UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material under Rule 14a-12

Straight Path Communications Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

¨

Fee computed on table below per Exchange Act Rule 14a-6(i)(1), and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transactions applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

¨

Fee paid previously with preliminary materials.

¨

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

5300 Hickory Park Drive, Suite 218

Glen Allen, Virginia 23059

(804) 433-1522

TIME AND DATE: |

10:00

a.m., local time, on Monday, January 12, 2015. |

|||||||||

PLACE: |

Hunton

& Williams LLP, 1751 Pinnacle Drive, Suite 1700, McLean, Virginia 22102 |

|||||||||

ITEMS OF BUSINESS: |

1. |

To elect four directors, each for a term of one year. |

||||||||

2. |

To approve an amendment and restatement to the Straight Path Communications Inc.’s 2013 Stock Option and Incentive Plan that

will increase (1) the number of shares of the Company’s Class B Common Stock available for the grant of awards thereunder by an additional 350,000

shares, and (2) the Non-Employee Director Annual Grant to 8,000 shares of restricted shares of the Company’s Class B Common

Stock. |

|||||||||

3. |

To ratify the appointment of Zwick & Banyai, PLLC as the Company’s independent registered public accounting firm for the

Fiscal Year ending July 31, 2015. |

|||||||||

4. |

To transact other business as may properly come before the Annual Meeting and any adjournment or postponement

thereof. |

|||||||||

RECORD DATE: |

You can

vote if you were a stockholder of record at close of business on November 18, 2014. |

|||||||||

PROXY VOTING: |

You can

vote either in person at the Annual Meeting or by proxy without attending the meeting. See details under the heading “How do I

Vote?” |

|||||||||

ANNUAL MEETING ADMISSION: |

If you

are a stockholder of record, a form of personal photo identification must be presented in order to be admitted to the Annual Meeting. If your shares

are held in the name of a bank, broker or other holder of record, you must bring a brokerage statement or other written proof of ownership as of

November 18, 2014 with you to the Annual Meeting, as well as a form of personal photo identification. |

|||||||||

ANNUAL MEETING DIRECTIONS: |

You may

request directions to the annual meeting via email at info@spathinc.com or by calling SPCI Investor Relations at (804) 433-1522. |

|||||||||

The Notice of Annual Meeting and Proxy Statement and the 2014 Annual Report are available at:

www.spathinc.com/investors

BY ORDER OF THE BOARD OF DIRECTORS |

||||||

|

||||||

Joyce Mason |

||||||

Corporate Secretary |

||||||

November 24, 2014

5300 Hickory Park Drive, Suite 218

Glen Allen, Virginia 23059

(804) 433-1522

No. 2) are non-routine matters. In the absence of voting instructions from the beneficial owner, a broker non-vote will occur. In the event of a broker non-vote or an abstention with respect to any proposal coming before the Annual Meeting, the shares represented by the relevant proxy will not be deemed to be present and entitled to vote on those proposals for the purpose of determining the total number of shares of which a majority is required for adoption, having the practical effect of reducing the number of affirmative votes required to achieve a majority vote for such matters by reducing the total number of shares from which a majority is calculated. However, if you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NYSE MKT rules to vote your shares on the ratification of the Company’s independent registered public accounting firm (Proposal No. 3), even if the broker does not receive voting instructions from you.

• |

Obscene materials; |

• |

Unsolicited marketing or advertising material or mass mailings; |

• |

Unsolicited newsletters, newspapers, magazines, books and publications; |

• |

Surveys and questionnaires; |

• |

Resumes and other forms of job inquiries; |

• |

Requests for business contacts or referrals; |

• |

Material that is threatening or illegal; or |

• |

Any communications or materials that are not in writing. |

• |

Routine questions, service and product complaints and comments that can be appropriately addressed by management; and |

• |

Routine invoices, bills, account statements and related communications that can be appropriately addressed by management. |

Governance Committee are independent within the meaning of Section 803 of the NYSE MKT Company Guide and the categorical standards set forth above.

| Name |

Dates of Board Service During Fiscal 2014 |

Fees Earned or Paid in Cash($)(1) |

Stock Awards ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

K. Chris Todd |

08/01/2013–07/31/2014 | $ | 30,000 | $ | 72,703 | (2) | $ | — | $ | 102,592 | ||||||||||||

William F. Weld |

08/01/2013–07/31/2014 | $ | 30,000 | $ | 72,703 | (2) | $ | — | $ | 102,592 | ||||||||||||

Fred S. Zeidman |

08/01/2013–07/31/2014 | $ | 30,000 | $ | 72,703 | (2) | $ | — | $ | 102,592 | ||||||||||||

(1) |

Represents the annual Board of Directors retainer earned in Fiscal 2014. |

(2) |

Represents the grant date fair value of an award of 1,250 shares of the Company’s Class B Common Stock on August 2, 2013, 2,500 shares of the Company’s Class B Common Stock on January 6, 2014 and 5,500 shares of the Company’s Class B Common Stock on January 16, 2014, computed in accordance with FASB ACS Topic 718. |

| Name |

Class B Common Stock |

Options to Purchase Class B Common Stock |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

K. Chris Todd |

9,250 | — | ||||||||

William F. Weld |

0 | — | ||||||||

Fred S. Zeidman |

9,250 | — | ||||||||

| Name |

Number of Shares of Class B Common Stock |

Percentage of Ownership of Class B Common Stock |

Percentage of Aggregate Voting Power(δ) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

The Patrick Henry TR DTD July 31 2013(1) c/o Alliance Trust Company, LLC 5375 Kietzke Lane, 2nd Floor Reno, Nevada 89511 |

2,190,512 | (2) | 18.3 | % | 72 | % | ||||||||

Davidi Jonas |

269,132 | (3) | 2.4 | % | * | |||||||||

Jonathan Rand |

82,898 | (4) | * | * | ||||||||||

K. Chris Todd |

9,250 | * | * | |||||||||||

William F. Weld |

0 | * | * | |||||||||||

Fred S. Zeidman |

9,250 | * | * | |||||||||||

All directors, Named Executive Officers and executive officers as a group (5 persons) |

430,530 | 3.9 | % | 1.2 | % | |||||||||

* |

Less than 1%. |

(δ) |

Voting power represents combined voting power of our Class A Common Stock (three votes per share) and our Class B Common Stock (one-tenth of one vote per share). |

(1) |

Howard Jonas is the beneficiary of the economic interest of the shares held by the Trust, but, subject to certain consent requirements, does not have voting power or control with respect to such shares. |

(2) |

Consists of 787,163 shares of Class A common stock (by virtue of the fact that they are convertible into the Company’s Class B common stock), and 1,403,349 shares of Class B common stock. |

(3) |

Consists of 45,060 shares of the Company’s Class B Common Stock held by Mr. Jonas directly and 224,072 shares of restricted shares of the Company’s Class B Common Stock (“Restricted Stock”). |

(4) |

Consists of 5,386 shares of the Company’s Class B Common Stock held by Mr. Rand directly and 77,512 shares of Restricted Stock. |

William F. Weld

Fred S. Zeidman

would not be reflective of the value generated during the year. With respect to Straight Path Spectrum, Mr. Jonas was a key participant in the development of the mid and long term strategies and plans for that business. In addition, Mr. Jonas was instrumental in the Company’s overall performance relative to its budget, and has been actively involved in the Company’s investor relations effort.

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($)(1) |

Stock Awards ($)(2) |

Option Awards ($) |

All other Compensation ($) |

Total ($) |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Davidi Jonas Chairman of the Board and Chief Executive Officer(3) |

Fiscal 2014 |

$ | 197,231 | $ | 60,000 | $ | 2,002,647 | (4) | $ | — | $ | 2,000 | (5) | $ | 2,261,878 | |||||||||||||||

Fiscal 2013 |

$ | 99,115 | $ | — | $ | — | $ | — | $ | — | $ | 99,115 | ||||||||||||||||||

Jonathan Rand Chief Financial Officer |

Fiscal 2014 |

$ | 175,000 | $ | 45,000 | $ | 730,220 | (6) | $ | — | $ | — | $ | 950,220 | ||||||||||||||||

Fiscal 2013 |

$ | 20,192 | $ | — | $ | — | $ | — | $ | — | $ | 20,192 | ||||||||||||||||||

(1) |

The amounts shown in this column reflect bonuses paid for performance during the relevant period irrespective of when such bonus was paid. |

(2) |

The amounts shown in this column reflect the aggregate grant date fair value of restricted stock awards computed in accordance with FASB ASC Topic 718. Please see Note 6 to SPCI’s Consolidated Financial Statements included in SPCI’s Annual Report on Form 10-K for the Fiscal Year ended July 31, 2014. |

(3) |

Mr. Jonas also served as Vice President, Business Development of IDT Corporation and manager of Straight Path Spectrum during Fiscal 2013. |

(4) |

On August 2, 2013, Mr. Jonas received a grant of 229,608 shares of Restricted Stock and on July 30, 2014, Mr. Jonas received a grant of 71,000 shares of Restricted Stock. |

(5) |

SPCI’s matching contribution to Mr. Jonas’ SPCI account established under the IDT 401(k) plan. |

(6) |

On August 2, 2013, Mr. Rand received a grant of 38,628 shares of Restricted Stock and on July 30, 2014, Mr. Rand received a grant of 52,000 shares of Restricted Stock. |

| Stock Awards |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested(1) ($) |

|||||||||

Davidi Jonas |

300,608 | (2) | 2,967,001 | ||||||||

Jonathan Rand |

90,268 | (3) | 890,945 | ||||||||

(1) |

Market value is computed by multiplying the closing price of our Class B Common Stock on July 31, 2014 (the last trading day of Fiscal 2014) which was $9.87 by the number of shares of restricted Class B Common Stock that had not vested as of July 31, 2014. |

(2) |

76,536 shares vested on August 2, 2014, 76,536 shares will vest on each of August 2, 2015 and August 2, 2016, 24,000 shares will vest on each of January 30, 2015 and January 30, 2016 and 23,000 shares will vest on January 30, 2017. |

(3) |

12,756 shares vested on August 2, 2014, 12,756 shares will vest on each of August 2, 2015 and August 2, 2016, 18,000 shares will vest on January 30, 2015 and 17,000 shares will vest on each of January 30, 2016 and January 30, 2017. |

| Plan Category |

Number of Securities to be Issued upon Exercise of Outstanding Options(1) |

Weighted-Average Exercise Price of Outstanding Options |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders |

28,992 |

$5.67 |

77,751 |

|||||||||||

Total |

28,992 |

$5.67 |

77,751 |

|||||||||||

(1) |

Reflects all outstanding options exercisable for shares of Class B Common Stock as of July 31, 2014. |

THE ELECTION OF THE NOMINEES NAMED ABOVE.

| Name |

Age |

Position |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Davidi Jonas |

28 |

Chairman of the Board of Directors, Director, Director Nominee, Chief Executive Officer and Named Executive

Officer |

||||||||

Jonathan Rand |

52 |

Chief Financial Officer and Named Executive Officer |

||||||||

Zhouyue Pi |

37 |

Chief Technology Officer |

||||||||

K. Chris Todd |

68 |

Director and Director Nominee |

||||||||

William F. Weld |

69 |

Director and Director Nominee |

||||||||

Fred S. Zeidman |

68 |

Director and Director Nominee |

||||||||

2013 STOCK OPTION AND INCENTIVE PLAN

including the delegation of certain of its authority. In determining the persons to whom awards shall be granted and the number of shares covered by each award, the Compensation Committee takes into account the duties of the respective persons, their present and potential contributions to the success of the Company and such other factors as the Compensation Committee deems relevant.

consultants. Actual awards under the 2013 Plan to Named Executive Officers for Fiscal 2014 are reported under the heading “Executive Compensation Table”

| Name and Principal Position |

Dollar Value |

Number of Shares of Stock |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Non-Employee Director |

$ | 196,845 | 24,000 | (1) | ||||||

(1) |

Each of the three non-employee directors of the Company will receive an annual grant of 8,000 shares of restricted Class B Common Stock for being a director, subject to stockholder approval of the proposed amendment and restatement. In 2014, this automatic grant was made on January 6, 2014 and January 16, 2014. Calculation is based upon the number of non-employee directors nominated for election at the Annual Meeting. |

NQSO in an amount equal to the excess of (i) the fair market value of the shares of Class B Common Stock at the time of exercise over (ii) the exercise price.

APPROVAL OF THE AMENDMENT AND RESTATEMENT

TO THE 2013 PLAN AS DESCRIBED ABOVE.

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR RATIFICATION OF THE APPOINTMENT OF ZWICK & BANYAI, PLLC AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JULY 31, 2015.

| Fiscal Year Ended July 31 |

2014 |

2013 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Audit Fees |

$ | 74,800 | (1) | $ | 48,753 | (2) | ||||

Audit Related Fees |

— | — | ||||||||

Tax Fees |

— | — | ||||||||

All Other Fees |

$ | 520 | — | |||||||

Total |

$ | 75,320 | $ | 48,753 | ||||||

(1) |

Audit fees for fiscal 2014 were principally for audit work performed on the consolidated financial statements for the fiscal year ended July 31, 2014 and for audit work performed for internal control of financial reporting for the fiscal year ended July 31, 2014. |

(2) |

Audit fees for fiscal 2013 were principally for audit work performed on the consolidated financial statements for the two years ended July 31, 2012 and for the fiscal year ended July 31, 2013 in connection with the Company’s Registration Statement on Form 10. |

and reports to the Audit Committee and to the Company’s management. Rotenberg is responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of the Company’s system of internal controls related to, for example, the reliability and integrity of the Company’s financial information and the safeguarding of the Company’s assets. With regard to the internal audit functions, the Audit Committee reviewed, and if required, approved, the audit plan, audit scope and its coverage in relation to the scope of the external audit, as well as approving Rotenberg to perform the internal audit function. The Company’s independent registered public accounting firm for Fiscal 2014, Zwick & Banyai, PLLC, is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards and expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles. In accordance with law, the Audit Committee has ultimate authority and responsibility for selecting, compensating, evaluating, and, when appropriate, replacing the Company’s independent audit firm, and evaluates its independence. The Audit Committee has the authority to engage its own outside advisors, including experts in particular areas of accounting, as it determines appropriate, apart from counsel or advisors hired by the Company’s management.

registered public accounting firm by applicable PCAOB rules regarding “Communication with Audit Committees.”

THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

||||||

Fred S. Zeidman — Chairman and Financial Expert |

||||||

K. Chris Todd |

||||||

William F. Weld |

||||||

BY ORDER OF THE BOARD OF DIRECTORS |

||||||

November 24, 2014 |

||||||

|

||||||

Joyce Mason |

||||||

Corporate Secretary |

||||||

2013 STOCK OPTION AND INCENTIVE PLAN

(Amended and Restated on October 23, 2014)

1. |

Purpose; Types of Awards; Construction. |

2. |

Definitions. |

(a)

|

“Agreement” shall mean a written agreement entered into between the Company and a Grantee in connection with an award under the Plan. |

(b)

|

“Board” shall mean the Board of Directors of the Company. |

(c)

|

“Change in Control” means a change in ownership or control of the Company effected through either of the following: |

(i)

|

any “person,” as such term is used in Sections 13(d) and 14(d) of the Exchange Act (other than (A) the Company, (B) any trustee or other fiduciary holding securities under an employee benefit plan of the Company, (C) any corporation or other entity owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of Class B Common Stock, or (D) any person who, immediately following the spin-off of the Company by way of a pro rata distribution of the Company’s Class B Common Stock to the stockholders of IDT Corporation, owned more than 25% of the combined voting power of the Company’s then outstanding voting securities), is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company (not including in the securities beneficially owned by such person any securities acquired directly from the Company or any of its affiliates other than in connection with the acquisition by the Company or its affiliates of a business) representing 25% or more of the combined voting power of the Company’s then outstanding voting securities; or |

(ii)

|

during any period of not more than two consecutive years, not including any period prior to the initial adoption of this Plan by the Board, individuals who at the beginning of such period constitute the Board, and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest, including, but not limited to a consent solicitation, relating to the election of directors of the Company) whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors at the beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute at least a majority thereof. |

(d)

|

“Class B Common Stock” shall mean shares of Class B Common Stock, par value $.01 per share, of the Company. |

(e)

|

“Code” shall mean the Internal Revenue Code of 1986, as amended from time to time. |

(f)

|

“Committee” shall mean the Compensation Committee of the Board or such other committee as the Board may designate from time to time to administer the Plan. The Board will cause the Committee to satisfy the applicable requirements of any stock exchange on which the Common Stock may then be listed. For purposes of awards intended to constitute performance awards, to the extent required by Code Section 162(m), Committee means all of the members of the Committee who are “outside directors” within the meaning of Section 162(m) of the Code. For purposes of awards to Grantees who are subject to Section 16 of the Exchange Act, Committee means all of the members of the Committee who are “non-employee directors” within the meaning of Rule 16b-3 adopted under the Exchange Act. |

(g)

|

“Company” shall mean Straight Path Communications Inc., a corporation incorporated under the laws of the State of Delaware, or any successor corporation. |

(h)

|

“Continuous Service” means that the provision of services to the Company or a Related Entity in any capacity of officer, employee, director or consultant is not interrupted or terminated. Continuous Service shall not be considered interrupted in the case of (i) any approved leave of absence, (ii) transfers between locations of the Company or among the Company, any Related Entity or any successor in any capacity of officer, employee, director or consultant, or (iii) any change in status as long as the individual remains in the service of the Company or a Related Entity in any capacity of officer, employee, director or consultant (except as otherwise provided in the applicable Agreement). An approved leave of absence shall include sick leave, short-term disability, maternity leave, military leave (including without limitation service in the National Guard or the Army Reserves) and any other personal leave approved by the Company or the Committee. For purposes of Incentive Stock Options, no such leave may exceed ninety (90) days unless reemployment upon expiration of such leave is guaranteed by statute or contract. |

(i)

|

“Corporate Transaction” means any of the following transactions: |

(i)

|

a merger or consolidation of the Company with any other corporation or other entity, other than (A) a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving or parent entity) 80% or more of the combined voting power of the voting securities of the Company or such surviving or parent entity outstanding immediately after such merger or consolidation or (B) a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no “person” (as defined in the Exchange Act) acquired 25% or more of the combined voting power of the Company’s then outstanding securities; or |

(ii)

|

a plan of complete liquidation of the Company or an agreement for the sale or disposition by the Company of all or substantially all of its assets (or any transaction having a similar effect). |

(j)

|

“Disability” shall mean cause for termination of a Grantee’s employment or service due to a determination that the Grantee is disabled in accordance with a long-term disability insurance program maintained by the Company or atotal and permanent disability as defined in Code Section 22(e)(3). |

(k)

|

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended from time to time. |

(l)

|

“Fair Market Value” per share as of a particular date shall mean (i) the closing sale price per share of Class B Common Stock on the national securities exchange on which the Class B Common Stock is principally traded for the last preceding date on which there was a sale of Class B Common Stock on such exchange, or (ii) if the shares of Class B Common Stock are then traded in an over-the-counter market, the average of the closing bid and asked prices for the shares of Class B Common Stock in such over-the-counter market for the last preceding date on which there was a sale of Class B Common Stock in such market, or (iii) if the shares of Class B Common Stock are not then readily tradable on an established securities market, such value as the Committee, in its sole discretion, shall determine, provided however that such determination (A) with respect to Nonqualified Stock Options, shall be in good faith using a “reasonable application of a reasonable valuation method” within the meaning of Treasury Regulation Section 1.409A-1(b)(5)(iv)(B), and (B) with respect to Incentive Stock Options, shall be in a manner that satisfies the applicable requirements of Code Section 422. |

(m)

|

“Grantee” shall mean a person who receives a grant of Options or Restricted Stock under the Plan. |

(n)

|

“Incentive Stock Option” shall mean any option intended to be, and designated as, an incentive stock option within the meaning of Section 422 of the Code. |

(o)

|

“Insider” shall mean a Grantee who is subject to the reporting requirements of Section 16(a) of the Exchange Act. |

(p)

|

“Insider Trading Policy” shall mean the Insider Trading Policy of the Company, as may be amended from time to time. |

(q)

|

“Non-Employee Director” means a member of the Board or the board of directors of any Subsidiary (other than any Subsidiary that has either (A) a class of “equity securities” (as defined in Rule 3a11-1 promulgated under the Exchange Act) registered under the Exchange Act or a similar foreign statute or (B) adopted any stock option plan, equity compensation plan or similar employee benefit plan in which non-employee directors of such Subsidiary are eligible to participate) who is not an employee of the Company or any Subsidiary. |

(r)

|

“Non-Employee Director Annual Grant” shall mean an award of 8,000shares of Restricted Stock . |

(s)

|

“Non-Employee Director Grant Date” shall mean January 5 of the applicable year (or the following business day if January 5 is not a business day). |

(t)

|

“Nonqualified Stock Option” shall mean any option not designated as an Incentive Stock Option. |

(u)

|

“Option” or “Options” shall mean a grant to a Grantee of an option or options to purchase shares of Class B Common Stock. |

(v)

|

“Option Agreement” shall have the meaning set forth in Section 6 of the Plan. |

(w)

|

“Option Price” shall mean the exercise price of the shares of Class B Common Stock covered by an Option. |

(x)

|

“Parent” shall mean any company (other than the Company) in an unbroken chain of companies ending with the Company if, at the time of granting an award under the Plan, each of the companies other than the Company owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other companies in such chain. |

(y)

|

“Related Entity” means any Parent, Subsidiary or any business, corporation, partnership, limited liability company or other entity in which the Company, a Parent or a Subsidiary holds a substantial ownership interest, directly or indirectly. The term “substantial ownership interest” means the possession, directly or indirectly, of the power to direct the management and policies of such person or entity, whether through the ownership of voting or other securities, by contract or otherwise. |

(z)

|

“Restricted Period” shall have the meaning set forth in Section 9(b) of the Plan. |

(aa)

|

“Restricted Stock” means shares of Class B Common Stock issued under the Plan to a Grantee for such consideration, if any, and subject to such restrictions on transfer, rights of refusal, repurchase provisions, forfeiture provisions and other terms and conditions as shall be determined by the Committee. |

(bb)

|

“Related Entity Disposition” means the sale, distribution or other disposition by the Company of all or substantially all of the Company’s interest in any Related Entity effected by a sale, merger or consolidation or other transaction involving such Related Entity or the sale of all or substantially all of the assets of such Related Entity. |

(cc)

|

“Retirement” shall mean a Grantee’s retirement in accordance with the terms of any tax-qualified retirement plan maintained by the Company or any of its affiliates in which the Grantee participates. |

(dd)

|

“Rule 16b-3” shall mean Rule 16b-3, as from time to time in effect, promulgated under the Exchange Act, including any successor to such Rule. |

(ee)

|

“Subsidiary” shall mean any company (other than the Company) in an unbroken chain of companies beginning with the Company if each of the companies other than the last company in the unbroken chain owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other companies in such chain. |

(ff)

|

“Tax Event” shall have the meaning set forth in Section 15 of the Plan. |

(gg)

|

“Ten Percent Stockholder” shall mean a Grantee who at the time an Incentive Stock Option is granted, owns stock possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or any Parent or Subsidiary. |

(a)

|

The Plan shall be administered by the Committee. |

(b)

|

The Committee shall have the authority in its discretion, subject to and not inconsistent with the express provisions of the Plan, to administer the Plan and to exercise all the powers and authorities either specifically granted to it under the Plan or necessary or advisable in the administration of the Plan, including, without limitation, the authority to grant Options and Restricted Stock; to determine which options shall constitute Incentive Stock Options and which Options shall constitute Nonqualified Stock Options; to determine the purchase price of the shares of Class B Common Stock covered by each Option; to determine the persons to whom, and the time or times at which awards shall be granted; to determine the number of shares to be covered by each award; to interpret the Plan and any award under the Plan; to reconcile any inconsistent terms in the Plan or any award under the Plan; to prescribe, amend and rescind rules and regulations relating to the Plan; to determine the terms and provisions of the Agreements (which need not be identical) and to cancel or suspend awards, as necessary; and to make all other determinations deemed necessary or advisable for the administration of the Plan. |

(c)

|

All decisions, determination and interpretations of the Committee shall be final and binding on all Grantees of any awards under this Plan. No member of the Board or Committee shall be liable for any action taken or determination made in good faith with respect to the Plan or any award granted hereunder. |

(d)

|

The Committee may delegate to one or more executive officers of the Company the authority to (i) grant awards under the Plan to employees of the Company and its Subsidiaries who are not officers or directors of the Company, (ii) execute and deliver documents or take such other ministerial actions on behalf of the Committee with respect to awards and (iii) to make interpretations of the Plan. The grant of authority in this Section 3(d) shall be subject to such conditions and limitations as may be determined by the Committee. If the Committee delegates authority to any such executive officer or executive officers of the Company pursuant to this Section 3(d), and such executive officer or executive officers grant awards pursuant to such delegated authority, references in this Plan to the “Committee” as they relate to such awards shall be deemed to refer to such executive officer or executive officers, as applicable. |

4. |

Eligibility. |

(a)

|

The maximum number of shares of Class B Common Stock reserved for the grant of awards under the Plan shall be 1,028,532 (after giving effect to the stock split of the Company’s shares of common stock to be effective prior to the Company’s spinoff from IDT Corporation), subject to adjustment as provided in Section 11 of the Plan. Such shares may, in whole or in part, be authorized but unissued shares or shares that shall have been or may be reacquired by the Company. |

(b)

|

If any outstanding award under the Plan should, for any reason expire, be canceled or be forfeited without having been exercised in full, the shares of Class B Common Stock allocable to the unexercised, canceled or terminated portion of such award shall (unless the Plan shall have been terminated) become available for subsequent grants of awards under the Plan, unless otherwise determined by the Committee. |

(c)

|

In no event may a Grantee be granted during any calendar year Options to acquire more than an aggregate of 50,000 shares of Class B Common Stock subject to adjustment as provided in Section 11 of the Plan. |

(a)

|

OPTION AGREEMENT. Each Option granted pursuant to the Plan shall be evidenced by a written agreement between the Company and the Grantee (the “Option Agreement”), in such form and containing such terms and conditions as the Committee shall from time to time approve, which Option Agreement shall comply with and be subject to the following terms and conditions, unless otherwise specifically provided in such Option Agreement. For purposes of interpreting this Section 6, a director’s service as a member of the Board or a consultant’s service shall be deemed to be employment with the Company. |

(b)

|

NUMBER OF SHARES. Each Option Agreement shall state the number of shares of Class B Common Stock to which the Option relates. |

(c)

|

TYPE OF OPTION. Each Option Agreement shall specifically state that the Option constitutes an Incentive Stock Option or a Nonqualified Stock Option. In the absence of such designation, the Option will be deemed to be a Nonqualified Stock Option. |

(d)

|

OPTION PRICE. Each Option Agreement shall state the Option Price, which, in the case of an Incentive Stock Option, shall not be less than one hundred percent (100%) of the Fair Market Value of the shares of Class B Common Stock covered by the Option on the date of grant. The Option Price shall be subject to adjustment as provided in Section 9 of the Plan. |

(e)

|

MEDIUM AND TIME OF PAYMENT. The Option Price shall be paid in full, at the time of exercise, in cash or in shares of Class B Common Stock having a Fair Market Value equal to such Option Price or in a combination of cash and Class B Common Stock including a cashless exercise procedure through a broker-dealer or otherwise; provided, however, that in the case of an Incentive Stock Option, the medium of payment shall be determined at the time of grant and set forth in the applicable Option Agreement. |

(f)

|

TERM AND EXERCISABILITY OF OPTIONS. Each Option Agreement shall provide the exercise schedule for the Option as determined by the Committee, provided, that, the Committee shall have the authority to accelerate the exercisability of any outstanding option at such time and under such circumstances as it, in its sole discretion, deems appropriate. The exercise period will be ten (10) years from the date of the grant of the option unless otherwise determined by the Committee; provided, however, that in the case of an Incentive Stock Option, such exercise period shall not exceed ten (10) years from the date of grant of such Option. The exercise period shall be subject to earlier termination as provided in Sections 6(g) and 6(h) of the Plan. An Option may be exercised, as to any or all full shares of Class B Common Stock as to which the Option has become exercisable, by written notice delivered in person or by mail to the administrator designated by the Company, specifying the number of shares of Class B Common Stock with respect to which the Option is being exercised. |

(g)

|

TERMINATION OF CONTINUOUS SERVICE. Except as expressly provided for in an applicable Option Agreement or as provided in this Section 6(g) and in Section 6(h) of the Plan, an Option may not be exercised unless the Grantee is then in the employ of, or maintaining a director or consultant relationship with, or otherwise a service provider to, the Company or a Subsidiary thereof (or a company or a Parent or Subsidiary of such company issuing or assuming the Option in a transaction to which Section 424(a) of the Code applies), and unless the Grantee has remained in Continuous Service with the Company or any Subsidiary since the date of grant of the Option. In the event that the Continuous Service of a Grantee shall terminate (other than by reason of death, Disability or Retirement), all Options of such Grantee that are exercisable at the time of Grantee’s termination may, unless earlier terminated in accordance with their terms, be exercised within one hundred eighty (180) days after the date of termination (or such different period as the Committee or the applicable Option Agreement shall prescribe).. |

(h)

|

DEATH, DISABILITY OR RETIREMENT OF GRANTEE. Unless otherwise expressly provided for in an Option Agreement, if a Grantee shall die while providing Continuous Service or if the Grantee’s Continuous Service shall terminate by reason of Disability, all Options theretofore granted to such Grantee (to the extent otherwise exercisable) may, unless earlier terminated in accordance with their terms, be exercised by the Grantee or by the Grantee’s estate or by a person who acquired the right to exercise such Options by bequest or inheritance or otherwise by result of death or Disability of the Grantee, at any time within one hundred eighty (180) days after the death or Disability of the Grantee (or such different period as the applicable Option Agreement or the Committee shall prescribe). In the event that an Option granted hereunder shall be exercised by the legal representatives of a deceased or former Grantee, written notice of such exercise shall be accompanied by a certified copy of letters testamentary or equivalent proof of the right of such |

| legal representative to exercise such Option. In the event that the Continuous Service of a Grantee shall terminate on account of such Grantee’s Retirement, all Options of such Grantee that are exercisable at the time of such Retirement may, unless earlier terminated in accordance with their terms, be exercised at any time within one hundred eighty (180) days after the date of such Retirement (or such different period as the applicable Option Agreement or the Committee shall prescribe). |

(i)

|

OTHER PROVISIONS. The Option Agreements evidencing awards under the Plan shall contain such other terms and conditions not inconsistent with the Plan as the Committee may determine. |

(a)

|

LIMITATION ON VALUE OF SHARES. To the extent that the aggregate Fair Market Value of shares of Class B Common Stock subject to Options designated as Incentive Stock Options which become exercisable for the first time by a Grantee during any calendar year (under all plans of the Company or any Subsidiary) exceeds $100,000, such excess Options, to the extent of the shares covered thereby in excess of the foregoing limitation, shall be treated as Nonqualified Stock Options. For this purpose, Incentive Stock Options shall be taken into account in the order in which they were granted, and the Fair Market Value of the shares of Class B Common Stock shall be determined as of the date that the Option with respect to such shares was granted. |

(b)

|

TEN PERCENT STOCKHOLDER. In the case of an Incentive Stock Option granted to a Ten Percent Stockholder, (i) the Option Price shall not be less than one hundred ten percent (110%) of the Fair Market Value of the shares of Class B Common Stock on the date of grant of such Incentive Stock Option, and (ii) the exercise period shall not exceed five (5) years from the date of grant of such Incentive Stock Option. |

(a)

|

NUMBER OF SHARES. Each Agreement shall state the number of shares of Restricted Stock to be subject to an award. |

(b)

|

RESTRICTIONS. Shares of Restricted Stock may not be sold, assigned, transferred, pledged, hypothecated or otherwise disposed of, except by will or the laws of descent and distribution, for such period as the Committee shall determine from the date on which the award is granted (the “Restricted Period”). The Committee may also impose such additional or alternative restrictions and conditions on the shares as it deems appropriate including, but not limited to, the satisfaction of performance criteria. Such performance criteria may include sales, earnings before interest and taxes, return on investment, earnings per share, any combination of the foregoing or rate of growth of any of the foregoing, as determined by the Committee. The Company may, at its option, |

| maintain issued shares in book entry form. Certificates, if any, for shares of stock issued pursuant to Restricted Stock awards shall bear an appropriate legend referring to such restrictions, and any attempt to dispose of any such shares of stock in contravention of such restrictions shall be null and void and without effect. During the Restricted Period, any such certificates shall be held in escrow by an escrow agent appointed by the Committee. In determining the Restricted Period of an award, the Committee may provide that the foregoing restrictions shall lapse with respect to specified percentages of the awarded shares on successive anniversaries of the date of such award. |

(c)

|

FORFEITURE. Subject to such exceptions as may be determined by the Committee, if the Grantee’s Continuous Service with the Company or any Subsidiary shall terminate for any reason prior to the expiration of the Restricted Period of an award, any shares remaining subject to restrictions (after taking into account the provisions of Subsection (e) of this Section 9) shall thereupon be forfeited by the Grantee and transferred to, and retired by, the Company without cost to the Company or such Subsidiary, and such shares shall become available for subsequent grants of awards under the Plan, unless otherwise determined by the Committee. |

(d)

|

OWNERSHIP. During the Restricted Period, the Grantee shall possess all incidents of ownership of such shares, subject to Subsection (b) of this Section 9, including the right to receive dividends with respect to such shares and to vote such shares. |

(e)

|

ACCELERATED LAPSE OF RESTRICTIONS. Upon the occurrence of any of the events specified in Section 12 of the Plan (and subject to the conditions set forth therein), all restrictions then outstanding on any shares of Restricted Stock awarded under the Plan shall lapse as of the applicable date set forth in Section 12. The Committee shall have the authority (and the Agreement may so provide) to cancel all or any portion of any outstanding restrictions prior to the expiration of the Restricted Period with respect to any or all of the shares of Restricted Stock awarded on such terms and conditions as the Committee shall deem appropriate. |

(a)

|

GENERAL. Non-Employee Directors shall receive Restricted Stock in accordance with this Section 10. Restricted Stock granted pursuant to this Section 10 shall be subject to the terms of such section and shall not be subject to discretionary acceleration of vesting by the Committee. Unless determined otherwise by the Committee, Non-Employee Directors shall not receive separate and additional grants hereunder for being a Non-Employee Director of (i) the Company and a Subsidiary or (ii) more than one Subsidiary. |

(b)

|

INITIAL GRANTS OF RESTRICTED STOCK. A Non-Employee Director who first becomes a Non-Employee Director shall receive a pro-rata amount (based on projected quarters of service until the following Non-Employee Director Grant Date) of a Non-Employee Director Annual Grant on his date of appointment as a Non-Employee Director. |

(c)

|

ANNUAL GRANTS OF RESTRICTED STOCK. On each Non-Employee Director Grant Date, each Non-Employee Director shall receive a Non-Employee Director Annual Grant. |

(d)

|

VESTING OF RESTRICTED STOCK. Restricted Stock granted under this Section 10 shall be fully vested on the date of grant. |

(a)

|

ADJUSTMENTS UPON CHANGES IN CAPITALIZATION. In the event of any extraordinary dividend, stock dividend, recapitalization, merger, consolidation, stock split, warrant or rights issuance, or combination or exchange of such shares, or other similar transactions, the Committee shall equitably adjust (i) the maximum number of Options or shares of Restricted Stock that may be awarded to a Grantee in any calendar year (as provided in Section 5 hereof), (ii) the number of shares of Class B Common Stock available for awards under the Plan, (iii) the number and/or kind of shares covered by outstanding awards and (iv) the price per share of Options so as to reflect such event and preserve the value of such awards; provided, however, that any fractional shares resulting from such adjustment shall be eliminated. |

(b)

|

CHANGE IN CLASS B COMMON STOCK. In the event of a change in the Class B Common Stock as presently constituted that is limited to a change of all of its authorized shares of Class B Common Stock, into the same number of shares with a different par value or without par value, the shares resulting from any such change shall be deemed to be the Class B Common Stock within the meaning of the Plan. |

(a)

|

CORPORATE TRANSACTION. In the event of a Corporate Transaction, each award which is at the time outstanding under the Plan shall automatically become fully vested and exercisable and, in the case of an award of Restricted Stock, shall be released from any restrictions on transfer (except with regard to the Insider Trading Policy and such other agreements between the Grantee and the Company) and repurchase or forfeiture rights, immediately prior to the specified effective date of such Corporate Transaction. Effective upon the consummation of the Corporate Transaction, all outstanding awards of Options under the Plan shall terminate, unless otherwise determined by the Committee. However, all such awards shall not terminate if the awards are, in connection with the Corporate Transaction, assumed by the successor corporation or Parent thereof. |

(b)

|

CHANGE IN CONTROL. In the event of a Change in Control (other than a Change in Control which is also a Corporate Transaction), each award which is at the time outstanding under the Plan automatically shall become fully vested and exercisable and, in the case of an award of Restricted Stock, shall be released from any restrictions on transfer and repurchase or forfeiture rights, immediately prior to the specified effective date of such Change in Control. |

(c)

|

RELATED ENTITY DISPOSITION. The Continuous Service of each Grantee (who is primarily engaged in service to a Related Entity at the time it is involved in a Related Entity Disposition) shall terminate effective upon the consummation of such Related Entity Disposition, and each outstanding award of such Grantee under the Plan shall become fully vested and exercisable and, in the case of an award of Restricted Stock, shall be released from any restrictions on transfer (except with regard to the Insider Trading Policy and such other agreements between the Grantee and the Company). Unless otherwise determined by the Committee, the Continuous Service of a Grantee shall not be deemed to terminate (and each outstanding award of such Grantee under the Plan shall not become fully vested and exercisable and, in the case of an award of Restricted Stock, shall not be released from any restrictions on transfer) if (i) a Related Entity Disposition involves the spin-off of a Related Entity, for so long as such Grantee continues to remain in the service of such entity that constituted the Related Entity immediately prior to the consummation of such Related Entity Disposition (“SpinCo”) in any capacity of officer, employee, director or consultant or (ii) an outstanding award is assumed by the surviving corporation (whether SpinCo or otherwise) or its parent entity in connection with a Related Entity Disposition. |

(d)

|

SUBSTITUTE AWARDS. The Committee may grant awards under the Plan in substitution of stock-based incentive awards held by employees, consultants or directors of another entity who become employees, consultants or directors of the Company or any Subsidiary by reason of a merger or consolidation of such entity with the Company or any Subsidiary, or the acquisition by the Company or a Subsidiary of property or equity of such entity, upon such terms and conditions as the Committee may determine, and such awards shall not count against the share limitation set forth in Section 5 of the Plan. |

14. |

Transferability of Awards. |

(a)

|

Incentive Stock Options may not be sold, pledged, assigned, hypothecated, transferred or disposed of in any manner other than by the laws of descent and distribution and may be exercised, during the lifetime of the Grantee, only by the Grantee or his or her guardian or legal representative. |

(b)

|

Nonqualified Stock Options shall be transferable in the manner and to the extent acceptable to the Committee, as evidenced by a writing signed by the Company and the Grantee. Nonqualified Stock Options shall be transferable by a Grantee as a gift to the Grantee’s “family members” (as defined in Form S-8) under such terms and conditions as may be established by the Committee; provided that the Grantee receives no consideration for the transfer. Notwithstanding the transfer by a Grantee of a Nonqualified Stock Option, the transferred Nonqualified Stock Option shall continue to be subject to the same terms and conditions as were applicable to the Nonqualified Stock Option immediately before the transfer (including, without limitation, the Insider Trading Policy) and the Grantee will continue to remain subject to the withholding tax requirements set forth in Section 15 hereof. |

(c)

|

The terms of any award granted under the Plan, including the transferability of any such award, shall be binding upon the executors, administrators, heirs and successors of the Grantee. |

(d)

|

Each Grantee who receives an award shall comply with any policy adopted by the Company from time to time covering transactions in the Company’s securities. By way of example, and not limitation, Restricted Stock shall remain subject to the Insider Trading Policy after the Restricted Period. |

(a)

|

APPROVAL. The Plan initially became effective when adopted by the Board on July 22, 2013 and shall terminate on the tenth anniversary of such date (except as to awards outstanding on that date). The Plan was ratified by the Company’s stockholder on July 24, 2013. |

(b)

|

AMENDMENT AND TERMINATION OF THE PLAN. The Board, or the Committee if so delegated by the Board, at any time and from time to time may suspend, terminate, modify or amend the Plan; however, unless otherwise determined by the Board, or the Committee if applicable, an amendment that requires stockholder approval in order for the Plan to continue to comply with any law, regulation or stock exchange requirement shall not be effective unless approved by the requisite vote of stockholders. Except as provided in Section 11(a) of the Plan, no suspension, termination, modification or amendment of the Plan may adversely affect any award previously granted, unless the written consent of the Grantee is obtained. |

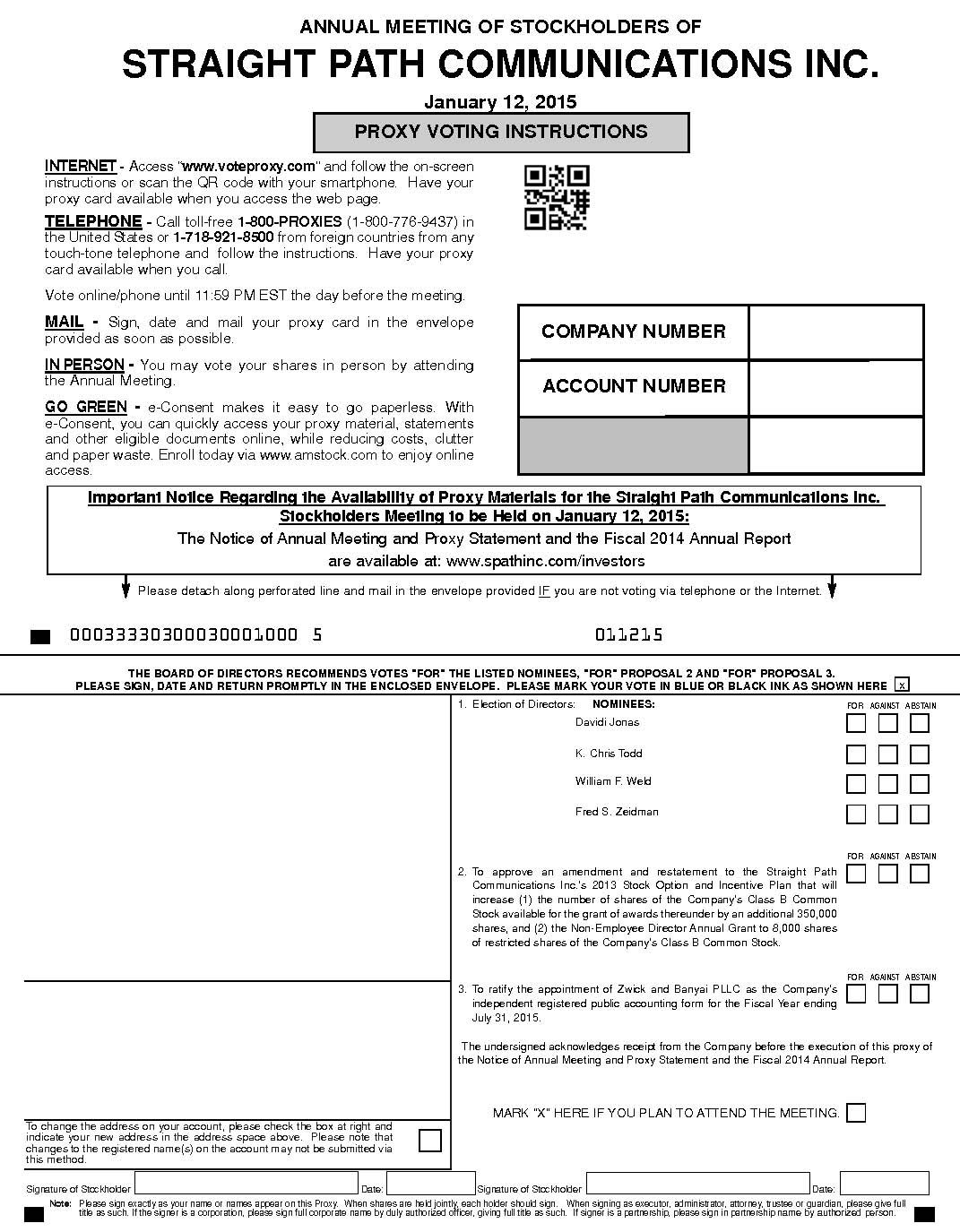

Signature of Stockholder Date: Signature of Stockholder Date: Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of Directors: O Eric F. Cosentino O James A. Courter O Howard S. Jonas O James R. Mellor O Judah Schorr 1. Election of Directors: NOMINEES: Davidi Jonas K. Chris Todd William F. Weld Fred S. Zeidman 2. To approve an amendment and restatement to the Straight Path Communications Inc.'s 2013 Stock Option and Incentive Plan that will increase (1) the number of shares of the Company's Class B Common Stock available for the grant of awards thereunder by an additional 350,000 shares, and (2) the Non-Employee Director Annual Grant to 8,000 shares of restricted shares of the Company's Class B Common Stock. 3. To ratify the appointment of Zwick and Banyai PLLC as the Company's independent registered public accounting form for the Fiscal Year ending July 31, 2015. The undersigned acknowledges receipt from the Company before the execution of this proxy of the Notice of Annual Meeting and Proxy Statement and the Fiscal 2014 Annual Report. FOR AGAINST ABSTAIN FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: JOHN SMITH 1234 MAIN STREET APT. 203 NEW YORK, NY 10038 NOMINEES: ANNUAL MEETING OF STOCKHOLDERS OF STRAIGHT PATH COMMUNICATIONS INC. January 12, 2015 INTERNET - Access “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. TELEPHONE - Call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. Vote online/phone until 11:59 PM EST the day before the meeting. MAIL - Sign, date and mail your proxy card in the envelope provided as soon as possible. IN PERSON - You may vote your shares in person by attending the Annual Meeting. GO GREEN - e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via www.amstock.com to enjoy online access. PROXY VOTING INSTRUCTIONS Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. THE BOARD OF DIRECTORS RECOMMENDS VOTES "FOR" THE LISTED NOMINEES, "FOR" PROPOSAL 2 AND "FOR" PROPOSAL 3. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x ---------------- 00033330300030001000 5 011215 COMPANY NUMBER ACCOUNT NUMBER Important Notice Regarding the Availability of Proxy Materials for the Straight Path Communications Inc. Stockholders Meeting to be Held on January 12, 2015: The Notice of Annual Meeting and Proxy Statement and the Fiscal 2014 Annual Report are available at: www.spathinc.com/investors MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN

14475 THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF STRAIGHT PATH COMMUNICATIONS INC. 5300 Hickory Park Drive, Suite 218 Glen Allen, Virginia 23059 (804) 433-1522 PROXY FOR ANNUAL MEETING OF STOCKHOLDERS To Be Held January 12, 2015 The undersigned appoints Davidi Jonas and Jonathan Rand, or either one of them, as the proxy of the undersigned with full power of substitution to attend and vote at the Annual Meeting of Stockholders (the "Annual Meeting") of Straight Path Communications Inc. to be held at the Law Offices of Hunton Williams LLP, 1751 Pinnacle Drive, Suite 1700, McLean, Virginia 22102 on January 12, 2015 at 10:00 a.m., and any adjournment or postponement of the Annual Meeting, according to the number of votes the undersigned would be entitled to cast if personally present, for or against any proposal, including the election of members of the Board of Directors, and any and all other business that may come before the Annual Meeting, except as otherwise indicated on the reverse side of this card. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEES FOR THE BOARD OF DIRECTORS AND FOR PROPOSAL NOS. 2 AND 3 LISTED ON THE REVERSE SIDE. CONTINUED AND TO BE SIGNED ON REVERSE SIDE Electronic Distribution If you would like to receive future STRAIGHT PATH COMMUNICATIONS INC. proxy statements and annual reports electronically, please visit www.amstock.com. Click on Shareholder Account Access to enroll. Please enter your account number and tax identification number to log in, then select Receive Company Mailings via E-Mail and provide your e-mail address.

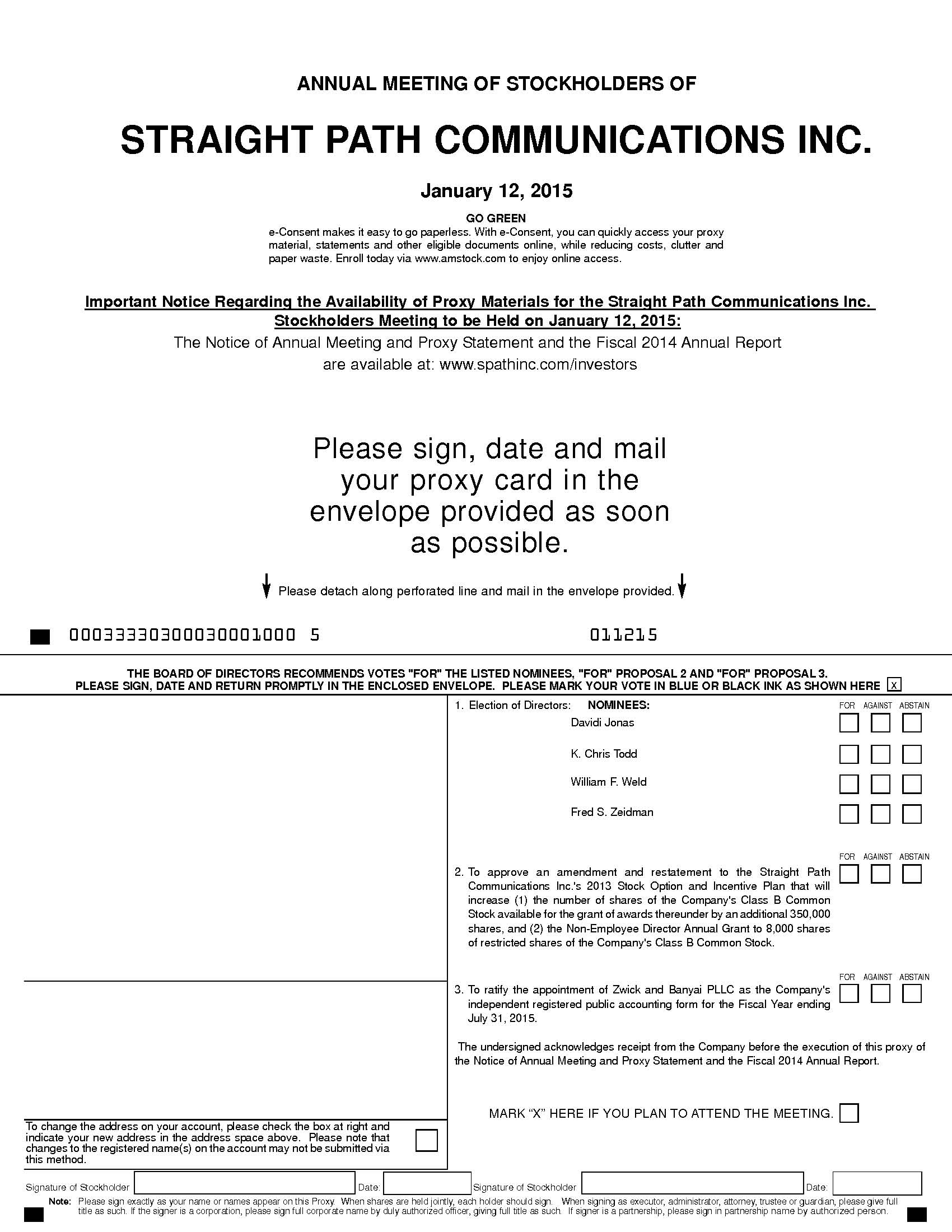

ANNUAL MEETINGOF STOCKHOLDERS OF STRAIGHT PATH COMMUNICATIONS INC. January 12, 2015 Important Notice Regarding the Availability of Proxy Materials for the Straight Path Communications Inc. Stockholders Meeting to be Held on January 12, 2015: The Notice of Annual Meeting and Proxy Statement and the Fiscal 2014 Annual Report are available at: www.spathinc.com/investors Please sign, date and mail your proxy card in the envelope provided as soon as possible. Signature of Stockholder Date: Signature of Stockholder Date: Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of Directors: O Eric F. Cosentino O James A. Courter O Howard S. Jonas O James R. Mellor O Judah Schorr 1. Election of Directors: NOMINEES: Davidi Jonas K. Chris Todd William F. Weld Fred S. Zeidman 2. To approve an amendment and restatement to the Straight Path Communications Inc.'s 2013 Stock Option and Incentive Plan that will increase (1) the number of shares of the Company's Class B Common Stock available for the grant of awards thereunder by an additional 350,000 shares, and (2) the Non-Employee Director Annual Grant to 8,000 shares of restricted shares of the Company's Class B Common Stock. 3. To ratify the appointment of Zwick and Banyai PLLC as the Company's independent registered public accounting form for the Fiscal Year ending July 31, 2015. The undersigned acknowledges receipt from the Company before the execution of this proxy of the Notice of Annual Meeting and Proxy Statement and the Fiscal 2014 Annual Report. FOR AGAINST ABSTAIN FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: NOMINEES: THE BOARD OF DIRECTORS RECOMMENDS VOTES "FOR" THE LISTED NOMINEES, "FOR" PROPOSAL 2 AND "FOR" PROPOSAL 3. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x --------------- Please detach along perforated line and mail in the envelope provided. ---------------- 00033330300030001000 5 011215 MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING. GO GREEN e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via www.amstock.com to enjoy online access. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN