Third Quarter 2025 Earnings Call October 29, 2025

Forward-Looking Statements Certain statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain “forward-looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets, while others are more specific to our business and operations. These risks and uncertainties include, but are not limited to: market competition; economic downturn or industry specific conditions including the impacts of tax and tariff programs, inflation, foreign currency exchange, and industry consolidation; disruption to business operations; natural disasters including severe flooding and other weather-related events; the conflict between Russia and Ukraine and other geopolitical tensions; the inability to meet customer demand and quality requirements; the loss of key customers, suppliers or other business relationships; supply disruptions; excessive inflation; the capacity and effectiveness of our hedging policy activities; the loss of key employees; levels of indebtedness which could limit our operating flexibility and opportunities; and other risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 10-K, and as described from time to time in subsequent reports filed with the U.S. Securities and Exchange Commission. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not predictable or within our control. Consequently, actual results may differ materially from the forward-looking statements contained in this press release. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Third Quarter 2025 - Earnings Call - 2

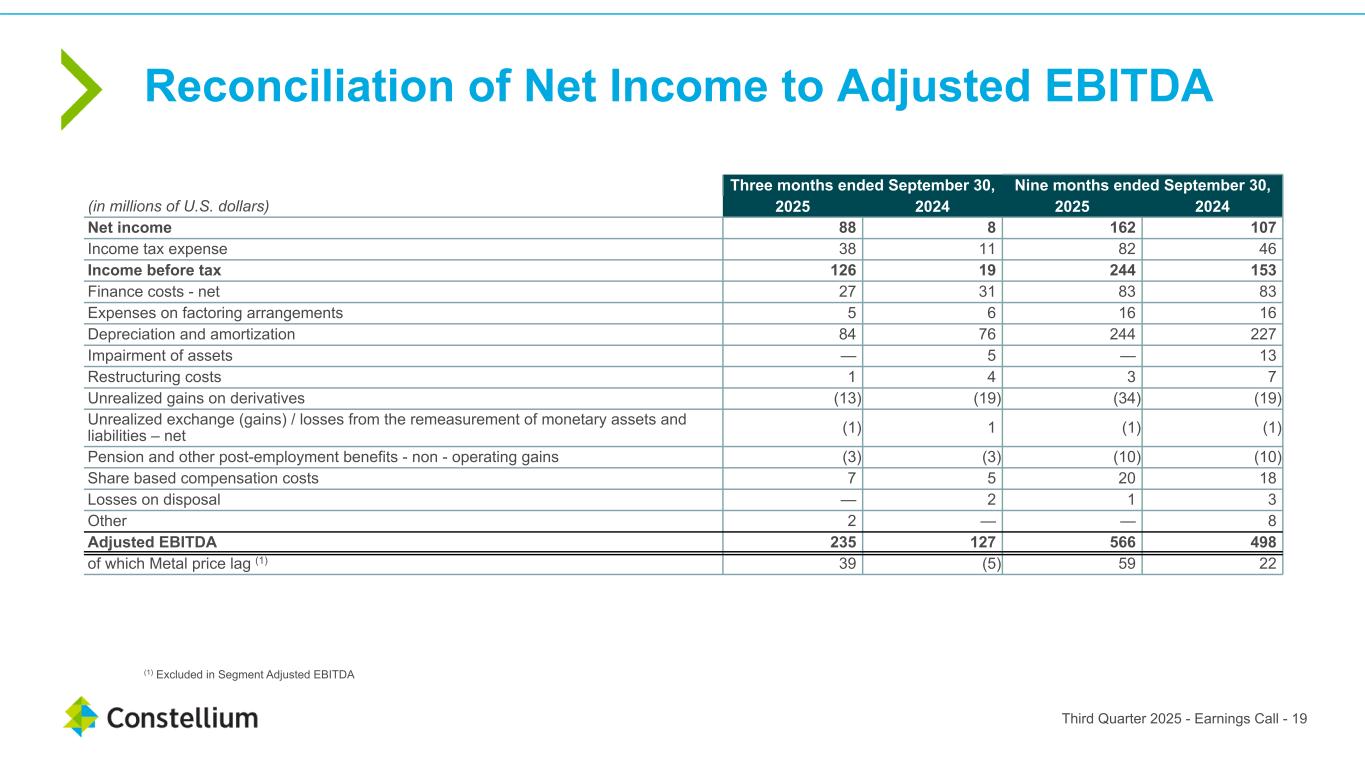

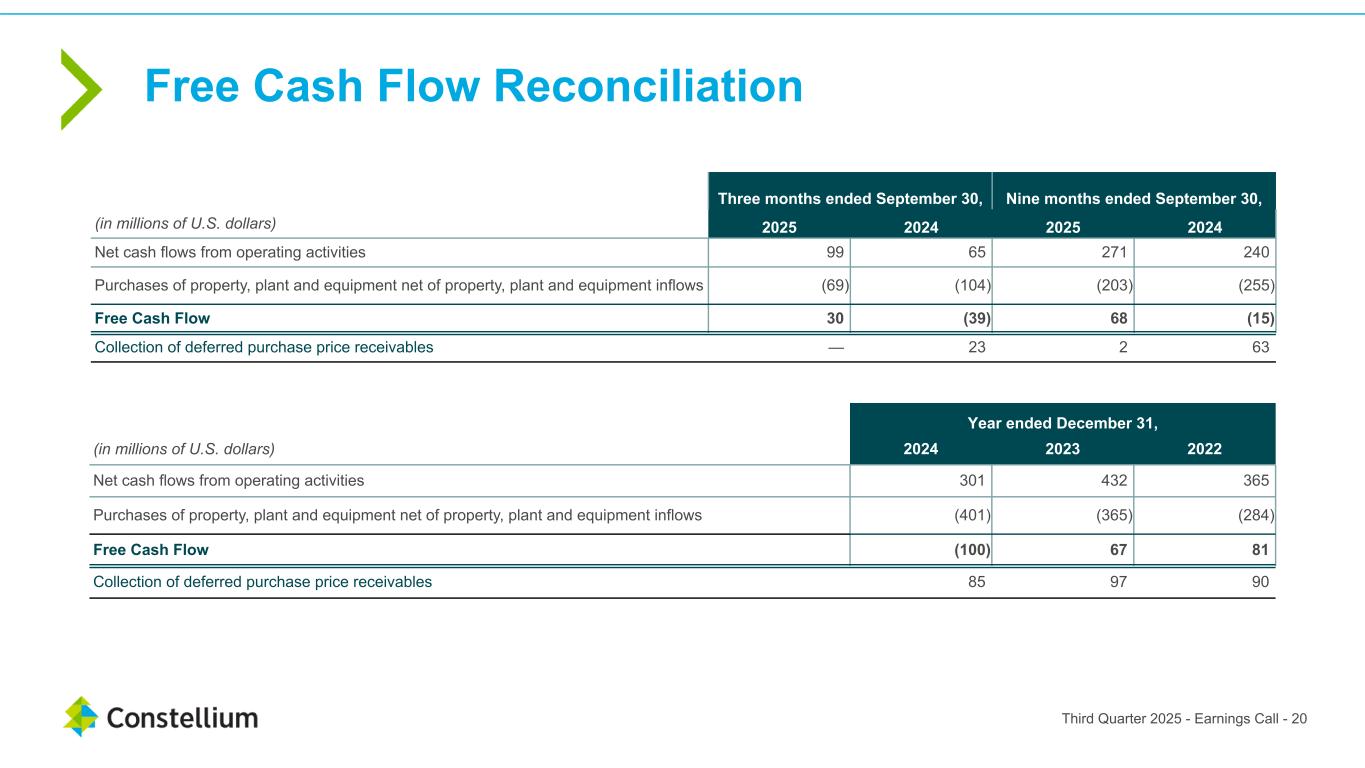

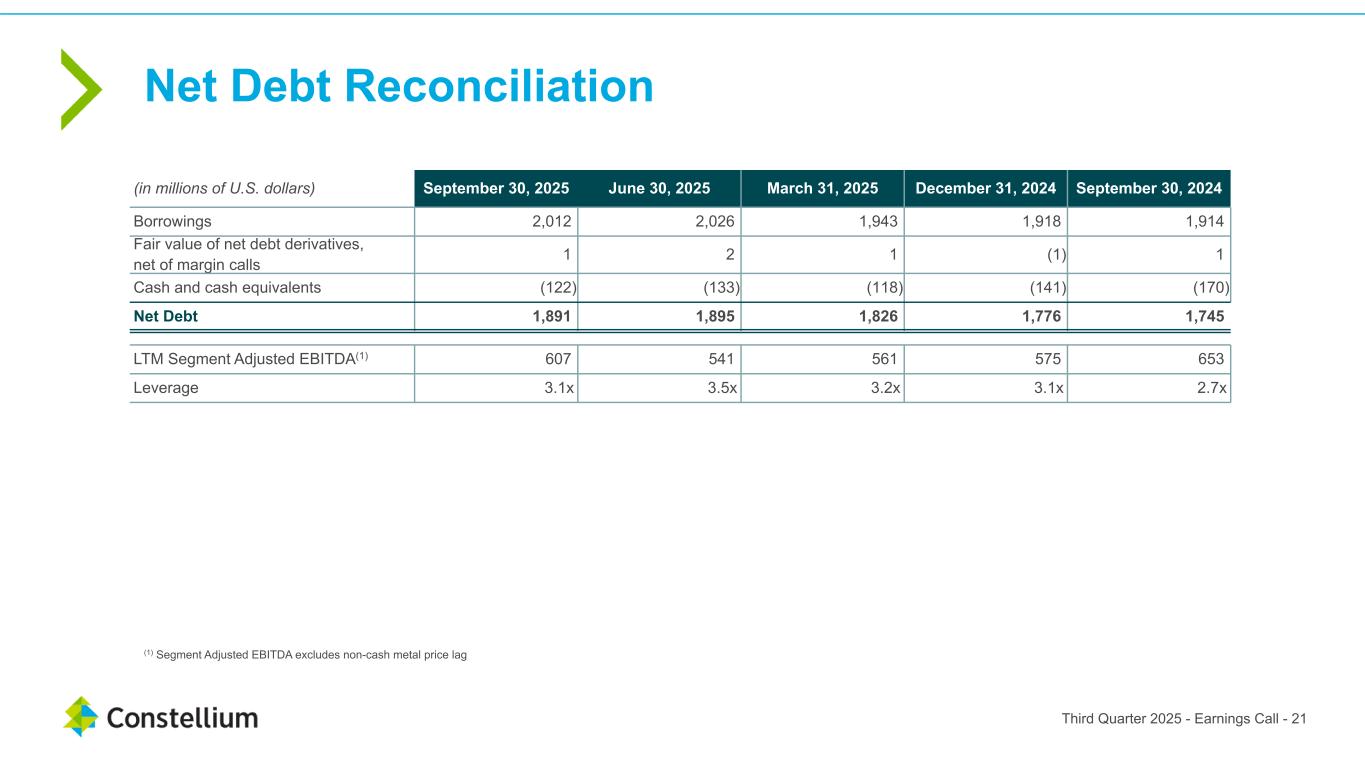

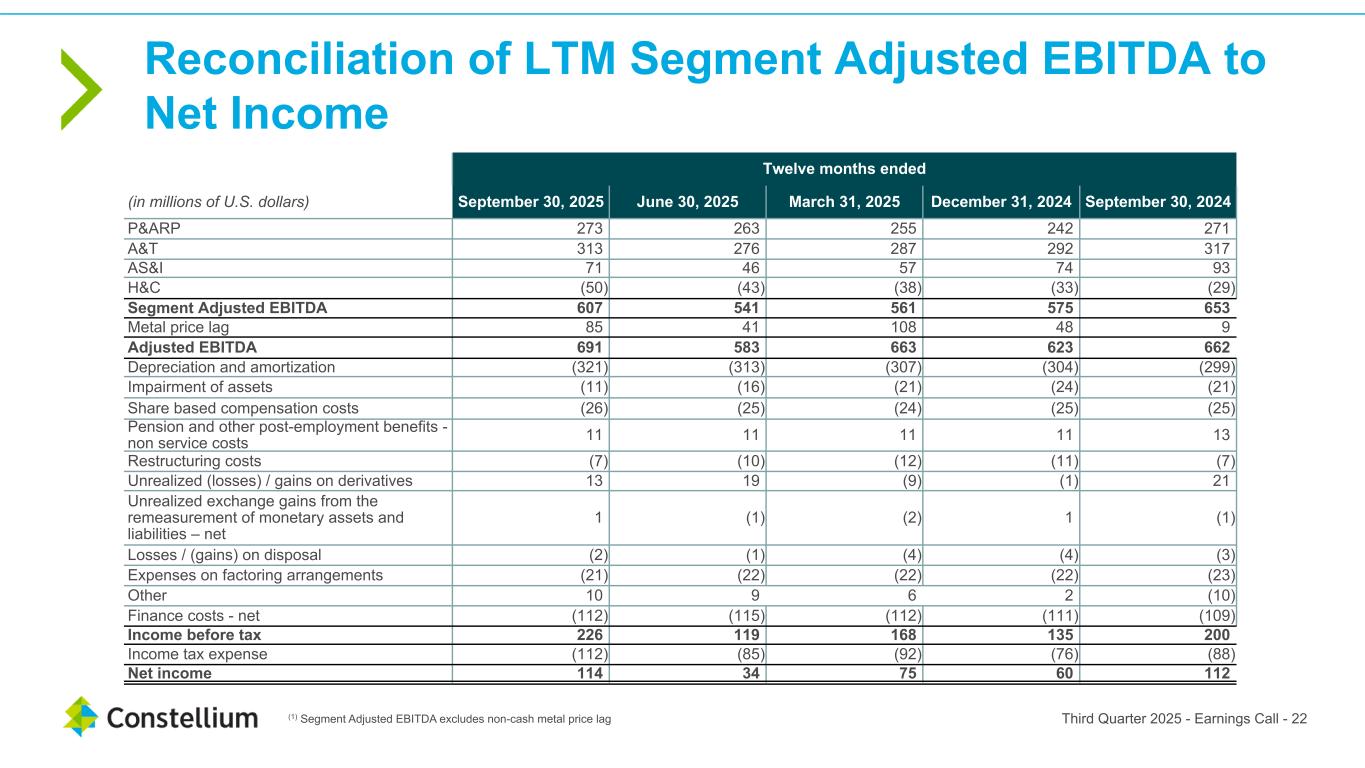

Non-GAAP Measures This presentation includes information regarding certain non-GAAP financial measures, including Adjusted EBITDA, Free Cash Flow and Net debt. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. Adjusted EBITDA measures are frequently used by securities analysts, investors and other interested parties in their evaluation of Constellium and in comparison to other companies, many of which present an adjusted EBITDA-related performance measure when reporting their results. Adjusted EBITDA, Free Cash Flow and Net debt are not presentations made in accordance with U.S. GAAP and may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measures. This presentation provides a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. For the definitions or Adjusted EBITDA, Free Cash Flow and Net debt, please refer to our accompanying press release. We are not able to provide a reconciliation of Adjusted EBITDA guidance to net income, the comparable GAAP measure, because certain items that are excluded from Adjusted EBITDA cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of realized and unrealized gains and losses on derivative instruments, non-cash impact of metal price lag, impairment or restructuring charges, or taxes without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, our net income in the future. Third Quarter 2025 - Earnings Call - 3

Jean-Marc Germain Chief Executive Officer

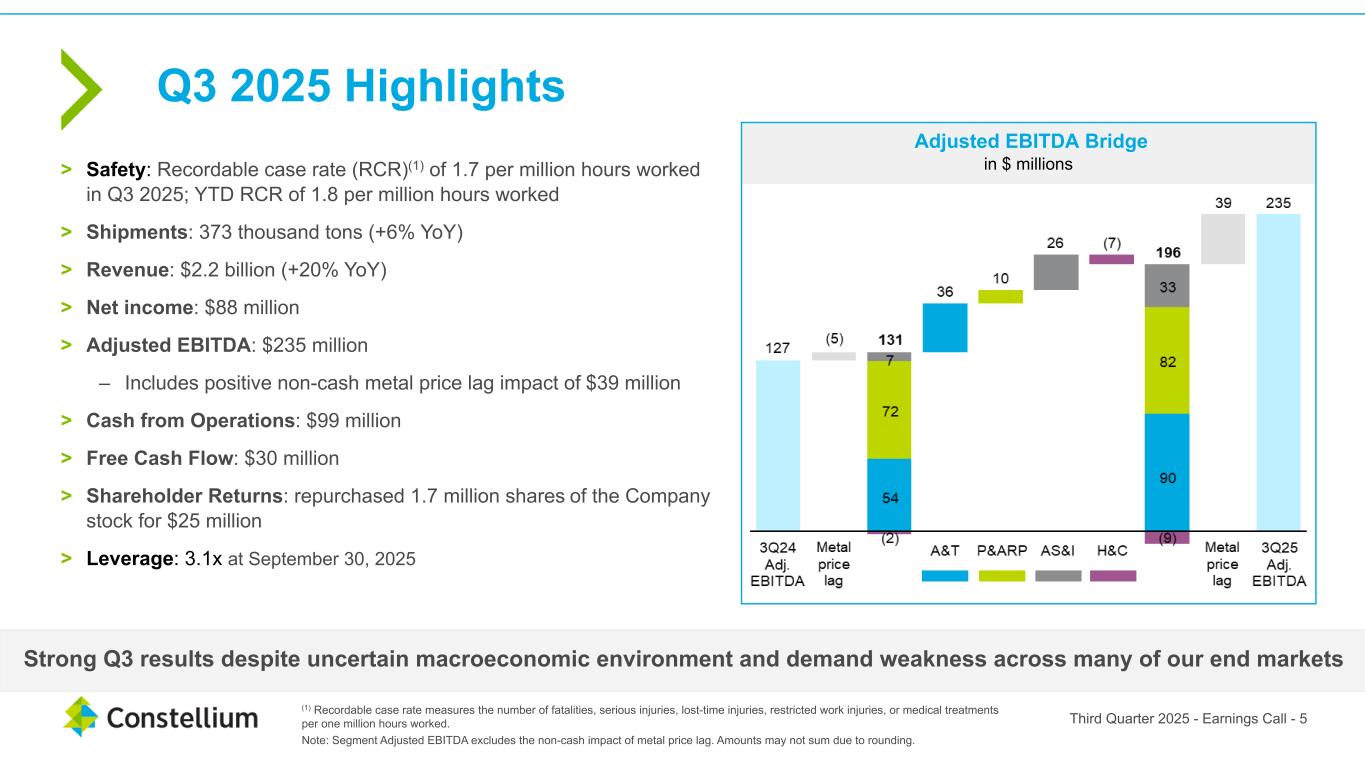

Q3 2025 Highlights > Safety: Recordable case rate (RCR)(1) of 1.7 per million hours worked in Q3 2025; YTD RCR of 1.8 per million hours worked > Shipments: 373 thousand tons (+6% YoY) > Revenue: $2.2 billion (+20% YoY) > Net income: $88 million > Adjusted EBITDA: $235 million – Includes positive non-cash metal price lag impact of $39 million > Cash from Operations: $99 million > Free Cash Flow: $30 million > Shareholder Returns: repurchased 1.7 million shares of the Company stock for $25 million > Leverage: 3.1x at September 30, 2025 Note: Segment Adjusted EBITDA excludes the non-cash impact of metal price lag. Amounts may not sum due to rounding. Strong Q3 results despite uncertain macroeconomic environment and demand weakness across many of our end markets Third Quarter 2025 - Earnings Call - 5 Adjusted EBITDA Bridge in $ millions (1) Recordable case rate measures the number of fatalities, serious injuries, lost-time injuries, restricted work injuries, or medical treatments per one million hours worked.

Current Assessment of Tariffs and Potential Impact on Constellium Third Quarter 2025 - Earnings Call - 6 > As a reminder, we are mostly “local for local” in the regions we operate > Our gross tariff exposure is mostly concentrated at our metal supply from Canada to our operations in the U.S. > We have made significant progress on pass-throughs and other actions to mitigate a large portion of our gross tariff exposure > At this stage, our tariff exposure remains manageable and consistent with our prior expectations > When combined with other factors, we continue to believe the current trade policies present a net positive opportunity for us > All known tariff impacts and mitigation efforts are included in our guidance

Jack Guo Chief Financial Officer

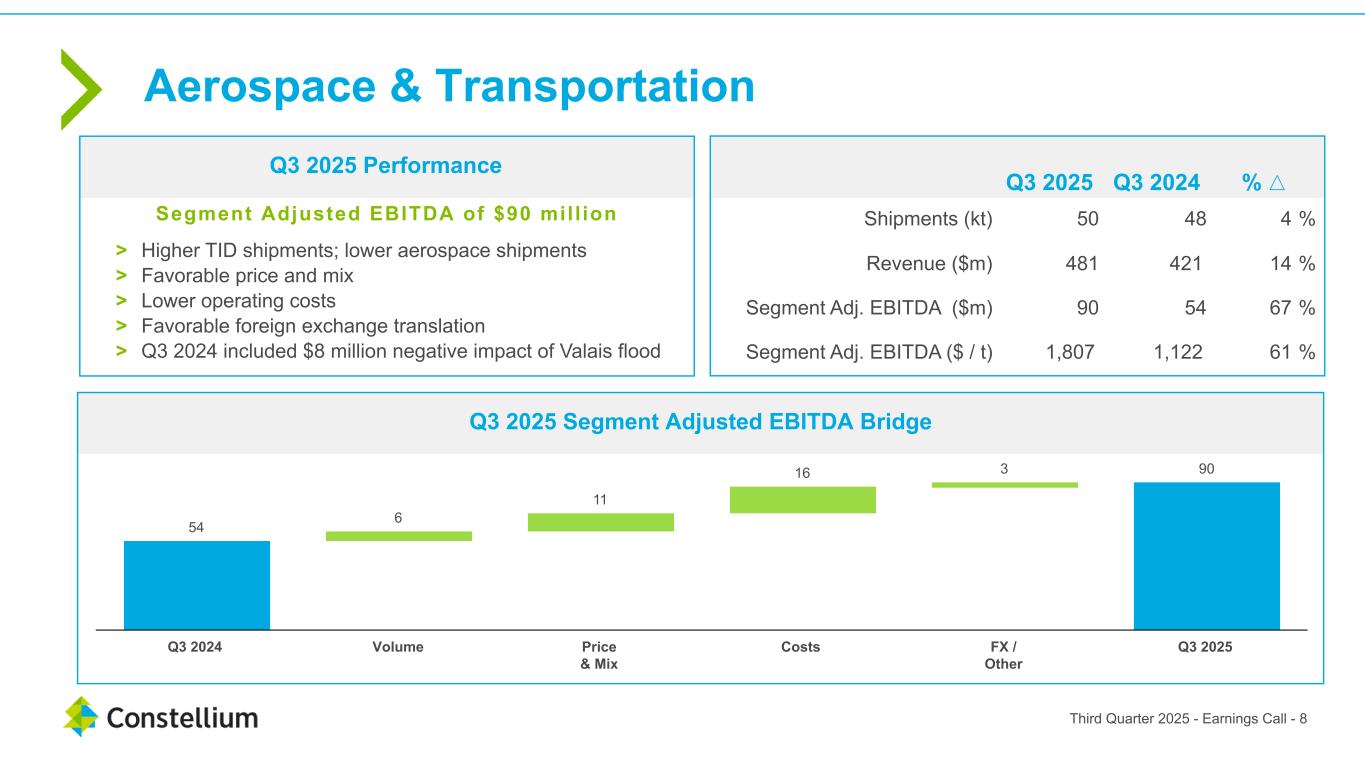

54 6 11 16 3 90 Q3 2024 Volume Price & Mix Costs FX / Other Q3 2025 Q3 2025 Q3 2024 % △ Shipments (kt) 50 48 4 % Revenue ($m) 481 421 14 % Segment Adj. EBITDA ($m) 90 54 67 % Segment Adj. EBITDA ($ / t) 1,807 1,122 61 % Aerospace & Transportation Q3 2025 Segment Adjusted EBITDA Bridge Q3 2025 Performance Third Quarter 2025 - Earnings Call - 8 Segment Adjusted EBITDA of $90 mil l ion > Higher TID shipments; lower aerospace shipments > Favorable price and mix > Lower operating costs > Favorable foreign exchange translation > Q3 2024 included $8 million negative impact of Valais flood

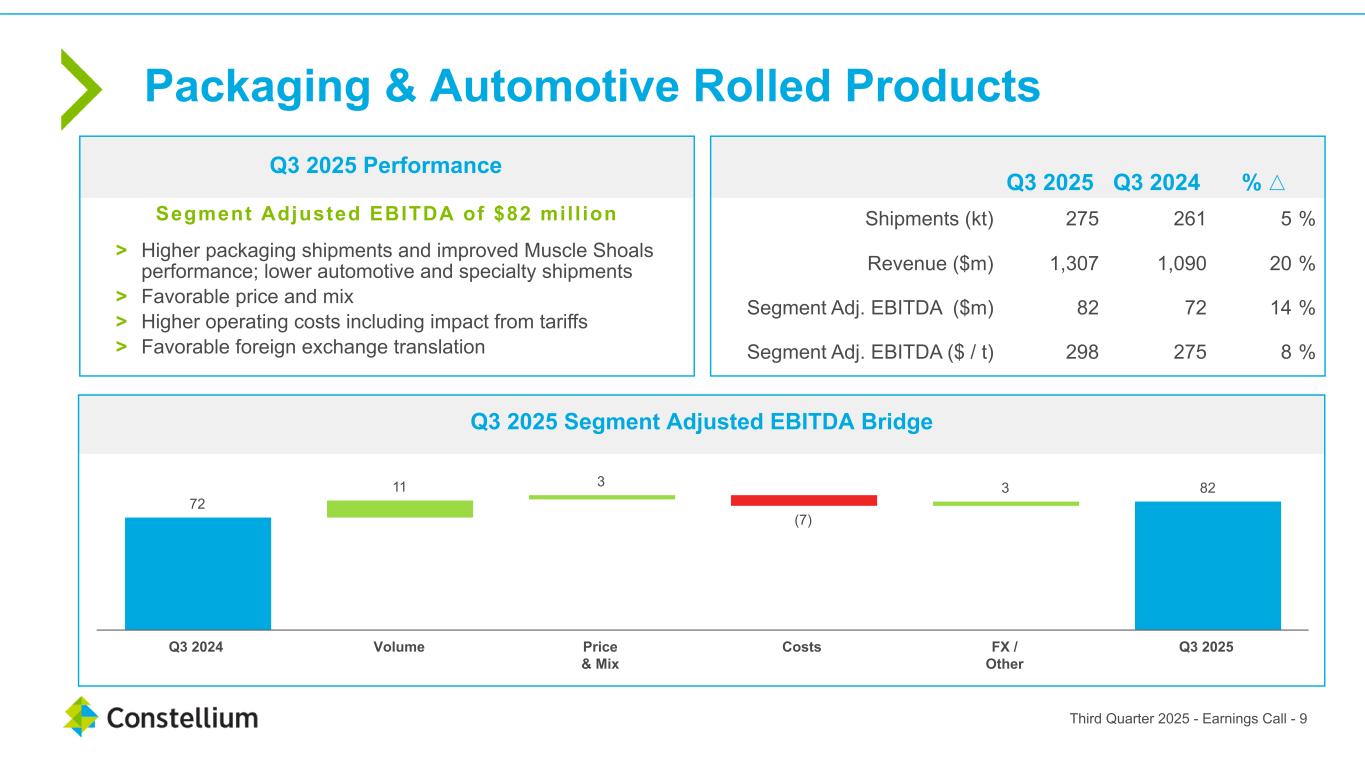

72 11 3 (7) 3 82 Q3 2024 Volume Price & Mix Costs FX / Other Q3 2025 Q3 2025 Q3 2024 % △ Shipments (kt) 275 261 5 % Revenue ($m) 1,307 1,090 20 % Segment Adj. EBITDA ($m) 82 72 14 % Segment Adj. EBITDA ($ / t) 298 275 8 % Packaging & Automotive Rolled Products Q3 2025 Segment Adjusted EBITDA Bridge Q3 2025 Performance Third Quarter 2025 - Earnings Call - 9 Segment Adjusted EBITDA of $82 mil l ion > Higher packaging shipments and improved Muscle Shoals performance; lower automotive and specialty shipments > Favorable price and mix > Higher operating costs including impact from tariffs > Favorable foreign exchange translation

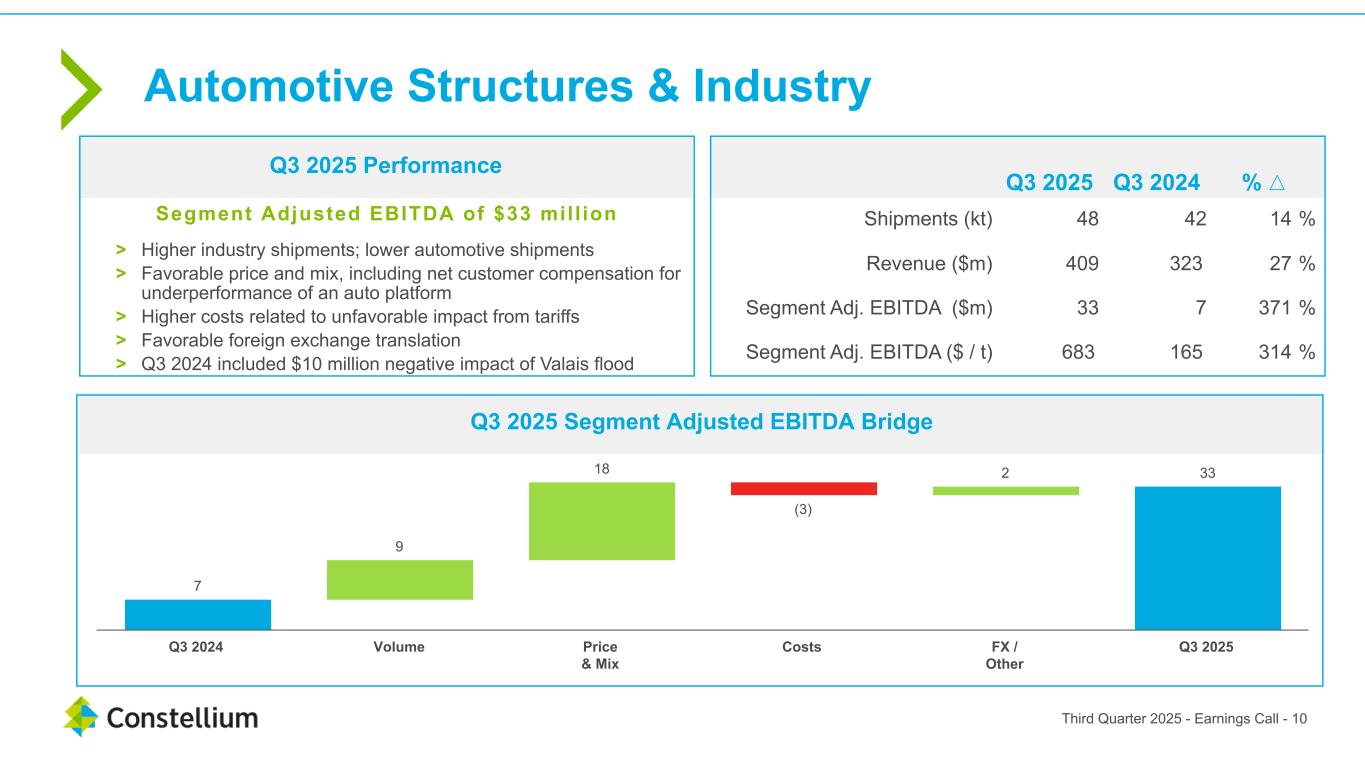

7 9 18 (3) 2 33 Q3 2024 Volume Price & Mix Costs FX / Other Q3 2025 Q3 2025 Q3 2024 % △ Shipments (kt) 48 42 14 % Revenue ($m) 409 323 27 % Segment Adj. EBITDA ($m) 33 7 371 % Segment Adj. EBITDA ($ / t) 683 165 314 % Automotive Structures & Industry Q3 2025 Segment Adjusted EBITDA Bridge Q3 2025 Performance Third Quarter 2025 - Earnings Call - 10 Segment Adjusted EBITDA of $33 mil l ion > Higher industry shipments; lower automotive shipments > Favorable price and mix, including net customer compensation for underperformance of an auto platform > Higher costs related to unfavorable impact from tariffs > Favorable foreign exchange translation > Q3 2024 included $10 million negative impact of Valais flood

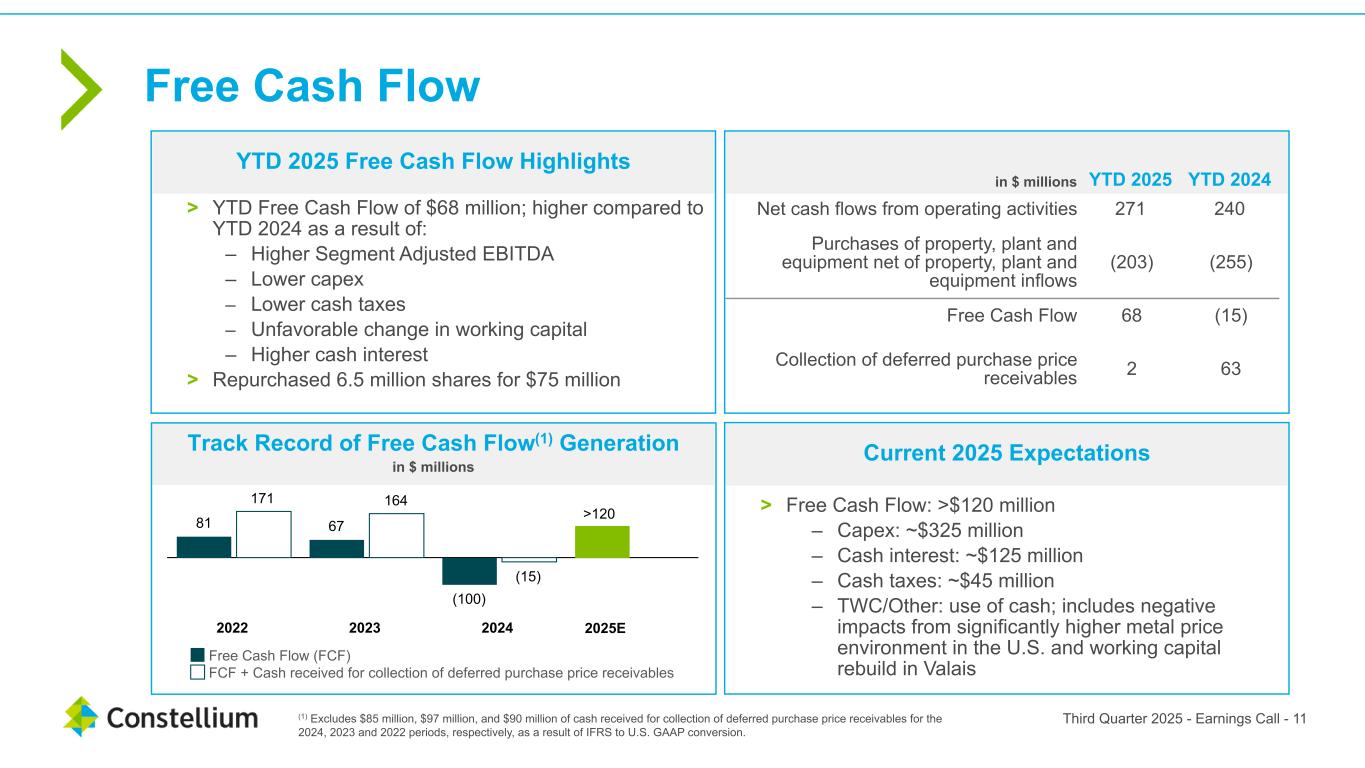

> YTD Free Cash Flow of $68 million; higher compared to YTD 2024 as a result of: – Higher Segment Adjusted EBITDA – Lower capex – Lower cash taxes – Unfavorable change in working capital – Higher cash interest > Repurchased 6.5 million shares for $75 million in $ millions YTD 2025 YTD 2024 Net cash flows from operating activities 271 240 Purchases of property, plant and equipment net of property, plant and equipment inflows (203) (255) Free Cash Flow 68 (15) Collection of deferred purchase price receivables 2 63 Track Record of Free Cash Flow(1) Generation in $ millions 81 67 (100) 171 164 (15) Free Cash Flow (FCF) FCF + Cash received for collection of deferred purchase price receivables 2022 2023 2024 YTD 2025 Free Cash Flow Highlights Current 2025 Expectations Third Quarter 2025 - Earnings Call - 11(1) Excludes $85 million, $97 million, and $90 million of cash received for collection of deferred purchase price receivables for the 2024, 2023 and 2022 periods, respectively, as a result of IFRS to U.S. GAAP conversion. >120 > Free Cash Flow: >$120 million – Capex: ~$325 million – Cash interest: ~$125 million – Cash taxes: ~$45 million – TWC/Other: use of cash; includes negative impacts from significantly higher metal price environment in the U.S. and working capital rebuild in Valais Free Cash Flow 2025E

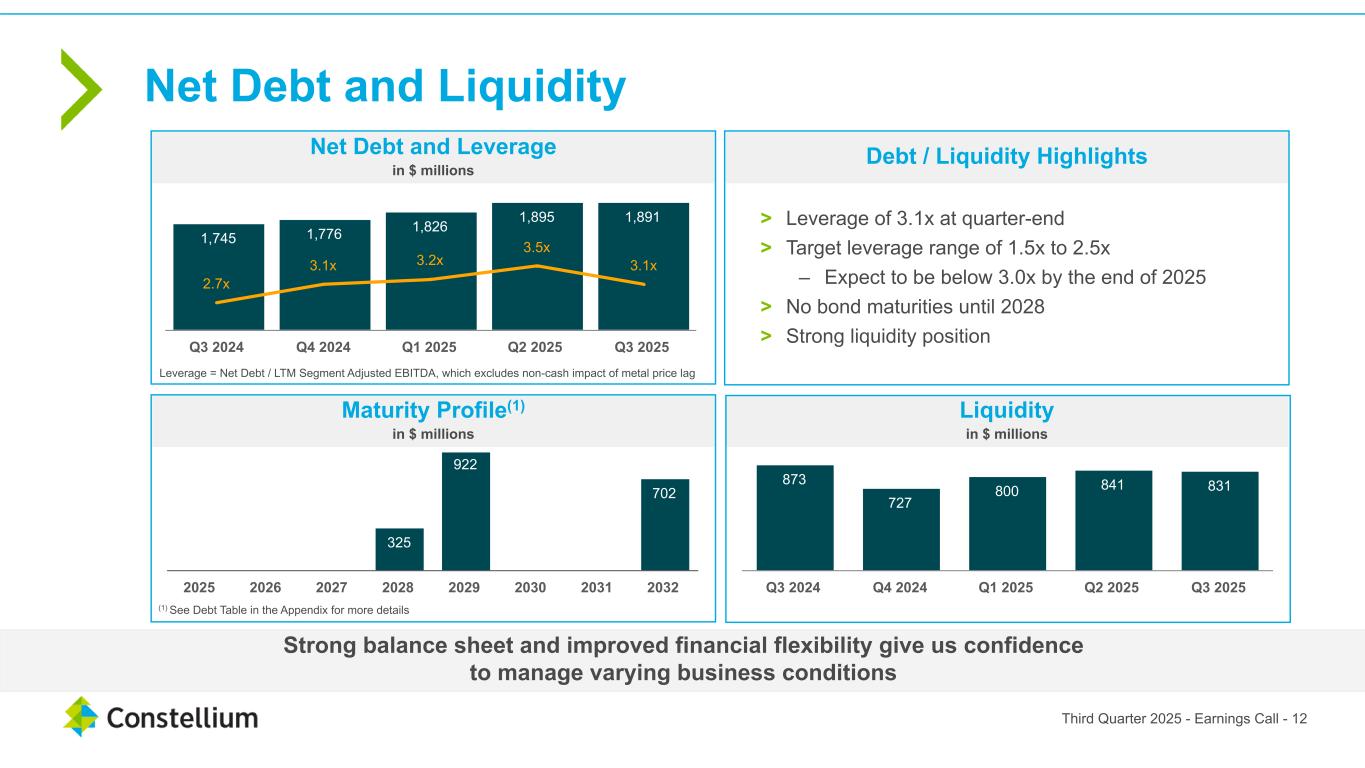

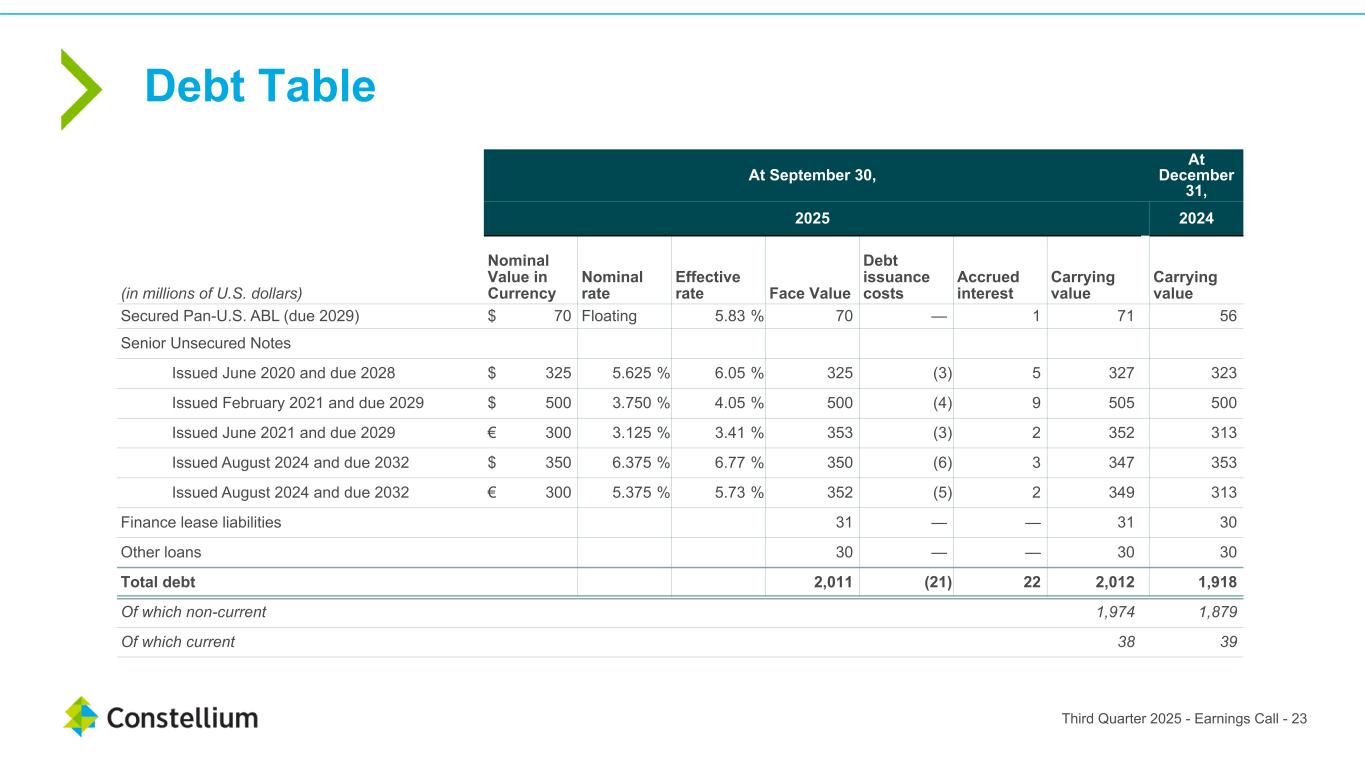

1,745 1,776 1,826 1,895 1,891 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 > Leverage of 3.1x at quarter-end > Target leverage range of 1.5x to 2.5x – Expect to be below 3.0x by the end of 2025 > No bond maturities until 2028 > Strong liquidity position Debt / Liquidity Highlights Net Debt and Liquidity Maturity Profile(1) in $ millions Liquidity in $ millions 0 0 0 325 922 0 0 702 2025 2026 2027 2028 2029 2030 2031 2032 Net Debt and Leverage in $ millions 873 727 800 841 831 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Strong balance sheet and improved financial flexibility give us confidence to manage varying business conditions Leverage = Net Debt / LTM Segment Adjusted EBITDA, which excludes non-cash impact of metal price lag (1) See Debt Table in the Appendix for more details Third Quarter 2025 - Earnings Call - 12 2.7x 3.1x 3.2x 3.5x 3.1x

Ingrid Joerg Chief Operating Officer, CEO Appointee

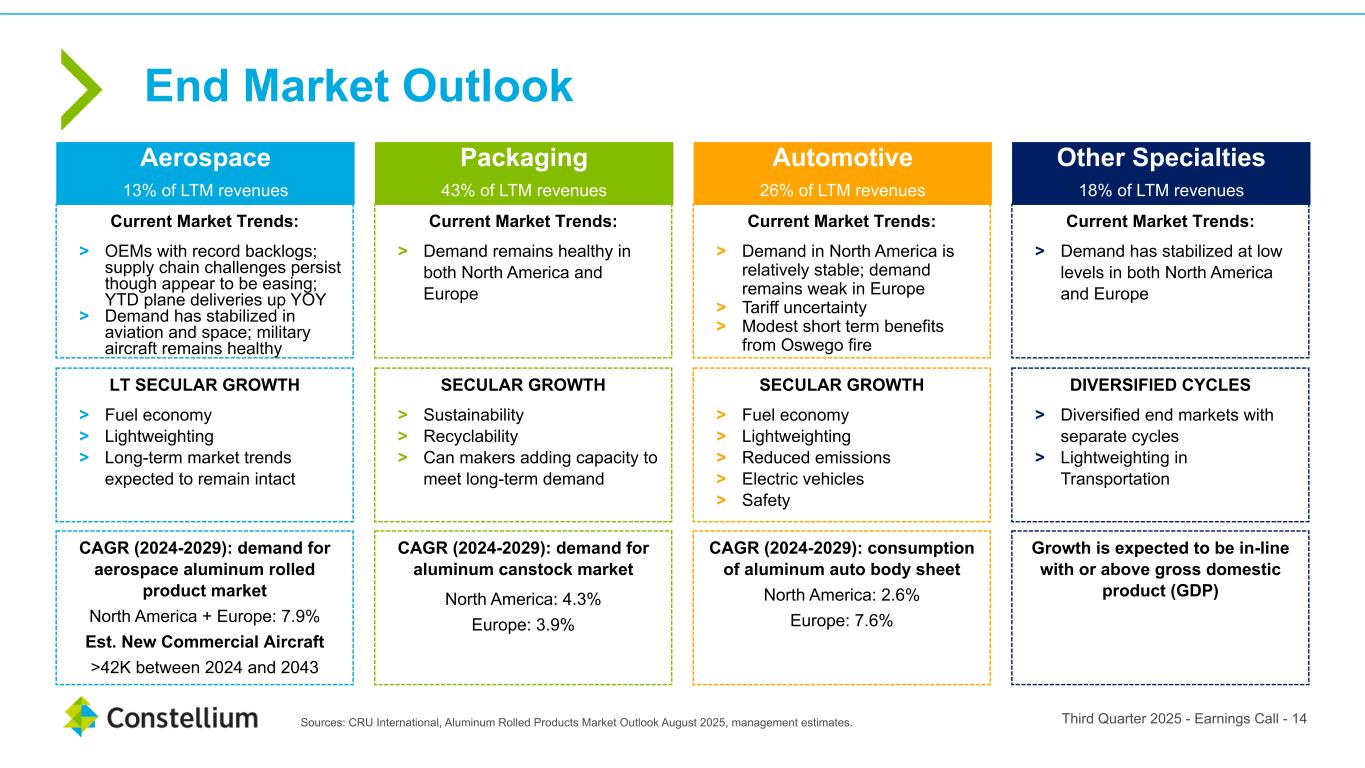

End Market Outlook Third Quarter 2025 - Earnings Call - 14Sources: CRU International, Aluminum Rolled Products Market Outlook August 2025, management estimates. Aerospace 13% of LTM revenues Packaging 43% of LTM revenues Automotive 26% of LTM revenues Other Specialties 18% of LTM revenues Current Market Trends: > Demand in North America is relatively stable; demand remains weak in Europe > Tariff uncertainty > Modest short term benefits from Oswego fire Current Market Trends: > Demand has stabilized at low levels in both North America and Europe Current Market Trends: > Demand remains healthy in both North America and Europe Current Market Trends: > OEMs with record backlogs; supply chain challenges persist though appear to be easing; YTD plane deliveries up YOY > Demand has stabilized in aviation and space; military aircraft remains healthy SECULAR GROWTH > Fuel economy > Lightweighting > Reduced emissions > Electric vehicles > Safety DIVERSIFIED CYCLES > Diversified end markets with separate cycles > Lightweighting in Transportation SECULAR GROWTH > Sustainability > Recyclability > Can makers adding capacity to meet long-term demand LT SECULAR GROWTH > Fuel economy > Lightweighting > Long-term market trends expected to remain intact CAGR (2024-2029): demand for aluminum canstock market North America: 4.3% Europe: 3.9% CAGR (2024-2029): demand for aerospace aluminum rolled product market North America + Europe: 7.9% Est. New Commercial Aircraft >42K between 2024 and 2043 CAGR (2024-2029): consumption of aluminum auto body sheet North America: 2.6% Europe: 7.6% Growth is expected to be in-line with or above gross domestic product (GDP)

Jean-Marc Germain Chief Executive Officer

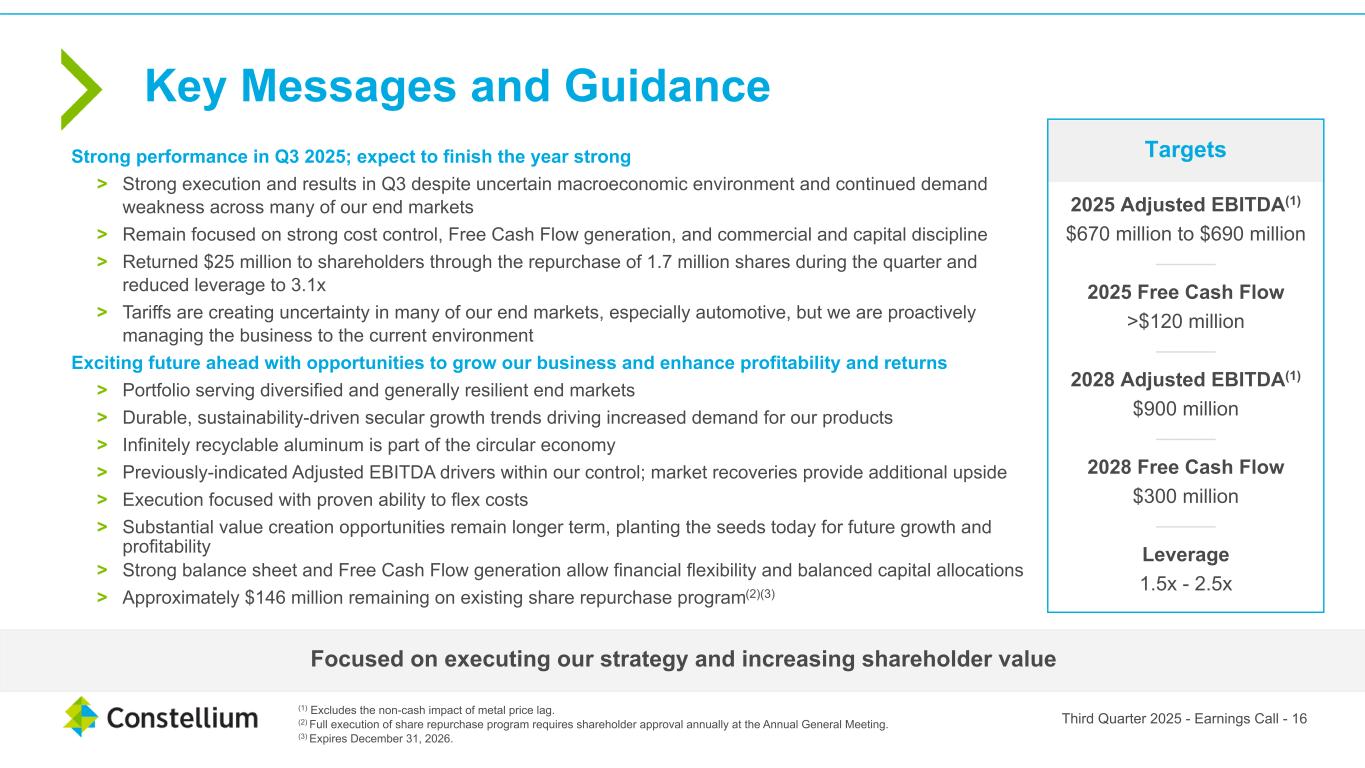

Strong performance in Q3 2025; expect to finish the year strong > Strong execution and results in Q3 despite uncertain macroeconomic environment and continued demand weakness across many of our end markets > Remain focused on strong cost control, Free Cash Flow generation, and commercial and capital discipline > Returned $25 million to shareholders through the repurchase of 1.7 million shares during the quarter and reduced leverage to 3.1x > Tariffs are creating uncertainty in many of our end markets, especially automotive, but we are proactively managing the business to the current environment Exciting future ahead with opportunities to grow our business and enhance profitability and returns > Portfolio serving diversified and generally resilient end markets > Durable, sustainability-driven secular growth trends driving increased demand for our products > Infinitely recyclable aluminum is part of the circular economy > Previously-indicated Adjusted EBITDA drivers within our control; market recoveries provide additional upside > Execution focused with proven ability to flex costs > Substantial value creation opportunities remain longer term, planting the seeds today for future growth and profitability > Strong balance sheet and Free Cash Flow generation allow financial flexibility and balanced capital allocations > Approximately $146 million remaining on existing share repurchase program(2)(3) Key Messages and Guidance Focused on executing our strategy and increasing shareholder value Targets (1) Excludes the non-cash impact of metal price lag. (2) Full execution of share repurchase program requires shareholder approval annually at the Annual General Meeting. (3) Expires December 31, 2026. Third Quarter 2025 - Earnings Call - 16 2025 Adjusted EBITDA(1) $670 million to $690 million ——— 2025 Free Cash Flow >$120 million ——— 2028 Adjusted EBITDA(1) $900 million ——— 2028 Free Cash Flow $300 million ——— Leverage 1.5x - 2.5x

Appendix

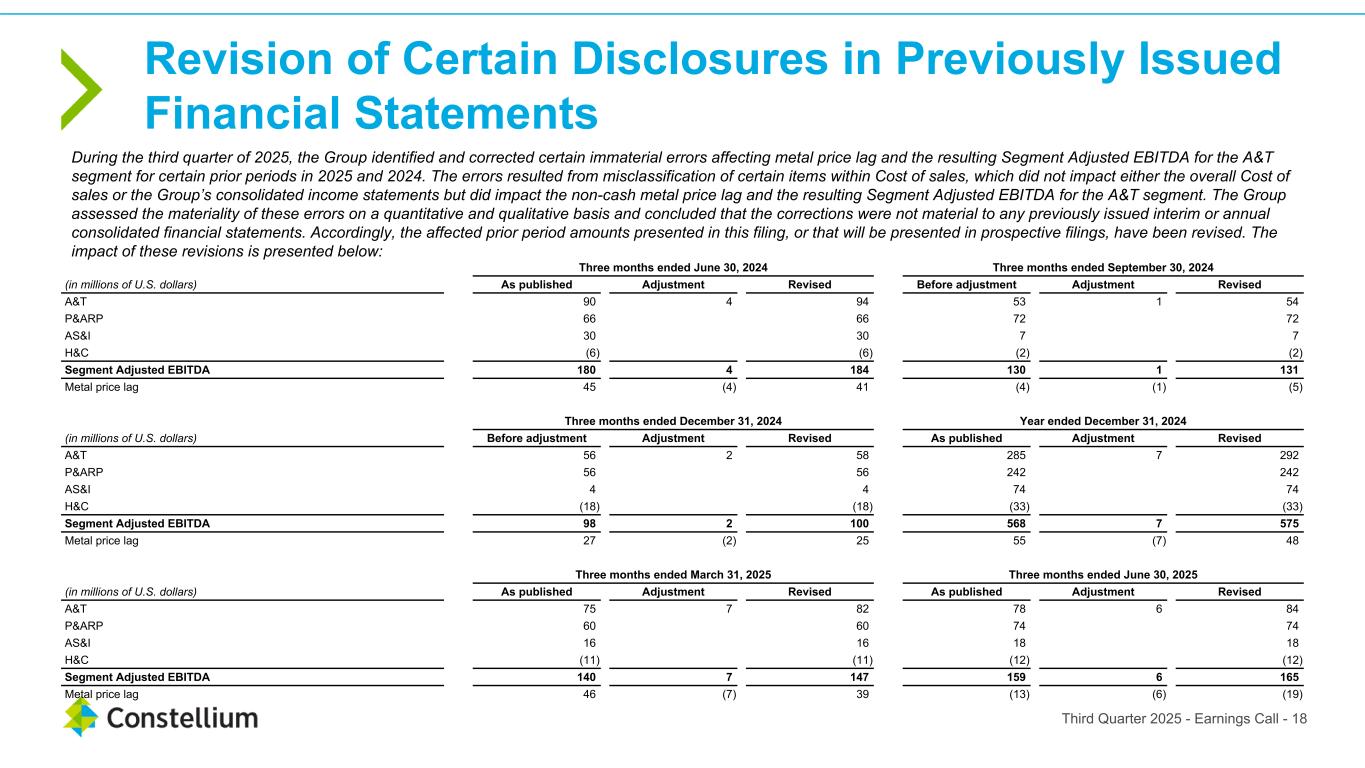

Revision of Certain Disclosures in Previously Issued Financial Statements Third Quarter 2025 - Earnings Call - 18 During the third quarter of 2025, the Group identified and corrected certain immaterial errors affecting metal price lag and the resulting Segment Adjusted EBITDA for the A&T segment for certain prior periods in 2025 and 2024. The errors resulted from misclassification of certain items within Cost of sales, which did not impact either the overall Cost of sales or the Group’s consolidated income statements but did impact the non-cash metal price lag and the resulting Segment Adjusted EBITDA for the A&T segment. The Group assessed the materiality of these errors on a quantitative and qualitative basis and concluded that the corrections were not material to any previously issued interim or annual consolidated financial statements. Accordingly, the affected prior period amounts presented in this filing, or that will be presented in prospective filings, have been revised. The impact of these revisions is presented below: Three months ended June 30, 2024 Three months ended September 30, 2024 (in millions of U.S. dollars) As published Adjustment Revised Before adjustment Adjustment Revised A&T 90 4 94 53 1 54 P&ARP 66 66 72 72 AS&I 30 30 7 7 H&C (6) (6) (2) (2) Segment Adjusted EBITDA 180 4 184 130 1 131 Metal price lag 45 (4) 41 (4) (1) (5) Three months ended December 31, 2024 Year ended December 31, 2024 (in millions of U.S. dollars) Before adjustment Adjustment Revised As published Adjustment Revised A&T 56 2 58 285 7 292 P&ARP 56 56 242 242 AS&I 4 4 74 74 H&C (18) (18) (33) (33) Segment Adjusted EBITDA 98 2 100 568 7 575 Metal price lag 27 (2) 25 55 (7) 48 Three months ended March 31, 2025 Three months ended June 30, 2025 (in millions of U.S. dollars) As published Adjustment Revised As published Adjustment Revised A&T 75 7 82 78 6 84 P&ARP 60 60 74 74 AS&I 16 16 18 18 H&C (11) (11) (12) (12) Segment Adjusted EBITDA 140 7 147 159 6 165 Metal price lag 46 (7) 39 (13) (6) (19)

Reconciliation of Net Income to Adjusted EBITDA ≥130 Three months ended September 30, Nine months ended September 30, (in millions of U.S. dollars) 2025 2024 2025 2024 Net income 88 8 162 107 Income tax expense 38 11 82 46 Income before tax 126 19 244 153 Finance costs - net 27 31 83 83 Expenses on factoring arrangements 5 6 16 16 Depreciation and amortization 84 76 244 227 Impairment of assets — 5 — 13 Restructuring costs 1 4 3 7 Unrealized gains on derivatives (13) (19) (34) (19) Unrealized exchange (gains) / losses from the remeasurement of monetary assets and liabilities – net (1) 1 (1) (1) Pension and other post-employment benefits - non - operating gains (3) (3) (10) (10) Share based compensation costs 7 5 20 18 Losses on disposal — 2 1 3 Other 2 — — 8 Adjusted EBITDA 235 127 566 498 of which Metal price lag (1) 39 (5) 59 22 Third Quarter 2025 - Earnings Call - 19 (1) Excluded in Segment Adjusted EBITDA

Three months ended September 30, Nine months ended September 30, (in millions of U.S. dollars) 2025 2024 2025 2024 Net cash flows from operating activities 99 65 271 240 Purchases of property, plant and equipment net of property, plant and equipment inflows (69) (104) (203) (255) Free Cash Flow 30 (39) 68 (15) Collection of deferred purchase price receivables — 23 2 63 Year ended December 31, (in millions of U.S. dollars) 2024 2023 2022 Net cash flows from operating activities 301 432 365 Purchases of property, plant and equipment net of property, plant and equipment inflows (401) (365) (284) Free Cash Flow (100) 67 81 Collection of deferred purchase price receivables 85 97 90 Third Quarter 2025 - Earnings Call - 20 Free Cash Flow Reconciliation

Net Debt Reconciliation ≥130 (in millions of U.S. dollars) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Borrowings 2,012 2,026 1,943 1,918 1,914 Fair value of net debt derivatives, net of margin calls 1 2 1 (1) 1 Cash and cash equivalents (122) (133) (118) (141) (170) Net Debt 1,891 1,895 1,826 1,776 1,745 LTM Segment Adjusted EBITDA(1) 607 541 561 575 653 Leverage 3.1x 3.5x 3.2x 3.1x 2.7x (1) Segment Adjusted EBITDA excludes non-cash metal price lag Third Quarter 2025 - Earnings Call - 21

Reconciliation of LTM Segment Adjusted EBITDA to Net Income ≥130 Twelve months ended (in millions of U.S. dollars) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 P&ARP 273 263 255 242 271 A&T 313 276 287 292 317 AS&I 71 46 57 74 93 H&C (50) (43) (38) (33) (29) Segment Adjusted EBITDA 607 541 561 575 653 Metal price lag 85 41 108 48 9 Adjusted EBITDA 691 583 663 623 662 Depreciation and amortization (321) (313) (307) (304) (299) Impairment of assets (11) (16) (21) (24) (21) Share based compensation costs (26) (25) (24) (25) (25) Pension and other post-employment benefits - non service costs 11 11 11 11 13 Restructuring costs (7) (10) (12) (11) (7) Unrealized (losses) / gains on derivatives 13 19 (9) (1) 21 Unrealized exchange gains from the remeasurement of monetary assets and liabilities – net 1 (1) (2) 1 (1) Losses / (gains) on disposal (2) (1) (4) (4) (3) Expenses on factoring arrangements (21) (22) (22) (22) (23) Other 10 9 6 2 (10) Finance costs - net (112) (115) (112) (111) (109) Income before tax 226 119 168 135 200 Income tax expense (112) (85) (92) (76) (88) Net income 114 34 75 60 112 (1) Segment Adjusted EBITDA excludes non-cash metal price lag Third Quarter 2025 - Earnings Call - 22

Debt Table ≥130 Third Quarter 2025 - Earnings Call - 23 At September 30, At December 31, 2025 2024 (in millions of U.S. dollars) Nominal Value in Currency Nominal rate Effective rate Face Value Debt issuance costs Accrued interest Carrying value Carrying value Secured Pan-U.S. ABL (due 2029) $ 70 Floating 5.83 % 70 — 1 71 56 Senior Unsecured Notes Issued June 2020 and due 2028 $ 325 5.625 % 6.05 % 325 (3) 5 327 323 Issued February 2021 and due 2029 $ 500 3.750 % 4.05 % 500 (4) 9 505 500 Issued June 2021 and due 2029 € 300 3.125 % 3.41 % 353 (3) 2 352 313 Issued August 2024 and due 2032 $ 350 6.375 % 6.77 % 350 (6) 3 347 353 Issued August 2024 and due 2032 € 300 5.375 % 5.73 % 352 (5) 2 349 313 Finance lease liabilities 31 — — 31 30 Other loans 30 — — 30 30 Total debt 2,011 (21) 22 2,012 1,918 Of which non-current 1,974 1,879 Of which current 38 39