.2

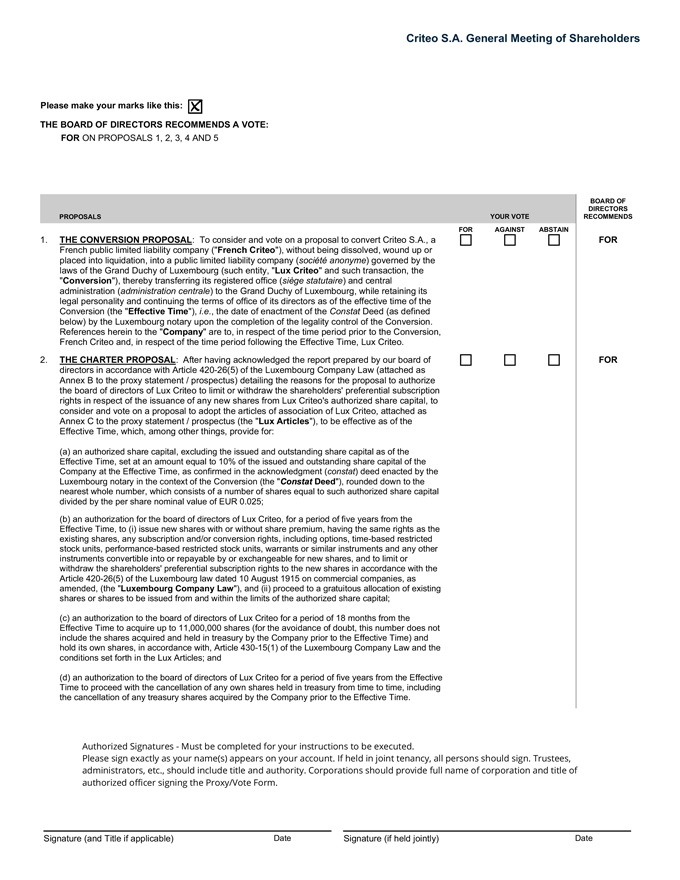

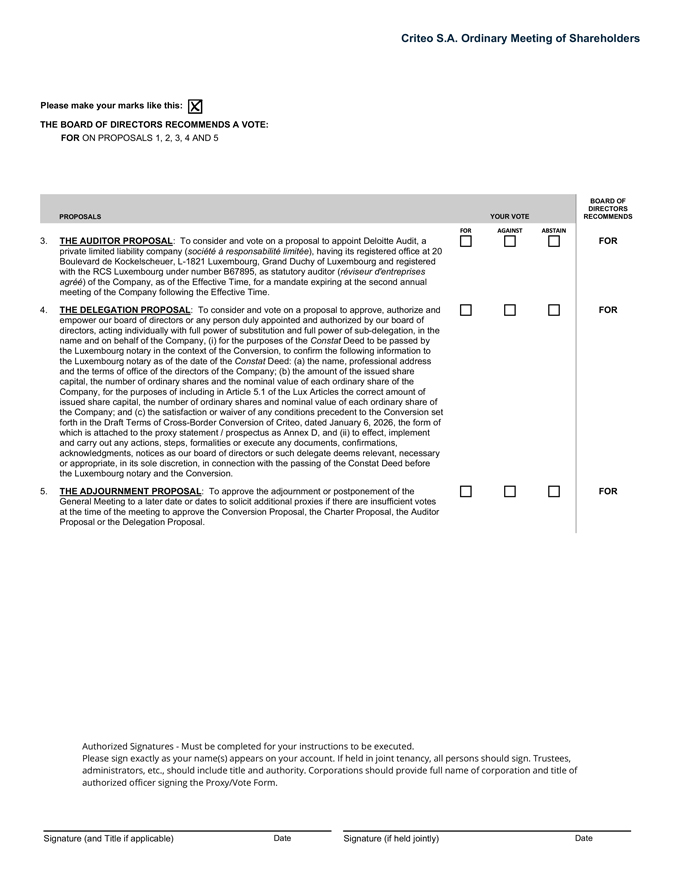

Your vote BNY: PO BOX 505006, Louisville, KY 40233-5006 matters! Have your ballot ready and please use one of the methods below for easy voting: Your control number Have the 12 digit control number located in the box above available when you access the website and follow the instructions. Criteo S.A. Mail: • Mark, sign and date your Proxy Card • Fold and return your Proxy Card in the postage-paid General Meeting of Shareholders envelope provided For ADR Owners of record as of January 20, 2026 Friday, February 27, 2026 10:00 AM, Paris Time 32 Rue Blanche, 75009 Paris, France (the “General Meeting”) YOUR VOTE IS IMPORTANT! PLEASE VOTE BY: 12:00 pm (Eastern Time) on February 23, 2026. CRITEO S.A. Instructions to The Bank of New York Mellon, as Depositary (must be received prior to 12:00 PM (Eastern Time) on February 23, 2026) The undersigned Owner of American Depositary Receipts hereby requests and instructs The Bank of New York Mellon, as Depositary, to endeavor, insofar as practicable, to vote or cause to be voted the ordinary shares of Criteo S.A. represented by such Receipts registered in the name of the undersigned on the books of the Depositary as of the close of business on January 20, 2026 at the General Meeting in respect of the resolutions specified in the enclosed proxy statement/prospectus. NOTE: 1. Instructions as to voting on the specified resolutions should be indicated by an “X” in the appropriate box. 2. If no instructions are received by the Depositary from an Owner on one or more Matter(s) with respect to an amount of the Deposited Securities represented by American Depositary Receipts of that Owner on or before the date established by the Depositary for such purpose, to the extent permitted by applicable law and if requested by the Company pursuant and subject to the terms of the deposit agreement, the Depositary shall deem that Owner to have instructed the Depositary to give a discretionary proxy to a person designated by the Company to vote (x) that amount of Deposited Securities as to such Matters at the General Meeting, and (y) against any Matter which may be subsequently added to the agenda of the General Meeting (including during the General Meeting) in accordance with applicable French law. 3. Capitalized terms not defined herein are defined in the Amended and Restated Deposit Agreement dated December 28, 2021, a copy of which is filed with Criteo’s SEC filings. PLEASE BE SURE TO SIGN AND DATE THIS PROXY CARD AND MARK ON THE REVERSE SIDE Copyright © 2025 BetaNXT, Inc. or its affiliates. All Rights Reserved