Information Statement dated October 30, 2025

PROMPT ACTION IS REQUIRED BY ALL BROKERS AND SHAREHOLDERS

PLEASE COMPLETE YOUR CERTIFICATION FORM AS SOON AS POSSIBLE—IF MALLINCKRODT HAS NOT RECEIVED SUFFICIENT VALID CERTIFICATION FORMS FROM QUALIFIED SHAREHOLDERS BY NOVEMBER 7, 2025, AT 5:30 P.M. (EASTERN TIME IN THE UNITED STATES) (OR SUCH OTHER DATE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION), THE MALLINCKRODT BOARD MAY DETERMINE NOT TO PROCEED WITH THE SPIN-OFF

FAILURE TO PROPERLY AND TIMELY COMPLETE THE CERTIFICATION FORM IN ACCORDANCE WITH THE INSTRUCTIONS IN THIS INFORMATION STATEMENT WILL RESULT IN YOUR ENTITLEMENT TO PAR HEALTH COMMON STOCK OR CASH IN THE SPIN OFF LAPSING AND EXPIRING

This Information Statement relates to the allocation by Mallinckrodt plc, a public limited company incorporated in Ireland (and that is in the process of changing its name to Keenova Therapeutics plc) (“Mallinckrodt”), of all of the issued and outstanding shares of common stock, par value $0.01 per share (the “Par Health Common Stock”), of Par Health, Inc., a Delaware corporation (“we,” “us,” “our,” “Par Health” or the “Company”), to Mallinckrodt shareholders (the “Spin-off”). The Spin-off is being implemented by way of a redemption (as defined herein, the “Redemption”) of all of Mallinckrodt’s issued and outstanding 2025 preferred shares, par value $0.001 per share, issued on or around October 10, 2025 and governed by the Mallinckrodt Preferred Share Terms (the “Mallinckrodt Preferred Shares”) comprising 1,796,196,578,472 Mallinckrodt Preferred Shares, upon which the Mallinckrodt Preferred Shares shall automatically be cancelled and no longer be outstanding. In connection with the Redemption and pursuant to Irish law, Mallinckrodt will allocate the right to receive 39,421,398 shares of Par Health Common Stock, being one hundred percent (100%) of the outstanding shares of Par Health Common Stock as of the Redemption Date (as defined below), to certain holders of record of Mallinckrodt Preferred Shares as of 5:30 p.m. (Eastern Time in the United States) on October 27, 2025 (the “Record Date”), as further described herein. This Information Statement is being furnished to you as a holder of Mallinckrodt Preferred Shares.

At the time of the Spin-off, Par Health will hold Mallinckrodt’s generic pharmaceuticals (including active pharmaceutical ingredients (“APIs”)) and sterile injectables businesses. Par Health will operate as an independent, private company following the Spin-off and will not be listed on a securities exchange.

At the closing of the Redemption (the date of such closing, the “Redemption Date”), the Mallinckrodt Preferred Shares will be redeemed in exchange for the following, subject to compliance with the Certification Procedures (as defined in the section of this Information Statement entitled “Terms and Definitions” and described briefly below) and the terms of the Redemption: (i) in the case of Qualified Shareholders (as defined below) only, the right to receive a certain number of shares of Par Health Common Stock for each Mallinckrodt Preferred Share, or (ii) in the case of Non-Qualified Shareholders (as defined below) only, the right to receive a certain amount of cash for each Mallinckrodt Preferred Share, in each case, as described in greater detail in this Information Statement and sometimes referred to as the “Redemption Consideration.” Please refer to the section of this Information Statement entitled “Information About the Transaction” for a detailed description of the Redemption and the Redemption Consideration.

-i-

Only holders of record of Mallinckrodt Preferred Shares as of the Record Date, as reflected in the Mallinckrodt Register of Members (“Record Holders”) (and/or Persons identified by a Record Holder that is a broker, bank or similar organization as the beneficial holders of Mallinckrodt Preferred Shares held by such Record Holder in such capacity on the Record Date (“Street Name Holders”)), that properly and timely complete the Certification Procedures, including the following documents, will be entitled to receive the Redemption Consideration:

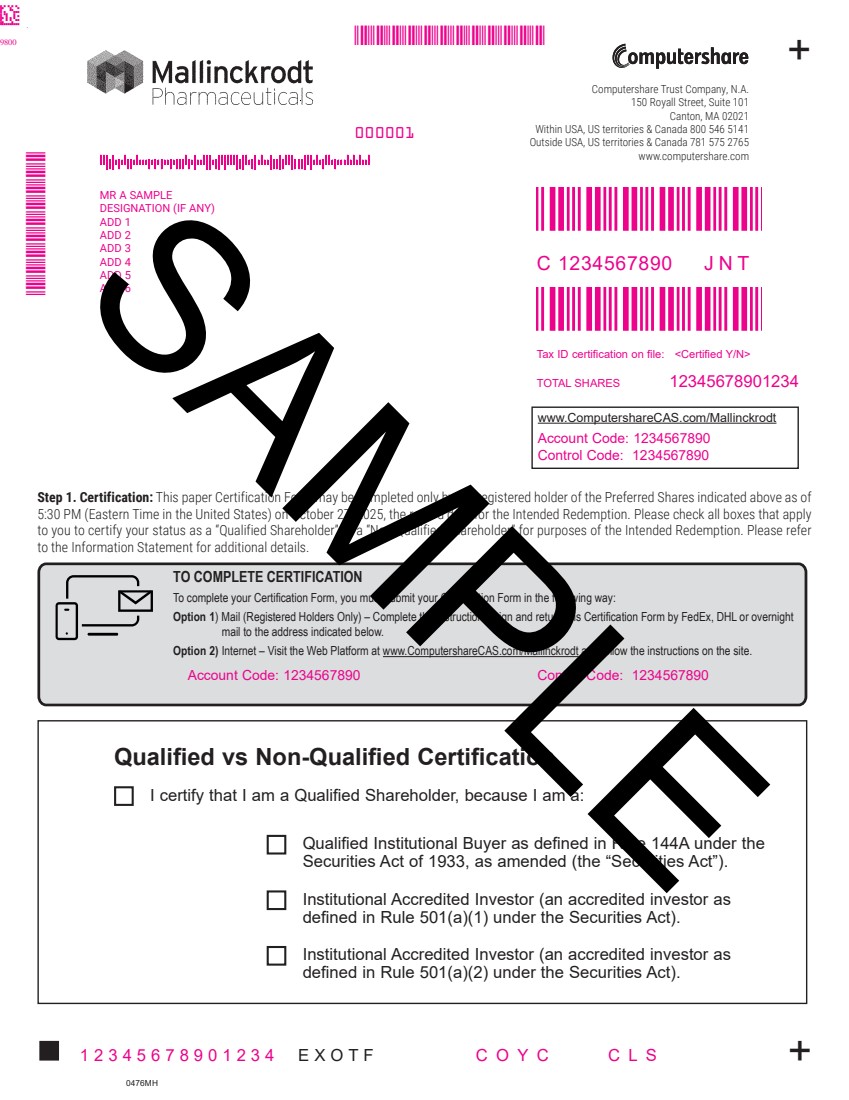

| 1. | A Certification Form to be made available by the Redemption Agent (as defined in the section of this Information Statement entitled “Terms and Definitions”), that requires each Record Holder (and/or Street Name Holder, as applicable) to certify, among other things, whether such person is a qualified institutional buyer (as defined in Rule 144A under the Securities Act of 1933, as amended (together with the rules and regulations promulgated thereunder, the “Securities Act”)), an institutional accredited investor (an “accredited investor” as defined in clauses (1), (2), (3), (7), (8), (9), (12) or (13) of Rule 501(a) under the Securities Act) or a director or officer of Mallinckrodt or Par Health as of the Redemption Date who is also an accredited investor (as defined in Rule 501(a) under the Securities Act); and |

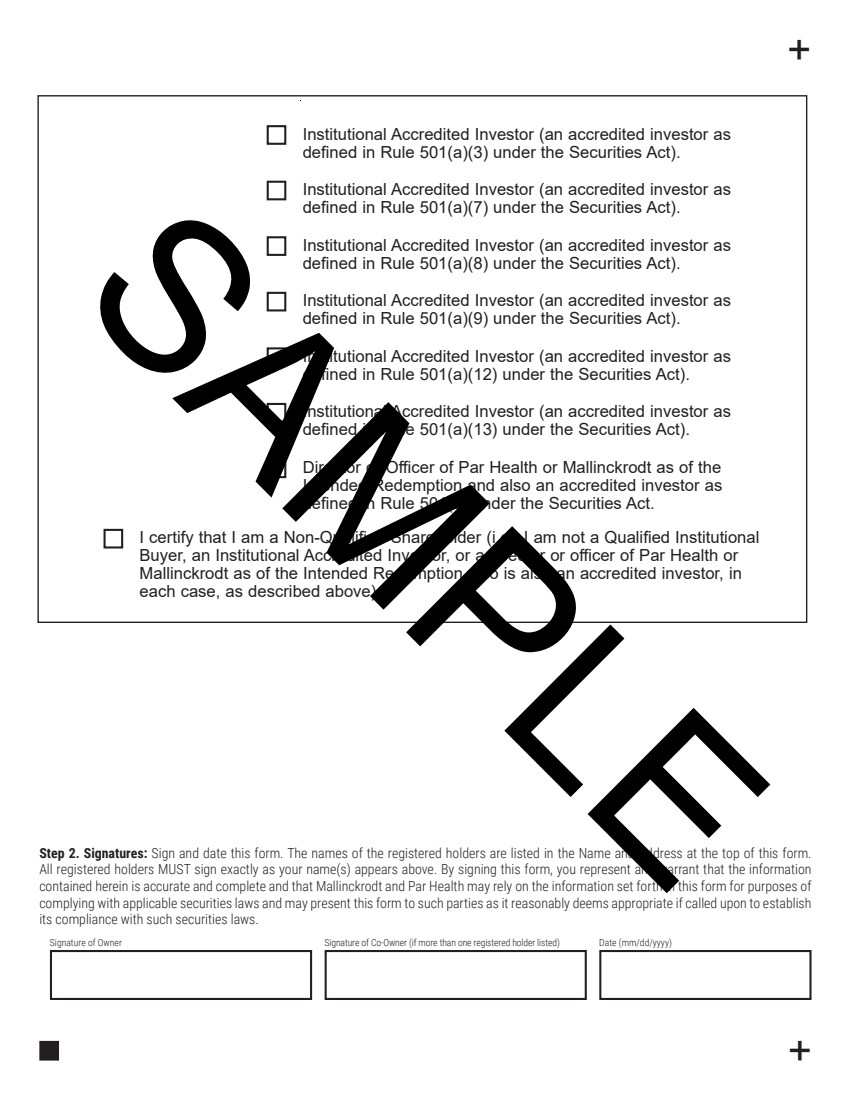

| 2. | Such other documents as may reasonably be required by Mallinckrodt or the Redemption Agent, including a validly executed appropriate Internal Revenue Service (“IRS”) Form W-8 or IRS Form W-9, as applicable, and any other documentation and attachments as may be required to establish that any payment made to such Qualified Shareholder or Non-Qualified Shareholder (and any Record Holder that is a bank, broker or similar organization receiving such payment for the benefit of such Qualified Shareholder or Non-Qualified Shareholder, if applicable) is not subject to U.S. backup withholding tax. |

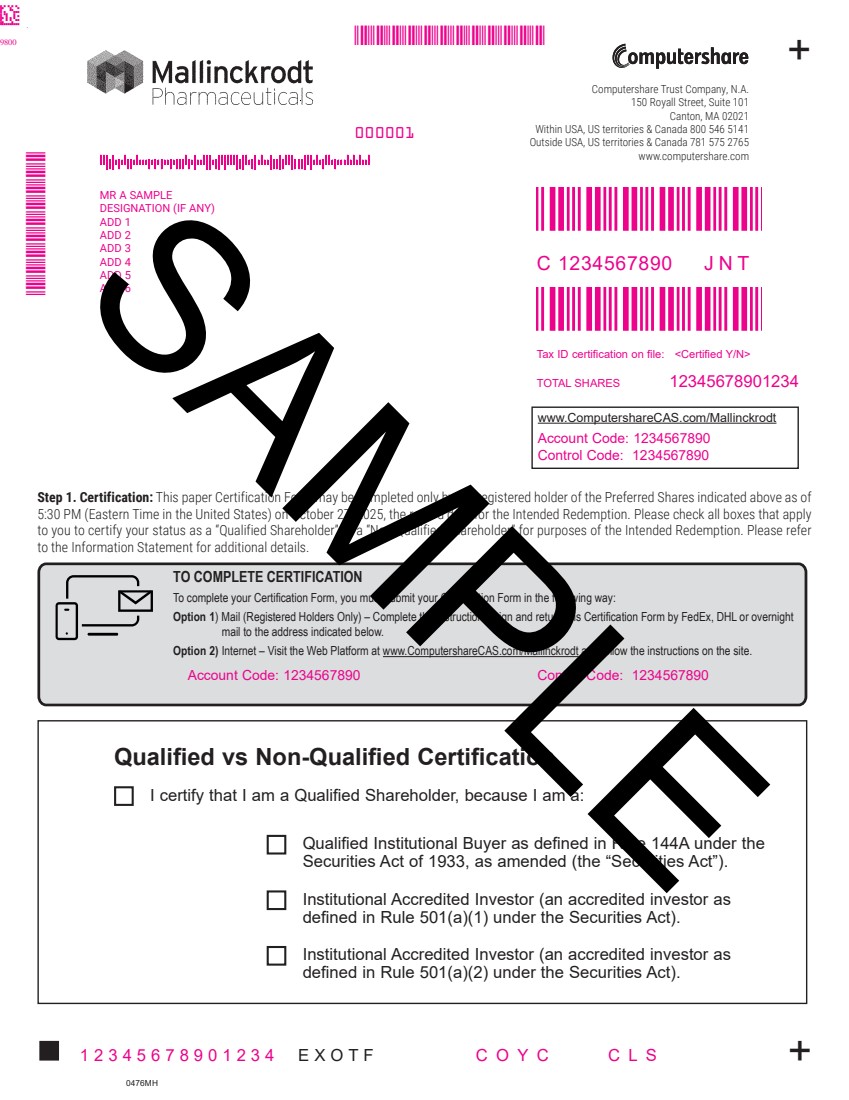

Certification Forms are available electronically through an online portal (the “Certification Portal”) maintained by the Redemption Agent. Record Holders have direct access to the Certification Portal by visiting www.ComputershareCAS.com/Mallinckrodt. Record Holders who are unable to access the Certification Portal may request and return a paper Certification Form as described in this Information Statement. A watermarked sample Certification Form is attached as Annex 1 to this Information Statement in order to facilitate the prompt completion of the Certification Procedures. Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal.

Shareholders must certify truthfully as to their status as a Qualified Shareholder or a Non-Qualified Shareholder—the Certification Form is not an “election” form and shareholders do not have a choice between the right to receive Par Health Common Stock or cash in the Redemption. A shareholder’s entitlement to the Redemption Consideration will lapse and expire if such shareholder does not accurately and timely complete a Certification Form and otherwise comply with the Certification Procedures in accordance with the instructions set forth in this Information Statement. Mallinckrodt or the Redemption Agent may reject, question or modify any Certification Form for any reason. Whether the Certification Procedures have been complied with in any specific case, or generally, will be determined by Mallinckrodt in its sole and absolute discretion. Mallinckrodt or the Redemption Agent may reject, question or modify any Certification Form for any reason.

SHAREHOLDERS ARE URGED TO COMPLETE THEIR CERTIFICATION FORMS AS SOON AS POSSIBLE. IF MALLINCKRODT HAS NOT RECEIVED VALID CERTIFICATION FORMS FROM QUALIFIED SHAREHOLDERS (OR PERSONS THAT ARE EXPECTED TO BE QUALIFIED SHAREHOLDERS UPON THE SATISFACTION OF THE REMAINING CERTIFICATION PROCEDURES OTHER THAN THE SUBMISSION OF A CERTIFICATION FORM) HOLDING AT LEAST A SPECIFIED PERCENTAGE (EXPECTED TO BE APPROXIMATELY 75%) (OR SUCH GREATER OR LESSER PERCENTAGE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION) OF MALLINCKRODT PREFERRED SHARES OUTSTANDING ON THE RECORD DATE (THE “RESPONSE THRESHOLD”) BY 5:30 P.M. (EASTERN TIME IN THE UNITED STATES) ON NOVEMBER 7, 2025 (OR SUCH OTHER DATE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION), THE MALLINCKRODT BOARD MAY DETERMINE NOT TO PROCEED WITH THE SPIN-OFF.

-ii-

The Par Health Common Stock to be allocated in connection with the Spin-off has not been and will not be registered under the Securities Act, or the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”).

MALLINCKRODT IS NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND MALLINCKRODT A PROXY.

Mallinckrodt is furnishing this Information Statement solely to provide information to shareholders of Mallinckrodt about the transactions described herein. This Information Statement does not constitute a public offering of the securities described herein and Mallinckrodt is not soliciting offers to buy these securities. In the event of any conflict, inconsistency, or difference in interpretation between this Information Statement and the Notice of Intention to Redeem (as defined herein), the terms and provisions of the Notice of Intention to Redeem shall prevail.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Spin-off or passed upon the accuracy of adequacy of this Information Statement or any document referred to herein. Any representation to the contrary is a criminal offense.

-iii-

TABLE OF CONTENTS

PAGE

| ADDITIONAL INFORMATION | 1 | |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | 2 | |

| SHAREHOLDER INQUIRIES | 3 | |

| QUESTIONS AND ANSWERS | 4 | |

| INDICATIVE TIMELINE | 14 | |

| TERMS AND DEFINITIONS | 15 | |

| EXECUTIVE SUMMARY | 22 | |

| INFORMATION ABOUT THE TRANSACTION | 26 | |

| DESCRIPTION OF THE BUSINESS | 37 | |

| VALUATION BY MALLINCKRODT’S FINANCIAL ADVISOR | 60 | |

| REASONS FOR THE SPIN-OFF | 68 | |

| RISK FACTORS | 69 | |

| FORWARD-LOOKING STATEMENTS | 113 | |

| DESCRIPTION OF THE PRIOR REORGANIZATION TRANSACTIONS | 116 | |

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 117 | |

| IRISH TAX CONSIDERATIONS | 123 | |

| DESCRIPTION OF MATERIAL INDEBTEDNESS | 125 | |

| LEGAL PROCEEDINGS | 126 | |

| CAPITALIZATION | 130 | |

| DIVIDENDS | 131 | |

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 132 | |

| NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 139 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF MALLINCKRODT’S SPECIALTY GENERICS BUSINESS’ FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 152 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF ENDO’S STERILE INJECTABLES AND GENERIC PHARMACEUTICALS BUSINESS’ FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 169 | |

| EXECUTIVE COMPENSATION | 197 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 199 | |

| CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS | 201 | |

| BOARD OF DIRECTORS AND MANAGEMENT | 209 | |

| DESCRIPTION OF PAR HEALTH CAPITAL STOCK | 214 |

ADDITIONAL INFORMATION

The shares of Par Health to be allocated in connection with the Spin-off have not been and will not be registered under the Securities Act.

This Information Statement incorporates by reference important business and financial information about Mallinckrodt from documents that are not included in or delivered with this Information Statement. This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated by reference in this Information Statement by requesting them in writing or by telephone from Mallinckrodt at the following address or telephone number:

Mallinckrodt plc

College Business & Technology Park,

Cruiserath, Blanchardstown,

Dublin 15, D15 TX2V, Ireland

+353 1 696 0000

ir.mallinckrodt.com

The information contained in this Information Statement is provided as of October 30, 2025, unless otherwise indicated. We make no representation as to the accuracy or completeness of the information after October 30, 2025, and undertake no obligation to update information to reflect the occurrence of events or circumstances after October 30, 2025, except as required by applicable law.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This Information Statement “incorporates by reference” certain documents that Mallinckrodt files or furnishes with the SEC, which means that important information is disclosed to you by referring you to those documents. The information incorporated by reference is considered to be part of this Information Statement, and certain later information that Mallinckrodt files or furnishes with the SEC will automatically update and supersede earlier information filed with the SEC or included in this Information Statement. The following documents are incorporated by reference:

| · | Mallinckrodt’s current reports on Form 8-K filed with or furnished to the SEC on June 9, 2025, August 1, 2025, October 6, 2025 and October 24, 2025; and |

| · | any future filings by Mallinckrodt on Form 8-K after the date of this Information Statement and before the Redemption Date that state that they are incorporated by reference into this Information Statement. |

2

SHAREHOLDER INQUIRIES

Shareholders of Mallinckrodt who have questions or require additional information are encouraged to use the following resources:

| · | For assistance with the Certification Procedures (including completion of the Certification Form), please contact Mallinckrodt’s shareholder liaison: |

Innisfree M&A Incorporated

(888) 750-9498

Innisfree will advise all Street Name Holders to contact their bank, broker or similar organization immediately to ensure they are able to obtain access to the Certification Portal.

| · | For assistance with share transfer procedures, verifying holdings of Mallinckrodt Preferred Shares in Computershare US, and other inquiries, please contact Mallinckrodt’s information agent: |

Georgeson

Toll Free: (866) 585-7241

Outside the US: (310) 853-6676

MallExchange@Georgeson.com.

Only Record Holders have an account with Computershare US. Street Name Holders should contact their bank, broker or similar organization for assistance.

| · | For Computershare US account assistance, shareholders should contact: |

Computershare US

Toll Free: (866) 644-4127

Outside US & Canada: (781) 575-2906

Only Record Holders have an account with Computershare US. Street Name Holders should contact their bank, broker or similar organization for assistance.

| · | For other inquiries, please contact Mallinckrodt’s Corporate Secretary’s Office at corporate.secretary@mnk.com. |

For more information regarding Mallinckrodt and Par Health, shareholders should visit the following website: ir.mallinckrodt.com. This URL, and all other URLs in this Information Statement, are intended to be inactive textual references only. They are not intended to be active hyperlinks to any website. Information presented on any website located at any URL in this Information Statement is not and shall not be deemed to be incorporated into this Information Statement, unless such information is explicitly stated as being so incorporated in “Incorporation of Certain Documents by Reference.”

Shareholders may obtain a free copy of the Information Statement by sending a written request addressed to Mallinckrodt’s Investor Relations department at Mallinckrodt’s offices at College Business & Technology Park, Cruiserath, Blanchardstown, Dublin 15, D15 TX2V, Ireland, or on its website: ir.mallinckrodt.com.

3

QUESTIONS AND ANSWERS

| What is Par Health, and why is Mallinckrodt spinning off its generic pharmaceuticals (including APIs) and sterile injectables businesses? | At the time of the Spin-off, Par Health will hold Mallinckrodt’s generic pharmaceuticals (including APIs) and sterile injectables businesses. The Spin-off of Par Health from Mallinckrodt is intended, among other things, to enable the management of Mallinckrodt and Par Health to pursue opportunities for long-term growth and profitability unique to each company’s business and to allow each company to more effectively implement a distinct capital structure and individual capital allocation and capital return strategies. Mallinckrodt expects that the Spin-off will create significant value, as discussed further in the section of this Information Statement entitled “Reasons for the Spin-Off.” |

| How will the Spin-off work? | The Spin-off is being implemented by way of the Redemption of all Mallinckrodt Preferred Shares. In connection with the Redemption and pursuant to Irish law, Mallinckrodt will allocate the right to receive 39,421,398 shares of Par Health Common Stock, being one hundred percent (100%) of the outstanding shares of Par Health Common Stock as of the Redemption Date, to certain holders of record of Mallinckrodt Preferred Shares as of the Record Date (5:30 p.m. Eastern Time in the United States) on October 27, 2025, as further described herein. |

| Why am I receiving this document? |

You are receiving this document because you are a holder of Mallinckrodt Preferred Shares as of the Record Date. At the closing of the Redemption, the Mallinckrodt Preferred Shares will be redeemed in exchange for the following, subject to compliance with the Certification Procedures (as defined in the section of this Information Statement entitled “Terms and Definitions”) and the terms of the Redemption:

· in the case of Qualified Shareholders (as defined in the section of this Information Statement entitled “Terms and Definitions”) only, the right to receive a certain number of shares of Par Health Common Stock for each Mallinckrodt Preferred Share, or

· in the case of Non-Qualified Shareholders (as defined in the section of this Information Statement entitled “Terms and Definitions”) only, the right to receive a certain amount of cash for each Mallinckrodt Preferred Share that the Mallinckrodt Board determines is equal in value to the Par Health Common Stock allocated to Qualified Shareholders for each Mallinckrodt Preferred Share, in each case, as described in greater detail in this Information Statement. |

4

|

What is a “Qualified Shareholder” and a “Non-Qualified Shareholder”?

|

A Qualified Shareholder is a Record Holder or Street Name Holder that has complied with the Certification Procedures and that has submitted a Certification Form, duly, truthfully and accurately completed and validly executed in accordance with the instructions thereto, certifying (among other things) that such Record Holder or Street Name Holder (as the case may be) is:

· a qualified institutional buyer (as defined in Rule 144A under the Securities Act),

· an institutional accredited investor (an “accredited investor”, as defined in clauses (1), (2), (3), (7), (8), (9), (12) or (13) of Rule 501(a) under the Securities Act), or

· a director or officer of Mallinckrodt or Par Health as of the Redemption Date who is also an accredited investor (as defined in Rule 501(a) under the Securities Act).

A Non-Qualified Shareholder is a Record Holder or Street Name Holder as of the Record Date that has complied with the Certification Procedures and that has submitted a Certification Form, duly, truthfully and accurately completed and validly executed in accordance with the instructions thereto, certifying (among other things) that such Record Holder or Street Name Holder (as the case may be) is not a Qualified Shareholder. |

| What are the “Certification Procedures”? |

Record Holders (and/or Street Name Holders, where applicable) (each described below) must comply with certain “Certification Procedures” to be entitled to the right to receive the Par Health Common Stock or cash in the Redemption. The Certification Procedures are set out in the section of this Information Statement entitled “Information about the Transaction—Certification Process; Response Threshold.”

YOU ARE URGED TO READ THE CERTIFICATION PROCEDURES AND TO COMPLETE YOUR CERTIFICATION FORM AS SOON AS POSSIBLE. IF MALLINCKRODT HAS NOT RECEIVED VALID CERTIFICATION FORMS MEETING THE RESPONSE THRESHOLD BY 5:30 P.M. (EASTERN TIME IN THE UNITED STATES) ON NOVEMBER 7, 2025 (OR SUCH OTHER DATE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION), THE MALLINCKRODT BOARD MAY DETERMINE NOT TO PROCEED WITH THE SPIN-OFF. |

| What is a Certification Form? |

A Certification Form (as defined in the section of this Information Statement entitled “Terms and Definitions”) is a certification form that requires each Record Holder (and/or Street Name Holder, as applicable) to certify, among other things, whether such Person is (a) a Qualified Shareholder or (b) a Non-Qualified Shareholder. The Certification Form is available electronically through the Certification Portal maintained by the Redemption Agent. Record Holders have direct access to the Certification Portal by visiting www.ComputershareCAS.com/Mallinckrodt. Record Holders who are unable to access the Certification Portal may request a paper Certification Form by contacting Innisfree M&A Incorporated at (888) 750-9498. A watermarked sample Certification Form is attached as Annex 1 to this Information Statement in order to facilitate the prompt completion of the Certification Procedures. Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal. |

5

The Certification Form is not an “election” form, and shareholders do not have a “choice” between the right to receive Par Health Common Stock or cash in the Redemption.

MALLINCKRODT SHAREHOLDERS SHOULD READ THIS INFORMATION STATEMENT CAREFULLY, AS CERTIFICATION PROCEDURES DIFFER FOR THE TWO CATEGORIES OF MALLINCKRODT SHAREHOLDERS ON THE RECORD DATE: (1) RECORD HOLDERS AND (2) STREET NAME HOLDERS. | |

| What is a Record Holder? |

A Record Holder is a holder of record of Mallinckrodt Preferred Shares as of the Record Date, as reflected in the Mallinckrodt Register of Members (i.e., the shareholder whose name appears in the Mallinckrodt Register of Members). Record Holders can directly exercise rights in respect of Mallinckrodt Preferred Shares.

As a Record Holder’s name appears in the Mallinckrodt Register of Members, Record Holders have direct access to the Certification Portal by visiting www.ComputershareCAS.com/Mallinckrodt. Record Holders who are unable to access the Certification Portal may request a paper Certification Form by contacting Innisfree M&A Incorporated at (888) 750-9498. |

| What is a Street Name Holder? |

A Street Name Holder is a person identified by a Record Holder (which Record Holder is a broker, bank or similar organization) as the beneficial holder of Mallinckrodt Preferred Shares held by such Record Holder in such capacity on the Record Date. In other words, it is the holder of shares that are held in an account at a bank, brokerage firm or other similar organization.

Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal. |

| In addition to the Certification Form, what other documents do I need to complete to comply with the Certification Procedures? |

In addition to the Certification Form, you must timely complete other documents as may reasonably be required by Mallinckrodt or the Redemption Agent, including a validly executed appropriate IRS Form W-8 or IRS Form W-9, as applicable, and any other documentation and attachments as may be required to establish that any payment made to such Qualified Shareholder or Non-Qualified Shareholder (and any Record Holder that is a bank, brokerage firm or similar organization receiving such payment for the benefit of such Qualified Shareholder or Non-Qualified Shareholder, if applicable) is not subject to U.S. backup withholding tax. |

6

| MALLINCKRODT SHAREHOLDERS SHOULD READ THIS INFORMATION STATEMENT CAREFULLY, AS CERTIFICATION PROCEDURES DIFFER FOR THE TWO CATEGORIES OF MALLINCKRODT SHAREHOLDERS ON THE RECORD DATE: (1) RECORD HOLDERS AND (2) STREET NAME HOLDERS. | |

| How do I submit my Certification Form and other required documents? | How to complete a Certification Form or submit your other required documents depends on whether you are: (1) a Record Holder or (2) a Street Name Holder:

Record Holders will have direct access to the Certification Form on the Certification Portal available at www.ComputershareCAS.com/Mallinckrodt. Record Holders (other than banks, brokers and similar organizations) should complete the Certification Form on the Certification Portal in accordance with the instructions therein. Record Holders who are unable to access the Certification Portal may request a paper Certification Form by contacting Innisfree M&A Incorporated at (888) 750-9498. Record Holders that obtain a paper Certification Form should return completed and validly executed Certification Forms by FedEx, DHL or overnight mail to the address indicated on the Certification Form.

Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization, which is the shareholder of record. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal. Once received, Street Name Holders should complete the Certification Form through the Certification Portal in accordance with the instructions provided by the shareholder of record.

If you are a Street Name Holder, please contact your bank, brokerage firm or other similar organization as soon as possible to ensure you receive access to the Certification Portal. If you do not promptly follow the instructions provided by your bank, brokerage firm or other similar organization and otherwise comply with the Certification Procedures before the expiration of the Escrow Period (as defined in the section of this Information Statement entitled “Terms and Definitions”), your right to receive the Base Proceeds and Excess Proceeds (as defined in the section of this Information Statement entitled “Terms and Definitions”) will LAPSE and EXPIRE.

WE URGE YOU TO SUBMIT YOUR CERTIFICATION FORM AS SOON AS POSSIBLE – do not wait for the Escrow Period. If you do not complete your Certification Form by 5:30 p.m. (Eastern Time in the United States) on November 7, 2025, the risk of not reaching the Response Threshold increases. The Redemption will only be completed if the Response Threshold is reached by 5:30 p.m. (Eastern Time in the United States) on November 7, 2025 (or such other date as may be determined by the Mallinckrodt Board in its sole and absolute discretion). |

7

| Does Mallinckrodt have discretion to question or reject my Certification Form? |

Yes. Where Mallinckrodt and/or the Redemption Agent is not satisfied for any reason:

i. as to the completeness, accuracy or truthfulness of a Certification Form, or

ii. as to the completeness, accuracy or truthfulness of any certification, representation, warranty or statement made in a Certification Form, or

iii. that a completed Certification Form accurately or fully verified the status of the applicable Record Holder or Street Name Holder for the purpose of determining whether the Record Holder or Street Name is a Qualified Shareholder or a Non-Qualified Shareholder, as applicable,

Mallinckrodt or the Redemption Agent may reject, question or modify such Certification Form.

Whether the Certification Procedures have been complied with in any specific case, or generally, will be determined in Mallinckrodt’s sole and absolute discretion. |

| When should I complete the Certification Form? |

You are urged to complete your Certification Form as soon as possible. If Mallinckrodt has not received valid Certification Forms from Qualified Shareholders (or Persons that are expected to be Qualified Shareholders upon the satisfaction of the remaining Certification Procedures other than the submission of a Certification Form) holding at least a specified percentage (expected to be approximately 75%) (or such greater or lesser percentage as may be determined by the Mallinckrodt Board in its sole and absolute discretion) of Mallinckrodt Preferred Shares outstanding on the Record Date by 5:30 p.m. (Eastern Time in the United States) on November 7, 2025 (or such other date as may be determined by the Mallinckrodt Board in its sole and absolute discretion), the Mallinckrodt Board may determine not to proceed with the Spin-off.

Please contact Innisfree M&A Incorporated at (888) 750-9498 for assistance with completing your Certification Form. If you are a Street Name Holder, please contact your bank, broker or similar organization to obtain access to the Certification Portal. |

| Can Mallinckrodt determine not to proceed with Redemption? |

Yes. The Mallinckrodt Board can modify the terms of, or abandon altogether, the Redemption at any time and for any reason until it has been consummated. Consummation of the Redemption will be subject to approval by the Mallinckrodt Board no later than thirty (30) days from the Record Date.

For more information on the Mallinckrodt Board’s ability to abandon the Redemption, see the section of this Information Statement entitled “Information About the Transaction—Board Authority to Abandon Redemption.” |

8

| Can I trade my Mallinckrodt Ordinary Shares after the Record Date? |

The Mallinckrodt Board closed the Mallinckrodt Register of Members with effect from 5:00 p.m. (Eastern Time in the United States) on October 23, 2025 until the earlier of (i) 5:00 p.m. (Eastern Time in the United States) on November 22, 2025 or (ii) such earlier date as may be notified by Mallinckrodt (the “Closed Share Register Period”).

Transfers of shares in the capital of Mallinckrodt will not be registered while the Mallinckrodt Register of Members is closed, regardless of when any such transfer may have occurred. Mallinckrodt Preferred Shares are stapled to the corresponding Mallinckrodt Ordinary Shares, meaning they cannot be traded separately from such Mallinckrodt Ordinary Shares.

Only Record Holders (or Street Name Holders) as of the Record Date will receive the Redemption Consideration (if the Redemption occurs). Therefore:

· If the Spin-off closes, you—as the legal owner of the Mallinckrodt Preferred Shares stapled to Mallinckrodt Ordinary Shares on the Record Date—will be entitled to the right to receive the Par Health Common Stock or cash, as applicable, in the Redemption. A buyer of Mallinckrodt Ordinary Shares whose purchase is registered in the Mallinckrodt Register of Members after the Record Date will only receive Mallinckrodt Ordinary Shares reflective of the value of Mallinckrodt’s other businesses once the share transfer is registered after the Closed Share Register Period.

· If the Spin-off is abandoned, a buyer of Mallinckrodt Ordinary Shares whose purchase is registered in the Mallinckrodt Register of Members after the Record Date will receive Mallinckrodt Ordinary Shares that reflect the value of Mallinckrodt’s entire business (including Par Health and Mallinckrodt’s other businesses). |

| If the Redemption occurs, what will happen? |

At the consummation of the Redemption, Mallinckrodt will redeem 100% of the outstanding Mallinckrodt Preferred Shares. In exchange, holders of Mallinckrodt Preferred Shares will receive the right to receive Par Health Common Stock or cash, as applicable, subject to compliance with the Certification Procedures and the terms of the Redemption.

To receive the right to receive Par Health Common Stock or cash, as applicable, promptly following the Redemption, Qualified Shareholders and Non-Qualified Shareholders (and, as applicable, Record Holders receiving Base Proceeds for the benefit of a Qualified Shareholder or Non-Qualified Shareholder) must have complied with and satisfied the Certification Procedures, no later than 5.30pm (Eastern Time in the United States) on the business day (by reference to business days in the United States) before the Redemption Date. |

9

| After the Redemption is consummated, Par Health will operate as an independent, private company and will not be listed on a securities exchange. | |

| What is the expected date of completion of the Redemption? | November 10, 2025 (or such other date as may be determined by the Mallinckrodt Board in its sole and absolute discretion). |

| Can I still receive the Par Health Common Stock or cash, as applicable, to which I am entitled even after the Redemption? | Yes, for the Escrow Period, Qualified Shareholders and Non-Qualified Shareholders that satisfy the Certification Procedures will receive the Redemption Consideration to which they are entitled. For more information on the Escrow Period see the section of this Information Statement entitled “Information about the Transaction—Escrow Period.” |

| Why should I submit my Certification Form early? |

WE URGE YOU TO SUBMIT YOUR CERTIFICATION FORM AS SOON AS POSSIBLE – do not wait for the Escrow Period. If you do not complete your Certification Form by 5:30 p.m. (Eastern Time in the United States) on November 7, 2025, the risk of not reaching the Response Threshold increases. If the Response Threshold is not reached by 5:30 p.m. (Eastern Time in the United States) on November 7, 2025 (or such other date as may be determined by the Mallinckrodt Board in its sole and absolute discretion) the Mallinckrodt Board may determine not to proceed with the Spin-off.

Please contact Innisfree M&A Incorporated at (888) 750-9498 for assistance with completing your Certification Form. If you are a Street Name Holder, please contact your bank, broker or similar organization to obtain access to the Certification Portal. |

| What happens when the Escrow Period expires? |

The right to receive Par Health Common Stock or cash, as applicable, will irrevocably expire and lapse for Record Holders (and/or any Street Name Holders, as applicable) that have not complied with the Certification Procedures before the expiration of the Escrow Period.

Promptly after the expiration of the Escrow Period, the Redemption Agent will:

· allocate any Par Health Common Stock remaining in the Escrow Account among the Qualified Shareholders as of immediately before the expiration of the Escrow Period, and

· make an additional cash payment to all Non-Qualified Shareholders as of immediately before the expiration of the Escrow Period.

For more information on the end of the Escrow Period, please see the section of this Information Statement entitled “Information About the Transaction—Escrow Closing.” |

10

| Will Mallinckrodt allocate or credit fractional shares of Par Health Common Stock in connection with the Redemption? | No fractional shares of Par Health Common Stock will be allocated or credited to book-entry accounts in connection with the Redemption, nor will any cash payments be made in lieu of any such fractional share interests. The Record Holder is not entitled to vote or to any other rights as a stockholder of Par Health for such fractional share interest. If, at the end of the Escrow Period, there are shares of Par Health Common Stock that cannot be allocated due to the prohibition on allocating fractional shares, then Par Health will cancel such shares. |

| Following the Redemption, can I trade my shares of Par Health Common Stock? |

Par Health Common Stock is not and will not be listed on any securities exchange. As a private company, there will continue to be no active trading market in Par Health’s capital stock. As a result, you may experience limited liquidity.

Moreover, shares of Par Health Common Stock are “restricted securities” as defined in Rule 144 under the Securities Act, and may not be resold unless such sale is registered under applicable federal and state securities laws, or an exemption is available from the registration requirements of those laws, as applicable.Additionally, Par Health Common Stock will be subject to certain additional restrictions set forth in the governing documents of Par Health. For more information on such, please see the section of this Information Statement entitled “Description of Par Health Capital Stock.” |

| Will the number of shares of Mallinckrodt Ordinary Shares that I own change as a result of the Redemption? | No. The number of shares of Mallinckrodt Ordinary Shares that you own will not change as a result of the Redemption. |

| What are the material U.S. federal income tax consequences of the Spin-off and the Redemption? |

The treatment of the Redemption generally for U.S. federal income tax purposes is subject to some uncertainty. However, it is expected that the Redemption will be treated as a distribution with respect to the Mallinckrodt Ordinary Shares to which the Mallinckrodt Preferred Shares are stapled, and the remainder of this Information Statement assumes that such treatment will be respected.

The treatment of the Share Redemption (as defined in the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences”) to U.S. Qualified Shareholders (as defined in the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences”) for U.S. federal income tax purposes (including the qualification of the Share Redemption, together with certain related transactions, as a “reorganization” within the meaning of Sections 368(a)(1)(D) and 355 of the Code) is uncertain.

The Cash Redemption (as defined in the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences”) is expected to be taxable to U.S. Non-Qualified Shareholders (as defined in the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences”) as a dividend for U.S. federal income tax purposes. |

11

| All U.S. Holders (as defined in the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences”) are urged to read the section of this Information Statement entitled “Material U.S. Federal Income Tax Consequences” and to consult their tax advisors as to the particular tax consequences of the Redemption to them, including the applicability and effect of U.S. federal, state, local, non-U.S. and other tax laws. | |

| What will Par Health’s relationship be with Mallinckrodt following the Spin-off? | After the Redemption, Mallinckrodt and Par Health will be separate companies with separate management teams and separate boards of directors, except that it is expected that one individual will serve on both boards of directors. Mallinckrodt and Par Health will enter into a Separation Agreement to effect the Spin-off and to provide a framework for Par Health’s relationship with Mallinckrodt after the Spin-off. Par Health and Mallinckrodt will also enter into certain other agreements, including a transition services agreement, a tax matters agreement, an employee matters agreement and other transaction agreements. These agreements will provide for the allocation between Par Health and Mallinckrodt of the assets, employees, liabilities and obligations (including, among others, property, employee benefits and tax-related assets and liabilities) of Mallinckrodt and its subsidiaries attributable to periods before, at and after the Spin-off and will govern the relationship between Par Health and Mallinckrodt subsequent to the completion of the Spin-off. For additional information regarding the Separation Agreement and other transaction agreements, see the section of this Information Statement entitled “Certain Relationships and Related-Party Transactions.” |

| Who will manage Par Health after the separation? | Par Health’s management team will be led by Stephen Welch, who will be Par Health’s Chief Executive Officer. For more information regarding Par Health’s management and directors, see the section of this Information Statement entitled “Board of Directors and Management.” |

| Are there risks associated with owning Par Health Common Stock? | Yes. Ownership of Par Health Common Stock is subject to both general and specific risks relating to its business, the industry in which it operates, its ongoing contractual relationships with Mallinckrodt and its status as a separate, private company. Ownership of Par Health Common Stock is also subject to risks relating to the Separation. Certain of these risks are described in the “Risk Factors” section of this Information Statement. We encourage you to read that section carefully. |

12

| Where can I find more information? |

Mallinckrodt shareholders with questions are directed to contact the appropriate resource below.

· For assistance with the Certification Procedures (including completion of the Certification Form), shareholders should contact Mallinckrodt’s shareholder liaison, Innisfree M&A Incorporated, at (888) 750-9498. Innisfree will advise all Street Name Holders to contact their bank, broker or similar organization immediately to ensure they are able to obtain access to the Certification Portal.

· For assistance with share transfer procedures, verifying holdings of Mallinckrodt Preferred Shares in Computershare US and other inquiries, shareholders should contact Mallinckrodt’s information agent, Georgeson, at (866) 585-7241 (toll free), (310) 853-6676 (outside the U.S.) or MallExchange@Georgeson.com. Only Record Holders have an account with Computershare US. Street Name Holders should contact their bank, broker or similar organization for assistance.

· For Computershare US account assistance, shareholders should contact Computershare US at (866) 644-4127 (toll free) or (781) 575-2906 (outside the U.S. or Canada). Only Record Holders have an account with Computershare US. Street Name Holders should contact their bank, broker or similar organization for assistance.

· For other inquiries, shareholders should contact Mallinckrodt’s Corporate Secretary’s Office at corporate.secretary@mnk.com. |

13

INDICATIVE TIMELINE

| Date | |

| Mallinckrodt Board Approved the Redemption in Principle | October 21, 2025 |

| Mallinckrodt Share Register Closed | October 23, 2025 |

| Mallinckrodt Board Issued Notice of Intention to Redeem | October 24, 2025 |

| Record Date | October 27, 2025 |

| Publication of this Information Statement | October 30, 2025 |

| Certification Portal Opens; Mallinckrodt Shareholders Begin Submitting Certification Forms | October 30, 2025 |

| Mallinckrodt Board Approves the Redemption (if applicable) | Estimated November 7, 2025 |

| Redemption of Mallinckrodt Preferred Shares (if applicable) | Estimated November 10, 2025 |

14

TERMS AND DEFINITIONS

Unless the context indicates otherwise, references to the following terms shall have the meanings below, both in singular and plural forms:

| Term |

Definition |

| Action | Any demand, action, claim, dispute, suit, countersuit, arbitration, inquiry, subpoena, proceeding or investigation of any nature (whether criminal, civil, legislative, administrative, regulatory, prosecutorial or otherwise) by or before any federal, state, local, foreign or international Governmental Authority or any arbitration or mediation tribunal. |

| Articles of Association | The articles of association of Mallinckrodt in effect as of the date of the Separation Agreement, as may be amended from time to time. |

| Certification Form |

The certification form to be made available by the Redemption Agent (as may be amended from time to time) that requires each Record Holder (and/or Street Name Holder, as applicable) to certify, among other things, whether such Person is a Qualified Shareholder or a Non-Qualified Shareholder as of the Record Date.

The Certification Form is available electronically through the Certification Portal maintained by the Redemption Agent. Record Holders have direct access to the Certification Portal by visiting www.ComputershareCAS.com/Mallinckrodt. Record Holders who are unable to access the Certification Portal may request a paper Certification Form by contacting Innisfree M&A Incorporated at (888) 750-9498. A watermarked sample Certification Form is attached as Annex 1 to this Information Statement in order to facilitate the prompt completion of the Certification Procedures. Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal. |

| Certification Procedures | (i) the submission by a Qualified Shareholder or a Non-Qualified Shareholder (and by a Record Holder that is a bank, broker or similar organization in the case of clauses (b) and (c)), and the receipt thereof by Mallinckrodt, of:

(a) a Certification Form, duly, truthfully and accurately completed and validly executed in accordance with the instructions thereto;

|

15

|

(b) a validly executed appropriate IRS Form W-8 or IRS Form W-9, as applicable, and any other documentation and attachments as may be required to establish that any payment made to such Qualified Shareholder or Non-Qualified Shareholder (and any Record Holder that is a bank, broker or similar organization receiving such payment for the benefit of such Qualified Shareholder or Non-Qualified Shareholder, if applicable) is not subject to U. S. backup withholding tax; and

(c) such other documents or confirmations as may be reasonably required by the Redemption Agent or Mallinckrodt to facilitate the allotment or payment of the Redemption Consideration, in each case, before the expiration of the Escrow Period;

(ii) the procedures of the Redemption Agent as approved by Mallinckrodt from time to time relating to the verification of the satisfaction of the requirements described in clause (i) and the authenticity or veracity of a Certification Form or its contents; and

(iii) such other procedures as may be approved by Mallinckrodt from time to time for the purposes of facilitating or securing compliance with applicable Law in connection with the Redemption. | |

| Companies Act 2014 | The Companies Act 2014 of Ireland, as amended. |

| Distributable Reserves | Mallinckrodt’s profits available for distribution (within the meaning of the Companies Act 2014) to effect the Redemption. |

| Effective Time | 5:30 p.m., United States Eastern Time, on the Redemption Date. |

| Encumbrances | Liens, claims, charges, mortgages, pledges, options, licenses, sublicenses, security interests, restrictions or other encumbrances of any kind. |

16

| Endo | Endo, Inc., a Delaware corporation (which has been converted into Endo LP, a Delaware limited partnership) and a wholly-owned subsidiary of Mallinckrodt. |

| Endo Historical Financial Statements | The historical annual audited and interim unaudited combined financial statements of Endo’s Sterile Injectables and Generic Pharmaceuticals businesses, and the notes thereto. |

| Escrow Account | The escrow account established by Mallinckrodt with the Redemption Agent to receive any shares of Par Health Common Stock that have not been allocated to Qualified Shareholders at the Effective Time, and any such replacement account as may be approved by Mallinckrodt for such purposes from time to time. |

| Endo GxSI | Endo’s Sterile Injectables and Generic Pharmaceuticals business. |

| Escrow Period | The period of time beginning immediately after the Effective Time and ending at 11:59 p.m., United States Eastern Time on the twelve month anniversary of the Redemption Date. |

| Excess Par Health Common Stock | The Par Health Common Stock in the Escrow Account not allocated to Qualified Shareholders before the expiration of the Escrow Period, being the Par Health Common Stock as of the Redemption Date that (a) would otherwise have been allocated to Non-Qualified Shareholders had they been Qualified Shareholders; or (b) would otherwise have been allocated to other Record Holders that have not satisfied the applicable Certification Procedures as Qualified Shareholders before the expiration of the Escrow Period. |

| Form 8-K | The Form 8-K furnished to the SEC on October 30, 2025, which includes this Information Statement as and the Historical Financial Statements as .2. |

| Governmental Authority | Any nation or government, any state, municipality or other political subdivision thereof, and any entity, body, agency, commission, department, board, bureau, court, tribunal or other instrumentality, whether federal, state, local, domestic, foreign or multinational, exercising executive, legislative, judicial, regulatory, administrative or other similar functions of, or pertaining to, a government and any executive official thereof. |

| Historical Financial Statements | .2 to the Form 8-K, which includes the Mallinckrodt Historical Financial Statements and the Endo Historical Financial Statements and which is incorporated into this Information Statement by reference. |

| Law | Any national, supranational, federal, state, provincial, local or similar law (including common law), statute, code, order, ordinance, rule, regulation, treaty (including any income tax treaty), license, Permit, decree, injunction, binding judicial or administrative interpretation or other requirement, in each case, enacted, promulgated, issued or entered by a Governmental Authority. |

17

| Mallinckrodt Board | The Board of Directors of Mallinckrodt. |

| Mallinckrodt Business | All businesses, operations and activities (whether or not such businesses, operations or activities are or have been terminated, divested or discontinued) conducted at any time before the Effective Time by Mallinckrodt, Par Health or any member of its respective group, other than the Par Health Business. |

| Mallinckrodt Historical Financial Statements | The historical annual audited and interim unaudited combined financial statements of Mallinckrodt’s Specialty Generics business, and the notes thereto. |

| Mallinckrodt Ordinary Shares | The ordinary shares, nominal value $0.01 per share, of Mallinckrodt. |

| Mallinckrodt Preferred Shares Terms | The terms governing the Mallinckrodt Preferred Shares adopted pursuant to the approval of resolutions of the Mallinckrodt Board on September 10, 2025. |

| Mallinckrodt Register of Members | The relevant statutory register of members of Mallinckrodt under applicable Laws, denoting the registered shareholders of Mallinckrodt. |

| Mallinckrodt SGx | Mallinckrodt’s Specialty Generics business. |

| Non-Qualified Shareholder | A Record Holder or Street Name Holder as of the Record Date that has complied with the Certification Procedures and that has submitted a Certification Form, duly, truthfully and accurately completed and validly executed in accordance with the instructions thereto, certifying (among other things) that such Record Holder or Street Name Holder (as the case may be) is not a Qualified Shareholder. |

| Notice of Intention to Redeem | The relevant notice of intention to redeem issued by Mallinckrodt on October 24, 2025 (attached at Annex 2) reflecting its non-binding intention to acquire, by way of share redemption pursuant to the provisions of Section 105 of the Companies Act 2014 and pursuant to Article 3(d) of the Articles of Association, some or all redeemable of the Mallinckrodt Preferred Shares in the issued share capital of Mallinckrodt. |

| Par Health Board | The Board of Directors of Par Health. |

18

| Par Health Business | (a) The business, operations and activities of the generic pharmaceuticals (including APIs) and sterile injectables businesses of Mallinckrodt as conducted as of immediately prior to the Effective Time by Mallinckrodt, Par Health or any of their subsidiaries, which includes the development, manufacturing and distribution of (i) generic medicinal products and APIs and (ii) sterile injectables medicinal products, including supply chain planning and oversight, quality assurance and procurement functions in respect of such products; and (b) any terminated, divested or discontinued businesses, operations and activities that, at the time of termination, divestiture or discontinuation, primarily related to the business, operations or activities described in clause (a) as then conducted; provided that the Par Health Business shall not include the business, operations and activities of the research, development, manufacture, use, marketing or distribution of specified products set forth on a schedule. |

| Par Health Value | The value ascribed by the Mallinckrodt Board to Par Health before the Effective Time for the purposes of determining the Per Share Cash Amount and the Per Share Excess Cash Amount (if any) to which Non-Qualified Shareholders are entitled pursuant to the Redemption. |

| Parent | Mallinckrodt |

| Per Share Cash Amount | An amount in cash that the Mallinckrodt Board determines is equal to the value of the Per Share Stock Amount as of the Redemption Date, being the Par Health Value divided by the total number of Mallinckrodt Preferred Shares at the Record Date. |

| Per Share Excess Cash Amount | An amount in cash that the Mallinckrodt Board determines is equal to the value of the Per Share Excess Stock Amount as of the Redemption Date, being (a) (i) the Par Health Value divided by (ii) the total number of Mallinckrodt Preferred Shares on the Record Date held by Qualified Shareholders that have satisfied the applicable Certification Procedures before the expiration of the Escrow Period less (b) the Per Share Cash Amount. |

| Per Share Excess Stock Amount |

The number (“A”) of shares of Par Health Common Stock derived from the following formula:

A = B/C

where:

“B” is the total number of shares of Excess Par Health Common Stock; and

“C” is the total number of Mallinckrodt Preferred Shares on the Record Date held by Qualified Shareholders that have satisfied the applicable Certification Procedures before the expiration of the Escrow Period. |

19

| Per Share Stock Amount | 0.0000219471513 shares of Par Health Common Stock, it being understood that the Per Share Stock Amount is intended to provide each Qualified Shareholder with proportionate ownership in Par Health that is equal to such Qualified Shareholder’s proportionate ownership of all Mallinckrodt Preferred Shares on the Record Date (including, for the purpose of such calculation, all Mallinckrodt Preferred Shares held on the Record Date, whether held by Qualified Shareholders or Non-Qualified Shareholders, or in respect of which the Certification Procedures are or are not satisfied before the expiration of the Escrow Period). |

| Permit | Permits, approvals, authorizations, consents, licenses or certificates issued by any Governmental Authority. |

| Person | An individual, a general or limited partnership, a corporation, a trust, a joint venture, an unincorporated organization, a limited liability entity, any other entity and any Governmental Authority. |

| Qualified Shareholder | A Record Holder or Street Name Holder as of the Record Date that has complied with the Certification Procedures and that has submitted a Certification Form, duly, truthfully and accurately completed and validly executed in accordance with the instructions thereto, certifying (among other things) that such Record Holder or Street Name Holder (as the case may be) is a qualified institutional buyer (as defined in Rule 144A under the Securities Act), an institutional accredited investor (an “accredited investor” as defined in clauses (1), (2), (3), (7), (8), (9), (12) and (13) of Rule 501(a) under the Securities Act) or director or officer of Mallinckrodt or Par Health as of the Redemption Date who is also an accredited investor (as defined in Rule 501(a) under the Securities Act). |

| Record Date | 5:30 p.m. (Eastern Time in the United States) on October 27, 2025, or such other time as may be determined by the Mallinckrodt Board as the record date for determining holders of Mallinckrodt Preferred Shares entitled to receive the Redemption Consideration. |

| Record Holder | A holder of record of Mallinckrodt Preferred Shares as of the Record Date, as reflected in the Mallinckrodt Register of Members. |

| Redemption | The redemption by Mallinckrodt at the Effective Time of the Mallinckrodt Preferred Shares, free and clear of all Encumbrances, other than Encumbrances arising under applicable securities laws, upon which the Mallinckrodt Preferred Shares shall automatically be canceled and no longer outstanding. |

20

| Redemption Agent | Computershare Trust Company, N.A., or such other trust company or bank duly appointed by Mallinckrodt to act as distribution agent, transfer agent, escrow agent and/or registrar for the Par Health Common Stock in connection with the Redemption. |

| Redemption Consideration | The right to receive (i) the Base Proceeds, plus (ii) the Excess Proceeds (if any), in each case, subject to the satisfaction of the terms of the Separation Agreement. |

| Redemption Date | The date of the consummation of the Redemption, which shall be determined by the Mallinckrodt Board in its sole and absolute discretion in accordance with the Articles of Association and the Mallinckrodt Preferred Shares Terms. |

| Response Threshold | The receipt by the Mallinckrodt Board of valid Certification Forms from Qualified Shareholders (or Persons that are expected to be Qualified Shareholders upon the satisfaction of the remaining Certification Procedures other than the submission of a Certification Form) holding at least a specified percentage (expected to be approximately 75%) (or such greater or lesser percentage as may be determined by the Mallinckrodt Board in its sole and absolute discretion) of Mallinckrodt Preferred Shares outstanding on the Record Date. |

| SEC | The U.S. Securities and Exchange Commission. |

| Separation | The separation of the Par Health Business from the Mallinckrodt Business to be effected by the Spin-off, inclusive of the Internal Reorganization that was substantially completed on or before July 31, 2025. |

|

Separation Agreement

|

The Separation Agreement, by and between Mallinckrodt and Par Health, to be executed if the Mallinckrodt Board proceeds with the Spin-off. |

| Street Name Holder | A Person identified by a Record Holder (which Record Holder is a broker, bank or similar organization) as the beneficial holder of Mallinckrodt Preferred Shares held by such Record Holder in such capacity on the Record Date. |

21

EXECUTIVE SUMMARY

The following summary provides a brief description of the Spin-off, and is not intended to contain all of the information that may be relevant to the Spin-off. The information provided below should be read together with the information and financial information included in other sections of this Information Statement. You should read carefully the entirety of this Information Statement, including the sections of this Information Statement entitled “Risk Factors,” “Description of the Business,” “Management’s Discussion and Analysis of Mallinckrodt’s Specialty Generics Business’ Financial Condition and Results of Operations” and “Management’s Discussion and Analysis of Endo’s Sterile Injectable and Generic Pharmaceuticals Business’ Financial Condition and Results of Operations” as well as the Unaudited Pro Forma Condensed Combined Financial Statements and the notes thereto, which are included in this Information Statement.

The Spin-Off

On October 21, 2025, the Mallinckrodt Board approved resolutions (a) granting the authority to set the Record Date, being as of 5:30 p.m. (Eastern Time in the United States) on October 27, 2025, and (b) authorizing, in principle, the Spin-off by means of the Redemption of the Mallinckrodt Preferred Shares in exchange for the right of shareholders as of the Record Date to receive, subject to compliance with the Certification Procedures and the terms of the Redemption, the Redemption Consideration. The Redemption Consideration consists of two components: the right to receive (1) the Base Proceeds and (2) the Excess Proceeds, in each case, as described in the section of this Information Statement entitled “Information About the Transaction.”

For Qualified Shareholders only, both the Base Proceeds and the Excess Proceeds will be delivered in shares of Par Health Common Stock. For Non-Qualified Shareholders only, the Base Proceeds and the Excess Proceeds will be paid in cash.

Only Record Holders (and/or Street Name Holders, as applicable) that properly comply with the Certification Procedures, including the timely completion of the Certification Form certifying, among other things, their status as a Qualified Shareholder or a Non-Qualified Shareholder, will be entitled to receive the Redemption Consideration.

Certification Forms are available electronically through the Certification Portal. Record Holders have direct access to the Certification Portal by visiting www.ComputershareCAS.com/Mallinckrodt, Record Holders who are unable to access the Certification Portal may request and return a paper Certification Form as described in this Information Statement. A watermarked sample Certification Form is attached as Annex 1 to this Information Statement in order to facilitate the prompt completion of the Certification Procedures. Street Name Holders may only access the Certification Portal through a unique hyperlink provided by their bank, brokerage firm or similar organization. Street Name Holders should immediately contact their bank, brokerage firm or similar organization to ensure they are able to obtain access to the Certification Portal.

The Mallinckrodt Board retains the authority to modify the terms of, or to abandon, the Redemption at any time and for any reason until it has been consummated, including by accelerating or delaying the timing of the consummation of all or part of the Redemption. Consummation of the Redemption will be subject to a separate approval by the Mallinckrodt Board.

22

SHAREHOLDERS ARE URGED TO COMPLETE THEIR CERTIFICATION FORMS AS SOON AS POSSIBLE. IF MALLINCKRODT HAS NOT RECEIVED VALID CERTIFICATION FORMS FROM QUALIFIED SHAREHOLDERS (OR PERSONS THAT ARE EXPECTED TO BE QUALIFIED SHAREHOLDERS UPON THE SATISFACTION OF THE REMAINING CERTIFICATION PROCEDURES OTHER THAN THE SUBMISSION OF A CERTIFICATION FORM) HOLDING AT LEAST A SPECIFIED PERCENTAGE (EXPECTED TO BE APPROXIMATELY 75%) (OR SUCH GREATER OR LESSER PERCENTAGE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION) OF MALLINCKRODT PREFERRED SHARES OUTSTANDING ON THE RECORD DATE BY 5:30 P.M. (EASTERN TIME IN THE UNITED STATES) ON NOVEMBER 7, 2025 (OR SUCH OTHER DATE AS MAY BE DETERMINED BY THE MALLINCKRODT BOARD IN ITS SOLE AND ABSOLUTE DISCRETION), THE MALLINCKRODT BOARD MAY DETERMINE NOT TO PROCEED WITH THE SPIN-OFF.

PLEASE CONTACT INNISFREE M&A INCORPORATED AT (888) 750-9498 FOR ASSISTANCE WITH COMPLETING YOUR CERTIFICATION FORM. IF YOU ARE A STREET NAME HOLDER, PLEASE CONTACT YOUR BANK, BROKER OR SIMILAR ORGANIZATION TO OBTAIN ACCESS TO THE CERTIFICATION PORTAL.

The main objectives of the Spin-off are as follows:

| · | The Spin-off will permit the management team of each company to better focus on strengthening its core business and operations and on its own strategic priorities with financial targets that best fit its own market and opportunities, to more effectively pursue its distinct operating priorities and strategies with increased flexibility, and to enable its respective boards and management to focus exclusively on its unique opportunities for long-term growth and profitability, better positioning each for long-term success. |

| · | The Spin-off will give each business the ability to create its own optimal capital structure and allow it to manage capital allocation and capital return strategies with greater focus and agility in response to changes in the operating environment and industry landscape. |

| · | The Spin-off will permit each company to more effectively attract, retain, and motivate team members. |

| · | The Spin-off will create the opportunity for both Mallinckrodt and Par Health to forge a new reputation in the marketplace, positioning each company to improve its financial performance, allowing for simplified investor communications and a streamlined and compelling investment profile. |

| · | The Spin-off will allow investors to value the two companies based on the distinct business models, financial characteristics and investment identities of each of Mallinckrodt’s branded business and Par Health’s generic pharmaceuticals (including APIs) and sterile injectables businesses and make investment decisions based on those characteristics. This will provide each company with better and more efficient access to the capital markets. |

Par Health’s Business

Par Health is a private company incorporated under the laws of Delaware and focused on generic pharmaceuticals (including APIs) and sterile injectables businesses. We are well positioned to be a leading pharmaceutical company, with a robust product portfolio spanning multiple disease areas, dosage forms, and delivery techniques.

23

Par Health is headquartered in Hazelwood, Missouri and we have operating locations in the United States, Ireland, the United Kingdom and India.

Information regarding the product portfolios and business strategies of Par Health is included in the following discussion.

Generics and APIs

Our generic pharmaceutical operations are focused on providing our customers generic drugs and APIs. We have a portfolio of approximately 83 different finished-dose generic drug product families, across a variety of therapeutic areas. Our finished-dose generic products feature a broad range of dosage forms, including transdermal patches, solid oral extended-release products, solid oral immediate-release products, liquids, semi-solids, and powders designed to address an array of therapeutic areas.

Within the generic pharmaceuticals business, we also provide bulk API products, including acetaminophen, stimulants, analgesics, and stearates (an excipient) to a wide variety of pharmaceutical companies. We are among the world’s largest manufacturers of bulk acetaminophen and the only producer of acetaminophen API in the North American region with manufacturing facilities in the United States. Our APIs and excipients are supplied directly to over 350 customers in approximately 70 countries. We also use our APIs for internal manufacturing of our finished-dose products.

Additionally, Par Health is one of the only generic manufacturers with its own controlled-substances API manufacturing capability. We offer a variety of product formulations, such as hydrocodone-containing tablets, oxycodone-containing tablets and several other controlled substances indicated for the treatment of pain. Other controlled-substances products include medicines used to treat attention-deficit/hyperactivity disorder and addiction treatment medicines.

We manufacture controlled substances under the U.S. Drug Enforcement Administration (“DEA”) quota restrictions, and in fiscal 2024, we estimated that we received greater than one-third of the total DEA quota provided to the U.S. market for the controlled substances we manufacture. We believe that our vertical integration and allocation of quota-governed, controlled-substances materials from the DEA are competitive advantages for our API business and, in turn, for our generic pharmaceutical business. The strategy for our API business is based on at-scale manufacturing of proven products and customized product offerings, responsive technical services and timely delivery to our customers.

Sterile Injectables

Our sterile injectables business includes a portfolio of approximately 40 products, including both vial and ready-to-use (“RTU”) formats. Our sterile injectables products are manufactured in dedicated facilities in various dosage forms and are administered at hospitals, clinics, and long-term care facilities. For products we develop for the U.S. market, after the completion of required clinical trials and testing, we seek approvals from regulatory bodies such as through the submission of 505(b)(2) New Drug Applications (“NDAs”), Abbreviated New Drug Applications (“ANDAs”), or Biologics License Applications (“BLAs”) to the U.S. Food and Drug Administration (“FDA”). We believe that our patents, the protection of discoveries in connection with our development activities, our proprietary products, technologies, processes, trade secrets, know-how, innovations, and all of our intellectual property are important to our business and achieving a competitive position. However, there can be no assurance that any of our patents, licenses or other intellectual property rights will afford us any protection from competition. Additional information is included in “Risk Factors—Par Health’s competitors or other third parties may allege that it is infringing their intellectual property, forcing it to expend substantial resources in litigation, the outcome of which is uncertain. Any unfavorable outcome of such litigation, including losses related to ‘at-risk’ product launches, could have a material adverse effect on Par Health’s business, financial condition, results of operations and cash flows.” and in “Risk Factors—Par Health may be unable to protect its intellectual property rights successfully, intellectual property rights may be limited or Par Health may be subject to claims that it infringes on the intellectual property rights of others.”

24

Key product offerings in this business include the following, among others:

| · | ADRENALIN®, which is a non-selective alpha and beta adrenergic agonist indicated for emergency treatment of certain allergic reactions, including anaphylaxis. We offer ADRENALIN® in multiple formulations, including the RTU premixed bag, which launched in an initial strength in October 2024, with four additional strengths launched into the market in 2025. |

| · | VASOSTRICT®, which is indicated to increase blood pressure in adults with vasodilatory shock who remain hypotensive despite fluids and catecholamines. We offer VASOSTRICT® in multiple formulations, including the RTU premixed bottle, which launched in February 2022. |

| · | APLISOL®, which is a sterile aqueous solution of a purified protein derivative for intradermal administration as an aid in the diagnosis of tuberculosis. |

Further information about Par Health’s business, including research and development, intellectual property, manufacturing and distribution, raw materials, sales, marketing, customers, regulatory matters, environmental matters and human capital is included in the section of this Information Statement entitled “Description of the Business.”

25

INFORMATION ABOUT THE TRANSACTION

A. Approval of the Redemption in Principle

On October 21, 2025 (such meeting, the “October 21 Meeting”), the Mallinckrodt Board approved resolutions authorizing, in principle, the Spin-off by means of the Redemption of the Mallinckrodt Preferred Shares in exchange for the right of shareholders as of the Record Date to receive, subject to compliance with the Certification Procedures and the terms of the Redemption, the Redemption Consideration (as defined in the section of this Information Statement entitled “Terms and Definitions”), being the right to receive:

| · | the “Base Proceeds,” being (i) in the case of Qualified Shareholders, the number of shares of Par Health Common Stock equal to the number of Mallinckrodt Preferred Shares held of record or beneficially, as applicable, by the relevant Qualified Shareholder as of the Record Date and certified on the Certification Form multiplied by the Per Share Stock Amount, rounded down to the nearest whole number; and (ii) in the case of Non-Qualified Shareholders, a cash amount equal to the number of Mallinckrodt Preferred Shares held of record or beneficially, as applicable, by the relevant Non-Qualified Shareholder as of the Record Date and certified on the Certification Form multiplied by the Per Share Cash Amount; and |

| · | the “Excess Proceeds,” being (i) in the case of Qualified Shareholders, the number of shares of Par Health Common Stock equal to the number of Mallinckrodt Preferred Shares held of record or beneficially, as applicable, by the relevant Qualified Shareholder as of the Record Date and certified on the Certification Form multiplied by the Per Share Excess Stock Amount, rounded down to the nearest whole number; and (ii) in the case of Non-Qualified Shareholders, a cash amount equal to the number of Mallinckrodt Preferred Shares held of record or beneficially, as applicable, by the relevant Non-Qualified Shareholder as of the Record Date and certified on the Certification Form multiplied by the Per Share Excess Cash Amount. |

Entitlements to cash payments in respect of Base Proceeds and Excess Proceeds with entitlements to fractions of a cent will be rounded up or down to the nearest cent.

On October 24, 2025, Mallinckrodt filed a Current Report on Form 8-K announcing that the Spin-off had been approved in principle and that the Record Date had been set as 5:30 p.m. (Eastern Time in the United States) on October 27, 2025.

Following the closing of the Redemption, Par Health will be an independent company owned by Qualified Shareholders. The Par Health Common Stock to be allocated in connection with the Spin-off has not been and will not be registered under the Securities Act or the Exchange Act. Par Health will operate as a private company following the Spin-off and will not be listed on a securities exchange.

B. Board Authority to Abandon Redemption

The Mallinckrodt Board retains the authority to modify the terms of, or to abandon, the Redemption at any time and for any reason until it has been consummated. Consummation of the Redemption will be subject to a separate approval by the Mallinckrodt Board no later than thirty (30) days from the Record Date (the “November Meeting”). In determining whether to finally approve the Redemption, the Mallinckrodt Board will consider a number of factors, including:

| · | Cash Requirements: Mallinckrodt will fund the cash payable to Non-Qualified Shareholders as part of the Redemption Consideration (for the avoidance of doubt, including the cash portions of the Base Proceeds and Excess Proceeds). At several meetings of the Mallinckrodt Board prior to the furnishing of this Information Statement, the Mallinckrodt Board considered that there could be a limit to the amount of cash that the Mallinckrodt Board would authorize Mallinckrodt to spend in satisfaction of such obligations; and |

26

| · | Distributable Reserves: Under Irish law, Mallinckrodt can only proceed with the Redemption if the total value to be allocated to Qualified Shareholders and Non-Qualified Shareholders pursuant to the Redemption Consideration (for the avoidance of doubt, including in respect of Base Proceeds and Excess Proceeds) does not exceed Mallinckrodt’s profits available for distribution (within the meaning of the Companies Act 2014) at the time of the Redemption and does not otherwise cause Mallinckrodt to breach section 1082 of the Companies Act 2014. As of September 26, 2025, Mallinckrodt’s Distributable Reserves are equal to approximately $1.7625 billion. |

The Mallinckrodt Board’s analysis of these factors at the November Meeting will be informed by, among other things, (a) the net asset value of Par Health on the balance sheet of Mallinckrodt as of the last practicable date before the Redemption Date and (b) the evaluation of the Certification Forms submitted by the Record Holders (and any Street Name Holders identified by such Record Holders) and the percentage of outstanding Mallinckrodt Preferred Shares represented by Qualified Shareholders that have properly and timely completed a Certification Form as of the date of the Mallinckrodt Board’s determination. Because the right to receive 100% of the outstanding shares of Par Health Common Stock as of the Redemption Date will be allocated in the Redemption, a higher equity value necessarily results in the use of more Distributable Reserves. As discussed in the section entitled “Escrow Closing,” the effect is compounded as the percentage of Mallinckrodt Preferred Shares held by Qualified Shareholders decreases. This results in the allocation of Par Health Common Stock among a smaller pool of Mallinckrodt Preferred Shares, which increases the value allocated to Qualified Shareholders in respect of each Mallinckrodt Preferred Share. Because the Mallinckrodt Board has determined that Qualified Shareholders and Non-Qualified Shareholders should receive equivalent value per Mallinckrodt Preferred Share in the Redemption, Mallinckrodt will, in turn, pay more cash per Mallinckrodt Ordinary Share to Non-Qualified Shareholders as the number of Non-Qualified Shareholders increases in order to maintain equivalence under the terms of the Redemption.

1. Equity Value of Par Health