.2

Q3 | 2025 1 This presentation contains certain financial information not derived in accordance with the United States generally accepted accounting principles (GAAP). These items include earnings before interest, income taxes, depreciation and amortization (EBITDA), EBITDA for real estate (EBITDAre), earnings before interest, income taxes, depreciation, amortization, rent and management fees (EBITDARM), funds from operations (FFO), core funds from operations (Core FFO), adjusted funds from operations (AFFO), net debt, net operating income (NOI), cash NOI, and same store cash NOI, as well as ratios derived from the foregoing. These measures (and the methodologies used to derive them) may not be comparable to those used by other companies. Refer to the glossary for a detailed explanation of these terms and reconciliations to the most directly comparable GAAP measures, as well as others appearing in the supplement. Management considers each item an important supplemental measure of operating and financial performance and believes they are frequently used by interested parties in the evaluation of real estate investment trusts. These measures should not be considered as alternatives, or superior measures, to net income or loss as an indicator of the Company's performance and should be considered only as a supplement to net income or loss and cash flows from operating, investing or financing activities as measures of profitability and/or liquidity, computed in accordance with GAAP. Certain statements contained herein, other than historical fact, may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provided by the same. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties. No forward-looking statement is intended to, nor shall it, serve as a guarantee of future performance. You can identify the forward-looking statements by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will” and other similar terms and phrases, including references to expected lease expiration and annualized base rent trends and extensions of the Company's term loan and revolving line of credit. Forward-looking statements are subject to various risks and uncertainties and factors that could cause actual results to differ materially from the expectations of Sila Realty Trust, Inc. (the "Company"), and investors should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond the Company’s control and could materially affect the Company’s results of operations, financial condition, cash flows, performance or future achievements or events, including those described under the section entitled Part I, Item 1A. “Risk Factors” of the Company's 2024 Annual Report on Form 10-K, as filed with the SEC on March 3, 2025. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Forward Looking Statements Non-GAAP Measures Unaudited Financial Information All quarterly information presented in this supplement is unaudited and should be read in conjunction with the Company’s audited consolidated financial statements (and the notes thereto) included in the Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on March 3, 2025. See the glossary for a description of the Company's non-GAAP financial and operating metrics. Disclosures

Q3 | 2025 2 Table of Contents Supplemental Information as of September 30, 2025 Corporate Address 1001 Water Street Suite 800 Tampa, FL 33602 Transfer Agent By Regular Mail: Computershare P.O. Box 43007 Providence, RI 02940-3007 By Overnight Delivery: Computershare 150 Royall Street, Suite 101 Canton, MA 02021 Contact Information Investor Support 833.404.4107 Drew Miles, Senior Capital Markets and Investor Relations Associate IR@silarealtytrust.com www.SilaRealtyTrust.com 3 Quarterly Financial Summary 4 Financial Statistics and Ratios 5 Condensed Consolidated Balance Sheets 6 Condensed Consolidated Statements of Income 7 Reconciliations of Non-GAAP Measures - FFO, Core FFO, and AFFO 8 Reconciliations of Non-GAAP Measures - EBITDA and EBITDAre 9 Reconciliations of Non-GAAP Measures - Net Operating Income (NOI) 10 Same Store Cash NOI and Leasing Trends 11 Debt 12 Acquisitions and Dispositions 13 Property Map 14 Real Estate Diversification 17 Portfolio 21 Glossary Pictured Above: Fort Smith Healthcare Facility

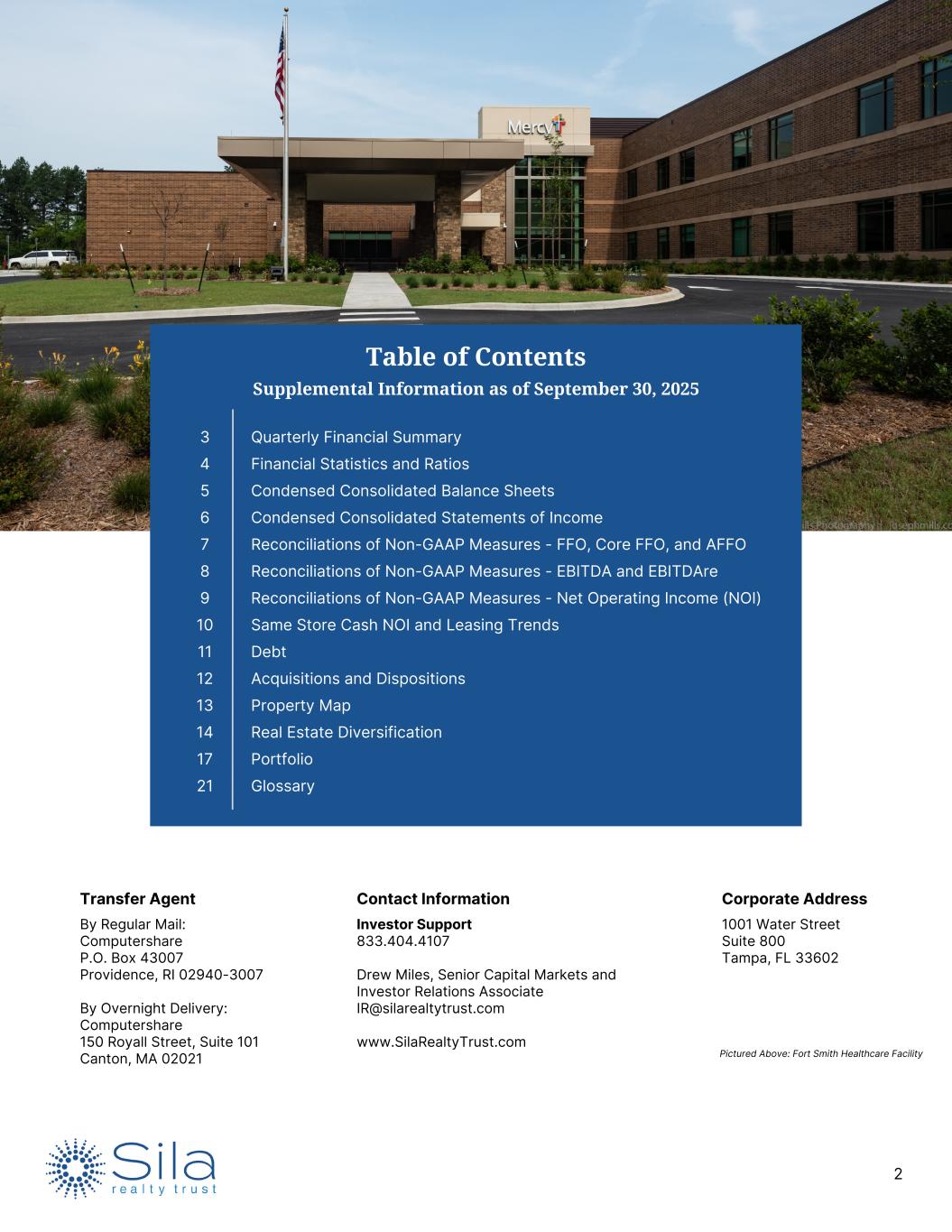

Q3 | 2025 3 Quarterly Financial Summary (dollars in thousands, except share data and per share amounts) The following tables summarize the Company's quarterly financial results and portfolio metrics. See the glossary for a description of the Company's non-GAAP financial and operating metrics. Three Months Ended Financial Results September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Rental revenue $ 49,421 $ 48,544 $ 48,256 $ 46,545 $ 46,118 Net income attributable to common stockholders $ 11,609 $ 8,598 $ 7,898 $ 11,114 $ 11,935 Net income per common share - diluted $ 0.21 $ 0.15 $ 0.14 $ 0.20 $ 0.21 EBITDAre $ 39,475 $ 37,870 $ 36,516 $ 33,859 $ 36,060 FFO $ 30,976 $ 30,014 $ 29,166 $ 28,571 $ 30,568 FFO per common share - diluted $ 0.56 $ 0.54 $ 0.52 $ 0.51 $ 0.54 FFO payout ratio 71.2 % 73.9 % 77.1 % 77.5 % 73.4 % Core FFO $ 31,154 $ 30,106 $ 29,607 $ 28,998 $ 30,798 Core FFO per common share - diluted $ 0.56 $ 0.54 $ 0.53 $ 0.52 $ 0.55 Core FFO payout ratio 70.8 % 73.7 % 76.0 % 76.4 % 72.8 % AFFO $ 31,081 $ 29,997 $ 29,448 $ 30,235 $ 31,714 AFFO per common share - diluted $ 0.56 $ 0.54 $ 0.53 $ 0.54 $ 0.57 AFFO payout ratio 71.0 % 74.0 % 76.4 % 73.3 % 70.7 % As of Portfolio Metrics September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Number of properties1 140 136 136 135 136 Rentable square feet (in thousands) 5,323 5,194 5,333 5,263 5,271 Weighted average rent escalation 2.1 % 2.2% 2.2% 2.2% 2.2% Leased rate2 99.1% 99.2% 96.0% 96.0% 95.5% Weighted average remaining lease term 9.7 years 9.5 years 9.7 years 9.7 years 8.3 years Number of leases3 173 169 169 169 168 Triple net lease exposure4,5 99.9 % 99.9 % 99.9 % 99.9 % 99.9 % (1) All periods exclude two undeveloped land parcels. Additionally, September 30, 2025 and June 30, 2025 exclude the Stoughton Healthcare Facility which has been taken out of service and is being demolished. (2) Excludes properties taken out of service. (3) Master leases account for a single lease. (4) Includes triple net leases and absolute net leases. (5) Based on annualized contractual base rent.

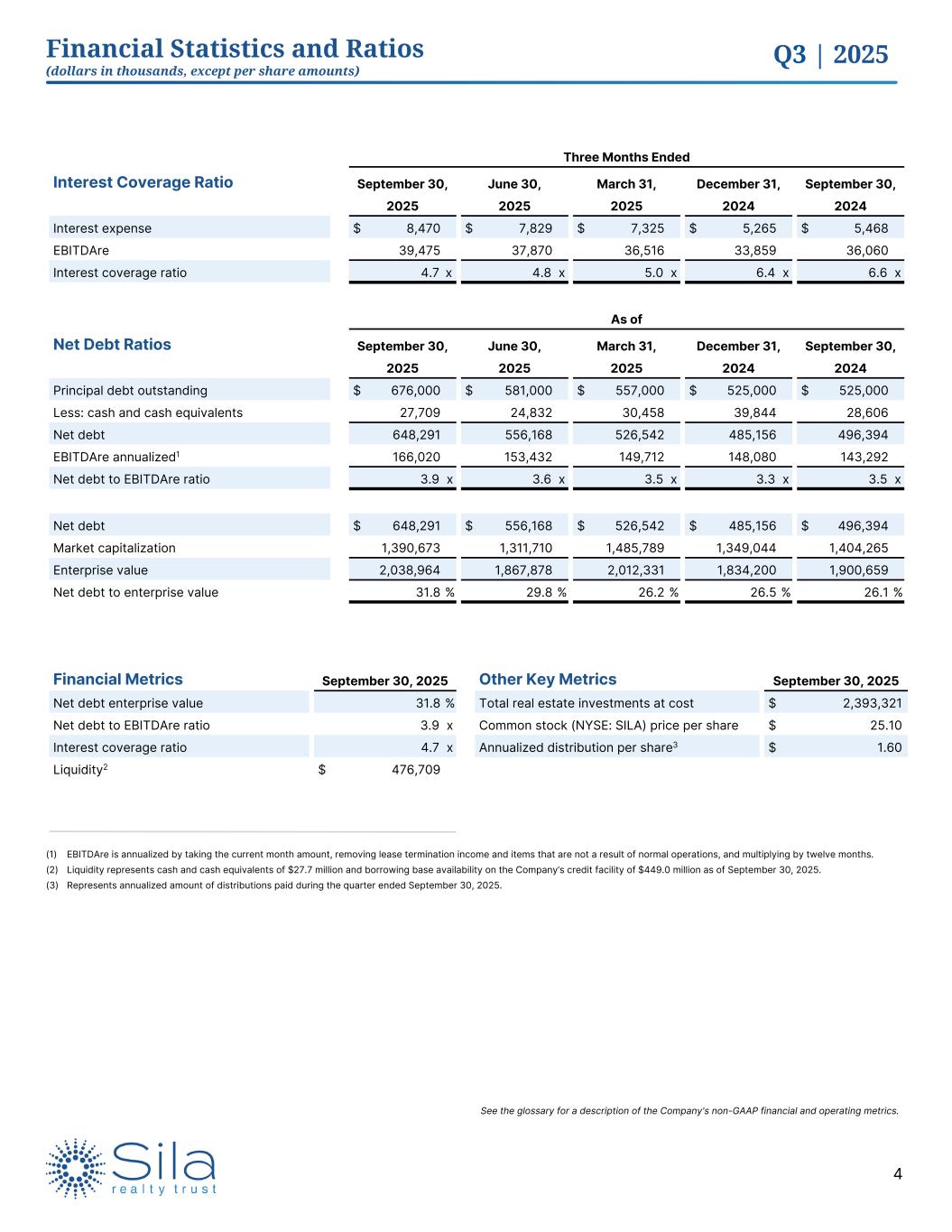

Q3 | 2025 4 Three Months Ended Interest Coverage Ratio September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Interest expense $ 8,470 $ 7,829 $ 7,325 $ 5,265 $ 5,468 EBITDAre 39,475 37,870 36,516 33,859 36,060 Interest coverage ratio 4.7 x 4.8 x 5.0 x 6.4 x 6.6 x As of Net Debt Ratios September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Principal debt outstanding $ 676,000 $ 581,000 $ 557,000 $ 525,000 $ 525,000 Less: cash and cash equivalents 27,709 24,832 30,458 39,844 28,606 Net debt 648,291 556,168 526,542 485,156 496,394 EBITDAre annualized1 166,020 153,432 149,712 148,080 143,292 Net debt to EBITDAre ratio 3.9 x 3.6 x 3.5 x 3.3 x 3.5 x Net debt $ 648,291 $ 556,168 $ 526,542 $ 485,156 $ 496,394 Market capitalization 1,390,673 1,311,710 1,485,789 1,349,044 1,404,265 Enterprise value 2,038,964 1,867,878 2,012,331 1,834,200 1,900,659 Net debt to enterprise value 31.8 % 29.8 % 26.2 % 26.5 % 26.1 % Financial Statistics and Ratios (dollars in thousands, except per share amounts) See the glossary for a description of the Company's non-GAAP financial and operating metrics. Financial Metrics September 30, 2025 Other Key Metrics September 30, 2025 Net debt enterprise value 31.8 % Total real estate investments at cost $ 2,393,321 Net debt to EBITDAre ratio 3.9 x Common stock (NYSE: SILA) price per share $ 25.10 Interest coverage ratio 4.7 x Annualized distribution per share3 $ 1.60 Liquidity2 $ 476,709 (1) EBITDAre is annualized by taking the current month amount, removing lease termination income and items that are not a result of normal operations, and multiplying by twelve months. (2) Liquidity represents cash and cash equivalents of $27.7 million and borrowing base availability on the Company’s credit facility of $449.0 million as of September 30, 2025. (3) Represents annualized amount of distributions paid during the quarter ended September 30, 2025.

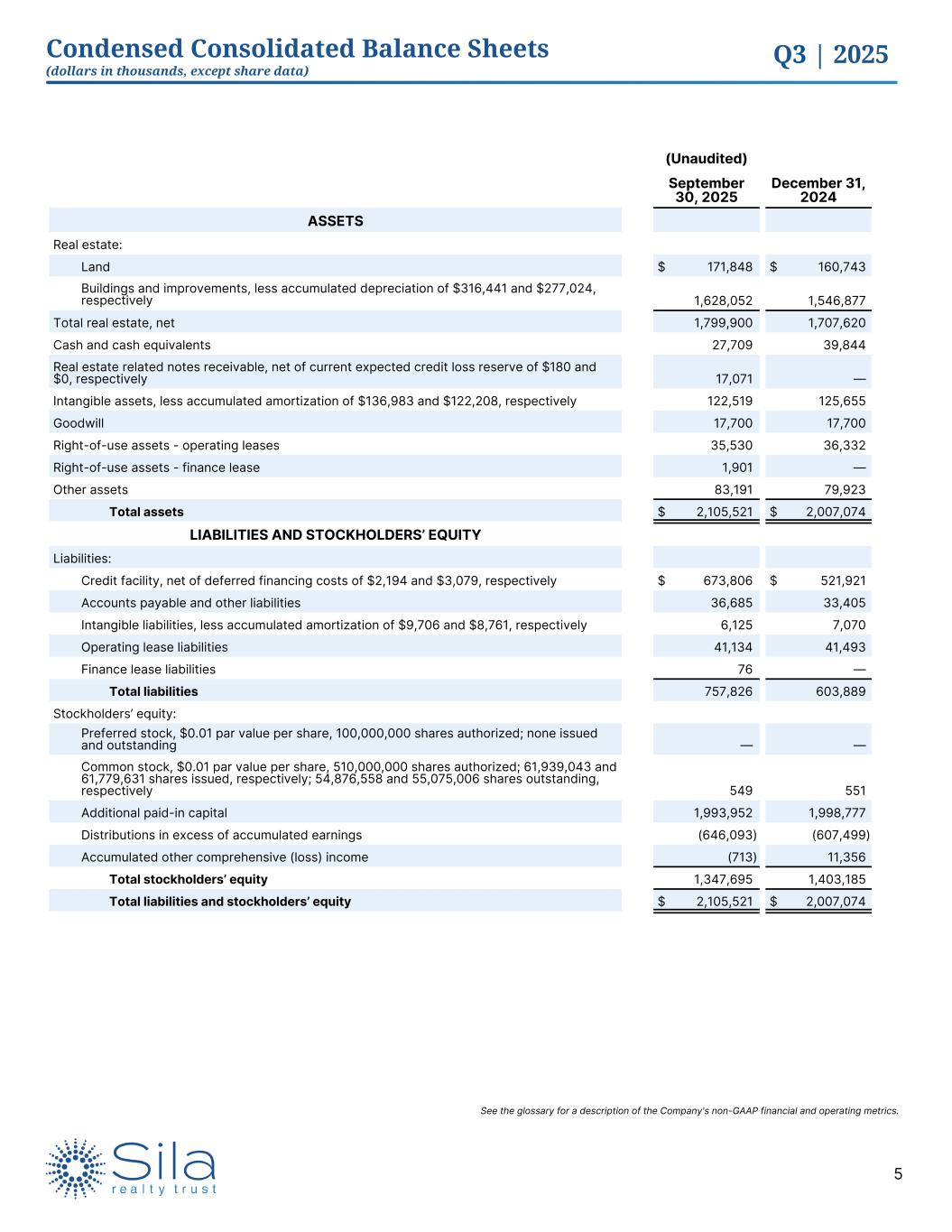

Q3 | 2025 5 (Unaudited) September 30, 2025 December 31, 2024 ASSETS Real estate: Land $ 171,848 $ 160,743 Buildings and improvements, less accumulated depreciation of $316,441 and $277,024, respectively 1,628,052 1,546,877 Total real estate, net 1,799,900 1,707,620 Cash and cash equivalents 27,709 39,844 Real estate related notes receivable, net of current expected credit loss reserve of $180 and $0, respectively 17,071 — Intangible assets, less accumulated amortization of $136,983 and $122,208, respectively 122,519 125,655 Goodwill 17,700 17,700 Right-of-use assets - operating leases 35,530 36,332 Right-of-use assets - finance lease 1,901 — Other assets 83,191 79,923 Total assets $ 2,105,521 $ 2,007,074 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities: Credit facility, net of deferred financing costs of $2,194 and $3,079, respectively $ 673,806 $ 521,921 Accounts payable and other liabilities 36,685 33,405 Intangible liabilities, less accumulated amortization of $9,706 and $8,761, respectively 6,125 7,070 Operating lease liabilities 41,134 41,493 Finance lease liabilities 76 — Total liabilities 757,826 603,889 Stockholders’ equity: Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding — — Common stock, $0.01 par value per share, 510,000,000 shares authorized; 61,939,043 and 61,779,631 shares issued, respectively; 54,876,558 and 55,075,006 shares outstanding, respectively 549 551 Additional paid-in capital 1,993,952 1,998,777 Distributions in excess of accumulated earnings (646,093) (607,499) Accumulated other comprehensive (loss) income (713) 11,356 Total stockholders’ equity 1,347,695 1,403,185 Total liabilities and stockholders’ equity $ 2,105,521 $ 2,007,074 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) See the glossary for a description of the Company's non-GAAP financial and operating metrics.

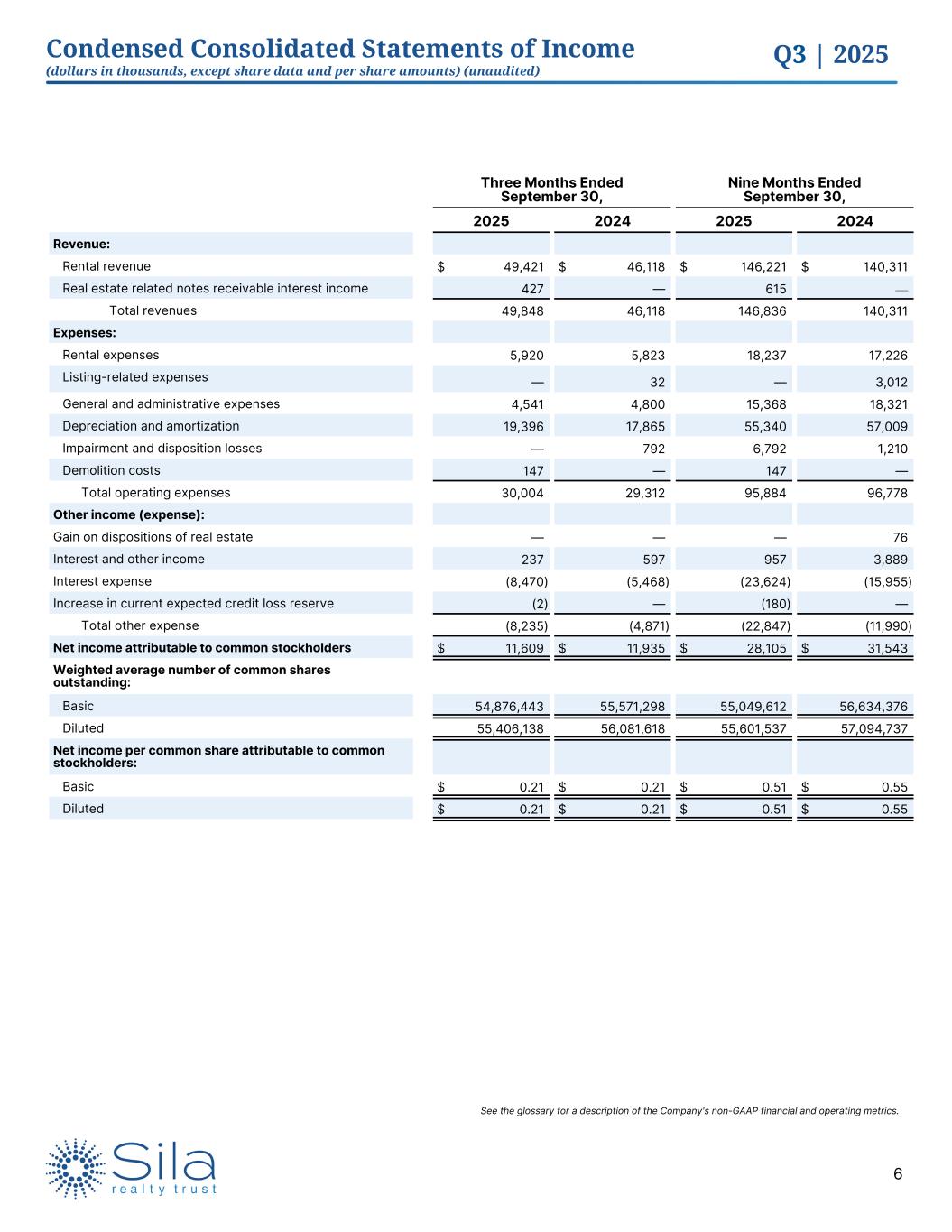

Q3 | 2025 6 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Revenue: Rental revenue $ 49,421 $ 46,118 $ 146,221 $ 140,311 Real estate related notes receivable interest income 427 — 615 — Total revenues 49,848 46,118 146,836 140,311 Expenses: Rental expenses 5,920 5,823 18,237 17,226 Listing-related expenses — 32 — 3,012 General and administrative expenses 4,541 4,800 15,368 18,321 Depreciation and amortization 19,396 17,865 55,340 57,009 Impairment and disposition losses — 792 6,792 1,210 Demolition costs 147 — 147 — Total operating expenses 30,004 29,312 95,884 96,778 Other income (expense): Gain on dispositions of real estate — — — 76 Interest and other income 237 597 957 3,889 Interest expense (8,470) (5,468) (23,624) (15,955) Increase in current expected credit loss reserve (2) — (180) — Total other expense (8,235) (4,871) (22,847) (11,990) Net income attributable to common stockholders $ 11,609 $ 11,935 $ 28,105 $ 31,543 Weighted average number of common shares outstanding: Basic 54,876,443 55,571,298 55,049,612 56,634,376 Diluted 55,406,138 56,081,618 55,601,537 57,094,737 Net income per common share attributable to common stockholders: Basic $ 0.21 $ 0.21 $ 0.51 $ 0.55 Diluted $ 0.21 $ 0.21 $ 0.51 $ 0.55 Condensed Consolidated Statements of Income (dollars in thousands, except share data and per share amounts) (unaudited) See the glossary for a description of the Company's non-GAAP financial and operating metrics.

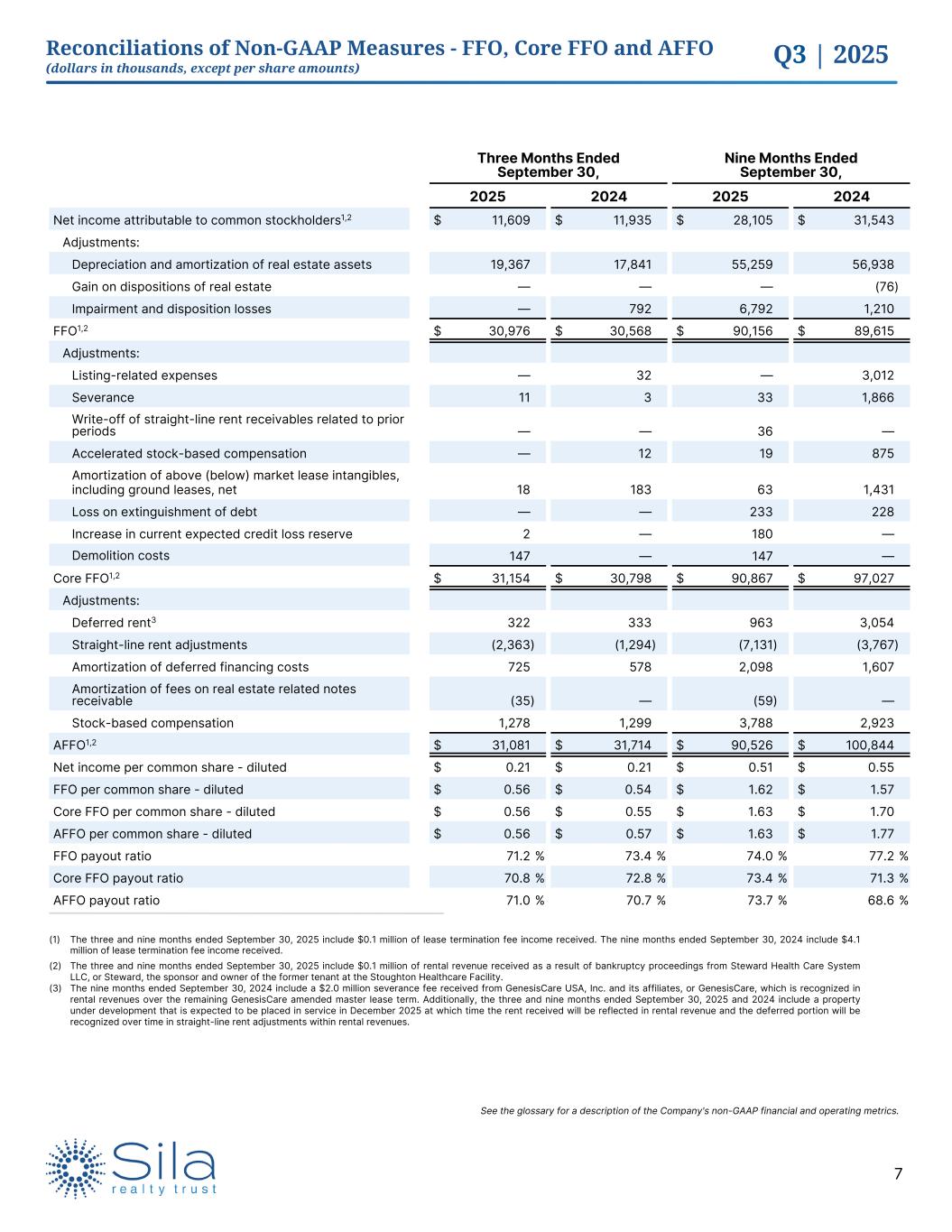

Q3 | 2025 7 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net income attributable to common stockholders1,2 $ 11,609 $ 11,935 $ 28,105 $ 31,543 Adjustments: Depreciation and amortization of real estate assets 19,367 17,841 55,259 56,938 Gain on dispositions of real estate — — — (76) Impairment and disposition losses — 792 6,792 1,210 FFO1,2 $ 30,976 $ 30,568 $ 90,156 $ 89,615 Adjustments: Listing-related expenses — 32 — 3,012 Severance 11 3 33 1,866 Write-off of straight-line rent receivables related to prior periods — — 36 — Accelerated stock-based compensation — 12 19 875 Amortization of above (below) market lease intangibles, including ground leases, net 18 183 63 1,431 Loss on extinguishment of debt — — 233 228 Increase in current expected credit loss reserve 2 — 180 — Demolition costs 147 — 147 — Core FFO1,2 $ 31,154 $ 30,798 $ 90,867 $ 97,027 Adjustments: Deferred rent3 322 333 963 3,054 Straight-line rent adjustments (2,363) (1,294) (7,131) (3,767) Amortization of deferred financing costs 725 578 2,098 1,607 Amortization of fees on real estate related notes receivable (35) — (59) — Stock-based compensation 1,278 1,299 3,788 2,923 AFFO1,2 $ 31,081 $ 31,714 $ 90,526 $ 100,844 Net income per common share - diluted $ 0.21 $ 0.21 $ 0.51 $ 0.55 FFO per common share - diluted $ 0.56 $ 0.54 $ 1.62 $ 1.57 Core FFO per common share - diluted $ 0.56 $ 0.55 $ 1.63 $ 1.70 AFFO per common share - diluted $ 0.56 $ 0.57 $ 1.63 $ 1.77 FFO payout ratio 71.2 % 73.4 % 74.0 % 77.2 % Core FFO payout ratio 70.8 % 72.8 % 73.4 % 71.3 % AFFO payout ratio 71.0 % 70.7 % 73.7 % 68.6 % Reconciliations of Non-GAAP Measures - FFO, Core FFO and AFFO (dollars in thousands, except per share amounts) See the glossary for a description of the Company's non-GAAP financial and operating metrics. (1) The three and nine months ended September 30, 2025 include $0.1 million of lease termination fee income received. The nine months ended September 30, 2024 include $4.1 million of lease termination fee income received. (2) The three and nine months ended September 30, 2025 include $0.1 million of rental revenue received as a result of bankruptcy proceedings from Steward Health Care System LLC, or Steward, the sponsor and owner of the former tenant at the Stoughton Healthcare Facility. (3) The nine months ended September 30, 2024 include a $2.0 million severance fee received from GenesisCare USA, Inc. and its affiliates, or GenesisCare, which is recognized in rental revenues over the remaining GenesisCare amended master lease term. Additionally, the three and nine months ended September 30, 2025 and 2024 include a property under development that is expected to be placed in service in December 2025 at which time the rent received will be reflected in rental revenue and the deferred portion will be recognized over time in straight-line rent adjustments within rental revenues.

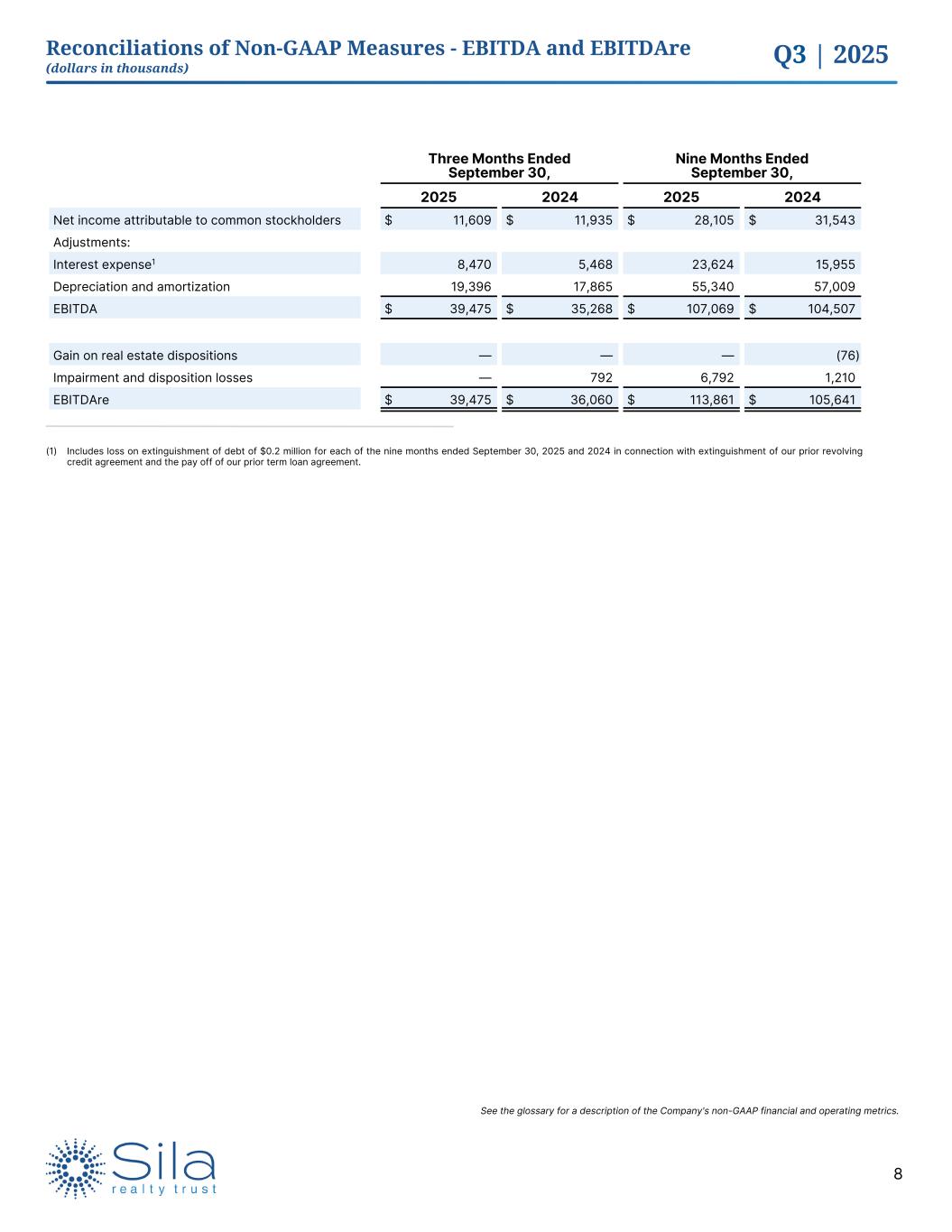

Q3 | 2025 8 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net income attributable to common stockholders $ 11,609 $ 11,935 $ 28,105 $ 31,543 Adjustments: Interest expense1 8,470 5,468 23,624 15,955 Depreciation and amortization 19,396 17,865 55,340 57,009 EBITDA $ 39,475 $ 35,268 $ 107,069 $ 104,507 Gain on real estate dispositions — — — (76) Impairment and disposition losses — 792 6,792 1,210 EBITDAre $ 39,475 $ 36,060 $ 113,861 $ 105,641 Reconciliations of Non-GAAP Measures - EBITDA and EBITDAre (dollars in thousands) See the glossary for a description of the Company's non-GAAP financial and operating metrics. (1) Includes loss on extinguishment of debt of $0.2 million for each of the nine months ended September 30, 2025 and 2024 in connection with extinguishment of our prior revolving credit agreement and the pay off of our prior term loan agreement.

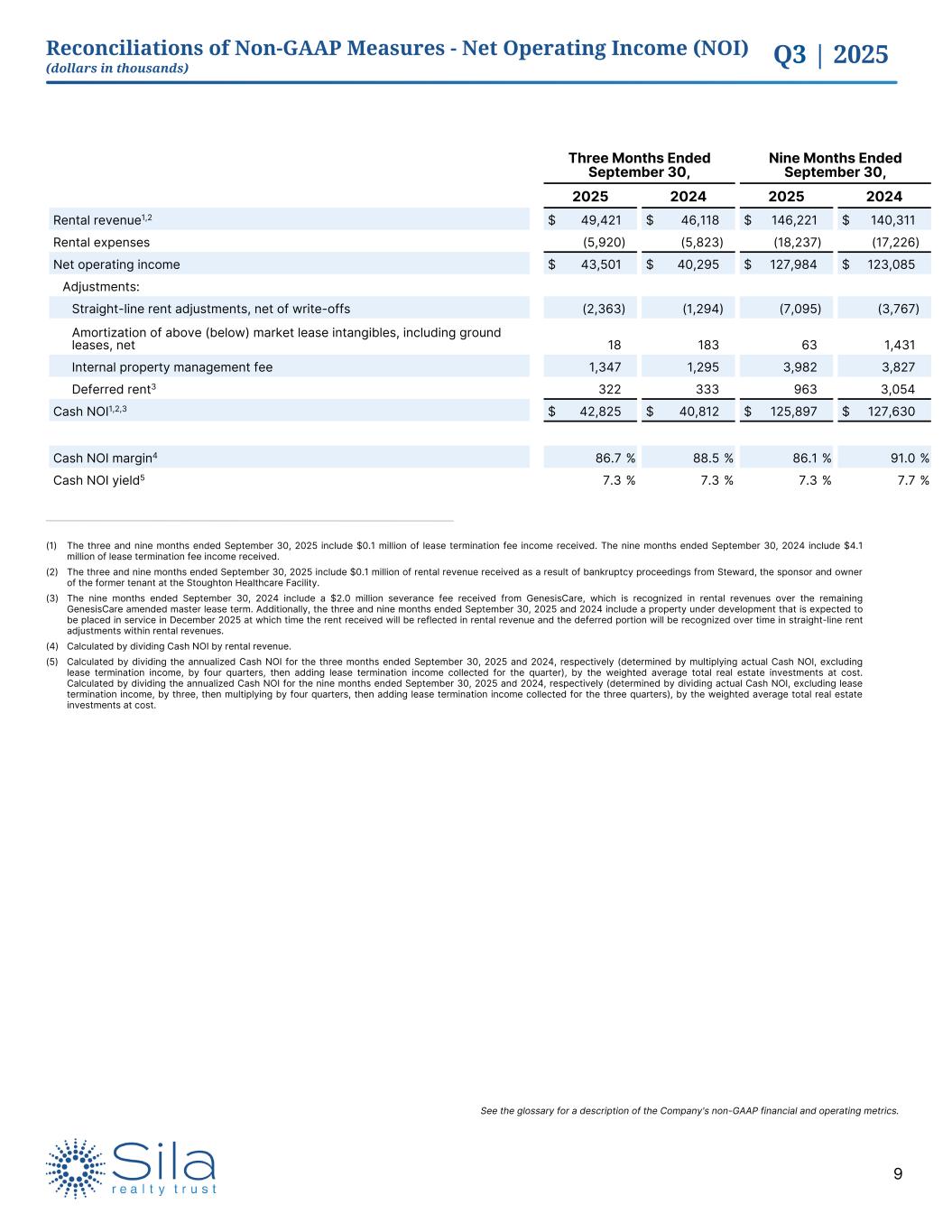

Q3 | 2025 9 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Rental revenue1,2 $ 49,421 $ 46,118 $ 146,221 $ 140,311 Rental expenses (5,920) (5,823) (18,237) (17,226) Net operating income $ 43,501 $ 40,295 $ 127,984 $ 123,085 Adjustments: Straight-line rent adjustments, net of write-offs (2,363) (1,294) (7,095) (3,767) Amortization of above (below) market lease intangibles, including ground leases, net 18 183 63 1,431 Internal property management fee 1,347 1,295 3,982 3,827 Deferred rent3 322 333 963 3,054 Cash NOI1,2,3 $ 42,825 $ 40,812 $ 125,897 $ 127,630 Cash NOI margin4 86.7 % 88.5 % 86.1 % 91.0 % Cash NOI yield5 7.3 % 7.3 % 7.3 % 7.7 % Reconciliations of Non-GAAP Measures - Net Operating Income (NOI) (dollars in thousands) See the glossary for a description of the Company's non-GAAP financial and operating metrics. (1) The three and nine months ended September 30, 2025 include $0.1 million of lease termination fee income received. The nine months ended September 30, 2024 include $4.1 million of lease termination fee income received. (2) The three and nine months ended September 30, 2025 include $0.1 million of rental revenue received as a result of bankruptcy proceedings from Steward, the sponsor and owner of the former tenant at the Stoughton Healthcare Facility. (3) The nine months ended September 30, 2024 include a $2.0 million severance fee received from GenesisCare, which is recognized in rental revenues over the remaining GenesisCare amended master lease term. Additionally, the three and nine months ended September 30, 2025 and 2024 include a property under development that is expected to be placed in service in December 2025 at which time the rent received will be reflected in rental revenue and the deferred portion will be recognized over time in straight-line rent adjustments within rental revenues. (4) Calculated by dividing Cash NOI by rental revenue. (5) Calculated by dividing the annualized Cash NOI for the three months ended September 30, 2025 and 2024, respectively (determined by multiplying actual Cash NOI, excluding lease termination income, by four quarters, then adding lease termination income collected for the quarter), by the weighted average total real estate investments at cost. Calculated by dividing the annualized Cash NOI for the nine months ended September 30, 2025 and 2024, respectively (determined by dividing actual Cash NOI, excluding lease termination income, by three, then multiplying by four quarters, then adding lease termination income collected for the three quarters), by the weighted average total real estate investments at cost.

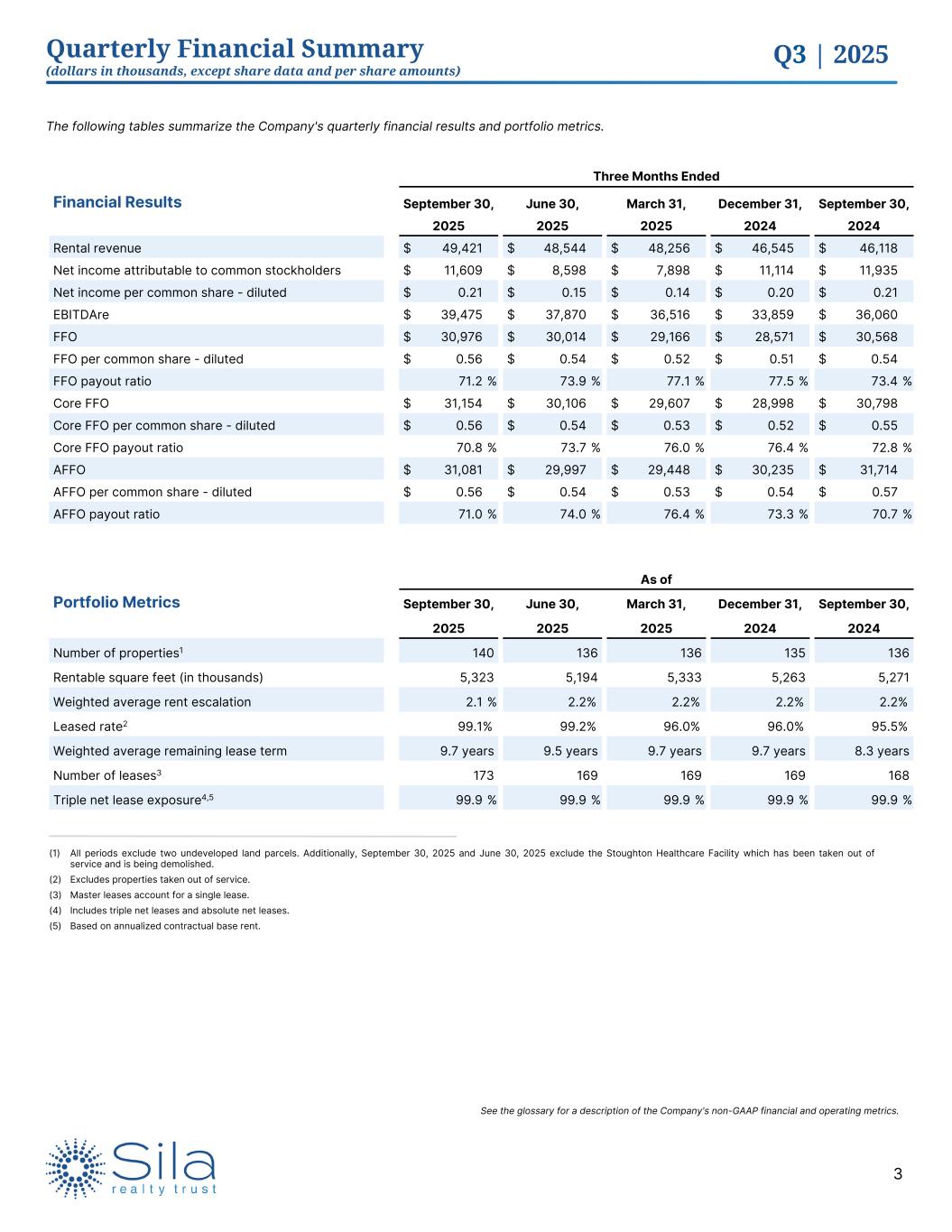

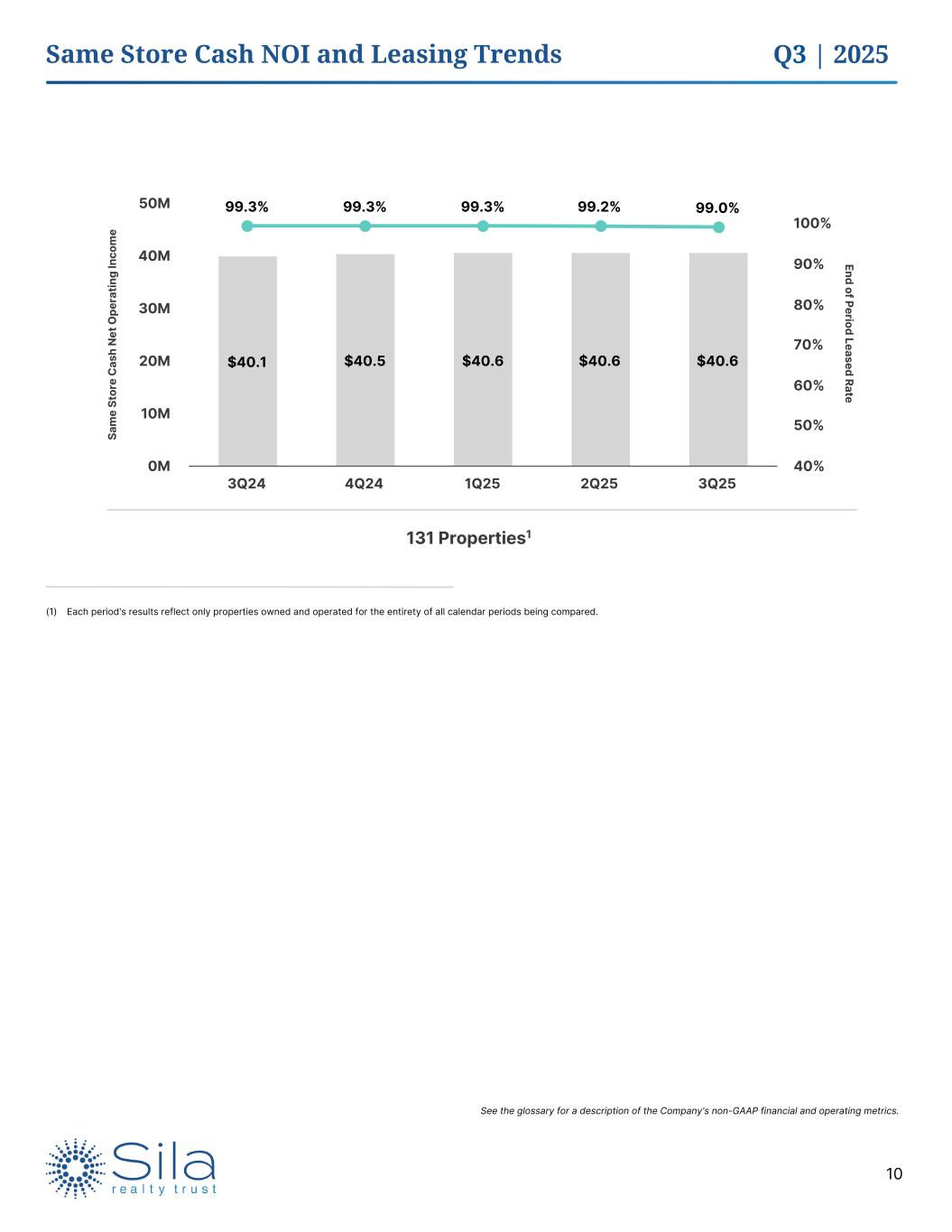

Q3 | 2025 10 See the glossary for a description of the Company's non-GAAP financial and operating metrics. Same Store Cash NOI and Leasing Trends (1) Each period's results reflect only properties owned and operated for the entirety of all calendar periods being compared. Sa m e St or e C as h N et O pe ra tin g In co m e End of Period Leased Rate $40.1 $40.5 $40.6 $40.6 $40.6 99.3% 99.3% 99.3% 99.2% 99.0% 3Q24 4Q24 1Q25 2Q25 3Q25 0M 10M 20M 30M 40M 50M 40% 50% 60% 70% 80% 90% 100% 131 Properties1

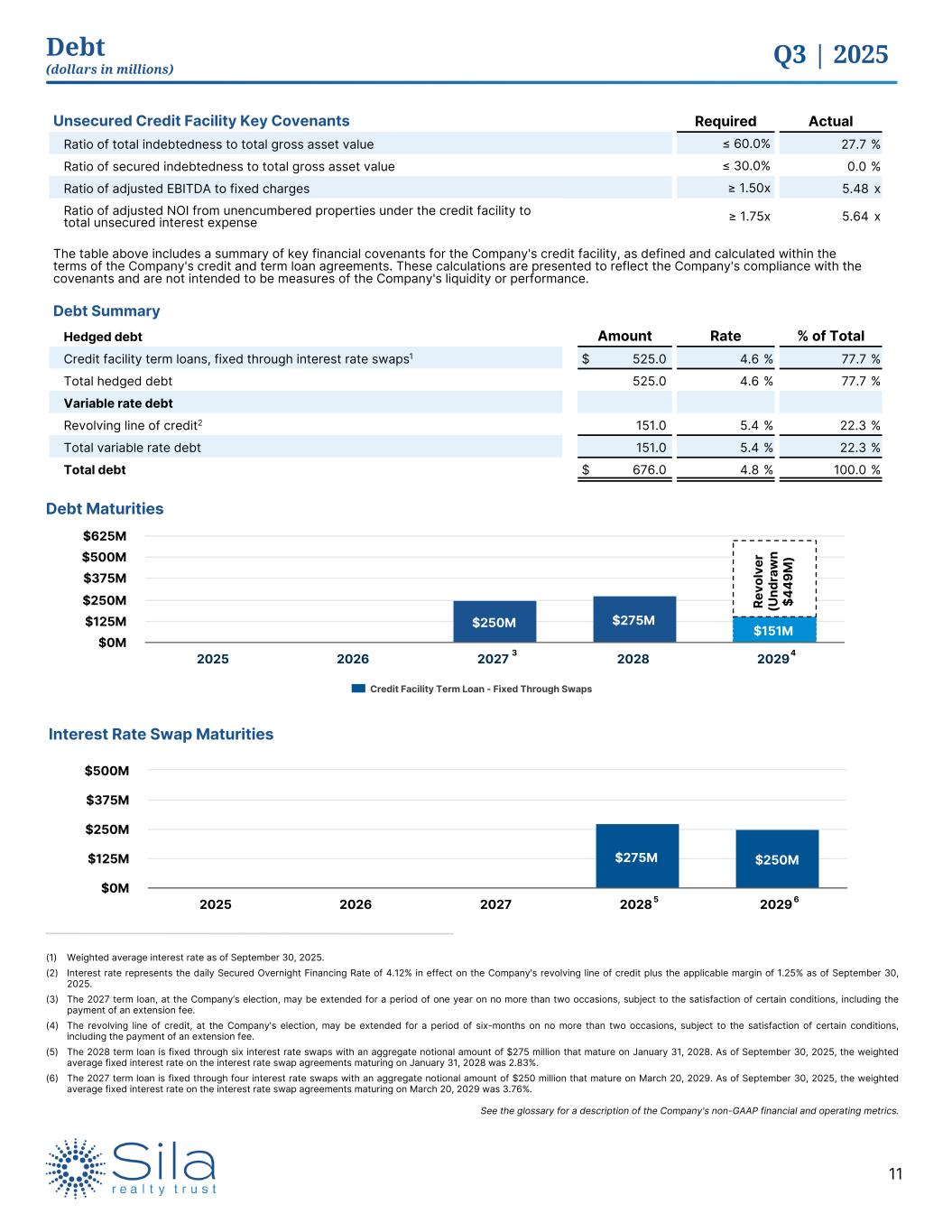

Q3 | 2025 11 See the glossary for a description of the Company's non-GAAP financial and operating metrics. Debt (dollars in millions) Unsecured Credit Facility Key Covenants Required Actual Ratio of total indebtedness to total gross asset value ≤ 60.0% 27.7 % Ratio of secured indebtedness to total gross asset value ≤ 30.0% 0.0 % Ratio of adjusted EBITDA to fixed charges ≥ 1.50x 5.48 x Ratio of adjusted NOI from unencumbered properties under the credit facility to total unsecured interest expense ≥ 1.75x 5.64 x The table above includes a summary of key financial covenants for the Company's credit facility, as defined and calculated within the terms of the Company's credit and term loan agreements. These calculations are presented to reflect the Company's compliance with the covenants and are not intended to be measures of the Company's liquidity or performance. Debt Summary Hedged debt Amount Rate % of Total Credit facility term loans, fixed through interest rate swaps1 $ 525.0 4.6 % 77.7 % Total hedged debt 525.0 4.6 % 77.7 % Variable rate debt Revolving line of credit2 151.0 5.4 % 22.3 % Total variable rate debt 151.0 5.4 % 22.3 % Total debt $ 676.0 4.8 % 100.0 % $250M $275M $151M 2025 2026 2027 2028 2029 $0M $125M $250M $375M $500M $625M Debt Maturities Interest Rate Swap Maturities $275M $250M 2025 2026 2027 2028 2029 $0M $125M $250M $375M $500M (1) Weighted average interest rate as of September 30, 2025. (2) Interest rate represents the daily Secured Overnight Financing Rate of 4.12% in effect on the Company's revolving line of credit plus the applicable margin of 1.25% as of September 30, 2025. (3) The 2027 term loan, at the Company’s election, may be extended for a period of one year on no more than two occasions, subject to the satisfaction of certain conditions, including the payment of an extension fee. (4) The revolving line of credit, at the Company's election, may be extended for a period of six-months on no more than two occasions, subject to the satisfaction of certain conditions, including the payment of an extension fee. (5) The 2028 term loan is fixed through six interest rate swaps with an aggregate notional amount of $275 million that mature on January 31, 2028. As of September 30, 2025, the weighted average fixed interest rate on the interest rate swap agreements maturing on January 31, 2028 was 2.83%. (6) The 2027 term loan is fixed through four interest rate swaps with an aggregate notional amount of $250 million that mature on March 20, 2029. As of September 30, 2025, the weighted average fixed interest rate on the interest rate swap agreements maturing on March 20, 2029 was 3.76%. 43 5 6 Re vo lv er (U nd ra w n $4 49 M ) Credit Facility Term Loan - Fixed Through Swaps

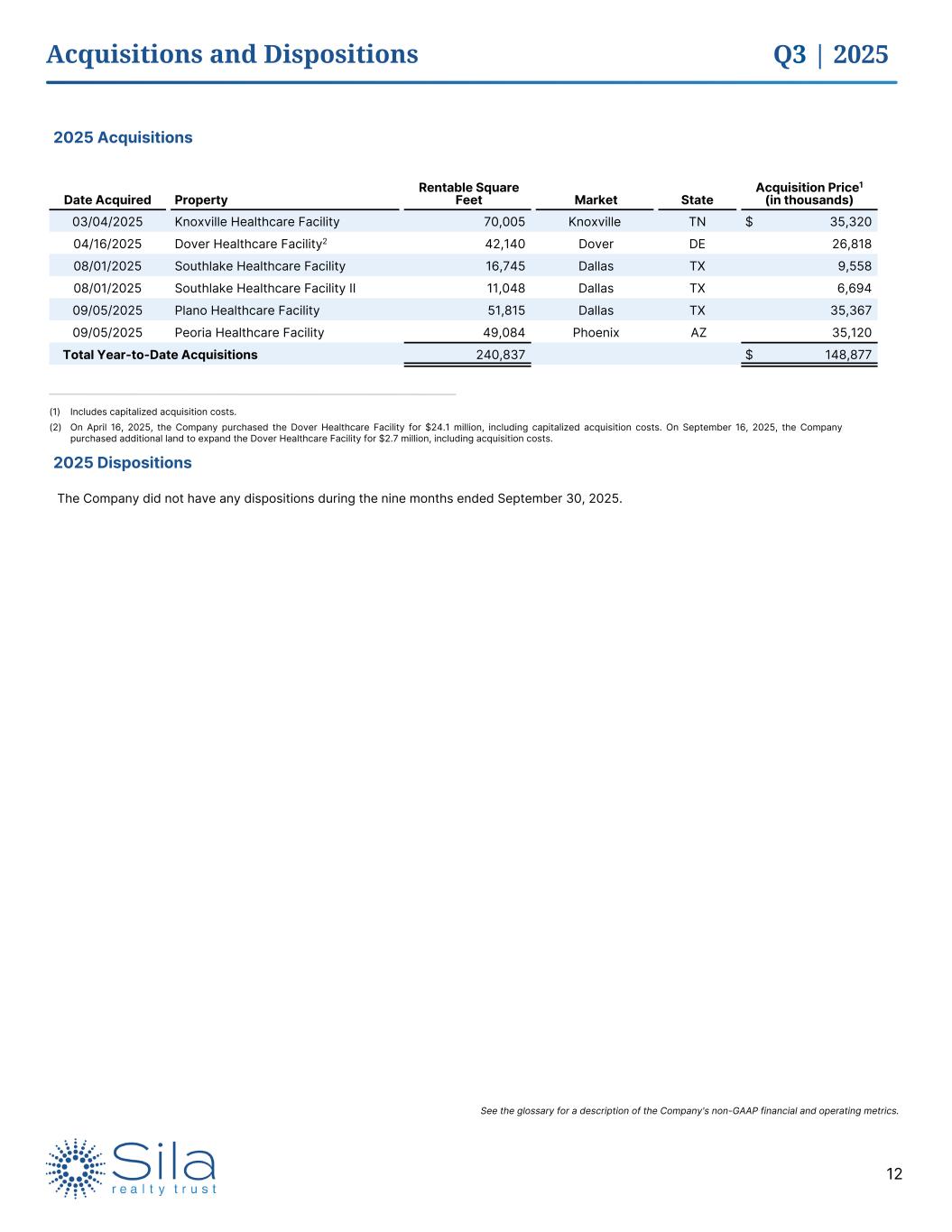

Q3 | 2025 12 See the glossary for a description of the Company's non-GAAP financial and operating metrics. Acquisitions and Dispositions 2025 Acquisitions Date Acquired Property Rentable Square Feet Market State Acquisition Price1 (in thousands) 03/04/2025 Knoxville Healthcare Facility 70,005 Knoxville TN $ 35,320 04/16/2025 Dover Healthcare Facility2 42,140 Dover DE 26,818 08/01/2025 Southlake Healthcare Facility 16,745 Dallas TX 9,558 08/01/2025 Southlake Healthcare Facility II 11,048 Dallas TX 6,694 09/05/2025 Plano Healthcare Facility 51,815 Dallas TX 35,367 09/05/2025 Peoria Healthcare Facility 49,084 Phoenix AZ 35,120 Total Year-to-Date Acquisitions 240,837 $ 148,877 (1) Includes capitalized acquisition costs. (2) On April 16, 2025, the Company purchased the Dover Healthcare Facility for $24.1 million, including capitalized acquisition costs. On September 16, 2025, the Company purchased additional land to expand the Dover Healthcare Facility for $2.7 million, including acquisition costs. 2025 Dispositions The Company did not have any dispositions during the nine months ended September 30, 2025.

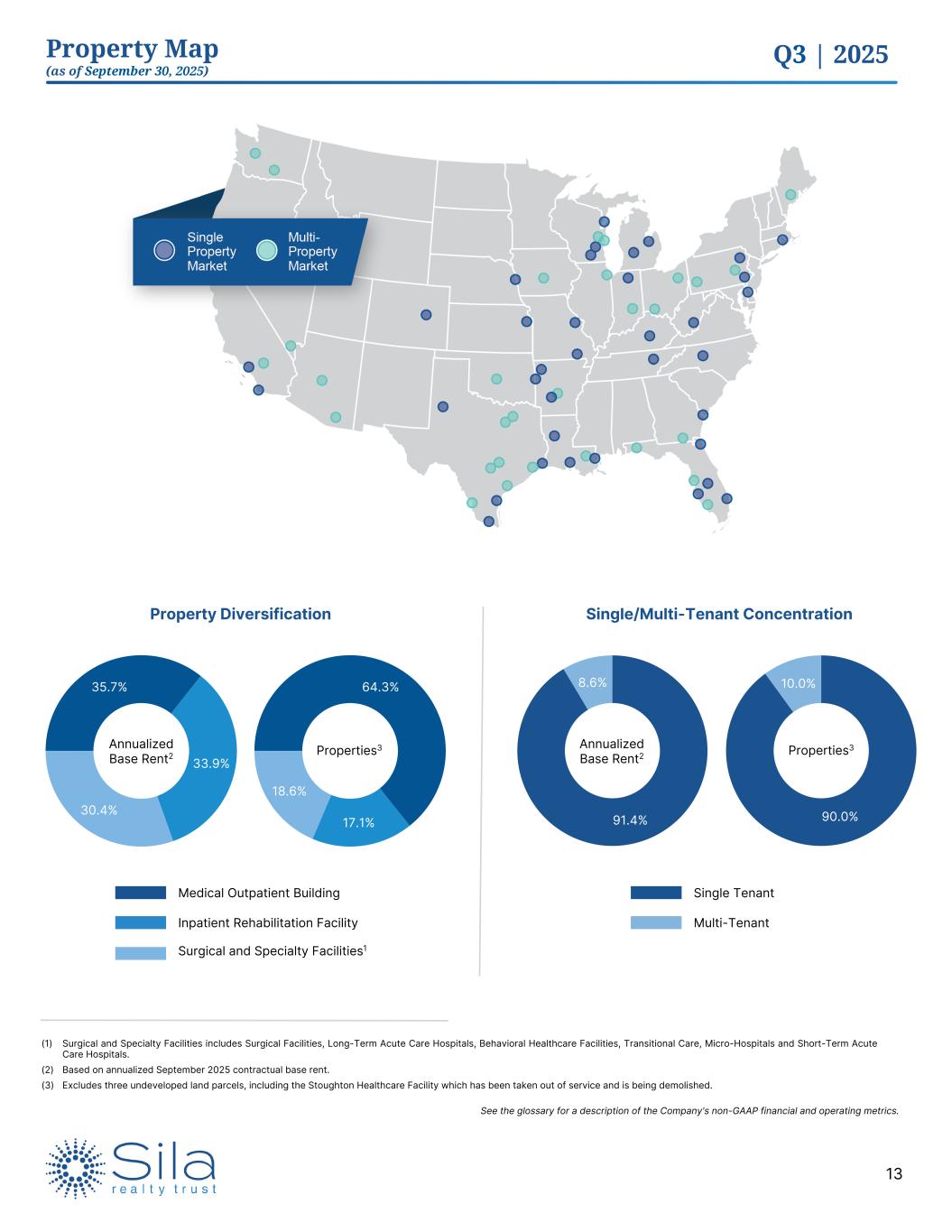

Q3 | 2025 13 Property Map (as of September 30, 2025) See the glossary for a description of the Company's non-GAAP financial and operating metrics. 35.7% 33.9% 30.4% 64.3% 17.1% 18.6% Properties3Annualized Base Rent2 Property Diversification Medical Outpatient Building Inpatient Rehabilitation Facility Surgical and Specialty Facilities1 (1) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals. (2) Based on annualized September 2025 contractual base rent. (3) Excludes three undeveloped land parcels, including the Stoughton Healthcare Facility which has been taken out of service and is being demolished. Single/Multi-Tenant Concentration 90.0% 10.0% 91.4% 8.6% Annualized Base Rent2 Properties3 Single Tenant Multi-Tenant

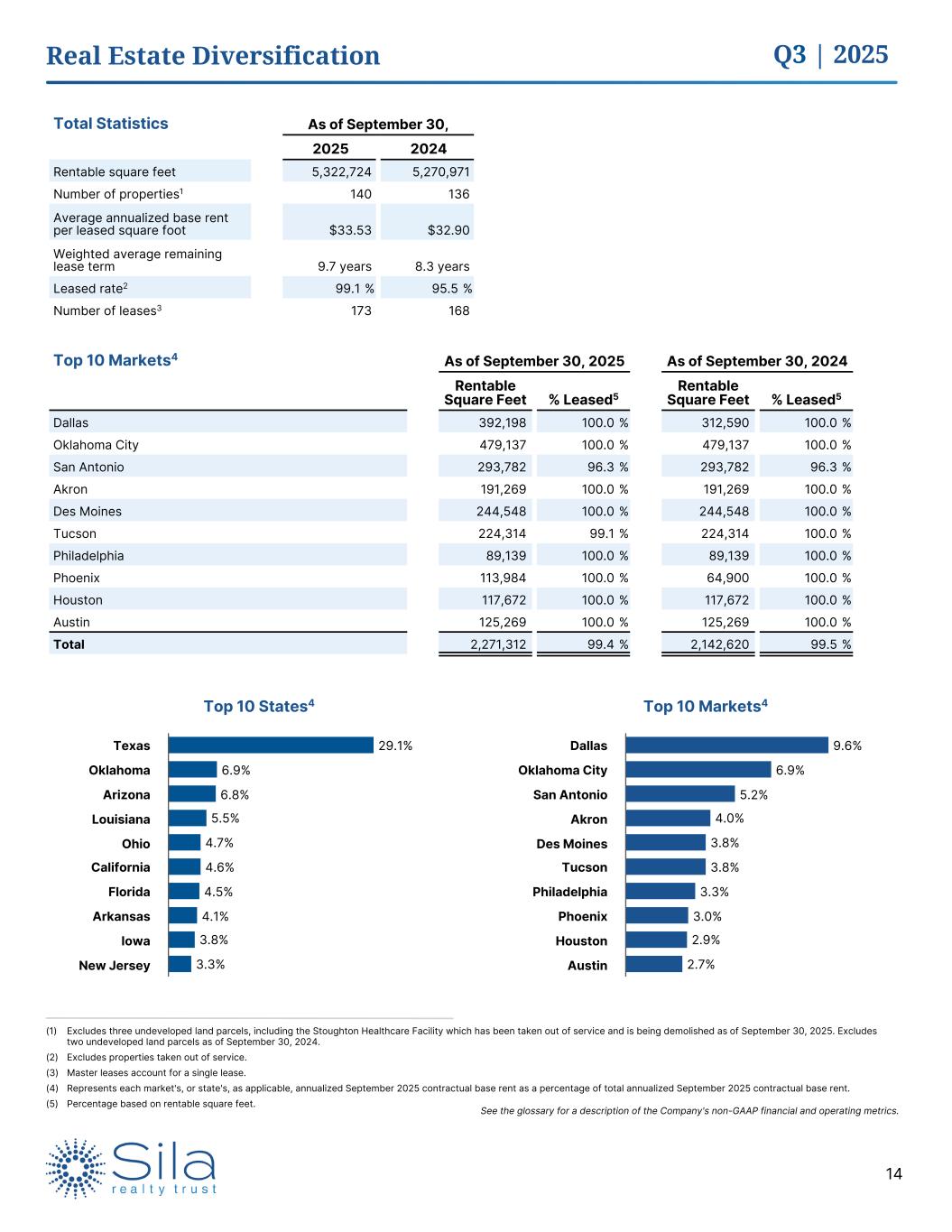

Q3 | 2025 14 29.1% 6.9% 6.8% 5.5% 4.7% 4.6% 4.5% 4.1% 3.8% 3.3% Texas Oklahoma Arizona Louisiana Ohio California Florida Arkansas Iowa New Jersey Real Estate Diversification See the glossary for a description of the Company's non-GAAP financial and operating metrics. Total Statistics As of September 30, 2025 2024 Rentable square feet 5,322,724 5,270,971 Number of properties1 140 136 Average annualized base rent per leased square foot $33.53 $32.90 Weighted average remaining lease term 9.7 years 8.3 years Leased rate2 99.1 % 95.5 % Number of leases3 173 168 Top 10 Markets4 As of September 30, 2025 As of September 30, 2024 Rentable Square Feet % Leased5 Rentable Square Feet % Leased5 Dallas 392,198 100.0 % 312,590 100.0 % Oklahoma City 479,137 100.0 % 479,137 100.0 % San Antonio 293,782 96.3 % 293,782 96.3 % Akron 191,269 100.0 % 191,269 100.0 % Des Moines 244,548 100.0 % 244,548 100.0 % Tucson 224,314 99.1 % 224,314 100.0 % Philadelphia 89,139 100.0 % 89,139 100.0 % Phoenix 113,984 100.0 % 64,900 100.0 % Houston 117,672 100.0 % 117,672 100.0 % Austin 125,269 100.0 % 125,269 100.0 % Total 2,271,312 99.4 % 2,142,620 99.5 % 9.6% 6.9% 5.2% 4.0% 3.8% 3.8% 3.3% 3.0% 2.9% 2.7% Dallas Oklahoma City San Antonio Akron Des Moines Tucson Philadelphia Phoenix Houston Austin Top 10 Markets4 (1) Excludes three undeveloped land parcels, including the Stoughton Healthcare Facility which has been taken out of service and is being demolished as of September 30, 2025. Excludes two undeveloped land parcels as of September 30, 2024. (2) Excludes properties taken out of service. (3) Master leases account for a single lease. (4) Represents each market's, or state's, as applicable, annualized September 2025 contractual base rent as a percentage of total annualized September 2025 contractual base rent. (5) Percentage based on rentable square feet. Top 10 States4

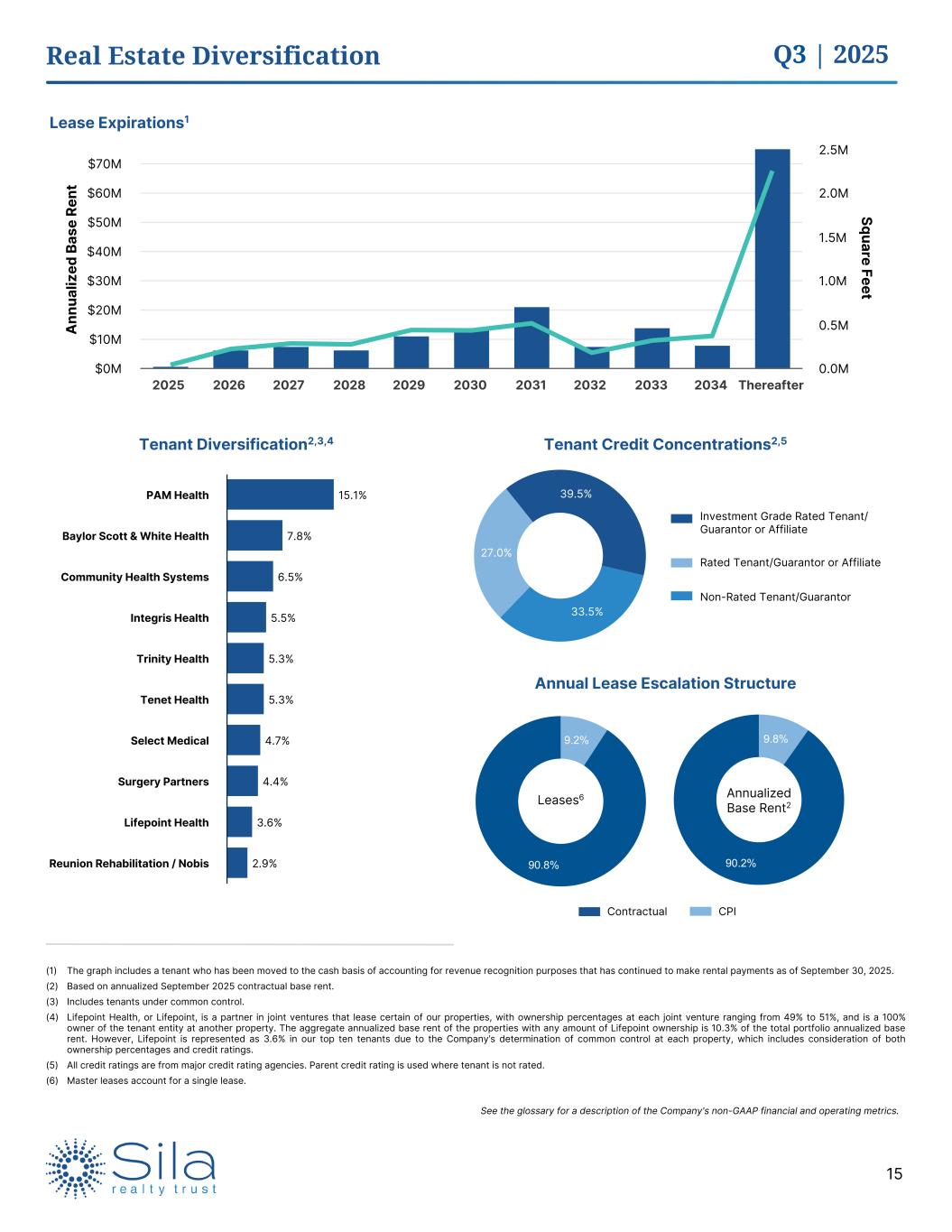

Q3 | 2025 15 15.1% 7.8% 6.5% 5.5% 5.3% 5.3% 4.7% 4.4% 3.6% 2.9% PAM Health Baylor Scott & White Health Community Health Systems Integris Health Trinity Health Tenet Health Select Medical Surgery Partners Lifepoint Health Reunion Rehabilitation / Nobis 9.8% 90.2% Real Estate Diversification See the glossary for a description of the Company's non-GAAP financial and operating metrics. A nn ua liz ed B as e Re nt Square Feet 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter $0M $10M $20M $30M $40M $50M $60M $70M 0.0M 0.5M 1.0M 1.5M 2.0M 2.5M Lease Expirations1 27.0% 39.5% 33.5% Tenant Diversification2,3,4 Tenant Credit Concentrations2,5 Investment Grade Rated Tenant/ Guarantor or Affiliate Rated Tenant/Guarantor or Affiliate Non-Rated Tenant/Guarantor Annual Lease Escalation Structure 9.2% 90.8% Contractual CPI Leases6 Annualized Base Rent2 (1) The graph includes a tenant who has been moved to the cash basis of accounting for revenue recognition purposes that has continued to make rental payments as of September 30, 2025. (2) Based on annualized September 2025 contractual base rent. (3) Includes tenants under common control. (4) Lifepoint Health, or Lifepoint, is a partner in joint ventures that lease certain of our properties, with ownership percentages at each joint venture ranging from 49% to 51%, and is a 100% owner of the tenant entity at another property. The aggregate annualized base rent of the properties with any amount of Lifepoint ownership is 10.3% of the total portfolio annualized base rent. However, Lifepoint is represented as 3.6% in our top ten tenants due to the Company’s determination of common control at each property, which includes consideration of both ownership percentages and credit ratings. (5) All credit ratings are from major credit rating agencies. Parent credit rating is used where tenant is not rated. (6) Master leases account for a single lease.

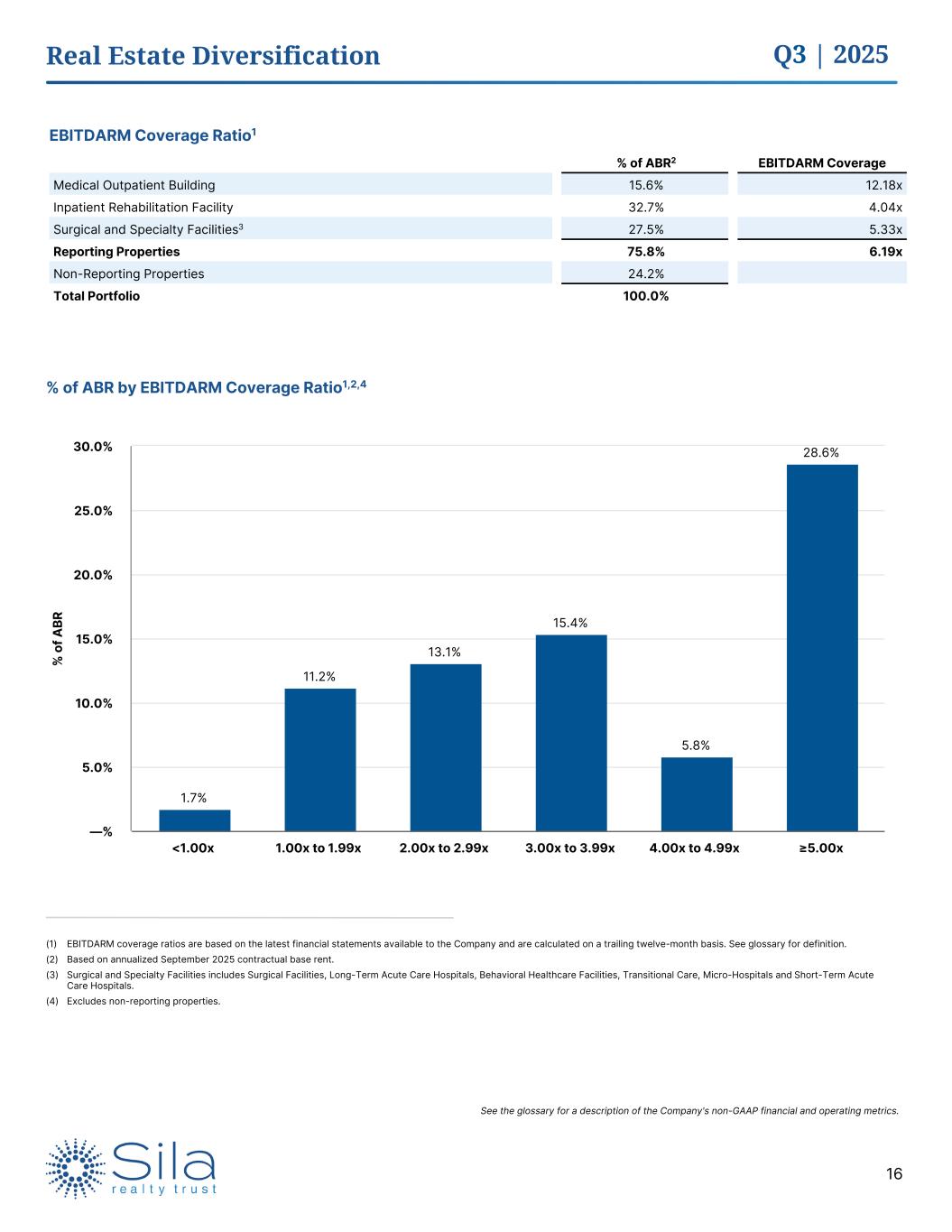

Q3 | 2025 16 Real Estate Diversification See the glossary for a description of the Company's non-GAAP financial and operating metrics. % of ABR2 EBITDARM Coverage Medical Outpatient Building 15.6% 12.18x Inpatient Rehabilitation Facility 32.7% 4.04x Surgical and Specialty Facilities3 27.5% 5.33x Reporting Properties 75.8% 6.19x Non-Reporting Properties 24.2% Total Portfolio 100.0% EBITDARM Coverage Ratio1 (1) EBITDARM coverage ratios are based on the latest financial statements available to the Company and are calculated on a trailing twelve-month basis. See glossary for definition. (2) Based on annualized September 2025 contractual base rent. (3) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals. (4) Excludes non-reporting properties. % o f A BR 1.7% 11.2% 13.1% 15.4% 5.8% 28.6% <1.00x 1.00x to 1.99x 2.00x to 2.99x 3.00x to 3.99x 4.00x to 4.99x ≥5.00x —% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% % of ABR by EBITDARM Coverage Ratio1,2,4

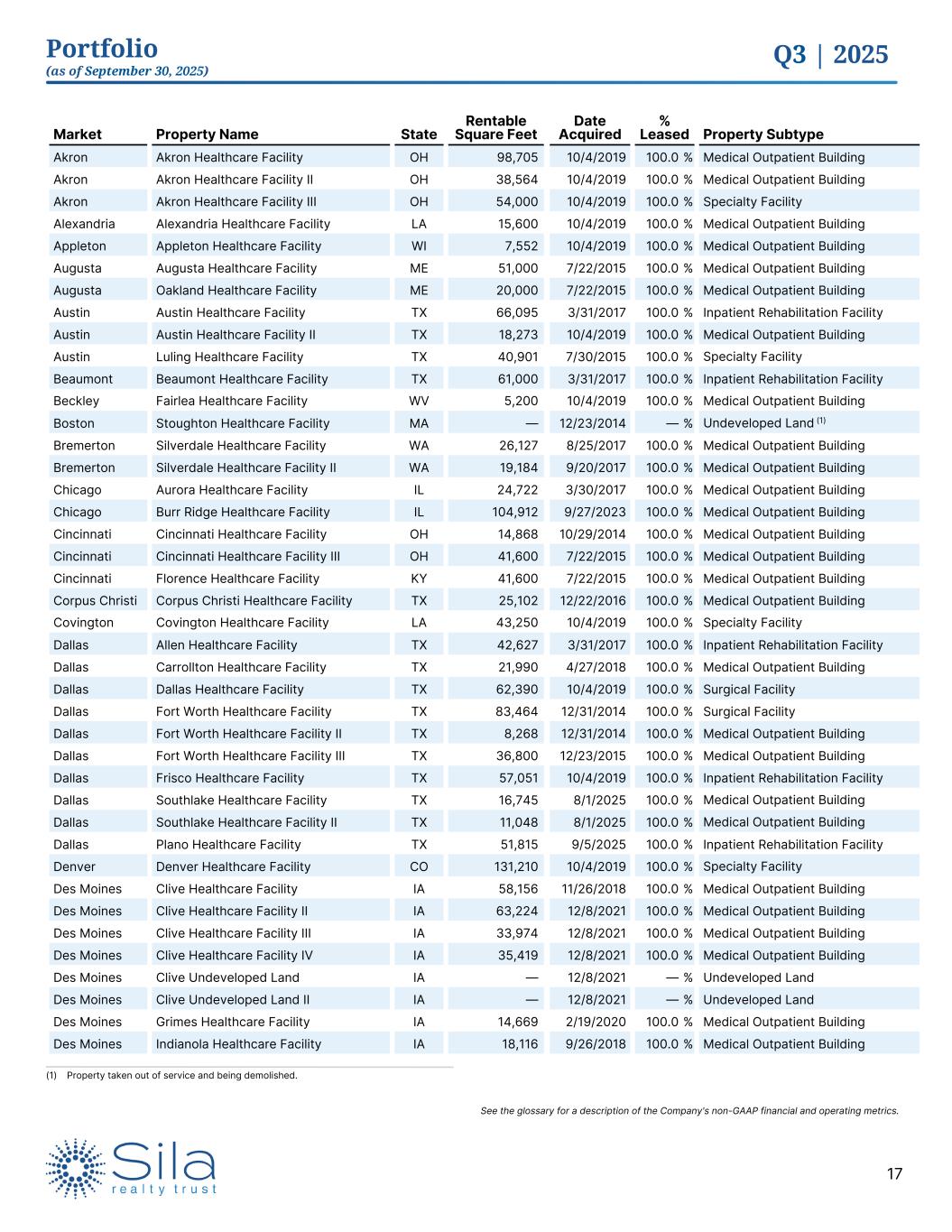

Q3 | 2025 17 Portfolio (as of September 30, 2025) See the glossary for a description of the Company's non-GAAP financial and operating metrics. Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Akron Akron Healthcare Facility OH 98,705 10/4/2019 100.0 % Medical Outpatient Building Akron Akron Healthcare Facility II OH 38,564 10/4/2019 100.0 % Medical Outpatient Building Akron Akron Healthcare Facility III OH 54,000 10/4/2019 100.0 % Specialty Facility Alexandria Alexandria Healthcare Facility LA 15,600 10/4/2019 100.0 % Medical Outpatient Building Appleton Appleton Healthcare Facility WI 7,552 10/4/2019 100.0 % Medical Outpatient Building Augusta Augusta Healthcare Facility ME 51,000 7/22/2015 100.0 % Medical Outpatient Building Augusta Oakland Healthcare Facility ME 20,000 7/22/2015 100.0 % Medical Outpatient Building Austin Austin Healthcare Facility TX 66,095 3/31/2017 100.0 % Inpatient Rehabilitation Facility Austin Austin Healthcare Facility II TX 18,273 10/4/2019 100.0 % Medical Outpatient Building Austin Luling Healthcare Facility TX 40,901 7/30/2015 100.0 % Specialty Facility Beaumont Beaumont Healthcare Facility TX 61,000 3/31/2017 100.0 % Inpatient Rehabilitation Facility Beckley Fairlea Healthcare Facility WV 5,200 10/4/2019 100.0 % Medical Outpatient Building Boston Stoughton Healthcare Facility MA — 12/23/2014 — % Undeveloped Land (1) Bremerton Silverdale Healthcare Facility WA 26,127 8/25/2017 100.0 % Medical Outpatient Building Bremerton Silverdale Healthcare Facility II WA 19,184 9/20/2017 100.0 % Medical Outpatient Building Chicago Aurora Healthcare Facility IL 24,722 3/30/2017 100.0 % Medical Outpatient Building Chicago Burr Ridge Healthcare Facility IL 104,912 9/27/2023 100.0 % Medical Outpatient Building Cincinnati Cincinnati Healthcare Facility OH 14,868 10/29/2014 100.0 % Medical Outpatient Building Cincinnati Cincinnati Healthcare Facility III OH 41,600 7/22/2015 100.0 % Medical Outpatient Building Cincinnati Florence Healthcare Facility KY 41,600 7/22/2015 100.0 % Medical Outpatient Building Corpus Christi Corpus Christi Healthcare Facility TX 25,102 12/22/2016 100.0 % Medical Outpatient Building Covington Covington Healthcare Facility LA 43,250 10/4/2019 100.0 % Specialty Facility Dallas Allen Healthcare Facility TX 42,627 3/31/2017 100.0 % Inpatient Rehabilitation Facility Dallas Carrollton Healthcare Facility TX 21,990 4/27/2018 100.0 % Medical Outpatient Building Dallas Dallas Healthcare Facility TX 62,390 10/4/2019 100.0 % Surgical Facility Dallas Fort Worth Healthcare Facility TX 83,464 12/31/2014 100.0 % Surgical Facility Dallas Fort Worth Healthcare Facility II TX 8,268 12/31/2014 100.0 % Medical Outpatient Building Dallas Fort Worth Healthcare Facility III TX 36,800 12/23/2015 100.0 % Medical Outpatient Building Dallas Frisco Healthcare Facility TX 57,051 10/4/2019 100.0 % Inpatient Rehabilitation Facility Dallas Southlake Healthcare Facility TX 16,745 8/1/2025 100.0 % Medical Outpatient Building Dallas Southlake Healthcare Facility II TX 11,048 8/1/2025 100.0 % Medical Outpatient Building Dallas Plano Healthcare Facility TX 51,815 9/5/2025 100.0 % Inpatient Rehabilitation Facility Denver Denver Healthcare Facility CO 131,210 10/4/2019 100.0 % Specialty Facility Des Moines Clive Healthcare Facility IA 58,156 11/26/2018 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility II IA 63,224 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility III IA 33,974 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility IV IA 35,419 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Undeveloped Land IA — 12/8/2021 — % Undeveloped Land Des Moines Clive Undeveloped Land II IA — 12/8/2021 — % Undeveloped Land Des Moines Grimes Healthcare Facility IA 14,669 2/19/2020 100.0 % Medical Outpatient Building Des Moines Indianola Healthcare Facility IA 18,116 9/26/2018 100.0 % Medical Outpatient Building (1) Property taken out of service and being demolished.

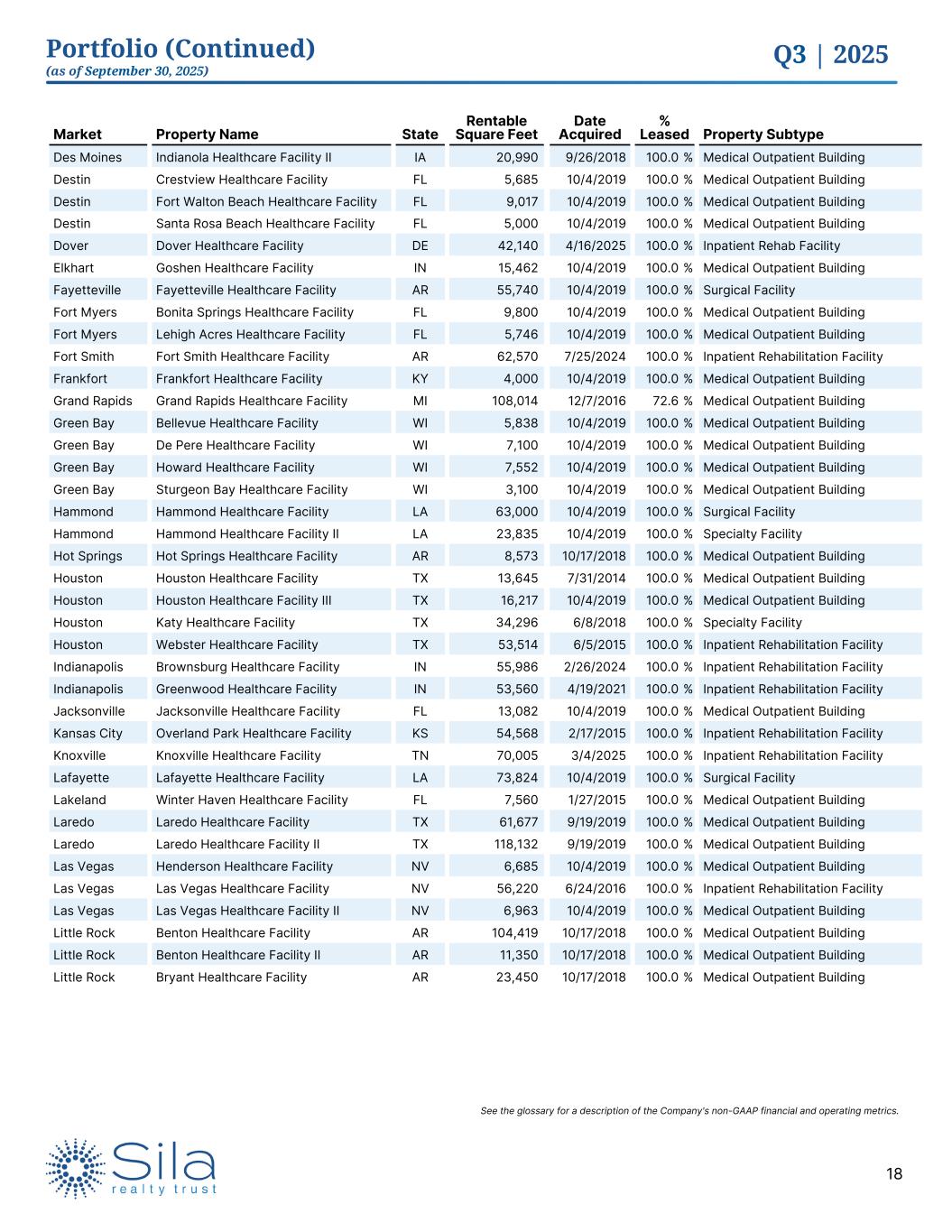

Q3 | 2025 18 Portfolio (Continued) (as of September 30, 2025) See the glossary for a description of the Company's non-GAAP financial and operating metrics. Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Des Moines Indianola Healthcare Facility II IA 20,990 9/26/2018 100.0 % Medical Outpatient Building Destin Crestview Healthcare Facility FL 5,685 10/4/2019 100.0 % Medical Outpatient Building Destin Fort Walton Beach Healthcare Facility FL 9,017 10/4/2019 100.0 % Medical Outpatient Building Destin Santa Rosa Beach Healthcare Facility FL 5,000 10/4/2019 100.0 % Medical Outpatient Building Dover Dover Healthcare Facility DE 42,140 4/16/2025 100.0 % Inpatient Rehab Facility Elkhart Goshen Healthcare Facility IN 15,462 10/4/2019 100.0 % Medical Outpatient Building Fayetteville Fayetteville Healthcare Facility AR 55,740 10/4/2019 100.0 % Surgical Facility Fort Myers Bonita Springs Healthcare Facility FL 9,800 10/4/2019 100.0 % Medical Outpatient Building Fort Myers Lehigh Acres Healthcare Facility FL 5,746 10/4/2019 100.0 % Medical Outpatient Building Fort Smith Fort Smith Healthcare Facility AR 62,570 7/25/2024 100.0 % Inpatient Rehabilitation Facility Frankfort Frankfort Healthcare Facility KY 4,000 10/4/2019 100.0 % Medical Outpatient Building Grand Rapids Grand Rapids Healthcare Facility MI 108,014 12/7/2016 72.6 % Medical Outpatient Building Green Bay Bellevue Healthcare Facility WI 5,838 10/4/2019 100.0 % Medical Outpatient Building Green Bay De Pere Healthcare Facility WI 7,100 10/4/2019 100.0 % Medical Outpatient Building Green Bay Howard Healthcare Facility WI 7,552 10/4/2019 100.0 % Medical Outpatient Building Green Bay Sturgeon Bay Healthcare Facility WI 3,100 10/4/2019 100.0 % Medical Outpatient Building Hammond Hammond Healthcare Facility LA 63,000 10/4/2019 100.0 % Surgical Facility Hammond Hammond Healthcare Facility II LA 23,835 10/4/2019 100.0 % Specialty Facility Hot Springs Hot Springs Healthcare Facility AR 8,573 10/17/2018 100.0 % Medical Outpatient Building Houston Houston Healthcare Facility TX 13,645 7/31/2014 100.0 % Medical Outpatient Building Houston Houston Healthcare Facility III TX 16,217 10/4/2019 100.0 % Medical Outpatient Building Houston Katy Healthcare Facility TX 34,296 6/8/2018 100.0 % Specialty Facility Houston Webster Healthcare Facility TX 53,514 6/5/2015 100.0 % Inpatient Rehabilitation Facility Indianapolis Brownsburg Healthcare Facility IN 55,986 2/26/2024 100.0 % Inpatient Rehabilitation Facility Indianapolis Greenwood Healthcare Facility IN 53,560 4/19/2021 100.0 % Inpatient Rehabilitation Facility Jacksonville Jacksonville Healthcare Facility FL 13,082 10/4/2019 100.0 % Medical Outpatient Building Kansas City Overland Park Healthcare Facility KS 54,568 2/17/2015 100.0 % Inpatient Rehabilitation Facility Knoxville Knoxville Healthcare Facility TN 70,005 3/4/2025 100.0 % Inpatient Rehabilitation Facility Lafayette Lafayette Healthcare Facility LA 73,824 10/4/2019 100.0 % Surgical Facility Lakeland Winter Haven Healthcare Facility FL 7,560 1/27/2015 100.0 % Medical Outpatient Building Laredo Laredo Healthcare Facility TX 61,677 9/19/2019 100.0 % Medical Outpatient Building Laredo Laredo Healthcare Facility II TX 118,132 9/19/2019 100.0 % Medical Outpatient Building Las Vegas Henderson Healthcare Facility NV 6,685 10/4/2019 100.0 % Medical Outpatient Building Las Vegas Las Vegas Healthcare Facility NV 56,220 6/24/2016 100.0 % Inpatient Rehabilitation Facility Las Vegas Las Vegas Healthcare Facility II NV 6,963 10/4/2019 100.0 % Medical Outpatient Building Little Rock Benton Healthcare Facility AR 104,419 10/17/2018 100.0 % Medical Outpatient Building Little Rock Benton Healthcare Facility II AR 11,350 10/17/2018 100.0 % Medical Outpatient Building Little Rock Bryant Healthcare Facility AR 23,450 10/17/2018 100.0 % Medical Outpatient Building

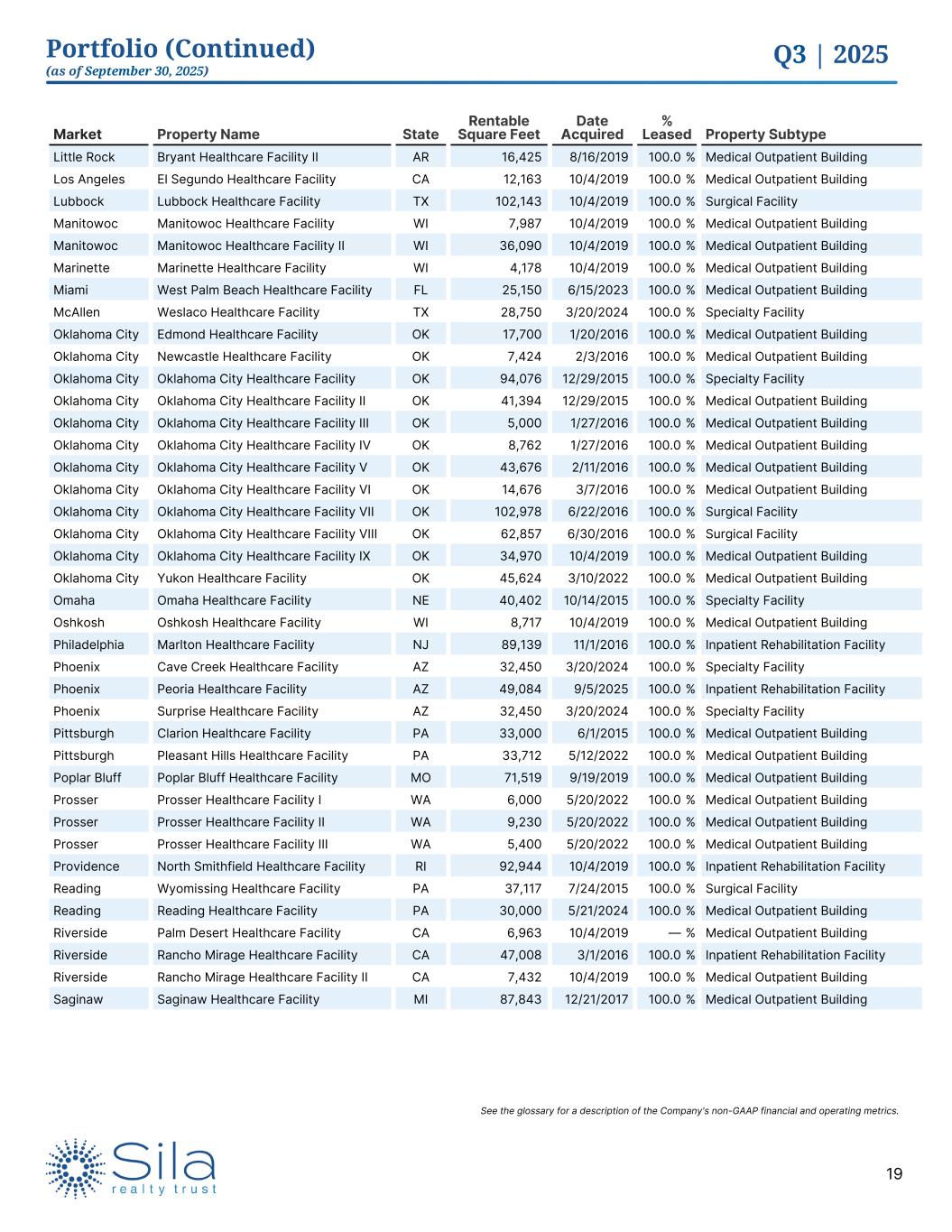

Q3 | 2025 19 Portfolio (Continued) (as of September 30, 2025) See the glossary for a description of the Company's non-GAAP financial and operating metrics. Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Little Rock Bryant Healthcare Facility II AR 16,425 8/16/2019 100.0 % Medical Outpatient Building Los Angeles El Segundo Healthcare Facility CA 12,163 10/4/2019 100.0 % Medical Outpatient Building Lubbock Lubbock Healthcare Facility TX 102,143 10/4/2019 100.0 % Surgical Facility Manitowoc Manitowoc Healthcare Facility WI 7,987 10/4/2019 100.0 % Medical Outpatient Building Manitowoc Manitowoc Healthcare Facility II WI 36,090 10/4/2019 100.0 % Medical Outpatient Building Marinette Marinette Healthcare Facility WI 4,178 10/4/2019 100.0 % Medical Outpatient Building Miami West Palm Beach Healthcare Facility FL 25,150 6/15/2023 100.0 % Medical Outpatient Building McAllen Weslaco Healthcare Facility TX 28,750 3/20/2024 100.0 % Specialty Facility Oklahoma City Edmond Healthcare Facility OK 17,700 1/20/2016 100.0 % Medical Outpatient Building Oklahoma City Newcastle Healthcare Facility OK 7,424 2/3/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility OK 94,076 12/29/2015 100.0 % Specialty Facility Oklahoma City Oklahoma City Healthcare Facility II OK 41,394 12/29/2015 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility III OK 5,000 1/27/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility IV OK 8,762 1/27/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility V OK 43,676 2/11/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility VI OK 14,676 3/7/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility VII OK 102,978 6/22/2016 100.0 % Surgical Facility Oklahoma City Oklahoma City Healthcare Facility VIII OK 62,857 6/30/2016 100.0 % Surgical Facility Oklahoma City Oklahoma City Healthcare Facility IX OK 34,970 10/4/2019 100.0 % Medical Outpatient Building Oklahoma City Yukon Healthcare Facility OK 45,624 3/10/2022 100.0 % Medical Outpatient Building Omaha Omaha Healthcare Facility NE 40,402 10/14/2015 100.0 % Specialty Facility Oshkosh Oshkosh Healthcare Facility WI 8,717 10/4/2019 100.0 % Medical Outpatient Building Philadelphia Marlton Healthcare Facility NJ 89,139 11/1/2016 100.0 % Inpatient Rehabilitation Facility Phoenix Cave Creek Healthcare Facility AZ 32,450 3/20/2024 100.0 % Specialty Facility Phoenix Peoria Healthcare Facility AZ 49,084 9/5/2025 100.0 % Inpatient Rehabilitation Facility Phoenix Surprise Healthcare Facility AZ 32,450 3/20/2024 100.0 % Specialty Facility Pittsburgh Clarion Healthcare Facility PA 33,000 6/1/2015 100.0 % Medical Outpatient Building Pittsburgh Pleasant Hills Healthcare Facility PA 33,712 5/12/2022 100.0 % Medical Outpatient Building Poplar Bluff Poplar Bluff Healthcare Facility MO 71,519 9/19/2019 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility I WA 6,000 5/20/2022 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility II WA 9,230 5/20/2022 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility III WA 5,400 5/20/2022 100.0 % Medical Outpatient Building Providence North Smithfield Healthcare Facility RI 92,944 10/4/2019 100.0 % Inpatient Rehabilitation Facility Reading Wyomissing Healthcare Facility PA 37,117 7/24/2015 100.0 % Surgical Facility Reading Reading Healthcare Facility PA 30,000 5/21/2024 100.0 % Medical Outpatient Building Riverside Palm Desert Healthcare Facility CA 6,963 10/4/2019 — % Medical Outpatient Building Riverside Rancho Mirage Healthcare Facility CA 47,008 3/1/2016 100.0 % Inpatient Rehabilitation Facility Riverside Rancho Mirage Healthcare Facility II CA 7,432 10/4/2019 100.0 % Medical Outpatient Building Saginaw Saginaw Healthcare Facility MI 87,843 12/21/2017 100.0 % Medical Outpatient Building

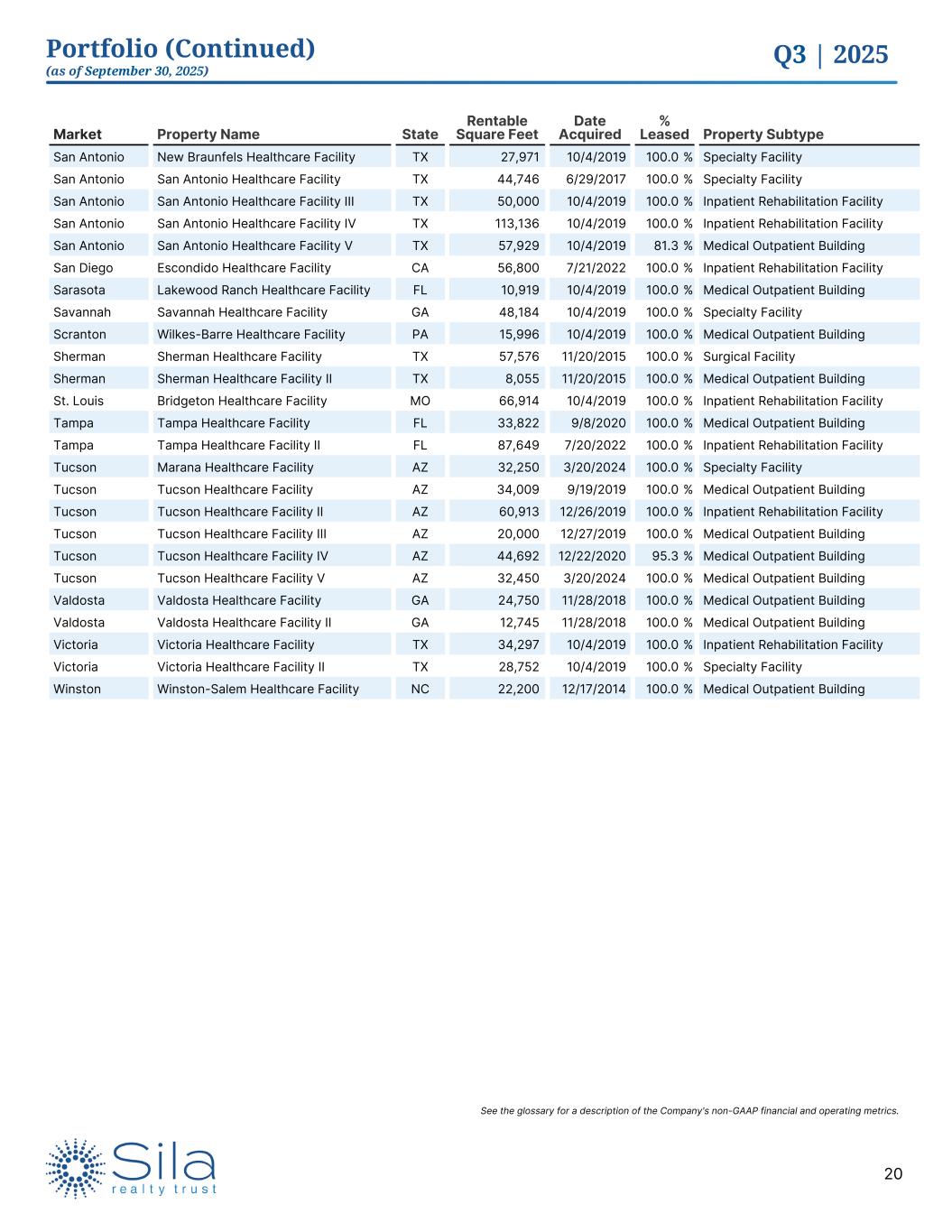

Q3 | 2025 20 Portfolio (Continued) (as of September 30, 2025) See the glossary for a description of the Company's non-GAAP financial and operating metrics. Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype San Antonio New Braunfels Healthcare Facility TX 27,971 10/4/2019 100.0 % Specialty Facility San Antonio San Antonio Healthcare Facility TX 44,746 6/29/2017 100.0 % Specialty Facility San Antonio San Antonio Healthcare Facility III TX 50,000 10/4/2019 100.0 % Inpatient Rehabilitation Facility San Antonio San Antonio Healthcare Facility IV TX 113,136 10/4/2019 100.0 % Inpatient Rehabilitation Facility San Antonio San Antonio Healthcare Facility V TX 57,929 10/4/2019 81.3 % Medical Outpatient Building San Diego Escondido Healthcare Facility CA 56,800 7/21/2022 100.0 % Inpatient Rehabilitation Facility Sarasota Lakewood Ranch Healthcare Facility FL 10,919 10/4/2019 100.0 % Medical Outpatient Building Savannah Savannah Healthcare Facility GA 48,184 10/4/2019 100.0 % Specialty Facility Scranton Wilkes-Barre Healthcare Facility PA 15,996 10/4/2019 100.0 % Medical Outpatient Building Sherman Sherman Healthcare Facility TX 57,576 11/20/2015 100.0 % Surgical Facility Sherman Sherman Healthcare Facility II TX 8,055 11/20/2015 100.0 % Medical Outpatient Building St. Louis Bridgeton Healthcare Facility MO 66,914 10/4/2019 100.0 % Inpatient Rehabilitation Facility Tampa Tampa Healthcare Facility FL 33,822 9/8/2020 100.0 % Medical Outpatient Building Tampa Tampa Healthcare Facility II FL 87,649 7/20/2022 100.0 % Inpatient Rehabilitation Facility Tucson Marana Healthcare Facility AZ 32,250 3/20/2024 100.0 % Specialty Facility Tucson Tucson Healthcare Facility AZ 34,009 9/19/2019 100.0 % Medical Outpatient Building Tucson Tucson Healthcare Facility II AZ 60,913 12/26/2019 100.0 % Inpatient Rehabilitation Facility Tucson Tucson Healthcare Facility III AZ 20,000 12/27/2019 100.0 % Medical Outpatient Building Tucson Tucson Healthcare Facility IV AZ 44,692 12/22/2020 95.3 % Medical Outpatient Building Tucson Tucson Healthcare Facility V AZ 32,450 3/20/2024 100.0 % Medical Outpatient Building Valdosta Valdosta Healthcare Facility GA 24,750 11/28/2018 100.0 % Medical Outpatient Building Valdosta Valdosta Healthcare Facility II GA 12,745 11/28/2018 100.0 % Medical Outpatient Building Victoria Victoria Healthcare Facility TX 34,297 10/4/2019 100.0 % Inpatient Rehabilitation Facility Victoria Victoria Healthcare Facility II TX 28,752 10/4/2019 100.0 % Specialty Facility Winston Winston-Salem Healthcare Facility NC 22,200 12/17/2014 100.0 % Medical Outpatient Building

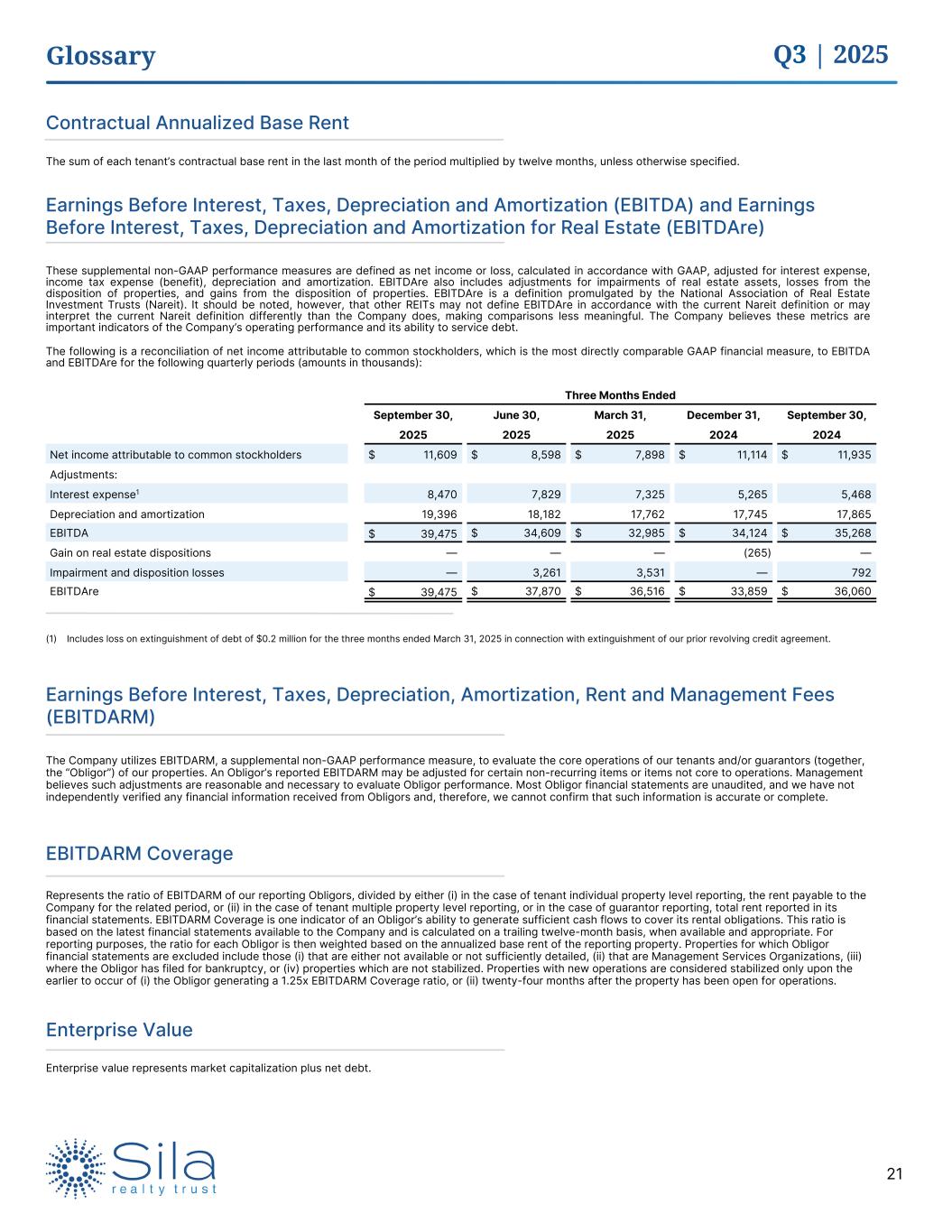

Q3 | 2025 21 Contractual Annualized Base Rent The sum of each tenant’s contractual base rent in the last month of the period multiplied by twelve months, unless otherwise specified. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) These supplemental non-GAAP performance measures are defined as net income or loss, calculated in accordance with GAAP, adjusted for interest expense, income tax expense (benefit), depreciation and amortization. EBITDAre also includes adjustments for impairments of real estate assets, losses from the disposition of properties, and gains from the disposition of properties. EBITDAre is a definition promulgated by the National Association of Real Estate Investment Trusts (Nareit). It should be noted, however, that other REITs may not define EBITDAre in accordance with the current Nareit definition or may interpret the current Nareit definition differently than the Company does, making comparisons less meaningful. The Company believes these metrics are important indicators of the Company’s operating performance and its ability to service debt. The following is a reconciliation of net income attributable to common stockholders, which is the most directly comparable GAAP financial measure, to EBITDA and EBITDAre for the following quarterly periods (amounts in thousands): Three Months Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Net income attributable to common stockholders $ 11,609 $ 8,598 $ 7,898 $ 11,114 $ 11,935 Adjustments: Interest expense1 8,470 7,829 7,325 5,265 5,468 Depreciation and amortization 19,396 18,182 17,762 17,745 17,865 EBITDA $ 39,475 $ 34,609 $ 32,985 $ 34,124 $ 35,268 Gain on real estate dispositions — — — (265) — Impairment and disposition losses — 3,261 3,531 — 792 EBITDAre $ 39,475 $ 37,870 $ 36,516 $ 33,859 $ 36,060 Earnings Before Interest, Taxes, Depreciation, Amortization, Rent and Management Fees (EBITDARM) EBITDARM Coverage The Company utilizes EBITDARM, a supplemental non-GAAP performance measure, to evaluate the core operations of our tenants and/or guarantors (together, the “Obligor”) of our properties. An Obligor’s reported EBITDARM may be adjusted for certain non-recurring items or items not core to operations. Management believes such adjustments are reasonable and necessary to evaluate Obligor performance. Most Obligor financial statements are unaudited, and we have not independently verified any financial information received from Obligors and, therefore, we cannot confirm that such information is accurate or complete. Represents the ratio of EBITDARM of our reporting Obligors, divided by either (i) in the case of tenant individual property level reporting, the rent payable to the Company for the related period, or (ii) in the case of tenant multiple property level reporting, or in the case of guarantor reporting, total rent reported in its financial statements. EBITDARM Coverage is one indicator of an Obligor’s ability to generate sufficient cash flows to cover its rental obligations. This ratio is based on the latest financial statements available to the Company and is calculated on a trailing twelve-month basis, when available and appropriate. For reporting purposes, the ratio for each Obligor is then weighted based on the annualized base rent of the reporting property. Properties for which Obligor financial statements are excluded include those (i) that are either not available or not sufficiently detailed, (ii) that are Management Services Organizations, (iii) where the Obligor has filed for bankruptcy, or (iv) properties which are not stabilized. Properties with new operations are considered stabilized only upon the earlier to occur of (i) the Obligor generating a 1.25x EBITDARM Coverage ratio, or (ii) twenty-four months after the property has been open for operations. (1) Includes loss on extinguishment of debt of $0.2 million for the three months ended March 31, 2025 in connection with extinguishment of our prior revolving credit agreement. Glossary Enterprise Value Enterprise value represents market capitalization plus net debt.

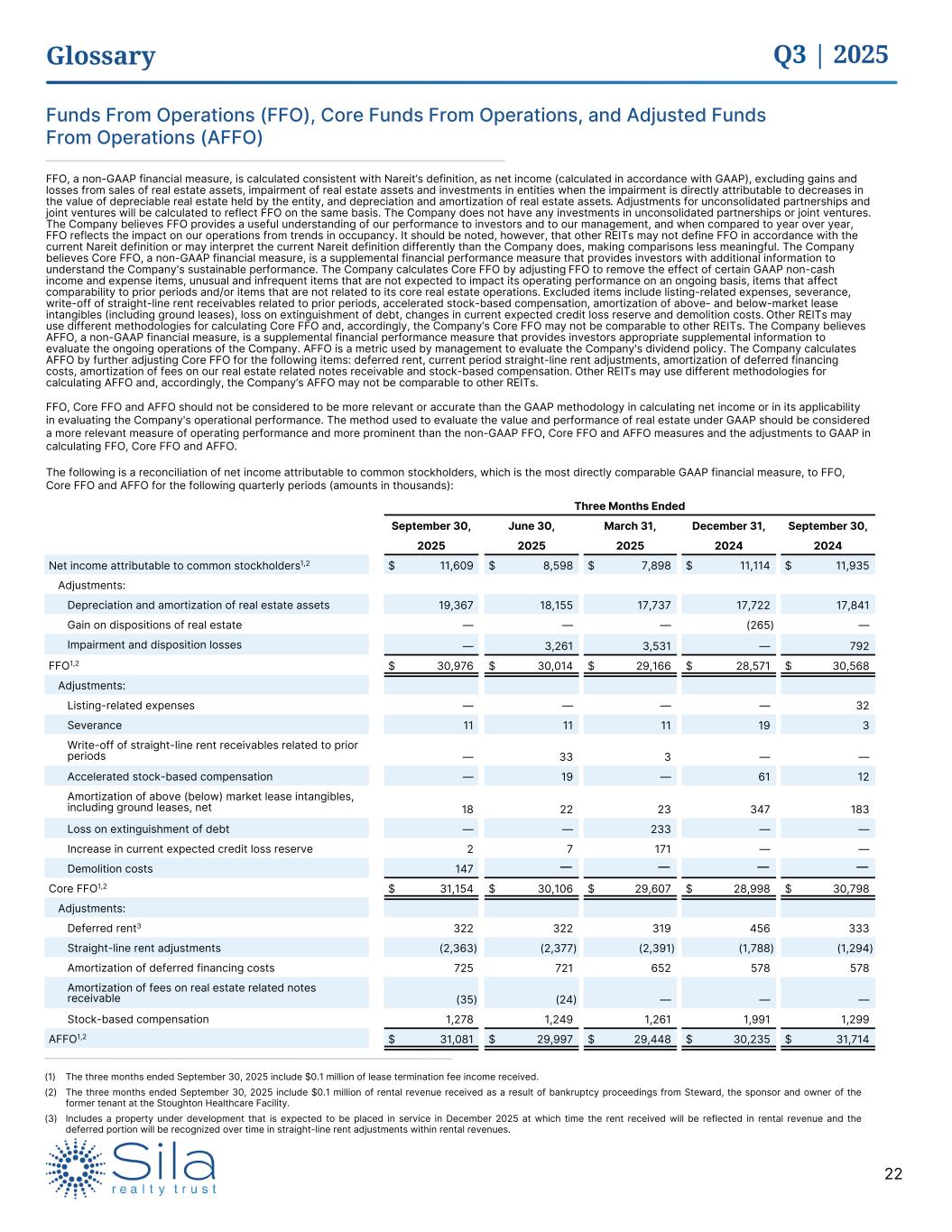

Q3 | 2025 22 Funds From Operations (FFO), Core Funds From Operations, and Adjusted Funds From Operations (AFFO) FFO, a non-GAAP financial measure, is calculated consistent with Nareit’s definition, as net income (calculated in accordance with GAAP), excluding gains and losses from sales of real estate assets, impairment of real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, and depreciation and amortization of real estate assets. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. The Company does not have any investments in unconsolidated partnerships or joint ventures. The Company believes FFO provides a useful understanding of our performance to investors and to our management, and when compared to year over year, FFO reflects the impact on our operations from trends in occupancy. It should be noted, however, that other REITs may not define FFO in accordance with the current Nareit definition or may interpret the current Nareit definition differently than the Company does, making comparisons less meaningful. The Company believes Core FFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors with additional information to understand the Company's sustainable performance. The Company calculates Core FFO by adjusting FFO to remove the effect of certain GAAP non-cash income and expense items, unusual and infrequent items that are not expected to impact its operating performance on an ongoing basis, items that affect comparability to prior periods and/or items that are not related to its core real estate operations. Excluded items include listing-related expenses, severance, write-off of straight-line rent receivables related to prior periods, accelerated stock-based compensation, amortization of above- and below-market lease intangibles (including ground leases), loss on extinguishment of debt, changes in current expected credit loss reserve and demolition costs. Other REITs may use different methodologies for calculating Core FFO and, accordingly, the Company’s Core FFO may not be comparable to other REITs. The Company believes AFFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors appropriate supplemental information to evaluate the ongoing operations of the Company. AFFO is a metric used by management to evaluate the Company's dividend policy. The Company calculates AFFO by further adjusting Core FFO for the following items: deferred rent, current period straight-line rent adjustments, amortization of deferred financing costs, amortization of fees on our real estate related notes receivable and stock-based compensation. Other REITs may use different methodologies for calculating AFFO and, accordingly, the Company’s AFFO may not be comparable to other REITs. FFO, Core FFO and AFFO should not be considered to be more relevant or accurate than the GAAP methodology in calculating net income or in its applicability in evaluating the Company's operational performance. The method used to evaluate the value and performance of real estate under GAAP should be considered a more relevant measure of operating performance and more prominent than the non-GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO. The following is a reconciliation of net income attributable to common stockholders, which is the most directly comparable GAAP financial measure, to FFO, Core FFO and AFFO for the following quarterly periods (amounts in thousands): Glossary Three Months Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Net income attributable to common stockholders1,2 $ 11,609 $ 8,598 $ 7,898 $ 11,114 $ 11,935 Adjustments: Depreciation and amortization of real estate assets 19,367 18,155 17,737 17,722 17,841 Gain on dispositions of real estate — — — (265) — Impairment and disposition losses — 3,261 3,531 — 792 FFO1,2 $ 30,976 $ 30,014 $ 29,166 $ 28,571 $ 30,568 Adjustments: Listing-related expenses — — — — 32 Severance 11 11 11 19 3 Write-off of straight-line rent receivables related to prior periods — 33 3 — — Accelerated stock-based compensation — 19 — 61 12 Amortization of above (below) market lease intangibles, including ground leases, net 18 22 23 347 183 Loss on extinguishment of debt — — 233 — — Increase in current expected credit loss reserve 2 7 171 — — Demolition costs 147 — — — — Core FFO1,2 $ 31,154 $ 30,106 $ 29,607 $ 28,998 $ 30,798 Adjustments: Deferred rent3 322 322 319 456 333 Straight-line rent adjustments (2,363) (2,377) (2,391) (1,788) (1,294) Amortization of deferred financing costs 725 721 652 578 578 Amortization of fees on real estate related notes receivable (35) (24) — — — Stock-based compensation 1,278 1,249 1,261 1,991 1,299 AFFO1,2 $ 31,081 $ 29,997 $ 29,448 $ 30,235 $ 31,714 (1) The three months ended September 30, 2025 include $0.1 million of lease termination fee income received. (2) The three months ended September 30, 2025 include $0.1 million of rental revenue received as a result of bankruptcy proceedings from Steward, the sponsor and owner of the former tenant at the Stoughton Healthcare Facility. (3) Includes a property under development that is expected to be placed in service in December 2025 at which time the rent received will be reflected in rental revenue and the deferred portion will be recognized over time in straight-line rent adjustments within rental revenues.

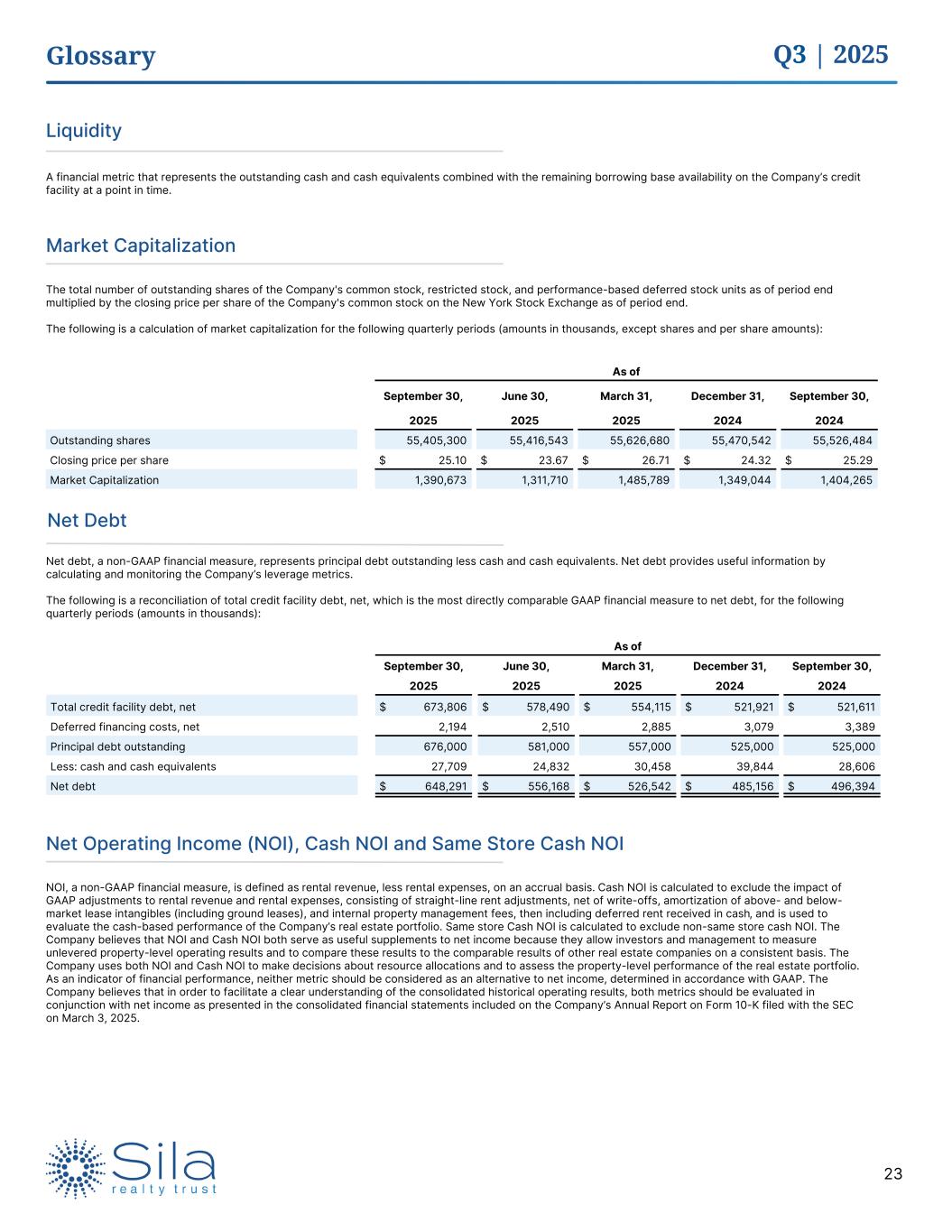

Q3 | 2025 23 Net debt, a non-GAAP financial measure, represents principal debt outstanding less cash and cash equivalents. Net debt provides useful information by calculating and monitoring the Company’s leverage metrics. The following is a reconciliation of total credit facility debt, net, which is the most directly comparable GAAP financial measure to net debt, for the following quarterly periods (amounts in thousands): Glossary Net Debt As of September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Total credit facility debt, net $ 673,806 $ 578,490 $ 554,115 $ 521,921 $ 521,611 Deferred financing costs, net 2,194 2,510 2,885 3,079 3,389 Principal debt outstanding 676,000 581,000 557,000 525,000 525,000 Less: cash and cash equivalents 27,709 24,832 30,458 39,844 28,606 Net debt $ 648,291 $ 556,168 $ 526,542 $ 485,156 $ 496,394 Liquidity A financial metric that represents the outstanding cash and cash equivalents combined with the remaining borrowing base availability on the Company’s credit facility at a point in time. Net Operating Income (NOI), Cash NOI and Same Store Cash NOI NOI, a non-GAAP financial measure, is defined as rental revenue, less rental expenses, on an accrual basis. Cash NOI is calculated to exclude the impact of GAAP adjustments to rental revenue and rental expenses, consisting of straight-line rent adjustments, net of write-offs, amortization of above- and below- market lease intangibles (including ground leases), and internal property management fees, then including deferred rent received in cash, and is used to evaluate the cash-based performance of the Company’s real estate portfolio. Same store Cash NOI is calculated to exclude non-same store cash NOI. The Company believes that NOI and Cash NOI both serve as useful supplements to net income because they allow investors and management to measure unlevered property-level operating results and to compare these results to the comparable results of other real estate companies on a consistent basis. The Company uses both NOI and Cash NOI to make decisions about resource allocations and to assess the property-level performance of the real estate portfolio. As an indicator of financial performance, neither metric should be considered as an alternative to net income, determined in accordance with GAAP. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results, both metrics should be evaluated in conjunction with net income as presented in the consolidated financial statements included on the Company’s Annual Report on Form 10-K filed with the SEC on March 3, 2025. Market Capitalization The total number of outstanding shares of the Company's common stock, restricted stock, and performance-based deferred stock units as of period end multiplied by the closing price per share of the Company's common stock on the New York Stock Exchange as of period end. The following is a calculation of market capitalization for the following quarterly periods (amounts in thousands, except shares and per share amounts): As of September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Outstanding shares 55,405,300 55,416,543 55,626,680 55,470,542 55,526,484 Closing price per share $ 25.10 $ 23.67 $ 26.71 $ 24.32 $ 25.29 Market Capitalization 1,390,673 1,311,710 1,485,789 1,349,044 1,404,265

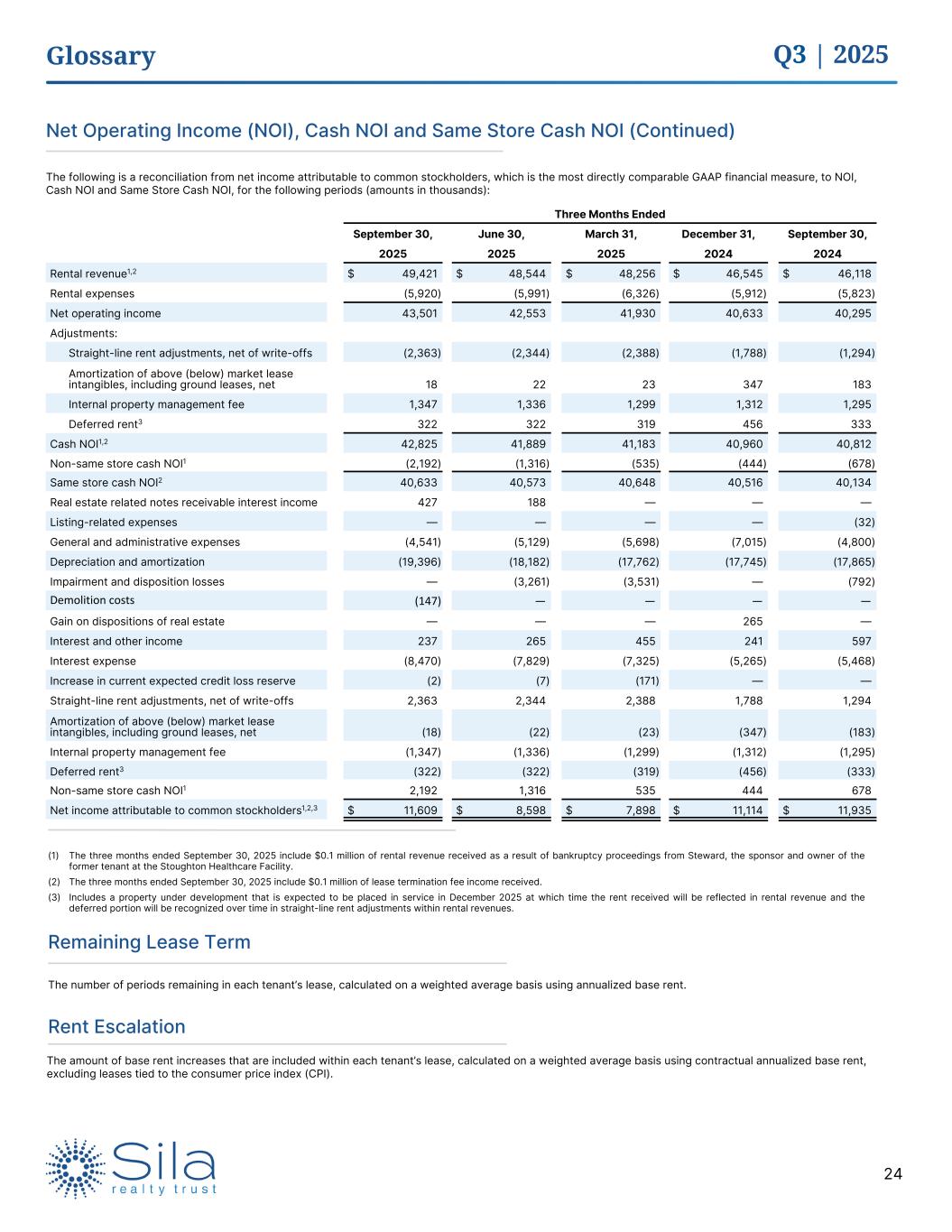

Q3 | 2025 24 Glossary Net Operating Income (NOI), Cash NOI and Same Store Cash NOI (Continued) The following is a reconciliation from net income attributable to common stockholders, which is the most directly comparable GAAP financial measure, to NOI, Cash NOI and Same Store Cash NOI, for the following periods (amounts in thousands): Three Months Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Rental revenue1,2 $ 49,421 $ 48,544 $ 48,256 $ 46,545 $ 46,118 Rental expenses (5,920) (5,991) (6,326) (5,912) (5,823) Net operating income 43,501 42,553 41,930 40,633 40,295 Adjustments: Straight-line rent adjustments, net of write-offs (2,363) (2,344) (2,388) (1,788) (1,294) Amortization of above (below) market lease intangibles, including ground leases, net 18 22 23 347 183 Internal property management fee 1,347 1,336 1,299 1,312 1,295 Deferred rent3 322 322 319 456 333 Cash NOI1,2 42,825 41,889 41,183 40,960 40,812 Non-same store cash NOI1 (2,192) (1,316) (535) (444) (678) Same store cash NOI2 40,633 40,573 40,648 40,516 40,134 Real estate related notes receivable interest income 427 188 — — — Listing-related expenses — — — — (32) General and administrative expenses (4,541) (5,129) (5,698) (7,015) (4,800) Depreciation and amortization (19,396) (18,182) (17,762) (17,745) (17,865) Impairment and disposition losses — (3,261) (3,531) — (792) Demolition costs (147) — — — — Gain on dispositions of real estate — — — 265 — Interest and other income 237 265 455 241 597 Interest expense (8,470) (7,829) (7,325) (5,265) (5,468) Increase in current expected credit loss reserve (2) (7) (171) — — Straight-line rent adjustments, net of write-offs 2,363 2,344 2,388 1,788 1,294 Amortization of above (below) market lease intangibles, including ground leases, net (18) (22) (23) (347) (183) Internal property management fee (1,347) (1,336) (1,299) (1,312) (1,295) Deferred rent3 (322) (322) (319) (456) (333) Non-same store cash NOI1 2,192 1,316 535 444 678 Net income attributable to common stockholders1,2,3 $ 11,609 $ 8,598 $ 7,898 $ 11,114 $ 11,935 Remaining Lease Term The number of periods remaining in each tenant’s lease, calculated on a weighted average basis using annualized base rent. Rent Escalation The amount of base rent increases that are included within each tenant’s lease, calculated on a weighted average basis using contractual annualized base rent, excluding leases tied to the consumer price index (CPI). (1) The three months ended September 30, 2025 include $0.1 million of rental revenue received as a result of bankruptcy proceedings from Steward, the sponsor and owner of the former tenant at the Stoughton Healthcare Facility. (2) The three months ended September 30, 2025 include $0.1 million of lease termination fee income received. (3) Includes a property under development that is expected to be placed in service in December 2025 at which time the rent received will be reflected in rental revenue and the deferred portion will be recognized over time in straight-line rent adjustments within rental revenues.

Q3 | 2025 25 Glossary Same Store Properties Operating properties that were owned and operated for the entirety of all calendar periods being compared, excluding properties under development, re- development, or classified as held for sale. To evaluate properties on a comparable basis, management analyzes metrics of same store properties in order to assess the core operations of the portfolio. By evaluating same store properties, management is able to monitor the operations of the Company's existing properties for comparable periods to measure the performance of the current portfolio and the effects of new acquisitions and dispositions on net income. Total Real Estate Investments at Cost Represents the contractual purchase price of real estate properties acquired, including capitalized acquisition costs, and capital expenditures incurred since acquisition, reduced by the cost basis of properties sold.