82 $ 1.42 Basic weighted average shares outstanding 81,965,156 81,846,170 82,307,970 Diluted weighted average shares outstanding 86,192,595 81,846,170 82,307,970

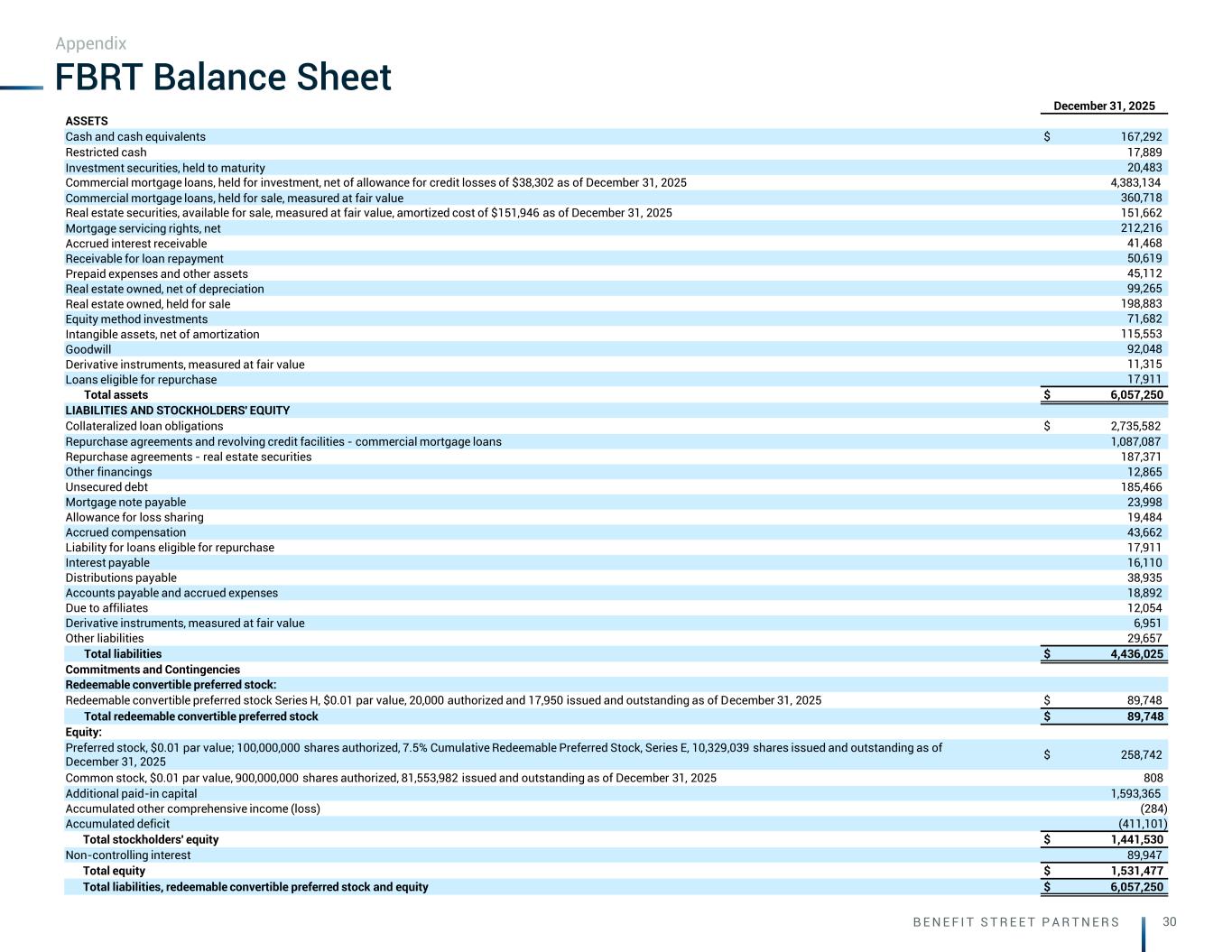

B E N E F I T S T R E E T P A R T N E R S 30 December 31, 2025 ASSETS Cash and cash equivalents $ 167,292 Restricted cash 17,889 Investment securities, held to maturity 20,483 Commercial mortgage loans, held for investment, net of allowance for credit losses of $38,302 as of December 31, 2025 4,383,134 Commercial mortgage loans, held for sale, measured at fair value 360,718 Real estate securities, available for sale, measured at fair value, amortized cost of $151,946 as of December 31, 2025 151,662 Mortgage servicing rights, net 212,216 Accrued interest receivable 41,468 Receivable for loan repayment 50,619 Prepaid expenses and other assets 45,112 Real estate owned, net of depreciation 99,265 Real estate owned, held for sale 198,883 Equity method investments 71,682 Intangible assets, net of amortization 115,553 Goodwill 92,048 Derivative instruments, measured at fair value 11,315 Loans eligible for repurchase 17,911 Total assets $ 6,057,250 LIABILITIES AND STOCKHOLDERS' EQUITY Collateralized loan obligations $ 2,735,582 Repurchase agreements and revolving credit facilities - commercial mortgage loans 1,087,087 Repurchase agreements - real estate securities 187,371 Other financings 12,865 Unsecured debt 185,466 Mortgage note payable 23,998 Allowance for loss sharing 19,484 Accrued compensation 43,662 Liability for loans eligible for repurchase 17,911 Interest payable 16,110 Distributions payable 38,935 Accounts payable and accrued expenses 18,892 Due to affiliates 12,054 Derivative instruments, measured at fair value 6,951 Other liabilities 29,657 Total liabilities $ 4,436,025 Commitments and Contingencies Redeemable convertible preferred stock: Redeemable convertible preferred stock Series H, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of December 31, 2025 $ 89,748 Total redeemable convertible preferred stock $ 89,748 Equity: Preferred stock, $0.01 par value; 100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred Stock, Series E, 10,329,039 shares issued and outstanding as of December 31, 2025 $ 258,742 Common stock, $0.01 par value, 900,000,000 shares authorized, 81,553,982 issued and outstanding as of December 31, 2025 808 Additional paid-in capital 1,593,365 Accumulated other comprehensive income (loss) (284) Accumulated deficit (411,101) Total stockholders' equity $ 1,441,530 Non-controlling interest 89,947 Total equity $ 1,531,477 Total liabilities, redeemable convertible preferred stock and equity $ 6,057,250 FBRT Balance Sheet Appendix

B E N E F I T S T R E E T P A R T N E R S 31 Definitions Distributable Earnings and Distributable Earnings to Common Distributable Earnings is a non-GAAP measure, which the Company defines as GAAP net income (loss), adjusted for (i) non-cash CLO amortization acceleration and amortization over the expected useful life of the Company's CLOs, (ii) unrealized gains and losses on loans and derivatives, including CECL reserves and impairments, net of realized gains and losses, as described further below, (iii) non-cash equity compensation expense, (iv) depreciation and amortization, (v) subordinated performance fee accruals/(reversal), (vi) realized gains and losses on debt extinguishment and CLO calls, (vii) non-cash income from mortgage servicing rights, and (viii) certain other non-cash items. Further, Distributable Earnings to Common, a non-GAAP measure, presents Distributable Earnings net of (x) perpetual preferred stock dividend payments and (y) non-controlling interests in joint ventures. As noted above, we exclude unrealized gains and losses on loans and other investments, including CECL reserves and impairments, from our calculation of Distributable Earnings and include realized gains and losses. The nature of these adjustments is described more fully in the footnotes to our reconciliation tables. GAAP loan loss reserves and any property impairment losses have been excluded from Distributable Earnings consistent with other unrealized losses pursuant to our existing definition of Distributable Earnings. We expect to only recognize such potential credit or property impairment losses in Distributable Earnings if and when such amounts are deemed nonrecoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized. The realized loss amount reflected in Distributable Earnings will generally equal the difference between the cash received and the Distributable Earnings basis of the asset. The timing of any such loss realization in our Distributable Earnings may differ materially from the timing of the corresponding loss reserves, charge-offs or impairments in our consolidated financial statements prepared in accordance with GAAP. The Company believes that Distributable Earnings and Distributable Earnings to Common provide meaningful information to consider in addition to the disclosed GAAP results. The Company believes Distributable Earnings and Distributable Earnings to Common are useful financial metrics for existing and potential future holders of its common stock as historically, over time, Distributable Earnings to Common has been an indicator of common dividends per share. As a REIT, the Company generally must distribute annually at least 90% of its taxable income, subject to certain adjustments, and therefore believes dividends are one of the principal reasons stockholders may invest in its common stock. Further, Distributable Earnings to Common helps investors evaluate performance excluding the effects of certain transactions and GAAP adjustments that the Company does not believe are necessarily indicative of current loan portfolio performance and the Company's operations and is one of the performance metrics the Company's board of directors considers when dividends are declared. Distributable Earnings and Distributable Earnings to Common do not represent net income (loss) and should not be considered as an alternative to GAAP net income (loss). The methodology for calculating Distributable Earnings and Distributable Earnings to Common may differ from the methodologies employed by other companies and thus may not be comparable to the Distributable Earnings reported by other companies.

www.bspcredit.com London Cannon Place 78 Cannon Street London EC4N 6HL UK West Palm Beach 360 South Rosemary Avenue Suite 1510 West Palm Beach FL 33401 USA Boston 100 Federal Street 22nd Floor Boston MA 02110 USA New York One Madison Avenue Suite 1600 New York NY 10010 USA