.2

Introduction In Q2, we made exciting progress on our long-term strategy to grow our community, enhance value for advertisers, and invest in the future of augmented reality. Enriching relationships between friends and family is central to our mission, and we continue to build products that bring people together and spark conversations among Snapchatters, from messaging and Maps to personalized content and AR experiences. Our team’s continuous innovation was evident as we reached 932 million monthly active users in Q2, an increase of 64 million or 7% year-over-year, moving us closer to our goal of serving 1 billion Snapchatters around the world. Our large and hard-to-reach audience, brand-safe environment, and performance advertising platform continues to make us a valuable partner for businesses looking to grow with Gen Z and Millennials. One of the many things that sets Snapchat apart is the unique space it provides Snapchatters to feel free to express their creativity and maintain close relationships without the pressures of public performance. This authentic communication and self-expression is a key differentiator in the crowded digital landscape because it empowers brands to build strong relationships with their audience. Revenue increased 9% year-over-year to reach $1.34 billion in Q2, driven primarily by the continued growth of our small and medium customers and delivery against lower funnel objectives. Snapchat+ approached 16 million subscribers in Q2 and was the primary driver of Other Revenue growing 64% year-over-year to reach an annualized run rate of nearly $700 million. To build on this momentum, we introduced Lens+, a new Snapchat+ subscription tier that offers access to exclusive new AI video Lenses, Bitmoji Game Lenses, as well as early access to new features. We continue to focus on aligning our investments with our core strategic priorities while improving financial performance. In Q2, we delivered $41 million of Adjusted EBITDA and generated $24 million of Free Cash Flow as we continue to make progress towards profitability while generating consistent and meaningful free cash flow. We ended the quarter with $2.9 billion in cash and marketable securities, providing financial flexibility to invest in our future. We have made a long term and consistent investment in augmented reality, committing more than $3 billion over the past 11 years to develop the world’s only full stack, vertically integrated augmented reality platform. With one of the world's largest AR developer communities, purpose-built developer tools, a proprietary rendering engine, our own highly optimized operating system, our own optical engine, as well as the design of the hardware itself, our tight control over each aspect of the hardware and software allow us to deliver a product experience that is unmatched. We're excited about our progress as we work to make Specs available to the public in 2026. While we are moving quickly to realize the full potential of our business, we believe there is an opportunity to better align Snap’s engineering and technology investments with our business priorities. We will be distributing our engineering teams to directly support our business functions, with our core applications team reporting to Bobby Murphy, Co-Founder and Chief Technology Officer, and our monetization engineering team reporting to Ajit Mohan, our Chief Business Officer. Our Chief Information Officer and Chief Information Security Officer will report to me and lead enterprise-wide foundational infrastructure and platform integrity. This new, distributed structure will empower our teams to take greater ownership and drive continued innovation for our community and advertising partners. We are grateful to Eric Young, SVP of Engineering, for his contributions and wish him all the best as he departs to pursue a new opportunity. SNAP INC. | Q2 2025 | INVESTOR LETTER 1

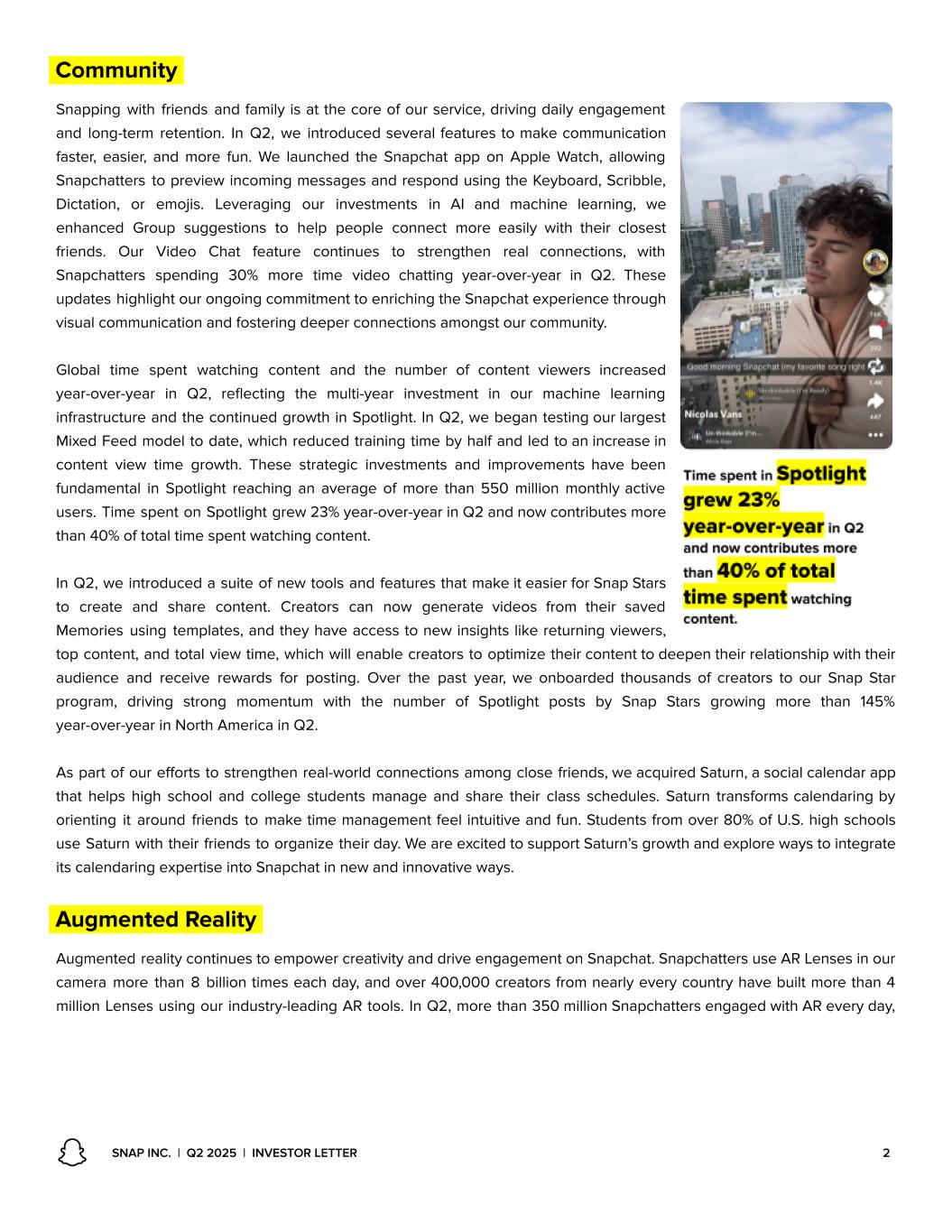

Community Snapping with friends and family is at the core of our service, driving daily engagement and long-term retention. In Q2, we introduced several features to make communication faster, easier, and more fun. We launched the Snapchat app on Apple Watch, allowing Snapchatters to preview incoming messages and respond using the Keyboard, Scribble, Dictation, or emojis. Leveraging our investments in AI and machine learning, we enhanced Group suggestions to help people connect more easily with their closest friends. Our Video Chat feature continues to strengthen real connections, with Snapchatters spending 30% more time video chatting year-over-year in Q2. These updates highlight our ongoing commitment to enriching the Snapchat experience through visual communication and fostering deeper connections amongst our community. Global time spent watching content and the number of content viewers increased year-over-year in Q2, reflecting the multi-year investment in our machine learning infrastructure and the continued growth in Spotlight. In Q2, we began testing our largest Mixed Feed model to date, which reduced training time by half and led to an increase in content view time growth. These strategic investments and improvements have been fundamental in Spotlight reaching an average of more than 550 million monthly active users. Time spent on Spotlight grew 23% year-over-year in Q2 and now contributes more than 40% of total time spent watching content. In Q2, we introduced a suite of new tools and features that make it easier for Snap Stars to create and share content. Creators can now generate videos from their saved Memories using templates, and they have access to new insights like returning viewers, top content, and total view time, which will enable creators to optimize their content to deepen their relationship with their audience and receive rewards for posting. Over the past year, we onboarded thousands of creators to our Snap Star program, driving strong momentum with the number of Spotlight posts by Snap Stars growing more than 145% year-over-year in North America in Q2. As part of our efforts to strengthen real-world connections among close friends, we acquired Saturn, a social calendar app that helps high school and college students manage and share their class schedules. Saturn transforms calendaring by orienting it around friends to make time management feel intuitive and fun. Students from over 80% of U.S. high schools use Saturn with their friends to organize their day. We are excited to support Saturn’s growth and explore ways to integrate its calendaring expertise into Snapchat in new and innovative ways. Augmented Reality Augmented reality continues to empower creativity and drive engagement on Snapchat. Snapchatters use AR Lenses in our camera more than 8 billion times each day, and over 400,000 creators from nearly every country have built more than 4 million Lenses using our industry-leading AR tools. In Q2, more than 350 million Snapchatters engaged with AR every day, SNAP INC. | Q2 2025 | INVESTOR LETTER 2

on average. Our 90’s School Photos AI Lens, Different Eras AI Lens, and Cartoon World AI Lens were collectively viewed over one billion times in Q2, highlighting strong engagement with our latest AR experiences powered by generative AI. Much of this momentum is driven by our growing AR creator and developer ecosystem. Lens Studio, our desktop authoring tool, has helped foster a global community of professional developers by giving them powerful tools to create innovative AR experiences. We have made AR creation increasingly more accessible with Easy Lens, an AI tool that empowers lens creators to build a Lens in just minutes by typing out a prompt for the Lens that they want to create. In Q2, we expanded access with the introduction of the Lens Studio iOS app and a new web-based Lens Studio creation tool at lensstudio.snapchat.com. While the desktop version of Lens Studio remains the primary tool for professional developers creating advanced and more sophisticated AR experiences across Snapchat, partner apps, and Spectacles, these new tools are designed to help more people at all skill levels get started with AR. To support creators building Lens Games, our latest Lens Studio update includes new features that simplify development. These include the new Bitmoji Suite for enhanced personalization and animation that makes it easier to bring 3D Bitmoji avatars to any game environment, along with new game assets, including leaderboards and multi-player features built specifically for Snapchat. As a result, Games engagement on Snapchat has continued to grow, now reaching more than 175 million monthly active users, up over 40% year-over-year. We believe games represent a compelling long term opportunity for driving engagement on Snapchat, and eventually new monetization opportunities for creators and our business. Specs In Q2 we announced plans to publicly launch our first fully standalone lightweight Specs AR glasses in 2026, marking an exciting milestone for our company and a critical step toward realizing our long-term vision for augmented reality. Snap is uniquely positioned as the only company in the world with a fully-integrated AR computing stack. Our upcoming Specs represent a leap forward in human-centered computing. They will be significantly smaller, lighter, and more capable than our 5th generation Spectacles released to developers in 2024. By combining advanced machine learning and AI with spatial intelligence, Specs will enable users to interact with computing in fundamentally new ways, delivering digital experiences embedded directly into the world around us. Our developer community continues to build new and compelling use cases and creative Lenses for Specs. Recently launched Lenses for Specs include, Gowaaa's "Super Travel" for real-time translation and currency conversion, Paradiddle's "Drum Kit" for interactive music learning overlaid on a physical drum set, and ANRK’s “Pool Assist” to help players make better shots while playing pool. These examples demonstrate how Specs seamlessly integrate computing experiences into three-dimensional space, enabling practical utilities, enriching educational experiences, and fostering imaginative new forms of entertainment. SNAP INC. | Q2 2025 | INVESTOR LETTER 3

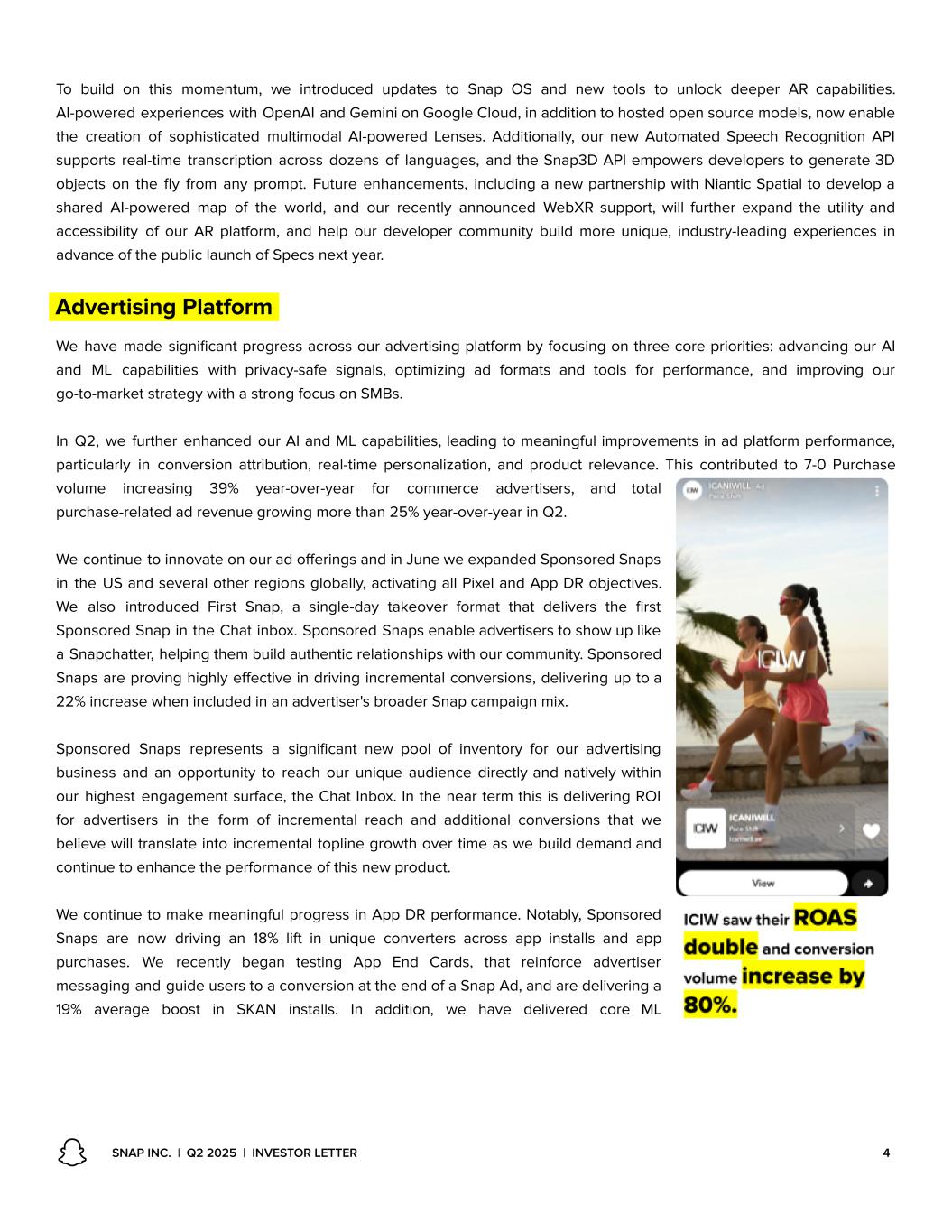

To build on this momentum, we introduced updates to Snap OS and new tools to unlock deeper AR capabilities. AI-powered experiences with OpenAI and Gemini on Google Cloud, in addition to hosted open source models, now enable the creation of sophisticated multimodal AI-powered Lenses. Additionally, our new Automated Speech Recognition API supports real-time transcription across dozens of languages, and the Snap3D API empowers developers to generate 3D objects on the fly from any prompt. Future enhancements, including a new partnership with Niantic Spatial to develop a shared AI-powered map of the world, and our recently announced WebXR support, will further expand the utility and accessibility of our AR platform, and help our developer community build more unique, industry-leading experiences in advance of the public launch of Specs next year. Advertising Platform We have made significant progress across our advertising platform by focusing on three core priorities: advancing our AI and ML capabilities with privacy-safe signals, optimizing ad formats and tools for performance, and improving our go-to-market strategy with a strong focus on SMBs. In Q2, we further enhanced our AI and ML capabilities, leading to meaningful improvements in ad platform performance, particularly in conversion attribution, real-time personalization, and product relevance. This contributed to 7-0 Purchase volume increasing 39% year-over-year for commerce advertisers, and total purchase-related ad revenue growing more than 25% year-over-year in Q2. We continue to innovate on our ad offerings and in June we expanded Sponsored Snaps in the US and several other regions globally, activating all Pixel and App DR objectives. We also introduced First Snap, a single-day takeover format that delivers the first Sponsored Snap in the Chat inbox. Sponsored Snaps enable advertisers to show up like a Snapchatter, helping them build authentic relationships with our community. Sponsored Snaps are proving highly effective in driving incremental conversions, delivering up to a 22% increase when included in an advertiser's broader Snap campaign mix. Sponsored Snaps represents a significant new pool of inventory for our advertising business and an opportunity to reach our unique audience directly and natively within our highest engagement surface, the Chat Inbox. In the near term this is delivering ROI for advertisers in the form of incremental reach and additional conversions that we believe will translate into incremental topline growth over time as we build demand and continue to enhance the performance of this new product. We continue to make meaningful progress in App DR performance. Notably, Sponsored Snaps are now driving an 18% lift in unique converters across app installs and app purchases. We recently began testing App End Cards, that reinforce advertiser messaging and guide users to a conversion at the end of a Snap Ad, and are delivering a 19% average boost in SKAN installs. In addition, we have delivered core ML SNAP INC. | Q2 2025 | INVESTOR LETTER 4

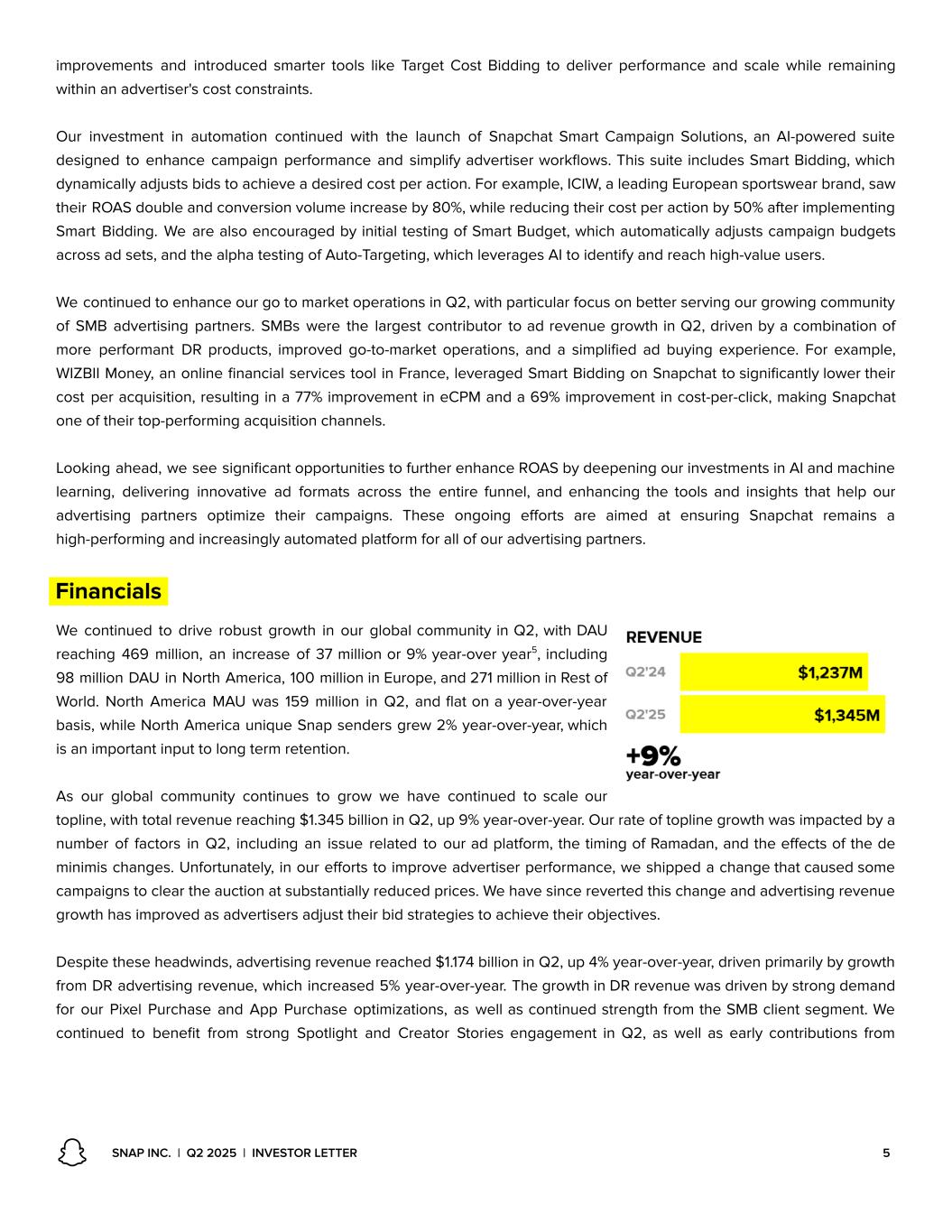

improvements and introduced smarter tools like Target Cost Bidding to deliver performance and scale while remaining within an advertiser's cost constraints. Our investment in automation continued with the launch of Snapchat Smart Campaign Solutions, an AI-powered suite designed to enhance campaign performance and simplify advertiser workflows. This suite includes Smart Bidding, which dynamically adjusts bids to achieve a desired cost per action. For example, ICIW, a leading European sportswear brand, saw their ROAS double and conversion volume increase by 80%, while reducing their cost per action by 50% after implementing Smart Bidding. We are also encouraged by initial testing of Smart Budget, which automatically adjusts campaign budgets across ad sets, and the alpha testing of Auto-Targeting, which leverages AI to identify and reach high-value users. We continued to enhance our go to market operations in Q2, with particular focus on better serving our growing community of SMB advertising partners. SMBs were the largest contributor to ad revenue growth in Q2, driven by a combination of more performant DR products, improved go-to-market operations, and a simplified ad buying experience. For example, WIZBII Money, an online financial services tool in France, leveraged Smart Bidding on Snapchat to significantly lower their cost per acquisition, resulting in a 77% improvement in eCPM and a 69% improvement in cost-per-click, making Snapchat one of their top-performing acquisition channels. Looking ahead, we see significant opportunities to further enhance ROAS by deepening our investments in AI and machine learning, delivering innovative ad formats across the entire funnel, and enhancing the tools and insights that help our advertising partners optimize their campaigns. These ongoing efforts are aimed at ensuring Snapchat remains a high-performing and increasingly automated platform for all of our advertising partners. Financials We continued to drive robust growth in our global community in Q2, with DAU reaching 469 million, an increase of 37 million or 9% year-over year5, including 98 million DAU in North America, 100 million in Europe, and 271 million in Rest of World. North America MAU was 159 million in Q2, and flat on a year-over-year basis, while North America unique Snap senders grew 2% year-over-year, which is an important input to long term retention. As our global community continues to grow we have continued to scale our topline, with total revenue reaching $1.345 billion in Q2, up 9% year-over-year. Our rate of topline growth was impacted by a number of factors in Q2, including an issue related to our ad platform, the timing of Ramadan, and the effects of the de minimis changes. Unfortunately, in our efforts to improve advertiser performance, we shipped a change that caused some campaigns to clear the auction at substantially reduced prices. We have since reverted this change and advertising revenue growth has improved as advertisers adjust their bid strategies to achieve their objectives. Despite these headwinds, advertising revenue reached $1.174 billion in Q2, up 4% year-over-year, driven primarily by growth from DR advertising revenue, which increased 5% year-over-year. The growth in DR revenue was driven by strong demand for our Pixel Purchase and App Purchase optimizations, as well as continued strength from the SMB client segment. We continued to benefit from strong Spotlight and Creator Stories engagement in Q2, as well as early contributions from SNAP INC. | Q2 2025 | INVESTOR LETTER 5

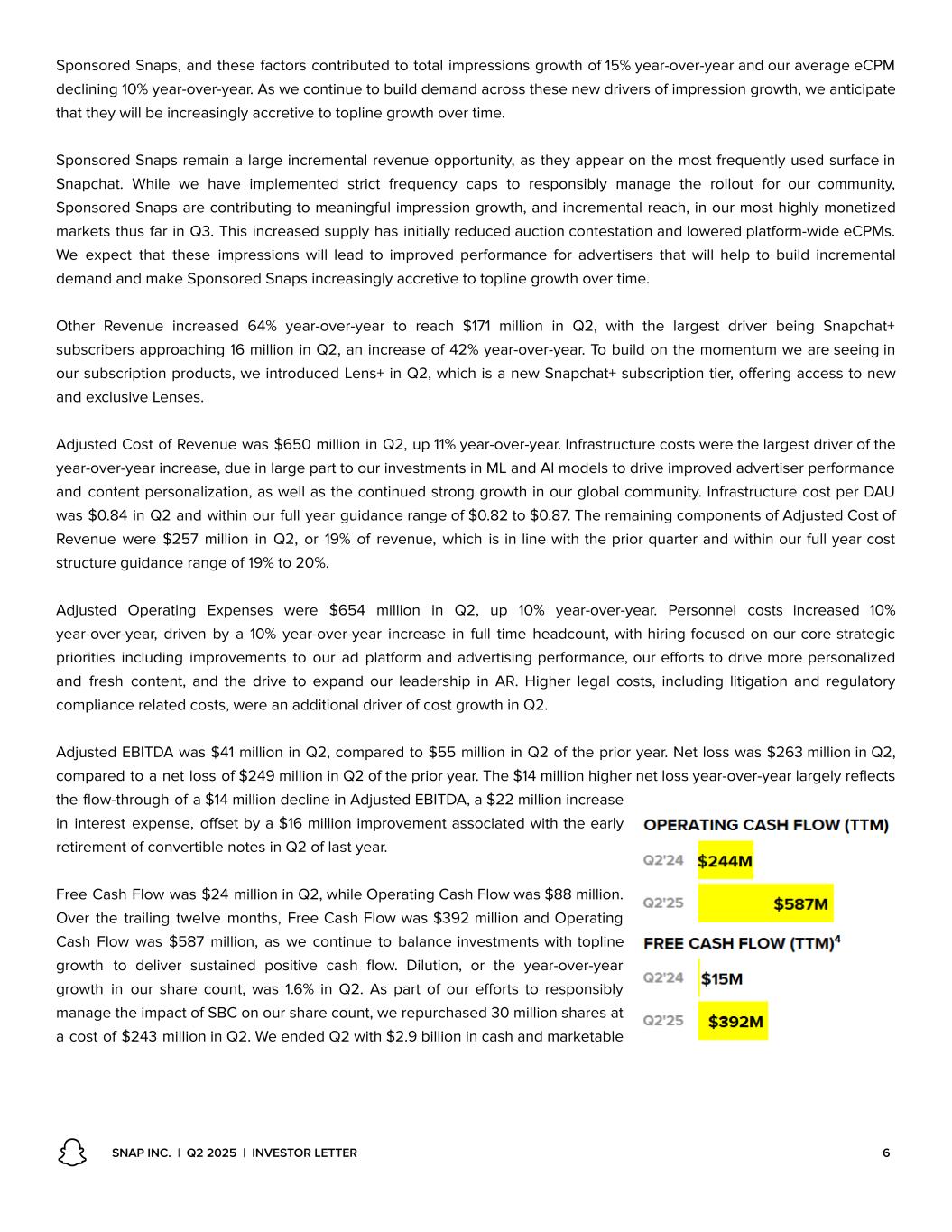

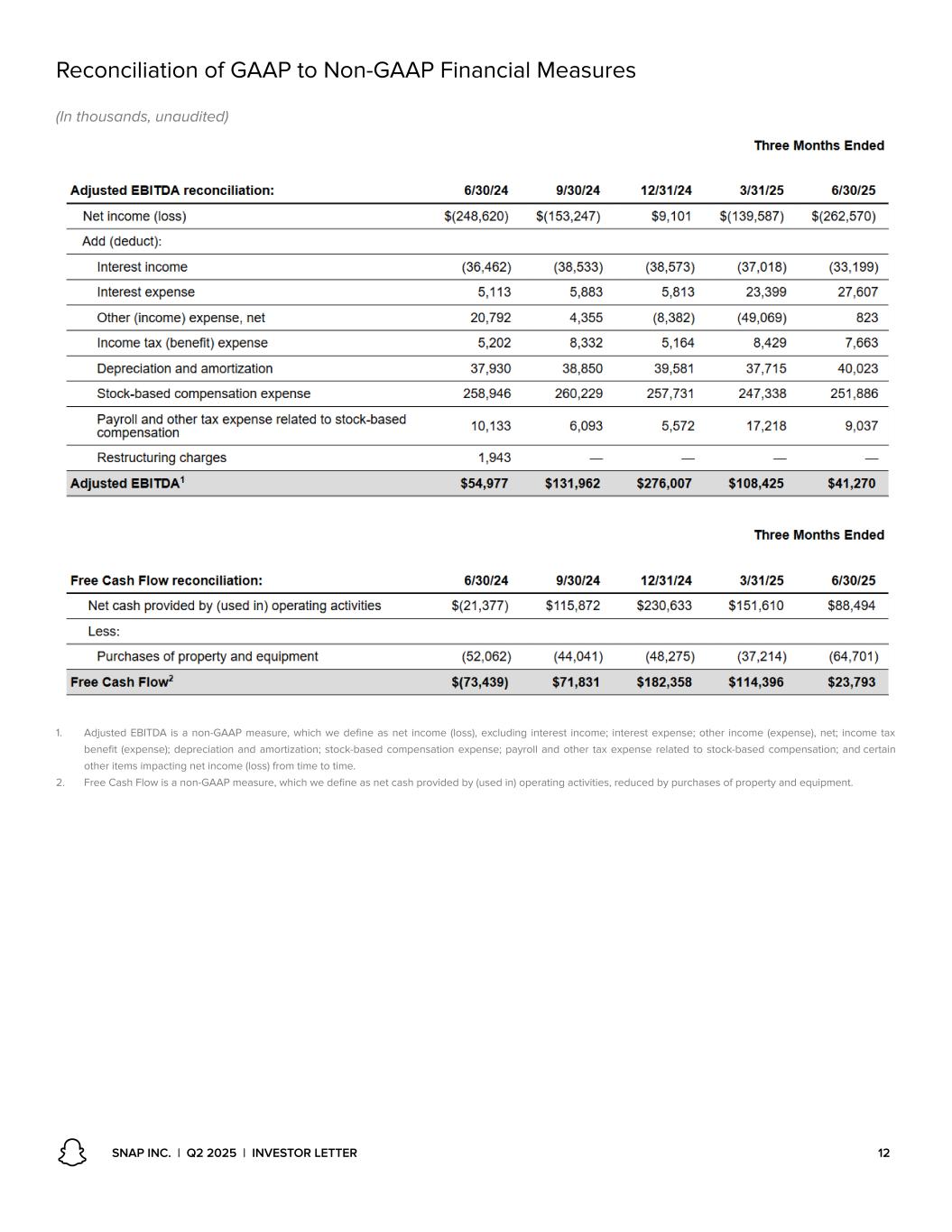

Sponsored Snaps, and these factors contributed to total impressions growth of 15% year-over-year and our average eCPM declining 10% year-over-year. As we continue to build demand across these new drivers of impression growth, we anticipate that they will be increasingly accretive to topline growth over time. Sponsored Snaps remain a large incremental revenue opportunity, as they appear on the most frequently used surface in Snapchat. While we have implemented strict frequency caps to responsibly manage the rollout for our community, Sponsored Snaps are contributing to meaningful impression growth, and incremental reach, in our most highly monetized markets thus far in Q3. This increased supply has initially reduced auction contestation and lowered platform-wide eCPMs. We expect that these impressions will lead to improved performance for advertisers that will help to build incremental demand and make Sponsored Snaps increasingly accretive to topline growth over time. Other Revenue increased 64% year-over-year to reach $171 million in Q2, with the largest driver being Snapchat+ subscribers approaching 16 million in Q2, an increase of 42% year-over-year. To build on the momentum we are seeing in our subscription products, we introduced Lens+ in Q2, which is a new Snapchat+ subscription tier, offering access to new and exclusive Lenses. Adjusted Cost of Revenue was $650 million in Q2, up 11% year-over-year. Infrastructure costs were the largest driver of the year-over-year increase, due in large part to our investments in ML and AI models to drive improved advertiser performance and content personalization, as well as the continued strong growth in our global community. Infrastructure cost per DAU was $0.84 in Q2 and within our full year guidance range of $0.82 to $0.87. The remaining components of Adjusted Cost of Revenue were $257 million in Q2, or 19% of revenue, which is in line with the prior quarter and within our full year cost structure guidance range of 19% to 20%. Adjusted Operating Expenses were $654 million in Q2, up 10% year-over-year. Personnel costs increased 10% year-over-year, driven by a 10% year-over-year increase in full time headcount, with hiring focused on our core strategic priorities including improvements to our ad platform and advertising performance, our efforts to drive more personalized and fresh content, and the drive to expand our leadership in AR. Higher legal costs, including litigation and regulatory compliance related costs, were an additional driver of cost growth in Q2. Adjusted EBITDA was $41 million in Q2, compared to $55 million in Q2 of the prior year. Net loss was $263 million in Q2, compared to a net loss of $249 million in Q2 of the prior year. The $14 million higher net loss year-over-year largely reflects the flow-through of a $14 million decline in Adjusted EBITDA, a $22 million increase in interest expense, offset by a $16 million improvement associated with the early retirement of convertible notes in Q2 of last year. Free Cash Flow was $24 million in Q2, while Operating Cash Flow was $88 million. Over the trailing twelve months, Free Cash Flow was $392 million and Operating Cash Flow was $587 million, as we continue to balance investments with topline growth to deliver sustained positive cash flow. Dilution, or the year-over-year growth in our share count, was 1.6% in Q2. As part of our efforts to responsibly manage the impact of SBC on our share count, we repurchased 30 million shares at a cost of $243 million in Q2. We ended Q2 with $2.9 billion in cash and marketable SNAP INC. | Q2 2025 | INVESTOR LETTER 6

securities on hand. We believe that our robust Free Cash Flow generation, and the strength of our balance sheet, ensure that our business has the capital and financial flexibility to invest in our core strategic priorities to drive long term growth. Financial Outlook As we enter Q3, we anticipate continued growth of our global community, and as a result, our Q3 guidance is built on the assumption that DAU will be approximately 476 million in Q3. Our Q3 guidance range for revenue is $1.475 billion to $1.505 billion. We believe it is prudent to continue to balance our level of investment with realized revenue growth, and are updating our full year cost structure guidance to reflect our current investment plans. For Infrastructure costs per DAU, we maintain our full year guidance range of $0.82 to $0.87 per quarter, and anticipate we will be in the top half of this range in Q3 as we continue to prioritize investments in ML and AI infrastructure to drive improvements in our ad platform and depth of content engagement. For all other cost of revenue we maintain our full year cost guidance at 19% to 20% of revenue, and anticipate we will be within this range in Q3. For Adjusted Operating Expenses, we are maintaining our range of $2.650 to $2.700 billion. For stock based compensation we are lowering our full year cost guidance from the prior range of $1.130 billion to $1.160 billion, to a new range of $1.10 billion to $1.13 billion, which implies a $30 million reduction at the midpoint. Given our updated full year cost guidance, and our investment plans for Q3, we estimate that Adjusted EBITDA will be between $110 million and $135 million in Q3. Moving forward, we will remain focused on executing against our strategic priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, and building towards our long term vision for augmented reality. SNAP INC. | Q2 2025 | INVESTOR LETTER 7 2025 Outlook Infrastructure Cost per DAU per Quarter $0.82 to $0.87 cents Content and Developer Partner Costs and Advertising Partner and Other Costs 19% to 20% of revenue Adjusted Operating Expenses $2.650 to $2.700 billion Stock-Based Compensation and Related Charges $1.10 to $1.13 billion

1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of GAAP Cost of Revenue to Adjusted Cost of Revenue. 2. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of GAAP Operating Expenses to Adjusted Operating Expenses. 3. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of net income (loss) to Adjusted EBITDA. 4. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. 5. In the first quarter of 2025, we refined our processes and controls to allow us to more accurately record user activity that would not otherwise be recorded during such period due to delays in receiving user metric information resulting from carrier or other user connectivity issues during the measurement period. For additional information concerning these refinements, see the “Note Regarding User Metrics and Other Data” in our Quarterly Report filed on Form 10-Q for the first quarter of 2025. As a result of such refinements, our DAUs may not be directly comparable to those in prior periods, as they reflect a comparison to previously reported numbers. SNAP INC. | Q2 2025 | INVESTOR LETTER 8

SNAP INC. | Q2 2025 | INVESTOR LETTER 9

Forward Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this letter, including statements regarding guidance, our future results of operations or financial condition, future stock repurchase programs or stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for future operations, and advertiser and partner offerings, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this letter. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this letter primarily on our current expectations and projections about future events and trends, including our financial outlook, macroeconomic uncertainty, and geo-political events and conflicts, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks and uncertainties related to: our financial performance; our ability to attain and sustain profitability; our ability to generate and sustain positive cash flow; our ability to attract and retain users, partners, and advertisers; competition and new market entrants; managing our growth and future expenses; compliance with new laws, regulations, and executive actions; our ability to maintain, protect, and enhance our intellectual property; our ability to succeed in existing and new market segments; our ability to attract and retain qualified team members and key personnel; our ability to repay or refinance outstanding debt, or to access additional financing; future acquisitions, divestitures, or investments; and the potential adverse impact of climate change, natural disasters, health epidemics, macroeconomic conditions, and war or other armed conflict, as well as risks, uncertainties, and other factors described in “Risk Factors” and elsewhere in our most recent periodic report filed with the U.S. Securities and Exchange Commission, or SEC, which is available on the SEC’s website at www.sec.gov. Additional information will be made available in Snap Inc.’s periodic report that will be filed with the SEC for the period covered by this letter and other filings that we make from time to time with the SEC. In addition, any forward-looking statements contained in this letter are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political events and conflicts and macroeconomic conditions, except as required by law. Non-GAAP Financial Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAP financial measure of Free Cash Flow, which is defined as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. We believe Free Cash Flow is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business and is a key financial indicator used by management. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. We use the non-GAAP financial measure of Adjusted EBITDA, which is defined as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in Adjusted EBITDA. We use other non-GAAP financial measures such as Adjusted Cost of Revenue and Adjusted Operating Expenses. These measures are defined as their respective GAAP expense line items, excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We use the non-GAAP financial measure of Adjusted Gross Profit, which we define as GAAP revenue less Adjusted Cost of Revenue. We use the non-GAAP financial measure of Adjusted Gross Margin, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses we exclude in the measure. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management for financial and operational decision-making. We are presenting these non-GAAP measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” included as an Appendix to this letter. Snap Inc., “Snapchat,” and our other registered and common law trade names, trademarks, and service marks are the property of Snap Inc. or our subsidiaries. SNAP INC. | Q2 2025 | INVESTOR LETTER 10

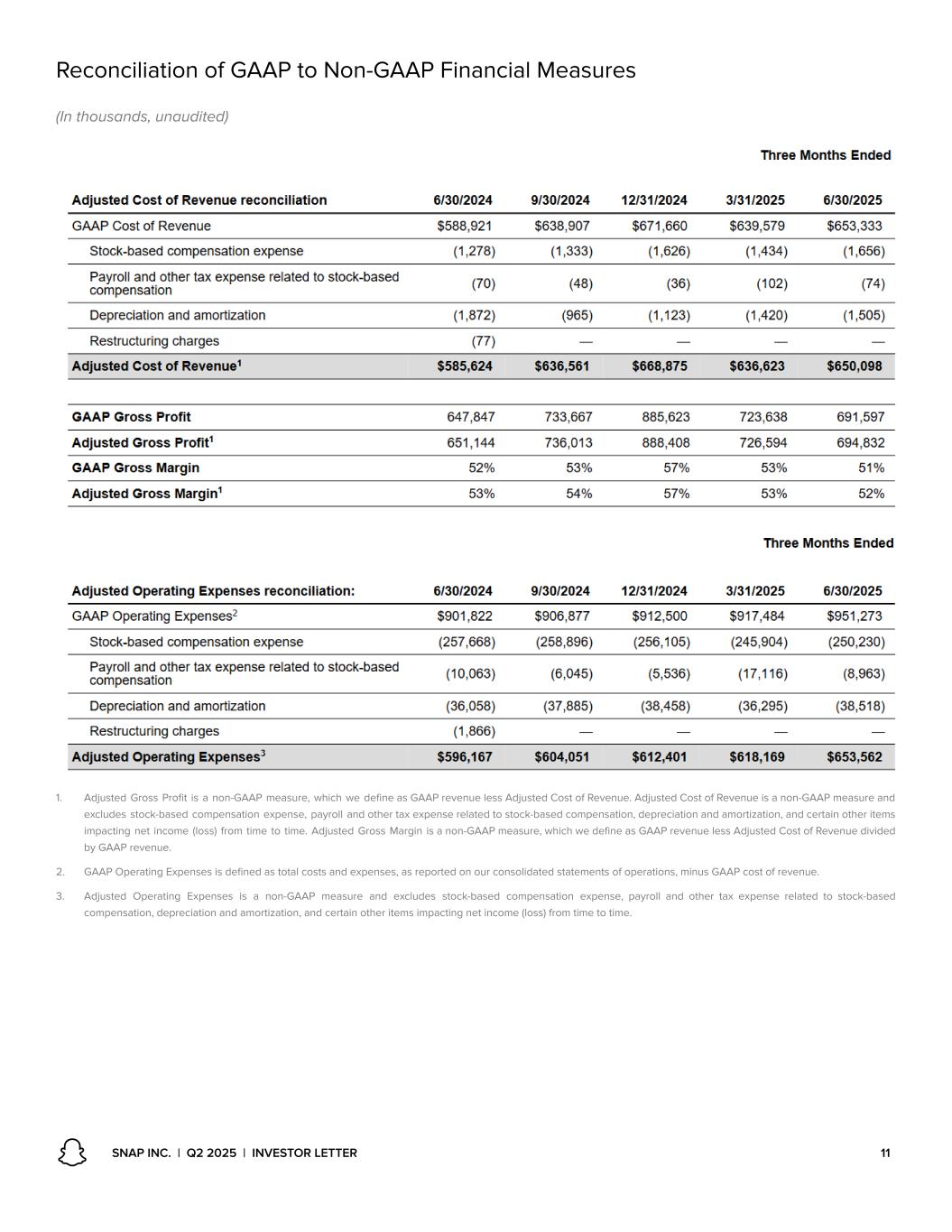

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. 2. GAAP Operating Expenses is defined as total costs and expenses, as reported on our consolidated statements of operations, minus GAAP cost of revenue. 3. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. SNAP INC. | Q2 2025 | INVESTOR LETTER 11

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. 2. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q2 2025 | INVESTOR LETTER 12