Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a‑12 |

|

| | |

NORCRAFT COMPANIES, INC. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NORCRAFT COMPANIES, INC.

3020 Denmark Avenue, Suite 100

Eagan, Minnesota 55121

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 27, 2014

To Our Stockholders:

The 2014 Annual Meeting of Stockholders of Norcraft Companies, Inc., or the 2014 Annual Meeting, will be held at the Hilton Minneapolis/St. Paul Airport Mall of America, 3800 American Blvd East, Bloomington, MN 55425, on Friday, June 27, 2014 at 8:30 A.M. local time, to consider and act upon the following matters:

| |

1. | To elect one (1) Class I director to our Board of Directors, to hold office for a three-year term and until his or her successor has been duly elected and qualified. |

| |

2. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2014. |

| |

3. | To transact such other business as may properly come before the 2014 Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors has fixed May 6, 2014 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2014 Annual Meeting. Accordingly, only stockholders of record at the close of business on the record date will be entitled to notice of, and to vote at, the meeting or any adjournments thereof.

To ensure your representation at the 2014 Annual Meeting, you are urged to vote by proxy by one of the following steps as promptly as possible:

| |

(a) | Vote via the Internet pursuant to the instructions provided in the Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, that we will mail no later than May 16, 2014 to all stockholders of record and beneficial owners as of the record date; or |

| |

(b) | Request email or printed copies of the proxy materials pursuant to the instructions provided in the Notice of Internet Availability and either: |

| |

(i) | complete, date, sign and return the proxy card that you will receive in response to your request; or |

| |

(ii) | vote via telephone (toll-free) in the United States or Canada in accordance with the instructions on the proxy card. |

The Internet and telephone voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares, and to confirm that stockholders’ instructions have been properly recorded. Your shares cannot be voted unless you vote by one of the methods described above or attend the 2014 Annual Meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the stockholders is important.

|

| |

| By Order of the Board of Directors, |

|

|

| MARK BULLER Chairman and Chief Executive Officer |

Eagan, Minnesota

April 30, 2014

NOTE: THE BOARD OF DIRECTORS SOLICITS YOUR VOTE BY PROXY. WHETHER OR NOT YOU EXPECT TO

BE PRESENT AT THE 2014 ANNUAL MEETING, PLEASE PROMPTLY VOTE VIA ANY OF THE METHODS DESCRIBED ABOVE. IF YOU ATTEND THE 2014 ANNUAL MEETING, YOU MAY REVOKE ANY PROXY GIVEN BY YOU AND VOTE YOUR SHARES IN PERSON.

TABLE OF CONTENTS

|

| |

GENERAL INFORMATION | |

PRINCIPAL AND MANAGEMENT STOCKHOLDERS | |

Principal Stockholders | |

Management Stockholders | |

EXECUTIVE COMPENSATION | |

Summary Compensation Table | |

Outstanding Equity Awards at Fiscal Year End | |

Employment Agreements and Arrangements Upon Termination or Change of Control | |

Arrangements with Other Employed Named Executive Officers | |

INFORMATION AS TO OUR BOARD OF DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | |

Directors and Nominees for Director | |

Executive Officers | |

Director Compensation | |

Director Independence | |

Information about Meetings and Board Committees | |

Corporate Governance | |

TRANSACTIONS WITH RELATED PERSONS | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

EQUITY COMPENSATION PLANS | |

AUDIT COMMITTEE REPORT | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

PROPOSAL NO. 1 ELECTION OF DIRECTORS | |

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

STOCKHOLDER PROPOSALS AND BOARD CANDIDATES | |

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS | |

OTHER BUSINESS | |

WHERE YOU CAN FIND MORE INFORMATION | |

NORCRAFT COMPANIES, INC.

3020 Denmark Avenue, Suite 100

Eagan, Minnesota 55121

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 27, 2014

GENERAL INFORMATION

Why are we soliciting proxies?

We are furnishing this Proxy Statement to the holders of our common stock, $0.01 par value per share, in connection with the solicitation of proxies on behalf of our Board of Directors, or our Board, for use at our 2014 Annual Meeting of Stockholders, or the 2014 Annual Meeting.

When and where is the 2014 Annual Meeting?

The 2014 Annual Meeting will be held at our offices at the Hilton Minneapolis/St. Paul Airport Mall of America, 3800 American Blvd East, Bloomington, MN 55425 on Friday, June 27, 2014 at 8:30 A.M., local time or at any future date and time following an adjournment or postponement of the meeting.

What are the purposes of the 2014 Annual Meeting?

The purposes of the 2014 Annual Meeting and the matters to be acted upon are set forth in the accompanying Notice of 2014 Annual Meeting of Stockholders, or the Notice. The Board knows of no other business that will come before the 2014 Annual Meeting.

How will I receive proxy materials?

We are furnishing our proxy materials, including the Notice, this Proxy Statement and the proxy card for the 2014 Annual Meeting, by providing access to such documents on the Internet. We will send a Notice of Internet Availability of Proxy Materials, or the Notice of Internet Availability, no later than May 16, 2014 to our stockholders of record and beneficial owners as of May 6, 2014, the record date for the 2014 Annual Meeting. The Notice of Internet Availability contains instructions for accessing and reviewing our proxy materials on the Internet and voting by proxy over the Internet. If you prefer to receive email or printed copies of our proxy materials, the Notice of Internet Availability contains instructions on how to request such materials. You will not receive printed copies of the proxy materials unless you request them. Viewing our proxy materials and voting by proxy electronically will save us the cost of printing and mailing documents to you and will reduce the impact on the environment.

Who will pay the costs of soliciting proxies and how would you solicit proxies?

We will bear the expense of printing and mailing proxy materials. In addition to the solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request brokers and nominees who hold shares of our common stock in their names to furnish proxy material to beneficial owners of the shares.

Who can vote?

Only stockholders of record at the close of business on May 6, 2014, the record date for the 2014 Annual Meeting, are entitled to notice of, and to vote at, the 2014 Annual Meeting or any adjournment or postponement of the meeting. On the record date, we had outstanding 17,311,573 shares of common stock, each of which is entitled to one vote upon each of the matters to be presented at the 2014 Annual Meeting.

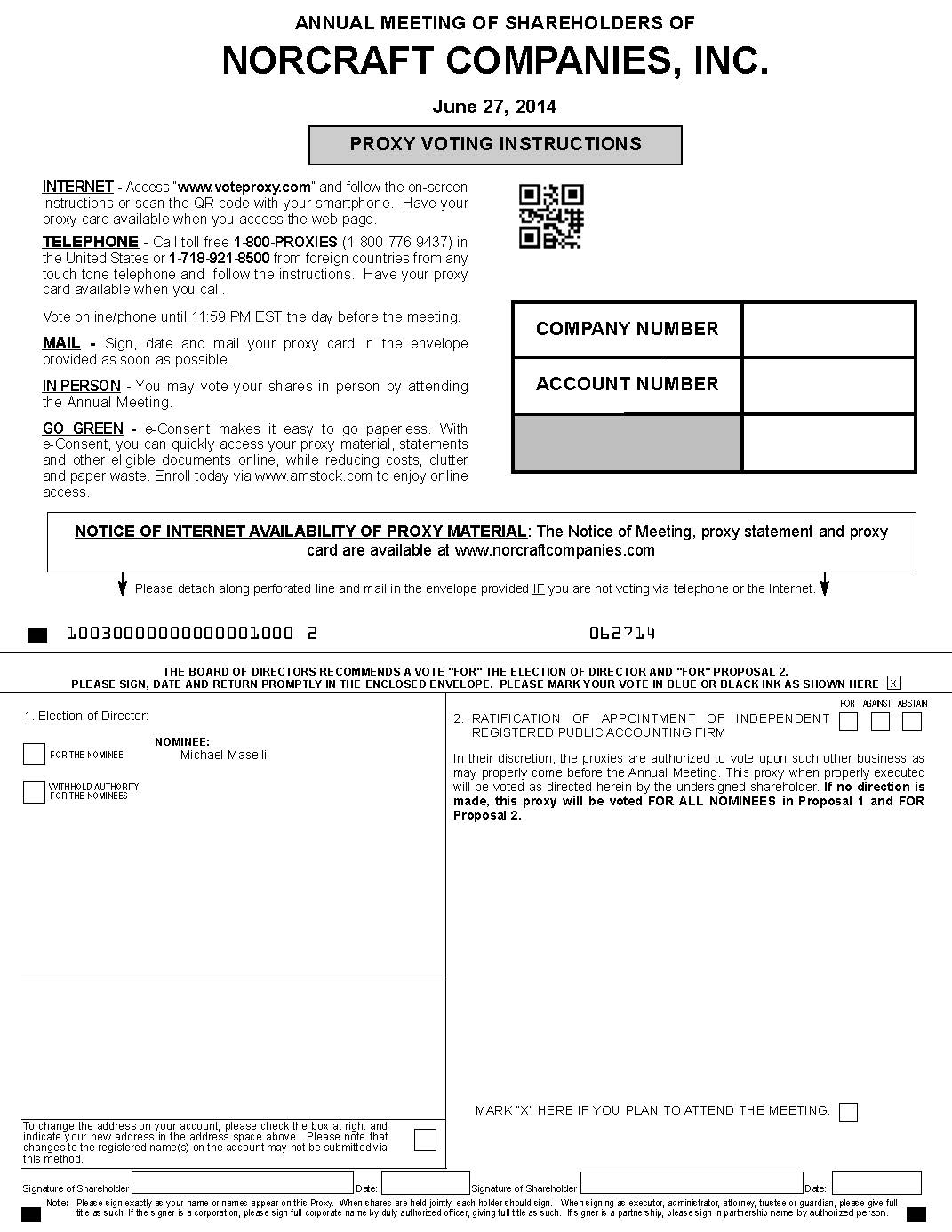

How do I vote?

Stockholders of record can vote their shares (1) via the Internet, (2) via a toll-free telephone call from the U.S. or Canada, (3) by mailing a signed proxy card, or (4) in person at the 2014 Annual Meeting.

You will be asked to vote, as follows:

| |

• | For Proposal No. 1, you will be asked, with respect to each nominee for Class I director, to vote “FOR” such nominee or to “WITHHOLD” your vote from such nominee. |

| |

• | For Proposal No. 2, you will be asked to vote “FOR” the ratification of our selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014, “AGAINST” such ratification or to “ABSTAIN” from voting on Proposal No. 2. |

Generally, voting via the Internet or telephone must be completed by 11:59 P.M. Eastern Time on June 26, 2014 (assuming the meeting is not postponed or adjourned), although you may be notified of an earlier deadline by your broker, custodian or other third party. Stockholders may revoke the authority granted by their execution of proxies at any time before the effective exercise of such authority by filing with our Secretary, at Norcraft Companies, Inc., 3020 Denmark Avenue, Suite 100, Eagan, Minnesota 55121, a written revocation or a duly executed proxy bearing a later date or by voting in person at the 2014 Annual Meeting. Shares represented by executed and unrevoked proxies will be voted in accordance with the choice or instructions specified thereon. If no choices or instructions are given, the persons named as proxies intend to vote the shares represented thereby:

| |

• | “FOR” Proposal No. 1 to elect the Class I director nominees to the Board; |

| |

• | “FOR” Proposal No. 2 to ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| |

• | In accordance with the best judgment of the persons named as proxies on any other matters that may properly come before the 2014 Annual Meeting. |

What is the vote required for a quorum?

The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock on the record date, will constitute a quorum for the transaction of business at the 2014 Annual Meeting. Votes withheld from any nominee, abstentions, and broker non-votes (as described below) are counted as present or represented for purposes of determining the presence or absence of a quorum for the 2014 Annual Meeting.

What is a broker non-vote and what is the impact of not voting?

A broker “non-vote” occurs when a nominee holding shares for a beneficial owner, who is also sometimes referred to as someone who holds shares in street name, does not vote on one or more proposals because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Your bank or broker does not have discretion to vote uninstructed shares on the proposals in this Proxy Statement, except for Proposal No. 2 to ratify the appointment of our independent registered public accounting firm. As a result, if you hold your shares in street name it is critical that you provide instructions to your bank or broker if you want your vote to count in the election of directors.

If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

What is the vote required for a proposal to pass?

| |

• | Proposal No. 1—Election of directors: The affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the 2014 Annual Meeting, in person or by proxy, is required for the election of each of the nominees. Abstentions and broker non-votes will have no effect on the voting outcome with respect to the election of directors. |

| |

• | Proposal No. 2—Ratification of the selection of our independent registered public accounting firm: The affirmative vote of the holders of a majority of the shares of common stock present or represented and entitled to vote at the 2014 Annual Meeting, in person or by proxy, is required to ratify our selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. Abstentions will have the practical effect of a vote against ratification of our selection. Because Proposal No. 2 is a routine proposal on which a broker or other nominee is generally empowered to vote, we do not expect any broker non-votes on this proposal. To the extent there are any broker non-votes, they will have the practical effect of a vote against this proposal. |

PRINCIPAL AND MANAGEMENT STOCKHOLDERS

Principal Stockholders

The following table sets forth certain information with respect to each person known to us to be the beneficial owner of more than 5% of our issued and outstanding common stock as of March 10, 2014, as reported to us. On March 10, 2014, we had 17,311,573 shares of common stock outstanding. Unless otherwise indicated, the address for each listed stockholder is: c/o Norcraft Companies, Inc., 3020 Denmark Avenue, Suite 100, Eagan, Minnesota 55121.

|

| | | |

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | Percentage of Class(1) |

Citadel Advisors LLC (2) |

| 1,042,563 | 6.02% |

131 S. Dearborn St., 32nd Floor |

|

|

|

Chicago, IL 60603 |

|

|

|

BlackRock, Inc. (3) |

| 886,819 | 5.12% |

40 East 52nd Street |

|

|

|

New York, NY 10022 |

|

|

|

SKM Equity Fund III, L.P. (4) |

| 5,521,325 | 31.89% |

SKM Investment Fund (4) |

| 110,426 | 0.64% |

Trimaran Fund II, L.L.C. (5) |

| 1,165,495 | 6.73% |

Trimaran Parallel Fund II, L.P. (5) |

| 490,705 | 2.83% |

CIBC Employee Private Equity Fund (Trimaran) Partners (5) |

| 758,911 | 4.38% |

CIBC Capital Corporation (5) |

| 827,949 | 4.78% |

Trimaran Capital, L.L.C. (5) |

| 75,253 | 0.43% |

| |

(1) | We calculated the percentage of class based on the number of shares outstanding as of March 10, 2014 and on the number of shares reported as beneficially owned in filings by the beneficial owners with the Securities and Exchange Commission, or SEC. |

| |

(2) | The information reported is based on a Schedule 13G filed with the SEC on January 30, 2014 by Citadel Advisors LLC (“Citadel Advisors”), Citadel Advisors Holdings II LP (“CAH2”), Citadel GP LLC (“CGP”) and Mr. Kenneth Griffin (collectively with Citadel Advisors, CAH2 and CGP, the “Reporting Persons”) with respect to shares of common stock owned by Citadel Global Equities Master Fund Ltd., a Cayman Islands limited company (“CG”), and Citadel Securities LLC, a Delaware limited liability company (“Citadel Securities”). Citadel Advisors is the portfolio manager for CG. CAH2 is the managing member of Citadel Advisors. CALC III LP, a Delaware limited partnership (“CALC3”), is the non-member manager of Citadel Securities. CGP is the general partner of CALC3 and CAH2. Mr. Griffin is the President and Chief Executive Officer of, and owns a controlling interest in, CGP. |

| |

(3) | The information reported is based on a Schedule 13G filed with the SEC on January 30, 2014 by BlackRock, Inc. (“BlackRock”). BlackRock reported that it beneficially owned 886,189 shares and that it had sole voting and dispositive power with respect to all such shares as of December 31, 2013. BlackRock reported that it is a parent holding company or control person of BlackRock Fund Advisors and various other subsidiaries which collectively own such shares. |

| |

(4) | The information reported is based on a Schedule 13G/A filed with the SEC on February 14, 2014 by SKM Equity Fund III, L.P. (“SKM Equity”) and SKM Investment Fund (“SKM Investment”). SKM Partners, L.L.C., a Delaware limited liability company (“SKM LLC”), is the general partner of SKM Equity. SKM LLC, as the general partner of SKM Equity, has voting and dispositive power over the common stock held by SKM Equity. An investment committee (“Investment Committee”) comprised of three members is authorized by SKM LLC to exercise voting and dispositive power with respect to the common stock held by SKM Equity. Apax Partners, L.P., a Delaware limited partnership (“Apax LP”), is the managing partner of SKM Investment. Apax Partners, LLC, a Delaware limited liability company (“Apax LLC”), is the general partner of Apax LP. John Megrue, as the sole member of the board of managers of Apax LLC, is authorized by Apax LLC to exercise voting and dispositive power with respect to the common stock held by SKM Investment. Each of the members of the Investment Committee, Mr. Megrue, SKM LLC, Apax LP and Apax LLC disclaims beneficial ownership of the common stock except to the extent of his or its pecuniary interest therein. |

| |

(5) | The information reported is based on a Schedule 13G filed with the SEC on February 18, 2014 by Trimaran Fund II, L.L.C. (“Trimaran Fund”), Trimaran Capital, L.L.C. (“Trimaran Capital”), Trimaran Parallel Fund II, L.P. (“Trimaran Parallel”), CIBC Employee Private Equity Fund (Trimaran) Partners (“CIBC EPEF”), and CIBC Capital Corporation (“CIBC CC”) (collectively the “Reporting Persons”). Jay R. Bloom and Dean C. Kehler are the managing members of Trimaran Investments II, L.L.C., a Delaware limited liability company (“Trimaran II”), which is the party with sole power to dispose of the shares of common stock held by the Reporting Persons. Messrs. Bloom and Kehler are also the managing members of Trimaran Fund Management, L.L.C., a Delaware limited liability company (“TFM”), which is the party with sole power to vote the shares of common stock held by the Reporting Persons. As a result, Messrs. Bloom and Kehler may be deemed to share voting and dispositive power with respect to the shares of common stock held by the Reporting Persons. Each of Messrs. Bloom and Kehler, Trimaran II and TFM disclaims beneficial ownership of the shares of common stock held by the Reporting Persons except to the extent of his or its pecuniary interest therein. |

Management Stockholders

The following table sets forth information as of March 10, 2014, with respect to the beneficial ownership of common stock by our directors and each named executive officer and by all of our current directors and executive officers as a group. The percentage of class is calculated based on 18,448,245 total shares, which includes all shares outstanding as of March 10, 2014 and assumes the exercise of stock options to purchase 1,136,672 shares under the 2013 Incentive Plan. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. Except as indicated below and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name.

|

| | | | |

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Class |

Mark Buller (1)(2) | 405,882 |

| 2.20 | % |

Leigh Ginter (1)(2) | 131,912 |

| * |

|

Kurt Wanninger (1)(2) | 91,324 |

| * |

|

Michael Maselli | — |

| * |

|

Christopher Reilly (3) | — |

| * |

|

Ira Zecher (1) | 6,538 |

| * |

|

Harvey Wagner (1) | 3,812 |

| * |

|

All Directors, Nominees and Executive Officers as a Group (9 persons) | 923,585 |

| 5.01 | % |

* Represents less than 1.00%.

| |

(1) | Represents stock options granted under the 2013 Incentive Plan. The stock options for Messrs. Buller, Ginter and Wanniger have a vesting period of four years. The stock options for Mr. Zecher have a vesting period of three years, commensurate with his initial term on our Board. The stock options for Mr. Wagner have a vesting period of two years, commensurate with his initial term on our Board. |

| |

(2) | Messrs. Buller, Ginter and Wanninger additionally hold 525,629, 79,157 and 82,141 common units, respectively in Norcraft Holdings LLC. Pursuant to an exchange agreement, from and after the first anniversary of the closing of our initial public offering, Messrs. Buller, Ginter and Wanninger may exchange their interests in Norcraft Holdings LLC into shares of our restricted common stock or, at our election, an amount of cash calculated by reference to the trading price of our common stock for the 15 trading days immediately prior to the effective date of any exchange |

| |

(3) | Does not include 5,521,325 shares owned by SKM Equity Fund III, L.P. or the 110,426 shares owned by SKM Investment Fund. Mr. Reilly as a partner of the general partner of the majority shareholder of each of SKM Equity Fund III, L.P. SKM Investment Fund and may be deemed to beneficially own the shares beneficially owned by SKM Equity Fund III, L.P. and SKM Investment Fund. Mr. Reilly disclaims ownership of such shares except to the extent of his pecuniary interest therein. |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation earned by our named executive officers in 2013 and 2012.

|

| | | | | | | | | | |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) | Non-Equity Incentive Plan Compen- sation ($) | All Other Compen-sation ($) (1) | Total ($) |

Mark Buller | 2013 | 510,000 |

| 504,536 |

| 3,387,410 | — | 690 | 4,402,636 |

|

Chief Executive Officer | 2012 | 481,063 |

| — |

| — | — | 690 | 481,753 |

|

Leigh Ginter | 2013 | 250,000 |

| 245,174 |

| 1,693,705 | — | 690 | 2,189,569 |

|

Chief Financial Officer | 2012 | 250,000 |

| — |

| — | — | 690 | 250,690 |

|

Kurt Wanninger | 2013 | 385,000 |

| 377,190 |

| 1,100,911 | — | 690 | 1,863,791 |

|

President, Mid Continent | 2012 | 385,000 |

| — |

| — | — | 690 | 385,690 |

|

| |

(1) | Company paid life insurance premiums. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the number of securities underlying outstanding options and other equity incentive plan awards for each of our named executive officers outstanding as of December 31, 2013.

|

| | | | | |

Name and Principal

Position | Grant Date | Number of Securities Underlying Unexercised Options (#) Unexercisable | Number of Securities

Underlying Unexercised

Options (#) Exercisable | Unit Exercise Price | Option Expiration Date |

Mark Buller | November 6, 2013 | 405,882 | — | $16.00 | November 6, 2023 |

Chief Executive Officer | | | | | |

Leigh Ginter | November 6, 2013 | 202,941 | — | $16.00 | November 6, 2023 |

Chief Financial Officer | | | | | |

Kurt Wanninger | November 6, 2013 | 131,912 | — | $16.00 | November 6, 2023 |

President, Mid Continent | | | | | |

Employment Agreements and Arrangements Upon Termination or Change of Control

Arrangements with Mark Buller

Mr. Buller entered into an employment agreement with us on October 21, 2003, the initial term of which expired October 20, 2006, which was amended on August 17, 2004. This term automatically extends for consecutive one-year periods unless he or Norcraft Holdings L.P. declines to extend the term. Mr. Buller received $510,000 as his base salary for 2013, as well as a cash performance bonus tied to certain financial performance and other objectives set by the board of managers of Norcraft GP. The board of managers has consistently in the past tied bonuses solely to EBITDA goals set each year by the board of managers. Pursuant to his employment agreement, Mr. Buller has, among other things, agreed that (i) he will not disclose any of our trade secrets or confidential information, during and after the term of his employment, (ii) he will assign and disclose to us all intellectual property and proprietary rights developed or reduced to practice that relate to our business, during and for three months after the term of his employment and (iii) he will not compete against us and will not solicit nor hire any of our current employees, regardless of the reason for his termination, during and for two years after the term of his employment.

In the event we terminate Mr. Buller’s employment without cause (as defined in his agreement) or if he terminates his employment for good reason (as defined in his agreement), he will continue to receive his base salary for 18 months following the date of termination. He will also be entitled to receive a pro-rated portion of any bonus accrued for the year in which termination occurred (payable when the bonus would have otherwise been paid) and certain other health and welfare benefits in accordance with his agreement. If we had terminated Mr. Buller’s employment without cause or if he had terminated his employment for good reason as of December 31, 2013, Mr. Buller would have been entitled to receive an aggregate $765,000 pursuant to such provisions in his employment agreement (payment of which would be made over time and subject to the provisions of such agreement).

In the event we terminate Mr. Buller’s employment for cause or if he terminates his employment other than for good reason, we are not obligated to provide Mr. Buller any severance other than his accrued and unpaid base salary and certain other health and welfare benefits in accordance with his agreement. In the event of Mr. Buller’s death or disability, he is entitled to receive his accrued and unpaid base salary, a pro-rated portion of any bonus accrued for the year in which his employment ceased (payable when the bonus would have otherwise been paid) and certain other health and welfare benefits in accordance with his agreement.

Mr. Buller also owns 525,629 common units of Norcraft Companies LLC with certain rights to exchange these common units into shares of Norcraft Companies, Inc. common stock and certain registration rights as further described under "Transactions with Related Persons - Related Person Transactions."

Arrangements with Other Employed Named Executive Officers

Mr. Ginter entered into an employment agreement with us on October 21, 2003, the initial term of which expired December 31, 2004. Pursuant to this employment agreement, the employment term is automatically extended for consecutive one-year periods unless Mr. Ginter, or Norcraft Holdings L.P. declines to extend the term. Mr. Wanninger entered into an employment agreement with Norcraft Holdings L.P., effective as of January 17, 2006, the initial term of which expired on December 31, 2007. Pursuant to Mr. Wanninger’s employment agreement, the employment term is automatically extended for consecutive one-year periods unless he or Norcraft Holdings L.P. declines to extend the term.

Pursuant to his employment agreement, Mr. Ginter received $250,000 and Mr. Wanninger received $385,000, in each case, as such officer’s base salary for 2013, as well as a bonus tied to certain financial and other performance objectives set by the board of managers of Norcraft GP. The board of managers has consistently in the past tied bonuses solely to EBITDA goals set each year by the board of managers. Pursuant to each employment agreement, each such named executive officer has, among other things, agreed that (i) he will not disclose any of our trade secrets or confidential information, during and after the term of his employment; (ii) he will assign and disclose to us all intellectual property and proprietary rights developed or reduced to practice that relate to our business, during and for three months after the term of his employment; (iii) he will not compete against us (x) until receipt of his last severance payment in the case of Mr. Ginter and (y) for one year following the end of employment in the case of Mr. Wanninger; and (iv) following the end of employment, he will not solicit or hire any of our current employees for (x) one year in the case of Mr. Ginter and (y) two years in the case of Mr. Wanninger. With respect to Mr. Ginter and Mr. Wanninger, in the event we terminate such officer’s employment without cause (as defined in his agreement) or if he terminates his employment for good reason (as defined in his agreement) they will continue to receive their base salaries for one year following the date of termination, plus, in each case, a pro-rated portion of any bonus accrued for the year in which termination occurred (payable when the bonus would have otherwise been paid) and certain other health and welfare benefits in accordance with their agreements. If we had terminated Mr. Ginter’s employment without cause or if he had terminated his employment for good reason as of December 31, 2013, Mr. Ginter would have been entitled to receive an aggregate $250,000 pursuant to such provisions in his employment agreement (payment of which would be made over time and subject to the provisions of such agreement). If we had terminated Mr. Wanninger’s employment without cause or if he had terminated his employment for good reason as of December 31, 2013, Mr. Wanninger would have been entitled to receive an aggregate $385,000 pursuant to such provisions in his employment agreement (payment of which would be made over time and subject to the provisions of such agreement).

With respect to Mr. Ginter and Mr. Wanninger, in the event we terminate such officer’s employment for cause or if he terminates his employment other than for good reason, we are not obligated to provide such officer any severance other than his accrued and unpaid base salary and certain other health and welfare benefits in accordance with his agreement. Mr. Ginter and Mr. Wanninger also own 79,157 and 82,141 common units, respectively, of Norcraft Companies LLC with certain rights to exchange these common units into shares of Norcraft Companies, Inc. common stock and certain registration rights as further described under "Transactions with Related Persons - Related Person Transactions."

INFORMATION AS TO OUR BOARD OF DIRECTORS, EXECUTIVE OFFICERS,

AND CORPORATE GOVERNANCE

Directors and Nominees for Director

Names, Ages and Classes. The names of our directors (including the nominee for re-election as Class I Director at the 2014 Annual Meeting) are as follows:

|

| | | | | |

Name | Age as

of the

Annual

Meeting | Position(s) Held | Director

Since | Term

Expires | Class of

Director |

Mark Buller | 49 | Chairman and CEO | 2013 | 2016 | III |

Michael Maselli | 54 | Director | 2013 | 2014 | I |

Christopher Reilly | 52 | Director | 2013 | 2015 | II |

Harvey Wagner | 73 | Director | 2014 | 2015 | II |

Ira Zecher | 60 | Director | 2013 | 2016 | III |

Biographies and Qualifications. The biographies of our directors and certain information regarding each director’s experience, attributes, skills and/or qualifications that led to the conclusion that the director should be serving as a director of Norcraft are as follows:

Mr. Buller became the chief executive officer of our predecessor, Norcraft Companies, L.P., and a member of our predecessor’s general partner’s board of managers in October 2003. In July 2013, Mr. Buller was appointed our chief executive officer and chairman of our board of directors. Mr. Buller has over 25 years of experience in the cabinetry industry and has been a chief executive officer or division president of a cabinet manufacturer during the past 17 years. From 1988 to 1996, Mr. Buller served in various management positions at Kitchen Craft Cabinets, a Canadian cabinetry maker. From 1996 to 1999, Mr. Buller was president of Kitchen Craft and following its acquisition by Omega Cabinets, Ltd., Mr. Buller continued as president of Kitchen Craft from 1999 to 2000. Mr. Buller was appointed chief executive officer of Omega in 2000 and remained in that position until 2002, leaving Omega after it was sold to Fortune Brands, Inc. Mr. Buller’s leadership, executive, managerial and business experience, along with his more than 25 years of experience in the cabinetry industry, qualify him to be a director.

Mr. Maselli joined our predecessor company as a member of our predecessor’s general partner’s board of managers in October 2003. In July 2013, Mr. Maselli was appointed to our board of directors. Mr. Maselli is a managing director of Trimaran Fund Management, L.L.C. Before joining Trimaran in February 2003, Mr. Maselli worked in the Corporate and Leverage Finance Groups of CIBC World Markets. Prior to joining CIBC in 1997, Mr. Maselli served as a managing director in Bear Stearns’ corporate finance group and, prior to that, as a vice president at Kidder Peabody. Mr. Maselli received a bachelor’s degree in economics from the University of Colorado and a master’s degree in business administration, with distinction, from The A.B. Freeman School at Tulane University. Mr. Maselli has served on the board of directors of Standard Steel, L.L.C., Charlie Brown’s Acquisition Corp. and El Pollo Loco, Inc. Mr. Maselli’s extensive private equity, financial and investment banking experience qualify him to serve as a director.

Mr. Reilly joined our predecessor company as a member of our predecessor’s general partner’s board of managers in October 2003. In July 2013, Mr. Reilly was appointed to our board of directors. Mr. Reilly is a founding partner at KarpReilly, LLC. Prior to founding KarpReilly, LLC, Mr. Reilly was a partner at Apax Partners, L.P. Before joining Saunders, Karp & Megrue, LLC, the predecessor to Apax Partners, in 1990, Mr. Reilly served in the Merchant Banking and Finance, Administration and Operations Departments of Morgan Stanley & Co. Incorporated. Prior to joining Morgan Stanley, Mr. Reilly spent two years at Bankers Trust. Mr. Reilly received a bachelor’s degree from Providence College and a master’s degree in business administration from New York University’s Leonard N. Stern School of Business. Mr. Reilly has served as a member of the board of directors of Z’Tejas, Inc., Habit Burger Grill, S.B. Restaurant Co. (Elephant Bar), Comark, Inc., Bob’s Discount Furniture, Encompass Home Health, Performance, Inc. and Wilshire Pies, Inc. Mr. Reilly’s substantial experience with portfolio companies and his private equity, financial and investment banking experience qualify him to serve as a director.

Mr. Wagner joined our Company as a member of the board of directors in January 2014. Mr. Wagner is the Managing Principal of the H.A. Wagner Group, LLC, a strategic and business consulting firm. From April 2008 to November 2010, he served as President, CEO and member of the board of Caregiver Services, Inc. (CSI), Florida’s largest nurse registry and supplemental nurse staffing company. Prior to joining CSI in April 2008, Mr. Wagner held the position of President, CEO and Director of Quovadx, Inc. and has served as EVP & Chief Financial Officer for four NYSE and two NASDAQ listed companies in Silicon Valley, San Antonio, Boston and Atlanta. Mr. Wagner served as a member of the board of directors of Cree, Inc. from 1994 to October 2013, Startek, Inc. from 2008 to May 2012 and FormFactor, Inc. from 2005 to December 2010. Mr. Wagner is a graduate of the University of Miami School of Business, holds a Certificate of Director Education from the National Association of Corporate Directors (NACD) and the Terry College of Business at the University of Georgia and is a member of Financial Executives International and NACD. Mr. Wagner’s extensive board experience qualifies him to be a director.

Mr. Zecher joined our Company as a member of the board of directors in July 2013. Mr. Zecher is a managing member of ILZ, LLC, and is a director, audit committee chairman and compensation committee member of the board of Chuy’s Holding. Prior to joining our Company, Mr. Zecher was with Ernst & Young LLP, a registered public accounting firm, for over 36 years until his retirement as a partner in 2010. Mr. Zecher gained extensive experience in audits and transactions at Ernst & Young LLP, where he served as a partner in the Audit and Transaction Advisory Services groups in New York and as the director of the Far East Area Private Equity practice, based in Hong Kong. Mr. Zecher is a CPA and holds a B.A. in accounting from Queens College of the City University of New York. He also completed the Executive Program of the Kellogg School of Management at Northwestern University. He currently is a professor in the Graduate Accounting program at Rutgers, the State University of New Jersey. Mr. Zecher’s extensive accounting and financial experience qualify him as a director.

Executive Officers

The following identifies the current executive officers of the Company.

|

| | |

Name | Age as

of the

Annual

Meeting | Position(s) Held |

Mark Buller | 49 | Chairman and Chief Executive Officer |

Leigh Ginter | 48 | Chief Financial Officer |

Kurt Wanninger | 53 | President, Mid Continent |

Simon Solomon | 61 | President, UltraCraft |

John Swedeen | 63 | President, Starmark |

Director Compensation

The following table provides additional detail regarding the 2013 compensation of our non-employee directors.

|

| | | | | | | |

Name | Fees Earned ($)(1) | Stock Awards ($) | Option Awards ($) | Non-equity Incentive Plan Compensation ($) | Nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) |

Michael Maselli | — | — | — | — | — | — | — |

Christopher Reilly | — | — | — | — | — | — | — |

Harvey Wagner (2) | — | — | — | — | — | — | — |

Ira Zecher (3) | 5,918 | — | 104,608 | — | — | — | 110,526 |

| |

(1) | Our officers, employees, consultants or advisors who also serve as directors do not receive additional compensation for their service as directors. |

| |

(2) | Mr. Wagner was appointed to the Norcraft Companies, Inc. board of directors in 2014, so he did not receive any compensation in 2013. |

| |

(3) | Mr. Zecher receives an additional retainer of $10,000 for service as the chair of the audit committee. |

Director Independence

The Board determined that all of our directors other than Mr. Buller, our Chairman and CEO, satisfied the independence requirements of the New York Stock Exchange, and the independence requirements of our Corporate Governance Guidelines, which is available on our website, www.norcraftcompanies.com. In making this determination, the Board considered the relationships that each director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Our Audit Committee, Compensation Committee and Governance and Nominating Committee consist solely of independent directors, as defined by the New York Stock Exchange. The members of our Audit Committee also meet the additional SEC and the New York Stock Exchange independence and experience requirements applicable specifically to members of the Audit Committee. In addition, all of the members of our Compensation Committee are “non-employee directors” within the meaning of the rules of Section 16 of the Securities Exchange Act and “outside directors” for purposes of Section 162(m) of the Internal Revenue Code.

Information about Meetings and Board Committees

During 2013, the Board held two meetings (including regularly scheduled and special meetings). No director attended fewer than 75% of the total number of Board meetings plus applicable committee meetings held while he or she was a director. Although the Board has no formal policy regarding the attendance of its members at the Annual Meeting, we encourage directors to attend.

The Board has an Audit Committee, a Compensation Committee and a Governance and Nominating Committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our Board.

The composition of the standing committees of our Board of Directors and the number of times that each committee met in 2013 are set forth in the following table:

|

| | |

Committee | Current Members | Number of

Meetings |

Audit Committee | Ira Zecher (Chair) | 1 |

| Harvey Wagner | |

| | |

Compensation Committee | Harvey Wagner | — |

| Ira Zecher | |

| | |

Governance and Nominating Committee | Michael Maselli | — |

| Christopher Reilly | |

Audit Committee

The functions of the Audit Committee are as set forth in the Audit Committee Charter, which can be viewed on our website at www.norcraftcompanies.com. The Audit Committee is required to pre-approve all audit and non-audit services performed by our independent registered public accounting firm in order to assure that the provision of such services does not impair the auditor’s independence. Unless a type of service to be provided has received general pre-approval from the Audit Committee, it requires specific pre-approval in each instance by the Audit Committee. Any proposed services exceeding pre-approved cost levels generally require specific pre-approval by the Audit Committee. The Audit Committee may delegate pre-approval authority for amounts in excess of those previously approved by the Audit Committee to the Chairman of the Audit Committee. If such authority is delegated, the Chairman must report pre-approval authorizations to the Audit Committee at its next scheduled meeting or via e-mail.

The Audit Committee is comprised of Messrs. Wagner and Zecher, and Mr. Zecher serves as the Audit Committee chairperson. The Board has determined that each of the directors serving on the Audit Committee meets the requirements for financial literacy under applicable rules and regulations of the SEC and the New York Stock Exchange. In addition, the Board has determined that Mr. Zecher meets the requirements of a financial expert as defined under the applicable rules and regulations of the SEC and who has the requisite financial sophistication as defined under the applicable rules and regulations of the New York Stock Exchange.

Compensation Committee

The functions of the Compensation Committee are as set forth in the Charter of the Compensation Committee of the Board of Directors of Norcraft Companies, Inc., which can be viewed on our website at www.norcraftcompanies.com.

As set forth in its charter, the purposes and responsibilities of the Compensation Committee are:

| |

• | to assist the Board in developing and evaluating potential candidates for executive positions; |

| |

• | to review and approve corporate goals and objectives relevant to executive officer compensation, evaluate the executive officers’ performance in light of those goals and objectives and determine and approve the executive officers’ compensation level based on this evaluation; |

| |

• | to make recommendations to the Board regarding compensation, if any, of the Board; |

| |

• | to make recommendations to the Board regarding the adoption of new employee incentive compensation plans and equity-based plans and administer the Company’s existing incentive compensation plans and equity-based plans; and |

| |

• | to perform an annual evaluation of the Compensation Committee. |

Under the charter, the Compensation Committee may form and delegate authority to sub-committees, if and when the committee deems appropriate.

In August 2013, the Compensation Committee retained Semler Brossy, the compensation consulting firm, to evaluate our compensation programs and to provide guidance with respect to developing and implementing our compensation philosophy and programs as a public company.

Governance and Nominating Committee

The functions of the Governance and Nominating Committee are as set forth in the Governance and Nominating Committee Charter, which can be viewed on our website at www.norcraftcompanies.com. The Governance and Nominating Committee is primarily responsible for overseeing our corporate governance efforts and framework, which are described in the next section of this Proxy Statement.

The Governance and Nominating Committee is comprised of Messrs. Maselli and Reilly. We have not designated a Governance and Nominating Committee chairperson. The Board has considered the independence and other characteristics of each member of the Governance and Nominating Committee. The Board believes that each member of the Governance and Nominating Committee meets the requirements for independence under the current requirements of the New York Stock Exchange.

Corporate Governance

Board Leadership Structure and Risk Oversight

Under our By-Laws, the chief executive officer of the Company serves as chairman of the Board. Mark Buller became the chief executive officer of our predecessor, Norcraft Companies, L.P., in October 2003 and was appointed our chief executive officer in July 2013. The Board believes that combining the chairman and chief executive officers positions is currently the most effective leadership structure for Norcraft given Mr. Buller’s extensive experience and deep knowledge of the Company and our industry. As chief executive officer, Mr. Buller is intimately involved in the day-to-day operations of the Company and is best positioned to lead the Board in setting the strategic focus and direction for the Company. The Board believes that the combination of the chairman and chief executive officer roles, as well as the exercise of key board oversight responsibilities by independent directors, provides an effective balance for the management of the Company in the best interest of our shareholders. The Board believes that the leadership structure it has chosen along with the risk oversight role, as described below, enables it to effectively oversee risk.

The key aspects of the Board’s risk oversight role are as follows:

| |

• | While the Board retains ultimate responsibility for risk oversight, the Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the Board. The Audit Committee receives reports from management regarding our assessment of risks. In addition, the Audit Committee reports regularly to the Board, which also considers our risk profile. The Audit Committee and the Board focus on the most significant risks we face and our general risk management strategies. |

| |

• | Company management is responsible for day-to-day risk management processes. Company management considers risk and risk management in each business decision, to proactively develop and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies adopted by the Audit Committee and the Board. |

We believe this division of responsibilities is the most effective approach for addressing the risks we face and that our Board leadership structure, which also emphasizes the independence of the Board in its oversight of our business and affairs, supports this approach.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines, which we refer to as the Guidelines, which are available on our website at www.norcraftcompanies.com and which are also available in print to any stockholder who requests them from our Secretary. The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders and relies on the Guidelines to provide that framework. Among other things, the Guidelines help to ensure that the Board is independent from management, that the Board adequately performs its oversight functions, and that the interests of the Board and management align with the interests of our stockholders.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics, which is available on our website at www.norcraftcompanies.com and also is available in print to any stockholder who requests it from our Secretary. Our Code of Business Conduct and Ethics is applicable to all directors, officers (including our chief executive officer, chief financial officer and other senior executives) and employees and embodies our principles and practices relating to the ethical conduct of our business and our long-standing commitment to honesty, fair dealing and full compliance with all laws affecting our business.

The Board has established a means for employees to report a violation or suspected violation of the Code of Business Conduct and Ethics anonymously, including those violations relating to accounting, internal accounting controls or auditing matters.

Director Qualifications and Consideration of Diversity

The Governance and Nominating Committee requires that directors possess personal and professional ethics, integrity and values and are committed to representing the interests of our stockholders. Directors must have an inquisitive and objective perspective, practical wisdom and mature judgment. We do not have a formal diversity policy. However, we and the Corporate Governance and Nominating Committee endeavor to have a Board representing diverse viewpoints as well as diverse expertise at policy-making levels in many areas, including business, accounting and finance, manufacturing, marketing and sales, education, legal, government affairs, regulatory, research and development, business development, insurance, international, technology, and in other areas that are relevant to our activities. A detailed description of the relevant experience and qualifications of our current directors is set forth in the “Directors and Nominees for Director” section of this Proxy Statement. Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and they should be committed to serving on the Board for an extended period of time.

Director Nomination Process

In addition to considering candidates suggested by stockholders, the Corporate Governance and Nominating Committee considers potential candidates recruited by the Corporate Governance and Nominating Committee and those recommended by our directors, executive officers, employees, and third parties. The Corporate Governance and Nominating Committee considers all candidates in the same manner regardless of the source of the recommendation.

Nominations of persons for election to the Board may be made at a meeting of stockholders in one of two ways: (a) by or at the direction of the Board, or (b) by any stockholder who is a stockholder of record at the time of giving of notice for the election of directors at the Annual Meeting of Stockholders and who complies with the notice procedures set forth below. Such nominations, other than those made by or at the direction of the Board, also must be made in accordance with our Amended and Restated Bylaws, or our By-Laws, as summarized below under the heading “Stockholder Proposals and Board Candidates” in writing to the Secretary of Norcraft Companies, Inc. at 3020 Denmark Avenue, Suite 100, Eagan, Minnesota 55121.

The stockholder’s notice must set forth (a) as to each person whom the stockholder proposes to nominate for election or re-election as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected) and (b) as to the stockholder giving the notice (i) the name and address, as they appear on our books, and (ii) the number of our shares that are beneficially owned by such stockholder. In addition to the requirements set forth above, a stockholder also must comply with applicable requirements of the Securities Exchange Act and the rules and regulations thereunder. The director nominee for election at the 2014 Annual Meeting was recommended by the Governance and Nominating Committee and was nominated by the Board. We have not received any stockholder director nominations for the 2014 Annual Meeting.

Stockholder Communications

Stockholders may send general communications to our Board, including stockholder proposals, recommendations for Board candidates, or concerns about our conduct. These communications may be sent to any director, including members of the Audit Committee, in care of our Secretary in one of two ways: in writing to Norcraft Companies, Inc. at 3020 Denmark Avenue, Suite 100, Eagan, Minnesota 55121; or by email through the “Investor Relations” section on our corporate website, www.norcraftcompanies.com. All communications will be reviewed by the Secretary and, unless otherwise indicated in such communication, submitted to the Board or an individual director, as appropriate.

TRANSACTIONS WITH RELATED PERSONS

Policies and Procedures Regarding Review, Approval, or Ratification of Related Person Transactions

In accordance with the Governance and Nominating Committee Charter, the Governance and Nominating Committee is responsible for reviewing and pre-approving or ratifying the terms and conditions of all transactions that would be considered related party transactions pursuant to SEC rules. Any such transaction must be approved by our Governance and Nominating Committee prior to Norcraft entering into the transaction and must be on terms no less favorable to Norcraft than could be obtained from unrelated third parties. A report is made to our Governance and Nominating Committee annually disclosing related party transactions during that year, if any. In carrying out this responsibility, the Governance and Nominating Committee has determined that we have no related party transactions other than those described below in - Related Persons Transactions.

Related Person Transactions

Reorganization Transactions

In November 2013, we completed our initial public offering (our “IPO”). In connection with our IPO, we and Norcraft Holdings, L.P. completed a series of reorganization transactions, which we refer to as the Reorganization, in order to reorganize our capital structure in preparation for the IPO. The Reorganization was designed to create a capital structure that preserves our ability to conduct our business through Norcraft Holdings, L.P., while permitting us to raise additional capital and provide access to liquidity through a public company. The Reorganization included, among other changes, the following:

Limited Liability Company Agreement of Norcraft Companies LLC. As a result of the Reorganization and the IPO, Norcraft Companies, Inc. holds (directly or indirectly) common units in, and is the sole managing member of, Norcraft Companies LLC. Accordingly, Norcraft Companies, Inc. operates and controls all of the business and affairs of Norcraft Companies LLC and, through Norcraft Holdings, L.P. and its operating entity subsidiaries, conducts our business. Pursuant to the limited liability company agreement of Norcraft Companies LLC, Norcraft Companies, Inc. has the right to determine, subject to restrictions in Norcraft Companies, L.P.’s senior secured first-lien asset-based revolving credit facility (the “ABL Facility”), when distributions will be made to unitholders of Norcraft Companies LLC and the amount of any such distributions. If a distribution is authorized, such distribution generally will be made to the unitholders of Norcraft Companies LLC pro rata in accordance with their number of common units. Holders of unvested common units of Norcraft Companies LLC generally will not share on a current basis pro rata in distributions other than tax distributions.

In general, Norcraft Companies, Inc., Norcraft Holdings Corp. I and Norcraft Holdings Corp. II will incur U.S. federal, state and local income taxes on their proportionate share of any taxable income of Norcraft Companies LLC. The limited liability company agreement of Norcraft Companies LLC will, subject to certain restrictions, provide for cash distributions, which we refer to as “tax distributions,” to the holders of the common units of Norcraft Companies LLC. Generally, these tax distributions will be pro rata among the members in accordance with their number of common units and computed based on our estimate of the taxable income of Norcraft Companies LLC allocable to a holder of common units of Norcraft Companies LLC (using certain assumptions) multiplied by an assumed tax rate equal to the highest effective marginal combined U.S. federal, state and local income tax rate prescribed for an individual or corporate resident in New York, New York (and using certain additional assumptions).

As a result of the potential differences in the amount of net taxable income allocable to us and to Norcraft Companies LLC’s other equity holders and potential differences in applicable tax rates, we may receive tax distributions in excess of our tax liabilities and our payment obligations under the tax receivable agreements. We do not currently expect to pay any cash dividends on our common stock and, to the extent we do not distribute such cash balances as dividends and instead retain such cash balances, Norcraft Companies LLC’s other equity holders would benefit from any value attributable to such accumulated cash balances as a result of their ownership of shares of common stock following an exchange of their common units of Norcraft Companies LLC pursuant to the exchange agreement described below.

The limited liability company agreement of Norcraft Companies LLC also provides that substantially all expenses incurred by or attributable to Norcraft Companies, Inc., but not including obligations incurred under the tax receivable agreement by Norcraft Companies, Inc., income tax expenses of Norcraft Companies, Inc. attributable to allocations of income by Norcraft Companies LLC (or payments on indebtedness incurred by Norcraft Companies, Inc.), will be borne by Norcraft Companies LLC.

Exchange Agreement. We entered into an exchange agreement with certain holders of common units of Norcraft Companies LLC. Pursuant to the terms of the exchange agreement, from and after the first anniversary of the date of the closing of the IPO, each such holder may from time-to-time exchange its common units of Norcraft Companies LLC for, at our option, (x) cash consideration (calculated based on the volume-weighted average price of our common stock as displayed under the heading Bloomberg VWAP on the Bloomberg page designated for our common stock for the 15 trading days immediately prior to the effective date of any such exchange) or (y) restricted shares of our common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications.

Registration Rights Agreement. We entered into a registration rights agreement with the former shareholders of SKM Norcraft Corp. and Trimaran Cabinet Corp., Buller Norcraft Holdings, L.L.C. and certain current and former members of our management and board. Pursuant to the registration rights agreement, these parties will have registration rights beginning six months after completion of our IPO with respect to the restricted shares of Norcraft Companies, Inc. common stock that they hold post-Reorganization or will hold upon exchange of their common units of Norcraft Companies LLC pursuant to the exchange agreement.

Tax Receivable Agreements. We entered into three tax receivable agreements (“TRAs”), with the former holders of SKM Norcraft Corp, the former holders of Trimaran Cabinet Corp. and the holders of common units of Norcraft Companies LLC:

| |

• | Under the first of these agreements we generally are required to pay to the holders of common stock of SKM Norcraft Corp. as of immediately prior to the Reorganization 85% of the applicable cash savings, if any, in U.S. federal, state or local tax that we actually realize (or are deemed to realize in certain circumstances) as a result of (i) the tax attributes associated with any increase in tax basis attributable to SKM Norcraft Corp.’s original acquisition of interests in Norcraft Holdings, L.P., (ii) the net operating losses of SKM Norcraft Corp. relating to taxable years ending on or before the date of the Reorganization (calculated by assuming the taxable year of SKM Norcraft Corp. closes on the date of the Reorganization) that are or become available to us and our wholly-owned subsidiaries as a result of the Reorganization, and (iii) tax benefits attributable to payments made under the tax receivable agreement. |

| |

• | Under the second of these agreements we generally are required to pay to the holders of common stock of Trimaran Cabinet Corp. as of immediately prior to the Reorganization 85% of the applicable cash savings, if any, in U.S. federal, state or local tax that we actually realize (or are deemed to realize in certain circumstances) as a result of (i) the tax attributes associated with any increase in tax basis attributable to Trimaran Cabinet Corp.’s original acquisition of interests in Norcraft Holdings, L.P., (ii) the net operating losses of Trimaran Cabinet Corp. relating to taxable years ending on or before the date of the Reorganization that are or become available to us and our wholly-owned subsidiaries as a result of the Reorganization, and (iii) tax benefits attributable to payments made under the tax receivable agreement. |

| |

• | Under the third of these agreements we generally are required to pay to the holders of units of Norcraft Companies LLC (other than units that we or our wholly-owned subsidiaries hold) 85% of the amount of cash savings, if any, in U.S. federal, state or local tax that we actually realize (or are deemed to realize in certain circumstances) as a result of (i) certain tax attributes that are created as a result of the exchanges of their units for restricted shares of our common stock or cash, including any basis adjustment relating to the assets of Norcraft Companies LLC and (ii) tax benefits attributable to payments made under the tax receivable agreements. |

The payment obligations under the tax receivable agreements are obligations of Norcraft Companies, Inc., not Norcraft Companies LLC, and we expect that the payments are required to make under the tax receivable agreements will be substantial. Potential future reductions in tax payments for us and tax receivable agreement payments by us will be calculated using the market value of our common stock at the time of exchange (or the 15 trading days immediately prior to the effective date of any exchange, where we elect to pay cash consideration for units of Norcraft Companies LLC) and the prevailing tax rates applicable to us over the life of the tax receivable agreements and will generally be dependent on us generating sufficient future taxable income to realize the benefit. Any actual increase in tax basis, as well as the amount and timing of any payments under the tax receivable agreements, will vary depending upon a number of factors, including the timing of exchanges by the holders of limited liability company units, the price of our common stock at the time of the exchange (or the 15 trading days immediately prior to the effective date of any exchange, where we elect to pay cash consideration for units of Norcraft Companies LLC), whether such exchanges are taxable, the amount and timing of the taxable income we generate in the future and the tax rate then applicable as well as the portion of our payments under the tax receivable agreements constituting imputed interest.

Under each of the TRAs, we generally will retain the benefit of the remaining 15% of the applicable tax savings. Payments under each of the TRAs are not conditioned on the pre-IPO owners of Norcraft Holdings, L.P.'s continued ownership of us. Payments under some or all of the TRAs are expected to give rise to certain additional tax benefits attributable to either further increases in basis or in the form of deductions for imputed interest, depending on the TRA and the circumstances. Any such benefits are the subject of the TRAs and will increase the amounts due thereunder. In addition, the TRAs will provide for interest, at a rate equal to LIBOR, accrued from the due date (without extensions) of the corresponding tax return to the date of payment specified by the TRAs.

Payments under the TRAs will be based on the tax reporting positions that we determine, consistent with the terms of the TRAs. We will not be reimbursed for any payments previously made under the TRAs if any basis increases or other benefits (including any net operating losses of SKM Norcraft Corp. and Trimaran Cabinet Corp.) are subsequently disallowed; if it is determined that excess payments have been made to a beneficiary under a TRA, certain future payments, if any, otherwise to be made will be reduced. As a result, in certain circumstances, payments could be made under the TRAs in excess of the benefits that we actually realize in respect of the attributes to which the TRAs relate.

Review, Approval or Ratification of Transactions with Related Persons

Any material potential or actual conflict of interest or transaction between the Company and any “related person” of the Company must be reviewed and approved or ratified by the Audit Committee or, alternatively, our Board. SEC rules define a “related person” of the Company as any Company director (or nominee), executive officer, 5%-or-greater shareholder or immediate family member of any of these persons.

Employment Agreements

We have entered into employment agreements with certain of our officers. For more information regarding these agreements, see “Executive Compensation-Employment Agreements and Arrangements upon Termination or Change of Control.”

Management and Monitoring Agreement

Norcraft Holdings, L.P. and Norcraft Companies, L.P. were parties to a Management and Monitoring Agreement Letter (the “Management and Monitoring Agreement”) with Saunders, Karp & Megrue, LLC (“SKM”), dated as of October 21, 2003. The Management and Monitoring Agreement provided for an annual fee of $1.0 million, payable quarterly in advance, to SKM. We terminated the Management and Monitoring Agreement in connection with our IPO. The Management and Monitoring Agreement also provided for certain customary expense reimbursement and indemnification provisions that survived the termination of such agreement.

Indemnification of Directors and Officers

We entered into customary indemnification agreements with our executive officers and directors that provide, in general, that we provide them with customary indemnification in connection with their service to us or on our behalf.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our executive officers, directors and persons holding more than 10% of our common stock to file with the SEC, and furnish to us, initial reports of beneficial ownership and reports of changes in beneficial ownership of our securities. Based solely on a review of the copies of such reports furnished to us and information provided to us by our directors and executive officers, we believe that, during 2013, all such parties complied with all applicable filing requirements, except that due to administrative errors and with the exception of Mr. Wagner: (i) our executive officers and directors each filed a Form 3 on November 13, 2013, seven days after the initial report was required to be filed on Form 3, and (ii) our executive officers and directors filed a Form 4 on November 13, 2013, five days after the transaction was required to be reported on Form 4.

EQUITY COMPENSATION PLANS

2013 Incentive Plan

The Board has adopted the Norcraft Companies, Inc. 2013 Incentive Plan (the “2013 Incentive Plan”) and all equity-based awards are granted under the 2013 Incentive Plan. The following summary describes the material terms of the 2013 Incentive Plan.

As of the date of this Proxy Statement, we granted Messrs. Buller, Ginter and Wanninger stock options to purchase 405,882; 202,941; and 131,912 shares of common stock, respectively. Additional stock options to purchase 395,937 shares of common stock in the aggregate were granted to certain officers and directors. All options were granted under the 2013 Incentive Plan. Of these additional options, 392,125 have an exercise price equal to the initial public offering price of $16.00 per share and a vesting period of four years (with the exception of grants made to Mr. Zecher, whose options will vest over a three year period commensurate with his initial term on our Board). The remaining 3,812 options were granted to Mr. Wagner in connection with his appointment to our Board in February 2014 and have an exercise price of $17.49 per share, the per-share fair market value of the common stock of the Company on the date of the grant, and a vesting period of two years, commensurate with his initial term on our Board. The fair value of the stock options granted have been determined on the grant date and will be expensed over the options vesting period. We expect that we will incur compensation expense of approximately $1.9 million over the four year vesting period for grants other than those to Mr. Zecher and Mr. Wagner. We do not currently expect to make additional stock option grants to these individuals during the first four years following our IPO (and, with respect to Mr. Zecher, within the first three years following our IPO, and Mr. Wagner, within the first two years following our IPO).

Plan Administration

The 2013 Incentive Plan is administered by our Compensation Committee. Our Compensation Committee has the authority to, among other things, interpret the 2013 Incentive Plan, determine eligibility for, grant and determine the terms of awards under the 2013 Incentive Plan, and to do all things necessary to carry out the purposes of the 2013 Incentive Plan. Our Compensation Committee’s determinations under the 2013 Incentive Plan are conclusive and binding.

Authorized Shares

The maximum number of shares of our common stock that may be delivered in satisfaction of awards under the 2013 Incentive Plan is approximately 10% of outstanding shares.

Shares of our common stock to be issued under the 2013 Incentive Plan may be authorized but unissued shares of our common stock or previously issued shares acquired by us. Any shares of our common stock underlying awards granted under the 2013 Incentive Plan that are settled in cash or otherwise expire, terminate, or are forfeited prior to the issuance of stock will again be available for issuance under the 2013 Incentive Plan.

Individual Limits

The maximum number of shares of our common stock subject to stock options and the maximum number of shares of our common stock subject to stock appreciation rights that may be granted to any person in any calendar year is each 375,589 shares. The maximum number of shares of our common stock subject to other awards that may be granted to any person in any calendar year is 2% of outstanding shares. The maximum amount of cash awards that may be granted to any person in any calendar year is $2,000,000.

Eligibility

Our Compensation Committee will select participants from among our key employees, directors, consultants and advisors and of our affiliates who are in a position to contribute significantly to the success of the Company and its affiliates. Eligibility for options intended to be incentive stock options, or ISOs, is limited to employees of the Company or certain affiliates.

Types of Awards

The 2013 Incentive Plan provides for grants of stock options, stock appreciation rights, restricted and unrestricted stock, stock units, performance awards, cash awards, and other awards convertible into or otherwise based on shares of our common stock. Dividend equivalents may also be provided in connection with an award under the 2013 Incentive Plan.

| |

• | Stock options and stock appreciation rights. The exercise price of an option, and the base price against which a stock appreciation right is to be measured, may not be less than the fair market value (or, in the case of an ISO granted to a ten percent shareholder, 110% of the fair market value) of a share of our common stock on the date of grant. Our Compensation Committee will determine the time or times at which stock options or stock appreciation rights become exercisable and the terms on which such awards remain exercisable. |

| |

• | Restricted and unrestricted stock. A restricted stock award is an award of common stock subject to forfeiture restrictions, while an unrestricted stock award is not subject to restrictions. |

| |

• | Stock units. A stock unit award is denominated in shares of our common stock and entitles the participant to receive stock or cash measured by the value of the shares in the future. The delivery of stock or cash under a stock unit may be subject to the satisfaction of performance conditions or other vesting conditions. |

| |

• | Performance awards. A performance award is an award the vesting, settlement or exercisability of which is subject to specified performance criteria. |

Vesting

Our Compensation Committee has the authority to determine the vesting schedule applicable to each award, and to accelerate the vesting or exercisability of any award.

Termination of Employment

Our Compensation Committee will determine the effect of termination of employment or service on an award. Unless otherwise provided by our Compensation Committee or in an award agreement, upon a termination of a participant’s employment all unvested options then held by the participant and other awards requiring exercise will terminate and all other unvested awards will be forfeited and all vested stock options and stock appreciation rights then held by the participant will remain outstanding for 45 days or, in the case of termination due to the participant’s death or disability, one year, or, in each case, until the applicable expiration date, if earlier. All stock options and stock appreciation rights held by a participant immediately prior to the participant’s termination of employment will immediately terminate upon termination of employment if the termination is for cause as defined in the 2013 Incentive Plan or occurs in circumstances that would have constituted grounds for the participant’s employment to be terminated for cause, in the determination of the Administrator.

Performance Criteria

The 2013 Incentive Plan provides for the grant of performance awards that are made based upon, and subject to achieving, “performance objectives”. Performance objectives with respect to those awards that are intended to qualify as “performance-based compensation” for purposes of Section 162(m) of the Code, or Section 162(m), are limited to an objectively determinable measure or measures of performance relating to any or any combination of the following (measured either absolutely or by reference to an index or indices and determined either on a consolidated basis or, as the context permits, on a divisional, subsidiary, line of business, project or geographical basis or in combinations thereof, and expressed as an absolute goal, percentage of revenue, on a per share basis, or as growth or improvement over a particular period): net income; pre-tax income; sales; revenues; assets; expenses; earnings before or after deduction for all or any portion of interest, taxes, depreciation, or amortization, whether or not on a continuing operations or an aggregate or per share basis; return on equity, investment, capital or assets; one or more operating ratios; borrowing levels, leverage ratios or credit rating; market share; capital expenditures; cash flow; operating cash flow; free cash flow; stock price; stockholder return; return on stockholder equity; book value; expense control; economic value added; sales of particular products or services; customer acquisition or retention; acquisitions and divestitures (in whole or in part); joint ventures and strategic alliances; spin-offs, split-ups and the like; reorganizations; or recapitalizations, restructurings, financings (issuance of debt or equity) or refinancings.