THERAVANCE BIOPHARMA ® , THERAVANCE ® , the Cross/Star logo and MEDICINES THAT MAKE A DIFFERENCE ® are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries). All third - party trademarks used herein are the property of their respective owners. © 2026 Theravance Biopharma. All rights reserved. Theravance Biopharma Corporate Presentation January 2026

2 Forward Looking Statements This presentation contains certain "forward - looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events . Theravance Biopharma, Inc . (the “Company”) intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . Examples of such statements include statements relating to : the Company’s expectations regarding its future profitability, expenses and uses of cash, the Company’s goals, designs, strategies, plans and objectives, future growth of YUPELRI sales, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, possible safety, efficacy or differentiation of our investigational therapy, commercial potential and market opportunity of our investigational therapy, the status of patent infringement litigation initiated by the Company and its partner against certain generic companies in federal district courts ; contingent Trelegy sales - based milestones payable by Royalty Pharma, and expectations around the use of OHSA scores as endpoints for clinical trials . These statements are based on the current estimates and assumptions of the management of Theravance Biopharma as of the date of this presentation and the conference call and are subject to risks, uncertainties, changes in circumstances, assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected in the forward - looking statements . Important factors that could cause actual results to differ materially from those indicated by such forward - looking statements include, among others, risks related to : factors that could increase the Company’s cash requirements or expenses beyond its expectations and any factors that could adversely affect its profitability, whether the milestone thresholds can be achieved, delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non - clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, the ability of the Company to protect and to enforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions . Other risks affecting the Company are in the Company’s Form 10 - Q filed with the SEC on November 12 , 2025 , and other periodic reports filed with the SEC . In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other unknown or unpredictable factors also could affect Theravance Biopharma’s results . No forward - looking statements can be guaranteed, and actual results may differ materially from such statements . Given these uncertainties, you should not place undue reliance on these forward - looking statements . Theravance Biopharma assumes no obligation to update its forward - looking statements on account of new information, future events or otherwise, except as required by law . Non - GAAP Financial Measures Theravance Biopharma provides a non - GAAP profitability target and a non - GAAP metric in this presentation . Theravance Biopharma believes that the non - GAAP profitability target and non - GAAP net income (loss) provide meaningful information to assist investors in assessing prospects for future performance and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results and the Company's cash position . Because non - GAAP financial targets and metrics, such as non - GAAP profitability and non - GAAP net income (loss) are not standardized, it may not be possible to compare these measures with other companies' non - GAAP targets or measures having the same or a similar name . Thus, Theravance Biopharma's non - GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the Company's actual GAAP results and other targets . This presentation contains a reconciliation of non - GAAP net income (loss) to its corresponding measure, net income (loss) . A reconciliation of non - GAAP net income (loss) to its corresponding GAAP measure is not available on a forward - looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future .

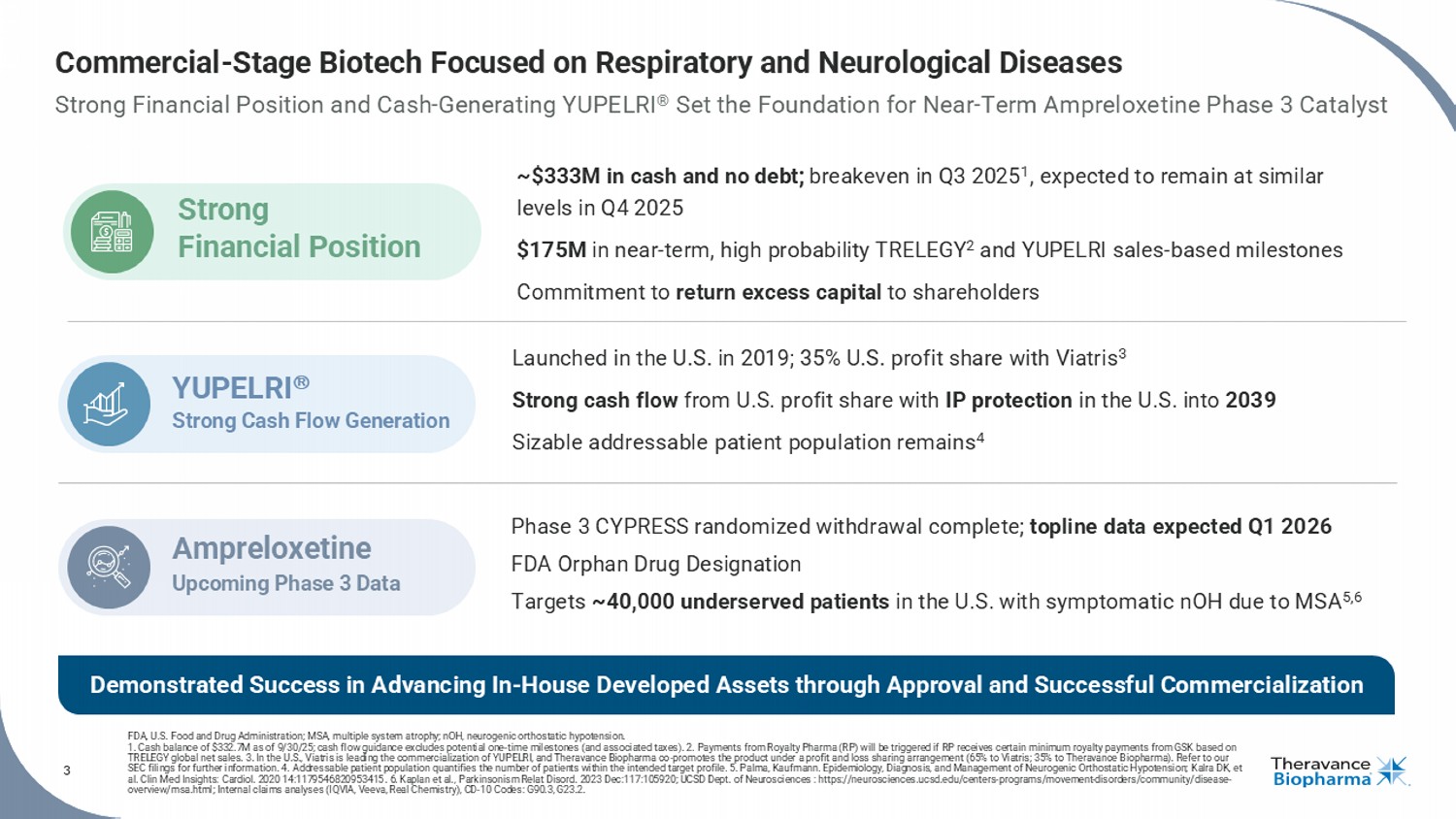

3 Commercial - Stage Biotech Focused on Respiratory and Neurological Diseases Strong Financial Position and Cash - Generating YUPELRI ® Set the Foundation for Near - Term Ampreloxetine Phase 3 Catalyst FDA, U.S. Food and Drug Administration; MSA, multiple system atrophy ; nOH, neurogenic orthostatic hypotension. 1. Cash balance of $332.7M as of 9/30/25; cash flow guidance excludes potential one - time milestones (and associated taxes). 2. P ayments from Royalty Pharma (RP) will be triggered if RP receives certain minimum royalty payments from GSK based on TRELEGY global net sales. 3. In the U.S., Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profi t and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). Refer to our SEC filings for further information. 4. Addressable patient population quantifies the number of patients within the intended target profile. 5. Palma, Kaufmann. Epid emi ology, Diagnosis, and Management of Neurogenic Orthostatic Hypotension; Kalra DK, et al. Clin Med Insights: Cardiol . 2020 14:1179546820953415 . 6. Kaplan et al., Parkinsonism Relat Disord . 2023 Dec:117:105920; UCSD Dept. of Neurosciences : https://neurosciences.ucsd.edu/centers - programs/movement - disorders/communit y/disease - overview/msa.html; Internal claims analyses (IQVIA, Veeva, Real Chemistry), CD - 10 Codes: G90.3, G23.2. Phase 3 CYPRESS randomized withdrawal complete; topline data expected Q1 2026 FDA Orphan Drug Designation Targets ~40,000 underserved patients in the U.S. with symptomatic nOH due to MSA 5,6 Ampreloxetine Upcoming Phase 3 Data Launched in the U.S. in 2019; 35% U.S. profit share with Viatris 3 Strong cash flow from U.S. profit share with IP protection in the U.S. into 2039 Sizable addressable patient population remains 4 YUPELRI Strong Cash Flow Generation ~$333M in cash and no debt; breakeven in Q3 2025 1 , expected to remain at similar levels in Q4 2025 $175M in near - term, high probability TRELEGY 2 and YUPELRI sales - based milestones Commitment to return excess capital to shareholders Strong Financial Position Demonstrated Success in Advancing In - House Developed Assets through Approval and Successful Commercialization

4 Rick Winningham Chief Executive Officer Aziz Sawaf, CFA SVP, Chief Financial Officer Rhonda Farnum SVP, Chief Business Officer Áine Miller SVP, Development Leadership with Extensive Experience in Biotech

5 AMPRELOXETINE The first once - daily, selective norepinephrine reuptake inhibitor in development to treat symptomatic neurogenic orthostatic hypotension ( nOH ) in patients with multiple system atrophy (MSA)

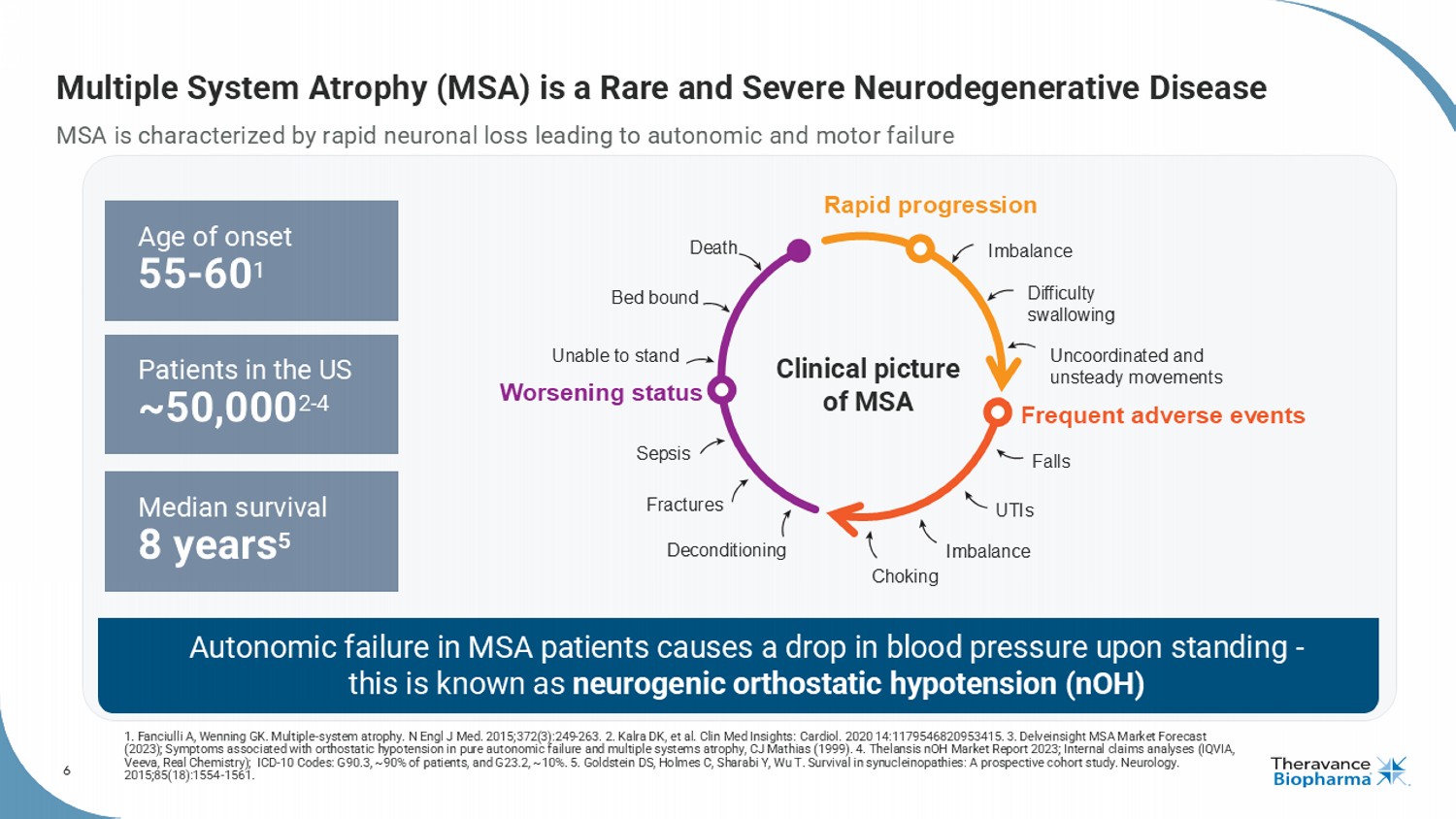

6 Multiple System Atrophy (MSA) is a Rare and Severe Neurodegenerative Disease MSA is characterized by rapid neuronal loss leading to autonomic and motor failure 1. Fanciulli A, Wenning GK. Multiple - system atrophy. N Engl J Med. 2015;372(3):249 - 263. 2. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 14:1179546820953415. 3. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias ( 199 9). 4. Thelansis nOH Market Report 2023; Internal claims analyses (IQVIA, Veeva, Real Chemistry); ICD - 10 Codes: G90.3, ~90% of patients, and G23.2, ~10%. 5. Goldstein DS, Holmes C, Sharabi Y, Wu T. Sur vival in synucleinopathies : A prospective cohort study. Neurology. 2015;85(18):1554 - 1561. Median survival 8 years 5 Patients in the US ~50,000 2 - 4 Age of onset 55 - 60 1 Autonomic failure in MSA patients causes a drop in blood pressure upon standing - this is known as neurogenic orthostatic hypotension ( nOH ) Clinical picture of MSA Rapid progression Frequent adverse events Worsening status Imbalance Difficulty swallowing Uncoordinated and unsteady movements Falls UTIs Imbalance Choking Deconditioning Fractures Sepsis Unable to stand Bed bound Death

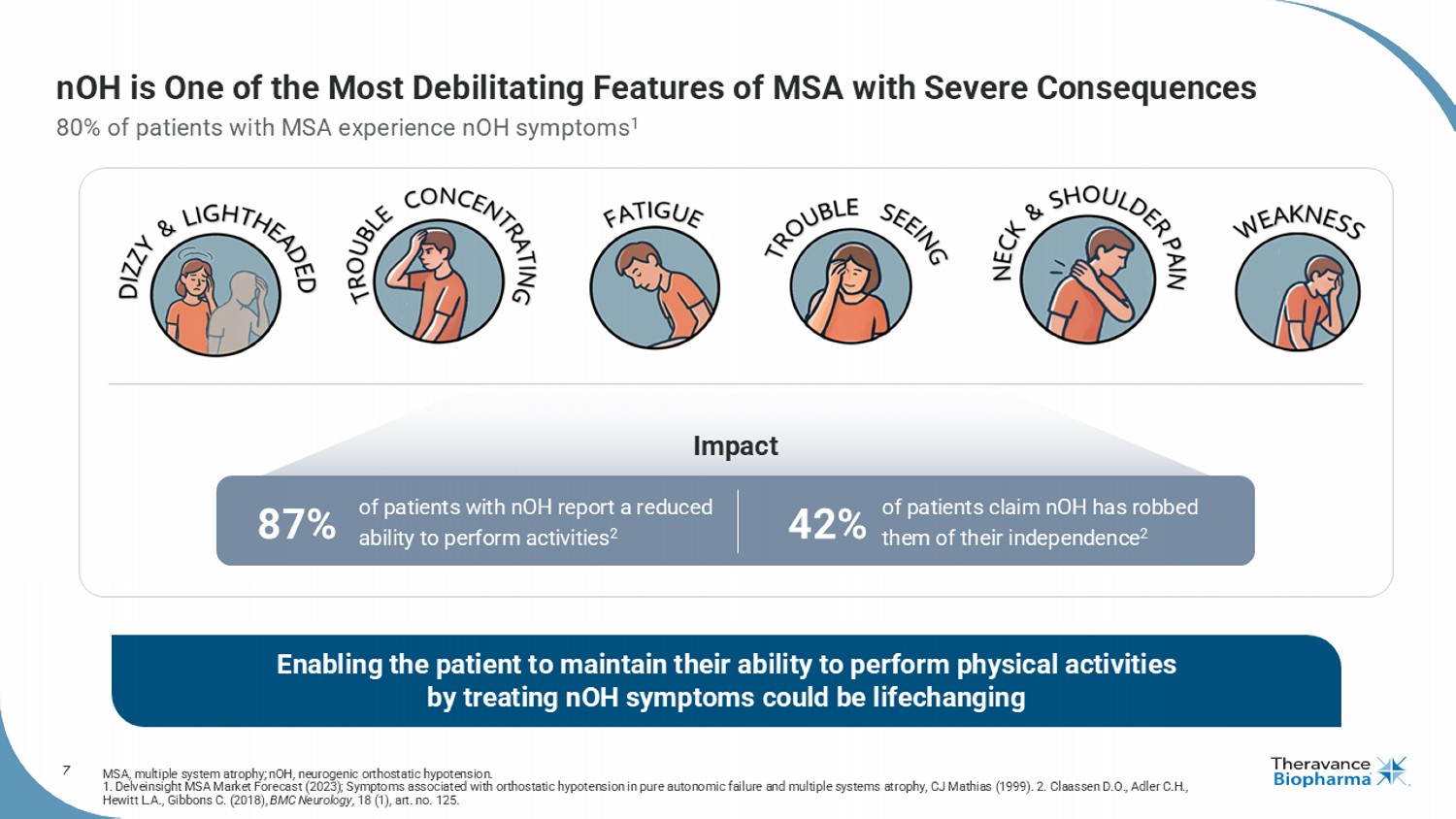

7 Enabling the patient to maintain their ability to perform physical activities by treating nOH symptoms could be lifechanging nOH is One of the Most Debilitating Features of MSA with Severe Consequences 80% of patients with MSA experience nOH symptoms 1 MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. 1. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems a tr ophy, CJ Mathias (1999). 2. Claassen D.O., Adler C.H., Hewitt L.A., Gibbons C. (2018), BMC Neurology , 18 (1), art. no. 125. Impact of patients with nOH report a reduced ability to perform activities 2 of patients claim nOH has robbed them of their independence 2 87% 42%

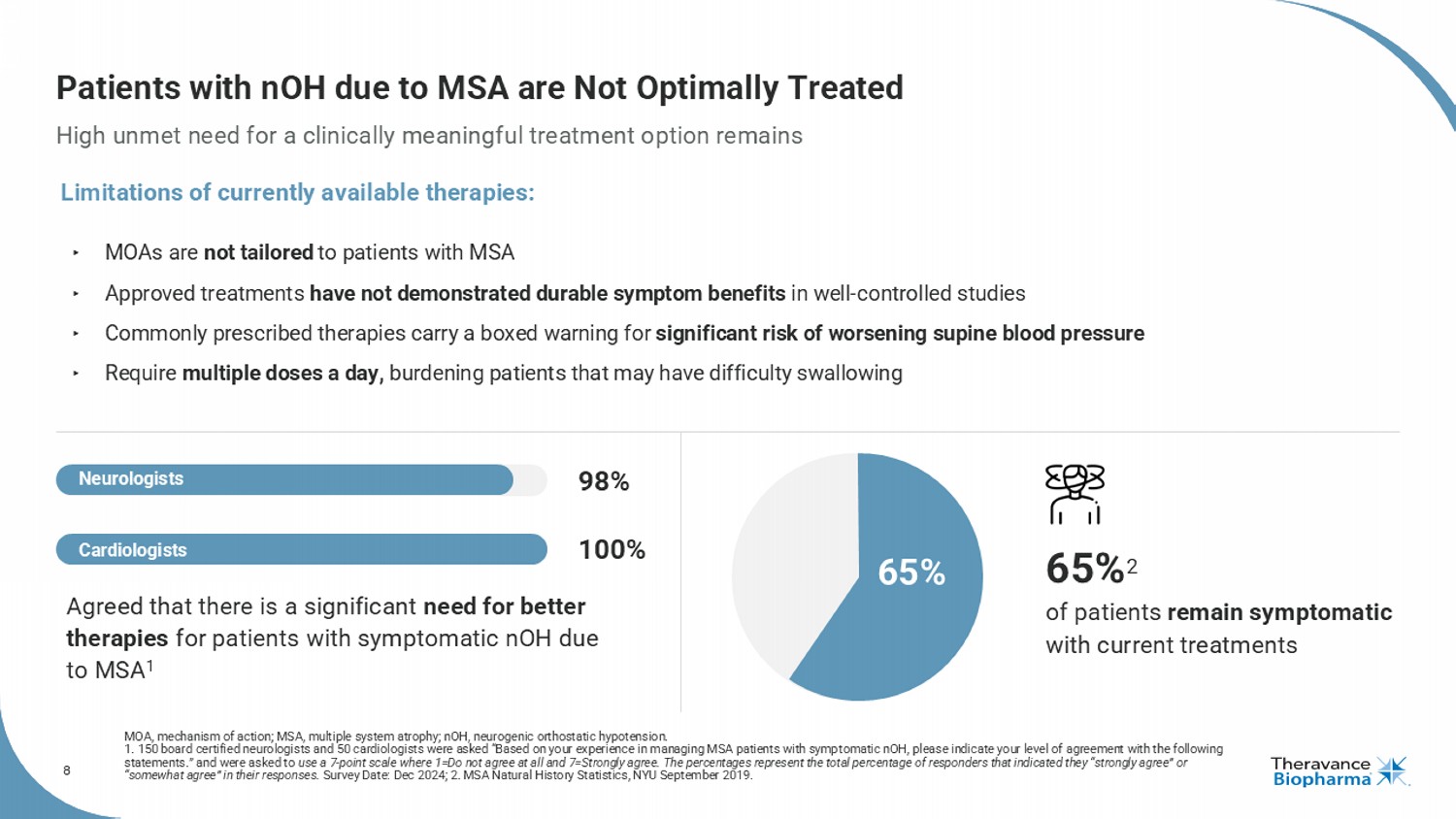

8 Patients with nOH due to MSA are Not Optimally Treated High unmet need for a clinically meaningful treatment option remains MOA, mechanism of action; MSA, multiple system atrophy ; nOH , neurogenic orthostatic hypotension. 1. 150 board certified neurologists and 50 cardiologists were asked “Based on your experience in managing MSA patients with s ymp tomatic nOH , please indicate your level of agreement with the following statements.” and were asked to use a 7 - point scale where 1=Do not agree at all and 7=Strongly agree. The percentages represent the total percentage of responde rs that indicated they “strongly agree” or “somewhat agree” in their responses. Survey Date: Dec 2024; 2. MSA Natural History Statistics, NYU September 2019. ‣ MOAs are not tailored to patients with MSA ‣ Approved treatments have not demonstrated durable symptom benefits in well - controlled studies ‣ Commonly prescribed therapies carry a boxed warning for significant risk of worsening supine blood pressure ‣ Require multiple doses a day, burdening patients that may have difficulty swallowing 65% 2 of patients remain symptomatic with current treatments Agreed that there is a significant need for better therapies for patients with symptomatic nOH due to MSA 1 65% Limitations of currently available therapies: 98% 100% Cardiologists Neurologists

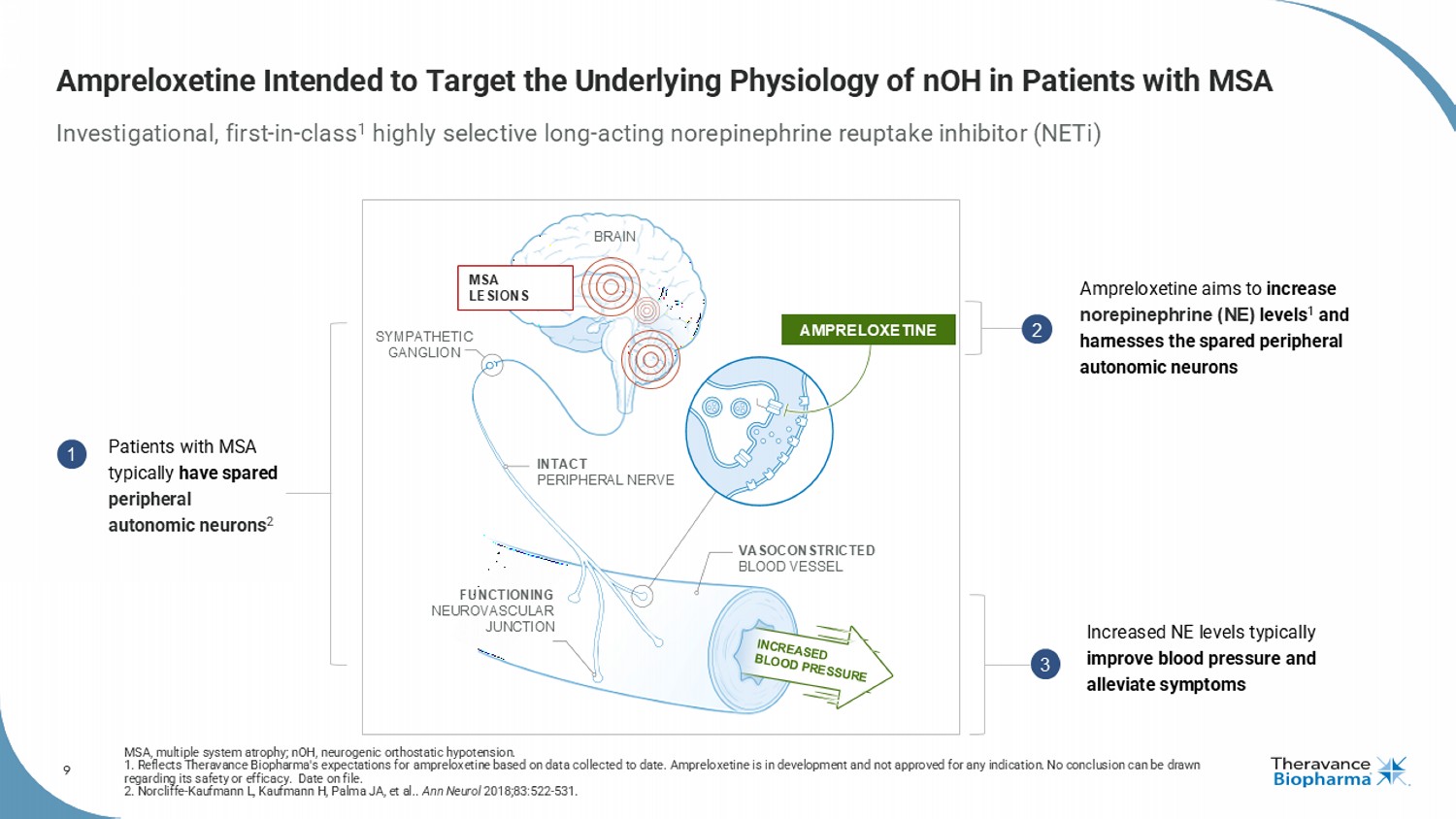

9 Ampreloxetine Intended to Target the Underlying Physiology of nOH in Patients with MSA Investigational, first - in - class 1 highly selective long - acting norepinephrine reuptake inhibitor ( NETi ) MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. 1. Reflects Theravance Biopharma's expectations for ampreloxetine based on data collected to date. Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Date on file. 2. Norcliffe - Kaufmann L, Kaufmann H, Palma JA, et al.. Ann Neurol 2018;83:522 - 531. MSA LESIONS SYMPATHETIC GANGLION BRAIN INTACT PERIPHERAL NERVE VASOCONSTRICTED BLOOD VESSEL FUNCTIONING NEUROVASCULAR JUNCTION AMPRELOXETINE Patients with MSA typically have spared peripheral autonomic neurons 2 Ampreloxetine aims to increase norepinephrine (NE) levels 1 and harnesses the spared peripheral autonomic neurons Increased NE levels typically improve blood pressure and alleviate symptoms 1 2 3

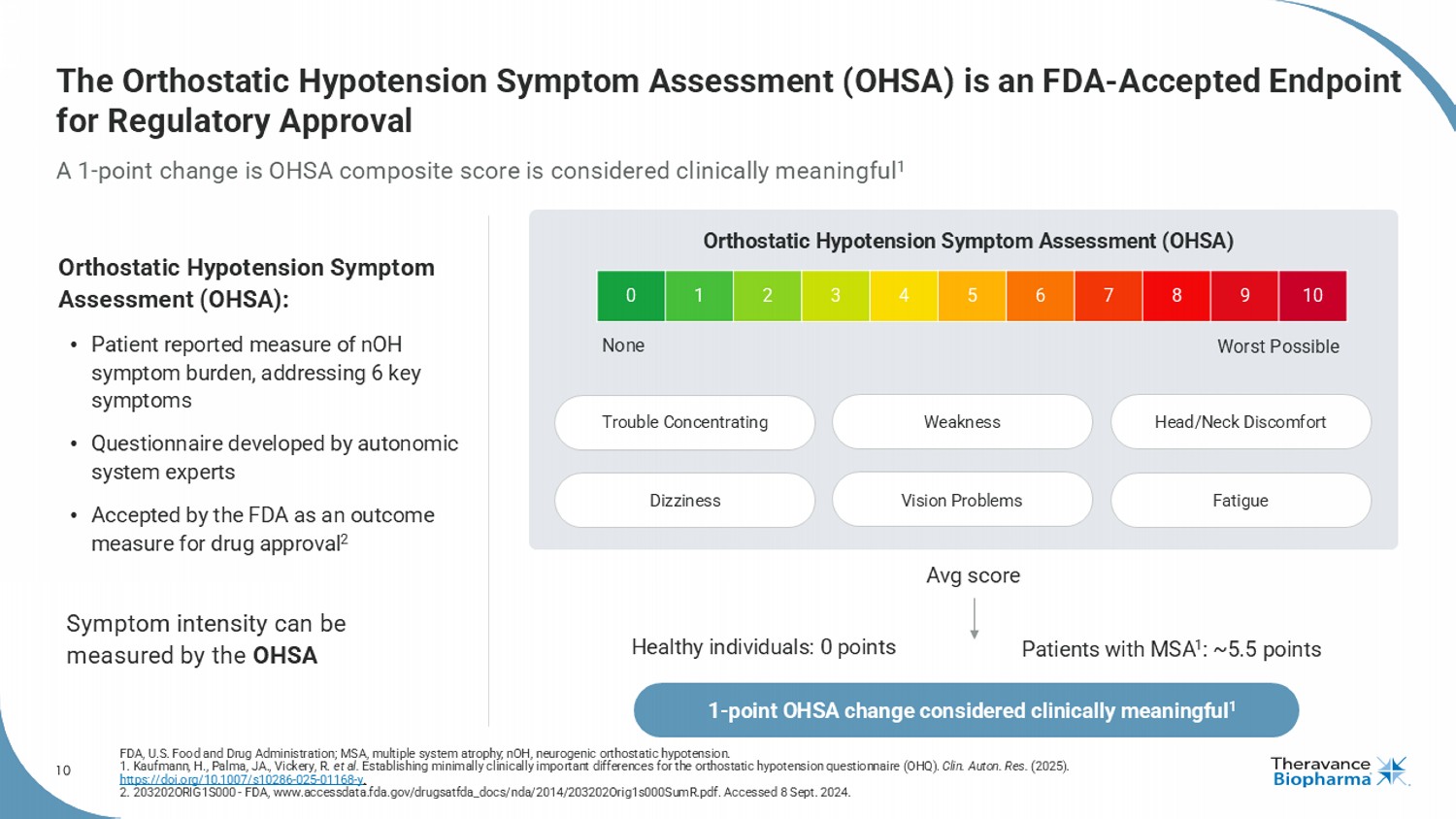

10 10 9 8 7 6 5 4 3 2 1 0 The Orthostatic Hypotension Symptom Assessment (OHSA) is an FDA - Accepted Endpoint for Regulatory Approval A 1 - point change is OHSA composite score is considered clinically meaningful 1 FDA, U.S. Food and Drug Administration; MSA, multiple system atrophy ; nOH , neurogenic orthostatic hypotension. 1. Kaufmann, H., Palma, JA., Vickery, R. et al. Establishing minimally clinically important differences for the orthostatic hypotension questionnaire (OHQ). Clin. Auton. Res. (2025). https://doi.org/10.1007/s10286 - 025 - 01168 - y . 2. 203202ORIG1S000 - FDA, www.accessdata.fda.gov/drugsatfda_docs/nda/2014/203202Orig1s000SumR.pdf. Accessed 8 Sept. 2024. Orthostatic Hypotension Symptom Assessment (OHSA): • Patient reported measure of nOH symptom burden, addressing 6 key symptoms • Questionnaire developed by autonomic system experts • Accepted by the FDA as an outcome measure for drug approval 2 Symptom intensity can be measured by the OHSA None Worst Possible Orthostatic Hypotension Symptom Assessment (OHSA) Fatigue Avg score Healthy individuals: 0 points Patients with MSA 1 : ~5.5 points 1 - point OHSA change considered clinically meaningful 1 Trouble Concentrating Dizziness Weakness Vision Problems Head/Neck Discomfort

11 AMPRELOXETINE Clinical Development

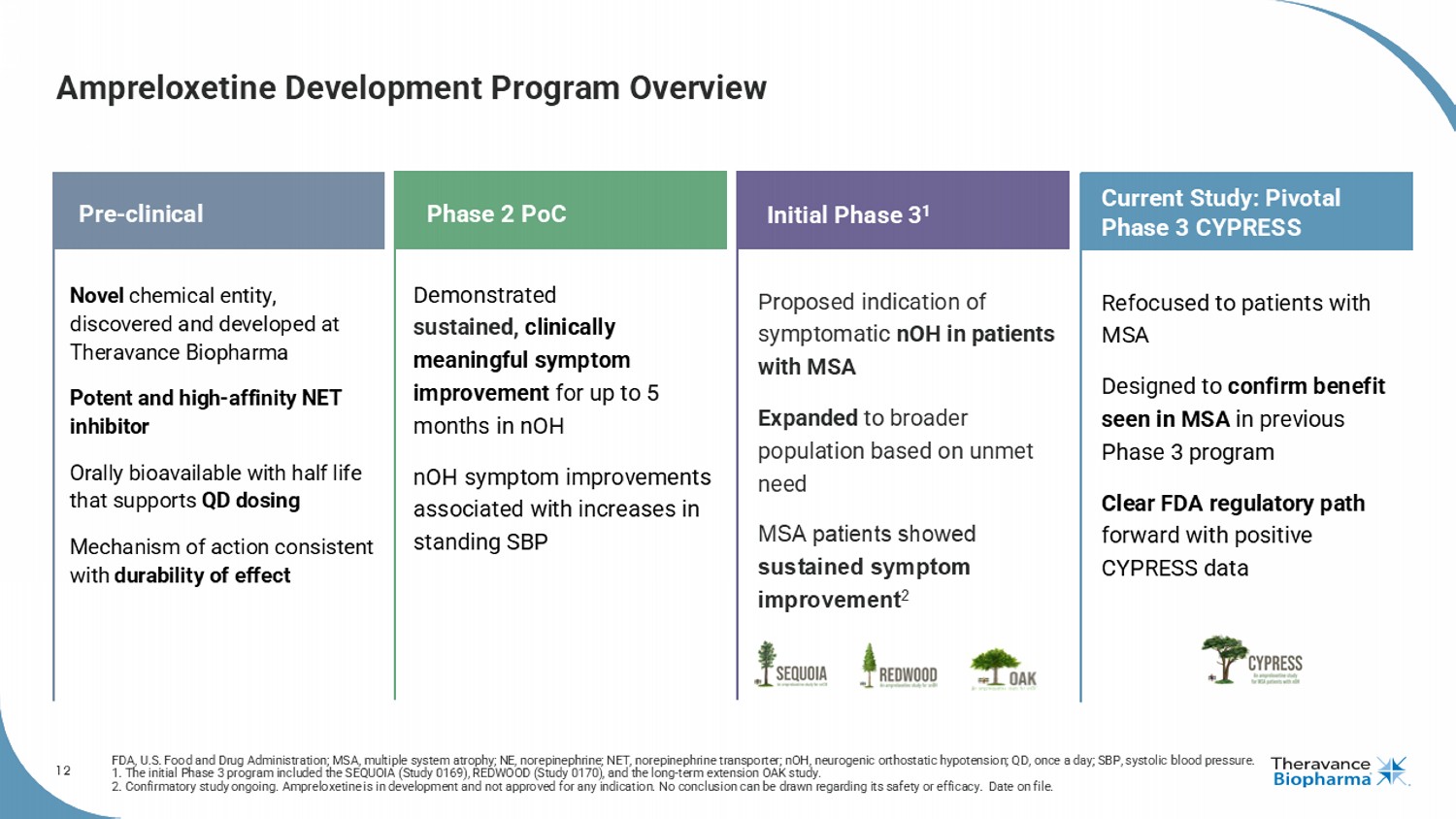

12 Ampreloxetine Development Program Overview FDA, U.S. Food and Drug Administration; MSA, multiple system atrophy; NE, norepinephrine; NET, norepinephrine transporter; nOH , neurogenic orthostatic hypotension; QD, once a day; SBP, systolic blood pressure. 1. The initial Phase 3 program included the SEQUOIA (Study 0169), REDWOOD (Study 0170), and the long - term extension OAK study. 2. Confirmatory study ongoing. Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Date on fi le. 12 Pre - clinical Phase 2 PoC Novel chemical entity, discovered and developed at Theravance Biopharma Potent and high - affinity NET inhibitor Orally bioavailable with half life that supports QD dosing Mechanism of action consistent with durability of effect Refocused to patients with MSA Designed to confirm benefit seen in MSA in previous Phase 3 program Clear FDA regulatory path forward with positive CYPRESS data Demonstrated sustained, clinically meaningful symptom improvement for up to 5 months in nOH nOH symptom improvements associated with increases in standing SBP Initial Phase 3 1 Proposed indication of symptomatic nOH in patients with MSA Expanded to broader population based on unmet need MSA patients showed sustained symptom improvement 2 Current Study: Pivotal Phase 3 CYPRESS

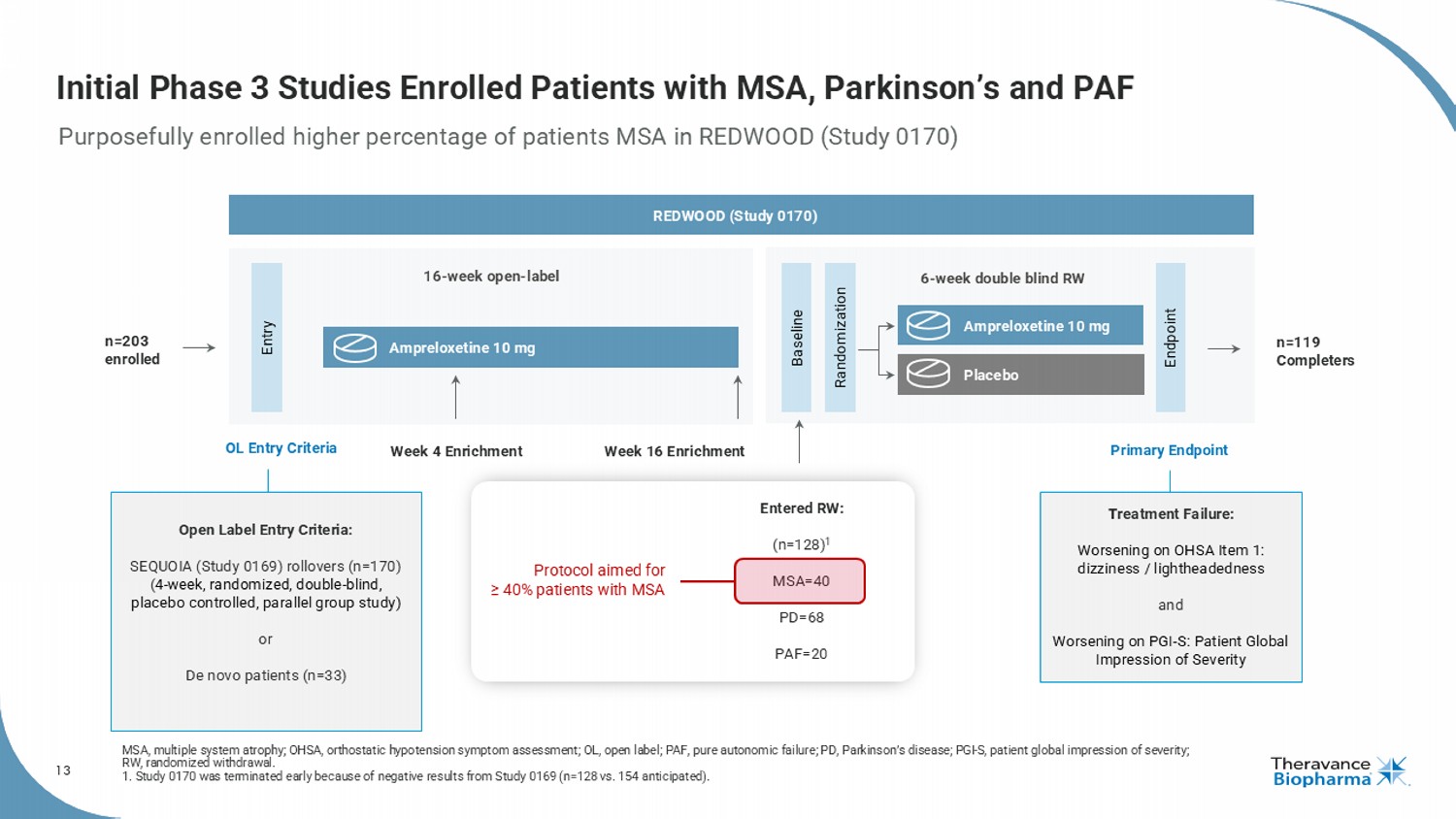

13 Initial Phase 3 Studies Enrolled Patients with MSA, Parkinson’s and PAF Purposefully enrolled higher percentage of patients MSA in REDWOOD (Study 0170) MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment; OL, open label; PAF, pure autonomic failure; PD, Parkinson’s disease; PGI - S, patient global impression of severity; RW, randomized withdrawal. 1. Study 0170 was terminated early because of negative results from Study 0169 (n=128 vs. 154 anticipated). Open Label Entry Criteria: SEQUOIA (Study 0169) rollovers (n=170) ( 4 - week, randomized, double - blind, placebo controlled, parallel group study) or De novo patients (n=33) Treatment Failure: Worsening on OHSA Item 1: dizziness / lightheadedness and Worsening on PGI - S: Patient Global Impression of Severity Entry Endpoint 6 - week double blind RW 16 - week open - label Baseline Randomization Ampreloxetine 10 mg Ampreloxetine 10 mg Placebo Week 16 Enrichment Entered RW: (n=128) 1 MSA=40 PD=68 PAF=20 Week 4 Enrichment REDWOOD (Study 0170) Primary Endpoint Protocol aimed for ≥ 40% patients with MSA n=119 Completers OL Entry Criteria n=203 enrolled

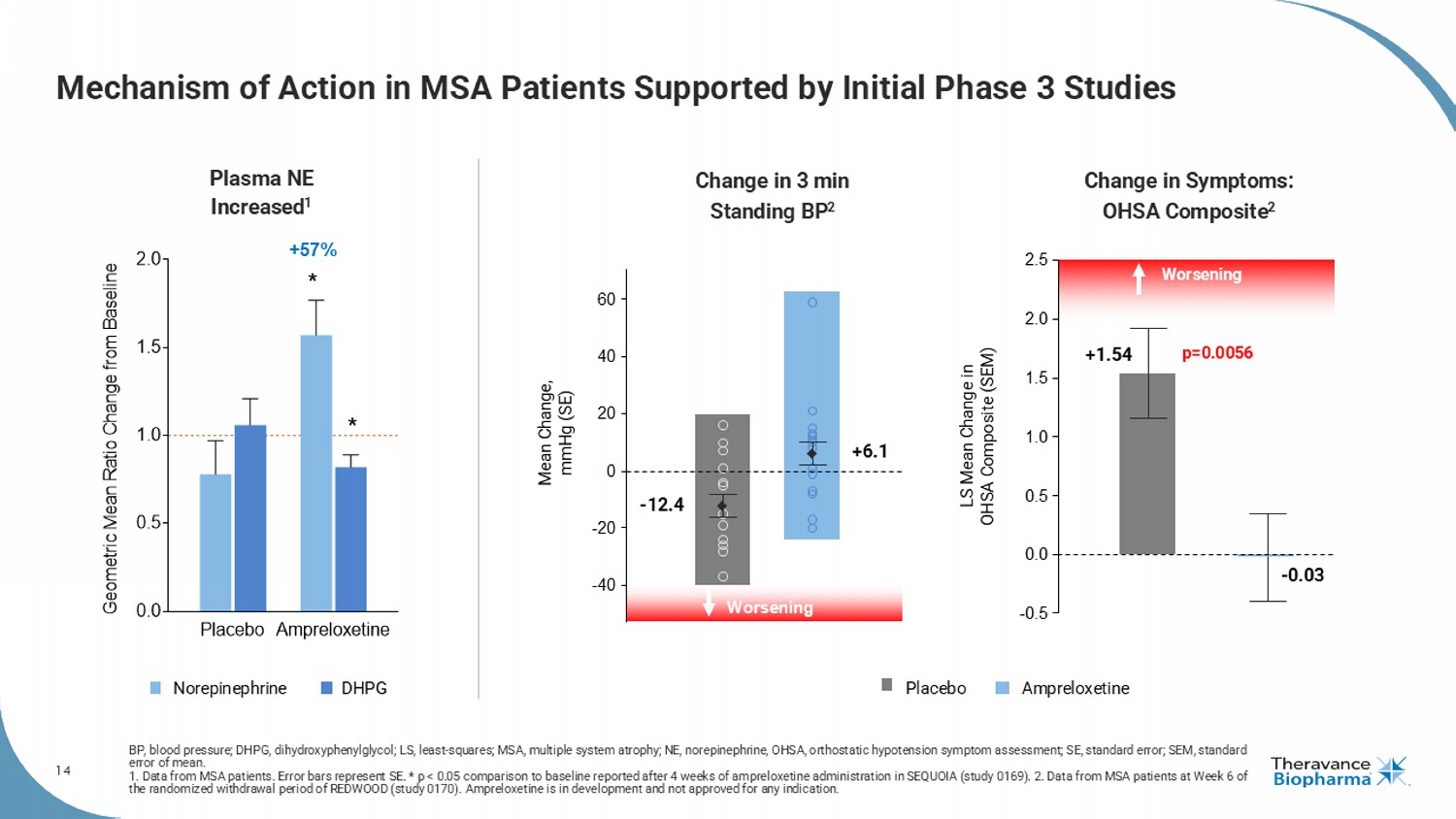

14 Mechanism of Action in MSA Patients Supported by Initial Phase 3 Studies BP, blood pressure; DHPG, dihydroxyphenylglycol ; LS, least - squares; MSA, multiple system atrophy; NE, norepinephrine, OHSA, orthostatic hypotension symptom assessment; SE, sta ndard error; SEM, standard error of mean. 1. Data from MSA patients. Error bars represent SE. * p < 0.05 comparison to baseline reported after 4 weeks of ampreloxetine ad ministration in SEQUOIA (study 0169). 2. Data from MSA patients at Week 6 of the randomized withdrawal period of REDWOOD (study 0170). Ampreloxetine is in development and not approved for any indication . Placebo Ampreloxetine 0.0 0.5 1.0 1.5 2.0 G e o m e t r i c M e a n R a t i o C h a n g e f r o m B a s e l i n e Plasma NE Increased 1 * * +57% - 40 - 20 0 20 40 60 Worsening - 12.4 +6.1 Mean Change, mmHg (SE) Placebo Ampreloxetine Norepinephrine DHPG 2.5 - 0.03 p=0.0056 LS Mean Change in OHSA Composite (SEM) Worsening +1.54 0.0 - 0.5 0.5 1.0 1.5 2.0 Change in 3 min Standing BP 2 Change in Symptoms: OHSA Composite 2

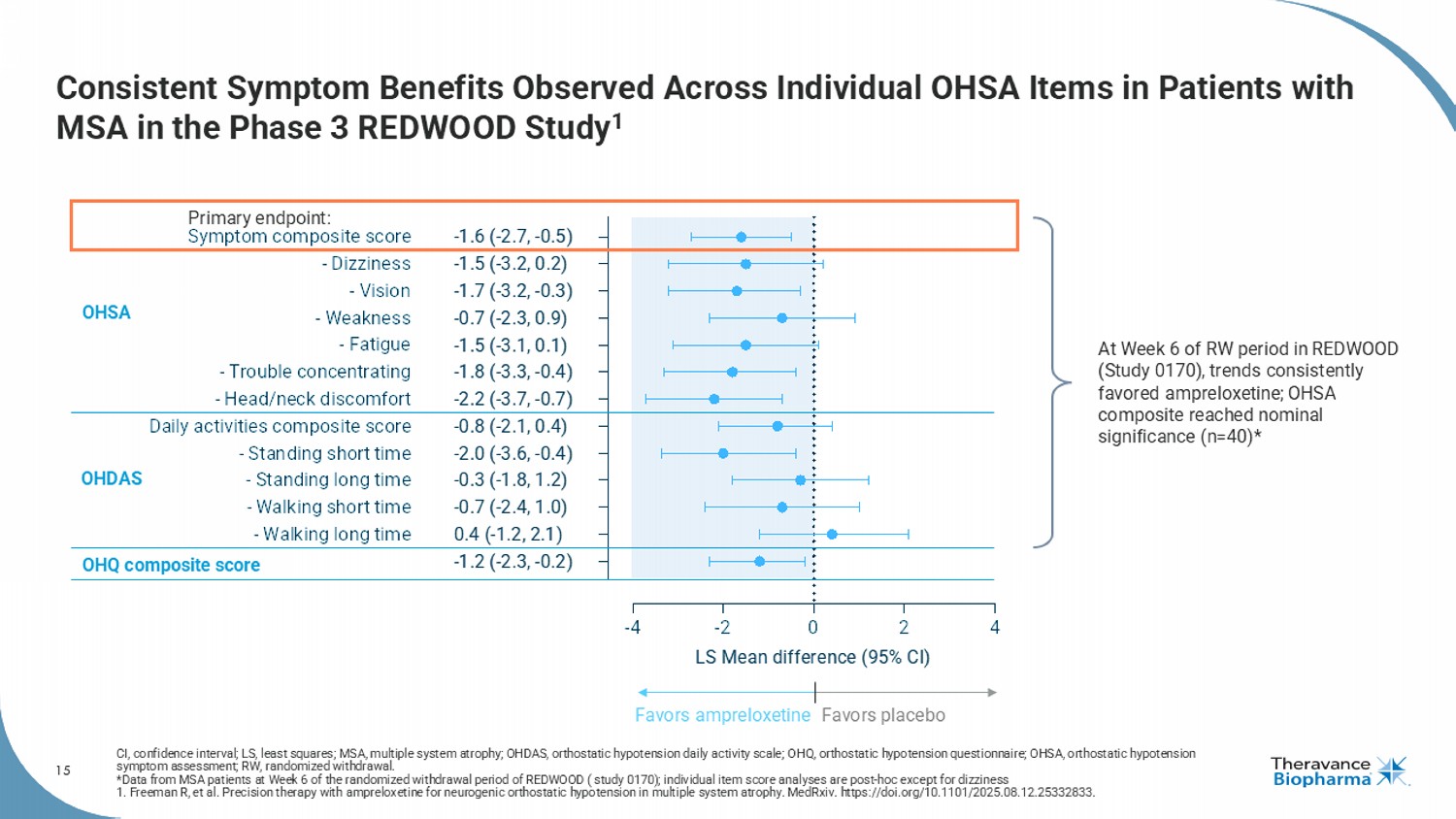

15 Consistent Symptom Benefits Observed Across Individual OHSA Items in Patients with MSA in the Phase 3 REDWOOD Study 1 CI, confidence interval; LS, least squares; MSA, multiple system atrophy; OHDAS, orthostatic hypotension daily activity scale ; O HQ, orthostatic hypotension questionnaire; OHSA, orthostatic hypotension symptom assessment; RW, randomized withdrawal. *Data from MSA patients at Week 6 of the randomized withdrawal period of REDWOOD ( study 0170); individual item score analyse s a re post - hoc except for dizziness 1. Freeman R, et al. Precision therapy with ampreloxetine for neurogenic orthostatic hypotension in multiple system atrophy. MedRxiv . https://doi.org/10.1101/2025.08.12.25332833. -4 -2 0 2 4 OHQ composite score - Walking long time - Walking short time - Standing long time - Standing short time Daily activities composite score - Head/neck discomfort - Trouble concentrating - Fatigue - Weakness - Vision - Dizziness Symptom composite score LS Mean difference (95% CI) -1.6 (-2.7, -0.5) -1.5 (-3.2, 0.2) -1.7 (-3.2, -0.3) -0.7 (-2.3, 0.9) -1.5 (-3.1, 0.1) -1.8 (-3.3, -0.4) -2.2 (-3.7, -0.7) -0.8 (-2.1, 0.4) -2.0 (-3.6, -0.4) -0.3 (-1.8, 1.2) -0.7 (-2.4, 1.0) 0.4 (-1.2, 2.1) -1.2 (-2.3, -0.2) OHSA OHDAS Favors ampreloxetine Favors placebo OHQ composite score At Week 6 of RW period in REDWOOD (Study 0170), trends consistently favored ampreloxetine ; OHSA composite reached nominal significance (n=40)* Primary endpoint:

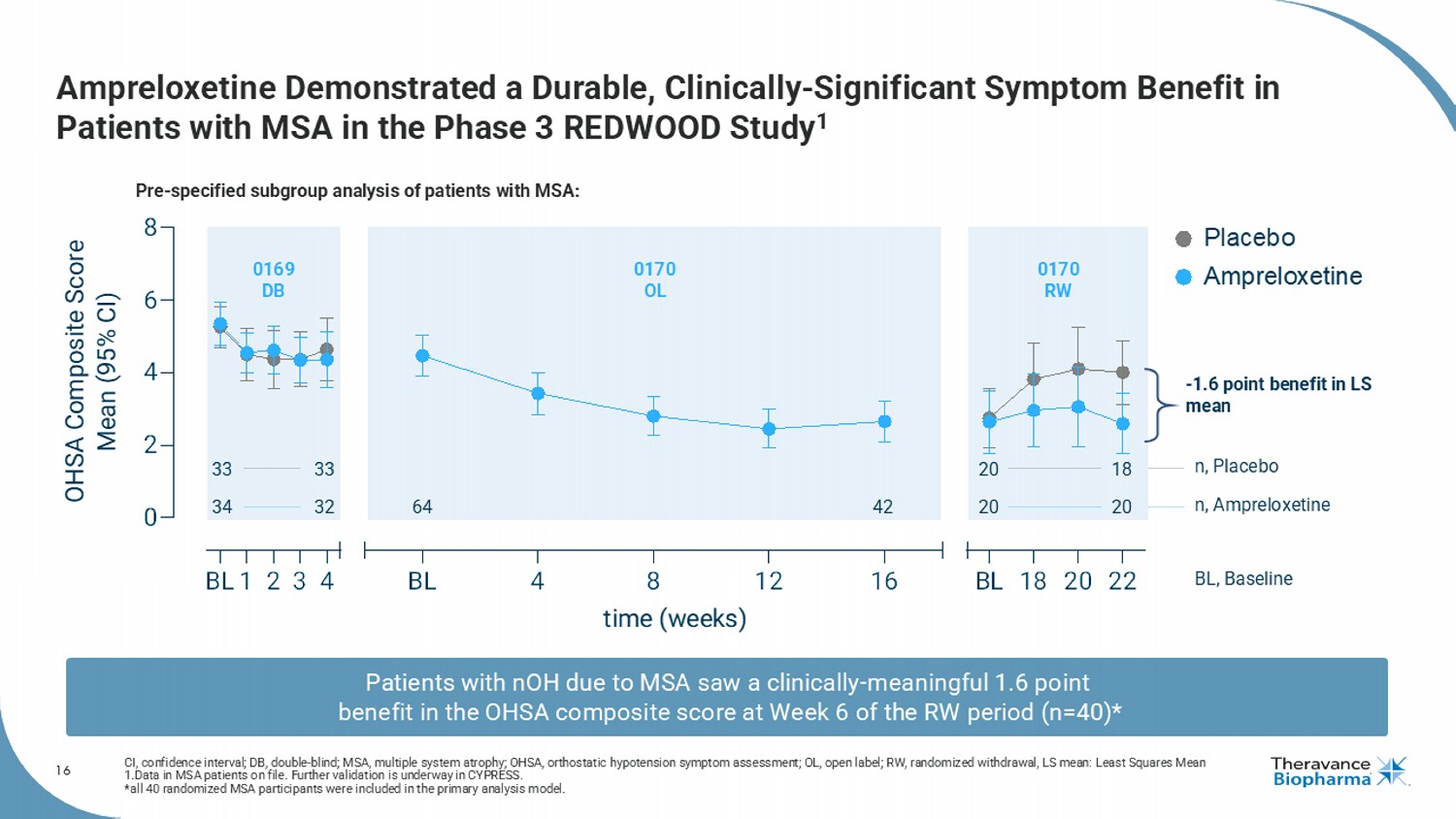

16 Ampreloxetine Demonstrated a Durable, Clinically - Significant Symptom Benefit in Patients with MSA in the Phase 3 REDWOOD Study 1 CI, confidence interval; DB, double - blind; MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment; OL, o pen label; RW, randomized withdrawal, LS mean: Least Squares Mean 1.Data in MSA patients on file. F urther validation is underway in CYPRESS. * all 40 randomized MSA participants were included in the primary analysis model. BL1 2 3 4 0 2 4 6 8 BL 4 8 12 16 BL 18 20 22 time (weeks) OHSA Composite Score Mean (95% CI) Placebo Ampreloxetine 33 33 20 18 34 32 20 20 64 42 n, Placebo n, Ampreloxetine BL, Baseline 0169 DB 0170 OL 0170 RW Pre - specified subgroup analysis of patients with MSA: Patients with nOH due to MSA saw a clinically - meaningful 1.6 point benefit in the OHSA composite score at Week 6 of the RW period (n=40)* - 1.6 point benefit in LS mean

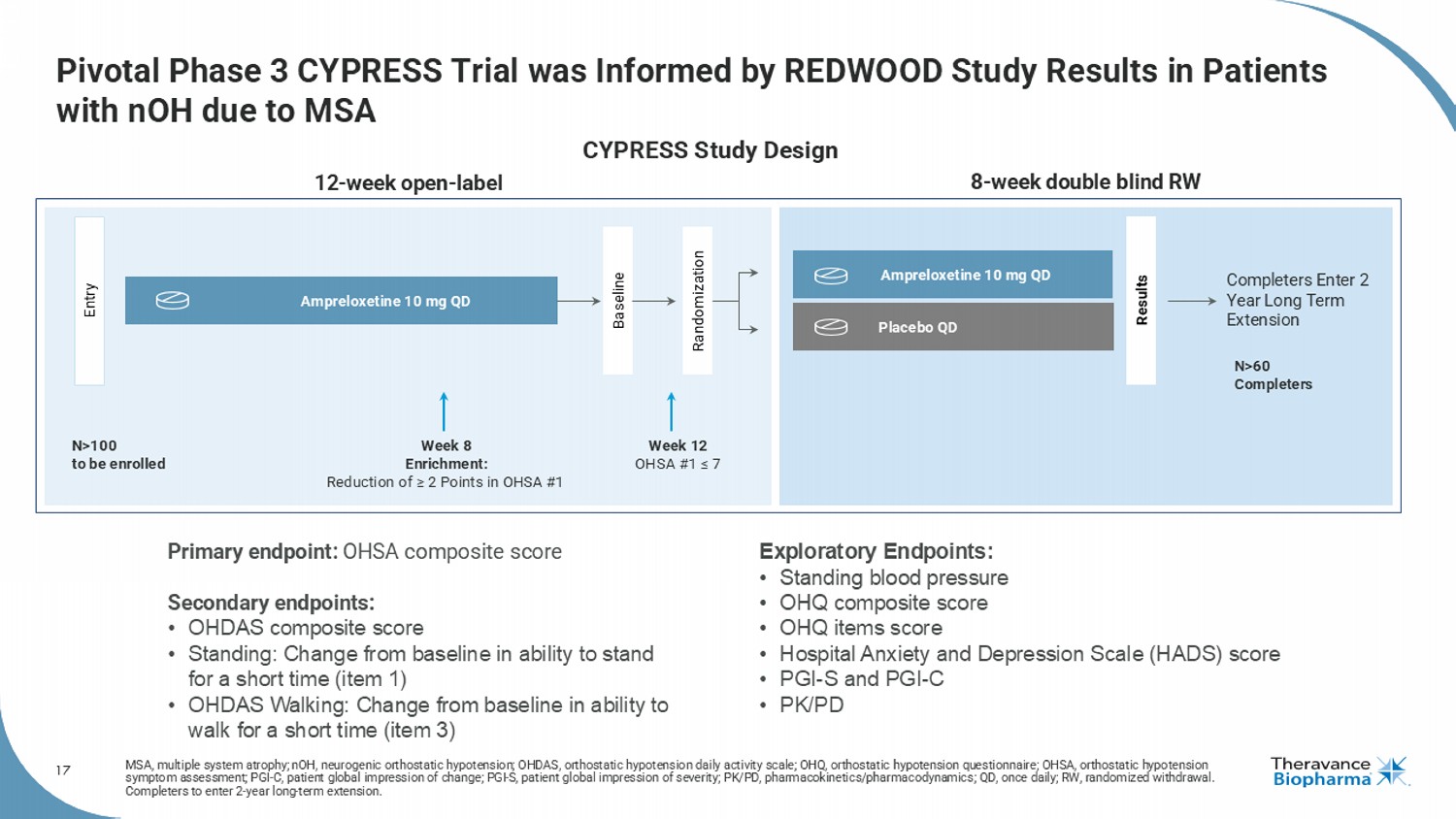

17 Pivotal Phase 3 CYPRESS Trial was Informed by REDWOOD Study Results in Patients with nOH due to MSA MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHDAS, orthostatic hypotension daily activity scale; OHQ, orthostatic hypotension quest ion naire; OHSA, orthostatic hypotension symptom assessment; PGI - C, patient global impression of change; PGI - S, patient global impression of severity; PK/PD, pharmacokin etics/pharmacodynamics; QD, once daily; RW, randomized withdrawal. Completers to enter 2 - year long - term extension. 8 - week double blind RW 12 - week open - label Entry Results Ampreloxetine 10 mg QD Week 8 Enrichment: Reduction of ≥ 2 Points in OHSA #1 N>100 to be enrolled N>60 Completers Ampreloxetine 10 mg QD Placebo QD Week 12 OHSA #1 ≤ 7 Completers Enter 2 Year Long Term Extension Randomization Baseline Primary endpoint: OHSA composite score Secondary endpoints: • OHDAS composite score • Standing: Change from baseline in ability to stand for a short time (item 1) • OHDAS Walking: Change from baseline in ability to walk for a short time (item 3) Exploratory Endpoints: • Standing blood pressure • OHQ composite score • OHQ items score • Hospital Anxiety and Depression Scale (HADS) score • PGI - S and PGI - C • PK/PD CYPRESS Study Design

18 CYPRESS Design and Execution Optimizes Probability of Success Replicating the elements that led to the observed benefits in patients with MSA in the REDWOOD study KOL, key opinion leader; MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment . CYPRESS protocol leverages learnings from REDWOOD (Study 0170) to enhance the likelihood of reproducing benefits observed in MSA patients through using the composite OHSA primary endpoint, the randomized withdrawal design, and the same enrichment criteria. Protocol Design Engagement with leading KOLs, MSA centers of excellence, and top academic sites from REDWOOD. Investigators and Site Selection Using the same external enrollment committee as REDWOOD ensures study integrity and patient quality through consistent enrollment criteria and independent review of MSA diagnosis. Patient Selection & Management Direct study management enables real - time oversight and agile execution, supported by training focused on study conduct, retention and minimizing variability . Study Conduct

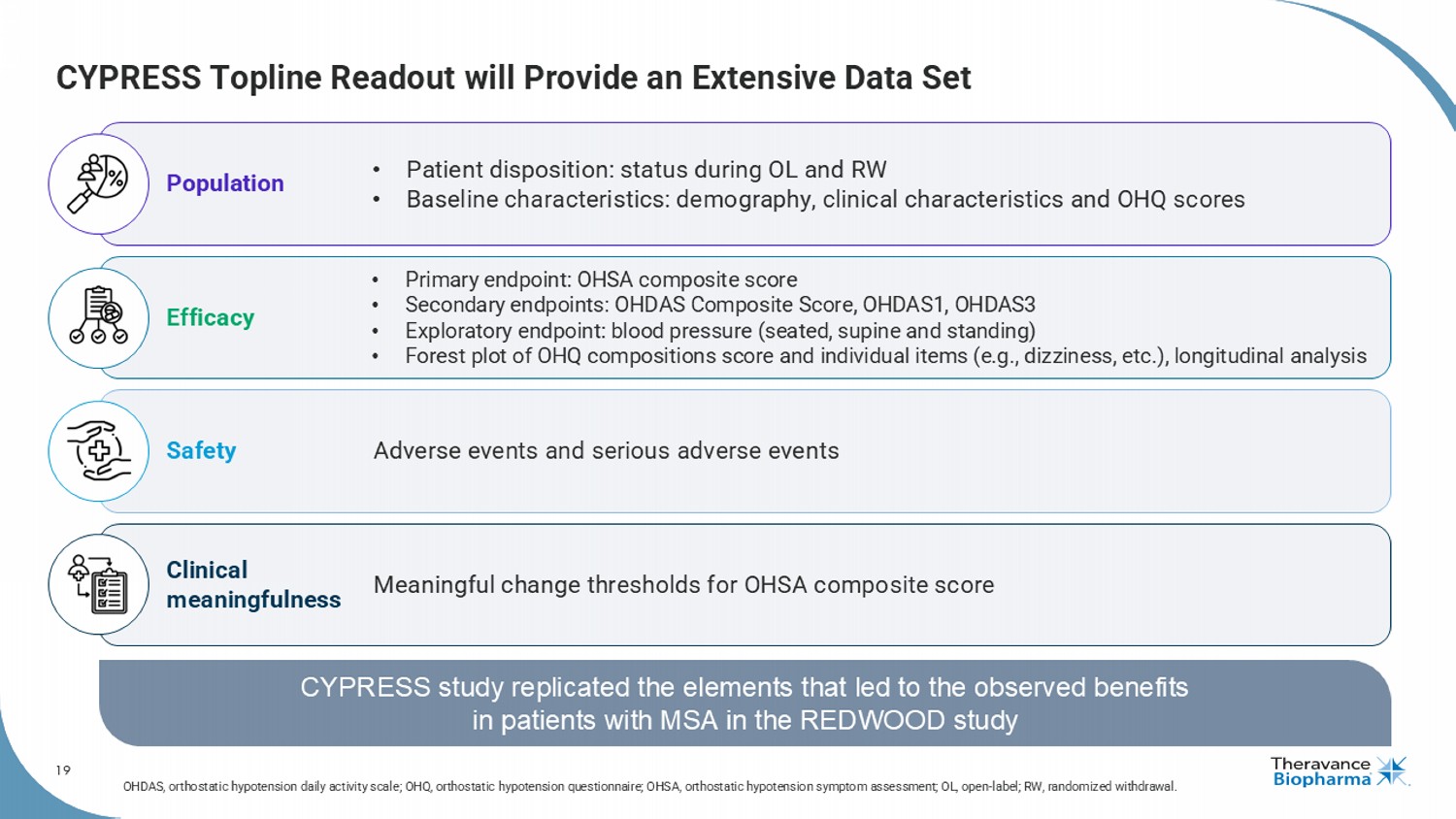

19 CYPRESS Topline Readout will Provide an Extensive Data Set CYPRESS study replicated the elements that led to the observed benefits in patients with MSA in the REDWOOD study Population • Patient disposition: status during OL and RW • Baseline characteristics: demography, clinical characteristics and OHQ scores Efficacy • Primary endpoint: OHSA composite score • Secondary endpoints: OHDAS Composite Score, OHDAS1, OHDAS3 • Exploratory endpoint: blood pressure (seated, supine and standing) • Forest plot of OHQ compositions score and individual items (e.g., dizziness, etc.), longitudinal analysis Safety Adverse events and serious adverse events Clinical meaningfulness Meaningful change thresholds for OHSA composite score OHDAS, orthostatic hypotension daily activity scale; OHQ, orthostatic hypotension questionnaire; OHSA, orthostatic hypotension symptom assessment; OL, open - label; RW, randomized withdraw al. 1

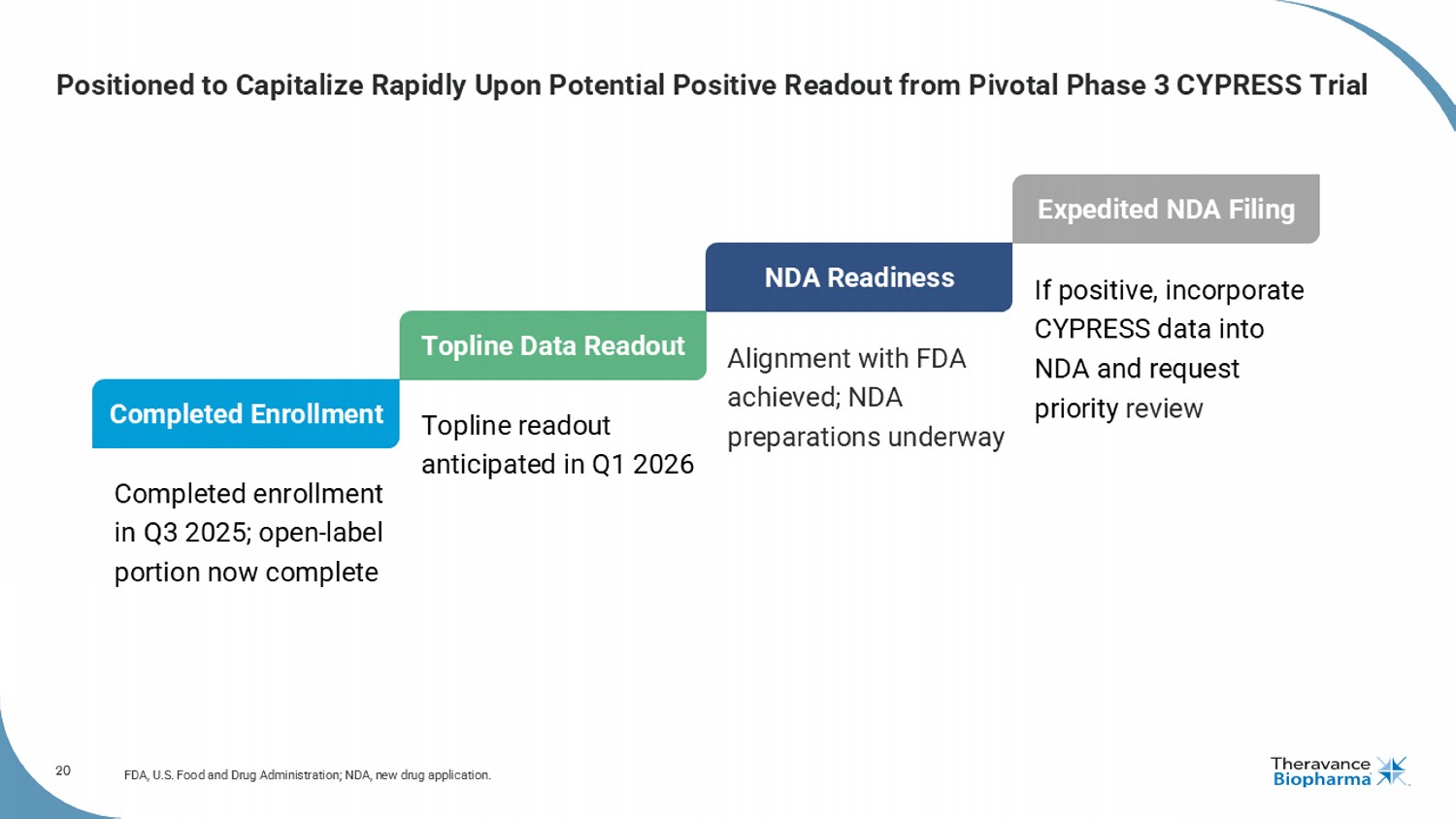

20 Positioned to Capitalize Rapidly Upon Potential Positive Readout from Pivotal Phase 3 CYPRESS Trial FDA, U.S. Food and Drug Administration; NDA, new drug application. Alignment with FDA achieved; NDA preparations underway NDA Readiness Completed enrollment in Q3 2025; open - label portion now complete Completed Enrollment Topline readout anticipated in Q1 2026 Topline Data Readout If positive, incorporate CYPRESS data into NDA and request priority review Expedited NDA Filing

21 AMPRELOXETINE Market Opportunity

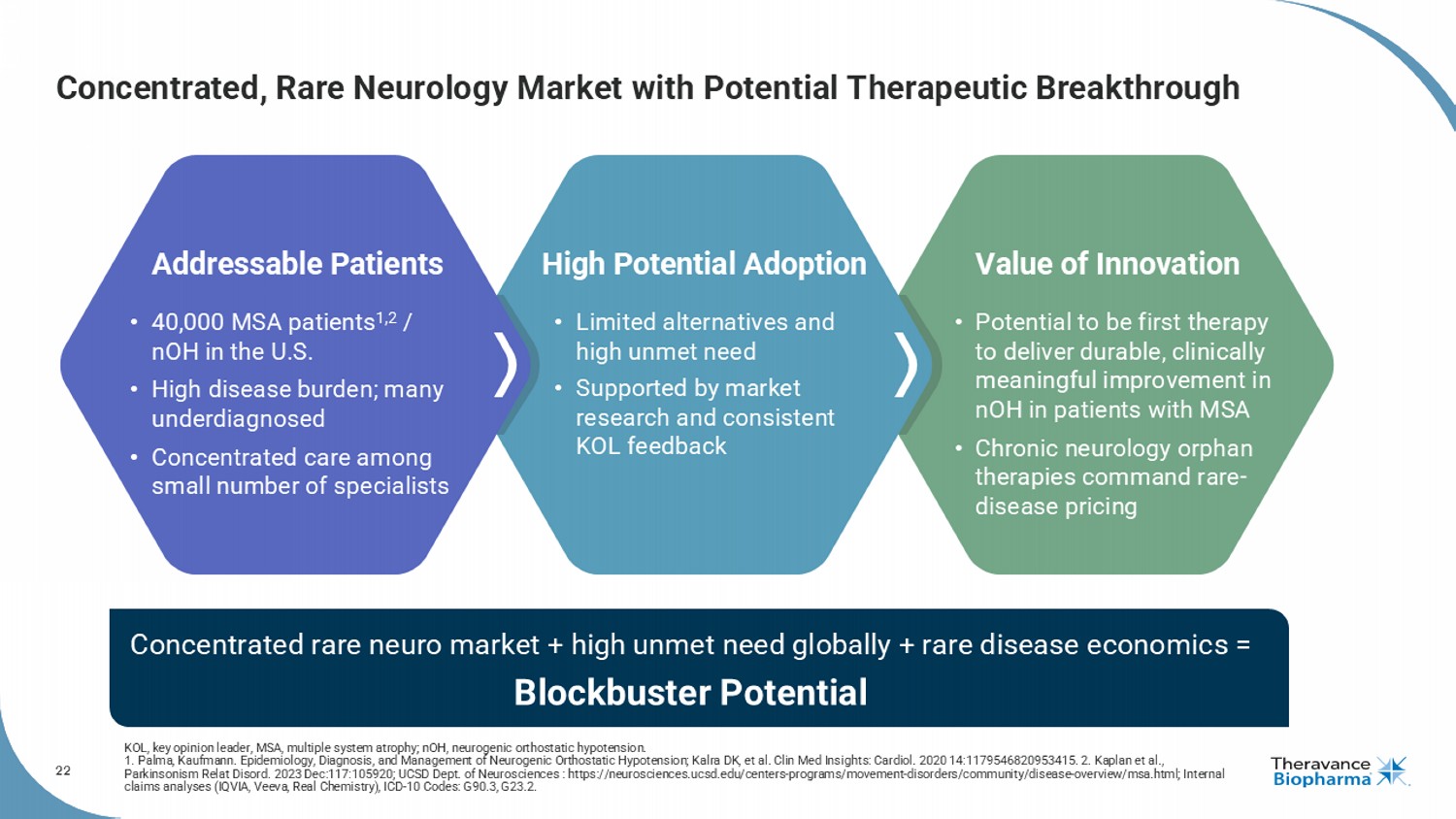

22 Concentrated, Rare Neurology Market with Potential Therapeutic Breakthrough High Potential Adoption Value of Innovation Addressable Patients • Potential to be first therapy to deliver durable, clinically meaningful improvement in nOH in patients with MSA • Chronic neurology orphan therapies command rare - disease pricing • 40,000 MSA patients 1,2 / nOH in the U.S. • High disease burden; many underdiagnosed • Concentrated care among small number of specialists • Limited alternatives and high unmet need • Supported by market research and consistent KOL feedback Concentrated rare neuro market + high unmet need globally + rare disease economics = Blockbuster Potential KOL, key opinion leader, MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. 1. Palma, Kaufmann. Epidemiology, Diagnosis, and Management of Neurogenic Orthostatic Hypotension; Kalra DK, et al. Clin Med Ins igh ts: Cardiol . 2020 14:1179546820953415. 2. Kaplan et al., Parkinsonism Relat Disord . 2023 Dec:117:105920; UCSD Dept. of Neurosciences : https://neurosciences.ucsd.edu/centers - programs/movement - disorders/communit y/disease - overview/msa.html; Internal claims analyses (IQVIA, Veeva, Real Chemistry), ICD - 10 Codes: G90.3, G23.2.

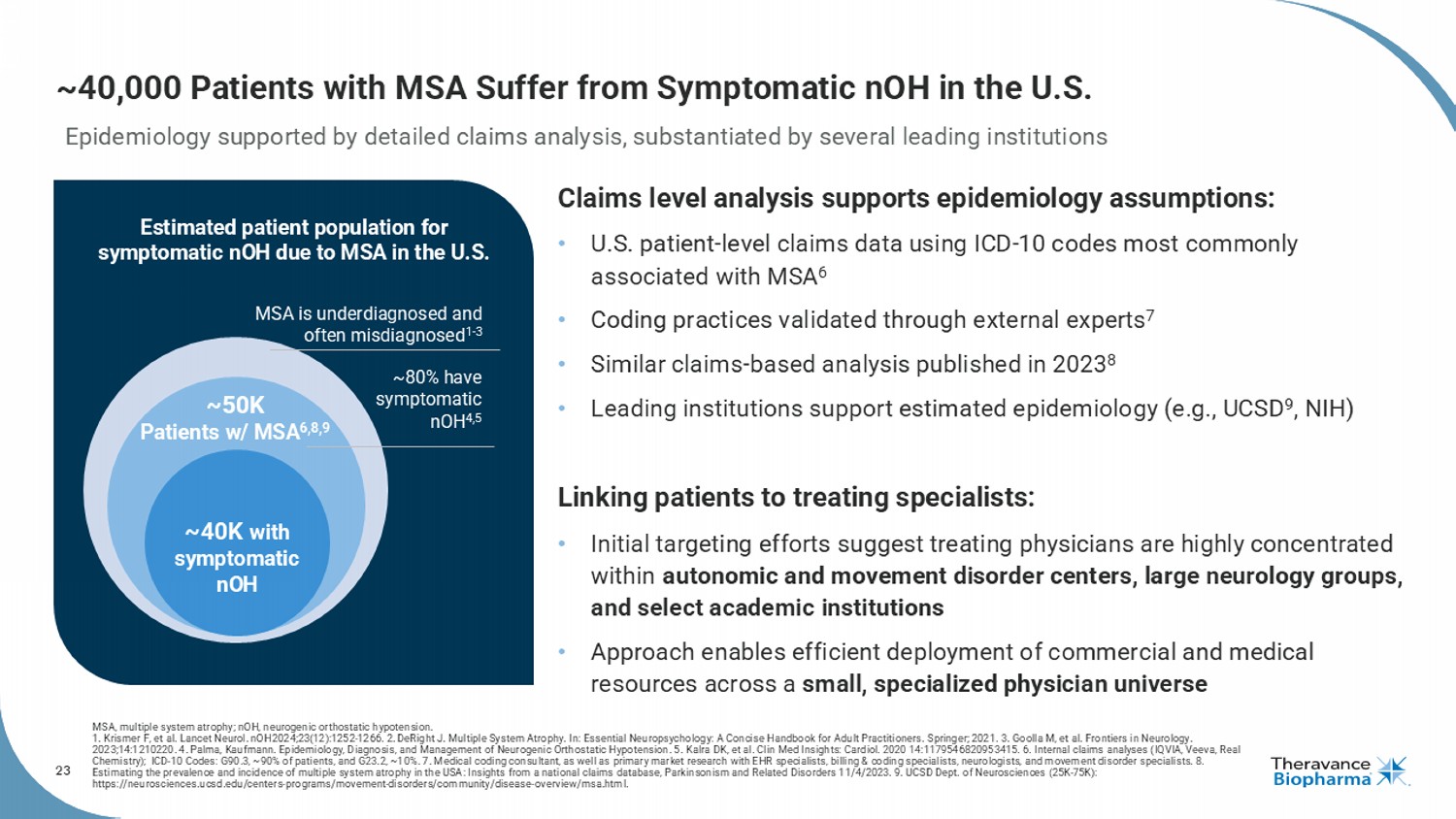

23 ~40,000 Patients with MSA Suffer from Symptomatic nOH in the U.S. MSA is underdiagnosed and often misdiagnosed 1 - 3 ~80% have symptomatic nOH 4,5 ~40K with symptomatic nOH ~50K Patients w/ MSA 6,8,9 Estimated patient population for symptomatic nOH due to MSA in the U.S. Epidemiology supported by detailed claims analysis, substantiated by several leading institutions Claims level analysis supports epidemiology assumptions: • U.S. patient - level claims data using ICD - 10 codes most commonly associated with MSA 6 • Coding practices validated through external experts 7 • S imilar claims - based analysis published in 2023 8 • Leading institutions support estimated epidemiology (e.g., UCSD 9 , NIH) Linking patients to treating specialists: • Initial targeting efforts suggest treating physicians are highly concentrated within autonomic and movement disorder centers, large neurology groups, and select academic institutions • Approach enables efficient deployment of commercial and medical resources across a small, specialized physician universe MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. 1. Krismer F, et al. Lancet Neurol. nOH 2024;23(12):1252-1266. 2. DeRight J. Multiple System Atrophy. In: Essential Neuropsychology: A Concise Handbook for Adult Practitioners. Springer; 2021. 3. Goolla M, et al. Frontiers in Neurology. 2023;14:1210220. 4. Palma, Kaufmann. Epidemiology, Diagnosis, and Management of Neurogenic Orthostatic Hypotension. 5. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 14:1179546820953415. 6. Internal claims analyses (IQVIA, Veeva, Real Chemistry); ICD - 10 Codes: G90.3, ~90% of patients, and G23.2, ~10%. 7. Medical coding consultant, as well as primary market res earch with EHR specialists, billing & coding specialists, neurologists, and movement disorder specialists. 8. Estimating the prevalence and incidence of multiple system atrophy in the USA: Insights from a national claims database, Park ins onism and Related Disorders 11/4/2023. 9. UCSD Dept. of Neurosciences (25K - 75K): https://neurosciences.ucsd.edu/centers - programs/movement - disorders/community/disease - overview/msa.html.

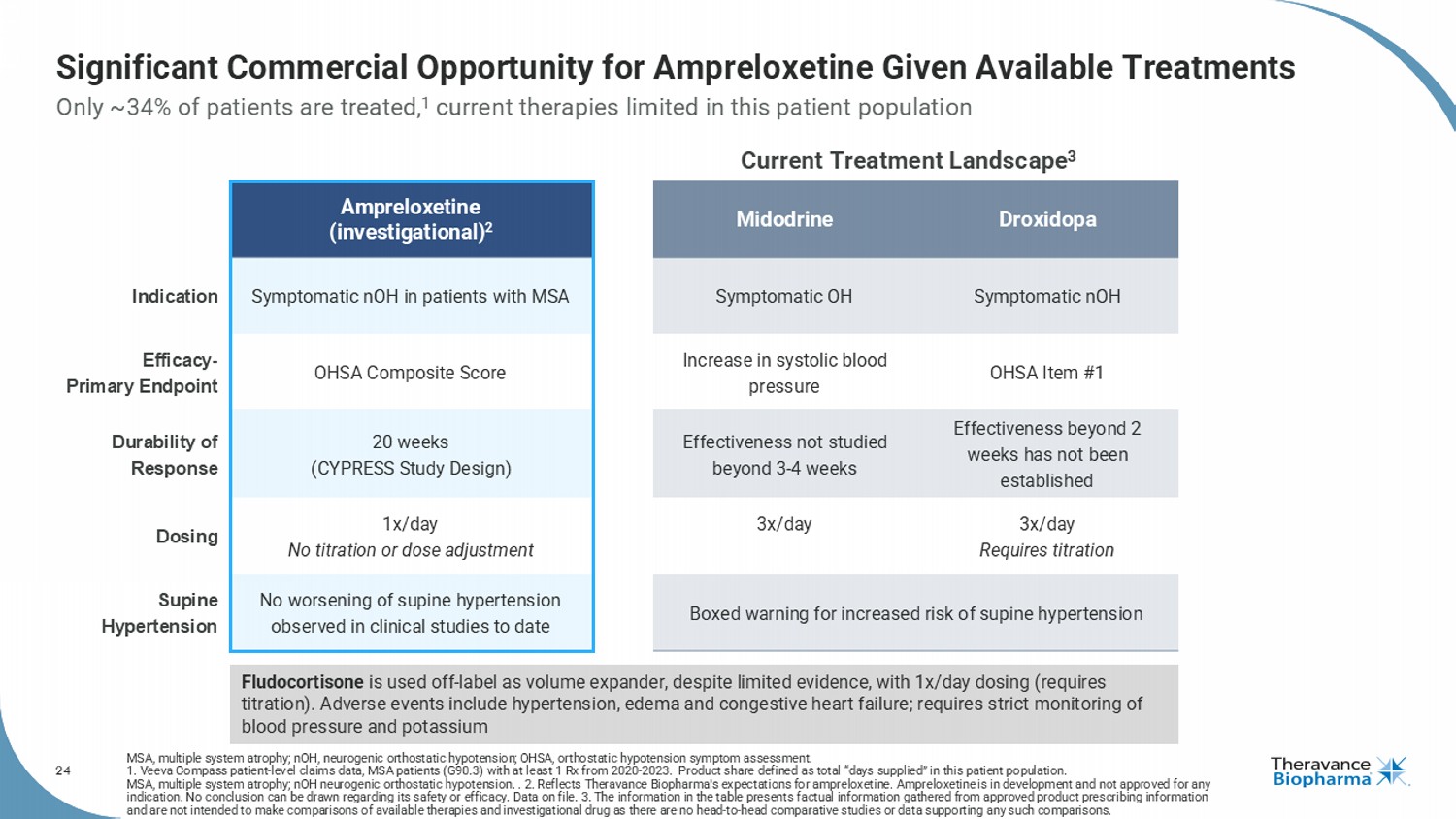

24 Significant Commercial Opportunity for Ampreloxetine Given Available Treatments MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHSA, orthostatic hypotension symptom assessment. 1. Veeva Compass patient - level claims data, MSA patients (G90.3) with at least 1 Rx from 2020 - 2023. Product share defined as to tal “days supplied” in this patient population. MSA, multiple system atrophy; nOH neurogenic orthostatic hypotension. . 2. Reflects Theravance Biopharma's expectations for ampreloxetine . Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Data on file. 3. The information in the table presen ts factual information gathered from approved product prescribing information and are not intended to make comparisons of available therapies and investigational drug as there are no head - to - head comparativ e studies or data supporting any such comparisons. Only ~34% of patients are treated, 1 current therapies limited in this patient population Droxidopa Midodrine Ampreloxetine (investigational) 2 Symptomatic nOH Symptomatic OH Symptomatic nOH in patients with MSA Indication OHSA Item #1 Increase in systolic blood pressure OHSA Composite Score Efficacy - Primary Endpoint Effectiveness beyond 2 weeks has not been established Effectiveness not studied beyond 3 - 4 weeks 20 weeks (CYPRESS Study Design) Durability of Response 3x/day Requires titration 3x/day 1x/day No titration or dose adjustment Dosing Boxed warning for increased risk of supine hypertension No worsening of supine hypertension observed in clinical studies to date Supine Hypertension Current Treatment Landscape 3 Fludocortisone is used off - label as volume expander, despite limited evidence, with 1x/day dosing (requires titration). Adverse events include hypertension, edema and congestive heart failure; requires strict monitoring of blood pressure and potassium

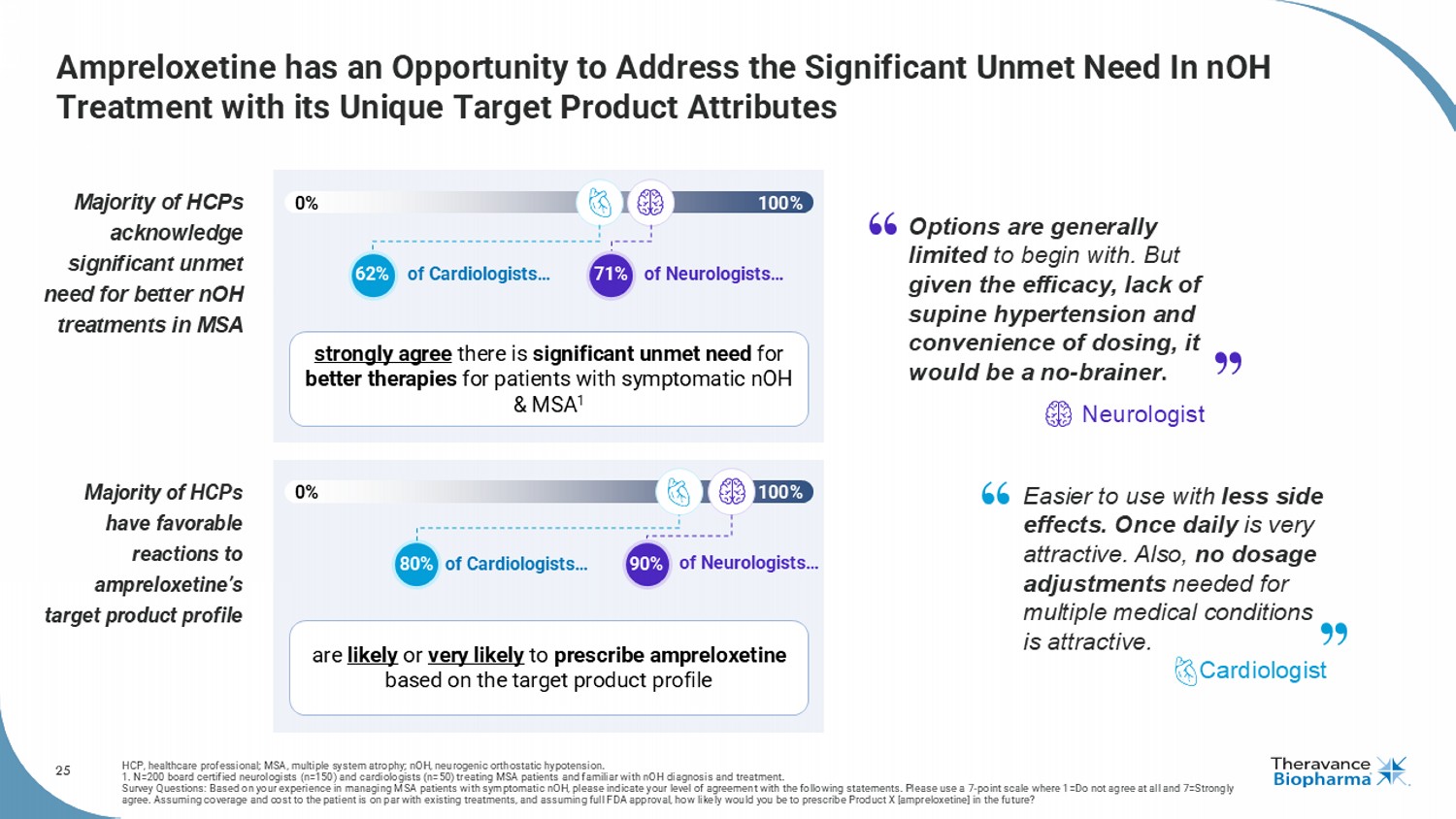

25 Ampreloxetine has an Opportunity to Address the Significant Unmet Need In nOH Treatment with its Unique Target Product Attributes HCP, healthcare professional; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. 1. N=200 board certified neurologists (n=150) and cardiologists (n=50) treating MSA patients and familiar with nOH diagnosis and treatment. Survey Questions: Based on your experience in managing MSA patients with symptomatic nOH , please indicate your level of agreement with the following statements. Please use a 7 - point scale where 1=Do not agree at all and 7=Strongly agree. Assuming coverage and cost to the patient is on par with existing treatments, and assuming full FDA approval, how like ly would you be to prescribe Product X [ ampreloxetine ] in the future? Majority of HCPs acknowledge significant unmet need for better nOH treatments in MSA Majority of HCPs have favorable reactions to ampreloxetine’s target product profile 0% 100% 0% 100% of Cardiologists… of Neurologists… of Cardiologists… of Neurologists… 80% 62% 90% strongly agree there is significant unmet need for better therapies for patients with symptomatic nOH & MSA 1 are likely or very likely to prescribe ampreloxetine based on the target product profile 71% Options are generally limited to begin with. But given the efficacy, lack of supine hypertension and convenience of dosing, it would be a no - brainer . Neurologist Easier to use with less side effects. Once daily is very attractive. Also, no dosage adjustments needed for multiple medical conditions is attractive. Cardiologist

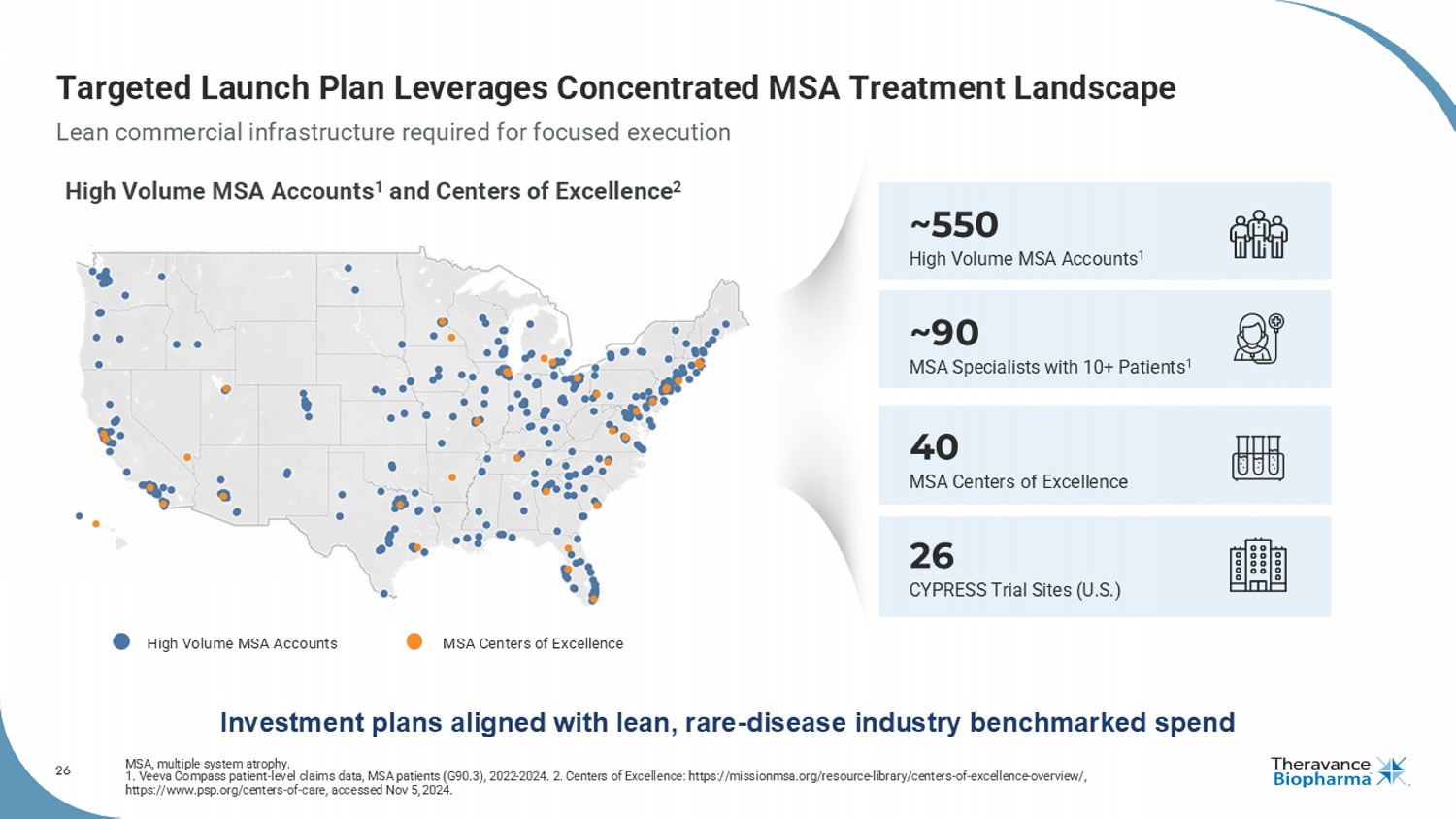

26 Targeted Launch Plan Leverages Concentrated MSA Treatment Landscape MSA, multiple system atrophy. 1. Veeva Compass patient - level claims data, MSA patients (G90.3), 2022 - 2024. 2. Centers of Excellence: https://missionmsa.org/re source - library/centers - of - excellence - overview/, https://www.psp.org/centers - of - care, accessed Nov 5, 2024. 40 MSA Centers of Excellence 26 CYPRESS Trial Sites (U.S.) ~550 High Volume MSA Accounts 1 ~90 MSA Specialists with 10+ Patients 1 Lean commercial infrastructure required for focused execution Investment plans aligned with lean, rare - disease industry benchmarked spend High Volume MSA Accounts 1 and Centers of Excellence 2 High Volume MSA Accounts MSA Centers of Excellence

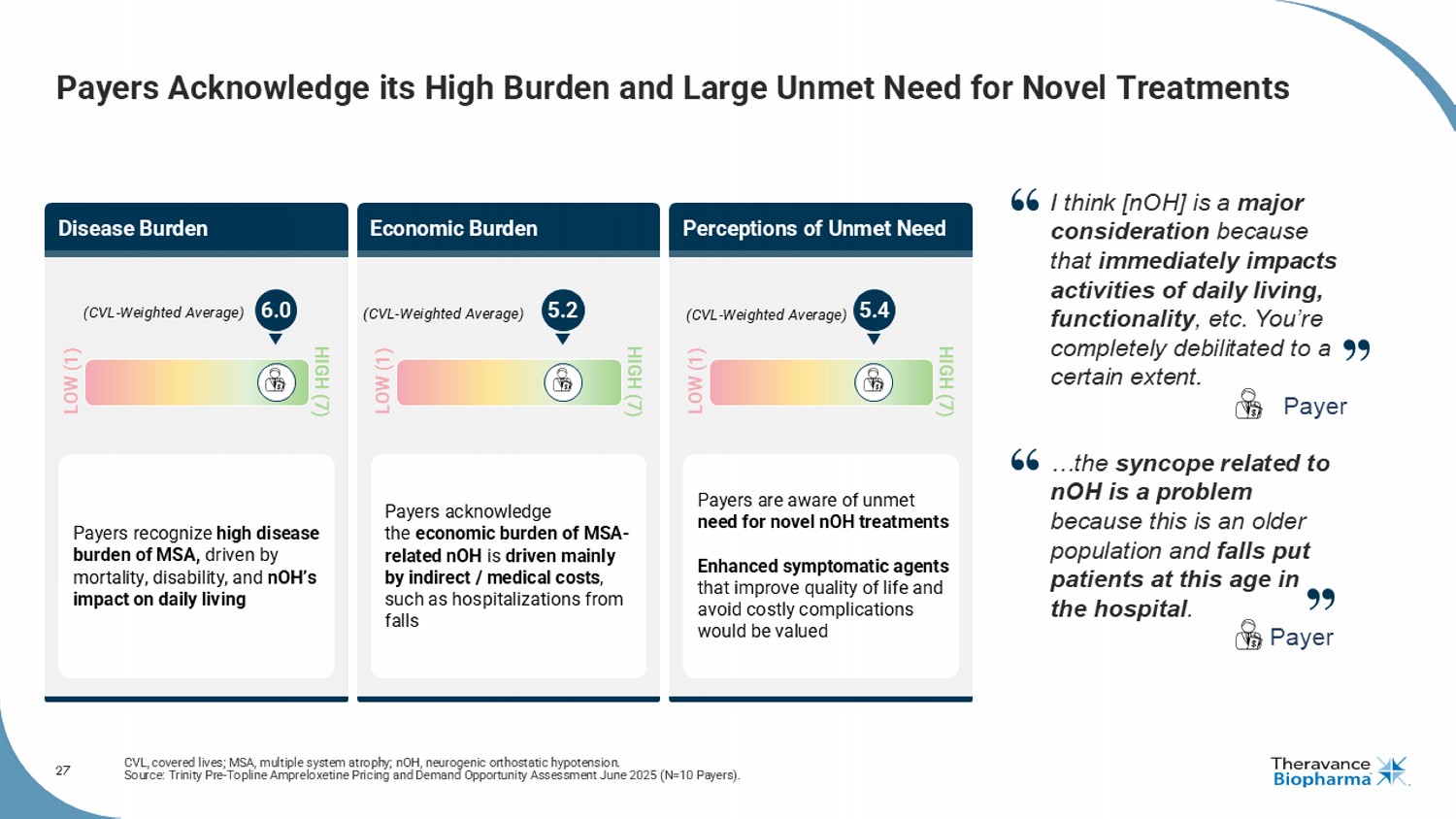

27 Payers Acknowledge its High Burden and Large Unmet Need for Novel Treatments CVL, covered lives; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. Source: Trinity Pre - Topline Ampreloxetine Pricing and Demand Opportunity Assessment June 2025 (N=10 Payers). Disease Burden Perceptions of Unmet Need Economic Burden Payers recognize high disease burden of MSA, driven by mortality, disability, and nOH’s impact on daily living Payers acknowledge the economic burden of MSA - related nOH is driven mainly by indirect / medical costs , such as hospitalizations from falls Payers are aware of unmet need for novel nOH treatments Enhanced symptomatic agents that improve quality of life and avoid costly complications would be valued (CVL - Weighted Average) LOW (1) HIGH (7) (CVL - Weighted Average) LOW (1) HIGH (7) LOW (1) HIGH (7) (CVL - Weighted Average) 6.0 5.2 5.4 I think [ nOH ] is a major consideration because that immediately impacts activities of daily living, functionality , etc. You’re completely debilitated to a certain extent. Payer …the syncope related to nOH is a problem because this is an older population and falls put patients at this age in the hospital . Payer

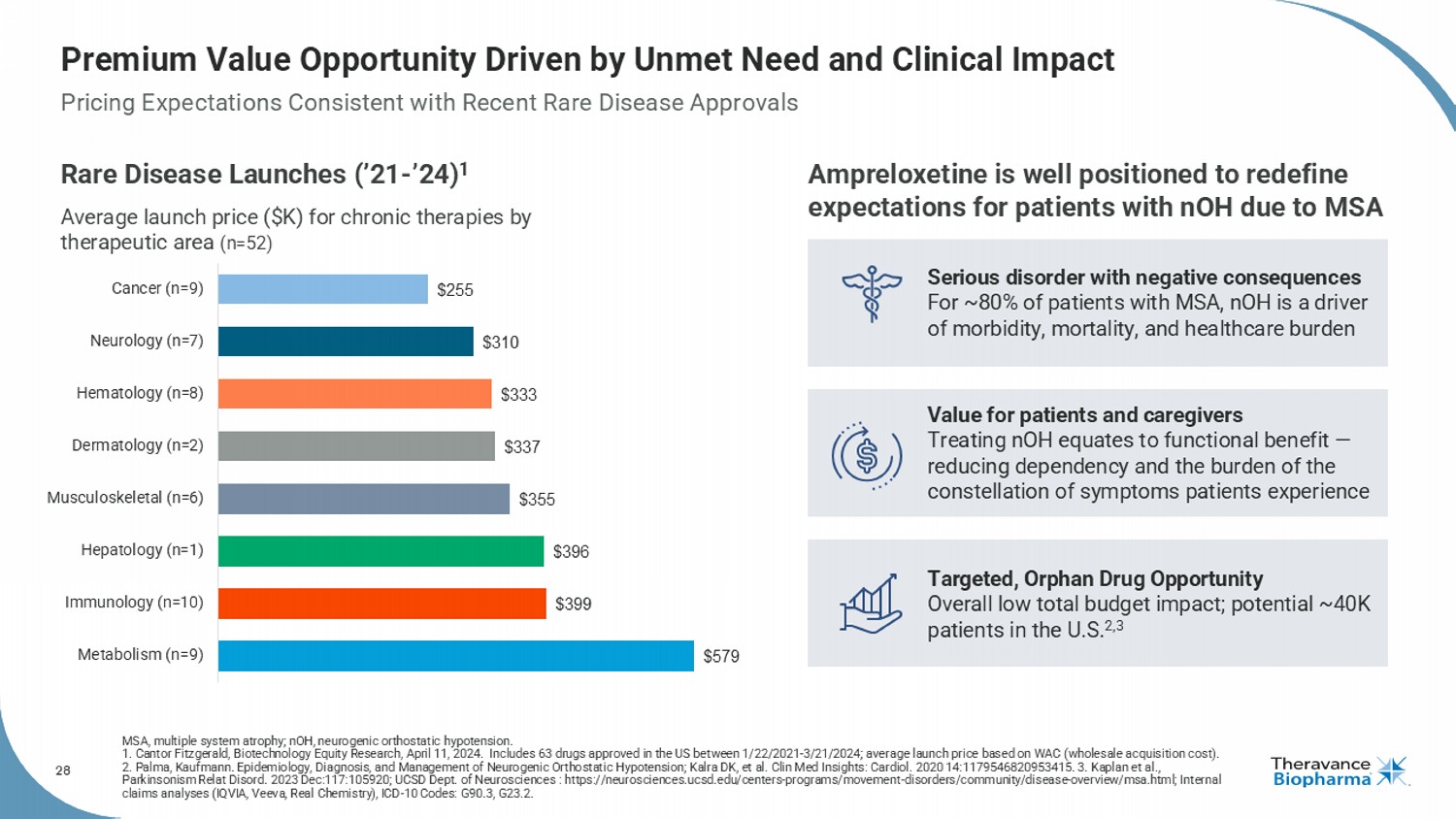

28 Premium Value Opportunity Driven by Unmet Need and Clinical Impact Rare Disease Launches (’21 - ’24) 1 Average launch price ($K) for chronic therapies by therapeutic area (n=52) $579 $399 $396 $355 $337 $333 $310 $255 Metabolism (n=9) Immunology (n=10) Hepatology (n=1) Musculoskeletal (n=6) Dermatology (n=2) Hematology (n=8) Neurology (n=7) Cancer (n=9) MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. 1. Cantor Fitzgerald, Biotechnology Equity Research, April 11, 2024. Includes 63 drugs approved in the US between 1/22/2021 - 3/2 1/2024; average launch price based on WAC (wholesale acquisition cost). 2. Palma, Kaufmann. Epidemiology, Diagnosis, and Management of Neurogenic Orthostatic Hypotension; Kalra DK, et al. Clin Med Ins ights: Cardiol . 2020 14:1179546820953415. 3. Kaplan et al., Parkinsonism Relat Disord . 2023 Dec:117:105920; UCSD Dept. of Neurosciences : https://neurosciences.ucsd.edu/centers - programs/movement - disorders/communit y/disease - overview/msa.html; Internal claims analyses (IQVIA, Veeva, Real Chemistry ), ICD - 10 Codes: G90.3, G23.2. Ampreloxetine is well positioned to redefine expectations for patients with nOH due to MSA Serious disorder with negative consequences For ~80% of patients with MSA, nOH is a driver of morbidity, mortality, and healthcare burden Value for patients and caregivers Treating nOH equates to functional benefit — reducing dependency and the burden of the constellation of symptoms patients experience Targeted, Orphan Drug Opportunity Overall low total budget impact; potential ~40K patients in the U.S. 2,3 Pricing Expectations Consistent with Recent Rare Disease Approvals

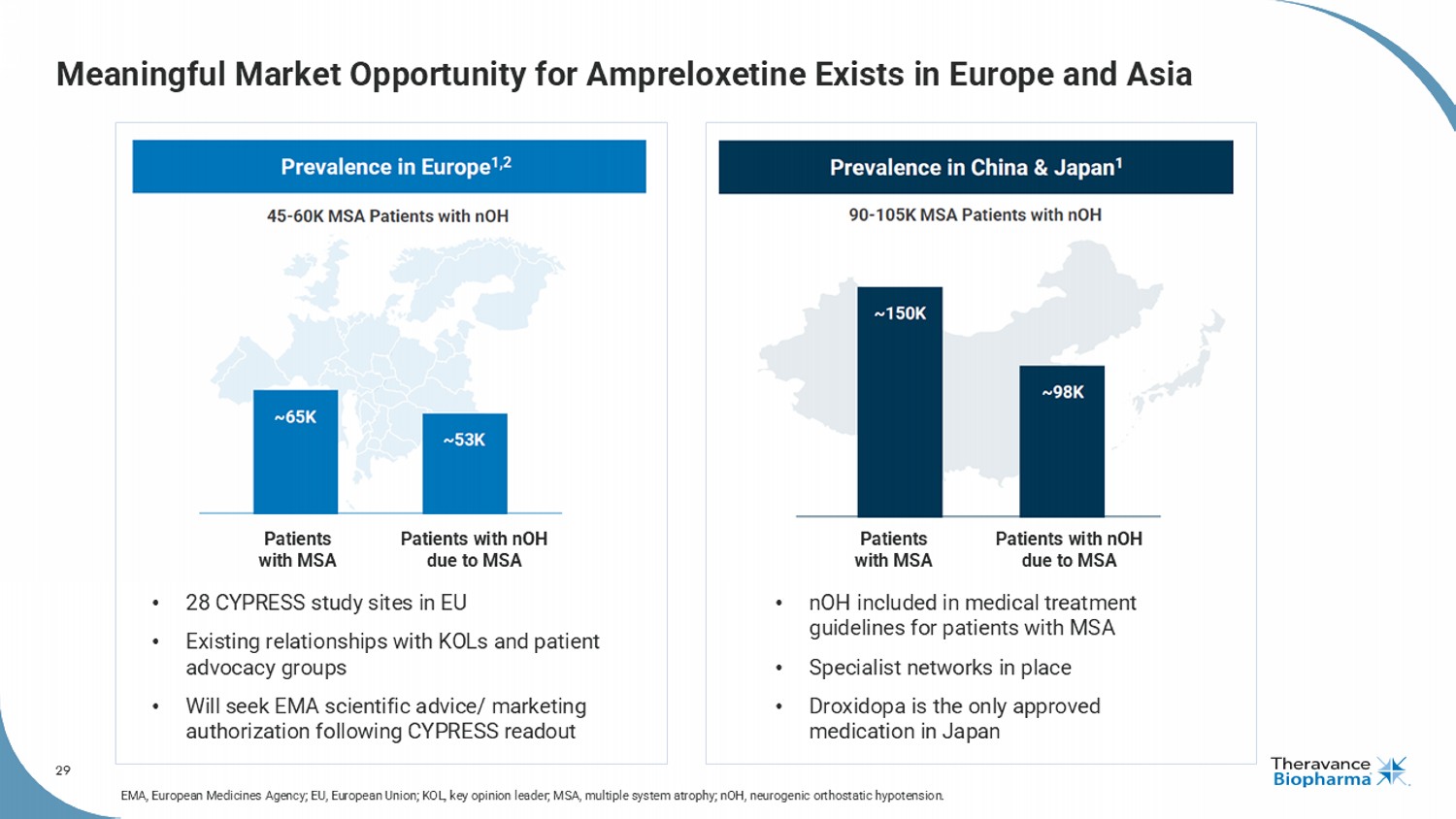

29 Meaningful Market Opportunity for Ampreloxetine Exists in Europe and Asia Patients with MSA Patients with nOH due to MSA Patients with MSA Patients with nOH due to MSA • 28 CYPRESS study sites in EU • Existing relationships with KOLs and patient advocacy groups • Will seek EMA scientific advice/ marketing authorization following CYPRESS readout • nOH included in medical treatment guidelines for patients with MSA • Specialist networks in place • Droxidopa is the only approved medication in Japan EMA, European Medicines Agency; EU, European Union; KOL, key opinion leader; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension.

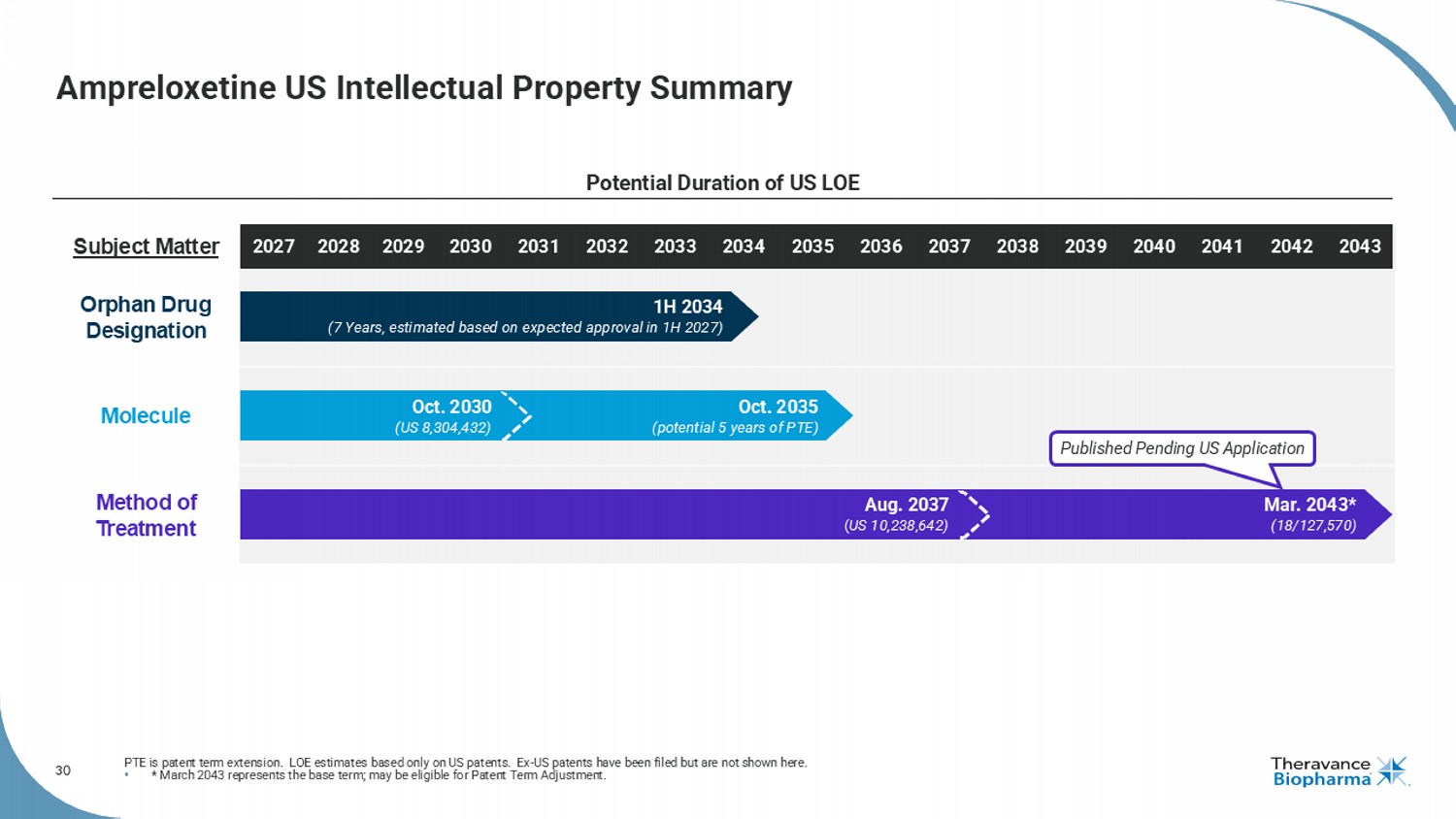

30 Subject Matter Orphan Drug Designation Molecule Method of Treatment Ampreloxetine US Intellectual Property Summary PTE is patent term extension. LOE estimates based only on US patents. Ex - US patents have been filed but are not shown here. • * March 2043 represents the base term; may be eligible for Patent Term Adjustment. Potential Duration of US LOE Published Pending US Application Mar. 2043* (18/127,570) Aug. 2037 ( US 10,238,642) 2032 2034 2028 2031 2035 2033 2036 2037 2038 2039 2040 2041 2042 2043 2030 2027 2029 Oct. 2035 (potential 5 years of PTE) Oct. 2030 (US 8,304,432) 1H 2034 (7 Years, estimated based on expected approval in 1H 2027)

31 Ampreloxetine: Potential to Transform Care in a Rare and Debilitating Disease FDA, U.S. Food and Drug Administration; MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. Addresses rare neurological disorder with high unmet need De - risked Phase 3 program designed with FDA alignment; Orphan Drug Designation Near - term catalyst: Phase 3 data expected Q1 2026 Potential to become standard of care for symptomatic nOH in MSA Substantial commercial opportunity in U.S. and ex - U.S. markets High profit potential based on low cost of goods and lean commercial model

32 COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist. The Only Once - Daily, Nebulized LAMA Maintenance Medicine for COPD

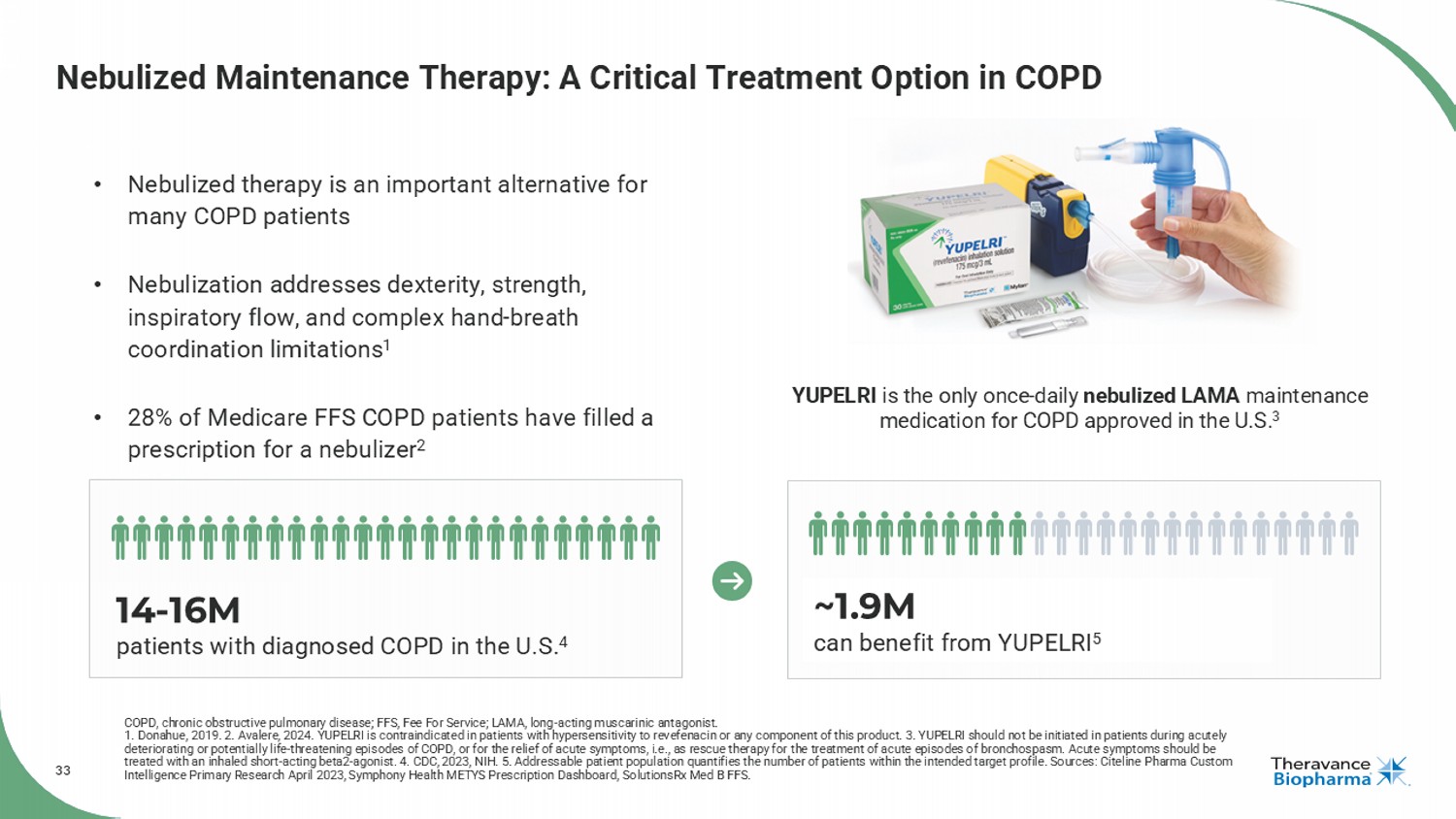

33 Nebulized Maintenance Therapy: A Critical Treatment Option in COPD COPD, chronic obstructive pulmonary disease; FFS, Fee For Service; LAMA, long - acting muscarinic antagonist. 1. Donahue, 2019. 2. Avalere, 2024. YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product. 3. YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i.e., as rescue therapy for the treatment of acute episodes of bronchospasm. Acute symptoms should be treated with an inhaled short - acting beta2 - agonist. 4. CDC, 2023, NIH. 5. Addressable patient population quantifies the number o f patients within the intended target profile. Sources: Citeline Pharma Custom Intelligence Primary Research April 2023, Symphony Health METYS Prescription Dashboard, SolutionsRx Med B FFS. YUPELRI is the only once - daily nebulized LAMA maintenance medication for COPD approved in the U.S. 3 • Nebulized therapy is an important alternative for many COPD patients • Nebulization addresses dexterity, strength, inspiratory flow, and complex hand - breath coordination limitations 1 • 28% of Medicare FFS COPD patients have filled a prescription for a nebulizer 2 14 - 16M patients with diagnosed COPD in the U.S. 4 ~1.9M can benefit from YUPELRI 5

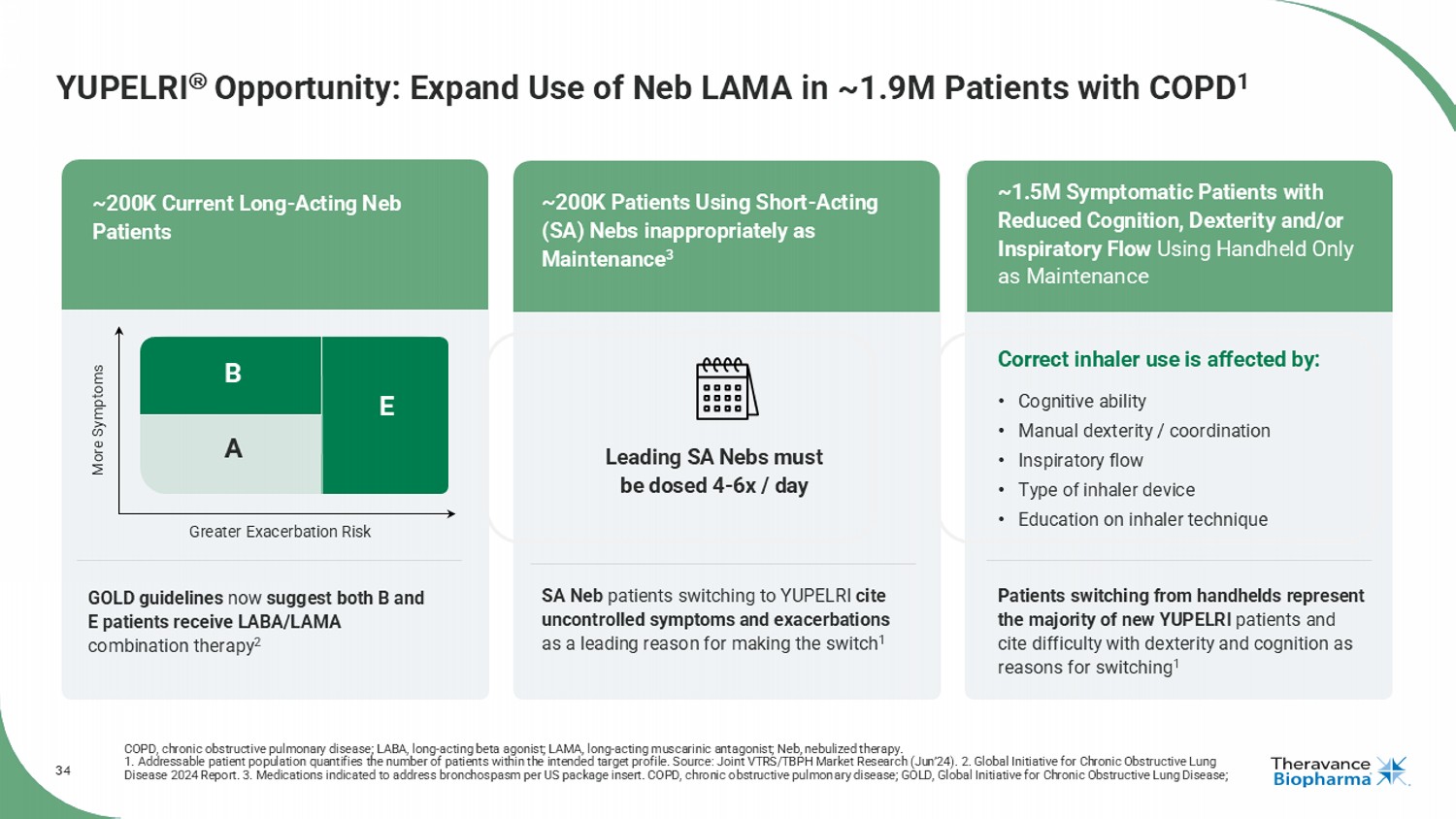

34 YUPELRI Opportunity: Expand Use of Neb LAMA in ~1.9M Patients with COPD 1 COPD, chronic obstructive pulmonary disease; LABA, long - acting beta agonist; LAMA, long - acting muscarinic antagonist; Neb, nebul ized therapy. 1. Addressable patient population quantifies the number of patients within the intended target profile. Source: Joint VTRS/TB PH Market Research (Jun’24). 2. Global Initiative for Chronic Obstructive Lung Disease 2024 Report. 3. Medications indicated to address bronchospasm per US package insert. COPD, chronic obstructive pulmon ary disease; GOLD, Global Initiative for Chronic Obstructive Lung Disease; GOLD guidelines now suggest both B and E patients receive LABA/LAMA combination therapy 2 SA Neb patients switching to YUPELRI cite uncontrolled symptoms and exacerbations as a leading reason for making the switch 1 Patients switching from handhelds represent the majority of new YUPELRI patients and cite difficulty with dexterity and cognition as reasons for switching 1 Leading SA Nebs must be dosed 4 - 6x / day More Symptoms Greater Exacerbation Risk A B E GOLD Risk Categories: Correct inhaler use is affected by: • Cognitive ability • Manual dexterity / coordination • Inspiratory flow • Type of inhaler device • Education on inhaler technique ~200K Current Long - Acting Neb Patients ~200K Patients Using Short - Acting (SA) Nebs inappropriately as Maintenance 3 ~1.5M Symptomatic Patients with Reduced Cognition, Dexterity and/or Inspiratory Flow Using Handheld Only as Maintenance

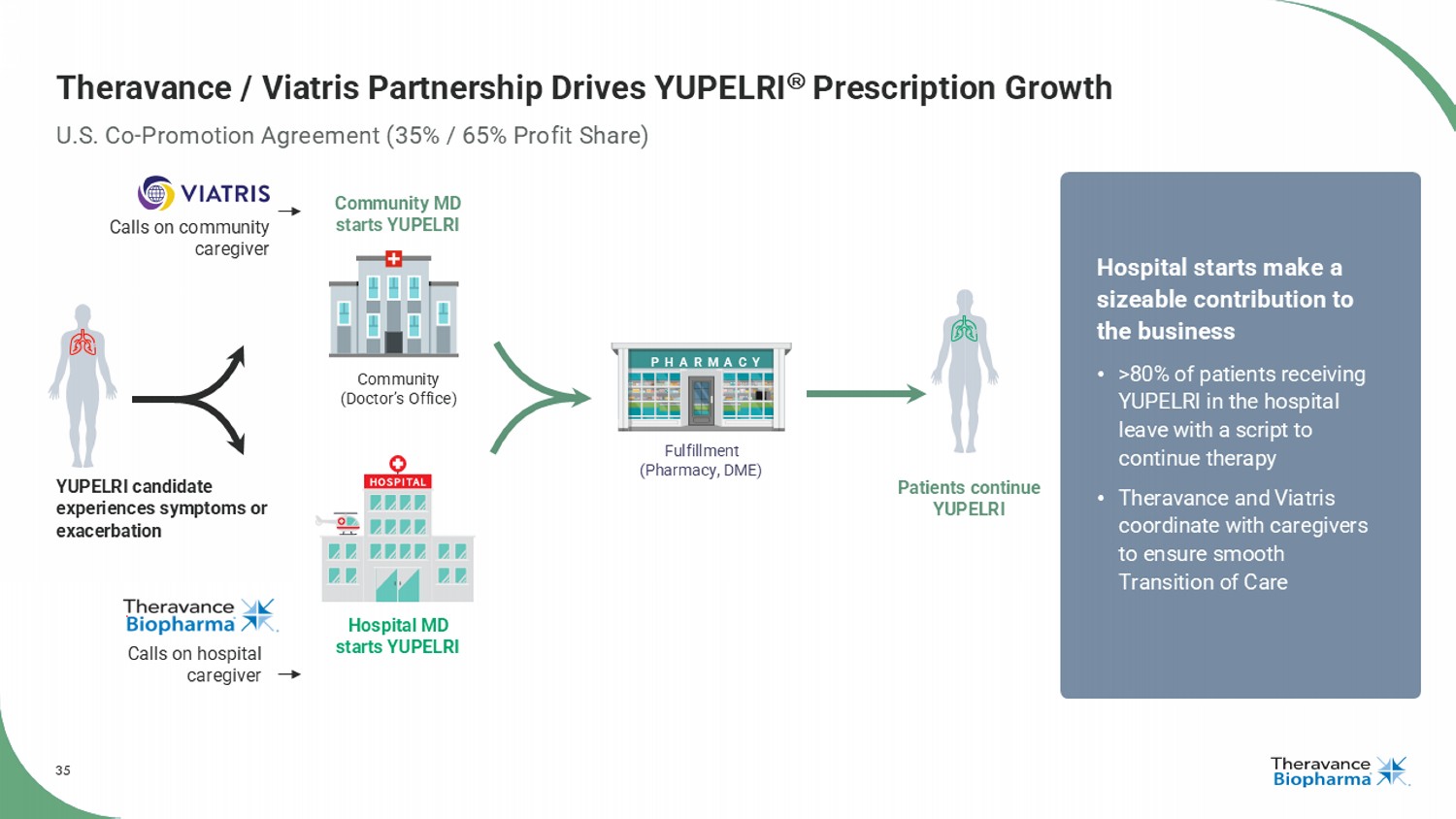

35 Theravance / Viatris Partnership Drives YUPELRI Prescription Growth U.S. Co - Promotion Agreement (35% / 65% Profit Share) Community (Doctor’s Office) Hospital MD starts YUPELRI Community MD starts YUPELRI Patients continue YUPELRI YUPELRI candidate experiences symptoms or exacerbation Fulfillment (Pharmacy, DME) PHARMACY Calls on community caregiver Calls on hospital caregiver Hospital starts make a sizeable contribution to the business • >80% of patients receiving YUPELRI in the hospital leave with a script to continue therapy • Theravance and Viatris coordinate with caregivers to ensure smooth Transition of Care

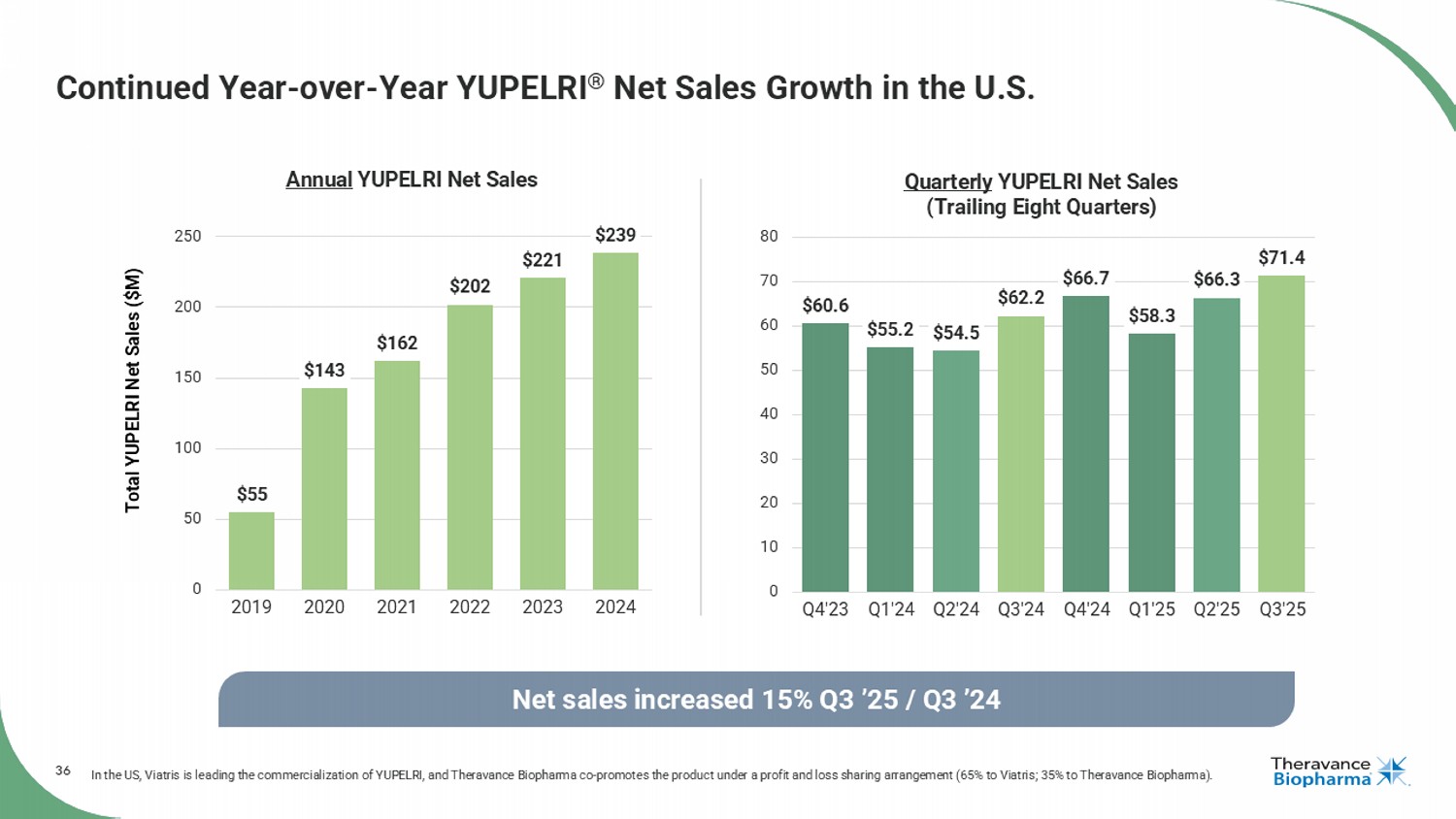

36 $60.6 $55.2 $54.5 $62.2 $66.7 $58.3 $66.3 $71.4 0 10 20 30 40 50 60 70 80 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Quarterly YUPELRI Net Sales (Trailing Eight Quarters) Continued Year - over - Year YUPELRI ® Net Sales Growth in the U.S. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). Net sales increased 15% Q3 ’25 / Q3 ’24 Total YUPELRI Net Sales ($M) $55 $143 $162 $202 $221 $239 0 50 100 150 200 250 2019 2020 2021 2022 2023 2024 Annual YUPELRI Net Sales

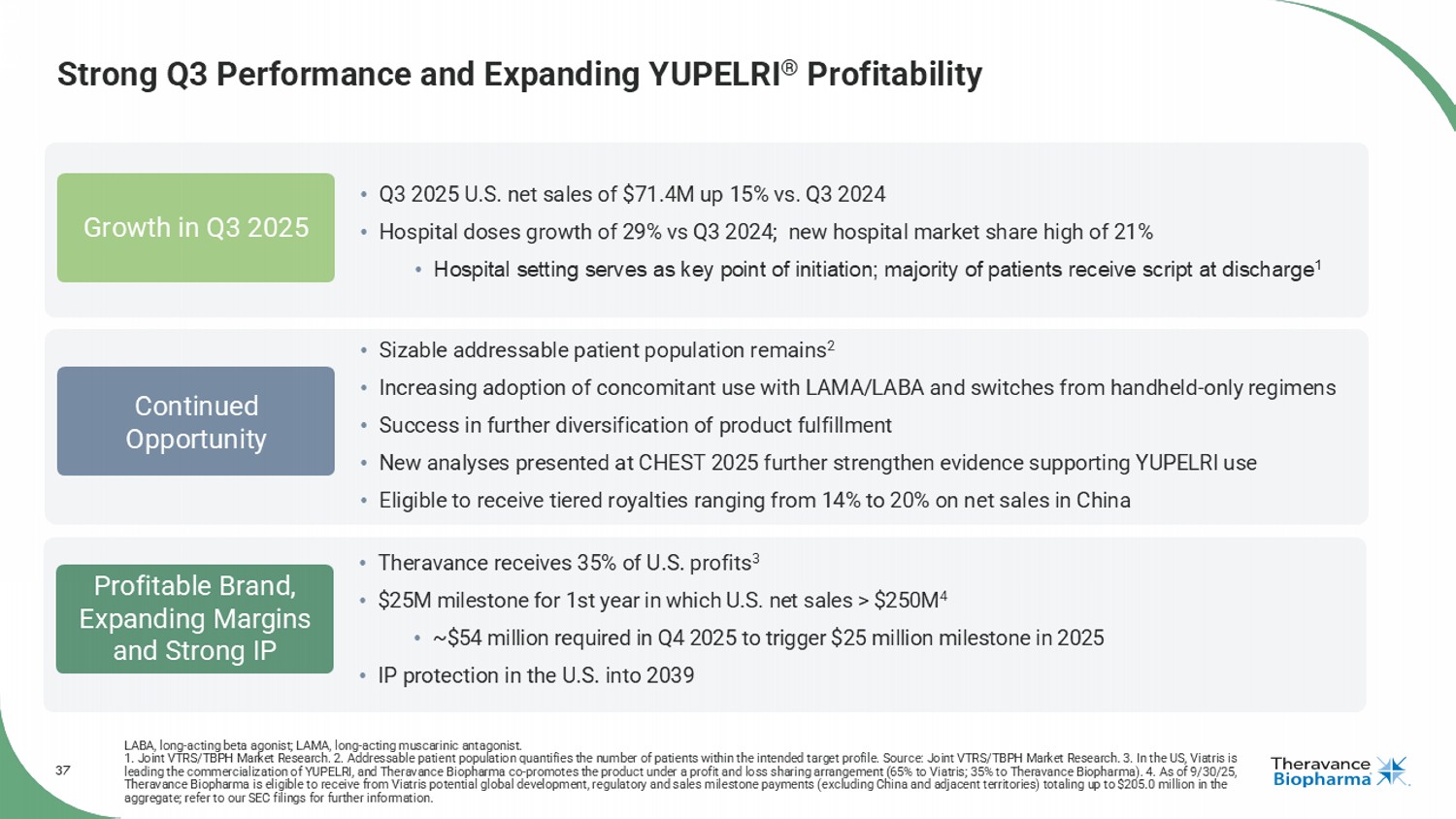

37 Strong Q3 Performance and Expanding YUPELRI ® Profitability LABA, long - acting beta agonist; LAMA, long - acting muscarinic antagonist. 1. Joint VTRS/TBPH Market Research. 2. Addressable patient population quantifies the number of patients within the intended t arg et profile. Source: Joint VTRS/TBPH Market Research. 3. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arran gement (65% to Viatris; 35% to Theravance Biopharma). 4. As of 9/30/25, Theravance Biopharma is eligible to receive from Viatris potential global development, regulatory and sales milestone payment s ( excluding China and adjacent territories) totaling up to $205.0 million in the aggregate; refer to our SEC filings for further information. Profitable Brand, Expanding Margins and Strong IP Growth in Q3 2025 Continued Opportunity • Theravance receives 35% of U.S. profits 3 • $25M milestone for 1st year in which U.S. net sales > $250M 4 • ~$54 million required in Q4 2025 to trigger $25 million milestone in 2025 • IP protection in the U.S. into 2039 • Q3 2025 U.S. net sales of $71.4M up 15% vs. Q3 2024 • Hospital doses growth of 29% vs Q3 2024; new hospital market share high of 21% • Hospital setting serves as key point of initiation; majority of patients receive script at discharge 1 • Sizable addressable patient population remains 2 • Increasing adoption of concomitant use with LAMA/LABA and switches from handheld - only regimens • Success in further diversification of product fulfillment • New analyses presented at CHEST 2025 further strengthen evidence supporting YUPELRI use • Eligible to receive tiered royalties ranging from 14% to 20% on net sales in China

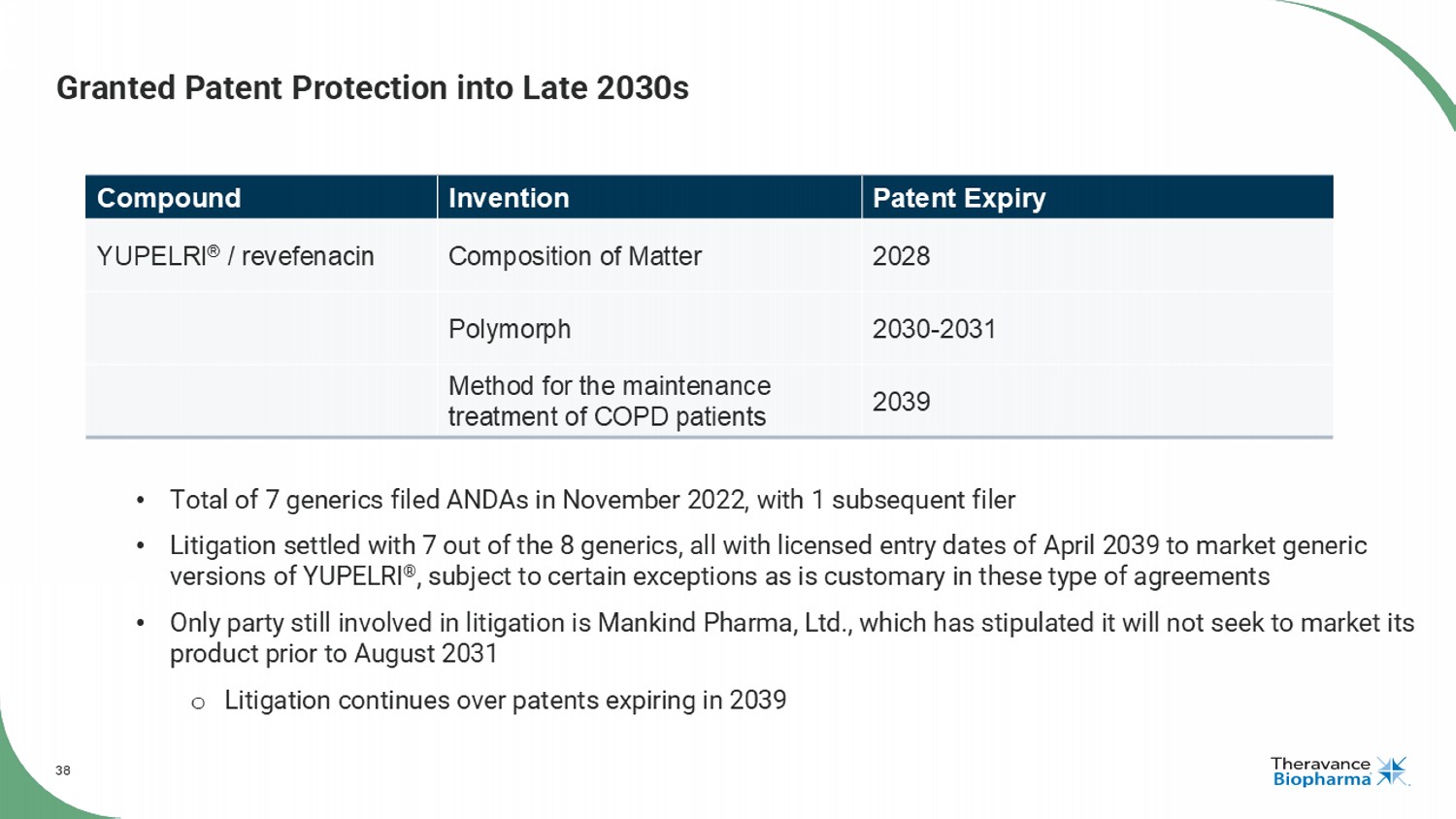

38 Granted Patent Protection into Late 2030s Patent Expiry Invention Compound 2028 Composition of Matter YUPELRI ® / revefenacin 2030 - 2031 Polymorph 2039 Method for the maintenance treatment of COPD patients • Total of 7 generics filed ANDAs in November 2022, with 1 subsequent filer • Litigation settled with 7 out of the 8 generics, all with licensed entry dates of April 2039 to market generic versions of YUPELRI ® , subject to certain exceptions as is customary in these type of agreements • Only party still involved in litigation is Mankind Pharma, Ltd., which has stipulated it will not seek to market its product prior to August 2031 o Litigation continues over patents expiring in 2039

39 GSK’s TRELEGY COPD, chronic obstructive pulmonary disease The First and Only Once - Daily Triple Therapy in a Single Inhaler for Adult Patients with COPD or Asthma Milestones from Royalty Pharma

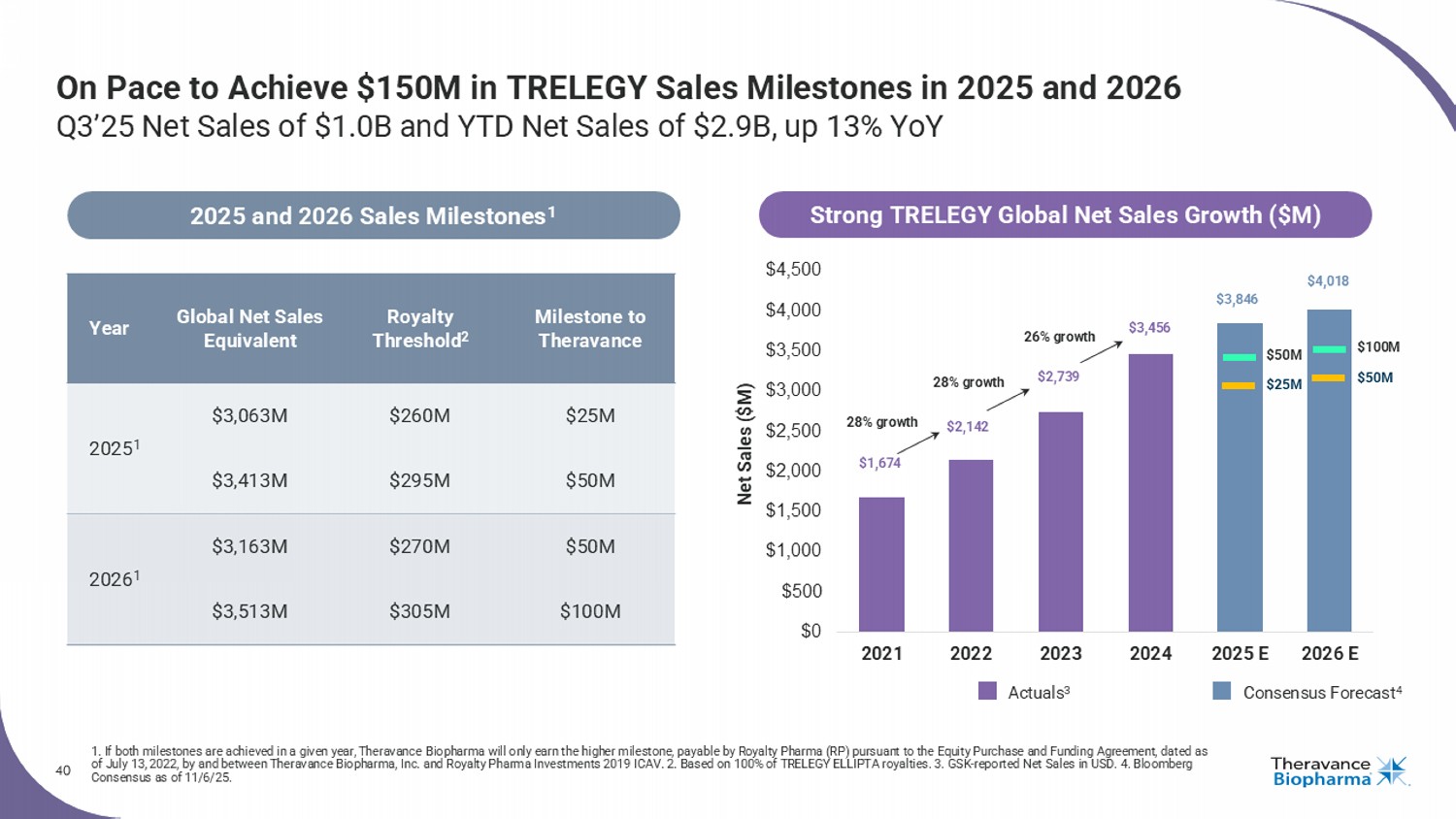

40 On Pace to Achieve $150M in TRELEGY Sales Milestones in 2025 and 2026 Q3’25 Net Sales of $1.0B and YTD Net Sales of $2.9B, up 13% YoY 1. If both milestones are achieved in a given year, Theravance Biopharma will only earn the higher milestone, payable by Royalty Pharma (RP) pursuant to the Equity Purchase and Funding Agr ee ment, dated as of July 13, 2022, by and between Theravance Biopharma, Inc. and Royalty Pharma Investments 2019 ICAV. 2. Based on 100% of TRELEGY ELLIPTA royalties. 3. GSK - reported Net Sa les in USD. 4. Bloomberg Consensus as of 11/6/25. Milestone to Theravance Royalty Threshold 2 Global Net Sales Equivalent Year $25M $260M $3,063M 2025 1 $50M $295M $3,413M $50M $270M $3,163M 2026 1 $100M $305M $3,513M 2025 and 2026 Sales Milestones 1 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2021 2022 2023 2024 2025 E 2026 E Consensus Forecast 4 Actuals 3 Net Sales ($M) $50M $25M $100M $50M $1,674 $2,142 $2,739 $3,456 $3,846 $4,018 28% growth 28% growth Strong TRELEGY Global Net Sales Growth ($M) 26% growth

41 Financials and Capital Management

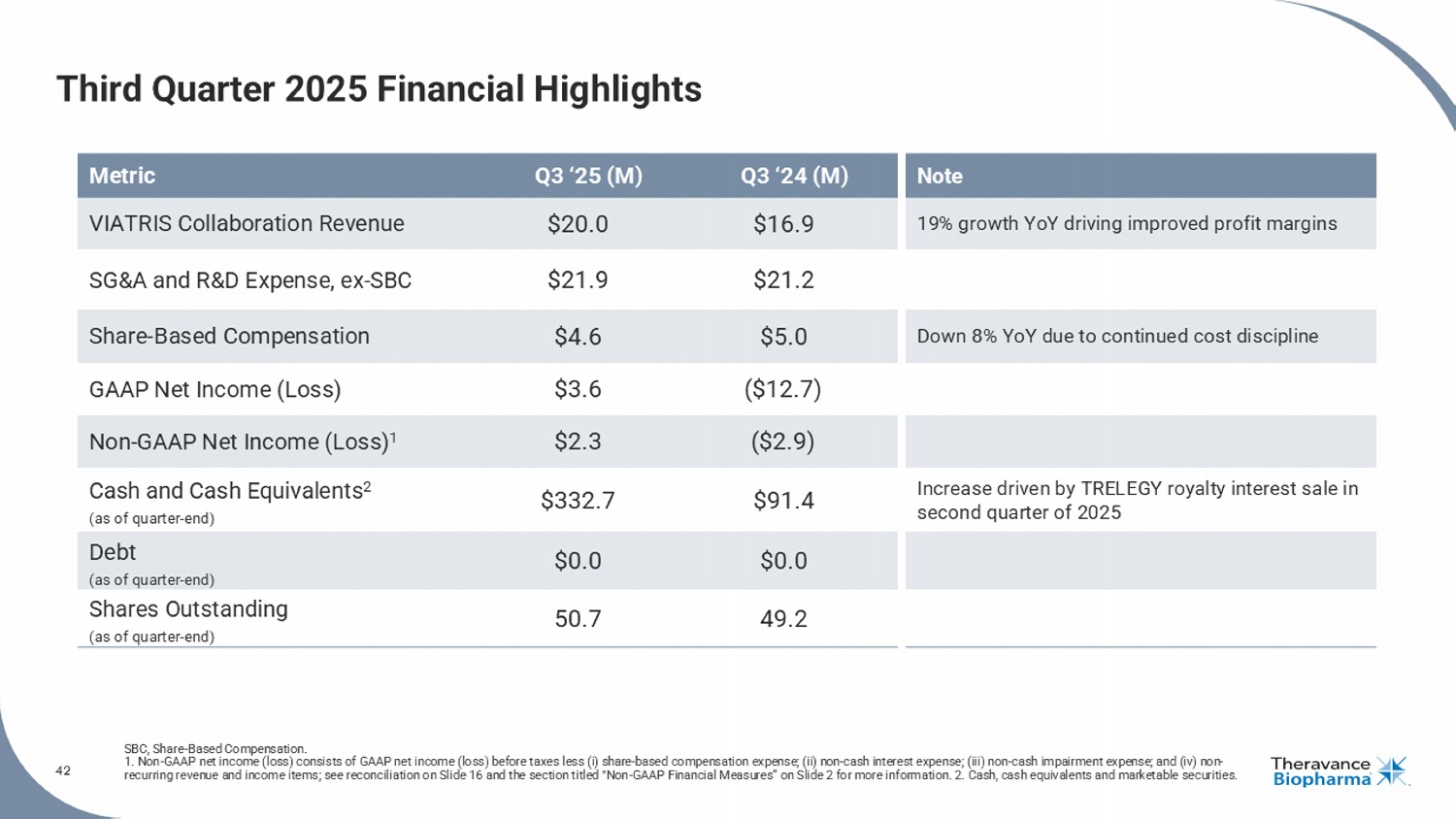

42 Third Quarter 2025 Financial Highlights SBC, Share - Based Compensation. 1. Non - GAAP net income (loss) consists of GAAP net income (loss) before taxes less (i) share - based compensation expense; (ii) no n - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 16 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. 2. Cash, cash equivalents and marketable securities. Note Q3 ‘24 (M) Q3 ‘25 (M) Metric 19% growth YoY driving improved profit margins $16.9 $20.0 VIATRIS Collaboration Revenue $21.2 $21.9 SG&A and R&D Expense, ex - SBC Down 8% YoY due to continued cost discipline $5.0 $4.6 Share - Based Compensation ($12.7) $3.6 GAAP Net Income (Loss) ($2.9) $2.3 Non - GAAP Net Income (Loss) 1 Increase driven by TRELEGY royalty interest sale in second quarter of 2025 $91.4 $332.7 Cash and Cash Equivalents 2 (as of quarter - end) $0.0 $0.0 Debt (as of quarter - end) 49.2 50.7 Shares Outstanding (as of quarter - end)

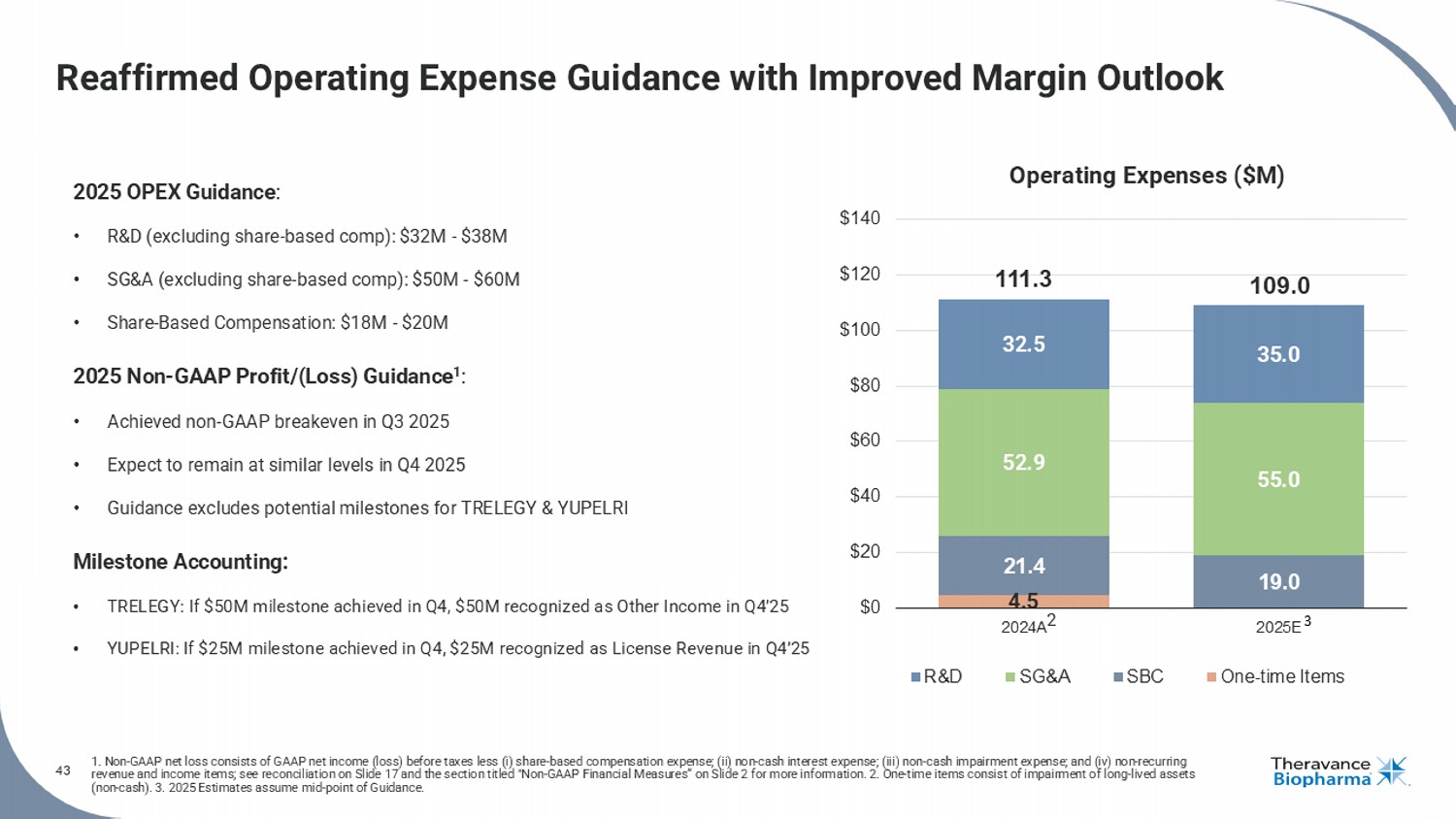

43 1. Non - GAAP net loss consists of GAAP net income (loss) before taxes less ( i ) share - based compensation expense; (ii) non - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 17 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for mor e information. 2. One - time items consist of impairment of long - lived assets (non - cash). 3. 2025 Estimates assume mid - point of Guidance. Reaffirmed Operating Expense Guidance with Improved Margin Outlook 2025 OPEX Guidance : • R&D (excluding share - based comp): $32M - $38M • SG&A (excluding share - based comp): $50M - $60M • Share - Based Compensation: $18M - $20M 2025 Non - GAAP Profit/(Loss) Guidance 1 : • Achieved non - GAAP breakeven in Q3 2025 • Expect to remain at similar levels in Q4 2025 • Guidance excludes potential milestones for TRELEGY & YUPELRI Milestone Accounting: • TRELEGY: If $50M milestone achieved in Q4, $50M recognized as Other Income in Q4’25 • YUPELRI: If $25M milestone achieved in Q4, $25M recognized as License Revenue in Q4’25 4.5 21.4 19.0 52.9 55.0 32.5 35.0 111.3 109.0 $0 $20 $40 $60 $80 $100 $120 $140 2024A 2025E R&D SG&A SBC One-time Items 3 Operating Expenses ($M) 2

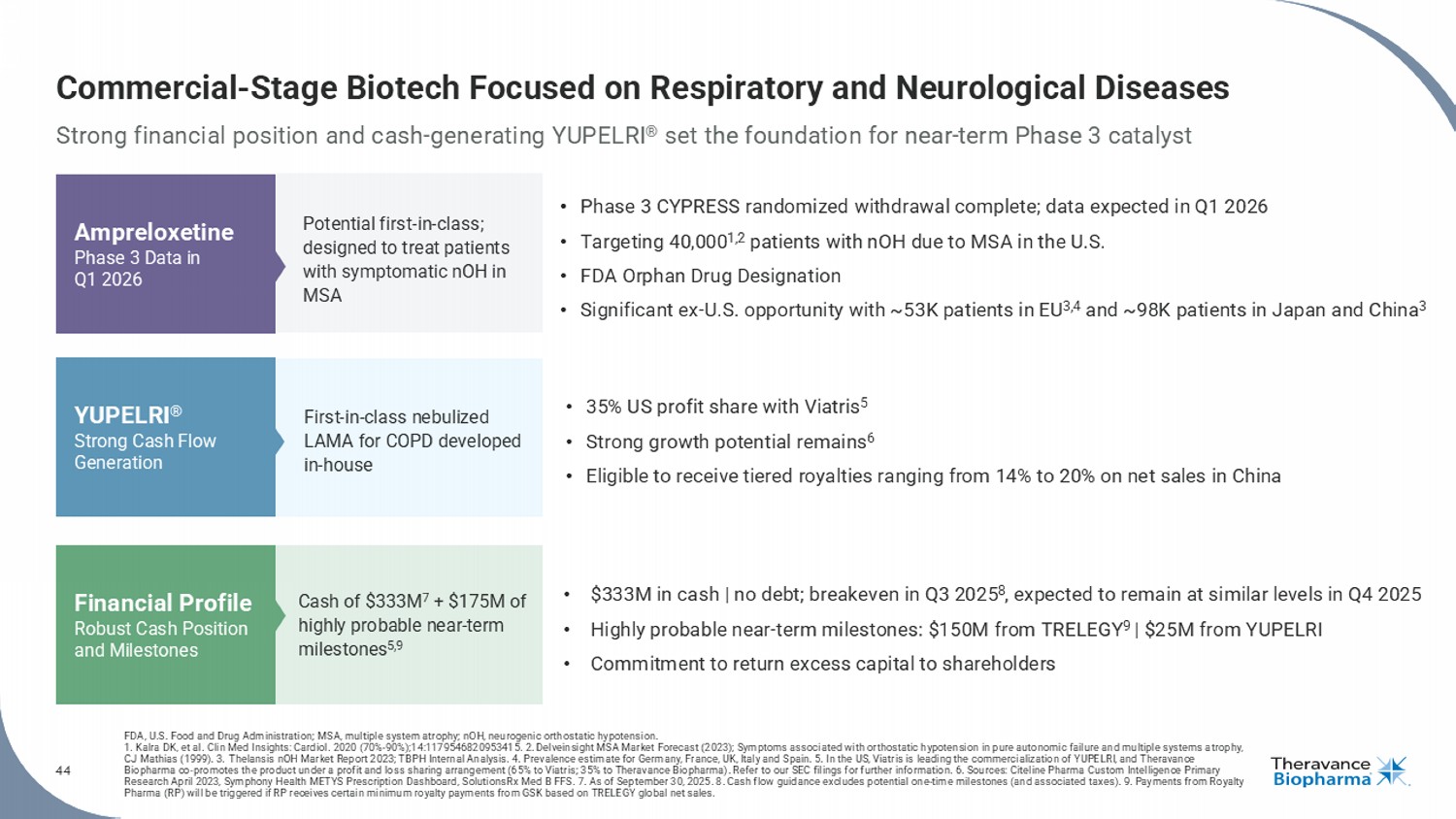

44 Commercial - Stage Biotech Focused on Respiratory and Neurological Diseases Strong financial position and cash - generating YUPELRI ® set the foundation for near - term Phase 3 catalyst FDA, U.S. Food and Drug Administration; MSA, multiple system atrophy ; nOH , neurogenic orthostatic hypotension. 1. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 (70% - 90%);14:1179546820953415. 2. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems a tr ophy, CJ Mathias (1999). 3. Thelansis nOH Market Report 2023; TBPH Internal Analysis. 4. Prevalence estimate for Germany, France, UK, Italy and Spain. 5. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris ; 35% to Theravance Biopharma). Refer to our SEC filings for further information. 6. Sources: Citeline Pharma Custom Intelligence Primary Research April 2023, Symphony Health METYS Prescription Dashboard, SolutionsRx Med B FFS. 7. As of September 30, 2025. 8. C ash flow guidance excludes potential one - time milestones (and associated taxes). 9. Payments from Royalty Pharma (RP) will be triggered if RP receives certain minimum royalty payments from GSK based on TRELEGY global net sales. Potential first - in - class; designed to treat patients with symptomatic nOH in MSA Ampreloxetine Phase 3 Data in Q1 2026 YUPELRI ® Strong Cash Flow Generation Financial Profile Robust Cash Position and Milestones • Phase 3 CYPRESS randomized withdrawal complete; data expected in Q1 2026 • Targeting 40,000 1,2 patients with nOH due to MSA in the U.S. • FDA Orphan Drug Designation • Significant ex - U.S. opportunity with ~53K patients in EU 3,4 and ~98K patients in Japan and China 3 First - in - class nebulized LAMA for COPD developed in - house Cash of $333M 7 + $175M of highly probable near - term milestones 5,9 • 35% US profit share with Viatris 5 • Strong growth potential remains 6 • Eligible to receive tiered royalties ranging from 14% to 20% on net sales in China • $333M in cash | no debt; breakeven in Q3 2025 8 , expected to remain at similar levels in Q4 2025 • Highly probable near - term milestones: $150M from TRELEGY 9 | $25M from YUPELRI • Commitment to return excess capital to shareholders

45 Appendix

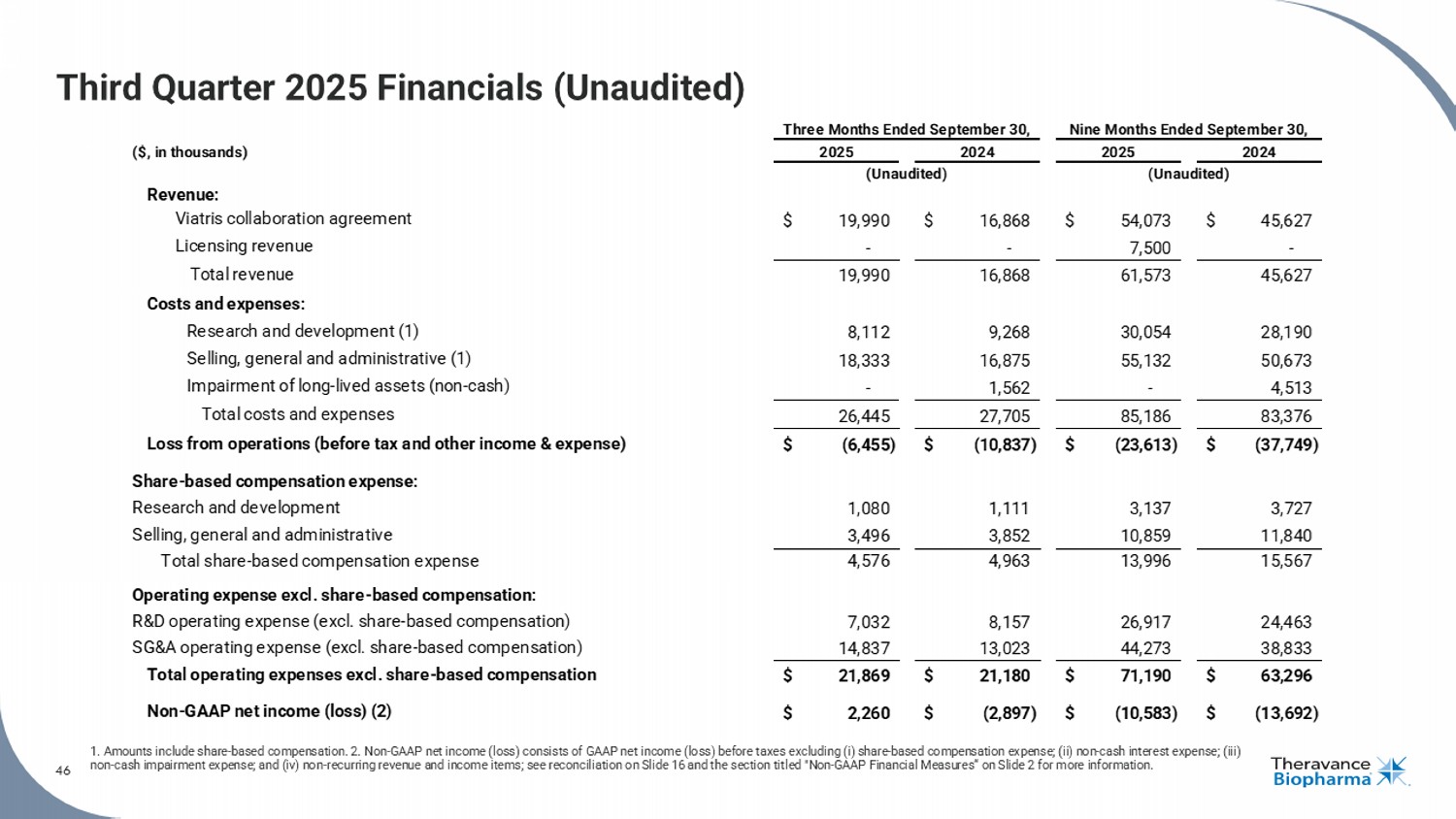

46 Third Quarter 2025 Financials (Unaudited) 1. Amounts include share - based compensation. 2. Non - GAAP net income (loss) consists of GAAP net income (loss) before taxes exclu ding (i) share - based compensation expense; (ii) non - cash interest expense; (iii) non - cash impairment expense; and (iv) non - recurring revenue and income items; see reconciliation on Slide 16 and the section tit led "Non - GAAP Financial Measures“ on Slide 2 for more information. 46 ($, in thousands) Revenue: Viatris collaboration agreement $ 19,990 $ 16,868 $ 54,073 $ 45,627 Licensing revenue - - 7,500 - Total revenue 19,990 16,868 61,573 45,627 Costs and expenses: Research and development (1) 8,112 9,268 30,054 28,190 Selling, general and administrative (1) 18,333 16,875 55,132 50,673 Impairment of long-lived assets (non-cash) - 1,562 - 4,513 Total costs and expenses 26,445 27,705 85,186 83,376 Loss from operations (before tax and other income & expense) $ (6,455) $ (10,837) $ (23,613) $ (37,749) Share-based compensation expense: Research and development 1,080 1,111 3,137 3,727 Selling, general and administrative 3,496 3,852 10,859 11,840 Total share-based compensation expense 4,576 4,963 13,996 15,567 Operating expense excl. share-based compensation: R&D operating expense (excl. share-based compensation) 7,032 8,157 26,917 24,463 SG&A operating expense (excl. share-based compensation) 14,837 13,023 44,273 38,833 Total operating expenses excl. share-based compensation $ 21,869 $ 21,180 $ 71,190 $ 63,296 Non-GAAP net income (loss) (2) $ 2,260 $ (2,897) $ (10,583) $ (13,692) Three Months Ended September 30, 2025 2024 (Unaudited) Nine Months Ended September 30, 2025 2024 (Unaudited)

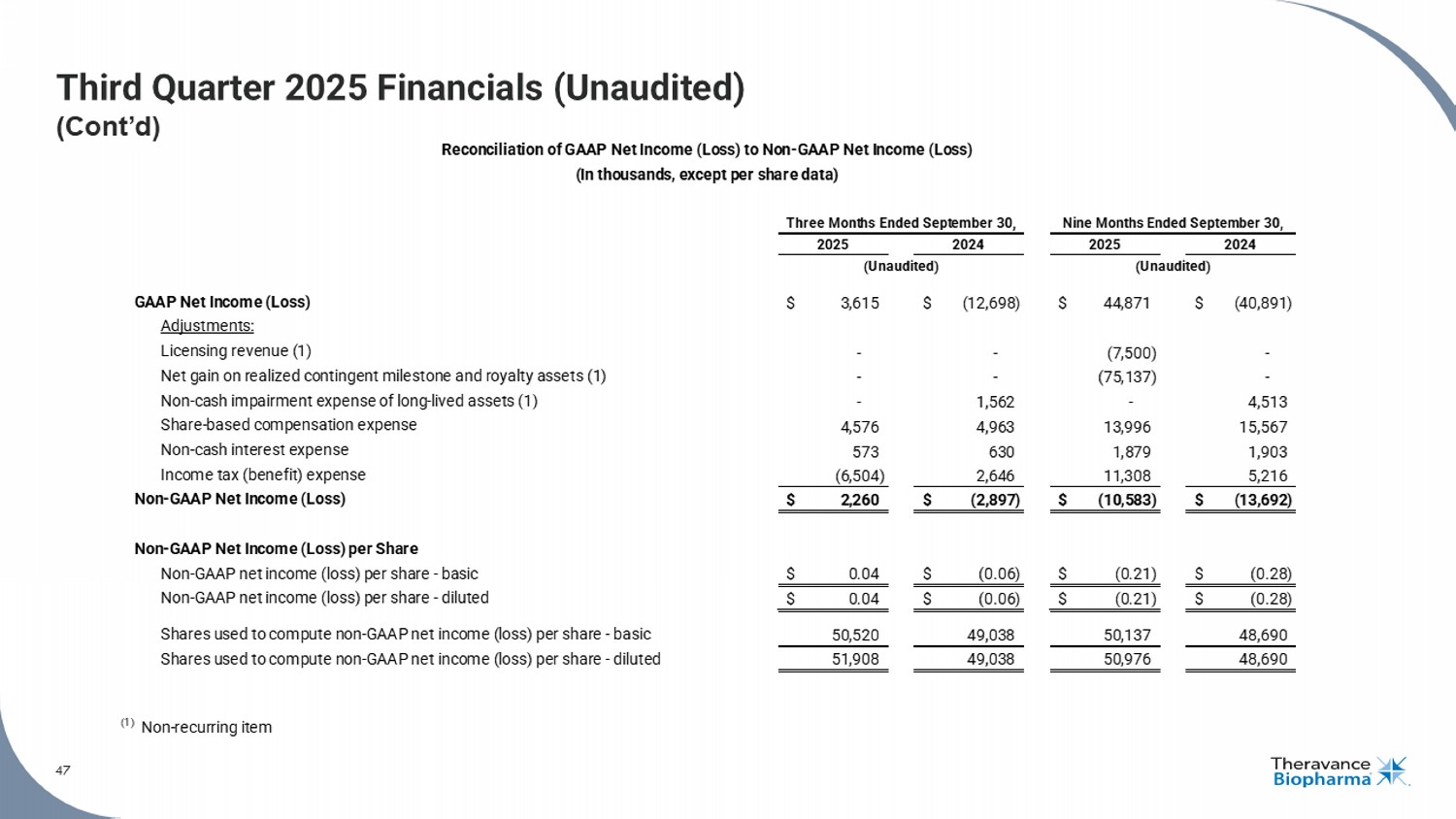

47 Third Quarter 2025 Financials (Unaudited) (Cont’d) 47 See the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. GAAP Net Income (Loss) $ 3,615 $ (12,698) $ 44,871 $ (40,891) Adjustments: Licensing revenue (1) - - (7,500) - Net gain on realized contingent milestone and royalty assets (1) - - (75,137) - Non-cash impairment expense of long-lived assets (1) - 1,562 - 4,513 Share-based compensation expense 4,576 4,963 13,996 15,567 Non-cash interest expense 573 630 1,879 1,903 Income tax (benefit) expense (6,504) 2,646 11,308 5,216 Non-GAAP Net Income (Loss) $ 2,260 $ (2,897) $ (10,583) $ (13,692) Non-GAAP Net Income (Loss) per Share Non-GAAP net income (loss) per share - basic $ 0.04 $ (0.06) $ (0.21) $ (0.28) Non-GAAP net income (loss) per share - diluted $ 0.04 $ (0.06) $ (0.21) $ (0.28) Shares used to compute non-GAAP net income (loss) per share - basic 50,520 49,038 50,137 48,690 Shares used to compute non-GAAP net income (loss) per share - diluted 51,908 49,038 50,976 48,690 (1) Non-recurring item (Unaudited) Reconciliation of GAAP Net Income (Loss) to Non-GAAP Net Income (Loss) (In thousands, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 (Unaudited)

Appendix COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist.

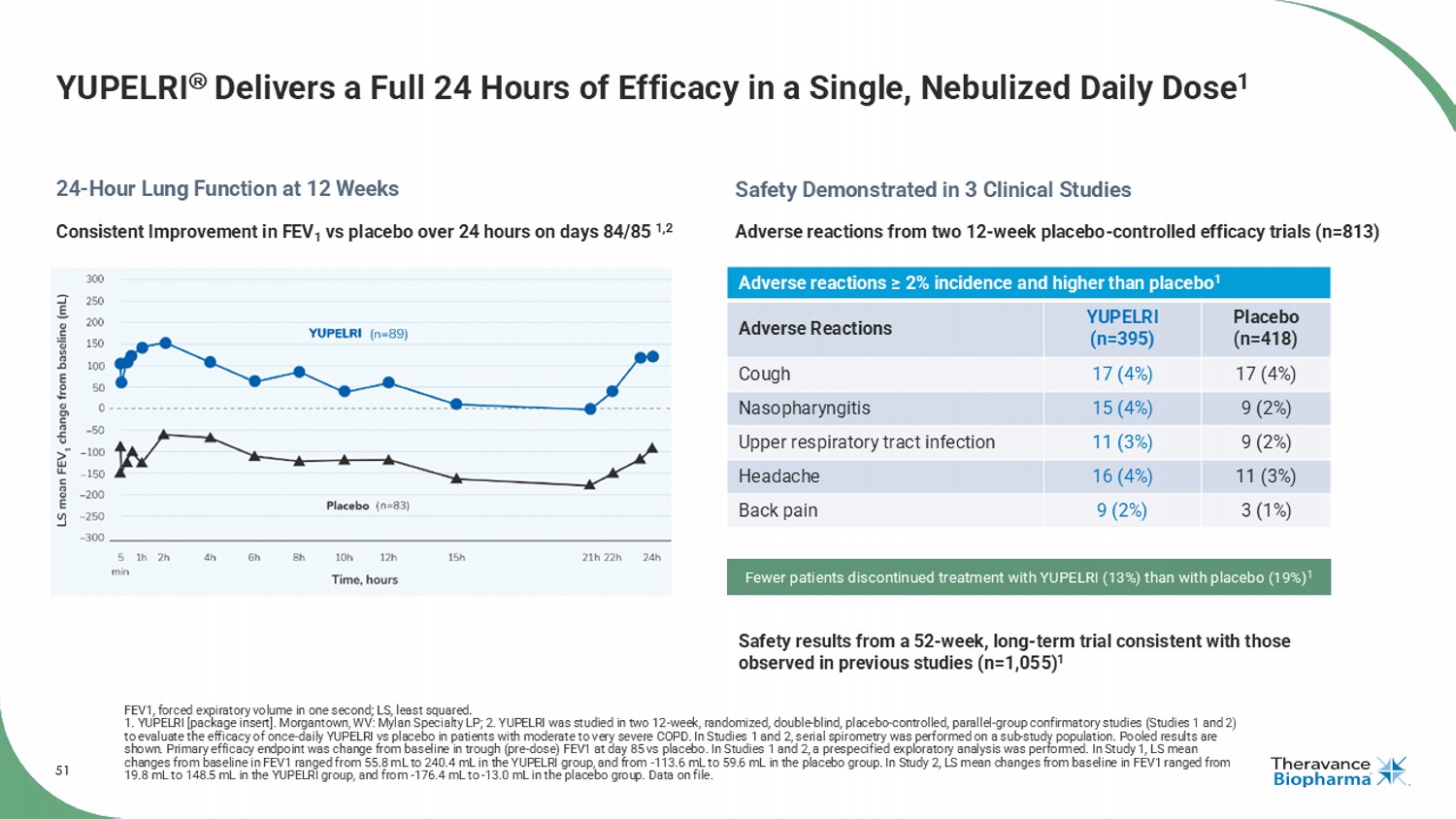

49 YUPELRI ® ( revefenacin ) Inhalation Solution YUPELRI ® inhalation solution is indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD) . Important Safety Information (US) YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product . YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i . e . , as rescue therapy for the treatment of acute episodes of bronchospasm . Acute symptoms should be treated with an inhaled short - acting beta 2 - agonist . As with other inhaled medicines, YUPELRI can produce paradoxical bronchospasm that may be life - threatening . If paradoxical bronchospasm occurs following dosing with YUPELRI, it should be treated immediately with an inhaled, short - acting bronchodilator . YUPELRI should be discontinued immediately and alternative therapy should be instituted . YUPELRI should be used with caution in patients with narrow - angle glaucoma . Patients should be instructed to immediately consult their healthcare provider if they develop any signs and symptoms of acute narrow - angle glaucoma, including eye pain or discomfort, blurred vision, visual halos or colored images in association with red eyes from conjunctival congestion and corneal edema . Worsening of urinary retention may occur . Use with caution in patients with prostatic hyperplasia or bladder - neck obstruction and instruct patients to contact a healthcare provider immediately if symptoms occur . Immediate hypersensitivity reactions may occur after administration of YUPELRI . If a reaction occurs, YUPELRI should be stopped at once and alternative treatments considered . The most common adverse reactions occurring in clinical trials at an incidence greater than or equal to 2 % in the YUPELRI group, and higher than placebo, included cough, nasopharyngitis, upper respiratory infection, headache and back pain . Coadministration of anticholinergic medicines or OATP 1 B 1 and OATP 1 B 3 inhibitors with YUPELRI is not recommended . YUPELRI is not recommended in patients with any degree of hepatic impairment . OATP, organic anion transporting polypeptide. 49

50 About YUPELRI ® ( revefenacin ) Inhalation Solution YUPELRI ® ( revefenacin ) inhalation solution is a once - daily nebulized LAMA approved for the maintenance treatment of COPD in the US . Market research by Theravance Biopharma indicates approximately 9 % of the treated COPD patients in the US use nebulizers for ongoing maintenance therapy . 1 LAMAs are a cornerstone of maintenance therapy for COPD and YUPELRI ® is positioned as the first once - daily single - agent bronchodilator product for COPD patients who require, or prefer, nebulized therapy . YUPELRI ® ’s stability in both metered dose inhaler and dry powder device formulations suggest that this LAMA could also serve as a foundation for novel handheld combination products . COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist. 1. TBPH market research (N=160 physicians); refers to US COPD patients. 50

51 YUPELRI Delivers a Full 24 Hours of Efficacy in a Single, Nebulized Daily Dose 1 FEV1, forced expiratory volume in one second; LS, least squared. 1. YUPELRI [package insert]. Morgantown, WV: Mylan Specialty LP; 2. YUPELRI was studied in two 12 - week, randomized, double - blind , placebo - controlled, parallel - group confirmatory studies (Studies 1 and 2) to evaluate the efficacy of once - daily YUPELRI vs placebo in patients with moderate to very severe COPD. In Studies 1 and 2, ser ial spirometry was performed on a sub - study population. Pooled results are shown. Primary efficacy endpoint was change from baseline in trough (pre - dose) FEV1 at day 85 vs placebo. In Studies 1 and 2, a prespecified exploratory analysis was performed. In Study 1, LS mean changes from baseline in FEV1 ranged from 55.8 mL to 240.4 mL in the YUPELRI group, and from - 113.6 mL to 59.6 mL in the placebo group. In Study 2, LS mean changes from baseline in FEV1 ranged from 19.8 mL to 148.5 mL in the YUPELRI group, and from - 176.4 mL to - 13.0 mL in the placebo group. Data on file. 24 - Hour Lung Function at 12 Weeks Safety Demonstrated in 3 Clinical Studies Adverse reactions ≥ 2% incidence and higher than placebo 1 Placebo (n=418) YUPELRI (n=395) Adverse Reactions 17 (4%) 17 (4%) Cough 9 (2%) 15 (4%) Nasopharyngitis 9 (2%) 11 (3%) Upper respiratory tract infection 11 (3%) 16 (4%) Headache 3 (1%) 9 (2%) Back pain Adverse reactions from two 12 - week placebo - controlled efficacy trials (n=813) Safety results from a 52 - week, long - term trial consistent with those observed in previous studies (n=1,055) 1 Fewer patients discontinued treatment with YUPELRI (13%) than with placebo (19%) 1 Consistent Improvement in FEV 1 vs placebo over 24 hours on days 84/85 1,2

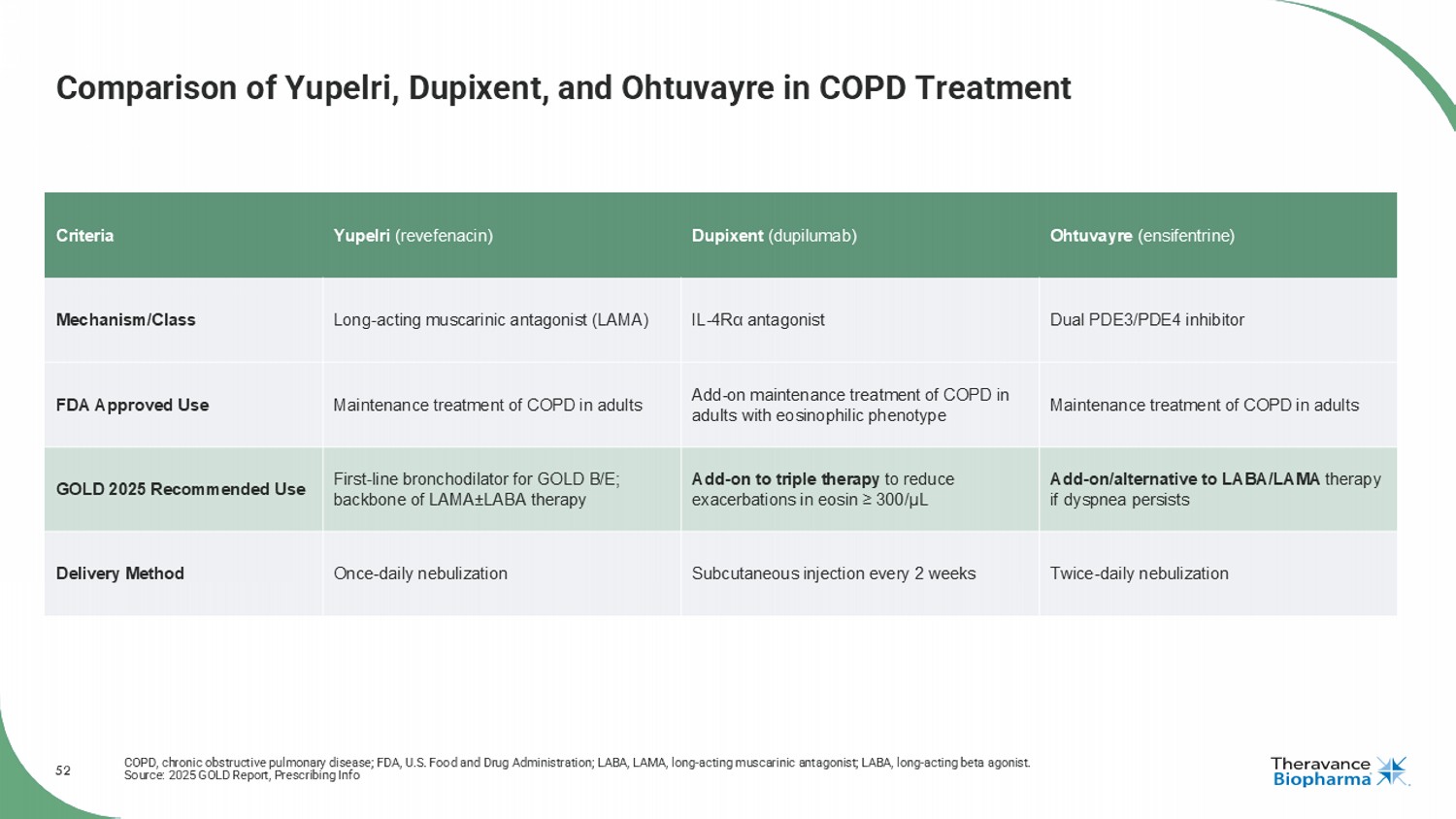

52 Comparison of Yupelri , Dupixent, and Ohtuvayre in COPD Treatment COPD, chronic obstructive pulmonary disease; FDA, U.S. Food and Drug Administration; LABA, LAMA, long - acting muscarinic antagonist; LABA, long - acting beta agonist. Source: 2025 GOLD Report, Prescribing Info Ohtuvayre ( ensifentrine ) Dupixent (dupilumab) Yupelri ( revefenacin ) Criteria Dual PDE3/PDE4 inhibitor IL - 4R α antagonist Long - acting muscarinic antagonist (LAMA) Mechanism/Class Maintenance treatment of COPD in adults Add - on maintenance treatment of COPD in adults with eosinophilic phenotype Maintenance treatment of COPD in adults FDA Approved Use Add - on/alternative to LABA/LAMA therapy if dyspnea persists Add - on to triple therapy to reduce exacerbations in eosin ≥ 300/ μL First - line bronchodilator for GOLD B/E; backbone of LAMA ± LABA therapy GOLD 2025 Recommended Use Twice - daily nebulization Subcutaneous injection every 2 weeks Once - daily nebulization Delivery Method

53 AMPRELOXETINE Appendix

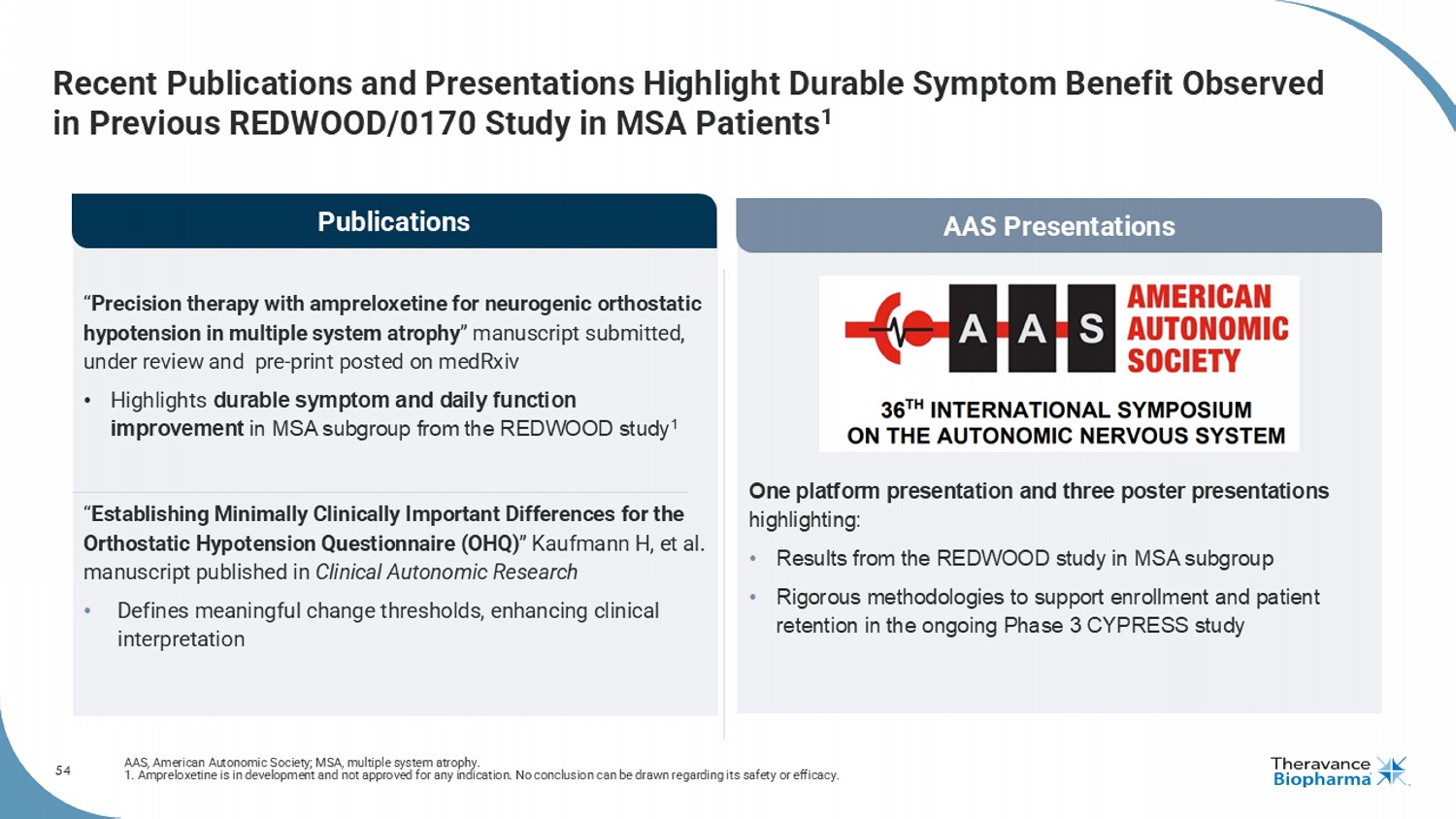

54 Recent Publications and Presentations Highlight Durable Symptom Benefit Observed in Previous REDWOOD/0170 Study in MSA Patients 1 AAS, American Autonomic Society; MSA, multiple system atrophy. 1. Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. Publications AAS Presentations “ Precision therapy with ampreloxetine for neurogenic orthostatic hypotension in multiple system atrophy ” manuscript submitted, under review and pre - print posted on medRxiv • Highlights durable symptom and daily function improvement in MSA subgroup from the REDWOOD study 1 “ Establishing Minimally Clinically Important Differences for the Orthostatic Hypotension Questionnaire (OHQ) ” Kaufmann H, et al. manuscript published in Clinical Autonomic Research • Defines meaningful change thresholds, enhancing clinical interpretation One platform presentation and three poster presentations highlighting: • Results from the REDWOOD study in MSA subgroup • Rigorous methodologies to support enrollment and patient retention in the ongoing Phase 3 CYPRESS study

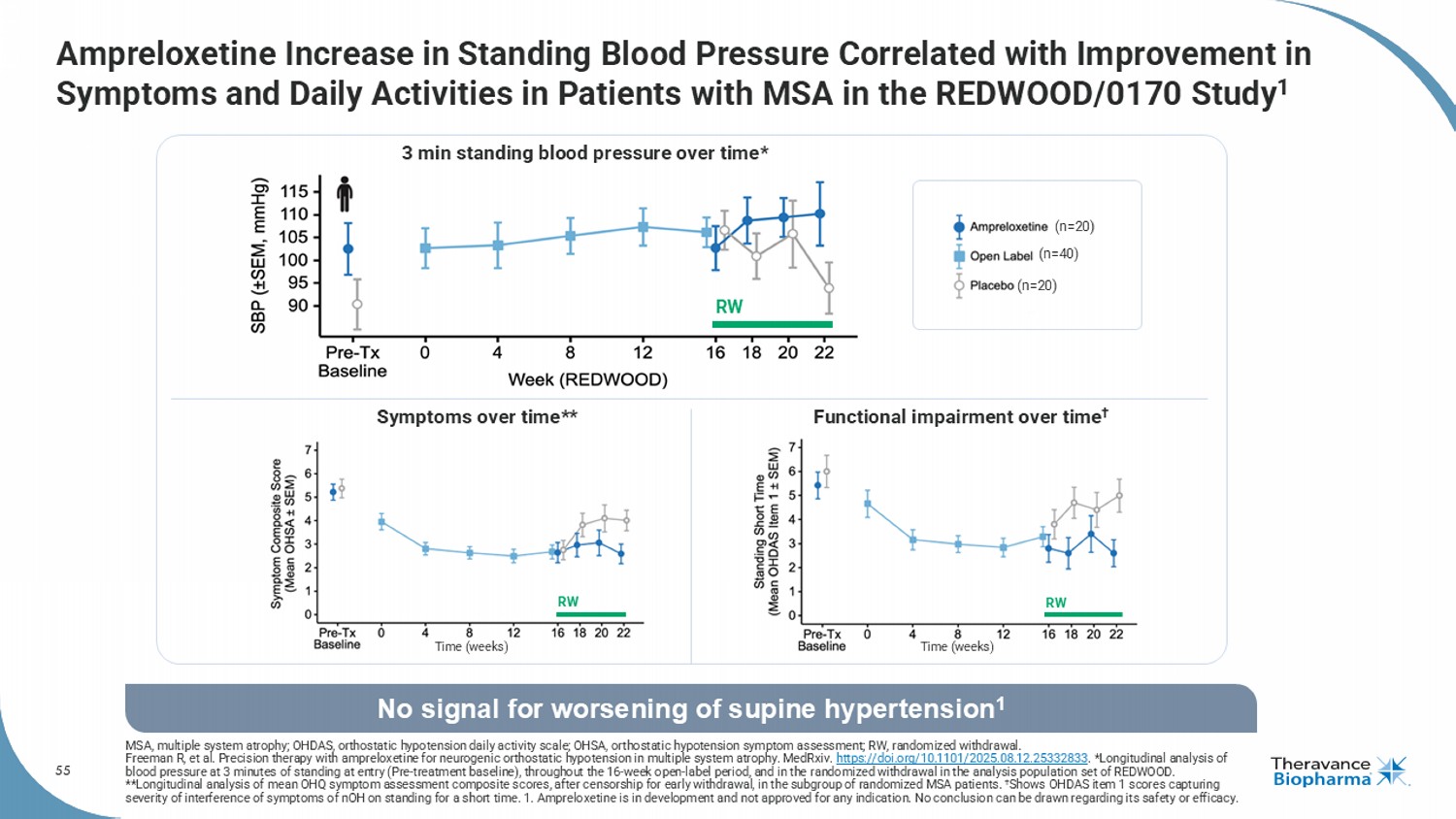

55 Ampreloxetine Increase in Standing Blood Pressure Correlated with Improvement in Symptoms and Daily Activities in Patients with MSA in the REDWOOD/0170 Study 1 MSA, multiple system atrophy; OHDAS, orthostatic hypotension daily activity scale; OHSA, orthostatic hypotension symptom assessment; RW, randomized withdrawal. Freeman R, et al. Precision therapy with ampreloxetine for neurogenic orthostatic hypotension in multiple system atrophy. MedRxiv . https://doi.org/10.1101/2025.08.12.25332833 . *Longitudinal analysis of blood pressure at 3 minutes of standing at entry (Pre - treatment baseline), throughout the 16 - week open - label period, and in the randomized withdrawal in the analysis population set of REDWOOD. **Longitudinal analysis of mean OHQ symptom assessment composite scores, after censorship for early withdrawal, in the subgro up of randomized MSA patients. † Shows OHDAS item 1 scores capturing severity of interference of symptoms of nOH on standing for a short time. 1. Ampreloxetine is in development and not approved for any indication. No conclusion can be drawn regarding its safety or efficacy. No signal for worsening of supine hypertension 1 (n=40) (n=20) (n=20) Time (weeks) Time (weeks) Symptoms over time** Functional impairment over time † 3 min standing blood pressure over time* RW RW RW

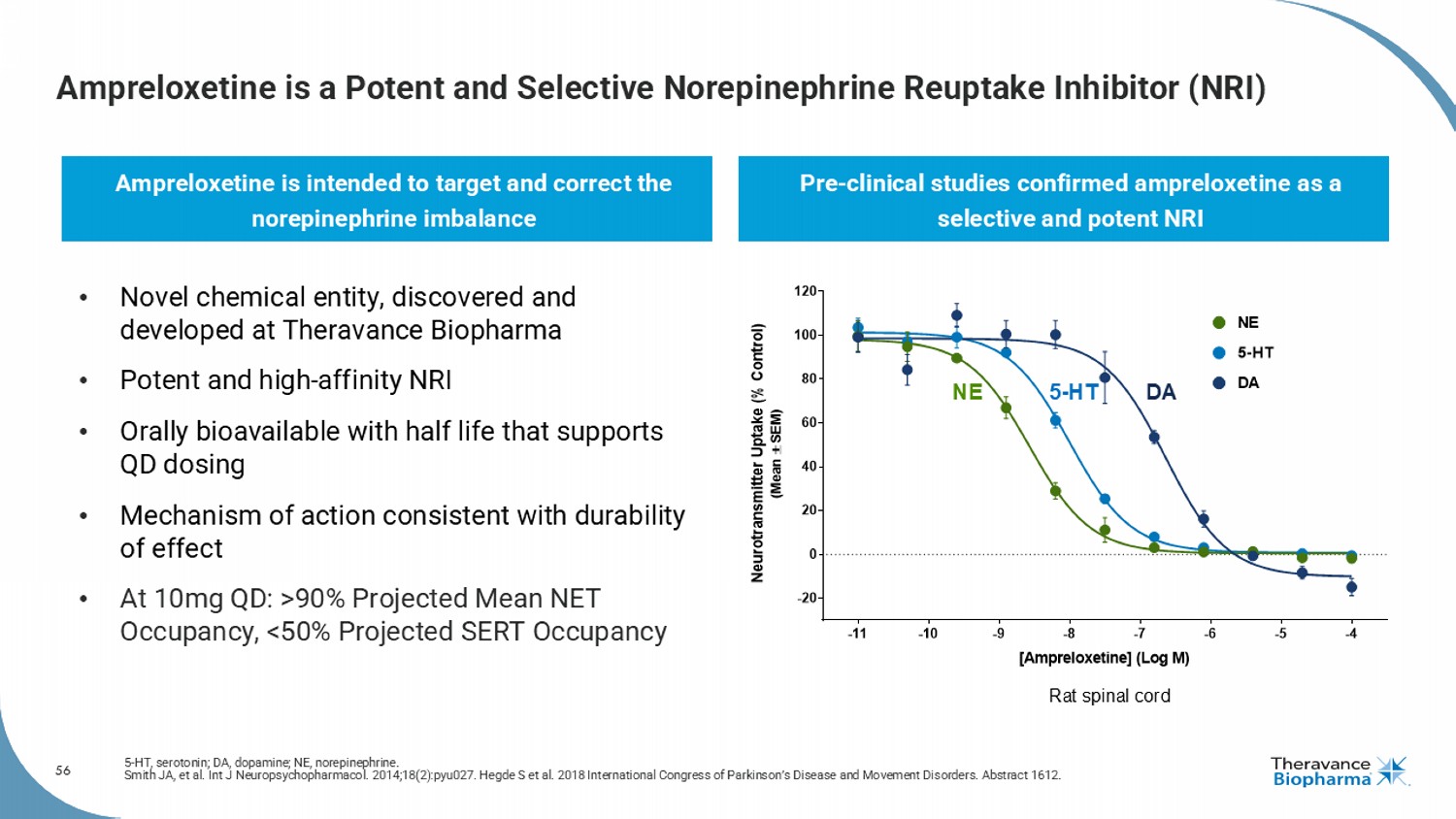

56 Ampreloxetine is a Potent and Selective Norepinephrine Reuptake Inhibitor (NRI) 5 - HT, serotonin; DA, dopamine; NE, norepinephrine. Smith JA, et al. Int J Neuropsychopharmacol . 2014;18(2):pyu027. Hegde S et al. 2018 International Congress of Parkinson’s Disease and Movement Disorders. Abstract 1612. Ampreloxetine is intended to target and correct the norepinephrine imbalance Pre - clinical studies confirmed ampreloxetine as a selective and potent NRI Rat spinal cord NE 5 - HT DA -11 -10 -9 -8 -7 -6 -5 -4 -20 0 20 40 60 80 100 120 [Ampreloxetine] (Log M) N e u r o t r a n s m i t t e r U p t a k e ( % C o n t r o l ) ( M e a n S E M ) DA NE 5-HT • Novel chemical entity, discovered and developed at Theravance Biopharma • Potent and high - affinity NRI • Orally bioavailable with half life that supports QD dosing • Mechanism of action consistent with durability of effect • At 10mg QD: >90% Projected Mean NET Occupancy, <50% Projected SERT Occupancy

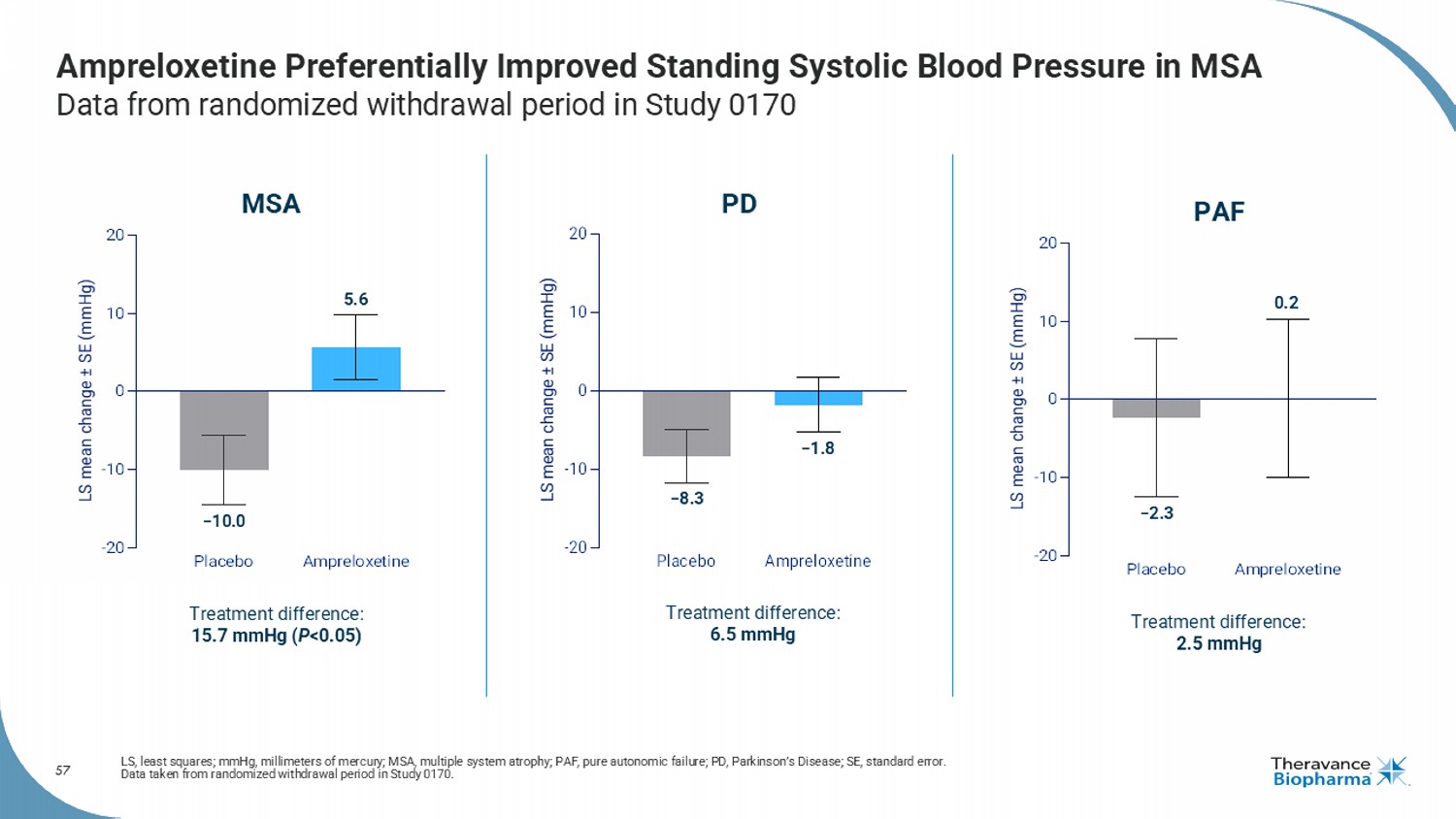

57 Ampreloxetine Preferentially Improved Standing Systolic Blood Pressure in MSA Data from randomized withdrawal period in Study 0170 LS, least squares; mmHg, millimeters of mercury; MSA, multiple system atrophy; PAF, pure autonomic failure; PD, Parkinson’s D ise ase; SE, standard error. Data taken from randomized withdrawal period in Study 0170. Placebo Ampreloxetine -20 -10 0 10 20 LS mean change ± SE (mmHg) MSA Treatment difference: 15.7 mmHg ( P <0.05) −10.0 5.6 Placebo Ampreloxetine -20 -10 0 10 20 LS mean change ± SE (mmHg) Treatment difference: 6.5 mmHg PD −8.3 −1.8 Treatment difference: 2.5 mmHg PAF −2.3 0.2

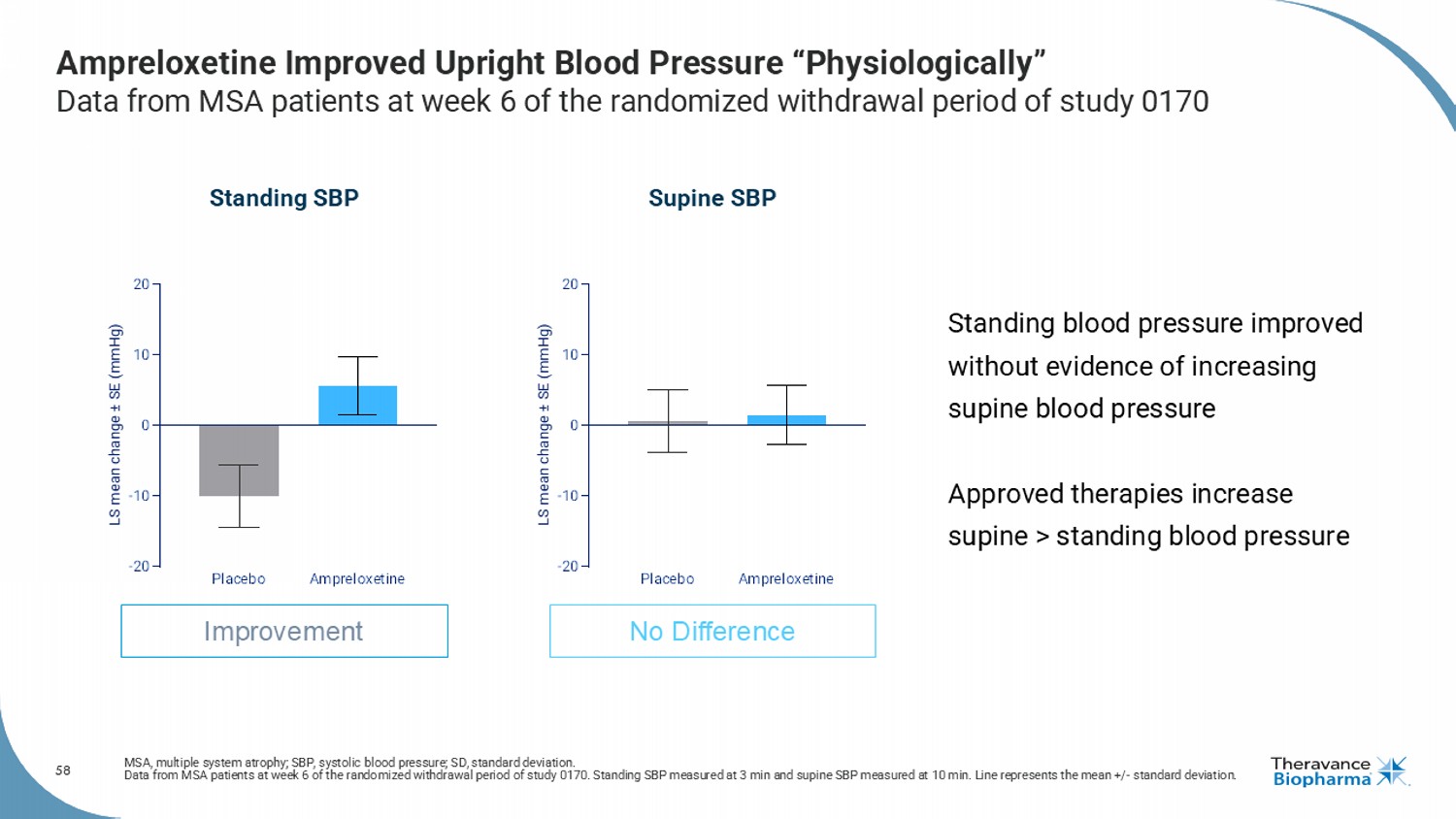

58 Ampreloxetine Improved Upright Blood Pressure “Physiologically” Data from MSA patients at week 6 of the randomized withdrawal period of study 0170 MSA, multiple system atrophy; SBP, systolic blood pressure; SD, standard deviation. Data from MSA patients at week 6 of the randomized withdrawal period of study 0170. Standing SBP measured at 3 min and supine SB P measured at 10 min. Line represents the mean +/ - standard deviation. Standing SBP Supine SBP Improvement No Difference Placebo Ampreloxetine -20 -10 0 10 20 LS mean change ± SE (mmHg) Placebo Ampreloxetine -20 -10 0 10 20 LS mean change ± SE (mmHg) Standing blood pressure improved without evidence of increasing supine blood pressure Approved therapies increase supine > standing blood pressure

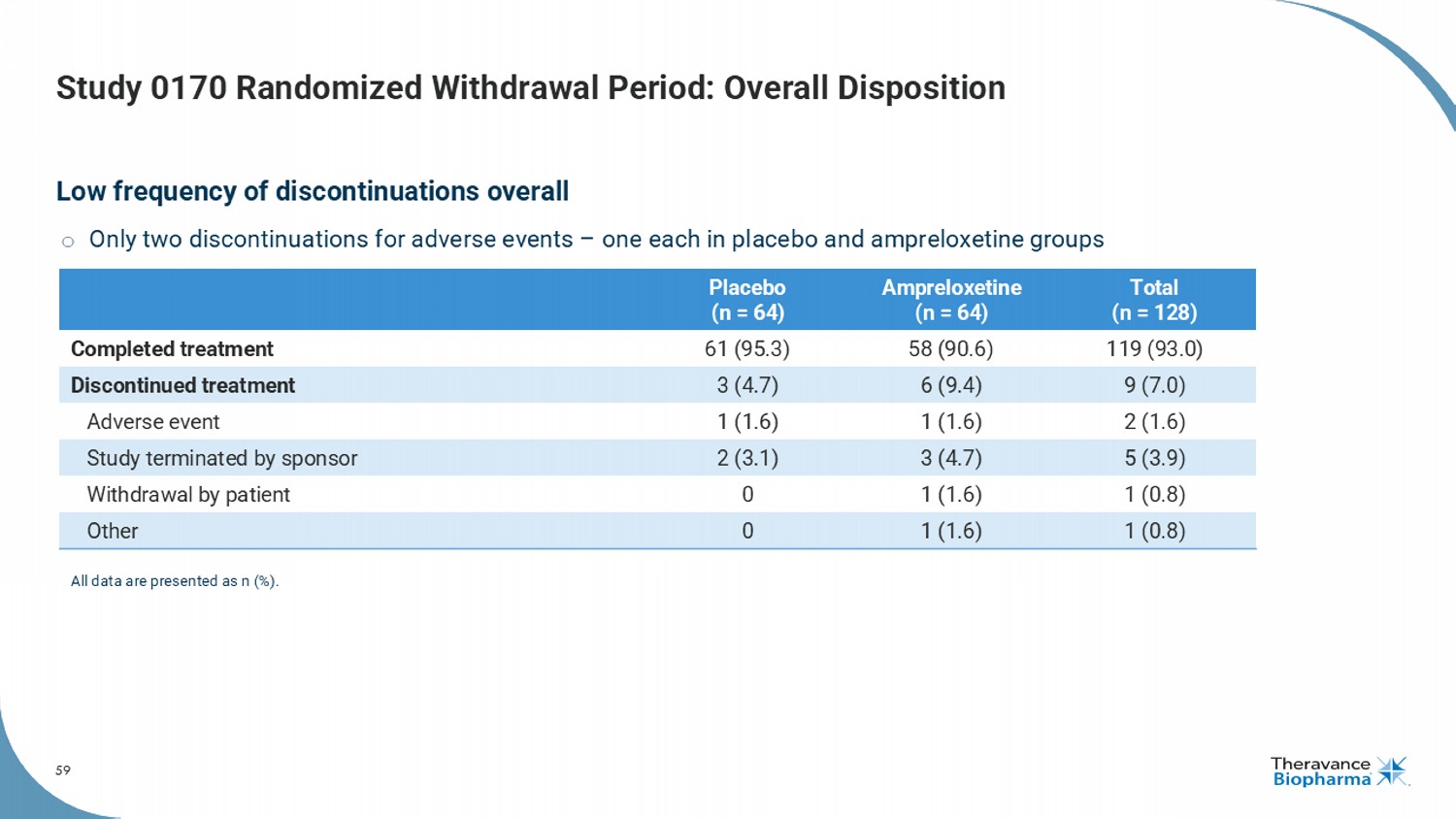

59 Study 0170 Randomized Withdrawal Period: Overall Disposition Low frequency of discontinuations overall o Only two discontinuations for adverse events – one each in placebo and ampreloxetine groups Total (n = 128) Ampreloxetine (n = 64) Placebo (n = 64) 119 (93.0) 58 (90.6) 61 (95.3) Completed treatment 9 (7.0) 6 (9.4) 3 (4.7) Discontinued treatment 2 (1.6) 1 (1.6) 1 (1.6) Adverse event 5 (3.9) 3 (4.7) 2 (3.1) Study terminated by sponsor 1 (0.8) 1 (1.6) 0 Withdrawal by patient 1 (0.8) 1 (1.6) 0 Other All data are presented as n (%).

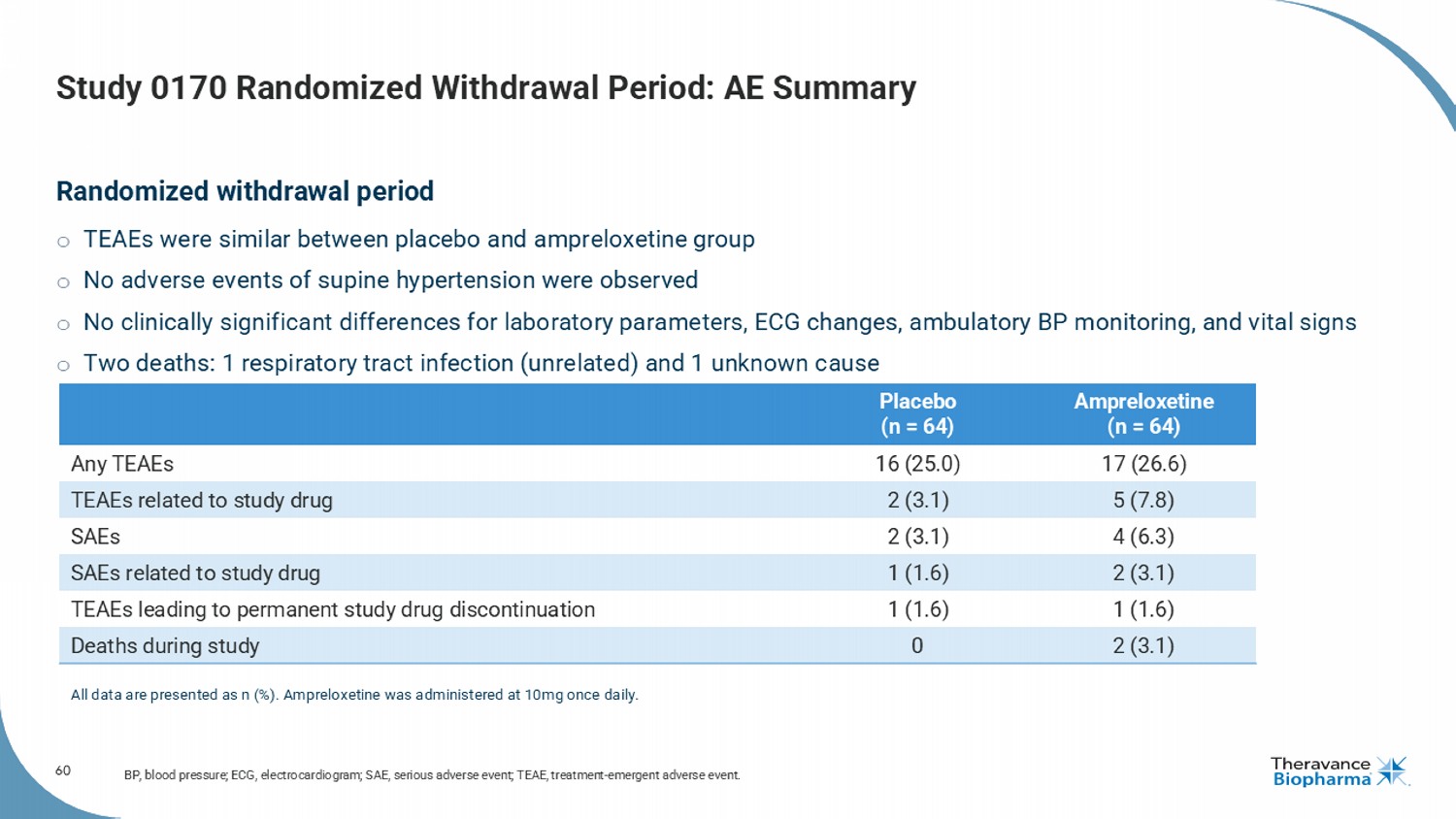

60 Study 0170 Randomized Withdrawal Period: AE Summary Randomized withdrawal period o TEAEs were similar between placebo and ampreloxetine group o No adverse events of supine hypertension were observed o No clinically significant differences for laboratory parameters, ECG changes, ambulatory BP monitoring, and vital signs o Two deaths: 1 respiratory tract infection (unrelated) and 1 unknown cause BP, blood pressure; ECG, electrocardiogram; SAE, serious adverse event; TEAE, treatment - emergent adverse event. Ampreloxetine (n = 64) Placebo (n = 64) 17 (26.6) 16 (25.0) Any TEAEs 5 (7.8) 2 (3.1) TEAEs related to study drug 4 (6.3) 2 (3.1) SAEs 2 (3.1) 1 (1.6) SAEs related to study drug 1 (1.6) 1 (1.6) TEAEs leading to permanent study drug discontinuation 2 (3.1) 0 Deaths during study All data are presented as n (%). Ampreloxetine was administered at 10mg once daily.

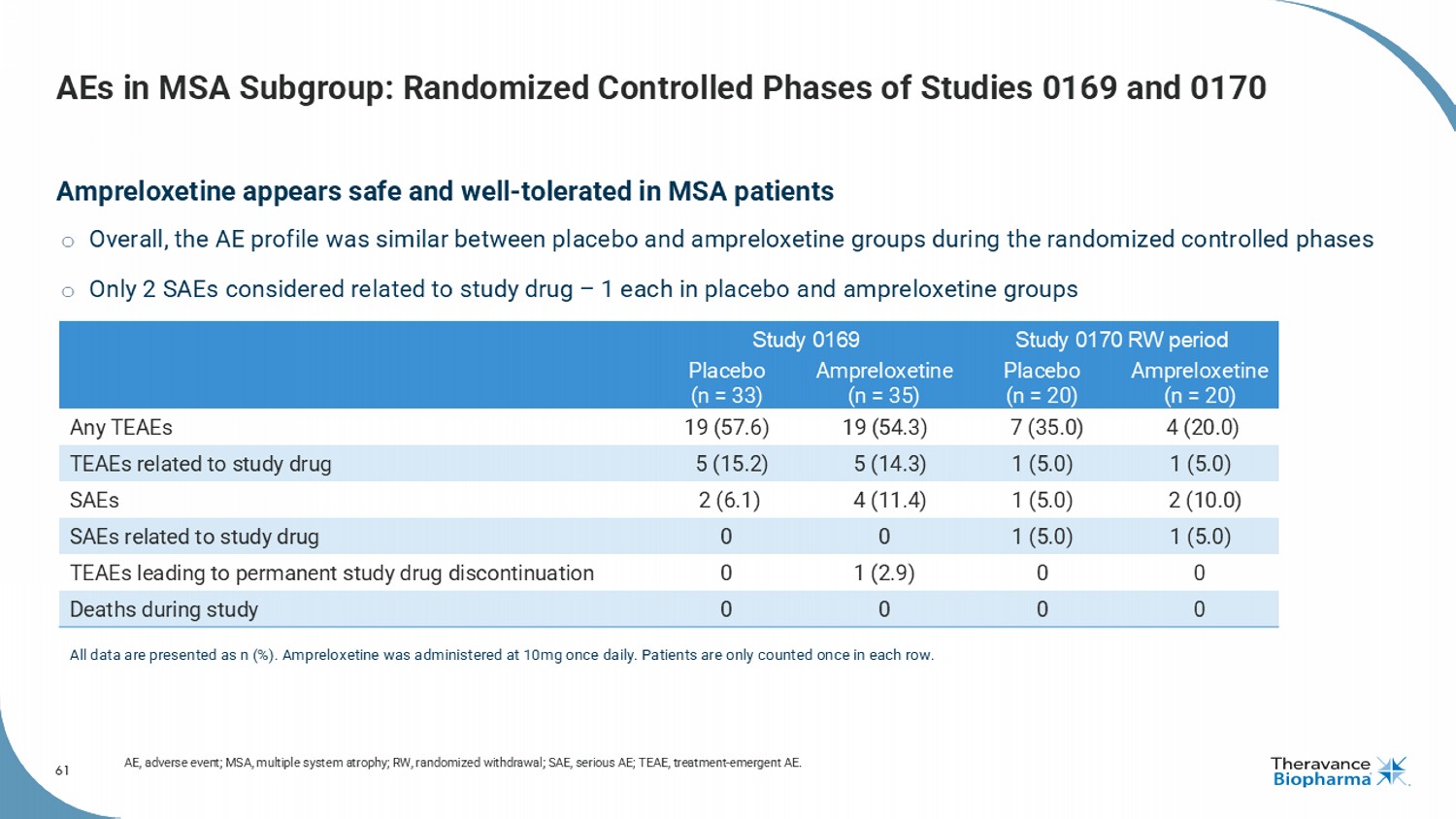

61 AEs in MSA Subgroup: Randomized Controlled Phases of Studies 0169 and 0170 Ampreloxetine appears safe and well - tolerated in MSA patients o Overall, the AE profile was similar between placebo and ampreloxetine groups during the randomized controlled phases o Only 2 SAEs considered related to study drug – 1 each in placebo and ampreloxetine groups AE, adverse event; MSA, multiple system atrophy; RW, randomized withdrawal; SAE, serious AE; TEAE, treatment - emergent AE. Study 0170 RW period Study 0169 Ampreloxetine (n = 20) Placebo (n = 20) Ampreloxetine (n = 35) Placebo (n = 33) 4 (20.0) 7 (35.0) 19 (54.3) 19 (57.6) Any TEAEs 1 (5.0) 1 (5.0) 5 (14.3) 5 (15.2) TEAEs related to study drug 2 (10.0) 1 (5.0) 4 (11.4) 2 (6.1) SAEs 1 (5.0) 1 (5.0) 0 0 SAEs related to study drug 0 0 1 (2.9) 0 TEAEs leading to permanent study drug discontinuation 0 0 0 0 Deaths during study All data are presented as n (%). Ampreloxetine was administered at 10mg once daily. Patients are only counted once in each ro w.

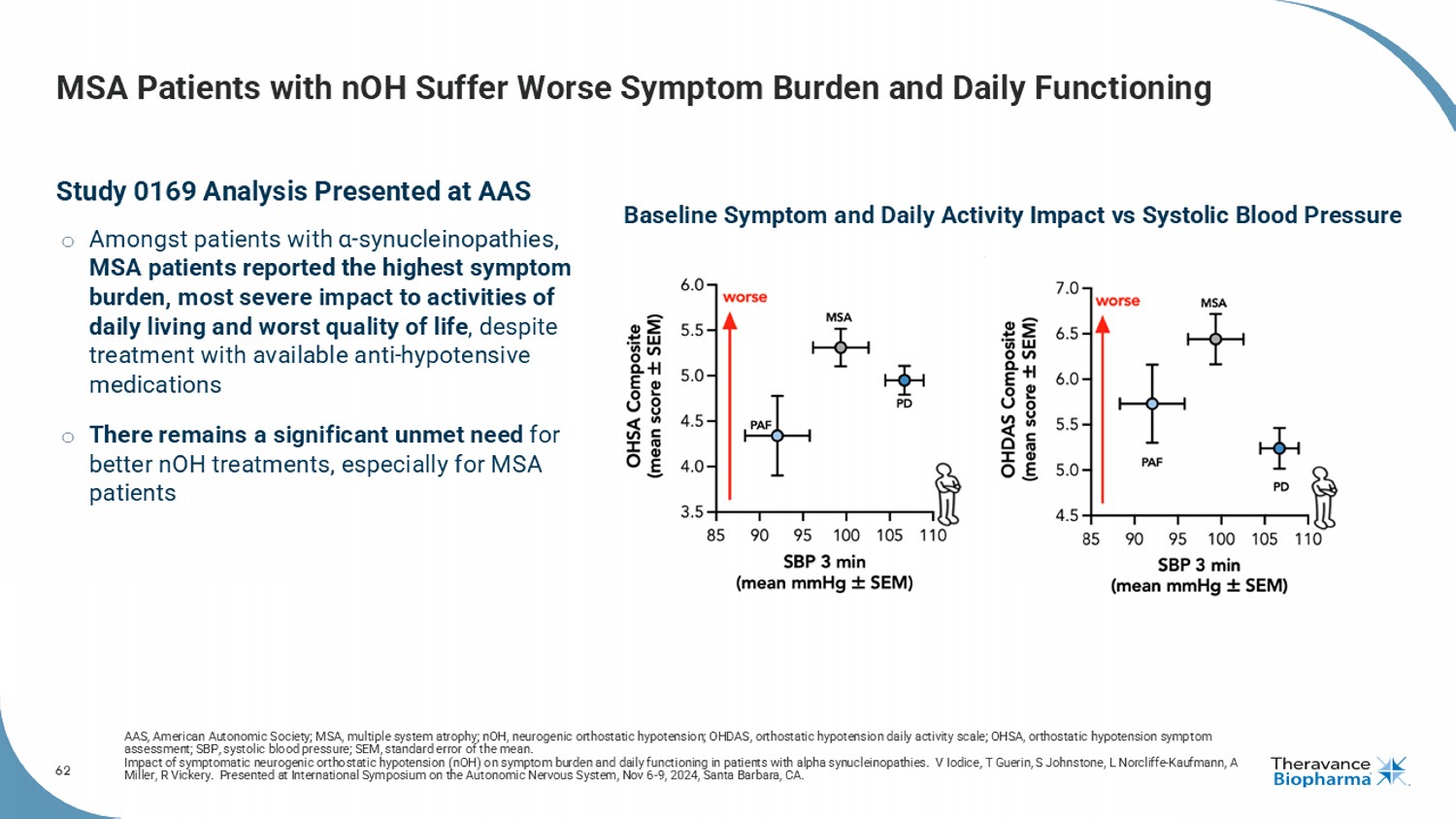

62 MSA Patients with nOH Suffer Worse Symptom Burden and Daily Functioning Study 0169 Analysis Presented at AAS o Amongst patients with α - synucleinopathies , MSA patients reported the highest symptom burden, most severe impact to activities of daily living and worst quality of life , despite treatment with available anti - hypotensive medications o There remains a significant unmet need for better nOH treatments, especially for MSA patients AAS, American Autonomic Society; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHDAS, orthostatic hypotension daily activity scale; OHSA, orthostatic hypotension symp tom assessment; SBP, systolic blood pressure; SEM, standard error of the mean. Impact of symptomatic neurogenic orthostatic hypotension ( nOH ) on symptom burden and daily functioning in patients with alpha synucleinopathies . V Iodice, T Guerin, S Johnstone, L Norcliffe - Kaufmann, A Miller, R Vickery. Presented at International Symposium on the Autonomic Nervous System, Nov 6 - 9, 2024, Santa Barbara, CA. Baseline Symptom and Daily Activity Impact vs Systolic Blood Pressure