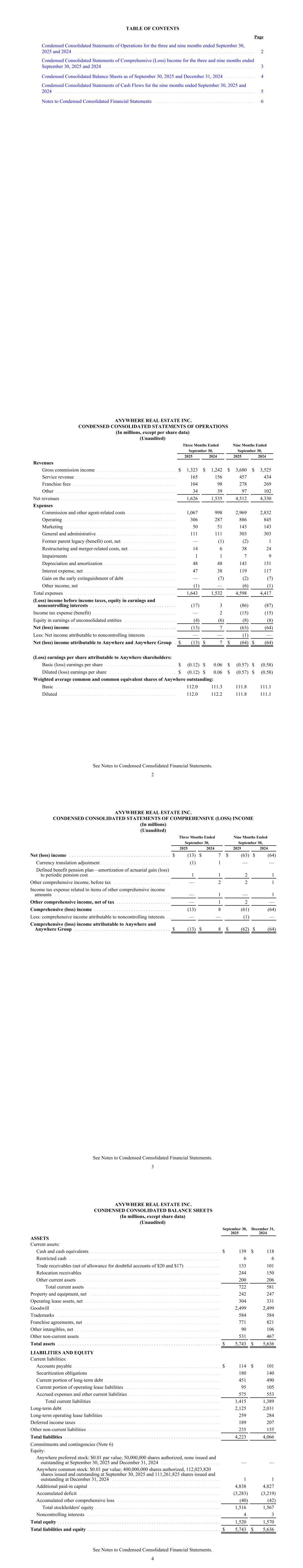

TABLE OF CONTENTS Page Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2025 and 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Condensed Consolidated Statements of Comprehensive (Loss) Income for the three and nine months ended September 30, 2025 and 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Condensed Consolidated Balance Sheets as of September 30, 2025 and December 31, 2024 . . . . . . . . . . . . 4 Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2025 and 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Notes to Condensed Consolidated Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 ANYWHERE REAL ESTATE INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share data) (Unaudited) Three Months Ended Nine Months Ended September 30, September 30, 2025 2024 2025 2024 Revenues Gross commission income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,323 $ 1,242 $ 3,680 $ 3,525 Service revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165 156 457 434 Franchise fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104 98 278 269 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 39 97 102 Net revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,626 1,535 4,512 4,330 Expenses Commission and other agent-related costs . . . . . . . . . . . . . . . . . . . . 1,067 998 2,969 2,832 Operating . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 306 287 886 845 Marketing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50 51 143 143 General and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111 111 303 303 Former parent legacy (benefit) cost, net . . . . . . . . . . . . . . . . . . . . . . — (1) (2) 1 Restructuring and merger-related costs, net . . . . . . . . . . . . . . . . . . . 14 6 38 24 Impairments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 7 9 Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 48 143 151 Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 38 119 117 Gain on the early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . — (7) (2) (7) Other income, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) — (6) (1) Total expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,643 1,532 4,598 4,417 (Loss) income before income taxes, equity in earnings and noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17) 3 (86) (87) Income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2 (15) (15) Equity in earnings of unconsolidated entities . . . . . . . . . . . . . . . . . . . . . (4) (6) (8) (8) Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13) 7 (63) (64) Less: Net income attributable to noncontrolling interests . . . . . . . . . . . . — — (1) — Net (loss) income attributable to Anywhere and Anywhere Group . $ (13) $ 7 $ (64) $ (64) (Loss) earnings per share attributable to Anywhere shareholders: Basic (loss) earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.12) $ 0.06 $ (0.57) $ (0.58) Diluted (loss) earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.12) $ 0.06 $ (0.57) $ (0.58) Weighted average common and common equivalent shares of Anywhere outstanding: Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112.0 111.3 111.8 111.1 Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112.0 112.2 111.8 111.1 See Notes to Condensed Consolidated Financial Statements. 2 ANYWHERE REAL ESTATE INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (In millions) (Unaudited) Three Months Ended Nine Months Ended September 30, September 30, 2025 2024 2025 2024 Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (13) $ 7 $ (63) $ (64) Currency translation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) 1 — — Defined benefit pension plan—amortization of actuarial gain (loss) to periodic pension cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 2 1 Other comprehensive income, before tax . . . . . . . . . . . . . . . . . . . . . . . — 2 2 1 Income tax expense related to items of other comprehensive income amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1 — 1 Other comprehensive income, net of tax . . . . . . . . . . . . . . . . . . . . . . — 1 2 — Comprehensive (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13) 8 (61) (64) Less: comprehensive income attributable to noncontrolling interests . . — — (1) — Comprehensive (loss) income attributable to Anywhere and Anywhere Group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (13) $ 8 $ (62) $ (64) See Notes to Condensed Consolidated Financial Statements. 3 ANYWHERE REAL ESTATE INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In millions, except share data) (Unaudited) September 30, 2025 December 31, 2024 ASSETS Current assets: Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 139 $ 118 Restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 6 Trade receivables (net of allowance for doubtful accounts of $20 and $17) . . . . . . . . . . . . . . 133 101 Relocation receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 244 150 Other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200 206 Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 722 581 Property and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 242 247 Operating lease assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 304 331 Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,499 2,499 Trademarks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 584 584 Franchise agreements, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 771 821 Other intangibles, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90 106 Other non-current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 531 467 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,743 $ 5,636 LIABILITIES AND EQUITY Current liabilities: Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 114 $ 101 Securitization obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 180 140 Current portion of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 451 490 Current portion of operating lease liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95 105 Accrued expenses and other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 575 553 Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,415 1,389 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,125 2,031 Long-term operating lease liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 259 284 Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 189 207 Other non-current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235 155 Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,223 4,066 Commitments and contingencies (Note 6) Equity: Anywhere preferred stock: $0.01 par value; 50,000,000 shares authorized, none issued and outstanding at September 30, 2025 and December 31, 2024 . . . . . . . . . . . . . . . . . . . . . . . . — — Anywhere common stock: $0.01 par value; 400,000,000 shares authorized, 112,023,820 shares issued and outstanding at September 30, 2025 and 111,261,825 shares issued and outstanding at December 31, 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,838 4,827 Accumulated deficit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,283) (3,219) Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (40) (42) Total stockholders' equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,516 1,567 Noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 3 Total equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,520 1,570 Total liabilities and equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,743 $ 5,636 See Notes to Condensed Consolidated Financial Statements. 4

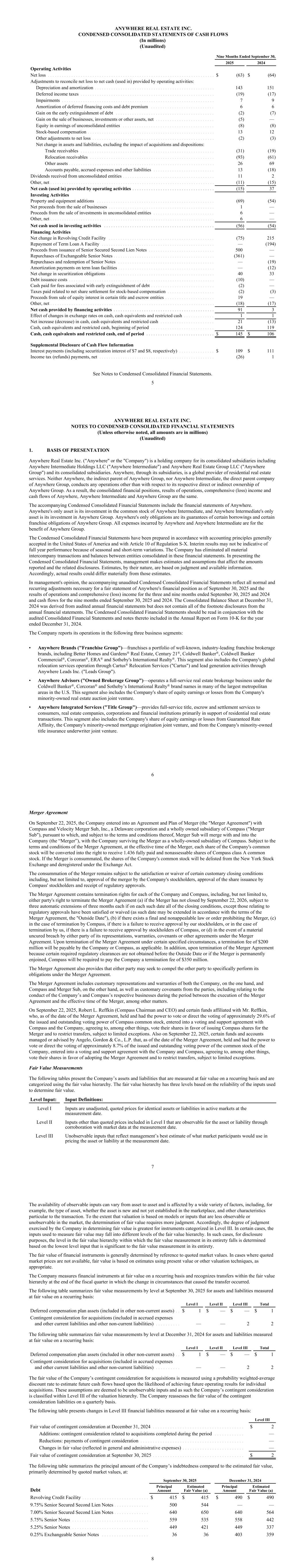

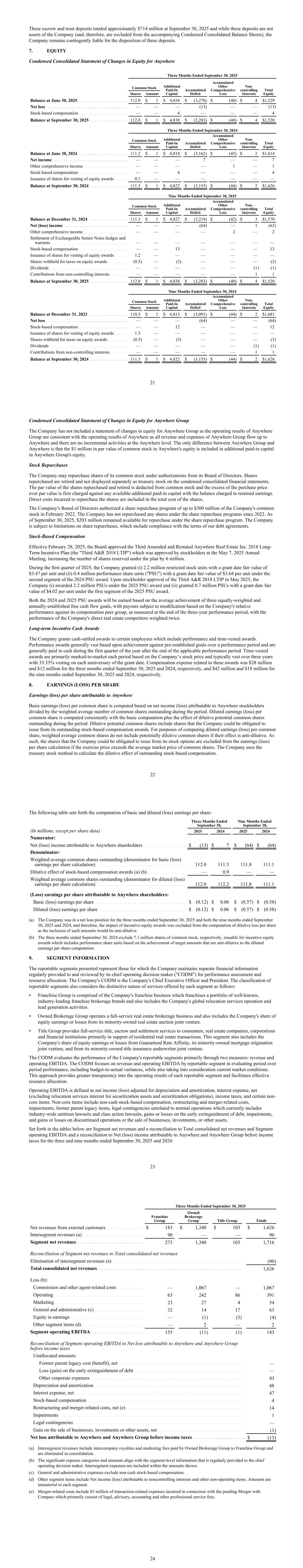

ANYWHERE REAL ESTATE INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) Operating Activities Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (63) $ (64) Adjustments to reconcile net loss to net cash (used in) provided by operating activities: Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143 151 Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19) (17) Impairments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 9 Amortization of deferred financing costs and debt premium . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 6 Gain on the early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) (7) Gain on the sale of businesses, investments or other assets, net . . . . . . . . . . . . . . . . . . . . . . . . . (5) — Equity in earnings of unconsolidated entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8) (8) Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 12 Other adjustments to net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) (3) Net change in assets and liabilities, excluding the impact of acquisitions and dispositions: Trade receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31) (19) Relocation receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (93) (61) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 69 Accounts payable, accrued expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . 13 (18) Dividends received from unconsolidated entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 2 Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11) (15) Net cash (used in) provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15) 37 Investing Activities Property and equipment additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (69) (54) Net proceeds from the sale of businesses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 — Proceeds from the sale of investments in unconsolidated entities . . . . . . . . . . . . . . . . . . . . . . . . . . 6 — Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 — Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (56) (54) Financing Activities Net change in Revolving Credit Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (75) 215 Repayment of Term Loan A Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (194) Proceeds from issuance of Senior Secured Second Lien Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 — Repurchases of Exchangeable Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (361) — Repurchases and redemption of Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (19) Amortization payments on term loan facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (12) Net change in securitization obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 33 Debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10) — Cash paid for fees associated with early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) — Taxes paid related to net share settlement for stock-based compensation . . . . . . . . . . . . . . . . . . . . (2) (3) Proceeds from sale of equity interest in certain title and escrow entities . . . . . . . . . . . . . . . . . . . . . 19 — Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18) (17) Net cash provided by financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 3 Effect of changes in exchange rates on cash, cash equivalents and restricted cash . . . . . . . . . . . . . 1 1 Net increase (decrease) in cash, cash equivalents and restricted cash . . . . . . . . . . . . . . . . . . . . . . . 21 (13) Cash, cash equivalents and restricted cash, beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . 124 119 Cash, cash equivalents and restricted cash, end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 145 $ 106 Supplemental Disclosure of Cash Flow Information Interest payments (including securitization interest of $7 and $8, respectively) . . . . . . . . . . . . . . . $ 109 $ 111 Income tax (refunds) payments, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26) 1 Nine Months Ended September 30, 2025 2024 See Notes to Condensed Consolidated Financial Statements. 5 ANYWHERE REAL ESTATE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unless otherwise noted, all amounts are in millions) (Unaudited) 1. BASIS OF PRESENTATION Anywhere Real Estate Inc. ("Anywhere" or the "Company") is a holding company for its consolidated subsidiaries including Anywhere Intermediate Holdings LLC ("Anywhere Intermediate") and Anywhere Real Estate Group LLC ("Anywhere Group") and its consolidated subsidiaries. Anywhere, through its subsidiaries, is a global provider of residential real estate services. Neither Anywhere, the indirect parent of Anywhere Group, nor Anywhere Intermediate, the direct parent company of Anywhere Group, conducts any operations other than with respect to its respective direct or indirect ownership of Anywhere Group. As a result, the consolidated financial positions, results of operations, comprehensive (loss) income and cash flows of Anywhere, Anywhere Intermediate and Anywhere Group are the same. The accompanying Condensed Consolidated Financial Statements include the financial statements of Anywhere. Anywhere's only asset is its investment in the common stock of Anywhere Intermediate, and Anywhere Intermediate's only asset is its investment in Anywhere Group. Anywhere's only obligations are its guarantees of certain borrowings and certain franchise obligations of Anywhere Group. All expenses incurred by Anywhere and Anywhere Intermediate are for the benefit of Anywhere Group. The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America and with Article 10 of Regulation S-X. Interim results may not be indicative of full year performance because of seasonal and short-term variations. The Company has eliminated all material intercompany transactions and balances between entities consolidated in these financial statements. In presenting the Condensed Consolidated Financial Statements, management makes estimates and assumptions that affect the amounts reported and the related disclosures. Estimates, by their nature, are based on judgment and available information. Accordingly, actual results could differ materially from those estimates. In management's opinion, the accompanying unaudited Condensed Consolidated Financial Statements reflect all normal and recurring adjustments necessary for a fair statement of Anywhere's financial position as of September 30, 2025 and the results of operations and comprehensive (loss) income for the three and nine months ended September 30, 2025 and 2024 and cash flows for the nine months ended September 30, 2025 and 2024. The Consolidated Balance Sheet at December 31, 2024 was derived from audited annual financial statements but does not contain all of the footnote disclosures from the annual financial statements. The Condensed Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2024. The Company reports its operations in the following three business segments: • Anywhere Brands ("Franchise Group")—franchises a portfolio of well-known, industry-leading franchise brokerage brands, including Better Homes and Gardens® Real Estate, Century 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA® and Sotheby's International Realty®. This segment also includes the Company's global relocation services operation through Cartus® Relocation Services ("Cartus") and lead generation activities through Anywhere Leads Inc. ("Leads Group"). • Anywhere Advisors ("Owned Brokerage Group")—operates a full-service real estate brokerage business under the Coldwell Banker®, Corcoran® and Sotheby’s International Realty® brand names in many of the largest metropolitan areas in the U.S. This segment also includes the Company's share of equity earnings or losses from the Company's minority-owned real estate auction joint venture. • Anywhere Integrated Services ("Title Group")—provides full-service title, escrow and settlement services to consumers, real estate companies, corporations and financial institutions primarily in support of residential real estate transactions. This segment also includes the Company's share of equity earnings or losses from Guaranteed Rate Affinity, the Company's minority-owned mortgage origination joint venture, and from the Company's minority-owned title insurance underwriter joint venture. 6 Merger Agreement On September 22, 2025, the Company entered into an Agreement and Plan of Merger (the "Merger Agreement") with Compass and Velocity Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Compass ("Merger Sub"), pursuant to which, and subject to the terms and conditions thereof, Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly-owned subsidiary of Compass. Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger, each share of the Company's common stock will be converted into the right to receive 1.436 fully paid and nonassessable shares of Compass class A common stock. If the Merger is consummated, the shares of the Company's common stock will be delisted from the New York Stock Exchange and deregistered under the Exchange Act. The consummation of the Merger remains subject to the satisfaction or waiver of certain customary closing conditions including, but not limited to, approval of the merger by the Company's stockholders, approval of the share issuance by Compass' stockholders and receipt of regulatory approvals. The Merger Agreement contains termination rights for each of the Company and Compass, including, but not limited to, either party's right to terminate the Merger Agreement (a) if the Merger has not closed by September 22, 2026, subject to three automatic extensions of three months each if on each such date all of the closing conditions, except those relating to regulatory approvals have been satisfied or waived (as such date may be extended in accordance with the terms of the Merger Agreement, the "Outside Date"), (b) if there exists a final and nonappealable law or order prohibiting the Merger, (c) in the case of termination by Compass, if there is a failure to receive approval by our stockholders, or in the case of termination by us, if there is a failure to receive approval by stockholders of Compass, or (d) in the event of a material uncured breach by either party of its representations, warranties, covenants or other agreements under the Merger Agreement. Upon termination of the Merger Agreement under certain specified circumstances, a termination fee of $200 million will be payable by the Company or Compass, as applicable. In addition, upon termination of the Merger Agreement because certain required regulatory clearances are not obtained before the Outside Date or if the Merger is permanently enjoined, Compass will be required to pay the Company a termination fee of $350 million. The Merger Agreement also provides that either party may seek to compel the other party to specifically perform its obligations under the Merger Agreement. The Merger Agreement includes customary representations and warranties of both the Company, on the one hand, and Compass and Merger Sub, on the other hand, as well as customary covenants from the parties, including relating to the conduct of the Company’s and Compass’s respective businesses during the period between the execution of the Merger Agreement and the effective time of the Merger, among other matters. On September 22, 2025, Robert L. Reffkin (Compass Chairman and CEO) and certain funds affiliated with Mr. Reffkin, who, as of the date of the Merger Agreement, held and had the power to vote or direct the voting of approximately 29.6% of the issued and outstanding voting power of Compass common stock, entered into a voting and support agreement with Compass and the Company, agreeing to, among other things, vote their shares in favor of issuing Compass shares for the Merger and to restrict transfers, subject to limited exceptions. Also on September 22, 2025, certain funds and accounts managed or advised by Angelo, Gordon & Co., L.P. that, as of the date of the Merger Agreement, held and had the power to vote or direct the voting of approximately 8.7% of the issued and outstanding voting power of the common stock of the Company, entered into a voting and support agreement with the Company and Compass, agreeing to, among other things, vote their shares in favor of adopting the Merger Agreement and to restrict transfers, subject to limited exceptions. Fair Value Measurements The following tables present the Company’s assets and liabilities that are measured at fair value on a recurring basis and are categorized using the fair value hierarchy. The fair value hierarchy has three levels based on the reliability of the inputs used to determine fair value. Level Input: Input Definitions: Level I Inputs are unadjusted, quoted prices for identical assets or liabilities in active markets at the measurement date. Level II Inputs other than quoted prices included in Level I that are observable for the asset or liability through corroboration with market data at the measurement date. Level III Unobservable inputs that reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. 7 The availability of observable inputs can vary from asset to asset and is affected by a wide variety of factors, including, for example, the type of asset, whether the asset is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for instruments categorized in Level III. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The fair value of financial instruments is generally determined by reference to quoted market values. In cases where quoted market prices are not available, fair value is based on estimates using present value or other valuation techniques, as appropriate. The Company measures financial instruments at fair value on a recurring basis and recognizes transfers within the fair value hierarchy at the end of the fiscal quarter in which the change in circumstances that caused the transfer occurred. The following table summarizes fair value measurements by level at September 30, 2025 for assets and liabilities measured at fair value on a recurring basis: Level I Level II Level III Total Deferred compensation plan assets (included in other non-current assets) . . $ 1 $ — $ — $ 1 Contingent consideration for acquisitions (included in accrued expenses and other current liabilities and other non-current liabilities) . . . . . . . . . . — — 2 2 The following table summarizes fair value measurements by level at December 31, 2024 for assets and liabilities measured at fair value on a recurring basis: Level I Level II Level III Total Deferred compensation plan assets (included in other non-current assets) . . $ 1 $ — $ — $ 1 Contingent consideration for acquisitions (included in accrued expenses and other current liabilities and other non-current liabilities) . . . . . . . . . . — — 2 2 The fair value of the Company’s contingent consideration for acquisitions is measured using a probability weighted-average discount rate to estimate future cash flows based upon the likelihood of achieving future operating results for individual acquisitions. These assumptions are deemed to be unobservable inputs and as such the Company’s contingent consideration is classified within Level III of the valuation hierarchy. The Company reassesses the fair value of the contingent consideration liabilities on a quarterly basis. The following table presents changes in Level III financial liabilities measured at fair value on a recurring basis: Level III Fair value of contingent consideration at December 31, 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2 Additions: contingent consideration related to acquisitions completed during the period . . . . . . . . . . . . — Reductions: payments of contingent consideration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — Changes in fair value (reflected in general and administrative expenses) . . . . . . . . . . . . . . . . . . . . . . . . . — Fair value of contingent consideration at September 30, 2025 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2 The following table summarizes the principal amount of the Company’s indebtedness compared to the estimated fair value, primarily determined by quoted market values, at: September 30, 2025 December 31, 2024 Debt Principal Amount Estimated Fair Value (a) Principal Amount Estimated Fair Value (a) Revolving Credit Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 415 $ 415 $ 490 $ 490 9.75% Senior Secured Second Lien Notes . . . . . . . . . . . . . . 500 544 — — 7.00% Senior Secured Second Lien Notes . . . . . . . . . . . . . . 640 650 640 564 5.75% Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 559 535 558 442 5.25% Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 449 421 449 337 0.25% Exchangeable Senior Notes . . . . . . . . . . . . . . . . . . . 36 36 403 359 8

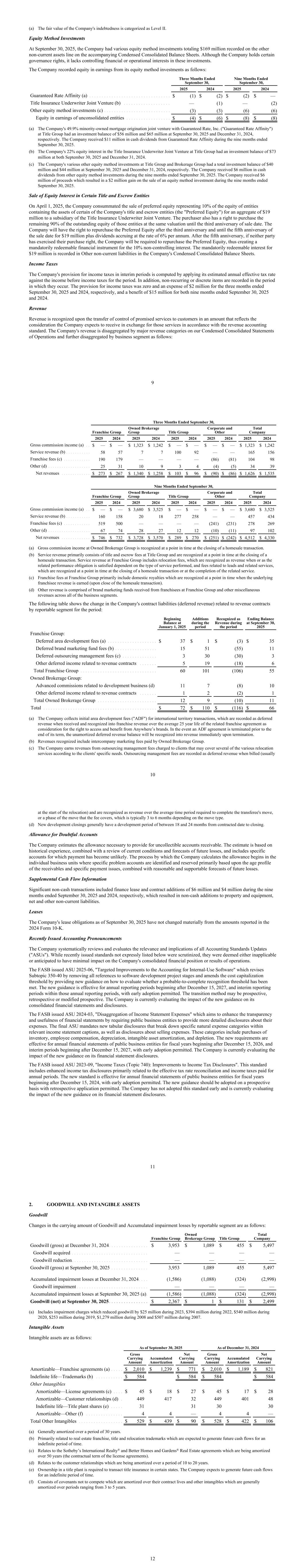

(a) The fair value of the Company's indebtedness is categorized as Level II. Equity Method Investments At September 30, 2025, the Company had various equity method investments totaling $169 million recorded on the other non-current assets line on the accompanying Condensed Consolidated Balance Sheets. Although the Company holds certain governance rights, it lacks controlling financial or operational interests in these investments. The Company recorded equity in earnings from its equity method investments as follows: Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Guaranteed Rate Affinity (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1) $ (2) $ (2) $ — Title Insurance Underwriter Joint Venture (b) . . . . . . . . . . . . . . . . . . . — (1) — (2) Other equity method investments (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . (3) (3) (6) (6) Equity in earnings of unconsolidated entities . . . . . . . . . . . . . . . . . . $ (4) $ (6) $ (8) $ (8) (a) The Company's 49.9% minority-owned mortgage origination joint venture with Guaranteed Rate, Inc. ("Guaranteed Rate Affinity") at Title Group had an investment balance of $56 million and $65 million at September 30, 2025 and December 31, 2024, respectively. The Company received $11 million in cash dividends from Guaranteed Rate Affinity during the nine months ended September 30, 2025. (b) The Company's 22% equity interest in the Title Insurance Underwriter Joint Venture at Title Group had an investment balance of $73 million at both September 30, 2025 and December 31, 2024. (c) The Company's various other equity method investments at Title Group and Brokerage Group had a total investment balance of $40 million and $44 million at September 30, 2025 and December 31, 2024, respectively. The Company received $6 million in cash dividends from other equity method investments during the nine months ended September 30, 2025. The Company received $6 million of proceeds which resulted in a $2 million gain on the sale of an equity method investment during the nine months ended September 30, 2025. Sale of Equity Interest in Certain Title and Escrow Entities On April 1, 2025, the Company consummated the sale of preferred equity representing 10% of the equity of entities containing the assets of certain of the Company's title and escrow entities (the "Preferred Equity") for an aggregate of $19 million to a subsidiary of the Title Insurance Underwriter Joint Venture. The purchaser also has a right to purchase the remaining 90% of the outstanding equity of those entities at the same valuation until the third anniversary of sale date. The Company will have the right to repurchase the Preferred Equity after the third anniversary and until the fifth anniversary of the sale date for $19 million plus dividends accruing at the rate of 6% per annum. After the fifth anniversary, if neither party has exercised their purchase right, the Company will be required to repurchase the Preferred Equity, thus creating a mandatorily redeemable financial instrument for the 10% non-controlling interest. The mandatorily redeemable interest for $19 million is recorded in Other non-current liabilities in the Company's Condensed Consolidated Balance Sheets. Income Taxes The Company's provision for income taxes in interim periods is computed by applying its estimated annual effective tax rate against the income before income taxes for the period. In addition, non-recurring or discrete items are recorded in the period in which they occur. The provision for income taxes was zero and an expense of $2 million for the three months ended September 30, 2025 and 2024, respectively, and a benefit of $15 million for both nine months ended September 30, 2025 and 2024. Revenue Revenue is recognized upon the transfer of control of promised services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those services in accordance with the revenue accounting standard. The Company's revenue is disaggregated by major revenue categories on our Condensed Consolidated Statements of Operations and further disaggregated by business segment as follows: 9 Three Months Ended September 30, Franchise Group Owned Brokerage Group Title Group Corporate and Other Total Company 2025 2024 2025 2024 2025 2024 2025 2024 2025 2024 Gross commission income (a) . . $ — $ — $ 1,323 $ 1,242 $ — $ — $ — $ — $ 1,323 $ 1,242 Service revenue (b) . . . . . . . . . . . 58 57 7 7 100 92 — — 165 156 Franchise fees (c) . . . . . . . . . . . . 190 179 — — — — (86) (81) 104 98 Other (d) . . . . . . . . . . . . . . . . . . . 25 31 10 9 3 4 (4) (5) 34 39 Net revenues . . . . . . . . . . . . . $ 273 $ 267 $ 1,340 $ 1,258 $ 103 $ 96 $ (90) $ (86) $ 1,626 $ 1,535 Nine Months Ended September 30, Franchise Group Owned Brokerage Group Title Group Corporate and Other Total Company 2025 2024 2025 2024 2025 2024 2025 2024 2025 2024 Gross commission income (a) . . $ — $ — $ 3,680 $ 3,525 $ — $ — $ — $ — $ 3,680 $ 3,525 Service revenue (b) . . . . . . . . . . . 160 158 20 18 277 258 — — 457 434 Franchise fees (c) . . . . . . . . . . . . 519 500 — — — — (241) (231) 278 269 Other (d) . . . . . . . . . . . . . . . . . . . 67 74 28 27 12 12 (10) (11) 97 102 Net revenues . . . . . . . . . . . . . $ 746 $ 732 $ 3,728 $ 3,570 $ 289 $ 270 $ (251) $ (242) $ 4,512 $ 4,330 (a) Gross commission income at Owned Brokerage Group is recognized at a point in time at the closing of a homesale transaction. (b) Service revenue primarily consists of title and escrow fees at Title Group and are recognized at a point in time at the closing of a homesale transaction. Service revenue at Franchise Group includes relocation fees, which are recognized as revenue when or as the related performance obligation is satisfied dependent on the type of service performed, and fees related to leads and related services, which are recognized at a point in time at the closing of a homesale transaction or at the completion of the related service. (c) Franchise fees at Franchise Group primarily include domestic royalties which are recognized at a point in time when the underlying franchisee revenue is earned (upon close of the homesale transaction). (d) Other revenue is comprised of brand marketing funds received from franchisees at Franchise Group and other miscellaneous revenues across all of the business segments. The following table shows the change in the Company's contract liabilities (deferred revenue) related to revenue contracts by reportable segment for the period: Beginning Balance at January 1, 2025 Additions during the period Recognized as Revenue during the period Ending Balance at September 30, 2025 Franchise Group: Deferred area development fees (a) . . . . . . . . . . . . . . . . . . . . $ 37 $ 1 $ (3) $ 35 Deferred brand marketing fund fees (b) . . . . . . . . . . . . . . . . . 15 51 (55) 11 Deferred outsourcing management fees (c) . . . . . . . . . . . . . . 3 30 (30) 3 Other deferred income related to revenue contracts . . . . . . . 5 19 (18) 6 Total Franchise Group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60 101 (106) 55 Owned Brokerage Group: Advanced commissions related to development business (d) 11 7 (8) 10 Other deferred income related to revenue contracts . . . . . . . 1 2 (2) 1 Total Owned Brokerage Group . . . . . . . . . . . . . . . . . . . . . . . . 12 9 (10) 11 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 72 $ 110 $ (116) $ 66 (a) The Company collects initial area development fees ("ADF") for international territory transactions, which are recorded as deferred revenue when received and recognized into franchise revenue over the average 25 year life of the related franchise agreement as consideration for the right to access and benefit from Anywhere’s brands. In the event an ADF agreement is terminated prior to the end of its term, the unamortized deferred revenue balance will be recognized into revenue immediately upon termination. (b) Revenues recognized include intercompany marketing fees paid by Owned Brokerage Group. (c) The Company earns revenues from outsourcing management fees charged to clients that may cover several of the various relocation services according to the clients' specific needs. Outsourcing management fees are recorded as deferred revenue when billed (usually 10 at the start of the relocation) and are recognized as revenue over the average time period required to complete the transferee's move, or a phase of the move that the fee covers, which is typically 3 to 6 months depending on the move type. (d) New development closings generally have a development period of between 18 and 24 months from contracted date to closing. Allowance for Doubtful Accounts The Company estimates the allowance necessary to provide for uncollectible accounts receivable. The estimate is based on historical experience, combined with a review of current conditions and forecasts of future losses, and includes specific accounts for which payment has become unlikely. The process by which the Company calculates the allowance begins in the individual business units where specific problem accounts are identified and reserved primarily based upon the age profile of the receivables and specific payment issues, combined with reasonable and supportable forecasts of future losses. Supplemental Cash Flow Information Significant non-cash transactions included finance lease and contract additions of $6 million and $4 million during the nine months ended September 30, 2025 and 2024, respectively, which resulted in non-cash additions to property and equipment, net and other non-current liabilities. Leases The Company's lease obligations as of September 30, 2025 have not changed materially from the amounts reported in the 2024 Form 10-K. Recently Issued Accounting Pronouncements The Company systematically reviews and evaluates the relevance and implications of all Accounting Standards Updates ("ASUs"). While recently issued standards not expressly listed below were scrutinized, they were deemed either inapplicable or anticipated to have minimal impact on the Company's consolidated financial position or results of operations. The FASB issued ASU 2025-06, "Targeted Improvements to the Accounting for Internal-Use Software" which revises Subtopic 350-40 by removing all references to software development project stages and amends the cost capitalization threshold by providing new guidance on how to evaluate whether a probable-to-complete recognition threshold has been met. The new guidance is effective for annual reporting periods beginning after December 15, 2027, and interim reporting periods within those annual reporting periods, with early adoption permitted. The transition method may be prospective, retrospective or modified prospective. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements and disclosures. The FASB issued ASU 2024-03, "Disaggregation of Income Statement Expenses" which aims to enhance the transparency and usefulness of financial statements by requiring public business entities to provide more detailed disclosures about their expenses. The final ASU mandates new tabular disclosures that break down specific natural expense categories within relevant income statement captions, as well as disclosures about selling expenses. These categories include purchases of inventory, employee compensation, depreciation, intangible asset amortization, and depletion. The new requirements are effective for annual financial statements of public business entities for fiscal years beginning after December 15, 2026, and interim periods beginning after December 15, 2027, with early adoption permitted. The Company is currently evaluating the impact of the new guidance on its financial statement disclosures. The FASB issued ASU 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures". This standard includes enhanced income tax disclosures primarily related to the effective tax rate reconciliation and income taxes paid for annual periods. The new standard is effective for annual financial statements of public business entities for fiscal years beginning after December 15, 2024, with early adoption permitted. The new guidance should be adopted on a prospective basis with retrospective application permitted. The Company has not adopted this standard early and is currently evaluating the impact of the new guidance on its financial statement disclosures. 11 2. GOODWILL AND INTANGIBLE ASSETS Goodwill Changes in the carrying amount of Goodwill and Accumulated impairment losses by reportable segment are as follows: Franchise Group Owned Brokerage Group Title Group Total Company Goodwill (gross) at December 31, 2024 . . . . . . . . . . . . . . . . $ 3,953 $ 1,089 $ 455 $ 5,497 Goodwill acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — — Goodwill reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — — Goodwill (gross) at September 30, 2025 . . . . . . . . . . . . . . . 3,953 1,089 455 5,497 Accumulated impairment losses at December 31, 2024 . . . . (1,586) (1,088) (324) (2,998) Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — — Accumulated impairment losses at September 30, 2025 (a) . (1,586) (1,088) (324) (2,998) Goodwill (net) at September 30, 2025 . . . . . . . . . . . . . . . . $ 2,367 $ 1 $ 131 $ 2,499 (a) Includes impairment charges which reduced goodwill by $25 million during 2023, $394 million during 2022, $540 million during 2020, $253 million during 2019, $1,279 million during 2008 and $507 million during 2007. Intangible Assets Intangible assets are as follows: As of September 30, 2025 As of December 31, 2024 Gross Carrying Amount Accumulated Amortization Net Carrying Amount Gross Carrying Amount Accumulated Amortization Net Carrying Amount Amortizable—Franchise agreements (a) . . . . . $ 2,010 $ 1,239 $ 771 $ 2,010 $ 1,189 $ 821 Indefinite life—Trademarks (b) . . . . . . . . . . . $ 584 $ 584 $ 584 $ 584 Other Intangibles Amortizable—License agreements (c) . . . . $ 45 $ 18 $ 27 $ 45 $ 17 $ 28 Amortizable—Customer relationships (d) . 449 417 32 449 401 48 Indefinite life—Title plant shares (e) . . . . . 31 31 30 30 Amortizable—Other (f) . . . . . . . . . . . . . . . 4 4 — 4 4 — Total Other Intangibles . . . . . . . . . . . . . . . . . . $ 529 $ 439 $ 90 $ 528 $ 422 $ 106 (a) Generally amortized over a period of 30 years. (b) Primarily related to real estate franchise, title and relocation trademarks which are expected to generate future cash flows for an indefinite period of time. (c) Relates to the Sotheby’s International Realty® and Better Homes and Gardens® Real Estate agreements which are being amortized over 50 years (the contractual term of the license agreements). (d) Relates to the customer relationships which are being amortized over a period of 10 to 20 years. (e) Ownership in a title plant is required to transact title insurance in certain states. The Company expects to generate future cash flows for an indefinite period of time. (f) Consists of covenants not to compete which are amortized over their contract lives and other intangibles which are generally amortized over periods ranging from 3 to 5 years. 12

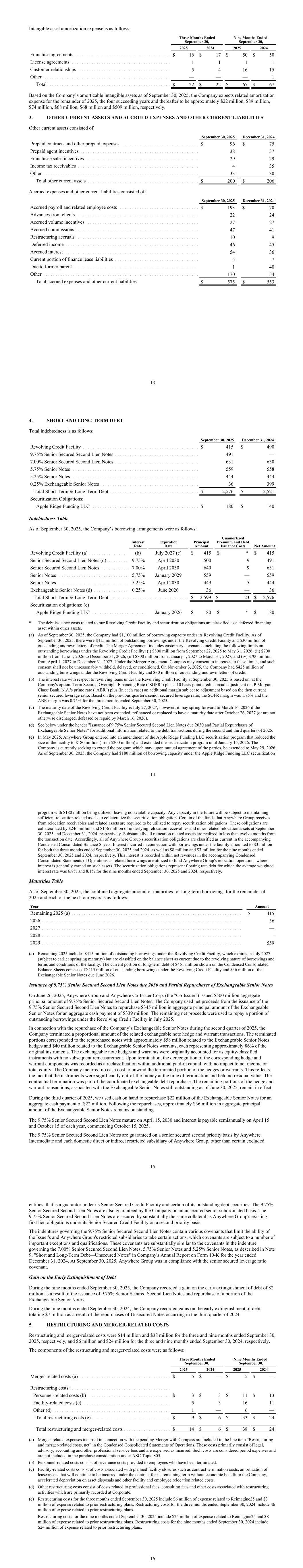

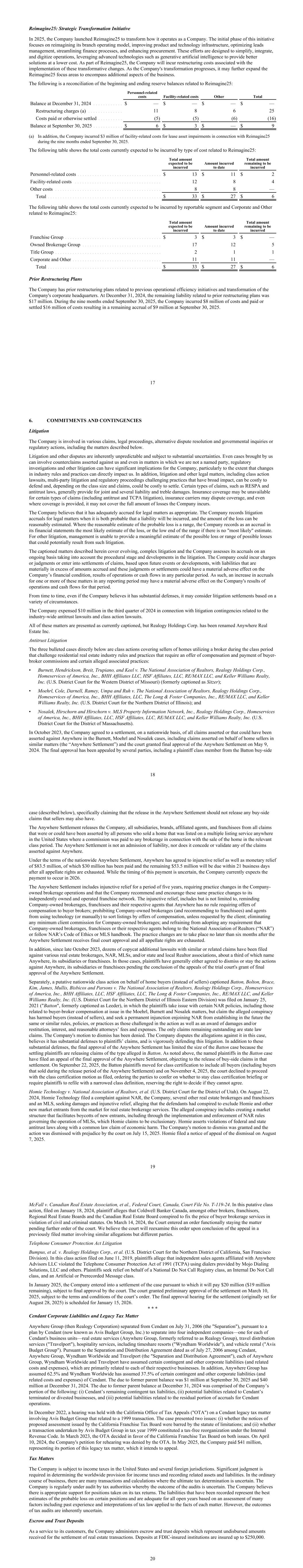

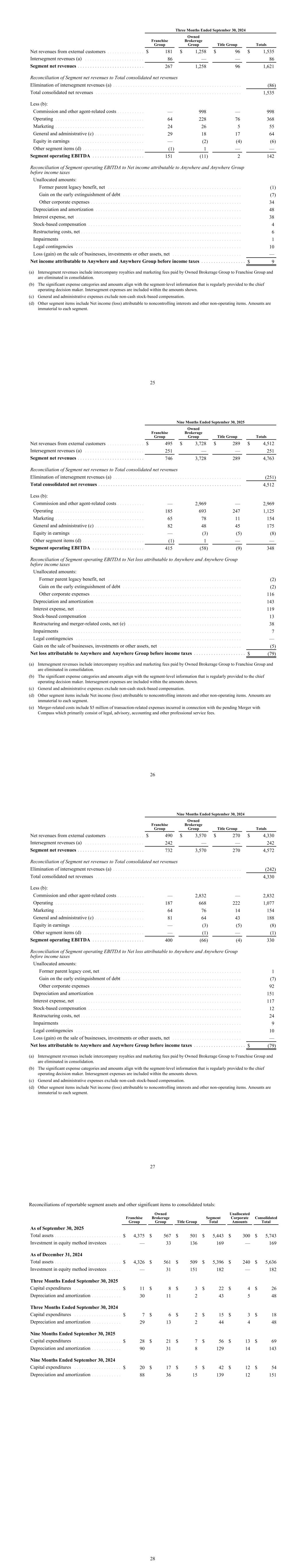

Intangible asset amortization expense is as follows: Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Franchise agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16 $ 17 $ 50 $ 50 License agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 1 1 Customer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 4 16 15 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — 1 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 22 $ 22 $ 67 $ 67 Based on the Company’s amortizable intangible assets as of September 30, 2025, the Company expects related amortization expense for the remainder of 2025, the four succeeding years and thereafter to be approximately $22 million, $89 million, $74 million, $68 million, $68 million and $509 million, respectively. 3. OTHER CURRENT ASSETS AND ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES Other current assets consisted of: September 30, 2025 December 31, 2024 Prepaid contracts and other prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 96 $ 75 Prepaid agent incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 37 Franchisee sales incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 29 Income tax receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 35 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 30 Total other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200 $ 206 Accrued expenses and other current liabilities consisted of: September 30, 2025 December 31, 2024 Accrued payroll and related employee costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 193 $ 170 Advances from clients . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 24 Accrued volume incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 27 Accrued commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 41 Restructuring accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 9 Deferred income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 45 Accrued interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 36 Current portion of finance lease liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 7 Due to former parent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 40 Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 170 154 Total accrued expenses and other current liabilities $ 575 $ 553 13 4. SHORT AND LONG-TERM DEBT Total indebtedness is as follows: September 30, 2025 December 31, 2024 Revolving Credit Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 415 $ 490 9.75% Senior Secured Second Lien Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 491 — 7.00% Senior Secured Second Lien Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 631 630 5.75% Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 559 558 5.25% Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 444 444 0.25% Exchangeable Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 399 Total Short-Term & Long-Term Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,576 $ 2,521 Securitization Obligations: Apple Ridge Funding LLC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 180 $ 140 Indebtedness Table As of September 30, 2025, the Company’s borrowing arrangements were as follows: Interest Rate Expiration Date Principal Amount Unamortized Premium and Debt Issuance Costs Net Amount Revolving Credit Facility (a) . . . . . . . . . . . . . . . . (b) July 2027 (c) $ 415 $ * $ 415 Senior Secured Second Lien Notes (d) . . . . . . . . 9.75% April 2030 500 9 491 Senior Secured Second Lien Notes . . . . . . . . . . . 7.00% April 2030 640 9 631 Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.75% January 2029 559 — 559 Senior Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.25% April 2030 449 5 444 Exchangeable Senior Notes (d) . . . . . . . . . . . . . . 0.25% June 2026 36 — 36 Total Short-Term & Long-Term Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,599 $ 23 $ 2,576 Securitization obligations: (e) Apple Ridge Funding LLC . . . . . . . . . . . . . . . . . . . . . . January 2026 $ 180 $ * $ 180 * The debt issuance costs related to our Revolving Credit Facility and securitization obligations are classified as a deferred financing asset within other assets. (a) As of September 30, 2025, the Company had $1,100 million of borrowing capacity under its Revolving Credit Facility. As of September 30, 2025, there were $415 million of outstanding borrowings under the Revolving Credit Facility and $30 million of outstanding undrawn letters of credit. The Merger Agreement includes customary covenants, including the following limits on outstanding borrowings under the Revolving Credit Facility: (i) $800 million from September 22, 2025 to May 31, 2026; (ii) $700 million from June 1, 2026 to December 31, 2026; (iii) $800 million from January 1, 2027 to March 31, 2027, and (iv) $700 million from April 1, 2027 to December 31, 2027. Under the Merger Agreement, Compass may consent to increases to these limits, and such consent shall not be unreasonably withheld, delayed, or conditioned. On November 3, 2025, the Company had $425 million of outstanding borrowings under the Revolving Credit Facility and $30 million of outstanding undrawn letters of credit. (b) The interest rate with respect to revolving loans under the Revolving Credit Facility at September 30, 2025 is based on, at the Company's option, Term Secured Overnight Financing Rate ("SOFR") plus a 10 basis point credit spread adjustment or JP Morgan Chase Bank, N.A.'s prime rate ("ABR") plus (in each case) an additional margin subject to adjustment based on the then current senior secured leverage ratio. Based on the previous quarter's senior secured leverage ratio, the SOFR margin was 1.75% and the ABR margin was 0.75% for the three months ended September 30, 2025. (c) The maturity date of the Revolving Credit Facility is July 27, 2027; however, it may spring forward to March 16, 2026 if the Exchangeable Senior Notes have not been extended, refinanced or replaced to have a maturity date after October 26, 2027 (or are not otherwise discharged, defeased or repaid by March 16, 2026). (d) See below under the header "Issuance of 9.75% Senior Secured Second Lien Notes due 2030 and Partial Repurchases of Exchangeable Senior Notes" for additional information related to the debt transactions during the second and third quarters of 2025. (e) In May 2025, Anywhere Group entered into an amendment of the Apple Ridge Funding LLC securitization program that reduced the size of the facility to $180 million (from $200 million) and extended the securitization program until January 15, 2026. The Company is currently seeking to extend the program which may, upon mutual agreement of the parties, be extended to May 29, 2026. As of September 30, 2025, the Company had $180 million of borrowing capacity under the Apple Ridge Funding LLC securitization 14 program with $180 million being utilized, leaving no available capacity. Any capacity in the future will be subject to maintaining sufficient relocation related assets to collateralize the securitization obligation. Certain of the funds that Anywhere Group receives from relocation receivables and related assets are required to be utilized to repay securitization obligations. These obligations are collateralized by $246 million and $156 million of underlying relocation receivables and other related relocation assets at September 30, 2025 and December 31, 2024, respectively. Substantially all relocation related assets are realized in less than twelve months from the transaction date. Accordingly, all of Anywhere Group's securitization obligations are classified as current in the accompanying Condensed Consolidated Balance Sheets. Interest incurred in connection with borrowings under the facility amounted to $3 million for both the three months ended September 30, 2025 and 2024, as well as $8 million and $7 million for the nine months ended September 30, 2025 and 2024, respectively. This interest is recorded within net revenues in the accompanying Condensed Consolidated Statements of Operations as related borrowings are utilized to fund Anywhere Group's relocation operations where interest is generally earned on such assets. The securitization obligations represent floating rate debt for which the average weighted interest rate was 6.8% and 8.1% for the nine months ended September 30, 2025 and 2024, respectively. Maturities Table As of September 30, 2025, the combined aggregate amount of maturities for long-term borrowings for the remainder of 2025 and each of the next four years is as follows: Year Amount Remaining 2025 (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 415 2026 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 2027 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2028 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2029 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 559 (a) Remaining 2025 includes $415 million of outstanding borrowings under the Revolving Credit Facility, which expires in July 2027 (subject to earlier springing maturity) but are classified on the balance sheet as current due to the revolving nature of borrowings and terms and conditions of the facility. The current portion of long-term debt of $451 million shown on the Condensed Consolidated Balance Sheets consists of $415 million of outstanding borrowings under the Revolving Credit Facility and $36 million of the Exchangeable Senior Notes due June 2026. Issuance of 9.75% Senior Secured Second Lien Notes due 2030 and Partial Repurchases of Exchangeable Senior Notes On June 26, 2025, Anywhere Group and Anywhere Co-Issuer Corp. (the "Co-Issuer") issued $500 million aggregate principal amount of 9.75% Senior Secured Second Lien Notes. The Company used net proceeds from the issuance of the 9.75% Senior Secured Second Lien Notes to repurchase $345 million in aggregate principal amount of the Exchangeable Senior Notes for an aggregate cash payment of $339 million. The remaining net proceeds were used to repay a portion of outstanding borrowings under the Revolving Credit Facility in July 2025. In connection with the repurchase of the Company’s Exchangeable Senior Notes during the second quarter of 2025, the Company terminated a proportional amount of the related exchangeable note hedge and warrant transactions. The terminated portions corresponded to the repurchased notes with approximately $58 million related to the Exchangeable Senior Notes hedges and $40 million related to the Exchangeable Senior Notes warrants, each representing approximately 86% of the original instruments. The exchangeable note hedges and warrants were originally accounted for as equity-classified instruments with no subsequent remeasurement. Upon termination, the derecognition of the corresponding hedge and warrant components was recorded as a reclassification within additional paid-in capital, with no impact to net income or total equity. The Company incurred no cash cost to unwind the terminated portion of the hedges or warrants. This reflects the fact that the instruments were significantly out-of-the-money at the time of termination and held no residual value. The contractual termination was part of the coordinated exchangeable debt repurchase. The remaining portions of the hedge and warrant transactions, associated with the Exchangeable Senior Notes still outstanding as of June 30, 2025, remain in effect. During the third quarter of 2025, we used cash on hand to repurchase $22 million of the Exchangeable Senior Notes for an aggregate cash payment of $22 million. Following the repurchases, approximately $36 million in aggregate principal amount of the Exchangeable Senior Notes remains outstanding. The 9.75% Senior Secured Second Lien Notes mature on April 15, 2030 and interest is payable semiannually on April 15 and October 15 of each year, commencing October 15, 2025. The 9.75% Senior Secured Second Lien Notes are guaranteed on a senior secured second priority basis by Anywhere Intermediate and each domestic direct or indirect restricted subsidiary of Anywhere Group, other than certain excluded 15 entities, that is a guarantor under its Senior Secured Credit Facility and certain of its outstanding debt securities. The 9.75% Senior Secured Second Lien Notes are also guaranteed by the Company on an unsecured senior subordinated basis. The 9.75% Senior Secured Second Lien Notes are secured by substantially the same collateral as Anywhere Group's existing first lien obligations under its Senior Secured Credit Facility on a second priority basis. The indentures governing the 9.75% Senior Secured Second Lien Notes contain various covenants that limit the ability of the Issuer's and Anywhere Group's restricted subsidiaries to take certain actions, which covenants are subject to a number of important exceptions and qualifications. These covenants are substantially similar to the covenants in the indenture governing the 7.00% Senior Secured Second Lien Notes, 5.75% Senior Notes and 5.25% Senior Notes, as described in Note 9, "Short and Long-Term Debt—Unsecured Notes" in Company's Annual Report on Form 10-K for the year ended December 31, 2024. At September 30, 2025, Anywhere Group was in compliance with the senior secured leverage ratio covenant. Gain on the Early Extinguishment of Debt During the nine months ended September 30, 2025, the Company recorded a gain on the early extinguishment of debt of $2 million as a result of the issuance of 9.75% Senior Secured Second Lien Notes and repurchase of a portion of the Exchangeable Senior Notes. During the nine months ended September 30, 2024, the Company recorded gains on the early extinguishment of debt totaling $7 million as a result of the repurchases of Unsecured Notes occurring in the third quarter of 2024. 5. RESTRUCTURING AND MERGER-RELATED COSTS Restructuring and merger-related costs were $14 million and $38 million for the three and nine months ended September 30, 2025, respectively, and $6 million and $24 million for the three and nine months ended September 30, 2024, respectively. The components of the restructuring and merger-related costs were as follows: Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Merger-related costs (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5 $ — $ 5 $ — Restructuring costs: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Personnel-related costs (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3 $ 3 $ 11 $ 13 Facility-related costs (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 3 16 11 Other (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 — 6 — Total restructuring costs (e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9 $ 6 $ 33 $ 24 Total restructuring and merger-related costs . . . . . . . . . . . . . . . . . . . $ 14 $ 6 $ 38 $ 24 (a) Merger-related expenses incurred in connection with the pending Merger with Compass are included in the line item “Restructuring and merger-related costs, net” in the Condensed Consolidated Statements of Operations. These costs primarily consist of legal, advisory, accounting and other professional service fees and are expensed as incurred. Such costs are considered period expenses and are not included in the purchase consideration under ASC Topic 805. (b) Personnel-related costs consist of severance costs provided to employees who have been terminated. (c) Facility-related costs consist of costs associated with planned facility closures such as contract termination costs, amortization of lease assets that will continue to be incurred under the contract for its remaining term without economic benefit to the Company, accelerated depreciation on asset disposals and other facility and employee relocation related costs. (d) Other restructuring costs consist of costs related to professional fees, consulting fees and other costs associated with restructuring activities which are primarily recorded at Corporate. (e) Restructuring costs for the three months ended September 30, 2025 include $6 million of expense related to Reimagine25 and $3 million of expense related to prior restructuring plans. Restructuring costs for the three months ended September 30, 2024 include $6 million of expense related to prior restructuring plans. Restructuring costs for the nine months ended September 30, 2025 include $25 million of expense related to Reimagine25 and $8 million of expense related to prior restructuring plans. Restructuring costs for the nine months ended September 30, 2024 include $24 million of expense related to prior restructuring plans. 16