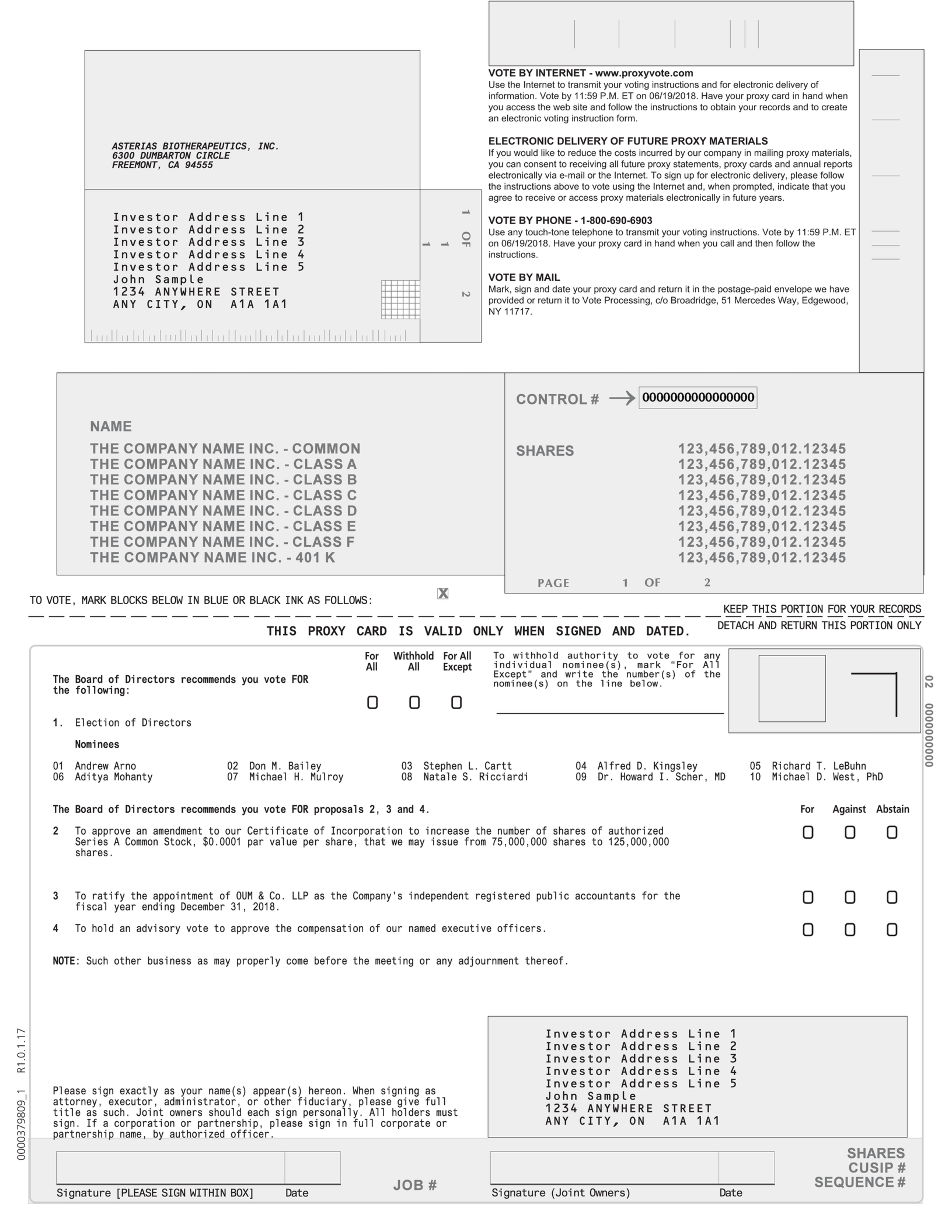

PROPOSAL NO. 2 - APPROVAL OF THE AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED SERIES A COMMON STOCK FROM 75,000,000 TO 125,000,000

We are asking our stockholders to approve an amendment (the “Amendment”) to our Certificate of Incorporation that, if approved, will increase the authorized number of shares of Series A Common Shares, par value $0.0001 from 75,000,0000 shares to 125,000,000 shares. We refer to this proposal as the Charter Amendment Proposal.

We have no plans, agreements, arrangements, or understandings, whether written or oral, relating to any issuance of the additional shares of Series A Common Stock that would be available under the Charter Amendment Proposal.

The operative provision of the proposed Amendment would read as follows:

The opening recital of Article 4 and Article 4.1.1 of the Corporation’s Amended and Restated Certificate of Incorporation is hereby amended and restated as follows:

Article 4

Capital Stock

The corporation is authorized to issue two classes of stock, which shall be designated “Common Stock” and “Preferred Stock.” The number of shares of Common Stock which the corporation is authorized to issue is Two Hundred Million (200,000,000). The Common Stock shall be divided into series as provided in Section 4.1. The number of shares of Preferred Stock which the corporation is authorized to issue is Five Million (5,000,000), with a par value of $0.0001 per share. The Preferred Stock shall be issuable in series as provided in Section 4.2.

4.1.1 Shares and Series. One Hundred Twenty-Five Million (125,000,000) shares of Common Stock with a par value of $0.0001 per share will be of a series designated Series A Common Stock, and Seventy Five Million (75,000,000) shares of Common Stock with a par value of $0.0001 per share will be of a series designated Series B Common Stock.

Each share of Series A Common Stock will be identical in all respects and will have equal rights, powers and privileges. All shares of Series A Common Stock acquired by the corporation, whether upon purchase, exchange, or otherwise, will be authorized but unissued shares of Series A Common Stock and may be reissued by resolution of the board of directors of the corporation.

Each share of Series B Common Stock will be identical in all respects and will have equal rights, powers and privileges. All shares of Series B Common Stock acquired by the corporation, whether upon purchase, exchange, or otherwise, will be authorized but unissued shares of Series B Common Stock and may be reissued by resolution of the board of directors of the corporation.

Vote Required; Effect of Abstentions and Broker Non-Votes

For the Charter Amendment Proposal to be approved in accordance with the requirements of Delaware law, the affirmative vote of the holders of not less than a majority of our outstanding shares entitled to vote is required.

If you check the “abstain” box for the Charter Amendment Proposal on the proxy card, if you attend the Meeting without submitting a proxy and you abstain from voting on the Charter Amendment Proposal, or if your shares are subject to a broker non-vote, your shares will be counted for purposes of determining the presence or absence of a quorum but will not be counted for purposes of determining whether the Charter Amendment Proposal has received an affirmative vote sufficient for approval. Because the vote to approve the Charter Amendment Proposal requires the affirmative vote of a majority of our outstanding common shares, an abstention or broker non-vote on the Charter Amendment Proposal has the effect of a vote against the Charter Amendment Proposal.

Reasons for the Articles Amendment Proposal

Our Certificate of Incorporation currently authorizes us to issue 150,000,000 shares of common stock, of which 75,000,000 shares are designated as Series A Common Stock, and 75,000,000 shares are designated as Series B Common Stock. Our Series A Common Stock is listed on the NYSE American. As of April 6, 2017,