First-in-disease therapies for patients with rare diseases Corporate Presentation January 2026

Forward Looking Statements This presentation contains forward-looking statements of Palvella Therapeutics, Inc. (“the Company”) within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts, and in some cases, can be identified by terms such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements contained in this presentation include, but are not limited to, statements regarding the Company’s future financial or business performance, conditions, plans, prospects, trends or strategies and other financial and business matters, the Company’s current and prospective product candidates and any additional indications or platform candidates, the Company's planned research and development activities, the Company's planned clinical trials, including timing of receipt of data from the same, the planned regulatory framework for the Company's product candidates, the strength of the Company's intellectual property portfolio, and projections of the Company’s future financial results and other metrics. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon current estimates and assumptions of the Company and its management and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this presentation. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: competition, the ability of the Company to grow and manage growth, maintain relationships with suppliers and retain its management and key employees; the success, cost and timing of the Company’s product development activities, studies and clinical trials; changes in applicable laws or regulations; the possibility that the Company may be adversely affected by other economic, business or competitive factors; the Company’s estimates of expenses and profitability; the evolution of the markets in which the Company competes; the ability of the Company to implement its strategic initiatives and continue to innovate its existing products; and the ability of the Company to defend its intellectual property. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. Industry and Market Data The Company may from time to time provide estimates, projections and other information concerning its industry, the general business environment, and the markets for certain conditions, including estimates regarding the potential size of those markets and the estimated incidence and prevalence of certain medical conditions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events, circumstances or numbers, including actual disease prevalence rates and market size, may differ materially from the information reflected in this presentation. Unless otherwise expressly stated, we obtained this industry, business information, market data, prevalence information and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources, in some cases applying our own assumptions and analysis that may, in the future, prove not to have been accurate. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

PALVELLA (pɑlʋelːɑ, Finnish): TO SERVE Building the leading rare disease biopharma company focused on developing and commercializing first-in-disease therapies for serious, rare skin diseases and vascular malformations

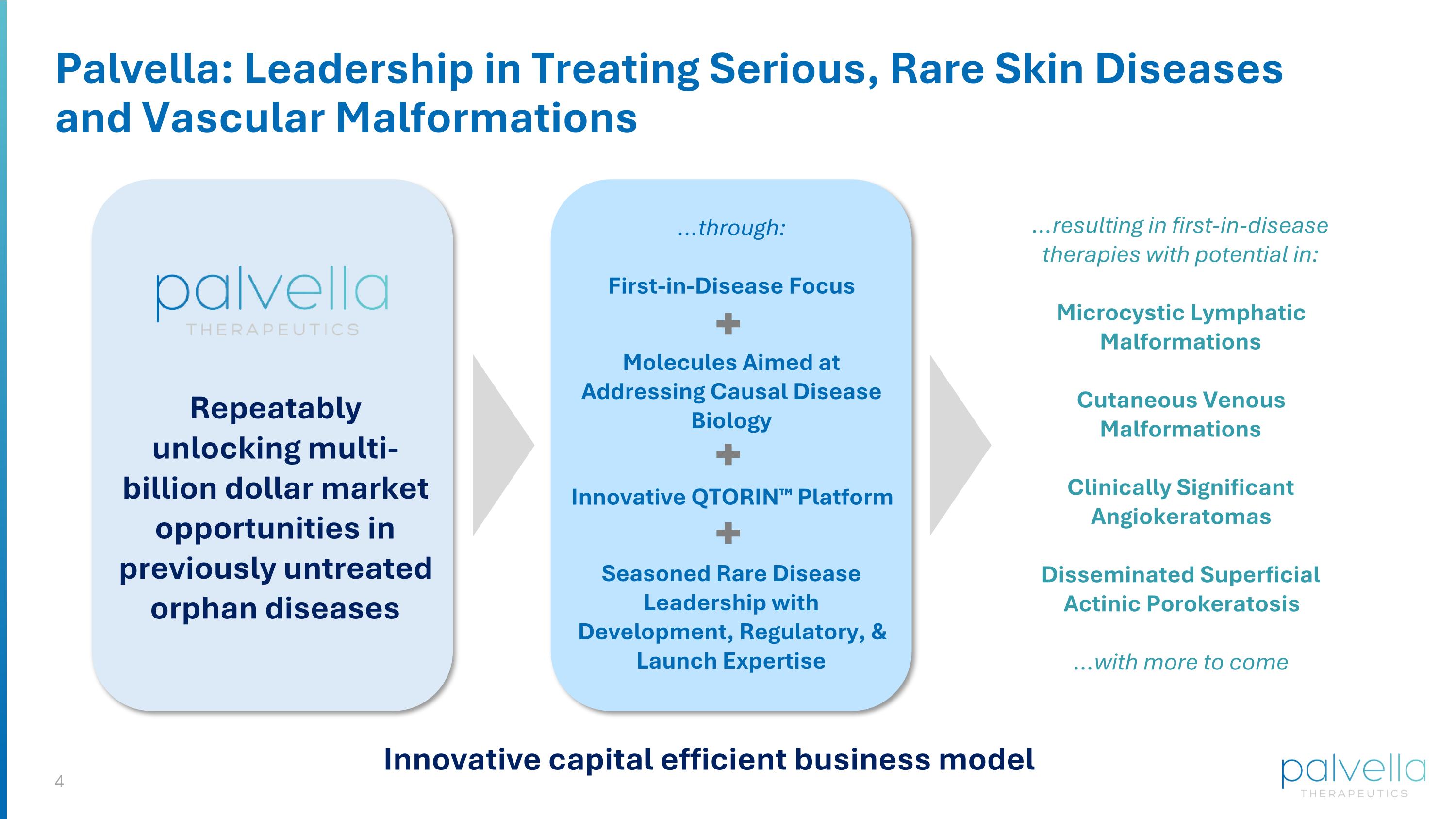

Palvella: Leadership in Treating Serious, Rare Skin Diseases and Vascular Malformations Repeatably unlocking multi-billion dollar market opportunities in previously untreated orphan diseases …through: First-in-Disease Focus Molecules Aimed at Addressing Causal Disease Biology Innovative QTORIN™ Platform Seasoned Rare Disease Leadership with Development, Regulatory, & Launch Expertise …resulting in first-in-disease therapies with potential in: Microcystic Lymphatic Malformations Cutaneous Venous Malformations Clinically Significant Angiokeratomas Disseminated Superficial Actinic Porokeratosis …with more to come Innovative capital efficient business model

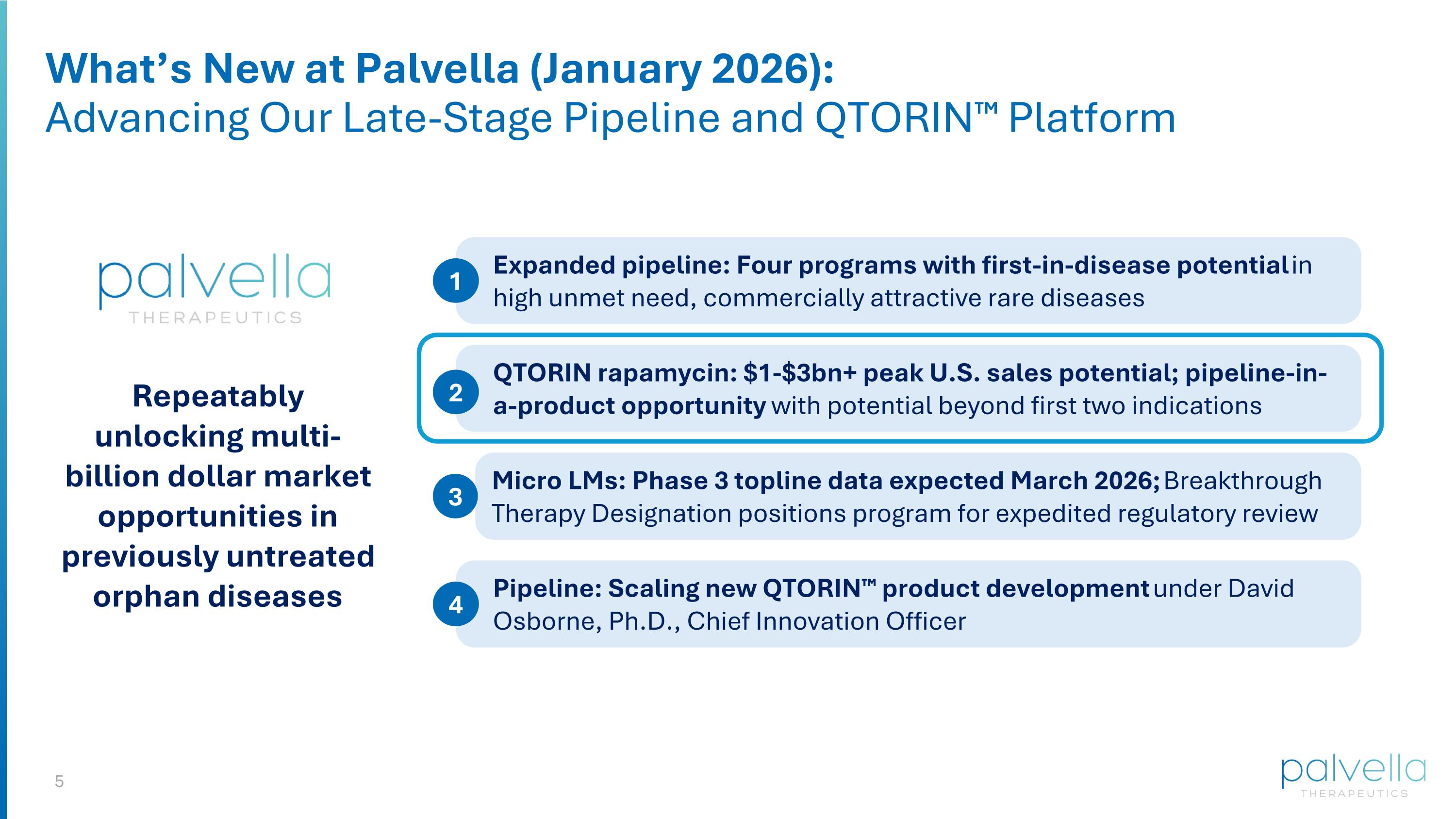

What’s New at Palvella (January 2026): Advancing Our Late-Stage Pipeline and QTORIN™ Platform Expanded pipeline: Four programs with first-in-disease potential in high unmet need, commercially attractive rare diseases 1 QTORIN rapamycin: $1-$3bn+ peak U.S. sales potential; pipeline-in-a-product opportunity with potential beyond first two indications 2 Micro LMs: Phase 3 topline data expected March 2026; Breakthrough Therapy Designation positions program for expedited regulatory review 3 Pipeline: Scaling new QTORIN™ product development under David Osborne, Ph.D., Chief Innovation Officer 4 Repeatably unlocking multi-billion dollar market opportunities in previously untreated orphan diseases

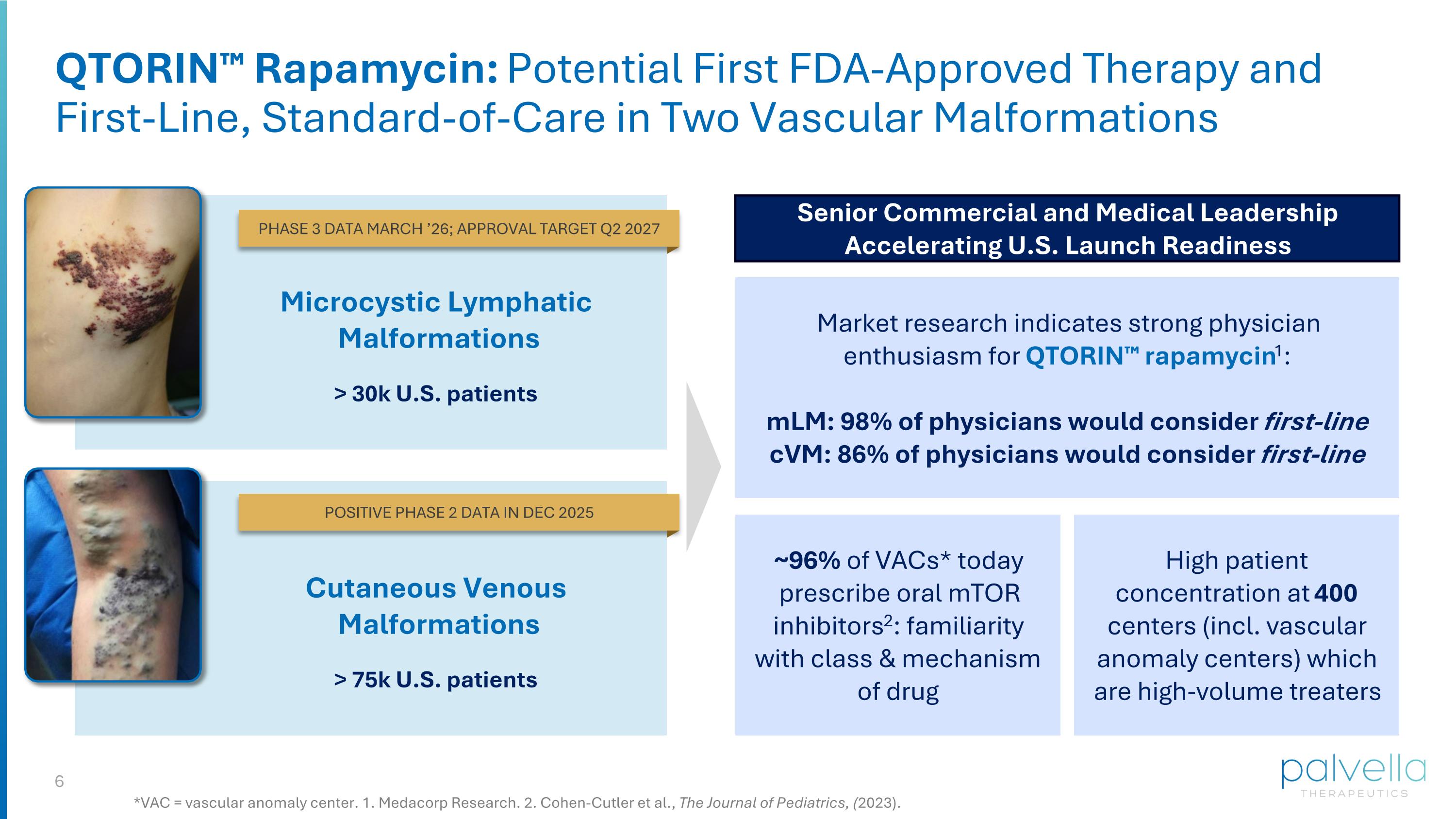

QTORIN™ Rapamycin: Potential First FDA-Approved Therapy and First-Line, Standard-of-Care in Two Vascular Malformations Microcystic Lymphatic Malformations > 30k U.S. patients Senior Commercial and Medical Leadership Accelerating U.S. Launch Readiness Market research indicates strong physician enthusiasm for QTORIN™ rapamycin1: mLM: 98% of physicians would consider first-line cVM: 86% of physicians would consider first-line High patient concentration at 400 centers (incl. vascular anomaly centers) which are high-volume treaters ~96% of VACs* today prescribe oral mTOR inhibitors2: familiarity with class & mechanism of drug *VAC = vascular anomaly center. 1. Medacorp Research. 2. Cohen-Cutler et al., The Journal of Pediatrics, (2023). Cutaneous Venous Malformations > 75k U.S. patients PHASE 3 DATA MARCH ’26; APPROVAL TARGET Q2 2027 POSITIVE PHASE 2 DATA IN DEC 2025

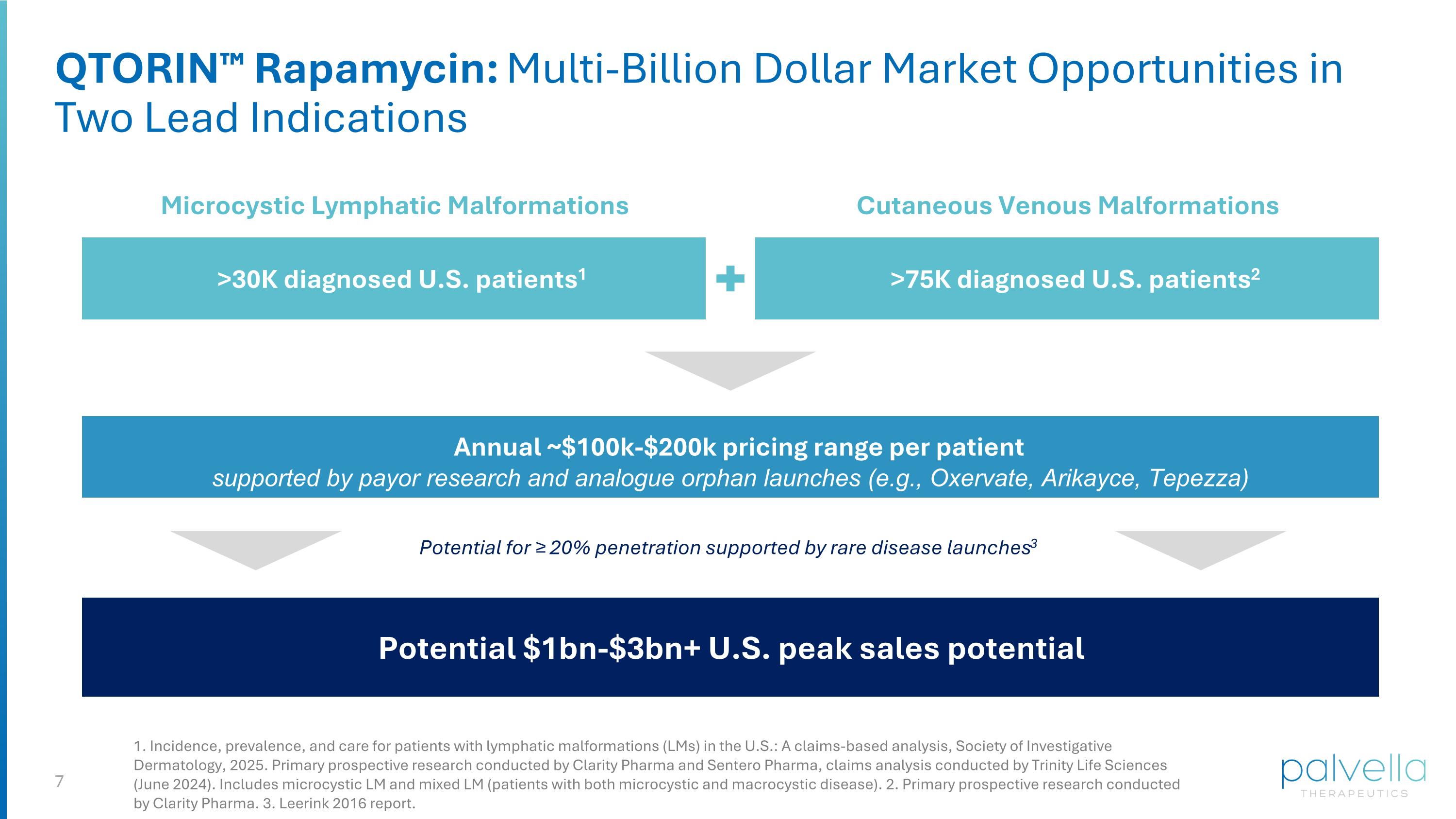

QTORIN™ Rapamycin: Multi-Billion Dollar Market Opportunities in Two Lead Indications >75K diagnosed U.S. patients2 Cutaneous Venous Malformations Potential $1bn-$3bn+ U.S. peak sales potential >30K diagnosed U.S. patients1 Microcystic Lymphatic Malformations Annual ~$100k-$200k pricing range per patient supported by payor research and analogue orphan launches (e.g., Oxervate, Arikayce, Tepezza) 1. Incidence, prevalence, and care for patients with lymphatic malformations (LMs) in the U.S.: A claims-based analysis, Society of Investigative Dermatology, 2025. Primary prospective research conducted by Clarity Pharma and Sentero Pharma, claims analysis conducted by Trinity Life Sciences (June 2024). Includes microcystic LM and mixed LM (patients with both microcystic and macrocystic disease). 2. Primary prospective research conducted by Clarity Pharma. 3. Leerink 2016 report. Potential for ≥ 20% penetration supported by rare disease launches3

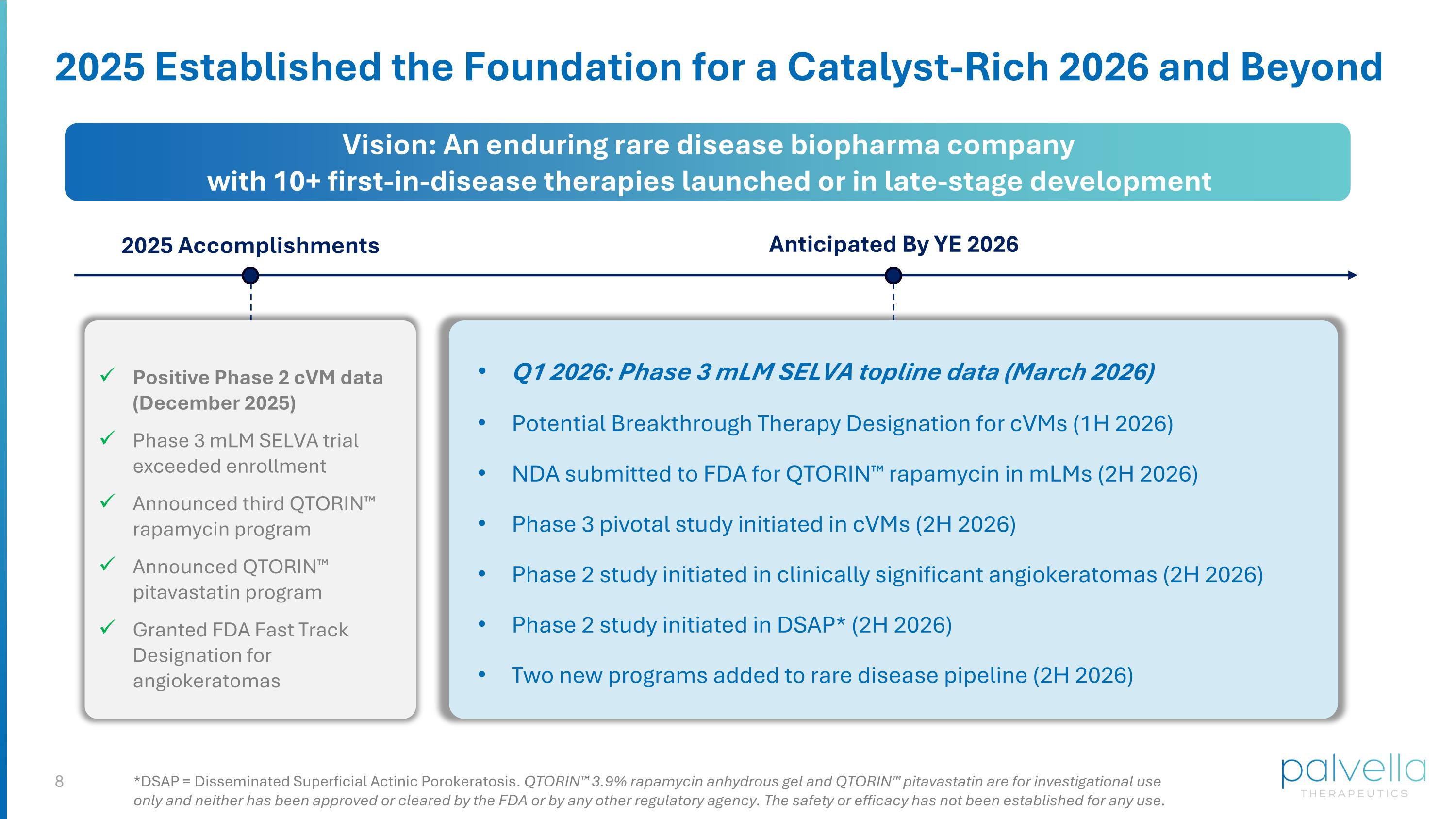

2025 Established the Foundation for a Catalyst-Rich 2026 and Beyond 2025 Accomplishments Anticipated By YE 2026 Vision: An enduring rare disease biopharma company with 10+ first-in-disease therapies launched or in late-stage development Positive Phase 2 cVM data (December 2025) Phase 3 mLM SELVA trial exceeded enrollment Announced third QTORIN™ rapamycin program Announced QTORIN™ pitavastatin program Granted FDA Fast Track Designation for angiokeratomas Q1 2026: Phase 3 mLM SELVA topline data (March 2026) Potential Breakthrough Therapy Designation for cVMs (1H 2026) NDA submitted to FDA for QTORIN™ rapamycin in mLMs (2H 2026) Phase 3 pivotal study initiated in cVMs (2H 2026) Phase 2 study initiated in clinically significant angiokeratomas (2H 2026) Phase 2 study initiated in DSAP* (2H 2026) Two new programs added to rare disease pipeline (2H 2026) *DSAP = Disseminated Superficial Actinic Porokeratosis. QTORIN™ 3.9% rapamycin anhydrous gel and QTORIN™ pitavastatin are for investigational use only and neither has been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use.

OUR LEAD PRODUCT CANDIDATE QTORIN™ 3.9% RAPAMYCIN ANHYDROUS GEL

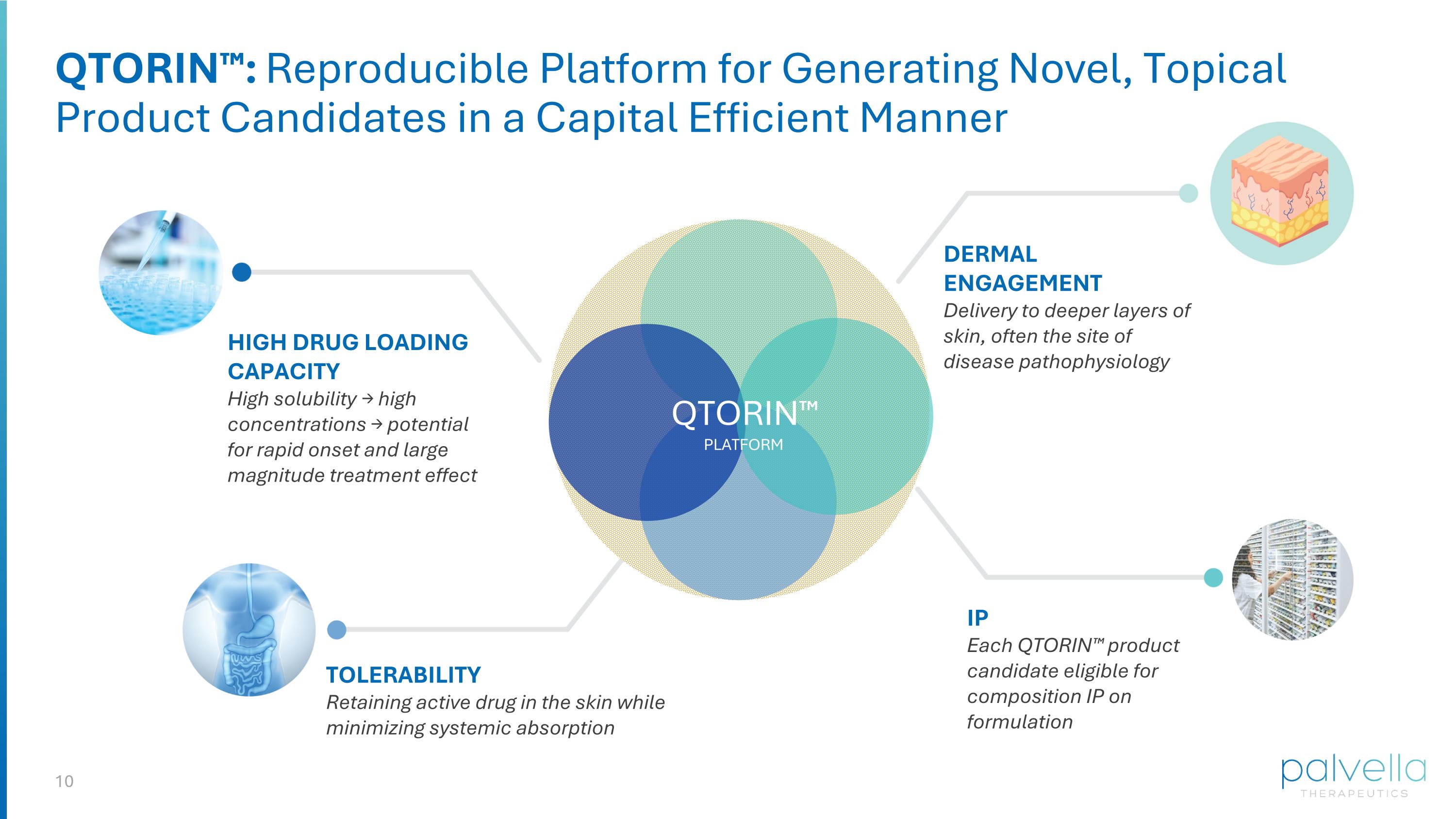

HIGH DRUG LOADING CAPACITY High solubility → high concentrations → potential for rapid onset and large magnitude treatment effect TOLERABILITY Retaining active drug in the skin while minimizing systemic absorption DERMAL ENGAGEMENT Delivery to deeper layers of skin, often the site of disease pathophysiology IP Each QTORIN™ product candidate eligible for composition IP on formulation QTORIN™: Reproducible Platform for Generating Novel, Topical Product Candidates in a Capital Efficient Manner QTORIN™ PLATFORM

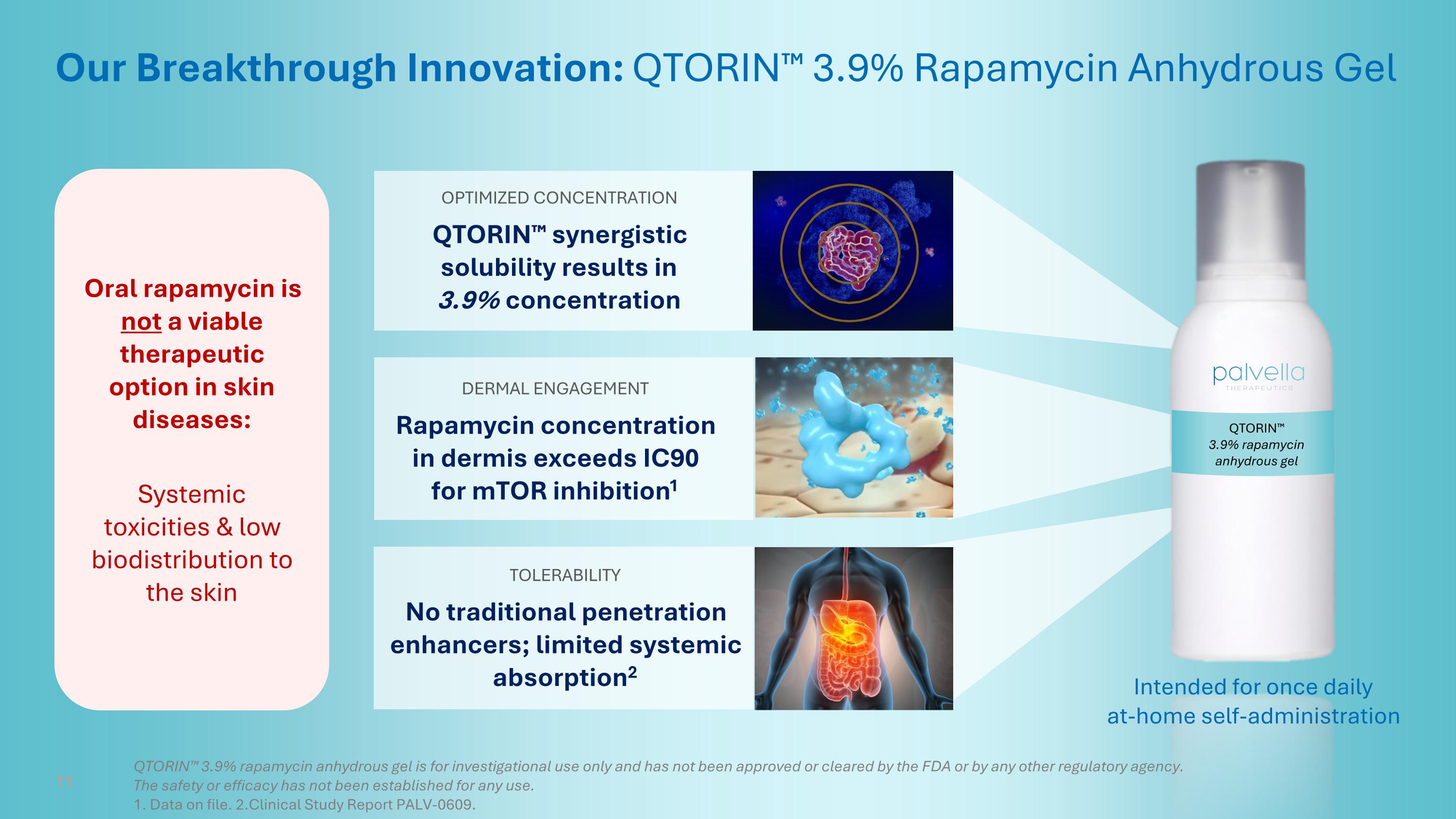

QTORIN™ 3.9% rapamycin anhydrous gel Our Breakthrough Innovation: QTORIN™ 3.9% Rapamycin Anhydrous Gel DERMAL ENGAGEMENT Rapamycin concentration in dermis exceeds IC90 for mTOR inhibition1 OPTIMIZED CONCENTRATION QTORIN™ synergistic solubility results in 3.9% concentration TOLERABILITY No traditional penetration enhancers; limited systemic absorption2 Intended for once daily at-home self-administration 11 QTORIN™ 3.9% rapamycin anhydrous gel is for investigational use only and has not been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use. 1. Data on file. 2.Clinical Study Report PALV-0609. Oral rapamycin is not a viable therapeutic option in skin diseases: Systemic toxicities & low biodistribution to the skin

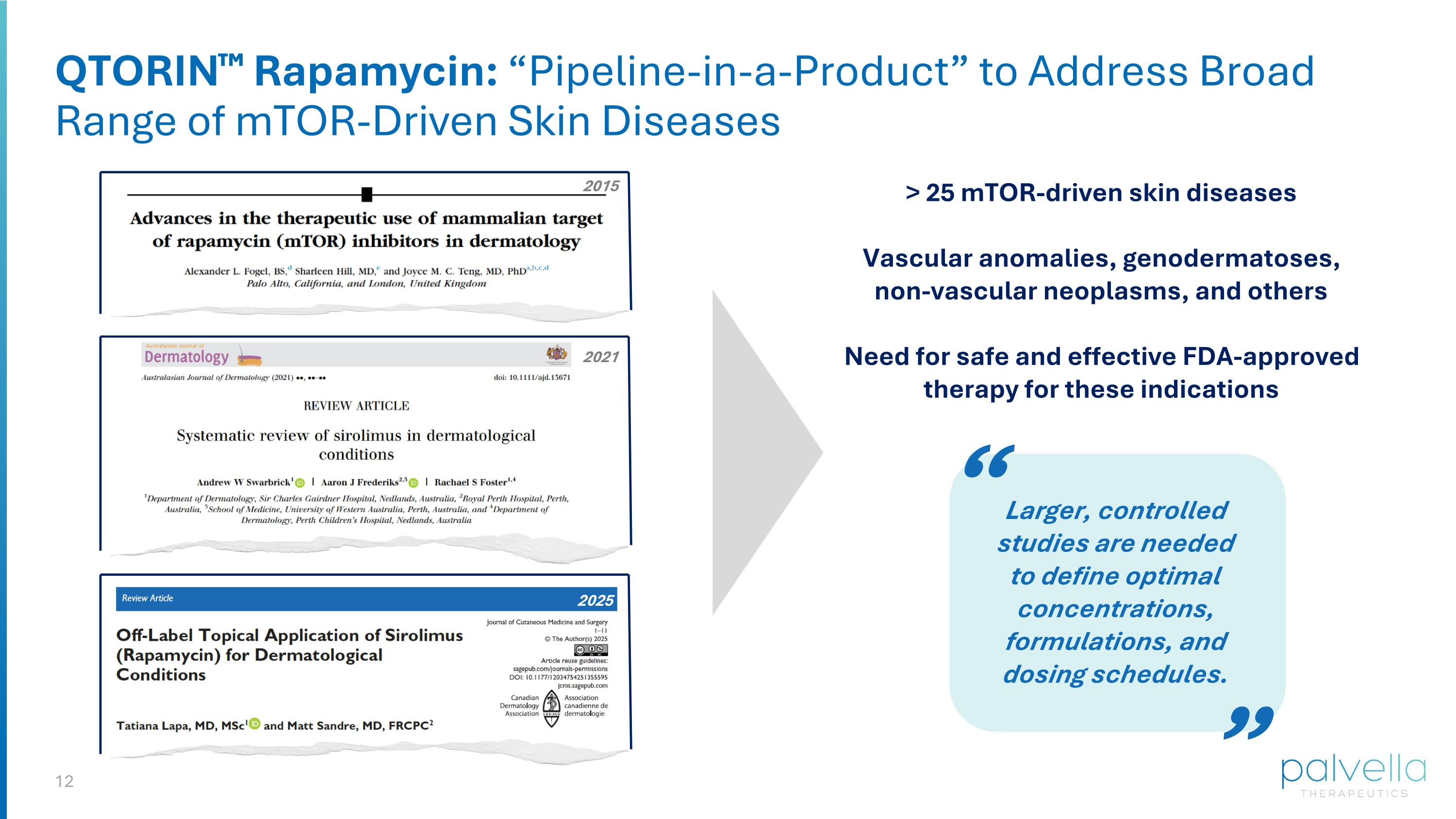

QTORIN™ Rapamycin: “Pipeline-in-a-Product” to Address Broad Range of mTOR-Driven Skin Diseases Larger, controlled studies are needed to define optimal concentrations, formulations, and dosing schedules. “ “ > 25 mTOR-driven skin diseases Vascular anomalies, genodermatoses, non-vascular neoplasms, and others Need for safe and effective FDA-approved therapy for these indications 2015 2021 2025

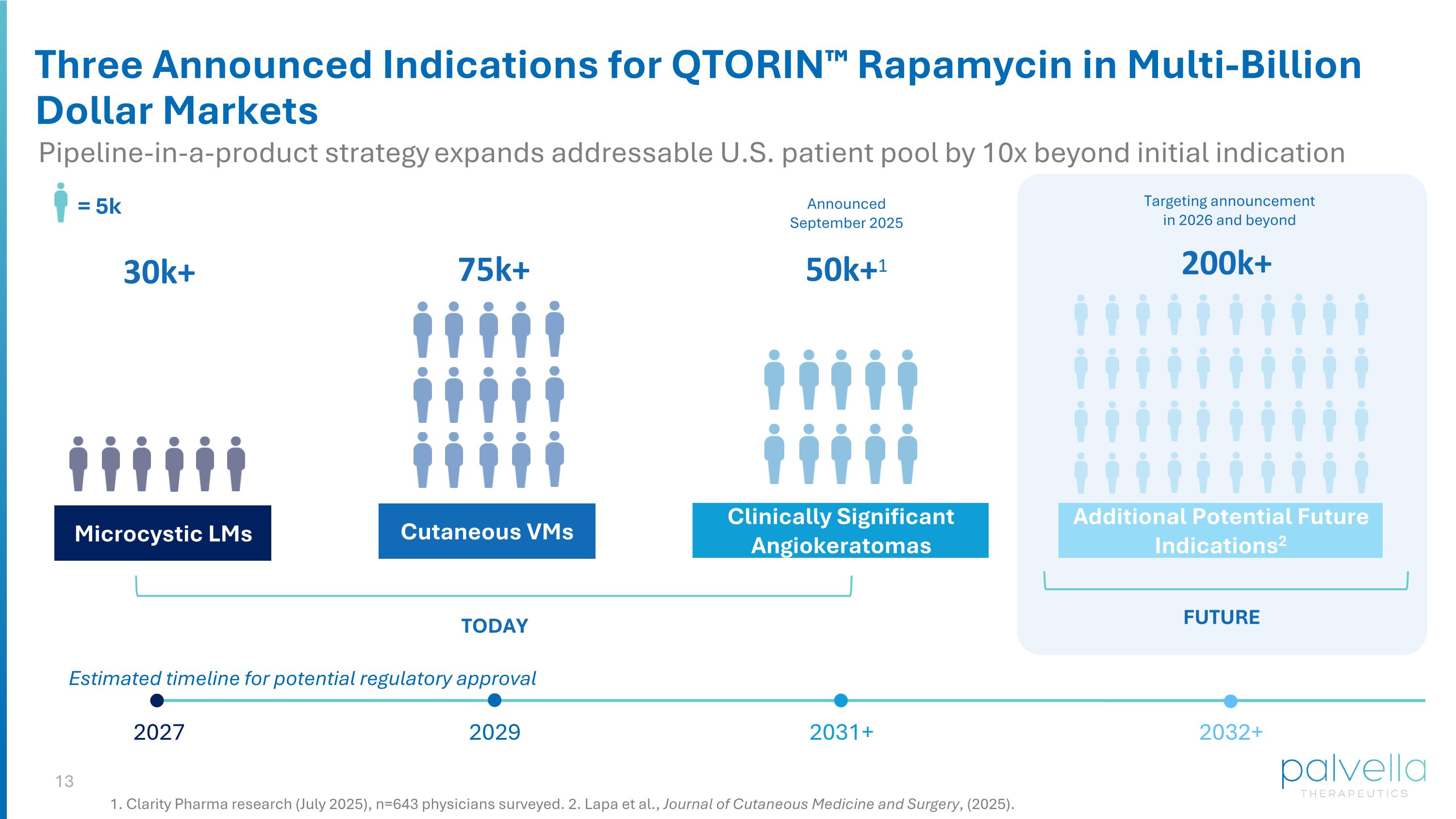

Microcystic LMs Cutaneous VMs Clinically Significant Angiokeratomas Additional Potential Future Indications2 TODAY FUTURE Announced September 2025 Targeting announcement in 2026 and beyond = 5k 30k+ 75k+ 200k+ 50k+1 Three Announced Indications for QTORIN™ Rapamycin in Multi-Billion Dollar Markets 1. Clarity Pharma research (July 2025), n=643 physicians surveyed. 2. Lapa et al., Journal of Cutaneous Medicine and Surgery, (2025). Pipeline-in-a-product strategy expands addressable U.S. patient pool by 10x beyond initial indication Estimated timeline for potential regulatory approval 2031+ 2032+ 2027 2029

QTORIN™ 3.9% RAPAMYCIN Microcystic Lymphatic Malformations FOR

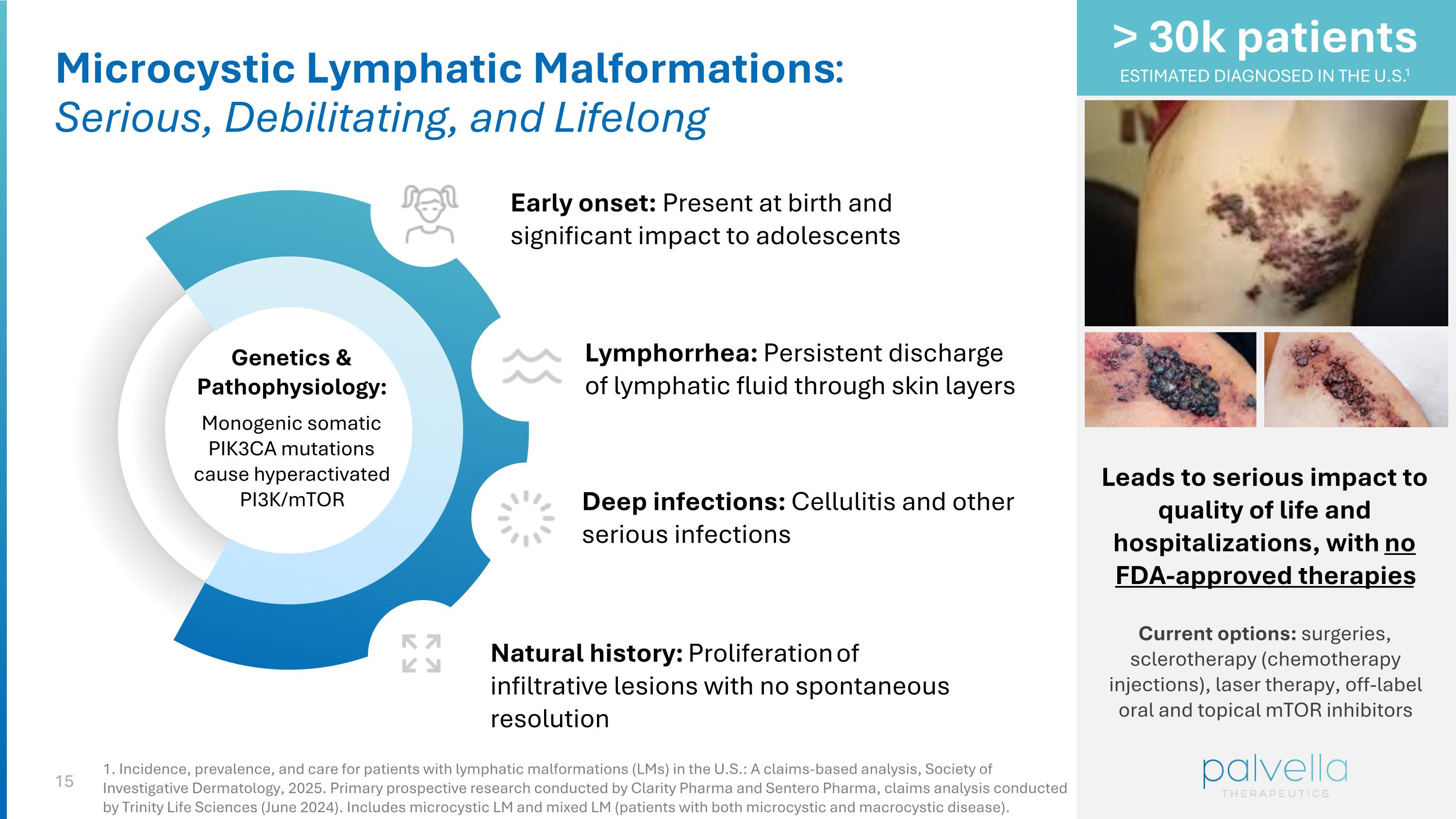

Microcystic Lymphatic Malformations: Serious, Debilitating, and Lifelong Genetics & Pathophysiology: Monogenic somatic PIK3CA mutations cause hyperactivated PI3K/mTOR Lymphorrhea: Persistent discharge of lymphatic fluid through skin layers Deep infections: Cellulitis and other serious infections Natural history: Proliferation of infiltrative lesions with no spontaneous resolution Leads to serious impact to quality of life and hospitalizations, with no FDA-approved therapies Current options: surgeries, sclerotherapy (chemotherapy injections), laser therapy, off-label oral and topical mTOR inhibitors > 30k patients ESTIMATED DIAGNOSED IN THE U.S.1 Early onset: Present at birth and significant impact to adolescents 1. Incidence, prevalence, and care for patients with lymphatic malformations (LMs) in the U.S.: A claims-based analysis, Society of Investigative Dermatology, 2025. Primary prospective research conducted by Clarity Pharma and Sentero Pharma, claims analysis conducted by Trinity Life Sciences (June 2024). Includes microcystic LM and mixed LM (patients with both microcystic and macrocystic disease).

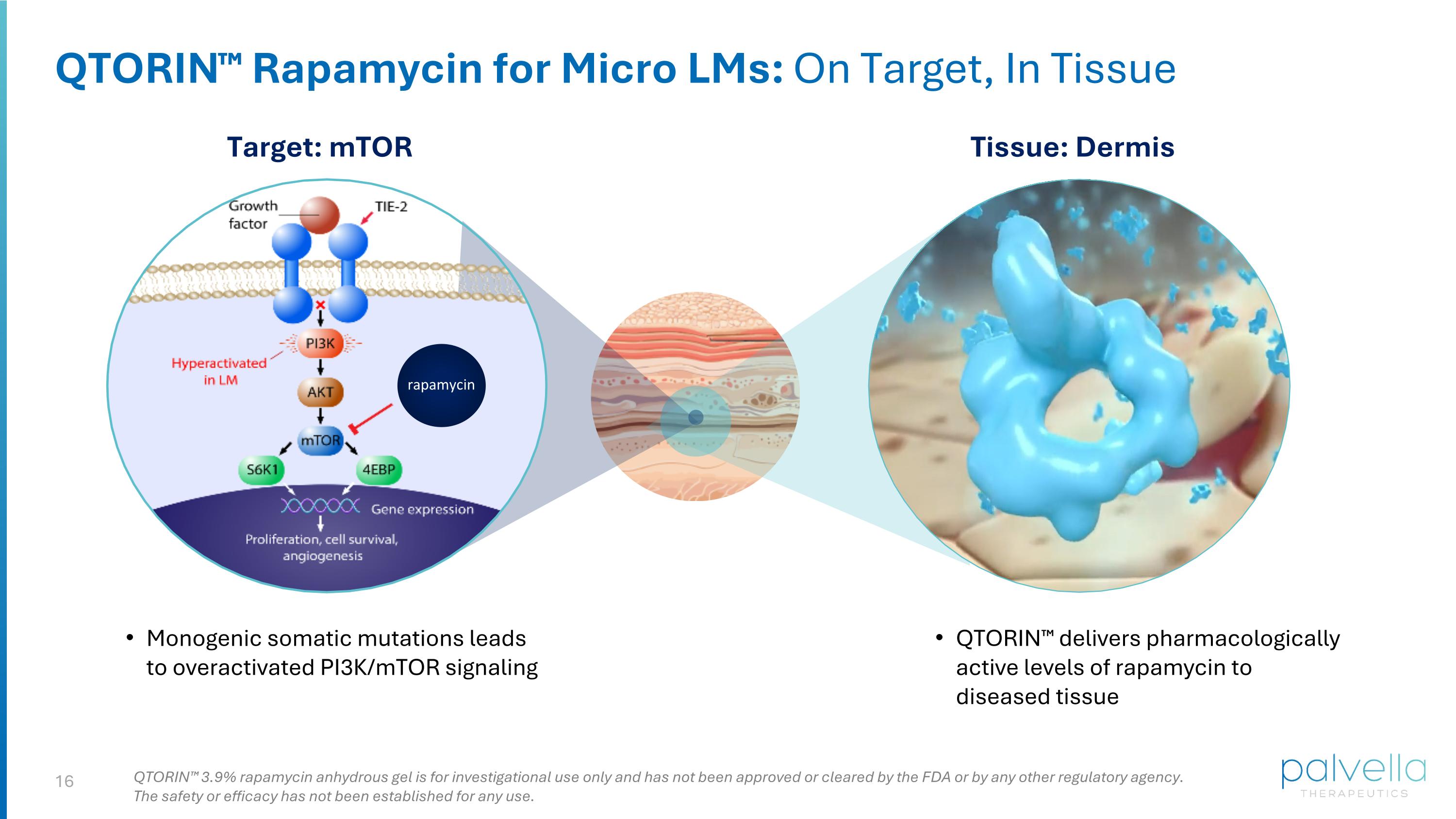

QTORIN™ Rapamycin for Micro LMs: On Target, In Tissue rapamycin Target: mTOR Tissue: Dermis Monogenic somatic mutations leads to overactivated PI3K/mTOR signaling QTORIN™ delivers pharmacologically active levels of rapamycin to diseased tissue QTORIN™ 3.9% rapamycin anhydrous gel is for investigational use only and has not been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use.

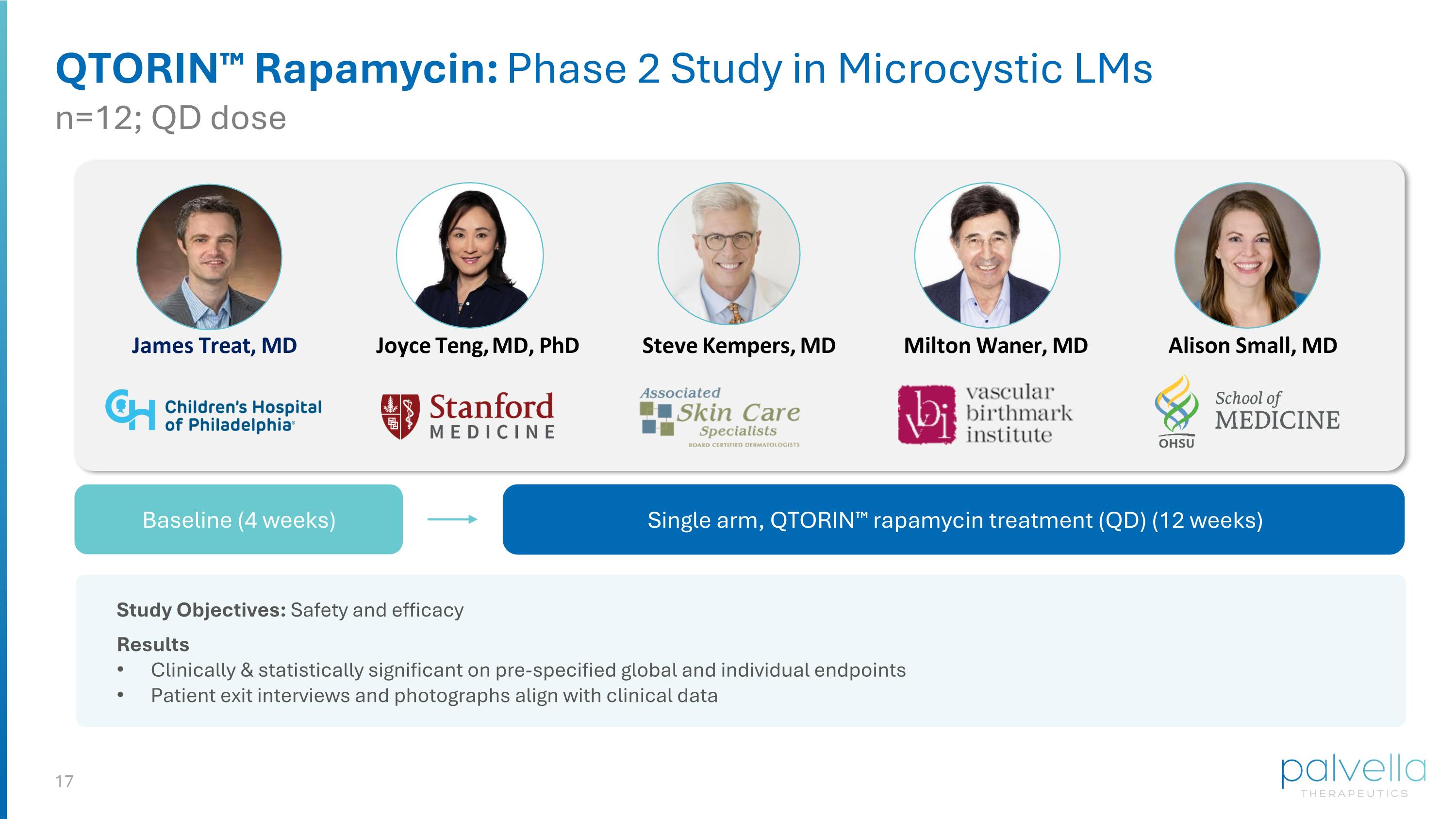

QTORIN™ Rapamycin: Phase 2 Study in Microcystic LMs n=12; QD dose James Treat, MD Joyce Teng, MD, PhD Alison Small, MD Milton Waner, MD Steve Kempers, MD Single arm, QTORIN™ rapamycin treatment (QD) (12 weeks) Baseline (4 weeks) Study Objectives: Safety and efficacy Results Clinically & statistically significant on pre-specified global and individual endpoints Patient exit interviews and photographs align with clinical data

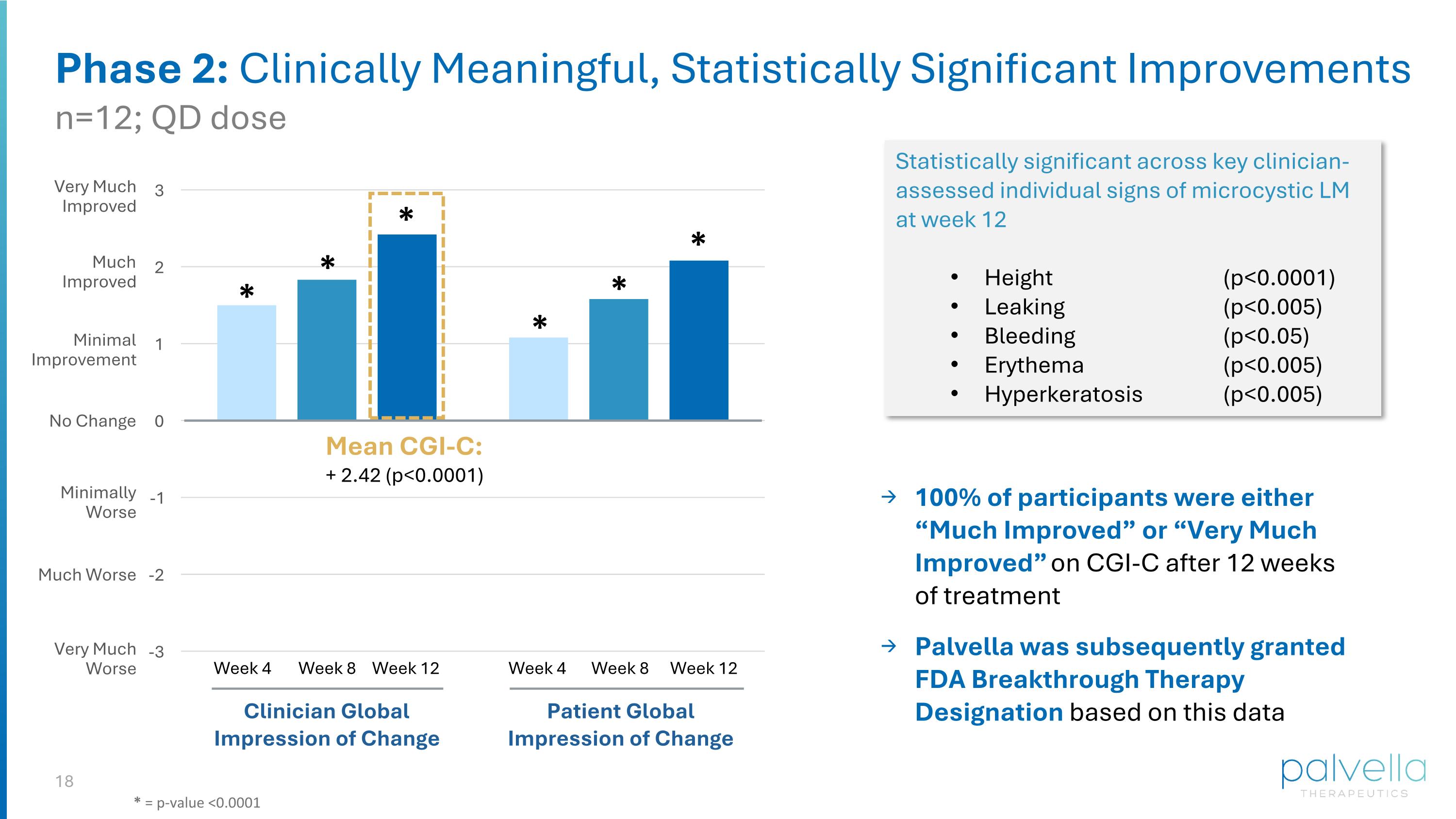

* * * * * * Statistically significant across key clinician-assessed individual signs of microcystic LM at week 12 Height (p<0.0001) Leaking (p<0.005) Bleeding (p<0.05) Erythema (p<0.005) Hyperkeratosis (p<0.005) Phase 2: Clinically Meaningful, Statistically Significant Improvements Mean CGI-C: + 2.42 (p<0.0001) Clinician Global Impression of Change Patient Global Impression of Change Week 4 Week 8 Week 12 Week 4 Week 8 Week 12 Very Much Improved Much Improved Minimal Improvement No Change Minimally Worse Much Worse Very Much Worse n=12; QD dose * = p-value <0.0001 100% of participants were either “Much Improved” or “Very Much Improved” on CGI-C after 12 weeks of treatment Palvella was subsequently granted FDA Breakthrough Therapy Designation based on this data

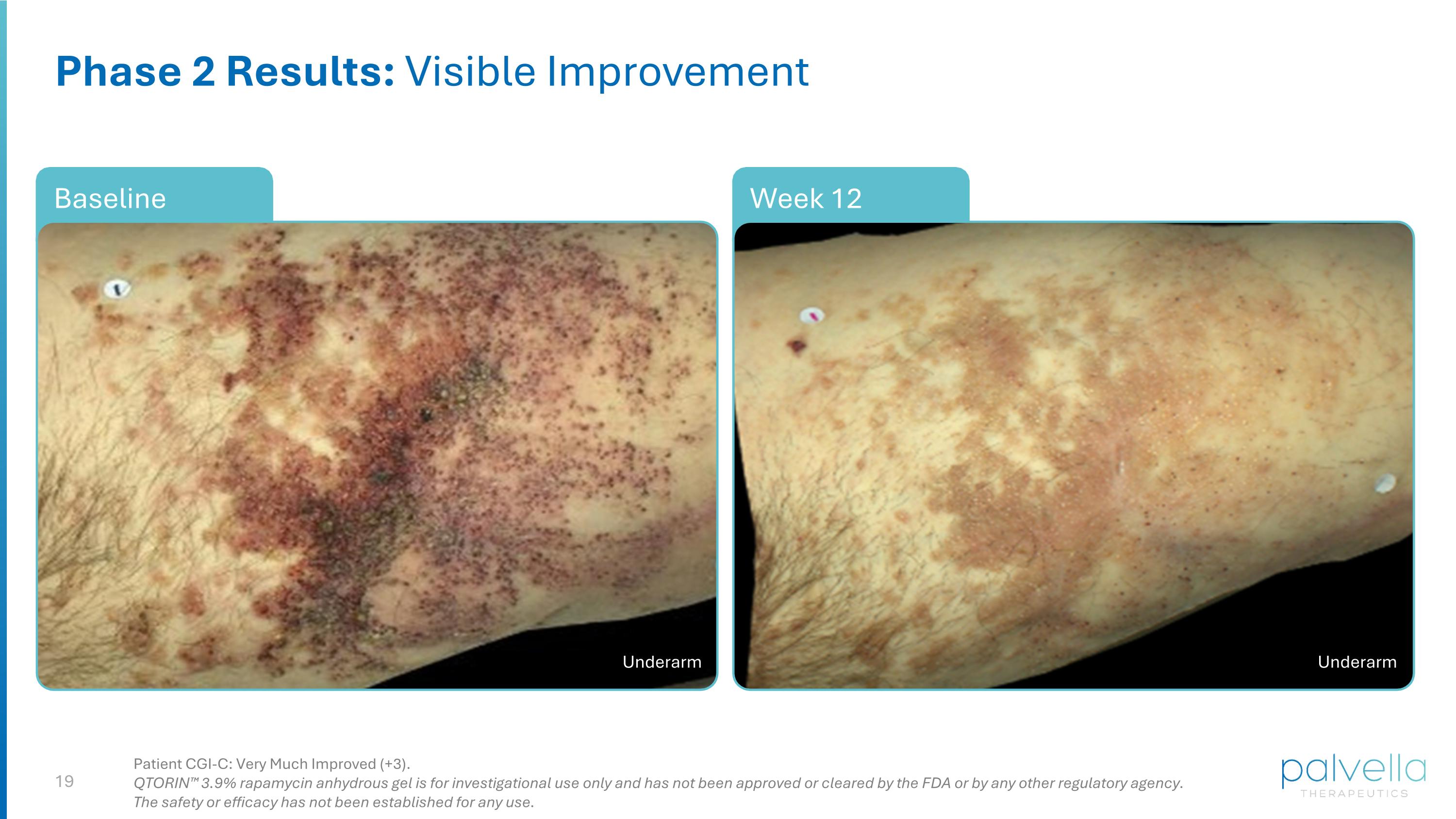

Week 12 Phase 2 Results: Visible Improvement Baseline Patient CGI-C: Very Much Improved (+3). QTORIN™ 3.9% rapamycin anhydrous gel is for investigational use only and has not been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use. Underarm Underarm

Week 12 Baseline Phase 2 Results: Visible Improvement Wrist Wrist Patient CGI-C: Very Much Improved (+3). QTORIN™ 3.9% rapamycin anhydrous gel is for investigational use only and has not been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use.

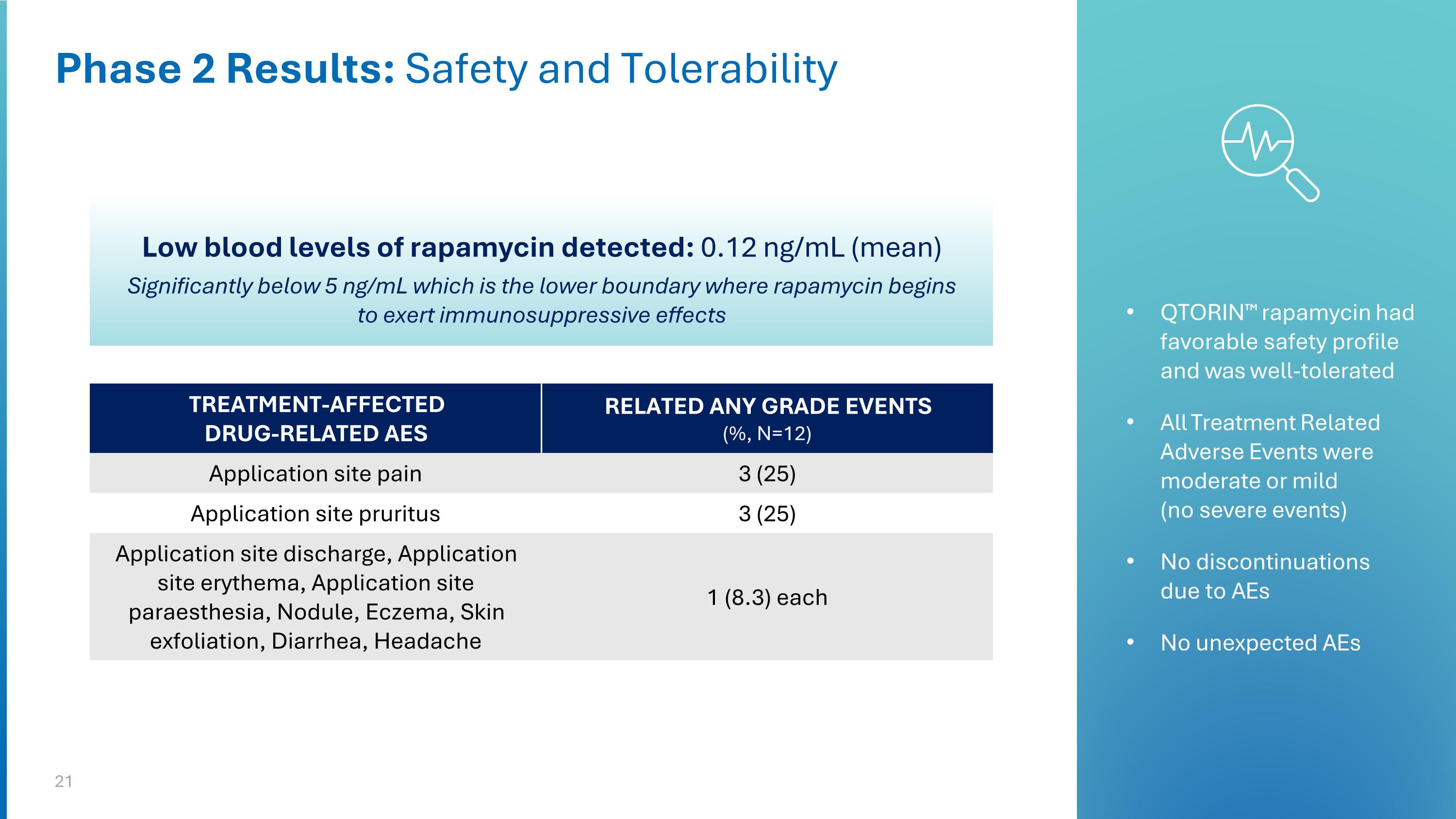

Phase 2 Results: Safety and Tolerability TREATMENT-AFFECTED DRUG-RELATED AES RELATED ANY GRADE EVENTS (%, N=12) Application site pain 3 (25) Application site pruritus 3 (25) Application site discharge, Application site erythema, Application site paraesthesia, Nodule, Eczema, Skin exfoliation, Diarrhea, Headache 1 (8.3) each QTORIN™ rapamycin had favorable safety profile and was well-tolerated All Treatment Related Adverse Events were moderate or mild (no severe events) No discontinuations due to AEs No unexpected AEs Low blood levels of rapamycin detected: 0.12 ng/mL (mean) Significantly below 5 ng/mL which is the lower boundary where rapamycin begins to exert immunosuppressive effects

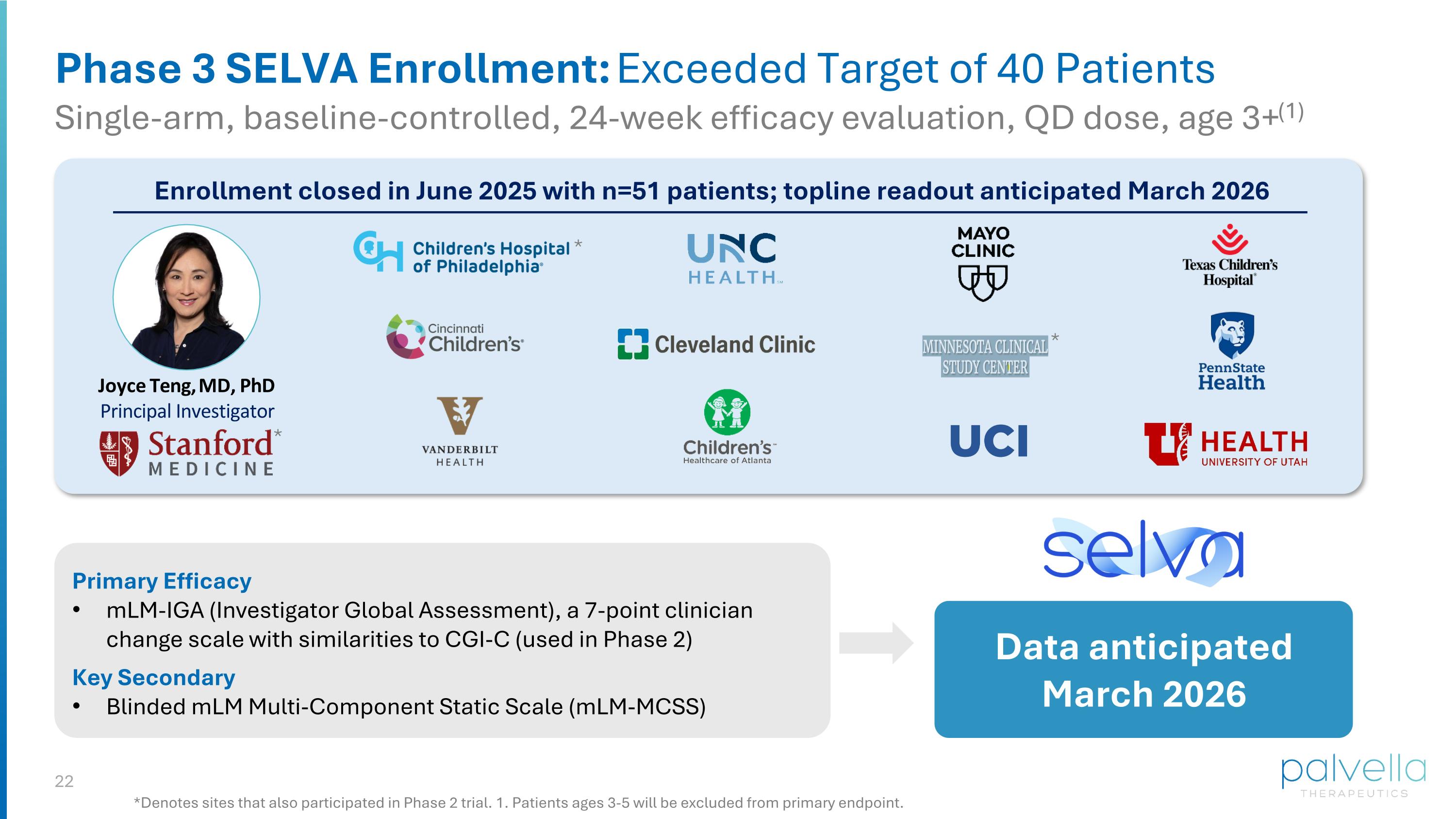

Phase 3 SELVA Enrollment: Exceeded Target of 40 Patients Single-arm, baseline-controlled, 24-week efficacy evaluation, QD dose, age 3+(1) *Denotes sites that also participated in Phase 2 trial. 1. Patients ages 3-5 will be excluded from primary endpoint. Enrollment closed in June 2025 with n=51 patients; topline readout anticipated March 2026 Joyce Teng, MD, PhD Principal Investigator * * * Primary Efficacy mLM-IGA (Investigator Global Assessment), a 7-point clinician change scale with similarities to CGI-C (used in Phase 2) Key Secondary Blinded mLM Multi-Component Static Scale (mLM-MCSS) Data anticipated March 2026

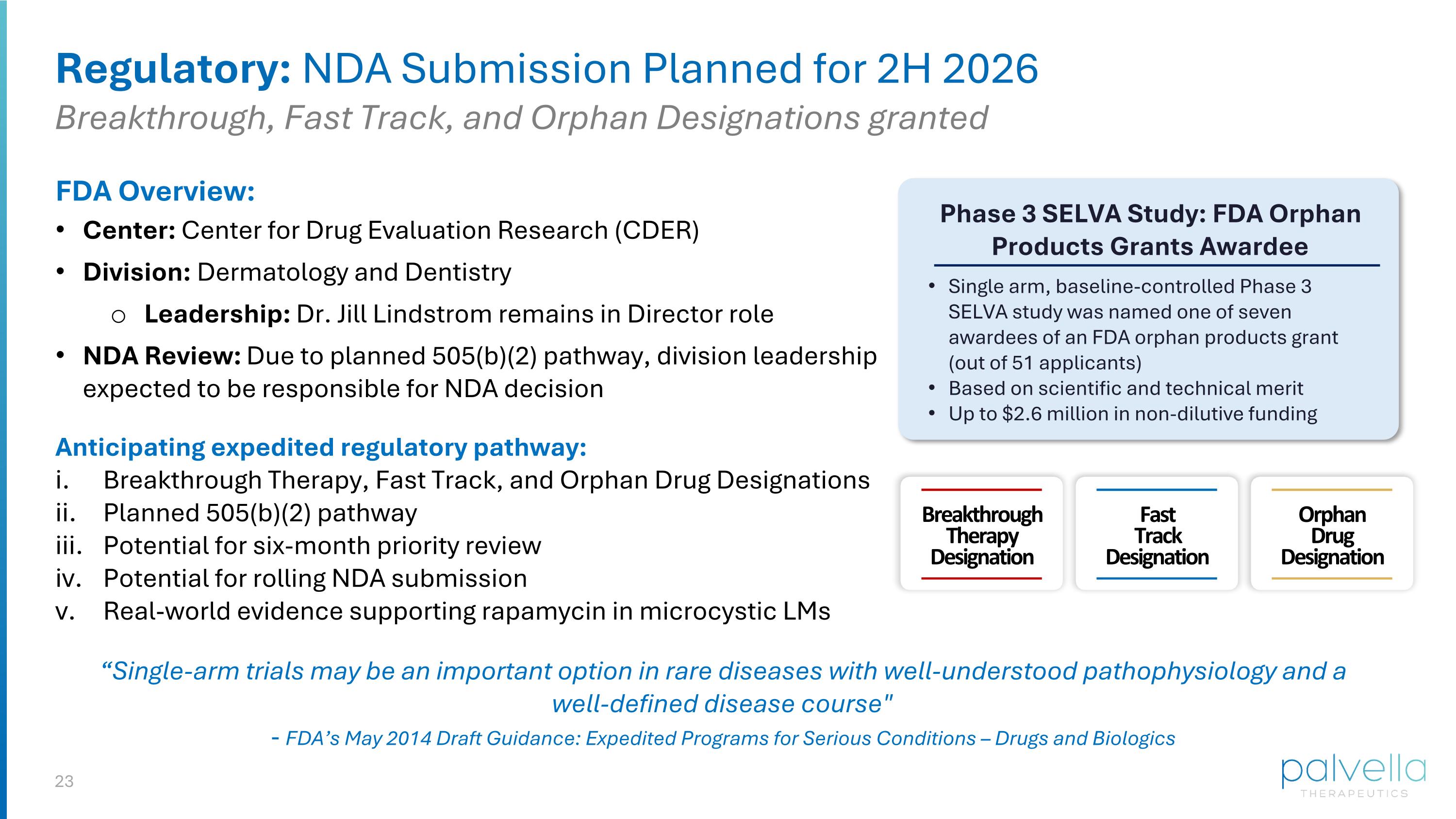

Regulatory: NDA Submission Planned for 2H 2026 Breakthrough, Fast Track, and Orphan Designations granted Anticipating expedited regulatory pathway: Breakthrough Therapy, Fast Track, and Orphan Drug Designations Planned 505(b)(2) pathway Potential for six-month priority review Potential for rolling NDA submission Real-world evidence supporting rapamycin in microcystic LMs Phase 3 SELVA Study: FDA Orphan Products Grants Awardee Single arm, baseline-controlled Phase 3 SELVA study was named one of seven awardees of an FDA orphan products grant (out of 51 applicants) Based on scientific and technical merit Up to $2.6 million in non-dilutive funding FDA Overview: Center: Center for Drug Evaluation Research (CDER) Division: Dermatology and Dentistry Leadership: Dr. Jill Lindstrom remains in Director role NDA Review: Due to planned 505(b)(2) pathway, division leadership expected to be responsible for NDA decision Breakthrough Therapy Designation Fast Track Designation Orphan Drug Designation “Single-arm trials may be an important option in rare diseases with well-understood pathophysiology and a well-defined disease course" - FDA’s May 2014 Draft Guidance: Expedited Programs for Serious Conditions – Drugs and Biologics

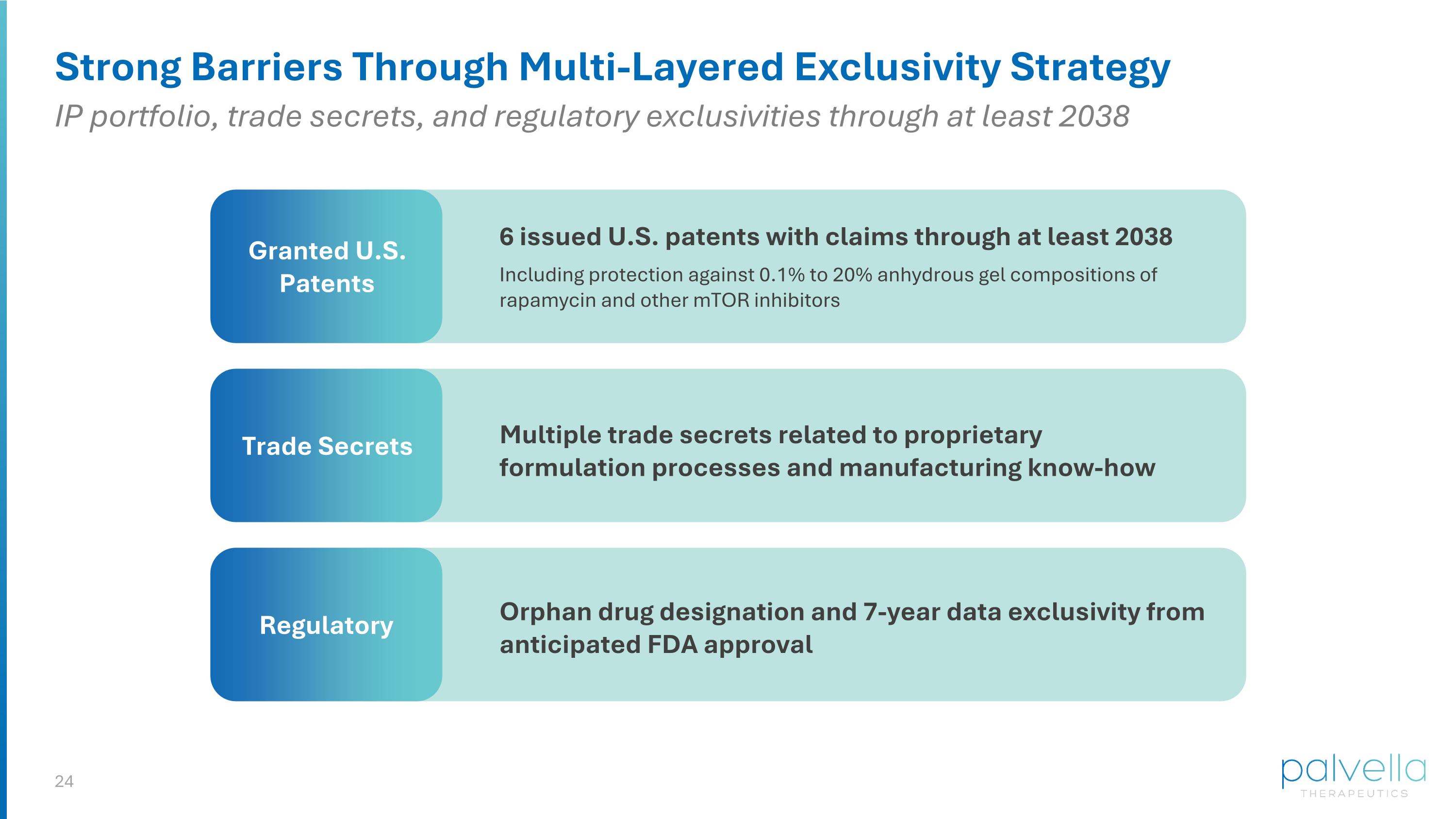

Strong Barriers Through Multi-Layered Exclusivity Strategy Granted U.S. Patents Trade Secrets Regulatory Orphan drug designation and 7-year data exclusivity from anticipated FDA approval Multiple trade secrets related to proprietary formulation processes and manufacturing know-how 6 issued U.S. patents with claims through at least 2038 Including protection against 0.1% to 20% anhydrous gel compositions of rapamycin and other mTOR inhibitors IP portfolio, trade secrets, and regulatory exclusivities through at least 2038

QTORIN™ 3.9% RAPAMYCIN U.S. Commercial Launch Planning

Microcystic LMs: Multi-billion Dollar, Uncontested U.S. Market Opportunity with Commercial Build-Out Underway ASHLEY KLINE Chief Commercial Officer Joined May 2025 Recently elucidated genetics enable development of first targeted therapy to address causal mTOR pathway with minimal side effects Large orphan market: Claims analyses verified > 30k estimated diagnosed U.S. patients, with >1,500 incident patients annually 1 Positioned to be first and only FDA-approved therapy; market research indicates strong intent to prescribe, including in pediatric population 2 Recent payor testing and orphan analogues validate expected orphan pricing corridor 3 Concentrated prescriber base in vascular anomaly centers (VACs) & other clinics 4

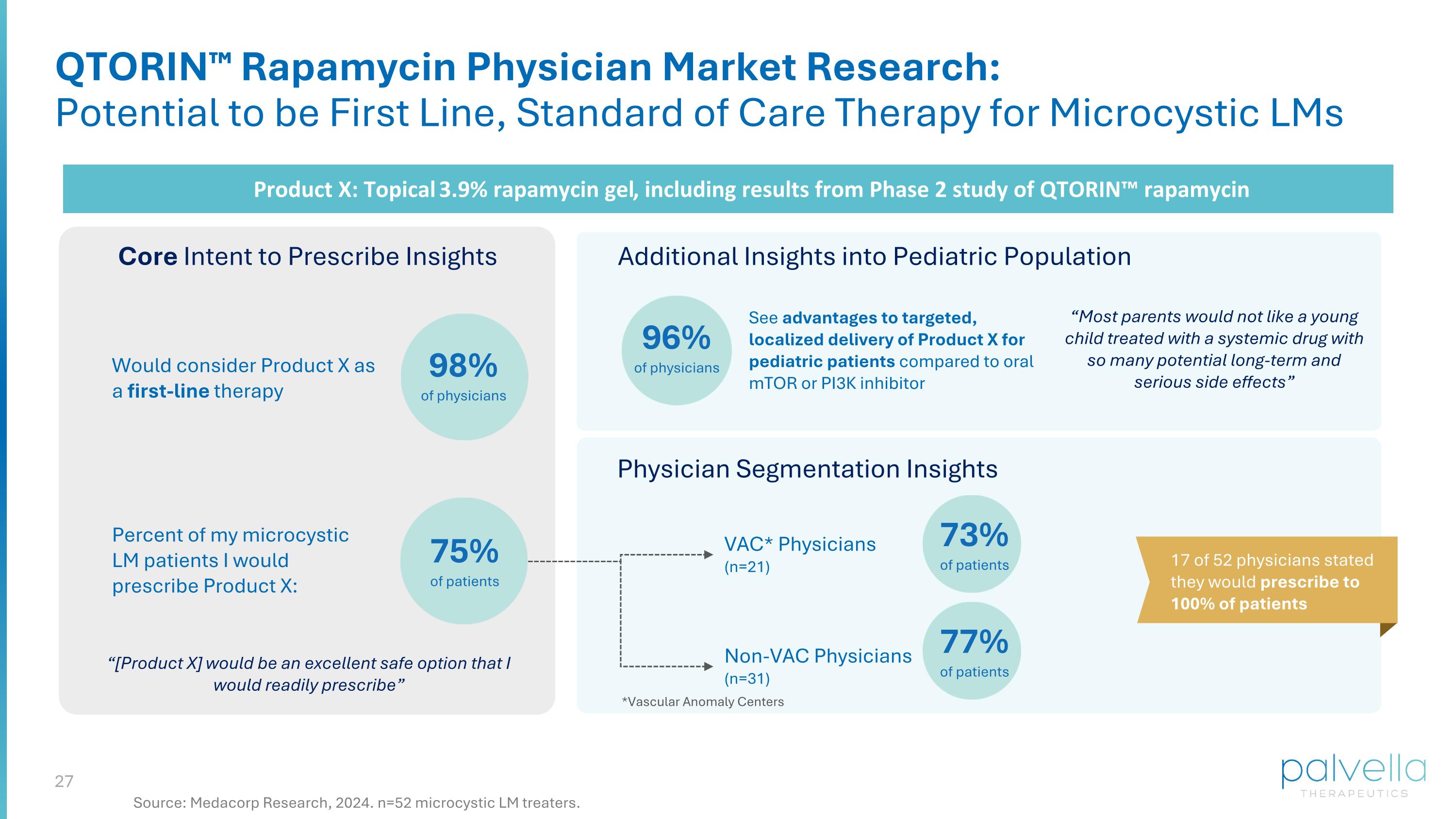

QTORIN™ Rapamycin Physician Market Research: Potential to be First Line, Standard of Care Therapy for Microcystic LMs Product X: Topical 3.9% rapamycin gel, including results from Phase 2 study of QTORIN™ rapamycin Core Intent to Prescribe Insights 98% of physicians Percent of my microcystic LM patients I would prescribe Product X: 75% of patients Additional Insights into Pediatric Population Physician Segmentation Insights VAC* Physicians (n=21) Non-VAC Physicians (n=31) 73% of patients 77% of patients *Vascular Anomaly Centers 17 of 52 physicians stated they would prescribe to 100% of patients “[Product X] would be an excellent safe option that I would readily prescribe” Would consider Product X as a first-line therapy 96% of physicians See advantages to targeted, localized delivery of Product X for pediatric patients compared to oral mTOR or PI3K inhibitor “Most parents would not like a young child treated with a systemic drug with so many potential long-term and serious side effects” Source: Medacorp Research, 2024. n=52 microcystic LM treaters.

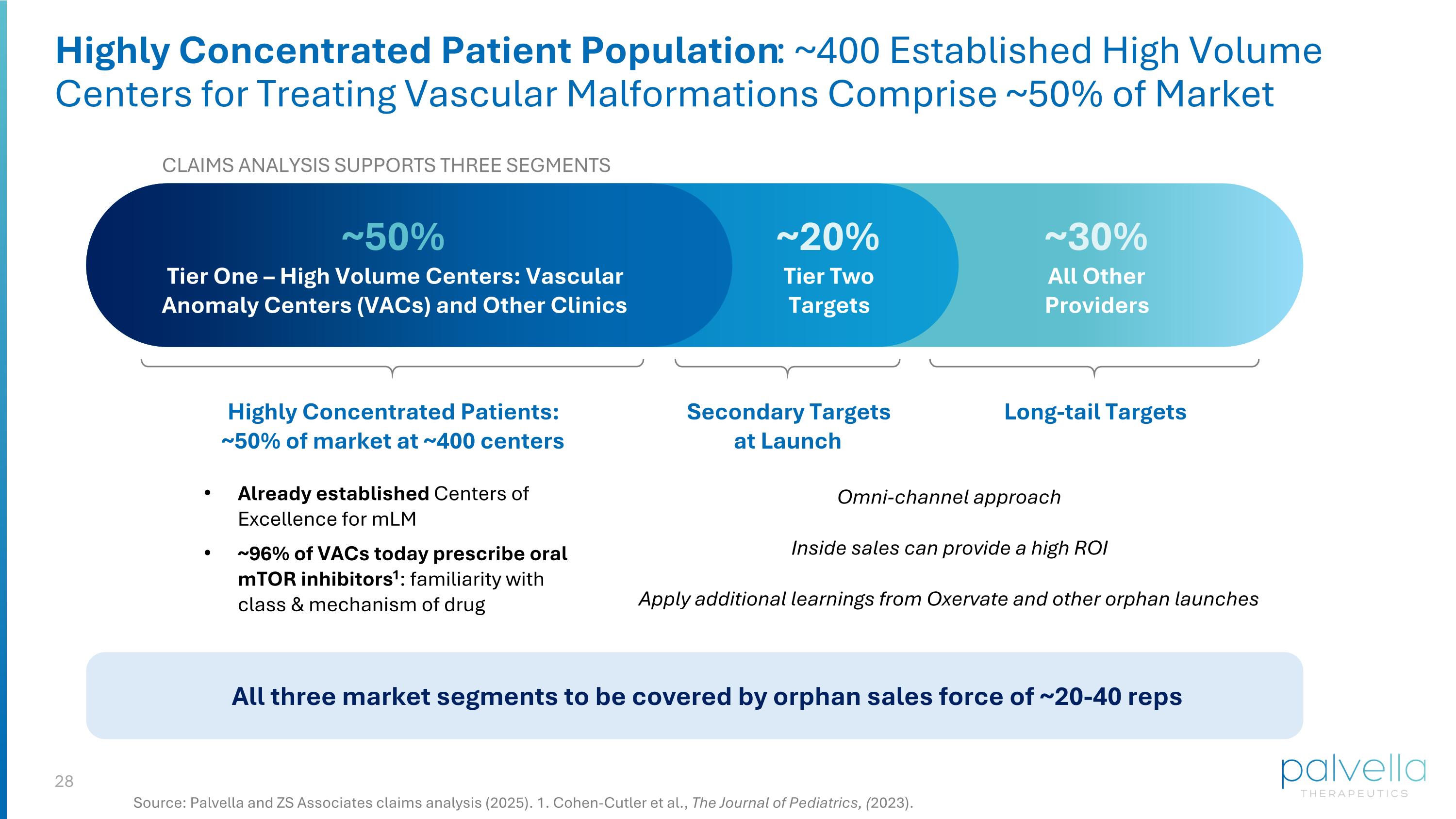

Highly Concentrated Patient Population: ~400 Established High Volume Centers for Treating Vascular Malformations Comprise ~50% of Market Source: Palvella and ZS Associates claims analysis (2025). 1. Cohen-Cutler et al., The Journal of Pediatrics, (2023). CLAIMS ANALYSIS SUPPORTS THREE SEGMENTS ~50% Tier One – High Volume Centers: Vascular Anomaly Centers (VACs) and Other Clinics Already established Centers of Excellence for mLM ~96% of VACs today prescribe oral mTOR inhibitors1: familiarity with class & mechanism of drug ~20% Tier Two Targets ~30% All Other Providers Highly Concentrated Patients: ~50% of market at ~400 centers Secondary Targets at Launch Long-tail Targets Omni-channel approach Inside sales can provide a high ROI Apply additional learnings from Oxervate and other orphan launches All three market segments to be covered by orphan sales force of ~20-40 reps

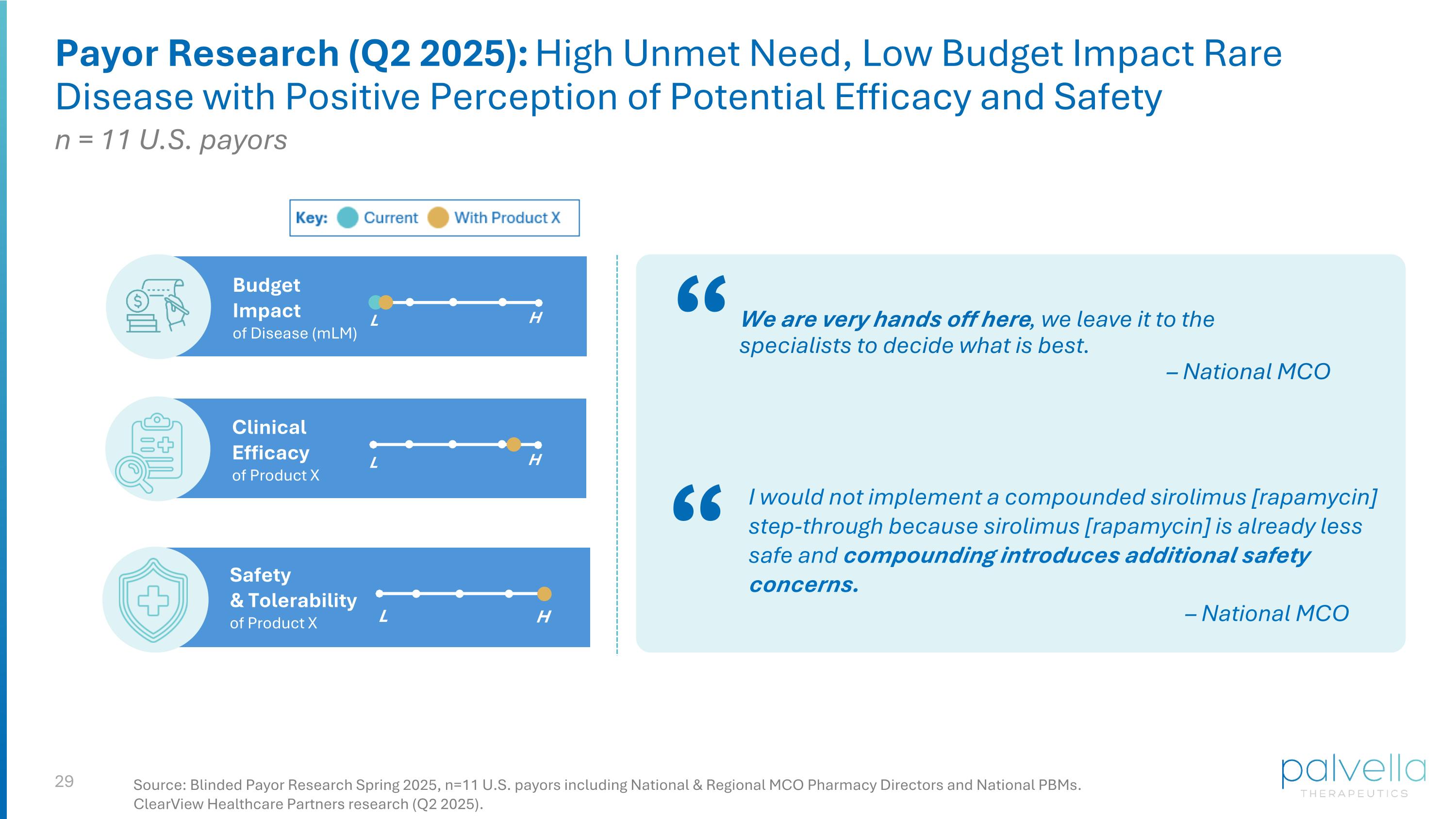

Payor Research (Q2 2025): High Unmet Need, Low Budget Impact Rare Disease with Positive Perception of Potential Efficacy and Safety Safety & Tolerability of Product X Clinical Efficacy of Product X L H L H Budget Impact of Disease (mLM) L H “ We are very hands off here, we leave it to the specialists to decide what is best. – National MCO I would not implement a compounded sirolimus [rapamycin] step-through because sirolimus [rapamycin] is already less safe and compounding introduces additional safety concerns. – National MCO “ Source: Blinded Payor Research Spring 2025, n=11 U.S. payors including National & Regional MCO Pharmacy Directors and National PBMs. ClearView Healthcare Partners research (Q2 2025). n = 11 U.S. payors

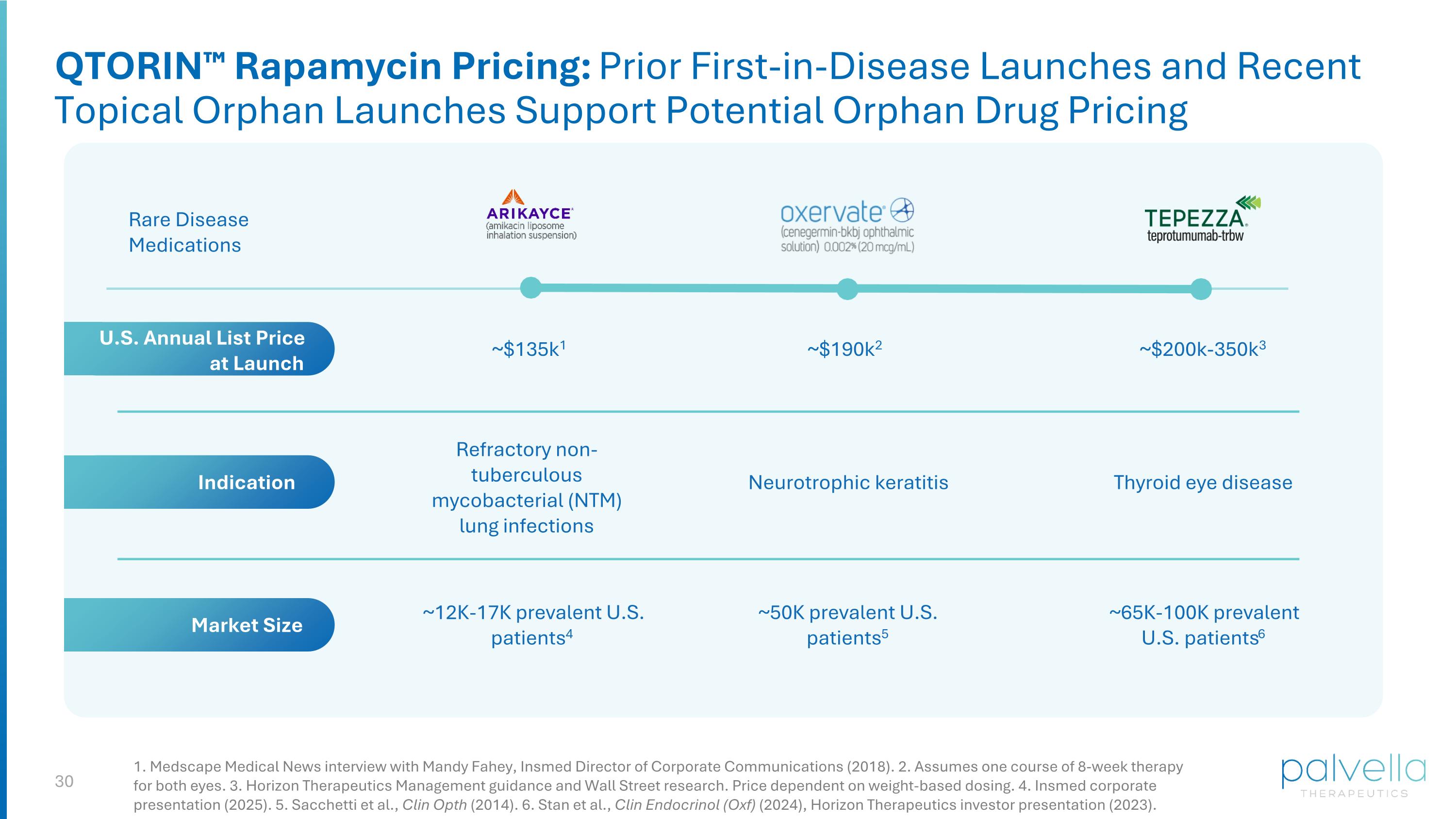

1. Medscape Medical News interview with Mandy Fahey, Insmed Director of Corporate Communications (2018). 2. Assumes one course of 8-week therapy for both eyes. 3. Horizon Therapeutics Management guidance and Wall Street research. Price dependent on weight-based dosing. 4. Insmed corporate presentation (2025). 5. Sacchetti et al., Clin Opth (2014). 6. Stan et al., Clin Endocrinol (Oxf) (2024), Horizon Therapeutics investor presentation (2023). ~$135k1 Rare Disease Medications Refractory non-tuberculous mycobacterial (NTM) lung infections Thyroid eye disease ~12K-17K prevalent U.S. patients4 ~65K-100K prevalent U.S. patients6 ~$200k-350k3 Indication Market Size U.S. Annual List Price at Launch QTORIN™ Rapamycin Pricing: Prior First-in-Disease Launches and Recent Topical Orphan Launches Support Potential Orphan Drug Pricing Neurotrophic keratitis ~50K prevalent U.S. patients5 ~$190k2

Strong Medical Affairs Presence in 2026 and Beyond Educating on underlying genetic pathology of disease and relevance of a targeted therapeutic approach Informing on importance of early therapeutic intervention to prevent progression, especially during early childhood and puberty High touch physician engagement with both dermatologists and hematologists-oncologists Many derms and hem-oncs are already working together as part of coordinated care teams in VACs Planned Attendance at Key Medical Congresses: Hired Vimal Patel, PharmD, Senior Vice President of Medical Affairs, to lead scientific engagement, KOL collaboration, disease state awareness, and medical education

QTORIN™ 3.9% RAPAMYCIN Cutaneous Venous Malformations FOR

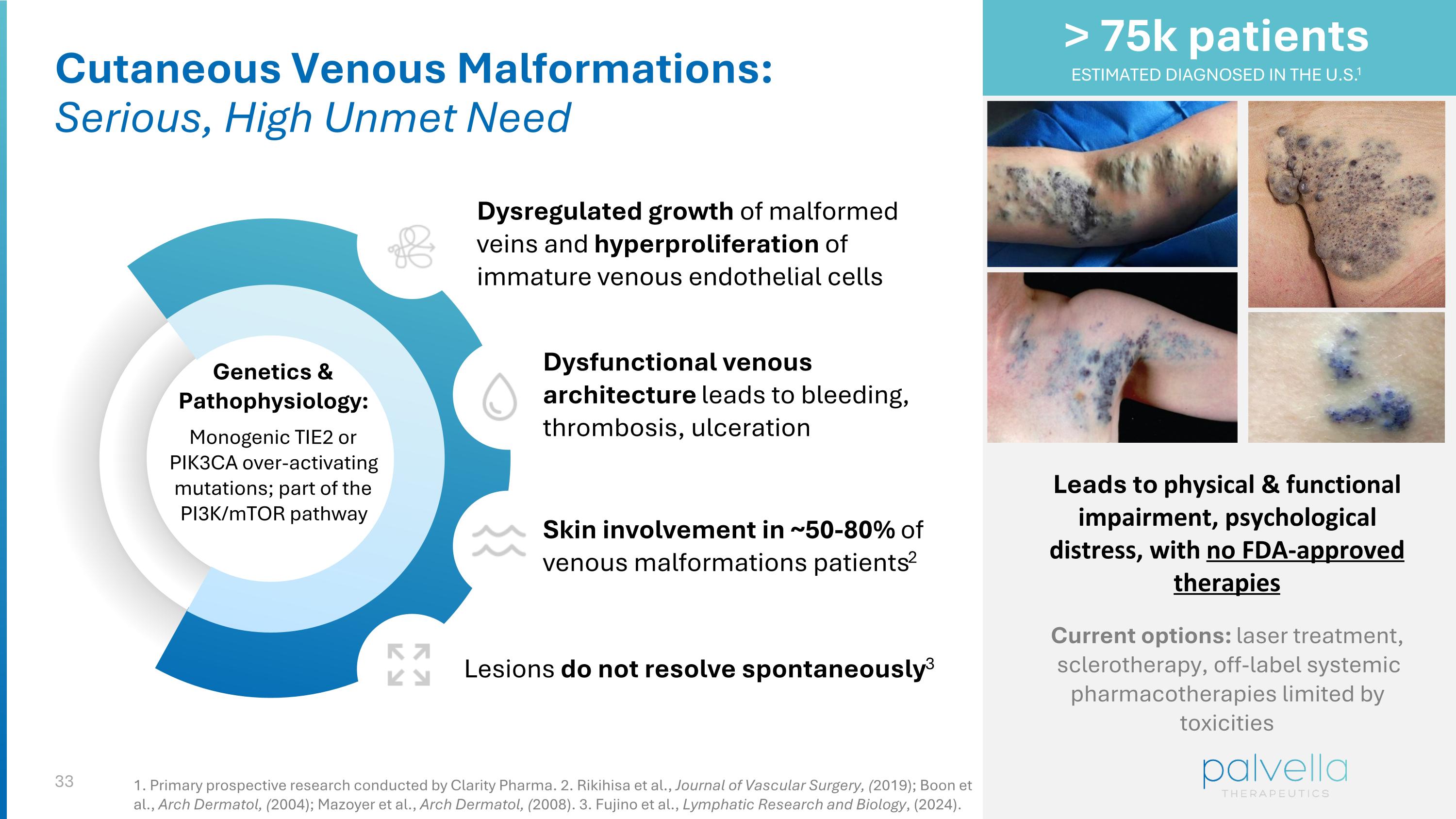

Cutaneous Venous Malformations: Serious, High Unmet Need Genetics & Pathophysiology: Monogenic TIE2 or PIK3CA over-activating mutations; part of the PI3K/mTOR pathway Dysregulated growth of malformed veins and hyperproliferation of immature venous endothelial cells Dysfunctional venous architecture leads to bleeding, thrombosis, ulceration Lesions do not resolve spontaneously3 Skin involvement in ~50-80% of venous malformations patients2 Leads to physical & functional impairment, psychological distress, with no FDA-approved therapies Current options: laser treatment, sclerotherapy, off-label systemic pharmacotherapies limited by toxicities > 75k patients ESTIMATED DIAGNOSED IN THE U.S.1 1. Primary prospective research conducted by Clarity Pharma. 2. Rikihisa et al., Journal of Vascular Surgery, (2019); Boon et al., Arch Dermatol, (2004); Mazoyer et al., Arch Dermatol, (2008). 3. Fujino et al., Lymphatic Research and Biology, (2024).

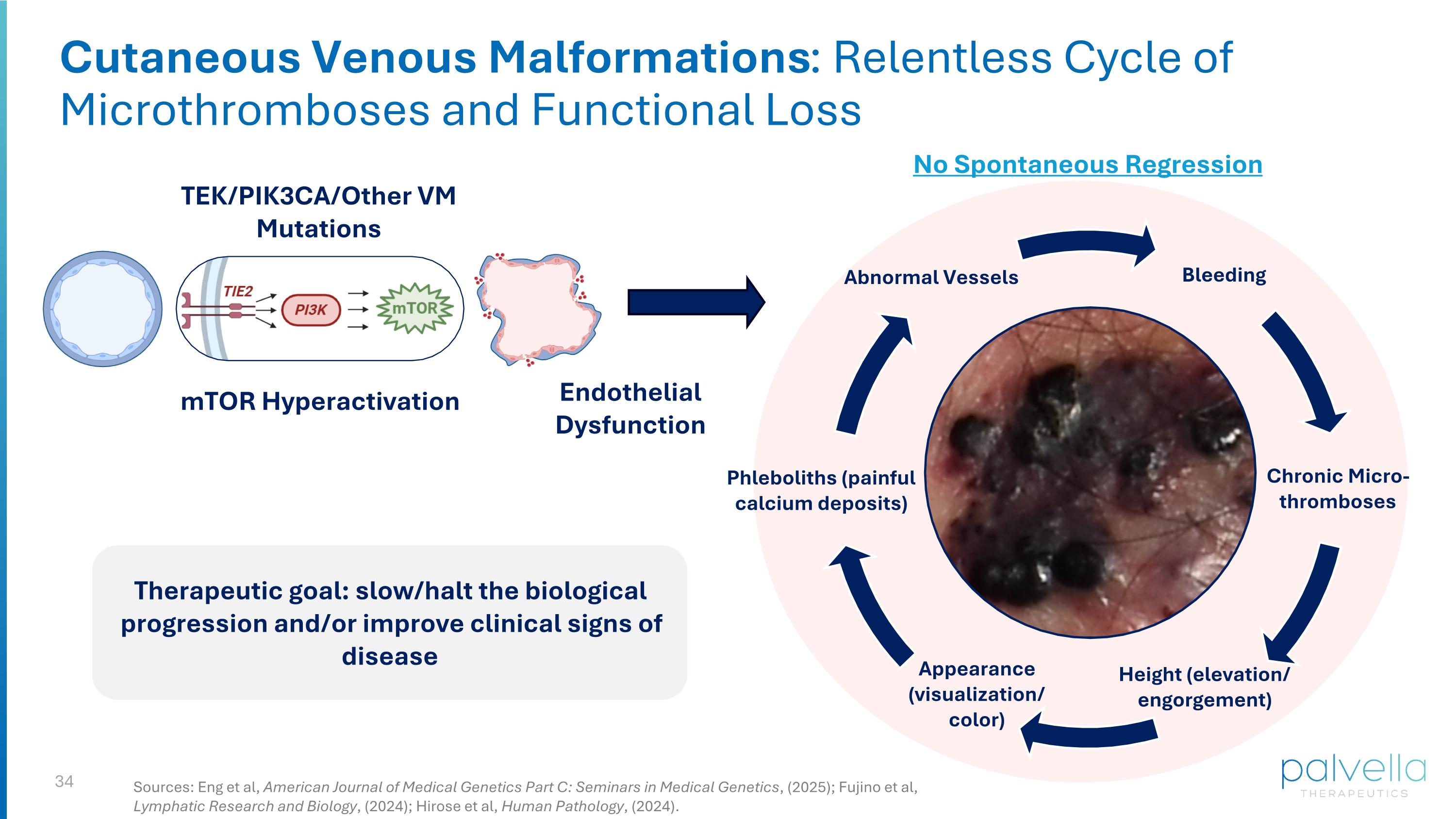

Cutaneous Venous Malformations: Relentless Cycle of Microthromboses and Functional Loss Abnormal Vessels Bleeding Chronic Micro-thromboses Height (elevation/ engorgement) Phleboliths (painful calcium deposits) TEK/PIK3CA/Other VM Mutations mTOR Hyperactivation Endothelial Dysfunction Therapeutic goal: slow/halt the biological progression and/or improve clinical signs of disease Appearance (visualization/ color) No Spontaneous Regression Sources: Eng et al, American Journal of Medical Genetics Part C: Seminars in Medical Genetics, (2025); Fujino et al, Lymphatic Research and Biology, (2024); Hirose et al, Human Pathology, (2024).

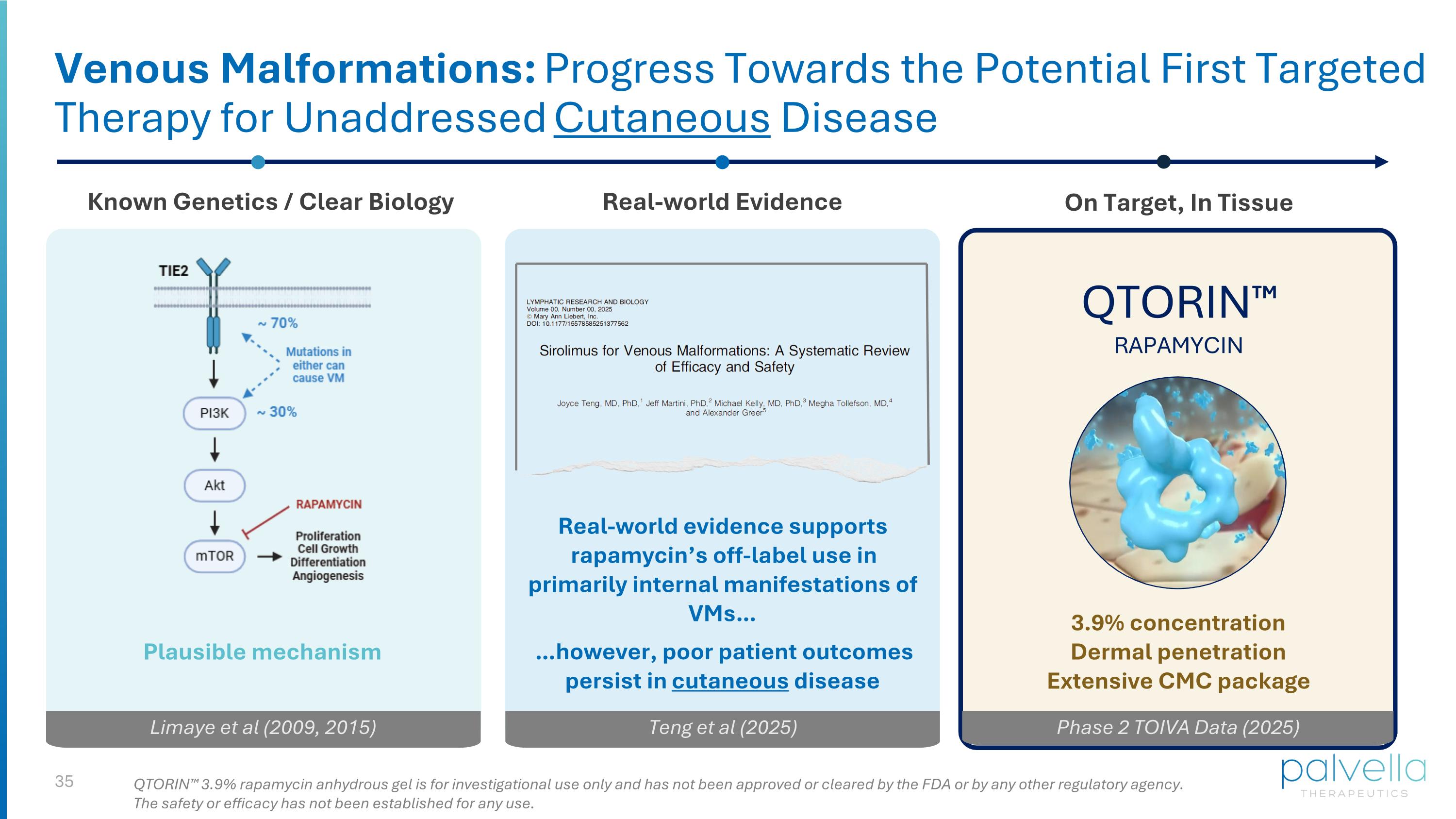

Venous Malformations: Progress Towards the Potential First Targeted Therapy for Unaddressed Cutaneous Disease Known Genetics / Clear Biology Real-world Evidence Real-world evidence supports rapamycin’s off-label use in primarily internal manifestations of VMs… …however, poor patient outcomes persist in cutaneous disease Limaye et al (2009, 2015) Teng et al (2025) QTORIN™ RAPAMYCIN On Target, In Tissue Phase 2 TOIVA Data (2025) Plausible mechanism 3.9% concentration Dermal penetration Extensive CMC package QTORIN™ 3.9% rapamycin anhydrous gel is for investigational use only and has not been approved or cleared by the FDA or by any other regulatory agency. The safety or efficacy has not been established for any use.

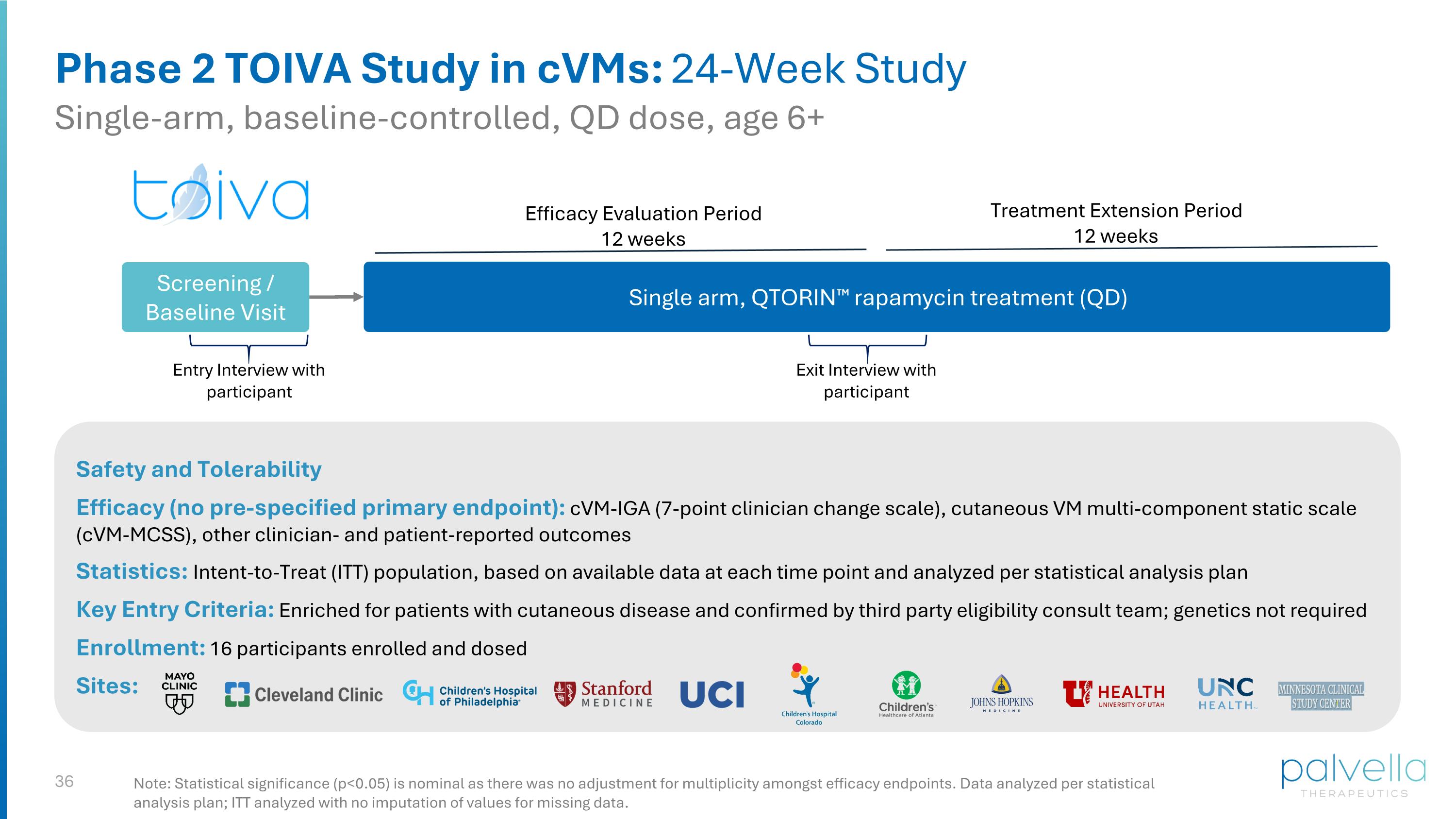

Phase 2 TOIVA Study in cVMs: 24-Week Study Single-arm, baseline-controlled, QD dose, age 6+ Safety and Tolerability Efficacy (no pre-specified primary endpoint): cVM-IGA (7-point clinician change scale), cutaneous VM multi-component static scale (cVM-MCSS), other clinician- and patient-reported outcomes Statistics: Intent-to-Treat (ITT) population, based on available data at each time point and analyzed per statistical analysis plan Key Entry Criteria: Enriched for patients with cutaneous disease and confirmed by third party eligibility consult team; genetics not required Enrollment: 16 participants enrolled and dosed Sites: Note: Statistical significance (p<0.05) is nominal as there was no adjustment for multiplicity amongst efficacy endpoints. Data analyzed per statistical analysis plan; ITT analyzed with no imputation of values for missing data. Single arm, QTORIN™ rapamycin treatment (QD) Efficacy Evaluation Period 12 weeks Screening / Baseline Visit Exit Interview with participant Entry Interview with participant Treatment Extension Period 12 weeks

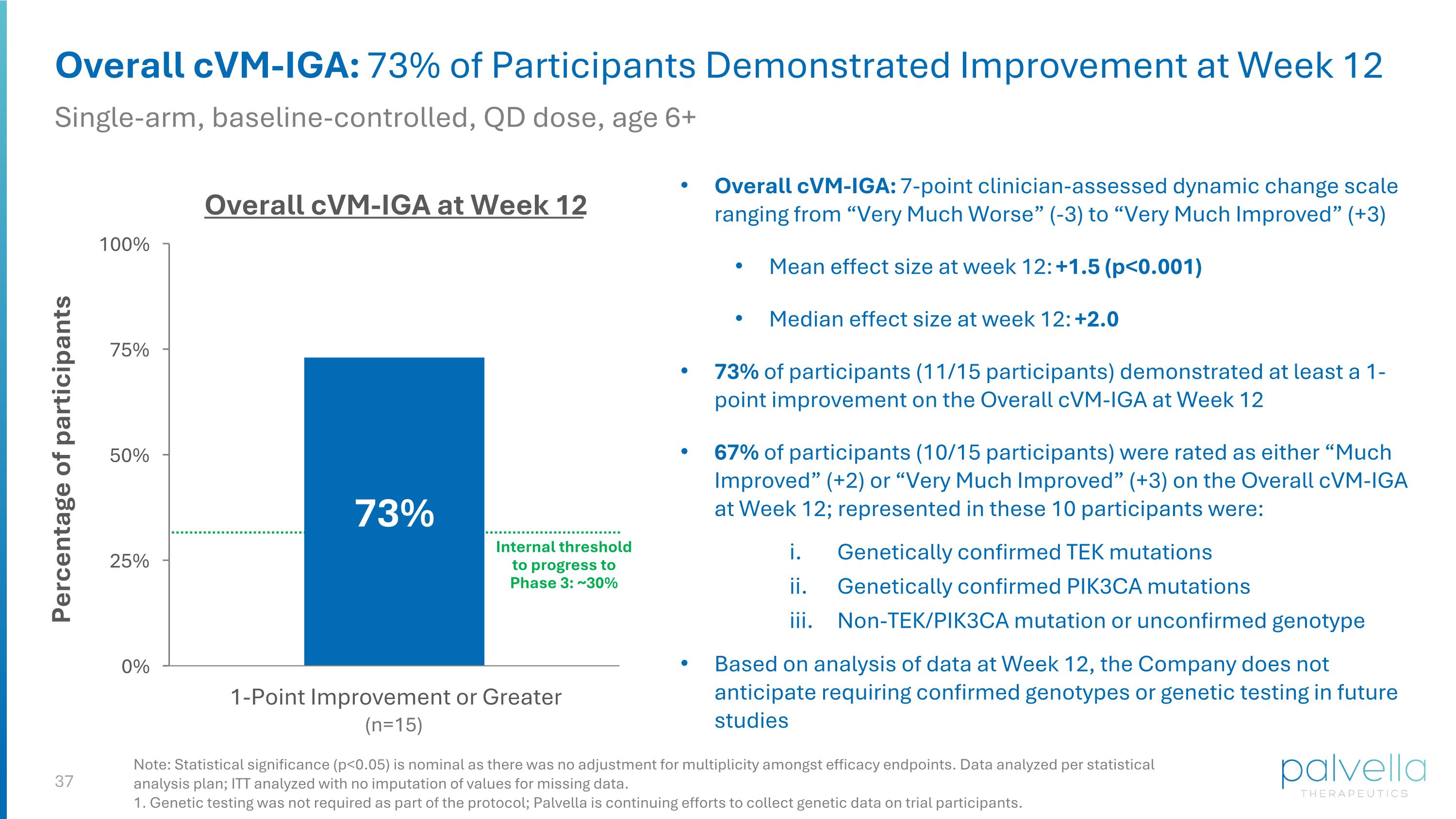

Overall cVM-IGA: 73% of Participants Demonstrated Improvement at Week 12 Single-arm, baseline-controlled, QD dose, age 6+ Overall cVM-IGA: 7-point clinician-assessed dynamic change scale ranging from “Very Much Worse” (-3) to “Very Much Improved” (+3) Mean effect size at week 12: +1.5 (p<0.001) Median effect size at week 12: +2.0 73% of participants (11/15 participants) demonstrated at least a 1-point improvement on the Overall cVM-IGA at Week 12 67% of participants (10/15 participants) were rated as either “Much Improved” (+2) or “Very Much Improved” (+3) on the Overall cVM-IGA at Week 12; represented in these 10 participants were: Genetically confirmed TEK mutations Genetically confirmed PIK3CA mutations Non-TEK/PIK3CA mutation or unconfirmed genotype Based on analysis of data at Week 12, the Company does not anticipate requiring confirmed genotypes or genetic testing in future studies Overall cVM-IGA at Week 12 (n=15) Internal threshold to progress to Phase 3: ~30% Note: Statistical significance (p<0.05) is nominal as there was no adjustment for multiplicity amongst efficacy endpoints. Data analyzed per statistical analysis plan; ITT analyzed with no imputation of values for missing data. 1. Genetic testing was not required as part of the protocol; Palvella is continuing efforts to collect genetic data on trial participants.

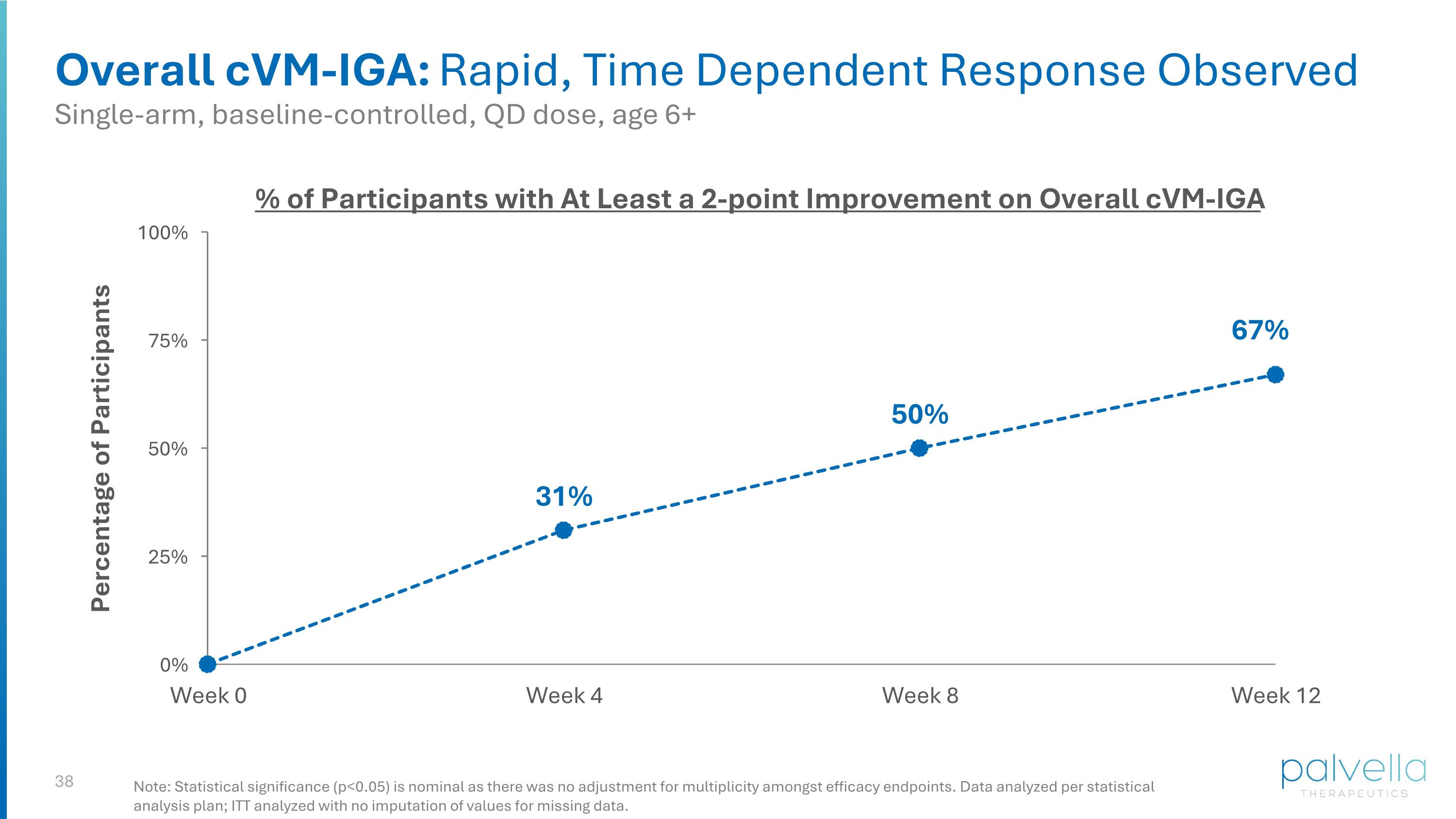

Overall cVM-IGA: Rapid, Time Dependent Response Observed % of Participants with At Least a 2-point Improvement on Overall cVM-IGA Single-arm, baseline-controlled, QD dose, age 6+ Note: Statistical significance (p<0.05) is nominal as there was no adjustment for multiplicity amongst efficacy endpoints. Data analyzed per statistical analysis plan; ITT analyzed with no imputation of values for missing data.

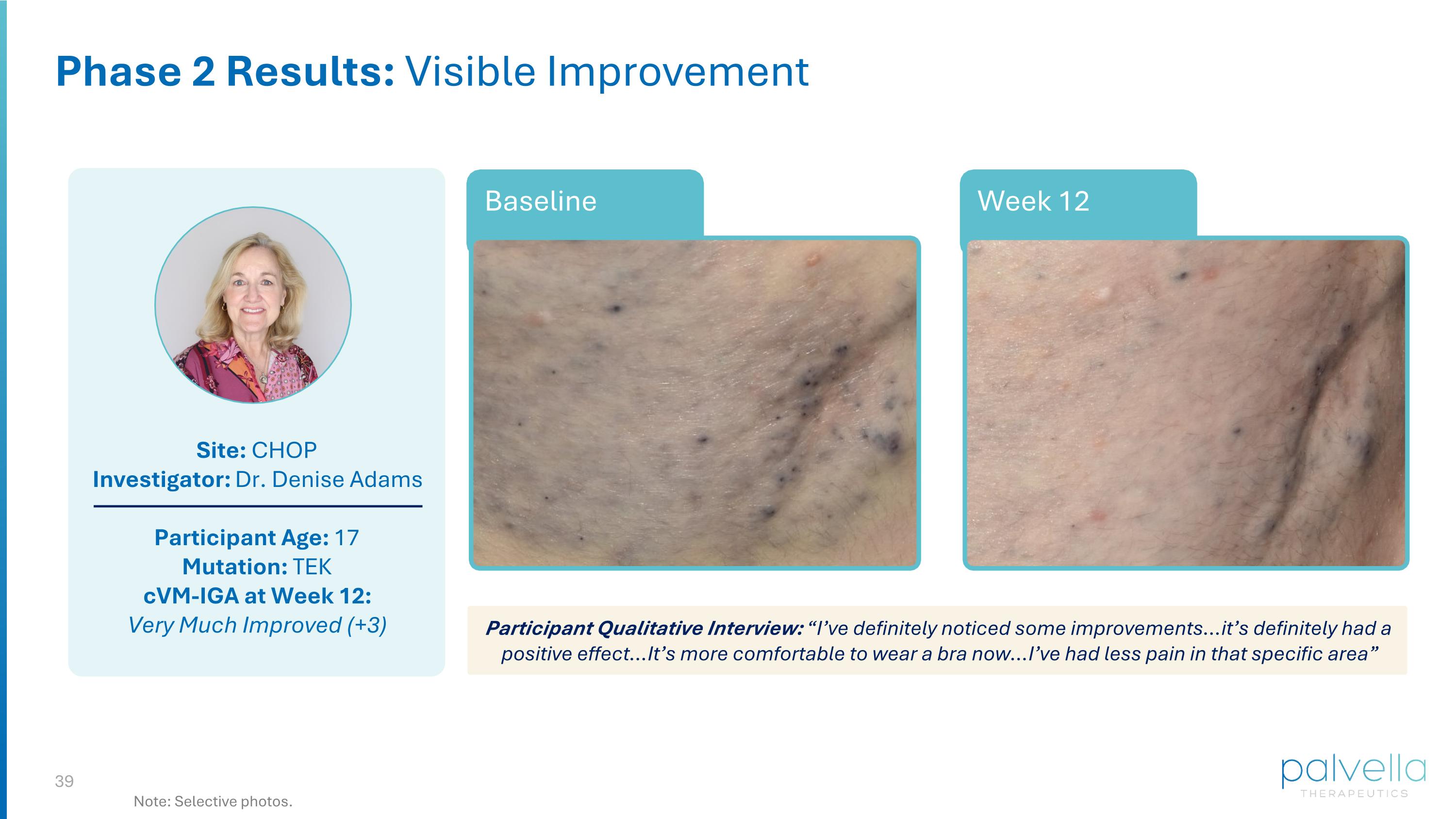

Site: CHOP Investigator: Dr. Denise Adams Participant Age: 17 Mutation: TEK cVM-IGA at Week 12: Very Much Improved (+3) Week 12 Baseline Phase 2 Results: Visible Improvement Participant Qualitative Interview: “I’ve definitely noticed some improvements…it’s definitely had a positive effect…It’s more comfortable to wear a bra now…I’ve had less pain in that specific area” Note: Selective photos.

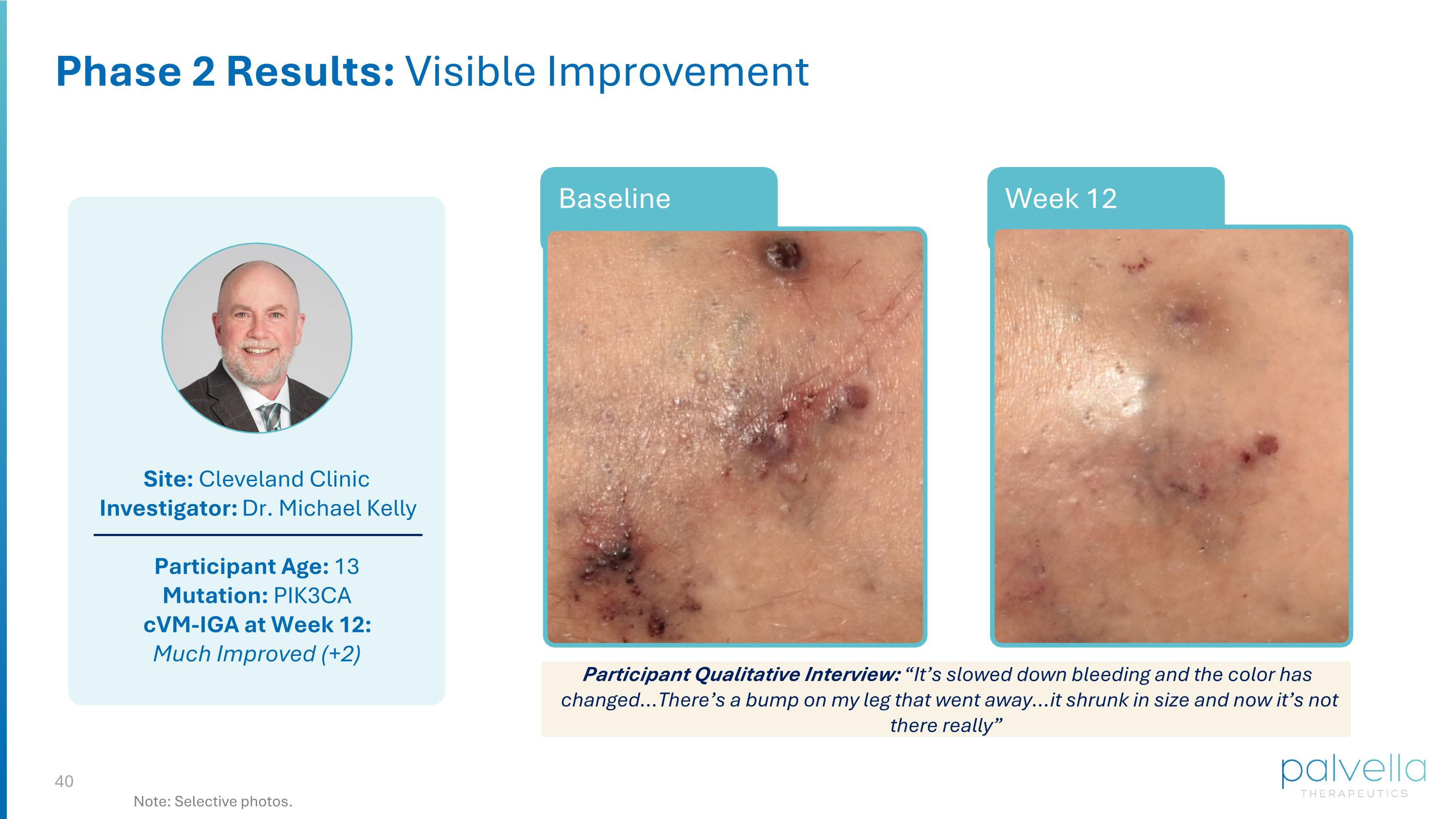

Site: Cleveland Clinic Investigator: Dr. Michael Kelly Participant Age: 13 Mutation: PIK3CA cVM-IGA at Week 12: Much Improved (+2) Week 12 Phase 2 Results: Visible Improvement Note: Selective photos. Week 12 Baseline Participant Qualitative Interview: “It’s slowed down bleeding and the color has changed…There’s a bump on my leg that went away…it shrunk in size and now it’s not there really”

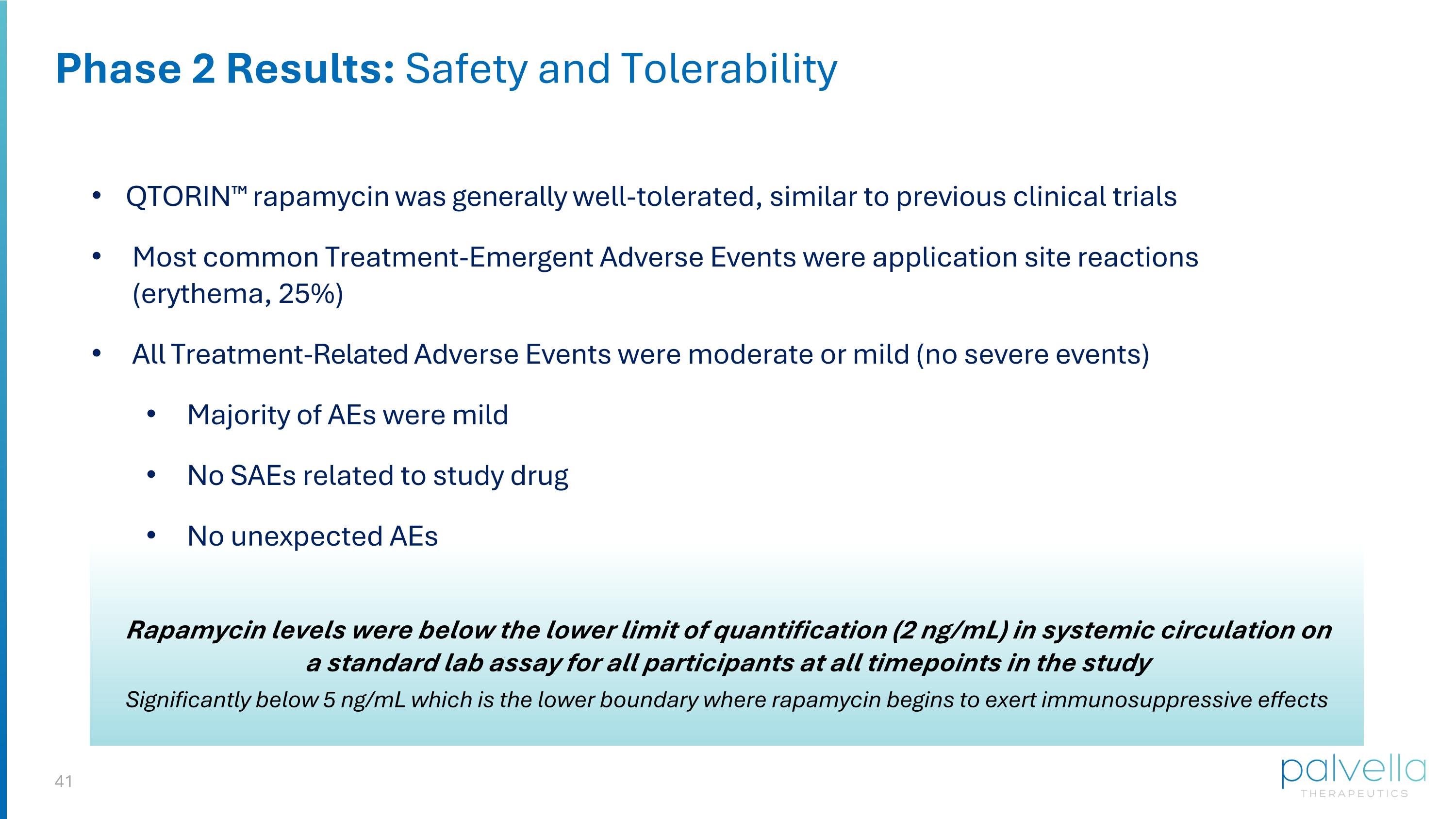

Phase 2 Results: Safety and Tolerability QTORIN™ rapamycin was generally well-tolerated, similar to previous clinical trials Most common Treatment-Emergent Adverse Events were application site reactions (erythema, 25%) All Treatment-Related Adverse Events were moderate or mild (no severe events) Majority of AEs were mild No SAEs related to study drug No unexpected AEs Rapamycin levels were below the lower limit of quantification (2 ng/mL) in systemic circulation on a standard lab assay for all participants at all timepoints in the study Significantly below 5 ng/mL which is the lower boundary where rapamycin begins to exert immunosuppressive effects

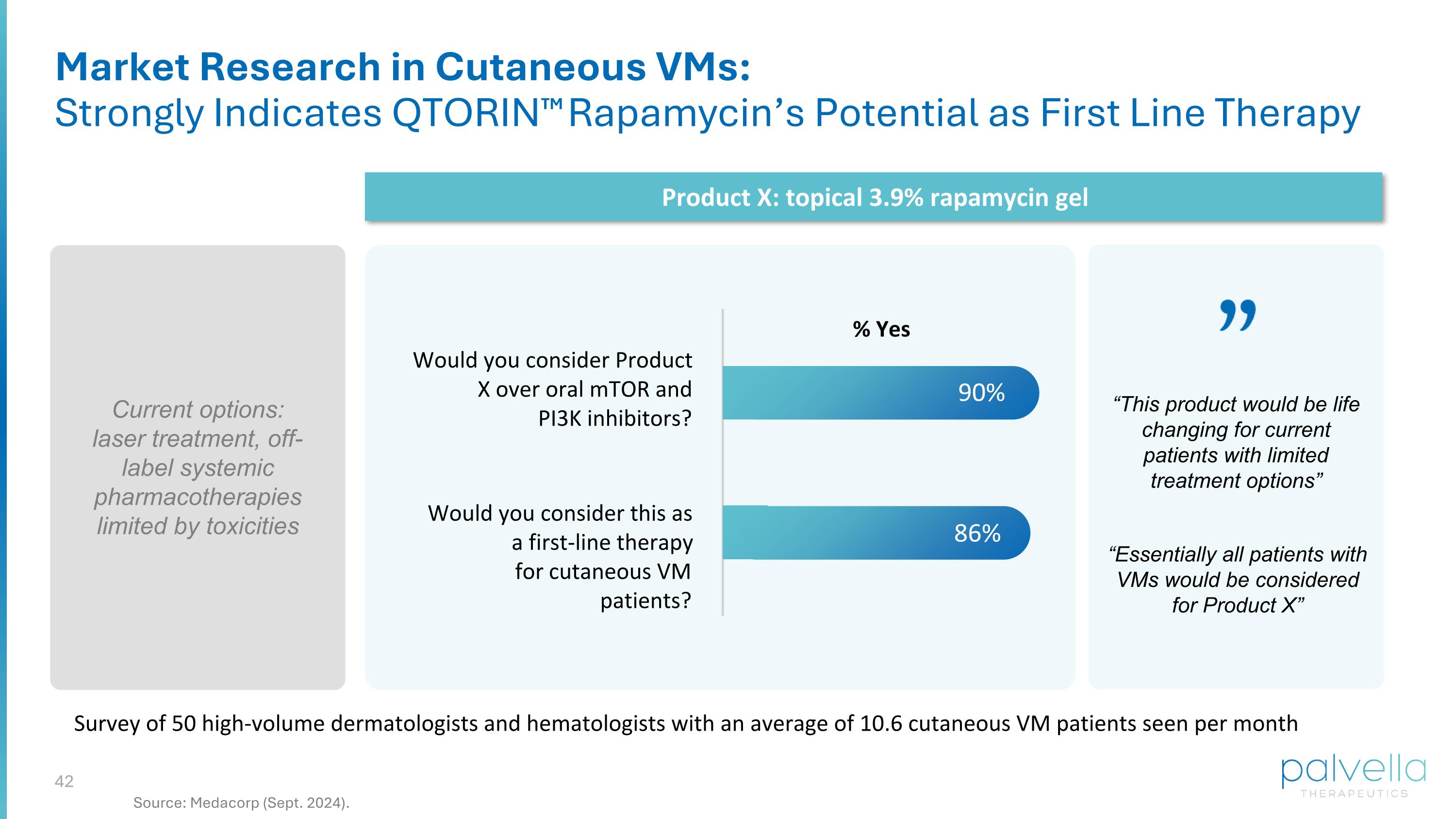

Would you consider Product X over oral mTOR and PI3K inhibitors? Would you consider this as a first-line therapy for cutaneous VM patients? 90% 86% Survey of 50 high-volume dermatologists and hematologists with an average of 10.6 cutaneous VM patients seen per month % Yes Current options: laser treatment, off-label systemic pharmacotherapies limited by toxicities Product X: topical 3.9% rapamycin gel Market Research in Cutaneous VMs: Strongly Indicates QTORIN™ Rapamycin’s Potential as First Line Therapy “Essentially all patients with VMs would be considered for Product X” “This product would be life changing for current patients with limited treatment options” Source: Medacorp (Sept. 2024).

QTORIN™ 3.9% RAPAMYCIN Clinically Significant Angiokeratomas FOR

> 50k patients ESTIMATED DIAGNOSED IN THE U.S.1 Clinically Significant Angiokeratomas: Superficial Lymphatic Malformations Persistent and extensive: Lesions can be large and increase in size, number, and extent over time Chronically debilitating lymphatic-derived skin lesions associated with bleeding, pain, and functional impairment Recurrent bleeding: Friction can cause fragile lesions to frequently bleed Disease Biology: Increased VEGF and mTOR signaling, leading to vessel dilation and hyperkeratosis Natural history: No tendency for spontaneous regression No FDA-approved therapies Current options: laser therapy, electrosurgery, cryotherapy, and surgical excision Wang et al., Journal of Cutaneous Pathology, (2014); Trindade et al., Am J Dermopathol, (2014); Prindaville et al., Pediatric Dermatology, (2017); Singh et al, Indian Journal of Dermatology, (2023); Caraffa et al, International Journal of Infection, (2025); Molla, Clinical, Cosmetic and Investigative Dermatology, (2024). Ivy H, Julian CA. Angiokeratoma Circumscriptum. Treasure Island (FL): StatPearls Publishing; 2025 Jan; Lapa et al., Journal of Cutaneous Medicine and Surgery, (2025). 1. Clarity Pharma research (July 2025), n=643 physicians surveyed. Palvella’s focus to include Fordyce, Solitary, Mibelli, and Circumscriptum subtypes

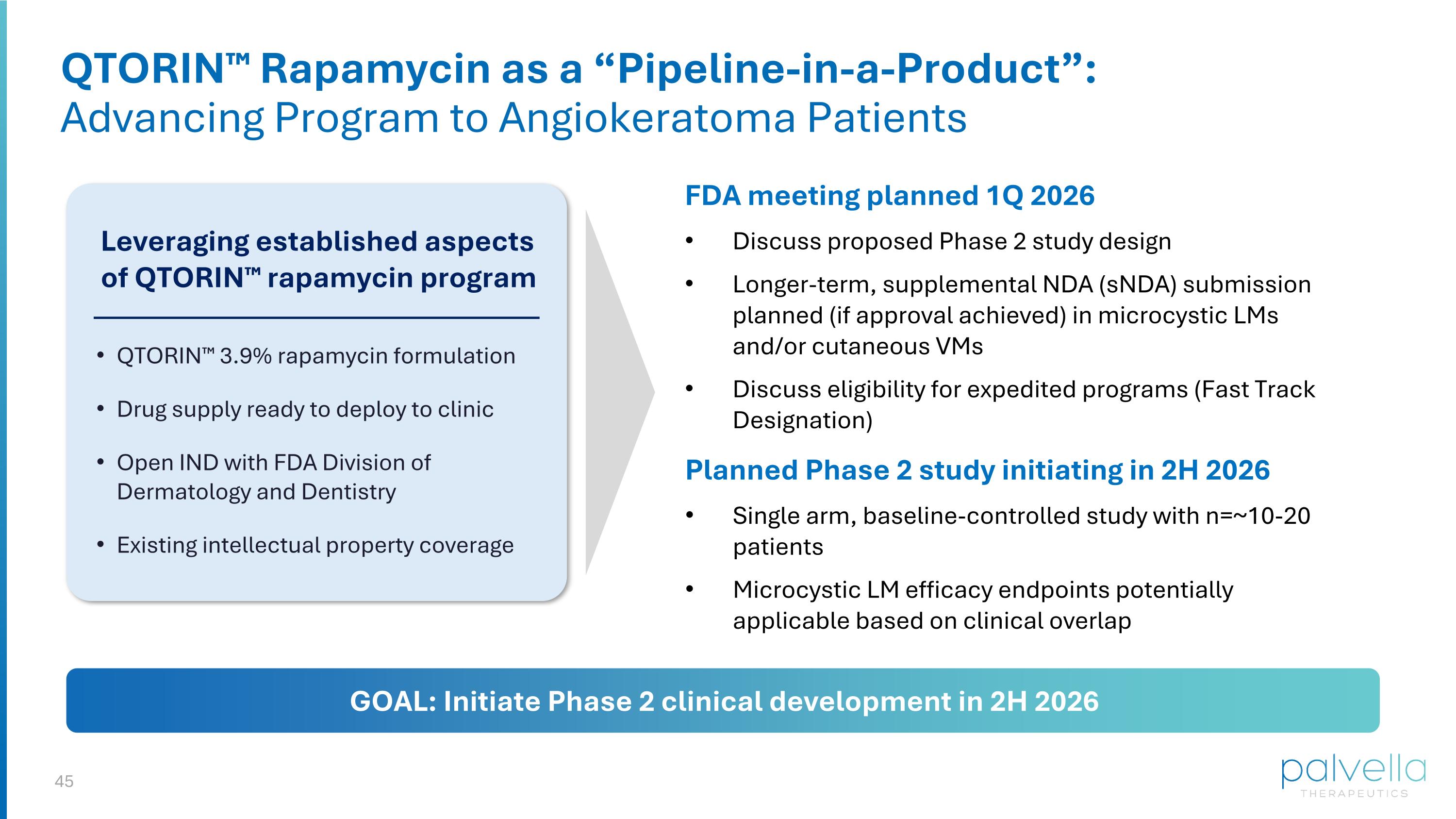

QTORIN™ Rapamycin as a “Pipeline-in-a-Product”: Advancing Program to Angiokeratoma Patients FDA meeting planned 1Q 2026 Discuss proposed Phase 2 study design Longer-term, supplemental NDA (sNDA) submission planned (if approval achieved) in microcystic LMs and/or cutaneous VMs Discuss eligibility for expedited programs (Fast Track Designation) Leveraging established aspects of QTORIN™ rapamycin program QTORIN™ 3.9% rapamycin formulation Drug supply ready to deploy to clinic Open IND with FDA Division of Dermatology and Dentistry Existing intellectual property coverage Planned Phase 2 study initiating in 2H 2026 Single arm, baseline-controlled study with n=~10-20 patients Microcystic LM efficacy endpoints potentially applicable based on clinical overlap GOAL: Initiate Phase 2 clinical development in 2H 2026

QTORIN™ PITAVASTATIN Disseminated Superficial Actinic Porokeratosis FOR

> 50k patients ESTIMATED DIAGNOSED IN THE U.S.1 Disseminated Superficial Actinic Porokeratosis (DSAP): Chronic, Pre-Cancerous, and Progressive Persistent and extensive: Clonal proliferation of abnormal keratinocytes leads to increased number and size of lesions Risk of malignant transformation: Premalignant disease with transformation to non-melanoma skin cancers2 Genetics & Disease Biology: Autosomal dominant (primary) or de novo germline mutation leads to accumulation of toxic intermediates Natural history: Spontaneous regression is extremely rare2 No FDA-approved therapies Current options: Laser, surgery, and off-label topical chemo agents & mevalonate pathway inhibitors 1. Clarity Pharma research (April 2025), n=277 physicians surveyed. 2. Williams, Grant M., et al. “Porokeratosis.” StatPearls Publishing, 2024. Significant impact to quality of life: clinical signs include skin disfigurement, burning, and persistent itch

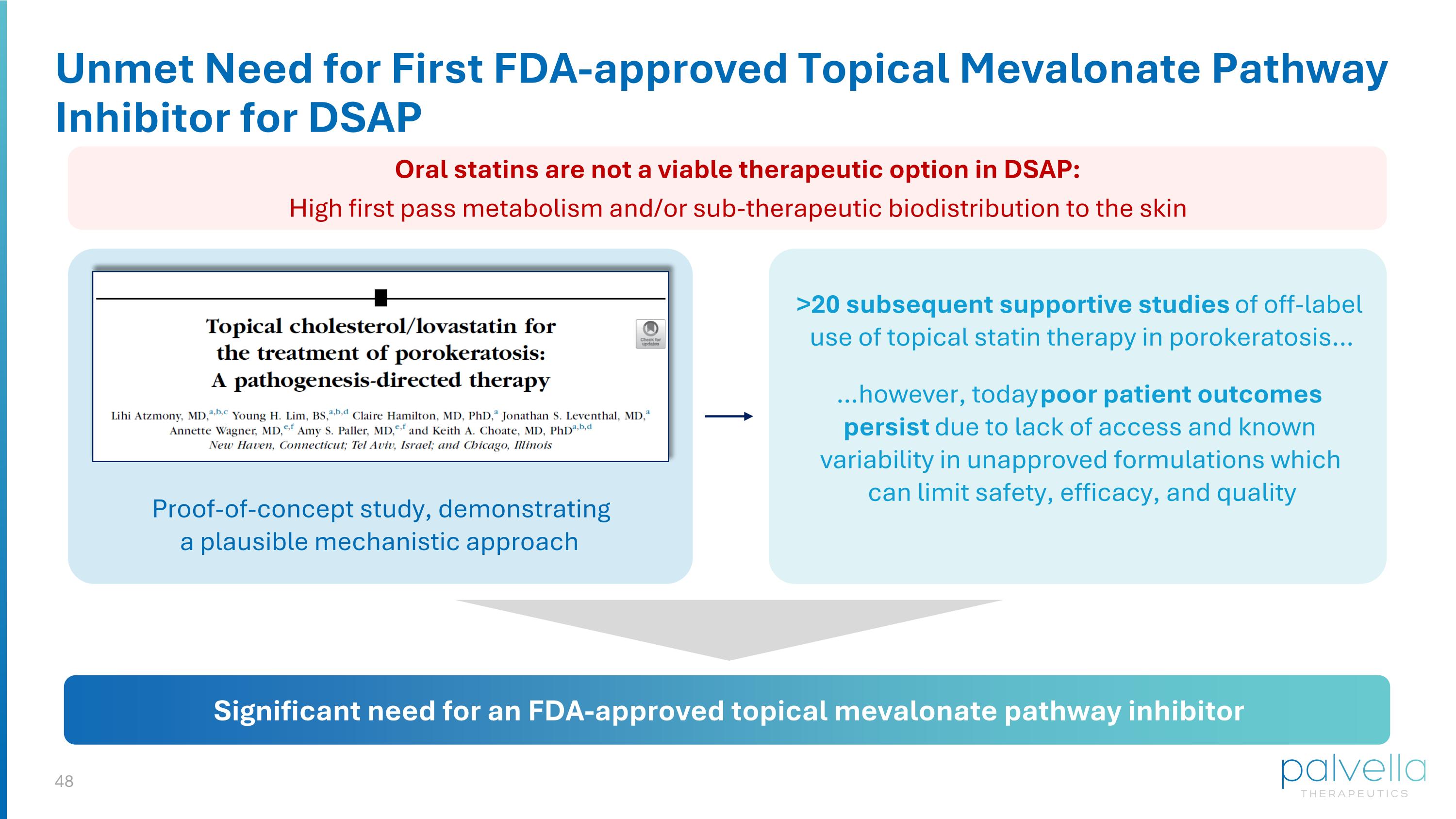

Unmet Need for First FDA-approved Topical Mevalonate Pathway Inhibitor for DSAP Proof-of-concept study, demonstrating a plausible mechanistic approach Significant need for an FDA-approved topical mevalonate pathway inhibitor >20 subsequent supportive studies of off-label use of topical statin therapy in porokeratosis… …however, today poor patient outcomes persist due to lack of access and known variability in unapproved formulations which can limit safety, efficacy, and quality Oral statins are not a viable therapeutic option in DSAP: High first pass metabolism and/or sub-therapeutic biodistribution to the skin

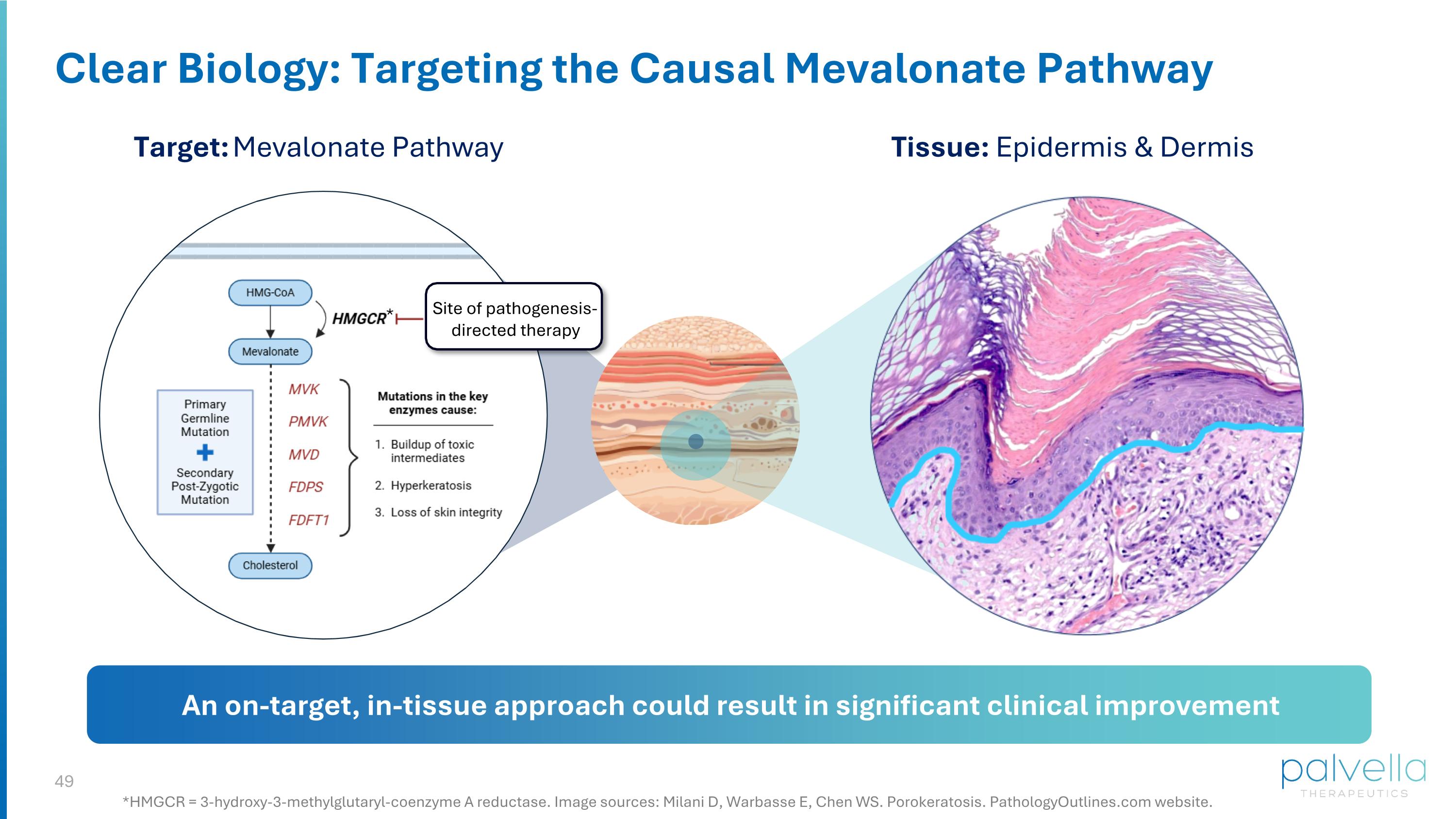

Clear Biology: Targeting the Causal Mevalonate Pathway Target: Mevalonate Pathway Tissue: Epidermis & Dermis Site of pathogenesis-directed therapy An on-target, in-tissue approach could result in significant clinical improvement *HMGCR = 3-hydroxy-3-methylglutaryl-coenzyme A reductase. Image sources: Milani D, Warbasse E, Chen WS. Porokeratosis. PathologyOutlines.com website. *

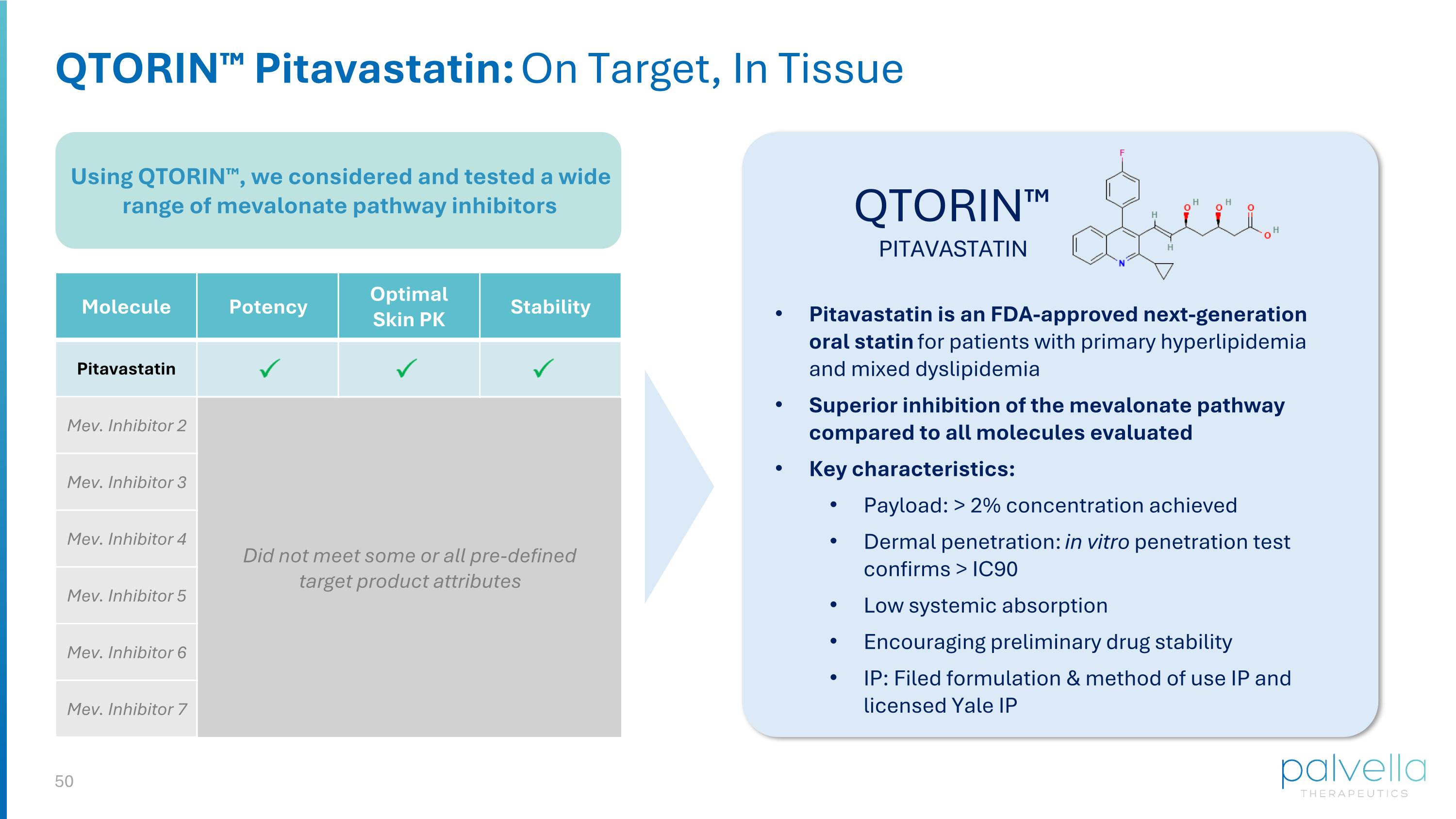

Using QTORIN™, we considered and tested a wide range of mevalonate pathway inhibitors QTORIN™ Pitavastatin: On Target, In Tissue QTORIN™ PITAVASTATIN Molecule Potency Optimal Skin PK Stability Pitavastatin Mev. Inhibitor 2 Mev. Inhibitor 3 Mev. Inhibitor 4 Mev. Inhibitor 5 Mev. Inhibitor 6 Mev. Inhibitor 7 Did not meet some or all pre-defined target product attributes Pitavastatin is an FDA-approved next-generation oral statin for patients with primary hyperlipidemia and mixed dyslipidemia Superior inhibition of the mevalonate pathway compared to all molecules evaluated Key characteristics: Payload: > 2% concentration achieved Dermal penetration: in vitro penetration test confirms > IC90 Low systemic absorption Encouraging preliminary drug stability IP: Filed formulation & method of use IP and licensed Yale IP

QTORIN™ Pitavastatin Clinical Pathway: Planned Initiation of Phase 2 in 2H 2026 FDA meeting planned 1H 2026 Discuss proposed Phase 2 study design Discuss eligibility for expedited programs (Fast Track Designation) QTORIN™ Pitavastatin: From Concept to Clinic QTORIN™ pitavastatin optimized for stability and drug delivery Working with FDA Division of Dermatology and Dentistry Filed intellectual property Initiation of Proposed Phase 2 study anticipated in 2H 2026 Phase 2 protocol drafted Endpoint development nearing completion with extensive input from key opinion leaders and patients GOAL: Initiate Phase 2 clinical development in 2H 2026

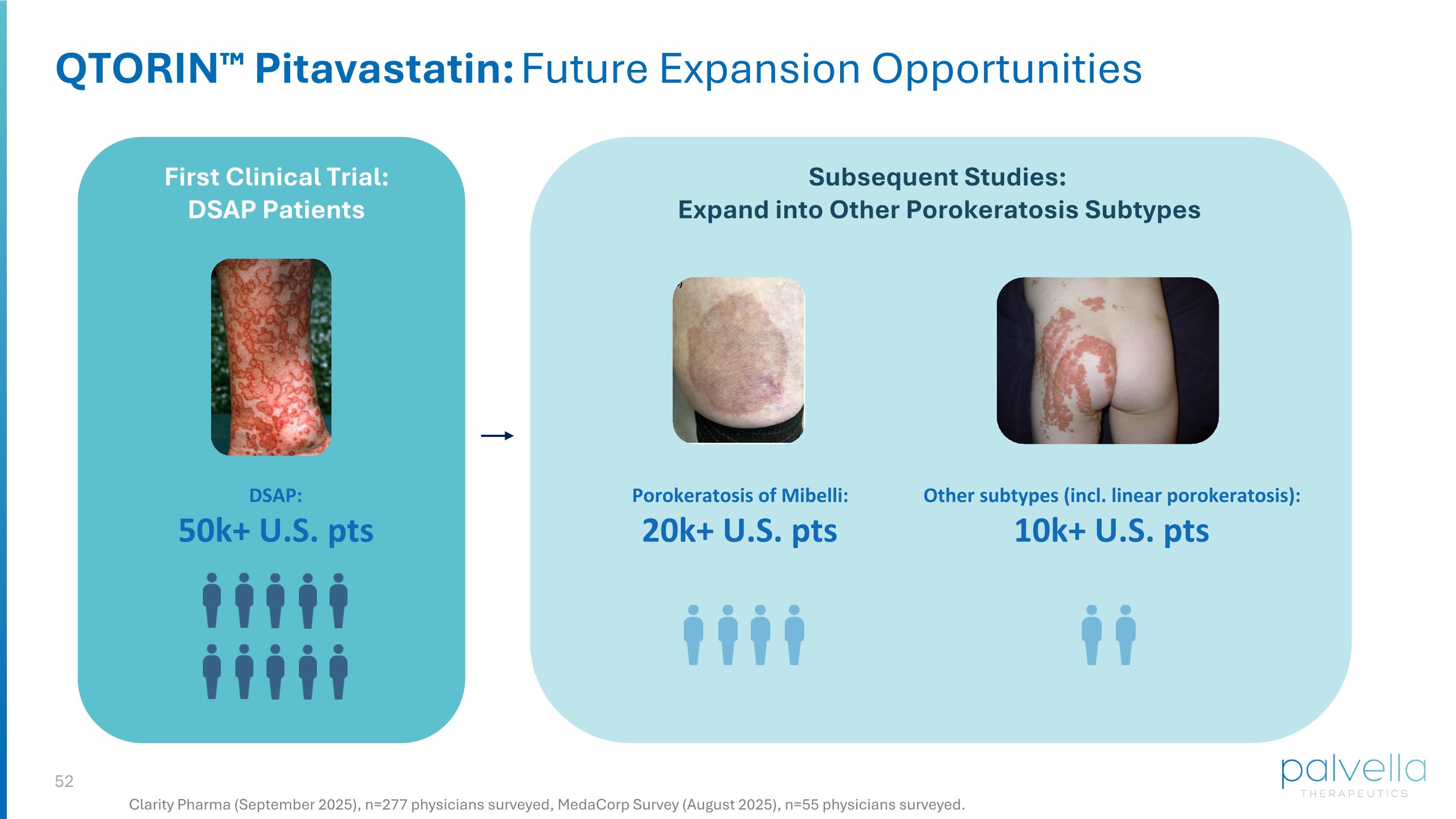

QTORIN™ Pitavastatin: Future Expansion Opportunities First Clinical Trial: DSAP Patients Subsequent Studies: Expand into Other Porokeratosis Subtypes DSAP: 50k+ U.S. pts Clarity Pharma (September 2025), n=277 physicians surveyed, MedaCorp Survey (August 2025), n=55 physicians surveyed. Porokeratosis of Mibelli: 20k+ U.S. pts Other subtypes (incl. linear porokeratosis): 10k+ U.S. pts

Finance

Well-Capitalized Through Multiple Inflection Points with Funding from Leading Healthcare-Dedicated Investors Dec. 2024 Financing Strong Cash Position Innovative operating model prioritizing capital efficiency Oversubscribed $78.9mm Financing co-led by $63.6 million Cash at 9/30/20251 $10.2 million R&D + G&A expenses in Q3 20251 ~$55 million Projected cash at year end 1 Runway into 2H 2027 1. As presented on Q3 2025 earnings call.

What Sets Palvella Apart: Building The Leader in Rare Skin Diseases and Vascular Malformations Late-stage rare disease pipeline and QTORIN™ platform QTORIN™ rapamycin in two late-stage indications: Microcystic LMs (Phase 3) and cutaneous VMs (positive Phase 2 data), with clinically significant angiokeratoma Phase 2 initiation 2H 2026 and additional QTORIN™ product candidates planned QTORIN™ rapamycin: potential to be first approved therapy and SOC in U.S. for microcystic LMs, cutaneous VMs, and angiokeratomas All are serious, rare diseases currently with no FDA-approved therapies Phase 3 designed for success & expedited regulatory pathway Highly statistically significant Phase 2 results in microcystic LMs contributed to Breakthrough Therapy Designation, single arm baseline-controlled Phase 3 study, and FDA Orphan Product Grant Striving to be first for rare disease patients U.S. commercial opportunity: multi-billion dollar TAM in mLMs and beyond Insights from recent physician and payor market research indicate potential for strong uptake

Striving to be first for rare disease patients Thank You