.2

Introduction Last fall, we embarked on a new chapter for our company with the articulation of the Crucible Moment faced by our business.Atthattime,welaidoutourplanstoaccelerateanddiversifyourrevenuegrowth,pivotourbusinesstowardmore profitablegrowth,anddeliveronthecommerciallaunchofSpecsin2026.Theimpactsofthisstrategicdirectionbeganto manifest in the operating results of our business in Q4, and we are excited to build on this momentum in the year ahead. Over the last 3 years, we have grown Monthly Active Users(MAU)bymorethan150million,reaching946millioninthe most recent quarter, and bringing us within striking distance of our goal to reach 1billionglobalMAU.Wehavealready achievedimmensereachanddepthofengagementinmanyoftheworld’smostattractiveadvertisinggeographies,andwe believethisaffordsusasignificantopportunitytogrowourtoplineandexpandaveragerevenueperuser(ARPU)overtime. Growing our community in these prosperous geographies remains apriority,andweremaincommittedtoourlongterm goal of reaching1billionMAU,butgoingforwardwewillseektostrikeabetterbalancebetweenthepaceofcommunity growth and rate of topline growth in order to pivot our business to more profitable growth. For the advertising business, our focus will be on threecoreinitiatives.Thefirstisfosteringdirectconnectionsbetween BrandsandSnapchattersbyleveragingourcoreproductcapabilitiesacrossSnapchat.Thesecondwillbemakingiteasier and more performant for advertisers to connect with Snapchatters by leveraging AI tooling and capabilities end-to-end throughouradplatformincludingcreativedevelopment,campaignsetup,andperformanceoptimization.Finally,weplanto grow our advertiser base by scaling and optimizing our go-to-market operations that support the success of small and mediumsizedbusinesses(SMBs).Ultimately,wewillgradetheperformanceofouradvertisingbusinessbasedontherate of growth in advertising revenue, with a focus on gaining share over time. The Other Revenue portion of our business has become an outsized source of growth, and is playing a critical role in diversifying our topline.Intheyearahead,wewillfocusongrowingexistingsubscriptionoffers,includingSnapchat+and Memories Storage Plans, while innovating to bring compelling new offers to our platform. This momentum is already materializing, with subscribers growing 71% year-over-year to reach 24 million in Q4. In the year ahead, growth in subscribers will be a critical input metric to track our progress, and we will ultimately grade ourperformancebasedon growth of the annualized run rate for Other Revenue. Wearefocusingonthreesignificantcatalystsforgrossmarginexpansiontodriveprofitablegrowth.First,withcommunity growthfocusedonmonetizablemarkets,andwithourcosttoserveincreasinglycalibratedtothemonetizationpotentialof eachmarket,weexpectthatourinfrastructurecostswillpivotfrombeingasourceofgrossmarginpressuretobecomea margin accretive investment. Second, as more of our ad revenue is derived from higher margin placements such as SponsoredSnapsandPromotedPlaces,weexpectadvertisingmarginstoimprove.Third,weexpectthatthegrowingscale of our subscription business, which is built on a foundation of existing engagement and infrastructure investment, will become increasingly accretivetooverallgrossmargins.IntheCrucibleMomentlettersharedlastfall,wesetanearterm goaltoachieve60%grossmargins.Wehavealreadymademeaningfulprogresstowardthatgoalbyachievinga59%gross margin in Q4, and we believe there is a clear path to exceed this goal in 2026. We are excited about our plans to accelerate toplinegrowth,diversifyourrevenuestreams,andbuildamorefinancially efficient business in the year ahead. Ultimately, we will grade our performance on our progress toward achieving SNAP INC. | Q4 2025 | INVESTOR LETTER 1

meaningfulNetIncomeprofitabilityoverthemediumterm.Importantly,webelievewecandeliveronthisprofitablegrowth path as we continue to invest in the future of augmented reality and support the consumer launch of Specs later this year. Community For our community, we are focused on strengthening engagement in the world’s most developed advertising geographies,bybuildingexperiencesacrossSnapchatthatspark conversations and deepen relationships between Snapchatters. The connections betweenfriendsandfamilyarewhatunifyourcamera,messaging,SnapMap,andcontent experiencesandenableourplatformtoenrichthelivesofSnapchattersaroundtheworld. By prioritizing features that encourage creativity,discovery,andinteractionacrossthese surfaces, we aim to increase the relevance and durability of engagement in ways that support long-term community growth and monetization. Our cameraremainscentraltohowSnapchatterscommunicateandexpressthemselves, and it is often the starting point for conversations on Snapchat. We are enhancing our camera with AI-powered capabilities that make creation more intuitive, dynamic, and social. Recent breakthroughs in our proprietary models allow us to deliver high-quality generative AI camera experiences efficiently at scale by running ourmodelson-device. AI-driven Lenses represent a meaningful evolution from traditional Lenses, shifting the experience from applying a fixed set of visual overlays to creating images and scenes dynamicallythroughgenerativeAI.Snapchatterscannowprompt,explore,andco-create personalizedcontentinrealtime,andthisshiftisalreadyresonatingwithourcommunity. More than 700millionSnapchattershaveengagedwithgenerativeAILensesmorethan 17 billion times, often discovering and sharing these Lenses throughconversationswith friendsandfamily.OurImagineLens,launchedinSeptember,hasalreadybeenengaged with nearly two billion times, highlighting strong early traction and repeat usage. This momentum is supported by a global creator and developer ecosystem that is unmatched in scale. More than 450,000 creators from nearly every country have built over 5 million Lenses using our industry-leading AR and AI tools,helping ensure that camera experiences remain fresh, relevant, and closely aligned with how our community builds relationships. SharingSnapswithfriendsandfamilyremainsthefoundationofSnapchatandacoredriverofengagement,retention,and long-term value creation. Our platform is designed around visual communication that enables frequent interactions and helpsourcommunitymaintaincloserelationshipsovertime.Wecontinuetoseestrongmomentumindirectcommunication between friends and family, with messaging behaviors reflecting the durability of Snapchat’scorevalueproposition.For example, average daily messages sent increased 5% year-over-year, and the number of bidirectional communicators increased 5% year-over-year in Q4. We are investing in product experiences that make it easier to start conversations, sustain them over time, and introduce new waysforfriendsandfamilytointeract.Forexample,inQ4,webegantesting Topic Chats, a new feature that allows Snapchatters to participate in public conversations around trending topics and events,discoversharedinterests,andexplorewhat’shappeningvisuallyacrossourcommunity.Wealsobeganrollingout newtwoplayerturn-basedgamesdesignedtocreateplayful,low-frictionwaysforfriendsandfamilytoconnect,suchas2 SNAP INC. | Q4 2025 | INVESTOR LETTER 2

PlayerMiniGolfandMagicJump.InQ4,theseexperiencescontributedtomorethan200 millionSnapchattersplayingGameseverymonthonaverage,representinganincreaseof 90% year-over-year. The Snap Map has become an increasingly important driver of engagementbyhelping Snapchatters stay connected to friends,localcommunities,andplacesintherealworld. SnapchattersusetheSnapMaptoseewherefriendsarespendingtime,discoverwhatis happening nearby, and engage with local businesses and events. Monthly active Snap Mapusersreached435millioninQ4,up6%year-over-year,creatingnaturalopportunities forbothorganicengagementandmonetizationthroughadplacementssuchasPromoted Places. Wehavebuiltadifferentiatedcontentplatformpoweredbyauthenticcontentthatisnative to Snapchat and that reinforces human connection through content sharing as a conversation starter. Our systems increasingly surface timely, relevant content by identifying emerging trends and original formats across Spotlight and Stories and matching them to the right audiences. In Q4, enhancements to our ranking and trend-detectionmodelscontributedtoimprovedcontentfreshnessandengagement.For example,thenumberofSpotlightrepostsandsharesincreased69%year-over-yearinthe US,reflectingourabilitytosurfacetimelycontentatscale.Inaddition,Snapchatcontinues to be a platform where both established and emerging creators can growanaudience and build a sustainable business. For example, RandaAdami,anaildesignerandtravel creator,grewherfollowerbasebymorethan20xoverthelastsixmonthsbyconsistently posting to Spotlight and leveraging engagement tools such as Q&A and Spotlight comments to strengthen connections with her viewers. As we continue to innovate across these surfaces, we are seeing the impact of better calibrating our investments in community growth and cost to serve with the long term monetizationpotentialofeachmarket.InQ4,globalmonthlyactiveusersincreasedby3 millionquarter-over-quarterto946million,whileglobaldailyactiveusersdeclinedby3millionquarter-over-quarterto474 million5. The decline in Global DAU in Q4 reflects, in part, our decision to substantially reduce our community growth marketing investments inordertofocusonmoreprofitablegrowth.ImprovingARPUthroughmoredirectmonetizationof ourcoreproductremainsakeypriority,includingcontinuedgrowthinSnapchat+,theexpansionofSponsoredSnapsand Promoted Places, the launch of Lens+, and Memories Storage Plans. While these initiatives involve trade-offs with engagement, they are strengthening topline performance, supporting more stable and retentive subscription-based revenue streams, and improving the gross margin profile of our business. Theregulatoryenvironmentalsopresentsnear-termrisktoengagementmetrics.InQ4,weimplementedplatform-levelage verificationinAustraliainaccordancewithanewlawrequiringuserstobeatleast16yearsold,resultingintheremovalof approximately400,000accounts.WehavesincebeguntestingnewsignalsfromApple’sDeclaredAgeRangeAPI,andwe plantotestGoogle’ssolutiononceitbecomesavailable.Whiletheseactionsmayadverselyaffectengagementmetricsas SNAP INC. | Q4 2025 | INVESTOR LETTER 3

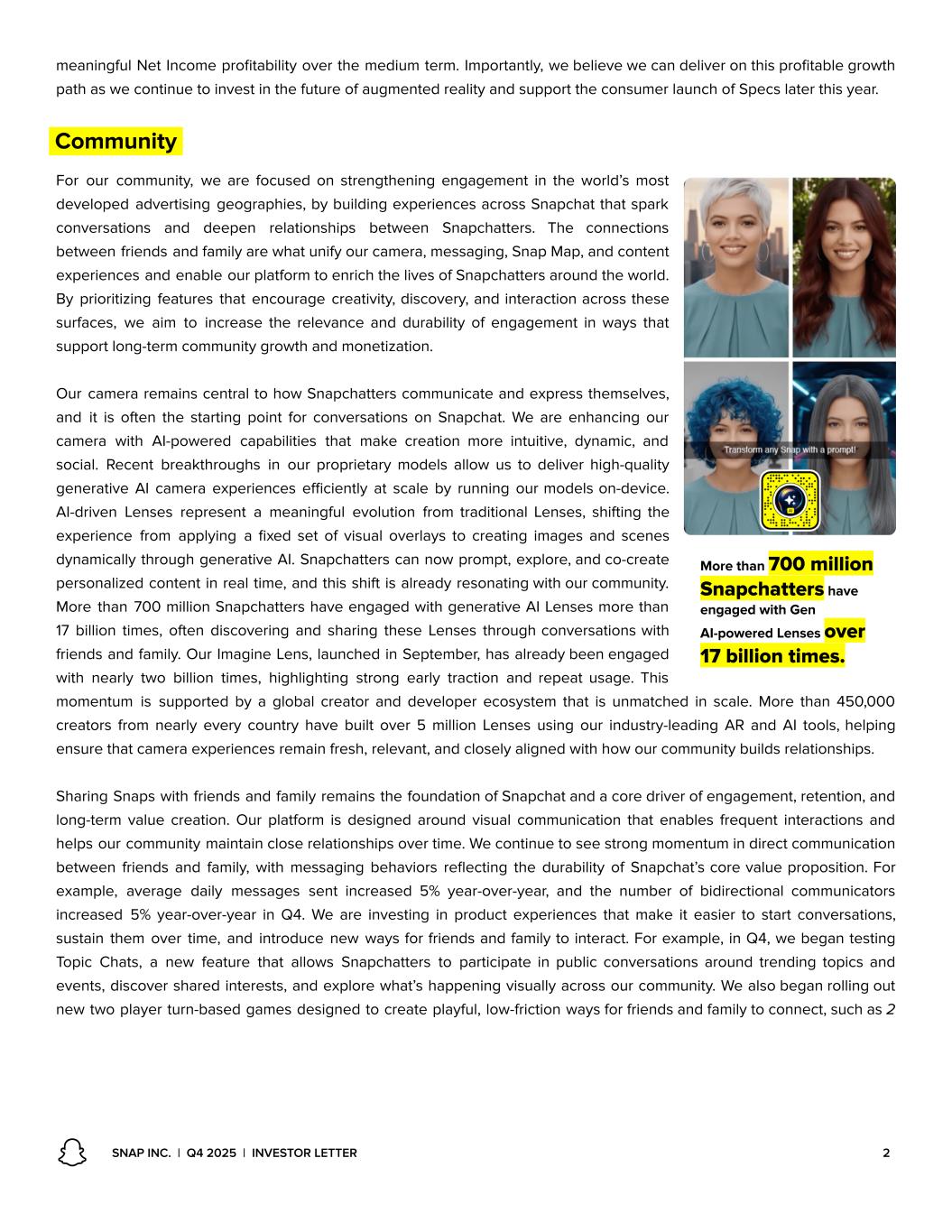

implementation progresses, we believe it is the right thing to do to maintain the long term trust of our community and partners, and we remain committed to our long-term goal of serving more than 1 billion global monthly active users. Specs Our long-termvisionforaugmentedrealityextendsbeyondthesmartphonetoafuturewherecomputingismorenatural, contextual,andseamlesslyintegratedintotherealworld.Formorethanadecade,wehaveinvestedinbuildingaplatform that brings digital experiences closer to how people see, move through, and interact withtheireverydayenvironments. Specsarecentraltothisvision.Afterfivegenerationsofdevelopmentandrefinement,weplantolaunchSpecspubliclyin 2026, which we believe represents a significantstepforwardinhuman-centeredcomputingandtheevolutionofourAR platform. As we prepare for launch, we have continued to strengthen both the platform and the ecosystem that is designed to supportadoptionatscale.WebegantestingSnapCloud,poweredbySupabase,tomakeadvancedbackendcapabilities moreaccessiblewithinLensStudio,enablingdeveloperstobuildricher,moredynamicARexperiences.Wealsoannounced that all Lenses built today for Spectacles will be compatible with Specs at launch, providing continuity and scale for developers from day one. PartnersanddevelopersarealreadybuildingcompellingARexperiencesthatdemonstratethebreadthofwhatispossible on Specs. Star Wars: Holocron Histories from ILM is now live onSpectacles,highlightingthepowerofsmartglassesfor immersivestorytellingwithoneoftheworld’smostbelovedfranchises.Thisexperienceshowcasesthestudio’scontinued innovation in technology andplatformsthroughanextensionoftheStarWarsgalaxy.Inaddition,developerHarryBanda created Card Master, a multiplayer AR card game that lets players face AI opponents in classic card games, with tutorials and achievements, evolving into a broader suite of AR card experiences for Specs. We believe Snap is uniquely positionedtoleadthe next wave of spatial computing. With Snap OS2.0, Lens Studio, Snap Cloud, and a global developer ecosystem,wehavebuiltanend-to-endARplatform spanning software, tools, and hardware. Together, these capabilities position us to deliver fully standalone, human-centered eyewear that expands creative expression and unlocks new ways for people to engage with the world around them. Advertising Platform In Q4, we made meaningful progress executing against the three priorities guiding the evolution of our advertising business:fosteringmoredirectconnectionsbetweenbrandsandSnapchatters,makingadvertisingonSnapchateasierand more performant through our AI-driven ad platform, and expanding our advertiser base by scaling and optimizing our go-to-market operations for small and medium-sized businesses. Together, these efforts delivered measurable improvements in advertiser performance, positioning us for more durable growth as we enter 2026. SNAP INC. | Q4 2025 | INVESTOR LETTER 4

We are focused on fostering more direct connections between brands and Snapchatters by enabling advertisers to participatenativelyintheexperiencesourcommunityuseeverydayonSnapchat,includingmessaging,theSnapMap,our AI-poweredcamera,andcreator-ledcontent.Thesesurfacesallowbrandstoshowupinwaysthatfeeltimely,relevant,and aligned with how our community communicates and discovers the world around them. High-impact, conversation-driven placements are playing an increasingly important role across both upper- and lower-funnel objectives. Sponsored Snaps continued to gain tractioninQ4asoneofourmostdifferentiatedadplacements,allowingbrandstoengage directly with Snapchatters. Sponsored Snaps revenue grew meaningfully quarter-over-quarter, supported by in-app optimizations and early testing of Dynamic ProductAd(DPA)integrations.Advertisersareseeingstrongresultsfromthisplacement: in Q4, Sponsored Snaps click-through rates grew 7% and click-throughpurchasesgrew 17% from Q3 to Q4, during which numerous format and ranking improvements were introduced. For example, global travel company Contiki usedSponsoredSnapstodrive lower-funnel bookings, achieving a 283% increaseinROASanda72%reductionincost per purchase, highlighting the format’s ability to connect creativity with measurable outcomes.Inaddition,SHEINusedSponsoredSnapsaspartofatotaltakeovercampaign to amplify the launch of its 2025 Collection, connecting an online-to-offline event with high-impact, camera-native creative that drove engagement beyond digitalimpressions. The campaign exceeded impression benchmarks by 20% while delivering CPMs below standard benchmarks, demonstrating strong efficiency, scale, and the effectiveness of clear product-led creative with a direct call to action. We are also seeing advertisers amplify lower-funnel outcomes by combining complementary ad formats across the Snapchatexperience.Forexample,SaudiQSRbrandKUDUcombinedcreativeARLenses withSponsoredSnapstodrivefull-funnelperformance,achievingupto49.5%lowercost persign-up,3.76xmoreappinstallsat76%lowerCPI,and38xmorepurchasesatan84% lower cost per purchase. Promoted Places further extends this strategy by translating digital engagement into real-world action. Early results from our Promoted Places beta saw an average 65% reductionincostperincrementalvisitandanaveragedouble-digitvisitationliftaccording to third-party foot traffic measurement by InMarket. WecontinuetoleverageAItomakeiteasierforadvertiserstoconnectwithSnapchatters while delivering stronger performance and more consistent returns. By embedding AI across our advertising platform, from creative development and campaign setup to delivery and optimization, wearereducingfrictionforadvertisersandimprovingROASatscale,particularlyacrossDirect Response use cases. A central focus of our AI strategy is simplifying how advertisers plan, launch,andmanagecampaignsonSnapchat.Our Smart Campaign Solutions suite, including Smart Targeting and Smart Budget,usesAItoidentifyincrementalhigh-value audiences and dynamically allocates spend across objectives, reducing the need for manual setup and ongoing optimization. We also began early testing of Smart Ads, which automatically assemble and iterate creative elements to identify the highest-performing combinations. These tools are designed to reduce creative friction, accelerate learning cycles, and shorten time to spend. SNAP INC. | Q4 2025 | INVESTOR LETTER 5

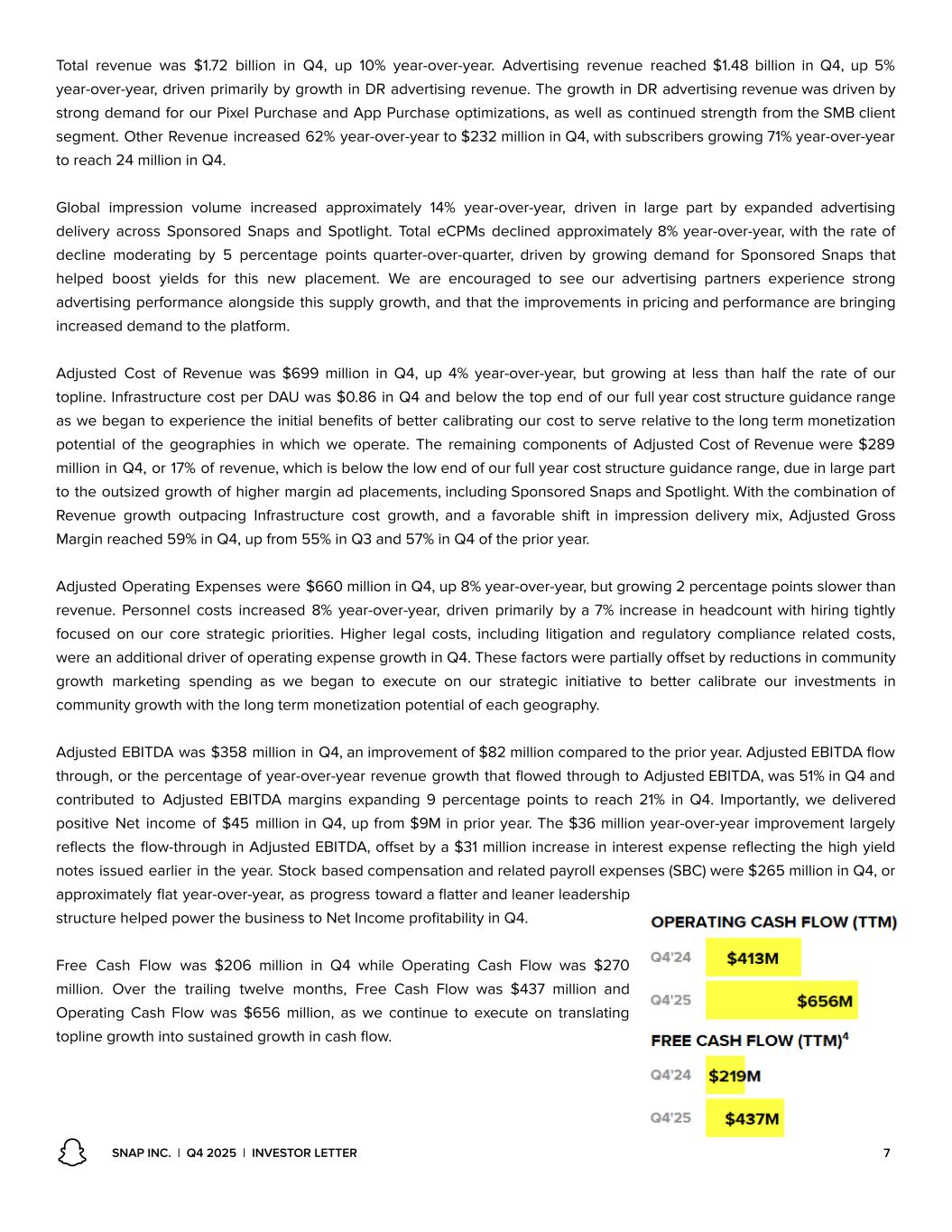

ImprovingDirectResponseperformanceremainsacoreprioritywithinthiseffort.InQ4,we delivered meaningful progress across both DPA and App advertising. For DPA, targeted ranking,format,anddeliveryimprovementsdelivereda55%reductionincostperactionfor 7-0conversionsanda45%reductionincostperactionfor1-0conversionsamongstallPixel PurchaseGBBs,basedoncumulativeinternaltestingoverthepastyear.DPArevenuegrew 19% year-over-year, supported by expanded adoption among large advertisers and continued migration to higher-performing dynamic solutions. For example, WOLFpak, a North America retail fashion & apparel brand, leveraged Dynamic Product Ads to drive lower-funnelperformance,delivering90%higherreturnonadspendcomparedtonon-DPA campaigns. Our App advertising business also accelerated meaningfully in Q4. RevenuefromIn-App Optimizations grew 89% year-over-year, supported by advances in foundational app models, broader adoption of the App Power Pack, and new immersive formats such as Playables. For example, our partnership with Triumph Arcade delivered 2.6x more app installs at 37% lower CPI and 94% more purchases at a 15% lower cost per purchase, demonstrating how native formats can drive strong lower-funnel outcomes. Wearegrowingouradvertiserbasebyscalingandoptimizinggo-to-marketoperationsthat supportthesuccessofsmallandmedium-sizedbusinesses.SMBscontributedthemajority of advertising revenue growth for the sixth consecutive quarter, underscoring sustained product-market fit and the impact of our investments. In Q4, total active advertisers increased28%year-over-year,driveninpartbysimplifiedonboarding,improvedcampaign workflows, and increased performance. We reduced setup friction by enhancing Ads Manager workflows and expanding integrations across the commerce and measurement ecosystem, enabling advertisers to launch campaigns directly frompartnerplatforms.We also strengthened our SMB offering through new partnerships, including a global integrationwithWix,whichallowsecommercebusinessestomoreeasilycreatecampaigns, manage catalogs, and improve measurement. In addition, we are investing in AI agents designed to accelerate SMB activation through automated recommendations and onboarding optimizations that reduce decision friction and improve performance. Our Q4 results reinforce our confidence in the strategic direction outlined in our 2026 plan. By fostering deeper connections between brands with Snapchatters, improving advertiser performance through AI, and expanding our advertiserbasewithgreaterdiscipline,wearebuildingamoreresilientandcompetitiveadvertisingbusiness.Aswemove into 2026, wewillcontinuetogradeourprogressbasedongrowthinconversions,improvementsinROAS,expansionof our active advertiser base, and ultimately the rate of growth in advertising revenue and share over time. Financials Q4 was a pivotal quarter for our business as we begantoseetheimpactofour strategic focus on profitable growth translate into further revenue diversification, meaningful gross margin expansion, elevated flow through of topline growth to adjusted EBITDA, the achievement of Net Income profitability, and substantially improved free cash flow generation. SNAP INC. | Q4 2025 | INVESTOR LETTER 6

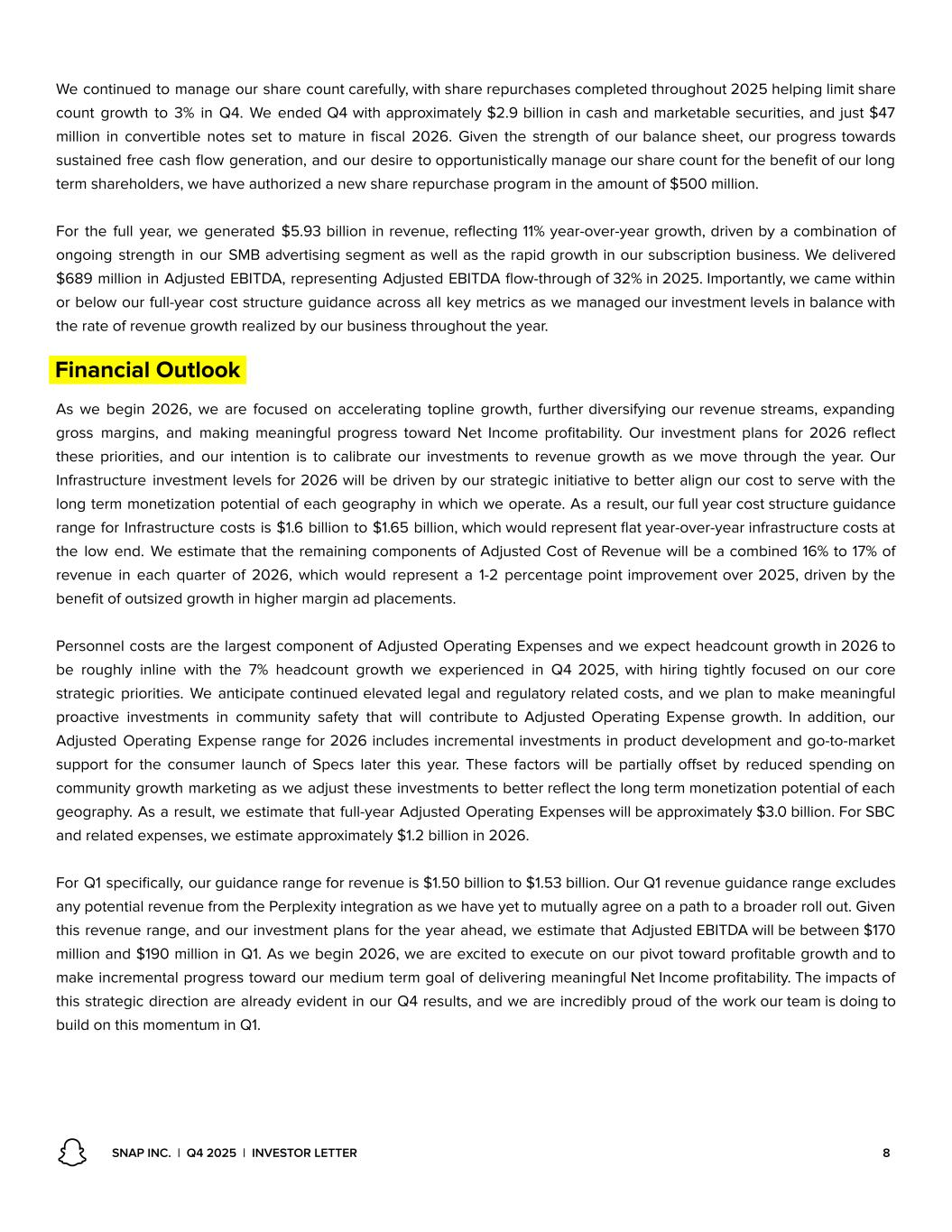

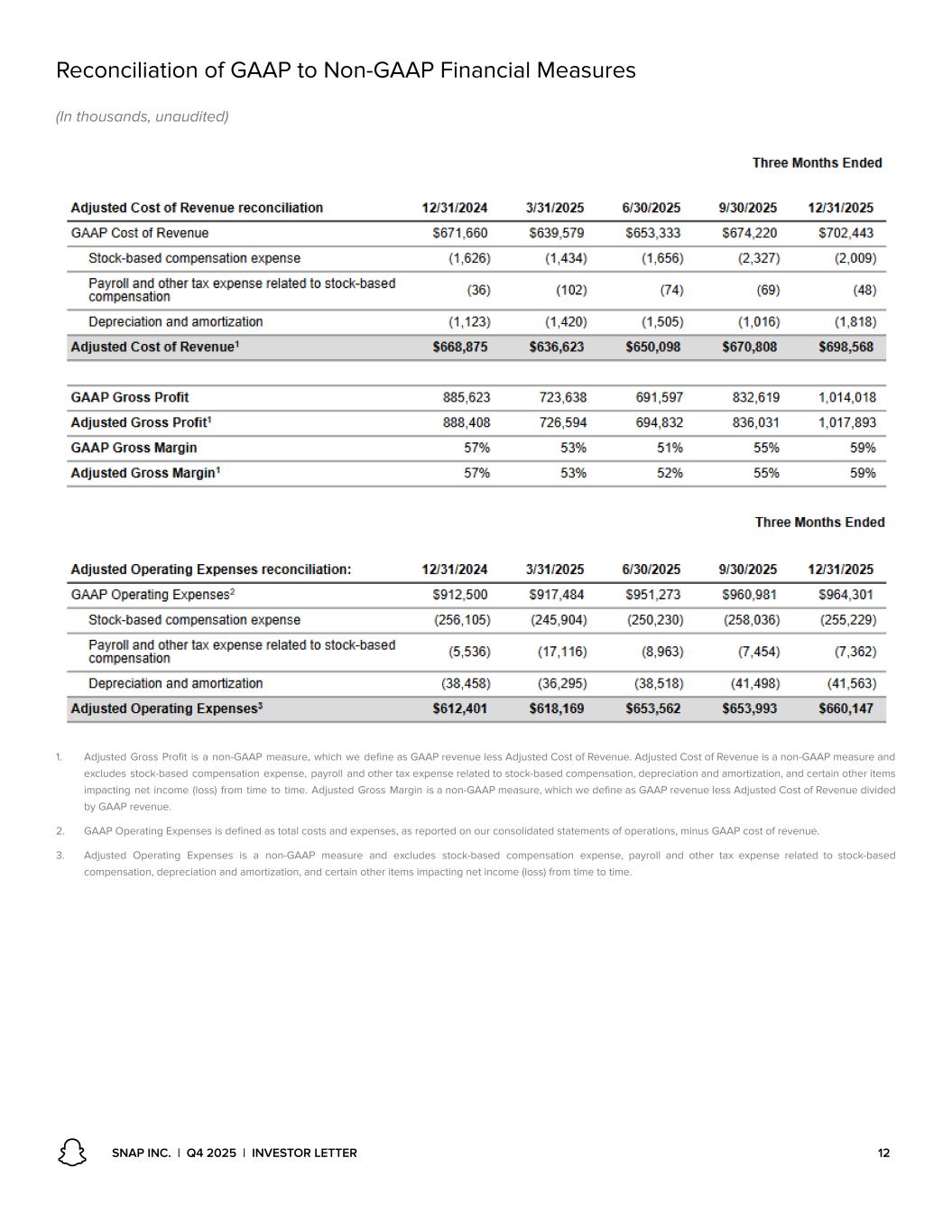

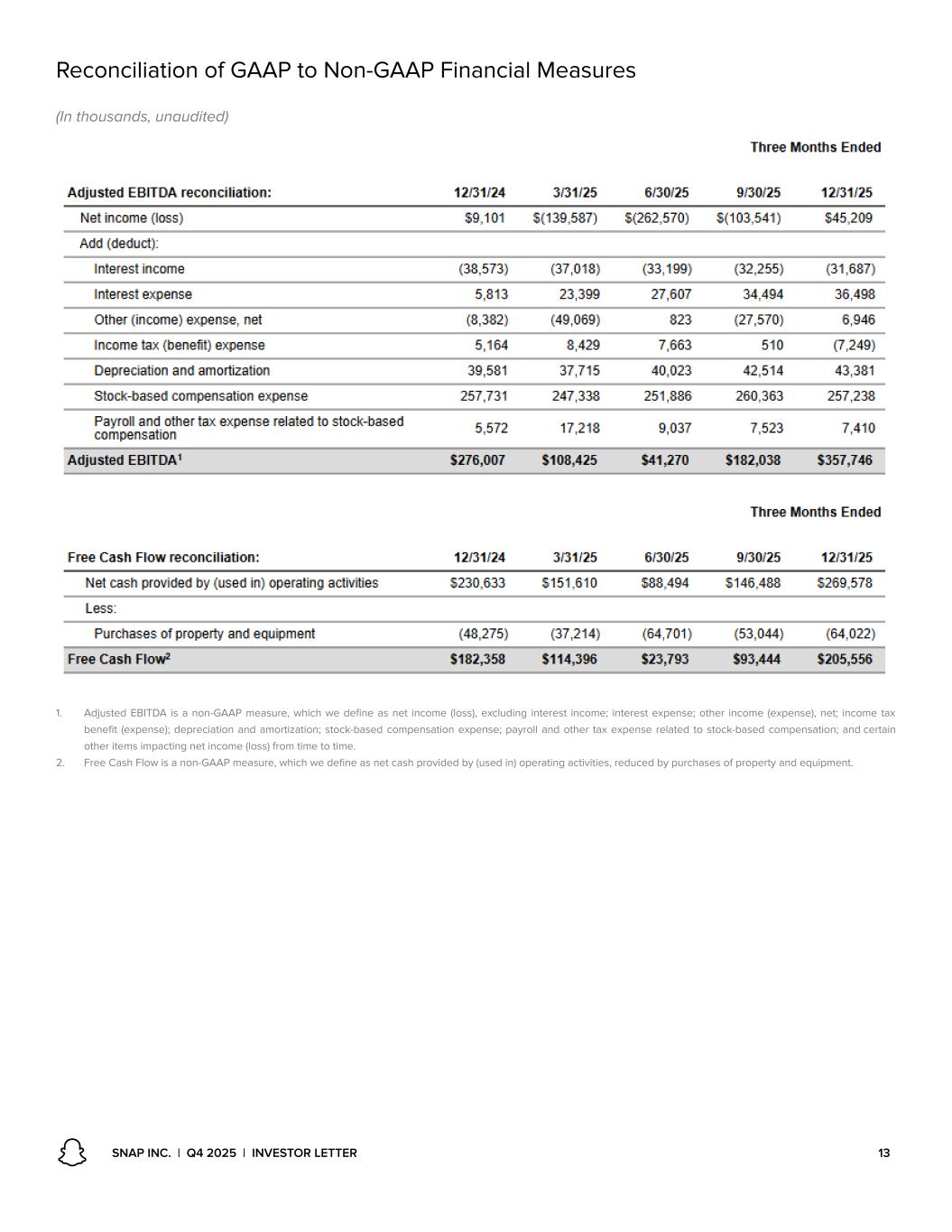

Total revenue was $1.72 billion in Q4, up 10% year-over-year. Advertising revenue reached $1.48 billion in Q4, up 5% year-over-year,drivenprimarilybygrowthinDRadvertisingrevenue.ThegrowthinDRadvertisingrevenuewasdrivenby strongdemandforourPixelPurchaseandAppPurchaseoptimizations,aswellascontinuedstrengthfromtheSMBclient segment.OtherRevenueincreased62%year-over-yearto$232millioninQ4,withsubscribersgrowing71%year-over-year to reach 24 million in Q4. Global impression volume increased approximately 14% year-over-year, driven in large part by expanded advertising delivery across Sponsored Snaps and Spotlight. Total eCPMs declined approximately8%year-over-year,withtherateof decline moderating by 5 percentage points quarter-over-quarter, driven by growing demand for Sponsored Snaps that helped boost yields for this new placement. We are encouraged to see our advertising partners experience strong advertisingperformancealongsidethissupplygrowth,andthattheimprovementsinpricingandperformancearebringing increased demand to the platform. Adjusted Cost of Revenue was $699 million in Q4, up 4% year-over-year, but growing at less than half the rate of our topline.InfrastructurecostperDAUwas$0.86inQ4andbelowthetopendofourfullyearcoststructureguidancerange aswebegantoexperiencetheinitialbenefitsofbettercalibratingourcosttoserverelativetothelongtermmonetization potential of the geographies in which we operate. The remaining components of AdjustedCostofRevenuewere$289 millioninQ4,or17%ofrevenue,whichisbelowthelowendofourfullyearcoststructureguidancerange,dueinlargepart totheoutsizedgrowthofhighermarginadplacements,includingSponsoredSnapsandSpotlight.Withthecombinationof Revenue growth outpacing Infrastructure cost growth, and a favorable shift in impression delivery mix, Adjusted Gross Margin reached 59% in Q4, up from 55% in Q3 and 57% in Q4 of the prior year. AdjustedOperatingExpenseswere$660millioninQ4,up8%year-over-year,butgrowing2percentagepointsslowerthan revenue. Personnel costs increased 8% year-over-year, driven primarily bya7%increaseinheadcountwithhiringtightly focused on our core strategic priorities. Higher legal costs, including litigation and regulatory compliance related costs, wereanadditionaldriverofoperatingexpensegrowthinQ4.Thesefactorswerepartiallyoffsetbyreductionsincommunity growth marketing spending as we began to execute on our strategic initiative to better calibrate our investments in community growth with the long term monetization potential of each geography. AdjustedEBITDAwas$358millioninQ4,animprovementof$82millioncomparedtotheprioryear.AdjustedEBITDAflow through,orthepercentageofyear-over-yearrevenuegrowththatflowedthroughtoAdjustedEBITDA,was51%inQ4and contributed to Adjusted EBITDA margins expanding 9 percentage points to reach 21% in Q4. Importantly, we delivered positive Net income of $45 millioninQ4,upfrom$9Minprioryear.The$36millionyear-over-yearimprovementlargely reflects the flow-throughinAdjustedEBITDA,offsetbya$31millionincreaseininterestexpensereflectingthehighyield notesissuedearlierintheyear.Stockbasedcompensationandrelatedpayrollexpenses(SBC)were$265millioninQ4,or approximatelyflatyear-over-year,asprogresstowardaflatterandleanerleadership structure helped power the business to Net Income profitability in Q4. Free Cash Flow was $206 million in Q4 while Operating Cash Flow was $270 million. Over the trailing twelve months, Free Cash Flow was $437 million and Operating Cash Flow was $656 million, as we continue to execute on translating topline growth into sustained growth in cash flow. SNAP INC. | Q4 2025 | INVESTOR LETTER 7

Wecontinuedtomanageoursharecountcarefully,withsharerepurchasescompletedthroughout2025helpinglimitshare count growth to 3% in Q4. We endedQ4withapproximately$2.9billionincashandmarketablesecurities,andjust$47 million in convertible notes set to mature in fiscal 2026. Given the strength of ourbalancesheet,ourprogresstowards sustainedfreecashflowgeneration,andourdesiretoopportunisticallymanageoursharecountforthebenefitofourlong term shareholders, we have authorized a new share repurchase program in the amount of $500 million. For the full year, we generated $5.93billioninrevenue,reflecting11%year-over-yeargrowth,drivenbyacombinationof ongoing strength in our SMBadvertisingsegmentaswellastherapidgrowthinoursubscriptionbusiness.Wedelivered $689millioninAdjustedEBITDA,representingAdjustedEBITDAflow-throughof32%in2025.Importantly,wecamewithin orbelowourfull-yearcoststructureguidanceacrossallkeymetricsaswemanagedourinvestmentlevelsinbalancewith the rate of revenue growth realized by our business throughout the year. Financial Outlook As we begin 2026, we are focused on accelerating topline growth, furtherdiversifyingourrevenuestreams,expanding gross margins, and making meaningful progress toward Net Income profitability. Our investment plans for 2026 reflect these priorities, and our intention is to calibrate our investments to revenue growth as we move through the year. Our Infrastructure investmentlevelsfor2026willbedrivenbyourstrategicinitiativetobetteralignourcosttoservewiththe longtermmonetizationpotentialofeachgeographyinwhichweoperate.Asaresult,ourfullyearcoststructureguidance rangeforInfrastructurecostsis$1.6billionto$1.65billion,whichwouldrepresentflatyear-over-yearinfrastructurecostsat the low end. WeestimatethattheremainingcomponentsofAdjustedCostofRevenuewillbeacombined16%to17%of revenue in each quarter of 2026, which would represent a 1-2 percentagepointimprovementover2025,drivenbythe benefit of outsized growth in higher margin ad placements. PersonnelcostsarethelargestcomponentofAdjustedOperatingExpensesandweexpectheadcountgrowthin2026to be roughly inline with the 7% headcount growth we experienced in Q4 2025, with hiring tightly focused on our core strategic priorities. We anticipatecontinuedelevatedlegalandregulatoryrelatedcosts,andweplantomakemeaningful proactive investments in community safety that will contribute to Adjusted Operating Expense growth. In addition, our Adjusted Operating Expenserangefor2026includesincrementalinvestmentsinproductdevelopmentandgo-to-market support for the consumer launch of Specs later this year. These factors will be partially offset by reduced spendingon communitygrowthmarketingasweadjusttheseinvestmentstobetterreflectthelongtermmonetizationpotentialofeach geography.Asaresult,weestimatethatfull-yearAdjustedOperatingExpenseswillbeapproximately$3.0billion.ForSBC and related expenses, we estimate approximately $1.2 billion in 2026. ForQ1specifically,ourguidancerangeforrevenueis$1.50billionto$1.53billion.OurQ1revenueguidancerangeexcludes anypotentialrevenuefromthePerplexityintegrationaswehaveyettomutuallyagreeonapathtoabroaderrollout.Given thisrevenuerange,andourinvestmentplansfortheyearahead,weestimatethatAdjustedEBITDAwillbebetween$170 millionand$190millioninQ1.Aswebegin2026,weareexcitedtoexecuteonourpivottowardprofitablegrowthandto makeincrementalprogresstowardourmediumtermgoalofdeliveringmeaningfulNetIncomeprofitability.Theimpactsof thisstrategicdirectionarealreadyevidentinourQ4results,andweareincrediblyproudoftheworkourteamisdoingto build on this momentum in Q1. SNAP INC. | Q4 2025 | INVESTOR LETTER 8

1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenuelessAdjustedCostofRevenue.AdjustedGrossMarginisanon-GAAPmeasure,which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other taxexpenserelatedtostock-basedcompensation,depreciationandamortization,andcertainotheritemsimpactingnetincome (loss) from time to time. See Appendix for reconciliation of GAAP Cost of Revenue to Adjusted Cost of Revenue. 2. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time.SeeAppendixforreconciliationofGAAPOperating Expenses to Adjusted Operating Expenses. 3. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; andcertain other items impacting net income (loss) from time to time. See Appendix for reconciliation of net income (loss) to Adjusted EBITDA. 4. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities,reducedbypurchasesofpropertyandequipment.See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. 5. In the first quarter of 2025, we refined our processes and controls to allow us to moreaccuratelyrecorduseractivitythatwouldnototherwiseberecordedduringsuch period due to delaysinreceivingusermetricinformationresultingfromcarrierorotheruserconnectivityissuesduringthemeasurementperiod.Foradditionalinformation concerning these refinements,seethe“NoteRegardingUserMetricsandOtherData”inourQuarterlyReportfiledonForm10-Qforthefirstquarterof2025.Asaresultof such refinements, our DAUs may not be directly comparable to those in prior periods, as they reflect a comparison to previously reported numbers. SNAP INC. | Q4 2025 | INVESTOR LETTER 9

SNAP INC. | Q4 2025 | INVESTOR LETTER 10

Forward Looking Statements This letter contains forward-lookingstatements within themeaningof Section27Aof theSecurities Act of 1933, as amended, or theSecuritiesAct,and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other thanstatementsofhistoricalfactscontainedinthisletter,includingstatementsregardingguidance,ourfutureresultsof operations or financial condition, future stock repurchase programs or stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for futureoperations, andadvertiser andpartner offerings, areforward-lookingstatements.Insomecases, you can identify forward-looking statements because they contain wordssuchas “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or thenegativeof thesewordsor other similar termsor expressions. Wecautionyouthat theforegoingmaynot includeall of theforward-lookingstatementsmadeinthisletter.Youshouldnot rely onforward-lookingstatements as predictionsoffutureevents.Wehavebasedtheforward-lookingstatementscontainedinthisletterprimarilyonour current expectationsandprojectionsabout futureevents andtrends,includingourfinancialoutlook,macroeconomicuncertainty,andgeo-politicalevents and conflicts, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks anduncertainties relatedto: our financial performance; our abilitytoattainandsustainprofitability;ourabilitytogenerate andsustain positive cashflow;ourabilitytoattractandretainusers,partners,andadvertisers;competitionandnewmarketentrants;managingourgrowth andfutureexpenses; compliancewith newlaws, regulations, andexecutiveactions;ourabilitytomaintain,protect,andenhanceourintellectualproperty; our ability tosucceedinexistingandnewmarketsegments;ourabilitytoattractandretainqualifiedteammembersandkeypersonnel;ourabilitytorepay or refinance outstanding debt, or to access additional financing; future acquisitions, divestitures, or investments; andthepotential adverseimpact of climatechange, natural disasters, health epidemics, macroeconomic conditions, andwar orotherarmedconflict,aswellasrisks,uncertainties,andother factors described in “Risk Factors” and elsewhere in our most recent periodic report filedwith theU.S. Securities andExchangeCommission, or SEC, whichis available ontheSEC’s website at www.sec.gov. Additional informationwill bemadeavailable in SnapInc.’speriodicreportthatwillbefiledwith theSECfor theperiodcoveredby this letter andother filingsthat wemakefromtimeto timewith theSEC. Inaddition,anyforward-lookingstatements contained in this letter are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update any forward-lookingstatements to reflect events or circumstancesafter thedate of thisletterortoreflectnewinformationortheoccurrenceofunanticipated events, including future developments related to geo-political events and conflicts and macroeconomic conditions, except as required by law. Non-GAAP Financial Measures To supplement our consolidatedfinancial statements, whichare preparedandpresentedin accordancewith GAAP, weusecertain non-GAAPfinancial measures, as describedbelow, to understandandevaluateourcoreoperatingperformance.Thesenon-GAAPfinancialmeasures,whichmaybedifferent than similarly titled measures used by other companies, are presented to enhance investors’ overall understandingof our financial performanceand should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAPfinancial measureof FreeCashFlow, whichisdefinedasnetcashprovidedby(usedin)operatingactivities,reducedbypurchasesofproperty and equipment. We believe Free Cash Flow is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business and is a key financial indicator used by management. Additionally, we believe that Free Cash Flow is an important measuresinceweusethird-party infrastructurepartners to host our servicesandthereforewedonot incursignificantcapitalexpendituresto support revenuegeneratingactivities.FreeCashFlowisusefultoinvestorsasaliquiditymeasurebecauseitmeasuresourabilitytogenerateorusecash. Onceourbusinessneedsandobligationsaremet,cashcanbeusedtomaintainastrongbalancesheetandinvestinfuturegrowth.Weusethenon-GAAP financial measure of AdjustedEBITDA, whichis definedas net income(loss), excludinginterest income; interest expense; other income(expense), net; incometax benefit (expense); depreciationandamortization; stock-basedcompensationexpense; payroll andother tax expenserelatedtostock-based compensation; andcertain other itemsimpactingnet income(loss) fromtimetotime.WebelievethatAdjustedEBITDAhelpsidentifyunderlyingtrendsin our business that could otherwise be masked by the effect of the expenses that we exclude in AdjustedEBITDA. Weuseother non-GAAPfinancial measures such as Adjusted Cost of Revenue and Adjusted OperatingExpenses. Thesemeasuresare definedas their respectiveGAAPexpenseline items, excludinginterest income; interest expense;otherincome(expense),net;incometaxbenefit(expense);depreciationandamortization;stock-based compensationexpense; payrollandothertaxexpenserelatedtostock-basedcompensation;andcertainotheritemsimpactingnetincome(loss)fromtime to time. Weusethenon-GAAPfinancial measureof AdjustedGross Profit,whichwedefineasGAAPrevenuelessAdjustedCostofRevenue.Weusethe non-GAAP financial measure of Adjusted Gross Margin, whichwedefineas GAAPrevenueless AdjustedCost of Revenuedividedby GAAPrevenue. SimilartoAdjustedEBITDA,webelievethesemeasureshelpidentifyunderlyingtrendsinourbusinessthatcouldotherwisebemaskedbytheeffectofthe expenses we excludein themeasure. Webelievethat thesenon-GAAPfinancial measuresprovideuseful informationabout our financial performance, enhancetheoverall understandingof our past performanceandfutureprospects,andallowforgreatertransparencywithrespecttokeymetricsusedby our management for financial andoperational decision-making. Weare presentingthesenon-GAAPmeasuresto assist investors in seeingourfinancial performancethroughtheeyesof management, andbecausewebelievethatthesemeasuresprovideanadditionaltoolforinvestorstouseincomparing our corefinancial performanceover multiple periodswith other companies in our industry. For a reconciliationofthesenon-GAAPfinancialmeasuresto themost directly comparable GAAPfinancial measure, pleasesee“ReconciliationofGAAPtoNon-GAAPFinancialMeasures”includedasanAppendixto this letter. SnapInc., “Snapchat,” andour other registeredandcommonlawtradenames, trademarks, andservicemarksarethepropertyofSnapInc.or our subsidiaries. SNAP INC. | Q4 2025 | INVESTOR LETTER 11

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted Gross Profit is a non-GAAP measure, which we defineasGAAPrevenuelessAdjustedCostofRevenue.AdjustedCostofRevenueisanon-GAAPmeasureand excludes stock-based compensation expense, payroll andothertaxexpenserelatedtostock-basedcompensation,depreciationandamortization,andcertainotheritems impacting net income (loss) from time to time. Adjusted Gross Margin isanon-GAAPmeasure,whichwedefineasGAAPrevenuelessAdjustedCostofRevenuedivided by GAAP revenue. 2. GAAP Operating Expenses is defined as total costs and expenses, as reported on our consolidated statements of operations, minus GAAP cost of revenue. 3. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. SNAP INC. | Q4 2025 | INVESTOR LETTER 12

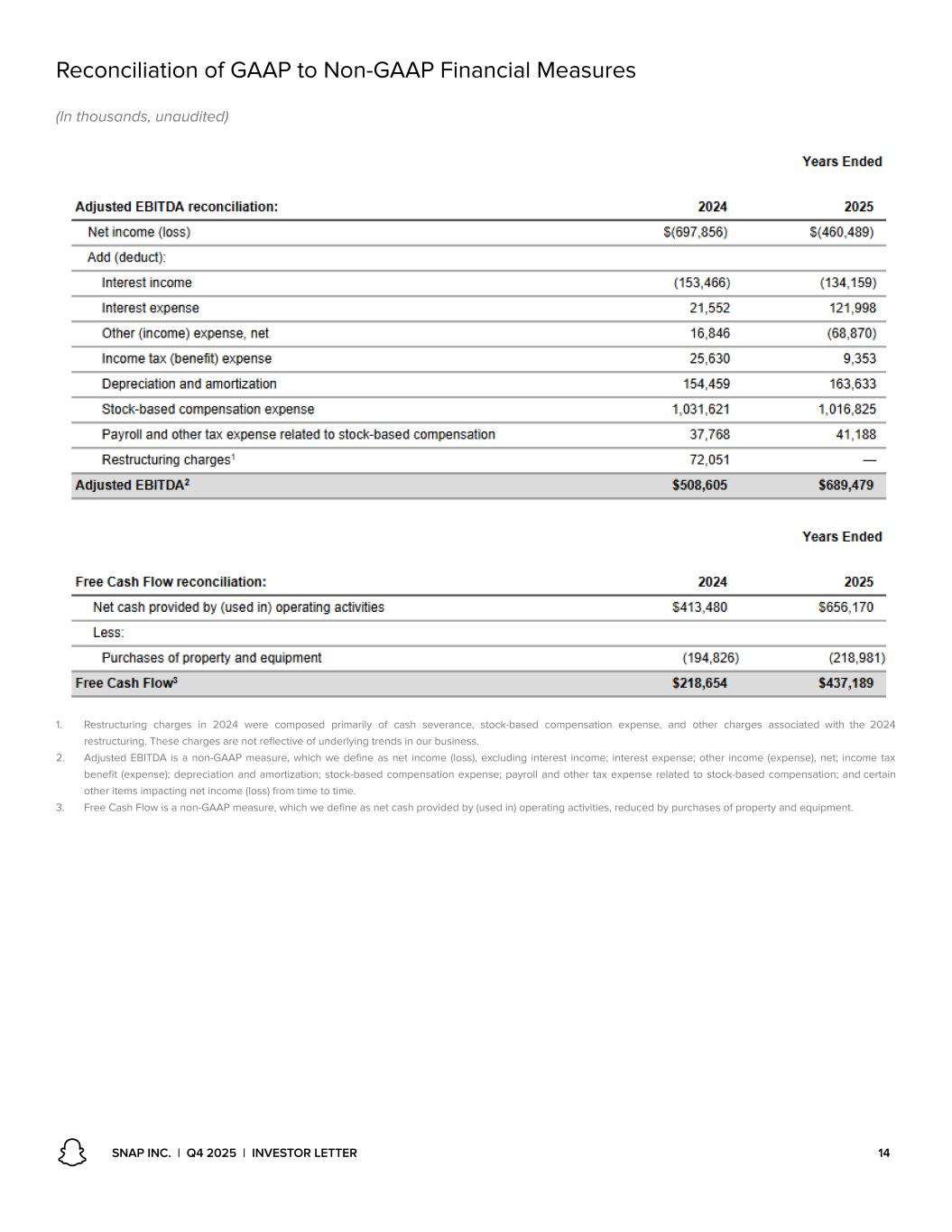

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; andcertain other items impacting net income (loss) from time to time. 2. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q4 2025 | INVESTOR LETTER 13

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Restructuring charges in 2024 were composed primarily of cash severance, stock-based compensation expense, and other charges associated with the 2024 restructuring. These charges are not reflective of underlying trends in our business. 2. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; andcertain other items impacting net income (loss) from time to time. 3. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q4 2025 | INVESTOR LETTER 14