.2

Lender Presentation October 2025

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Information Regarding Forward - Looking Statements 2 Mallinckrodt - Endo Statements in this presentation regarding the businesses of Mallinckrodt plc and its subsidiaries, including Par Health (coll ect ively, “Mallinckrodt”) and Endo LP (formerly Endo, Inc.) and its subsidiaries (collectively, “Endo” and, together with Mallinckrodt, the “Companies”) that are not strictly historical, including statements regarding expected synergies of combini ng Mallinckrodt’s and Endo’s businesses, the contemplated separation of Par Health from Mallinckrodt and any other statements regarding events or developments Mallinckrodt believes or anticipates will or may occur in the future, may b e “ forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward - looking statements and you should not place undue reliance on any such forward - looking statements. These factors include risks and uncertainties related to, among other things: ability to achieve the anticipated syn ergies of combining Mallinckrodt’s and Endo’s businesses; unanticipated difficulties and costs of integrating the businesses of Mallinckrodt and Endo; uncertainties related to the contemplated separation of Par Health from Mallinckrodt, in clu ding the risk that the separation may not occur on a timely basis or at all, unforeseen costs and disruptions to the Companies’ businesses; potential changes in Mallinckrodt’s and Par Health’s business strategy and performance; exposure t o g lobal economic conditions and market uncertainty; the exercise of contingent value rights by the Opioid Master Disbursement Trust II; governmental investigations and inquiries, regulatory actions, and lawsuits, in each case relat ed to Mallinckrodt or its officers; Mallinckrodt’s contractual and court - ordered compliance obligations that, if violated, could result in penalties; compliance with and restrictions under the global settlements to resolve all opioid - related claims against Mallinckrodt and Endo; matters related to Acthar® Gel, including the settlement with governmental parties to resolve certain disputes and compliance with and restrictions under the related corporate integrity agreement; the ab ility to maintain relationships with Mallinckrodt’s and Endo’s suppliers, customers, employees and other third parties following emergence from the Companies’ respective Chapter 11 bankruptcy proceedings; scrutiny from governments, legi sla tive bodies and enforcement agencies related to sales, marketing and pricing practices; pricing pressure on certain of the Companies’ products due to legal changes or changes in insurers’ or other payers’ reimbursement practices resu lti ng from recent increased public scrutiny of healthcare and pharmaceutical costs; the reimbursement practices of governmental health administration authorities, private health coverage insurers and other third - party payers; complex report ing and payment obligations under the Medicare and Medicaid rebate programs and other governmental purchasing and rebate programs; cost containment efforts of customers, purchasing groups, third - party payers and governmental or ganizations; changes in or failure to comply with relevant laws and regulations; any undesirable side effects caused by the Companies’ approved and investigational products, which could limit their commercial profile or result in other ne gative consequences; the Companies’ and its partners’ ability to successfully develop, commercialize or launch new products or expand commercial opportunities of existing products, including XIAFLEX, Acthar Gel (repository corticotropin in jection) SelfJect , the INOmax Evolve DS delivery system, and Terlivaz; the Companies’ ability to successfully identify or discover additional products or product candidates; the Companies’ ability to navigate price fluctuations and pre ssu res, including the ability to achieve anticipated benefits of price increases of its products; competition; the Companies’ and its partners’ ability to protect intellectual property rights, including in relation to ongoing and future lit iga tion; limited clinical trial data for Acthar Gel; the timing, expense and uncertainty associated with clinical studies and related regulatory processes; product liability losses and other litigation liability; material health, safety and environmen tal laws and related liabilities; business development activities or other strategic transactions; attraction and retention of key personnel; the effectiveness of information technology infrastructure, including risks of external attacks or failures; c ust omer concentration; the Companies’ reliance on certain individual products that are material to its financial performance; the Companies’ ability to receive sufficient procurement and production quotas granted by the U.S. Drug Enforcem ent Administration; complex manufacturing processes; reliance on third - party manufacturers and supply chain providers and related market disruptions; conducting business internationally; the Companies’ significant levels of intangibl e a ssets and related impairment testing; natural disasters or other catastrophic events; the Companies’ substantial indebtedness and settlement obligation, its ability to generate sufficient cash to reduce its indebtedness and its potential nee d and ability to incur further indebtedness; restrictions contained in the agreements governing the Companies’ indebtedness and settlement obligation on Mallinckrodt’s operations, future financings and use of proceeds; Mallinckrodt’s va ria ble rate indebtedness; Mallinckrodt’s tax treatment by the Internal Revenue Service under Section 7874 and Section 382 of the Internal Revenue Code of 1986, as amended; future changes to applicable tax laws or the impact of disputes wi th governmental tax authorities; and the impact of Irish laws. While the list of factors presented herein is considered representative, no such list should be considered to be a complete s tat ement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to Mallinckrodt’s most recent Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q, and other filings with the SEC, which are available from the SEC’s website (www.sec.gov) and Mallinckrodt’s website (www.mallinckrodt.com) and Endo’s most re cen t Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q and other filings with the SEC, which are available from the SEC’s website (www.sec.gov) and Endo’s website (www.endo.com). There may be other risks and un certainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. The forward - looking statements made herein speak only as of the date hereof and Mallinckrodt doe s not assume any obligation to update or revise any forward - looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law. Given these uncertainties, one should no t p ut undue reliance on any forward - looking statements.

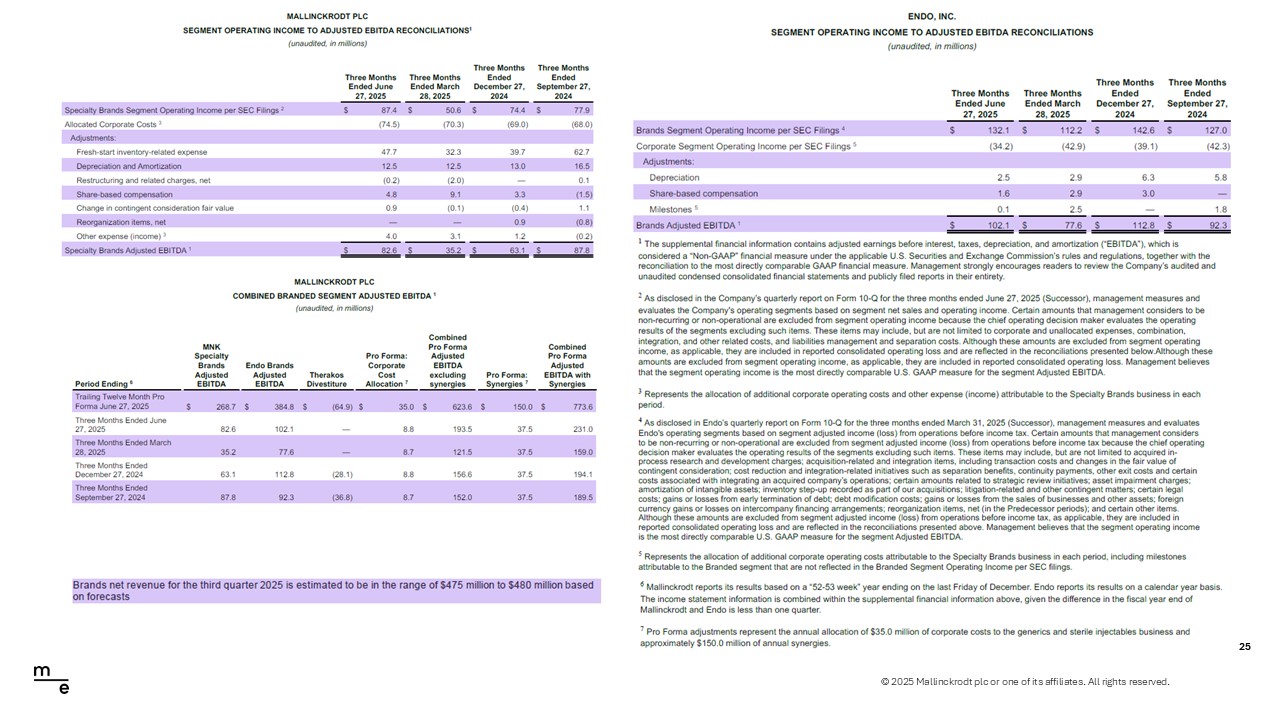

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Non - GAAP Financial Measures 3 Mallinckrodt - Endo To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this pr esentation includes certain financial information of the Companies that are not prescribed by or prepared in accordance with GAAP. We utilize these non - GAAP financial measures as supplements to financial measures determined in accordance with GAAP when evaluating operating performance and we believe that these measures will be used by certain investors to evaluate operating results. We believe that presenting these non - GAAP financial measures provides useful in formation about performance across reporting periods on a consistent basis by excluding certain items, which may be favorable or unfavorable. Certain of this financial information is presented on a pro forma basis. Such information does not give effect to the financi al effects of Mallinckrodt’s business combination with Endo, may not necessarily reflect what Mallinckrodt’s results of operations would have been had the business combination occurred during the periods presented and does not purport to project wh at Mallinckrodt’s results of operations or financial position will be in the future. The pro forma financial information in this presentation has not been prepared and presented in accordance with the requirements of Article 11 of Reg ula tion S - X or Accounting Standards Codification 805, Business Combinations. Despite the importance of these measures to management in goal setting and performance measurement, these are non - GAAP financial measures that have no standardized meaning prescribed by GAAP and, therefore, have limits in their usefulness to investors. Because of the non - standardized definitions, metrics such as non - GAAP adjusted EBITDA, free cash flow, net debt and similar metrics provided on a pro forma basis (unlike GAAP measures and relevant components) may differ from, and may not be comparable to, the calculation of similar measures of other companies. These non - GAAP financial measures are presented solely to permit investors to more fully understand how management assesses performance. These non - GAAP financial measures should not be viewed in isolation or as substitutes for, or superior to, financial measures ca lculated in accordance with GAAP. These non - GAAP financial measures should be read in conjunction with Mallinckrodt’s and Endo’s unaudited condensed consolidated financial statements, audited financial statements, and publicly f ile d reports in their entirety. Reconciliations of certain of these historical adjusted financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this presentation. Further information r ega rding non - GAAP financial measures can be found on the Company’s website at https://www.MNK - Endo.com.

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Introduction to Today’s Speakers 4 Mallinckrodt - Endo Sigurdur (Siggi) Olafsson President and Chief Executive Officer 30+ Years of Experience Prior Experience Christiana Stamoulis President and Chief Financial Officer 30 Years of Experience Prior Experience Matt Peters Senior Vice President, Corporate Treasurer & Chief Tax Officer 25+ Years of Experience Prior Experience

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Agenda Transaction Overview Mallinckrodt - Endo Overview Branded Business Overview Appendix Mallinckrodt - Endo 5

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Transaction Overview 6 01

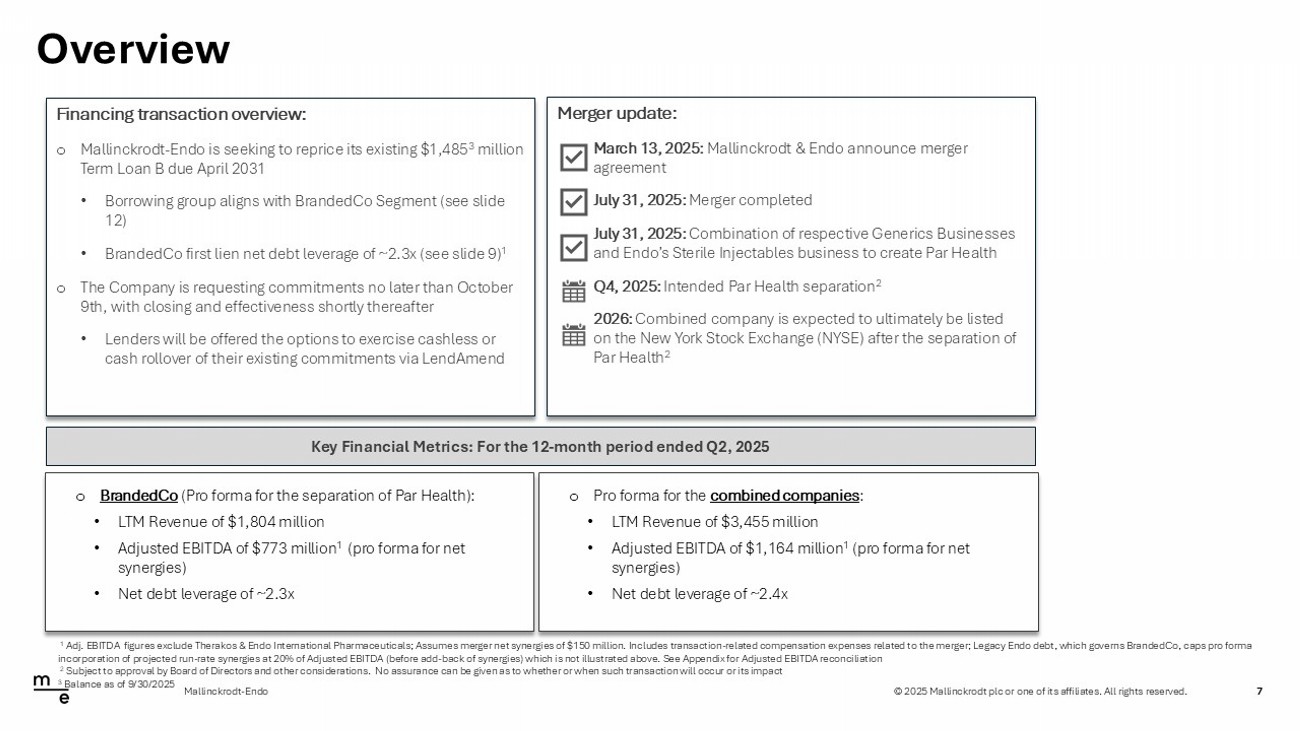

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Overview 7 Mallinckrodt - Endo 1 Adj. EBITDA figures exclude Therakos & Endo International Pharmaceuticals; Assumes merger net synergies of $150 million. Inc lu des transaction - related compensation expenses related to the merger; Legacy Endo debt, which governs BrandedCo, caps pro forma incorporation of projected run - rate synergies at 20% of Adjusted EBITDA (before add - back of synergies) which is not illustrated above. See Appendix for Adjusted EBITDA reconciliation 2 Subject to approval by Board of Directors and other considerations. No assurance can be given as to whether or when such tra ns action will occur or its impact 3 Balance as of 9/30/2025 Merger update: March 13, 2025: Mallinckrodt & Endo announce merger agreement July 31, 2025: Merger completed July 31, 2025: Combination of respective Generics Businesses and Endo’s Sterile Injectables business to create Par Health Q4, 2025: Intended Par Health separation 2 2026: Combined company is expected to ultimately be listed on the New York Stock Exchange (NYSE) after the separation of Par Health 2 o Pro forma for the combined companies : • LTM Revenue of $3,455 million • Adjusted EBITDA of $1,164 million 1 (pro forma for net synergies) • Net debt leverage of ~2.4x o BrandedCo (Pro forma for the separation of Par Health): • LTM Revenue of $1,804 million • Adjusted EBITDA of $773 million 1 (pro forma for net synergies) • Net debt leverage of ~2.3x Key Financial Metrics: For the 12 - month period ended Q2, 2025 Financing transaction overview: o Mallinckrodt - Endo is seeking to reprice its existing $1,485 3 million Term Loan B due April 2031 • Borrowing group aligns with BrandedCo Segment (see slide 12) • BrandedCo first lien net debt leverage of ~2.3x (see slide 9) 1 o The Company is requesting commitments no later than October 9th, with closing and effectiveness shortly thereafter • Lenders will be offered the options to exercise cashless or cash rollover of their existing commitments via LendAmend

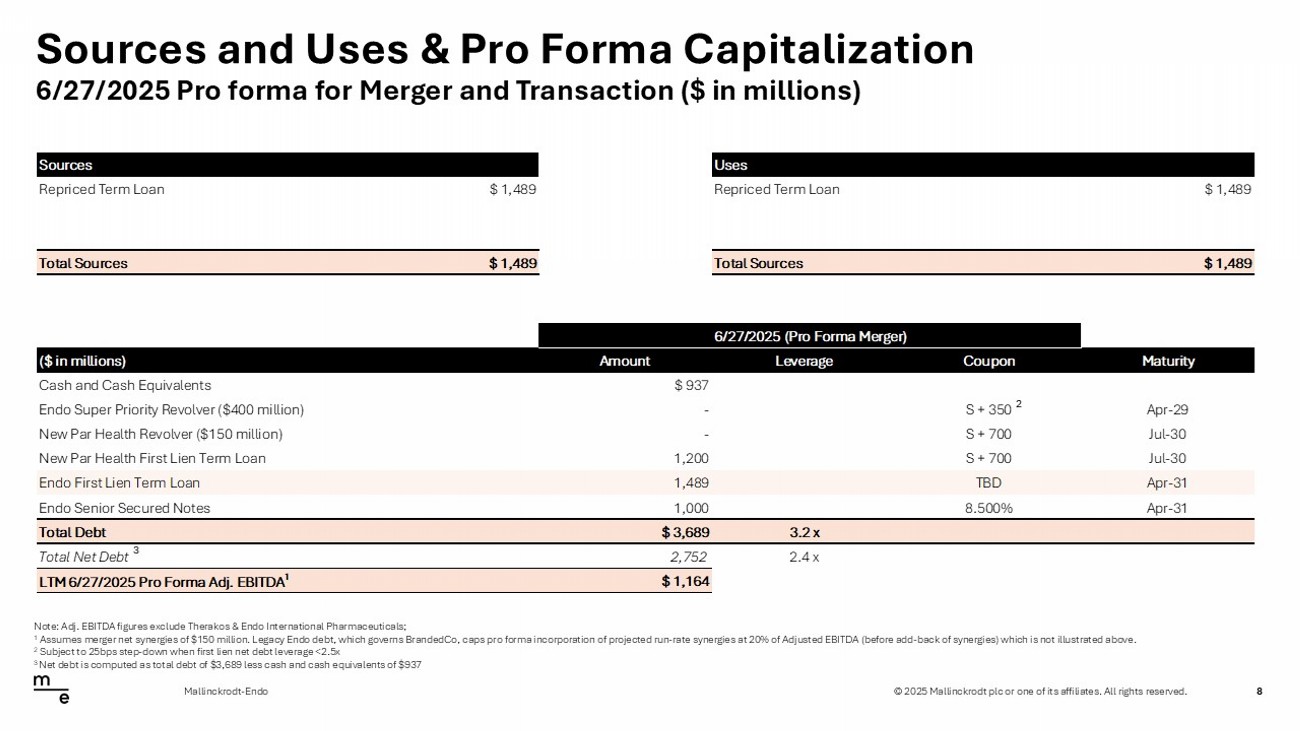

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Sources and Uses & Pro Forma Capitalization 8 Mallinckrodt - Endo Note: Adj. EBITDA figures exclude Therakos & Endo International Pharmaceuticals; 1 Assumes merger net synergies of $150 million. Legacy Endo debt, which governs BrandedCo, caps pro forma incorporation of proj ec ted run - rate synergies at 20% of Adjusted EBITDA (before add - back of synergies) which is not illustrated above. 2 Subject to 25bps step - down when first lien net debt leverage <2.5x 3 Net debt is computed as total debt of $3,689 less cash and cash equivalents of $937 6/27/2025 Pro forma for Merger and Transaction ($ in millions) Sources Uses Repriced Term Loan $ 1,489 Repriced Term Loan $ 1,489 Total Sources $ 1,489 Total Sources $ 1,489 6/27/2025 (Pro Forma Merger) ($ in millions) Amount Leverage Coupon Maturity Cash and Cash Equivalents $ 937 Endo Super Priority Revolver ($400 million) - S + 350 Apr-29 New Par Health Revolver ($150 million) - S + 700 Jul-30 New Par Health First Lien Term Loan 1,200 S + 700 Jul-30 Endo First Lien Term Loan 1,489 TBD Apr-31 Endo Senior Secured Notes 1,000 8.500% Apr-31 Total Debt $ 3,689 3.2 x Total Net Debt 2,752 2.4 x LTM 6/27/2025 Pro Forma Adj. EBITDA 1 $ 1,164 2 3

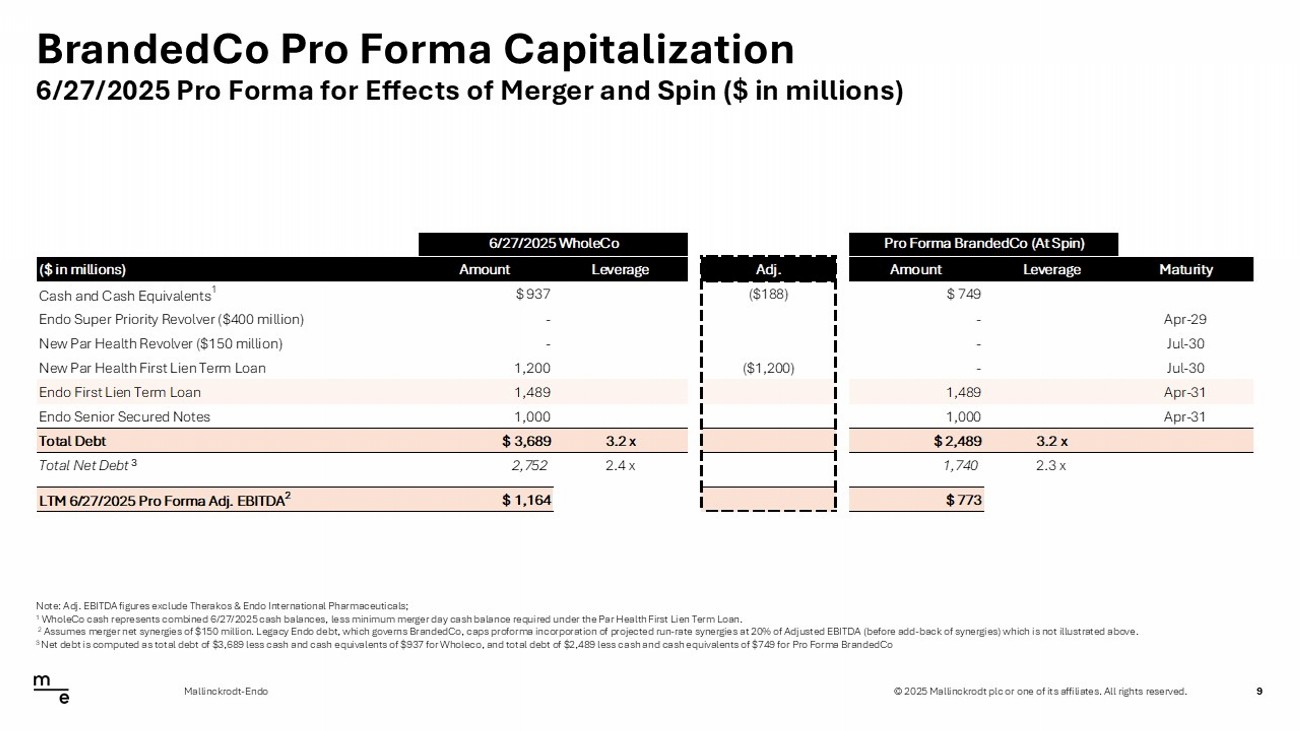

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. BrandedCo Pro Forma Capitalization 9 Mallinckrodt - Endo Note: Adj. EBITDA figures exclude Therakos & Endo International Pharmaceuticals; 1 WholeCo cash represents combined 6/27/2025 cash balances, less minimum merger day cash balance required under the Par Health Fi rst Lien Term Loan. 2 Assumes merger net synergies of $150 million. Legacy Endo debt, which governs BrandedCo, caps proforma incorporation of proje ct ed run - rate synergies at 20% of Adjusted EBITDA (before add - back of synergies) which is not illustrated above. 3 Net debt is computed as total debt of $3,689 less cash and cash equivalents of $937 for Wholeco, and total debt of $2,489 les s c ash and cash equivalents of $749 for Pro Forma BrandedCo 6/27/2025 Pro Forma for Effects of Merger and Spin ($ in millions) 6/27/2025 WholeCo Pro Forma BrandedCo (At Spin) ($ in millions) Amount Leverage Adj. Amount Leverage Maturity Cash and Cash Equivalents 1 $ 937 ($188) $ 749 Endo Super Priority Revolver ($400 million) - - Apr-29 New Par Health Revolver ($150 million) - - Jul-30 New Par Health First Lien Term Loan 1,200 ($1,200) - Jul-30 Endo First Lien Term Loan 1,489 1,489 Apr-31 Endo Senior Secured Notes 1,000 1,000 Apr-31 Total Debt $ 3,689 3.2 x $ 2,489 3.2 x Total Net Debt 2,752 2.4 x 1,740 2.3 x LTM 6/27/2025 Pro Forma Adj. EBITDA 2 $ 1,164 $(391) $ 773 3

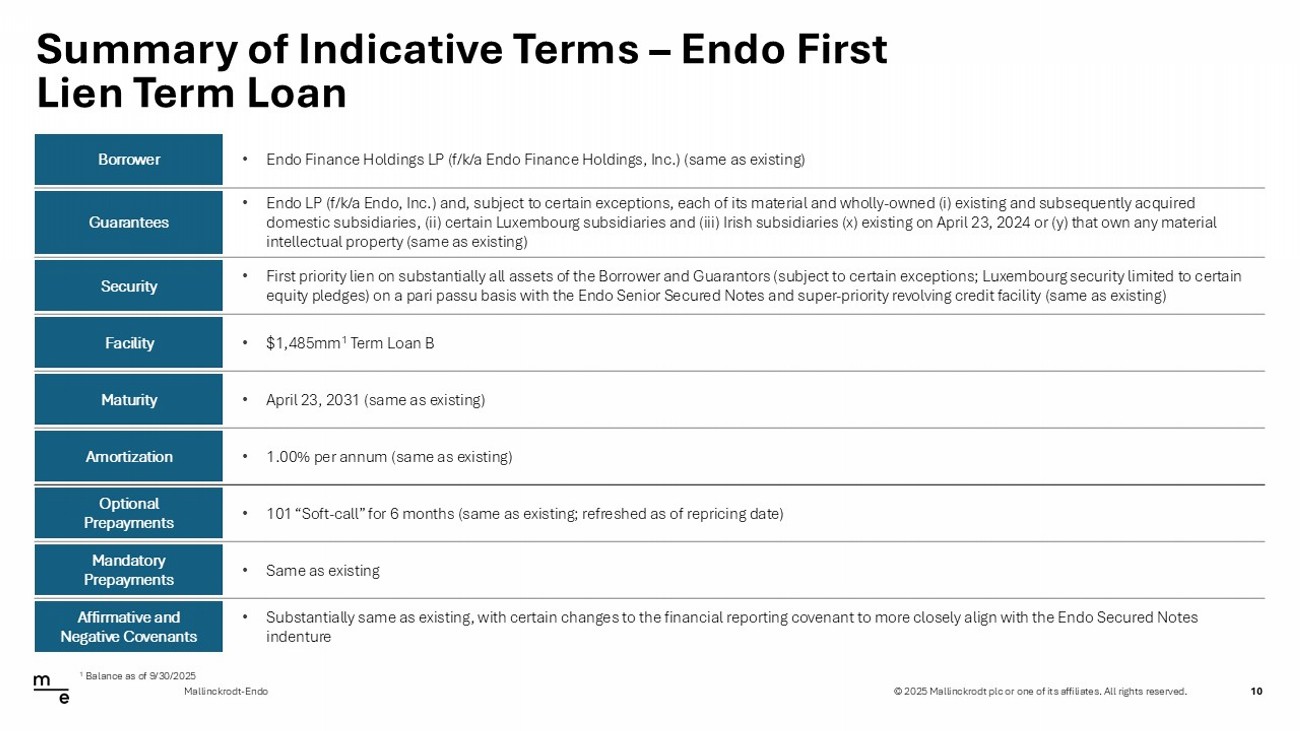

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Summary of Indicative Terms – Endo First Lien Term Loan 10 Mallinckrodt - Endo • Endo Finance Holdings LP (f/k/a Endo Finance Holdings, Inc.) (same as existing) Borrower • Endo LP (f/k/a Endo, Inc.) and, subject to certain exceptions, each of its material and wholly - owned (i) existing and subsequent ly acquired domestic subsidiaries, (ii) certain Luxembourg subsidiaries and (iii) Irish subsidiaries (x) existing on April 23, 2024 or (y ) t hat own any material intellectual property (same as existing) Guarantees • First priority lien on substantially all assets of the Borrower and Guarantors (subject to certain exceptions; Luxembourg sec uri ty limited to certain equity pledges) on a pari passu basis with the Endo Senior Secured Notes and super - priority revolving credit facility (same as e xisting) Security • $1,485mm 1 Term Loan B Facility • April 23, 2031 (same as existing) Maturity • 1.00% per annum (same as existing) Amortization • 101 “Soft - call” for 6 months (same as existing; refreshed as of repricing date) Optional Prepayments • Same as existing Mandatory Prepayments • Substantially same as existing, with certain changes to the financial reporting covenant to more closely align with the Endo Sec ured Notes indenture Affirmative and Negative Covenants 1 Balance as of 9/30/2025

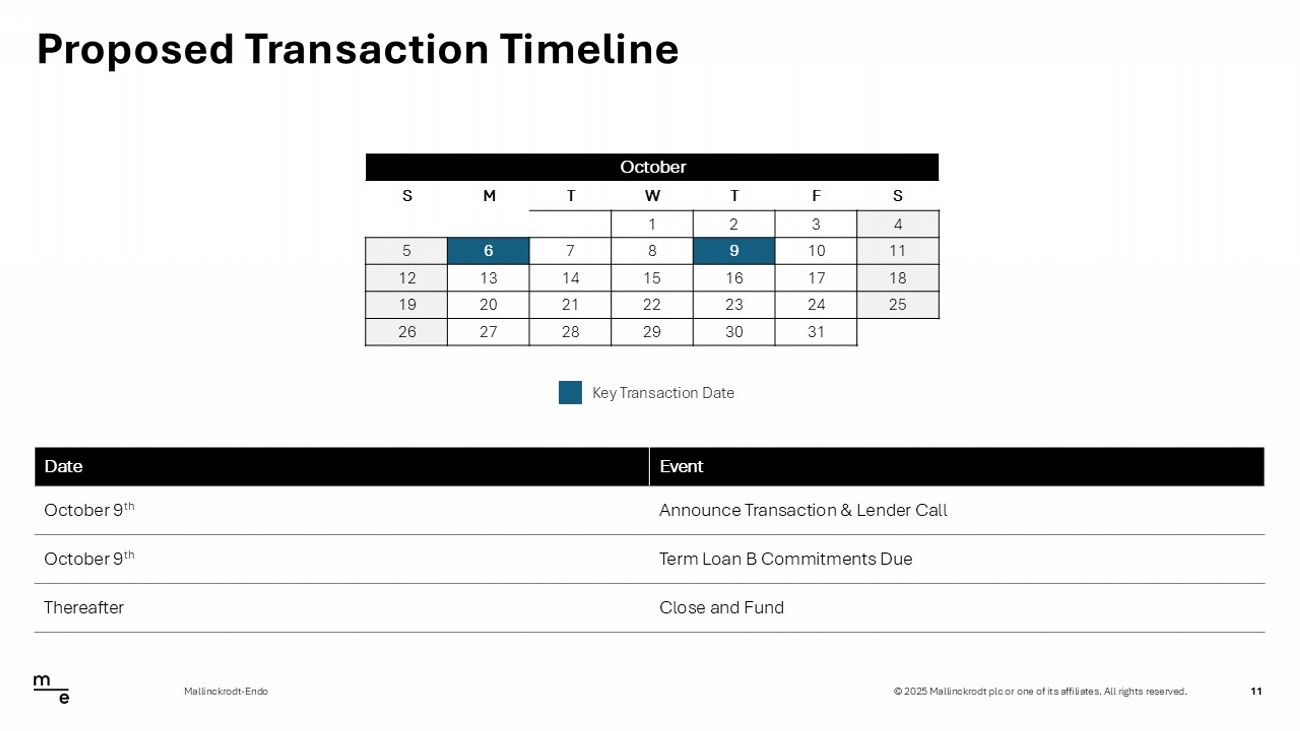

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Proposed Transaction Timeline 11 Mallinckrodt - Endo October S F T W T M S 4 3 2 1 11 10 9 8 7 6 5 18 17 16 15 14 13 12 25 24 23 22 21 20 19 31 30 29 28 27 26 Key Transaction Date Event Date Announce Transaction & Lender Call October 9 th Term Loan B Commitments Due October 9 th Close and Fund Thereafter

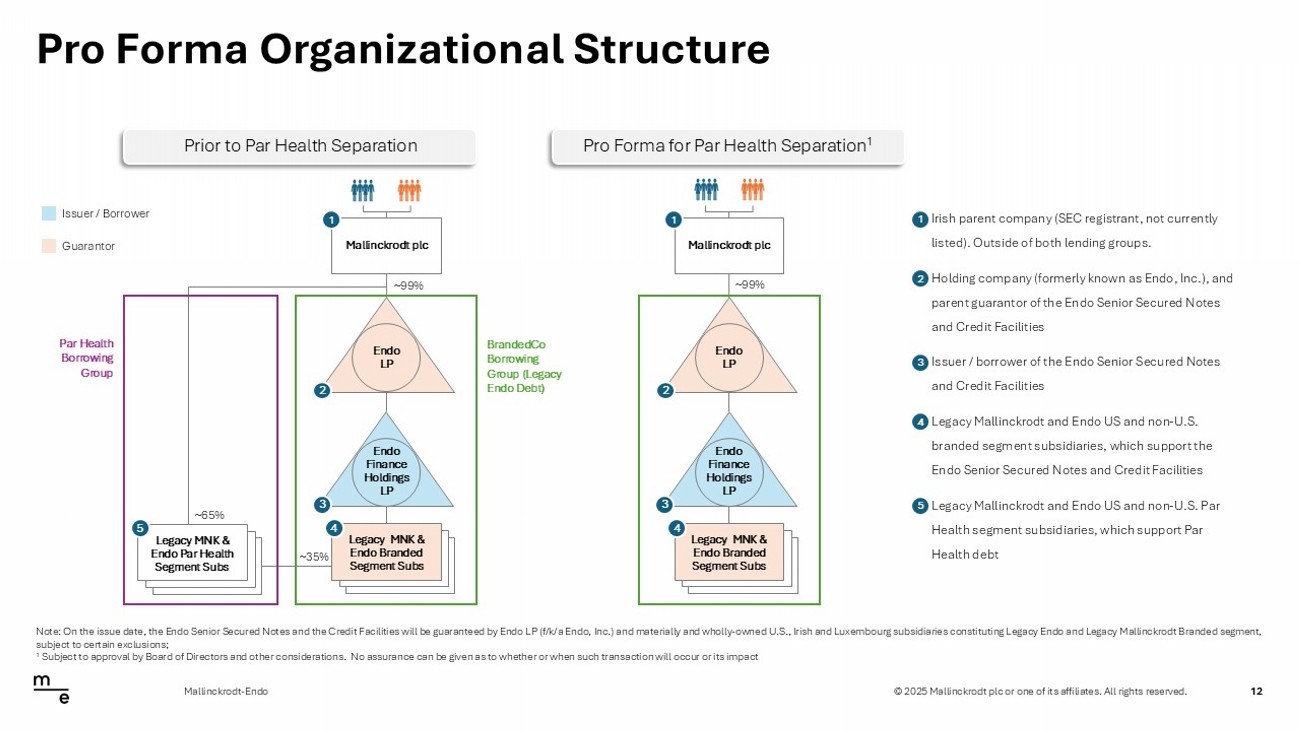

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. • Irish parent company (SEC registrant, not currently listed). Outside of both lending groups. • Holding company (formerly known as Endo, Inc.), and parent guarantor of the Endo Senior Secured Notes and Credit Facilities • Issuer / borrower of the Endo Senior Secured Notes and Credit Facilities • Legacy Mallinckrodt and Endo US and non - U.S. branded segment subsidiaries, which support the Endo Senior Secured Notes and Credit Facilities • Legacy Mallinckrodt and Endo US and non - U.S. Par Health segment subsidiaries, which support Par Health debt 1 2 3 4 5 Pro Forma Organizational Structure 12 Mallinckrodt - Endo Note: On the issue date, the Endo Senior Secured Notes and the Credit Facilities will be guaranteed by Endo LP (f/k/a Endo, I nc. ) and materially and wholly - owned U.S., Irish and Luxembourg subsidiaries constituting Legacy Endo and Legacy Mallinckrodt Brand ed segment, subject to certain exclusions; 1 Subject to approval by Board of Directors and other considerations. No assurance can be given as to whether or when such tra ns action will occur or its impact Issuer / Borrower Guarantor Mallinckrodt plc Endo Finance Holdings LP Legacy MNK & Endo Par Health Segment Subs ~65% ~35% 1 2 ~99% 3 5 Legacy MNK & Endo Branded Segment Subs 4 BrandedCo Borrowing Group (Legacy Endo Debt) Par Health Borrowing Group Endo LP Prior to Par Health Separation Mallinckrodt plc Endo Finance Holdings LP 1 2 3 Legacy MNK & Endo Branded Segment Subs 4 Endo LP Pro Forma for Par Health Separation 1 ~99%

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Mallinckrodt - Endo Overview 13 02

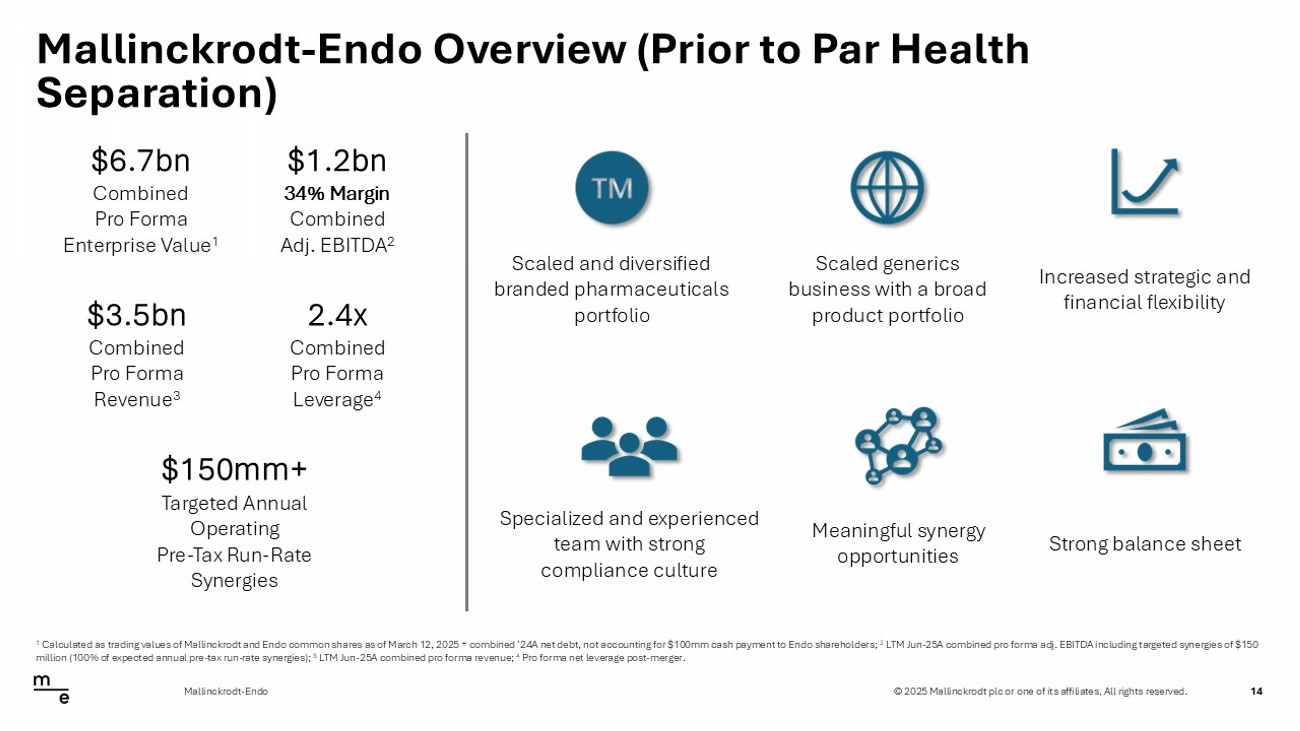

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Mallinckrodt - Endo Overview (Prior to Par Health Separation) 14 Mallinckrodt - Endo Scaled and diversified branded pharmaceuticals portfolio Scaled generics business with a broad product portfolio Increased strategic and financial flexibility Specialized and experienced team with strong compliance culture Meaningful synergy opportunities Strong balance sheet $6.7bn Combined Pro Forma Enterprise Value 1 $3.5bn Combined Pro Forma Revenue 3 $150mm+ Targeted Annual Operating Pre - Tax Run - Rate Synergies $1.2bn 34% Margin Combined Adj. EBITDA 2 2.4x Combined Pro Forma Leverage 4 1 Calculated as trading values of Mallinckrodt and Endo common shares as of March 12, 2025 + combined ’24A net debt, not accoun ti ng for $100mm cash payment to Endo shareholders; 2 LTM Jun - 25A combined pro forma adj. EBITDA including targeted synergies of $150 million (100% of expected annual pre - tax run - rate synergies); 3 LTM Jun - 25A combined pro forma revenue; 4 Pro forma net leverage post - merger.

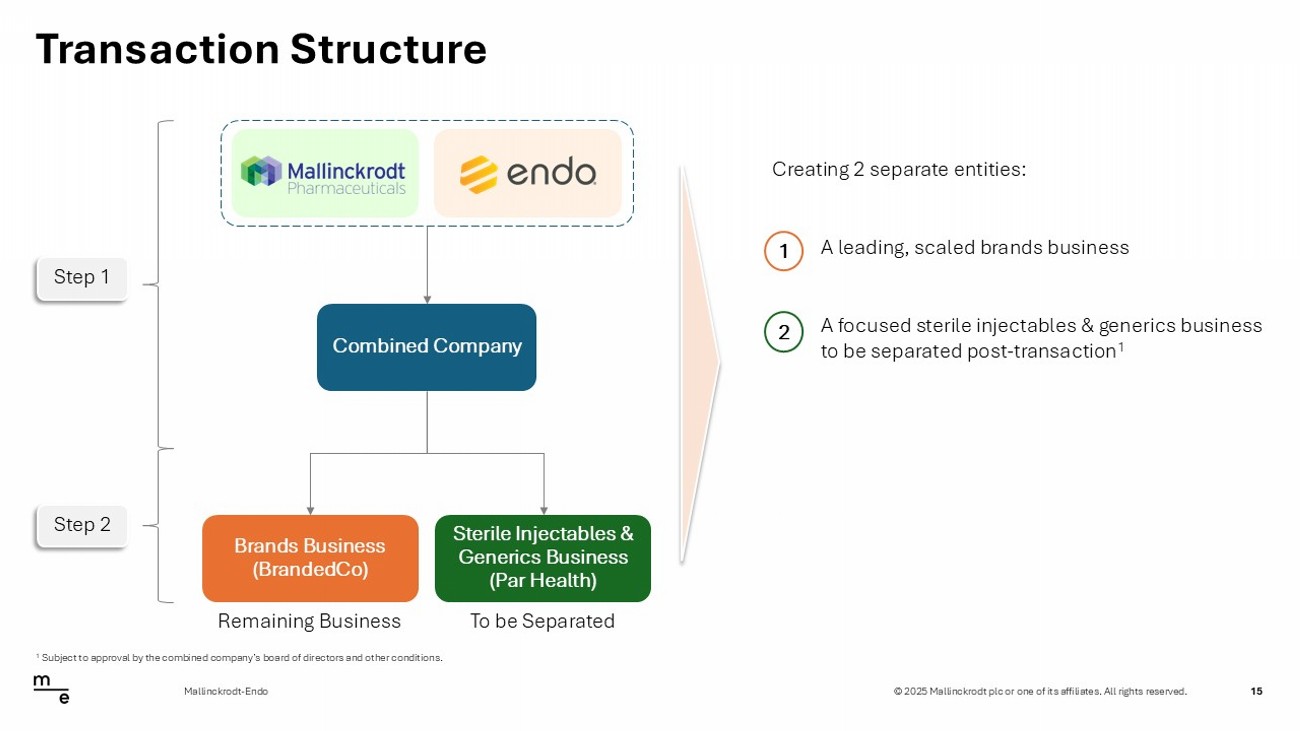

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Transaction Structure 15 Mallinckrodt - Endo Creating 2 separate entities: 1 A leading, scaled brands business 2 A focused sterile injectables & generics business to be separated post - transaction 1 Combined Company Sterile Injectables & Generics Business (Par Health) Brands Business (BrandedCo) Step 1 Step 2 Remaining Business To be Separated 1 Subject to approval by the combined company’s board of directors and other conditions.

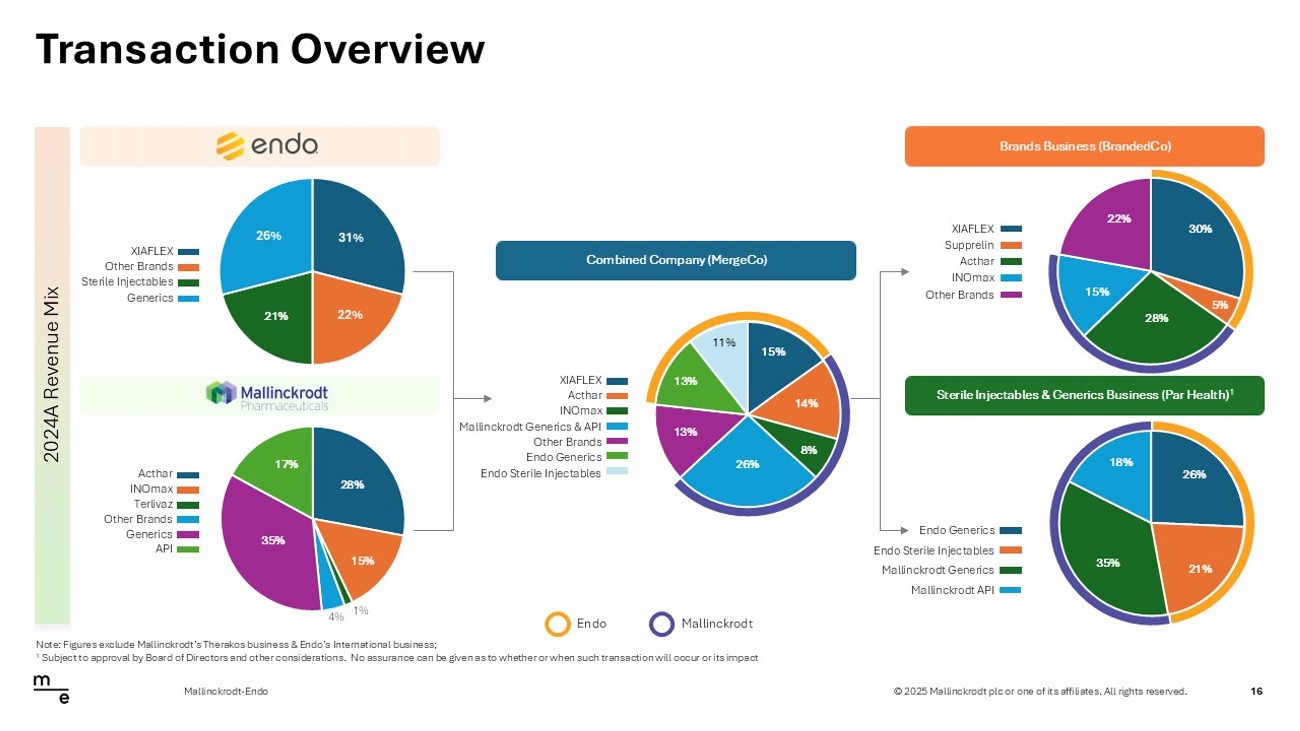

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. 15% 14% 8% 26% 13% 13% 11% Transaction Overview 16 Mallinckrodt - Endo 2024A Revenue Mix Brands Business (BrandedCo) Sterile Injectables & Generics Business (Par Health) 1 Combined Company (MergeCo) Endo Mallinckrodt XIAFLEX Other Brands Sterile Injectables Generics Terlivaz Other Brands Generics API INOmax Acthar INOmax Mallinckrodt Generics & API Other Brands Endo Generics Acthar XIAFLEX Endo Sterile Injectables Acthar INOmax Other Brands Supprelin XIAFLEX Mallinckrodt Generics Mallinckrodt API Endo Sterile Injectables Endo Generics Note: Figures exclude Mallinckrodt’s Therakos business & Endo’s International business; 1 Subject to approval by Board of Directors and other considerations. No assurance can be given as to whether or when such tra ns action will occur or its impact 28% 15% 1% 4% 35% 17% 29% 21% 21% 29% 31% 22% 26%

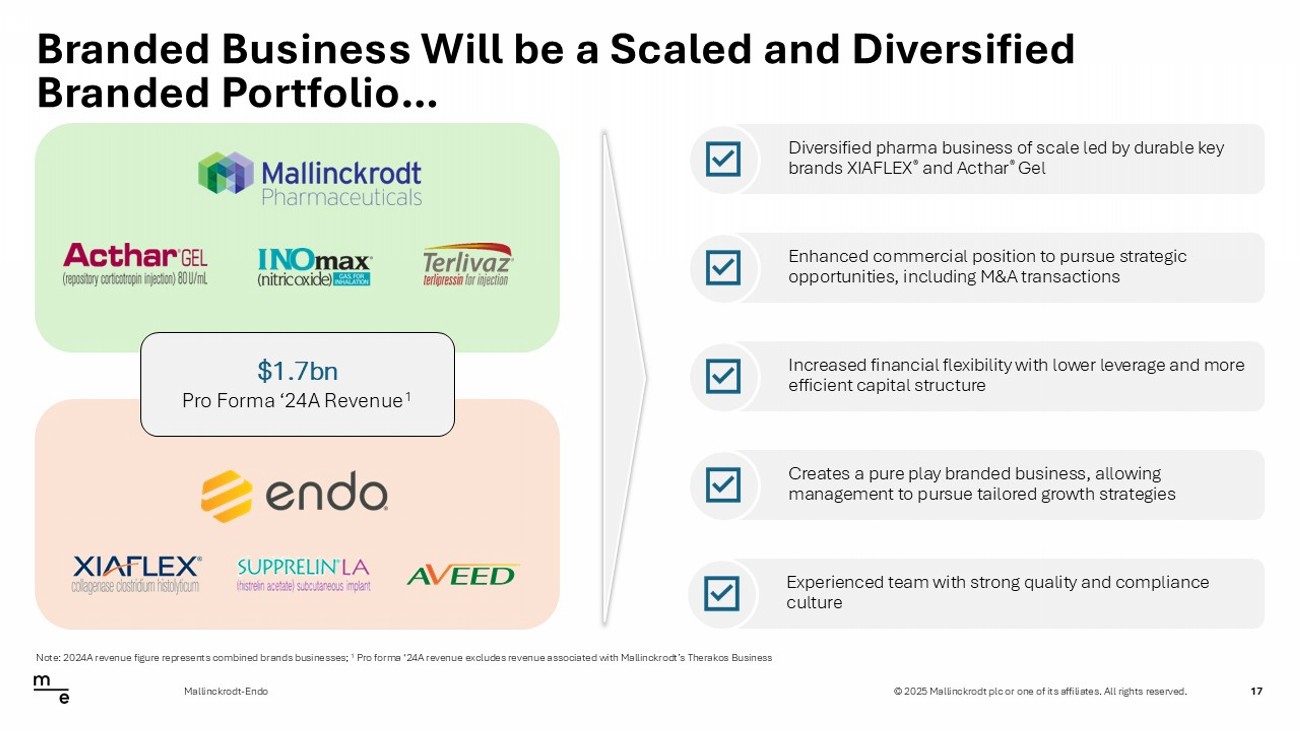

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Branded Business Will be a Scaled and Diversified Branded Portfolio… 17 Mallinckrodt - Endo Diversified pharma business of scale led by durable key brands XIAFLEX ® and Acthar ® Gel $1.7bn Pro Forma ‘24A Revenue 1 Enhanced commercial position to pursue strategic opportunities, including M&A transactions Increased financial flexibility with lower leverage and more efficient capital structure Creates a pure play branded business, allowing management to pursue tailored growth strategies Experienced team with strong quality and compliance culture Note: 2024A revenue figure represents combined brands businesses; 1 Pro forma ‘24A revenue excludes revenue associated with Mallinckrodt’s Therakos Business

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Branded Business Overview 18 03

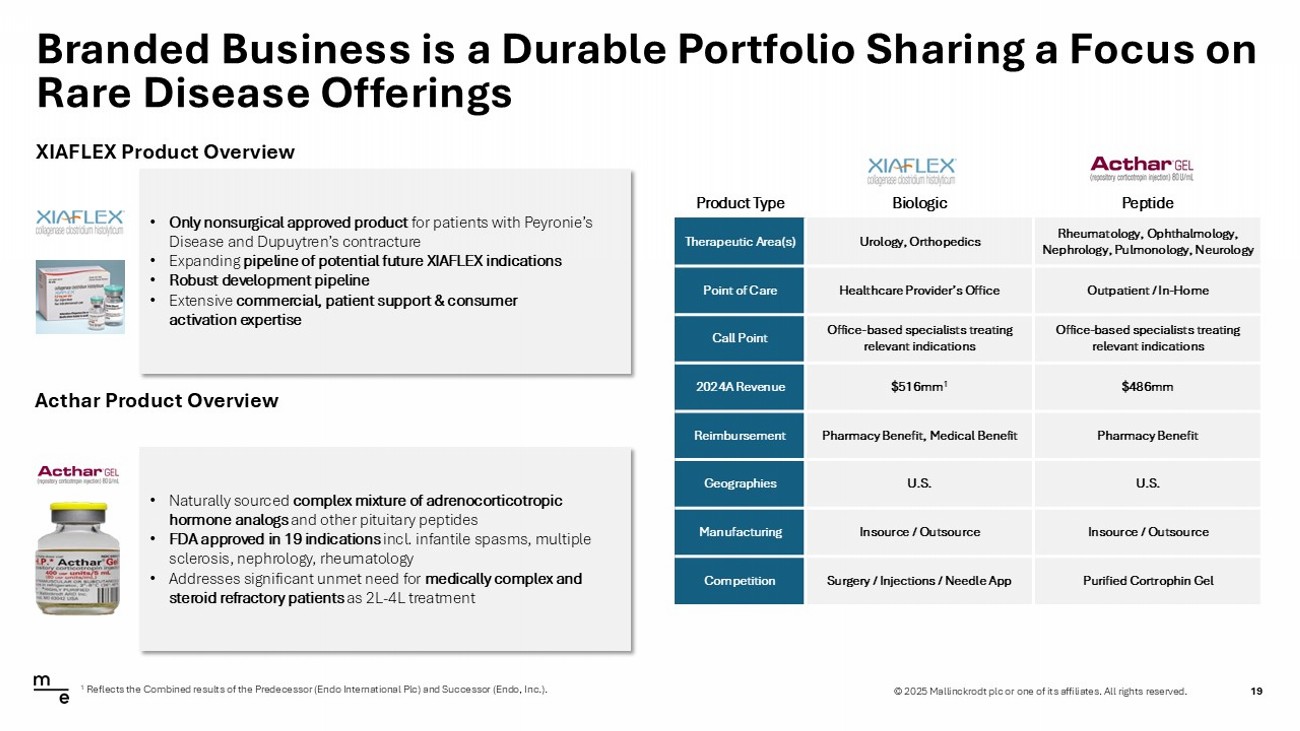

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Branded Business is a Durable Portfolio Sharing a Focus on Rare Disease Offerings 19 XIAFLEX Product Overview Acthar Product Overview • Only nonsurgical approved product for patients with Peyronie’s Disease and Dupuytren’s contracture • Expanding pipeline of potential future XIAFLEX indications • Robust development pipeline • Extensive commercial, patient support & consumer activation expertise • Naturally sourced complex mixture of adrenocorticotropic hormone analogs and other pituitary peptides • FDA approved in 19 indications incl. infantile spasms, multiple sclerosis, nephrology, rheumatology • Addresses significant unmet need for medically complex and steroid refractory patients as 2L - 4L treatment Peptide Biologic Product Type Rheumatology, Ophthalmology, Nephrology, Pulmonology, Neurology Urology, Orthopedics Therapeutic Area(s) Outpatient / In - Home Healthcare Provider’s Office Point of Care Office - based specialists treating relevant indications Office - based specialists treating relevant indications Call Point $486mm $516mm 1 2024A Revenue Pharmacy Benefit Pharmacy Benefit, Medical Benefit Reimbursement U.S. U.S. Geographies Insource / Outsource Insource / Outsource Manufacturing Purified Cortrophin Gel Surgery / Injections / Needle App Competition 1 Reflects the Combined results of the Predecessor (Endo International Plc) and Successor (Endo, Inc.).

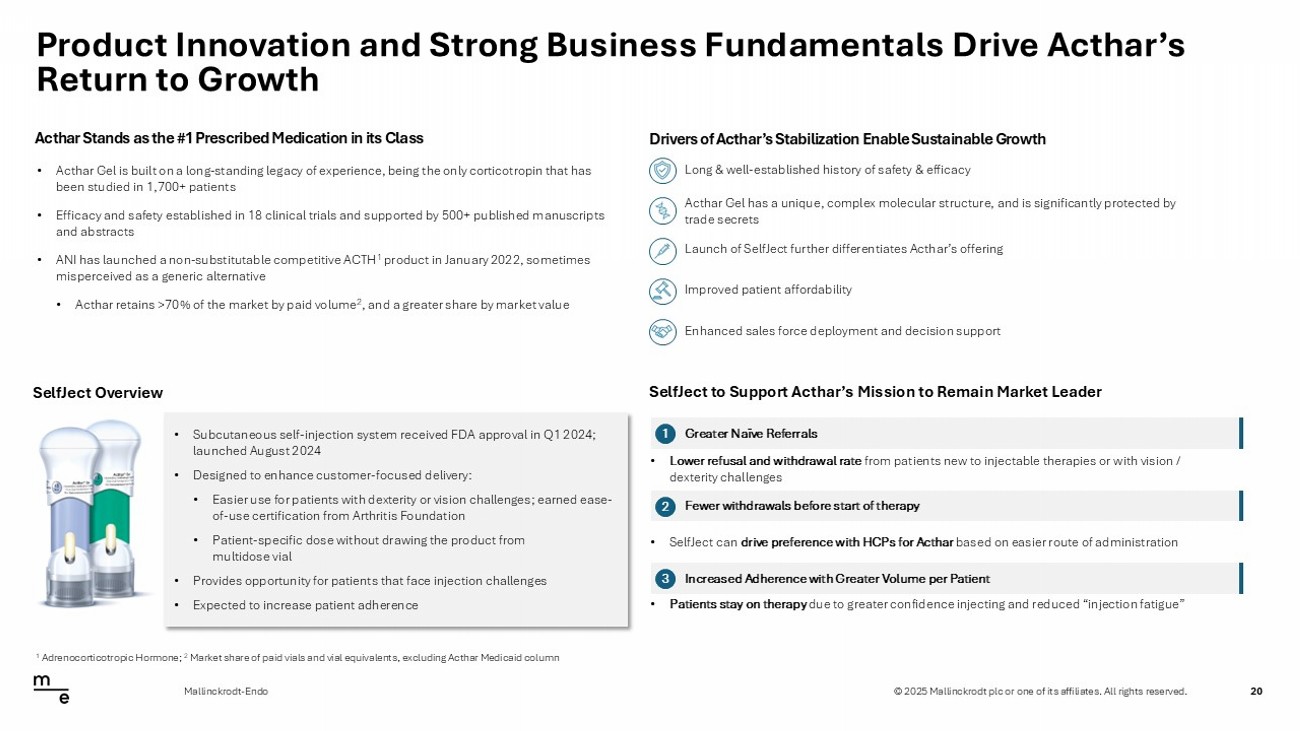

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Product Innovation and Strong Business Fundamentals Drive Acthar’s Return to Growth 20 Mallinckrodt - Endo Launch of SelfJect further differentiates Acthar’s offering • Acthar Gel is built on a long - standing legacy of experience, being the only corticotropin that has been studied in 1,700+ patients • Efficacy and safety established in 18 clinical trials and supported by 500+ published manuscripts and abstracts • ANI has launched a non - substitutable competitive ACTH 1 product in January 2022, sometimes misperceived as a generic alternative • Acthar retains >70% of the market by paid volume 2 , and a greater share by market value Long & well - established history of safety & efficacy Acthar Gel has a unique, complex molecular structure, and is significantly protected by trade secrets Enhanced sales force deployment and decision support Improved patient affordability Acthar Stands as the #1 Prescribed Medication in its Class Drivers of Acthar’s Stabilization Enable Sustainable Growth 1 Adrenocorticotropic Hormone; 2 Market share of paid vials and vial equivalents, excluding Acthar Medicaid column SelfJect to Support Acthar’s Mission to Remain Market Leader Greater Naïve Referrals 1 Fewer withdrawals before start of therapy 2 Increased Adherence with Greater Volume per Patient 3 • Lower refusal and withdrawal rate from patients new to injectable therapies or with vision / dexterity challenges • SelfJect can drive preference with HCPs for Acthar based on easier route of administration • Patients stay on therapy due to greater confidence injecting and reduced “injection fatigue” SelfJect Overview • Subcutaneous self - injection system received FDA approval in Q1 2024; launched August 2024 • Designed to enhance customer - focused delivery: • Easier use for patients with dexterity or vision challenges; earned ease - of - use certification from Arthritis Foundation • Patient - specific dose without drawing the product from multidose vial • Provides opportunity for patients that face injection challenges • Expected to increase patient adherence

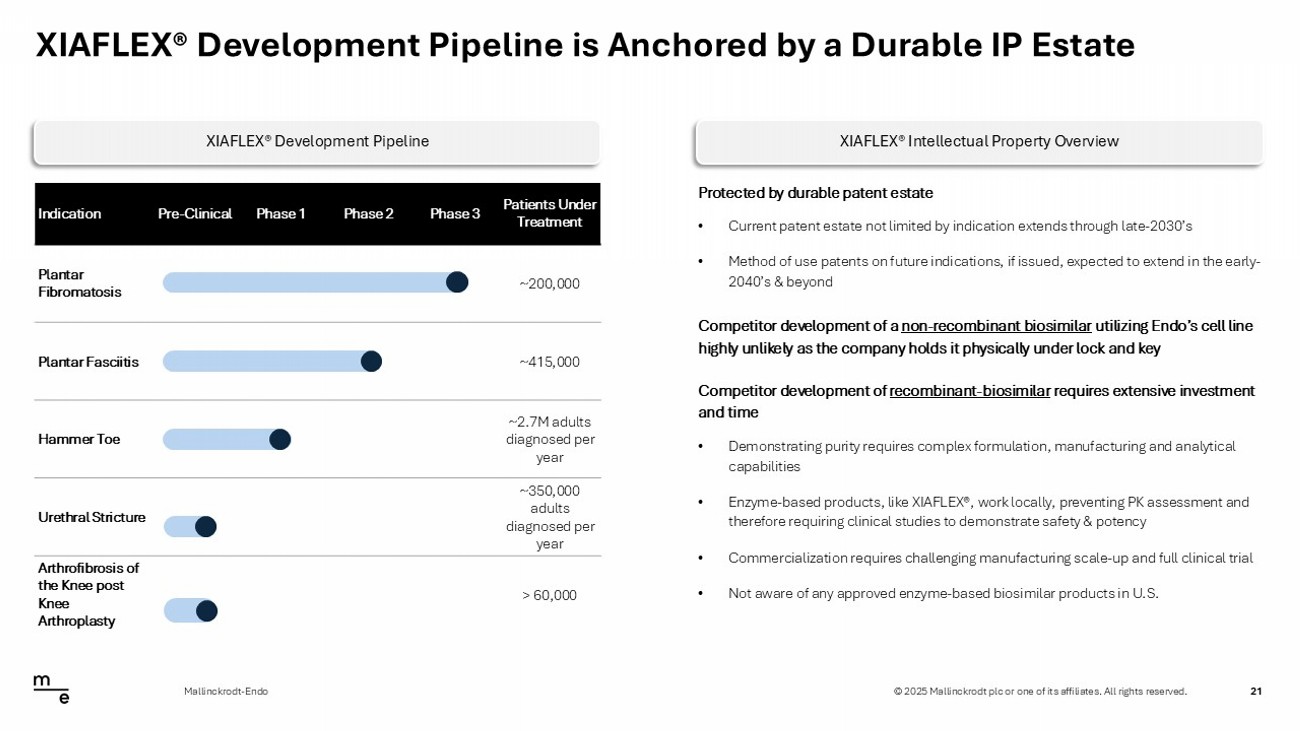

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. XIAFLEX® Development Pipeline is Anchored by a Durable IP Estate 21 Mallinckrodt - Endo Patients Under Treatment Phase 3 Phase 2 Phase 1 Pre - Clinical Indication ~200,000 Plantar Fibromatosis ~415,000 Plantar Fasciitis ~2.7M adults diagnosed per year Hammer Toe ~350,000 adults diagnosed per year Urethral Stricture > 60,000 Arthrofibrosis of the Knee post Knee Arthroplasty Protected by durable patent estate • Current patent estate not limited by indication extends through late - 2030’s • Method of use patents on future indications, if issued, expected to extend in the early - 2040’s & beyond Competitor development of a non - recombinant biosimilar utilizing Endo’s cell line highly unlikely as the company holds it physically under lock and key Competitor development of recombinant - biosimilar requires extensive investment and time • Demonstrating purity requires complex formulation, manufacturing and analytical capabilities • Enzyme - based products, like XIAFLEX®, work locally, preventing PK assessment and therefore requiring clinical studies to demonstrate safety & potency • Commercialization requires challenging manufacturing scale - up and full clinical trial • Not aware of any approved enzyme - based biosimilar products in U.S. XIAFLEX® Development Pipeline XIAFLEX® Intellectual Property Overview

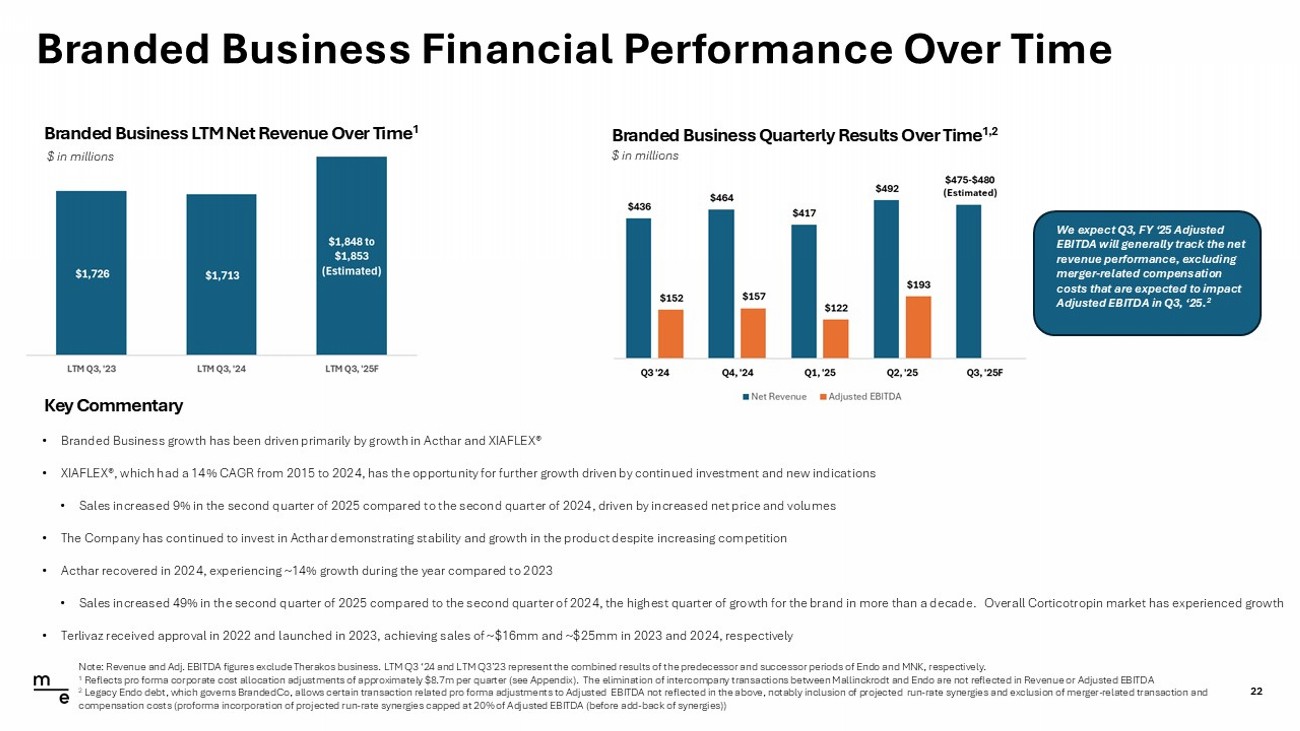

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Branded Business Financial Performance Over Time 22 Key Commentary • Branded Business growth has been driven primarily by growth in Acthar and XIAFLEX® • XIAFLEX®, which had a 14% CAGR from 2015 to 2024, has the opportunity for further growth driven by continued investment and n ew indications • Sales increased 9% in the second quarter of 2025 compared to the second quarter of 2024, driven by increased net price and vo lum es • The Company has continued to invest in Acthar demonstrating stability and growth in the product despite increasing competitio n • Acthar recovered in 2024, experiencing ~14% growth during the year compared to 2023 • Sales increased 49% in the second quarter of 2025 compared to the second quarter of 2024, the highest quarter of growth for t he brand in more than a decade. Overall Corticotropin market has experienced growth • Terlivaz received approval in 2022 and launched in 2023, achieving sales of ~$16mm and ~$25mm in 2023 and 2024, respectively Branded Business LTM Net Revenue Over Time 1 $ in millions Branded Business Quarterly Results Over Time 1,2 $ in millions $157 Note: Revenue and Adj. EBITDA figures exclude Therakos business. LTM Q3 ‘24 and LTM Q3’23 represent the combined results of t he predecessor and successor periods of Endo and MNK, respectively. 1 Reflects pro forma corporate cost allocation adjustments of approximately $8.7m per quarter (see Appendix). The elimination of intercompany transactions between Mallinckrodt and Endo are not reflected in Revenue or Adjusted EBITDA 2 Legacy Endo debt, which governs BrandedCo, allows certain transaction related pro forma adjustments to Adjusted EBITDA not r ef lected in the above, notably inclusion of projected run - rate synergies and exclusion of merger - related transaction and compensation costs (proforma incorporation of projected run - rate synergies capped at 20% of Adjusted EBITDA (before add - back of synergies)) We expect Q3, FY ‘25 Adjusted EBITDA will generally track the net revenue performance, excluding merger - related compensation costs that are expected to impact Adjusted EBITDA in Q3, ‘25. 2

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Appendix 23 04

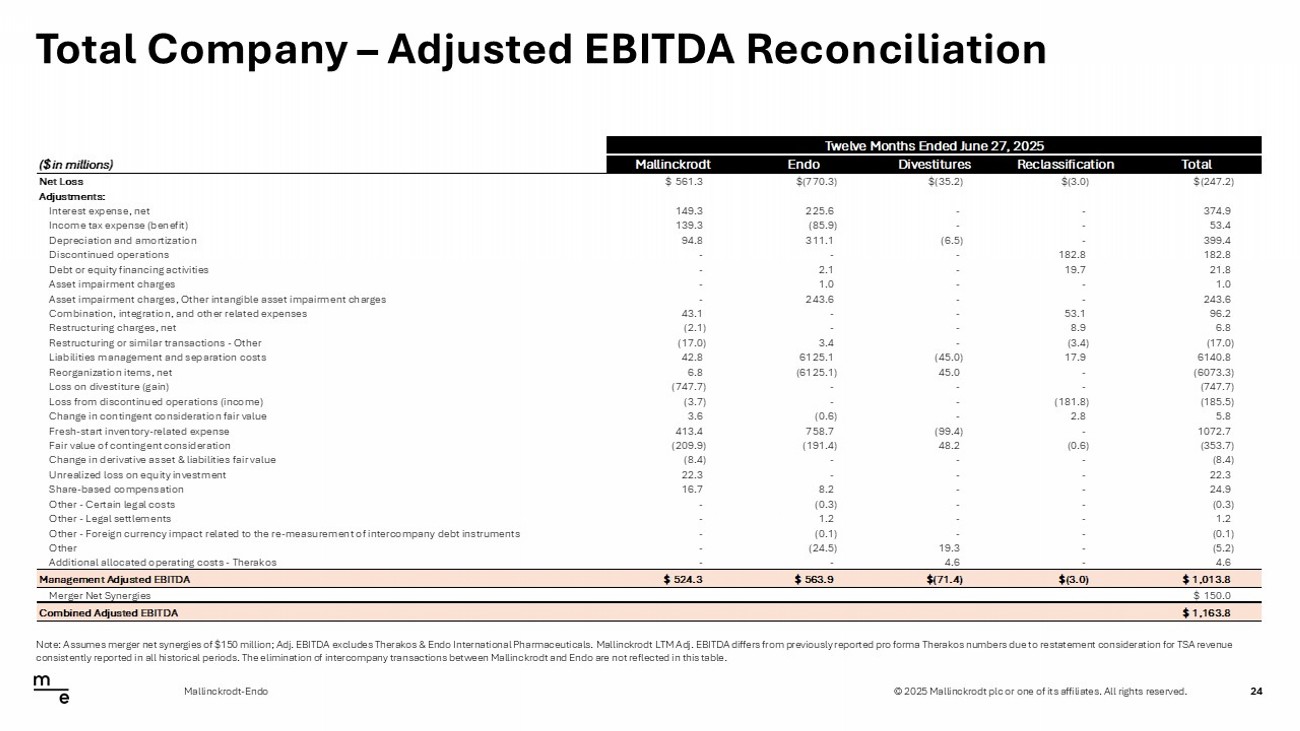

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. Total Company – Adjusted EBITDA Reconciliation 24 Mallinckrodt - Endo Note: Assumes merger net synergies of $150 million; Adj. EBITDA excludes Therakos & Endo International Pharmaceuticals. Malli nck rodt LTM Adj. EBITDA differs from previously reported pro forma Therakos numbers due to restatement consideration for TSA rev enu e consistently reported in all historical periods. The elimination of intercompany transactions between Mallinckrodt and Endo a re not reflected in this table. Twelve Months Ended June 27, 2025 ($ in millions) Mallinckrodt Endo Divestitures Reclassification Total Net Loss $561.3 $(770.3) $(35.2) $(3.0) $(247.2) Adjustments: Interest expense, net 149.3 225.6 - - 374.9 Income tax expense (benefit) 139.3 (85.9) - - 53.4 Depreciation and amortization 94.8 311.1 (6.5) - 399.4 Discontinued operations - - - 182.8 182.8 Debt or equity financing activities - 2.1 - 19.7 21.8 Asset impairment charges - 1.0 - - 1.0 Asset impairment charges, Other intangible asset impairment charges - 243.6 - - 243.6 Combination, integration, and other related expenses 43.1 - - 53.1 96.2 Restructuring charges, net (2.1) - - 8.9 6.8 Restructuring or similar transactions - Other (17.0) 3.4 - (3.4) (17.0) Liabilities management and separation costs 42.8 6125.1 (45.0) 17.9 6140.8 Reorganization items, net 6.8 (6125.1) 45.0 - (6073.3) Loss on divestiture (gain) (747.7) - - - (747.7) Loss from discontinued operations (income) (3.7) - - (181.8) (185.5) Change in contingent consideration fair value 3.6 (0.6) - 2.8 5.8 Fresh-start inventory-related expense 413.4 758.7 (99.4) - 1072.7 Fair value of contingent consideration (209.9) (191.4) 48.2 (0.6) (353.7) Change in derivative asset & liabilities fair value (8.4) - - - (8.4) Unrealized loss on equity investment 22.3 - - - 22.3 Share-based compensation 16.7 8.2 - - 24.9 Other - Certain legal costs - (0.3) - - (0.3) Other - Legal settlements - 1.2 - - 1.2 Other - Foreign currency impact related to the re-measurement of intercompany debt instruments - (0.1) - - (0.1) Other - (24.5) 19.3 - (5.2) Additional allocated operating costs - Therakos - - 4.6 - 4.6 Management Adjusted EBITDA $524.3 $563.9 $(71.4) $(3.0) $1,013.8 Merger Net Synergies $150.0 Combined Adjusted EBITDA $1,163.8

© 2025 Mallinckrodt plc or one of its affiliates. All rights reserved. 25