November 3, 2025 3Q 2025 Corporate Presentation

Forward looking statements & safe harbor Certain matters discussed in this presentation are “forward-looking statements”. The Company may, in some cases, use terms such as “predicts,” “believes,” “potential,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. In particular, the Company’s statements regarding trends and potential future results are examples of such forward-looking statements. The forward-looking statements include risks and uncertainties, including, but not limited to, the commercial success of the Company’s SUNOSI®, AUVELITY®, and SYMBRAVO® products and the success of the Company’s efforts to obtain any additional indication(s) with respect to solriamfetol and/or AXS-05; the Company’s ability to maintain and expand payer coverage; the success, timing and cost of the Company’s ongoing clinical trials and anticipated clinical trials for the Company’s current product candidates, including statements regarding the timing of initiation, pace of enrollment and completion of the trials (including the Company’s ability to fully fund the Company’s disclosed clinical trials, which assumes no material changes to the Company’s currently projected revenues or expenses), futility analyses and receipt of interim results, which are not necessarily indicative of the final results of the Company’s ongoing clinical trials, and/or data readouts, and the number or type of studies or nature of results necessary to support the filing of a new drug application (“NDA”) for any of the Company’s current product candidates; the Company’s ability to fund additional clinical trials to continue the advancement of the Company’s product candidates; the timing of and the Company’s ability to obtain and maintain U.S. Food and Drug Administration (“FDA”) or other regulatory authority approval of, or other action with respect to, the Company’s product candidates, including statements regarding the timing of any NDA submission; the Company’s ability to successfully defend its intellectual property or obtain the necessary licenses at a cost acceptable to the Company, if at all; the Company’s ability to successfully resolve any intellectual property litigation, and even if such disputes are settled, whether the applicable federal agencies will approve of such settlements; the successful implementation of the Company’s research and development programs and collaborations; the success of the Company’s license agreements; the acceptance by the market of the Company’s products and product candidates, if approved; the Company’s anticipated capital requirements, including the amount of capital required for the commercialization of SUNOSI, AUVELITY, and SYMBRAVO and for the Company’s commercial launch of its other product candidates, if approved, and the potential impact on the Company’s anticipated cash runway; the Company’s ability to convert sales to recognized revenue and maintain a favorable gross to net sales; unforeseen circumstances or other disruptions to normal business operations arising from or related to domestic political climate, geo-political conflicts or a global pandemic and other factors, including general economic conditions and regulatory developments, not within the Company’s control. The factors discussed herein could cause actual results and developments to be materially different from those expressed in or implied by such statements. The forward-looking statements are made only as of the date of this presentation and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. This presentation contains statements regarding the Company’s observations based upon the reported clinical data. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about the Company's industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, these projections, assumptions and estimates are necessarily subject to a high degree of uncertainty and risk. Axsome, AUVELITY, SUNOSI, SYMBRAVO, and MoSEIC, are trademarks or registered trademarks of Axsome Therapeutics, Inc. or its affiliates. Except as with respect to AUVELITY and SUNOSI for their approved indications, the development products referenced herein have not been approved by the FDA.

Our Mission Develop and deliver transformative medicines for the hundreds of millions of people impacted by central nervous system conditions

Develop first-in-class or best-in-class medicines Enabled by clinical research and regulatory innovation Deliver novel mechanisms of action Apply precision approaches in novel, underserved indications Leverage our deep expertise in neuroscience How we drive innovation in brain health

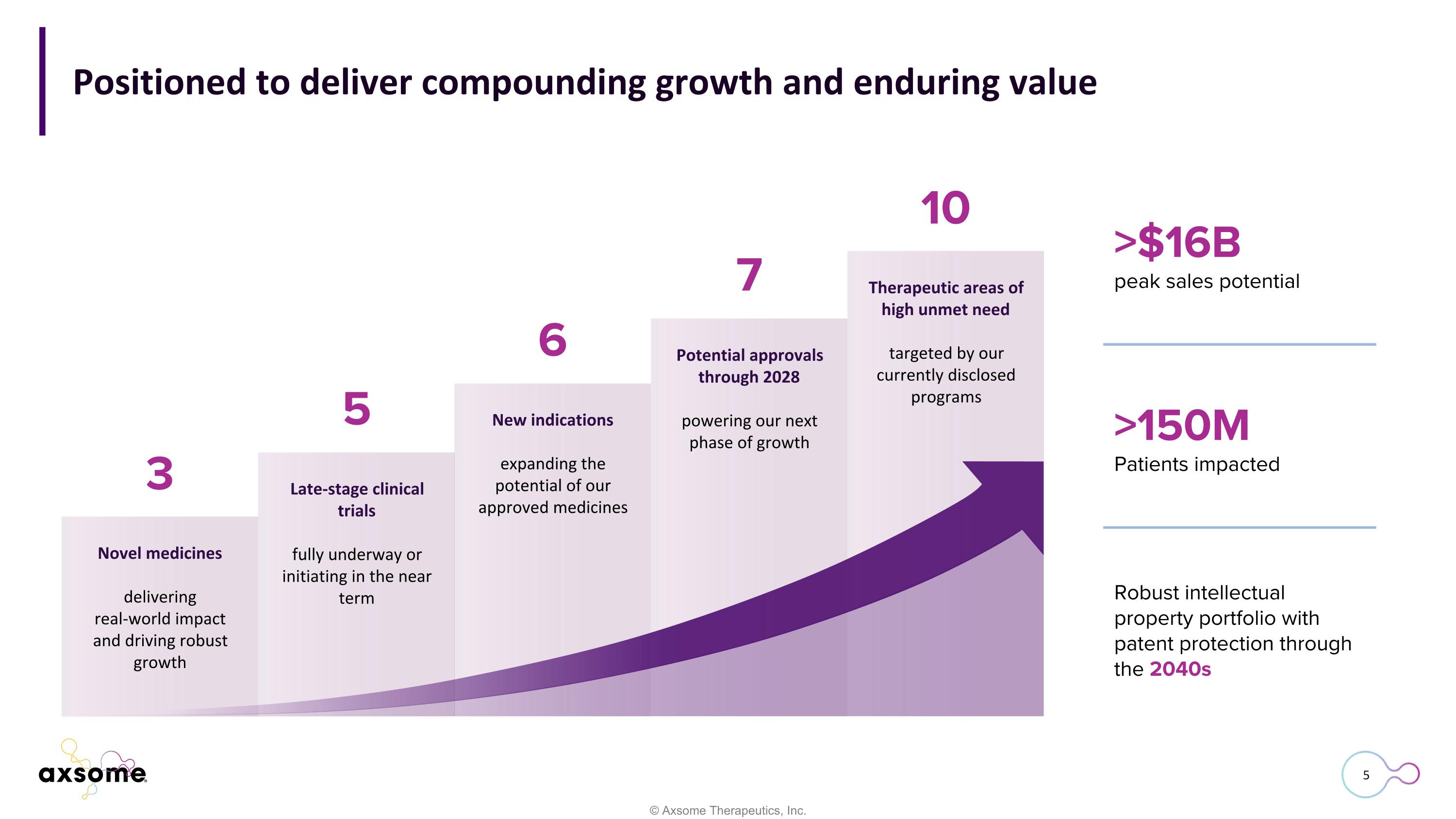

Positioned to deliver compounding growth and enduring value Novel medicines delivering real-world impact and driving robust growth Late-stage clinical trials fully underway or initiating in the near term New indications expanding the potential of our approved medicines Potential approvals through 2028 powering our next phase of growth Therapeutic areas of high unmet need targeted by our currently disclosed programs 3 5 6 7 10 >$16B peak sales potential Robust intellectual property portfolio with patent protection through the 2040s >150M Patients impacted

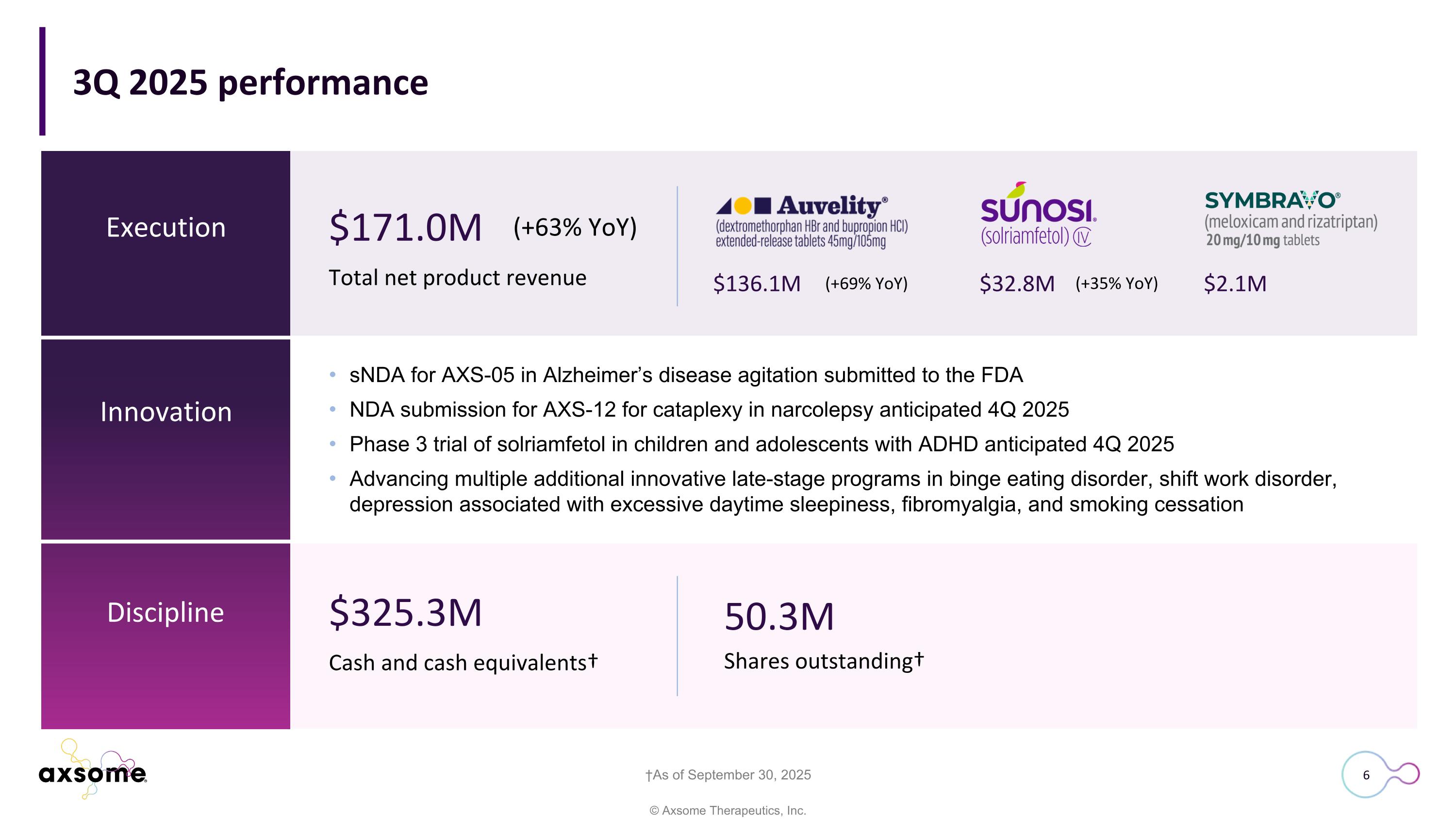

3Q 2025 performance Innovation Discipline Execution sNDA for AXS-05 in Alzheimer’s disease agitation submitted to the FDA NDA submission for AXS-12 for cataplexy in narcolepsy anticipated 4Q 2025 Phase 3 trial of solriamfetol in children and adolescents with ADHD anticipated 4Q 2025 Advancing multiple additional innovative late-stage programs in binge eating disorder, shift work disorder, depression associated with excessive daytime sleepiness, fibromyalgia, and smoking cessation †As of September 30, 2025 Total net product revenue $171.0M $2.1M (+63% YoY) $136.1M (+69% YoY) $32.8M (+35% YoY) Shares outstanding† 50.3M Cash and cash equivalents† $325.3M

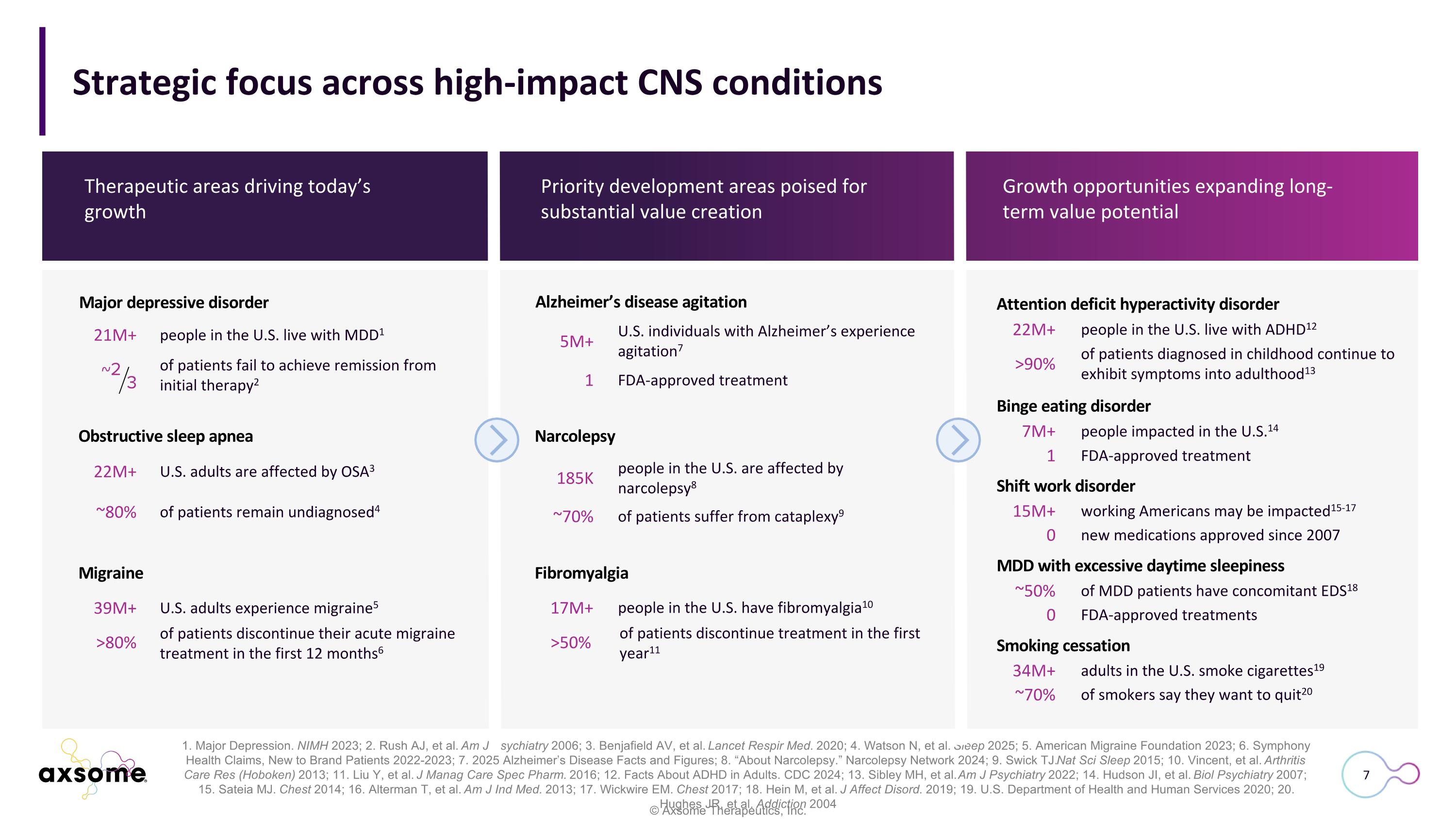

>50% people in the U.S. have fibromyalgia10 39M+ 17M+ Strategic focus across high-impact CNS conditions 1. Major Depression. NIMH 2023; 2. Rush AJ, et al. Am J Psychiatry 2006; 3. Benjafield AV, et al. Lancet Respir Med. 2020; 4. Watson N, et al. Sleep 2025; 5. American Migraine Foundation 2023; 6. Symphony Health Claims, New to Brand Patients 2022-2023; 7. 2025 Alzheimer’s Disease Facts and Figures; 8. “About Narcolepsy.” Narcolepsy Network 2024; 9. Swick TJ. Nat Sci Sleep 2015; 10. Vincent, et al. Arthritis Care Res (Hoboken) 2013; 11. Liu Y, et al. J Manag Care Spec Pharm. 2016; 12. Facts About ADHD in Adults. CDC 2024; 13. Sibley MH, et al. Am J Psychiatry 2022; 14. Hudson JI, et al. Biol Psychiatry 2007; 15. Sateia MJ. Chest 2014; 16. Alterman T, et al. Am J Ind Med. 2013; 17. Wickwire EM. Chest 2017; 18. Hein M, et al. J Affect Disord. 2019; 19. U.S. Department of Health and Human Services 2020; 20. Hughes JR, et al. Addiction 2004 Therapeutic areas driving today’s growth Priority development areas poised for substantial value creation Growth opportunities expanding long-term value potential Major depressive disorder 21M+ ~ people in the U.S. live with MDD1 of patients fail to achieve remission from initial therapy2 Obstructive sleep apnea 22M+ ~80% U.S. adults are affected by OSA3 of patients remain undiagnosed4 Migraine >80% U.S. adults experience migraine5 of patients discontinue their acute migraine treatment in the first 12 months6 Alzheimer’s disease agitation 5M+ 1 U.S. individuals with Alzheimer’s experience agitation7 FDA-approved treatment Narcolepsy 185K ~70% people in the U.S. are affected by narcolepsy8 of patients suffer from cataplexy9 Shift work disorder 15M+ 0 working Americans may be impacted15-17 new medications approved since 2007 Smoking cessation 34M+ ~70% adults in the U.S. smoke cigarettes19 of smokers say they want to quit20 Fibromyalgia of patients discontinue treatment in the first year11 MDD with excessive daytime sleepiness ~50% 0 of MDD patients have concomitant EDS18 FDA-approved treatments Attention deficit hyperactivity disorder 22M+ >90% people in the U.S. live with ADHD12 of patients diagnosed in childhood continue to exhibit symptoms into adulthood13 7M+ people impacted in the U.S.14 Binge eating disorder FDA-approved treatment 1

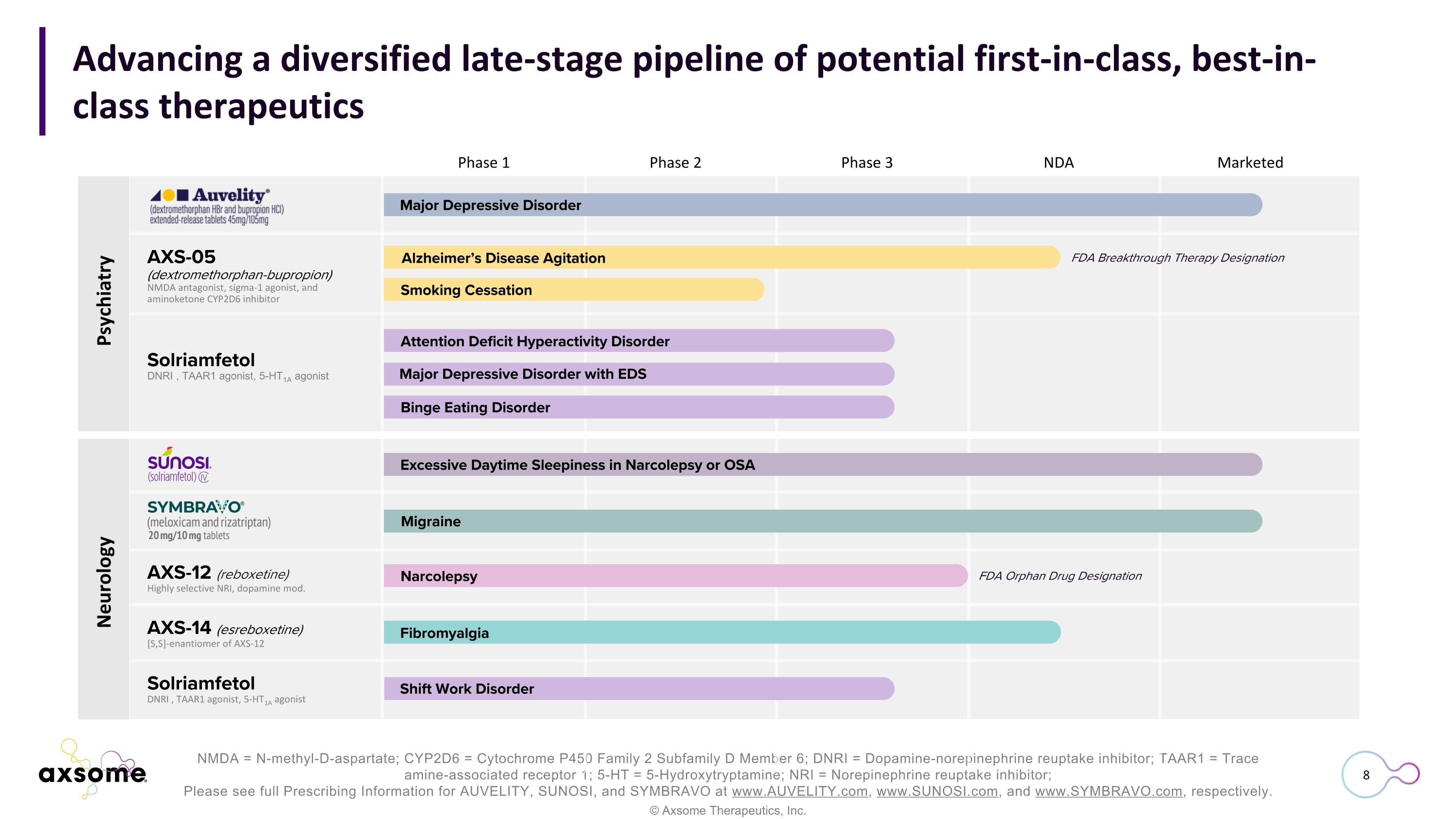

NMDA = N-methyl-D-aspartate; CYP2D6 = Cytochrome P450 Family 2 Subfamily D Member 6; DNRI = Dopamine-norepinephrine reuptake inhibitor; TAAR1 = Trace amine-associated receptor 1; 5-HT = 5-Hydroxytryptamine; NRI = Norepinephrine reuptake inhibitor; Please see full Prescribing Information for AUVELITY, SUNOSI, and SYMBRAVO at www.AUVELITY.com, www.SUNOSI.com, and www.SYMBRAVO.com, respectively. Phase 1 Phase 2 Phase 3 NDA Marketed Advancing a diversified late-stage pipeline of potential first-in-class, best-in-class therapeutics FDA Breakthrough Therapy Designation FDA Orphan Drug Designation Major Depressive Disorder Alzheimer’s Disease Agitation Smoking Cessation Attention Deficit Hyperactivity Disorder Binge Eating Disorder Major Depressive Disorder with EDS Excessive Daytime Sleepiness in Narcolepsy or OSA Migraine Narcolepsy Fibromyalgia Shift Work Disorder Psychiatry Neurology AXS-05 (dextromethorphan-bupropion) NMDA antagonist, sigma-1 agonist, and aminoketone CYP2D6 inhibitor Solriamfetol DNRI , TAAR1 agonist, 5-HT1A agonist AXS-12 (reboxetine) Highly selective NRI, dopamine mod. AXS-14 (esreboxetine) [S,S]-enantiomer of AXS-12 Solriamfetol DNRI , TAAR1 agonist, 5-HT1A agonist

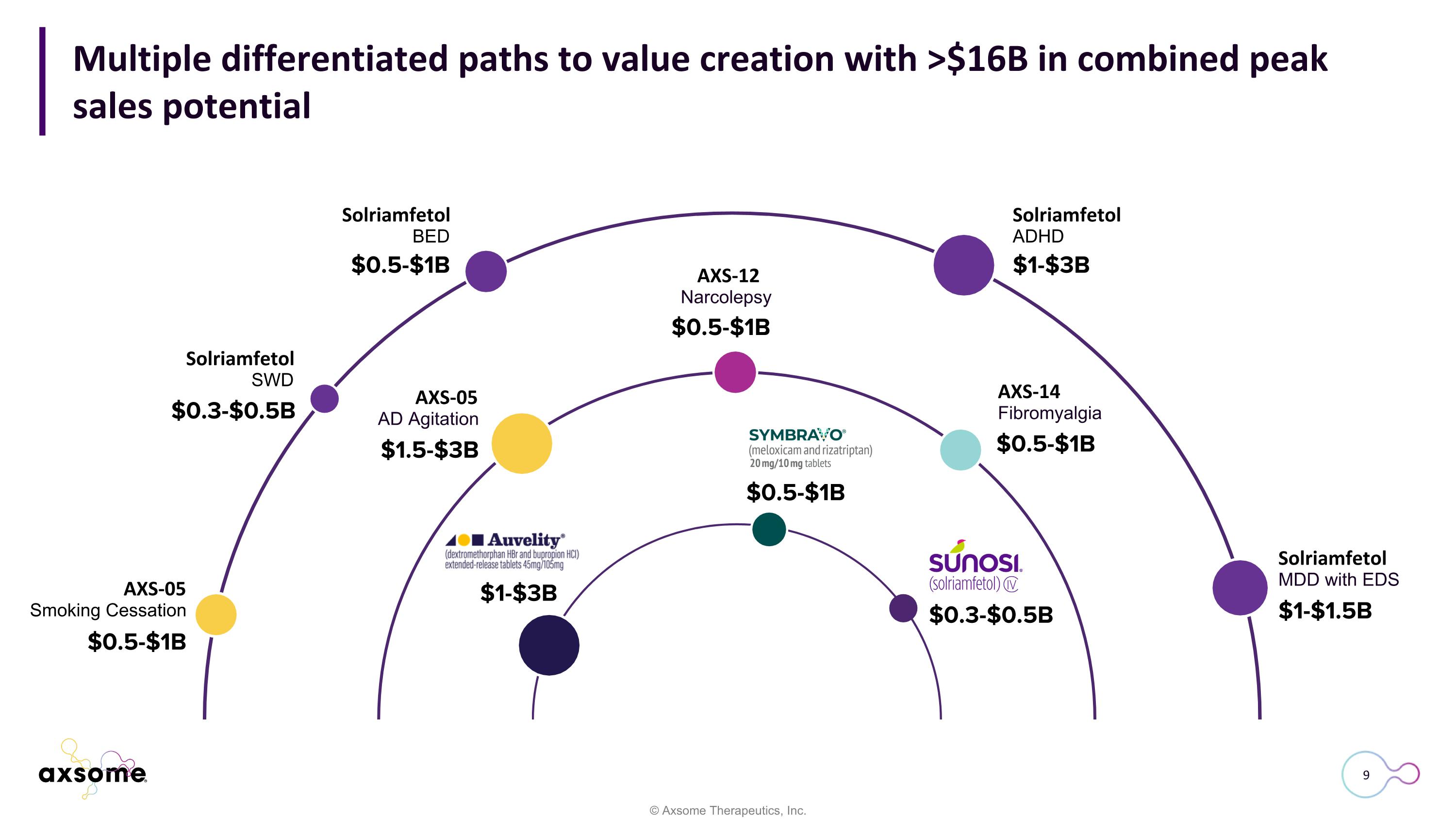

Multiple differentiated paths to value creation with >$16B in combined peak sales potential AXS-05 AD Agitation $0.5-$1B AXS-14 Fibromyalgia AXS-12 Narcolepsy $0.5-$1B $1.5-$3B Solriamfetol MDD with EDS Solriamfetol ADHD $1-$3B $0.5-$1B Solriamfetol BED $0.3-$0.5B Solriamfetol SWD $0.5-$1B AXS-05 Smoking Cessation $1-$1.5B $0.3-$0.5B $1-$3B $0.5-$1B

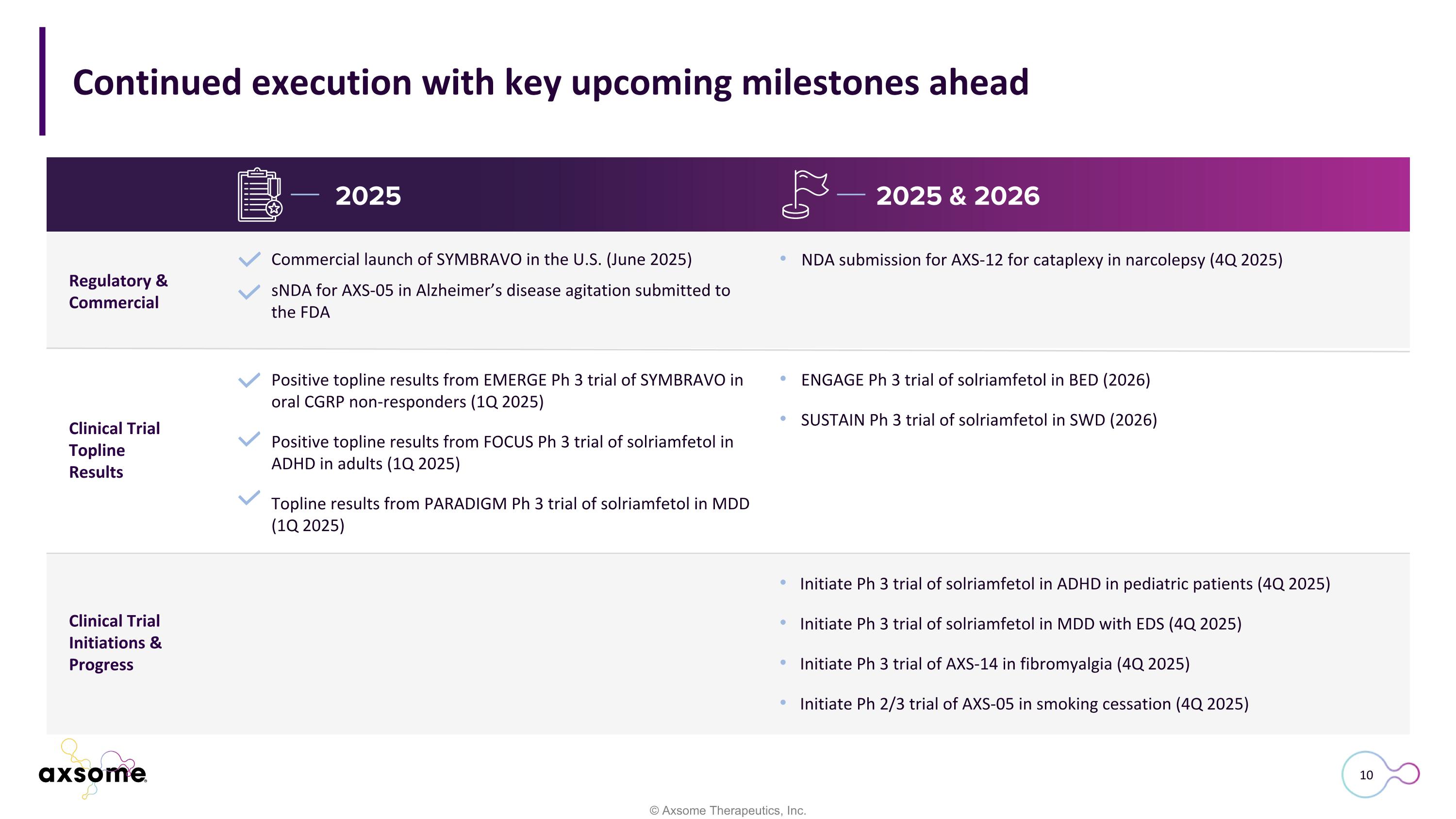

Continued execution with key upcoming milestones ahead 2025 & 2026 Clinical Trial Topline Results Clinical Trial Initiations & Progress Positive topline results from EMERGE Ph 3 trial of SYMBRAVO in oral CGRP non-responders (1Q 2025) Positive topline results from FOCUS Ph 3 trial of solriamfetol in ADHD in adults (1Q 2025) Topline results from PARADIGM Ph 3 trial of solriamfetol in MDD (1Q 2025) ENGAGE Ph 3 trial of solriamfetol in BED (2026) SUSTAIN Ph 3 trial of solriamfetol in SWD (2026) 2025 Initiate Ph 3 trial of solriamfetol in ADHD in pediatric patients (4Q 2025) Initiate Ph 3 trial of solriamfetol in MDD with EDS (4Q 2025) Initiate Ph 3 trial of AXS-14 in fibromyalgia (4Q 2025) Initiate Ph 2/3 trial of AXS-05 in smoking cessation (4Q 2025) Commercial launch of SYMBRAVO in the U.S. (June 2025) sNDA for AXS-05 in Alzheimer’s disease agitation submitted to the FDA NDA submission for AXS-12 for cataplexy in narcolepsy (4Q 2025) Regulatory & Commercial

Shaping the frontier of differentiated innovation in brain health

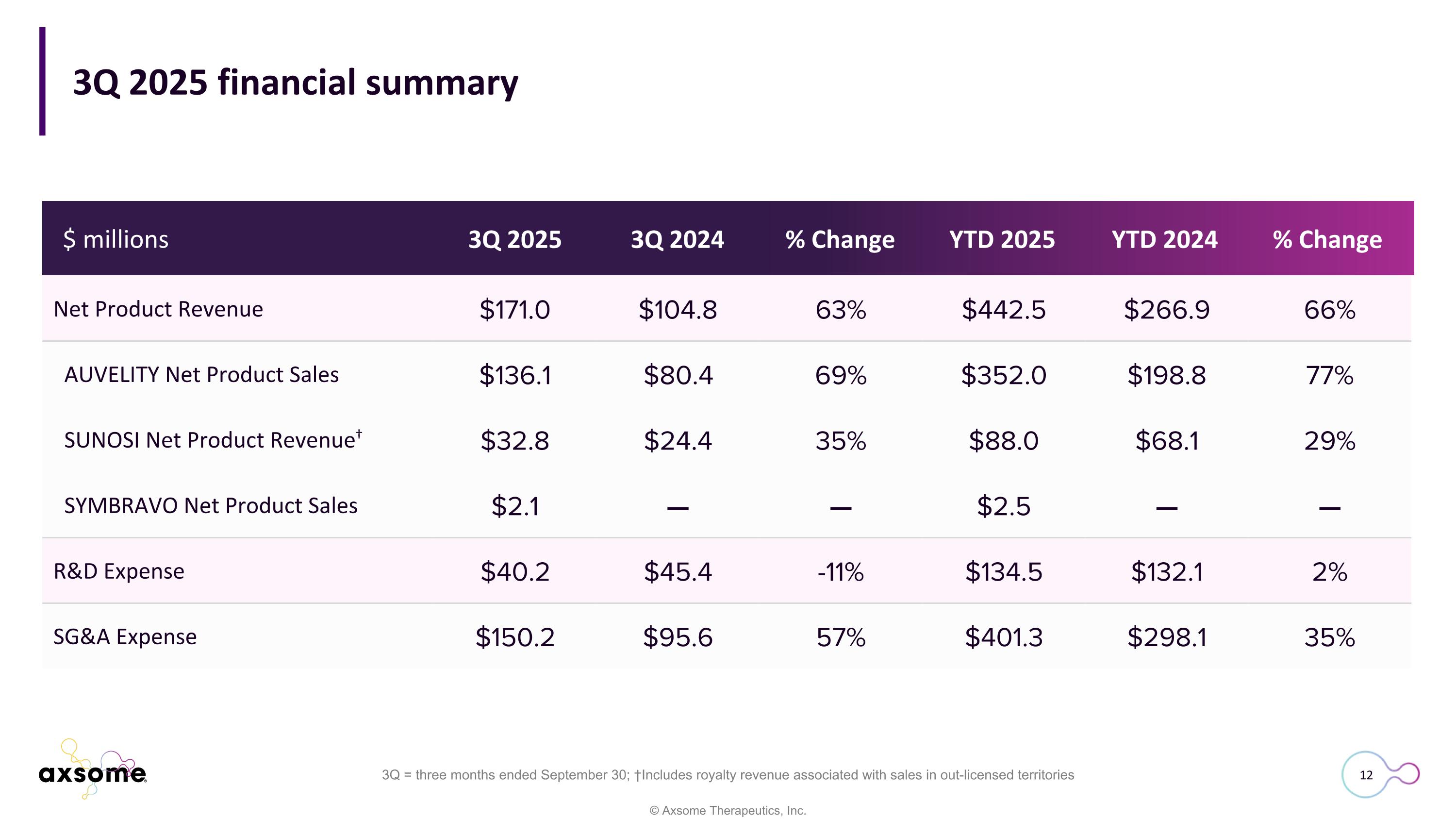

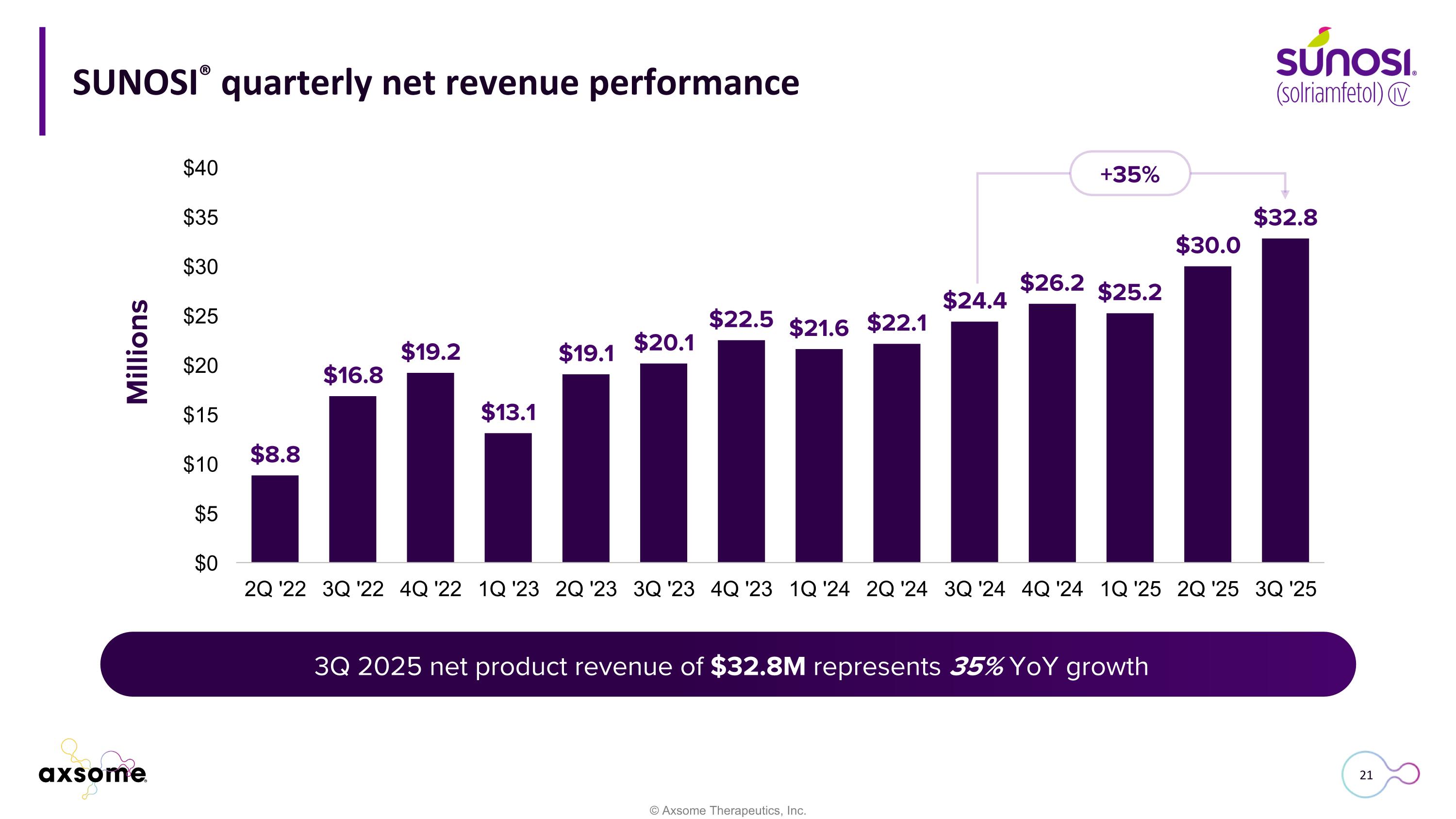

3Q 2025 financial summary 3Q = three months ended September 30; †Includes royalty revenue associated with sales in out-licensed territories Net Product Revenue $171.0 $104.8 63% $442.5 $266.9 66% AUVELITY Net Product Sales $136.1 $80.4 69% $352.0 $198.8 77% SUNOSI Net Product Revenue† $32.8 $24.4 35% $88.0 $68.1 29% SYMBRAVO Net Product Sales $2.1 — — $2.5 — — R&D Expense $40.2 $45.4 -11% $134.5 $132.1 2% SG&A Expense $150.2 $95.6 57% $401.3 $298.1 35% 3Q 2025 3Q 2024 % Change YTD 2025 YTD 2024 % Change $ millions

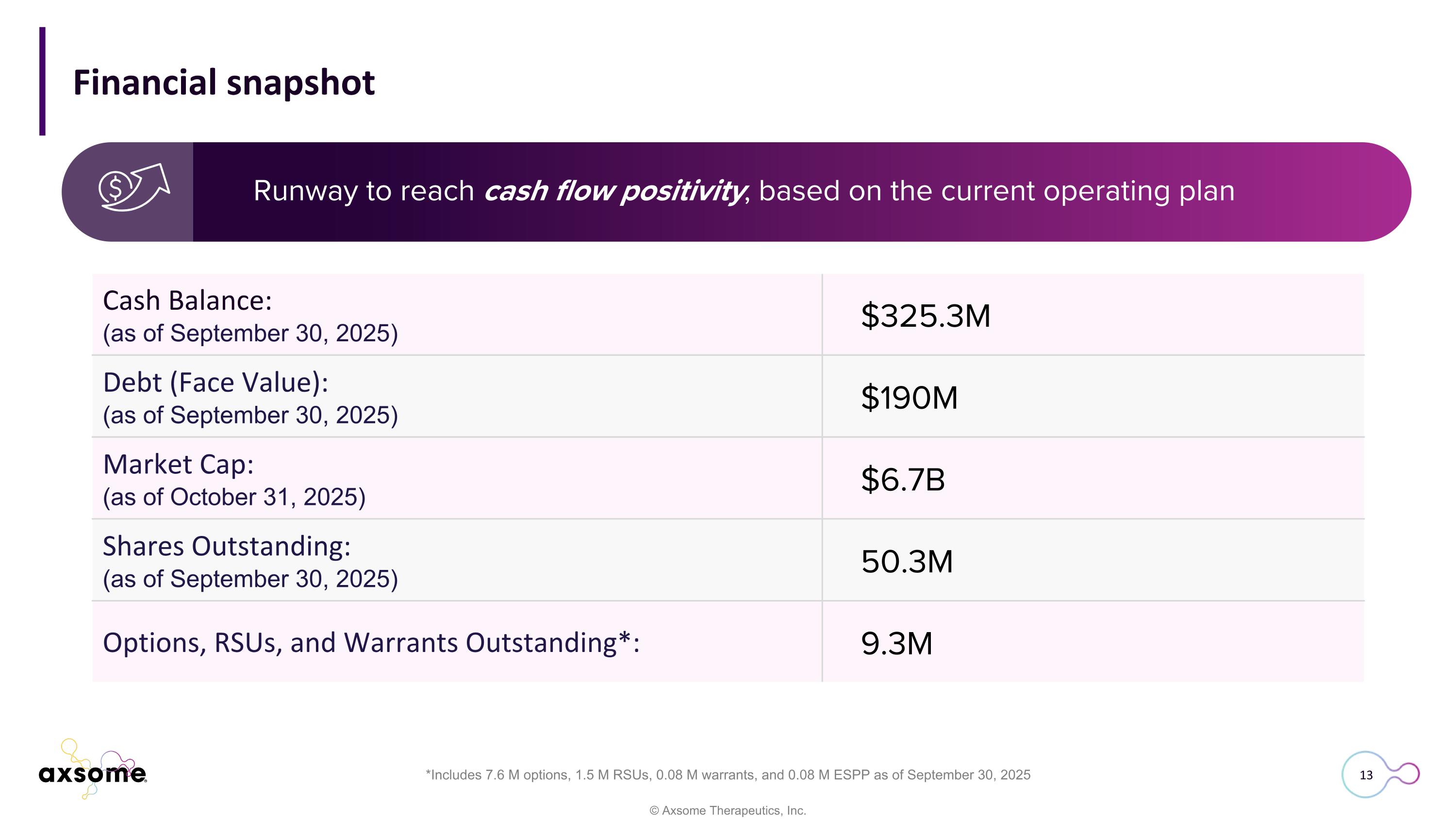

Cash Balance: (as of September 30, 2025) $325.3M Debt (Face Value): (as of September 30, 2025) $190M Market Cap: (as of October 31, 2025) $6.7B Shares Outstanding: (as of September 30, 2025) 50.3M Options, RSUs, and Warrants Outstanding*: 9.3M Runway to reach cash flow positivity, based on the current operating plan Financial snapshot *Includes 7.6 M options, 1.5 M RSUs, 0.08 M warrants, and 0.08 M ESPP as of September 30, 2025

Commercial Highlights

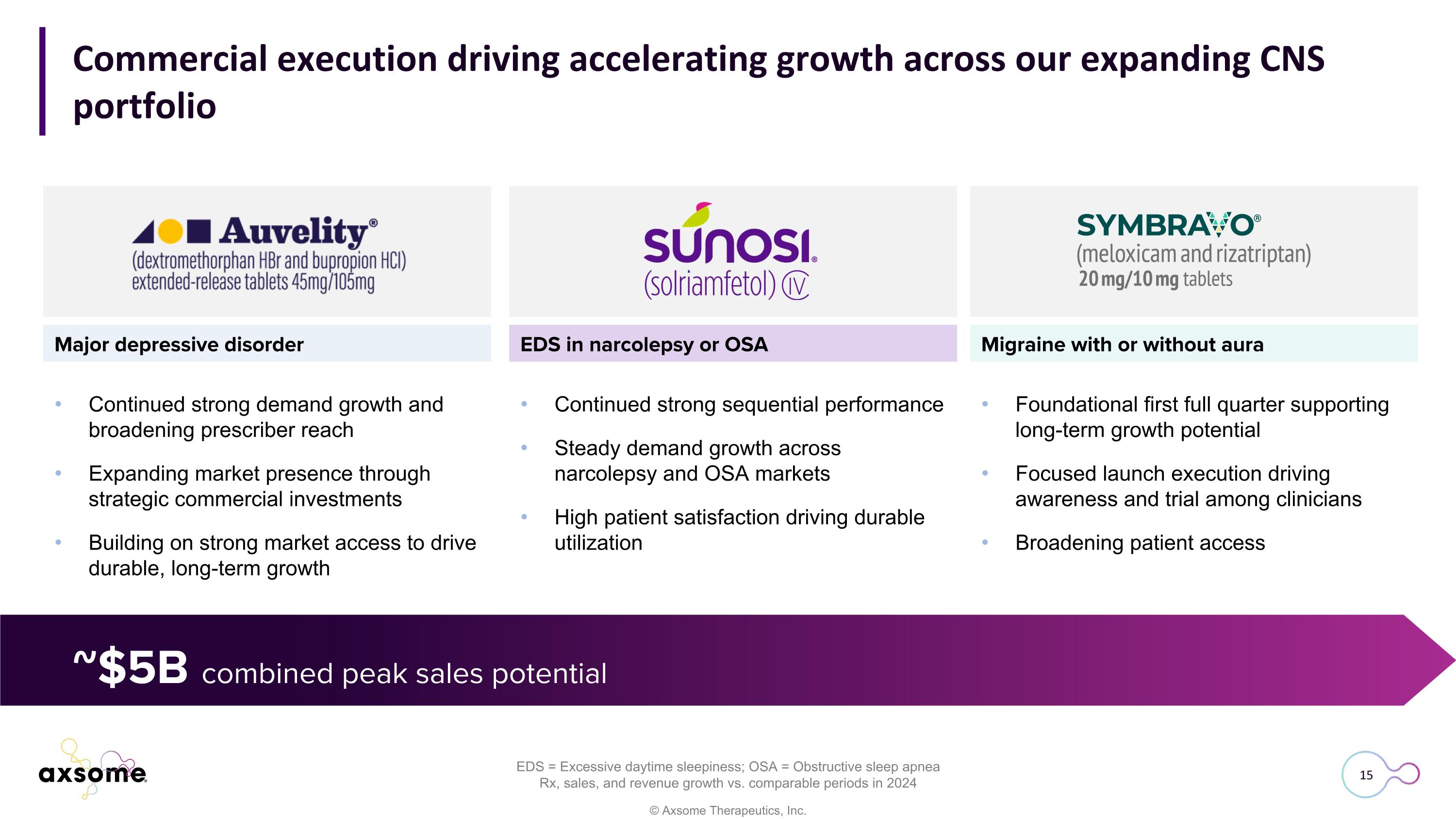

Commercial execution driving accelerating growth across our expanding CNS portfolio EDS = Excessive daytime sleepiness; OSA = Obstructive sleep apnea Rx, sales, and revenue growth vs. comparable periods in 2024 ~$5B combined peak sales potential Continued strong demand growth and broadening prescriber reach Expanding market presence through strategic commercial investments Building on strong market access to drive durable, long-term growth Migraine with or without aura Major depressive disorder EDS in narcolepsy or OSA Continued strong sequential performance Steady demand growth across narcolepsy and OSA markets High patient satisfaction driving durable utilization Foundational first full quarter supporting long-term growth potential Focused launch execution driving awareness and trial among clinicians Broadening patient access

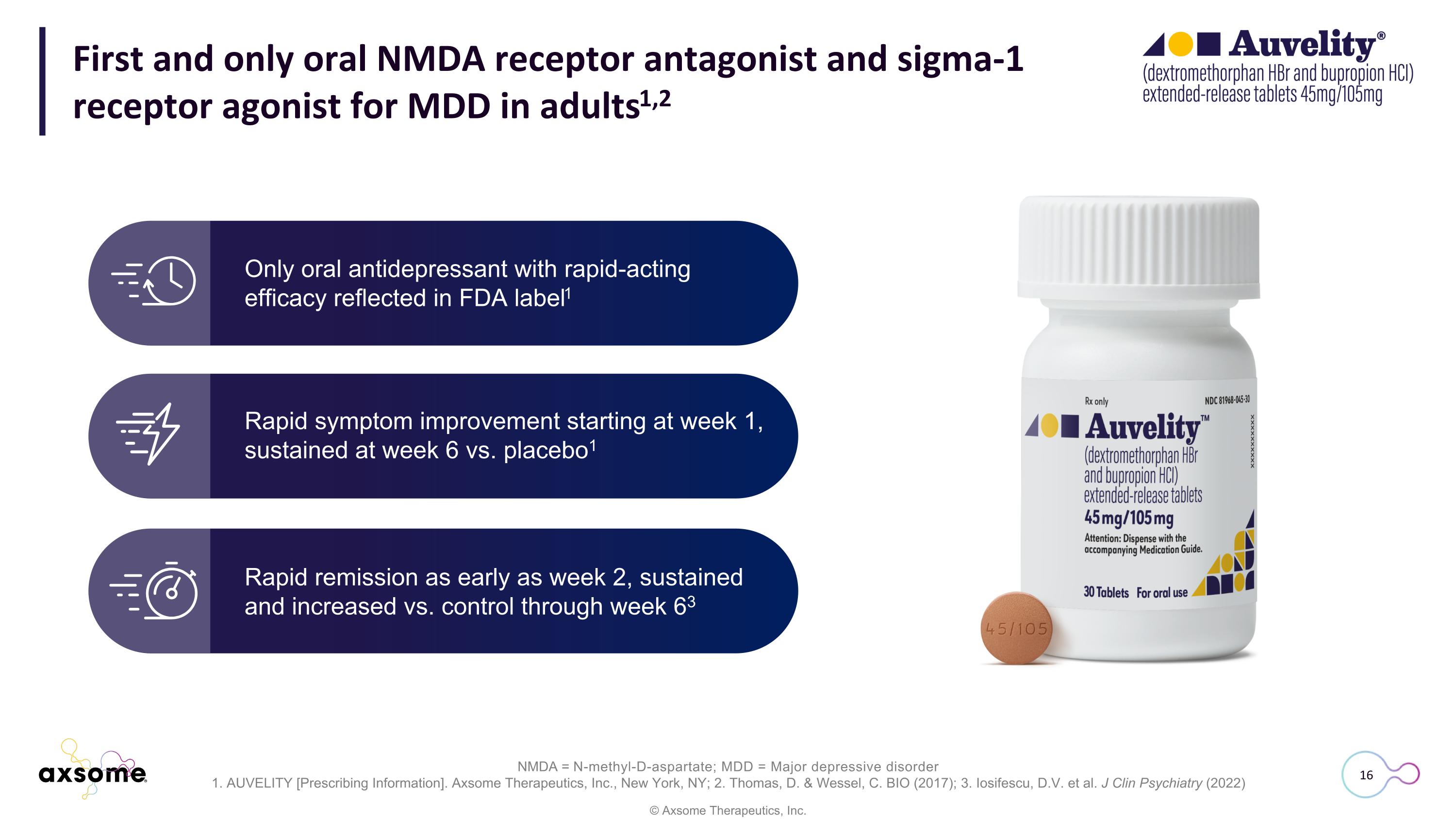

First and only oral NMDA receptor antagonist and sigma-1 receptor agonist for MDD in adults1,2 NMDA = N-methyl-D-aspartate; MDD = Major depressive disorder 1. AUVELITY [Prescribing Information]. Axsome Therapeutics, Inc., New York, NY; 2. Thomas, D. & Wessel, C. BIO (2017); 3. Iosifescu, D.V. et al. J Clin Psychiatry (2022) Only oral antidepressant with rapid-acting efficacy reflected in FDA label1 Rapid remission as early as week 2, sustained and increased vs. control through week 63 Rapid symptom improvement starting at week 1, sustained at week 6 vs. placebo1

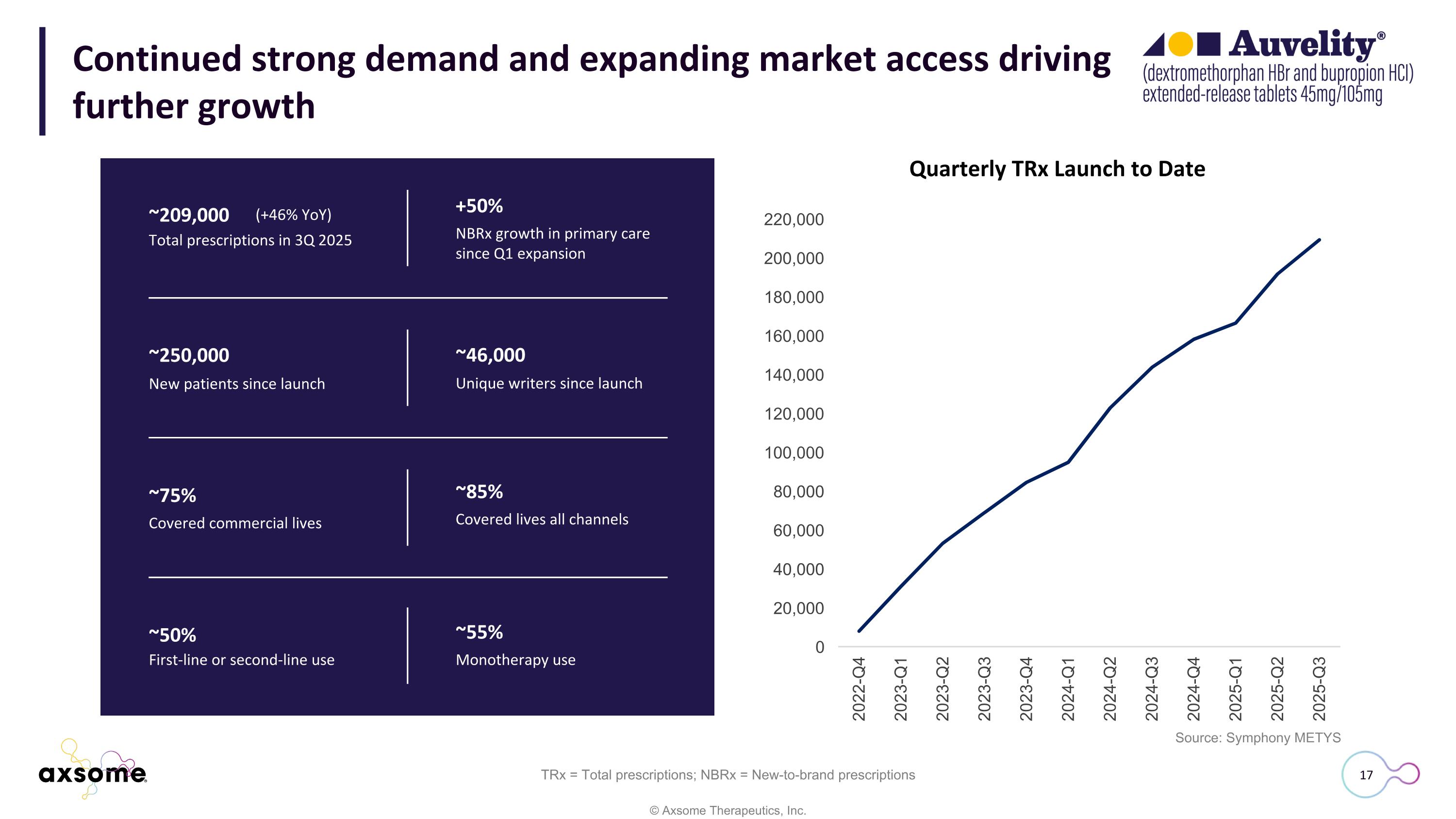

Source: Symphony METYS Quarterly TRx Launch to Date Continued strong demand and expanding market access driving further growth TRx = Total prescriptions; NBRx = New-to-brand prescriptions +50% NBRx growth in primary care since Q1 expansion ~250,000 New patients since launch ~46,000 Unique writers since launch ~75% Covered commercial lives ~50% First-line or second-line use ~55% Monotherapy use ~85% Covered lives all channels ~209,000 Total prescriptions in 3Q 2025 (+46% YoY)

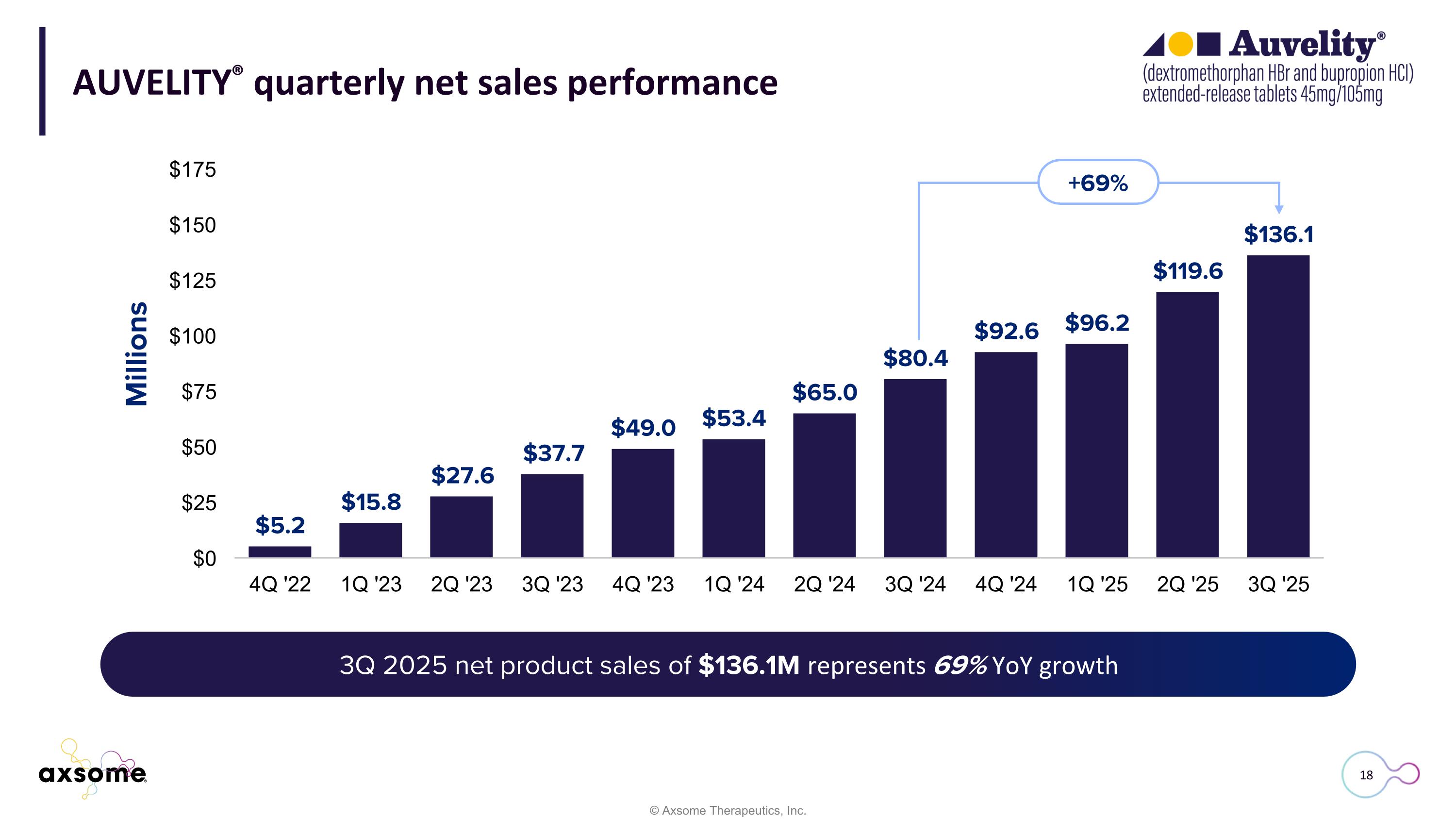

AUVELITY® quarterly net sales performance 3Q 2025 net product sales of $136.1M represents 69% YoY growth +69%

First and only wakefulness promoting agent proven to improve wakefulness through 9 hours1 Improvements in cognitive functioning vs. placebo demonstrated in clinical trials 90% of patients reported feeling better with SUNOSI 150 mg2 First and only dopamine and norepinephrine reuptake inhibitor for EDS associated with narcolepsy or OSA1 EDS = Excessive daytime sleepiness; OSA = Obstructive sleep apnea; DNRI = Dopamine-norepinephrine reuptake inhibitor 1. SUNOSI [Prescribing Information]. Axsome Therapeutics, Inc., New York, NY; 2. Schweitzer, P.K. et al. Am J Resp Crit Care Med. (2019)

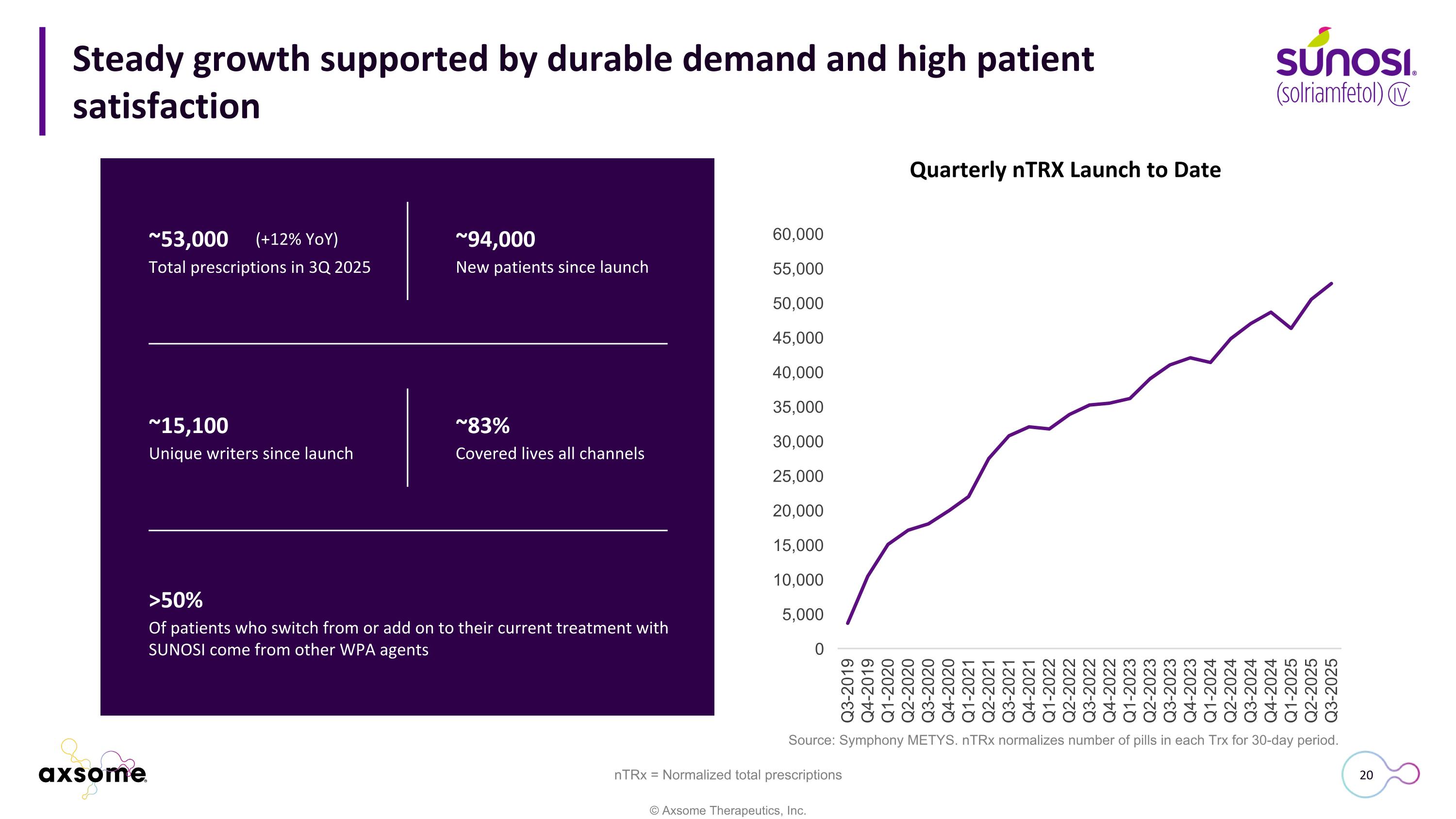

Quarterly nTRX Launch to Date Steady growth supported by durable demand and high patient satisfaction nTRx = Normalized total prescriptions ~94,000 New patients since launch ~15,100 Unique writers since launch ~83% Covered lives all channels Source: Symphony METYS. nTRx normalizes number of pills in each Trx for 30-day period. >50% Of patients who switch from or add on to their current treatment with SUNOSI come from other WPA agents ~53,000 Total prescriptions in 3Q 2025 (+12% YoY)

SUNOSI® quarterly net revenue performance 3Q 2025 net product revenue of $32.8M represents 35% YoY growth +35%

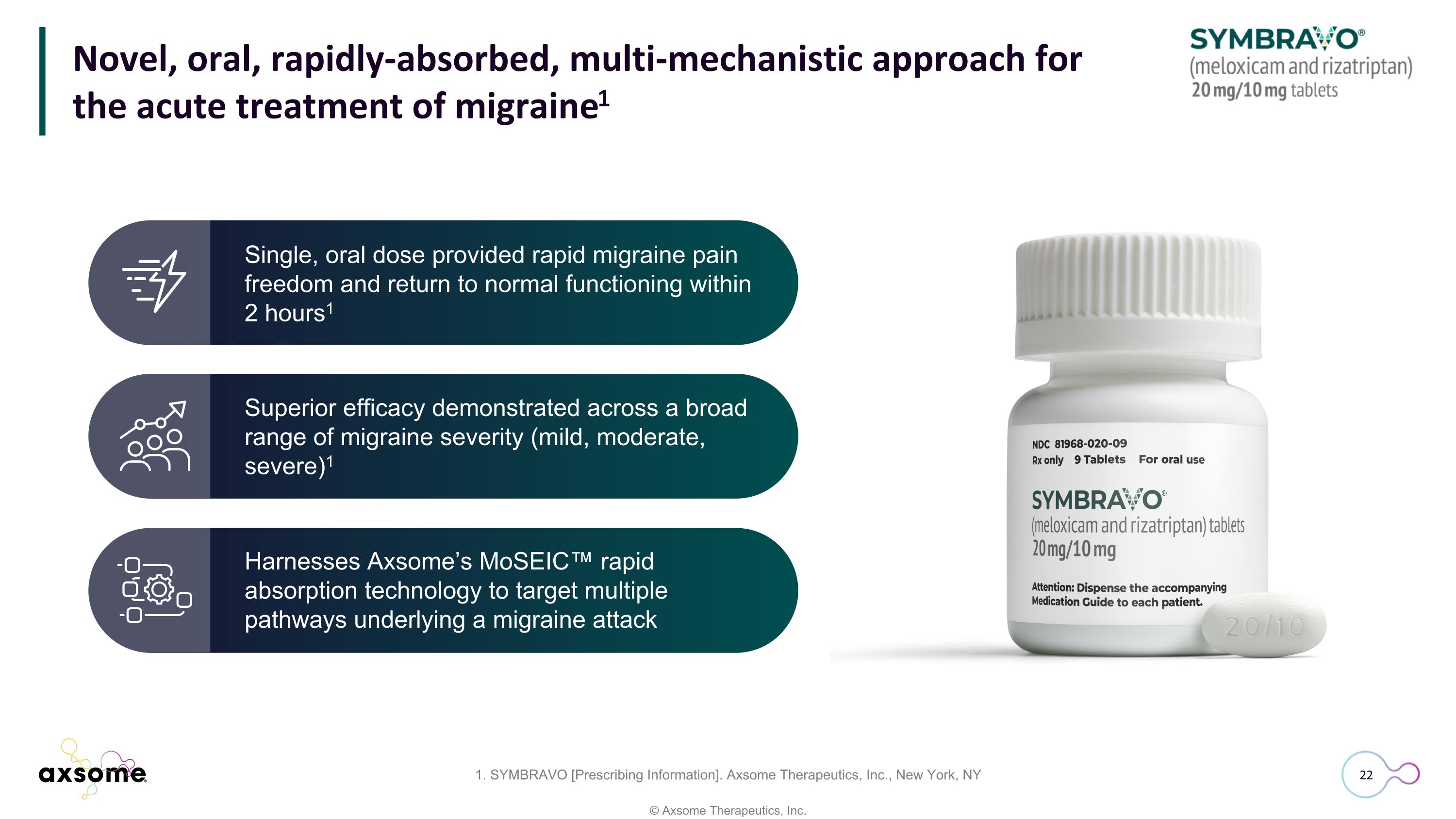

Single, oral dose provided rapid migraine pain freedom and return to normal functioning within 2 hours1 Harnesses Axsome’s MoSEIC™ rapid absorption technology to target multiple pathways underlying a migraine attack Superior efficacy demonstrated across a broad range of migraine severity (mild, moderate, severe)1 Novel, oral, rapidly-absorbed, multi-mechanistic approach for the acute treatment of migraine1 1. SYMBRAVO [Prescribing Information]. Axsome Therapeutics, Inc., New York, NY

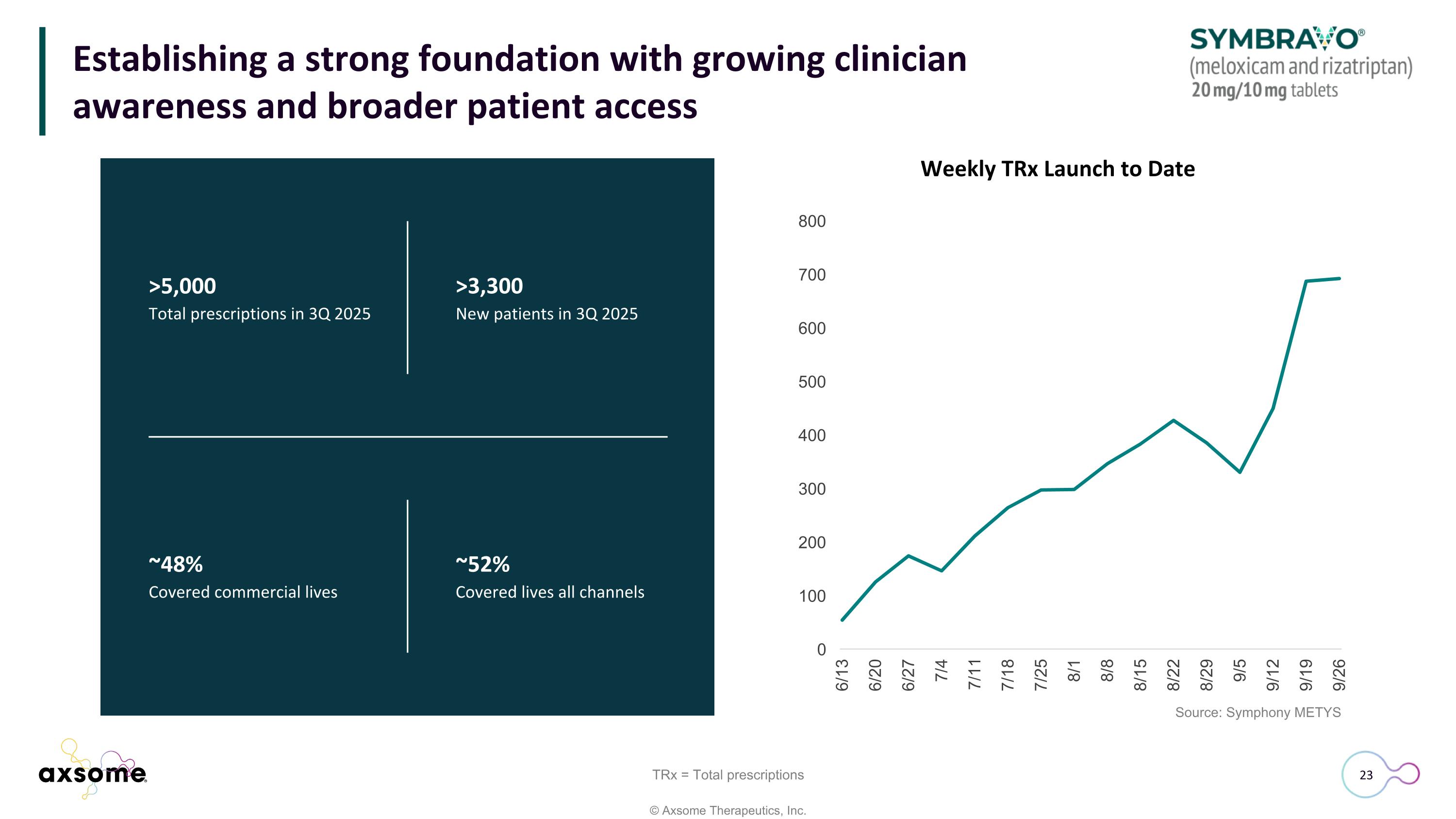

Establishing a strong foundation with growing clinician awareness and broader patient access TRx = Total prescriptions Weekly TRx Launch to Date Source: Symphony METYS >5,000 Total prescriptions in 3Q 2025 >3,300 New patients in 3Q 2025 ~48% Covered commercial lives ~52% Covered lives all channels

Development Pipeline

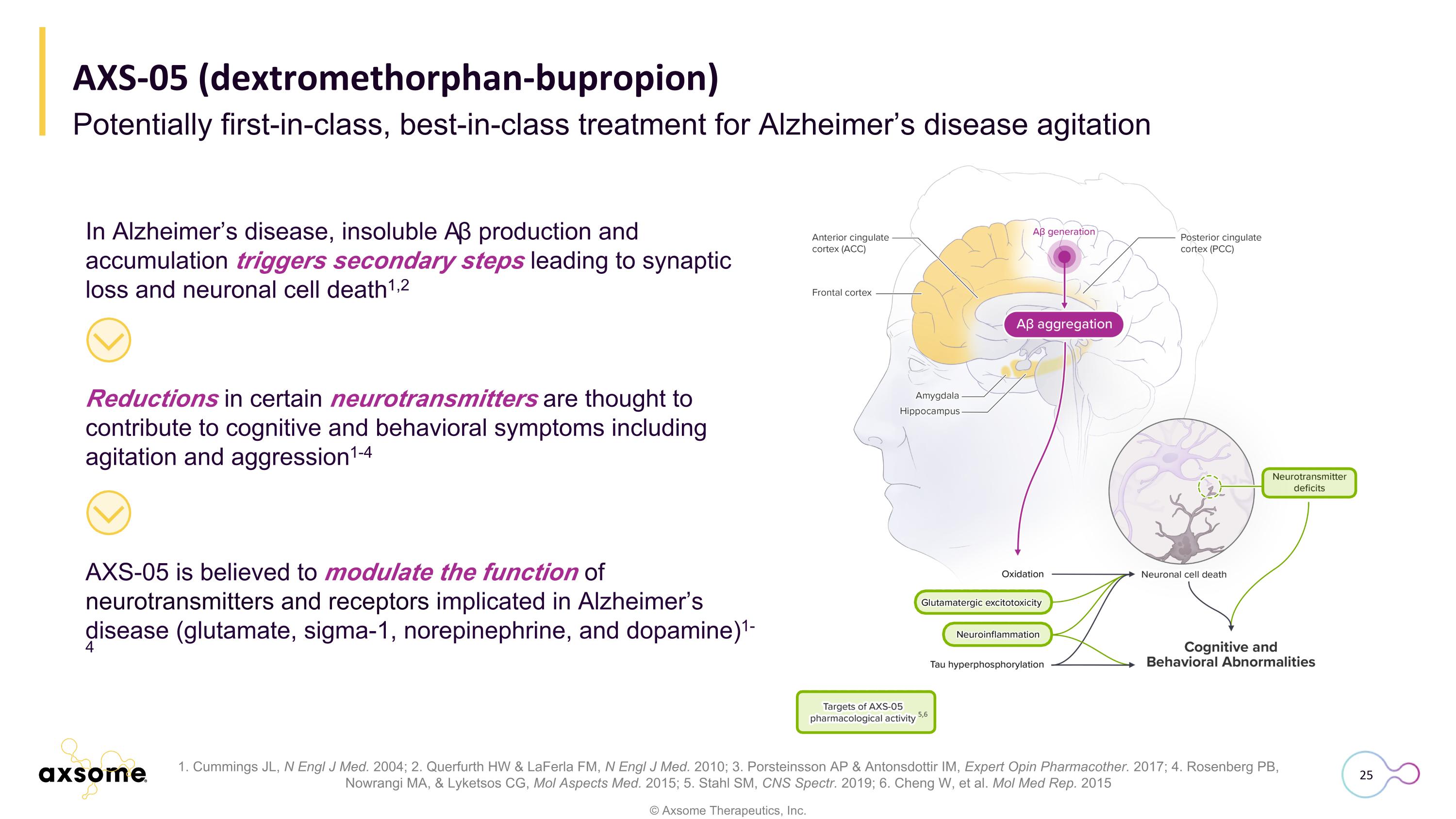

AXS-05 is believed to modulate the function of neurotransmitters and receptors implicated in Alzheimer’s disease (glutamate, sigma-1, norepinephrine, and dopamine)1-4 In Alzheimer’s disease, insoluble Aβ production and accumulation triggers secondary steps leading to synaptic loss and neuronal cell death1,2 Reductions in certain neurotransmitters are thought to contribute to cognitive and behavioral symptoms including agitation and aggression1-4 Potentially first-in-class, best-in-class treatment for Alzheimer’s disease agitation AXS-05 (dextromethorphan-bupropion) 1. Cummings JL, N Engl J Med. 2004; 2. Querfurth HW & LaFerla FM, N Engl J Med. 2010; 3. Porsteinsson AP & Antonsdottir IM, Expert Opin Pharmacother. 2017; 4. Rosenberg PB, Nowrangi MA, & Lyketsos CG, Mol Aspects Med. 2015; 5. Stahl SM, CNS Spectr. 2019; 6. Cheng W, et al. Mol Med Rep. 2015 5,6

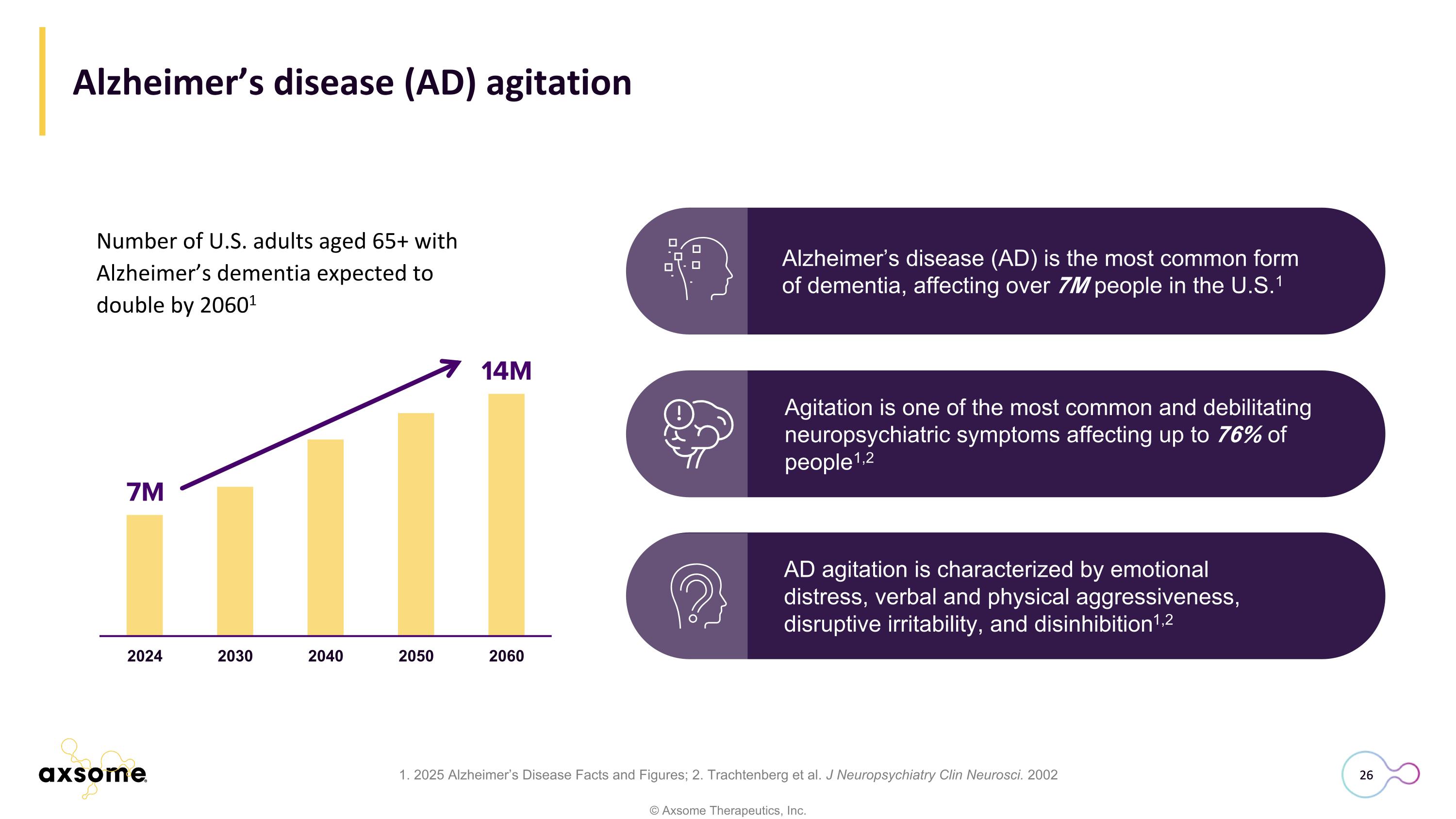

Alzheimer’s disease (AD) agitation 1. 2025 Alzheimer’s Disease Facts and Figures; 2. Trachtenberg et al. J Neuropsychiatry Clin Neurosci. 2002 Number of U.S. adults aged 65+ with Alzheimer’s dementia expected to double by 20601 26 Alzheimer’s disease (AD) is the most common form of dementia, affecting over 7M people in the U.S.1 AD agitation is characterized by emotional distress, verbal and physical aggressiveness, disruptive irritability, and disinhibition1,2 Agitation is one of the most common and debilitating neuropsychiatric symptoms affecting up to 76% of people1,2

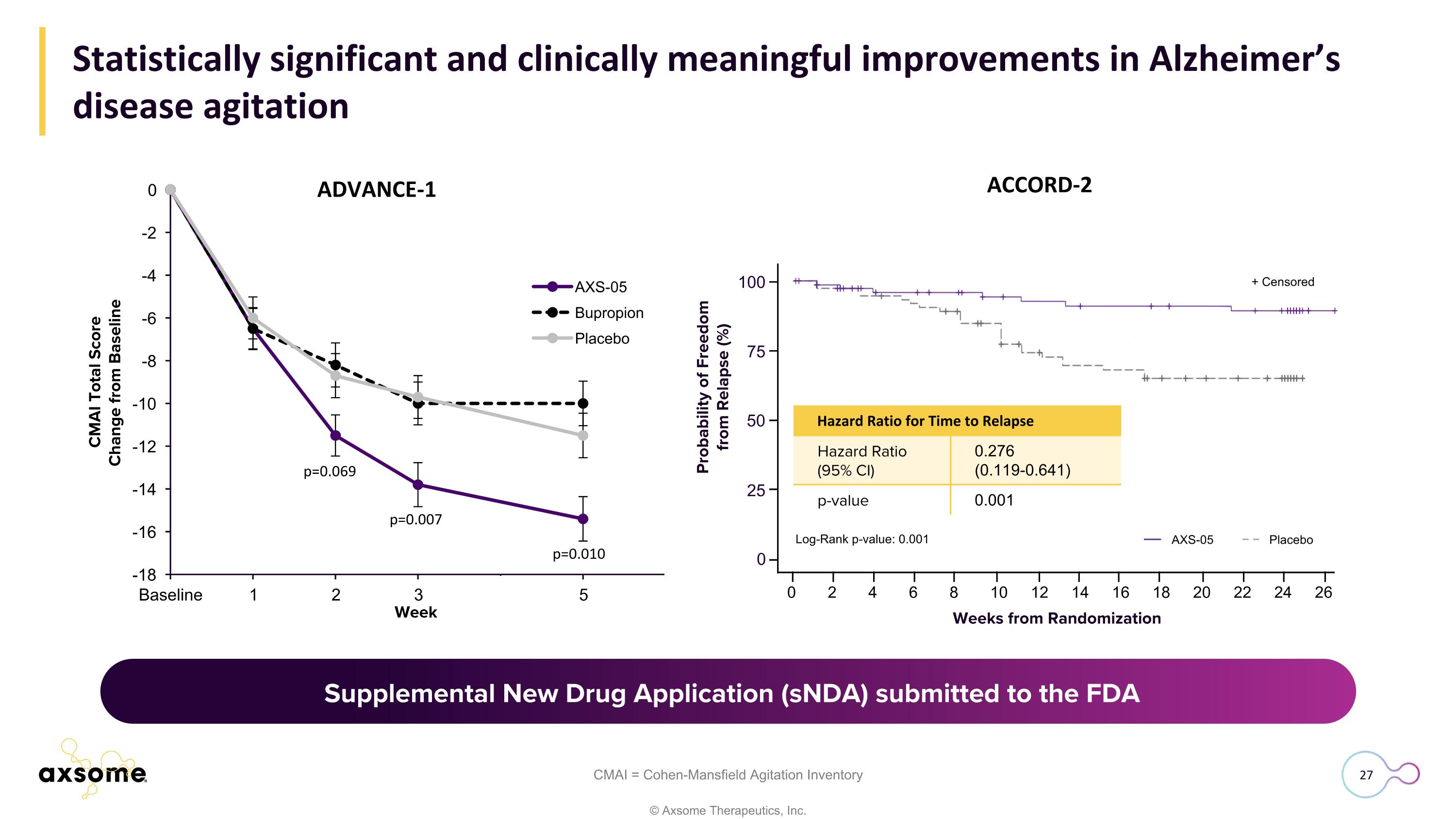

Statistically significant and clinically meaningful improvements in Alzheimer’s disease agitation CMAI = Cohen-Mansfield Agitation Inventory p=0.069 p=0.007 p=0.010 0 Weeks from Randomization Probability of Freedom from Relapse (%) ACCORD-2 100 75 50 25 0 2 4 6 8 10 12 14 16 18 20 22 24 26 + Censored Log-Rank p-value: 0.001 AXS-05 Placebo Hazard Ratio for Time to Relapse Hazard Ratio (95% CI) 0.276 (0.119-0.641) p-value 0.001 Supplemental New Drug Application (sNDA) submission anticipated 3Q 2025 Supplemental New Drug Application (sNDA) submitted to the FDA

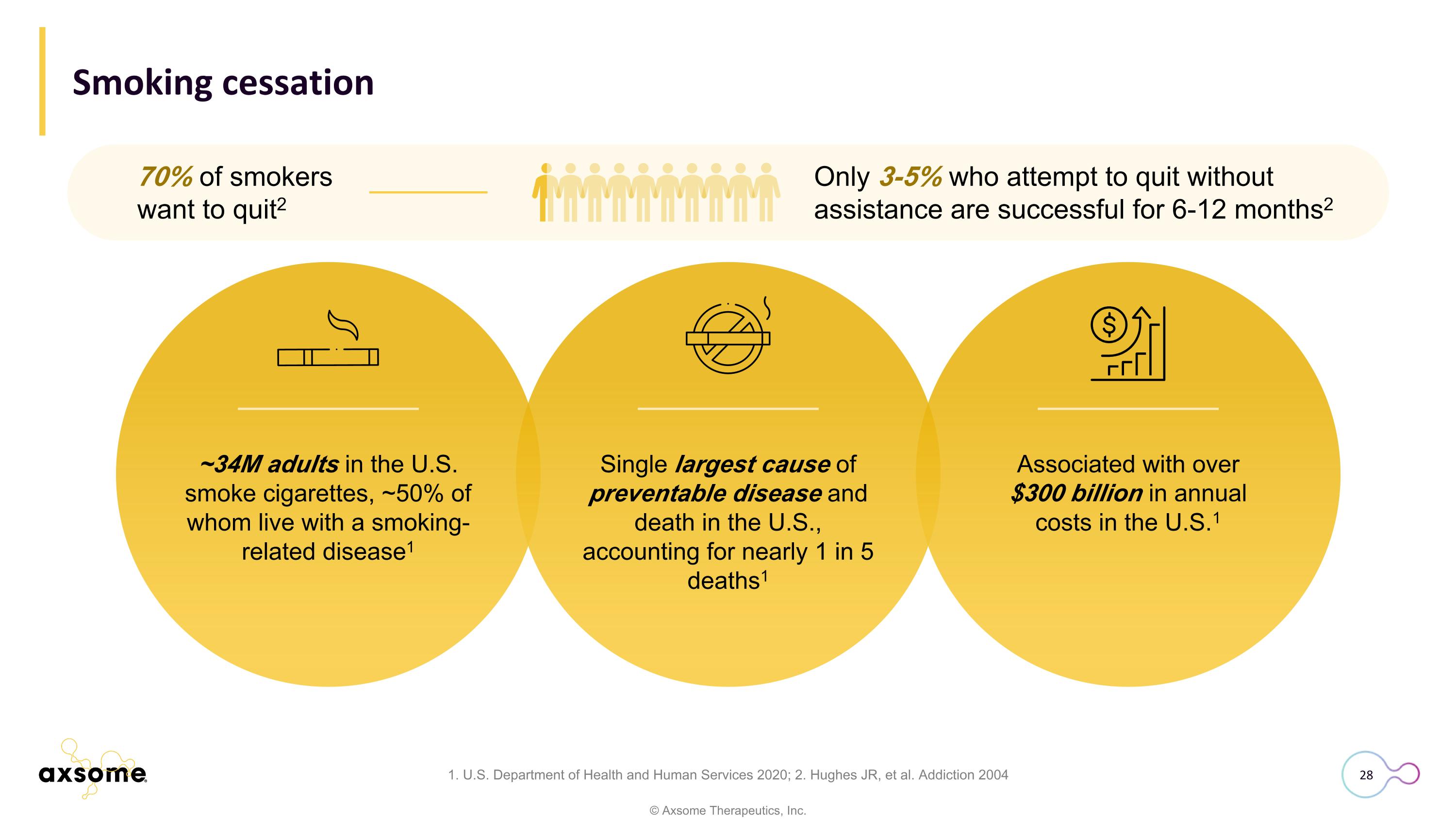

70% of smokers want to quit2 Only 3-5% who attempt to quit without assistance are successful for 6-12 months2 Smoking cessation Single largest cause of preventable disease and death in the U.S., accounting for nearly 1 in 5 deaths1 Associated with over $300 billion in annual costs in the U.S.1 ~34M adults in the U.S. smoke cigarettes, ~50% of whom live with a smoking-related disease1 1. U.S. Department of Health and Human Services 2020; 2. Hughes JR, et al. Addiction 2004

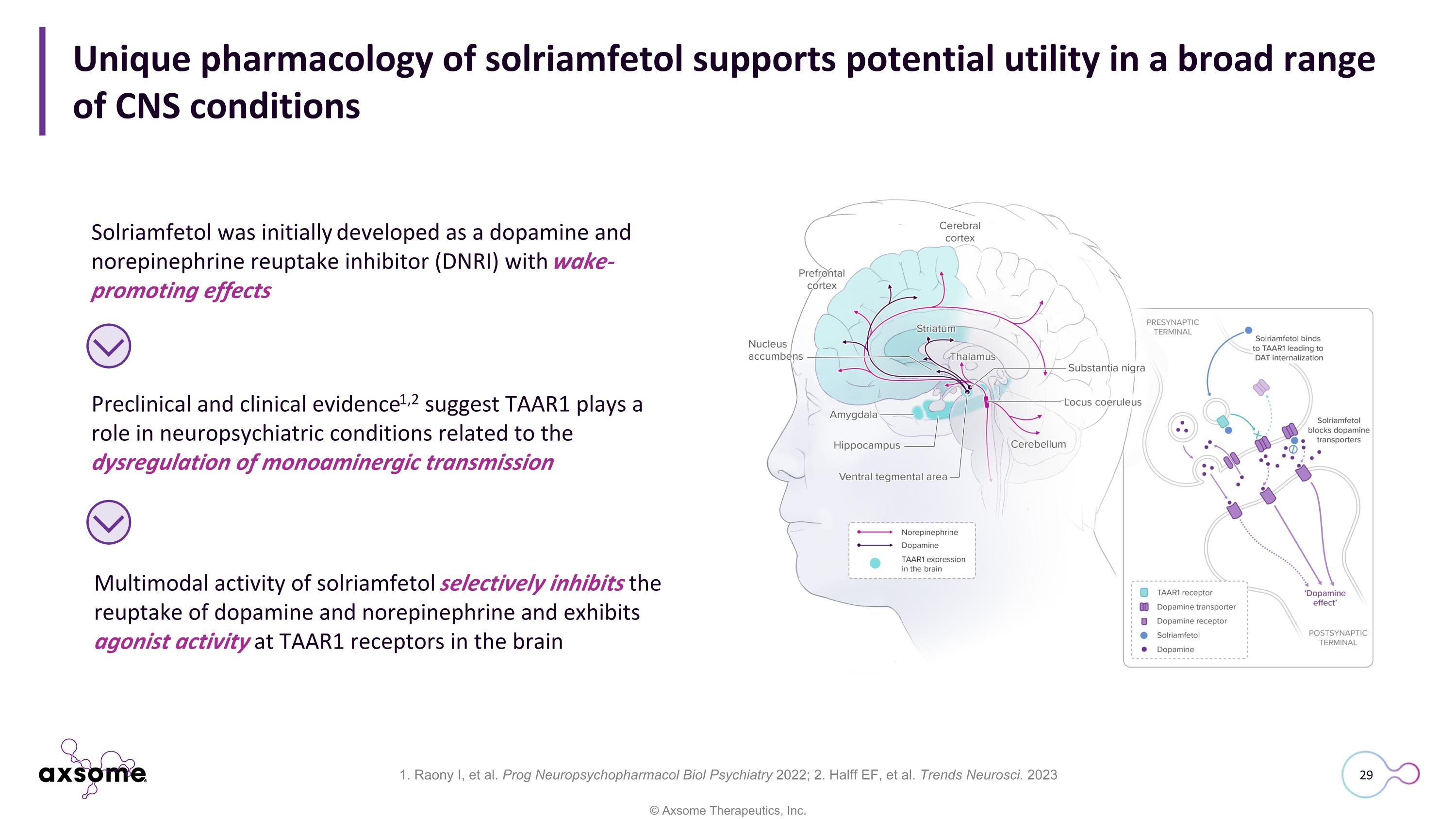

Unique pharmacology of solriamfetol supports potential utility in a broad range of CNS conditions 1. Raony I, et al. Prog Neuropsychopharmacol Biol Psychiatry 2022; 2. Halff EF, et al. Trends Neurosci. 2023 Solriamfetol was initially developed as a dopamine and norepinephrine reuptake inhibitor (DNRI) with wake-promoting effects Preclinical and clinical evidence1,2 suggest TAAR1 plays a role in neuropsychiatric conditions related to the dysregulation of monoaminergic transmission Multimodal activity of solriamfetol selectively inhibits the reuptake of dopamine and norepinephrine and exhibits agonist activity at TAAR1 receptors in the brain

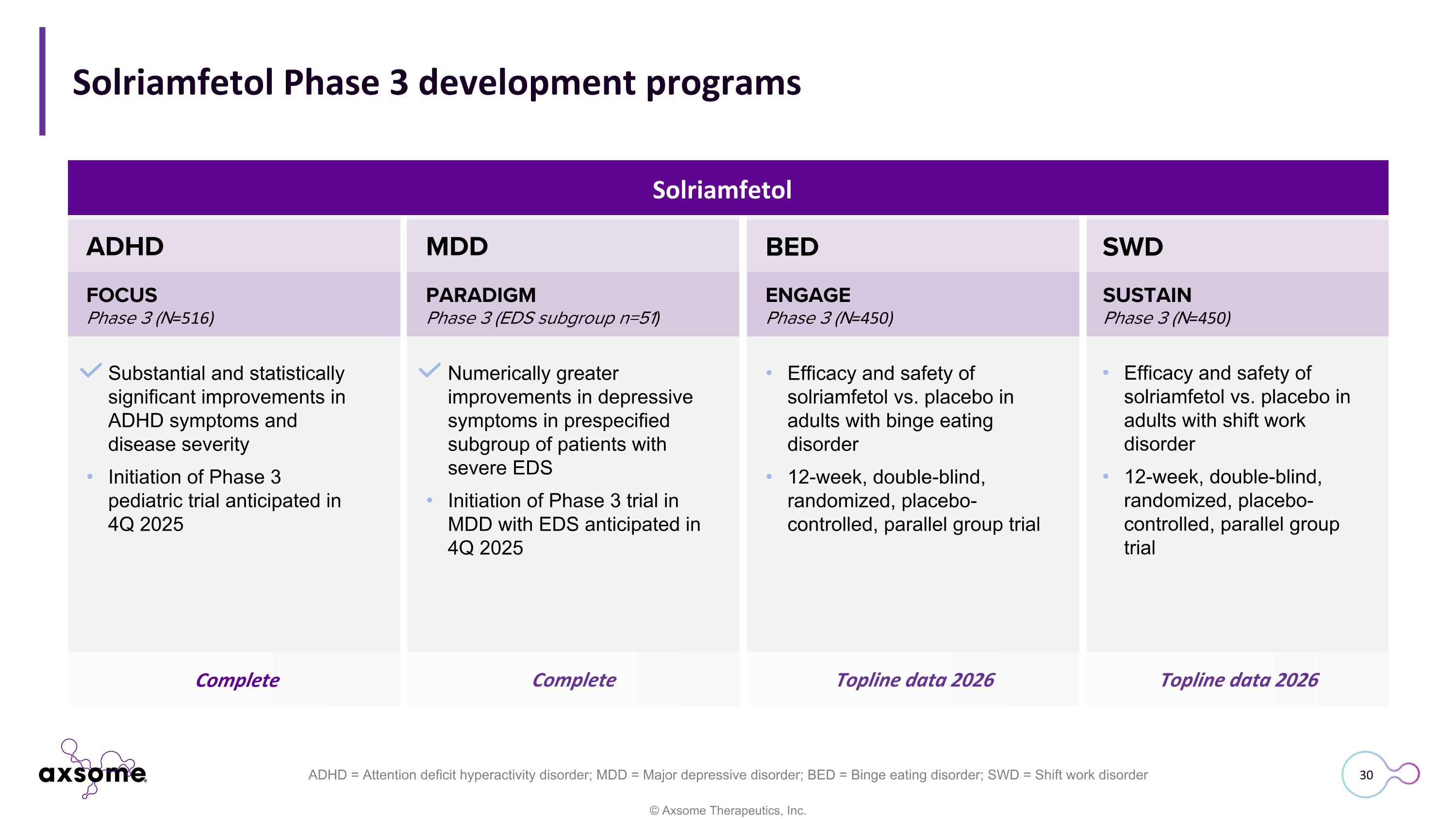

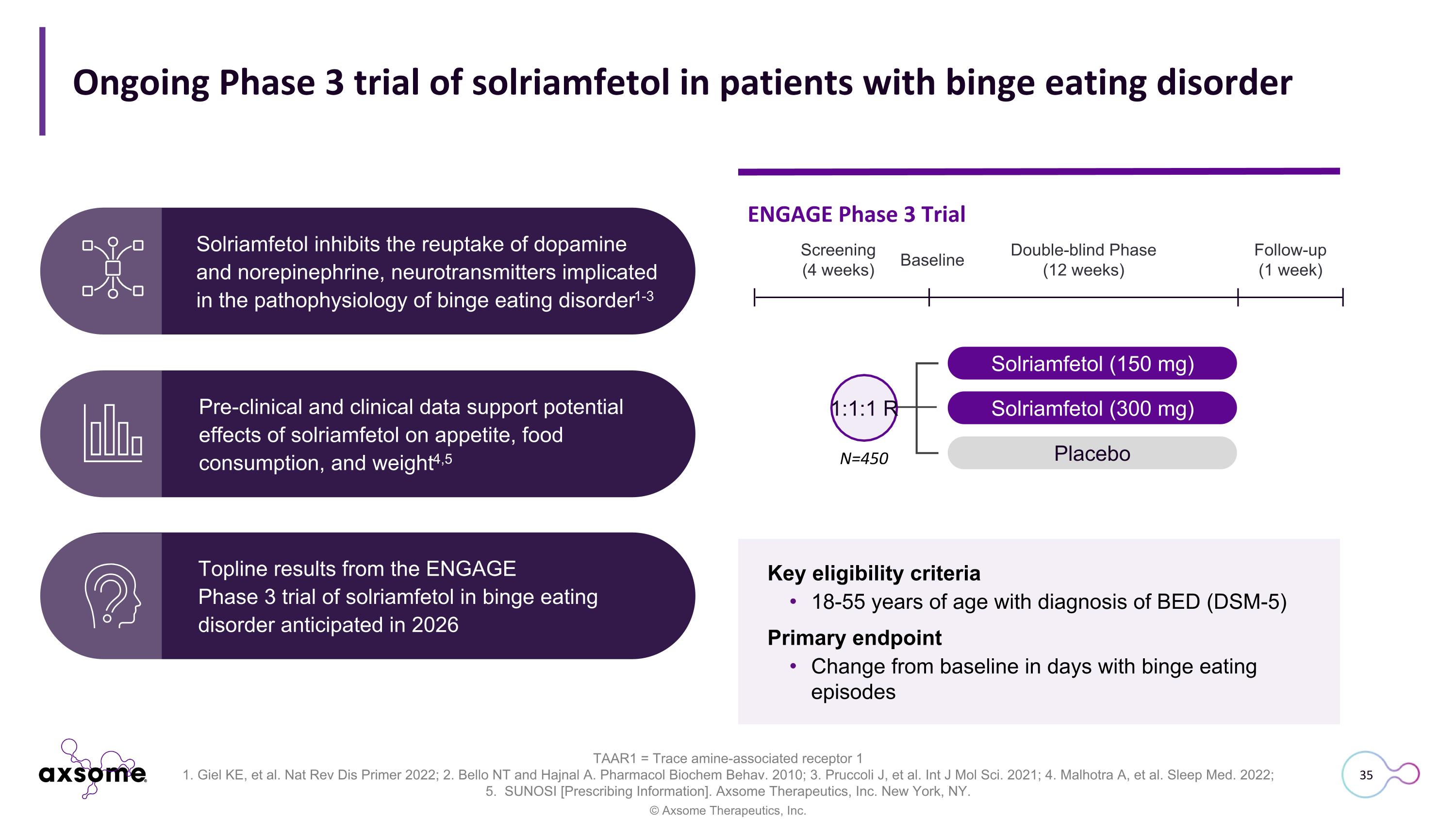

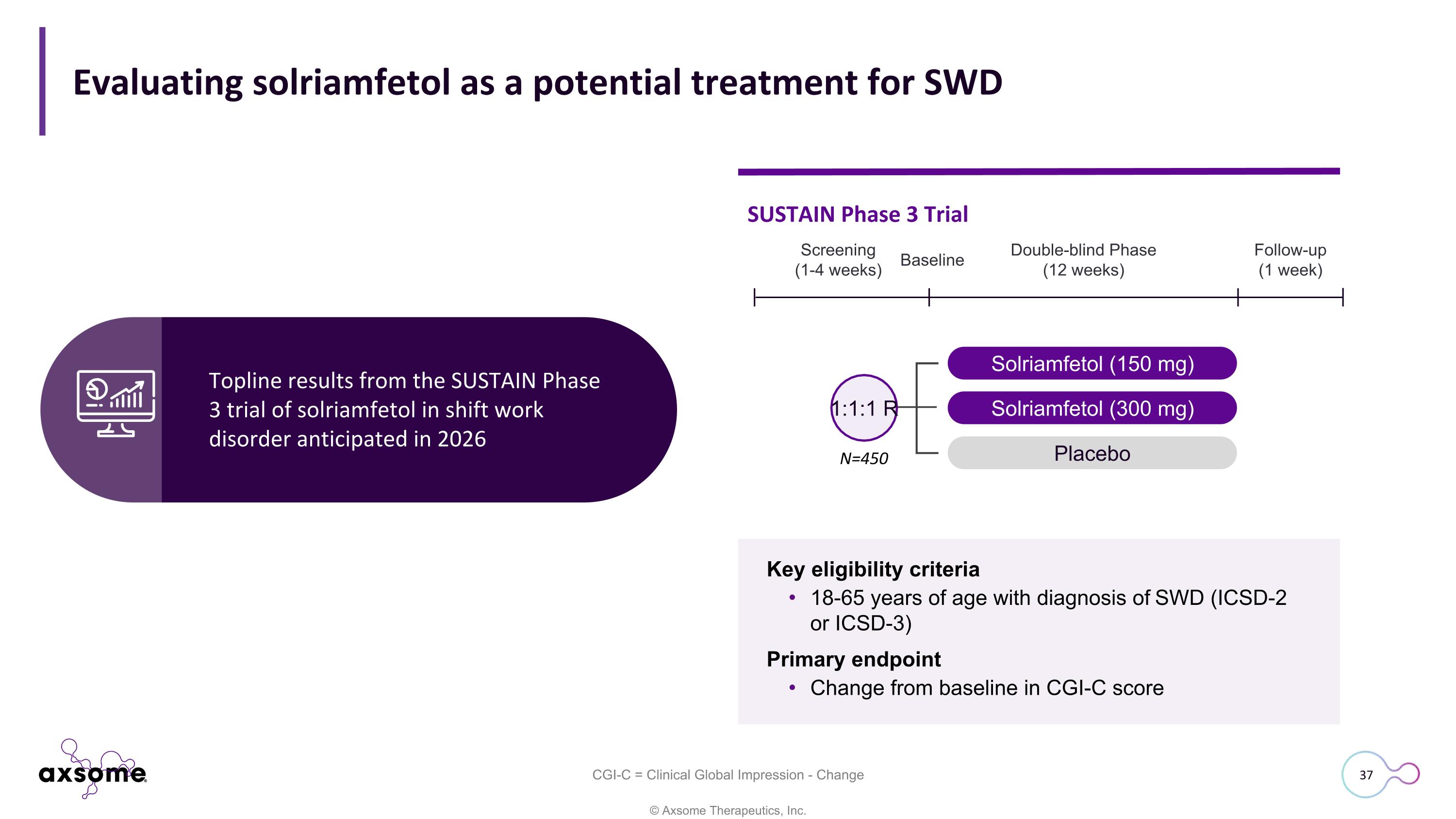

Solriamfetol Phase 3 development programs Topline data 2026 Topline data 2026 Complete Complete Substantial and statistically significant improvements in ADHD symptoms and disease severity Initiation of Phase 3 pediatric trial anticipated in 4Q 2025 Solriamfetol FOCUS Phase 3 (N=516) PARADIGM Phase 3 (EDS subgroup n=51) ENGAGE Phase 3 (N=450) SUSTAIN Phase 3 (N=450) Numerically greater improvements in depressive symptoms in prespecified subgroup of patients with severe EDS Initiation of Phase 3 trial in MDD with EDS anticipated in 4Q 2025 Efficacy and safety of solriamfetol vs. placebo in adults with binge eating disorder 12-week, double-blind, randomized, placebo-controlled, parallel group trial Efficacy and safety of solriamfetol vs. placebo in adults with shift work disorder 12-week, double-blind, randomized, placebo-controlled, parallel group trial ADHD MDD BED SWD ADHD = Attention deficit hyperactivity disorder; MDD = Major depressive disorder; BED = Binge eating disorder; SWD = Shift work disorder

Attention deficit hyperactivity disorder (ADHD) Chronic neurobiological and developmental disorder affecting an estimated ~22M people in the U.S.1, including ~7M children aged 3-17 years old2 Characterized by a persistent pattern of inattention and/or hyperactive-impulsive behaviors3 Associated with significant impairment in social, academic, and occupational functioning and development3 1. Facts About ADHD in Adults. CDC 2024; 2. Data and Statistics on ADHD. CDC 2024; 3. Attention-Deficit/Hyperactivity Disorder. NIMH 2024

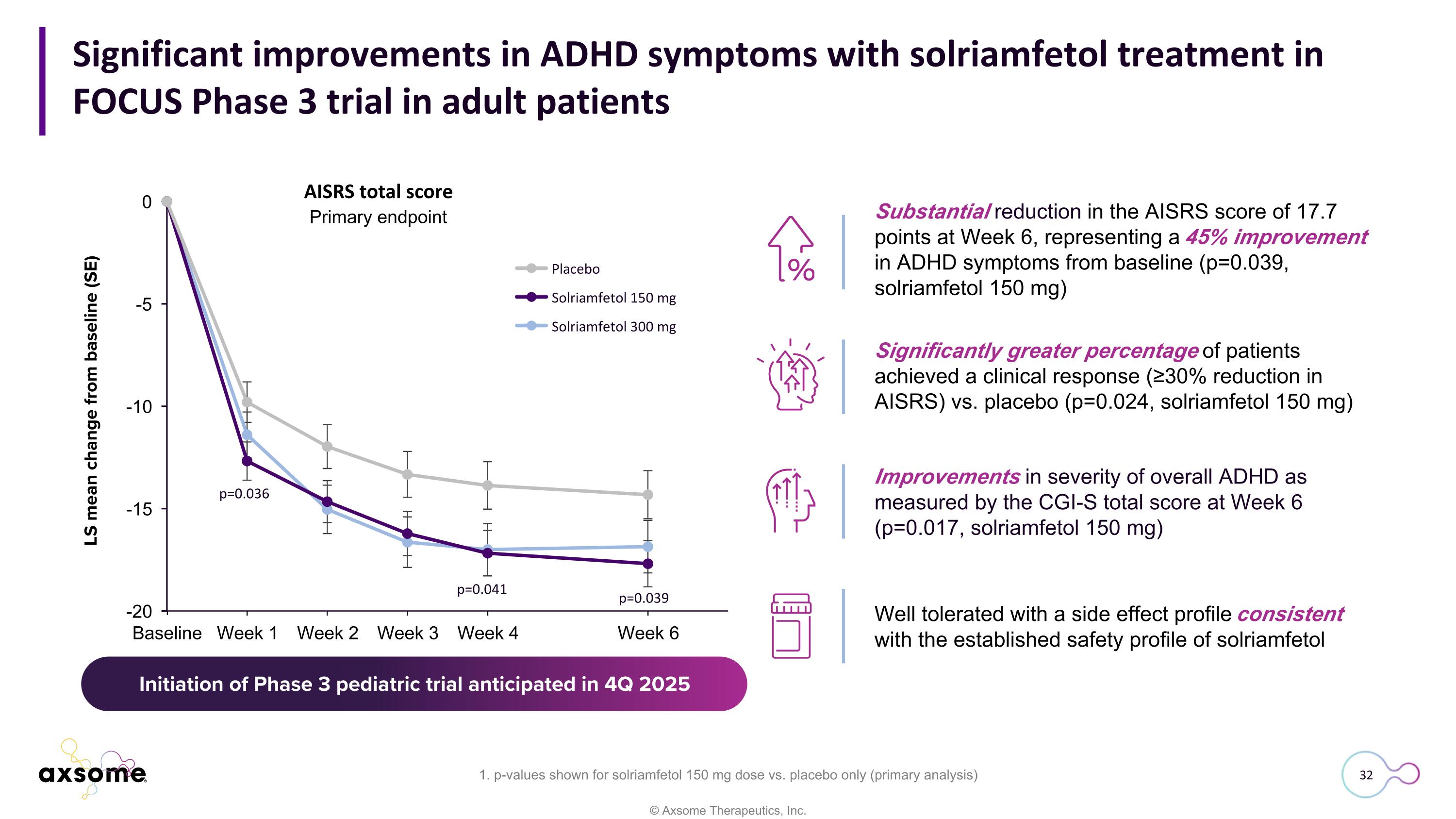

1. p-values shown for solriamfetol 150 mg dose vs. placebo only (primary analysis) Significant improvements in ADHD symptoms with solriamfetol treatment in FOCUS Phase 3 trial in adult patients Substantial reduction in the AISRS score of 17.7 points at Week 6, representing a 45% improvement in ADHD symptoms from baseline (p=0.039, solriamfetol 150 mg) Significantly greater percentage of patients achieved a clinical response (≥30% reduction in AISRS) vs. placebo (p=0.024, solriamfetol 150 mg) Improvements in severity of overall ADHD as measured by the CGI-S total score at Week 6 (p=0.017, solriamfetol 150 mg) Well tolerated with a side effect profile consistent with the established safety profile of solriamfetol p=0.036 p=0.041 p=0.039 Solriamfetol 300 mg Solriamfetol 150 mg Placebo Initiation of Phase 3 pediatric trial anticipated in 4Q 2025

Major depressive disorder ~2/3 of patients experience inadequate response to first-line treatment1 1. Rush AJ, et al. Am J Psychiatry 2006; 2. Major Depression. NIMH 2023; 3. Hasin DS, et al. JAMA Psychiatry 2018; 4. Hein M, et al. J Affect Disord. 2019 Approximately 50% of patients with MDD also experience excessive daytime sleepiness (EDS)4, for which there are no approved treatments Initiation of Phase 3 trial of solriamfetol in MDD patients with EDS anticipated in 4Q 2025 Major depressive disorder (MDD) is one of the most common mental disorders in the U.S., impacting ~21M adults each year2,3

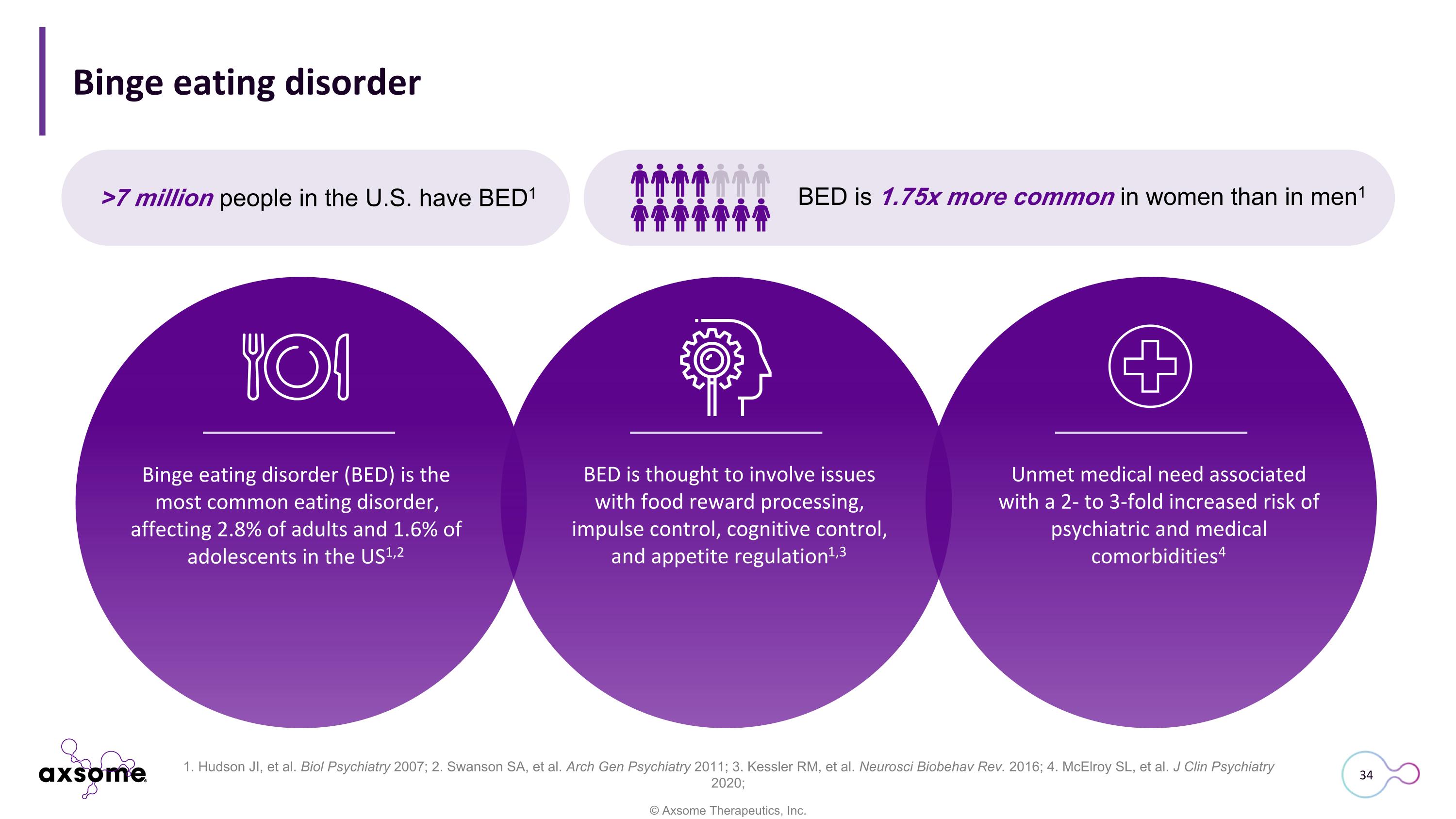

Binge eating disorder 1. Hudson JI, et al. Biol Psychiatry 2007; 2. Swanson SA, et al. Arch Gen Psychiatry 2011; 3. Kessler RM, et al. Neurosci Biobehav Rev. 2016; 4. McElroy SL, et al. J Clin Psychiatry 2020; BED is thought to involve issues with food reward processing, impulse control, cognitive control, and appetite regulation1,3 Unmet medical need associated with a 2- to 3-fold increased risk of psychiatric and medical comorbidities4 >7 million people in the U.S. have BED1 Binge eating disorder (BED) is the most common eating disorder, affecting 2.8% of adults and 1.6% of adolescents in the US1,2 BED is 1.75x more common in women than in men1

Solriamfetol inhibits the reuptake of dopamine and norepinephrine, neurotransmitters implicated in the pathophysiology of binge eating disorder1-3 Topline results from the ENGAGE Phase 3 trial of solriamfetol in binge eating disorder anticipated in 2026 Pre-clinical and clinical data support potential effects of solriamfetol on appetite, food consumption, and weight4,5 Ongoing Phase 3 trial of solriamfetol in patients with binge eating disorder TAAR1 = Trace amine-associated receptor 1 1. Giel KE, et al. Nat Rev Dis Primer 2022; 2. Bello NT and Hajnal A. Pharmacol Biochem Behav. 2010; 3. Pruccoli J, et al. Int J Mol Sci. 2021; 4. Malhotra A, et al. Sleep Med. 2022; 5. SUNOSI [Prescribing Information]. Axsome Therapeutics, Inc. New York, NY. Solriamfetol (150 mg) Solriamfetol (300 mg) Placebo 1:1:1 R Screening (4 weeks) Double-blind Phase (12 weeks) Follow-up (1 week) Baseline ENGAGE Phase 3 Trial N=450 Key eligibility criteria 18-55 years of age with diagnosis of BED (DSM-5) Primary endpoint Change from baseline in days with binge eating episodes

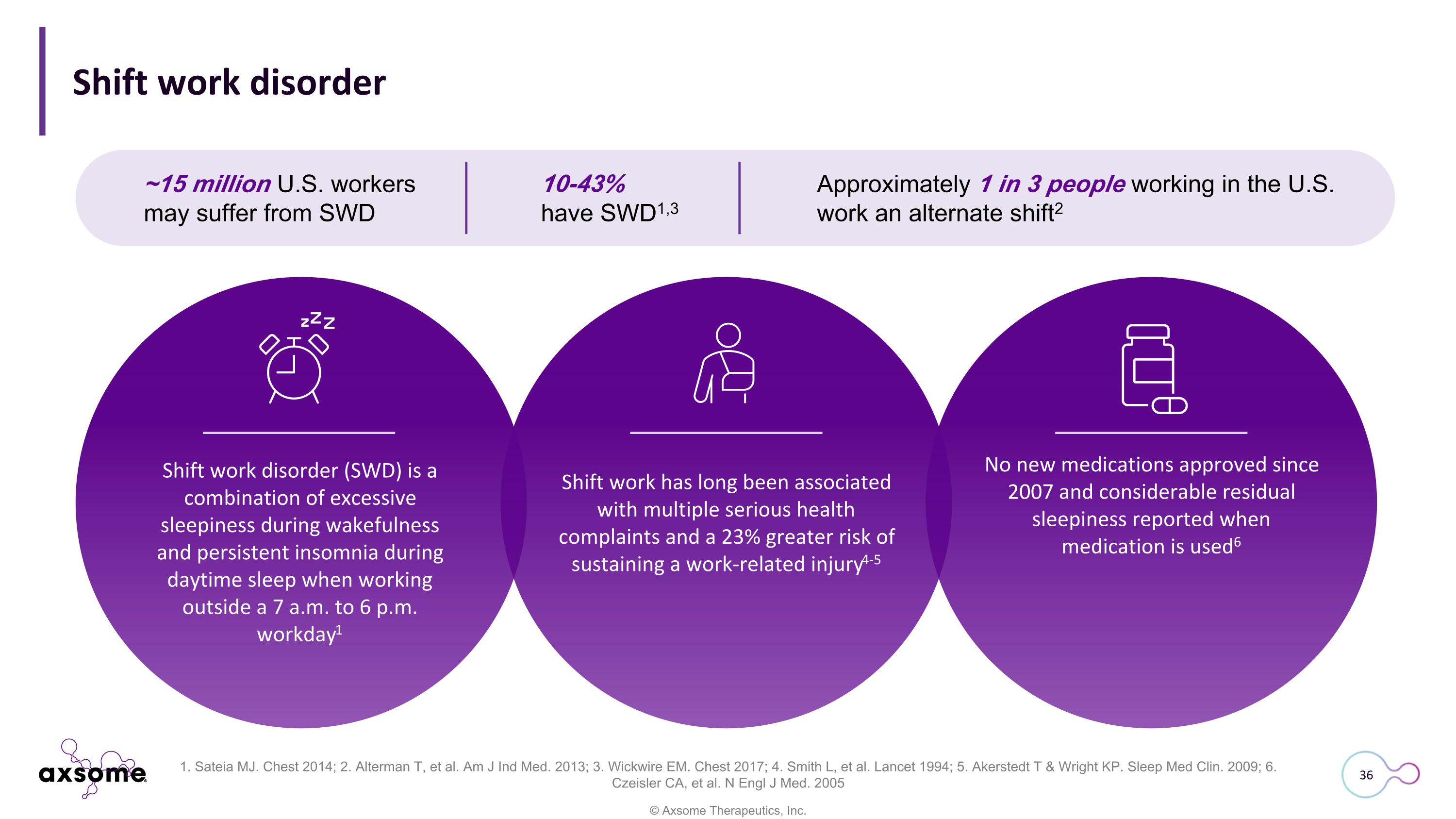

Shift work has long been associated with multiple serious health complaints and a 23% greater risk of sustaining a work-related injury4-5 Shift work disorder No new medications approved since 2007 and considerable residual sleepiness reported when medication is used6 ~15 million U.S. workers may suffer from SWD Approximately 1 in 3 people working in the U.S. work an alternate shift2 10-43% have SWD1,3 Shift work disorder (SWD) is a combination of excessive sleepiness during wakefulness and persistent insomnia during daytime sleep when working outside a 7 a.m. to 6 p.m. workday1 1. Sateia MJ. Chest 2014; 2. Alterman T, et al. Am J Ind Med. 2013; 3. Wickwire EM. Chest 2017; 4. Smith L, et al. Lancet 1994; 5. Akerstedt T & Wright KP. Sleep Med Clin. 2009; 6. Czeisler CA, et al. N Engl J Med. 2005

Evaluating solriamfetol as a potential treatment for SWD Solriamfetol (150 mg) Solriamfetol (300 mg) Placebo Screening (1-4 weeks) Double-blind Phase (12 weeks) Follow-up (1 week) Baseline SUSTAIN Phase 3 Trial N=450 Key eligibility criteria 18-65 years of age with diagnosis of SWD (ICSD-2 or ICSD-3) Primary endpoint Change from baseline in CGI-C score Topline results from the SUSTAIN Phase 3 trial of solriamfetol in shift work disorder anticipated in 2026 CGI-C = Clinical Global Impression - Change 1:1:1 R

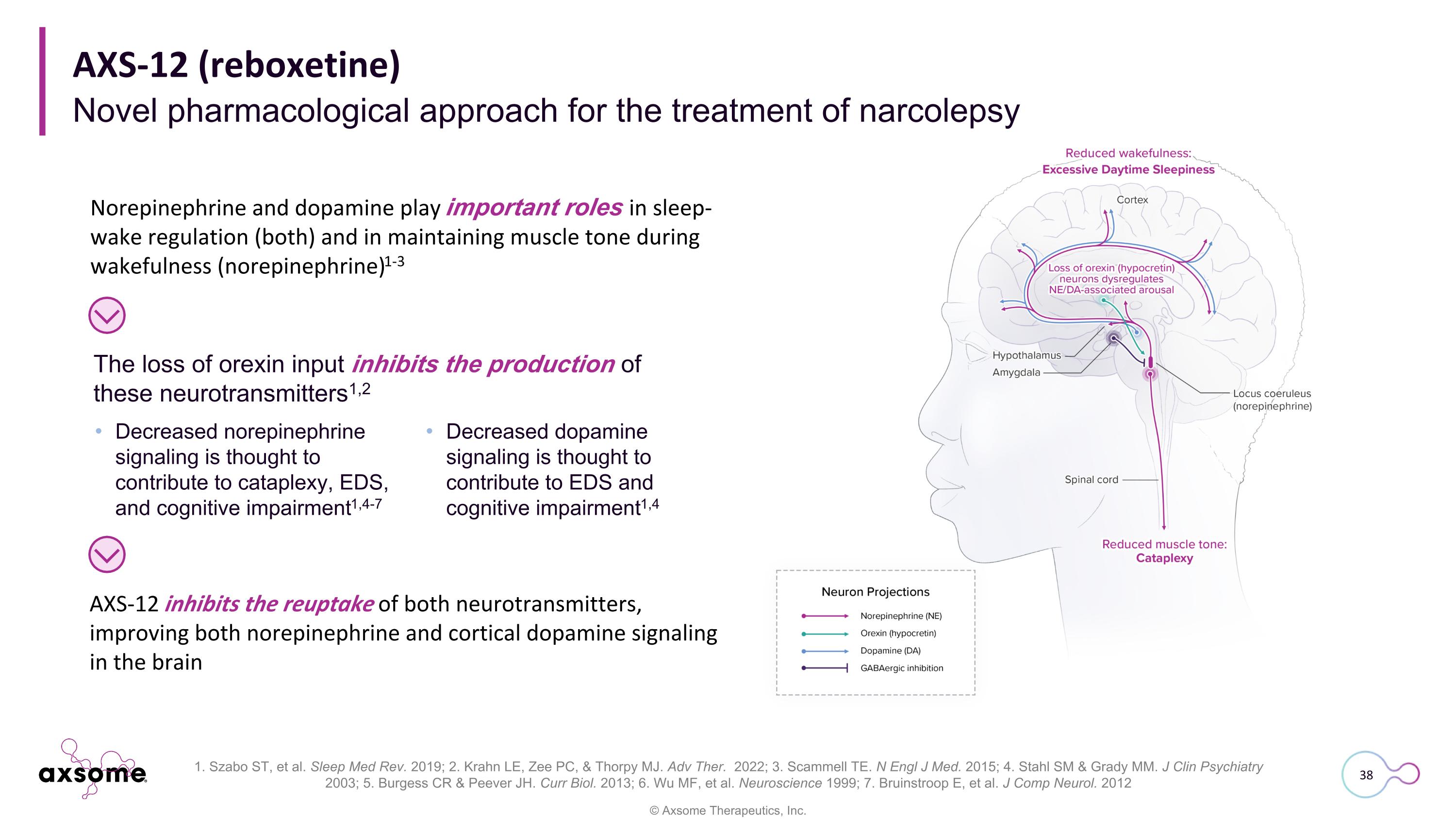

1. Szabo ST, et al. Sleep Med Rev. 2019; 2. Krahn LE, Zee PC, & Thorpy MJ. Adv Ther. 2022; 3. Scammell TE. N Engl J Med. 2015; 4. Stahl SM & Grady MM. J Clin Psychiatry 2003; 5. Burgess CR & Peever JH. Curr Biol. 2013; 6. Wu MF, et al. Neuroscience 1999; 7. Bruinstroop E, et al. J Comp Neurol. 2012 Norepinephrine and dopamine play important roles in sleep-wake regulation (both) and in maintaining muscle tone during wakefulness (norepinephrine)1-3 AXS-12 inhibits the reuptake of both neurotransmitters, improving both norepinephrine and cortical dopamine signaling in the brain The loss of orexin input inhibits the production of these neurotransmitters1,2 Decreased norepinephrine signaling is thought to contribute to cataplexy, EDS, and cognitive impairment1,4-7 Decreased dopamine signaling is thought to contribute to EDS and cognitive impairment1,4 Novel pharmacological approach for the treatment of narcolepsy AXS-12 (reboxetine)

Narcolepsy Rare and debilitating neurological condition that affects approximately 185,000 people in the U.S.1 Characterized by cataplexy, excessive daytime sleepiness (EDS), hypnagogic hallucinations, sleep paralysis, and disrupted nocturnal sleep2-4 An estimated 70% of patients suffer from cataplexy, or the sudden reduction or loss of muscle tone while awake5 1. “About Narcolepsy.” Narcolepsy Network 2024; 2. Sateia MJ. Chest 2014; 3. “Narcolepsy.” NINDS 2024; 4. España RA & Scammell TE. Sleep 2011; 5. Swick TJ. Nat Sci Sleep 2015

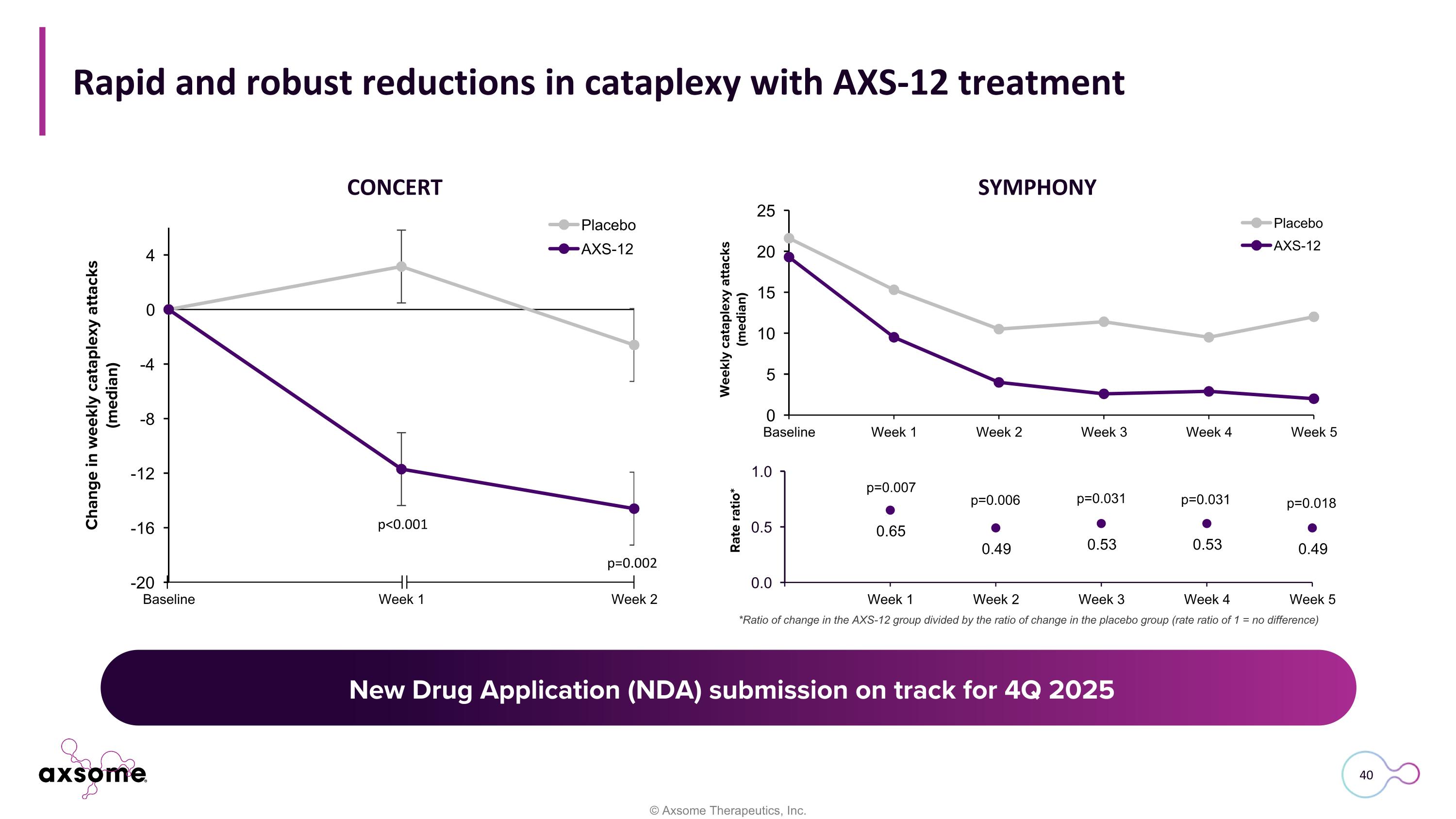

Rate ratio* p=0.007 p=0.006 p=0.031 p=0.031 p=0.018 p<0.001 p=0.002 *Ratio of change in the AXS-12 group divided by the ratio of change in the placebo group (rate ratio of 1 = no difference) CONCERT SYMPHONY Rapid and robust reductions in cataplexy with AXS-12 treatment New Drug Application (NDA) submission on track for 4Q 2025

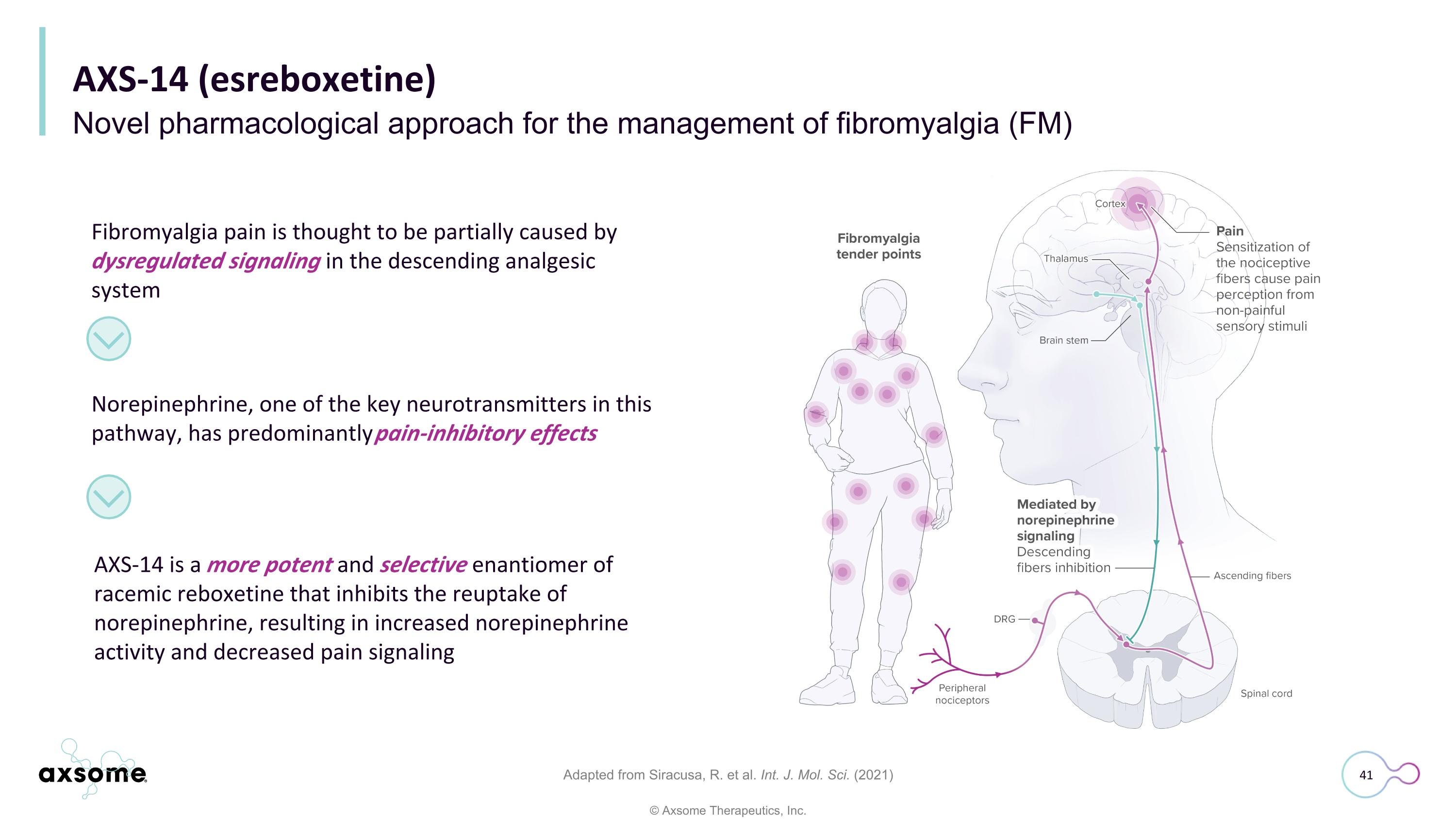

Fibromyalgia pain is thought to be partially caused by dysregulated signaling in the descending analgesic system Norepinephrine, one of the key neurotransmitters in this pathway, has predominantly pain-inhibitory effects AXS-14 is a more potent and selective enantiomer of racemic reboxetine that inhibits the reuptake of norepinephrine, resulting in increased norepinephrine activity and decreased pain signaling AXS-14 (esreboxetine) Novel pharmacological approach for the management of fibromyalgia (FM) Adapted from Siracusa, R. et al. Int. J. Mol. Sci. (2021)

Fibromyalgia 1. Vincent, et al. Arthritis Care Res (Hoboken) 2013; 3. Choy E, et al. BMC Health Serv Res. 2010; 3. Arnold LM, et al. Patient Educ Couns. 2008; 4. Bair MJ & Krebs EE. Ann Intern Med. 2020; 5. Clauw DJ. Ann Rheum Dis. 2024 Chronic and debilitating neurological pain syndrome resulting from a dysfunction in central pain processing2,3 Characterized by widespread musculoskeletal pain, fatigue, disturbed sleep, mood disturbances, cognitive impairment, and hypersensitivity to sensory sitmuli4,5 Associated with substantial physical disability and reduced emotional and social wellbeing, financial burden, and reduced quality of life2,3 An estimated ~17 million people in the U.S. are impacted by fibromyalgia1

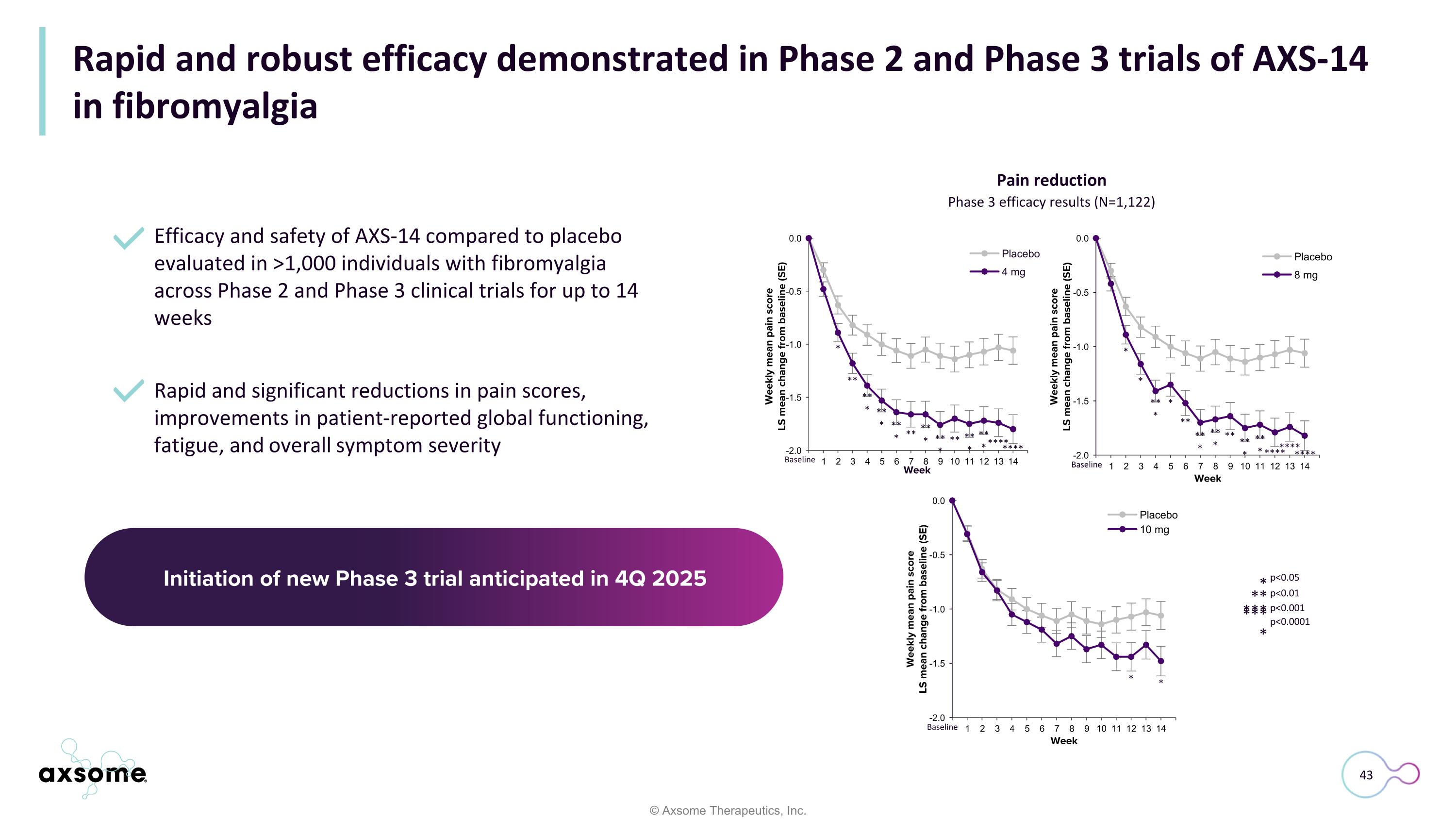

Rapid and robust efficacy demonstrated in Phase 2 and Phase 3 trials of AXS-14 in fibromyalgia Baseline * * *** * ** *** *** ** *** *** **** **** **** p<0.05 * p<0.01 ** p<0.001 *** p<0.0001 **** *** *** **** Baseline * ** *** *** *** ** *** *** ** **** Baseline * * Pain reduction Phase 3 efficacy results (N=1,122) Efficacy and safety of AXS-14 compared to placebo evaluated in >1,000 individuals with fibromyalgia across Phase 2 and Phase 3 clinical trials for up to 14 weeks Rapid and significant reductions in pain scores, improvements in patient-reported global functioning, fatigue, and overall symptom severity Initiation of new Phase 3 trial anticipated in 4Q 2025

Strong intellectual property and barriers to entry Protected by a robust patent estate extending to at least 2043; Multiple pending Proprietary drug product formulation and methods of treatment Protected by a robust patent estate extending to at least 2041; Multiple pending Proprietary MoSEICTM formulation, drug product formulation, and methods of treatment Protected by a robust patent estate extending to at least 2042; Multiple pending Proprietary drug substance and drug product formulation Orphan Drug Designation Claims extending to at least 2039 9 issued U.S. patents and 4 issued O.U.S. patents; Multiple pending Proprietary drug substance, drug product formulation, and methods of treatment Claims extending to at least 2043 >150 issued U.S. patents and >100 issued O.U.S. patents; Multiple pending Proprietary drug product formulation and methods of treatment Multiple pending U.S. patents Proprietary drug substance, drug product formulation, and methods of treatment AXS-05 AXS-12 AXS-14

Leadership team Roger Jeffs, PhD CEO, Liquidia Corporation Former President, Co-CEO, Director United Therapeutics Corp. Prior positions at Amgen and Burroughs Wellcome Herriot Tabuteau, MD Founder & CEO Management Board of Directors Nick Pizzie, CPA, MBA Chief Financial Officer Mark Jacobson, MA Chief Operating Officer Hunter Murdock, JD General Counsel Ari Maizel Chief Commercial Officer Mark Saad CEO, NuLids, LLC Former COO of the Global Healthcare Group at UBS Mark Coleman, MD Medical Director, National Spine and Pain Centers Diplomat of the American Board of Anesthesiology Susan Mahony, PhD Former SVP of Eli Lilly and President Lilly Oncology Prior positions at BMS, Amgen and Schering-Plough Herriot Tabuteau, MD Chairman

Thank you