.2

Introduction In Q3, we made meaningful progress on our long-term strategy to grow our global community, deliver stronger performance for advertisers, and invest in the future of augmented reality. At the core of Snapchat is a mission that has endured since our founding: to reinvent the camera to strengthen human connection. Snapchat is built around real communication, helping people share moments and build closer relationships every day. This clarity of purpose continues to drive durable growth. Our community reached 477 million daily active users (DAU), an increase of 34 million or 8% year-over-year, and 943 million monthly active users (MAU), an increase of 60 million or 7% year-over-year. With this momentum we have made further progress toward our goal of reaching one billion MAU around the world. Revenue increased 10% year-over-year to $1.51 billion, driven by improved advertising demand and the rapid expansion of our direct revenue streams. On the advertising front, continued growth in our small- and medium-sized business (SMBs) customers, and improvements in direct response advertising performance, drove an acceleration in direct response advertising revenue, which increased 8% year-over-year and 13% quarter-over-quarter. Other Revenue, which includes Snapchat+ subscription revenue, increased 54% year-over-year to $190 million in Q3, reaching an annualized run rate of more than $750 million. To build on this momentum, we expanded our premium offerings, introduced new storage plans for Memories, and launched AI-powered experiences in Lens+ and Platinum bundles that we believe will deliver incremental value to our most engaged community members. We remain disciplined in aligning our investments with our core strategic priorities while driving operating leverage over time. In Q3, we delivered $182 million of Adjusted EBITDA and generated $93 million of Free Cash Flow, while reducing our Net Loss by more than 30% year-over-year to $104 million, underscoring our progress toward sustained profitability. With approximately $3 billion in cash and marketable securities on hand, we are well-positioned to continue investing confidently in innovation and long-term growth. We also continue to scale differentiated ad formats and offerings such as Sponsored Snaps, Promoted Places, and the App Power Pack, supported by advances in AI for ranking, creative generation, and personalization. These investments are expected to compound performance over time, unlocking greater advertiser ROI and long-term revenue growth. At the same time, we are improving key components of our service to make Snapchat more reliable and as fast to launch as the native camera, an essential part of ensuring our service remains simple, accessible, and enduring. Community Snapping between friends and family remains the foundation of Snapchat, driving both daily engagement and long-term retention. In Q3, we shared that Snapchatters created over one trillion selfie Snaps in 2024, demonstrating how deeply our community uses our camera to communicate and feel closer together. Over the next year, we are prioritizing sharing and conversations through new conversation starters such as Status Updates, Flashbacks, and Topics, building new ways to play games with friends, and making it effortless to share Spotlight videos through Stories and Chat. Our goal is to spark conversations, strengthen friendships, and inspire creativity. SNAP INC. | Q3 2025 | INVESTOR LETTER 1

This quarter, we rolled out several new features that make communication faster, easier, and more expressive. Infinite Retention allows users to save chats indefinitely, while Home Safe gives friends peace of mind with an automatic check-in after returning home. We also launched the Snapchat Keyboard, extending our sticker library to other apps, and introduced Customoji, enabling users to generate personalized Bitmoji stickers from text prompts. These updates underscore our commitment to enhancing the Snapchat experience through richer visual communication while fostering deeper community connections. Global time spent watching content and the number of content viewers increased year-over-year in Q3, reflecting our multi-year investment in machine learning and the continued strength of Spotlight. Building on this momentum, we launched our largest content recommendation model to date, improving freshness and relevance across the platform. We also upgraded our infrastructure to get a step closer to delivering content in near real-time, reducing latency and cutting model training cycles from days to just two hours. As a result, the share of total Spotlight views from content posted in the last 24 hours increased more than 300% year-over-year in the US, as our models now surface more topical and original content. In addition, we launched our first unified user model that combines signals from Spotlight, Discover, and the camera, while advancing work on a trend-detection model that identifies emerging creative trends and amplifies their reach. Snapchat is a platform where any creator can express themselves authentically, grow an audience, and build a business. Over the past year, we onboarded thousands of Snap Stars, reaching a record level of active creators. We’re also seeing established creators and homegrown talent thrive, such as Kaylee Rosie, a nursing student and plant enthusiast, who has increased her followers by more than 50x in the last six months by posting Stories and Spotlight content nearly every day. To help creators succeed, we expanded monetization tools and new collaboration formats with brands, such as Sponsored First Snaps. This growing ecosystem has made Snapchat more resilient and diverse, driving a nearly 180% year-over-year increase in Snap Star Spotlight posts in North America. More creator activity enhances the relevance and quality of our content inventory, strengthening the overall engagement flywheel for both users and advertisers. While we continue to innovate on our core product experience for our community, including efforts to address ongoing engagement headwinds, we are also navigating a number of evolving factors that we expect will influence community growth and engagement in the near term. A key focus of our current strategy is improving average revenue per user (ARPU) by more directly monetizing our core product. This includes the continued growth of Snapchat+, the introduction of Sponsored Snaps and Promoted Places, the launch of Lens+, and the testing of Memories Storage Plans. These initiatives are designed to strengthen our topline performance, but they do involve tradeoffs with engagement, so we expect some adverse impact on engagement metrics as these experiences are rolled out globally. SNAP INC. | Q3 2025 | INVESTOR LETTER 2

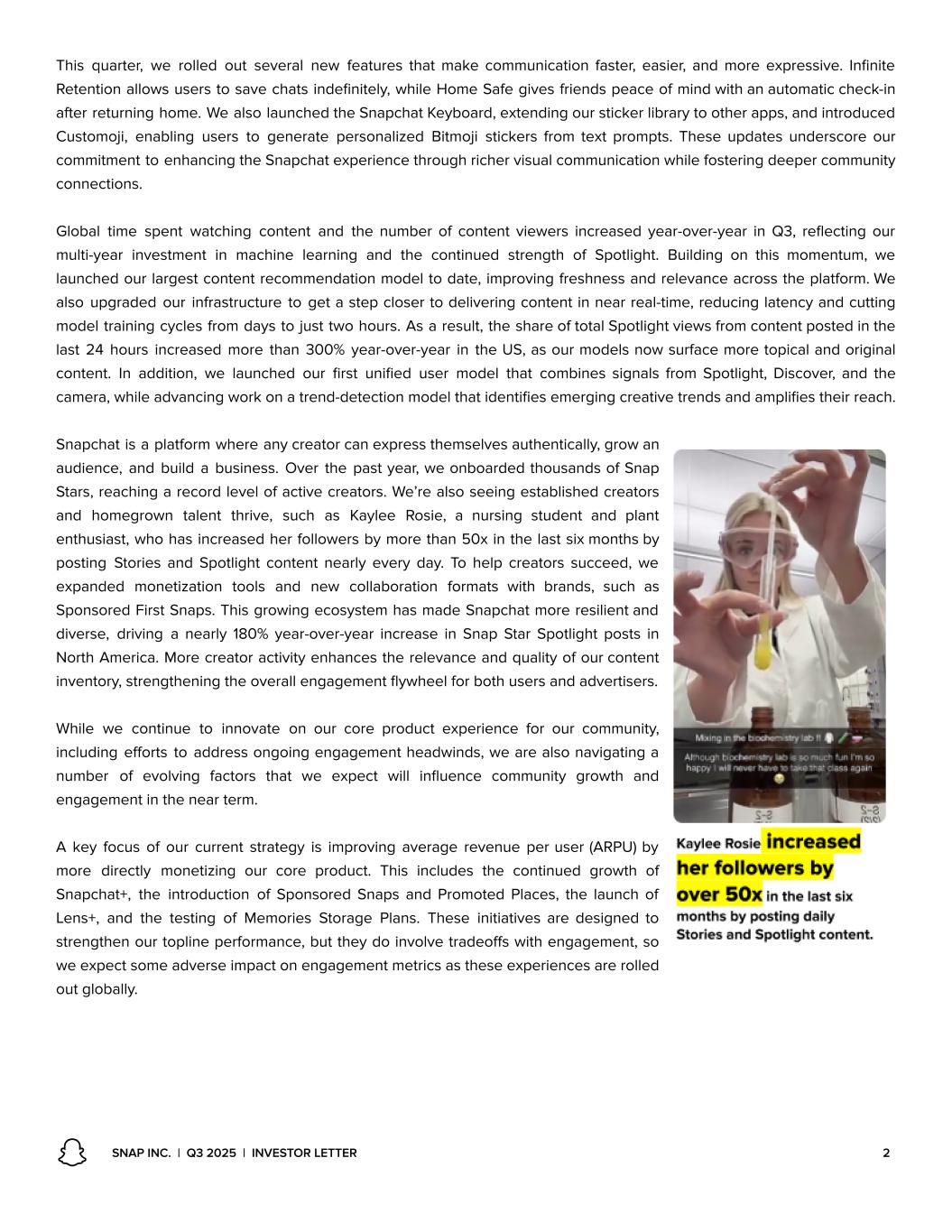

At the same time, we are recalibrating our investments in community growth and the cost to serve our community in order to improve financial efficiency. This includes testing changes to our infrastructure that will lower costs in regions with less long-term monetization potential, allowing us to better align our resources with the financial opportunity of each geography, but potentially coming at the cost of adverse tradeoffs with engagement in these countries. We are also preparing for the upcoming rollout of platform-level age verification, which will use new signals provided by Apple — and soon Google — to help us better determine the age of our users and remove those we learn are under 13, or under 16 in certain geographies such as Australia. These actions are an important step in maintaining a safe and compliant platform, though we expect they will also adversely affect engagement metrics as implementation progresses. In addition to these internal initiatives, we continue to experience the effects of regulation and government policy actions. Recent examples include Australia’s Social Media Minimum Age bill, which takes effect in December, and government restrictions on access to internet services in certain countries. We anticipate that similar regulations in other jurisdictions may take effect or be passed in the near future. These policy developments, combined with potential platform-level age verification, are likely to have negative impacts on user engagement metrics that we cannot currently predict. While we remain committed to our goal of serving 1 billion global monthly active users, we expect overall DAU may decline in Q4 given these internal and external factors, and as noted above we expect particularly negative impacts in certain jurisdictions. We believe these are the right actions to strengthen our business for the long term by improving monetization efficiency, ensuring compliance with evolving regulations, and positioning Snap for sustainable growth. Augmented Reality Snap continues to be a global leader in augmented reality engagement and innovation. Every day, Snapchatters use AR Lenses more than 8 billion times, and more than 350 million Snapchatters engage with AR experiences daily. Over 400,000 creators from nearly every country have built more than 4 million Lenses using our AR tools, making Snapchat one of the most scaled AR platforms globally. In Q3, we introduced the Imagine Lens, our first open-prompt image generation Lens, allowing Snapchatters to create or reimagine Snaps by simply typing a prompt. More than 500 million Snapchatters have engaged with Gen AI-powered Lenses over 6 billion times, reflecting the growing appeal of AI-driven creativity on our platform. Snapchatters engaged with our AI Face Swap Lens over one billion times in Q3, illustrating how generative AI can turn self-expression into shared moments and open up new ways to spark conversations and connections. Our investment in generative AI is designed to make communication more expressive, personal, and human. Realistic StyleGen delivers lifelike fit, texture, lighting, and perspective, unlocking cinematic-quality transformations and generating nearly 100 million Lens views in Q3. Enhanced FaceGen enables higher-fidelity face effects, generating over 700 million Lens views, while Selfie Attachments use 3D asset SNAP INC. | Q3 2025 | INVESTOR LETTER 3

generation to add realistic, context-aware elements like hats and hairstyles, generating over 145 million Lens views. Coming soon, AI Clips will allow creators to generate short, shareable videos from simple prompts, turning AI video creation into a social and collaborative experience. Together, these innovations demonstrate why our leadership in generative AI matters. They transform how people express themselves, create content, and share moments that strengthen their connections on Snapchat every day. We continue to see strong momentum with Games. Over 180 million people now play Games on Snapchat every month, with sharing up more than 100% year-over-year. To make these experiences more social, we introduced the Games Chat Drawer, bringing games directly into Chat so friends can play together seamlessly. Developers are using new tools in Lens Studio like the Character Controller, Camera Controller, Input System, and Bitmoji Suite, which make it easier than ever to build personalized, interactive experiences. New features like Turn-Based Gameplay and enhanced Leaderboards are driving innovation across popular titles such as 2P Mini Golf, and Bitmoji Tower Defense. To support creator monetization, we expanded the Lens Creator Rewards program with Lens+ Payouts, enabling developers to earn based on engagement from Lens+ and Snapchat Platinum subscribers. Outside of Snapchat, Camera Kit reached over 68 million monthly active users by the end of Q3 and no longer requires mandatory Snapchat branding, making it a flexible, free SDK for brands and developers to deliver immersive AR experiences across apps, the web, and AR mirrors. Together, these updates reinforce our commitment to building the most expressive, scalable, and monetizable AR ecosystem in the world. Specs Our long-term vision for AR extends far beyond the smartphone. For over a decade, we have been building toward a future where computing feels more natural, contextual, and integrated seamlessly into the world around us. After five generations of product development, Specs will launch publicly next year, representing a major leap forward in human centered computing. In Q3, we introduced Snap OS 2.0, our largest system update yet. It delivers faster performance and a redesigned browser optimized for streaming and productivity, adds full WebXR support, and includes a new UI Kit and Mobile Kit to simplify interface and cross-device development. We also added features like Travel Mode, which keeps AR content stable while in transit, and EyeConnect, which enables SNAP INC. | Q3 2025 | INVESTOR LETTER 4

instant shared experiences simply by looking at another person to co-locate content. Developers and brands are already building with Spectacles, including Enklu and Artglass, who are redefining live events with location-based Lenses. These projects highlight the vast potential for creativity and commerce on Specs. To help developers monetize these experiences, we introduced Commerce Kit, enabling developers to accept payments directly within Lenses, unlocking digital goods and premium features in real time. Specs are purpose-built for the age of AR and AI, designed to make computing more personal, intuitive, and contextually aware. Unlike traditional devices centered around apps and files, Specs understand the environment and adapt to user patterns over time. To support this next generation of computing, we introduced Snap Cloud, powered by Supabase, a scalable backend platform that enables richer and more dynamic AR and AI experiences on Snap OS. Snap Cloud is a key step in building the infrastructure that allows developers to create immersive, real-time applications and reflects our long-term commitment to advancing the AR ecosystem through Specs. We believe Snap is uniquely positioned to win the next wave of AR computing. With Snap OS 2.0, Lens Studio, Snap Cloud, and our global developer ecosystem, we are at the forefront with an end-to-end AR stack, spanning software, developer tools, and hardware. Together, these investments bring us closer to delivering the world’s first fully standalone, human-centered AR glasses. Advertising Platform We made significant progress across our advertising platform by focusing on three priorities: advancing our AI-driven ad performance, optimizing high-impact ad formats, and strengthening our go-to-market execution across SMBs and mid-market customers. Our investments in AI and machine learning are delivering measurable gains for advertisers. We advanced Dynamic Product Ads with large language models that better understand products, driving over 4x higher conversion rates compared to baseline for certain campaigns. As a result of these and other improvements, purchase-related ad revenue grew over 30% year-over-year, reflecting higher attribution accuracy and better campaign performance. For example, Comfrt, a lifestyle and apparel eCommerce brand, leveraged Target Cost and Max Bid in their Snap campaign to scale faster and reach an incremental audience that delivered an 85% lift in site visits, a 79% increase in new customers, and a more than 3x ROAS improvement as measured by WorkMagic since the start of their 2025 campaign. Sponsored Snaps allow brands to join real-time conversations on Snapchat in a way that feels authentic and relevant to users. Early results show strong performance with up to 22 percent higher conversions and up to 19 percent lower cost per action when including Sponsored Snaps in advertiser campaigns. Advertisers across industries are using Sponsored Snaps to reach audiences where they are most active and engaged. For example, to strengthen share of voice and drive user preference, ASICS partnered with SNAP INC. | Q3 2025 | INVESTOR LETTER 5

Zeno Group to promote its latest running shoe collection through Sponsored Snaps, reaching 2 million unique Snapchatters in the Chat Inbox and driving a 4 point lift in overall brand awareness and a 16 point lift among Snapchatters aged 35 and older, along with stronger return on ad spend compared to existing media. In addition, eBay’s Sponsored Snaps campaign to drive brand awareness was highly effective, achieving nearly 2x incremental unique reach and positive lifts in Ad Awareness and Brand Association. Sponsored Snaps are also becoming increasingly direct response focused, delivering more personalized and contextually relevant experiences. According to a Kantar study, approximately 85 percent of US Snapchatters say Sponsored Snaps feel relevant and fit naturally within their habits on the platform. Promoted Places complements this offering by bridging digital engagement with real-world action. The format allows advertisers to highlight nearby store locations directly within the Snapchat Map, unlocking new opportunities for performance-driven local marketing. Early testing shows double-digit lifts in visitation, demonstrating its ability to influence real-world outcomes. For example, the fast-casual chain Panda Express ran a Promoted Places campaign that resulted in a 15% incremental lift in visits as measured by our 3P measurement partner, InMarket. In addition, they saw a 10-point increase in brand favorability and a 6-point increase in action as measured by a brand lift study. Together, Sponsored Snaps and Promoted Places demonstrate how Snap’s ad platform can influence the full marketing funnel from discovery and engagement to measurable, real-world results, while creating new opportunities for revenue growth across our global advertiser base. For app-based advertisers, we introduced the App Power Pack, a unified suite designed to improve performance across both SKAN and non-SKAN campaigns. Key features include Target Cost Bidding, new App End Cards that automatically incorporate app store images, and Playables for interactive game previews. Early results show that the App Power Pack is driving over 25% lift in iOS App Installs. Early adopters are seeing strong returns, reinforcing Snapchat’s role as a scalable performance channel for mobile marketers. For example, mobile gaming app Yotta chose Snapchat to reach Gen Z through culturally relevant, fast-turnaround ads leveraging Target Cost bidding, delivering 35x more iOS installs at 84% lower CPI, 60x more purchases at 90% lower CPP, and 6x more first time purchases at 13% lower cost per add to cart since implementing this new strategy. We continued to advance our automation capabilities through the Snap Smart Campaign Solutions suite. Smart Targeting, which treats targeting inputs as suggestions and uses machine learning to identify incremental, high-performing audiences, has launched, delivering an average 8.8% increase in conversions for adopted ad sets. Smart Budget, our automated budgeting solution that optimizes overall campaign performance, has also rolled out across select advertiser objectives and bid strategies. Early results are encouraging, with a 5% improvement in median CPA and a 17% increase in median spend and we plan to broaden availability early next year. In addition, we have begun testing Smart Ad, which enables advertisers to upload raw creative assets and leverage Snap’s ML systems to automatically drive performance. SNAP INC. | Q3 2025 | INVESTOR LETTER 6

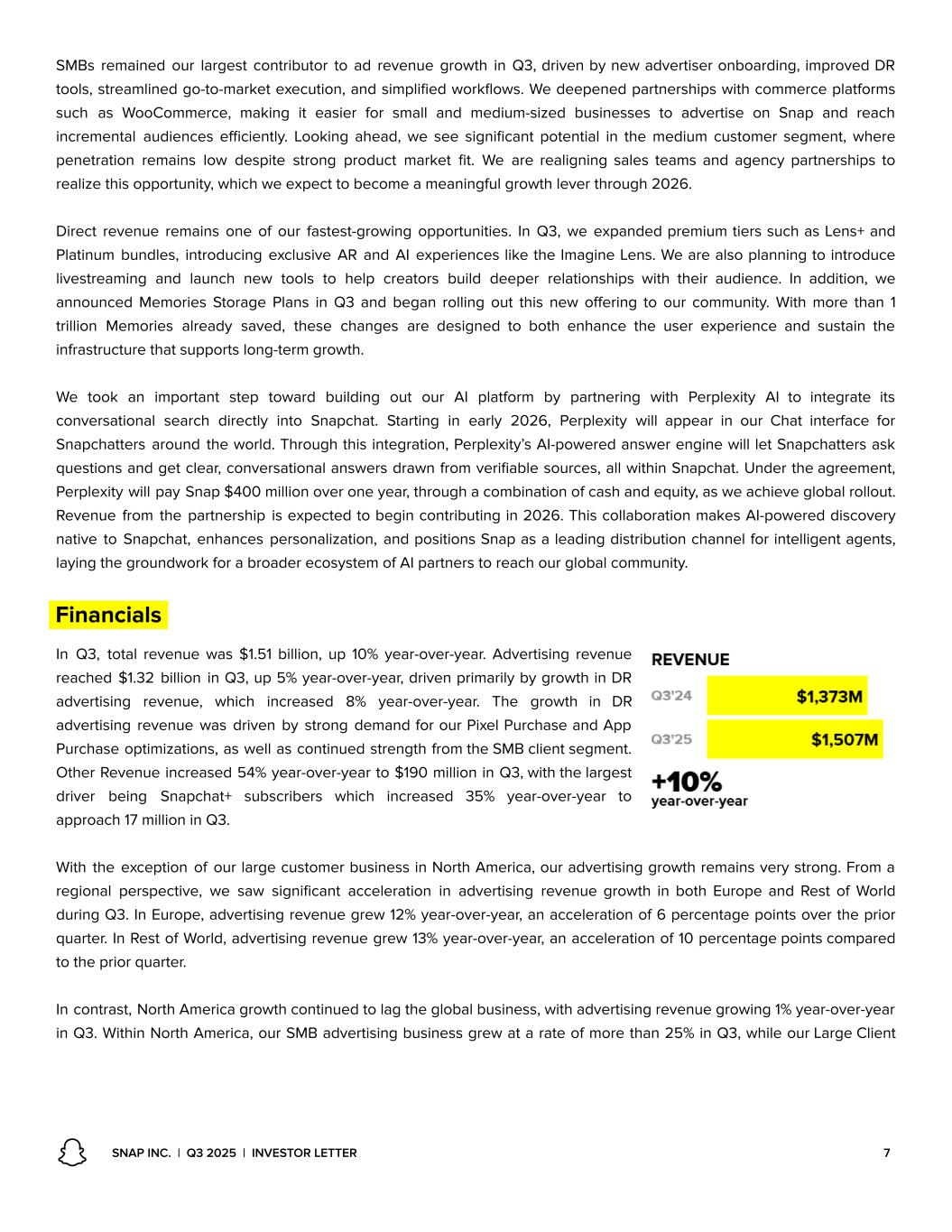

SMBs remained our largest contributor to ad revenue growth in Q3, driven by new advertiser onboarding, improved DR tools, streamlined go-to-market execution, and simplified workflows. We deepened partnerships with commerce platforms such as WooCommerce, making it easier for small and medium-sized businesses to advertise on Snap and reach incremental audiences efficiently. Looking ahead, we see significant potential in the medium customer segment, where penetration remains low despite strong product market fit. We are realigning sales teams and agency partnerships to realize this opportunity, which we expect to become a meaningful growth lever through 2026. Direct revenue remains one of our fastest-growing opportunities. In Q3, we expanded premium tiers such as Lens+ and Platinum bundles, introducing exclusive AR and AI experiences like the Imagine Lens. We are also planning to introduce livestreaming and launch new tools to help creators build deeper relationships with their audience. In addition, we announced Memories Storage Plans in Q3 and began rolling out this new offering to our community. With more than 1 trillion Memories already saved, these changes are designed to both enhance the user experience and sustain the infrastructure that supports long-term growth. We took an important step toward building out our AI platform by partnering with Perplexity AI to integrate its conversational search directly into Snapchat. Starting in early 2026, Perplexity will appear in our Chat interface for Snapchatters around the world. Through this integration, Perplexity’s AI-powered answer engine will let Snapchatters ask questions and get clear, conversational answers drawn from verifiable sources, all within Snapchat. Under the agreement, Perplexity will pay Snap $400 million over one year, through a combination of cash and equity, as we achieve global rollout. Revenue from the partnership is expected to begin contributing in 2026. This collaboration makes AI-powered discovery native to Snapchat, enhances personalization, and positions Snap as a leading distribution channel for intelligent agents, laying the groundwork for a broader ecosystem of AI partners to reach our global community. Financials In Q3, total revenue was $1.51 billion, up 10% year-over-year. Advertising revenue reached $1.32 billion in Q3, up 5% year-over-year, driven primarily by growth in DR advertising revenue, which increased 8% year-over-year. The growth in DR advertising revenue was driven by strong demand for our Pixel Purchase and App Purchase optimizations, as well as continued strength from the SMB client segment. Other Revenue increased 54% year-over-year to $190 million in Q3, with the largest driver being Snapchat+ subscribers which increased 35% year-over-year to approach 17 million in Q3. With the exception of our large customer business in North America, our advertising growth remains very strong. From a regional perspective, we saw significant acceleration in advertising revenue growth in both Europe and Rest of World during Q3. In Europe, advertising revenue grew 12% year-over-year, an acceleration of 6 percentage points over the prior quarter. In Rest of World, advertising revenue grew 13% year-over-year, an acceleration of 10 percentage points compared to the prior quarter. In contrast, North America growth continued to lag the global business, with advertising revenue growing 1% year-over-year in Q3. Within North America, our SMB advertising business grew at a rate of more than 25% in Q3, while our Large Client SNAP INC. | Q3 2025 | INVESTOR LETTER 7

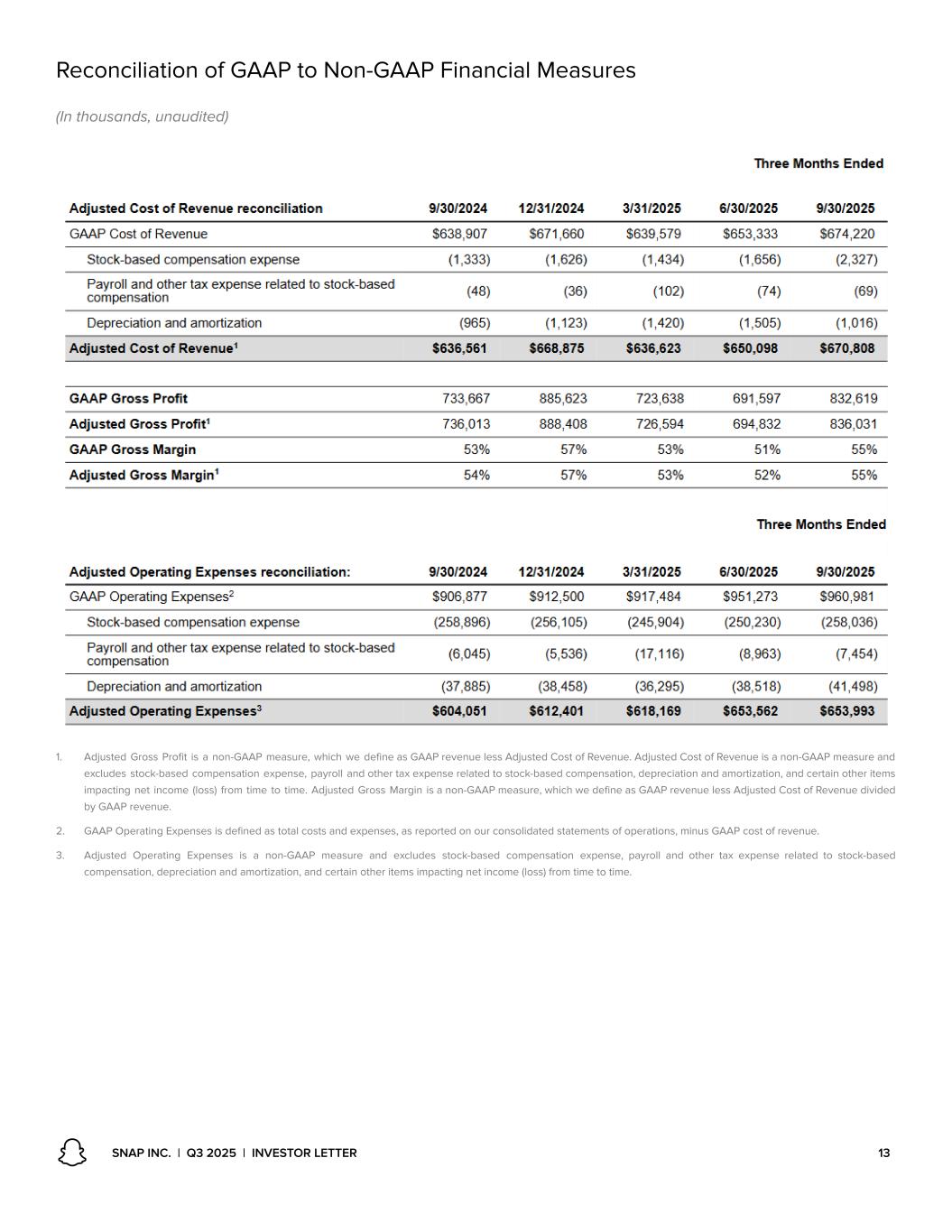

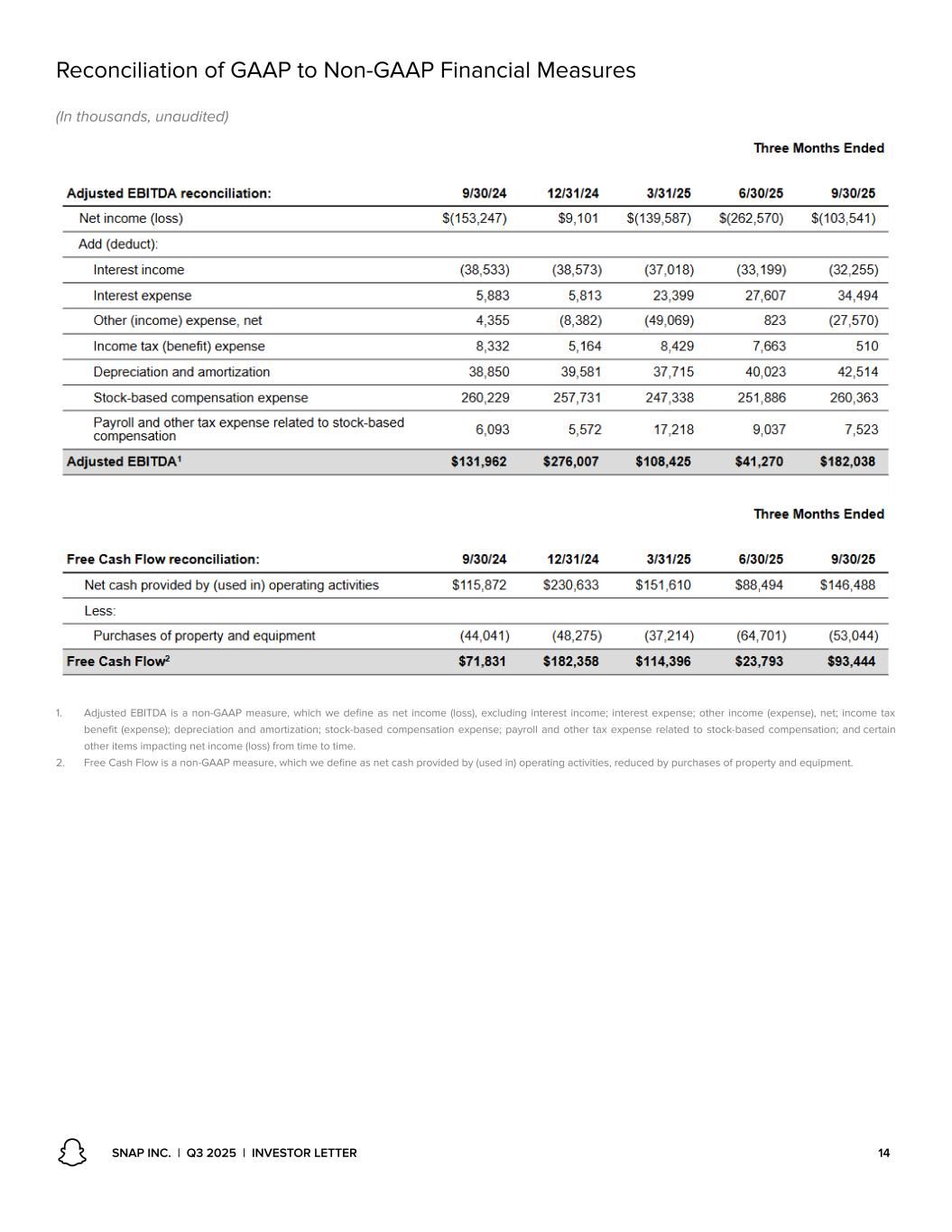

Solutions (LCS) business posted a modest decline in the quarter. The North America LCS business accounted for approximately 43% of total global revenue in Q3, decreasing as a share of total revenue by roughly 10 percentage points over the past two years, reflecting meaningful diversification of our revenue base as growth accelerates across other regions and customer segments. While this mix shift demonstrates healthy progress toward a more balanced business, the North America LCS segment remains the primary headwind to our overall revenue growth. Given the strong momentum we are seeing with our ad products and platform, and the rapid growth in demand from SMB clients globally, we are redoubling our focus on what we believe is working. At the same time, we are making targeted adjustments to our go-to-market operations in North America to improve performance and reignite growth in our LCS business in this region. Global impression volume grew approximately 22% year-over-year, driven in large part by expanded advertising delivery within Sponsored Snaps and Spotlight. Total eCPMs were down approximately 13% year-over-year due to the strong growth in impression delivery. While the increased inventory from Sponsored Snaps has initially put downward pressure on platform-wide eCPMs, we are encouraged to see our advertising partners experience strong advertising performance, which is bringing increased demand to the platform. This improved performance has contributed in part to a 3 percentage point acceleration in the rate of year-over-year growth in DR advertising revenue in Q3. Adjusted Cost of Revenue was $671 million in Q3, up 5% year-over-year. Infrastructure costs are the largest component of Adjusted Cost of Revenue, and increased 8% year-over-year in Q3, driven by investments in ML and AI compute as well as an 8% year-over-year increase in Global DAU to reach 477 million in Q3. Infrastructure cost per DAU was $0.85 in Q3, up from $0.84 in both the prior quarter and prior year. The remaining components of Adjusted Cost of Revenue were $266 million in Q3, or 18% of revenue, which is below the prior quarter and our full year cost structure guidance range of 19% to 20%, due in part to the benefit of a shift in impression mix toward Sponsored Snaps and Spotlight. With the combination of accelerating topline growth, and more efficient scaling of Adjusted Cost of Revenue, Adjusted Gross Margin reached 55% in Q3, up from 52% in Q2 and 54% in Q3 of the prior year. Adjusted Operating Expenses were $654 million in Q3, up 8% year-over-year. Personnel costs increased 12% year-over-year, driven by an 8% increase in headcount. Our hiring in Q3 was tightly focused on our core strategic priorities of improving advertising performance, enhancing our SMB-go-to market efforts, driving more personalized and fresh content, as well as expanding our leadership in AR. Higher legal costs, including litigation and regulatory compliance related costs, were an additional driver of operating expense growth in Q3. The increases in personnel and legal costs were partially offset by lower marketing expenses compared to the prior year due to a combination of cost efficiency initiatives and timing factors on marketing expenses in Q3. Adjusted EBITDA was $182 million in Q3, an improvement of $50 million compared to the prior year. Adjusted EBITDA flow through, or the percentage of year-over-year revenue growth that flowed through to Adjusted EBITDA, was 37% in Q3 and contributed to Adjusted EBITDA margins expanding 2 percentage points to reach 12% in Q3. Net loss was $104 million in Q3, compared to a net loss of $153 million in Q3 of the prior year. The $50 million year-over-year improvement largely reflects the flow-through of a $50 million increase in Adjusted EBITDA, a $32 million increase in Other Income due primarily to repurchasing convertible notes at below par prices, offset by a $29 million increase in interest expense reflecting high yield notes issued earlier this year. Stock based compensation and related payroll expenses (SBC) were $268 million in Q3, SNAP INC. | Q3 2025 | INVESTOR LETTER 8

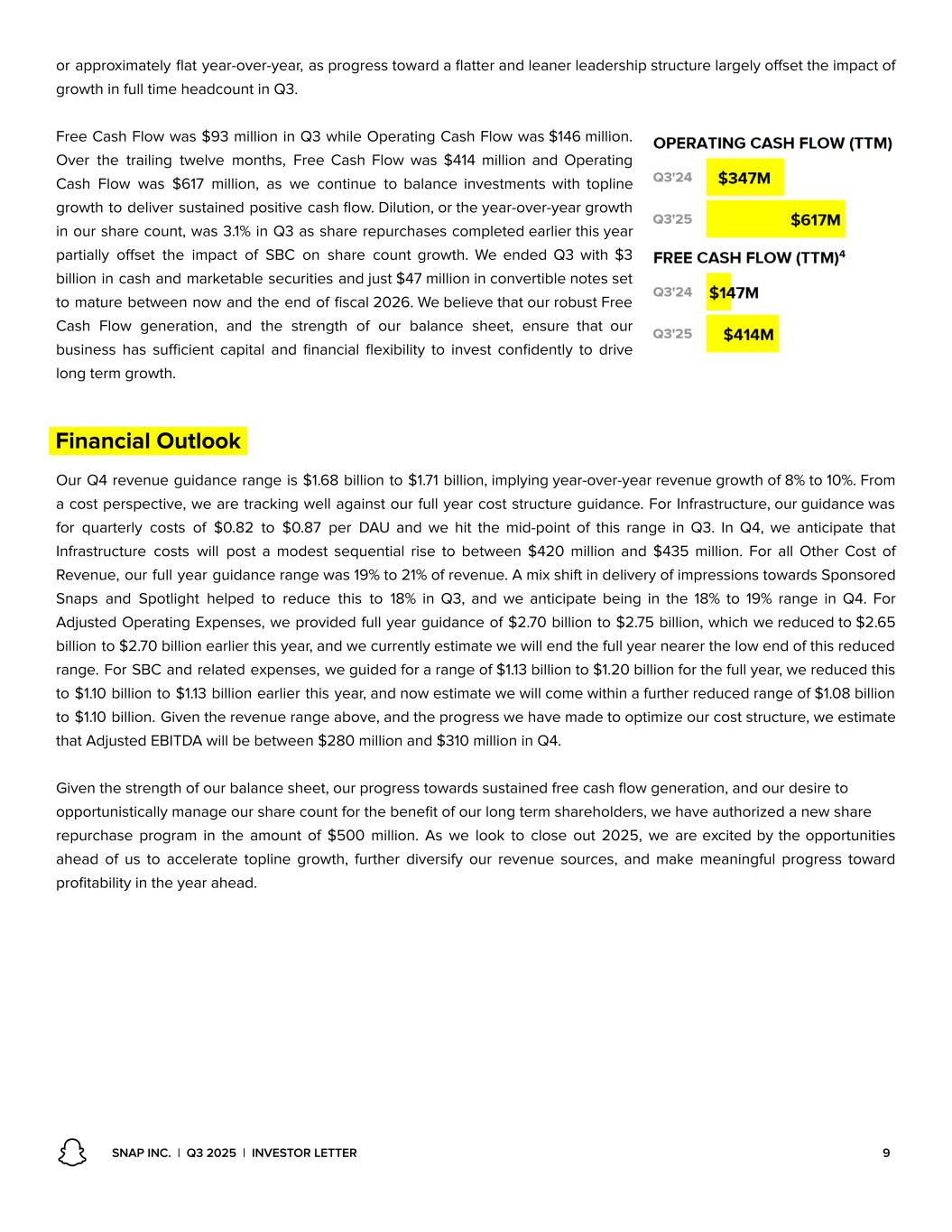

or approximately flat year-over-year, as progress toward a flatter and leaner leadership structure largely offset the impact of growth in full time headcount in Q3. Free Cash Flow was $93 million in Q3 while Operating Cash Flow was $146 million. Over the trailing twelve months, Free Cash Flow was $414 million and Operating Cash Flow was $617 million, as we continue to balance investments with topline growth to deliver sustained positive cash flow. Dilution, or the year-over-year growth in our share count, was 3.1% in Q3 as share repurchases completed earlier this year partially offset the impact of SBC on share count growth. We ended Q3 with $3 billion in cash and marketable securities and just $47 million in convertible notes set to mature between now and the end of fiscal 2026. We believe that our robust Free Cash Flow generation, and the strength of our balance sheet, ensure that our business has sufficient capital and financial flexibility to invest confidently to drive long term growth. Financial Outlook Our Q4 revenue guidance range is $1.68 billion to $1.71 billion, implying year-over-year revenue growth of 8% to 10%. From a cost perspective, we are tracking well against our full year cost structure guidance. For Infrastructure, our guidance was for quarterly costs of $0.82 to $0.87 per DAU and we hit the mid-point of this range in Q3. In Q4, we anticipate that Infrastructure costs will post a modest sequential rise to between $420 million and $435 million. For all Other Cost of Revenue, our full year guidance range was 19% to 21% of revenue. A mix shift in delivery of impressions towards Sponsored Snaps and Spotlight helped to reduce this to 18% in Q3, and we anticipate being in the 18% to 19% range in Q4. For Adjusted Operating Expenses, we provided full year guidance of $2.70 billion to $2.75 billion, which we reduced to $2.65 billion to $2.70 billion earlier this year, and we currently estimate we will end the full year nearer the low end of this reduced range. For SBC and related expenses, we guided for a range of $1.13 billion to $1.20 billion for the full year, we reduced this to $1.10 billion to $1.13 billion earlier this year, and now estimate we will come within a further reduced range of $1.08 billion to $1.10 billion. Given the revenue range above, and the progress we have made to optimize our cost structure, we estimate that Adjusted EBITDA will be between $280 million and $310 million in Q4. Given the strength of our balance sheet, our progress towards sustained free cash flow generation, and our desire to opportunistically manage our share count for the benefit of our long term shareholders, we have authorized a new share repurchase program in the amount of $500 million. As we look to close out 2025, we are excited by the opportunities ahead of us to accelerate topline growth, further diversify our revenue sources, and make meaningful progress toward profitability in the year ahead. SNAP INC. | Q3 2025 | INVESTOR LETTER 9

1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of GAAP Cost of Revenue to Adjusted Cost of Revenue. 2. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of GAAP Operating Expenses to Adjusted Operating Expenses. 3. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of net income (loss) to Adjusted EBITDA. 4. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. 5. In the first quarter of 2025, we refined our processes and controls to allow us to more accurately record user activity that would not otherwise be recorded during such period due to delays in receiving user metric information resulting from carrier or other user connectivity issues during the measurement period. For additional information concerning these refinements, see the “Note Regarding User Metrics and Other Data” in our Quarterly Report filed on Form 10-Q for the first quarter of 2025. As a result of such refinements, our DAUs may not be directly comparable to those in prior periods, as they reflect a comparison to previously reported numbers. SNAP INC. | Q3 2025 | INVESTOR LETTER 10

SNAP INC. | Q3 2025 | INVESTOR LETTER 11

Forward Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this letter, including statements regarding guidance, our future results of operations or financial condition, future stock repurchase programs or stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for future operations, and advertiser and partner offerings, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this letter. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this letter primarily on our current expectations and projections about future events and trends, including our financial outlook, macroeconomic uncertainty, and geo-political events and conflicts, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks and uncertainties related to: our financial performance; our ability to attain and sustain profitability; our ability to generate and sustain positive cash flow; our ability to attract and retain users, partners, and advertisers; competition and new market entrants; managing our growth and future expenses; compliance with new laws, regulations, and executive actions; our ability to maintain, protect, and enhance our intellectual property; our ability to succeed in existing and new market segments; our ability to attract and retain qualified team members and key personnel; our ability to repay or refinance outstanding debt, or to access additional financing; future acquisitions, divestitures, or investments; and the potential adverse impact of climate change, natural disasters, health epidemics, macroeconomic conditions, and war or other armed conflict, as well as risks, uncertainties, and other factors described in “Risk Factors” and elsewhere in our most recent periodic report filed with the U.S. Securities and Exchange Commission, or SEC, which is available on the SEC’s website at www.sec.gov. Additional information will be made available in Snap Inc.’s periodic report that will be filed with the SEC for the period covered by this letter and other filings that we make from time to time with the SEC. In addition, any forward-looking statements contained in this letter are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political events and conflicts and macroeconomic conditions, except as required by law. Non-GAAP Financial Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAP financial measure of Free Cash Flow, which is defined as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. We believe Free Cash Flow is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business and is a key financial indicator used by management. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. We use the non-GAAP financial measure of Adjusted EBITDA, which is defined as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in Adjusted EBITDA. We use other non-GAAP financial measures such as Adjusted Cost of Revenue and Adjusted Operating Expenses. These measures are defined as their respective GAAP expense line items, excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We use the non-GAAP financial measure of Adjusted Gross Profit, which we define as GAAP revenue less Adjusted Cost of Revenue. We use the non-GAAP financial measure of Adjusted Gross Margin, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses we exclude in the measure. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management for financial and operational decision-making. We are presenting these non-GAAP measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” included as an Appendix to this letter. Snap Inc., “Snapchat,” and our other registered and common law trade names, trademarks, and service marks are the property of Snap Inc. or our subsidiaries. SNAP INC. | Q3 2025 | INVESTOR LETTER 12

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. 2. GAAP Operating Expenses is defined as total costs and expenses, as reported on our consolidated statements of operations, minus GAAP cost of revenue. 3. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. SNAP INC. | Q3 2025 | INVESTOR LETTER 13

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. 2. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q3 2025 | INVESTOR LETTER 14