SAIC PROPRIETARY INFORMATION I © SAIC. ALL RIGHTS RESERVED BUSINESS UPDATE FEBRUARY 11, 2026

2 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions identify forward-looking statements in this presentation. Such statements include, but are not limited to, statements about future financial and operating results, plans, objectives, expectations and intentions, and other statements that are not historical facts. These statements are subject to numerous assumptions, risks, and uncertainties, and other factors, many of which are outside the control of SAIC. These factors could cause actual results to differ materially from such forward-looking statements. Risks, uncertainties and assumptions that could cause SAIC’s actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to, those described in the “Risk Factors” section of SAIC’s most recent Form 10-K filed with the Securities and Exchange Commission (“SEC”) and updated in any subsequent Quarterly Reports on Form 10 -Q and other filings with the SEC. The reports referenced above are available on SAIC’s website at www.saic.com or on the SEC’s website at www.sec.gov. No assurance can be given that the results of events described in forward-looking statements will be achieved and actual results may differ materially from these statements. SAIC disclaims any obligation to update any forward-looking statements provided in this presentation to reflect subsequent events, actual results, or changes in SAIC’s expectations. In addition, these slides should be read in conjunction with our press release dated February 11, 2026, along with listening to or reading a transcript of the management comments delivered in a webcast held on February 11, 2026. All information in these slides are as of February 11, 2026. SAIC expressly disclaims any duty to update any forward-looking statement provided in this release to reflect subsequent events, actual results or changes in SAIC’s expectations. SAIC also disclaims any duty to comment upon or correct information that may be contained in reports published by investment analysts or others. FORWARD LOOKING STATEMENTS

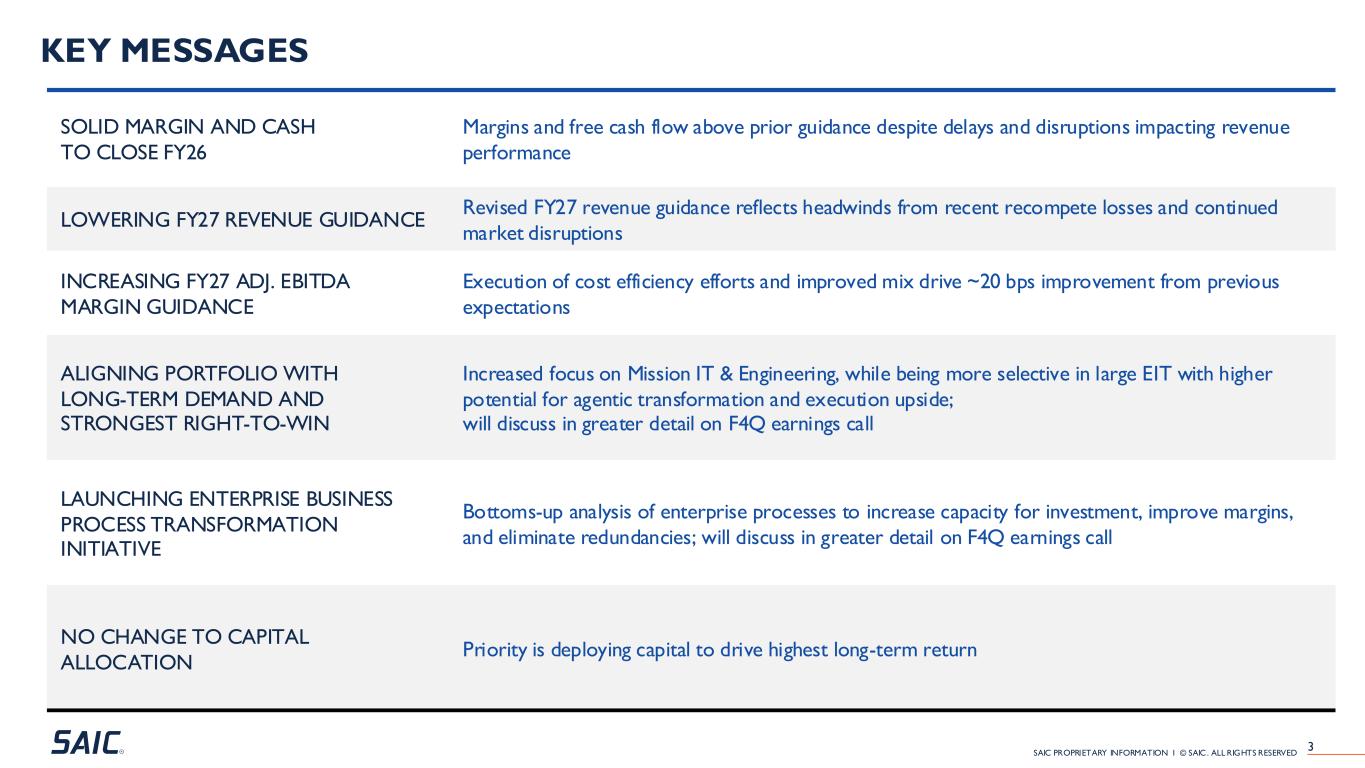

3 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED KEY MESSAGES SOLID MARGIN AND CASH TO CLOSE FY26 Margins and free cash flow above prior guidance despite delays and disruptions impacting revenue performance LOWERING FY27 REVENUE GUIDANCE Revised FY27 revenue guidance reflects headwinds from recent recompete losses and continued market disruptions INCREASING FY27 ADJ. EBITDA MARGIN GUIDANCE Execution of cost efficiency efforts and improved mix drive ~20 bps improvement from previous expectations ALIGNING PORTFOLIO WITH LONG-TERM DEMAND AND STRONGEST RIGHT-TO-WIN Increased focus on Mission IT & Engineering, while being more selective in large EIT with higher potential for agentic transformation and execution upside; will discuss in greater detail on F4Q earnings call LAUNCHING ENTERPRISE BUSINESS PROCESS TRANSFORMATION INITIATIVE Bottoms-up analysis of enterprise processes to increase capacity for investment, improve margins, and eliminate redundancies; will discuss in greater detail on F4Q earnings call NO CHANGE TO CAPITAL ALLOCATION Priority is deploying capital to drive highest long-term return

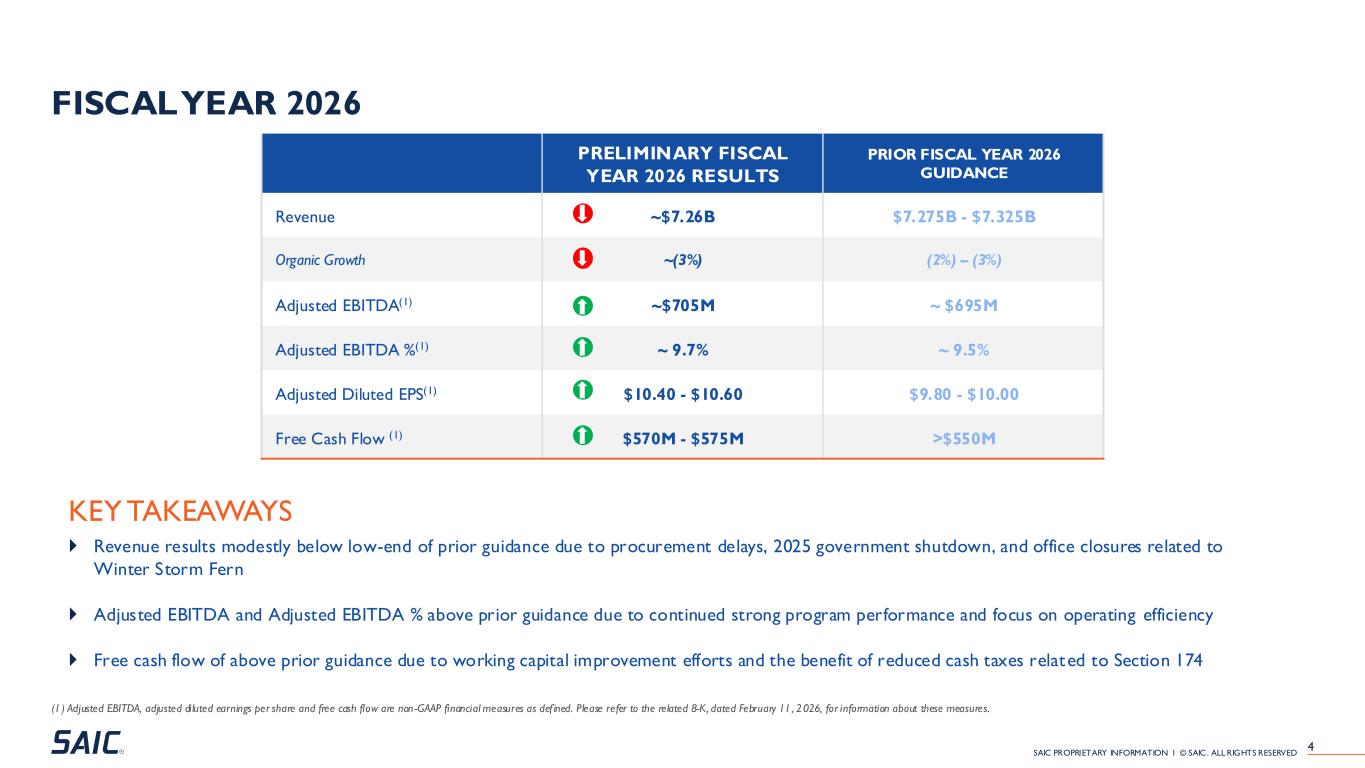

4 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED FISCAL YEAR 2026 PRELIMINARY FISCAL YEAR 2026 RESULTS PRIOR FISCAL YEAR 2026 GUIDANCE Revenue ~$7.26B $7.275B - $7.325B Organic Growth ~(3%) (2%) – (3%) Adjusted EBITDA(1) ~$705M ~ $695M Adjusted EBITDA %(1) ~ 9.7% ~ 9.5% Adjusted Diluted EPS(1) $10.40 - $10.60 $9.80 - $10.00 Free Cash Flow (1) $570M - $575M >$550M KEY TAKEAWAYS Revenue results modestly below low-end of prior guidance due to procurement delays, 2025 government shutdown, and office closures related to Winter Storm Fern Adjusted EBITDA and Adjusted EBITDA % above prior guidance due to continued strong program performance and focus on operating efficiency Free cash flow of above prior guidance due to working capital improvement efforts and the benefit of reduced cash taxes related to Section 174 (1) Adjusted EBITDA, adjusted diluted earnings per share and free cash flow are non -GAAP financial measures as def ined. Please refer to the related 8-K, dated February 11 , 2026, for information about these measures.

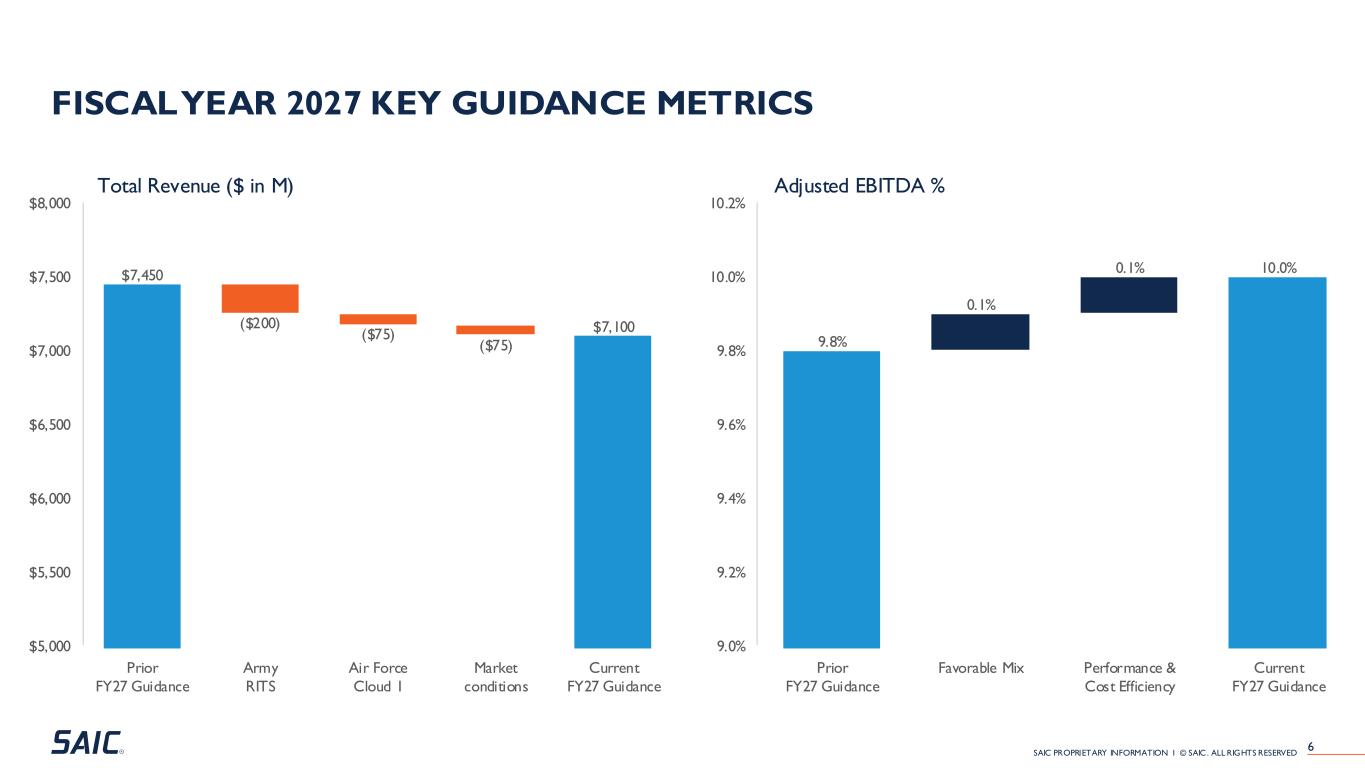

5 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED FISCAL YEAR 2027 CURRENT FISCAL YEAR 2027 GUIDANCE PRIOR FISCAL YEAR 2027 GUIDANCE Revenue $7.0B - $7.2B $7.35B - $7.55B Organic Growth (4%) – (2%) 0% - 3% Adjusted EBITDA(1) $705M - $715M $725M - $735M Adjusted EBITDA %(1) 9.9% - 10.1% 9.7% - 9.9% Free Cash Flow (1) >$600M >$600M KEY TAKEAWAYS Lower revenue outlook due to loss of EIT recompetes. Revised guidance assumes unchanged market conditions including delayed n ew-win ramps, lower on-contract growth, and slower customer outlays. Higher Adjusted EBITDA % outlook due to favorable mix impact from recompete losses and further execution against cost efficiency initiatives Free cash flow assumes continued working capital improvement and minimal cash taxes due to changes to Section 174 legislation (1) Adjusted EBITDA, adjusted diluted earnings per share and free cash flow are non -GAAP financial measures as def ined. Please refer to the related 8-K, dated February 11 , 2026, for information about these measures.

6 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED FISCAL YEAR 2027 KEY GUIDANCE METRICS $7,450 ($200) ($75) ($75) $7,100 Prior FY27 Guidance Army RITS Air Force Cloud 1 Market conditions Current FY27 Guidance $5,000 $5,500 $6,000 $6,500 $7,000 $7,500 $8,000 9.8% 10.0% 0.1% 0.1% Prior FY27 Guidance Favorable Mix Performance & Cost Efficiency Current FY27 Guidance 9.0% 9.2% 9.4% 9.6% 9.8% 10.0% 10.2% Total Revenue ($ in M) Adjusted EBITDA %

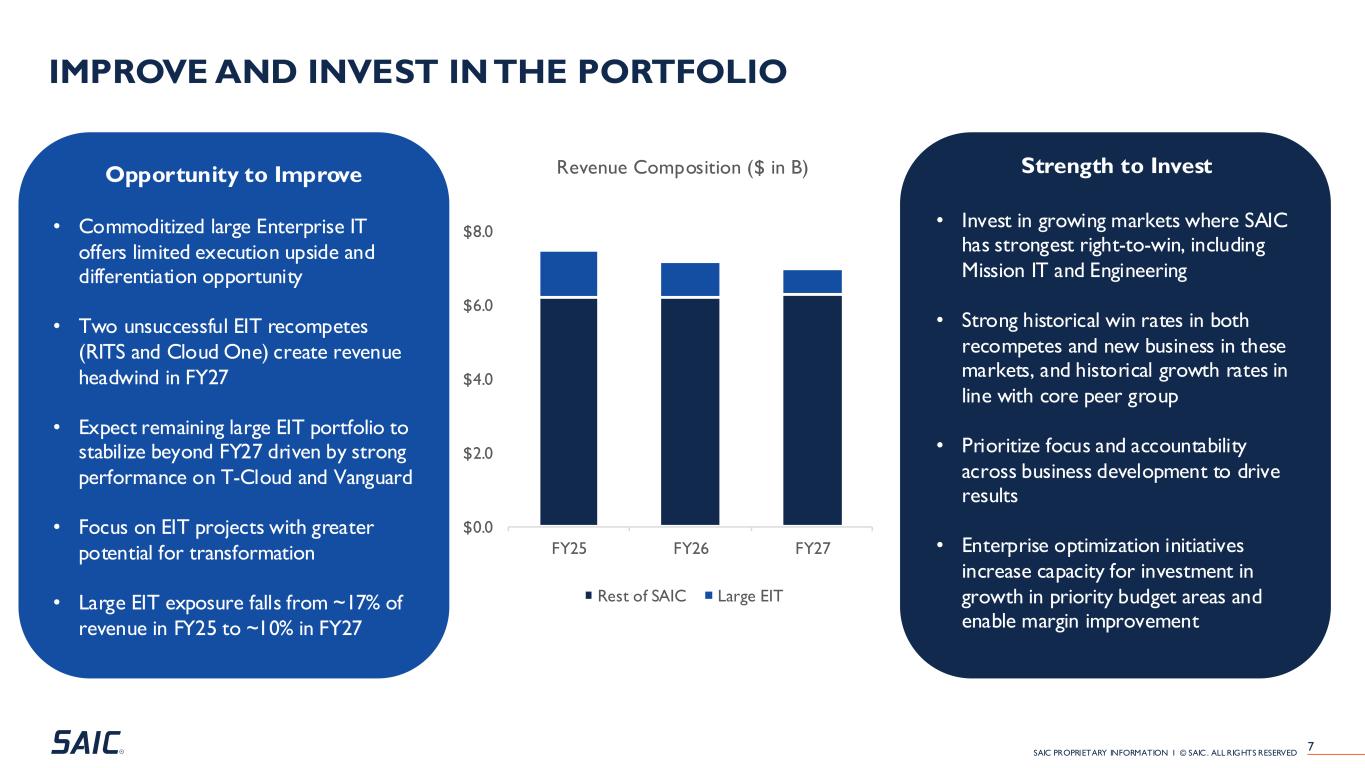

7 SAIC PROPRIETARY INFORMATION I © SAIC . ALL RIGHTS RESERVED IMPROVE AND INVEST IN THE PORTFOLIO Strength to Invest • Invest in growing markets where SAIC has strongest right-to-win, including Mission IT and Engineering • Strong historical win rates in both recompetes and new business in these markets, and historical growth rates in line with core peer group • Prioritize focus and accountability across business development to drive results • Enterprise optimization initiatives increase capacity for investment in growth in priority budget areas and enable margin improvement Opportunity to Improve • Commoditized large Enterprise IT offers limited execution upside and differentiation opportunity • Two unsuccessful EIT recompetes (RITS and Cloud One) create revenue headwind in FY27 • Expect remaining large EIT portfolio to stabilize beyond FY27 driven by strong performance on T-Cloud and Vanguard • Focus on EIT projects with greater potential for transformation • Large EIT exposure falls from ~17% of revenue in FY25 to ~10% in FY27 $0.0 $2.0 $4.0 $6.0 $8.0 FY25 FY26 FY27 Revenue Composition ($ in B) Rest of SAIC Large EIT