Investor Presentation | November 2025 10 Nov 2025 U.S. PT | 11 Nov 2025 AEDT Q3’25 Investor Presentation

Investor Presentation | November 2025 DISCLAIMER These materials and the accompanying oral presentation have been prepared by Life360, Inc. (ARBN 629 412 942) (“Company”) on a confidential and non-reliance basis, and may not be reproduced in whole or in part, nor may any of its contents be disclosed, to any other person, without the prior written consent of the Company. These materials are for informational purposes only. This presentation contains summary information about the Company and its activities and is current as of the date of this presentation. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. It should be read in conjunction with the Company’s periodic and continuous disclosure announcements filed with the Australian Securities Exchange and the U.S. Securities and Exchange Commission (“SEC”), available at www.asx.com.au and www.sec.gov, respectively. These materials do not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in the Company or interest therein nor does it constitute financial product advice. These materials are not a prospectus, product disclosure statement or other offer document under Australian law or under any other law. These materials have not been filed, registered or approved by regulatory authorities in any jurisdiction. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. The information contained in these materials is not intended to be relied upon as advice or a recommendation to investors and is not intended to form the basis of any investment decision in the Company’s securities. The information does not take into account the investment objectives, financial situation, taxation situation or needs of any particular investor. An investor must not act on the basis of any matter contained in these materials but must make its own assessment of the Company and conduct its own investigations and analysis. Investors should assess their own individual financial circumstances and consider talking to a financial adviser, professional adviser or consultant before making any investment decision. By reading these materials you agree to be bound by the limitations set out in these materials. No representation or warranty, express or implied, is made as to the accuracy, reliability, completeness or fairness of the information, opinions, forecasts, reports, estimates and conclusions contained in these materials. The Company does not undertake any obligation to provide any additional information nor update or revise the information in these materials nor correct any inaccuracies or omissions. To the maximum extent permitted by law, none of the Company and its related bodies corporate, or their respective directors, employees or agents, nor any other person accepts any responsibility nor any liability for loss arising from the use of or reliance on information contained in these materials or otherwise arising in connection with it, nor in relation to any other written or oral information or opinions provided now or in the future to the recipient or its advisers and representatives, including without limitation any liability from fault of negligence. Past performance is not indicative of future performance and no guarantee of future returns is implied or given. Nothing contained in these materials nor any information made available to you is, or shall be relied upon as, a promise, representation, warranty or guarantee as to the past, present or the future performance of the Company. Certain statements in these materials constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PLSRA”), Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not historical in nature, including the words “anticipate”, “expect”, “suggests”, “plan”, “believe”, “intend”, “estimates”, “targets”, “projects”, “should”, “could”, “would”, “may”, “will”, “forecast,” “opportunity,” “goal,” “vision,” “outlook” and other similar expressions are intended to identify forward-looking statements. These forward- looking statements include, but are not limited to, statements regarding: the Company’s growth strategy and business plan and the Company’s ability to effectively manage its growth and meet future capital requirements; the Company’s expectations regarding future financial performance, including its expectations regarding its revenue, revenue growth, adjusted EBITDA, and operating cash flow, and the Company’s ability to achieve or maintain future profitability; the Company’s ability to further penetrate its existing member base, maintain and expand its member base and increase monetization of its member base; the Company’s ability to expand internationally and the significance of its global opportunity; the Company’s ability to anticipate market needs or develop new products and services or enhance existing products and services to meet those needs; the Company’s ability to increase sales of its products and services; and the Company’s proposed acquisition of Nativo, its expected timing and completion, the anticipated benefits and synergies of the transaction, and the potential impact on the Company’s business strategy, financial condition, and growth prospects. Such forward-looking statements are prediction, projections and other statements about future events that are based on current expectations and assumptions and, as a result, involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the Company and which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements. Forward-looking statements are provided as a general guide only, and should not be relied on as an indication or guarantee of future performance. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Given these uncertainties, recipients are cautioned to not place undue reliance on any forward- looking statement. Forward-looking statements speak only as of the date they are made. Subject to any continuing obligations under applicable law the Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements in these materials to reflect any change in expectations in relation to such forward-looking statements or any change in events, conditions or circumstances on which any such statement is based. This presentation contains certain measures of financial performance not determined in accordance with U.S. generally accepted accounting principles (“GAAP”), including Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP Operating Expenses (the “non-GAAP financial measures”). The non-GAAP financial measures are used by Company management to evaluate financial performance of, and determine resource allocation for, each of the Company's operating segments. Items excluded from each of the non-GAAP financial measures are significant components in understanding and assessing financial performance. The non-GAAP financial measures should not be considered in isolation, or as alternatives to, or substitutes for, net income, net income margin, income from operations, cash flows generated by operations, investing or financing activities, or other financial statement data presented in the Company's consolidated financial statements as indicators of financial performance or liquidity. Because the non-GAAP financial measures are not measurements determined in accordance with GAAP and are thus susceptible to varying definitions, the non-GAAP financial measurements as presented may not be comparable to other similarly titled measures of other companies. Please refer to the Appendix beginning on slide 43 of this presentation for a reconciliation of these financial measures to the most directly comparable financial measure prepared in accordance with GAAP. This presentation includes our trademarks and trade names that we own or license and our logo. This presentation also includes trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this prospectus appear without any “TM” or “®” symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. This presentation includes industry and market data derived from internal analyses based upon publicly available data or other proprietary research and analysis, surveys or studies conducted by third parties and industry and general publications. Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on these various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. All values are stated in US dollars unless otherwise stated.

Investor Presentation | November 2025 3 Life360 Overview (4 – 24) Financial Update Q3’25 (30 – 42)Contents FY’25 Outlook (43 – 44) 1. 2. 3. 4. Appendix (45 – 52) Operating metrics Financials GAAP to Non-GAAP reconciliations & Non-GAAP financial measures Competitive landscape Life360 Strategy (25 – 29)02 01 04 03 05 1. 2. 3. 4. Appendix (51 – 58) Operating metrics Financials GAAP to Non-GAAP reconciliations & Non-GAAP financial measures Competitive landscape 06 FY’25 Outlook (49 – 50)05 Financial Update Q3’25 (36 – 48)04 Life360 Strategy (31 – 35)03 Advertising Update (25 – 30)02 Life360 Overview (4 – 24)01

Investor Presentation | November 2025 Life360 Overview 01

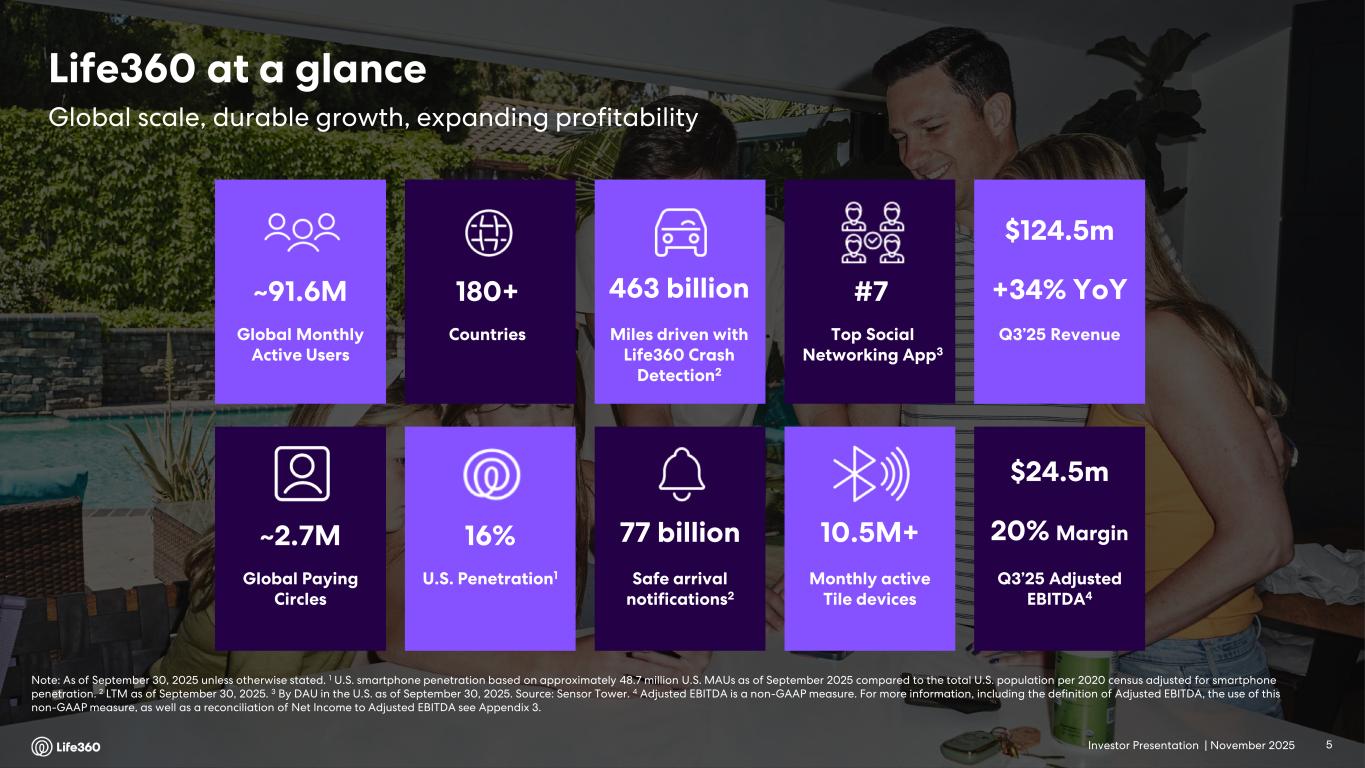

Investor Presentation | November 2025 Note: As of September 30, 2025 unless otherwise stated. 1 U.S. smartphone penetration based on approximately 48.7 million U.S. MAUs as of September 2025 compared to the total U.S. population per 2020 census adjusted for smartphone penetration. 2 LTM as of September 30, 2025. 3 By DAU in the U.S. as of September 30, 2025. Source: Sensor Tower. 4 Adjusted EBITDA is a non-GAAP measure. For more information, including the definition of Adjusted EBITDA, the use of this non-GAAP measure, as well as a reconciliation of Net Income to Adjusted EBITDA see Appendix 3. Global Paying Circles ~2.7M Safe arrival notifications2 77 billion U.S. Penetration1 16% 10.5M+ Monthly active Tile devices Global Monthly Active Users ~91.6M Miles driven with Life360 Crash Detection2 463 billion Countries 180+ Top Social Networking App3 #7 Q3’25 Revenue $124.5m +34% YoY Q3’25 Adjusted EBITDA4 $24.5m 20% Margin Global scale, durable growth, expanding profitability Life360 at a glance 5

Investor Presentation | November 2025 Location sharing for the whole family ...with safety top of mind Private map for your inner circle Free to use Built for families Devices for people, pets, and things Premium safety services Market leading driving safety Busy families want peace of mind - Life360 makes everyday family life better through safety and connection 6

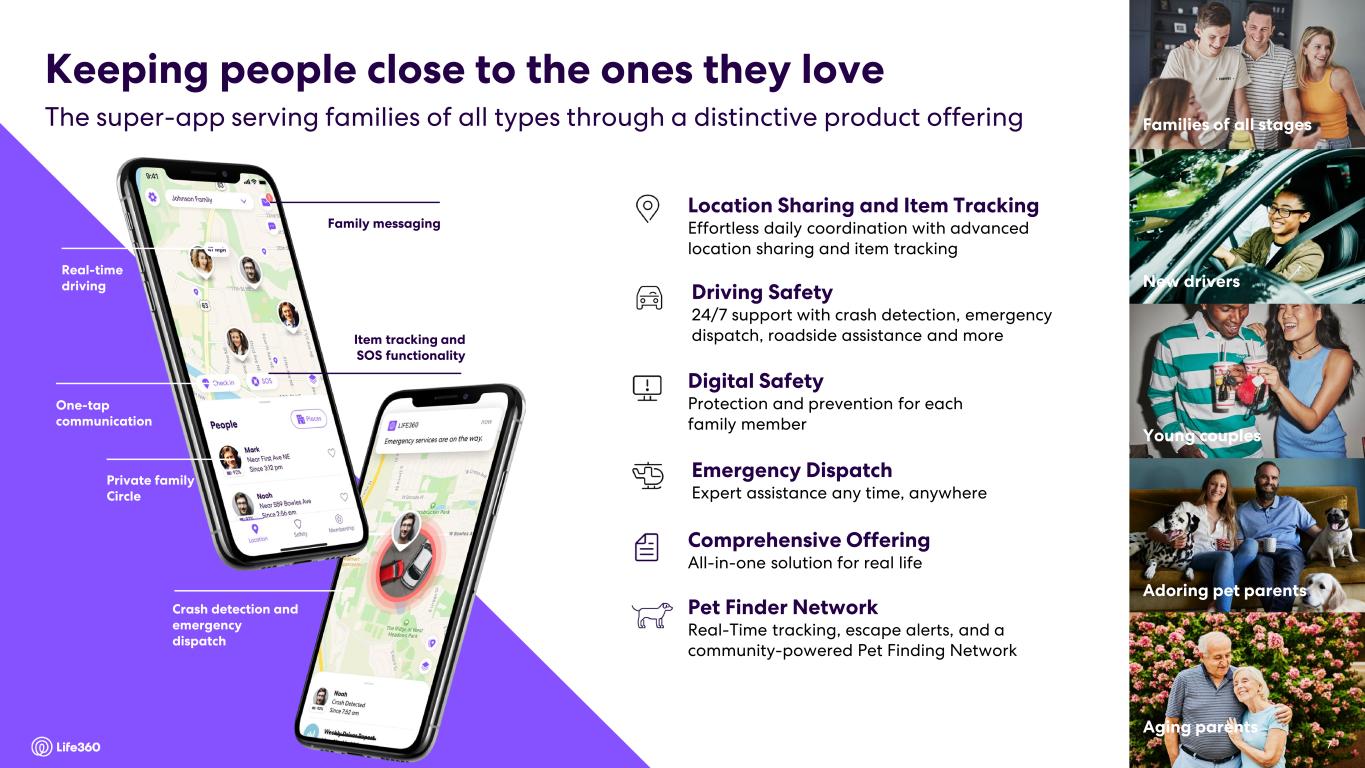

Investor Presentation | November 2025 7 Family messaging Real-time driving One-tap communication Private family Circle Item tracking and SOS functionality Crash detection and emergency dispatch Driving Safety 24/7 support with crash detection, emergency dispatch, roadside assistance and more Digital Safety Protection and prevention for each family member Location Sharing and Item Tracking Effortless daily coordination with advanced location sharing and item tracking Emergency Dispatch Expert assistance any time, anywhere Comprehensive Offering All-in-one solution for real life Young couples New drivers Families of all stages Aging parents Adoring pet parents The super-app serving families of all types through a distinctive product offering Keeping people close to the ones they love 7 Pet Finder Network Real-Time tracking, escape alerts, and a community-powered Pet Finding Network

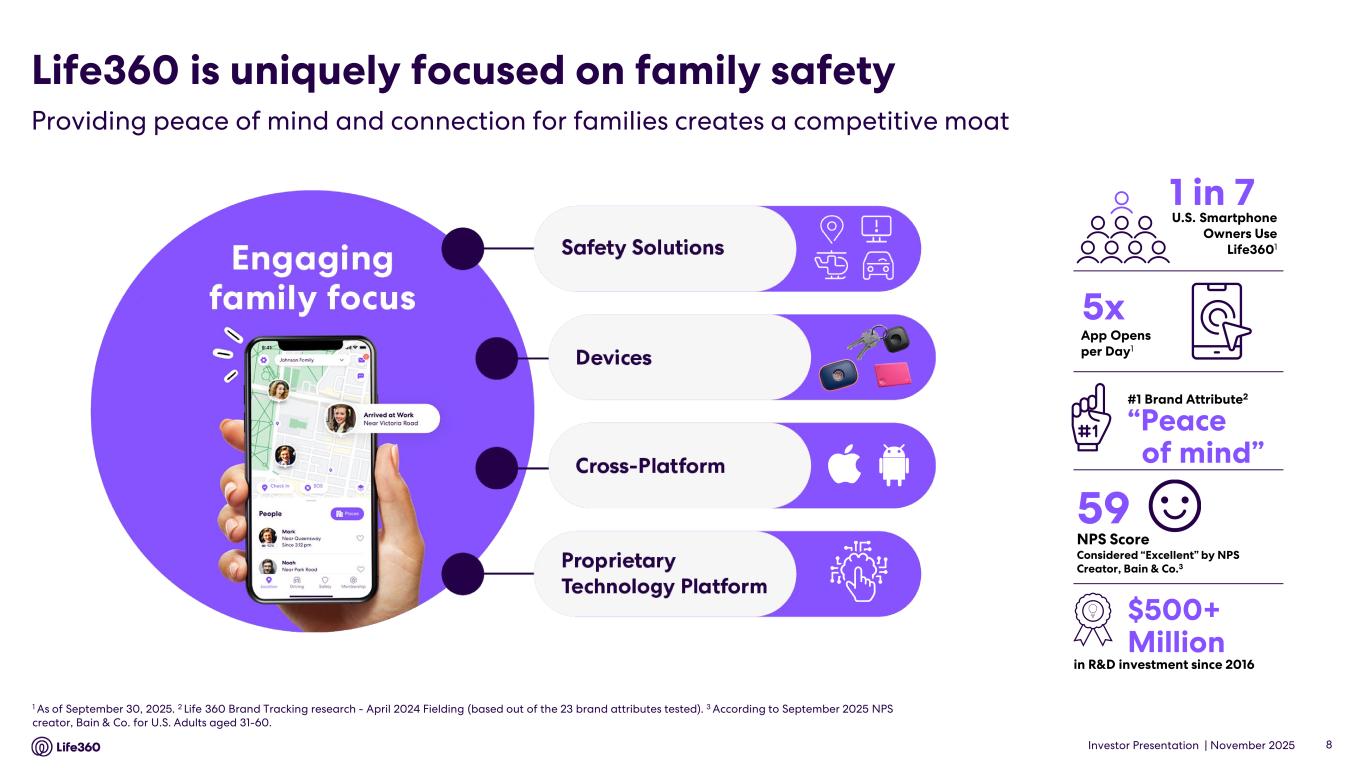

Investor Presentation | November 2025 8 1 As of September 30, 2025. 2 Life 360 Brand Tracking research - April 2024 Fielding (based out of the 23 brand attributes tested). 3 According to September 2025 NPS creator, Bain & Co. for U.S. Adults aged 31-60. in R&D investment since 2016 #1 Brand Attribute2 1 in 7 59 NPS Score Considered “Excellent” by NPS Creator, Bain & Co.3 “Peace of mind” 5x U.S. Smartphone Owners Use Life3601 $500+ Million App Opens per Day1 Life360 is uniquely focused on family safety Providing peace of mind and connection for families creates a competitive moat

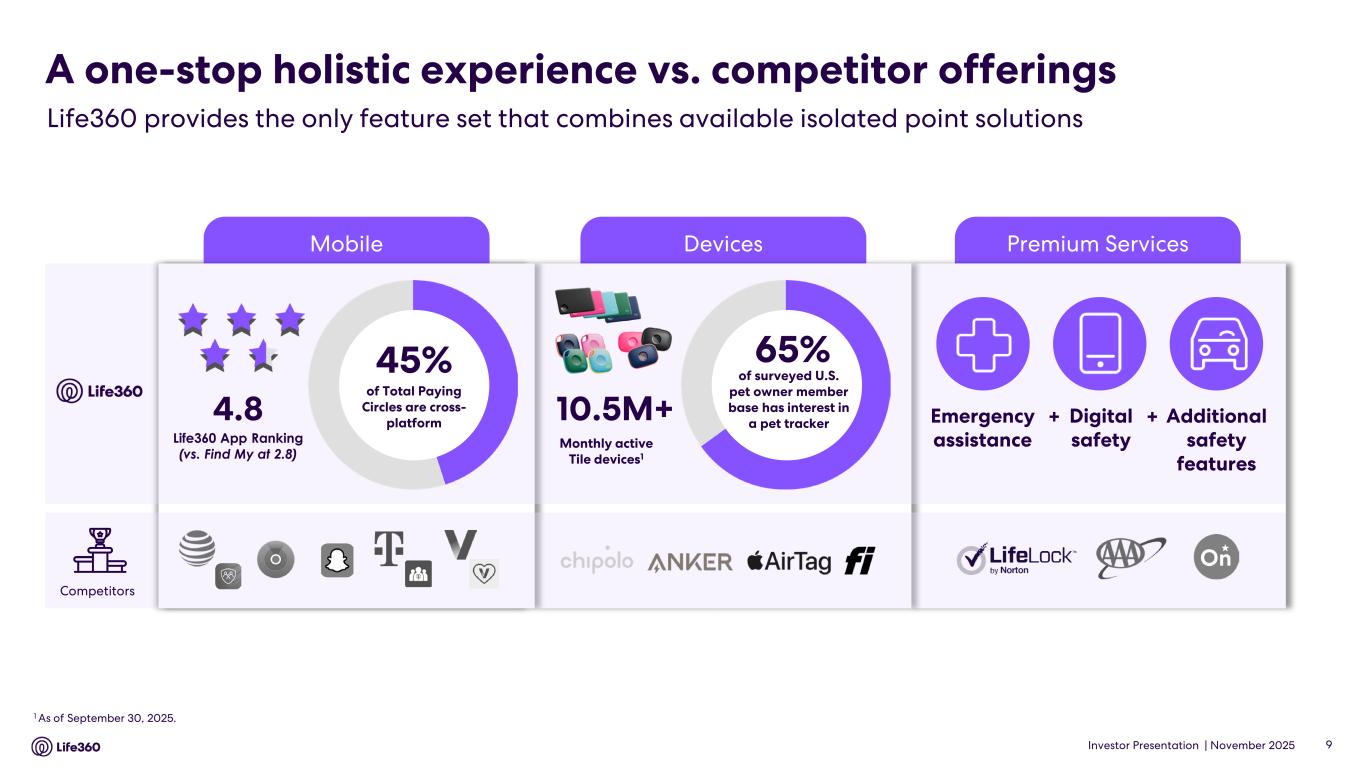

Investor Presentation | November 2025 Premium ServicesDevicesMobile A one-stop holistic experience vs. competitor offerings Life360 provides the only feature set that combines available isolated point solutions 1 As of September 30, 2025. 10.5M+ 65% of surveyed U.S. pet owner member base has interest in a pet tracker Monthly active Tile devices1 Emergency assistance Digital safety Additional safety features + +4.8 Life360 App Ranking (vs. Find My at 2.8) Competitors 9 45% of Total Paying Circles are cross- platform

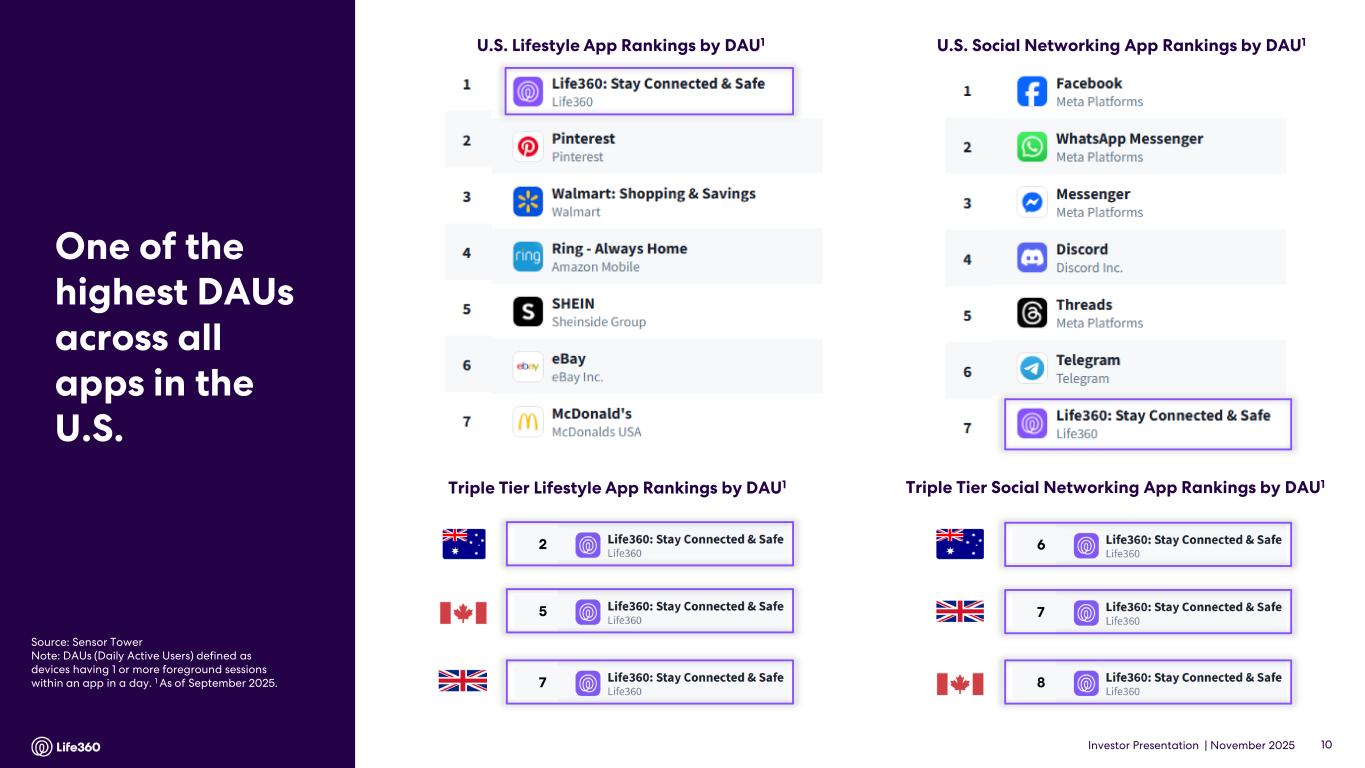

Investor Presentation | November 2025 10 U.S. Social Networking App Rankings by DAU1U.S. Lifestyle App Rankings by DAU1 Source: Sensor Tower Note: DAUs (Daily Active Users) defined as devices having 1 or more foreground sessions within an app in a day. 1 As of September 2025. One of the highest DAUs across all apps in the U.S. Triple Tier Social Networking App Rankings by DAU1 6 7 8 Triple Tier Lifestyle App Rankings by DAU1 2 7 5

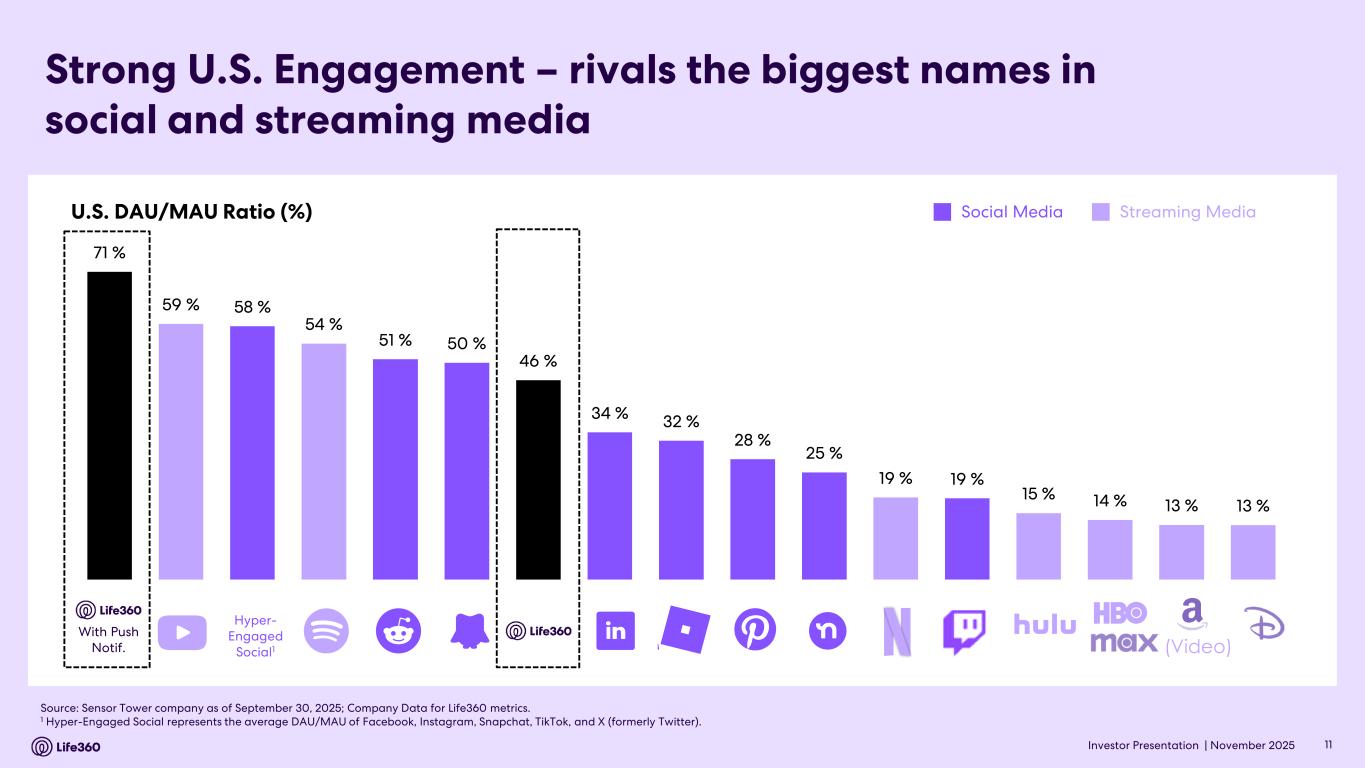

Investor Presentation | November 2025 Strong U.S. Engagement – rivals the biggest names in social and streaming media Source: Sensor Tower company as of September 30, 2025; Company Data for Life360 metrics. 1 Hyper-Engaged Social represents the average DAU/MAU of Facebook, Instagram, Snapchat, TikTok, and X (formerly Twitter). 11 U.S. DAU/MAU Ratio (%) Social Media Streaming Media (Video) Hyper- Engaged Social1 With Push Notif. 71 % 59 % 58 % 54 % 51 % 50 % 46 % 34 % 32 % 28 % 25 % 19 % 19 % 15 % 14 % 13 % 13 %

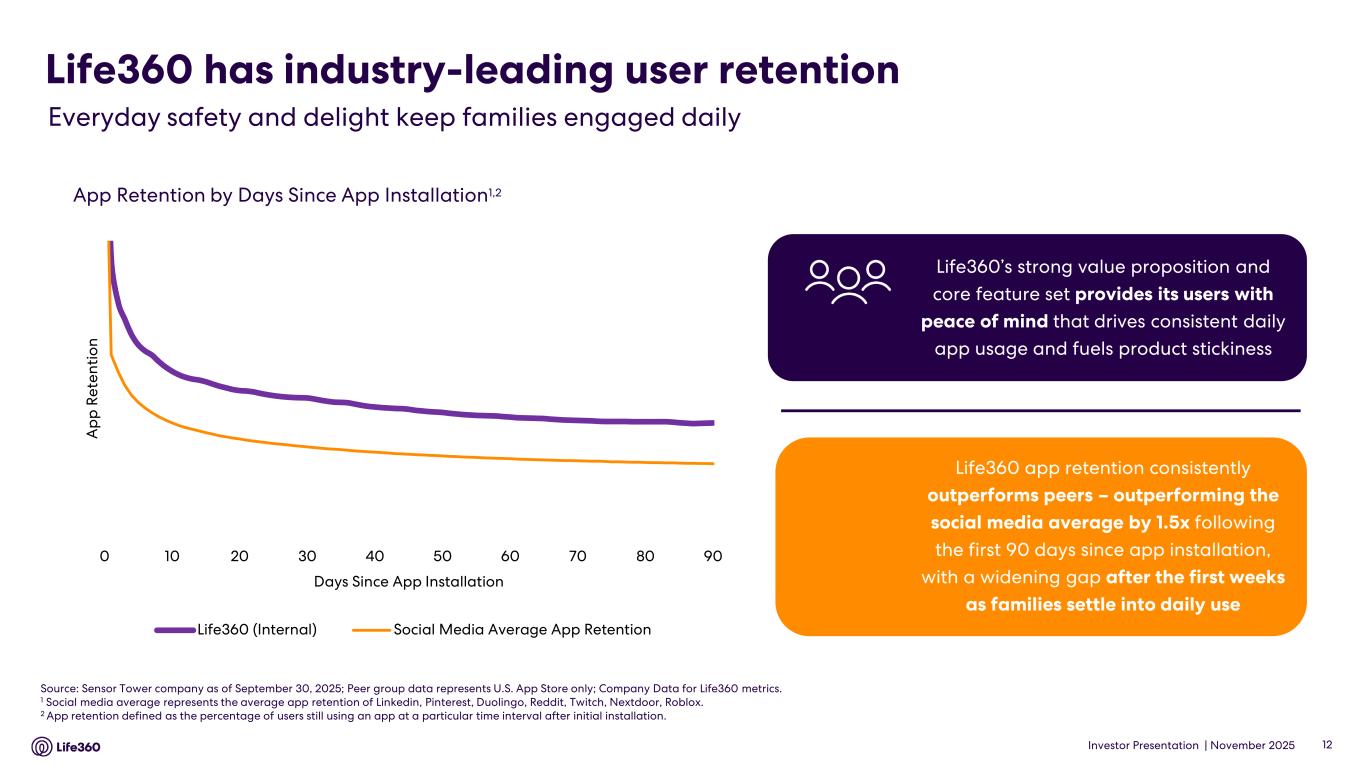

Investor Presentation | November 2025 Life360 has industry-leading user retention 12 Everyday safety and delight keep families engaged daily App Retention by Days Since App Installation1,2 Source: Sensor Tower company as of September 30, 2025; Peer group data represents U.S. App Store only; Company Data for Life360 metrics. 1 Social media average represents the average app retention of Linkedin, Pinterest, Duolingo, Reddit, Twitch, Nextdoor, Roblox. 2 App retention defined as the percentage of users still using an app at a particular time interval after initial installation. Life360 app retention consistently outperforms peers – outperforming the social media average by 1.5x following the first 90 days since app installation, with a widening gap after the first weeks as families settle into daily use Life360’s strong value proposition and core feature set provides its users with peace of mind that drives consistent daily app usage and fuels product stickiness 0 10 20 30 40 50 60 70 80 90 A p p R et en ti o n Days Since App Installation Life360 (Internal) Social Media Average App Retention

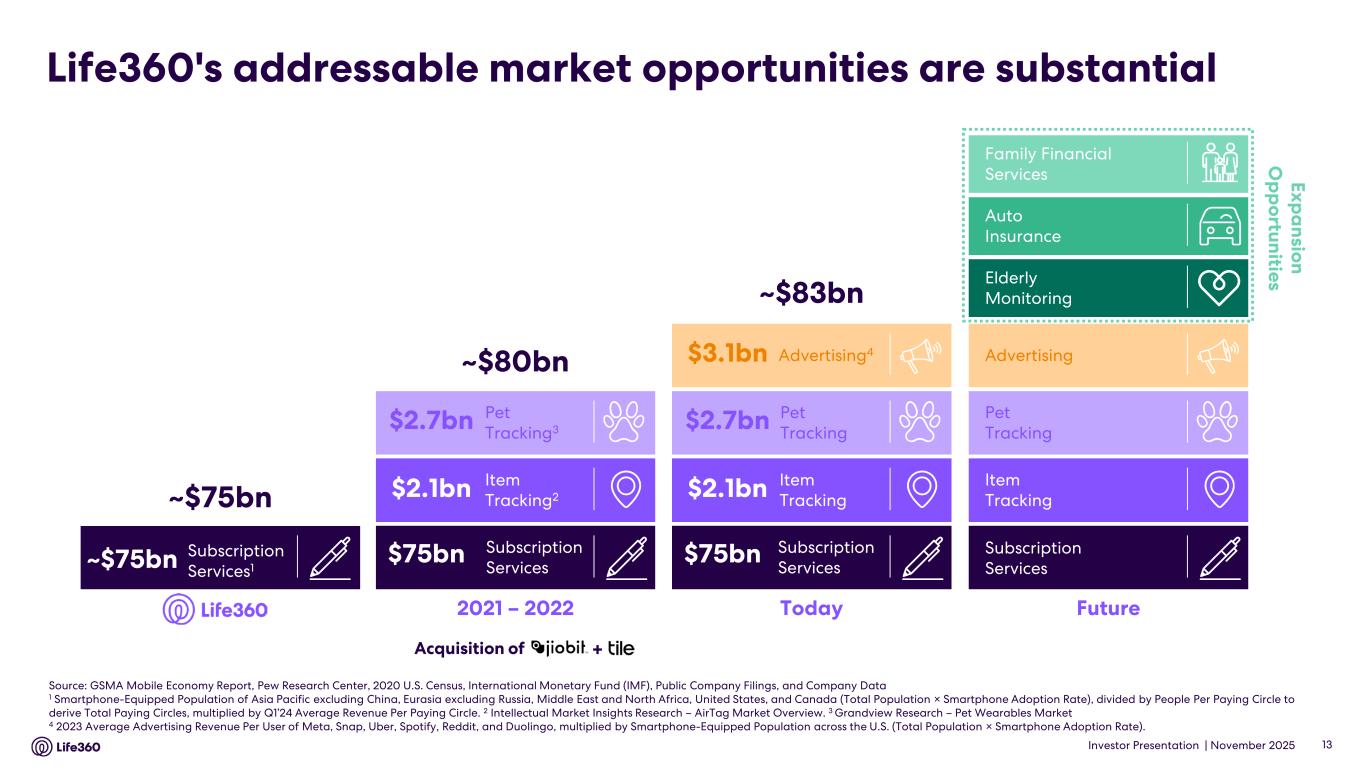

Investor Presentation | November 2025 Life360's addressable market opportunities are substantial Source: GSMA Mobile Economy Report, Pew Research Center, 2020 U.S. Census, International Monetary Fund (IMF), Public Company Filings, and Company Data 1 Smartphone-Equipped Population of Asia Pacific excluding China, Eurasia excluding Russia, Middle East and North Africa, United States, and Canada (Total Population × Smartphone Adoption Rate), divided by People Per Paying Circle to derive Total Paying Circles, multiplied by Q1’24 Average Revenue Per Paying Circle. 2 Intellectual Market Insights Research – AirTag Market Overview. 3 Grandview Research – Pet Wearables Market 4 2023 Average Advertising Revenue Per User of Meta, Snap, Uber, Spotify, Reddit, and Duolingo, multiplied by Smartphone-Equipped Population across the U.S. (Total Population × Smartphone Adoption Rate). 13 2021 – 2022 ~$80bn Item Tracking2 Pet Tracking3 Subscription Services $2.7bn $2.1bn $75bn Today ~$83bn Advertising4 Item Tracking Pet Tracking Subscription Services $2.7bn $2.1bn $75bn $3.1bn Subscription Services1 ~$75bn ~$75bn Acquisition of + Future Exp a nsion O p p ortunities Family Financial Services Elderly Monitoring Auto Insurance Advertising Item Tracking Pet Tracking Subscription Services

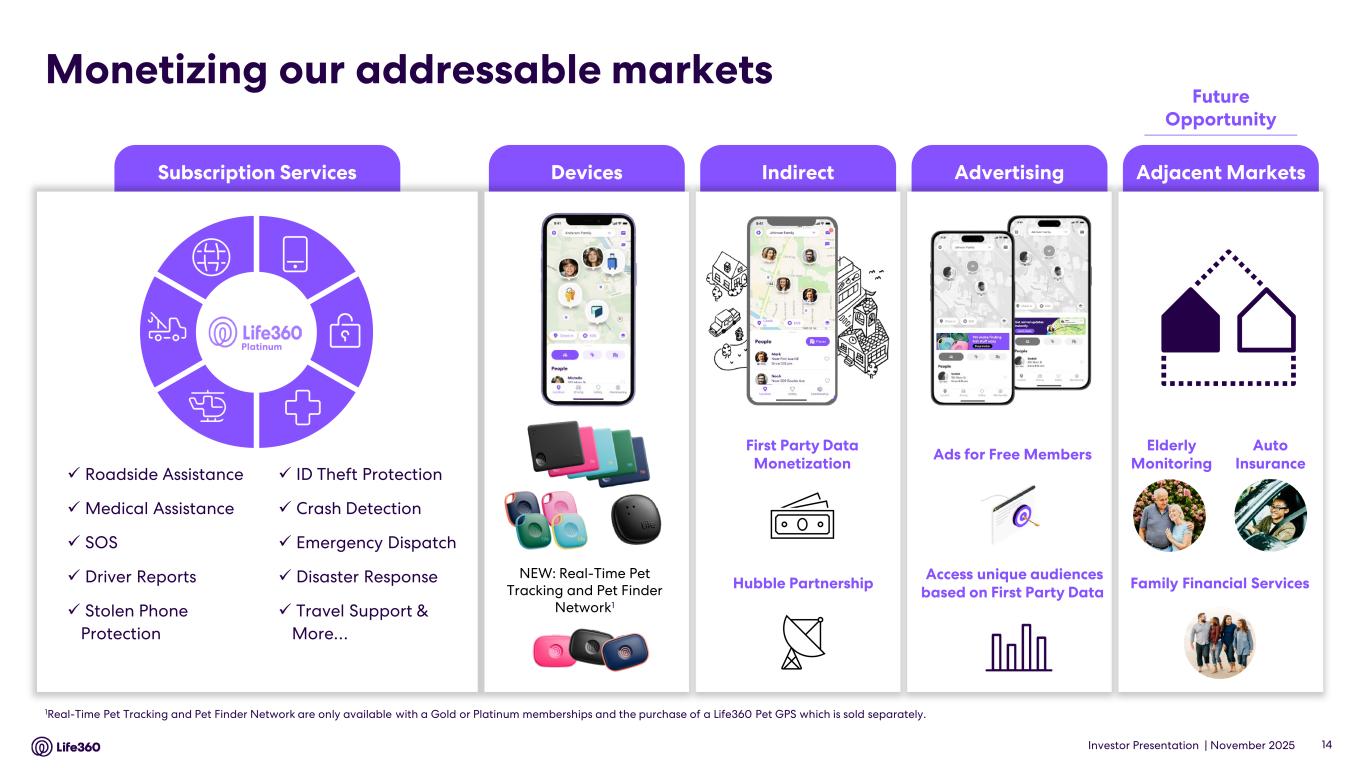

Investor Presentation | November 2025 1Real-Time Pet Tracking and Pet Finder Network are only available with a Gold or Platinum memberships and the purchase of a Life360 Pet GPS which is sold separately. Subscription Services IndirectDevices Advertising Adjacent Markets Monetizing our addressable markets Roadside Assistance Medical Assistance SOS Driver Reports Stolen Phone Protection ID Theft Protection Crash Detection Emergency Dispatch Disaster Response Travel Support & More… Platinum Ads for Free Members Access unique audiences based on First Party Data Elderly Monitoring Family Financial Services Auto Insurance First Party Data Monetization Hubble Partnership 14 Future Opportunity NEW: Real-Time Pet Tracking and Pet Finder Network1

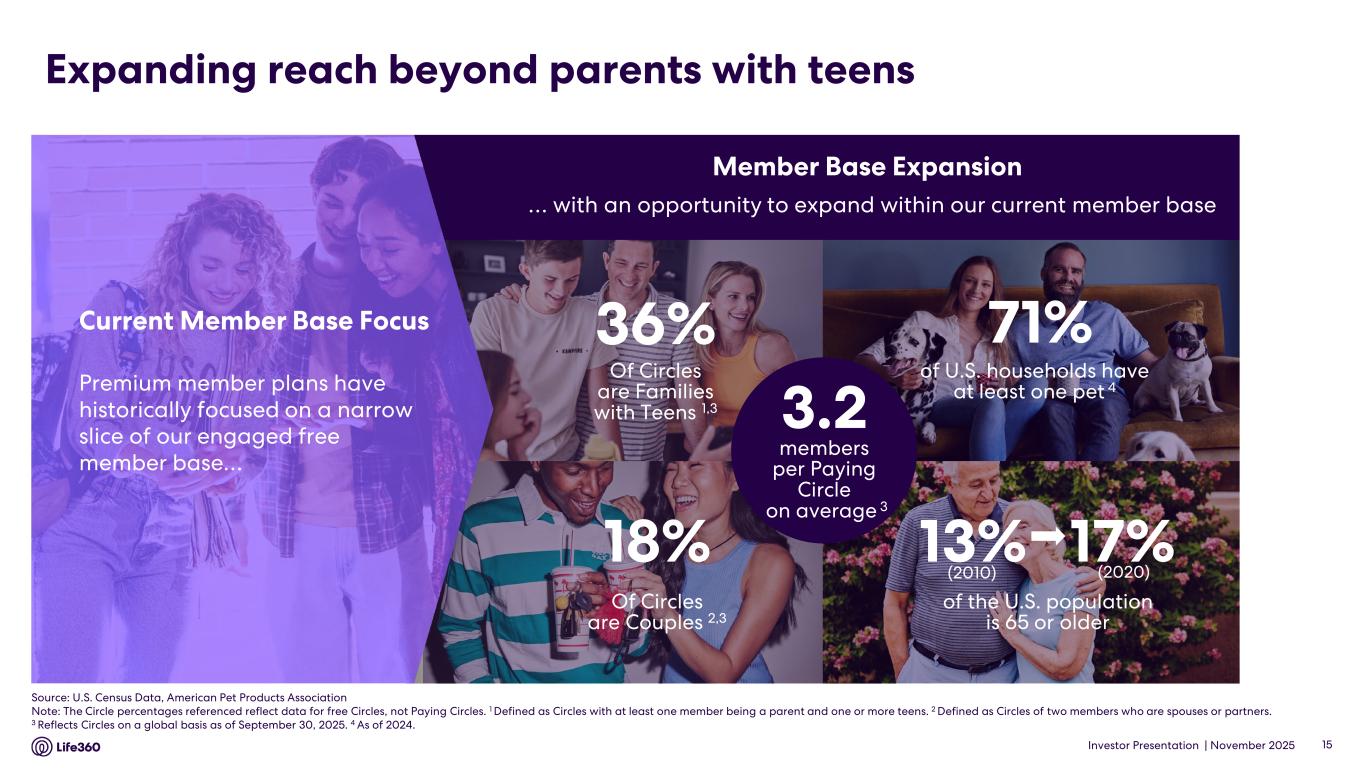

Investor Presentation | November 2025 Expanding reach beyond parents with teens 15 Of Circles are Families with Teens 1,3 36% of U.S. households have at least one pet 4 of the U.S. population is 65 or older 13% 17% (2020)(2010) Of Circles are Couples 2,3 18% 71% … with an opportunity to expand within our current member base Premium member plans have historically focused on a narrow slice of our engaged free member base… Current Member Base Focus Member Base Expansion 3.2 members per Paying Circle on average 3 Source: U.S. Census Data, American Pet Products Association Note: The Circle percentages referenced reflect data for free Circles, not Paying Circles. 1 Defined as Circles with at least one member being a parent and one or more teens. 2 Defined as Circles of two members who are spouses or partners. 3 Reflects Circles on a global basis as of September 30, 2025. 4 As of 2024.

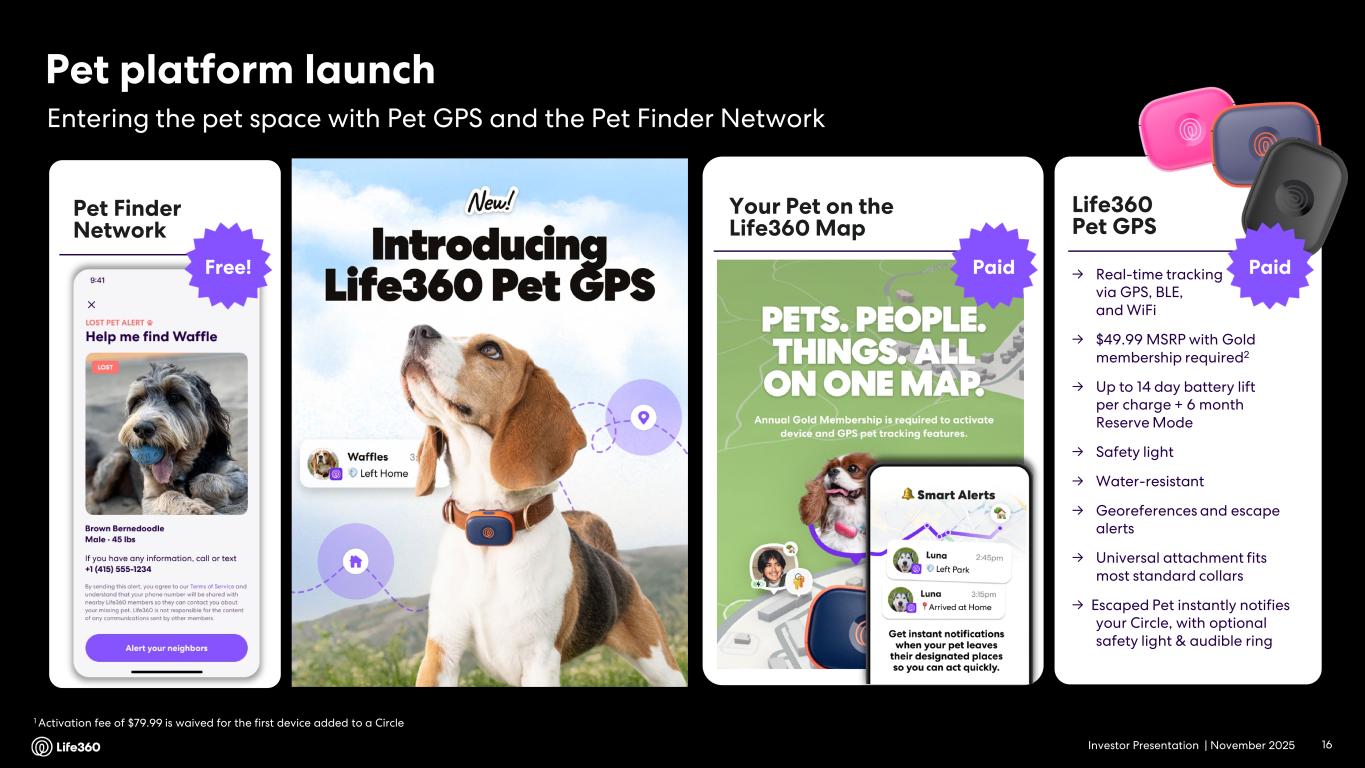

Investor Presentation | November 2025 Life360 Pet GPS → Real-time tracking via GPS, BLE, and WiFi → $49.99 MSRP with Gold membership required2 → Up to 14 day battery lift per charge + 6 month Reserve Mode → Safety light → Water-resistant → Georeferences and escape alerts → Universal attachment fits most standard collars → Escaped Pet instantly notifies your Circle, with optional safety light & audible ring Pet platform launch Entering the pet space with Pet GPS and the Pet Finder Network 1 Activation fee of $79.99 is waived for the first device added to a Circle 16 Your Pet on the Life360 Map Pet Finder Network Free! Paid Paid

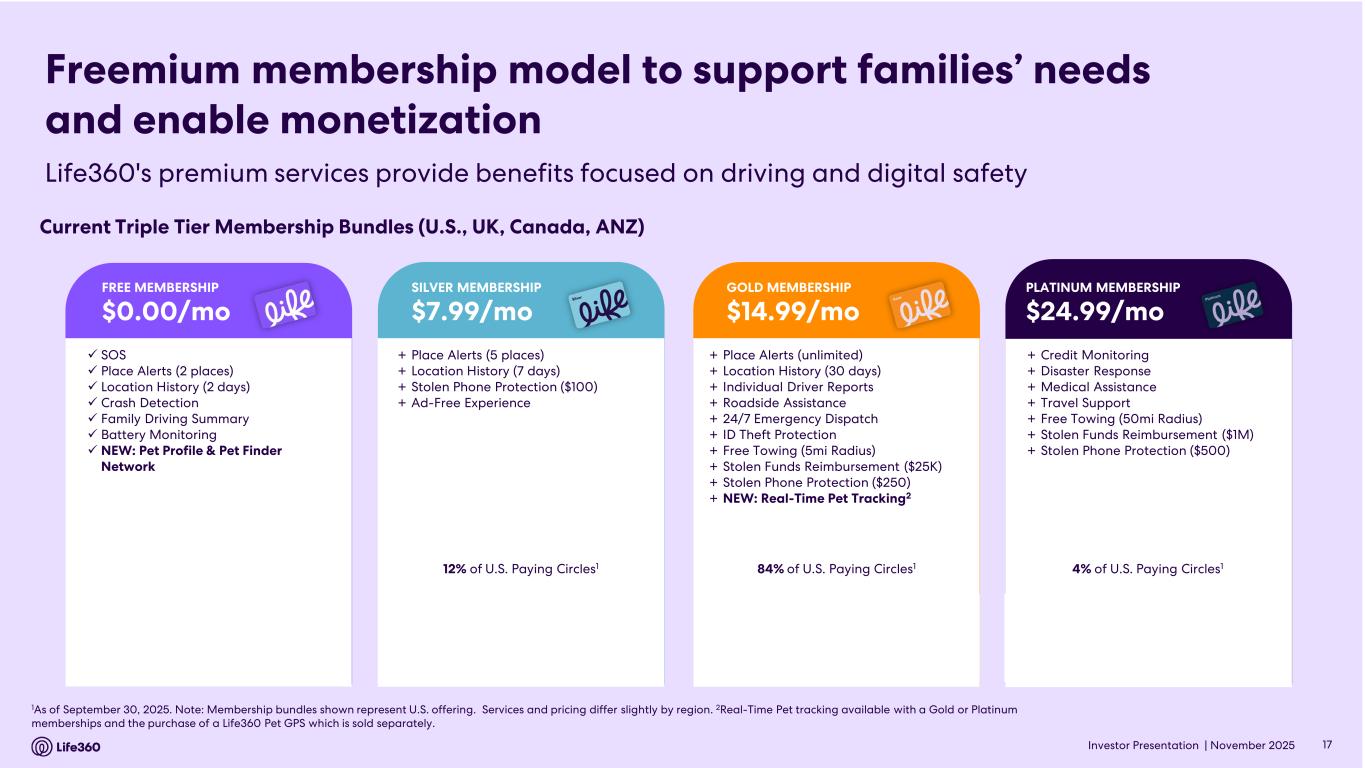

Investor Presentation | November 2025 1As of September 30, 2025. Note: Membership bundles shown represent U.S. offering. Services and pricing differ slightly by region. 2Real-Time Pet tracking available with a Gold or Platinum memberships and the purchase of a Life360 Pet GPS which is sold separately. Freemium membership model to support families’ needs and enable monetization Current Triple Tier Membership Bundles (U.S., UK, Canada, ANZ) + Place Alerts (5 places) + Location History (7 days) + Stolen Phone Protection ($100) + Ad-Free Experience 12% of U.S. Paying Circles1 SILVER MEMBERSHIP $7.99/mo + Place Alerts (unlimited) + Location History (30 days) + Individual Driver Reports + Roadside Assistance + 24/7 Emergency Dispatch + ID Theft Protection + Free Towing (5mi Radius) + Stolen Funds Reimbursement ($25K) + Stolen Phone Protection ($250) + NEW: Real-Time Pet Tracking2 84% of U.S. Paying Circles1 GOLD MEMBERSHIP $14.99/mo + Credit Monitoring + Disaster Response + Medical Assistance + Travel Support + Free Towing (50mi Radius) + Stolen Funds Reimbursement ($1M) + Stolen Phone Protection ($500) 4% of U.S. Paying Circles1 PLATINUM MEMBERSHIP $24.99/mo SOS Place Alerts (2 places) Location History (2 days) Crash Detection Family Driving Summary Battery Monitoring NEW: Pet Profile & Pet Finder Network FREE MEMBERSHIP $0.00/mo 17 Life360's premium services provide benefits focused on driving and digital safety

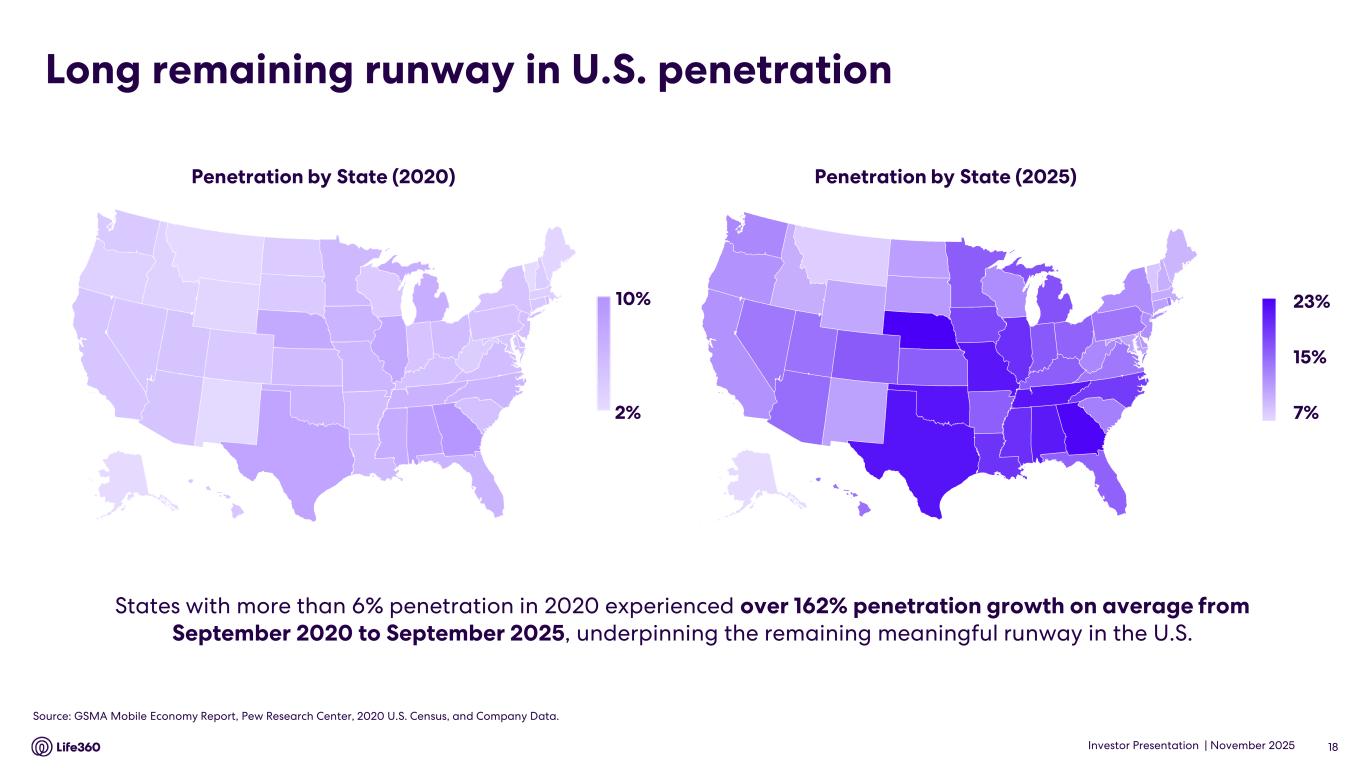

Investor Presentation | November 2025 States with more than 6% penetration in 2020 experienced over 162% penetration growth on average from September 2020 to September 2025, underpinning the remaining meaningful runway in the U.S. Long remaining runway in U.S. penetration Penetration by State (2025)Penetration by State (2020) Source: GSMA Mobile Economy Report, Pew Research Center, 2020 U.S. Census, and Company Data. 18 10% 2% 23% 15% 7% © GeoN

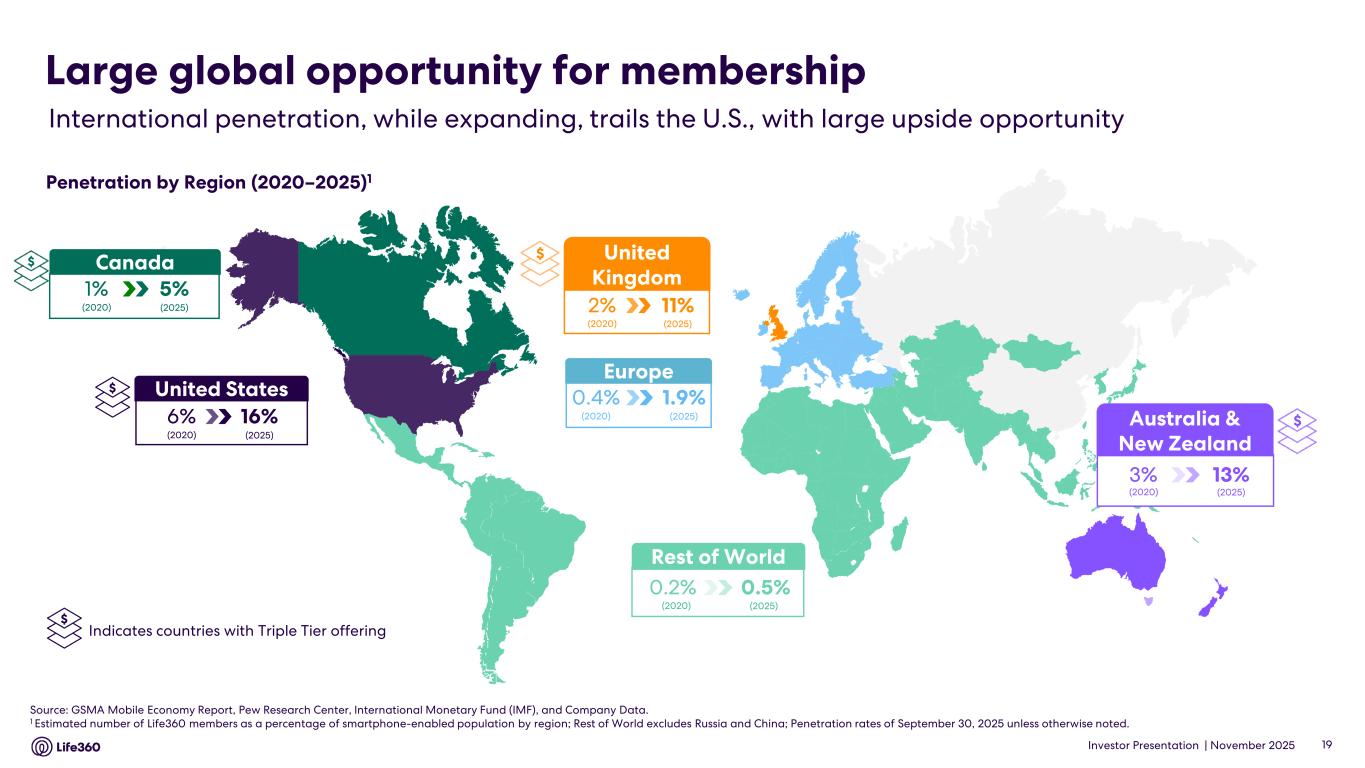

Investor Presentation | November 2025 Source: GSMA Mobile Economy Report, Pew Research Center, International Monetary Fund (IMF), and Company Data. 1 Estimated number of Life360 members as a percentage of smartphone-enabled population by region; Rest of World excludes Russia and China; Penetration rates of September 30, 2025 unless otherwise noted. Rest of World 0.5%0.2% (2020) (2025) Europe 1.9%0.4% (2020) (2025) International penetration, while expanding, trails the U.S., with large upside opportunity Large global opportunity for membership Penetration by Region (2020–2025)1 19 $Australia & New Zealand 13%3% (2020) (2025) $ United Kingdom 11%2% (2020) (2025) $ Indicates countries with Triple Tier offering United States 16%6% (2020) (2025) $ Canada 5%1% (2020) (2025) $

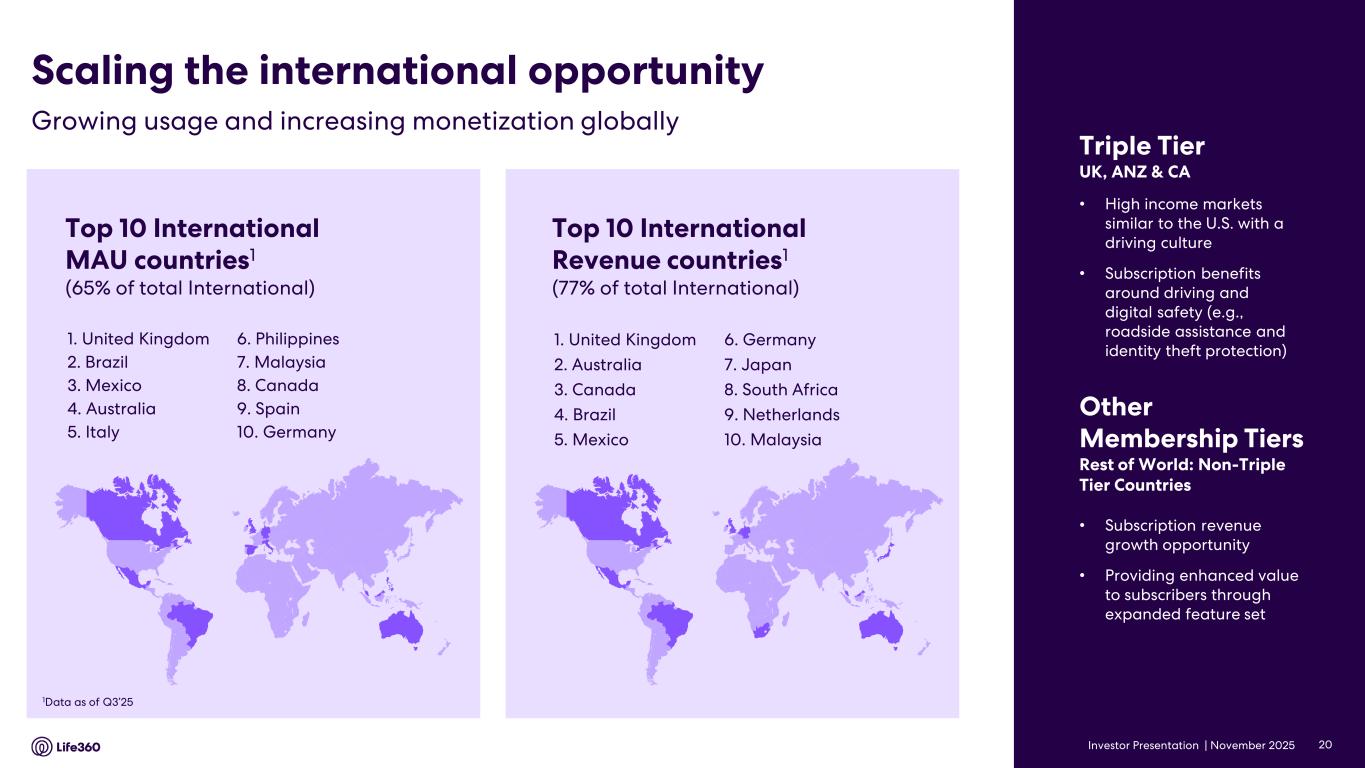

Investor Presentation | November 2025 Top 10 International MAU countries1 (65% of total International) 1. United Kingdom 2. Brazil 3. Mexico 4. Australia 5. Italy 1Data as of Q3’25 Top 10 International Revenue countries1 (77% of total International) 1. United Kingdom 2. Australia 3. Canada 4. Brazil 5. Mexico • Subscription revenue growth opportunity • Providing enhanced value to subscribers through expanded feature set Other Membership Tiers Rest of World: Non-Triple Tier Countries Growing usage and increasing monetization globally Scaling the international opportunity Triple Tier UK, ANZ & CA • High income markets similar to the U.S. with a driving culture • Subscription benefits around driving and digital safety (e.g., roadside assistance and identity theft protection) 6. Germany 7. Japan 8. South Africa 9. Netherlands 10. Malaysia 6. Philippines 7. Malaysia 8. Canada 9. Spain 10. Germany 20

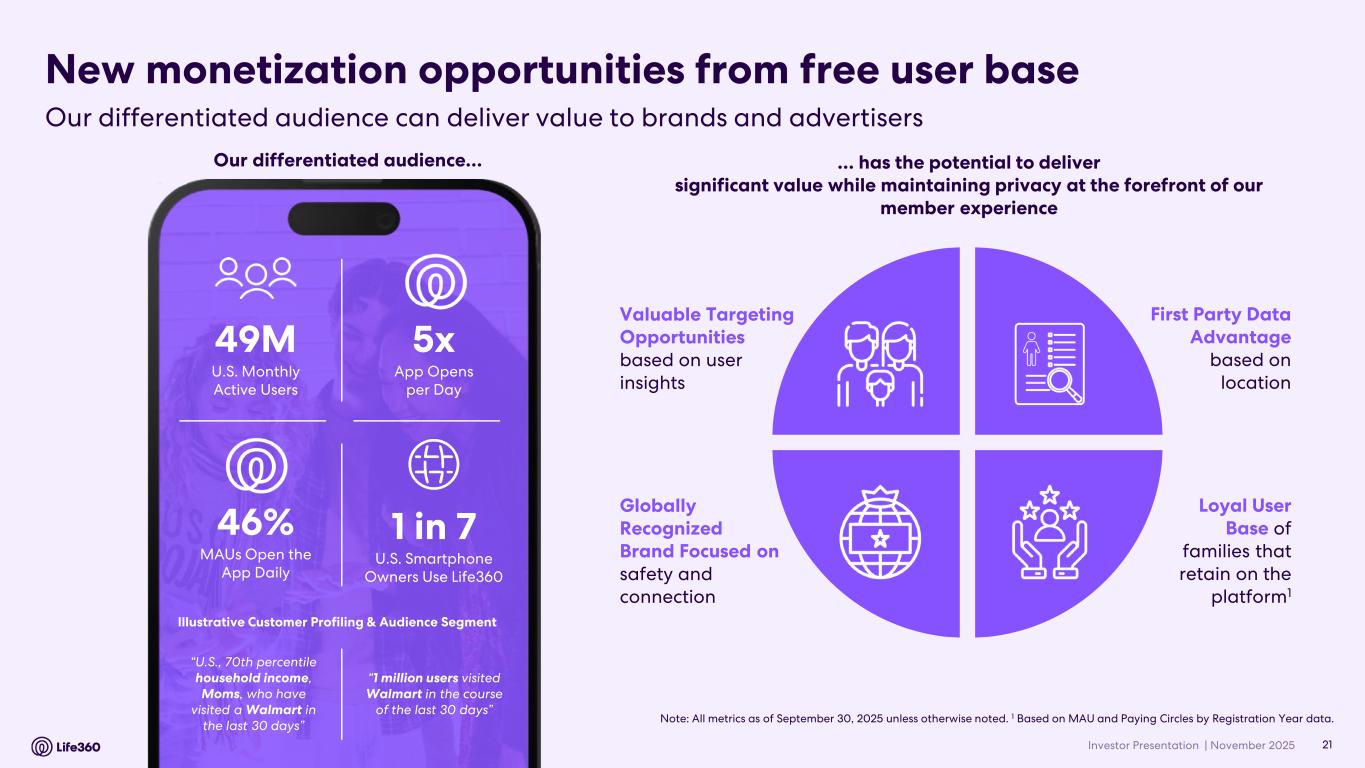

Investor Presentation | November 2025 New monetization opportunities from free user base Loyal User Base of families that retain on the platform1 Globally Recognized Brand Focused on safety and connection First Party Data Advantage based on location Valuable Targeting Opportunities based on user insights … has the potential to deliver significant value while maintaining privacy at the forefront of our member experience Note: All metrics as of September 30, 2025 unless otherwise noted. 1 Based on MAU and Paying Circles by Registration Year data. 49M U.S. Monthly Active Users 1 in 7 U.S. Smartphone Owners Use Life360 5x App Opens per Day 46% MAUs Open the App Daily “U.S., 70th percentile household income, Moms, who have visited a Walmart in the last 30 days” Illustrative Customer Profiling & Audience Segment “1 million users visited Walmart in the course of the last 30 days” Our differentiated audience… 21 Our differentiated audience can deliver value to brands and advertisers

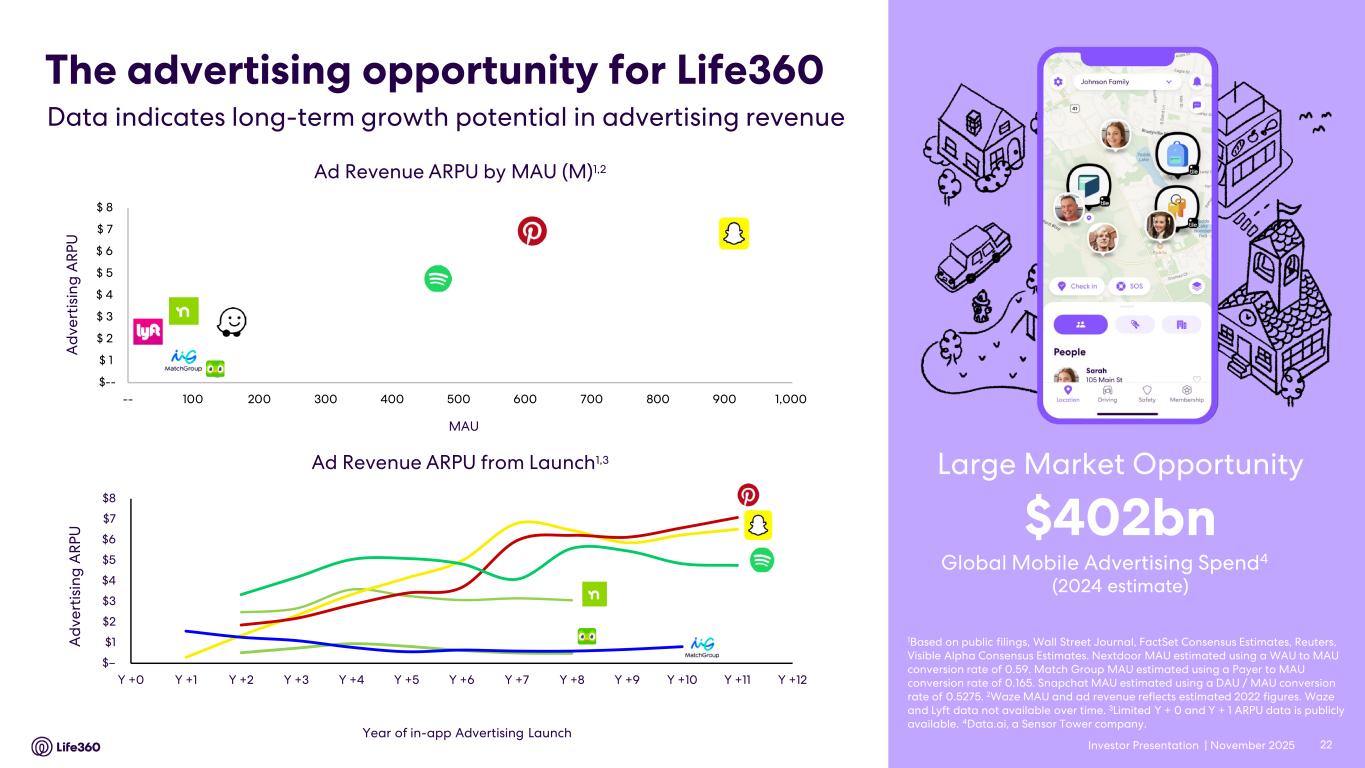

Investor Presentation | November 2025 $-- $ 1 $ 2 $ 3 $ 4 $ 5 $ 6 $ 7 $ 8 -- 100 200 300 400 500 600 700 800 900 1,000 Ad Revenue ARPU by MAU (M)1,2 MAU Ad Revenue ARPU from Launch1,3 22 The advertising opportunity for Life360 1Based on public filings, Wall Street Journal, FactSet Consensus Estimates, Reuters, Visible Alpha Consensus Estimates. Nextdoor MAU estimated using a WAU to MAU conversion rate of 0.59. Match Group MAU estimated using a Payer to MAU conversion rate of 0.165. Snapchat MAU estimated using a DAU / MAU conversion rate of 0.5275. 2Waze MAU and ad revenue reflects estimated 2022 figures. Waze and Lyft data not available over time. 3Limited Y + 0 and Y + 1 ARPU data is publicly available. 4Data.ai, a Sensor Tower company. Global Mobile Advertising Spend4 $402bn (2024 estimate) Large Market Opportunity Year of in-app Advertising Launch Data indicates long-term growth potential in advertising revenue A d ve rt is in g A R PU A d ve rt is in g A R PU $– $1 $2 $3 $4 $5 $6 $7 $8 Y +0 Y +1 Y +2 Y +3 Y +4 Y +5 Y +6 Y +7 Y +8 Y +9 Y +10 Y +11 Y +12

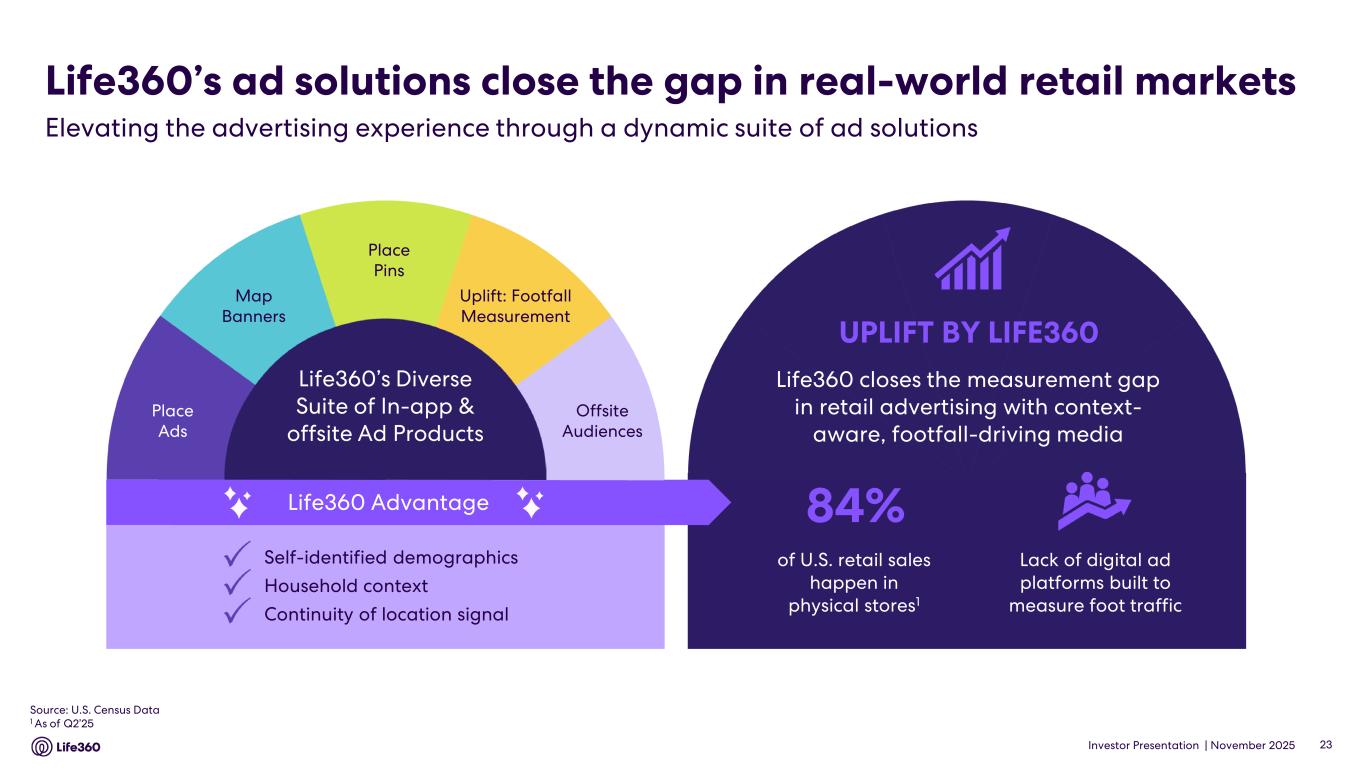

Investor Presentation | November 2025 UPLIFT BY LIFE360 Offsite Audiences Uplift: Footfall Measurement Map Banners Place Ads Place Pins Self-identified demographics Household context Continuity of location signal Life360 closes the measurement gap in retail advertising with context- aware, footfall-driving media Life360’s ad solutions close the gap in real-world retail markets Life360 Advantage 84% Lack of digital ad platforms built to measure foot traffic of U.S. retail sales happen in physical stores1 Source: U.S. Census Data 1 As of Q2’25 23 Elevating the advertising experience through a dynamic suite of ad solutions

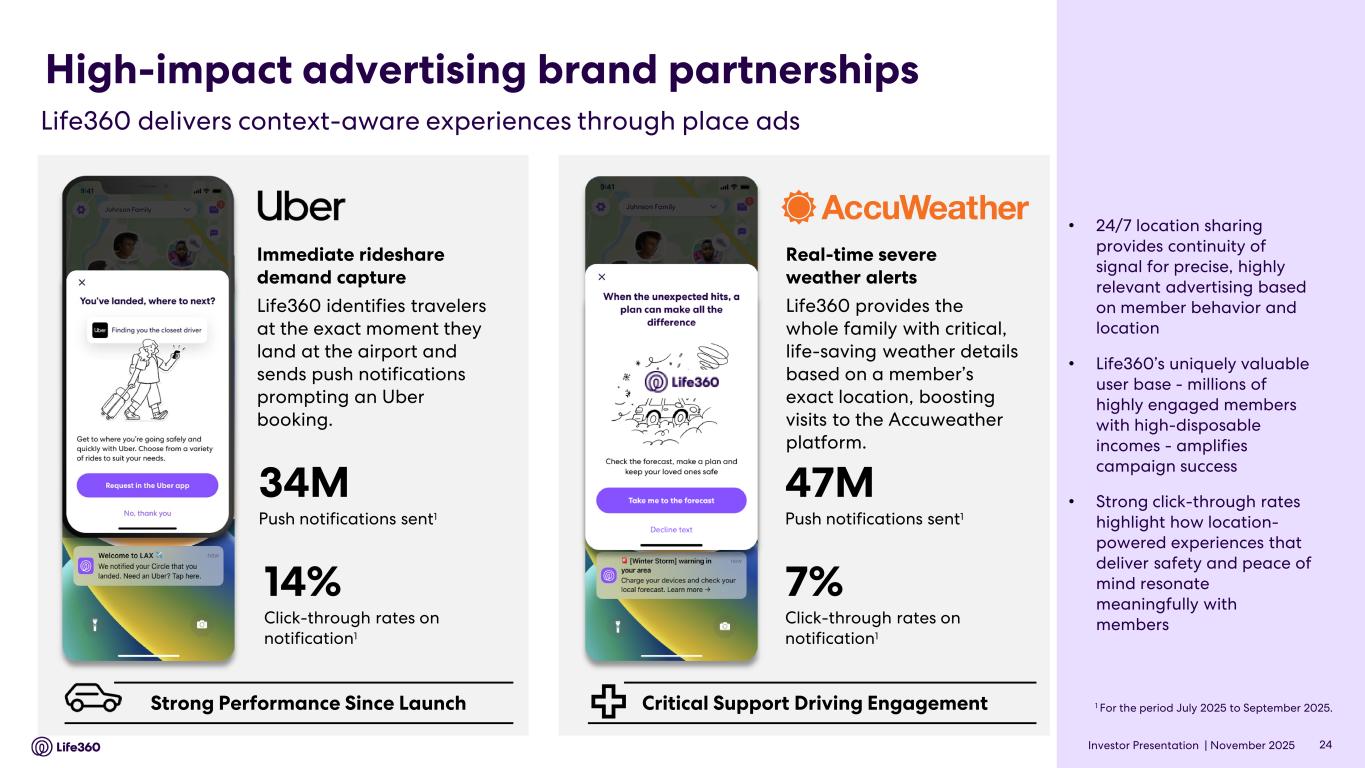

Investor Presentation | November 2025 High-impact advertising brand partnerships 24 Life360 delivers context-aware experiences through place ads 34M Push notifications sent1 14% Click-through rates on notification1 Immediate rideshare demand capture Life360 identifies travelers at the exact moment they land at the airport and sends push notifications prompting an Uber booking. • 24/7 location sharing provides continuity of signal for precise, highly relevant advertising based on member behavior and location • Life360’s uniquely valuable user base - millions of highly engaged members with high-disposable incomes - amplifies campaign success • Strong click-through rates highlight how location- powered experiences that deliver safety and peace of mind resonate meaningfully with members Real-time severe weather alerts Life360 provides the whole family with critical, life-saving weather details based on a member’s exact location, boosting visits to the Accuweather platform. Critical Support Driving Engagement 47M Push notifications sent1 Strong Performance Since Launch 7% Click-through rates on notification1 1 For the period July 2025 to September 2025.

Investor Presentation | November 2025 Advertising Update 02

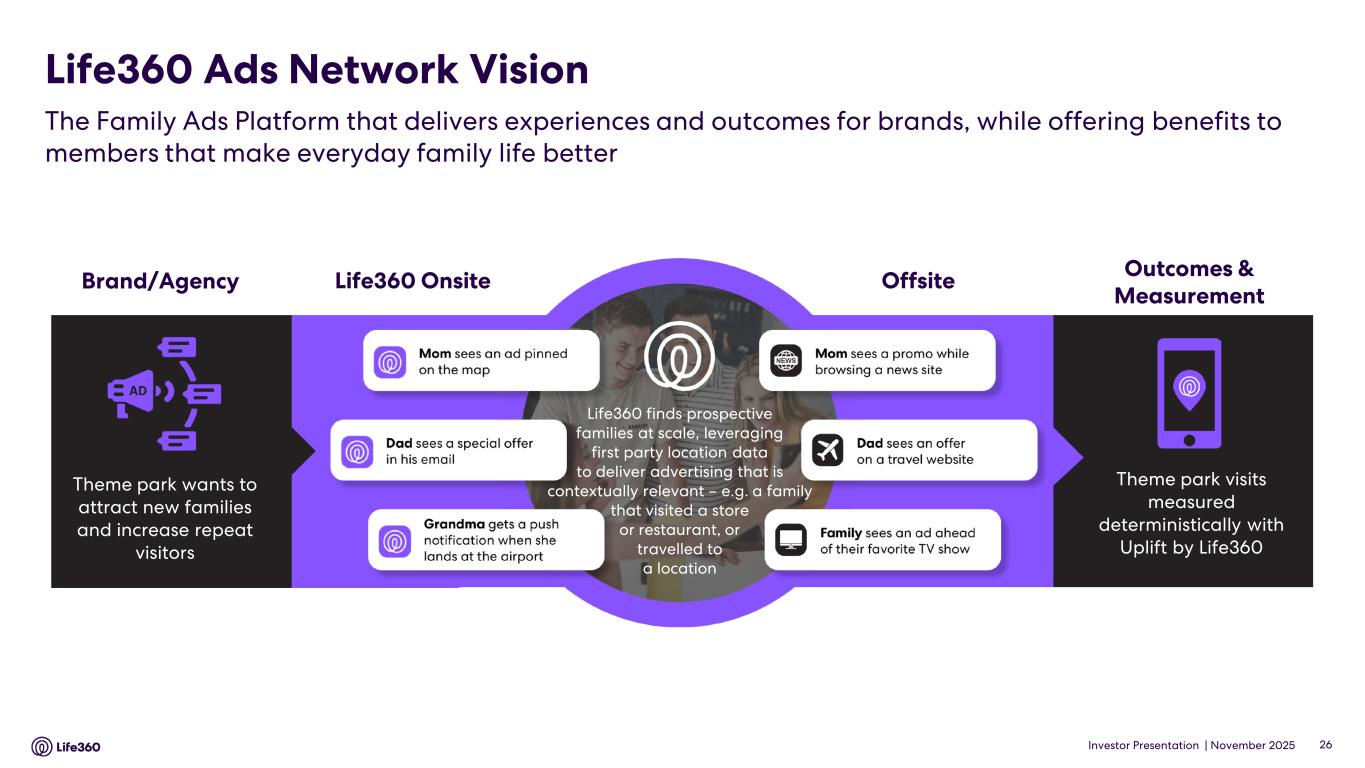

Investor Presentation | November 2025 Life360 Ads Network Vision The Family Ads Platform that delivers experiences and outcomes for brands, while offering benefits to members that make everyday family life better Brand/Agency Theme park wants to attract new families and increase repeat visitors Life360 finds prospective families at scale, leveraging first party location data to deliver advertising that is contextually relevant – e.g. a family that visited a store or restaurant, or travelled to a location Theme park visits measured deterministically with Uplift by Life360 OffsiteLife360 Onsite Outcomes & Measurement 26

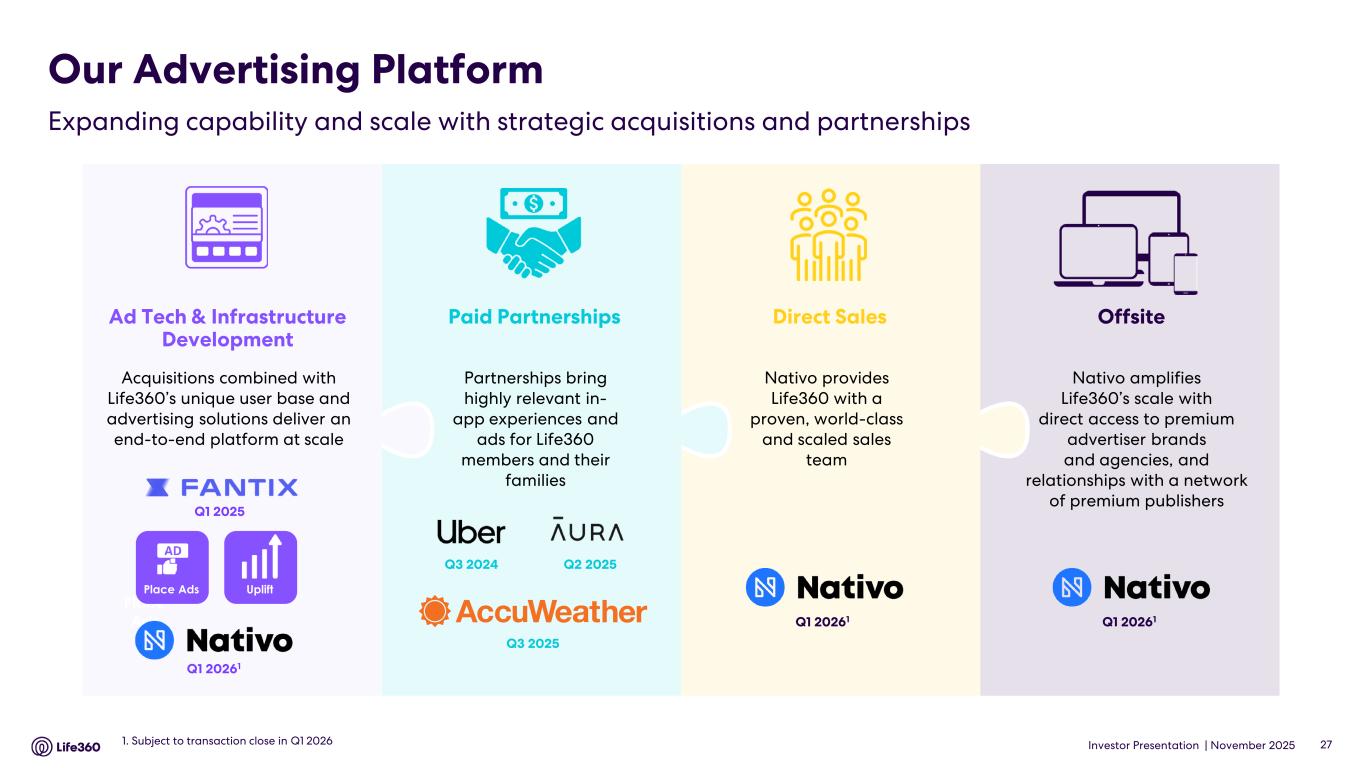

Investor Presentation | November 2025 Our Advertising Platform Expanding capability and scale with strategic acquisitions and partnerships 271. Subject to transaction close in Q1 2026 Nativo provides Life360 with a proven, world-class and scaled sales team Nativo amplifies Life360’s scale with direct access to premium advertiser brands and agencies, and relationships with a network of premium publishers Place Ads Place Ads Uplift Q1 2025 Q1 20261 Q2 2025Q3 2024 Q3 2025 OffsiteDirect SalesPaid PartnershipsAd Tech & Infrastructure Development Partnerships bring highly relevant in- app experiences and ads for Life360 members and their families Acquisitions combined with Life360’s unique user base and advertising solutions deliver an end-to-end platform at scale Q1 20261Q1 20261

Investor Presentation | November 2025 Nativo accelerates Life360’s advertising roadmap Nativo transforms our advertising platform into an end-to-end offering with best-in-class technology, established relationships, and experienced sales team 28 Advanced Ad Renderer Ad renderer technology to easily deploy custom ad formats and dynamic landing page experiences at scale Unique Demand & Publisher Network Seasoned direct sales team generating unique demand from agencies and brands – bought managed, programmatic and self-serve Advanced Measurement Robust measurement capabilities including real-time surveys, attention metrics and advanced insights with easy UI Proprietary Targeting Proprietary privacy- compliant, predictive targeting that uses unique engagement signals and outperforms

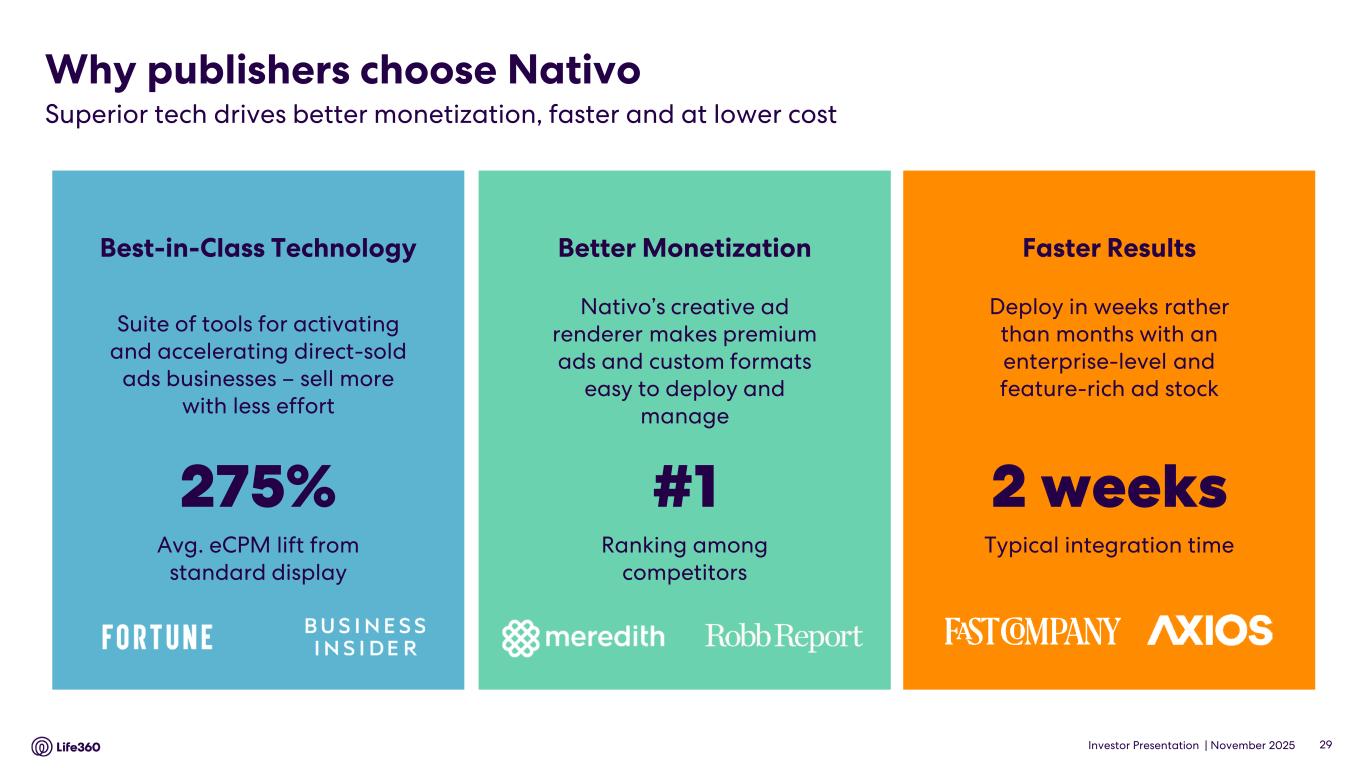

Investor Presentation | November 2025 Best-in-Class Technology Suite of tools for activating and accelerating direct-sold ads businesses – sell more with less effort 275% Avg. eCPM lift from standard display Better Monetization Nativo’s creative ad renderer makes premium ads and custom formats easy to deploy and manage #1 Ranking among competitors Faster Results Deploy in weeks rather than months with an enterprise-level and feature-rich ad stock 2 weeks Typical integration time Why publishers choose Nativo 29 Superior tech drives better monetization, faster and at lower cost

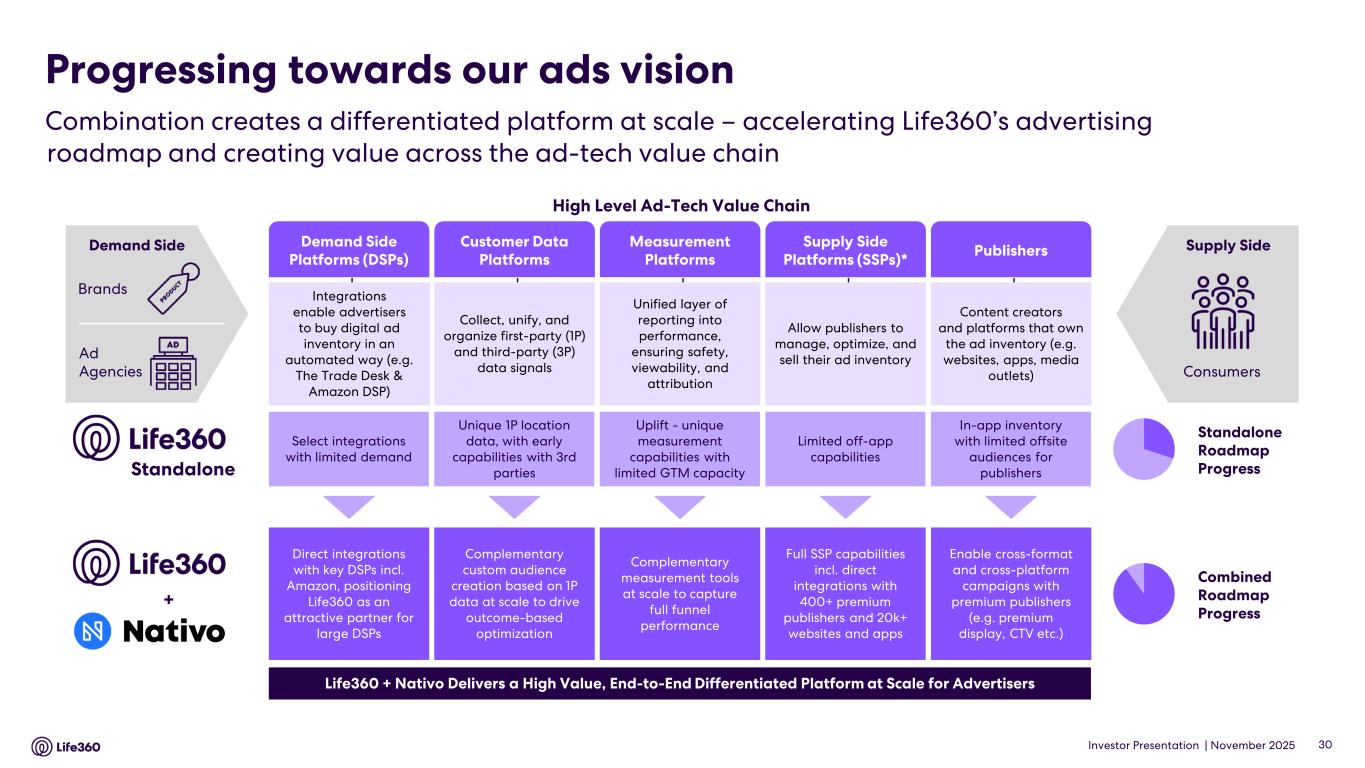

Investor Presentation | November 2025 Progressing towards our ads vision Combination creates a differentiated platform at scale – accelerating Life360’s advertising roadmap and creating value across the ad-tech value chain 30 Demand Side Platforms (DSPs) Customer Data Platforms Measurement Platforms Supply Side Platforms (SSPs)* Publishers High Level Ad-Tech Value Chain Allow publishers to manage, optimize, and sell their ad inventory Collect, unify, and organize first-party (1P) and third-party (3P) data signals Unified layer of reporting into performance, ensuring safety, viewability, and attribution Content creators and platforms that own the ad inventory (e.g. websites, apps, media outlets) Integrations enable advertisers to buy digital ad inventory in an automated way (e.g. The Trade Desk & Amazon DSP) Consumers Supply Side Enable cross-format and cross-platform campaigns with premium publishers (e.g. premium display, CTV etc.) Complementary custom audience creation based on 1P data at scale to drive outcome-based optimization Direct integrations with key DSPs incl. Amazon, positioning Life360 as an attractive partner for large DSPs Full SSP capabilities incl. direct integrations with 400+ premium publishers and 20k+ websites and apps Complementary measurement tools at scale to capture full funnel performance Standalone Unique 1P location data, with early capabilities with 3rd parties Select integrations with limited demand In-app inventory with limited offsite audiences for publishers Uplift - unique measurement capabilities with limited GTM capacity Limited off-app capabilities Life360 + Nativo Delivers a High Value, End-to-End Differentiated Platform at Scale for Advertisers + Standalone Roadmap Progress Combined Roadmap Progress Brands Ad Agencies Demand Side

Investor Presentation | November 2025 Life360 Strategy 03

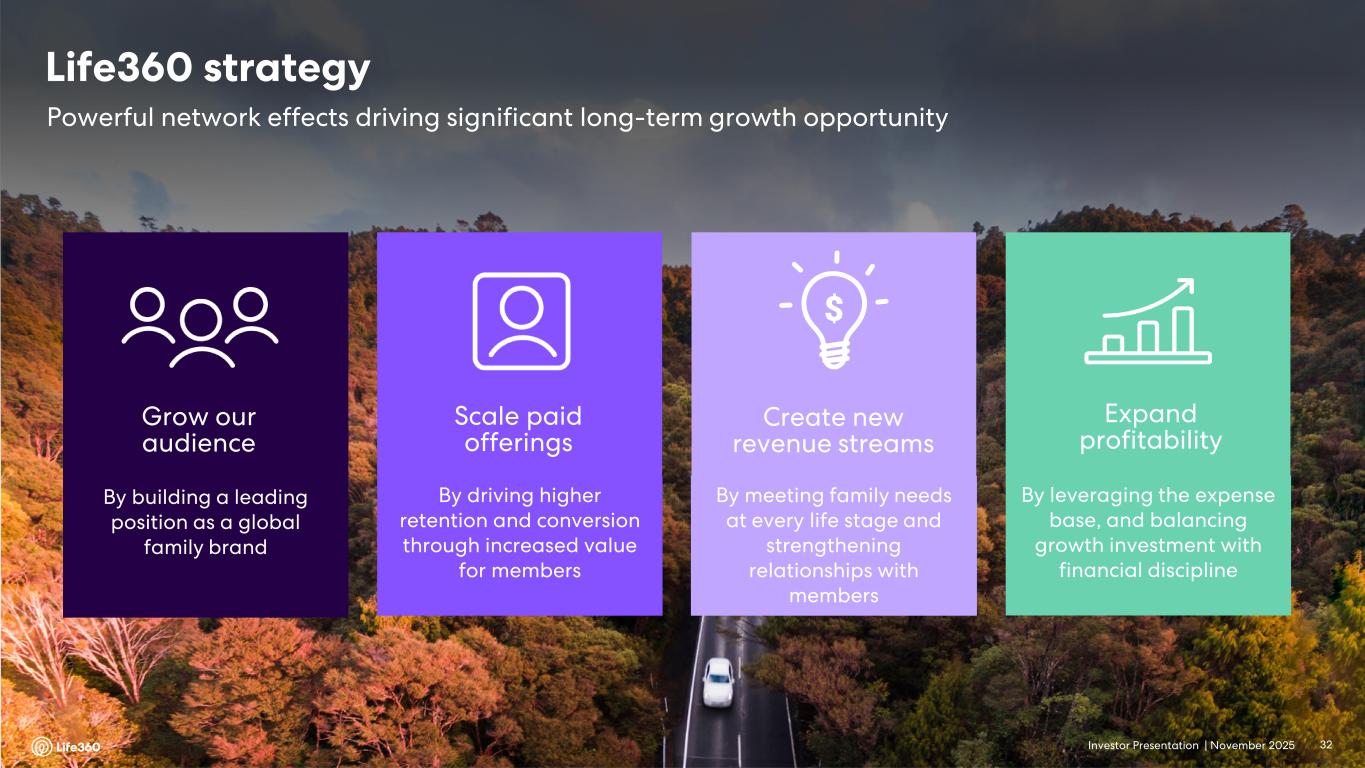

Investor Presentation | November 2025 Grow our audience By building a leading position as a global family brand Scale paid offerings By driving higher retention and conversion through increased value for members Create new revenue streams By meeting family needs at every life stage and strengthening relationships with members Expand profitability By leveraging the expense base, and balancing growth investment with financial discipline Powerful network effects driving significant long-term growth opportunity Life360 strategy 32

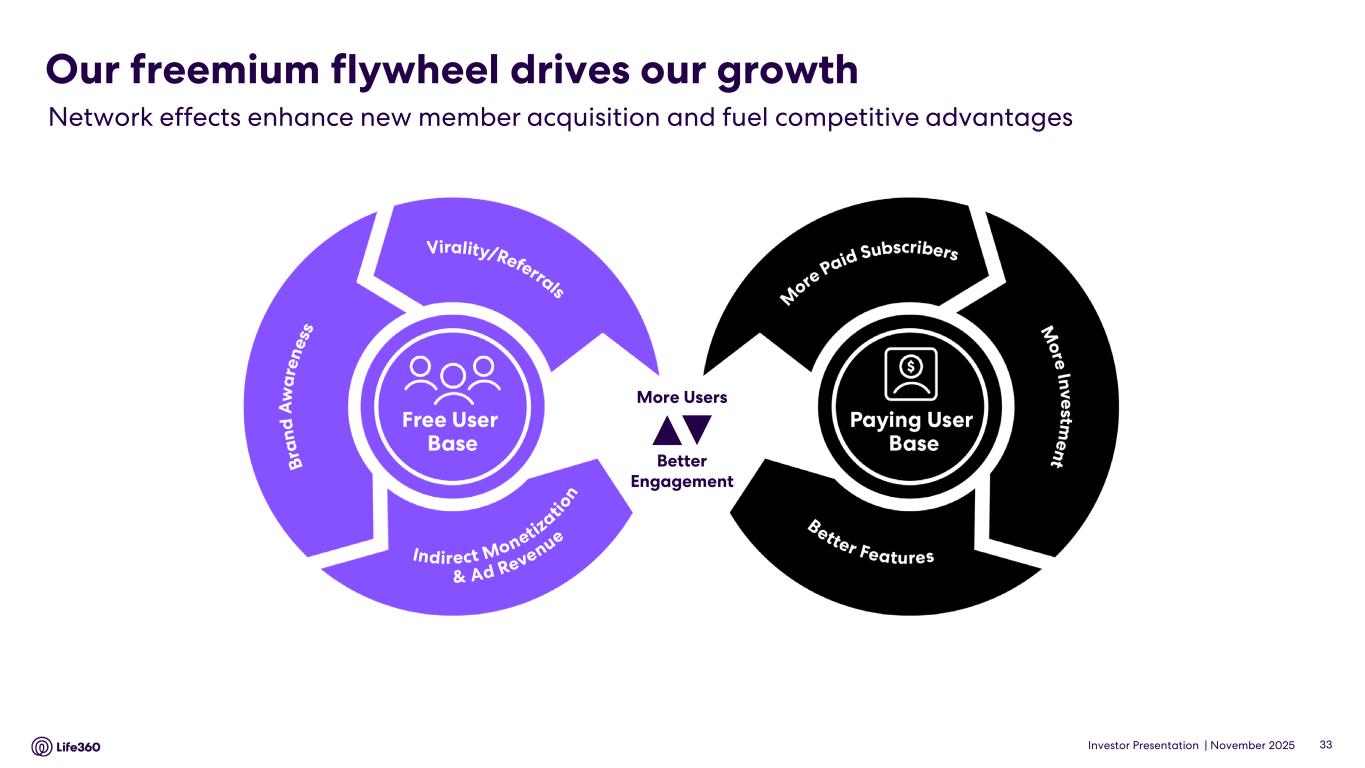

Investor Presentation | November 2025 Our freemium flywheel drives our growth 33 Network effects enhance new member acquisition and fuel competitive advantages Better Engagement More Users

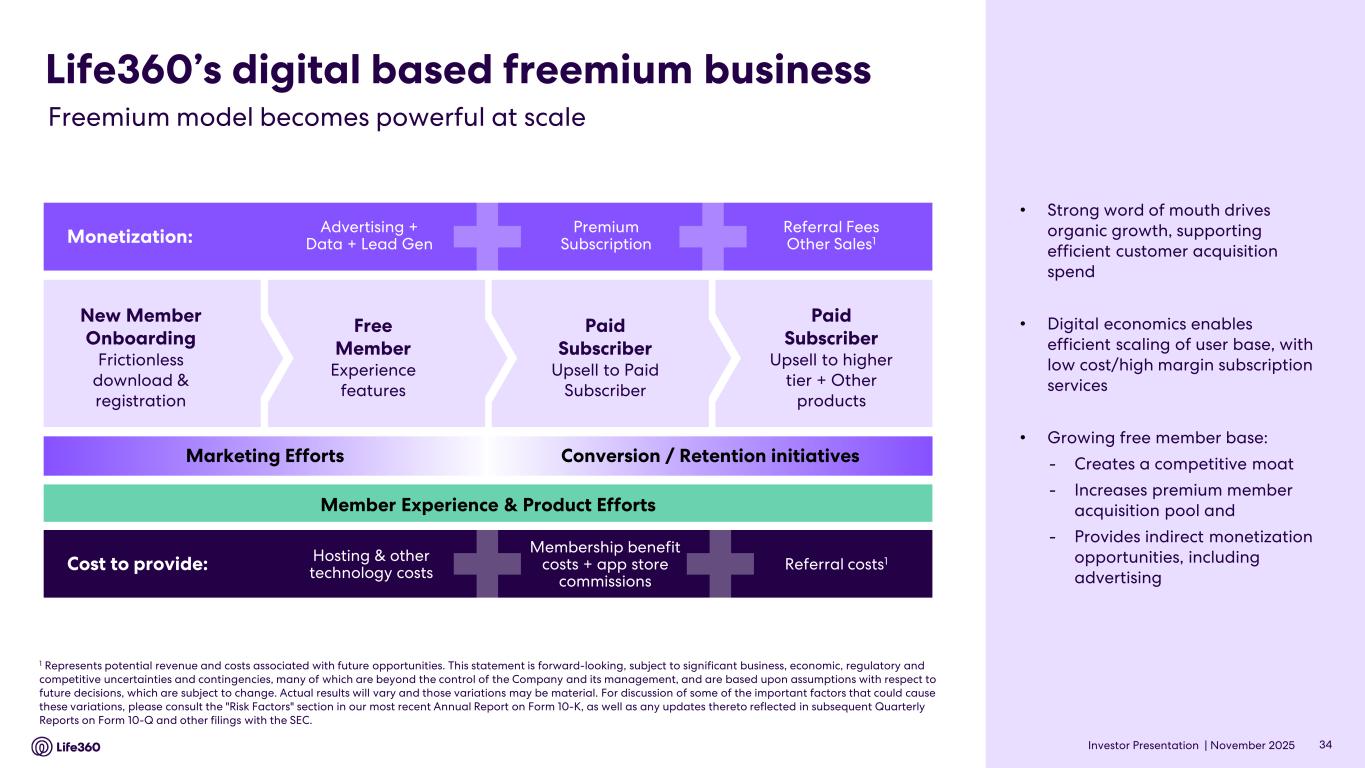

Investor Presentation | November 2025 New Member Onboarding Frictionless download & registration Free Member Experience features Paid Subscriber Upsell to Paid Subscriber Paid Subscriber Upsell to higher tier + Other products Life360’s digital based freemium business Monetization: Advertising + Data + Lead Gen Premium Subscription Referral Fees Other Sales1 Cost to provide: Hosting & other technology costs Membership benefit costs + app store commissions Referral costs1 Marketing Efforts Conversion / Retention initiatives Member Experience & Product Efforts 1 Represents potential revenue and costs associated with future opportunities. This statement is forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" section in our most recent Annual Report on Form 10-K, as well as any updates thereto reflected in subsequent Quarterly Reports on Form 10-Q and other filings with the SEC. 34 Freemium model becomes powerful at scale • Strong word of mouth drives organic growth, supporting efficient customer acquisition spend • Digital economics enables efficient scaling of user base, with low cost/high margin subscription services • Growing free member base: - Creates a competitive moat - Increases premium member acquisition pool and - Provides indirect monetization opportunities, including advertising

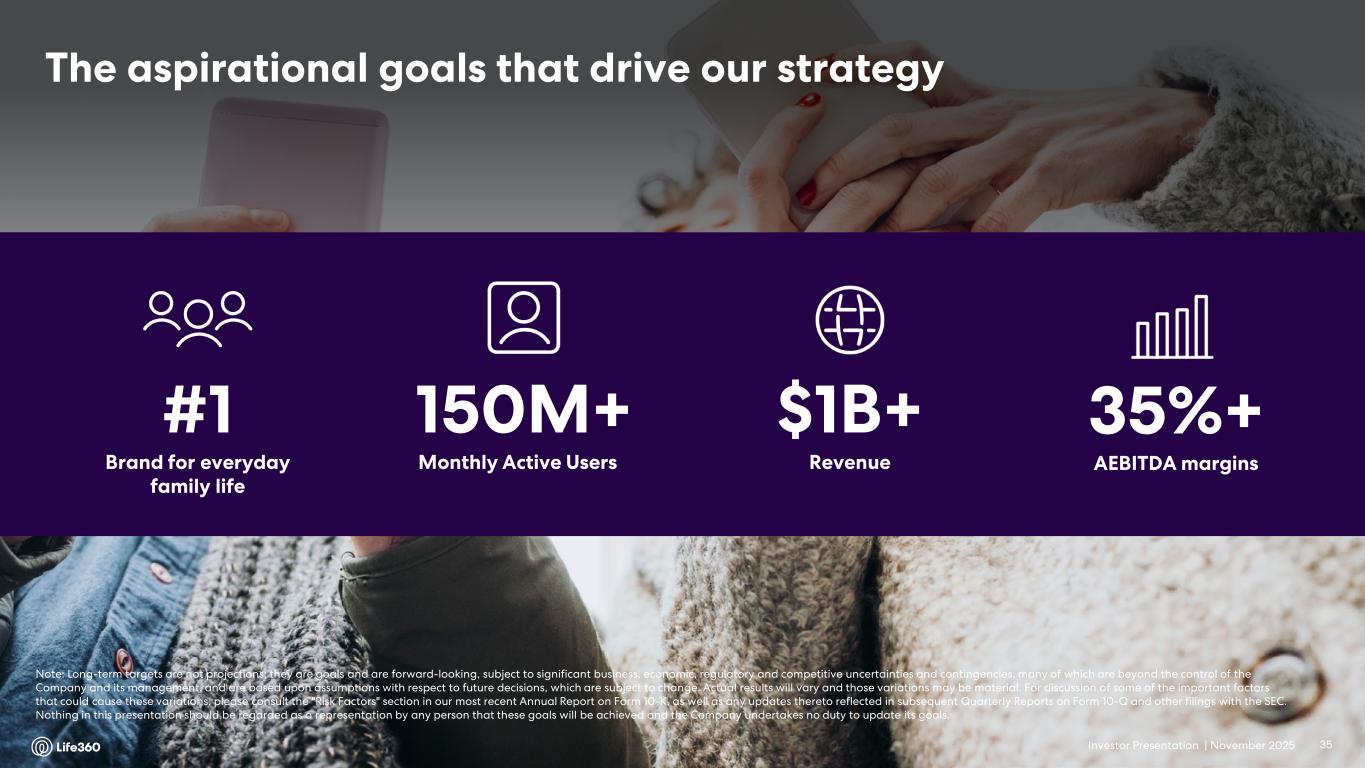

Investor Presentation | November 2025 The aspirational goals that drive our strategy #1 Brand for everyday family life 150M+ Monthly Active Users $1B+ Revenue 35%+ AEBITDA margins Note: Long-term targets are not projections; they are goals and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" section in our most recent Annual Report on Form 10-K, as well as any updates thereto reflected in subsequent Quarterly Reports on Form 10-Q and other filings with the SEC. Nothing in this presentation should be regarded as a representation by any person that these goals will be achieved and the Company undertakes no duty to update its goals. 35

Investor Presentation | November 2025 Financial Update Q3’25 04

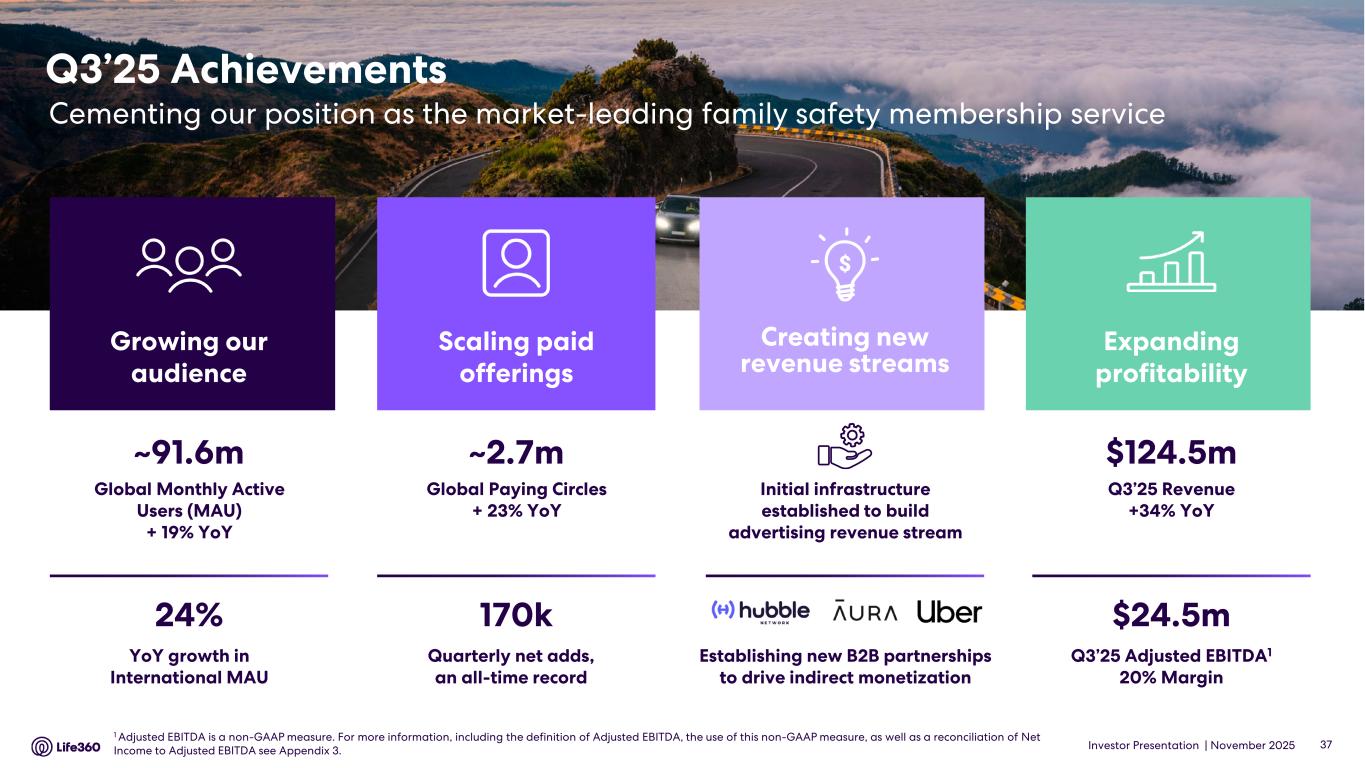

Investor Presentation | November 2025 Q3’25 Achievements Cementing our position as the market-leading family safety membership service $124.5m Q3’25 Revenue +34% YoY $24.5m Q3’25 Adjusted EBITDA1 20% Margin Expanding profitability ~2.7m Global Paying Circles + 23% YoY 170k Quarterly net adds, an all-time record Scaling paid offerings ~91.6m Global Monthly Active Users (MAU) + 19% YoY 24% YoY growth in International MAU Growing our audience Establishing new B2B partnerships to drive indirect monetization Initial infrastructure established to build advertising revenue stream Creating new revenue streams 37 1 Adjusted EBITDA is a non-GAAP measure. For more information, including the definition of Adjusted EBITDA, the use of this non-GAAP measure, as well as a reconciliation of Net Income to Adjusted EBITDA see Appendix 3.

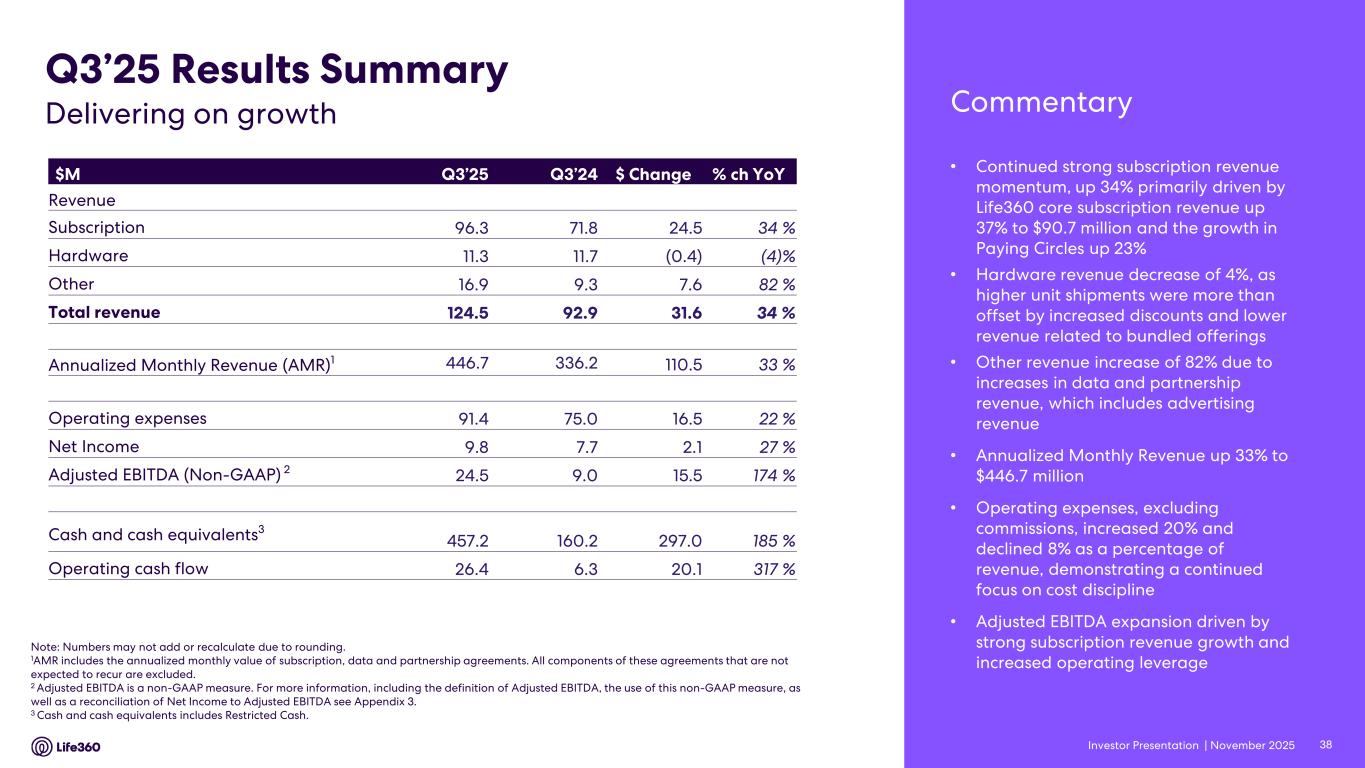

Investor Presentation | November 2025 • Continued strong subscription revenue momentum, up 34% primarily driven by Life360 core subscription revenue up 37% to $90.7 million and the growth in Paying Circles up 23% • Hardware revenue decrease of 4%, as higher unit shipments were more than offset by increased discounts and lower revenue related to bundled offerings • Other revenue increase of 82% due to increases in data and partnership revenue, which includes advertising revenue • Annualized Monthly Revenue up 33% to $446.7 million • Operating expenses, excluding commissions, increased 20% and declined 8% as a percentage of revenue, demonstrating a continued focus on cost discipline • Adjusted EBITDA expansion driven by strong subscription revenue growth and increased operating leverage $M Q3’25 Q3’24 $ Change % ch YoY Revenue Subscription 96.3 71.8 24.5 34 % Hardware 11.3 11.7 (0.4) (4)% Other 16.9 9.3 7.6 82 % Total revenue 124.5 92.9 31.6 34 % Annualized Monthly Revenue (AMR)1 446.7 336.2 110.5 33 % Operating expenses 91.4 75.0 16.5 22 % Net Income 9.8 7.7 2.1 27 % Adjusted EBITDA (Non-GAAP) 2 24.5 9.0 15.5 174 % Cash and cash equivalents3 457.2 160.2 297.0 185 % Operating cash flow 26.4 6.3 20.1 317 % Note: Numbers may not add or recalculate due to rounding. 1AMR includes the annualized monthly value of subscription, data and partnership agreements. All components of these agreements that are not expected to recur are excluded. 2 Adjusted EBITDA is a non-GAAP measure. For more information, including the definition of Adjusted EBITDA, the use of this non-GAAP measure, as well as a reconciliation of Net Income to Adjusted EBITDA see Appendix 3. 3 Cash and cash equivalents includes Restricted Cash. Q3’25 Results Summary CommentaryDelivering on growth 38

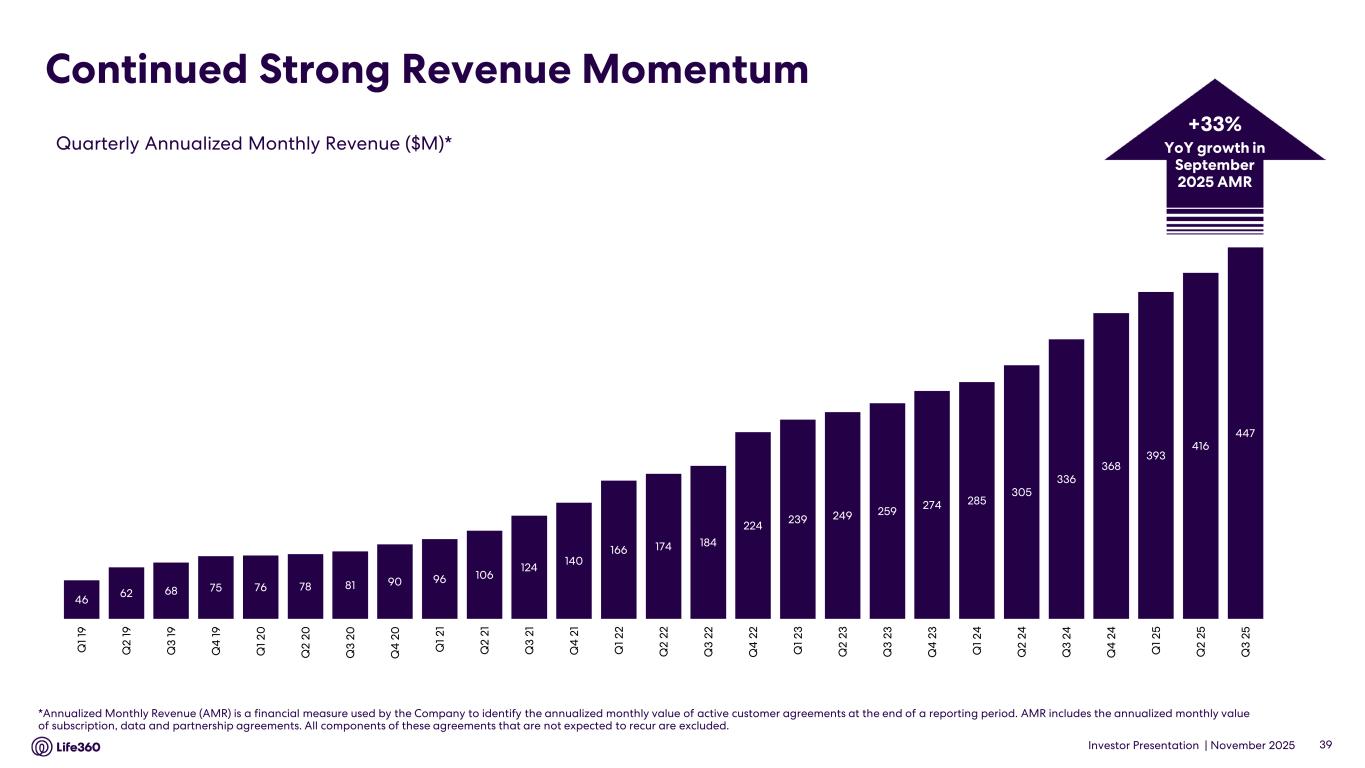

Investor Presentation | November 2025 Continued Strong Revenue Momentum *Annualized Monthly Revenue (AMR) is a financial measure used by the Company to identify the annualized monthly value of active customer agreements at the end of a reporting period. AMR includes the annualized monthly value of subscription, data and partnership agreements. All components of these agreements that are not expected to recur are excluded. Quarterly Annualized Monthly Revenue ($M)* 39 +33% YoY growth in September 2025 AMR 46 62 68 75 76 78 81 90 96 106 124 140 166 174 184 224 239 249 259 274 285 305 336 368 393 416 447 Q 1 19 Q 2 19 Q 3 19 Q 4 1 9 Q 1 20 Q 2 20 Q 3 20 Q 4 2 0 Q 1 21 Q 2 21 Q 3 21 Q 4 2 1 Q 1 22 Q 2 22 Q 3 22 Q 4 2 2 Q 1 23 Q 2 23 Q 3 23 Q 4 2 3 Q 1 24 Q 2 24 Q 3 24 Q 4 2 4 Q 1 25 Q 2 25 Q 3 25

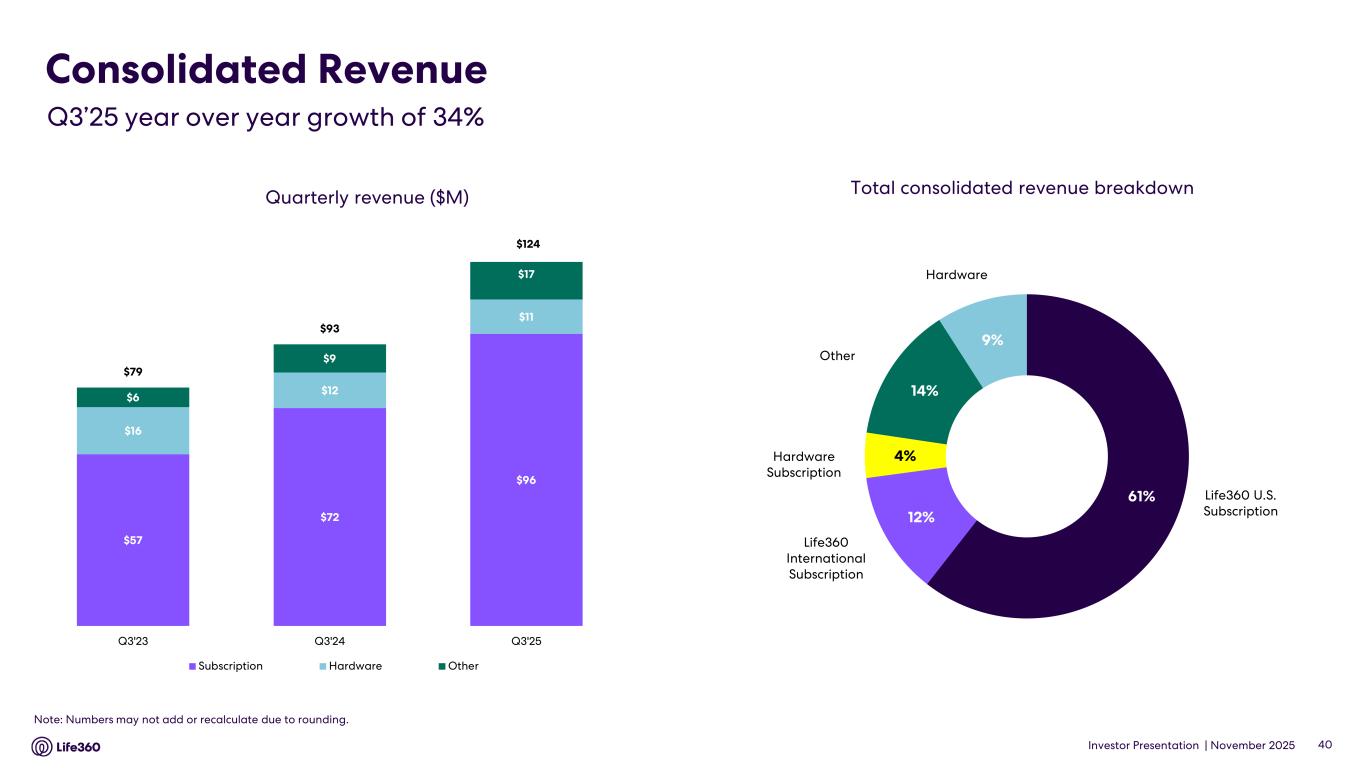

Investor Presentation | November 2025 Consolidated Revenue 40 Quarterly revenue ($M) Total consolidated revenue breakdown Hardware Life360 U.S. Subscription Life360 International Subscription Hardware Subscription Other Q3’25 year over year growth of 34% Note: Numbers may not add or recalculate due to rounding. $57 $72 $96 $16 $12 $11 $6 $9 $17 $79 $93 Q3'23 Q3'24 Q3'25 Subscription Hardware Other $124 61% 12% 4% 14% 9%

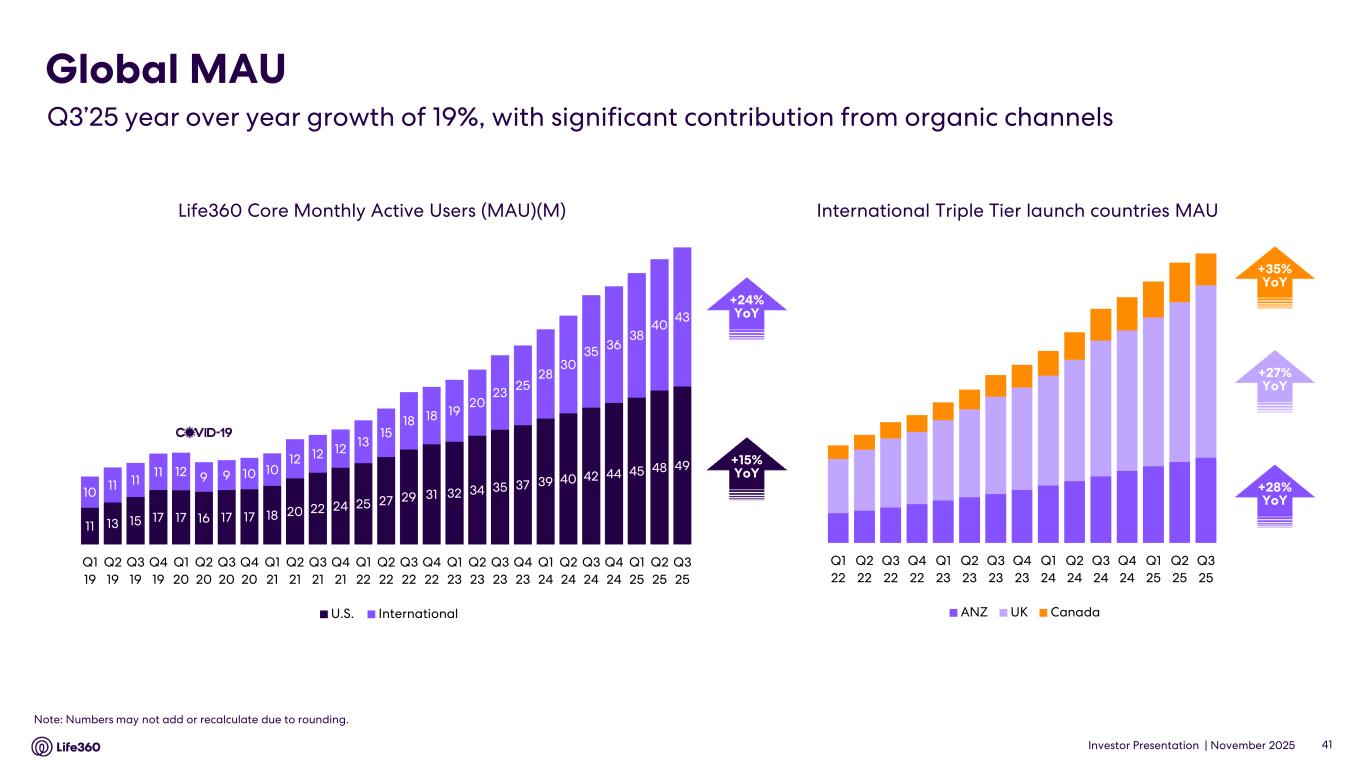

Investor Presentation | November 2025 Life360 Core Monthly Active Users (MAU)(M) Note: Numbers may not add or recalculate due to rounding. Global MAU Q3’25 year over year growth of 19%, with significant contribution from organic channels International Triple Tier launch countries MAU +27% YoY +35% YoY +28% YoY +24% YoY +15% YoY 41 11 13 15 17 17 16 17 17 18 20 22 24 25 27 29 31 32 34 35 37 39 40 42 44 45 48 49 10 11 11 11 12 9 9 10 10 12 12 12 13 15 18 18 19 20 23 25 28 30 35 36 38 40 43 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 U.S. International Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 ANZ UK Canada

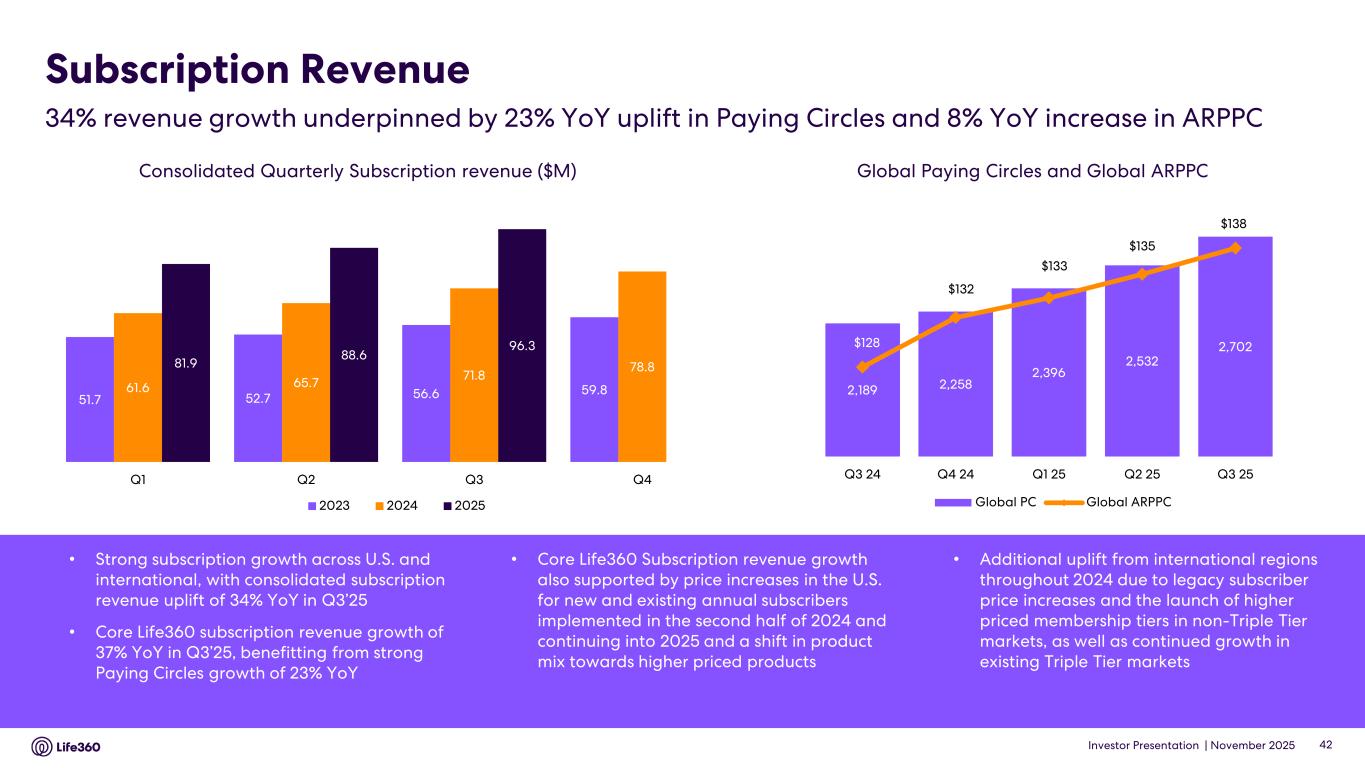

Investor Presentation | November 2025 Subscription Revenue Consolidated Quarterly Subscription revenue ($M) Global Paying Circles and Global ARPPC • Strong subscription growth across U.S. and international, with consolidated subscription revenue uplift of 34% YoY in Q3’25 • Core Life360 subscription revenue growth of 37% YoY in Q3’25, benefitting from strong Paying Circles growth of 23% YoY • Core Life360 Subscription revenue growth also supported by price increases in the U.S. for new and existing annual subscribers implemented in the second half of 2024 and continuing into 2025 and a shift in product mix towards higher priced products • Additional uplift from international regions throughout 2024 due to legacy subscriber price increases and the launch of higher priced membership tiers in non-Triple Tier markets, as well as continued growth in existing Triple Tier markets 34% revenue growth underpinned by 23% YoY uplift in Paying Circles and 8% YoY increase in ARPPC 42 51.7 52.7 56.6 59.861.6 65.7 71.8 78.881.9 88.6 96.3 Q1 Q2 Q3 Q4 2023 2024 2025 2,189 2,258 2,396 2,532 2,702$128 $132 $133 $135 $138 $120 $122 $124 $126 $128 $130 $132 $134 $136 $138 $140 1,400 1,600 1,800 2,000 2,200 2,400 2,600 2,800 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Global PC Global ARPPC

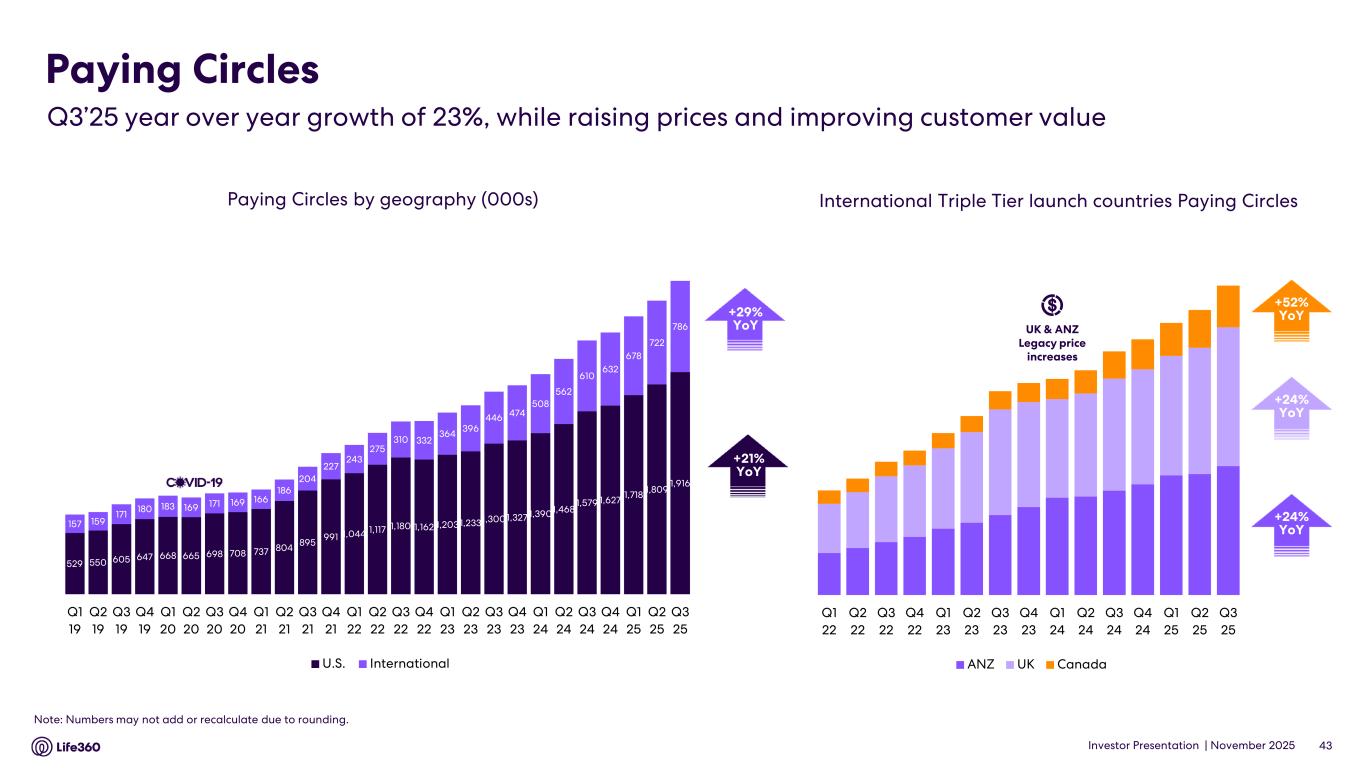

Investor Presentation | November 2025 Paying Circles by geography (000s) Paying Circles $140 $1398 +42% YoY$38 +42% YoYInternational Triple Tier launch countries Paying Circles +24% YoY +52% YoY +24% YoY +29% YoY +21% YoY 43 Note: Numbers may not add or recalculate due to rounding. Q3’25 year over year growth of 23%, while raising prices and improving customer value UK & ANZ Legacy price increases 529 550 605 647 668 665 698 708 737 804 895 991 1,044 1,117 1,180 1,162 1,2031,2331,3001,327 1,3901,468 1,579 1,627 1,718 1,809 1,916 157 159 171 180 183 169 171 169 166 186 204 227 243 275 310 332 364 396 446 474 508 562 610 632 678 722 786 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 U.S. International Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 ANZ UK Canada

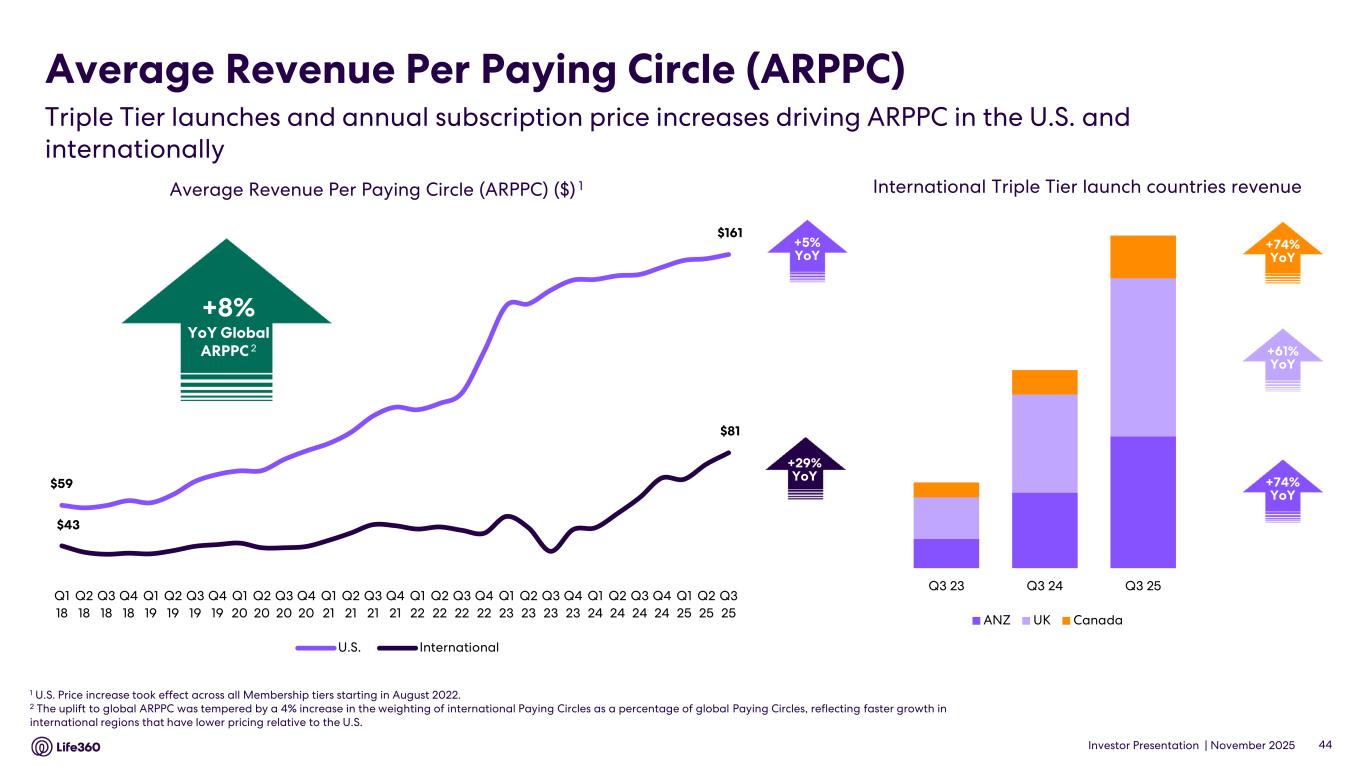

Investor Presentation | November 2025 Average Revenue Per Paying Circle (ARPPC) 1 U.S. Price increase took effect across all Membership tiers starting in August 2022. 2 The uplift to global ARPPC was tempered by a 4% increase in the weighting of international Paying Circles as a percentage of global Paying Circles, reflecting faster growth in international regions that have lower pricing relative to the U.S. Average Revenue Per Paying Circle (ARPPC) ($) 1 +29% YoY 44 +5% YoY +61% YoY +74% YoY +74% YoY Triple Tier launches and annual subscription price increases driving ARPPC in the U.S. and internationally International Triple Tier launch countries revenue Q3 23 Q3 24 Q3 25 ANZ UK Canada $59 $161 $43 $81 Q1 18 Q2 18 Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 U.S. International +8% YoY Global ARPPC 2

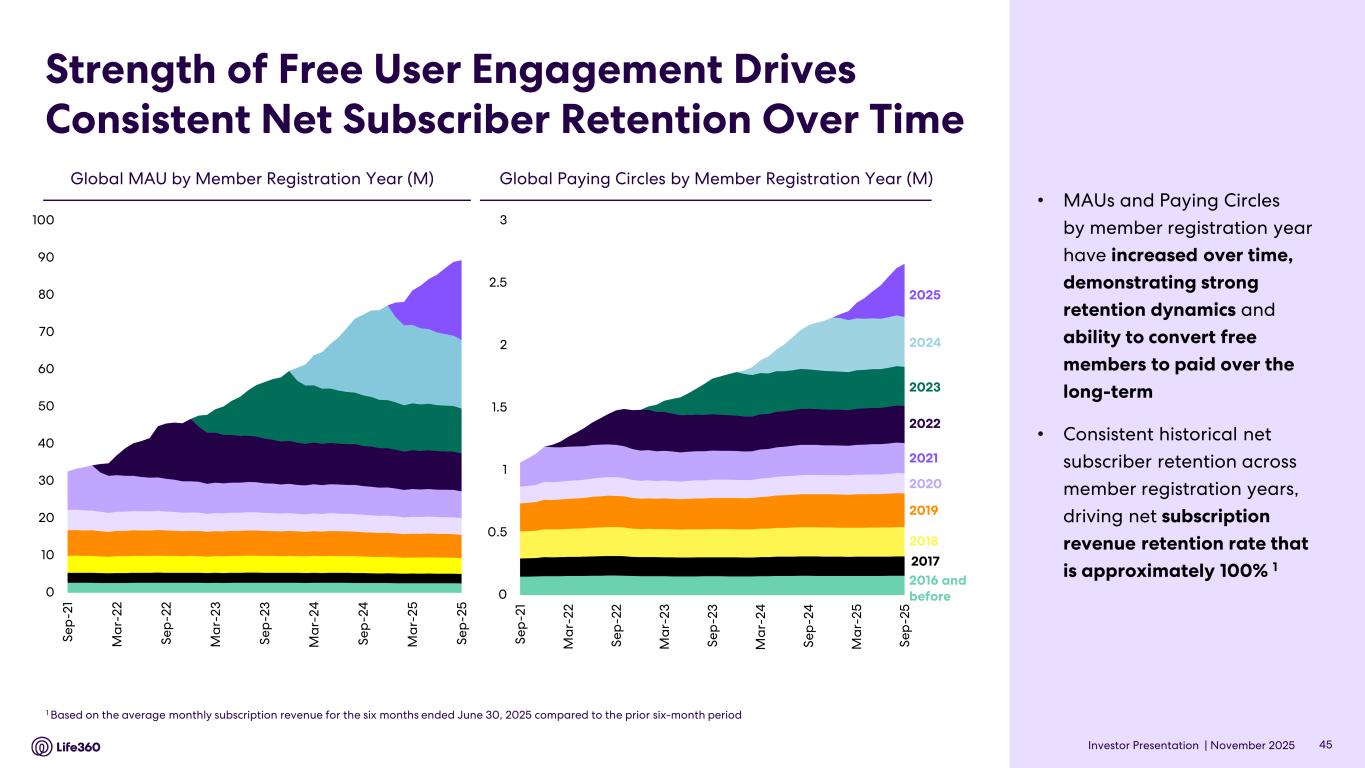

Investor Presentation | November 2025 Strength of Free User Engagement Drives Consistent Net Subscriber Retention Over Time • MAUs and Paying Circles by member registration year have increased over time, demonstrating strong retention dynamics and ability to convert free members to paid over the long-term • Consistent historical net subscriber retention across member registration years, driving net subscription revenue retention rate that is approximately 100% 1 Global Paying Circles by Member Registration Year (M)Global MAU by Member Registration Year (M) 1 Based on the average monthly subscription revenue for the six months ended June 30, 2025 compared to the prior six-month period 2023 2022 2021 2020 2019 2018 2017 2016 and before 2024 45 2025 0 10 20 30 40 50 60 70 80 90 100 Se p -2 1 M a r- 22 Se p -2 2 M a r- 23 Se p -2 3 M a r- 24 Se p -2 4 M a r- 25 Se p -2 5 0 0.5 1 1.5 2 2.5 3 Se p -2 1 M a r- 22 Se p -2 2 M a r- 23 Se p -2 3 M a r- 24 Se p -2 4 M a r- 25 Se p -2 5

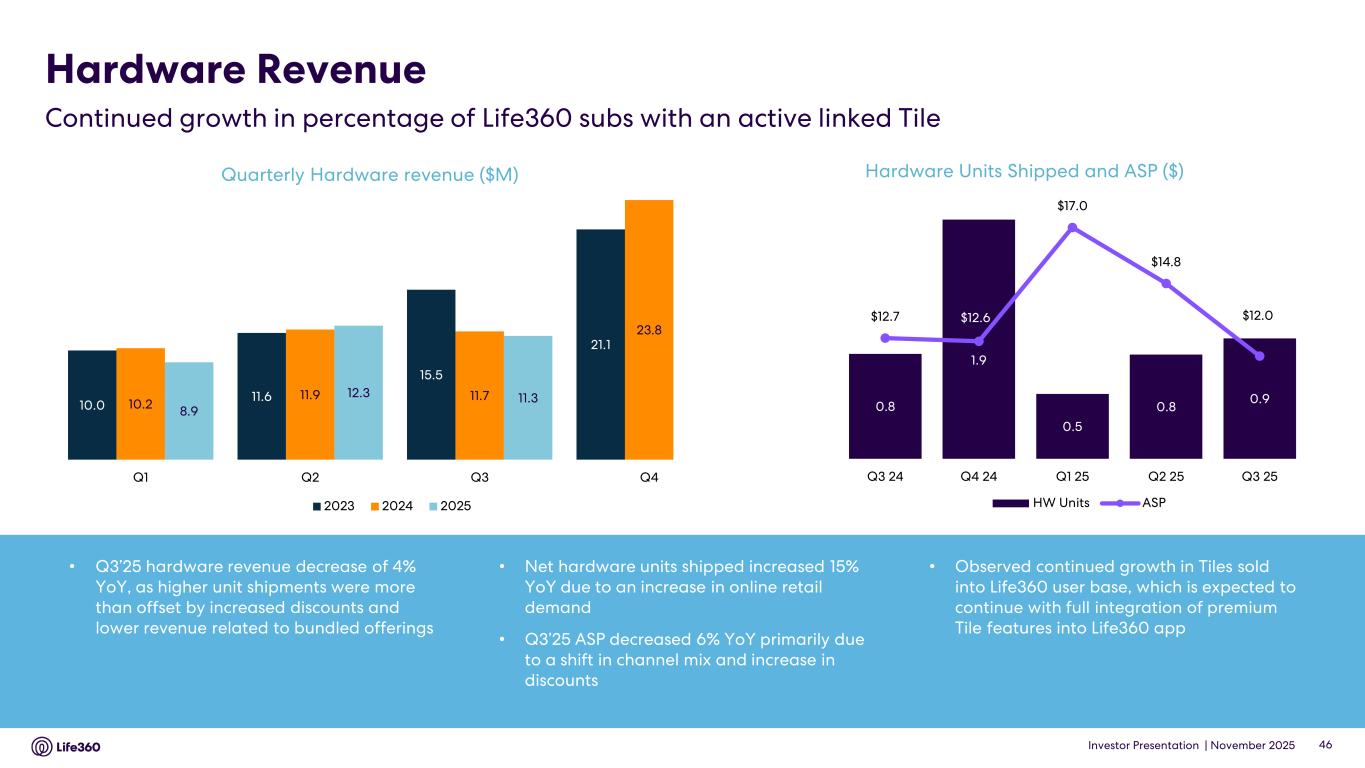

Investor Presentation | November 2025 Hardware Revenue Quarterly Hardware revenue ($M) 46 • Q3’25 hardware revenue decrease of 4% YoY, as higher unit shipments were more than offset by increased discounts and lower revenue related to bundled offerings • Net hardware units shipped increased 15% YoY due to an increase in online retail demand • Q3’25 ASP decreased 6% YoY primarily due to a shift in channel mix and increase in discounts • Observed continued growth in Tiles sold into Life360 user base, which is expected to continue with full integration of premium Tile features into Life360 app Hardware Units Shipped and ASP ($) Continued growth in percentage of Life360 subs with an active linked Tile 10.0 11.6 15.5 21.1 10.2 11.9 11.7 23.8 8.9 12.3 11.3 Q1 Q2 Q3 Q4 2023 2024 2025 0.8 1.9 0.5 0.8 0.9 $12.7 $12.6 $17.0 $14.8 $12.0 8.00 9.00 10.00 11.00 12.00 13.00 14.00 15.00 16.00 17.00 18.00 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 HW Units ASP

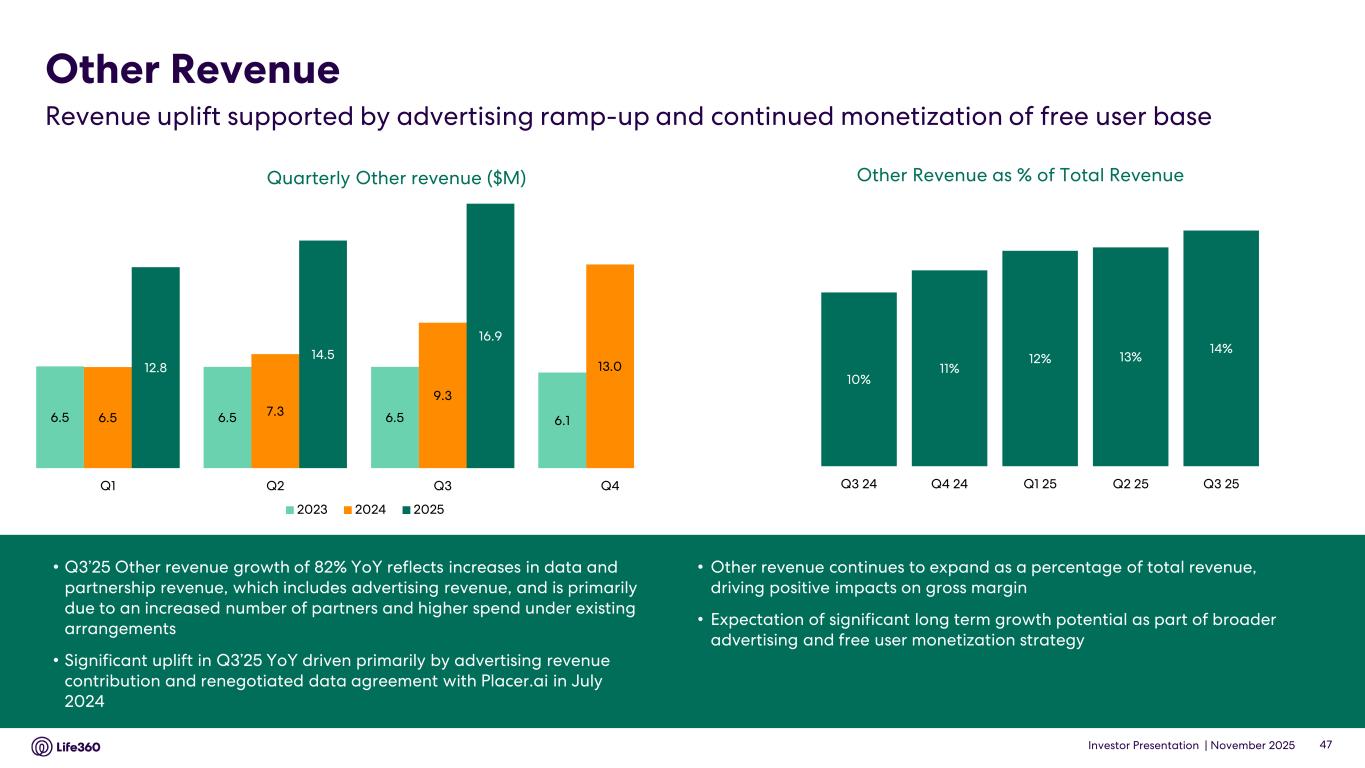

Investor Presentation | November 2025 10% 11% 12% 13% 14% Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 • Q3’25 Other revenue growth of 82% YoY reflects increases in data and partnership revenue, which includes advertising revenue, and is primarily due to an increased number of partners and higher spend under existing arrangements • Significant uplift in Q3’25 YoY driven primarily by advertising revenue contribution and renegotiated data agreement with Placer.ai in July 2024 • Other revenue continues to expand as a percentage of total revenue, driving positive impacts on gross margin • Expectation of significant long term growth potential as part of broader advertising and free user monetization strategy Quarterly Other revenue ($M) Other Revenue Revenue uplift supported by advertising ramp-up and continued monetization of free user base 47 Other Revenue as % of Total Revenue 6.5 6.5 6.5 6.16.5 7.3 9.3 13.012.8 14.5 16.9 Q1 Q2 Q3 Q4 2023 2024 2025

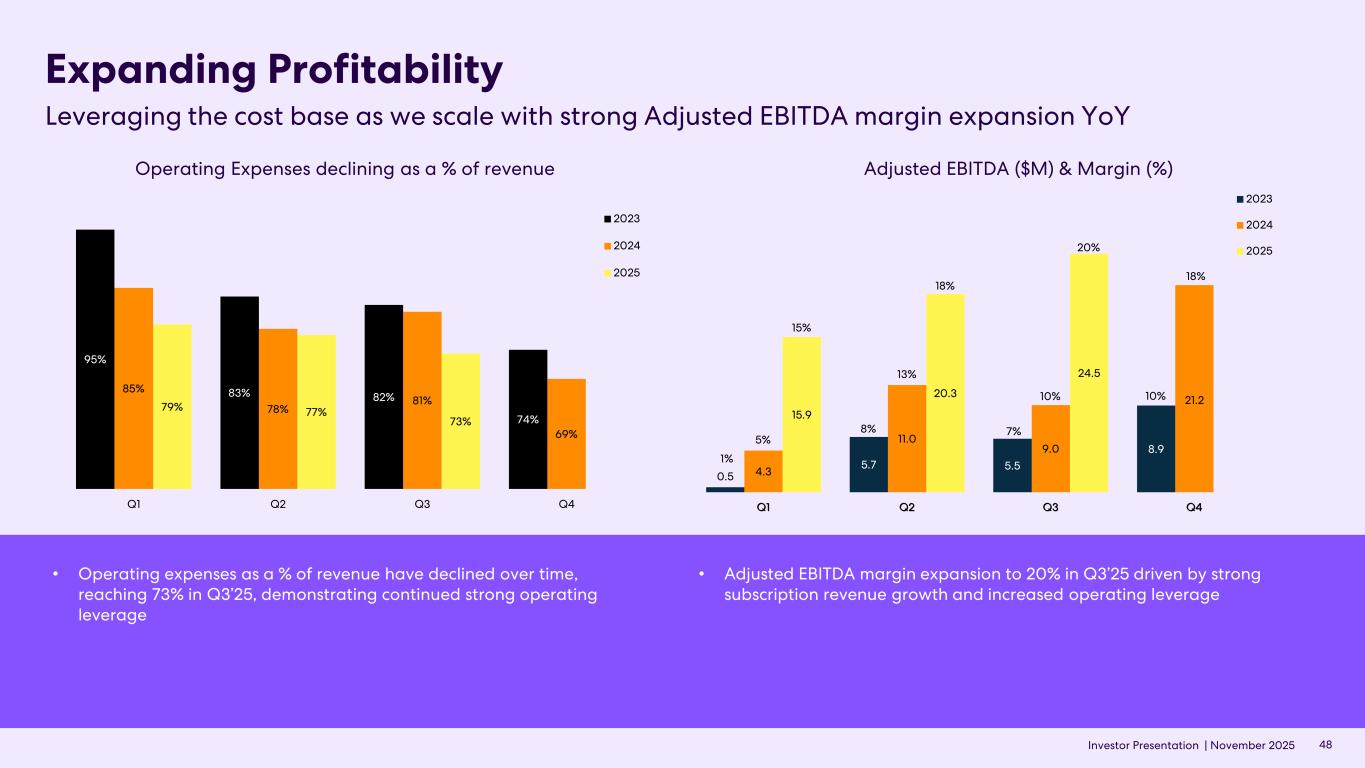

Investor Presentation | November 2025 Expanding Profitability Leveraging the cost base as we scale with strong Adjusted EBITDA margin expansion YoY 48 Adjusted EBITDA ($M) & Margin (%)Operating Expenses declining as a % of revenue • Operating expenses as a % of revenue have declined over time, reaching 73% in Q3’25, demonstrating continued strong operating leverage • Adjusted EBITDA margin expansion to 20% in Q3’25 driven by strong subscription revenue growth and increased operating leverage 95% 83% 82% 74% 85% 78% 81% 69% 79% 77% 73% Q1 Q2 Q3 Q4 2023 2024 2025 0.5 5.7 5.5 8.9 4.3 11.0 9.0 21.2 15.9 20.3 24.5 Q1 Q2 Q3 Q4 2023 2024 2025 1% 8% 7% 10% 5% 13% 10% 18% 15% 18% 20%

Investor Presentation | November 2025 FY’25 Outlook 05

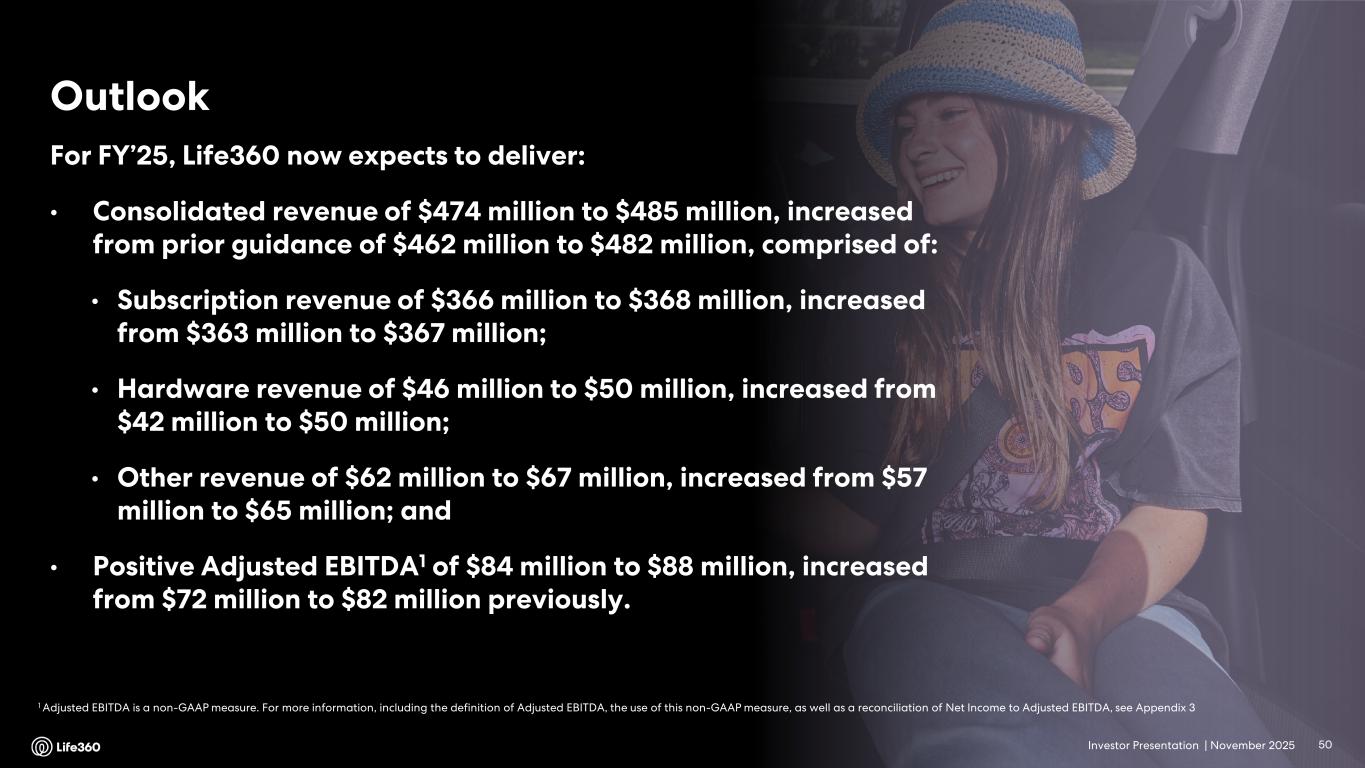

Investor Presentation | November 2025 1 Adjusted EBITDA is a non-GAAP measure. For more information, including the definition of Adjusted EBITDA, the use of this non-GAAP measure, as well as a reconciliation of Net Income to Adjusted EBITDA, see Appendix 3 Outlook 50 For FY’25, Life360 now expects to deliver: • Consolidated revenue of $474 million to $485 million, increased from prior guidance of $462 million to $482 million, comprised of: • Subscription revenue of $366 million to $368 million, increased from $363 million to $367 million; • Hardware revenue of $46 million to $50 million, increased from $42 million to $50 million; • Other revenue of $62 million to $67 million, increased from $57 million to $65 million; and • Positive Adjusted EBITDA1 of $84 million to $88 million, increased from $72 million to $82 million previously.

Investor Presentation | November 2025 Appendix 06

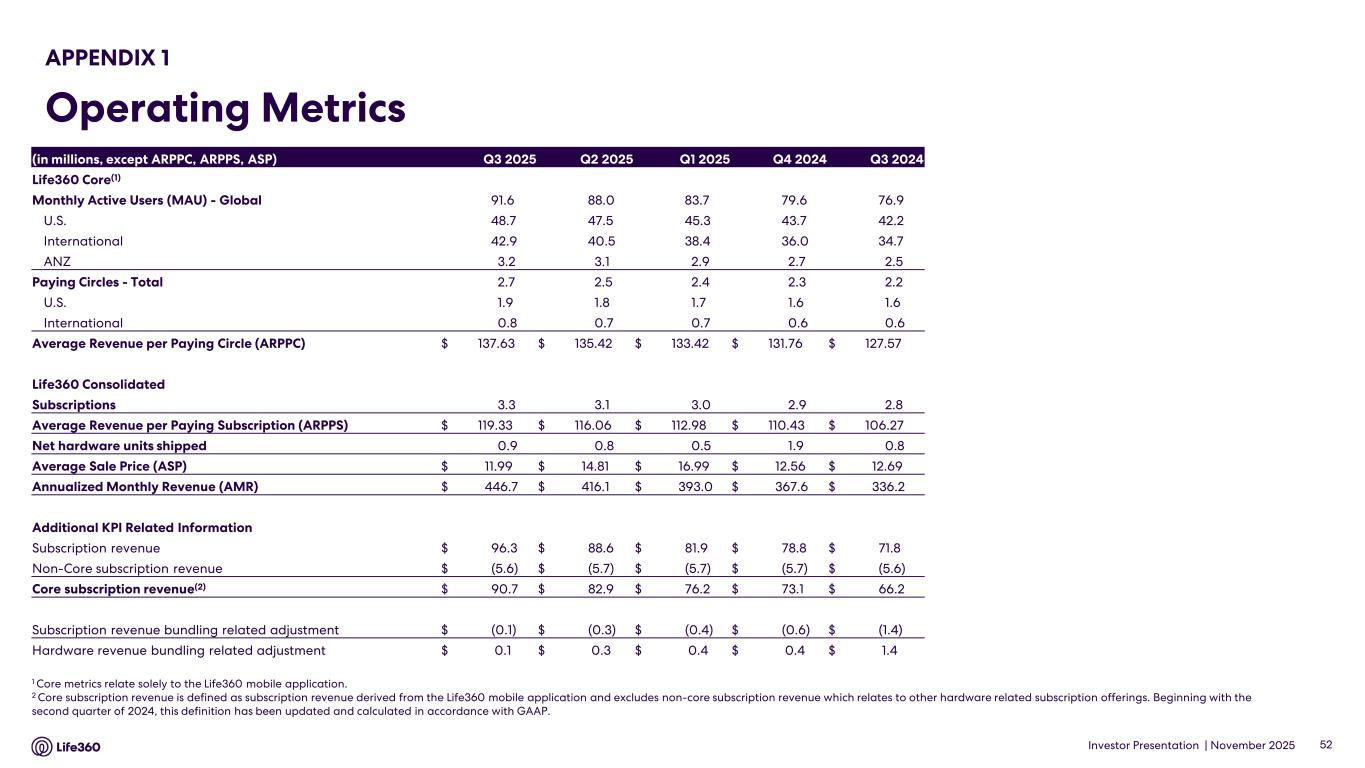

Investor Presentation | November 2025 APPENDIX 1 Operating Metrics 1 Core metrics relate solely to the Life360 mobile application. 2 Core subscription revenue is defined as subscription revenue derived from the Life360 mobile application and excludes non-core subscription revenue which relates to other hardware related subscription offerings. Beginning with the second quarter of 2024, this definition has been updated and calculated in accordance with GAAP. 52 (in millions, except ARPPC, ARPPS, ASP) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Life360 Core(1) Monthly Active Users (MAU) - Global 91.6 88.0 83.7 79.6 76.9 U.S. 48.7 47.5 45.3 43.7 42.2 International 42.9 40.5 38.4 36.0 34.7 ANZ 3.2 3.1 2.9 2.7 2.5 Paying Circles - Total 2.7 2.5 2.4 2.3 2.2 U.S. 1.9 1.8 1.7 1.6 1.6 International 0.8 0.7 0.7 0.6 0.6 Average Revenue per Paying Circle (ARPPC) $ 137.63 $ 135.42 $ 133.42 $ 131.76 $ 127.57 Life360 Consolidated Subscriptions 3.3 3.1 3.0 2.9 2.8 Average Revenue per Paying Subscription (ARPPS) $ 119.33 $ 116.06 $ 112.98 $ 110.43 $ 106.27 Net hardware units shipped 0.9 0.8 0.5 1.9 0.8 Average Sale Price (ASP) $ 11.99 $ 14.81 $ 16.99 $ 12.56 $ 12.69 Annualized Monthly Revenue (AMR) $ 446.7 $ 416.1 $ 393.0 $ 367.6 $ 336.2 Additional KPI Related Information Subscription revenue $ 96.3 $ 88.6 $ 81.9 $ 78.8 $ 71.8 Non-Core subscription revenue $ (5.6) $ (5.7) $ (5.7) $ (5.7) $ (5.6) Core subscription revenue(2) $ 90.7 $ 82.9 $ 76.2 $ 73.1 $ 66.2 Subscription revenue bundling related adjustment $ (0.1) $ (0.3) $ (0.4) $ (0.6) $ (1.4) Hardware revenue bundling related adjustment $ 0.1 $ 0.3 $ 0.4 $ 0.4 $ 1.4

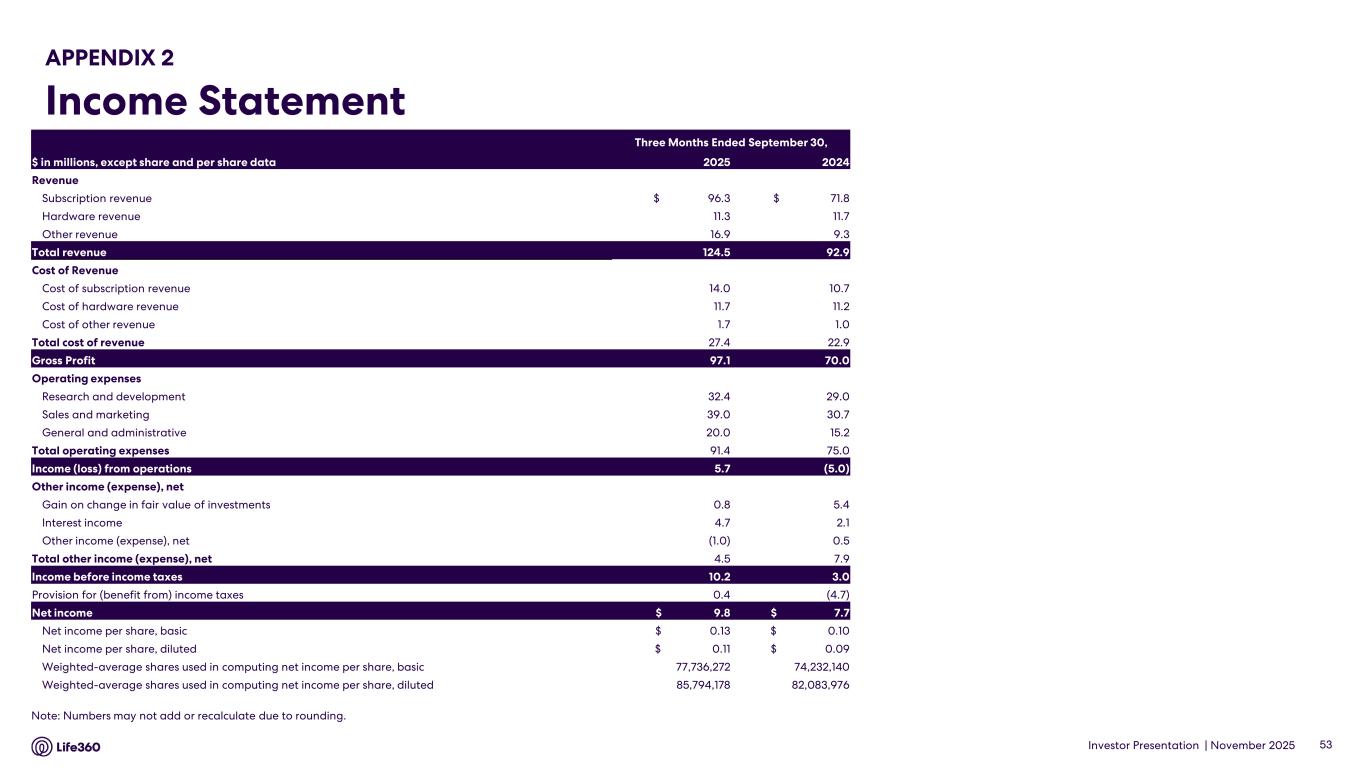

Investor Presentation | November 2025 APPENDIX 2 Income Statement 53 Note: Numbers may not add or recalculate due to rounding. Three Months Ended September 30, $ in millions, except share and per share data 2025 2024 Revenue Subscription revenue $ 96.3 $ 71.8 Hardware revenue 11.3 11.7 Other revenue 16.9 9.3 Total revenue 124.5 92.9 Cost of Revenue Cost of subscription revenue 14.0 10.7 Cost of hardware revenue 11.7 11.2 Cost of other revenue 1.7 1.0 Total cost of revenue 27.4 22.9 Gross Profit 97.1 70.0 Operating expenses Research and development 32.4 29.0 Sales and marketing 39.0 30.7 General and administrative 20.0 15.2 Total operating expenses 91.4 75.0 Income (loss) from operations 5.7 (5.0) Other income (expense), net Gain on change in fair value of investments 0.8 5.4 Interest income 4.7 2.1 Other income (expense), net (1.0) 0.5 Total other income (expense), net 4.5 7.9 Income before income taxes 10.2 3.0 Provision for (benefit from) income taxes 0.4 (4.7) Net income $ 9.8 $ 7.7 Net income per share, basic $ 0.13 $ 0.10 Net income per share, diluted $ 0.11 $ 0.09 Weighted-average shares used in computing net income per share, basic 77,736,272 74,232,140 Weighted-average shares used in computing net income per share, diluted 85,794,178 82,083,976

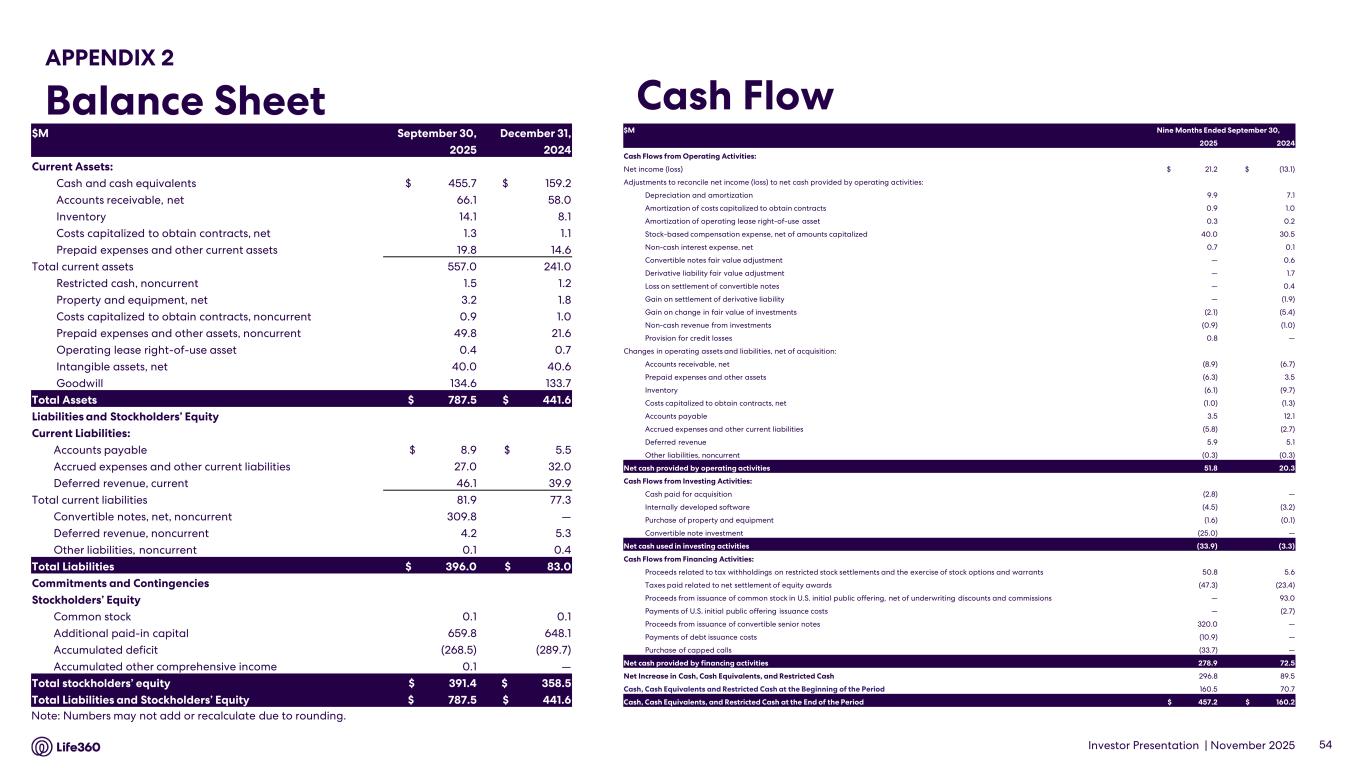

Investor Presentation | November 2025 APPENDIX 2 Balance Sheet Cash Flow 54 Note: Numbers may not add or recalculate due to rounding. $M September 30, December 31, 2025 2024 Current Assets: Cash and cash equivalents $ 455.7 $ 159.2 Accounts receivable, net 66.1 58.0 Inventory 14.1 8.1 Costs capitalized to obtain contracts, net 1.3 1.1 Prepaid expenses and other current assets 19.8 14.6 Total current assets 557.0 241.0 Restricted cash, noncurrent 1.5 1.2 Property and equipment, net 3.2 1.8 Costs capitalized to obtain contracts, noncurrent 0.9 1.0 Prepaid expenses and other assets, noncurrent 49.8 21.6 Operating lease right-of-use asset 0.4 0.7 Intangible assets, net 40.0 40.6 Goodwill 134.6 133.7 Total Assets $ 787.5 $ 441.6 Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 8.9 $ 5.5 Accrued expenses and other current liabilities 27.0 32.0 Deferred revenue, current 46.1 39.9 Total current liabilities 81.9 77.3 Convertible notes, net, noncurrent 309.8 — Deferred revenue, noncurrent 4.2 5.3 Other liabilities, noncurrent 0.1 0.4 Total Liabilities $ 396.0 $ 83.0 Commitments and Contingencies Stockholders’ Equity Common stock 0.1 0.1 Additional paid-in capital 659.8 648.1 Accumulated deficit (268.5) (289.7) Accumulated other comprehensive income 0.1 — Total stockholders’ equity $ 391.4 $ 358.5 Total Liabilities and Stockholders’ Equity $ 787.5 $ 441.6 $M Nine Months Ended September 30, 2025 2024 Cash Flows from Operating Activities: Net income (loss) $ 21.2 $ (13.1) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation and amortization 9.9 7.1 Amortization of costs capitalized to obtain contracts 0.9 1.0 Amortization of operating lease right-of-use asset 0.3 0.2 Stock-based compensation expense, net of amounts capitalized 40.0 30.5 Non-cash interest expense, net 0.7 0.1 Convertible notes fair value adjustment — 0.6 Derivative liability fair value adjustment — 1.7 Loss on settlement of convertible notes — 0.4 Gain on settlement of derivative liability — (1.9) Gain on change in fair value of investments (2.1) (5.4) Non-cash revenue from investments (0.9) (1.0) Provision for credit losses 0.8 — Changes in operating assets and liabilities, net of acquisition: Accounts receivable, net (8.9) (6.7) Prepaid expenses and other assets (6.3) 3.5 Inventory (6.1) (9.7) Costs capitalized to obtain contracts, net (1.0) (1.3) Accounts payable 3.5 12.1 Accrued expenses and other current liabilities (5.8) (2.7) Deferred revenue 5.9 5.1 Other liabilities, noncurrent (0.3) (0.3) Net cash provided by operating activities 51.8 20.3 Cash Flows from Investing Activities: Cash paid for acquisition (2.8) — Internally developed software (4.5) (3.2) Purchase of property and equipment (1.6) (0.1) Convertible note investment (25.0) — Net cash used in investing activities (33.9) (3.3) Cash Flows from Financing Activities: Proceeds related to tax withholdings on restricted stock settlements and the exercise of stock options and warrants 50.8 5.6 Taxes paid related to net settlement of equity awards (47.3) (23.4) Proceeds from issuance of common stock in U.S. initial public offering, net of underwriting discounts and commissions — 93.0 Payments of U.S. initial public offering issuance costs — (2.7) Proceeds from issuance of convertible senior notes 320.0 — Payments of debt issuance costs (10.9) — Purchase of capped calls (33.7) — Net cash provided by financing activities 278.9 72.5 Net Increase in Cash, Cash Equivalents, and Restricted Cash 296.8 89.5 Cash, Cash Equivalents and Restricted Cash at the Beginning of the Period 160.5 70.7 Cash, Cash Equivalents, and Restricted Cash at the End of the Period $ 457.2 $ 160.2

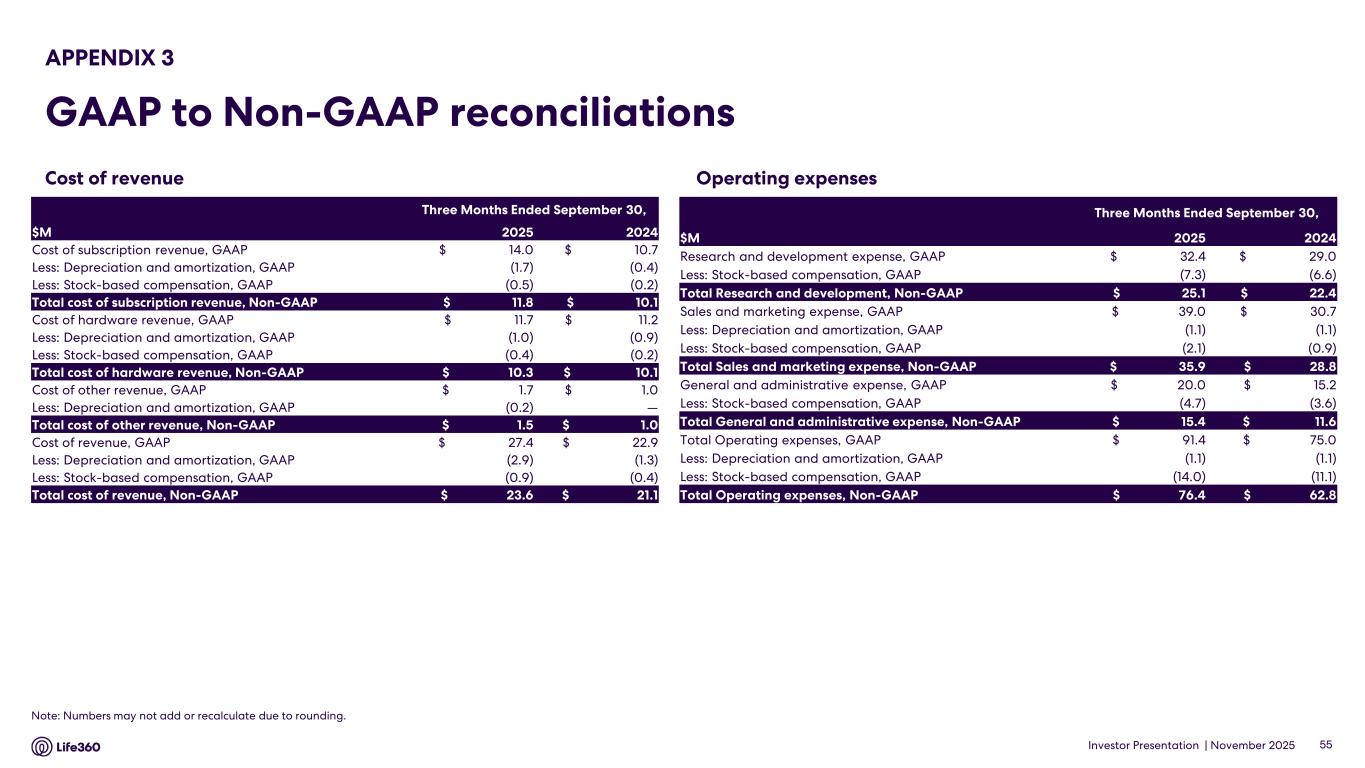

Investor Presentation | November 2025 Operating expenses APPENDIX 3 GAAP to Non-GAAP reconciliations 55 Note: Numbers may not add or recalculate due to rounding. Cost of revenue Three Months Ended September 30, $M 2025 2024 Research and development expense, GAAP $ 32.4 $ 29.0 Less: Stock-based compensation, GAAP (7.3) (6.6) Total Research and development, Non-GAAP $ 25.1 $ 22.4 Sales and marketing expense, GAAP $ 39.0 $ 30.7 Less: Depreciation and amortization, GAAP (1.1) (1.1) Less: Stock-based compensation, GAAP (2.1) (0.9) Total Sales and marketing expense, Non-GAAP $ 35.9 $ 28.8 General and administrative expense, GAAP $ 20.0 $ 15.2 Less: Stock-based compensation, GAAP (4.7) (3.6) Total General and administrative expense, Non-GAAP $ 15.4 $ 11.6 Total Operating expenses, GAAP $ 91.4 $ 75.0 Less: Depreciation and amortization, GAAP (1.1) (1.1) Less: Stock-based compensation, GAAP (14.0) (11.1) Total Operating expenses, Non-GAAP $ 76.4 $ 62.8 Three Months Ended September 30, $M 2025 2024 Cost of subscription revenue, GAAP $ 14.0 $ 10.7 Less: Depreciation and amortization, GAAP (1.7) (0.4) Less: Stock-based compensation, GAAP (0.5) (0.2) Total cost of subscription revenue, Non-GAAP $ 11.8 $ 10.1 Cost of hardware revenue, GAAP $ 11.7 $ 11.2 Less: Depreciation and amortization, GAAP (1.0) (0.9) Less: Stock-based compensation, GAAP (0.4) (0.2) Total cost of hardware revenue, Non-GAAP $ 10.3 $ 10.1 Cost of other revenue, GAAP $ 1.7 $ 1.0 Less: Depreciation and amortization, GAAP (0.2) — Total cost of other revenue, Non-GAAP $ 1.5 $ 1.0 Cost of revenue, GAAP $ 27.4 $ 22.9 Less: Depreciation and amortization, GAAP (2.9) (1.3) Less: Stock-based compensation, GAAP (0.9) (0.4) Total cost of revenue, Non-GAAP $ 23.6 $ 21.1

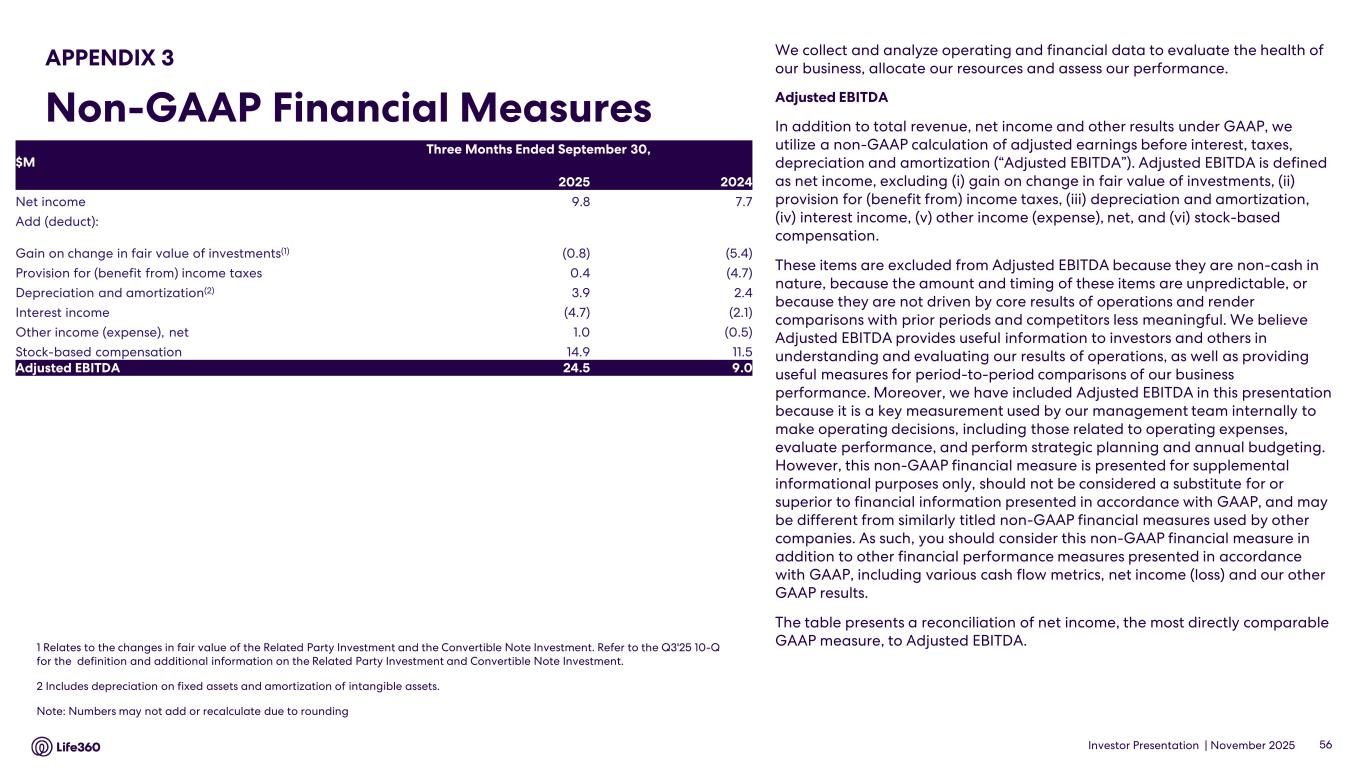

Investor Presentation | November 2025 We collect and analyze operating and financial data to evaluate the health of our business, allocate our resources and assess our performance. Adjusted EBITDA In addition to total revenue, net income and other results under GAAP, we utilize a non-GAAP calculation of adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). Adjusted EBITDA is defined as net income, excluding (i) gain on change in fair value of investments, (ii) provision for (benefit from) income taxes, (iii) depreciation and amortization, (iv) interest income, (v) other income (expense), net, and (vi) stock-based compensation. These items are excluded from Adjusted EBITDA because they are non-cash in nature, because the amount and timing of these items are unpredictable, or because they are not driven by core results of operations and render comparisons with prior periods and competitors less meaningful. We believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations, as well as providing useful measures for period-to-period comparisons of our business performance. Moreover, we have included Adjusted EBITDA in this presentation because it is a key measurement used by our management team internally to make operating decisions, including those related to operating expenses, evaluate performance, and perform strategic planning and annual budgeting. However, this non-GAAP financial measure is presented for supplemental informational purposes only, should not be considered a substitute for or superior to financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP financial measures used by other companies. As such, you should consider this non-GAAP financial measure in addition to other financial performance measures presented in accordance with GAAP, including various cash flow metrics, net income (loss) and our other GAAP results. The table presents a reconciliation of net income, the most directly comparable GAAP measure, to Adjusted EBITDA.1 Relates to the changes in fair value of the Related Party Investment and the Convertible Note Investment. Refer to the Q3'25 10-Q for the definition and additional information on the Related Party Investment and Convertible Note Investment. 2 Includes depreciation on fixed assets and amortization of intangible assets. Note: Numbers may not add or recalculate due to rounding 56 APPENDIX 3 Non-GAAP Financial Measures $M Three Months Ended September 30, 2025 2024 Net income 9.8 7.7 Add (deduct): Gain on change in fair value of investments(1) (0.8) (5.4) Provision for (benefit from) income taxes 0.4 (4.7) Depreciation and amortization(2) 3.9 2.4 Interest income (4.7) (2.1) Other income (expense), net 1.0 (0.5) Stock-based compensation 14.9 11.5 Adjusted EBITDA 24.5 9.0

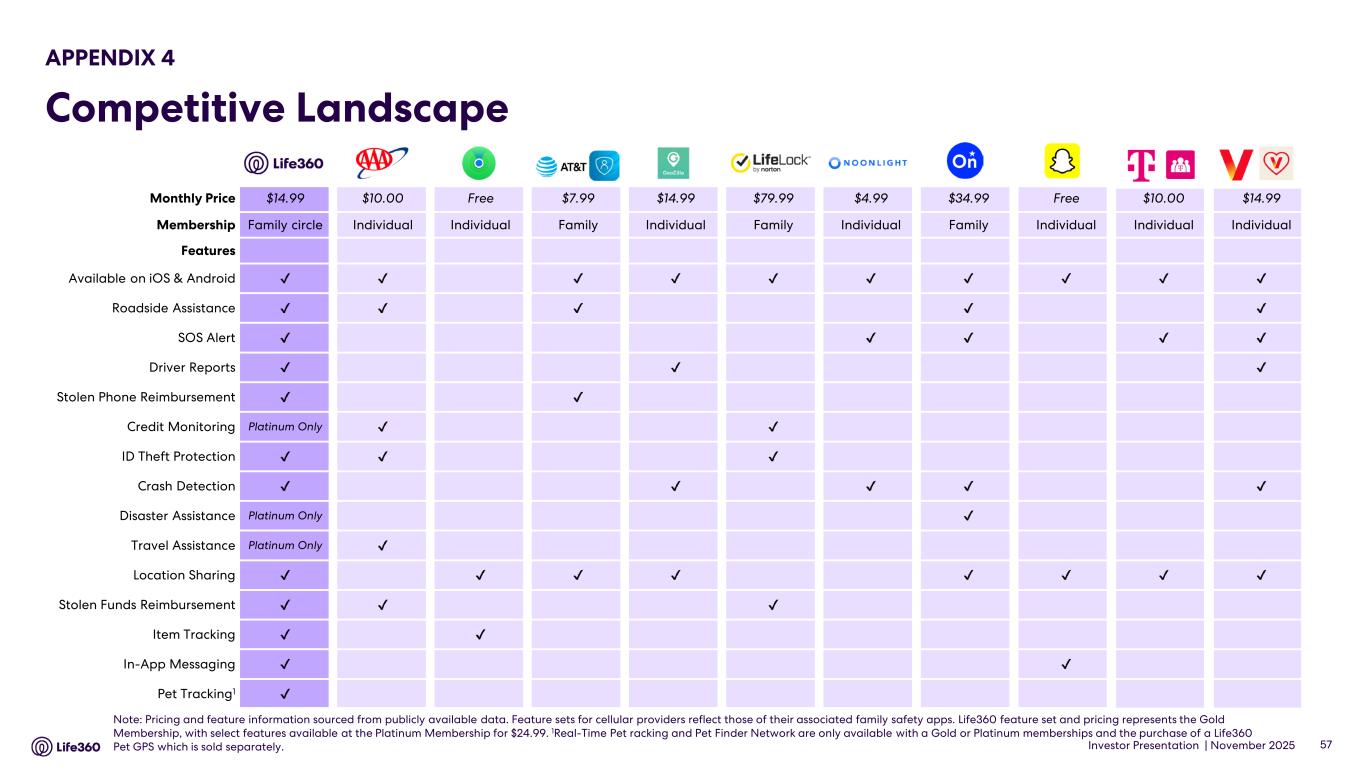

Investor Presentation | November 2025 57 Note: Pricing and feature information sourced from publicly available data. Feature sets for cellular providers reflect those of their associated family safety apps. Life360 feature set and pricing represents the Gold Membership, with select features available at the Platinum Membership for $24.99. 1Real-Time Pet racking and Pet Finder Network are only available with a Gold or Platinum memberships and the purchase of a Life360 Pet GPS which is sold separately. APPENDIX 4 Competitive Landscape Monthly Price $14.99 $10.00 Free $7.99 $14.99 $79.99 $4.99 $34.99 Free $10.00 $14.99 Membership Family circle Individual Individual Family Individual Family Individual Family Individual Individual Individual Features Available on iOS & Android Roadside Assistance SOS Alert Driver Reports Stolen Phone Reimbursement Credit Monitoring Platinum Only ID Theft Protection Crash Detection Disaster Assistance Platinum Only Travel Assistance Platinum Only Location Sharing Stolen Funds Reimbursement Item Tracking In-App Messaging Pet Tracking1

Investor Presentation | November 2025 Thank you.