Items of Business: | Board’s Recommendation: | |

1.To elect as Class I directors, the nominees named in our proxy statement, to serve until the 2028 annual meeting of stockholders and until his successor is duly elected and qualified, subject to their earlier death, resignation, or removal. | ✓ | FOR ALL the director nominees |

2.To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending January 31, 2026. | ✓ | FOR the ratification of the appointment |

3.To approve, on a non-binding advisory basis, the compensation of our named executive officers. | ✓ | FOR the approval of the compensation |

4.To transact any other business that properly comes before the Annual Meeting. | ||

Page | |

General Information .......................................................................................................................................... | |

Questions and Answers ..................................................................................................................................... | |

Board of Directors and Corporate Governance ................................................................................................ | |

Compensation of Non-Employee Directors ................................................................................................. | |

Corporate Responsibility and Sustainability ..................................................................................................... | |

Proposal No. 1: Election of Directors ............................................................................................................... | |

Proposal No. 3: Advisory Vote on the Compensation of Our Named Executive Officers ............................... | |

Executive Officers ........................................................................................................................................... | |

Executive Compensation ................................................................................................................................. | |

Compensation Discussion and Analysis .................................................................................................... | |

Executive Compensation Tables ............................................................................................................... | |

CEO Pay Ratio ........................................................................................................................................... | |

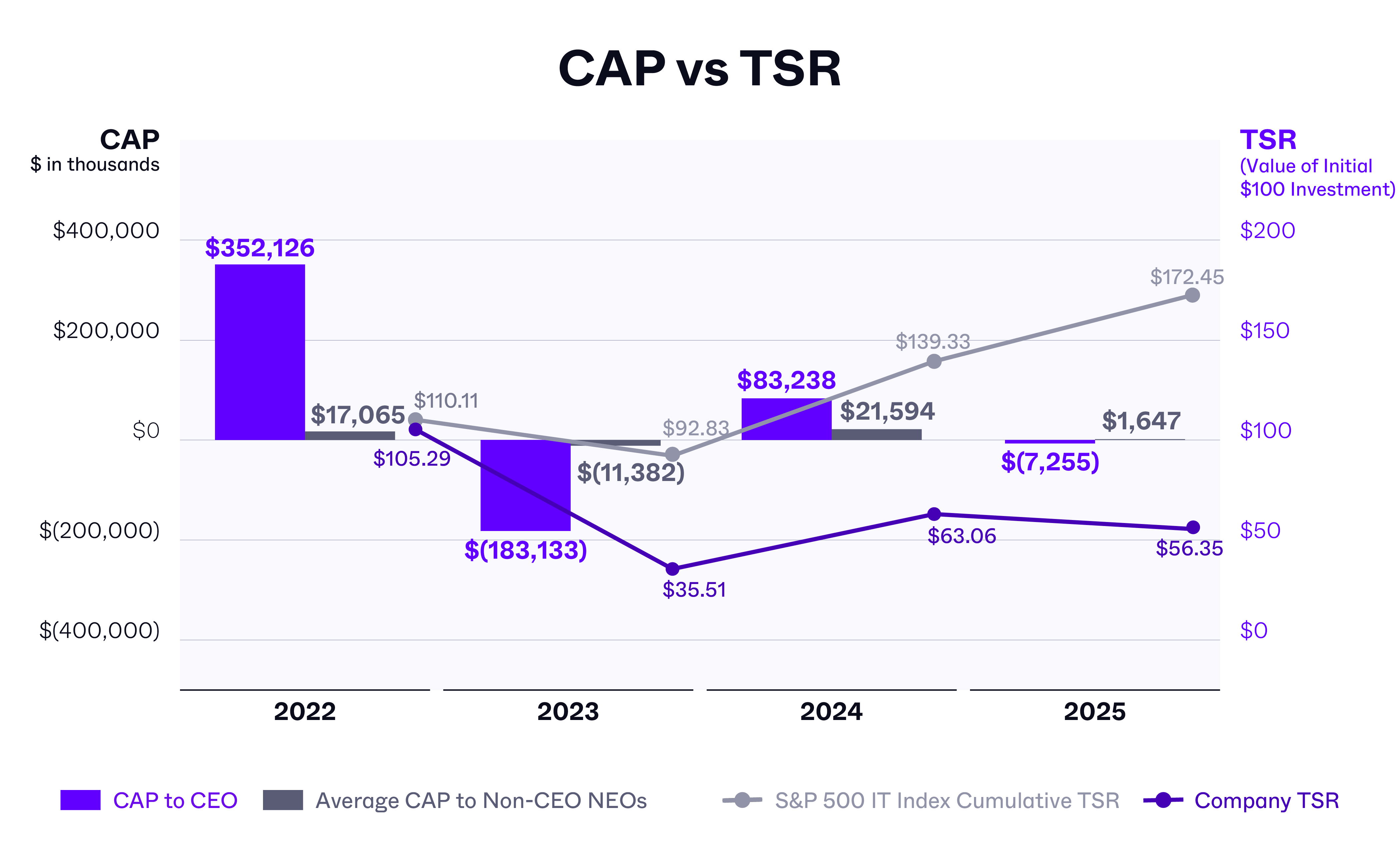

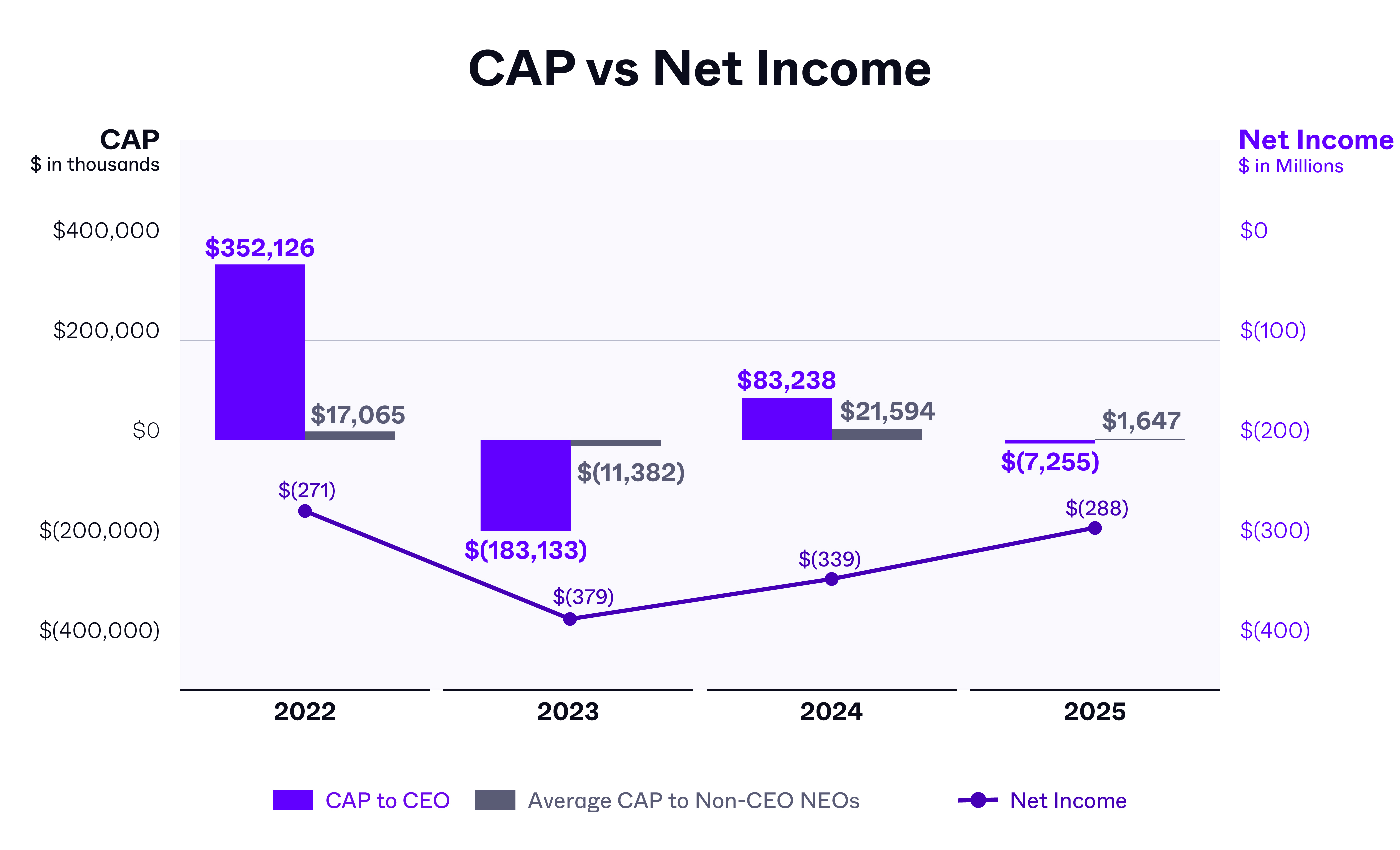

Pay Versus Performance ............................................................................................................................ | |

Related Person Transactions ............................................................................................................................. | |

Security Ownership .......................................................................................................................................... | |

Other Matters ................................................................................................................................................... | |

Stockholder Proposal Deadlines for 2026 Annual Meeting of Stockholders ................................................... |

Name | Class | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | ||||||

Nominees for Director | ||||||||||||

Tomer Weingarten ............ | I | 42 | Co-Founder, President, CEO, and Chairman of our Board | 2013 | 2025 | 2028 | ||||||

Daniel Scheinman(1)(2) ....... | I | 62 | Lead Independent Director | 2019 | 2025 | 2028 | ||||||

Teddie Wardi(1) ................. | I | 40 | Director | 2015 | 2025 | 2028 | ||||||

Continuing Directors | ||||||||||||

Ana G. Pinczuk(2) .............. | II | 62 | Director | 2022 | 2026 | — | ||||||

Charlene T. Begley(3) ........ | III | 58 | Director | 2021 | 2027 | — | ||||||

Aaron Hughes(3) ............. | III | 49 | Director | 2021 | 2027 | — | ||||||

Mark S. Peek(1)(3) .............. | III | 67 | Director | 2021 | 2027 | — |

Board/Committee | Cash Retainer | |||

Lead Independent Director (in addition to Board fee) ................................................. | $20,000 | |||

Board ............................................................................................................................ | $50,000 | |||

Chair | Member | |||

Audit Committee .......................................................................................................... | $20,000 | $10,000 | ||

Compensation Committee(1) ......................................................................................... | $15,000 | $7,500 | ||

Nominating and Corporate Governance Committee .................................................... | $12,000 | $6,000 | ||

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Total | |||

Charlene T. Begley(3) ................................................................ | $70,000 | $255,392 | $325,392 | |||

Aaron Hughes(4) ........................................................................ | $60,000 | $255,392 | $315,392 | |||

Mark S. Peek(5) ......................................................................... | $75,000 | $255,392 | $330,392 | |||

Ana G. Pinczuk(6) ..................................................................... | $56,000 | $255,392 | $311,392 | |||

Daniel Scheinman(7) ................................................................. | $88,750 | $255,392 | $344,142 |

2025 | 2024 | ||

Audit Fees(1) .............................................................................................................. | $4,030,000 | $3,644,000 | |

Audit-Related Fees(2) ................................................................................................. | — | 257,000 | |

Tax Fees(3) ................................................................................................................. | 1,156,000 | 1,282,000 | |

All Other Fees(4) ........................................................................................................ | 5,000 | 2,000 | |

Total Fees .................................................................................................................. | $5,191,000 | $5,185,000 |

Name | Age | Position | ||

Tomer Weingarten ............... | 42 | Co-Founder, President, Chief Executive Officer, and Chairman of our Board | ||

Barbara Larson(1) .................. | 54 | Chief Financial Officer | ||

Richard Smith, Jr. ............... | 45 | President, Product, Technology, and Operations | ||

Keenan Conder .................... | 62 | Chief Legal Officer and Corporate Secretary |

Name | Title |

Tomer Weingarten .......................... | Co-Founder, Chief Executive Officer, President, and Chairman of our Board |

Barbara Larson(1) ............................. | Chief Financial Officer |

Richard Smith, Jr. ........................... | President, Product, Technology, and Operations |

Keenan Conder ................................ | Chief Legal Officer and Corporate Secretary |

“Vats” Narayanan Srivatsan(2) ....... | Former Chief Operating Officer |

David Bernhardt(3) ........................... | Former Chief Financial Officer |

Market-Driven Competitive Pay | Pay is targeted to be competitive against peers, with flexibility to adjust compensation elements based on individual job requirements and scope, experience, business needs, qualifications and performance, in order to attract and retain critical talent. |

Long-term Orientation | Compensation is most heavily weighted to long-term, stock-based components, driving focus on strategic long-term priorities. |

Pay for Performance | We believe in rewarding our executives by utilizing a “pay-for-performance” approach to compensation, the goal of which is to create meaningful links between the level of the executive's compensation and financial and strategic performance. |

Alignment with Stockholders | We effectively align named executive officer interests with those of our stockholders by focusing on long-term incentive compensation in the form of equity awards that correlate with the growth of sustainable long-term value for our stockholders. A meaningful portion of our named executive officers’ compensation opportunity is “at-risk” and variable in nature. |

Our Approach | Practices We Avoid |

Maintain an independent compensation committee and advisors | Do not use “single-trigger” change in control benefits for our named executive officers |

Conduct an annual executive compensation review | Do not offer executive retirement plans |

Ensure that the vast majority of our executive pay is in the form of equity and is “at risk” | Prohibit hedging of our equity securities by our employees, our named executive officers, and the members of our Board |

Ensure succession planning through periodic review between the Chief Executive Officer and the Nominating and Corporate Governance Committee | Do not provide reimbursements or “gross ups” for excise tax payments |

Subject to feedback from our stockholders, we intend to annually conduct a say-on-pay vote | Do not provide perquisites for purposes that are not business-related or not otherwise necessary for the security of our named executive officers |

Emphasize a “pay-for-performance” philosophy, including granting performance stock units (PSUs) to senior executives to further align compensation to performance | No discounted stock option awards |

Require executives to comply with our Compensation Recovery Policy | No pledging without prior consent of our Chief Legal Officer |

Stock ownership requirements applicable to our directors and executive officers |

Compensation Committee a.Sets incentive program targets and approves payouts b.Evaluates performance of our CEO and other executive officers c.Reviews and approves our CEO’s and other executive officers’ base salaries d.Reviews and approves all other elements of pay for executive officers e. Assesses independence of compensation consultant |

Management a.Our CEO and our Chief People Officer recommends compensation program design b.Our CEO assisted by our Chief People Officer recommend compensation for other executive officers (in each case, excluding recommendations relating to such officer’s own compensation) c.Our Chief Financial Officer provides financial information to inform our Compensation Committee’s decision-making on incentive goals and payouts d. Implements compensation decisions of our Compensation Committee and our Board |

Independent Compensation Consultant a.Presents peer group pay practices and benchmarks for executive officer compensation to our Compensation Committee and management b.Reviews and provides recommendations to our Compensation Committee regarding management’s program design and pay proposals c.Meets with compensation committee in executive session d.Conducts annual independent evaluation of our incentive programs to assess risk e.Provides additional consultation to the Compensation Committee or members thereof as needed regarding our compensation practices and individual executive compensation matters |

Fiscal 2025 Peer Group | ||

Appian Corporation (APPN) | Five9, Inc. (FIVN) | Qualys, Inc. (QLYS) |

CloudFlare, Inc. (NET) | GitLab Inc. (GTLB) | Rapid7, Inc. (RPD) |

Confluent, Inc. (CFLT) | HashiCorp, Inc. (HCP) | Samsara Inc. (IOT) |

CrowdStrike Holdings, Inc. (CRWD) | MongoDB, Inc. (MDB) | Smartsheet Inc. (SMAR) |

Datadog, Inc. (DDOG) | nCino, Inc. (NCNO) | Splunk Inc. (SPLK) |

Dynatrace, Inc. (DT) | Okta, Inc. (OKTA) | Tenable Holdings, Inc. (TENB) |

Elastic N.V. (ESTC) | Palo Alto Networks, Inc. (PANW) | Workiva Inc. (WK) |

Name | Fiscal 2024 Base Salary | Fiscal 2025 Base Salary | Percentage Adjustment |

Tomer Weingarten .............. | $600,000 | $700,000 | 16.7% |

Barbara Larson (1) ............... | n/a | $527,000 | n/a |

Richard Smith, Jr. ............... | $450,000 | $550,000 | 22.2% |

Keenan Conder ................... | $425,000 | $450,000 | 5.9% |

“Vats”Srivatsan Narayanan (2) ....................... | $450,000 | $450,000 | —% |

David Bernhardt ................. | $425,000 | $465,000 | 9.4% |

Metric | Weight | Fiscal 2025 Threshold | Fiscal 2025 Targets | Fiscal 2025 Maximum | Fiscal 2025 Results | Resulting Fiscal 2025 Payout |

Revenue ............................. | 50% | $774.0M | $815.0M | $856.0M | $821.5M | 108% |

Non-GAAP Operating Margin(1) ............................ | 25% | (6.0)% | (4.0)% | (2.0)% | (3.1)% | 123% |

Strategic Objectives .......... | 25% | 100% | ||||

Name | Fiscal 2025 Target Cash Incentive Opportunity | Fiscal 2025 Target Annual Cash Incentive as a Percentage of Salary | Fiscal 2025 Cash Incentive Payout |

Tomer Weingarten ..................... | $875,000 | 125% | $962,500 |

Barbara Larson(1) ........................ | $368,900 | 70% | $158,546 |

Richard Smith, Jr. ...................... | $385,000 | 70% | $423,500 |

Keenan Conder .......................... | $270,000 | 60% | $297,000 |

“Vats”Narayanan Srivatsan(2) .... | $450,000 | 100% | $0 |

David Bernhardt(3) ...................... | $325,500 | 70% | $0 |

Name | Fiscal 2025 LTI Award(1) | Total Target PSU Value(1) | RSU Value(1) |

Tomer Weingarten ............................... | $19,000,000 | $4,750,000 | $14,250,000 |

Barbara Larson ..................................... | $14,000,000 | $3,500,000 | $10,500,000 |

Richard Smith, Jr. ............................... | $10,000,000 | $2,500,000 | $7,500,000 |

Keenan Conder .................................... | $4,375,000 | $1,093,750 | $3,281,250 |

“Vats” Narayanan Srivatsan ............... | $5,000,000 | $2,500,000 | $2,500,000 |

David Bernhardt ................................... | $5,500,000 | $1,375,000 | $4,125,000 |

Metric | Weight | Fiscal 2025 Threshold | Fiscal 2025 Targets | Fiscal 2025 Maximum | Fiscal 2025 Results | Resulting Fiscal 2025 Payout |

ARR .................................. | 37.5% | $911.0M | $959.0M | $1,079.0M | $920.1M | 59% |

Revenue ............................. | 37.5% | $774.0M | $815.0M | $917.0M | $821.5M | 108% |

Non-GAAP Operating Margin(1) ............................ | 25.0% | (6.0)% | (4.0)% | 0.0% | (3.1)% | 123% |

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2)(3) | Non-Equity Incentive Plan Compensation ($)(4) | All Other Compensation ($) | Total ($) | ||||||||

Tomer Weingarten Co-Founder, President, CEO, and Chairman of our Board ...................... | 2025 | 700,000 | — | 16,556,346 | 962,500 | 746,620 | (5) | 18,965,466 | |||||||

2024 | 600,000 | — | 15,054,808 | 660,000 | 229,280 | 16,544,088 | |||||||||

2023 | 600,000 | 660,000 | 12,027,805 | — | 234,557 | 13,522,362 | |||||||||

Barbara Larson Chief Financial Officer(6) ................... | 2025 | 204,213 | — | 11,271,975 | 158,546 | 26,041 | (7) | 11,660,775 | |||||||

Richard Smith, Jr. President, Product, Technology, and Operations ......................................... | 2025 | 550,000 | — | 8,713,875 | 423,500 | 1,688 | 9,689,063 | ||||||||

2024 | 450,000 | — | 10,753,441 | 297,000 | 1,688 | 11,502,129 | |||||||||

2023 | 450,000 | 297,000 | 3,708,574 | — | 2,500 | 4,459,199 | |||||||||

Keenan Conder Chief Legal Officer and Corporate Secretary ........................................... | 2025 | 450,000 | — | 3,812,055 | 297,000 | 6,077 | 4,565,132 | ||||||||

2024 | 425,000 | — | 4,704,672 | 280,500 | 2,500 | 5,412,672 | |||||||||

2023 | 424,375 | 280,500 | 2,004,609 | — | 3,563 | 2,713,047 | |||||||||

“Vats” Narayanan Srivatsan Former Chief Operating Officer(8) ..... | 2025 | 421,023 | — | 4,063,323 | — | 246,199 | (8) | 4,730,545 | |||||||

2024 | 450,000 | — | 5,376,721 | 495,000 | 2,500 | 6,324,221 | |||||||||

2023 | 373,295 | 395,428 | 14,188,118 | — | 3,625 | 14,959,341 | |||||||||

David Bernhardt Former Chief Financial Officer(9) ...... | 2025 | 426,250 | — | 8,607,016 | — | 551,630 | (9) | 9,584,896 | |||||||

2024 | 425,000 | — | 6,452,059 | 280,500 | 6,395 | 7,163,954 | |||||||||

2023 | 425,000 | 280,500 | 4,009,256 | — | 3,564 | 4,718,320 | |||||||||

Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stock (#) | Grant Date Fair Value of Share Awards ($)(1) | |||||||||||||||||||

Name | Type of Award | Grant Date | Threshold ($) | Target ($) | Maxi- mum ($) | Threshold (#) | Target (#) | Maxi- mum (#) | Plan | |||||||||||||

Tomer Weingarten | Cash Incentive | — | 437,500 | 875,000 | 1,312,500 | — | — | — | — | — | — | |||||||||||

RSU | 2/15/2024(2) | — | — | — | — | — | — | 519,710 | 15,591,300 | 2021 | ||||||||||||

PSU | 3/15/2024(3) | — | — | — | 21,843 | 43,687 | 98,295 | 43,687 | 965,046 | 2021 | ||||||||||||

Barbara Larson(4) ..... | Cash Incentive | — | 184,450 | 368,900 | 553,350 | — | — | — | — | — | — | |||||||||||

RSU | 9/16/2024(5) | — | — | — | — | — | — | 448,487 | 10,404,898 | 2021 | ||||||||||||

PSU | 9/16/2024(3) | — | — | — | 18,687 | 37,374 | 84,091 | 37,374 | 867,077 | 2021 | ||||||||||||

Richard Smith, Jr. .... | Cash Incentive | — | 192,500 | 385,000 | 577,500 | — | — | — | — | — | — | |||||||||||

RSU | 2/15/2024(2) | — | — | — | — | — | — | 273,532 | 8,205,960 | 2021 | ||||||||||||

PSU | 3/15/2024(3) | — | — | — | 11,496 | 22,993 | 51,734 | 22,993 | 507,915 | 2021 | ||||||||||||

Keenan Conder ....... | Cash Incentive | — | 135,000 | 270,000 | 405,000 | — | — | — | — | — | — | |||||||||||

RSU | 2/15/2024(2) | — | — | — | — | — | — | 119,661 | 3,589,830 | 2021 | ||||||||||||

PSU | 3/15/2024(3) | — | — | — | 5,030 | 10,060 | 22,635 | 10,060 | 222,225 | 2021 | ||||||||||||

“Vats” Narayanan Srivatsan(6) . | Cash Incentive | — | 225,000 | 450,000 | 675,000 | — | — | — | — | — | — | |||||||||||

RSU | 3/15/2024(2) | — | — | — | — | — | — | 91,972 | 2,031,661 | 2021 | ||||||||||||

PSU | 3/15/2024(3) | — | — | — | (7) | 91,972 | 114,966 | 91,972 | 2,031,661 | 2021 | ||||||||||||

David Bernhardt(8) | Cash Incentive | — | 162,750 | 325,500 | 488,250 | — | — | — | — | — | — | |||||||||||

RSU | 2/15/2024(2) | — | — | — | — | — | — | 150,442 | 4,513,260 | 2021 | ||||||||||||

RSU Modification | 9/10/2024 | — | — | — | — | — | — | 173,089 | 3,745,646 | 2021 | ||||||||||||

Option Modification | 9/10/2024 | — | — | — | — | — | — | 1,751,098 | 68,738 | 2013 | ||||||||||||

PSU | 3/15/2024(3) | — | — | — | 6,323 | 12,647 | 28,455 | 12,647 | 279,372 | 2021 | ||||||||||||

Option Awards(1) | Stock Awards(1) | |||||||||||||||||||

Name | Grant Date | Number of Securiti es Underly ing Unexerc ised Options (#) Exercisa ble | Number of Securities Underlying Unexercise d Options (#) Unexercisa ble | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Opti on Exer cise Price ($) | Option Expiratio n Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have not Vested(2) ($) | Equity Incentive Plan Awards: Number of Unearne d Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearne d Shares, Units or Other Rights That Have Not Vested ($) | ||||||||||

Tomer Weingarten .. | 3/8/2019 | 147,135 | — | — | 1.20 | 3/7/2029 | — | — | — | — | ||||||||||

3/27/2020 | 17,483 | — | — | 2.27 | 3/26/2030 | — | — | — | — | |||||||||||

3/24/2021 | 2,747,618 | 1,217,344(3) | — | 9.74 | 3/23/2031 | — | — | — | — | |||||||||||

3/24/2021 | — | — | 1,304,605(4) | 9.74 | 3/23/2031 | — | — | — | — | |||||||||||

3/17/2022 | — | — | — | — | — | 99,780(5) | 2,389,731 | — | — | |||||||||||

2/15/2023 | — | — | — | — | — | 389,827(6) | 9,336,357 | — | — | |||||||||||

2/15/2024 | — | — | — | — | — | 422,265(7) | 10,113,247 | — | — | |||||||||||

3/15/2024(8) | — | — | — | — | — | — | — | 43,687 | 1,046,304 | |||||||||||

Barbara Larson ......... | 9/16/2024 | — | — | — | — | — | 448,487(9) | 10,741,264 | — | — | ||||||||||

9/16/2024(8) | — | — | — | — | — | — | — | 37,374 | 895,107 | |||||||||||

Richard Smith, Jr. ..... | 3/24/2021 | — | 14,584(10) | — | 9.74 | 3/23/2031 | — | — | — | — | ||||||||||

3/17/2022 | — | — | — | — | — | 30,766(5) | 736,846 | — | — | |||||||||||

2/15/2023 | — | — | — | — | — | 278,448(6) | 6,668,830 | — | — | |||||||||||

2/15/2024 | — | — | — | — | — | 222,245(7) | 5,322,768 | — | — | |||||||||||

3/15/2024(8) | — | — | — | — | — | — | — | 22,993 | 550,682 | |||||||||||

Keenan Conder ......... | 9/9/2021 | — | — | — | — | — | 21,127(11) | 505,992 | — | — | ||||||||||

3/17/2022 | — | — | — | — | — | 16,630(5) | 398,289 | — | — | |||||||||||

2/15/2023 | — | — | — | — | — | 121,823(6) | 2,917,661 | — | — | |||||||||||

2/15/2024 | — | — | — | — | — | 97,225(7) | 2,328,539 | — | — | |||||||||||

3/15/2024(8) | — | — | — | — | — | — | — | 10,060 | 240,937 | |||||||||||

“Vats” Narayanan Srivatsan(12) . | 4/6/2022 | — | — | — | — | — | 125,072(13) | 2,995,474 | — | — | ||||||||||

2/15/2023 | — | — | — | — | — | 139,224(6) | 3,334,415 | — | — | |||||||||||

3/15/2024(8) | — | — | — | — | — | 57,483 | 1,376,718 | — | — | |||||||||||

David Bernhardt(14) | 10/1/2020 | 1,350,000 | — | — | 3.02 | 9/30/2030 | — | — | — | — | ||||||||||

3/17/2022 | — | — | — | — | — | 26,608(5) | 637,262 | — | — | |||||||||||

2/15/2023 | — | — | — | — | — | 74,253(6) | 1,778,359 | — | — | |||||||||||

2/15/2024 | — | — | — | — | — | 37,611(7) | 900,783 | — | — | |||||||||||

Option Awards | Stock Awards | ||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1)(2) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($)(3) | |

Tomer Weingarten ........................... | 2,010,012 | 32,756,541 | 350,524 | 7,932,135 | |

Barbara Larson ................................. | — | — | — | — | |

Richard Smith, Jr. ............................ | 199,750 | 2,653,928 | 199,654 | 4,499,015 | |

Keenan Conder ................................ | — | — | 118,052 | 2,666,327 | |

“Vats” Narayanan Srivatsan ............ | — | — | 196,424 | 4,398,178 | |

David Bernhardt ............................... | 491,098 | 10,860,776 | 129,068 | 2,924,958 | |

Named Executive Officer | Termination of Employment No Change-of-Control | Termination of Employment Change-of-Control | |||||||||||||

Severance Payment ($) | Medical Benefits Continuation ($) | Accelerated Vesting of Equity Awards ($) | Total ($) | Severance Payment ($) | Medical Benefits Continuation ($) | Accelerated Vesting of Equity Awards ($) | Total ($) | ||||||||

Tomer Weingarten . | 700,000 | 31,333 | 13,046,451 | 13,777,784 | 1,925,000 | 46,999 | 40,184,096 | 42,156,095 | |||||||

Barbara Larson(1) .... | 263,500 | 12,993 | — | 276,493 | 895,900 | 25,986 | 11,636,371 | 12,558,257 | |||||||

Richard Smith Jr. ... | 275,000 | 16,599 | — | 291,599 | 765,000 | 33,197 | 13,486,364 | 14,284,561 | |||||||

Keenan Conder ....... | 212,500 | 16,599 | — | 229,099 | 680,000 | 33,197 | 6,391,417 | 7,104,614 | |||||||

“Vats” Narayanan Srivastan(2) .............. | 225,000 | 18,699 | — | 243,699 | — | — | 4,979,684 | 4,979,684 | |||||||

David Bernhardt(3) .. | 530,430 | 18,699 | 3,745,646 | 4,294,775 | — | — | — | — | |||||||

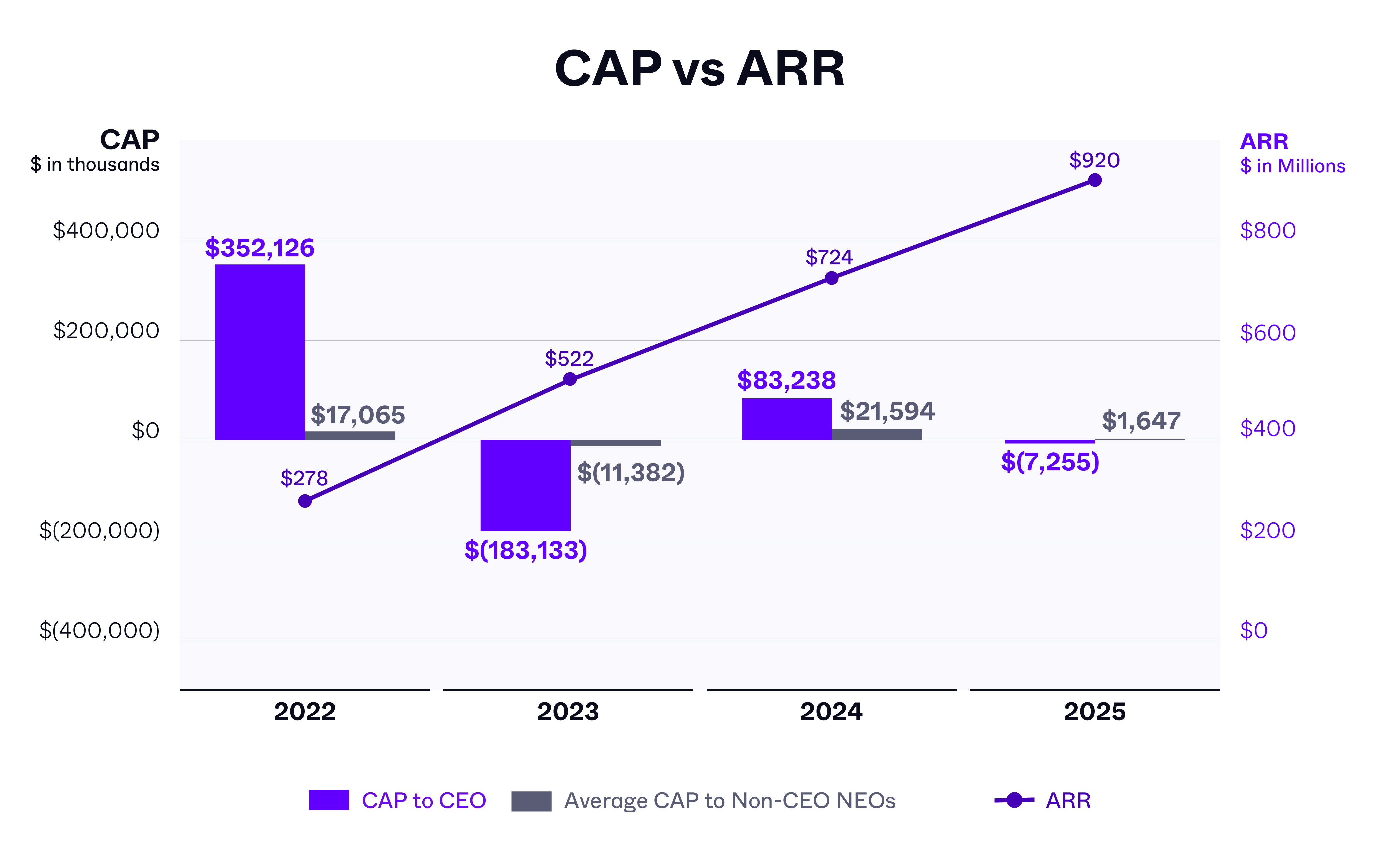

Value of Initial Fixed $100 Investment Based on: | ||||||||||||||||

Fiscal Year | Summary Compensation Table Total for CEO(1)(2) ($) | Compensation Actually Paid to CEO(3) ($) | Average Summary Compensation Table Total for Non-CEO NEOs(4) ($) | Average Summary Actually Paid to Non-CEO NEOs(5) ($) | Total Stockholder Return(6) ($) | Peer Group Total Stockholder Return(7) ($) | Net Income (Loss)(8) ($ millions) | ARR(9) ($ millions) | ||||||||

2025 ....... | ( | ( | ||||||||||||||

2024 ....... | ( | |||||||||||||||

2023 ........ | ( | ( | ( | |||||||||||||

2022 ....... | ( | |||||||||||||||

Financial Performance Measures |

Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | (b) Weighted- average Exercise Price of Outstanding Options, Warrants and Rights ($) | (c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) | ||||||

Equity compensation plans approved by security holders(1) .............. | 41,017,262 | (2) | $6.37 | (3) | 52,854,150 | (4)(5) | |||

Equity compensation plans not approved by security holders(6) ........ | 164,100 | 1.60 | (7) | — | |||||

Total ............................................................................................... | 41,181,362 | $6.31 | 52,854,150 | ||||||

Shares Beneficially Owned | Total Voting Power | |||||||||

Class A | Class B | |||||||||

Name of Beneficial Owners | Shares | % | Shares | % | % | |||||

Named Executive Officers and Directors: | ||||||||||

Tomer Weingarten(1) | 179,743 | * | 7,299,373 | 43.41% | 22.38% | |||||

Shares subject to voting proxy(2) | 4,607,784 | 1.45% | — | —% | * | |||||

Total | 4,787,527 | 1.51% | 7,299,373 | 43.41% | 23.08% | |||||

Barbara Larson(3) | 24,736 | * | — | —% | —% | |||||

Richard Smith, Jr.(4) | 54,186 | * | — | —% | * | |||||

Keenan Conder(5) | 232,244 | * | — | —% | * | |||||

“Vats” Narayanan Srivatsan(6) | 393,732 | * | — | —% | * | |||||

David Bernhardt(7) | 248,656 | * | — | —% | * | |||||

Charlene T. Begley(8) | 59,794 | * | 33,000 | * | * | |||||

Aaron Hughes(9) | 47,229 | * | 40,000 | * | * | |||||

Mark S. Peek(10) | 128,913 | * | 40,000 | * | * | |||||

Ana G. Pinczuk(11) | 54,913 | * | — | —% | * | |||||

Daniel Scheinman(12) | 77,657 | * | 1,423,149 | 10.03% | 4.75% | |||||

Teddie Wardi(13) | 17,264 | * | — | —% | * | |||||

All executive officers and directors as a group (10 persons)(14) | 5,484,463 | 1.73% | 8,835,522 | 52.19% | 27.79% | |||||

Greater than 5% Stockholders: | ||||||||||

Entities affiliated with The Vanguard Group(15) | 25,158,987 | 7.94% | — | — | 4.19% | |||||

BlackRock, Inc.(16) | 15,569,041 | 4.91% | — | —% | 2.59% | |||||

Entities affiliated with Insight Ventures(17) | 3,984,112 | 1.26% | 7,440,914 | 52.43% | 25.44% | |||||