Q3 FY2026 Earnings Presentation December 4, 2025

2 Safe Harbor This presentation includes express and implied “forward-looking statements”, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts, and in some cases, can be identified by terms such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms, and similar expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this presentation include, but are not limited to, statements concerning our estimates of market size and opportunity, our strategic plans or objectives, our growth prospects, projections (including our long-term model), actual or perceived defects, errors or vulnerabilities in our platform; our ability to successfully integrate any acquisitions and strategic investments; risks associated with managing our rapid growth; general global political, economic, and macroeconomic climate, intense competition in the market we compete in, fluctuations in our operating results, our ability to attract new and retain existing customers, or renew and expand our relationships with them; the ability of our platform to effectively interoperate within our customers’ IT infrastructure; disruptions or other business interruptions that affect the availability of our platform including cybersecurity incidents; the failure to timely develop and achieve market acceptance of new products and subscriptions as well as existing products, subscriptions and support offerings; rapidly evolving technological developments in the market for security products and subscription and support offerings; length of sales cycles; and risks of securities class action litigation. By their nature, these statements are subject to numerous risks and uncertainties, including factors beyond our control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the statements. Such risks and uncertainties are described in the “Risk Factors” of our most recent Form 10-K, most recent Form 10-Q, and subsequent filings with the Securities and Exchange Commission. Although our management believes that the expectations reflected in our statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward- looking statements will be achieved or occur. Recipients are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date such statements are made and should not be construed as statements of fact. Except to the extent required by federal securities laws, we undertake no obligation to update these forward- looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of unanticipated events. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and SentinelOne’s own internal estimates and research. While SentinelOne believes these third-party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not independently verified, and makes no representations as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no independent source has evaluated the reasonableness or accuracy of SentinelOne’s internal estimates or research and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research.

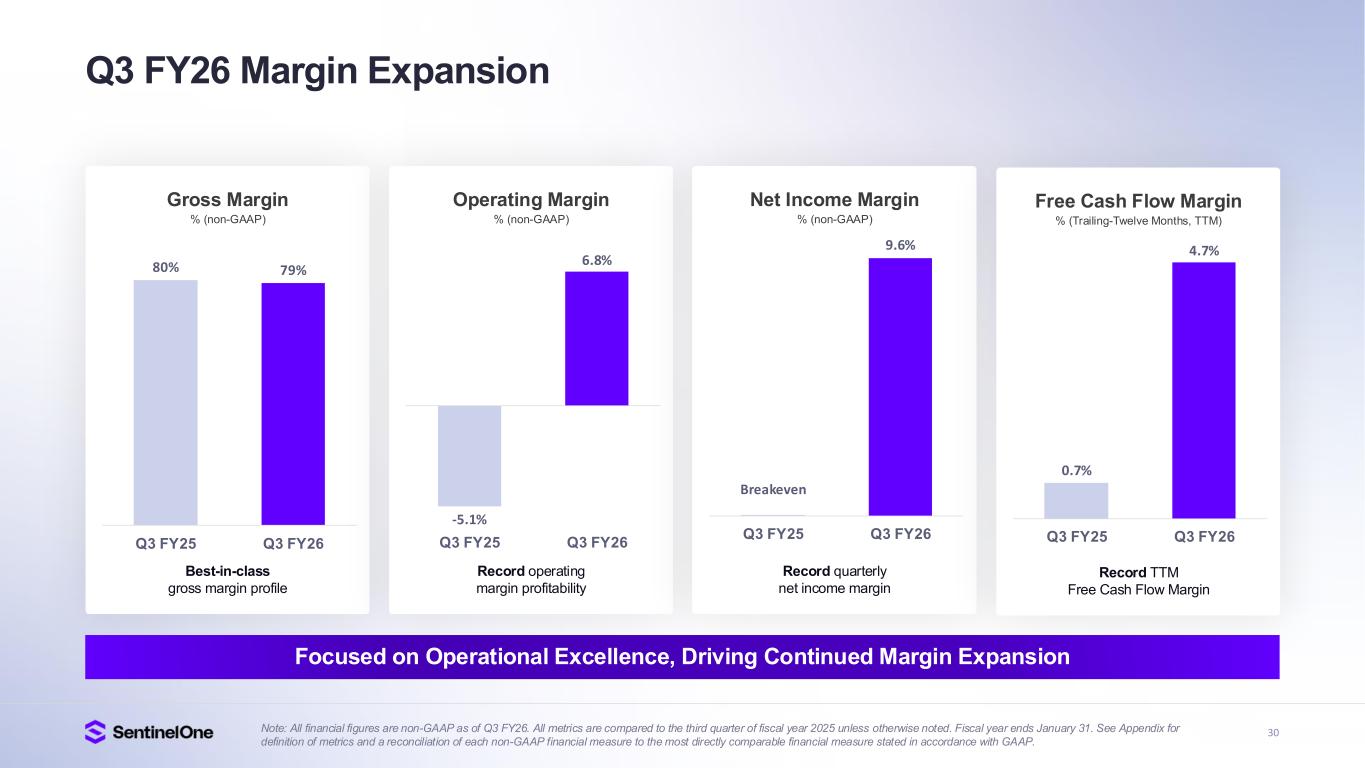

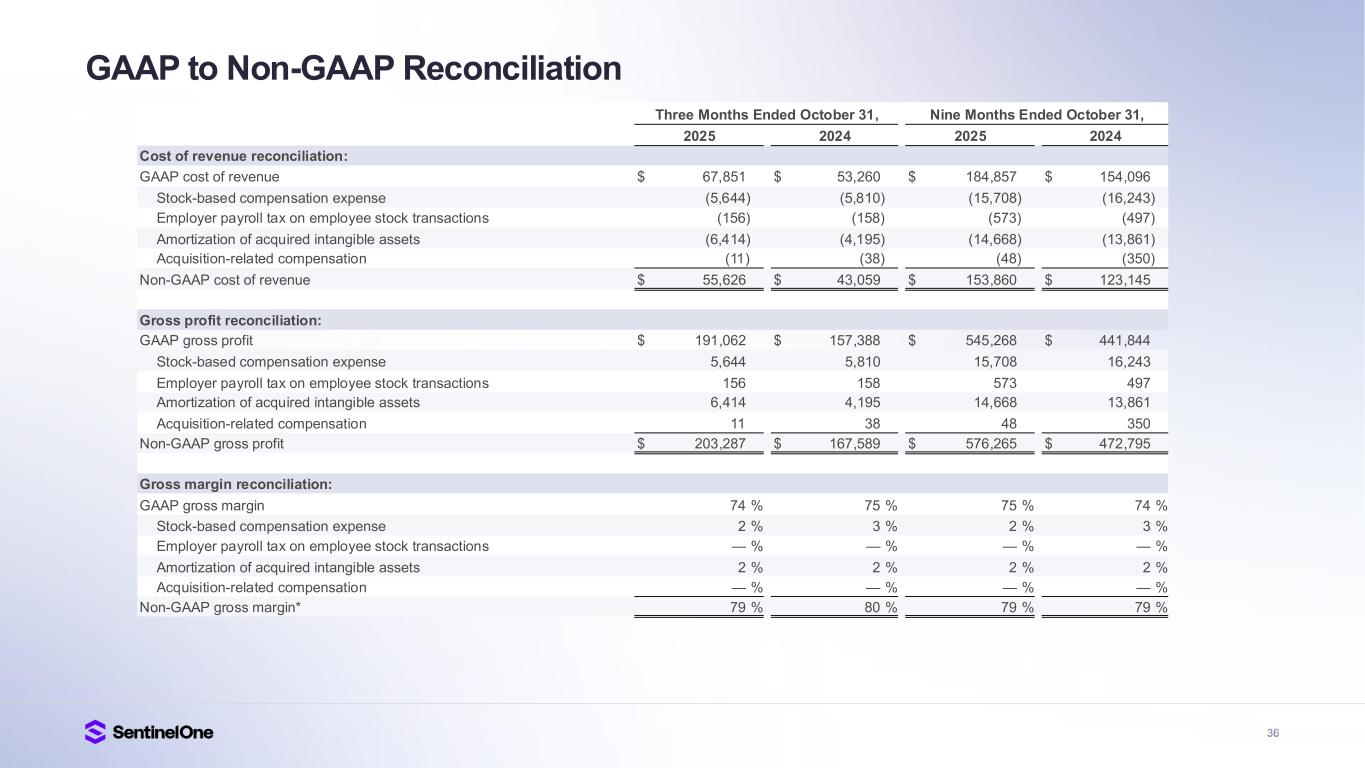

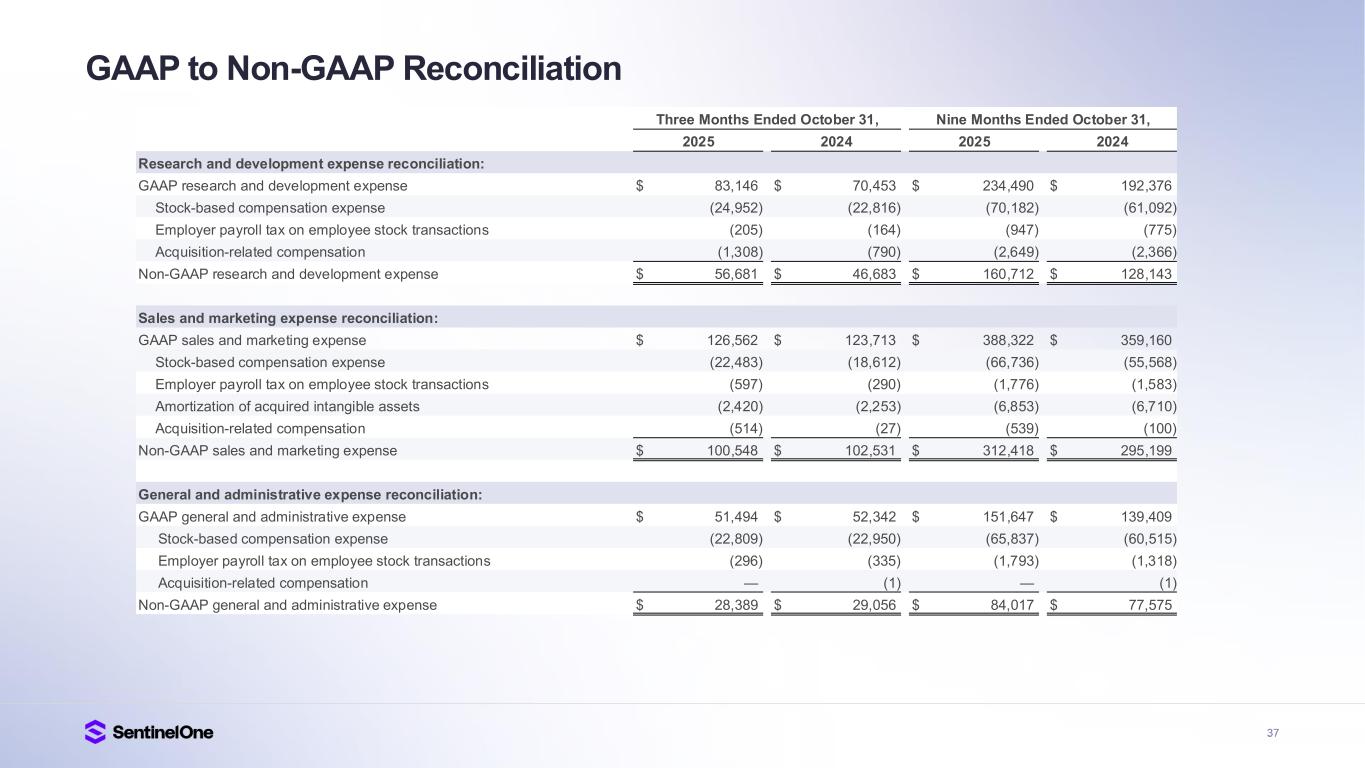

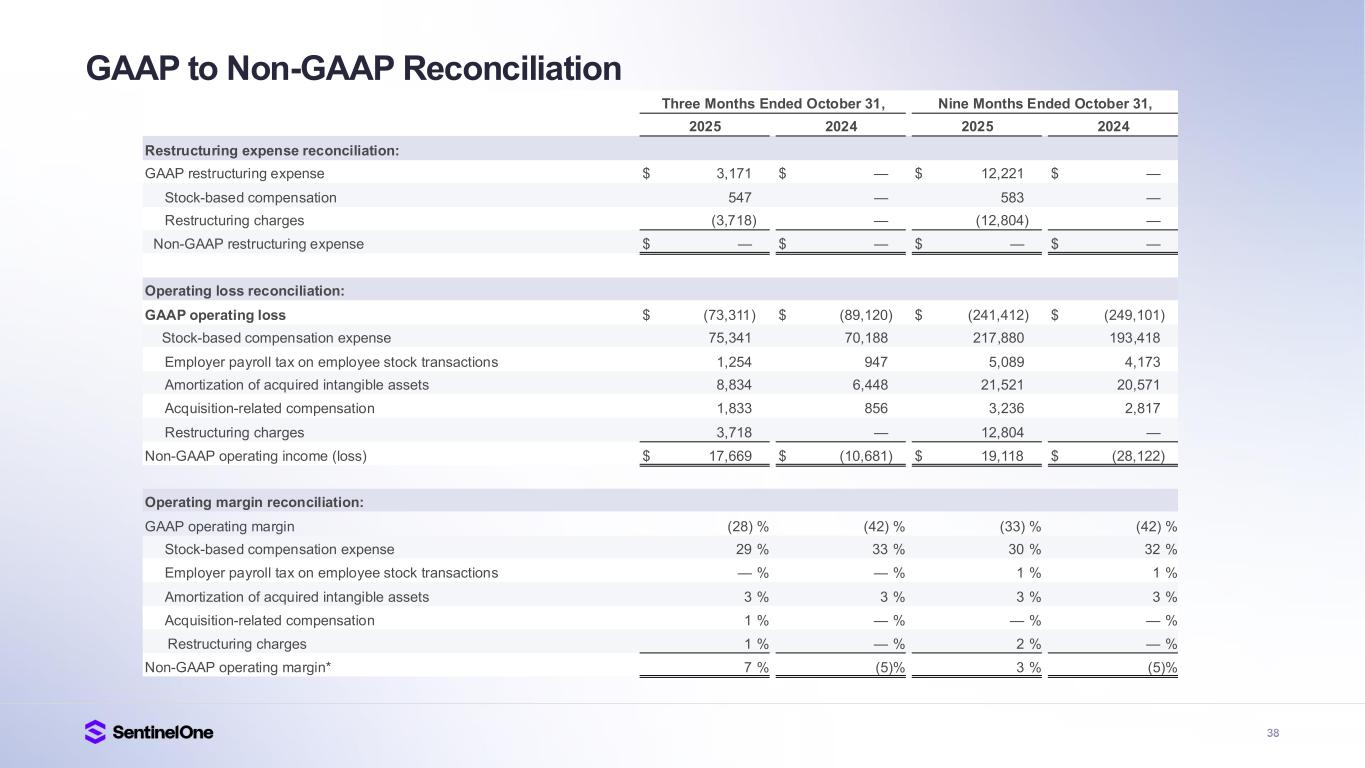

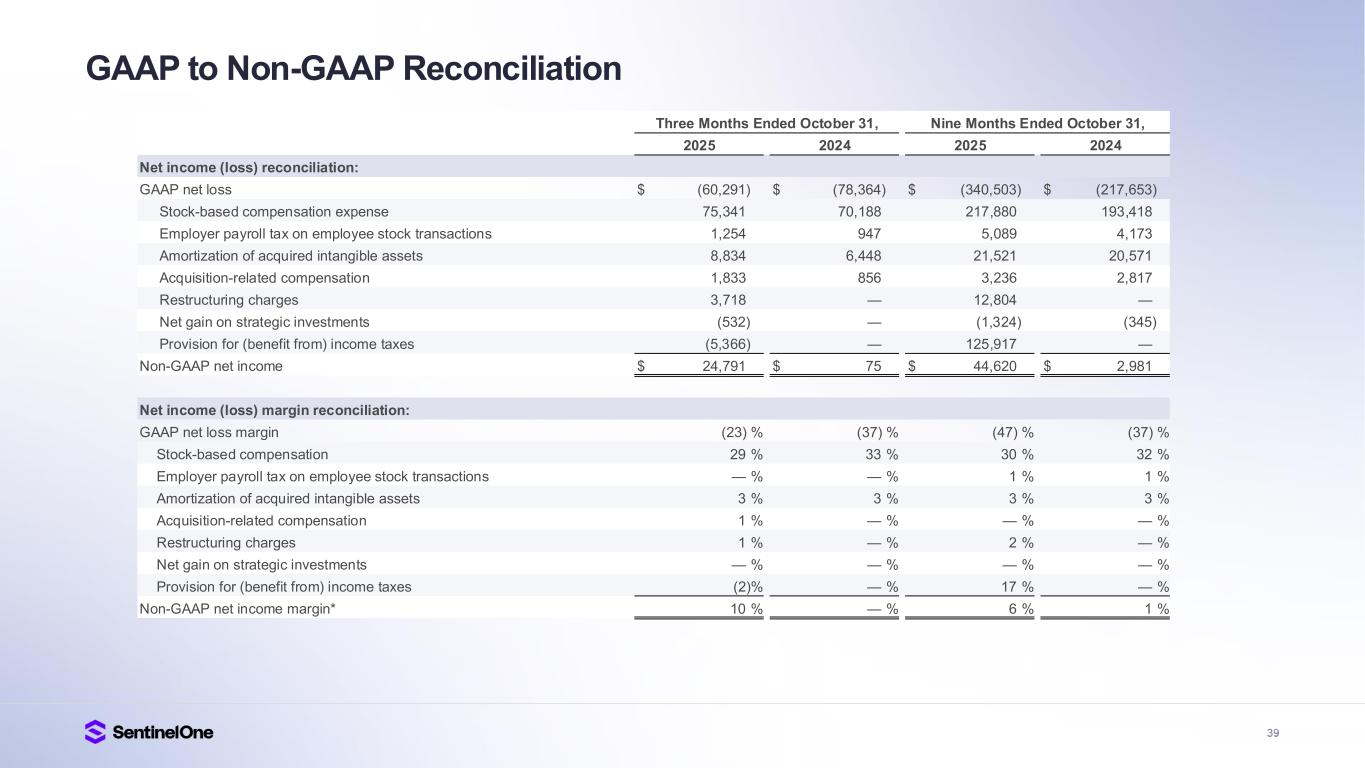

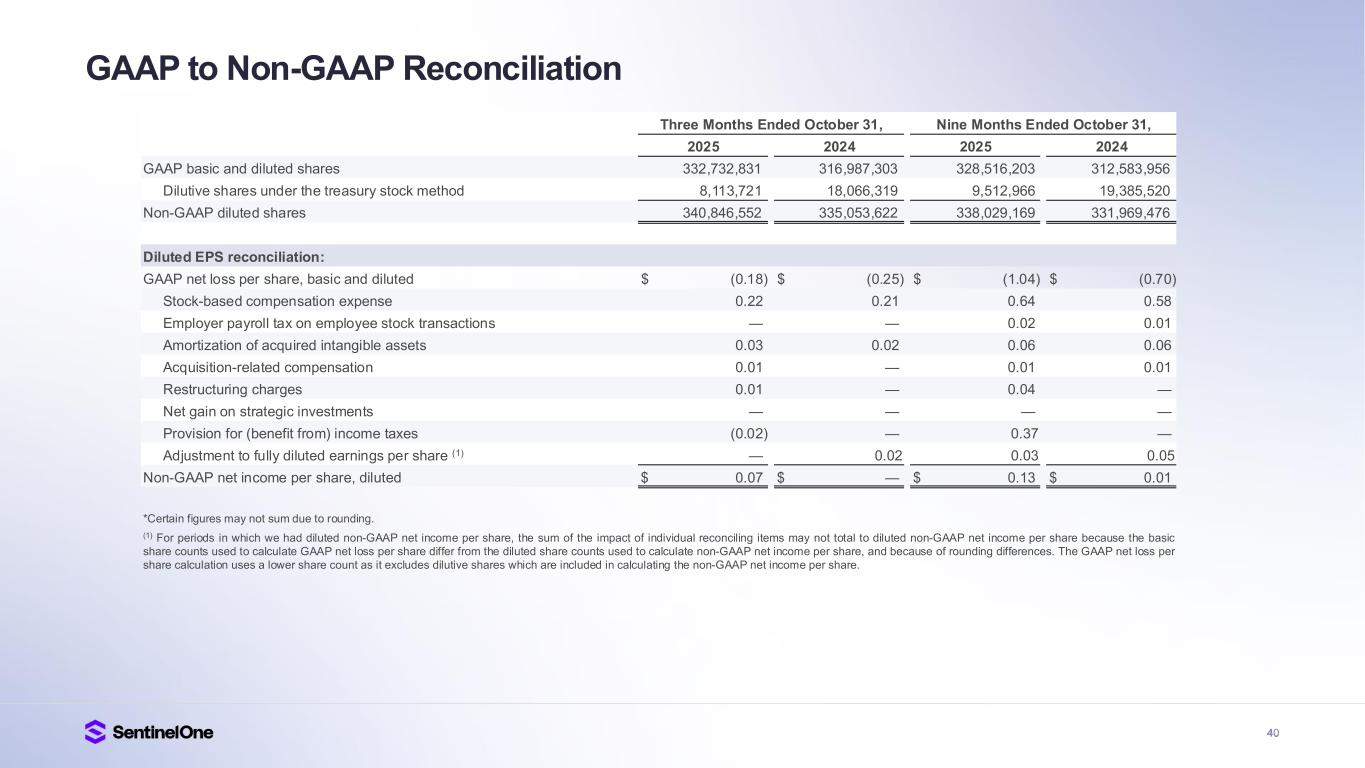

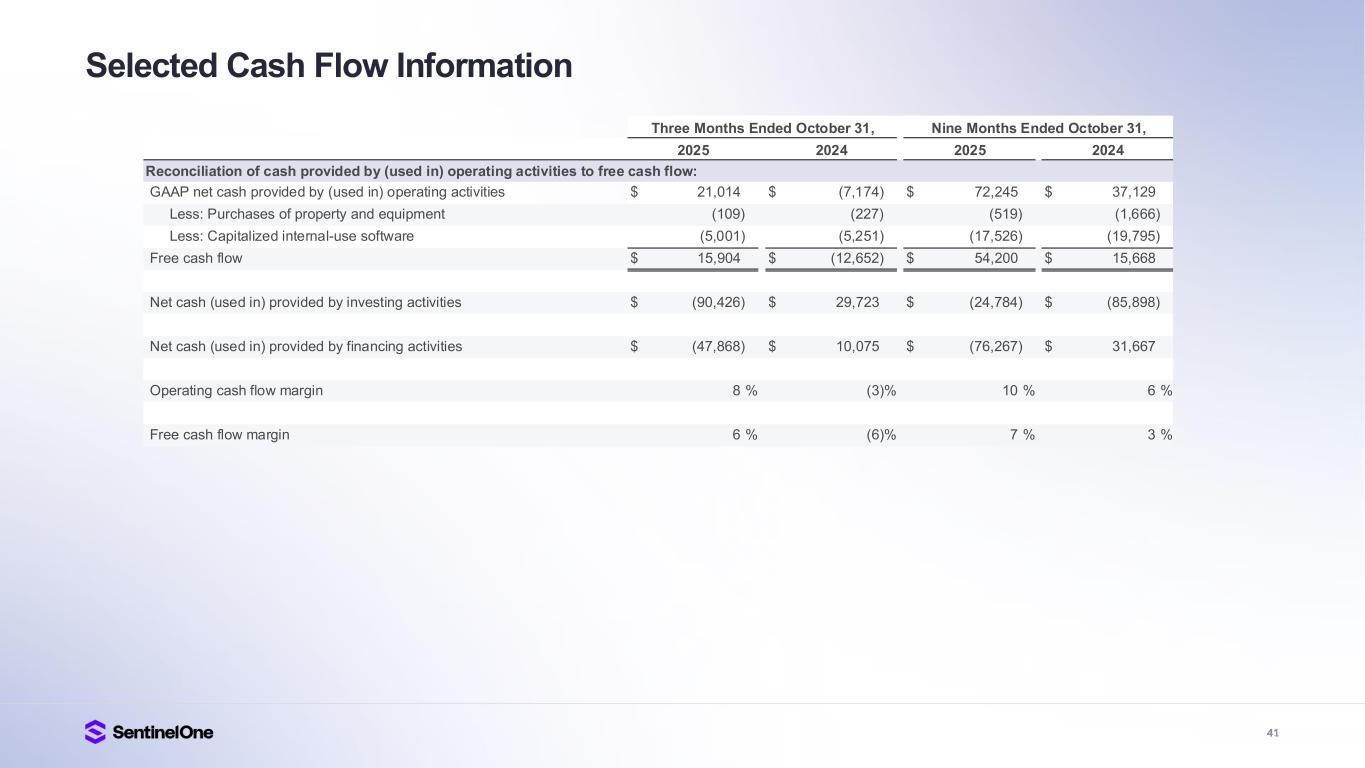

3 Financial Information Use of Non-GAAP Financial Measures In addition to our results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we believe non-GAAP measures used in this presentation, such as non-GAAP Gross Margin, non-GAAP Operating Margin, non-GAAP Net Income Margin, and Free Cash Flow Margin, are useful in evaluating our operating performance. We use such non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. In addition, the utility of Free Cash Flow Margin as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business. Please see the appendix included at the end of this presentation for a discussion of non- GAAP financial measures and a reconciliation of historical non-GAAP measures to historical GAAP measures. Our Fiscal Year Our fiscal year end is January 31, and our fiscal quarters end on April 30, July 31, October 31 and January 31.

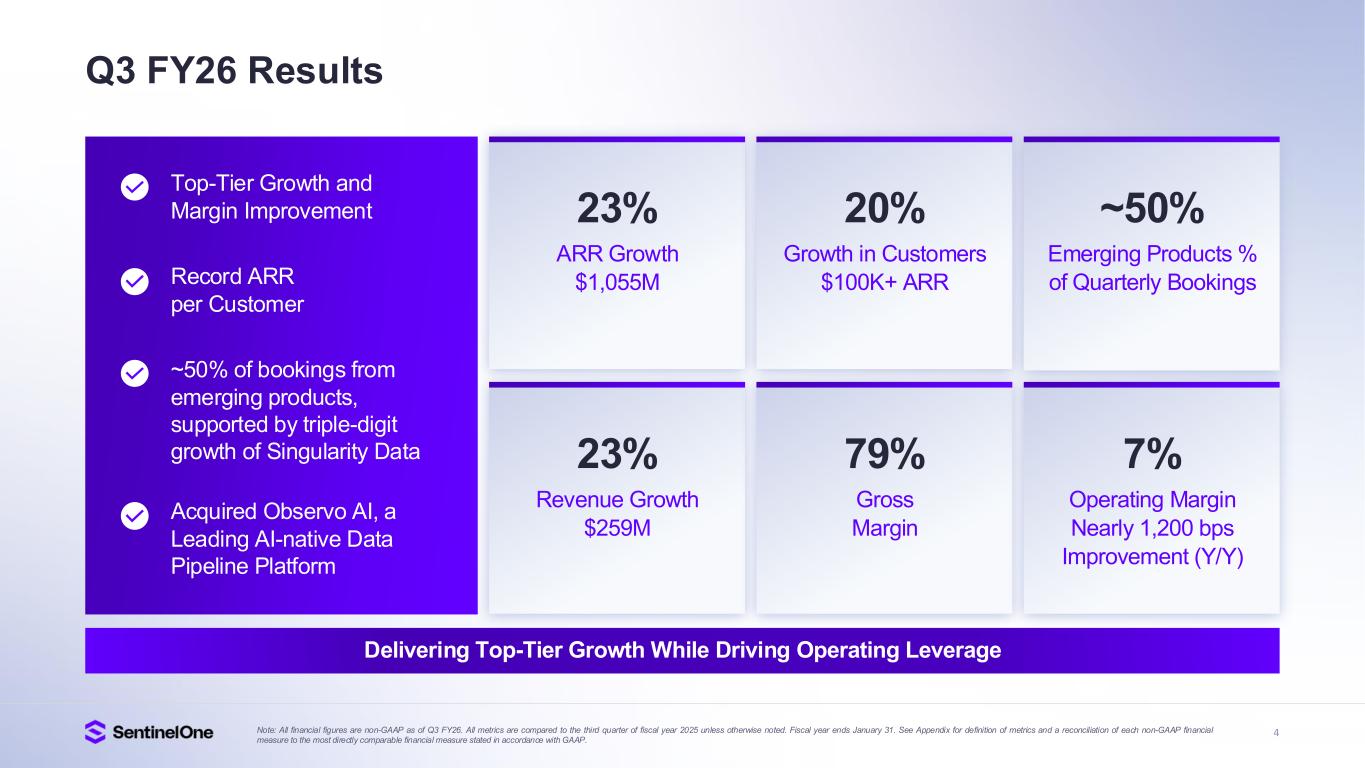

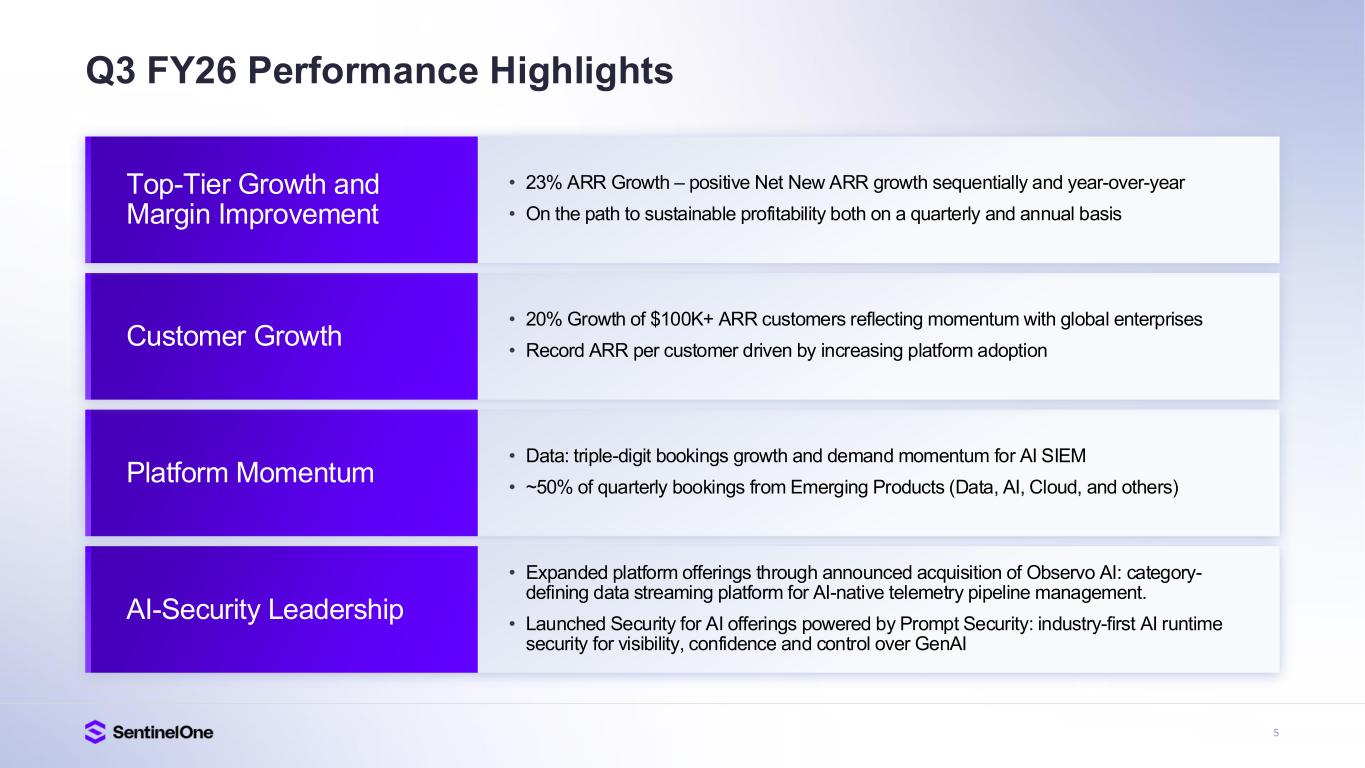

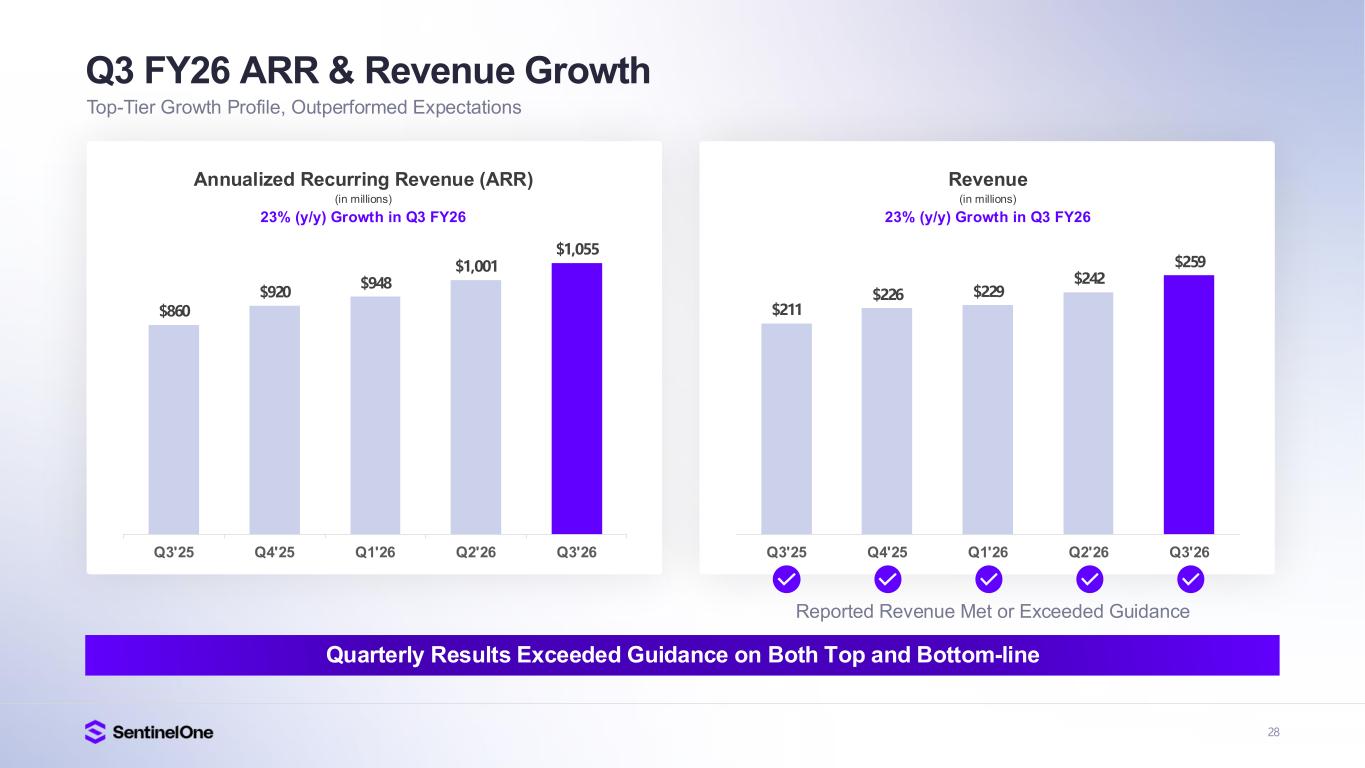

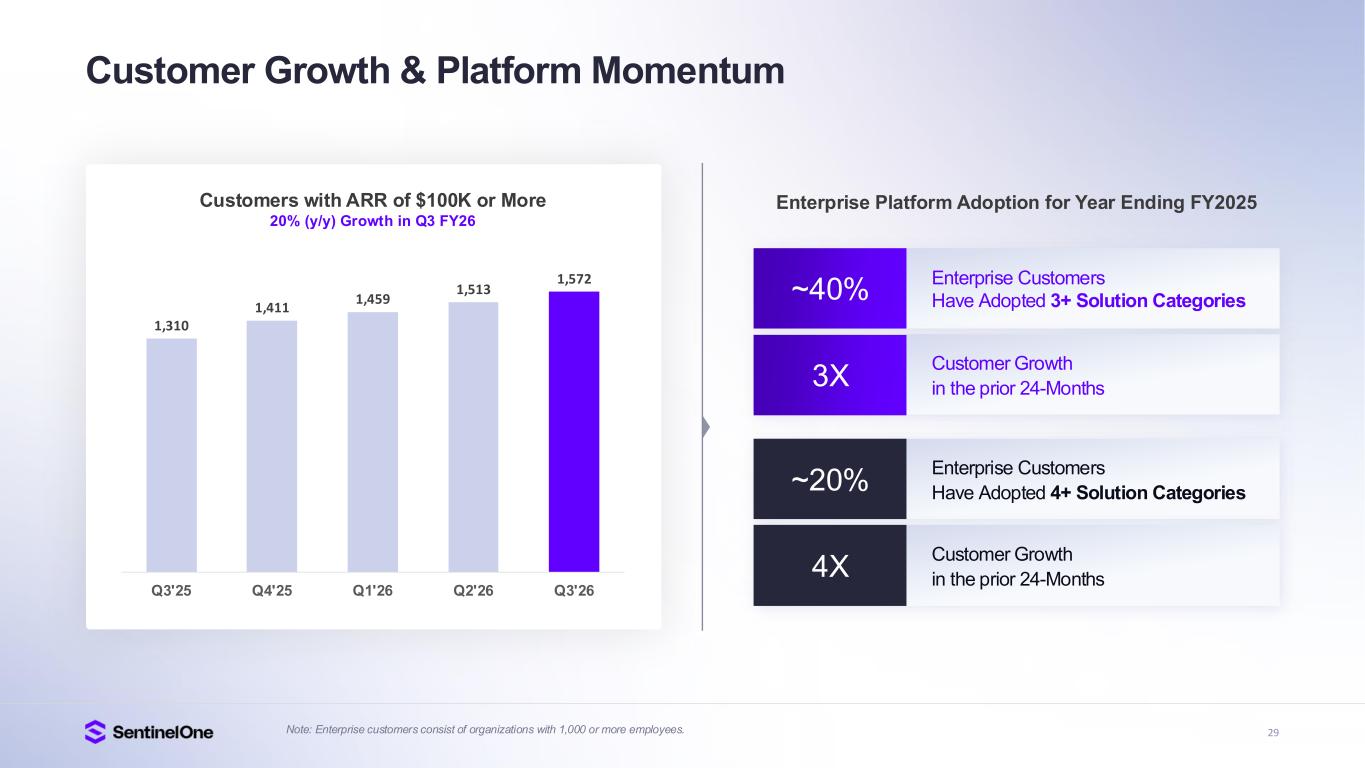

4 Q3 FY26 Results Note: All financial figures are non-GAAP as of Q3 FY26. All metrics are compared to the third quarter of fiscal year 2025 unless otherwise noted. Fiscal year ends January 31. See Appendix for definition of metrics and a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. 23% ARR Growth $1,055M 20% Growth in Customers $100K+ ARR ~50% Emerging Products % of Quarterly Bookings 79% Gross Margin 7% Operating Margin Nearly 1,200 bps Improvement (Y/Y) Top-Tier Growth and Margin Improvement Record ARR per Customer ~50% of bookings from emerging products, supported by triple-digit growth of Singularity Data Acquired Observo AI, a Leading AI-native Data Pipeline Platform Delivering Top-Tier Growth While Driving Operating Leverage 23% Revenue Growth $259M

5 Q3 FY26 Performance Highlights • Data: triple-digit bookings growth and demand momentum for AI SIEM • ~50% of quarterly bookings from Emerging Products (Data, AI, Cloud, and others) Platform Momentum • Expanded platform offerings through announced acquisition of Observo AI: category- defining data streaming platform for AI-native telemetry pipeline management. • Launched Security for AI offerings powered by Prompt Security: industry-first AI runtime security for visibility, confidence and control over GenAI AI-Security Leadership • 20% Growth of $100K+ ARR customers reflecting momentum with global enterprises • Record ARR per customer driven by increasing platform adoption Customer Growth • 23% ARR Growth – positive Net New ARR growth sequentially and year-over-year • On the path to sustainable profitability both on a quarterly and annual basis Top-Tier Growth and Margin Improvement

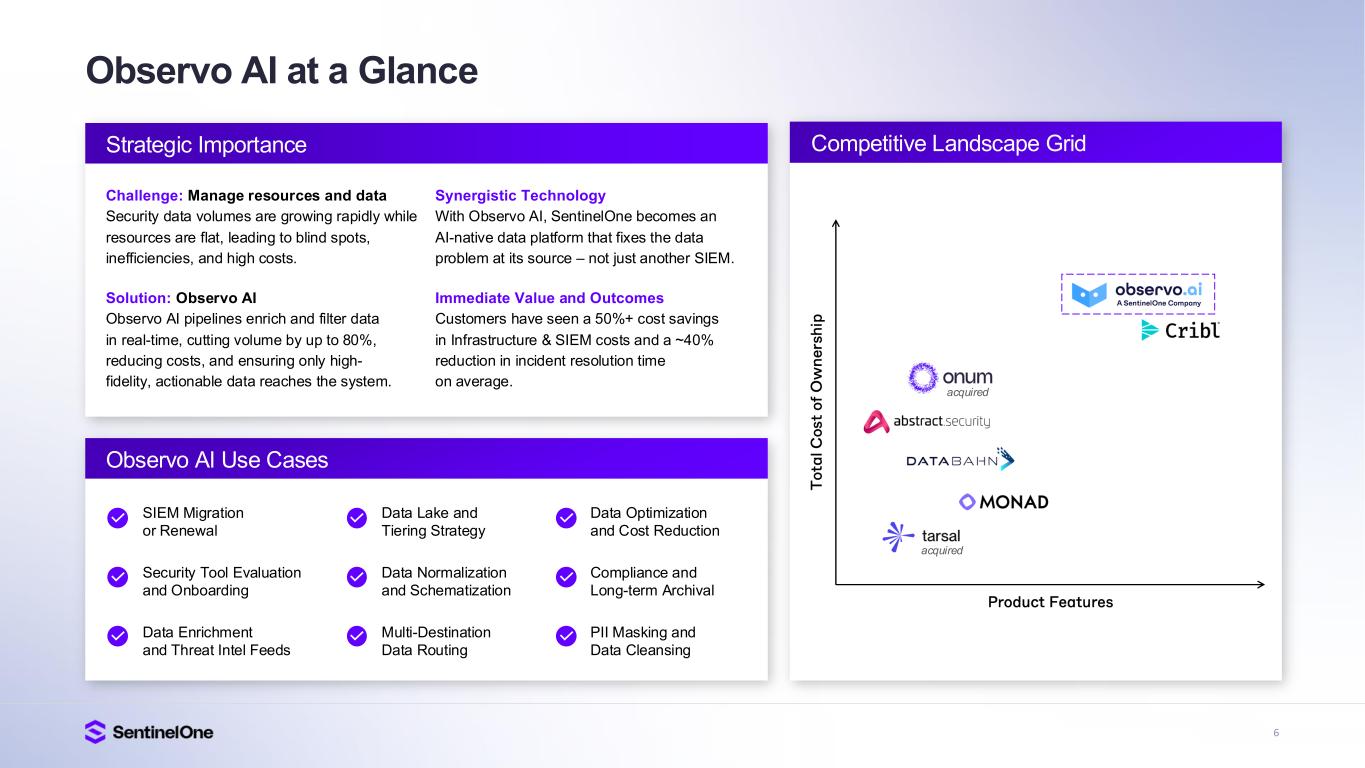

6 Observo AI at a Glance Challenge: Manage resources and data Security data volumes are growing rapidly while resources are flat, leading to blind spots, inefficiencies, and high costs. Solution: Observo AI Observo AI pipelines enrich and filter data in real-time, cutting volume by up to 80%, reducing costs, and ensuring only high- fidelity, actionable data reaches the system. Synergistic Technology With Observo AI, SentinelOne becomes an AI-native data platform that fixes the data problem at its source – not just another SIEM. Immediate Value and Outcomes Customers have seen a 50%+ cost savings in Infrastructure & SIEM costs and a ~40% reduction in incident resolution time on average. Strategic Importance Observo AI Use Cases Competitive Landscape Grid SIEM Migration or Renewal Security Tool Evaluation and Onboarding Data Enrichment and Threat Intel Feeds Data Lake and Tiering Strategy Data Normalization and Schematization Multi-Destination Data Routing Data Optimization and Cost Reduction Compliance and Long-term Archival PII Masking and Data Cleansing acquired acquired

7 7 Observo.AI 50%+ Savings in SIEM Costs* ~40% More efficient investigations ~55% Faster to remediate security threats* *Customer outcomes may vary based customer’s unique environment Observo AI: a category-defining data streaming platform for AI-native telemetry pipeline management

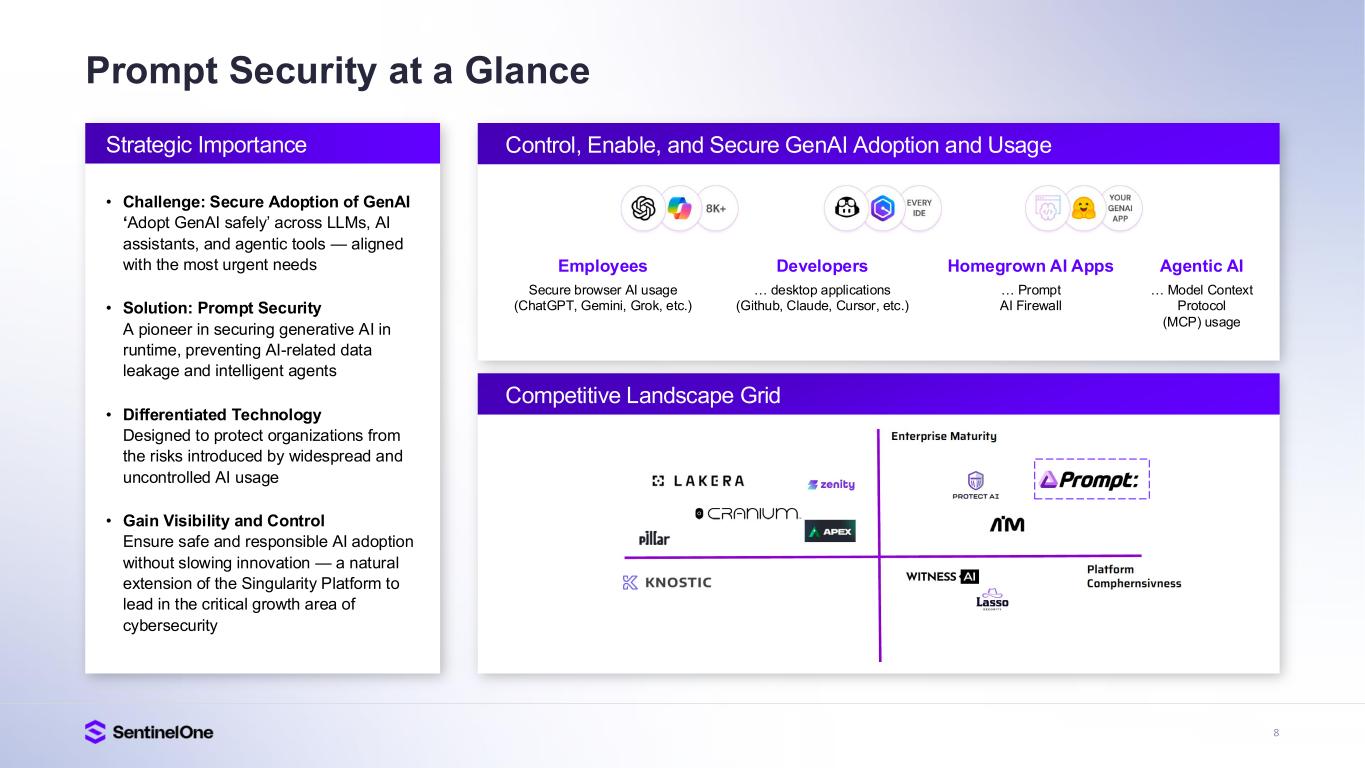

8 Prompt Security at a Glance • Challenge: Secure Adoption of GenAI ‘Adopt GenAI safely’ across LLMs, AI assistants, and agentic tools — aligned with the most urgent needs • Solution: Prompt Security A pioneer in securing generative AI in runtime, preventing AI-related data leakage and intelligent agents • Differentiated Technology Designed to protect organizations from the risks introduced by widespread and uncontrolled AI usage • Gain Visibility and Control Ensure safe and responsible AI adoption without slowing innovation — a natural extension of the Singularity Platform to lead in the critical growth area of cybersecurity Strategic Importance Control, Enable, and Secure GenAI Adoption and Usage Competitive Landscape Grid Employees Secure browser AI usage (ChatGPT, Gemini, Grok, etc.) Developers … desktop applications (Github, Claude, Cursor, etc.) Homegrown AI Apps … Prompt AI Firewall Agentic AI … Model Context Protocol (MCP) usage

Singularity Platform & Market Opportunity

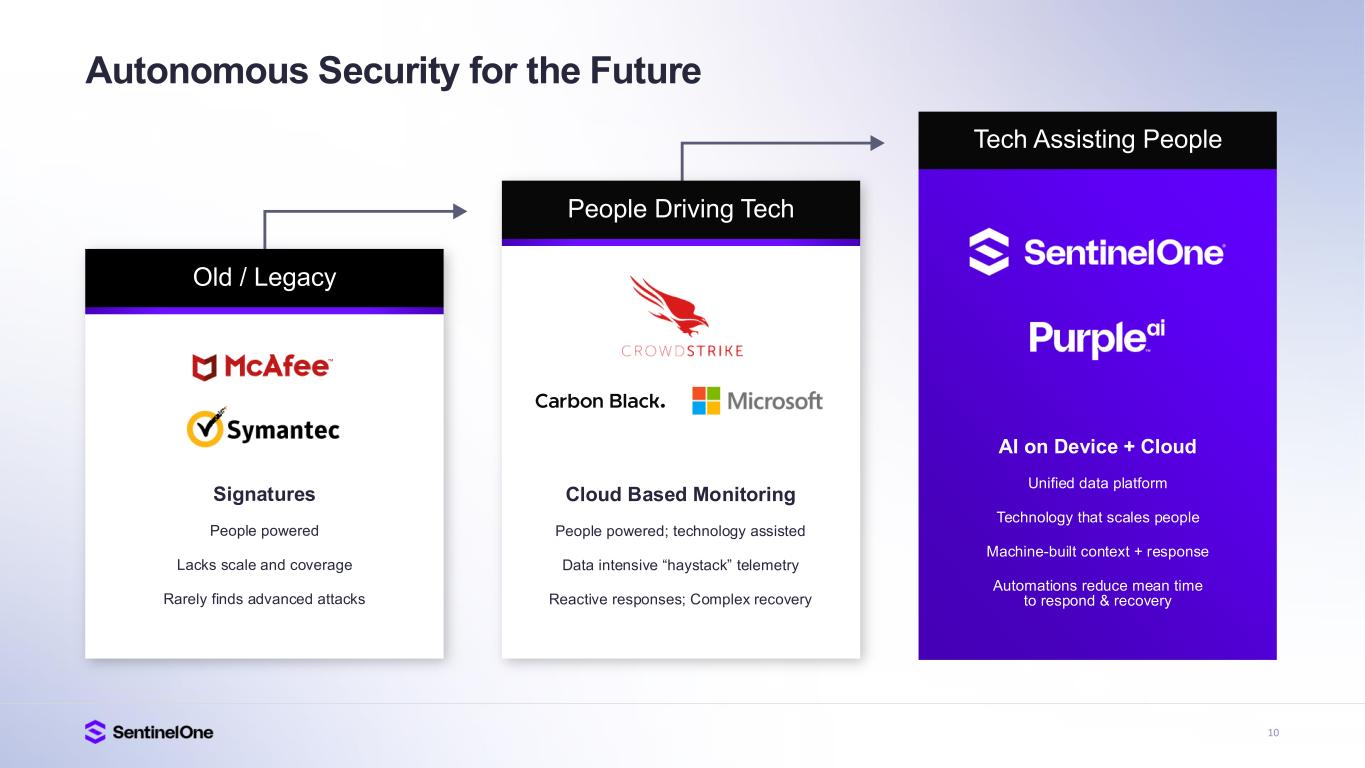

10 Autonomous Security for the Future AI on Device + Cloud Unified data platform Technology that scales people Machine-built context + response Automations reduce mean time to respond & recovery Tech Assisting People Cloud Based Monitoring People powered; technology assisted Data intensive “haystack” telemetry Reactive responses; Complex recovery People Driving Tech Signatures People powered Lacks scale and coverage Rarely finds advanced attacks Old / Legacy

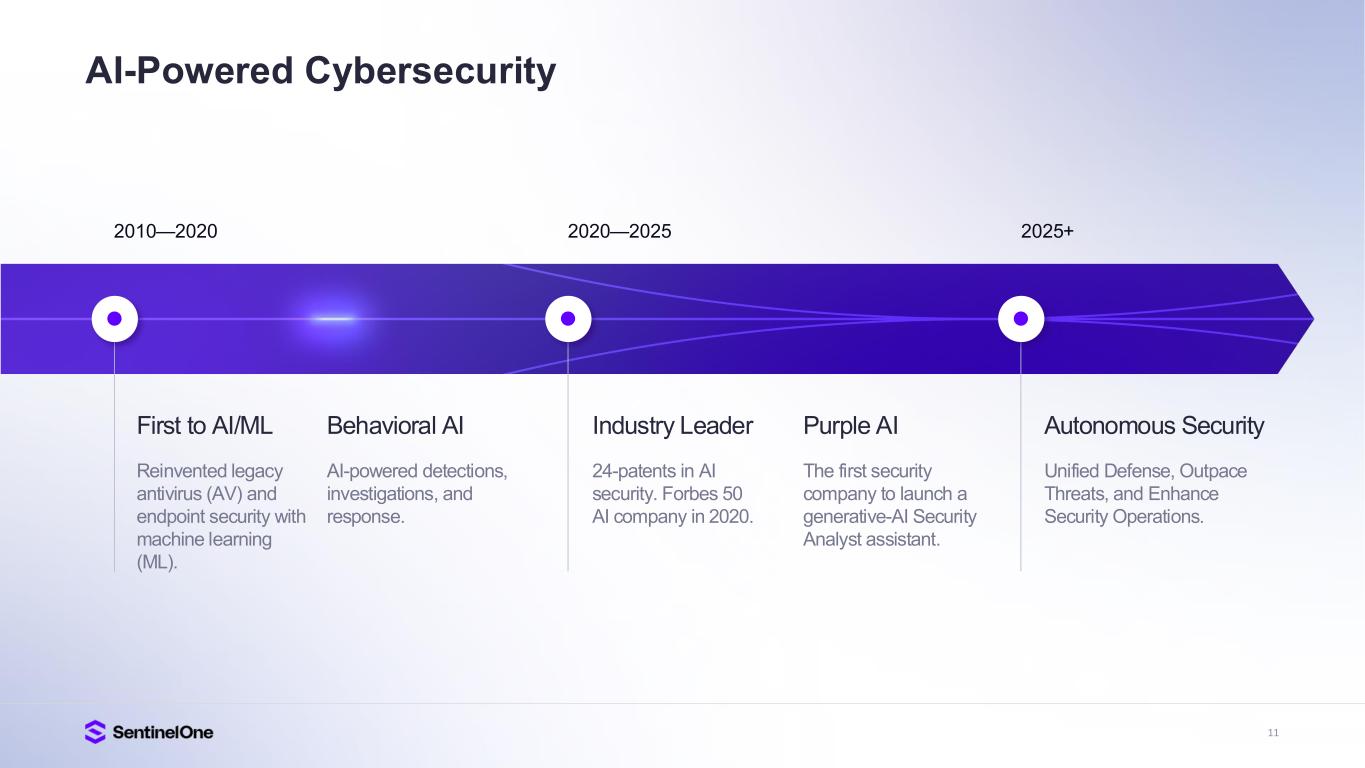

11 AI-Powered Cybersecurity First to AI/ML Reinvented legacy antivirus (AV) and endpoint security with machine learning (ML). Behavioral AI AI-powered detections, investigations, and response. Industry Leader 24-patents in AI security. Forbes 50 AI company in 2020. Purple AI The first security company to launch a generative-AI Security Analyst assistant. Autonomous Security Unified Defense, Outpace Threats, and Enhance Security Operations. 2010—2020 2020—2025 2025+

12 Complete Attack Surface Protection Data, AI, and Automation Human Expertise Powered by AI & Human Intelligence

13

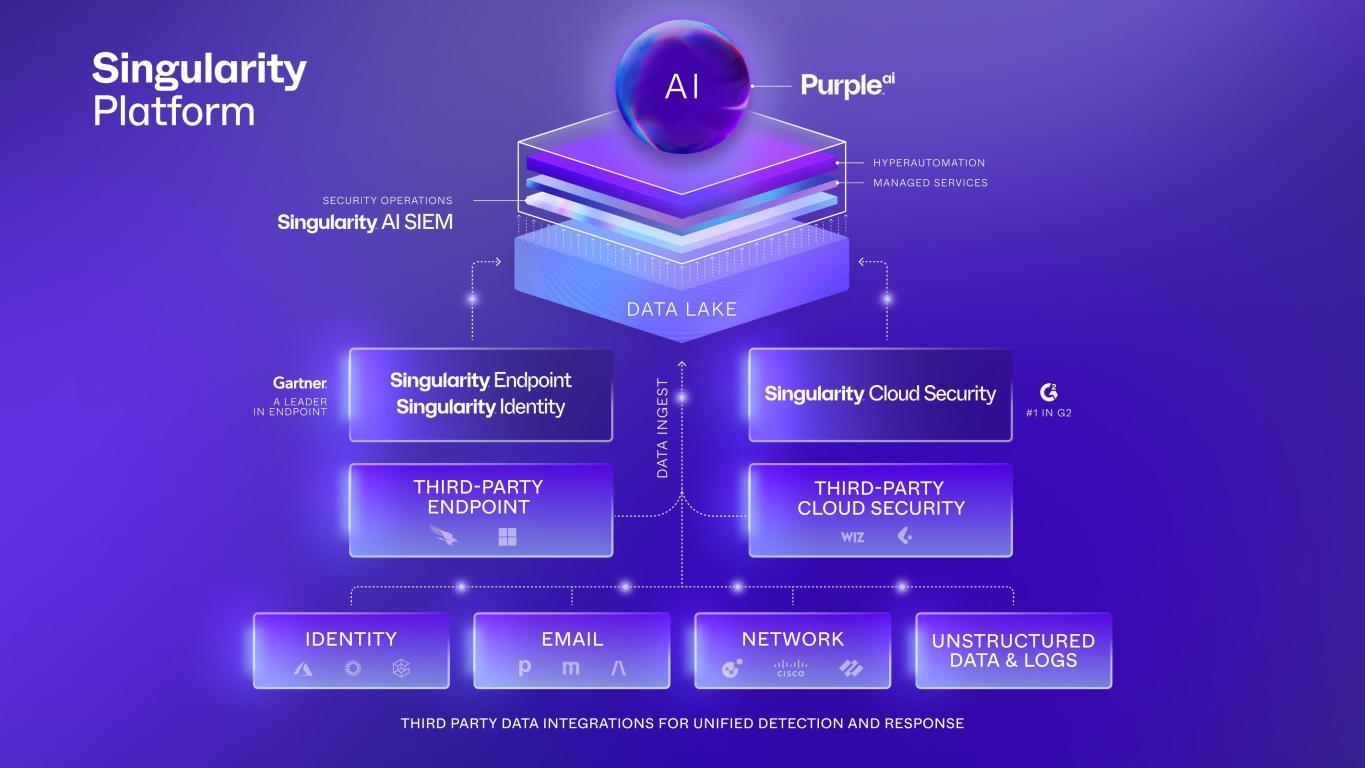

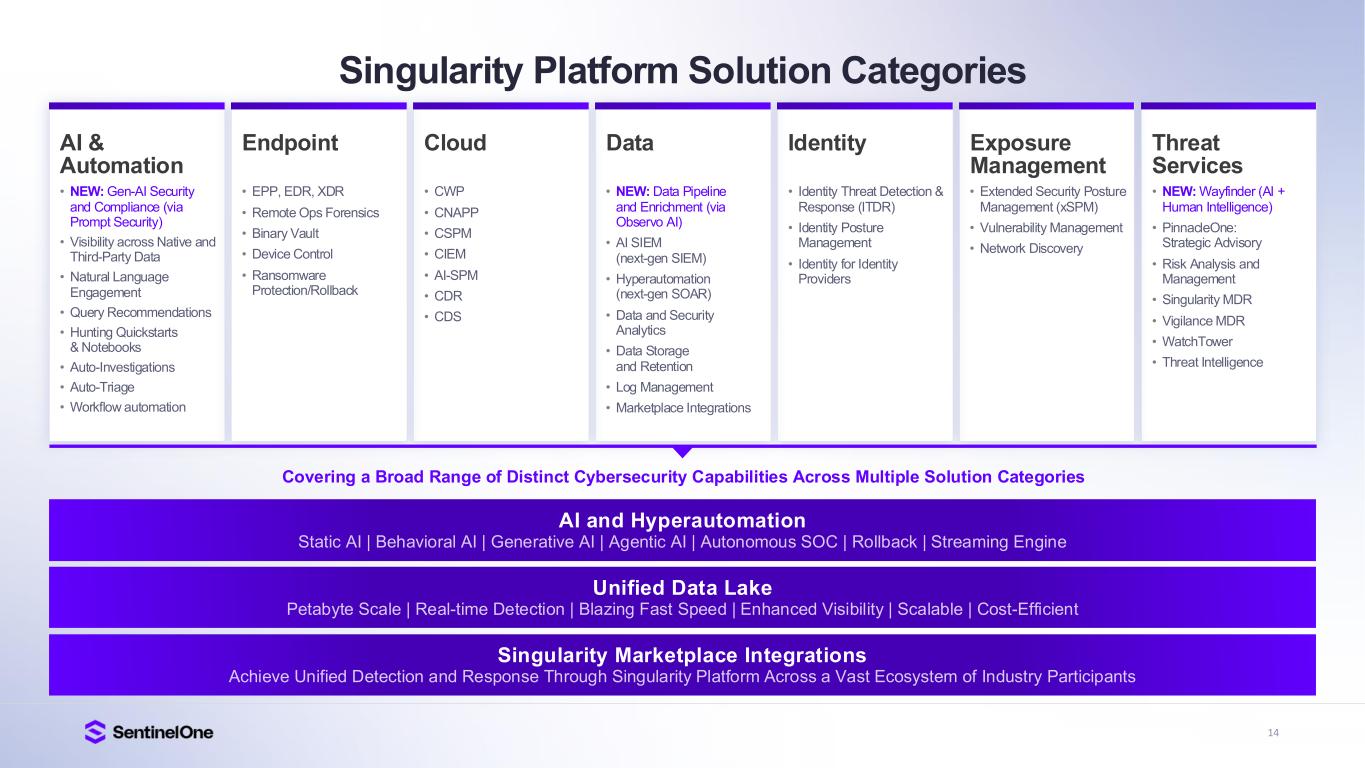

14 Singularity Platform Solution Categories AI & Automation • EPP, EDR, XDR • Remote Ops Forensics • Binary Vault • Device Control • Ransomware Protection/Rollback Endpoint • CWP • CNAPP • CSPM • CIEM • AI-SPM • CDR • CDS Cloud • NEW: Data Pipeline and Enrichment (via Observo AI) • AI SIEM (next-gen SIEM) • Hyperautomation (next-gen SOAR) • Data and Security Analytics • Data Storage and Retention • Log Management • Marketplace Integrations Data • Identity Threat Detection & Response (ITDR) • Identity Posture Management • Identity for Identity Providers Identity • Extended Security Posture Management (xSPM) • Vulnerability Management • Network Discovery Exposure Management • NEW: Wayfinder (AI + Human Intelligence) • PinnacleOne: Strategic Advisory • Risk Analysis and Management • Singularity MDR • Vigilance MDR • WatchTower • Threat Intelligence Threat Services AI and Hyperautomation Covering a Broad Range of Distinct Cybersecurity Capabilities Across Multiple Solution Categories Unified Data Lake Singularity Marketplace Integrations • NEW: Gen-AI Security and Compliance (via Prompt Security) • Visibility across Native and Third-Party Data • Natural Language Engagement • Query Recommendations • Hunting Quickstarts & Notebooks • Auto-Investigations • Auto-Triage • Workflow automation

15 Vast, Growing, and Diverse Total Addressable Market At the Intersection of Data, Security and AI $100B+ Total Addressable Market 2025 Market Forecasts* Cloud Security $12B Data Analytics $31B Endpoint Security $17B Generative AI Security $3B $50B+ • Identity Security • Exposure Management • Managed Detection and Response • Data Protection • Threat Intelligence Source: IDC and company estimates. See appendix.

16 Partner Ecosystem Scales Market Presence VARs, DistributorsFederal MSSPs, MSPs Hyperscalers, OEMs Winning Together Cyber Insurers Incident Response Leader in MSSP Ecosystem Extending scale and reach through Hyperscalers and OEM relationships SentinelOne Risk Assurance Initiative FedRAMP High Authorized for Endpoint, AI-SIEM, Purple AI, CNAPP, and Hyperautomation Partnering with a majority of Incident Response providers Expanding Partnerships

Recognized Technology Leadership Industry Accolades & Recognitions

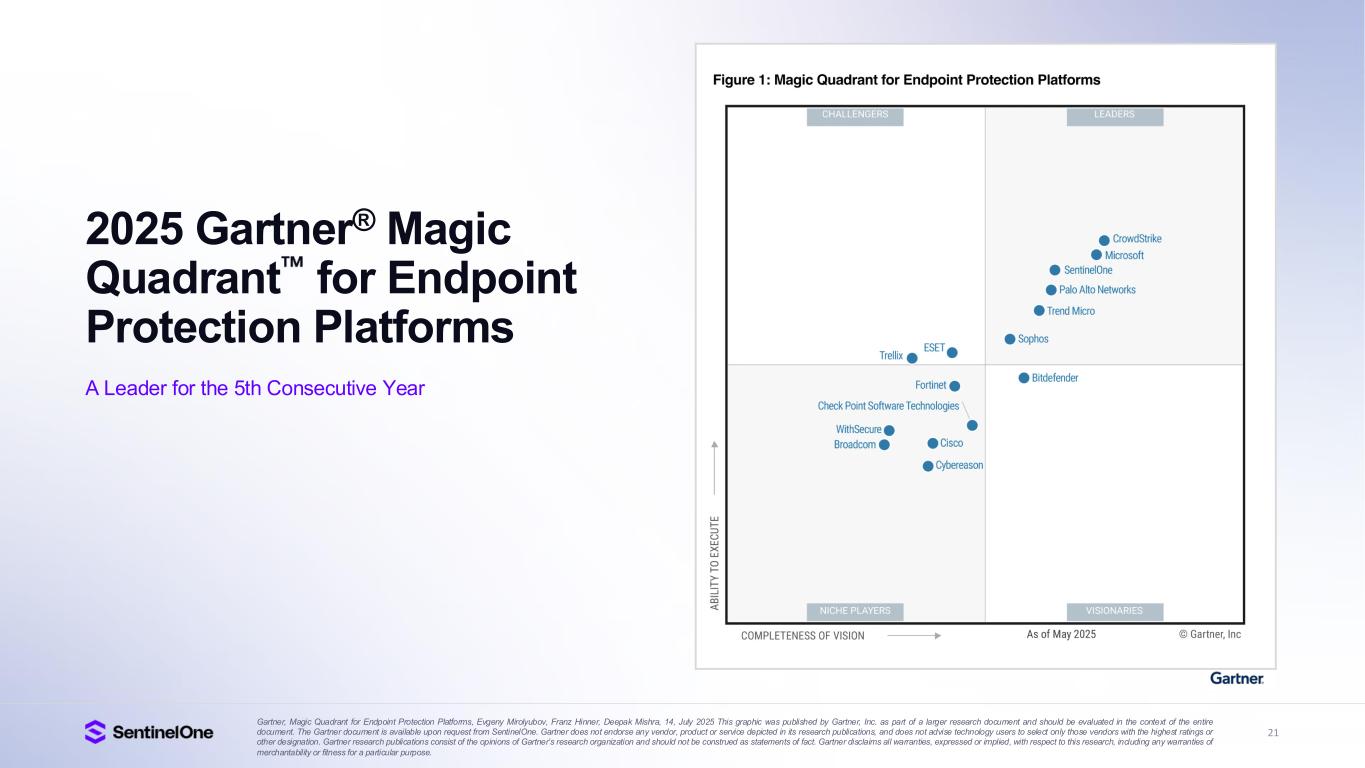

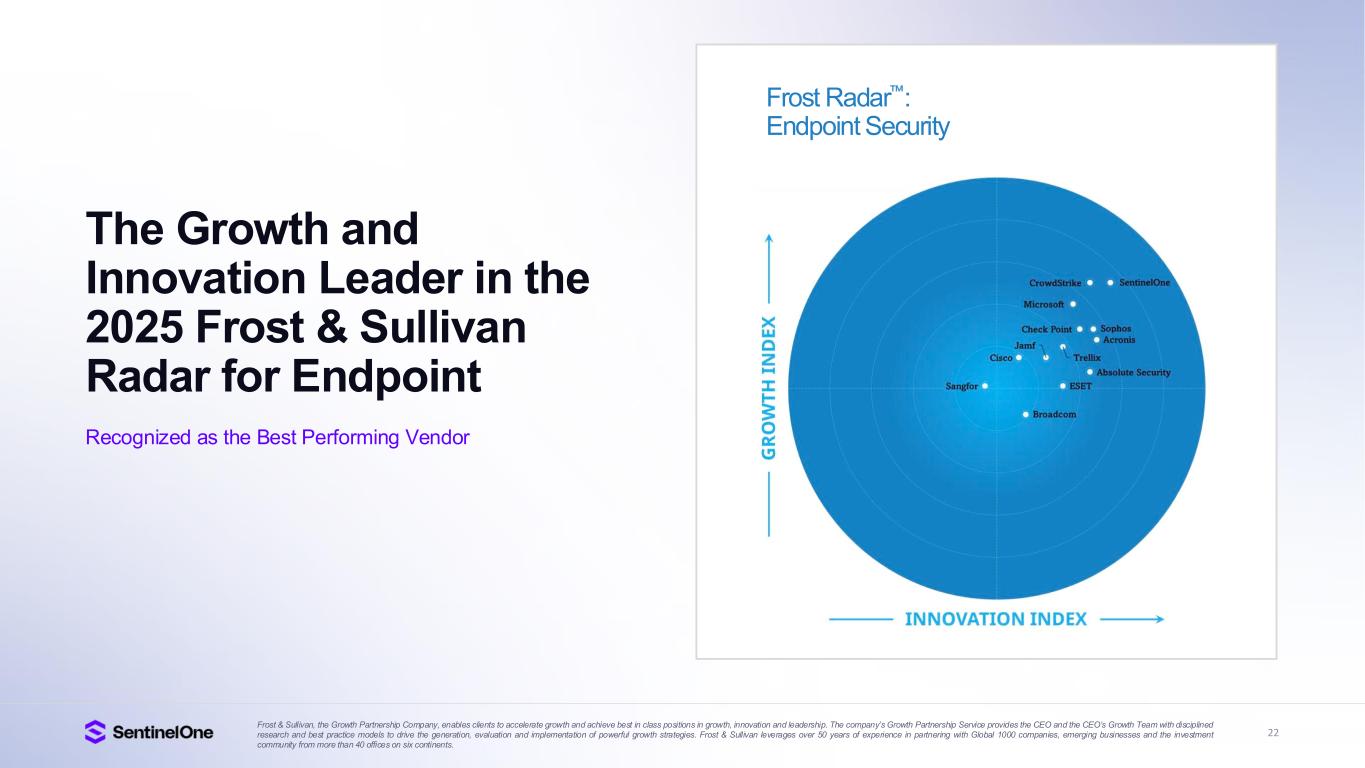

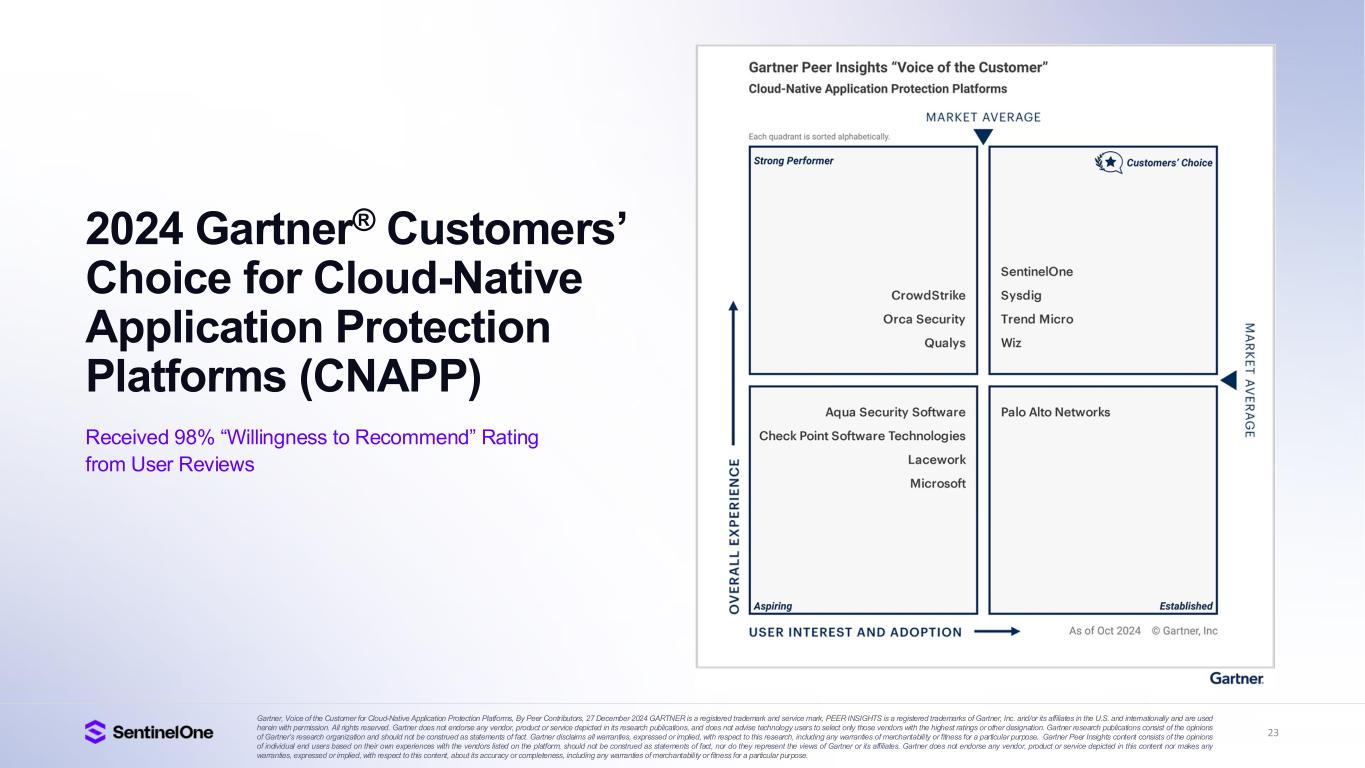

18 Leader G2 Grid® for Cloud-Native Application Protection Platform (CNAPP), Highest Rated 4.9 out of 5 FedRAMP High Authorized for Endpoint, AI-SIEM, Purple AI, CNAPP, and Hyperautomation A Leader in Frost Radar A Growth and Innovation Leader in 2025 Frost & Sullivan Radar for Endpoint, MDR and CWPP A Leader in the 2025 Gartner® Magic Quadrant for Endpoint Protection Platforms for 5th consecutive year Enterprise Evaluation 100% Protection & Detection, and Zero Delays or Configuration Changes 95%+ Would Recommend SentinelOne Trusted and Industry Proven Gartner® Peer Insights: EPP (based on 480 reviews, 95%, as of Apr 2024) MDR (based on 214 reviews, 95%, as of Sep 2024) CNAPP (based on 201 reviews, 98%, as of Oct 2024). Gartner®, Magic Quadrant for Endpoint Protection Platforms, Evgeny Mirolyubov et al., 23 September 2024. Gartner®, Peer Insights , Voice of the Customer for Managed Detection and Response, Peer Contributors, 28 November 2024. Gartner®, Peer Insights , Voice of the Customer for Endpoint Protection Platforms, Peer Contributors, 28 June 2024. Gartner®, Peer Insights , Voice of the Customer for Cloud-Native Application Protection Platforms, Peer Contributors, 27 December 2024 GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT and PEER INSIGHTS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose. The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this Earnings Presentation), and the opinions expressed in the Gartner Content are subject to change without notice. Gartner® Peer Insights Voice of the Customer Customer’s Choice XDR (based on 144 reviews, 97%, Jan 2025) CNAPP (based on 201 reviews, 98%, Oct 2024) MDR (based on 214 reviews, 95%, Sep 2024)

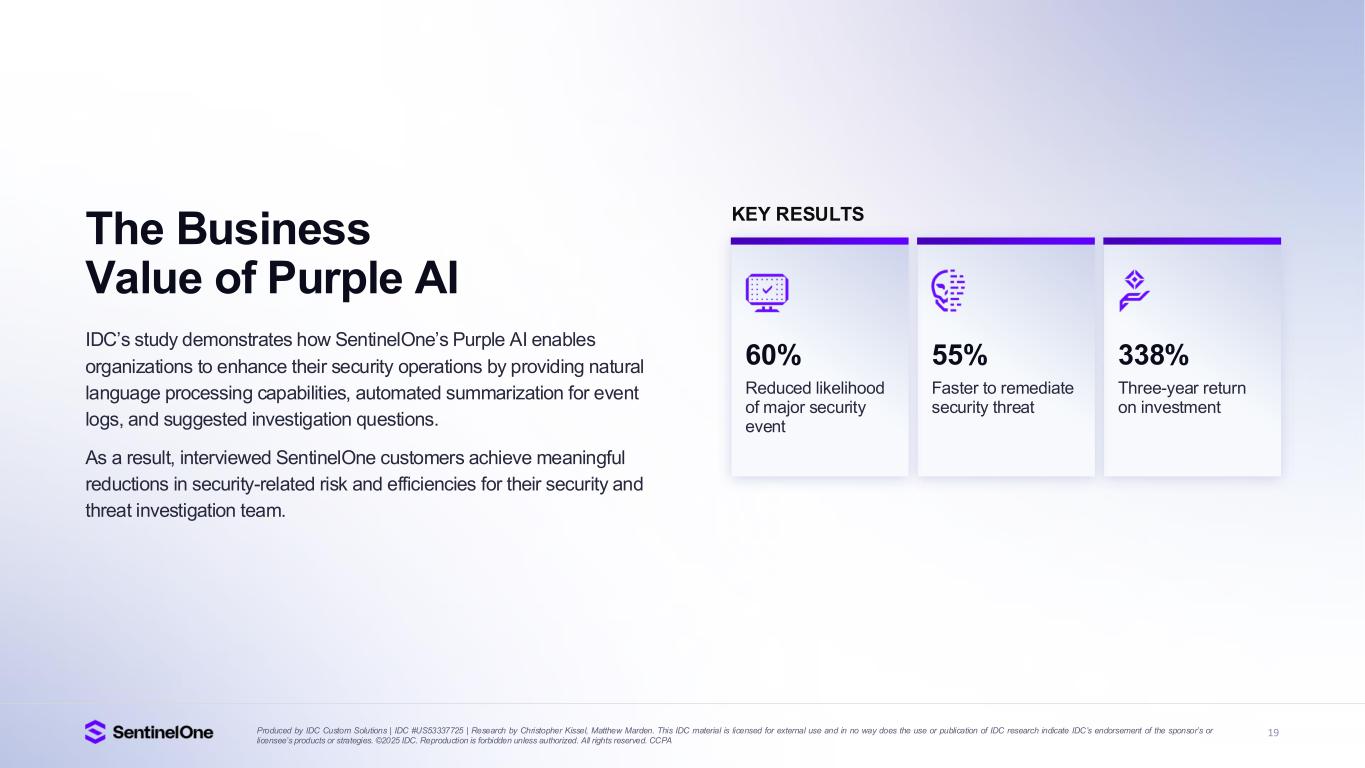

19Produced by IDC Custom Solutions | IDC #US53337725 | Research by Christopher Kissel, Matthew Marden. This IDC material is licensed for external use and in no way does the use or publication of IDC research indicate IDC’s endorsement of the sponsor’s or licensee’s products or strategies. ©2025 IDC. Reproduction is forbidden unless authorized. All rights reserved. CCPA The Business Value of Purple AI IDC’s study demonstrates how SentinelOne’s Purple AI enables organizations to enhance their security operations by providing natural language processing capabilities, automated summarization for event logs, and suggested investigation questions. As a result, interviewed SentinelOne customers achieve meaningful reductions in security-related risk and efficiencies for their security and threat investigation team. 338% Three-year return on investment 55% Faster to remediate security threat KEY RESULTS 60% Reduced likelihood of major security event

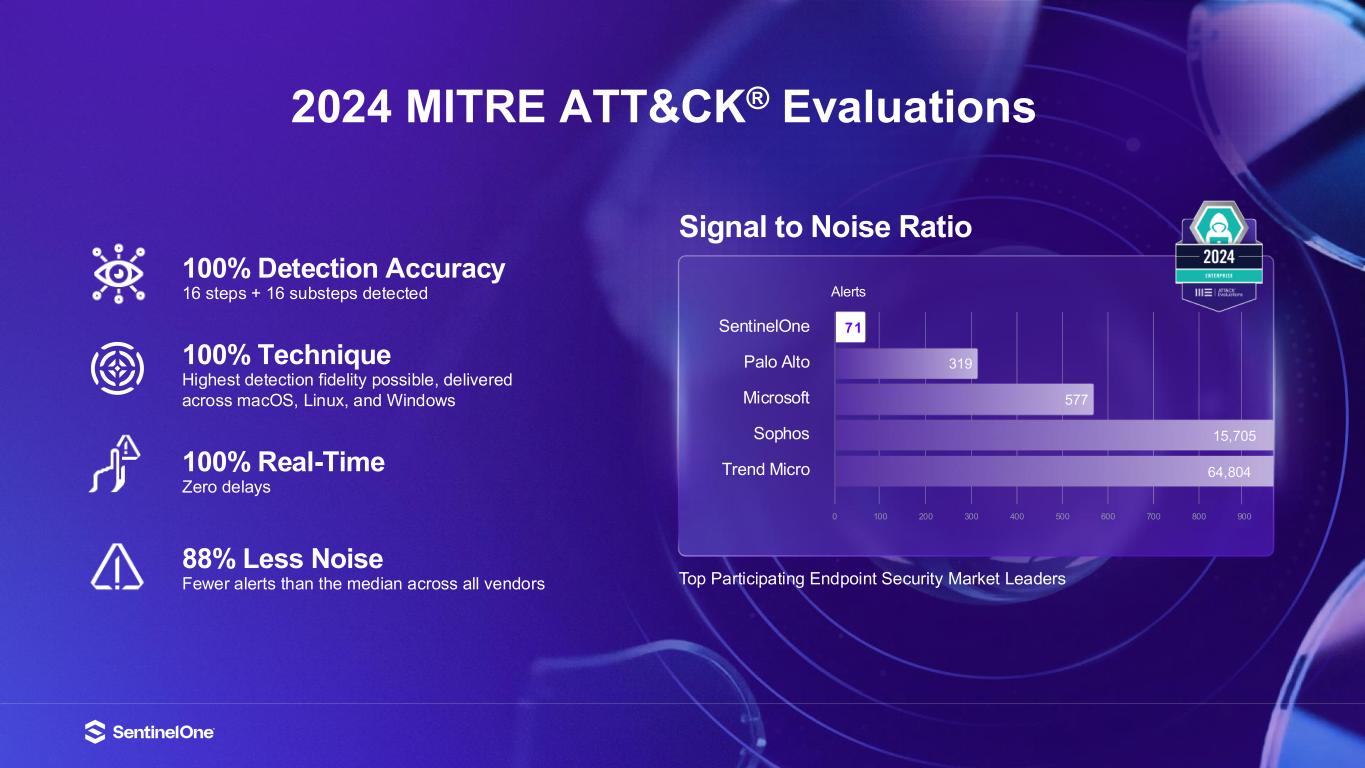

20 Top Participating Endpoint Security Market Leaders Signal to Noise Ratio Alerts SentinelOne Palo Alto Microsoft Sophos Trend Micro 0 100 200 300 400 500 600 700 800 900 71 319 577 15,705 64,804 100% Detection Accuracy 16 steps + 16 substeps detected 100% Technique Highest detection fidelity possible, delivered across macOS, Linux, and Windows 100% Real-Time Zero delays 88% Less Noise Fewer alerts than the median across all vendors 2024 MITRE ATT&CK® Evaluations

21 2025 Gartner® Magic Quadrant for Endpoint Protection Platforms A Leader for the 5th Consecutive Year Gartner, Magic Quadrant for Endpoint Protection Platforms, Evgeny Mirolyubov, Franz Hinner, Deepak Mishra, 14, July 2025 This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from SentinelOne. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

22 Frost & Sullivan, the Growth Partnership Company, enables clients to accelerate growth and achieve best in class positions in growth, innovation and leadership. The company’s Growth Partnership Service provides the CEO and the CEO’s Growth Team with disciplined research and best practice models to drive the generation, evaluation and implementation of powerful growth strategies. Frost & Sullivan leverages over 50 years of experience in partnering with Global 1000 companies, emerging businesses and the investment community from more than 40 offices on six continents. The Growth and Innovation Leader in the 2025 Frost & Sullivan Radar for Endpoint Recognized as the Best Performing Vendor Frost Radar : Endpoint Security

23 2024 Gartner® Customers’ Choice for Cloud-Native Application Protection Platforms (CNAPP) Received 98% “Willingness to Recommend” Rating from User Reviews Gartner, Voice of the Customer for Cloud-Native Application Protection Platforms, By Peer Contributors, 27 December 2024 GARTNER is a registered trademark and service mark, PEER INSIGHTS is a registered trademarks of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences with the vendors listed on the platform, should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

24Source: SentinelOne, SC Media Best Endpoint Security and Cloud Security at 2025 SC Awards

25 Best-in-class Portfolio Across Security, AI and Data Alumni Acquired by Cisco Acquired by Rubrik Acquired by Rapid7 Acquired by Kela

26 A Culture Built on Trust Our Values Trust | Accountability | Ingenuity | OneSentinel | Relentlessness | Community

Q3 FY2026 Financial Overview

28 $211 $226 $229 $242 $259 $- $50 $10 $150 $20 $250 $30 Q3'25 Q4'25 Q1'26 Q2'26 Q3'26 $860 $920 $948 $1,001 $1,055 $20 $30 $40 $50 $60 $70 $80 $90 $1,00 $1,10 Q3'25 Q4'25 Q1'26 Q2'26 Q3'26 Q3 FY26 ARR & Revenue Growth Annualized Recurring Revenue (ARR) (in millions) 23% (y/y) Growth in Q3 FY26 Revenue (in millions) 23% (y/y) Growth in Q3 FY26 Quarterly Results Exceeded Guidance on Both Top and Bottom-line Top-Tier Growth Profile, Outperformed Expectations Reported Revenue Met or Exceeded Guidance

29 Enterprise Customers Have Adopted 4+ Solution Categories Customer Growth in the prior 24-Months Enterprise Customers Have Adopted 3+ Solution Categories Customer Growth in the prior 24-Months 1,310 1,411 1,459 1,513 1,572 0 20 40 60 80 100 1200 1400 1600 Q3'25 Q4'25 Q1'26 Q2'26 Q3'26 Customers with ARR of $100K or More 20% (y/y) Growth in Q3 FY26 Customer Growth & Platform Momentum Note: Enterprise customers consist of organizations with 1,000 or more employees. Enterprise Platform Adoption for Year Ending FY2025 ~40% 3X ~20% 4X

30 Q3 FY26 Margin Expansion Best-in-class gross margin profile Gross Margin % (non-GAAP) 80% 79% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Q3 FY25 Q3 FY26 Record operating margin profitability Operating Margin % (non-GAAP) -5.1% 6.8% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% Q3 FY25 Q3 FY26 Record quarterly net income margin Net Income Margin % (non-GAAP) Breakeven 9.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10. 0% 12. 0% Q3 FY25 Q3 FY26 Record TTM Free Cash Flow Margin Free Cash Flow Margin % (Trailing-Twelve Months, TTM) 0.7% 4.7% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% Q3 FY25 Q3 FY26 Focused on Operational Excellence, Driving Continued Margin Expansion Note: All financial figures are non-GAAP as of Q3 FY26. All metrics are compared to the third quarter of fiscal year 2025 unless otherwise noted. Fiscal year ends January 31. See Appendix for definition of metrics and a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP.

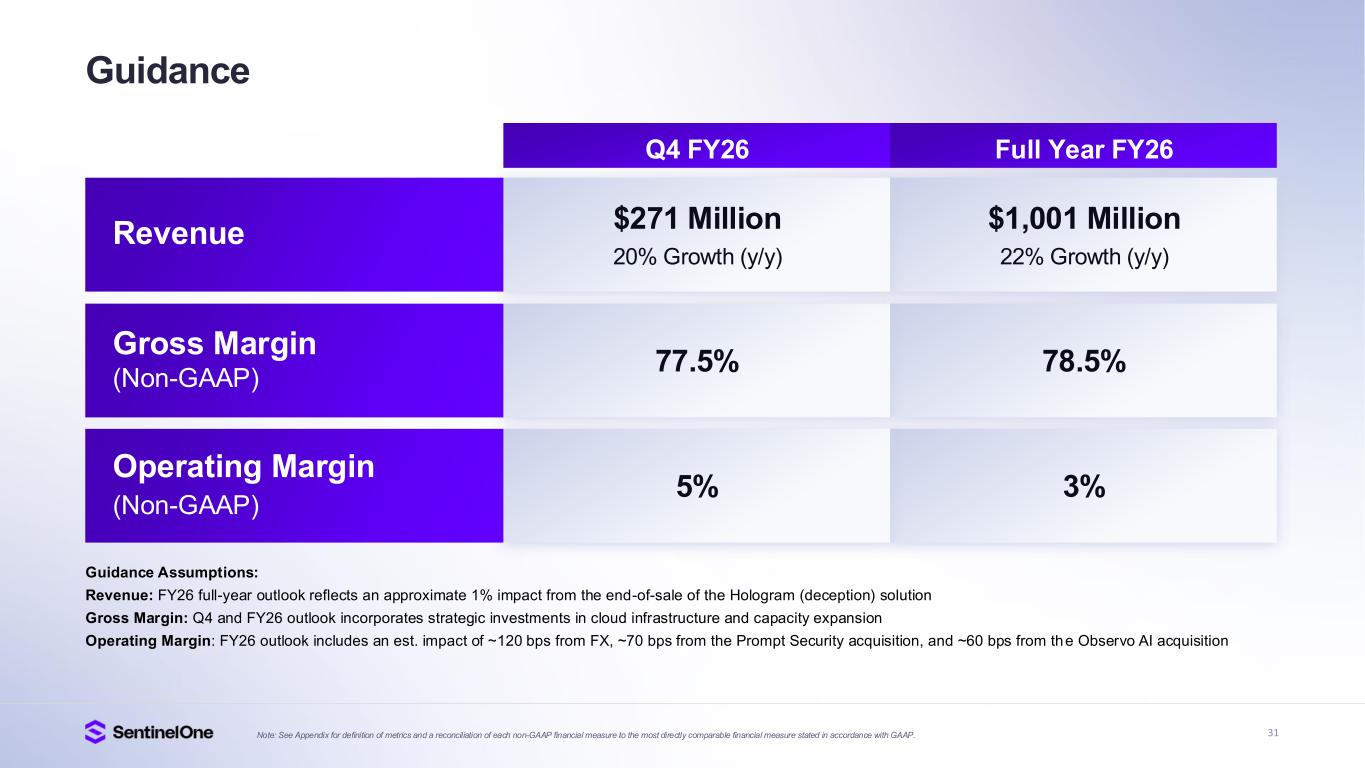

31 Guidance Guidance Assumptions: Revenue: FY26 full-year outlook reflects an approximate 1% impact from the end-of-sale of the Hologram (deception) solution Gross Margin: Q4 and FY26 outlook incorporates strategic investments in cloud infrastructure and capacity expansion Operating Margin: FY26 outlook includes an est. impact of ~120 bps from FX, ~70 bps from the Prompt Security acquisition, and ~60 bps from the Observo AI acquisition Q4 FY26 Full Year FY26 $1,001 Million 22% Growth (y/y) 78.5% 3% $271 Million 20% Growth (y/y) 77.5% 5% Revenue Gross Margin (Non-GAAP) Operating Margin (Non-GAAP) Note: See Appendix for definition of metrics and a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP.

Appendix

33 Appendix Key Business Metrics We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. Annualized Recurring Revenue (ARR) We believe that ARR is a key operating metric to measure our business because it is driven by our ability to acquire new subscription and consumption and usage-based customers, and to maintain and expand our relationship with existing customers. ARR represents the annualized revenue run rate of our subscription and consumption and usage-based agreements at the end of a reporting period, assuming contracts are renewed on their existing terms for customers that are under contracts with us. ARR is not a forecast of future revenue, which can be impacted by contract start and end dates, usage, renewal rates, and other contractual terms. Customers with ARR of $100,000 or More We believe that our ability to increase the number of customers with ARR of $100,000 or more is an indicator of our market penetration and strategic demand for our platform. Definitions Customers: We define a customer as an entity that has an active subscription for access to our platform. We count Managed Service Providers (MSPs), Managed Security Service Providers (MSSPs), Managed Detection & Response firms (MDRs), and Original Equipment Manufacturers (OEMs), who may purchase our products on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers.

34 Appendix (Cont’d) Non-GAAP Gross Margin We define non-GAAP gross margin as GAAP gross margin, excluding stock-based compensation (SBC) expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets and acquisition-related compensation costs. Non-GAAP Operating Margin We define non-GAAP operating margin as GAAP operating margin, excluding SBC expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets, acquisition-related compensation costs and restructuring charges. Non-GAAP Net Income, Non-GAAP Net Income Margin and Non-GAAP Net Income per Share, Basic and Diluted We define non-GAAP net income as GAAP net loss excluding SBC expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets, acquisition-related compensation costs, restructuring charges, gains and losses on strategic investments and provision for (benefit from) income taxes. We define non-GAAP net income per share, basic and diluted, as non-GAAP net income divided by the weighted average common shares outstanding, which includes the effect of dilutive shares applying the treasury stock method. Free Cash Flow Free cash flow is a non-GAAP financial measure that we define free cash flow as cash provided by (used in) operating activities less purchases of property and equipment and capitalized internal-use software costs. We believe free cash flow is a useful indicator of liquidity that provides our management, board of directors, and investors with information about our future ability to generate or use cash to enhance the strength of our balance sheet and further invest in our business and pursue potential strategic initiatives.

35 Appendix (Cont’d) Reports used for data shown in the chart titled ‘Vast, Growing, and Diverse Total Addressable Market’: CY25 TAM: • IDC Worldwide Corporate Endpoint Security Forecast Update, 2023–2027: Endpoint Security Platformization Propels Robust Growth (January 2024) • IDC Worldwide Threat Intelligence Forecast, 2024–2028: Beyond Reaction—The Rise of Predictive Threat Intelligence (April 2024) • IDC Worldwide Security Information & Event Management Forecast, 2023–2027: In the Face of XDR, Many Organizations Are Still Living in SIEM (August 2023) • IDC Worldwide and U.S. Comprehensive Security Services Forecast, 2024–2028 (April 2024) • Forrester Global AI Software Forecast, 2023–2030 (September 2023) • Company estimates

36 GAAP to Non-GAAP Reconciliation Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 Cost of revenue reconciliation: GAAP cost of revenue $ 67,851 $ 53,260 $ 184,857 $ 154,096 Stock-based compensation expense (5,644) (5,810) (15,708) (16,243) Employer payroll tax on employee stock transactions (156) (158) (573) (497) Amortization of acquired intangible assets (6,414) (4,195) (14,668) (13,861) Acquisition-related compensation (11) (38) (48) (350) Non-GAAP cost of revenue $ 55,626 $ 43,059 $ 153,860 $ 123,145 Gross profit reconciliation: GAAP gross profit $ 191,062 $ 157,388 $ 545,268 $ 441,844 Stock-based compensation expense 5,644 5,810 15,708 16,243 Employer payroll tax on employee stock transactions 156 158 573 497 Amortization of acquired intangible assets 6,414 4,195 14,668 13,861 Acquisition-related compensation 11 38 48 350 Non-GAAP gross profit $ 203,287 $ 167,589 $ 576,265 $ 472,795 Gross margin reconciliation: GAAP gross margin 74 % 75 % 75 % 74 % Stock-based compensation expense 2 % 3 % 2 % 3 % Employer payroll tax on employee stock transactions — % — % — % — % Amortization of acquired intangible assets 2 % 2 % 2 % 2 % Acquisition-related compensation — % — % — % — % Non-GAAP gross margin* 79 % 80 % 79 % 79 %

37 GAAP to Non-GAAP Reconciliation Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 Research and development expense reconciliation: GAAP research and development expense $ 83,146 $ 70,453 $ 234,490 $ 192,376 Stock-based compensation expense (24,952) (22,816) (70,182) (61,092) Employer payroll tax on employee stock transactions (205) (164) (947) (775) Acquisition-related compensation (1,308) (790) (2,649) (2,366) Non-GAAP research and development expense $ 56,681 $ 46,683 $ 160,712 $ 128,143 Sales and marketing expense reconciliation: GAAP sales and marketing expense $ 126,562 $ 123,713 $ 388,322 $ 359,160 Stock-based compensation expense (22,483) (18,612) (66,736) (55,568) Employer payroll tax on employee stock transactions (597) (290) (1,776) (1,583) Amortization of acquired intangible assets (2,420) (2,253) (6,853) (6,710) Acquisition-related compensation (514) (27) (539) (100) Non-GAAP sales and marketing expense $ 100,548 $ 102,531 $ 312,418 $ 295,199 General and administrative expense reconciliation: GAAP general and administrative expense $ 51,494 $ 52,342 $ 151,647 $ 139,409 Stock-based compensation expense (22,809) (22,950) (65,837) (60,515) Employer payroll tax on employee stock transactions (296) (335) (1,793) (1,318) Acquisition-related compensation — (1) — (1) Non-GAAP general and administrative expense $ 28,389 $ 29,056 $ 84,017 $ 77,575

38 GAAP to Non-GAAP Reconciliation Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 Restructuring expense reconciliation: GAAP restructuring expense $ 3,171 $ — $ 12,221 $ — Stock-based compensation 547 — 583 — Restructuring charges (3,718) — (12,804) — Non-GAAP restructuring expense $ — $ — $ — $ — Operating loss reconciliation: GAAP operating loss $ (73,311) $ (89,120) $ (241,412) $ (249,101) Stock-based compensation expense 75,341 70,188 217,880 193,418 Employer payroll tax on employee stock transactions 1,254 947 5,089 4,173 Amortization of acquired intangible assets 8,834 6,448 21,521 20,571 Acquisition-related compensation 1,833 856 3,236 2,817 Restructuring charges 3,718 — 12,804 — Non-GAAP operating income (loss) $ 17,669 $ (10,681) $ 19,118 $ (28,122) Operating margin reconciliation: GAAP operating margin (28) % (42) % (33) % (42) % Stock-based compensation expense 29 % 33 % 30 % 32 % Employer payroll tax on employee stock transactions — % — % 1 % 1 % Amortization of acquired intangible assets 3 % 3 % 3 % 3 % Acquisition-related compensation 1 % — % — % — % Restructuring charges 1 % — % 2 % — % Non-GAAP operating margin* 7 % (5)% 3 % (5)%

39 GAAP to Non-GAAP Reconciliation Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 Net income (loss) reconciliation: GAAP net loss $ (60,291) $ (78,364) $ (340,503) $ (217,653) Stock-based compensation expense 75,341 70,188 217,880 193,418 Employer payroll tax on employee stock transactions 1,254 947 5,089 4,173 Amortization of acquired intangible assets 8,834 6,448 21,521 20,571 Acquisition-related compensation 1,833 856 3,236 2,817 Restructuring charges 3,718 — 12,804 — Net gain on strategic investments (532) — (1,324) (345) Provision for (benefit from) income taxes (5,366) — 125,917 — Non-GAAP net income $ 24,791 $ 75 $ 44,620 $ 2,981 Net income (loss) margin reconciliation: GAAP net loss margin (23) % (37) % (47) % (37) % Stock-based compensation 29 % 33 % 30 % 32 % Employer payroll tax on employee stock transactions — % — % 1 % 1 % Amortization of acquired intangible assets 3 % 3 % 3 % 3 % Acquisition-related compensation 1 % — % — % — % Restructuring charges 1 % — % 2 % — % Net gain on strategic investments — % — % — % — % Provision for (benefit from) income taxes (2)% — % 17 % — % Non-GAAP net income margin* 10 % — % 6 % 1 %

40 GAAP to Non-GAAP Reconciliation Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 GAAP basic and diluted shares 332,732,831 316,987,303 328,516,203 312,583,956 Dilutive shares under the treasury stock method 8,113,721 18,066,319 9,512,966 19,385,520 Non-GAAP diluted shares 340,846,552 335,053,622 338,029,169 331,969,476 Diluted EPS reconciliation: GAAP net loss per share, basic and diluted $ (0.18) $ (0.25) $ (1.04) $ (0.70) Stock-based compensation expense 0.22 0.21 0.64 0.58 Employer payroll tax on employee stock transactions — — 0.02 0.01 Amortization of acquired intangible assets 0.03 0.02 0.06 0.06 Acquisition-related compensation 0.01 — 0.01 0.01 Restructuring charges 0.01 — 0.04 — Net gain on strategic investments — — — — Provision for (benefit from) income taxes (0.02) — 0.37 — Adjustment to fully diluted earnings per share (1) — 0.02 0.03 0.05 Non-GAAP net income per share, diluted $ 0.07 $ — $ 0.13 $ 0.01 *Certain figures may not sum due to rounding. (1) For periods in which we had diluted non-GAAP net income per share, the sum of the impact of individual reconciling items may not total to diluted non-GAAP net income per share because the basic share counts used to calculate GAAP net loss per share differ from the diluted share counts used to calculate non-GAAP net income per share, and because of rounding differences. The GAAP net loss per share calculation uses a lower share count as it excludes dilutive shares which are included in calculating the non-GAAP net income per share.

41 Selected Cash Flow Information Three Months Ended October 31, Nine Months Ended October 31, 2025 2024 2025 2024 Reconciliation of cash provided by (used in) operating activities to free cash flow: GAAP net cash provided by (used in) operating activities $ 21,014 $ (7,174) $ 72,245 $ 37,129 Less: Purchases of property and equipment (109) (227) (519) (1,666) Less: Capitalized internal-use software (5,001) (5,251) (17,526) (19,795) Free cash flow $ 15,904 $ (12,652) $ 54,200 $ 15,668 Net cash (used in) provided by investing activities $ (90,426) $ 29,723 $ (24,784) $ (85,898) Net cash (used in) provided by financing activities $ (47,868) $ 10,075 $ (76,267) $ 31,667 Operating cash flow margin 8 % (3)% 10 % 6 % Free cash flow margin 6 % (6)% 7 % 3 %