Q3 2025 INVESTOR PRESENTATION October 30, 2025 NYSE: SPNT

Basis of Presentation and Non-GAAP Financial Measures: Unless the context otherwise indicates or requires, as used in this presentation references to “we,” “our,” “us,” the “Company,” and "SiriusPoint" refer to SiriusPoint Ltd. and its directly and indirectly owned subsidiaries, as a combined entity, except where otherwise stated or where it is clear that the terms mean only SiriusPoint Ltd. exclusive of its subsidiaries. We have made rounding adjustments to reach some of the figures included in this presentation and, unless otherwise indicated, percentages presented in this presentation are approximate. In presenting SiriusPoint’s results, management has included financial measures that are not calculated under standards or rules that comprise accounting principles generally accepted in the United States (“GAAP”). SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core underwriting income, Core net services income, Core income, Core combined ratio, accident year loss ratio, accident year combined ratio, attritional loss ratio and attritional combined ratio are non-GAAP financial measures. Management believes it is useful to review Core results as it better reflects how management views the business and reflects the Company’s decision to exit the runoff business. Book value per diluted common share excluding accumulated other comprehensive income (loss) ("AOCI") and tangible book value per diluted common share, as presented, are non-GAAP financial measures and the most directly comparable U.S. GAAP measure is book value per common share. Management believes it is useful to exclude AOCI because it may fluctuate significantly between periods based on movements in interest and currency rates. Management believes the effects of intangible assets are not indicative of underlying underwriting results or trends and make book value comparisons to less acquisitive peer companies less meaningful. Operating net income and Operating diluted earnings per share are non-GAAP financial measures and the most directly comparable U.S. GAAP measure is net income and diluted earnings per share, respectively. Operating net income excludes items which we believe are not indicative of the operations of our operating businesses, including realized and unrealized gains (losses) on strategic and other investments and liability-classified capital instruments, income (expense) related to loss portfolio transfers, deferred tax assets attributable to the enactment of the Bermuda corporate income tax, development on COVID-19 reserves resulting from the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024, and foreign exchange gains (losses). We believe it is useful to review Operating net income as it better reflects how we view the business, as well as provides investors with an alternative metric that can assist in predicting future earnings and profitability that are complementary to GAAP metrics. Annualized Operating ROE is calculated by dividing Operating net income for the period by average common shareholders’ equity, excluding AOCI, and after adjusting for the above noted items to arrive at Operating net income. Management believes it is useful to exclude AOCI because it may fluctuate significantly between periods based on movements in interest and currency rates. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is contained in our Form 10-Q, earnings release or financial Supplement for the quarter ended September 30, 2025. Safe Harbor Statement Regarding Forward-Looking Statements: This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking information presented in this presentation is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “intends,” “seeks,” “anticipates,” “aims,” “plans,” “targets,” “estimates,” “expects,” “assumes,” “continues,” “guidance,” “should,” “could,” “will,” “may” and the negative of these or similar terms and phrases. Specific forward-looking statements in this presentation include, but not limited to, statements regarding the trend of our performance as compared to the previous guidance, the current insurtech market trends, our ability to generate shareholder value and whether we will continue to have momentum in our business in the future. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: our ability to execute on our strategic transformation, including re-underwriting to reduce volatility and improve underwriting performance, de-risking our investment portfolio, and transforming our business; the impact of unpredictable catastrophic events, including uncertainties with respect to losses from health pandemics across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates and equity market volatility; inadequacy of loss and loss adjustment expense reserves, the lack of available capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation and interest rates, and foreign currency fluctuations; our ability to compete successfully in the insurance and reinsurance market and the effect of consolidation in the insurance and reinsurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including wildfires, and increased severity and frequency of weather-related natural disasters and catastrophes and increased coastal flooding in many geographic areas; geopolitical uncertainty, including the ongoing conflicts in Europe and the Middle East and the uncertainty from policies under the current presidential administration in the U.S., such as the federal government shutdown and financial markets' and businesses' reactions to such events; global economic uncertainty caused by the imposition and/or announcement of tariffs imposed on the import of certain goods into the U.S. from various countries which may have unpredictable consequences including, but not limited to, inflation or trade wars, potential impact on the Company’s credit and mortgage business and potential increase in credit spread which could impact the Company’s short-term capital and liquidity; our ability to retain key senior management and key employees; a downgrade or withdrawal of our financial ratings; fluctuations in our results of operations; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; the outcome of legal and regulatory proceedings and regulatory constraints on our business; reduced returns or losses in SiriusPoint’s investment portfolio; our exposure or potential exposure to corporate income tax in Bermuda and the E.U., U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; risks associated with delegating authority to third party managing general agents; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures; and other risks and factors listed under "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. 2 DISCLAIMER

AGENDA 3 Highlights & Strategic Update Scott Egan, Group CEO Third Quarter & Nine Months Results Update Jim McKinney, Group CFO Q&A

Highlights & Strategic Update

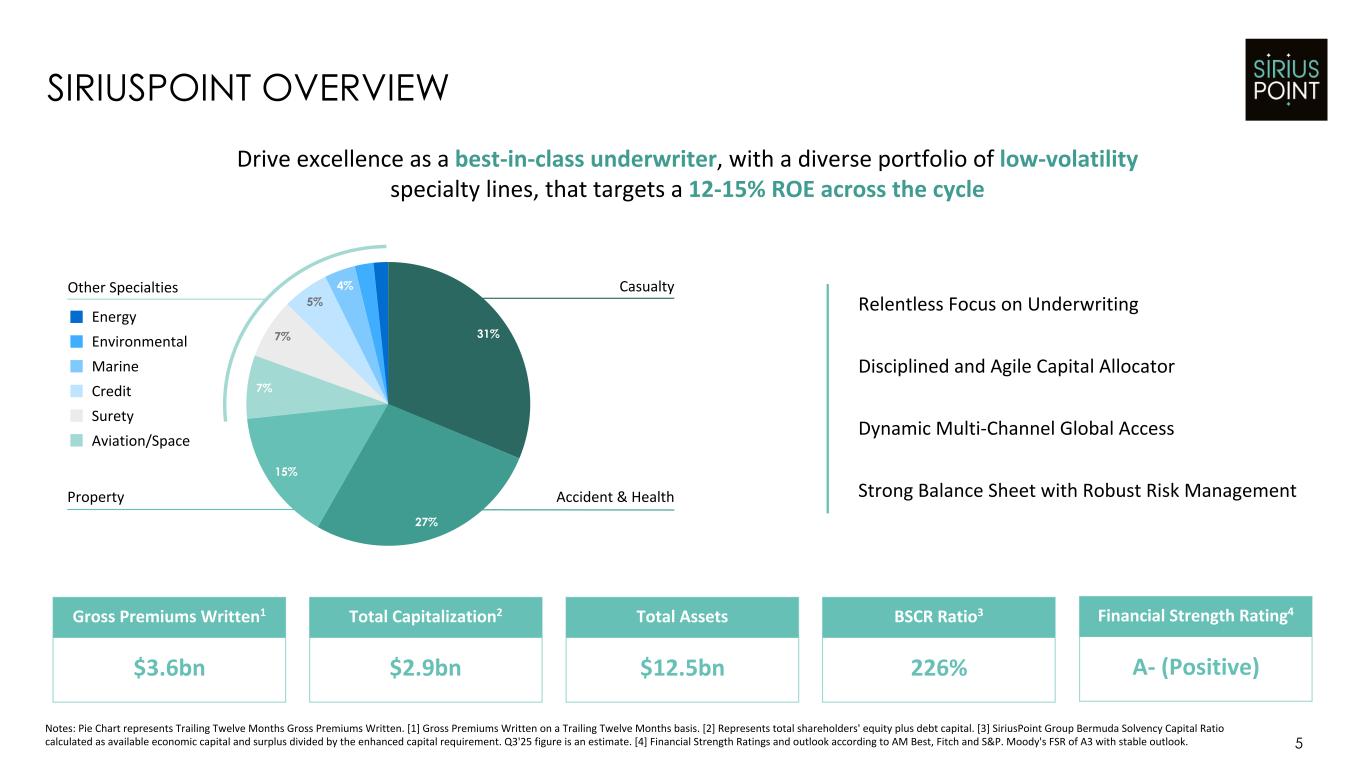

5 SIRIUSPOINT OVERVIEW Notes: Pie Chart represents Trailing Twelve Months Gross Premiums Written. [1] Gross Premiums Written on a Trailing Twelve Months basis. [2] Represents total shareholders' equity plus debt capital. [3] SiriusPoint Group Bermuda Solvency Capital Ratio calculated as available economic capital and surplus divided by the enhanced capital requirement. Q3'25 figure is an estimate. [4] Financial Strength Ratings and outlook according to AM Best, Fitch and S&P. Moody's FSR of A3 with stable outlook. Drive excellence as a best-in-class underwriter, with a diverse portfolio of low-volatility specialty lines, that targets a 12-15% ROE across the cycle Energy Aviation/Space Casualty Surety Other Specialties Credit Environmental Marine Total AssetsTotal Capitalization2Gross Premiums Written1 $3.6bn $2.9bn $12.5bn Accident & HealthProperty BSCR Ratio3 226% Financial Strength Rating4 A- (Positive) Strong Balance Sheet with Robust Risk Management Relentless Focus on Underwriting Disciplined and Agile Capital Allocator Dynamic Multi-Channel Global Access 31% 27% 15% 7% 7% 5% 4%

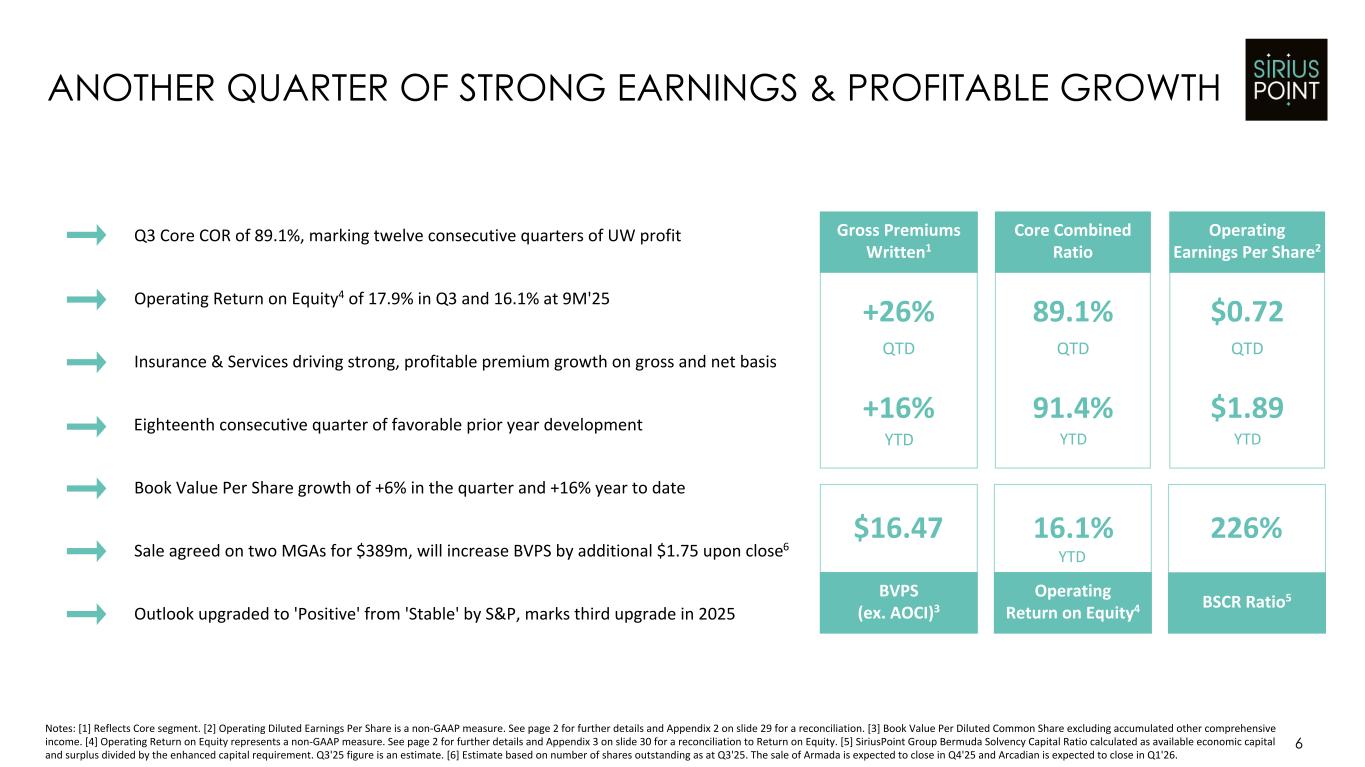

6 ANOTHER QUARTER OF STRONG EARNINGS & PROFITABLE GROWTH Notes: [1] Reflects Core segment. [2] Operating Diluted Earnings Per Share is a non-GAAP measure. See page 2 for further details and Appendix 2 on slide 29 for a reconciliation. [3] Book Value Per Diluted Common Share excluding accumulated other comprehensive income. [4] Operating Return on Equity represents a non-GAAP measure. See page 2 for further details and Appendix 3 on slide 30 for a reconciliation to Return on Equity. [5] SiriusPoint Group Bermuda Solvency Capital Ratio calculated as available economic capital and surplus divided by the enhanced capital requirement. Q3'25 figure is an estimate. [6] Estimate based on number of shares outstanding as at Q3'25. The sale of Armada is expected to close in Q4'25 and Arcadian is expected to close in Q1'26. BVPS (ex. AOCI)3 $16.47 Operating Return on Equity4 16.1% BSCR Ratio5 226% Gross Premiums Written1 +26% Core Combined Ratio +16% QTD YTD 89.1% 91.4% QTD YTD Operating Earnings Per Share2 $0.72 $1.89 QTD YTD Q3 Core COR of 89.1%, marking twelve consecutive quarters of UW profit Operating Return on Equity4 of 17.9% in Q3 and 16.1% at 9M'25 Eighteenth consecutive quarter of favorable prior year development Insurance & Services driving strong, profitable premium growth on gross and net basis Outlook upgraded to 'Positive' from 'Stable' by S&P, marks third upgrade in 2025 YTD Book Value Per Share growth of +6% in the quarter and +16% year to date Sale agreed on two MGAs for $389m, will increase BVPS by additional $1.75 upon close6

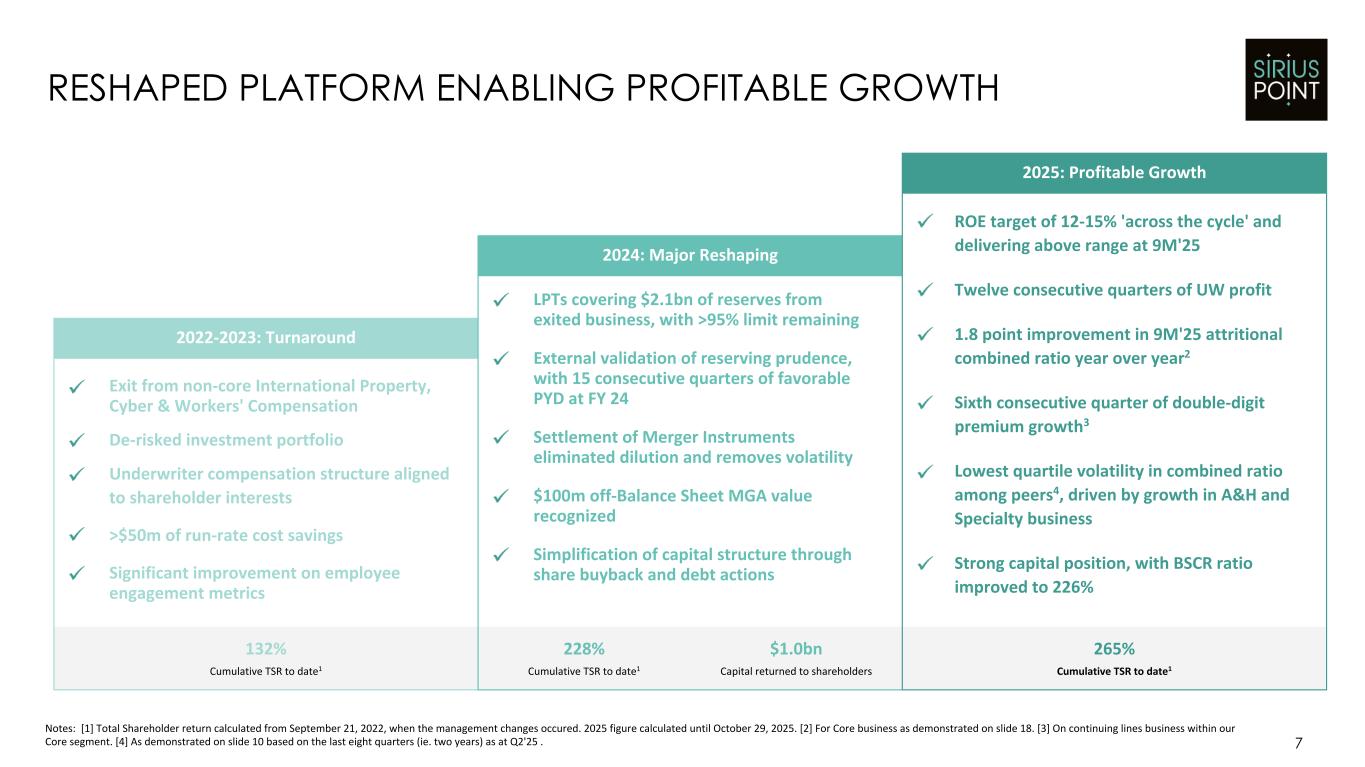

7 RESHAPED PLATFORM ENABLING PROFITABLE GROWTH Notes: [1] Total Shareholder return calculated from September 21, 2022, when the management changes occured. 2025 figure calculated until October 29, 2025. [2] For Core business as demonstrated on slide 18. [3] On continuing lines business within our Core segment. [4] As demonstrated on slide 10 based on the last eight quarters (ie. two years) as at Q2'25 . 2022-2023: Turnaround 132% Cumulative TSR to date1 228% Cumulative TSR to date1 Exit from non-core International Property, Cyber & Workers' Compensation De-risked investment portfolio Underwriter compensation structure aligned to shareholder interests >$50m of run-rate cost savings Significant improvement on employee engagement metrics 2024: Major Reshaping LPTs covering $2.1bn of reserves from exited business, with >95% limit remaining External validation of reserving prudence, with 15 consecutive quarters of favorable PYD at FY 24 Settlement of Merger Instruments eliminated dilution and removes volatility $100m off-Balance Sheet MGA value recognized Simplification of capital structure through share buyback and debt actions ROE target of 12-15% 'across the cycle' and delivering above range at 9M'25 Twelve consecutive quarters of UW profit 1.8 point improvement in 9M'25 attritional combined ratio year over year2 Sixth consecutive quarter of double-digit premium growth3 Lowest quartile volatility in combined ratio among peers4, driven by growth in A&H and Specialty business Strong capital position, with BSCR ratio improved to 226% 2025: Profitable Growth 265% Cumulative TSR to date1 $1.0bn Capital returned to shareholders

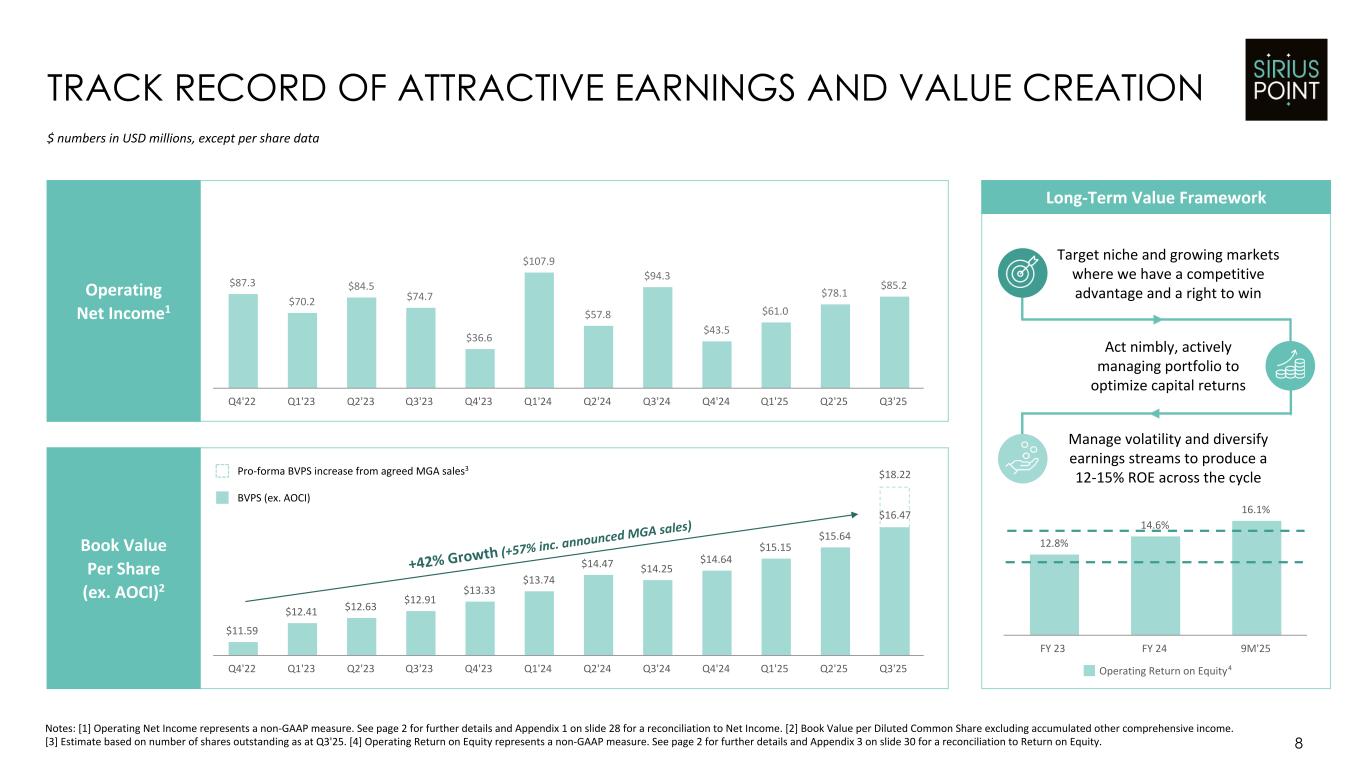

$11.59 $12.41 $12.63 $12.91 $13.33 $13.74 $14.47 $14.25 $14.64 $15.15 $15.64 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 $87.3 $70.2 $84.5 $74.7 $36.6 $107.9 $57.8 $94.3 $43.5 $61.0 $78.1 $85.2 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 8 TRACK RECORD OF ATTRACTIVE EARNINGS AND VALUE CREATION Notes: [1] Operating Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 1 on slide 28 for a reconciliation to Net Income. [2] Book Value per Diluted Common Share excluding accumulated other comprehensive income. [3] Estimate based on number of shares outstanding as at Q3'25. [4] Operating Return on Equity represents a non-GAAP measure. See page 2 for further details and Appendix 3 on slide 30 for a reconciliation to Return on Equity. Operating Net Income1 Book Value Per Share (ex. AOCI)2 $ numbers in USD millions, except per share data +42% Grow th (+57% inc . announce d MGA sales) Long-Term Value Framework 12.8% 14.6% 16.1% Operating Return on Equity FY 23 FY 24 9M'25 Target niche and growing markets where we have a competitive advantage and a right to win Act nimbly, actively managing portfolio to optimize capital returns Manage volatility and diversify earnings streams to produce a 12-15% ROE across the cycle 4 $16.47 $18.22Pro-forma BVPS increase from agreed MGA sales3 BVPS (ex. AOCI)

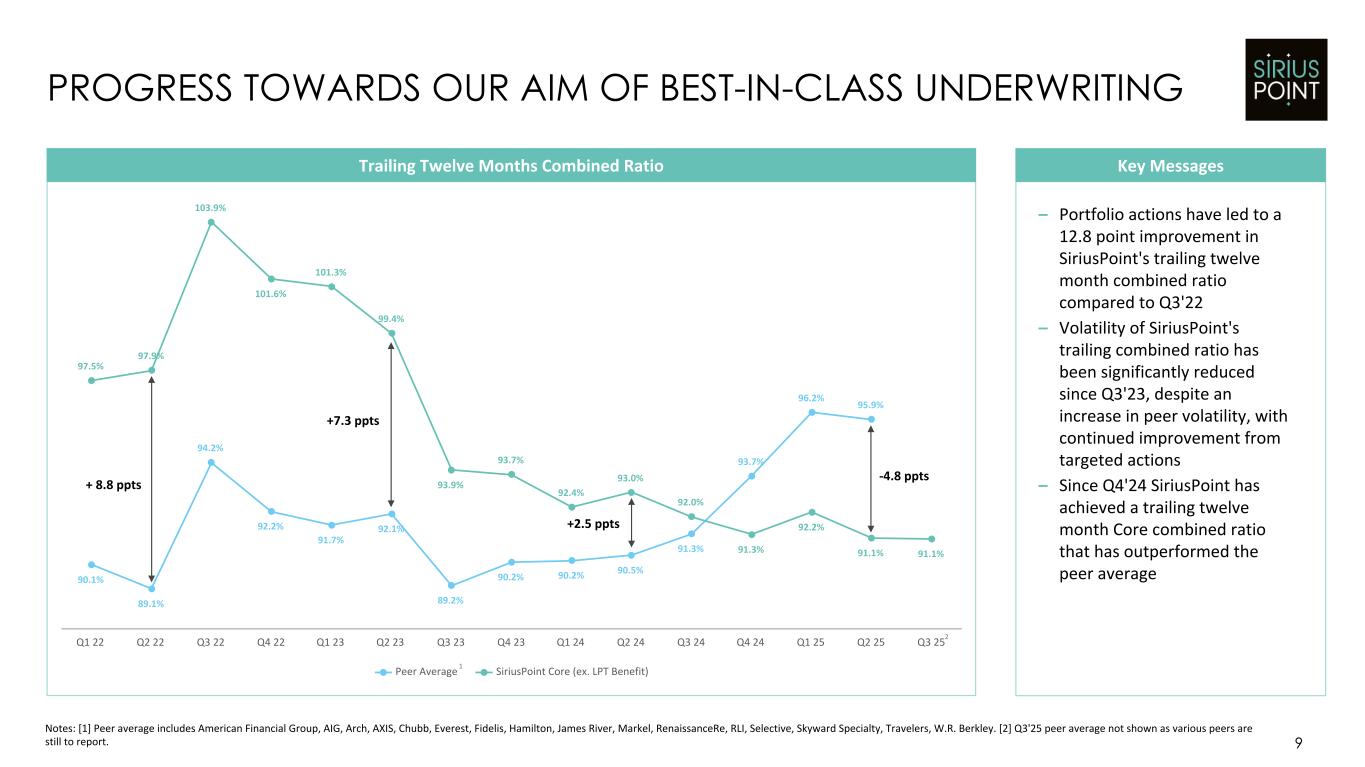

90.1% 89.1% 94.2% 92.2% 91.7% 92.1% 89.2% 90.2% 90.2% 90.5% 91.3% 93.7% 96.2% 95.9% 97.5% 97.9% 103.9% 101.6% 101.3% 99.4% 93.9% 93.7% 92.4% 93.0% 92.0% 91.3% 92.2% 91.1% 91.1% Peer Average SiriusPoint Core (ex. LPT Benefit) Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 9 PROGRESS TOWARDS OUR AIM OF BEST-IN-CLASS UNDERWRITING Notes: [1] Peer average includes American Financial Group, AIG, Arch, AXIS, Chubb, Everest, Fidelis, Hamilton, James River, Markel, RenaissanceRe, RLI, Selective, Skyward Specialty, Travelers, W.R. Berkley. [2] Q3'25 peer average not shown as various peers are still to report. Trailing Twelve Months Combined Ratio 1 +7.3 ppts +2.5 ppts Key Messages – Portfolio actions have led to a 12.8 point improvement in SiriusPoint's trailing twelve month combined ratio compared to Q3'22 – Volatility of SiriusPoint's trailing combined ratio has been significantly reduced since Q3'23, despite an increase in peer volatility, with continued improvement from targeted actions – Since Q4'24 SiriusPoint has achieved a trailing twelve month Core combined ratio that has outperformed the peer average -4.8 ppts 2 + 8.8 ppts

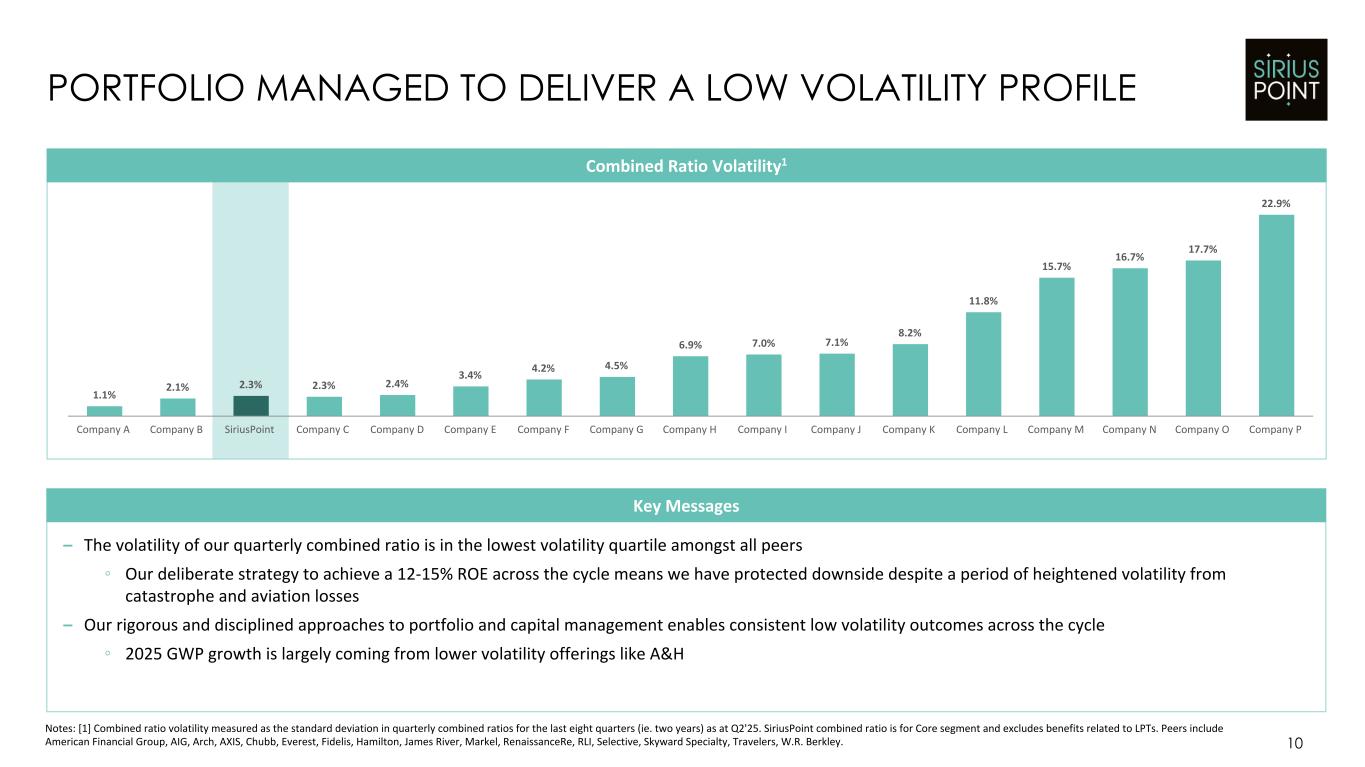

Combined Ratio Volatility1 10 PORTFOLIO MANAGED TO DELIVER A LOW VOLATILITY PROFILE Notes: [1] Combined ratio volatility measured as the standard deviation in quarterly combined ratios for the last eight quarters (ie. two years) as at Q2'25. SiriusPoint combined ratio is for Core segment and excludes benefits related to LPTs. Peers include American Financial Group, AIG, Arch, AXIS, Chubb, Everest, Fidelis, Hamilton, James River, Markel, RenaissanceRe, RLI, Selective, Skyward Specialty, Travelers, W.R. Berkley. 1.1% 2.1% 2.3% 2.3% 2.4% 3.4% 4.2% 4.5% 6.9% 7.0% 7.1% 8.2% 11.8% 15.7% 16.7% 17.7% 22.9% Company A Company B SiriusPoint Company C Company D Company E Company F Company G Company H Company I Company J Company K Company L Company M Company N Company O Company P Key Messages – The volatility of our quarterly combined ratio is in the lowest volatility quartile amongst all peers ◦ Our deliberate strategy to achieve a 12-15% ROE across the cycle means we have protected downside despite a period of heightened volatility from catastrophe and aviation losses – Our rigorous and disciplined approaches to portfolio and capital management enables consistent low volatility outcomes across the cycle ◦ 2025 GWP growth is largely coming from lower volatility offerings like A&H

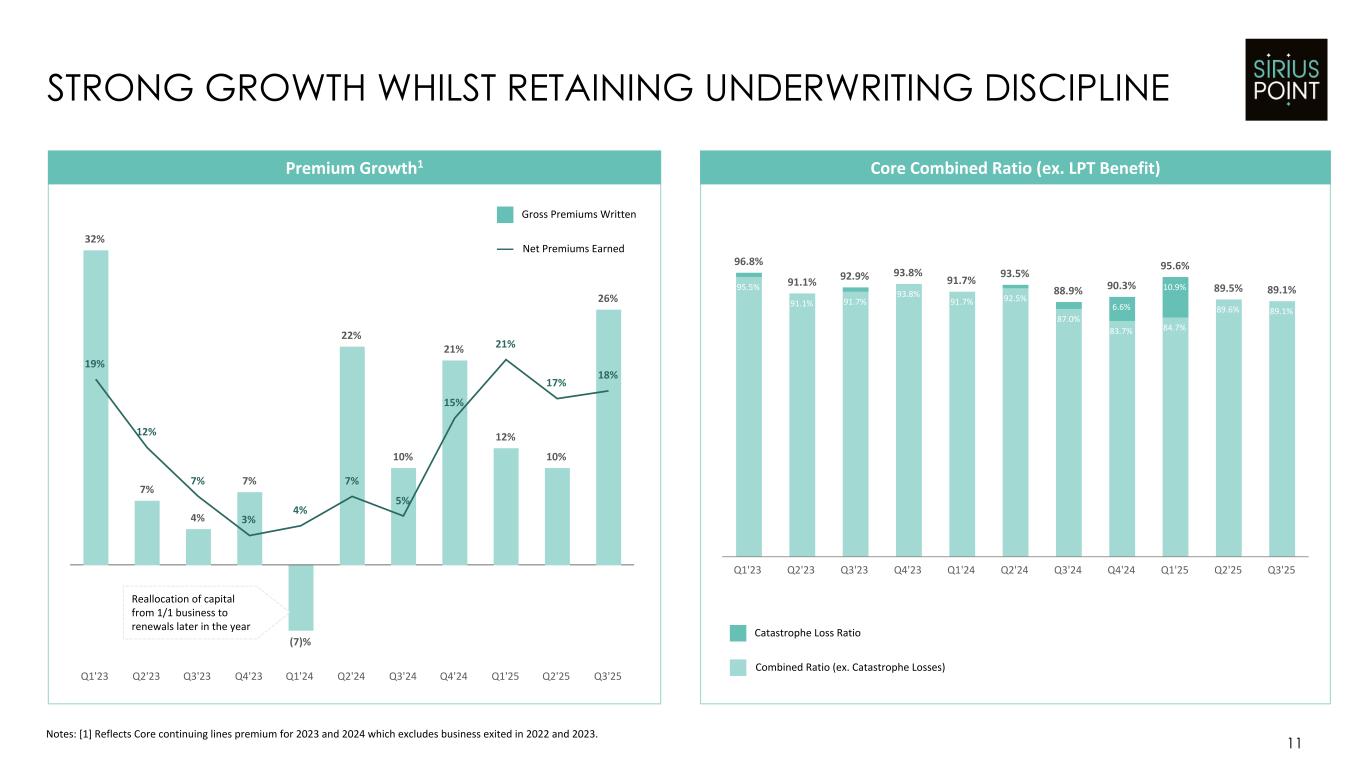

11 STRONG GROWTH WHILST RETAINING UNDERWRITING DISCIPLINE Notes: [1] Reflects Core continuing lines premium for 2023 and 2024 which excludes business exited in 2022 and 2023. 32% 7% 4% 7% (7)% 22% 10% 21% 12% 10% 26% 19% 12% 7% 3% 4% 7% 5% 15% 21% 17% 18% Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Core Combined Ratio (ex. LPT Benefit)Premium Growth1 Reallocation of capital from 1/1 business to renewals later in the year 95.5% 91.1% 91.7% 93.8% 91.7% 92.5% 87.0% 83.7% 84.7% 89.6% 89.1%6.6% 10.9% 96.8% 91.1% 92.9% 93.8% 91.7% 93.5% 88.9% 90.3% 95.6% 89.5% 89.1% Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Catastrophe Loss Ratio Combined Ratio (ex. Catastrophe Losses) Gross Premiums Written Net Premiums Earned

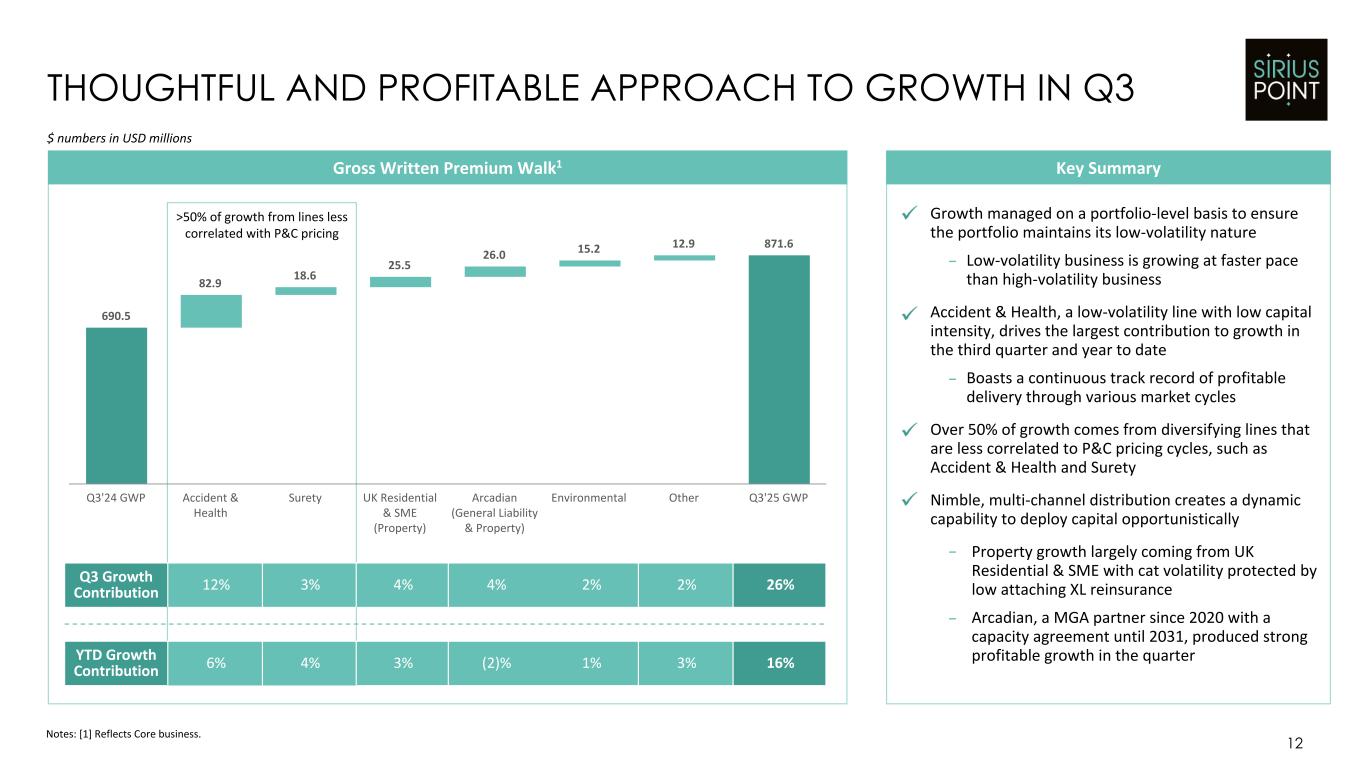

12 THOUGHTFUL AND PROFITABLE APPROACH TO GROWTH IN Q3 Notes: [1] Reflects Core business. Key SummaryGross Written Premium Walk1 690.5 82.9 18.6 25.5 26.0 15.2 12.9 871.6 Q3'24 GWP Accident & Health Surety UK Residential & SME (Property) Arcadian (General Liability & Property) Environmental Other Q3'25 GWP Q3 Growth Contribution 12% 3% 4% 4% 2% 2% 26% YTD Growth Contribution 6% 4% 3% (2)% 1% 3% 16% Growth managed on a portfolio-level basis to ensure the portfolio maintains its low-volatility nature Low-volatility business is growing at faster pace than high-volatility business Accident & Health, a low-volatility line with low capital intensity, drives the largest contribution to growth in the third quarter and year to date Boasts a continuous track record of profitable delivery through various market cycles Over 50% of growth comes from diversifying lines that are less correlated to P&C pricing cycles, such as Accident & Health and Surety Nimble, multi-channel distribution creates a dynamic capability to deploy capital opportunistically Property growth largely coming from UK Residential & SME with cat volatility protected by low attaching XL reinsurance Arcadian, a MGA partner since 2020 with a capacity agreement until 2031, produced strong profitable growth in the quarter $ numbers in USD millions – – – – >50% of growth from lines less correlated with P&C pricing

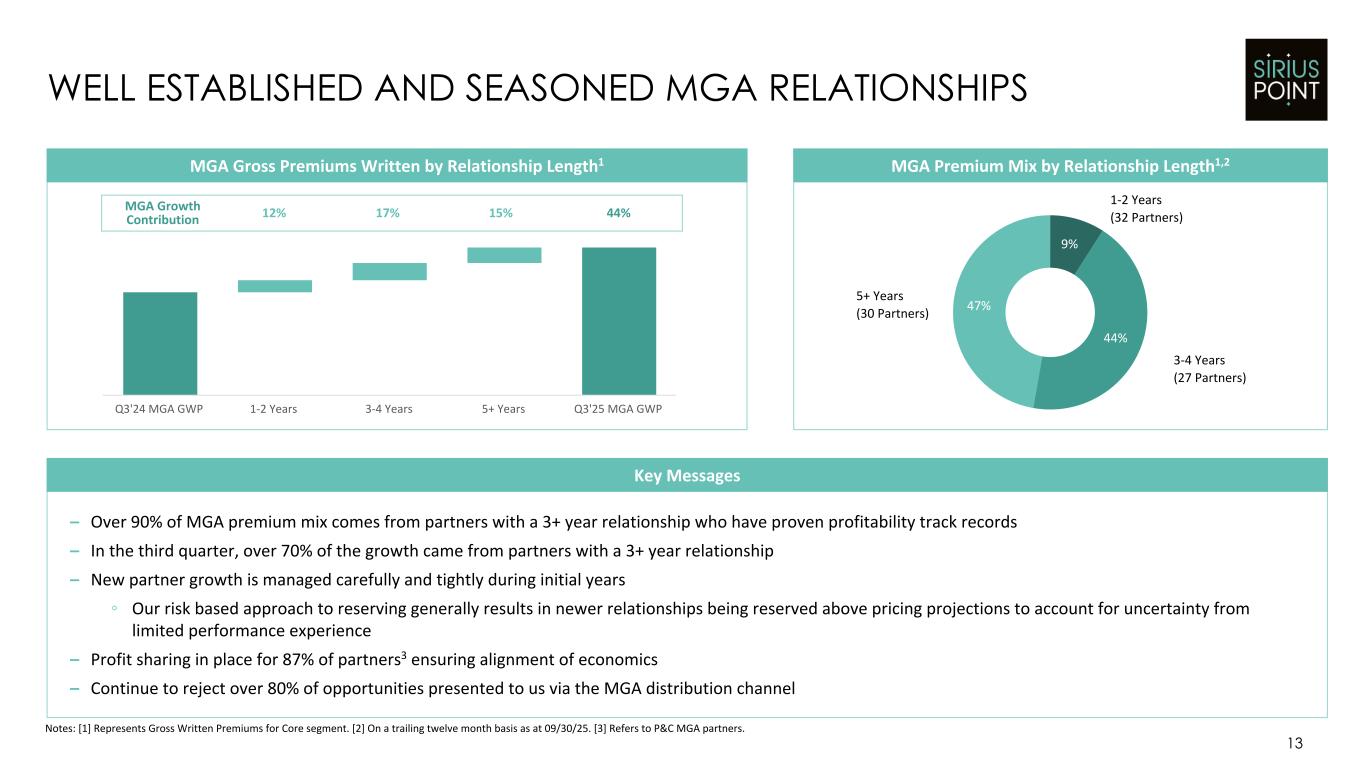

9% 44% 47% 13 WELL ESTABLISHED AND SEASONED MGA RELATIONSHIPS Notes: [1] Represents Gross Written Premiums for Core segment. [2] On a trailing twelve month basis as at 09/30/25. [3] Refers to P&C MGA partners. MGA Gross Premiums Written by Relationship Length1 Key Messages MGA Premium Mix by Relationship Length1,2 1-2 Years (32 Partners) 5+ Years (30 Partners) 3-4 Years (27 Partners) – Over 90% of MGA premium mix comes from partners with a 3+ year relationship who have proven profitability track records – In the third quarter, over 70% of the growth came from partners with a 3+ year relationship – New partner growth is managed carefully and tightly during initial years ◦ Our risk based approach to reserving generally results in newer relationships being reserved above pricing projections to account for uncertainty from limited performance experience – Profit sharing in place for 87% of partners3 ensuring alignment of economics – Continue to reject over 80% of opportunities presented to us via the MGA distribution channel Q3'24 MGA GWP 1-2 Years 3-4 Years 5+ Years Q3'25 MGA GWP MGA Growth Contribution 12% 17% 15% 44%

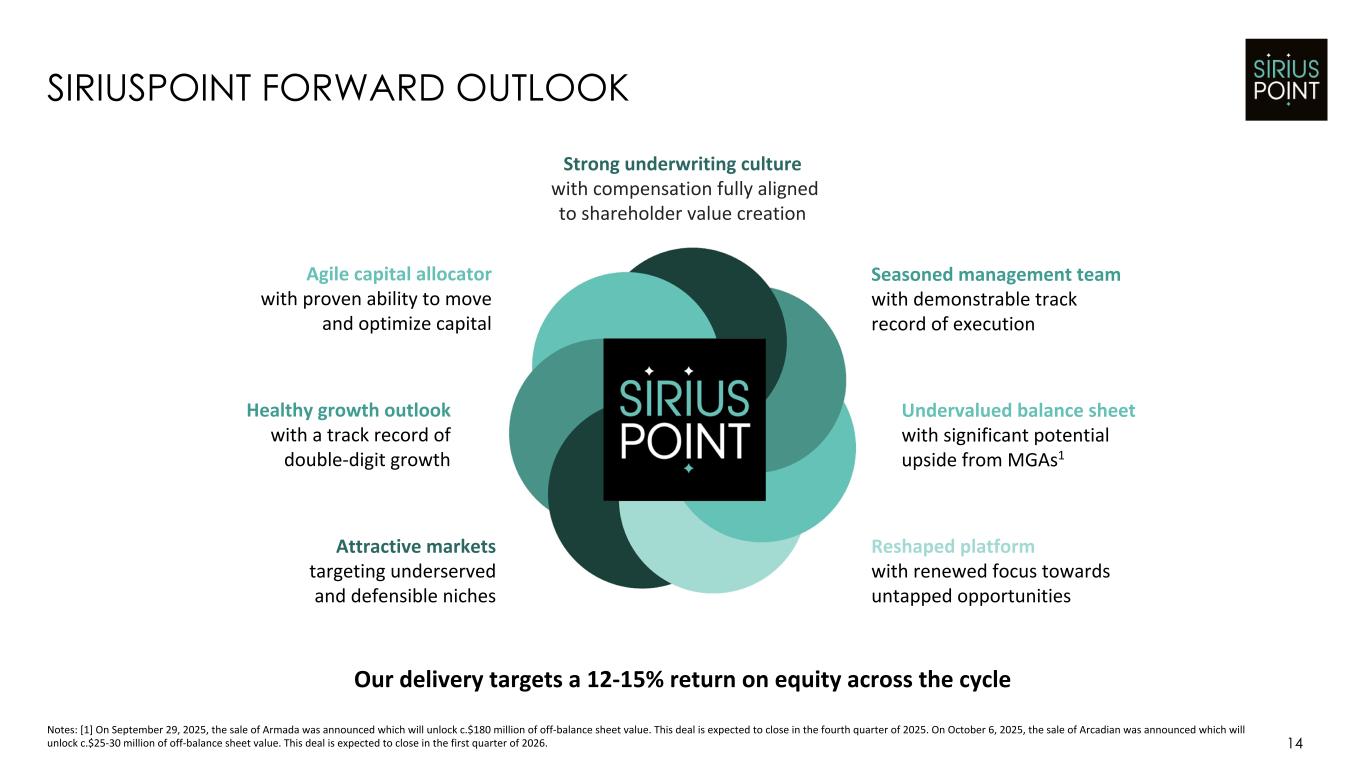

14 SIRIUSPOINT FORWARD OUTLOOK Seasoned management team with demonstrable track record of execution Undervalued balance sheet with significant potential upside from MGAs1 Reshaped platform with renewed focus towards untapped opportunities Agile capital allocator with proven ability to move and optimize capital Healthy growth outlook with a track record of double-digit growth Attractive markets targeting underserved and defensible niches Our delivery targets a 12-15% return on equity across the cycle Strong underwriting culture with compensation fully aligned to shareholder value creation Notes: [1] On September 29, 2025, the sale of Armada was announced which will unlock c.$180 million of off-balance sheet value. This deal is expected to close in the fourth quarter of 2025. On October 6, 2025, the sale of Arcadian was announced which will unlock c.$25-30 million of off-balance sheet value. This deal is expected to close in the first quarter of 2026.

Third Quarter and Nine Months Results Update

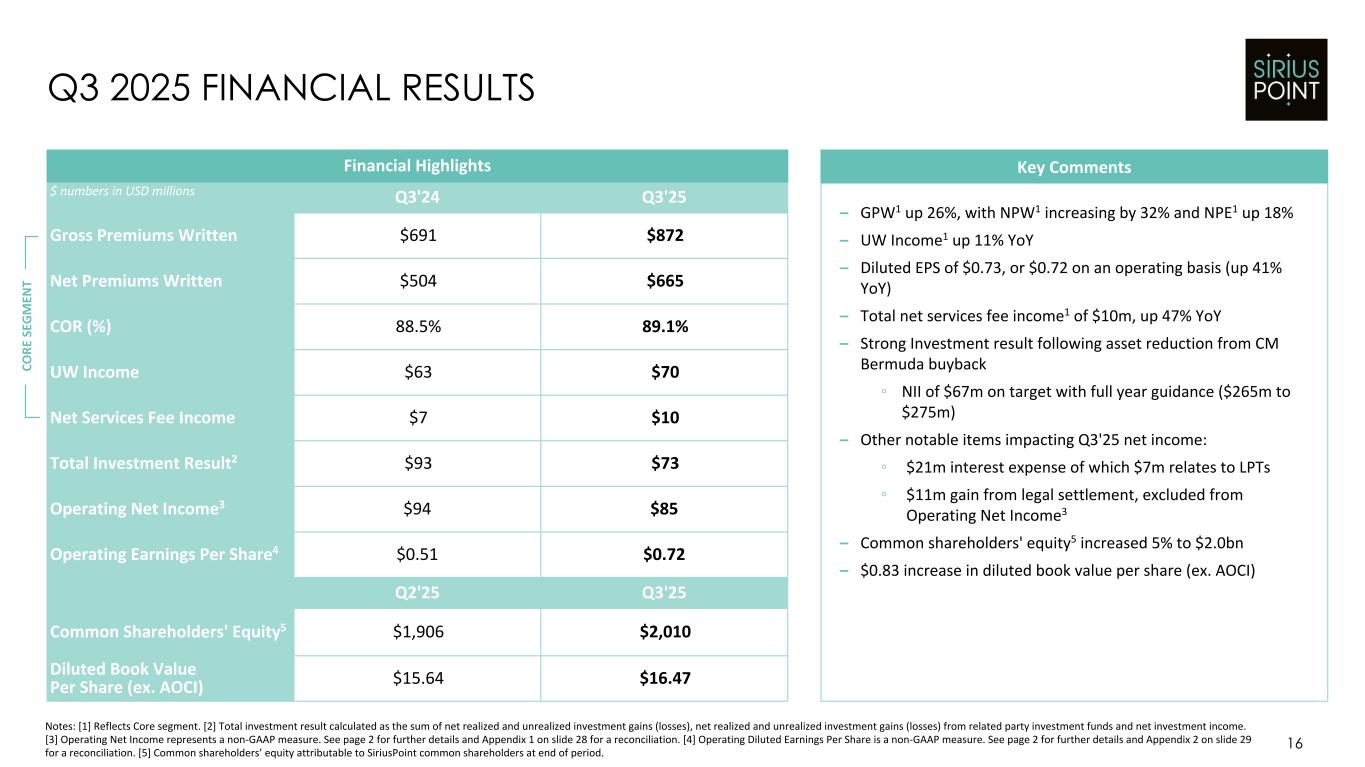

Financial Highlights $ numbers in USD millions Q3'24 Q3'25 Gross Premiums Written $691 $872 Net Premiums Written $504 $665 COR (%) 88.5% 89.1% UW Income $63 $70 Net Services Fee Income $7 $10 Total Investment Result2 $93 $73 Operating Net Income3 $94 $85 Operating Earnings Per Share4 $0.51 $0.72 Q2'25 Q3'25 Common Shareholders' Equity5 $1,906 $2,010 Diluted Book Value Per Share (ex. AOCI) $15.64 $16.47 Q3 2025 FINANCIAL RESULTS 16 Notes: [1] Reflects Core segment. [2] Total investment result calculated as the sum of net realized and unrealized investment gains (losses), net realized and unrealized investment gains (losses) from related party investment funds and net investment income. [3] Operating Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 1 on slide 28 for a reconciliation. [4] Operating Diluted Earnings Per Share is a non-GAAP measure. See page 2 for further details and Appendix 2 on slide 29 for a reconciliation. [5] Common shareholders’ equity attributable to SiriusPoint common shareholders at end of period. – GPW1 up 26%, with NPW1 increasing by 32% and NPE1 up 18% – UW Income1 up 11% YoY – Diluted EPS of $0.73, or $0.72 on an operating basis (up 41% YoY) – Total net services fee income1 of $10m, up 47% YoY – Strong Investment result following asset reduction from CM Bermuda buyback ◦ NII of $67m on target with full year guidance ($265m to $275m) – Other notable items impacting Q3'25 net income: ◦ $21m interest expense of which $7m relates to LPTs ◦ $11m gain from legal settlement, excluded from Operating Net Income3 – Common shareholders' equity5 increased 5% to $2.0bn – $0.83 increase in diluted book value per share (ex. AOCI) Key Comments CO RE S EG M EN T

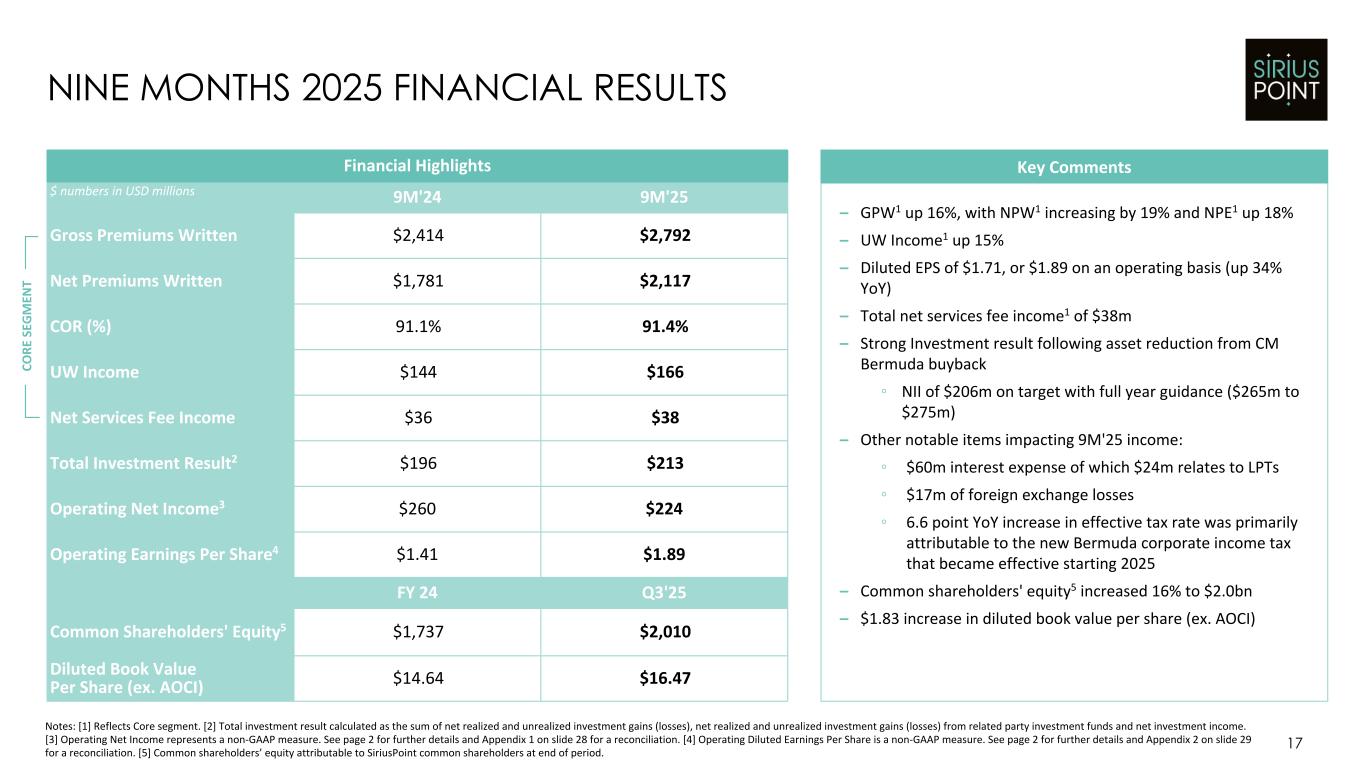

Financial Highlights $ numbers in USD millions 9M'24 9M'25 Gross Premiums Written $2,414 $2,792 Net Premiums Written $1,781 $2,117 COR (%) 91.1% 91.4% UW Income $144 $166 Net Services Fee Income $36 $38 Total Investment Result2 $196 $213 Operating Net Income3 $260 $224 Operating Earnings Per Share4 $1.41 $1.89 FY 24 Q3'25 Common Shareholders' Equity5 $1,737 $2,010 Diluted Book Value Per Share (ex. AOCI) $14.64 $16.47 NINE MONTHS 2025 FINANCIAL RESULTS 17 Notes: [1] Reflects Core segment. [2] Total investment result calculated as the sum of net realized and unrealized investment gains (losses), net realized and unrealized investment gains (losses) from related party investment funds and net investment income. [3] Operating Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 1 on slide 28 for a reconciliation. [4] Operating Diluted Earnings Per Share is a non-GAAP measure. See page 2 for further details and Appendix 2 on slide 29 for a reconciliation. [5] Common shareholders’ equity attributable to SiriusPoint common shareholders at end of period. – GPW1 up 16%, with NPW1 increasing by 19% and NPE1 up 18% – UW Income1 up 15% – Diluted EPS of $1.71, or $1.89 on an operating basis (up 34% YoY) – Total net services fee income1 of $38m – Strong Investment result following asset reduction from CM Bermuda buyback ◦ NII of $206m on target with full year guidance ($265m to $275m) – Other notable items impacting 9M'25 income: ◦ $60m interest expense of which $24m relates to LPTs ◦ $17m of foreign exchange losses ◦ 6.6 point YoY increase in effective tax rate was primarily attributable to the new Bermuda corporate income tax that became effective starting 2025 – Common shareholders' equity5 increased 16% to $2.0bn – $1.83 increase in diluted book value per share (ex. AOCI) Key Comments CO RE S EG M EN T

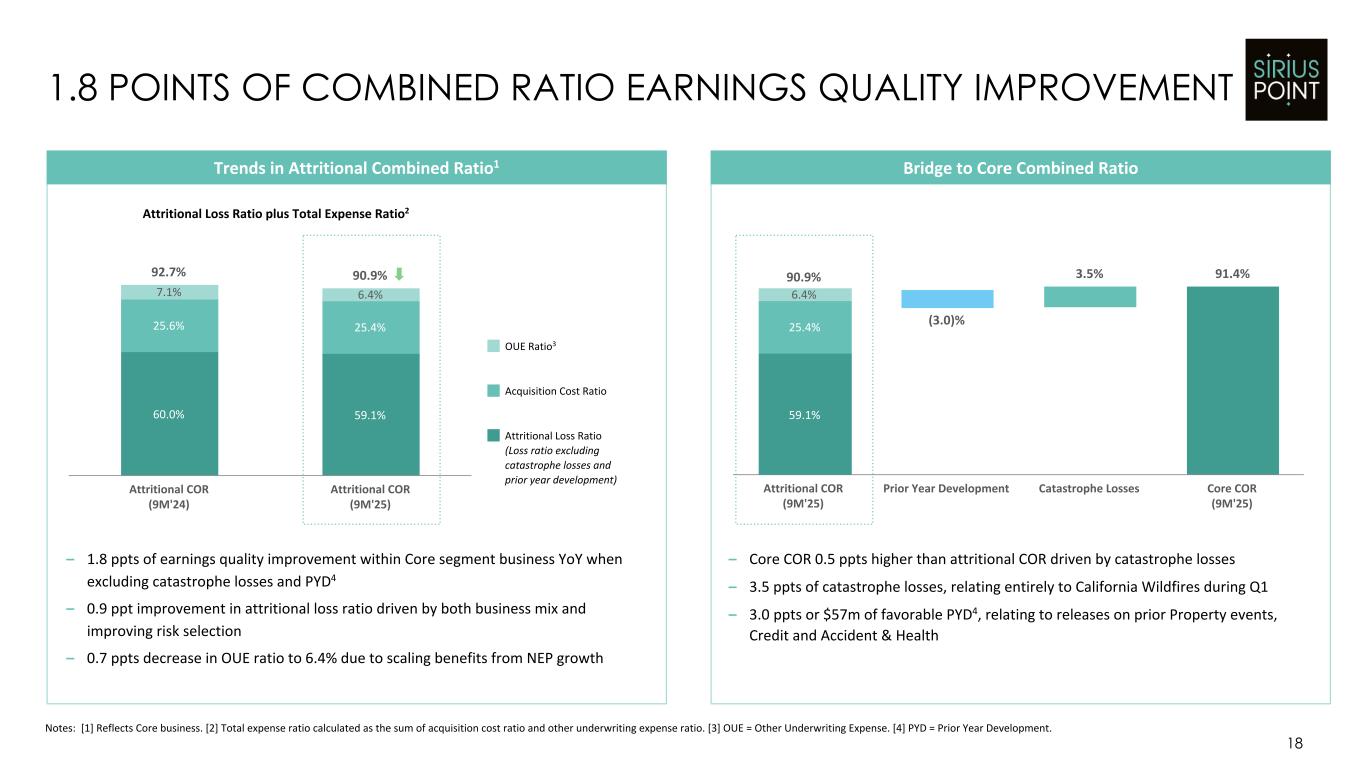

1.8 POINTS OF COMBINED RATIO EARNINGS QUALITY IMPROVEMENT 18 Attritional Loss Ratio (Loss ratio excluding catastrophe losses and prior year development) OUE Ratio3 Notes: [1] Reflects Core business. [2] Total expense ratio calculated as the sum of acquisition cost ratio and other underwriting expense ratio. [3] OUE = Other Underwriting Expense. [4] PYD = Prior Year Development. 60.0% 59.1% 25.6% 25.4% 7.1% 6.4% 92.7% 90.9% Attritional COR (9M'24) Attritional COR (9M'25) – 1.8 ppts of earnings quality improvement within Core segment business YoY when excluding catastrophe losses and PYD4 – 0.9 ppt improvement in attritional loss ratio driven by both business mix and improving risk selection – 0.7 ppts decrease in OUE ratio to 6.4% due to scaling benefits from NEP growth Attritional Loss Ratio plus Total Expense Ratio2 Acquisition Cost Ratio 90.9% (3.0)% 3.5% 91.4% Attritional COR (9M'25) Prior Year Development Catastrophe Losses Core COR (9M'25) Bridge to Core Combined RatioTrends in Attritional Combined Ratio1 – Core COR 0.5 ppts higher than attritional COR driven by catastrophe losses – 3.5 ppts of catastrophe losses, relating entirely to California Wildfires during Q1 – 3.0 ppts or $57m of favorable PYD4, relating to releases on prior Property events, Credit and Accident & Health 59.1% 25.4% 6.4%

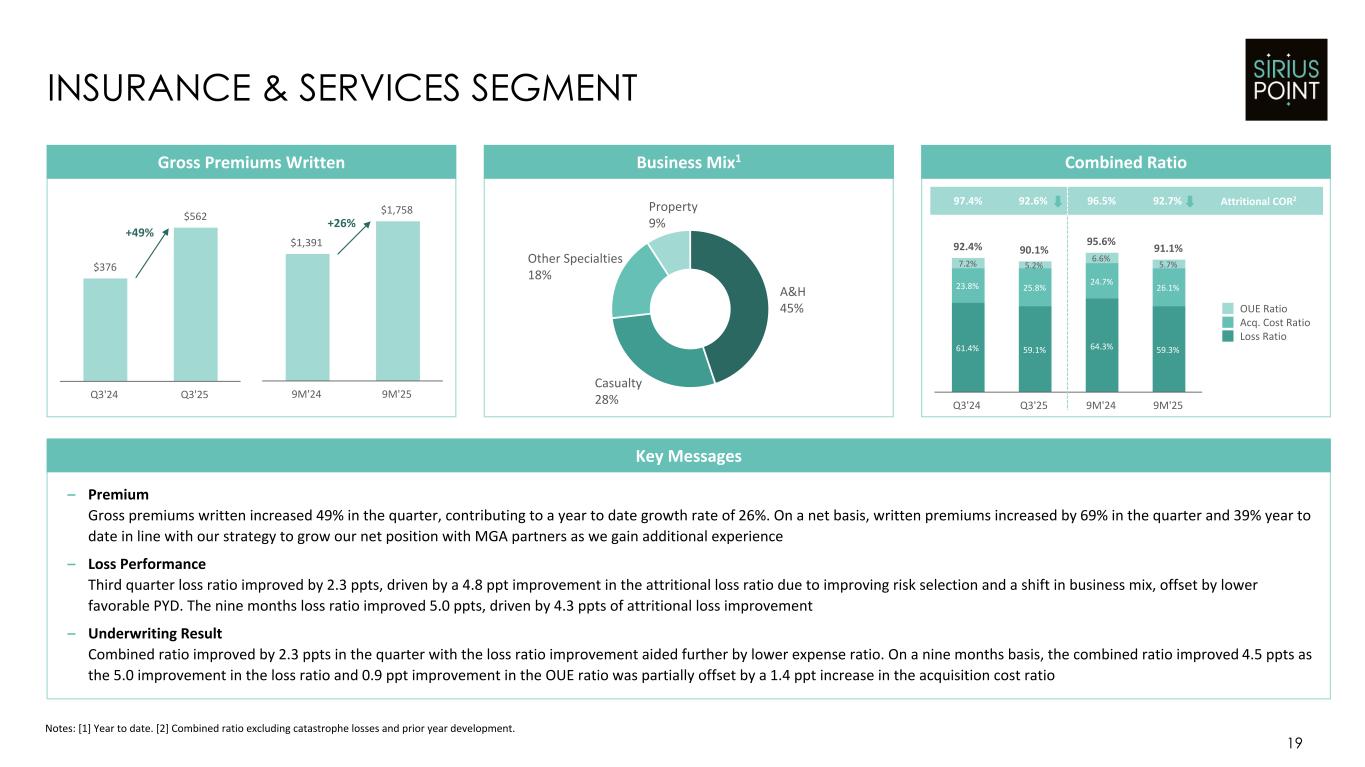

$376 $562 Q3'24 Q3'25 $1,391 $1,758 9M'24 9M'25 19 INSURANCE & SERVICES SEGMENT Notes: [1] Year to date. [2] Combined ratio excluding catastrophe losses and prior year development. Gross Premiums Written Combined Ratio Key Messages 61.4% 59.1% 64.3% 59.3% 23.8% 25.8% 24.7% 26.1% 7.2% 5.2% 6.6% 5.7% 92.4% 90.1% 95.6% 91.1% OUE Ratio Acq. Cost Ratio Loss Ratio Q3'24 Q3'25 9M'24 9M'25 Business Mix1 A&H 45% Casualty 28% Other Specialties 18% Property 9% +49% – Premium Gross premiums written increased 49% in the quarter, contributing to a year to date growth rate of 26%. On a net basis, written premiums increased by 69% in the quarter and 39% year to date in line with our strategy to grow our net position with MGA partners as we gain additional experience – Loss Performance Third quarter loss ratio improved by 2.3 ppts, driven by a 4.8 ppt improvement in the attritional loss ratio due to improving risk selection and a shift in business mix, offset by lower favorable PYD. The nine months loss ratio improved 5.0 ppts, driven by 4.3 ppts of attritional loss improvement – Underwriting Result Combined ratio improved by 2.3 ppts in the quarter with the loss ratio improvement aided further by lower expense ratio. On a nine months basis, the combined ratio improved 4.5 ppts as the 5.0 improvement in the loss ratio and 0.9 ppt improvement in the OUE ratio was partially offset by a 1.4 ppt increase in the acquisition cost ratio Attritional COR297.4% 92.7% +26% 92.6% 96.5%

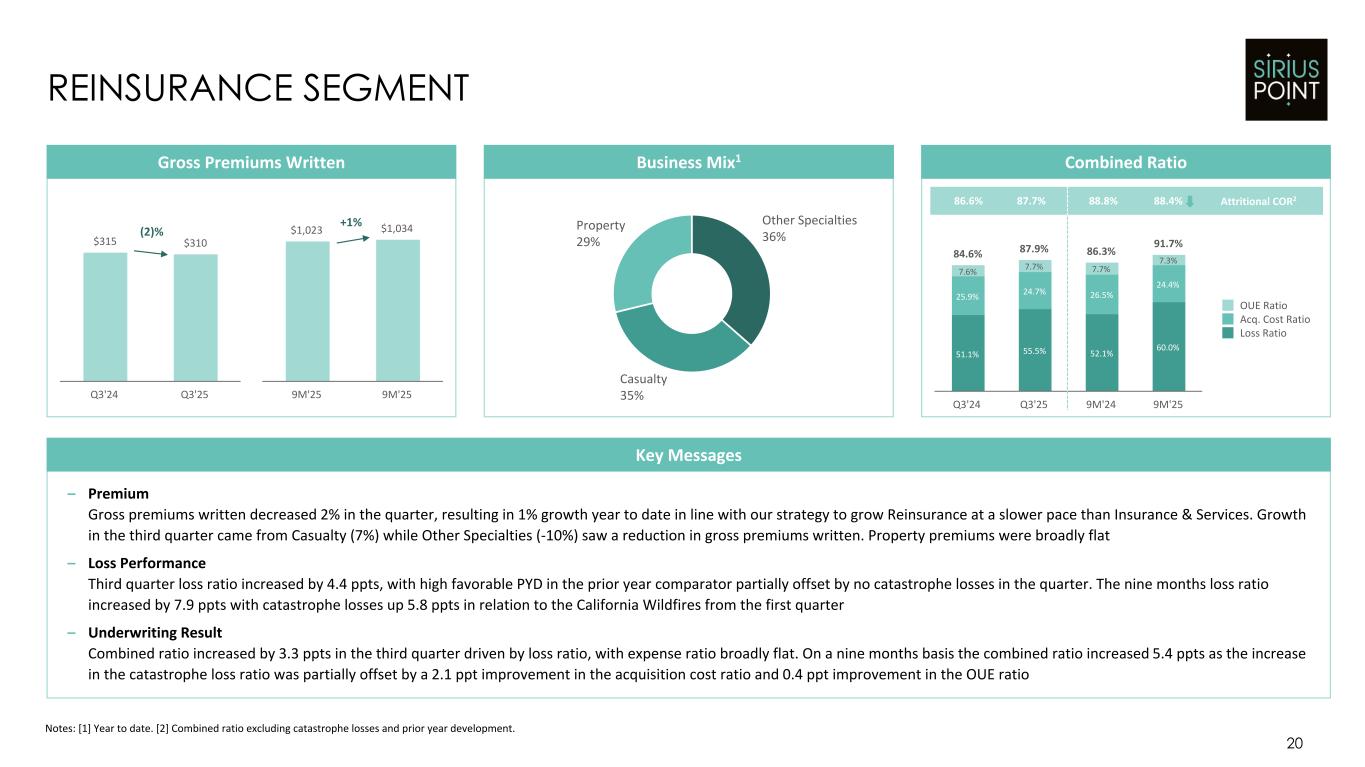

20 REINSURANCE SEGMENT Notes: [1] Year to date. [2] Combined ratio excluding catastrophe losses and prior year development. Gross Premiums Written Combined Ratio Key Messages 51.1% 55.5% 52.1% 60.0% 25.9% 24.7% 26.5% 24.4% 7.6% 7.7% 7.7% 7.3% 84.6% 87.9% 86.3% 91.7% OUE Ratio Acq. Cost Ratio Loss Ratio Q3'24 Q3'25 9M'24 9M'25 Business Mix1 Other Specialties 36% Casualty 35% Property 29% – Premium Gross premiums written decreased 2% in the quarter, resulting in 1% growth year to date in line with our strategy to grow Reinsurance at a slower pace than Insurance & Services. Growth in the third quarter came from Casualty (7%) while Other Specialties (-10%) saw a reduction in gross premiums written. Property premiums were broadly flat – Loss Performance Third quarter loss ratio increased by 4.4 ppts, with high favorable PYD in the prior year comparator partially offset by no catastrophe losses in the quarter. The nine months loss ratio increased by 7.9 ppts with catastrophe losses up 5.8 ppts in relation to the California Wildfires from the first quarter – Underwriting Result Combined ratio increased by 3.3 ppts in the third quarter driven by loss ratio, with expense ratio broadly flat. On a nine months basis the combined ratio increased 5.4 ppts as the increase in the catastrophe loss ratio was partially offset by a 2.1 ppt improvement in the acquisition cost ratio and 0.4 ppt improvement in the OUE ratio Attritional COR286.6% 87.7% 88.4% $315 $310 Q3'24 Q3'25 $1,023 $1,034 9M'25 9M'25 (2)% +1% 88.8%

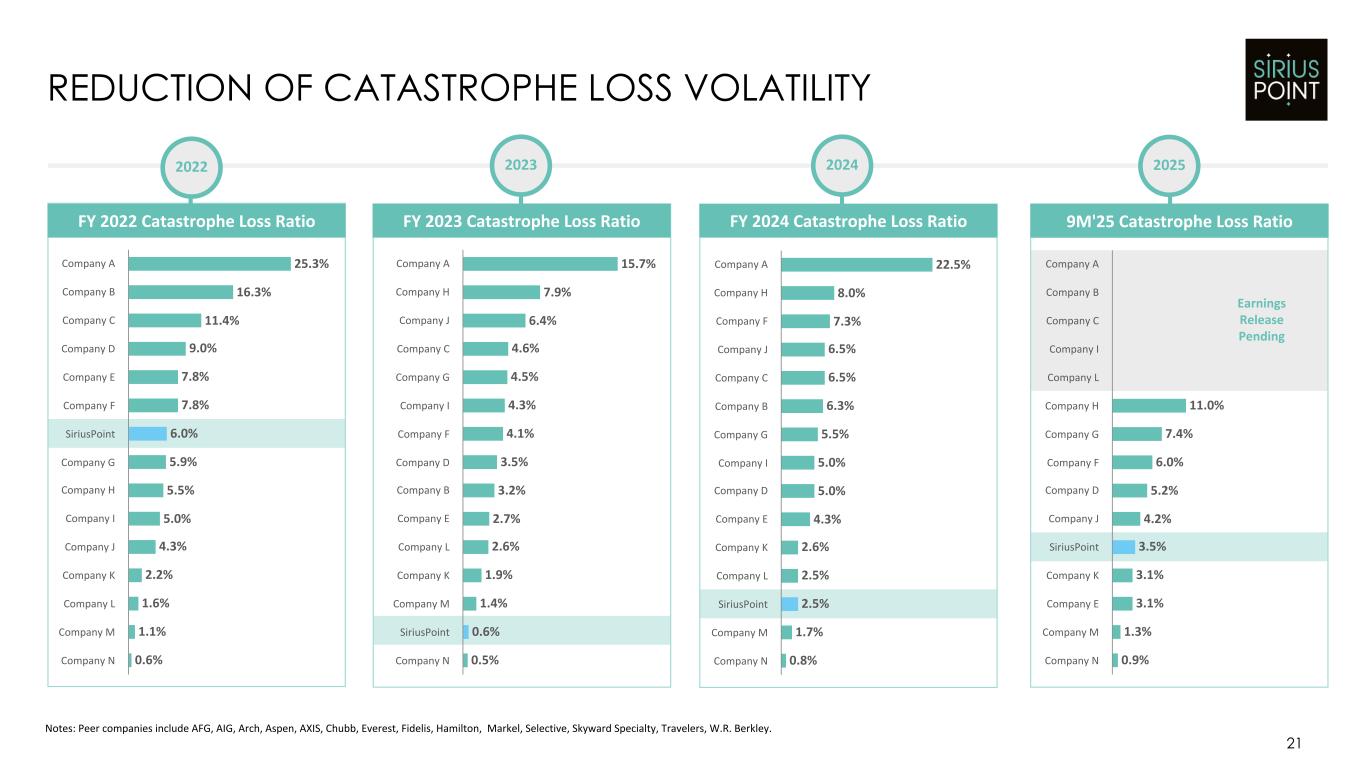

15.7% 7.9% 6.4% 4.6% 4.5% 4.3% 4.1% 3.5% 3.2% 2.7% 2.6% 1.9% 1.4% 0.6% 0.5% Company A Company H Company J Company C Company G Company I Company F Company D Company B Company E Company L Company K Company M SiriusPoint Company N 11.0% 7.4% 6.0% 5.2% 4.2% 3.5% 3.1% 3.1% 1.3% 0.9% Company A Company B Company C Company I Company L Company H Company G Company F Company D Company J SiriusPoint Company K Company E Company M Company N 22.5% 8.0% 7.3% 6.5% 6.5% 6.3% 5.5% 5.0% 5.0% 4.3% 2.6% 2.5% 2.5% 1.7% 0.8% Company A Company H Company F Company J Company C Company B Company G Company I Company D Company E Company K Company L SiriusPoint Company M Company N 25.3% 16.3% 11.4% 9.0% 7.8% 7.8% 6.0% 5.9% 5.5% 5.0% 4.3% 2.2% 1.6% 1.1% 0.6% Company A Company B Company C Company D Company E Company F SiriusPoint Company G Company H Company I Company J Company K Company L Company M Company N 21 REDUCTION OF CATASTROPHE LOSS VOLATILITY FY 2022 Catastrophe Loss Ratio 2022 FY 2023 Catastrophe Loss Ratio 2023 FY 2024 Catastrophe Loss Ratio 2024 HY 2025 Catastrophe Loss Ratio 2025 Notes: Peer companies include AFG, AIG, Arch, Aspen, AXIS, Chubb, Everest, Fidelis, Hamilton, Markel, Selective, Skyward Specialty, Travelers, W.R. Berkley. 9M'25 Catastrophe Los Ratio Earnings Release Pending

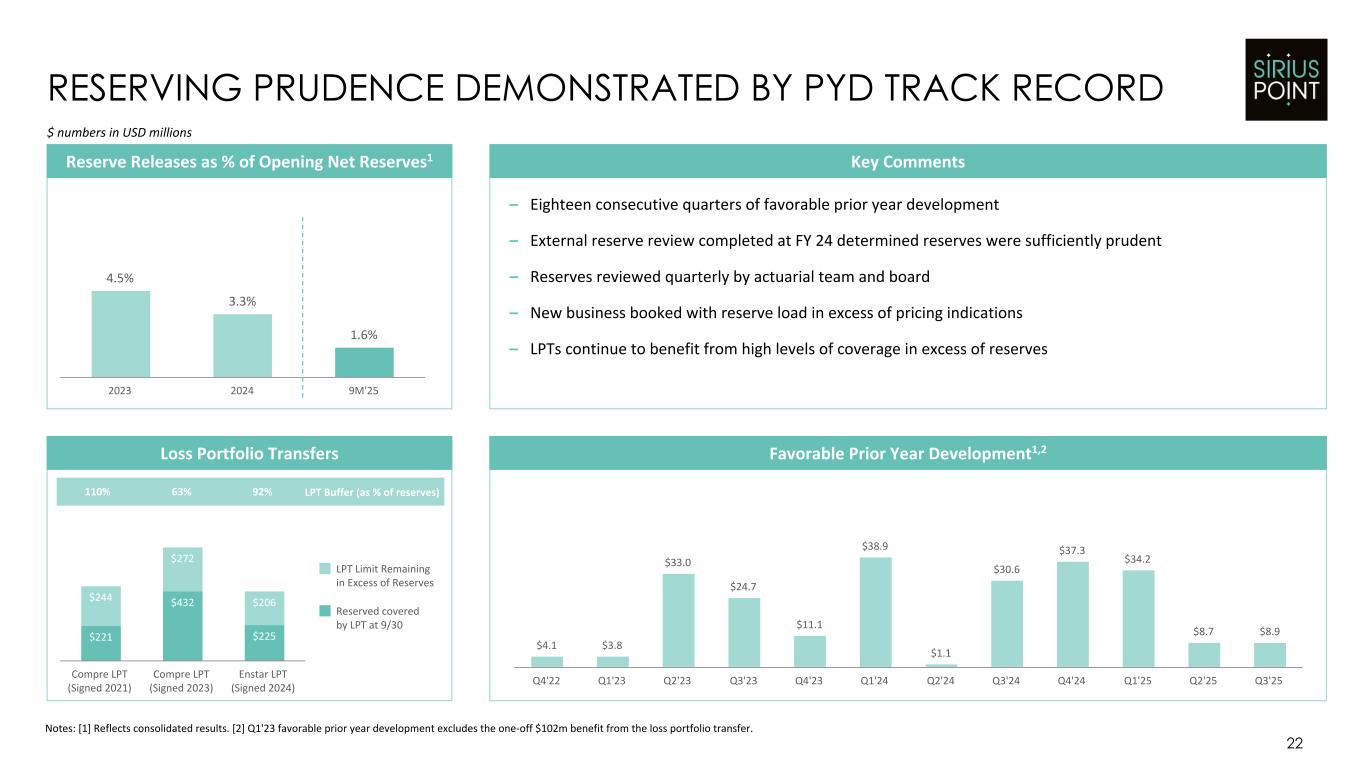

22 RESERVING PRUDENCE DEMONSTRATED BY PYD TRACK RECORD Notes: [1] Reflects consolidated results. [2] Q1'23 favorable prior year development excludes the one-off $102m benefit from the loss portfolio transfer. Favorable Prior Year Development1,2 $4.1 $3.8 $33.0 $24.7 $11.1 $38.9 $1.1 $30.6 $37.3 $34.2 $8.7 $8.9 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 4.5% 3.3% 1.6% 2023 2024 9M'25 Reserve Releases as % of Opening Net Reserves1 $ numbers in USD millions – Eighteen consecutive quarters of favorable prior year development – External reserve review completed at FY 24 determined reserves were sufficiently prudent – Reserves reviewed quarterly by actuarial team and board – New business booked with reserve load in excess of pricing indications – LPTs continue to benefit from high levels of coverage in excess of reserves Key Comments $221 $432 $225 $244 $272 $206 LPT Limit Remaining in Excess of Reserves Reserved covered by LPT at 9/30 Compre LPT (Signed 2021) Compre LPT (Signed 2023) Enstar LPT (Signed 2024) Loss Portfolio Transfers LPT Buffer (as % of reserves)110% 63% 92%

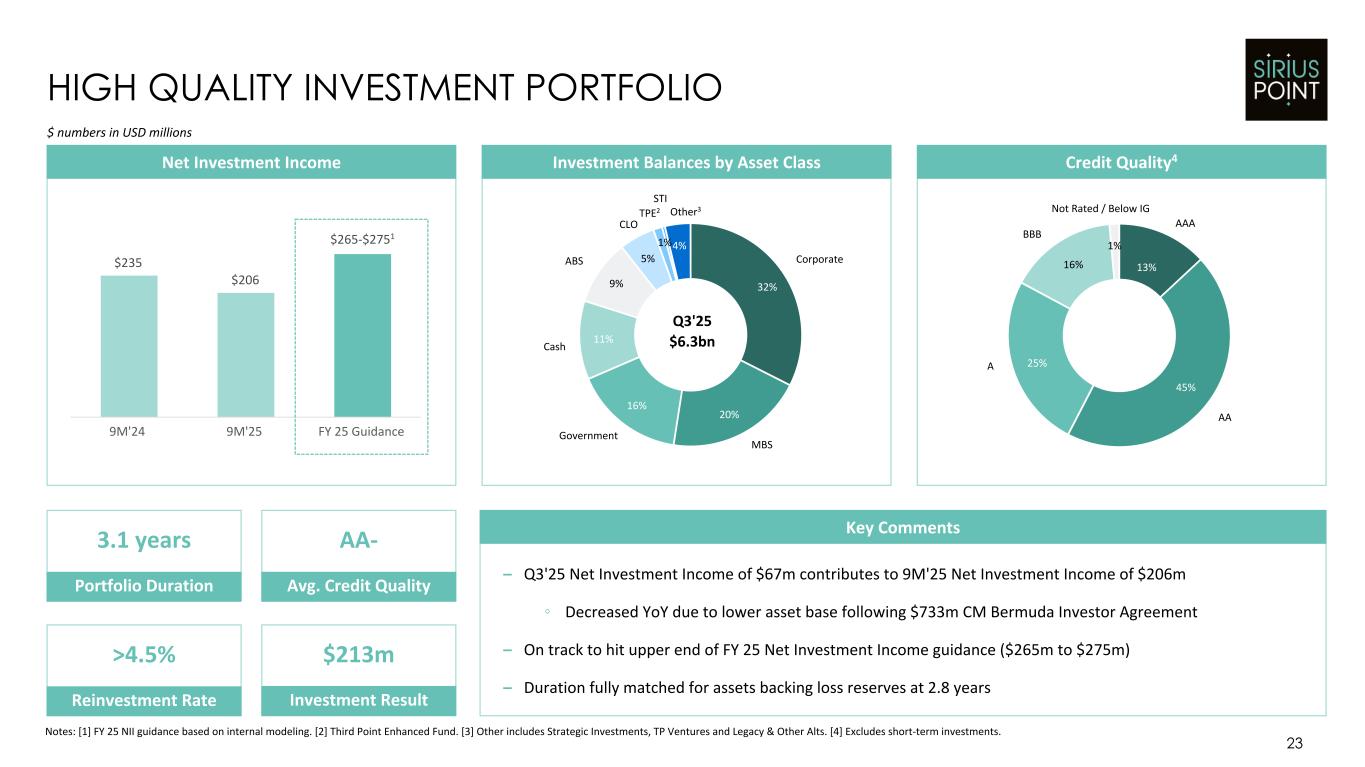

13% 45% 25% 16% 1% $235 $206 9M'24 9M'25 FY 25 Guidance HIGH QUALITY INVESTMENT PORTFOLIO 23 $ numbers in USD millions Key Comments Notes: [1] FY 25 NII guidance based on internal modeling. [2] Third Point Enhanced Fund. [3] Other includes Strategic Investments, TP Ventures and Legacy & Other Alts. [4] Excludes short-term investments. $265-$2751 Net Investment Income – Q3'25 Net Investment Income of $67m contributes to 9M'25 Net Investment Income of $206m ◦ Decreased YoY due to lower asset base following $733m CM Bermuda Investor Agreement – On track to hit upper end of FY 25 Net Investment Income guidance ($265m to $275m) – Duration fully matched for assets backing loss reserves at 2.8 years Credit Quality4Investment Balances by Asset Class 32% 20% 16% 11% 9% 5% 1%4% AAA AA A BBB Not Rated / Below IG STI Corporate Other3 Portfolio Duration Avg. Credit Quality 3.1 years AA- Reinvestment Rate >4.5% Investment Result $213m MBS Government Cash ABS CLO TPE2 Q3'25 $6.3bn

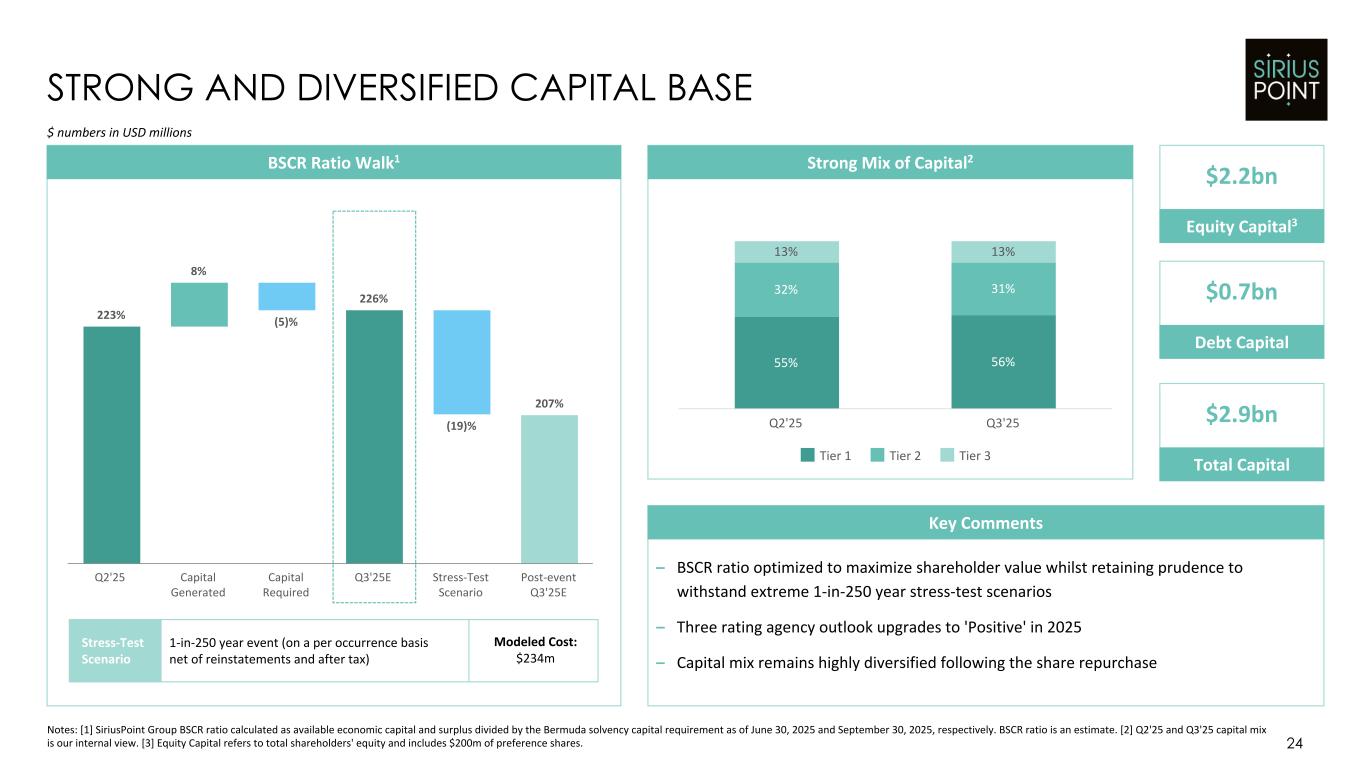

223% 8% (5)% 226% (19)% 207% Q2'25 Capital Generated Capital Required Q3'25E Stress-Test Scenario Post-event Q3'25E 24 Notes: [1] SiriusPoint Group BSCR ratio calculated as available economic capital and surplus divided by the Bermuda solvency capital requirement as of June 30, 2025 and September 30, 2025, respectively. BSCR ratio is an estimate. [2] Q2'25 and Q3'25 capital mix is our internal view. [3] Equity Capital refers to total shareholders' equity and includes $200m of preference shares. STRONG AND DIVERSIFIED CAPITAL BASE – BSCR ratio optimized to maximize shareholder value whilst retaining prudence to withstand extreme 1-in-250 year stress-test scenarios – Three rating agency outlook upgrades to 'Positive' in 2025 – Capital mix remains highly diversified following the share repurchase 55% 56% 32% 31% 13% 13% Tier 1 Tier 2 Tier 3 Q2'25 Q3'25 BSCR Ratio Walk1 $ numbers in USD millions Stress-Test Scenario 1-in-250 year event (on a per occurrence basis net of reinstatements and after tax) Modeled Cost: $234m Strong Mix of Capital2 Key Comments Equity Capital3 Total Capital Debt Capital $2.2bn $0.7bn $2.9bn

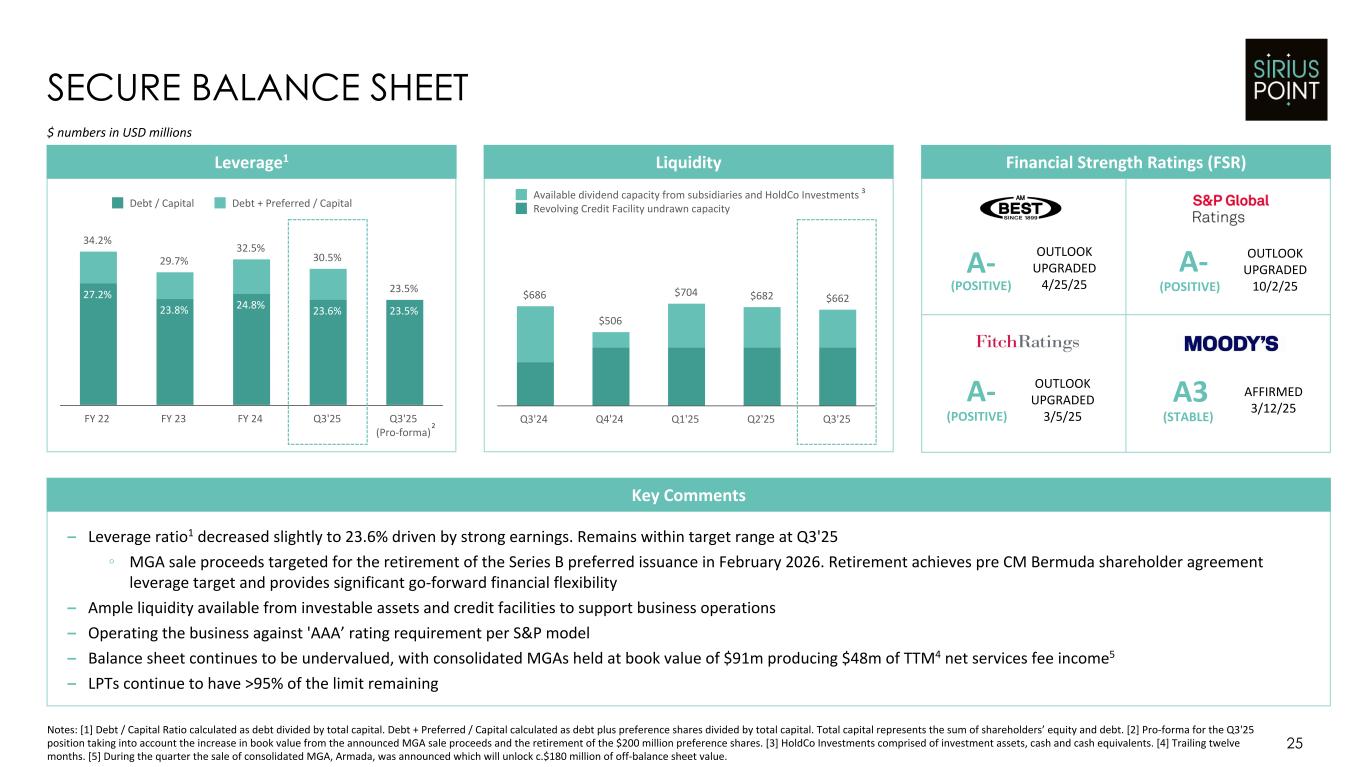

27.2% 23.8% 24.8% 23.6% 23.5% 34.2% 29.7% 32.5% 30.5% 23.5% Debt / Capital Debt + Preferred / Capital FY 22 FY 23 FY 24 Q3'25 Q3'25 (Pro-forma) 25 Notes: [1] Debt / Capital Ratio calculated as debt divided by total capital. Debt + Preferred / Capital calculated as debt plus preference shares divided by total capital. Total capital represents the sum of shareholders’ equity and debt. [2] Pro-forma for the Q3'25 position taking into account the increase in book value from the announced MGA sale proceeds and the retirement of the $200 million preference shares. [3] HoldCo Investments comprised of investment assets, cash and cash equivalents. [4] Trailing twelve months. [5] During the quarter the sale of consolidated MGA, Armada, was announced which will unlock c.$180 million of off-balance sheet value. SECURE BALANCE SHEET – Leverage ratio1 decreased slightly to 23.6% driven by strong earnings. Remains within target range at Q3'25 ◦ MGA sale proceeds targeted for the retirement of the Series B preferred issuance in February 2026. Retirement achieves pre CM Bermuda shareholder agreement leverage target and provides significant go-forward financial flexibility – Ample liquidity available from investable assets and credit facilities to support business operations – Operating the business against 'AAA’ rating requirement per S&P model – Balance sheet continues to be undervalued, with consolidated MGAs held at book value of $91m producing $48m of TTM4 net services fee income5 – LPTs continue to have >95% of the limit remaining Leverage1 Financial Strength Ratings (FSR)Liquidity $ numbers in USD millions Key Comments OUTLOOK UPGRADED 4/25/25 AFFIRMED 3/12/25 OUTLOOK UPGRADED 3/5/25 OUTLOOK UPGRADED 10/2/25 $686 $506 $704 $682 $662 Available dividend capacity from subsidiaries and HoldCo Investments Revolving Credit Facility undrawn capacity Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 A- A3 A- A- (POSITIVE) (STABLE)(POSITIVE) (POSITIVE) 3 2

Thank You investors.siriuspt.com

Appendix

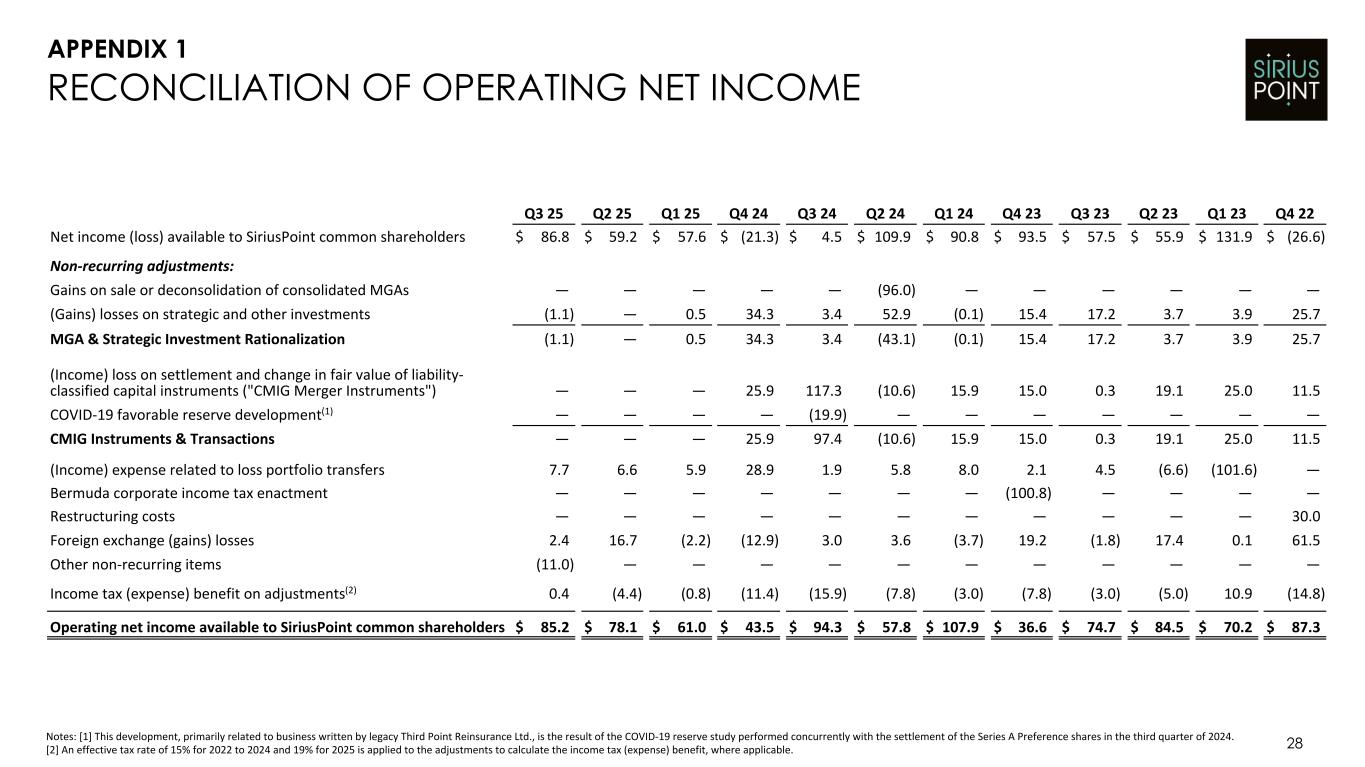

28 RECONCILIATION OF OPERATING NET INCOME Q3 25 Q2 25 Q1 25 Q4 24 Q3 24 Q2 24 Q1 24 Q4 23 Q3 23 Q2 23 Q1 23 Q4 22 Net income (loss) available to SiriusPoint common shareholders $ 86.8 $ 59.2 $ 57.6 $ (21.3) $ 4.5 $ 109.9 $ 90.8 $ 93.5 $ 57.5 $ 55.9 $ 131.9 $ (26.6) Non-recurring adjustments: Gains on sale or deconsolidation of consolidated MGAs — — — — — (96.0) — — — — — — (Gains) losses on strategic and other investments (1.1) — 0.5 34.3 3.4 52.9 (0.1) 15.4 17.2 3.7 3.9 25.7 MGA & Strategic Investment Rationalization (1.1) — 0.5 34.3 3.4 (43.1) (0.1) 15.4 17.2 3.7 3.9 25.7 (Income) loss on settlement and change in fair value of liability- classified capital instruments ("CMIG Merger Instruments") — — — 25.9 117.3 (10.6) 15.9 15.0 0.3 19.1 25.0 11.5 COVID-19 favorable reserve development(1) — — — — (19.9) — — — — — — — CMIG Instruments & Transactions — — — 25.9 97.4 (10.6) 15.9 15.0 0.3 19.1 25.0 11.5 (Income) expense related to loss portfolio transfers 7.7 6.6 5.9 28.9 1.9 5.8 8.0 2.1 4.5 (6.6) (101.6) — Bermuda corporate income tax enactment — — — — — — — (100.8) — — — — Restructuring costs — — — — — — — — — — — 30.0 Foreign exchange (gains) losses 2.4 16.7 (2.2) (12.9) 3.0 3.6 (3.7) 19.2 (1.8) 17.4 0.1 61.5 Other non-recurring items (11.0) — — — — — — — — — — — Income tax (expense) benefit on adjustments(2) 0.4 (4.4) (0.8) (11.4) (15.9) (7.8) (3.0) (7.8) (3.0) (5.0) 10.9 (14.8) Operating net income available to SiriusPoint common shareholders $ 85.2 $ 78.1 $ 61.0 $ 43.5 $ 94.3 $ 57.8 $ 107.9 $ 36.6 $ 74.7 $ 84.5 $ 70.2 $ 87.3 Notes: [1] This development, primarily related to business written by legacy Third Point Reinsurance Ltd., is the result of the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024. [2] An effective tax rate of 15% for 2022 to 2024 and 19% for 2025 is applied to the adjustments to calculate the income tax (expense) benefit, where applicable. APPENDIX 1

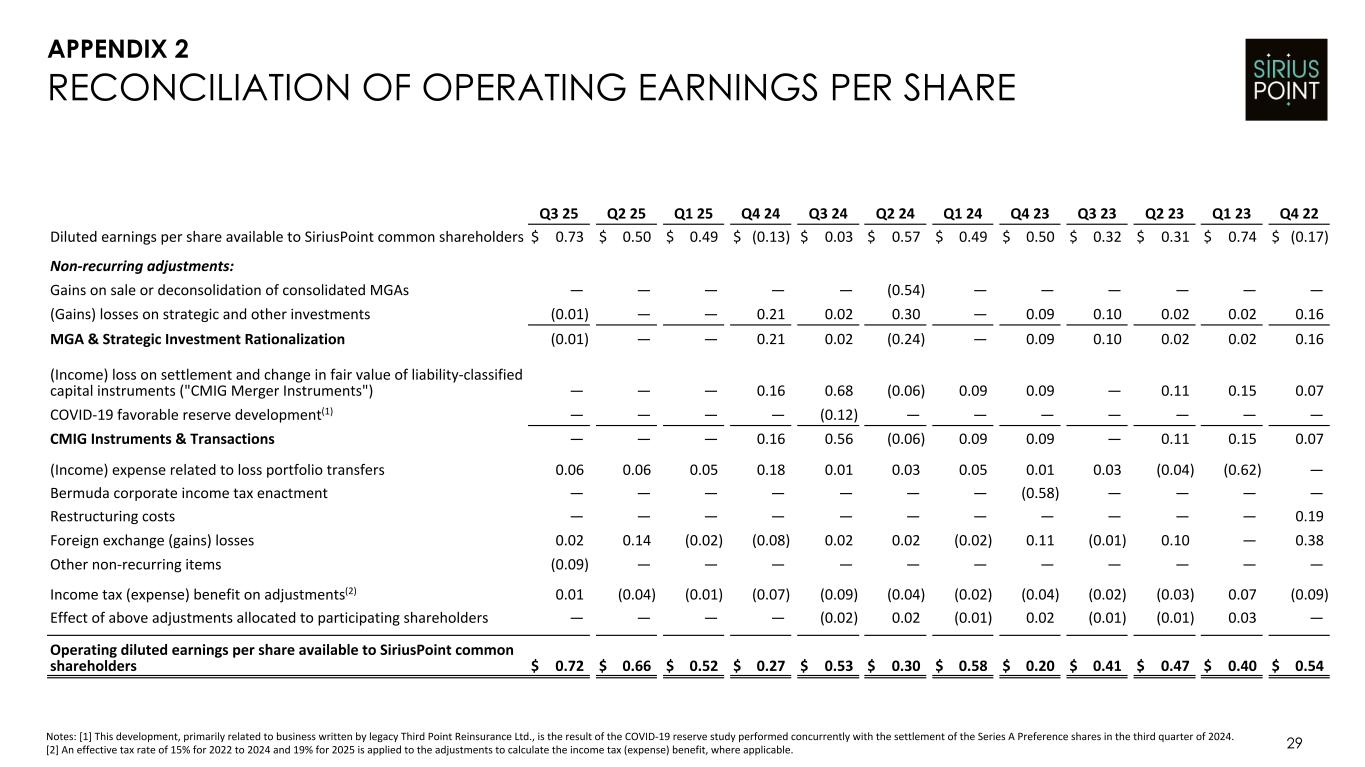

29 RECONCILIATION OF OPERATING EARNINGS PER SHARE Q3 25 Q2 25 Q1 25 Q4 24 Q3 24 Q2 24 Q1 24 Q4 23 Q3 23 Q2 23 Q1 23 Q4 22 Diluted earnings per share available to SiriusPoint common shareholders $ 0.73 $ 0.50 $ 0.49 $ (0.13) $ 0.03 $ 0.57 $ 0.49 $ 0.50 $ 0.32 $ 0.31 $ 0.74 $ (0.17) Non-recurring adjustments: Gains on sale or deconsolidation of consolidated MGAs — — — — — (0.54) — — — — — — (Gains) losses on strategic and other investments (0.01) — — 0.21 0.02 0.30 — 0.09 0.10 0.02 0.02 0.16 MGA & Strategic Investment Rationalization (0.01) — — 0.21 0.02 (0.24) — 0.09 0.10 0.02 0.02 0.16 (Income) loss on settlement and change in fair value of liability-classified capital instruments ("CMIG Merger Instruments") — — — 0.16 0.68 (0.06) 0.09 0.09 — 0.11 0.15 0.07 COVID-19 favorable reserve development(1) — — — — (0.12) — — — — — — — CMIG Instruments & Transactions — — — 0.16 0.56 (0.06) 0.09 0.09 — 0.11 0.15 0.07 (Income) expense related to loss portfolio transfers 0.06 0.06 0.05 0.18 0.01 0.03 0.05 0.01 0.03 (0.04) (0.62) — Bermuda corporate income tax enactment — — — — — — — (0.58) — — — — Restructuring costs — — — — — — — — — — — 0.19 Foreign exchange (gains) losses 0.02 0.14 (0.02) (0.08) 0.02 0.02 (0.02) 0.11 (0.01) 0.10 — 0.38 Other non-recurring items (0.09) — — — — — — — — — — — Income tax (expense) benefit on adjustments(2) 0.01 (0.04) (0.01) (0.07) (0.09) (0.04) (0.02) (0.04) (0.02) (0.03) 0.07 (0.09) Effect of above adjustments allocated to participating shareholders — — — — (0.02) 0.02 (0.01) 0.02 (0.01) (0.01) 0.03 — Operating diluted earnings per share available to SiriusPoint common shareholders $ 0.72 $ 0.66 $ 0.52 $ 0.27 $ 0.53 $ 0.30 $ 0.58 $ 0.20 $ 0.41 $ 0.47 $ 0.40 $ 0.54 Notes: [1] This development, primarily related to business written by legacy Third Point Reinsurance Ltd., is the result of the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024. [2] An effective tax rate of 15% for 2022 to 2024 and 19% for 2025 is applied to the adjustments to calculate the income tax (expense) benefit, where applicable. APPENDIX 2

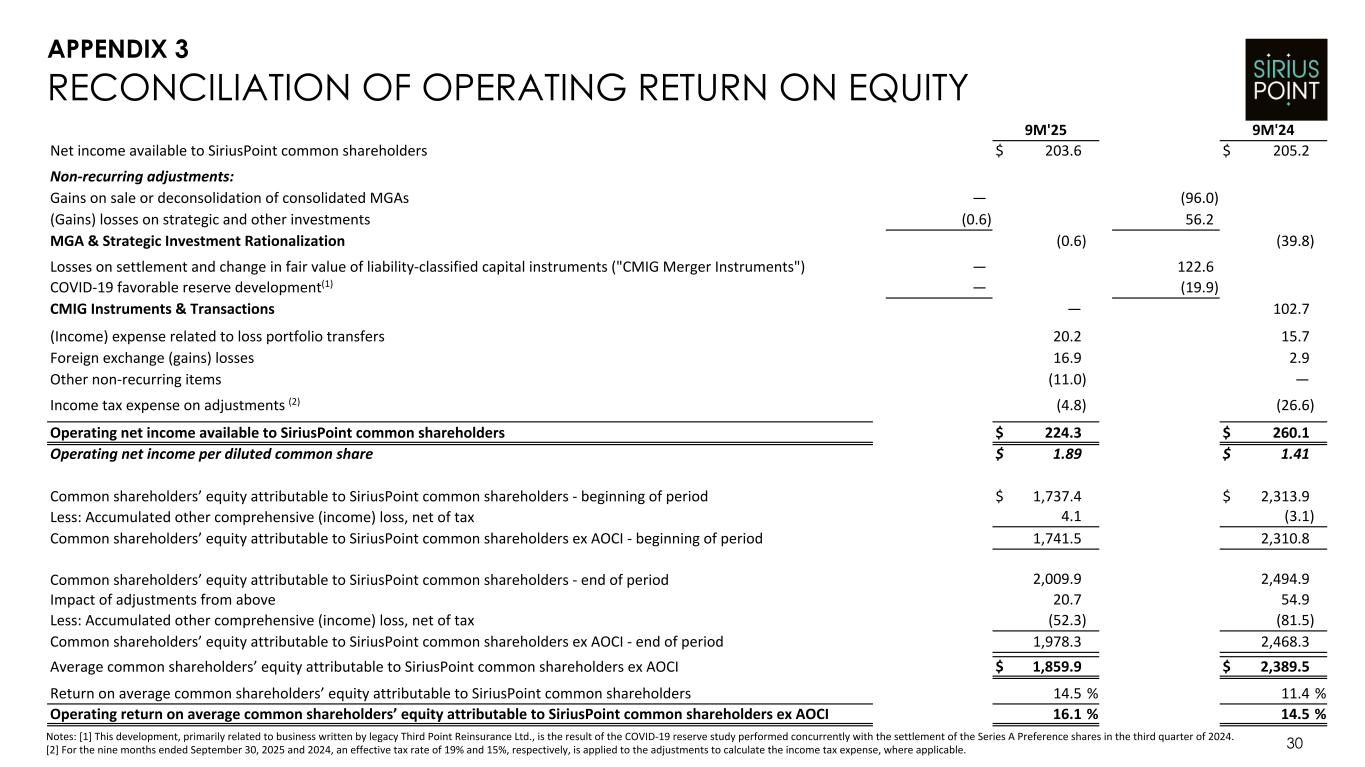

30 RECONCILIATION OF OPERATING RETURN ON EQUITY 9M'25 9M'24 Net income available to SiriusPoint common shareholders $ 203.6 $ 205.2 Non-recurring adjustments: Gains on sale or deconsolidation of consolidated MGAs — (96.0) (Gains) losses on strategic and other investments (0.6) 56.2 MGA & Strategic Investment Rationalization (0.6) (39.8) Losses on settlement and change in fair value of liability-classified capital instruments ("CMIG Merger Instruments") — 122.6 COVID-19 favorable reserve development(1) — (19.9) CMIG Instruments & Transactions — 102.7 (Income) expense related to loss portfolio transfers 20.2 15.7 Foreign exchange (gains) losses 16.9 2.9 Other non-recurring items (11.0) — Income tax expense on adjustments (2) (4.8) (26.6) Operating net income available to SiriusPoint common shareholders $ 224.3 $ 260.1 Operating net income per diluted common share $ 1.89 $ 1.41 Common shareholders’ equity attributable to SiriusPoint common shareholders - beginning of period $ 1,737.4 $ 2,313.9 Less: Accumulated other comprehensive (income) loss, net of tax 4.1 (3.1) Common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI - beginning of period 1,741.5 2,310.8 Common shareholders’ equity attributable to SiriusPoint common shareholders - end of period 2,009.9 2,494.9 Impact of adjustments from above 20.7 54.9 Less: Accumulated other comprehensive (income) loss, net of tax (52.3) (81.5) Common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI - end of period 1,978.3 2,468.3 Average common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI $ 1,859.9 $ 2,389.5 Return on average common shareholders’ equity attributable to SiriusPoint common shareholders 14.5 % 11.4 % Operating return on average common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI 16.1 % 14.5 % Notes: [1] This development, primarily related to business written by legacy Third Point Reinsurance Ltd., is the result of the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024. [2] For the nine months ended September 30, 2025 and 2024, an effective tax rate of 19% and 15%, respectively, is applied to the adjustments to calculate the income tax expense, where applicable. APPENDIX 3

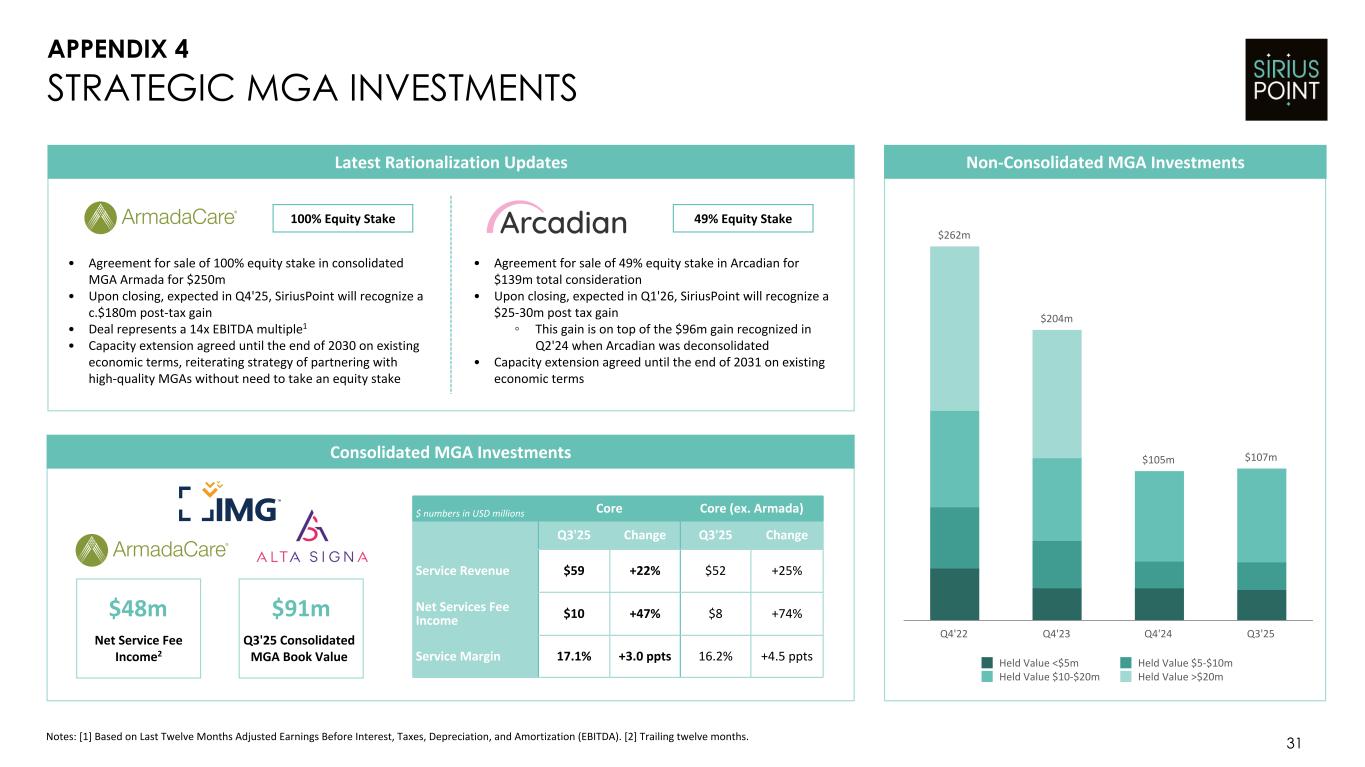

$262m $204m $105m $107m Held Value <$5m Held Value $5-$10m Held Value $10-$20m Held Value >$20m Q4'22 Q4'23 Q4'24 Q3'25 31 STRATEGIC MGA INVESTMENTS Latest Rationalization Updates Net Service Fee Income2 $48m Q3'25 Consolidated MGA Book Value $91m Non-Consolidated MGA Investments $ numbers in USD millions Core Core (ex. Armada) Q3'25 Change Q3'25 Change Service Revenue $59 +22% $52 +25% Net Services Fee Income $10 +47% $8 +74% Service Margin 17.1% +3.0 ppts 16.2% +4.5 ppts APPENDIX 4 Notes: [1] Based on Last Twelve Months Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). [2] Trailing twelve months. 100% Equity Stake 49% Equity Stake • Agreement for sale of 100% equity stake in consolidated MGA Armada for $250m • Upon closing, expected in Q4'25, SiriusPoint will recognize a c.$180m post-tax gain • Deal represents a 14x EBITDA multiple1 • Capacity extension agreed until the end of 2030 on existing economic terms, reiterating strategy of partnering with high-quality MGAs without need to take an equity stake • Agreement for sale of 49% equity stake in Arcadian for $139m total consideration • Upon closing, expected in Q1'26, SiriusPoint will recognize a $25-30m post tax gain ◦ This gain is on top of the $96m gain recognized in Q2'24 when Arcadian was deconsolidated • Capacity extension agreed until the end of 2031 on existing economic terms Consolidated MGA Investments