Investcorp Credit Management BDC, Inc. Investor Update Presentation September 30, 2025 .2

Forward-looking Statements and Disclosures Statements included in this presentation may contain “forward-looking statements,” which relate to future performance or financial condition of Investcorp Credit Management BDC, Inc. (“ICMB”). Forward-looking statements are based on estimates, projections, beliefs and assumptions of ICMB’s management at the time of such statements, which change over time, and are not guarantees of future performance or results. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by ICMB with the Securities and Exchange Commission. Forward-looking statements are made as of the date of this presentation, or as of the prior date referenced in this presentation and are subject to change without notice. ICMB undertakes no duty to update any forward-looking statement made herein except as required by law. This presentation is neither an offer to sell nor a solicitation of an offer to buy ICMB’s securities. An offering is made only by an applicable prospectus. This presentation must be read in conjunction with a prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy of such a prospectus must be made available to you in connection with any offering. The summary descriptions and other information included herein are intended only for informational purposes and convenient reference. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Before making an investment decision with respect to ICMB, investors are advised to carefully review an applicable prospectus to review the risk factors described therein, and to consult with their tax, financial, investment and legal advisors. These materials do not purport to be complete and are qualified in their entirety by reference to the more detailed disclosures contained in an applicable prospectus and ICMB’s related documentation. No representation or warranty, express or implied, is made as to the accuracy or completeness of the information contained herein, and nothing shall be relied upon as a promise or representation as to the future performance of ICMB.

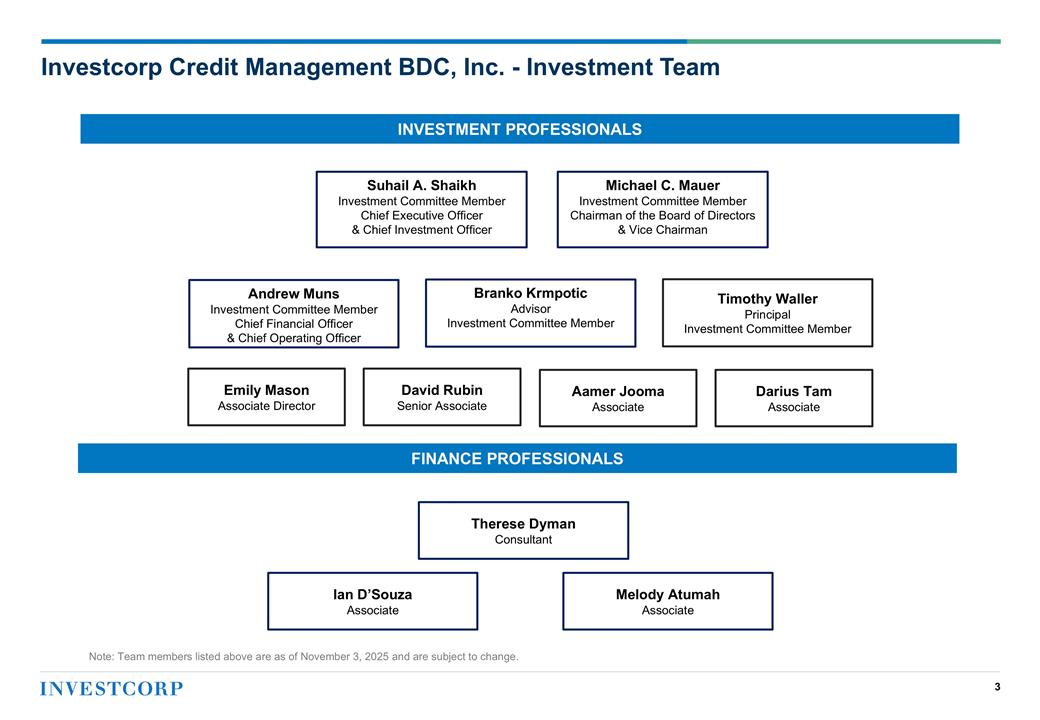

Suhail A. Shaikh Investment Committee Member Chief Executive Officer & Chief Investment Officer Michael C. Mauer Investment Committee Member Chairman of the Board of Directors & Vice Chairman INVESTMENT PROFESSIONALS FINANCE PROFESSIONALS Investcorp Credit Management BDC, Inc. - Investment Team Andrew Muns Investment Committee Member Chief Financial Officer & Chief Operating Officer Branko Krmpotic Advisor Investment Committee Member Timothy Waller Principal Investment Committee Member Emily Mason Associate Director David Rubin Senior Associate Therese Dyman Consultant Darius Tam Associate Melody Atumah Associate Ian D’Souza Associate Note: Team members listed above are as of November 3, 2025 and are subject to change. Aamer Jooma Associate

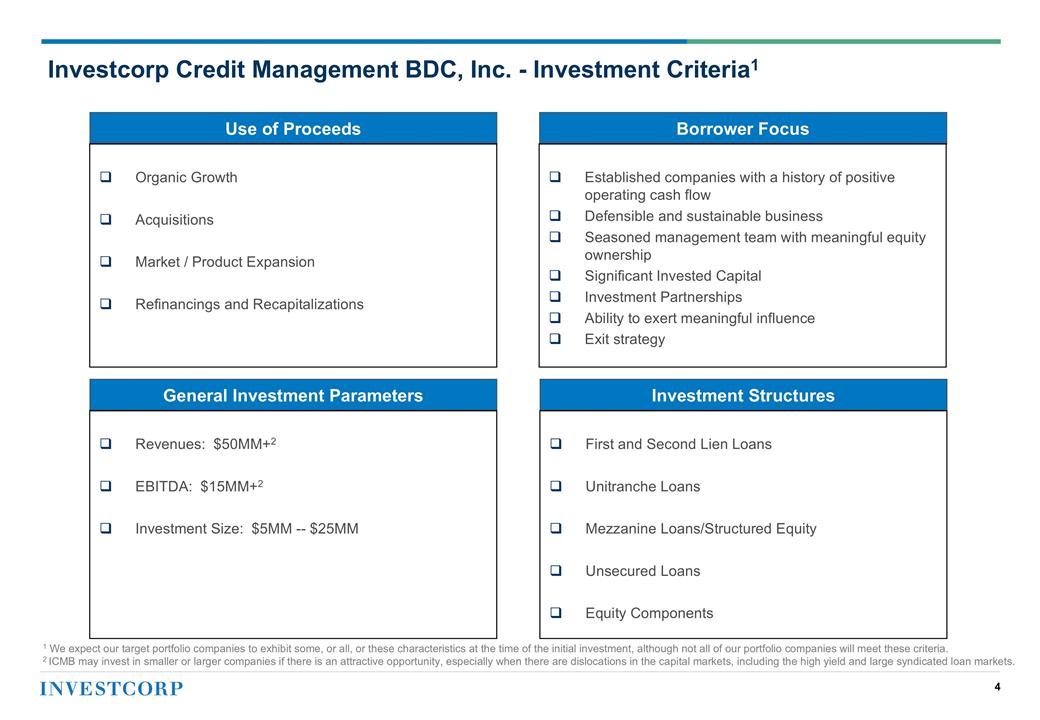

Use of Proceeds Borrower Focus General Investment Parameters Investment Structures Organic Growth Acquisitions Market / Product Expansion Refinancings and Recapitalizations Established companies with a history of positive operating cash flow Defensible and sustainable business Seasoned management team with meaningful equity ownership Significant Invested Capital Investment Partnerships Ability to exert meaningful influence Exit strategy Revenues: $50MM+2 EBITDA: $15MM+2 Investment Size: $5MM -- $25MM First and Second Lien Loans Unitranche Loans Mezzanine Loans/Structured Equity Unsecured Loans Equity Components Investcorp Credit Management BDC, Inc. - Investment Criteria1 1 We expect our target portfolio companies to exhibit some, or all, or these characteristics at the time of the initial investment, although not all of our portfolio companies will meet these criteria. 2 ICMB may invest in smaller or larger companies if there is an attractive opportunity, especially when there are dislocations in the capital markets, including the high yield and large syndicated loan markets.

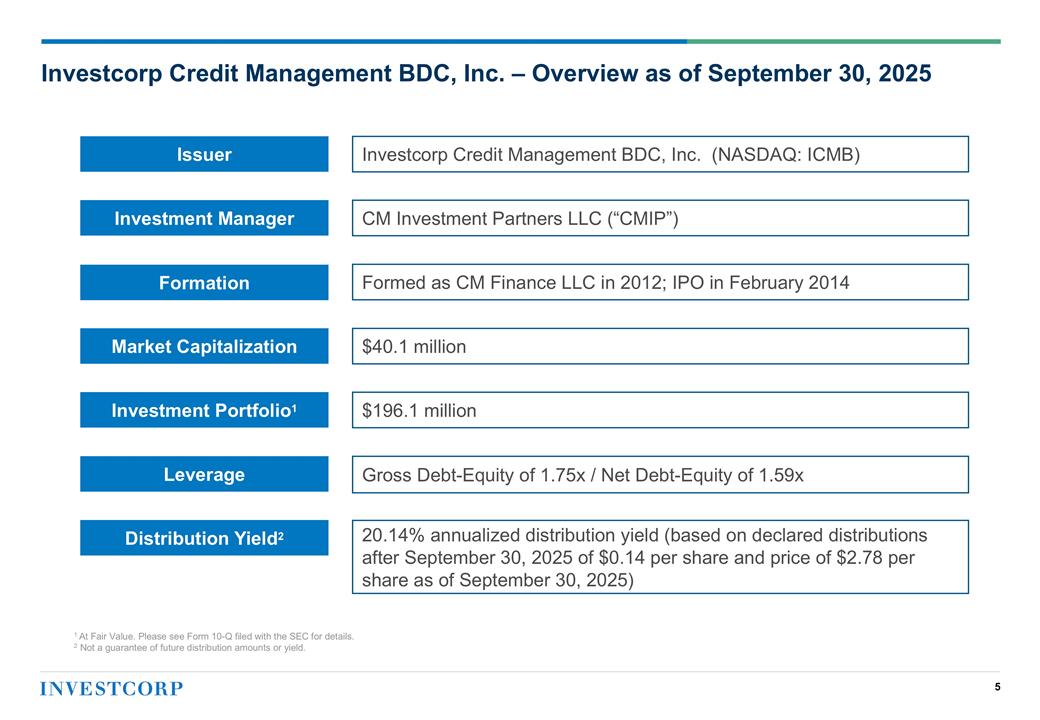

Investcorp Credit Management BDC, Inc. – Overview as of September 30, 2025 Issuer Investcorp Credit Management BDC, Inc. (NASDAQ: ICMB) Investment Manager CM Investment Partners LLC (“CMIP”) Formation Formed as CM Finance LLC in 2012; IPO in February 2014 Market Capitalization $40.1 million Investment Portfolio1 $196.1 million Leverage Gross Debt-Equity of 1.75x / Net Debt-Equity of 1.59x 20.14% annualized distribution yield (based on declared distributions after September 30, 2025 of $0.14 per share and price of $2.78 per share as of September 30, 2025) Distribution Yield2 A 1 At Fair Value. Please see Form 10-Q filed with the SEC for details. 2 Not a guarantee of future distribution amounts or yield.

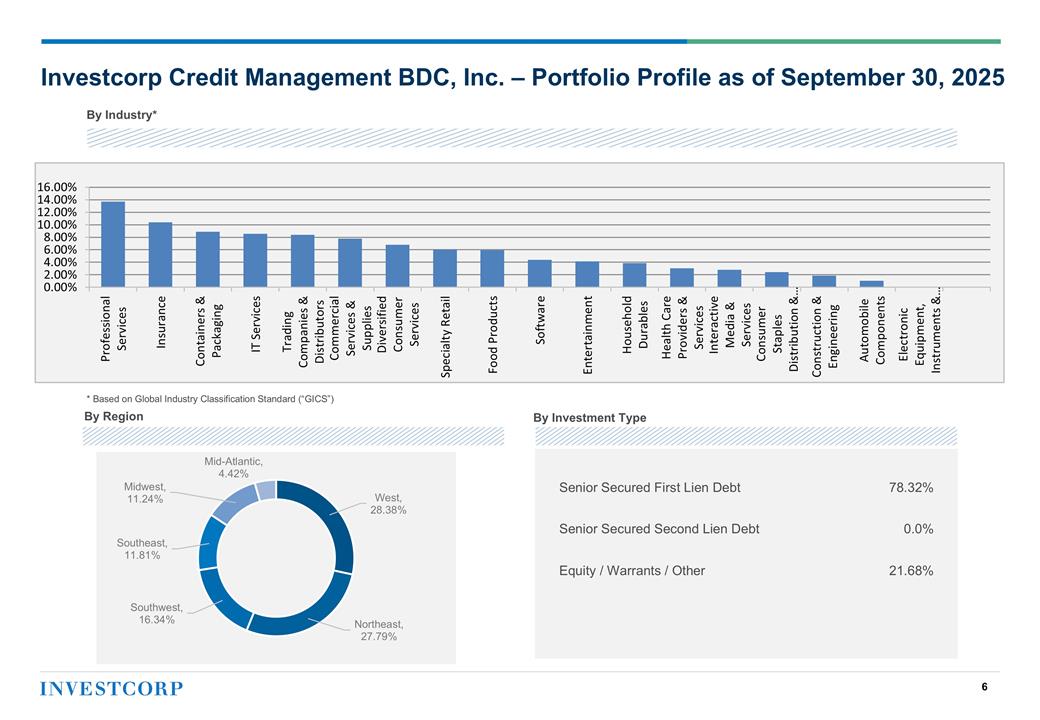

By Region Investcorp Credit Management BDC, Inc. – Portfolio Profile as of September 30, 2025 By Industry* By Investment Type Senior Secured First Lien Debt 78.32% Senior Secured Second Lien Debt 0.0% Equity / Warrants / Other 21.68% * Based on Global Industry Classification Standard (“GICS”) UPDATE

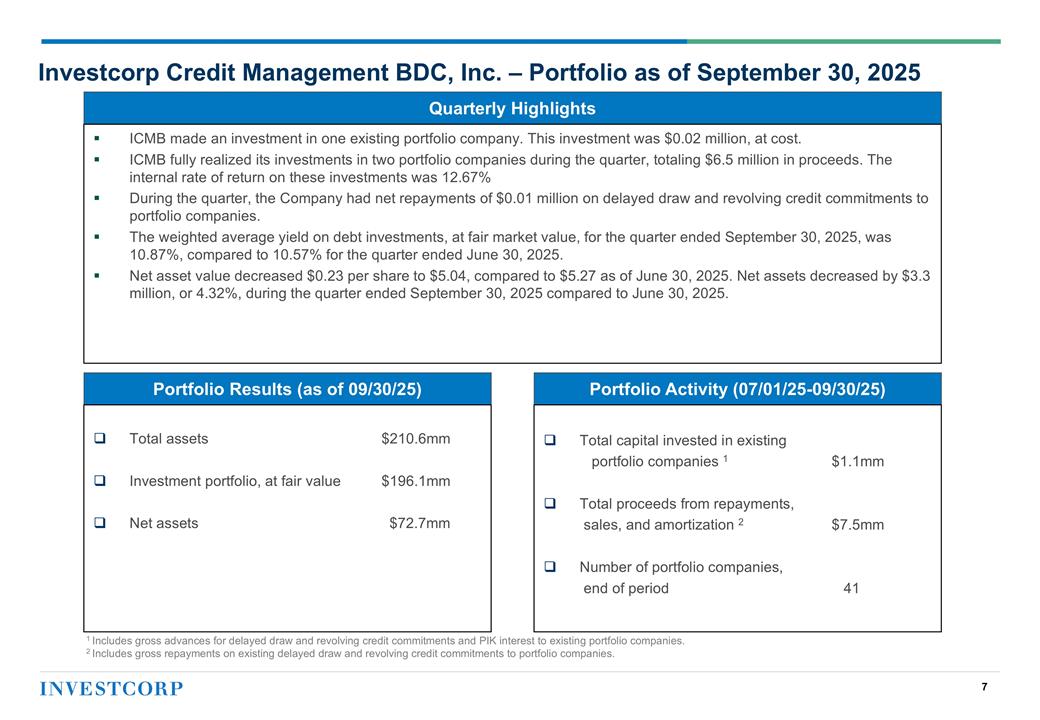

Quarterly Highlights Portfolio Results (as of 09/30/25) Portfolio Activity (07/01/25-09/30/25) ICMB made an investment in one existing portfolio company. This investment was $0.02 million, at cost. ICMB fully realized its investments in two portfolio companies during the quarter, totaling $6.5 million in proceeds. The internal rate of return on these investments was 12.67% During the quarter, the Company had net repayments of $0.01 million on delayed draw and revolving credit commitments to portfolio companies. The weighted average yield on debt investments, at fair market value, for the quarter ended September 30, 2025, was 10.87%, compared to 10.57% for the quarter ended June 30, 2025. Net asset value decreased $0.23 per share to $5.04, compared to $5.27 as of June 30, 2025. Net assets decreased by $3.3 million, or 4.32%, during the quarter ended September 30, 2025 compared to June 30, 2025. Total assets $210.6mm Investment portfolio, at fair value $196.1mm Net assets $72.7mm Total capital invested in existing portfolio companies 1$1.1mm Total proceeds from repayments, sales, and amortization 2$7.5mm Number of portfolio companies, end of period 41 Investcorp Credit Management BDC, Inc. – Portfolio as of September 30, 2025 1 Includes gross advances for delayed draw and revolving credit commitments and PIK interest to existing portfolio companies. 2 Includes gross repayments on existing delayed draw and revolving credit commitments to portfolio companies.

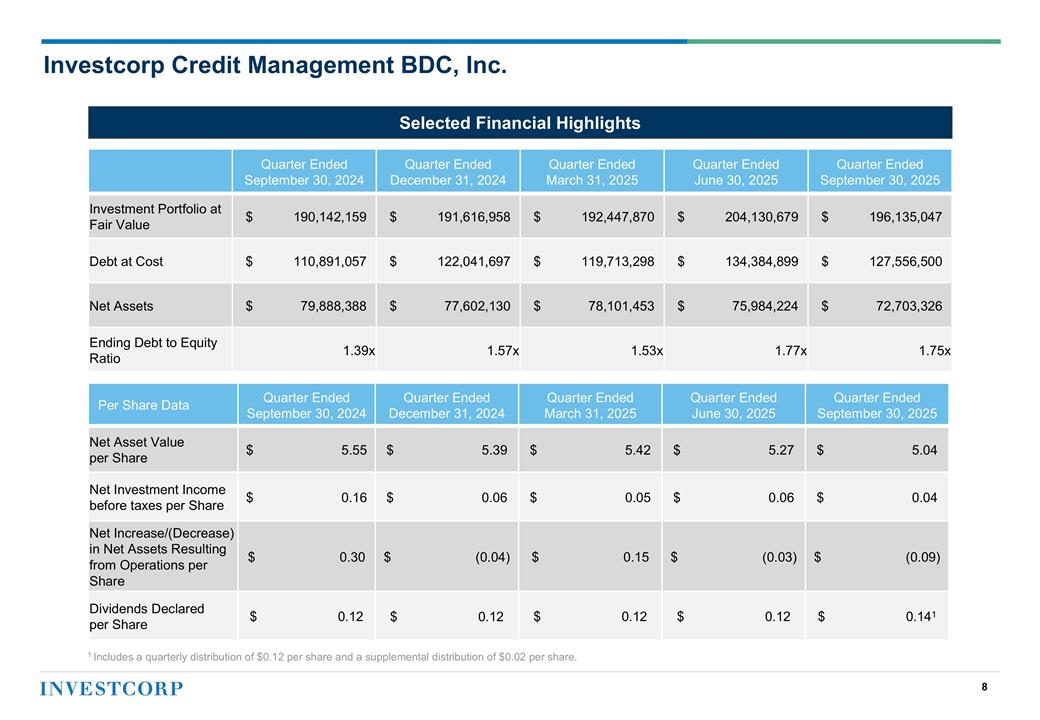

Selected Financial Highlights Investcorp Credit Management BDC, Inc. Quarter Ended September 30, 2024 Quarter Ended December 31, 2024 Quarter Ended March 31, 2025 Quarter Ended June 30, 2025 Quarter Ended September 30, 2025 Investment Portfolio at Fair Value $ 190,142,159 $ 191,616,958 $ 192,447,870 $ 204,130,679 $ 196,135,047 Debt at Cost $ 110,891,057 $ 122,041,697 $ 119,713,298 $ 134,384,899 $ 127,556,500 Net Assets $ 79,888,388 $ 77,602,130 $ 78,101,453 $ 75,984,224 $ 72,703,326 Ending Debt to Equity Ratio 1.39x 1.57x 1.53x 1.77x 1.75x Per Share Data Quarter Ended September 30, 2024 Quarter Ended December 31, 2024 Quarter Ended March 31, 2025 Quarter Ended June 30, 2025 Quarter Ended September 30, 2025 Net Asset Value per Share $ 5.55 $ 5.39 $ 5.42 $ 5.27 $ 5.04 Net Investment Income before taxes per Share $ 0.16 $ 0.06 $ 0.05 $ 0.06 $ 0.04 Net Increase/(Decrease) in Net Assets Resulting from Operations per Share $ 0.30 $ (0.04) $ 0.15 $ (0.03) $ (0.09) Dividends Declared per Share $ 0.12 $ 0.12 $ 0.12 $ 0.12 $ 0.141 1 Includes a quarterly distribution of $0.12 per share and a supplemental distribution of $0.02 per share.

icmbinfo@investcorp.com