Docusign Envelope ID: 10718228-9548-49EB-9CB5-BF93D38D3AB1 CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. SUCH EXCLUDED INFORMATION HAS BEEN MARKED WITH “[***]. August 8, 2025 Lauren Antonoff [***] Dear Lauren, On behalf of the Board of Directors (the “Board”) of Life360, Inc. (the “Company”), I am pleased to offer you the position of Chief Executive Officer, reporting directly to the Board, effective August 11, 2025 (the “Effective Date”). Effective as of the Effective Date, you will also be appointed as a member of the Board, serving as a Class I Director. While serving as Chief Executive Officer, the Company shall cause you to be nominated for election as a member of the Board. In the event that your employment as Chief Executive Officer terminates for any reason, you will be deemed to have automatically resigned from the Board and any and all other positions with the Company and its affiliates. While serving as Chief Executive Officer, you will be eligible for the following compensation and benefits: Exhibit 10.2 - Base Salary: Effective as of the Effective Date, your new annual base salary will be $515,000, payable in accordance with the Company’s normal payroll practices and less required taxes and withholdings. - Performance Bonus: You will continue to participate in the Life360 Compensation Plan for Board Directors and Company Leadership, with a bonus target equal to 100% of your base salary, with the actual payout subject to the achievement of the underlying performance goals established by the Compensation Committee of the Board (the “Compensation Committee”). Your bonus target for 2025 will be pro-rated from the Effective Date to reflect your change in compensation. - Promotion Grants: You will be granted a one-time promotion grant in the form of restricted stock units (the “RSUs”) and performance-based restricted stock units (the “PSUs”). The RSU grant will be granted as of September 1, 2025 and will have a grant date fair value of $4,800,000, with the number of shares subject to the award determined by dividing $4,800,000 by the 5-day volume-weighted average stock price measured as of and including the business day before the grant date and will vest in 48 equal monthly installments, subject to your continued employment through each vesting date and the terms of the Life360, Inc. Amended and Restated 2011 Stock Plan (the “2011 Plan”) and the Company’s standard form of award agreement. The PSU grant will have a target grant date fair value of $3,600,000, with the number of shares subject to the award determined by

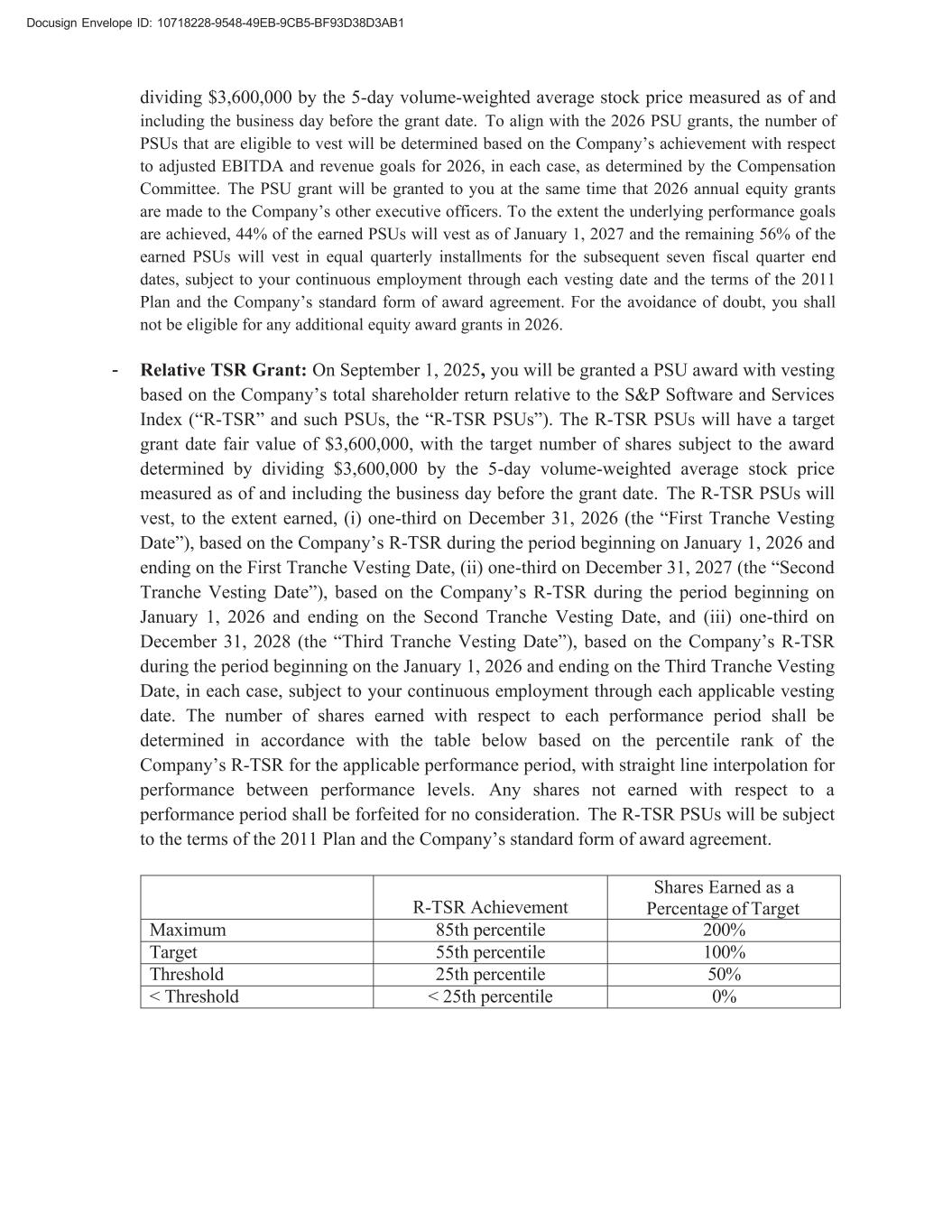

Docusign Envelope ID: 10718228-9548-49EB-9CB5-BF93D38D3AB1 R-TSR Achievement Shares Earned as a Percentage of Target Maximum 85th percentile 200% Target 55th percentile 100% Threshold 25th percentile 50% < Threshold < 25th percentile 0% dividing $3,600,000 by the 5-day volume-weighted average stock price measured as of and including the business day before the grant date. To align with the 2026 PSU grants, the number of PSUs that are eligible to vest will be determined based on the Company’s achievement with respect to adjusted EBITDA and revenue goals for 2026, in each case, as determined by the Compensation Committee. The PSU grant will be granted to you at the same time that 2026 annual equity grants are made to the Company’s other executive officers. To the extent the underlying performance goals are achieved, 44% of the earned PSUs will vest as of January 1, 2027 and the remaining 56% of the earned PSUs will vest in equal quarterly installments for the subsequent seven fiscal quarter end dates, subject to your continuous employment through each vesting date and the terms of the 2011 Plan and the Company’s standard form of award agreement. For the avoidance of doubt, you shall not be eligible for any additional equity award grants in 2026. - Relative TSR Grant: On September 1, 2025, you will be granted a PSU award with vesting based on the Company’s total shareholder return relative to the S&P Software and Services Index (“R-TSR” and such PSUs, the “R-TSR PSUs”). The R-TSR PSUs will have a target grant date fair value of $3,600,000, with the target number of shares subject to the award determined by dividing $3,600,000 by the 5-day volume-weighted average stock price measured as of and including the business day before the grant date. The R-TSR PSUs will vest, to the extent earned, (i) one-third on December 31, 2026 (the “First Tranche Vesting Date”), based on the Company’s R-TSR during the period beginning on January 1, 2026 and ending on the First Tranche Vesting Date, (ii) one-third on December 31, 2027 (the “Second Tranche Vesting Date”), based on the Company’s R-TSR during the period beginning on January 1, 2026 and ending on the Second Tranche Vesting Date, and (iii) one-third on December 31, 2028 (the “Third Tranche Vesting Date”), based on the Company’s R-TSR during the period beginning on the January 1, 2026 and ending on the Third Tranche Vesting Date, in each case, subject to your continuous employment through each applicable vesting date. The number of shares earned with respect to each performance period shall be determined in accordance with the table below based on the percentile rank of the Company’s R-TSR for the applicable performance period, with straight line interpolation for performance between performance levels. Any shares not earned with respect to a performance period shall be forfeited for no consideration. The R-TSR PSUs will be subject to the terms of the 2011 Plan and the Company’s standard form of award agreement.

Docusign Envelope ID: 10718228-9548-49EB-9CB5-BF93D38D3AB1 − Annual Equity Grants: Beginning in 2027, during the Company’s regularly scheduled annual merit cycle, you will be eligible for an equity award as a refresh annual grant, with the actual size of the grant determined by the Compensation Committee commensurate with executive’s role and performance as Chief Executive Officer and following market practices. The refresh grant will be delivered through the same equity vehicles and design as the annual equity awards granted to the Company’s other executive officers. As a reminder, you acknowledge that you shall also be subject to additional policies of the Company and its affiliates as in effect from time-to-time, including the Company’s Code of Conduct and policies about stock ownership and securities trading by senior executives. Further, you also acknowledge that you remain bound by your Confidential Information and Invention Assignment Agreement. As Chief Executive Officer, you will participate in the Company’s 2023 Severance and Change in Control Plan (the “Severance Plan”) at the Tier 1 level, as modified pursuant to this Promotion Letter, and subject to your execution of the applicable participation agreement. Your participation agreement will provide that, (1) the “Cause” and “Good Reason” definitions in your employment agreement shall apply for purposes of the Severance Plan and your severance entitlements thereunder; (2) the definition of “Covered Termination” shall include your termination for Good Reason as well as a termination by the Company without Cause; (3) for purposes of Section 3 of the participation agreement (Enhanced Severance Benefits) and in the definition of “Enhanced Termination,” the words “Change of Control” shall be substituted for the words “Board Change;” and (4) the base salary cash payment and COBRA benefits payable to you in connection with an “Enhanced Termination” shall each be equal to one and one-half times the base salary cash payment and COBRA benefits, respectively, payable to you in connection with a “Covered Termination” that is not an “Enhanced Termination.” For the avoidance of doubt, your severance entitlements under the Severance Plan shall supersede any severance entitlements under your existing employment agreement. Please note that nothing in this Promotion Letter constitutes or represents any contractual commitments between the Company and you, nor does it alter your “at will” employment with the Company. You have the right to terminate your employment at any time and the Company reserves the same right. For the compensation programs and plans mentioned above, the plan documents and any applicable award agreements for each control the terms of the benefit. Moreover, the Company reserves the right to change or terminate its benefit programs and plan at any time in accordance with the terms of such benefit programs and plans.

Docusign Envelope ID: 10718228-9548-49EB-9CB5-BF93D38D3AB1 Lauren, the Board is very excited about the prospect of you assuming the role of Chief Executive Officer as we enter this exciting new chapter for the Company. Over the past two years you have brought deep leadership and built a strong relationship with Chris and the Board to facilitate this transition. You have the full support of the Board as you transition into this new role. If you agree to the foregoing, please indicate your acceptance electronically by accepting this Promotion Letter. Sincerely, Heather Houston Chief People Officer Approved and Accepted By: 8/9/2025 I 9:43 AM PDT Lauren Antonoff