UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________________________________________________________________ SCHEDULE 14A (Rule 14a-101) SCHEDULE INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ____) _____________________________________________________________________________________ Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 _____________________________________________________________________________________ PAGERDUTY, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) ____________________________________________________________________________________________________ Payment of Filing Fee (Check all boxes that apply): No fee required. Fee paid previously with preliminary materials. Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Proxy Statement Supplement June 2025

Safe Harbor © PagerDuty Inc. PagerDuty and the PagerDuty logo are trademarks of PagerDuty, Inc. Other names and brands may be claimed as the property of others. Th is presentation contains forward-looking statements. All statements other than statements of historical fact contained in this presentation are forward-looking statements, including but not limited to: statements regarding the future financial and operational performance, and strategies, objectives, opportunity, expectations and market positioning of PagerDuty, Inc. (“PagerDuty” or the “Company”). In some cases, you can identify forward-looking statements by terms such as “can,” “desire,” “able,” “guidance,” “expect,” “extend,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “accelerate,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “in tend,” “shall” or the negative of these terms or other similar words or expressions. You should not rely upon forward-looking statements as predictions of future events. The outcome of events described in the forward-looking statements contained in this presentation is subject to known and unknown risks, uncertainties, assumptions and other factors that may cause PagerDuty’s actual results, per formance or outcomes to differ materially from those expressed or implied by such forward-looking statements, including: the Company’s ability to achieve and maintain future profitability; the Company’s ability to sustain and manage its growth; the Company’s ability to attract new customers and retain and sell additional functionality and services to its existing customers; the Company’s dependence on revenue from a single product; the Company’s ability to compete effectively in an increasingly competitive market; the impact of seasonality on the Company’s business; the Company’s ability to adapt and respond effectively to rapidly developing technology; the Company’s ability to effectively develop and expand its marketing and sales capacities; the Company’s ability to enhance and improve its platform or develop new functionality or use cases; the effect of unfavorable conditions in the Company’s industry or the global economy, or reductions in information spending, on the Company’s business and results of operations; adverse consequences that could arise as a result of international trade policies, including tar iffs, sanctions and trade barr iers; the accuracy of the Company’s estimates of market opportunity and forecasts of market growth; the Company’s assumptions and limitations to which ARR and certain other operational data are subject that may cause such metr ics to not provide an accurate indication of actual performance or future results; adverse consequences that could resu lt from any compromise of the Company’s in formation technology systems or those of third parties with whom the Company works or the Company’s data; adverse consequences that could result from any interruptions or delays in performance of the Company’s service; and the Company’s ability to maintain the compatibility of its platform with th ird par ty applications that its customers use in their businesses. The forward-looking statements contained in this presentation are also subject to additional r isks, uncertainties, and factors, including those more fully described in PagerDuty’s filings with the Securities and Exchange Commission (the “SEC”), including its most recently filed Form 10-K and subsequent filings with the SEC. Forward-looking statements represent PagerDuty’s management’s beliefs and assumptions only as of the date such statements are made. PagerDuty does not undertake, and expressly disclaims any duty, to update any statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. This presentation also includes references to non-GAAP operating margin, which we define as GAAP operating margin excluding stock-based compensation expense, employer taxes related to employee stock transactions, amortization of acquired intangible assets, acquisition-related expenses, and restructur ing costs. The Company believes that these expenses are not necessar ily reflective of operational performance during a period, and that consideration of this measure can assist in the comparison of operational per formance in different periods which may or may not include such expenses. This non-GAAP financial measure is in addition to, and not a substitu te for or superior to measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of th is non-GAAP financial measure versus its nearest GAAP equivalent. For example, other companies may calculate this non-GAAP financial measure differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of this non- GAAP financial measure as a tool for compar ison. For a reconciliation of this non-GAAP financial measure to its most directly comparable GAAP measure, please see the Company’s Form 10-K filed with the SEC on March 17, 2025. The last day of the Company’s fiscal year is January 31. The Company’s fiscal quarters end on April 30, July 31, October 31 and January 31. References to a fiscal year (FY) refer to the fiscal year ended January 31 of such year. For example, fiscal 2026 or FY26 refer to the fiscal year ending January 31, 2026.

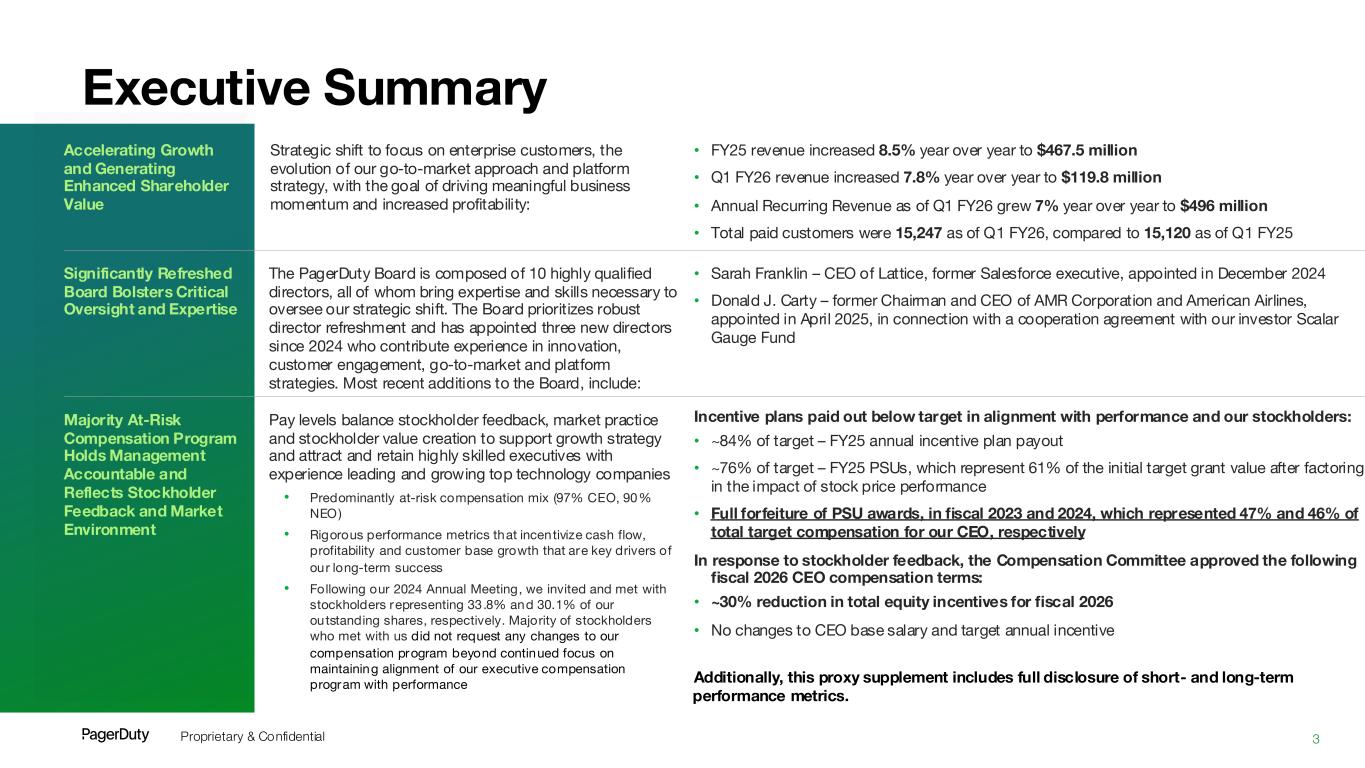

Proprietary & Confidential Executive Summary Accelerating Growth and Generating Enhanced Shareholder Value Strategic shift to focus on enterprise customers, the evolution of our go-to-market approach and platform strategy, with the goal of driving meaningful business momentum and increased profitability: • FY25 revenue increased 8.5% year over year to $467.5 million • Q1 FY26 revenue increased 7.8% year over year to $119.8 million • Annual Recurring Revenue as of Q1 FY26 grew 7% year over year to $496 million • Total paid customers were 15,247 as of Q1 FY26, compared to 15,120 as of Q1 FY25 Significantly Refreshed Board Bolsters Critical Oversight and Expertise The PagerDuty Board is composed of 10 highly qualified directors, all of whom bring expertise and skills necessary to oversee our strategic shift. The Board prioritizes robust director refreshment and has appointed three new directors since 2024 who contribute experience in innovation, customer engagement, go-to-market and platform strategies. Most recent additions to the Board, include: • Sarah Franklin – CEO of Lattice, former Salesforce executive, appointed in December 2024 • Donald J. Carty – former Chairman and CEO of AMR Corporation and American Airlines, appointed in April 2025, in connection with a cooperation agreement with our investor Scalar Gauge Fund Majority At-Risk Compensation Program Holds Management Accountable and Reflects Stockholder Feedback and Market Environment Pay levels balance stockholder feedback, market practice and stockholder value creation to support growth strategy and attract and retain highly skilled executives with experience leading and growing top technology companies • Predominantly at-risk compensation mix (97% CEO, 90% NEO) • Rigorous performance metrics that incentivize cash flow, profitability and customer base growth that are key drivers of our long-term success • Following our 2024 Annual Meeting, we invited and met with stockholders representing 33.8% and 30.1% of our outstanding shares, respectively. Majority of stockholders who met with us did not request any changes to our compensation program beyond continued focus on maintaining alignment of our executive compensation program with performance Incentive plans paid out below target in alignment with performance and our stockholders: • ~84% of target – FY25 annual incentive plan payout • ~76% of target – FY25 PSUs, which represent 61% of the initial target grant value after factoring in the impact of stock price performance • Full forfeiture of PSU awards, in fiscal 2023 and 2024, which represented 47% and 46% of total target compensation for our CEO, respectively In response to stockholder feedback, the Compensation Committee approved the following fiscal 2026 CEO compensation terms: • ~30% reduction in total equity incentives for fiscal 2026 • No changes to CEO base salary and target annual incentive Additionally, this proxy supplement includes full disclosure of short- and long-term performance metrics. 3

Solid revenue growth with significant operating margin expansion and sustained free cash flow generation Investment Highlights Real-time leading operations cloud platform Significant market opportunity Expansive enterprise adoption Consistent innovation Durable profitable growth Expanding competitive advantage through product offerings Strong enterprise demand with opportunity to further expand across the operations cloud platform Customer-driven demand across development, IT and infrastructure, security, customer service and business operations Comprehensive product offerings to optimize operating efficiency and offer tangible ROI

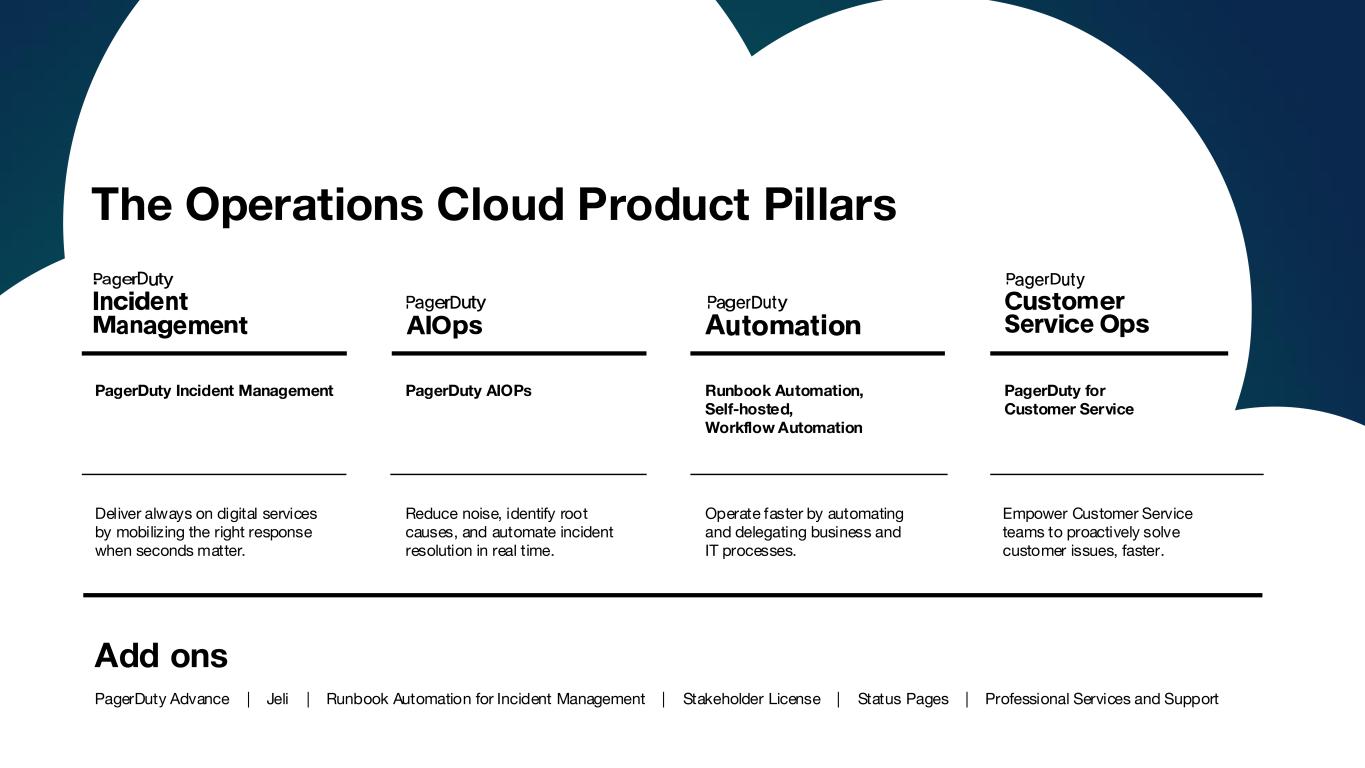

PagerDuty Incident Management PagerDuty for Customer Service PagerDuty AIOPs Runbook Automation, Self-hosted, Workflow Automation The Operations Cloud Product Pillars Reduce noise, identify root causes, and automate incident resolution in real time. Operate faster by automating and delegating business and IT processes. Empower Customer Service teams to proactively solve customer issues, faster. Deliver always on digital services by mobilizing the right response when seconds matter. Add ons PagerDuty Advance | Jeli | Runbook Automation for Incident Management | Stakeholder License | Status Pages | Professional Services and Support

Highly-Qualified and Engaged Board Jennifer Tejada CEO and Chairperson of PagerDuty Director Since 2016 Public boards: The Estee Lauder Companies Zachary Nelson Presiding Director, CC*, NCG Former CEO of NetSuite Director Since 2018 Public boards: Freshworks Elena Gomez AC Chief Financial Officer of Toast Director Since 2018 Rathi Murthy CC Former Chief Techno logy Officer & President of Expedia Services Director Since 2019 Alex Solomon Co-Founder and General Manger o f PagerDuty, Inc. Director Since 2010 Bonita C. Stewart CC, NCG* Former Board Partner of Gradient Ventures Google Director Since 2021 Public boards: Deckers Outdoors Teresa Carlson AC, NCG Former Chief Growth Officer of Splunk Director Since 2024 Bill Losch AC* Former Chief Financial Officer of Okta, Inc. Director Since 2022 AC: Audit Committee CC: Compensation Committee 6 Directors Standing for Re-election at 2025 Annual Meeting Donald J. Carty AC Former CEO of AMR Corporation Director Since 2025 Sarah Franklin AC Chief Executive Officer of Lattice Director Since 2024 NCG: Nominating and Corporate Governance * : Committee Chair 3 New independent directors appointed since 2024 • Corporate Development, Strategy and M&A • Emerging Technologies and Artificial Intelligence (AI) • Finance • Global Experience • Governance, Risk, Regulatory and Compliance • Human Capital and Talent Management • Public Company CEO • Sales and Marketing • Scaling a SaaS Company • Technology, Product and Cybersecurity BOARD SKILLS

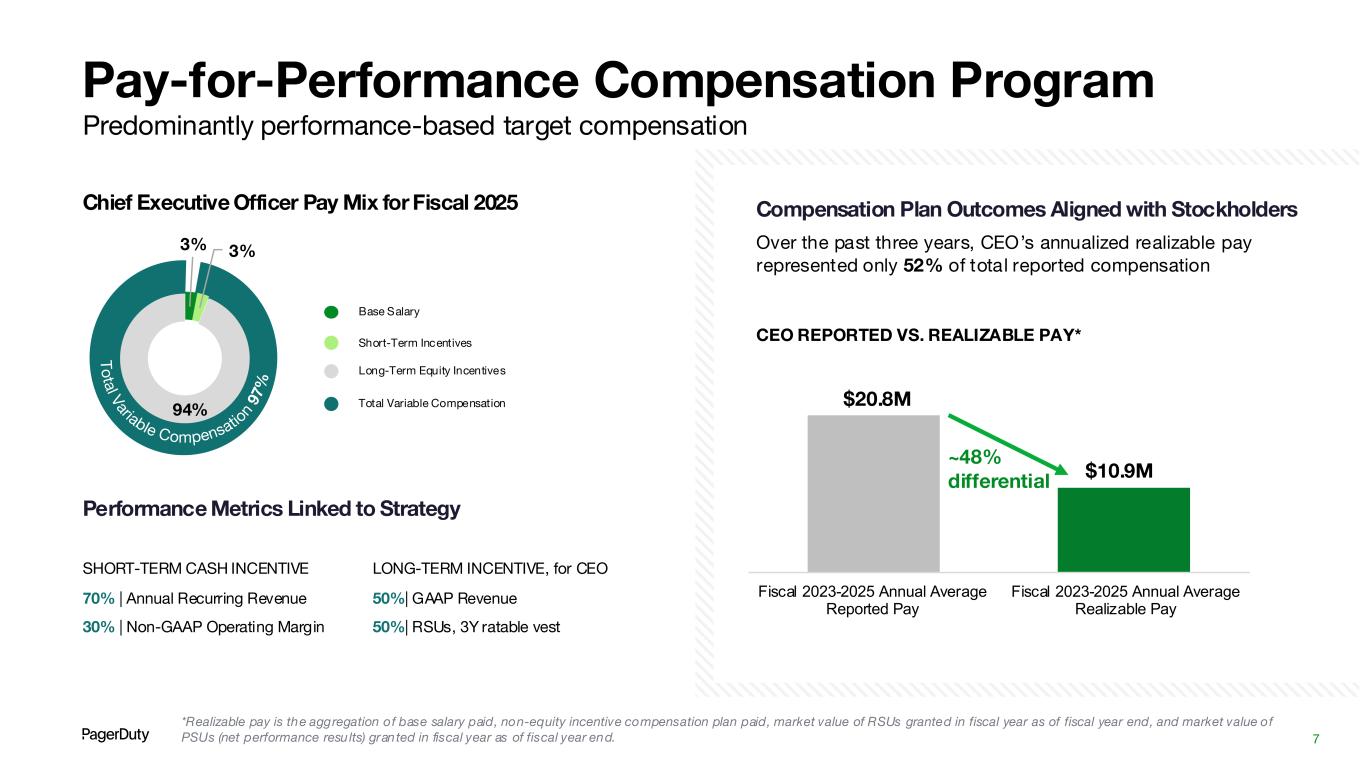

Performance Metrics Linked to Strategy SHORT-TERM CASH INCENTIVE 70% | Annual Recurring Revenue 30% | Non-GAAP Operating Margin LONG-TERM INCENTIVE, for CEO 50%| GAAP Revenue 50%| RSUs, 3Y ratable vest Chief Executive Officer Pay Mix for Fiscal 2025 Pay-for-Performance Compensation Program Total Variable Compensatio n 97 % 7 Over the past three years, CEO’s annualized realizable pay represented only 52% of total reported compensation Predominantly performance-based target compensation Compensation Plan Outcomes Aligned with Stockholders *Realizable pay is the aggregation of base salary paid, non-equity incentive compensation plan paid, market value of RSUs granted in fiscal year as of fiscal year end, and market value of PSUs (net performance results) granted in fiscal year as of fiscal year end. Fiscal 2023-2025 Annual Average Reported Pay Fiscal 2023-2025 Annual Average Realizable Pay ~48% differential $20.8M $10.9M CEO REPORTED VS. REALIZABLE PAY* Total Variable Compensation Long-Term Equity Incentives Base Salary Short-Term Incentives 3% 3% 94% Total Variable Compensatio n 97 %

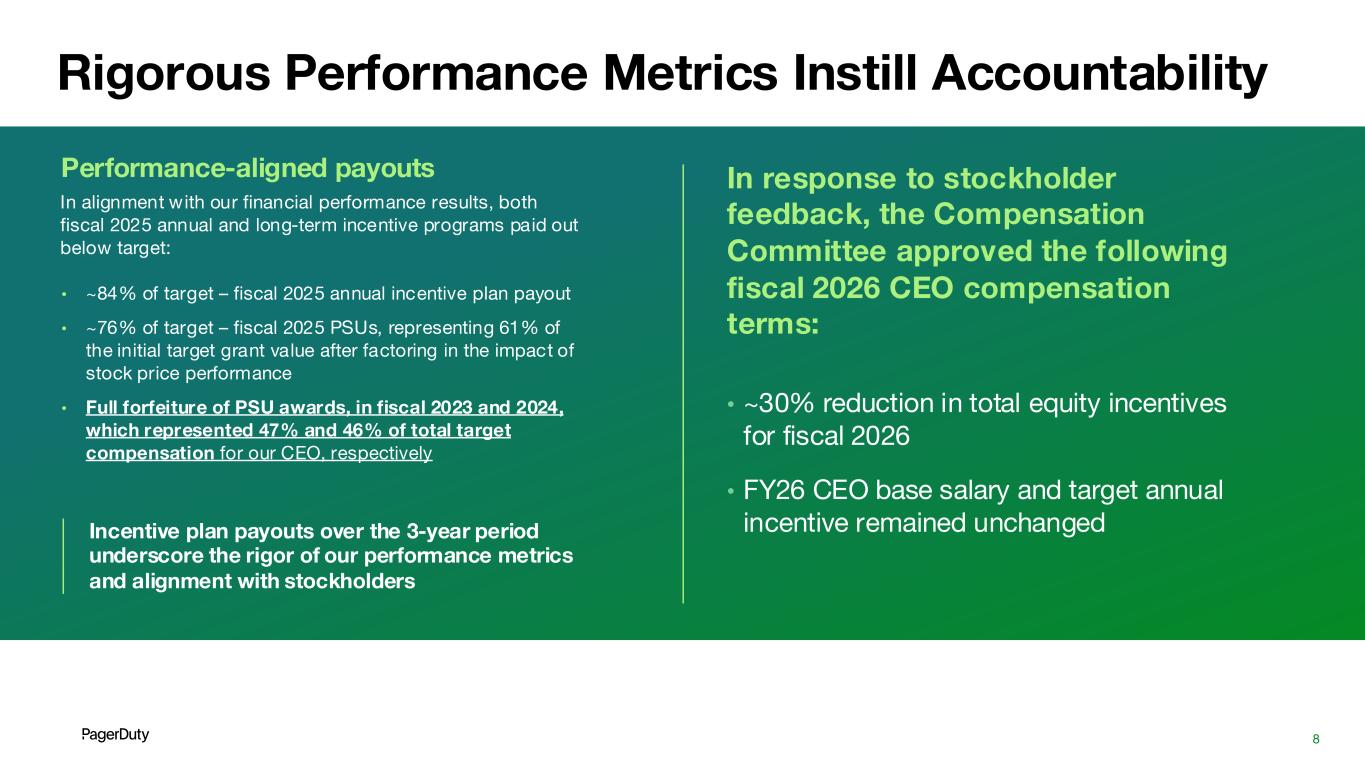

8 Rigorous Performance Metrics Instill Accountability Performance-aligned payouts Incentive plan payouts over the 3-year period underscore the rigor of our performance metrics and alignment with stockholders In response to stockholder feedback, the Compensation Committee approved the following fiscal 2026 CEO compensation terms: • ~30% reduction in total equity incentives for fiscal 2026 • FY26 CEO base salary and target annual incentive remained unchanged In alignment with our financial performance results, both fiscal 2025 annual and long-term incentive programs paid out below target: • ~84% of target – fiscal 2025 annual incentive plan payout • ~76% of target – fiscal 2025 PSUs, representing 61% of the initial target grant value after factoring in the impact of stock price performance • Full forfeiture of PSU awards, in fiscal 2023 and 2024, which represented 47% and 46% of total target compensation for our CEO, respectively

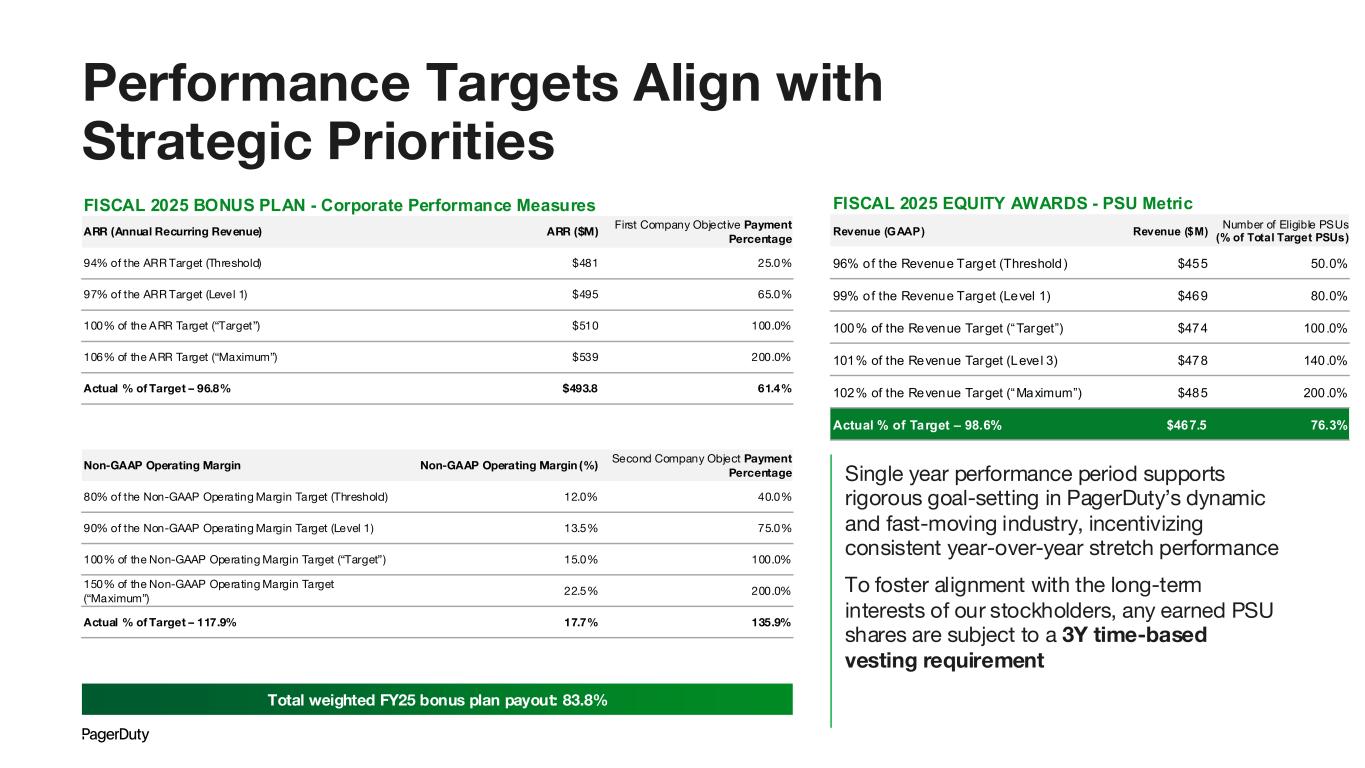

FISCAL 2025 BONUS PLAN - Corporate Performance Measures ARR (Annual Recurring Revenue) ARR ($M) First Company Objective Payment Percentage 94% of the ARR Target (Threshold) $481 25.0% 97% of the ARR Target (Level 1) $495 65.0% 100% of the ARR Target (“Target”) $510 100.0% 106% of the ARR Target (“Maximum”) $539 200.0% Actual % of Target – 96.8% $493.8 61.4% Non-GAAP Operating Margin Non-GAAP Operating Margin (%) Second Company Object Payment Percentage 80% of the Non-GAAP Operating Margin Target (Threshold) 12.0% 40.0% 90% of the Non-GAAP Operating Margin Target (Level 1) 13.5% 75.0% 100% of the Non-GAAP Operating Margin Target (“Target”) 15.0% 100.0% 150% of the Non-GAAP Operating Margin Target (“Maximum”) 22.5% 200.0% Actual % of Target – 117.9% 17.7% 135.9% Total weighted FY25 bonus plan payout: 83.8% Single year performance period supports rigorous goal-setting in PagerDuty’s dynamic and fast-moving industry, incentivizing consistent year-over-year stretch performance To foster alignment with the long-term interests of our stockholders, any earned PSU shares are subject to a 3Y time-based vesting requirement Performance Targets Align with Strategic Priorities FISCAL 2025 EQUITY AWARDS - PSU Metric Revenue (GAAP) Revenue ($M) Number of Eligible PSUs (% of Total Target PSUs) 96% of the Revenue Target (Threshold) $455 50.0% 99% of the Revenue Target (Level 1) $469 80.0% 100% of the Revenue Target (“Target”) $474 100.0% 101% of the Revenue Target (Level 3) $478 140.0% 102% of the Revenue Target (“Maximum”) $485 200.0% Actual % of Target – 98.6% $467.5 76.3%

Contact Irving Gomez VP, Deputy General Counsel igomez@pagerduty.com Tony Righetti VP, Investor Relations trighetti@pagerduty.com