F E B R U A R Y 5 , 2 0 2 6 Earnings Q42025

2 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words "believe," "expect," "anticipate," "project," "estimate," "budget," "continue," "could," "intend," "may," "plan," "potential," "predict," "seek," "should," "will," "would," "objective," "forecast," "goal," "guidance," "outlook," "effort," "target," and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this presentation are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; risks associated with increasing our inventories in advance of anticipated orders by customers; escalating international trade tensions, new or increased tariffs and trade wars among countries; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber-attack, cyber breach, theft, or other unauthorized access; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; global economic instability, including due to inflation, rising interest rates, or the impacts of geopolitical uncertainties; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, adjusted earnings before interest, taxes, depreciation, and amortization; adjusted earnings before interest, taxes, depreciation, and amortization margin; non-GAAP gross profit margin, non-GAAP diluted earnings per share, non-GAAP operating expense; free cash flow; and free cash flow margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix.

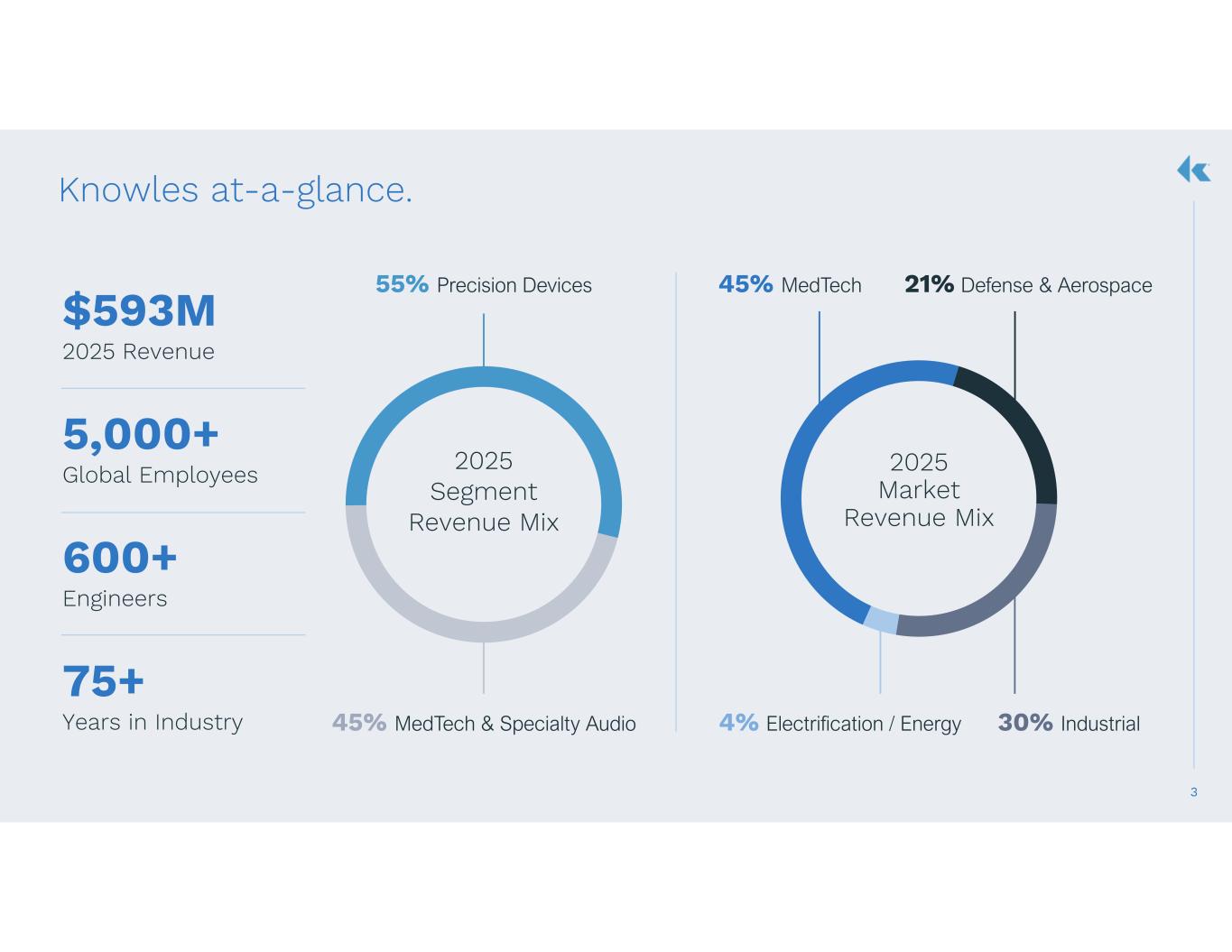

3 Knowles at-a-glance. $593M 2025 Revenue 5,000+ Global Employees 600+ Engineers 75+ Years in Industry 55% Precision Devices 45% MedTech & Specialty Audio 45% MedTech 4% Electrification / Energy 21% Defense & Aerospace 30% Industrial 2025 Market Revenue Mix 2025 Segment Revenue Mix

4 Why we win. High Performance Technology Enabler of Customer Innovation Customization at Scale High Performance Ceramic Capacitors & RF / Microwave Filters Serving a diverse and innovative customer base across attractive end markets. Scale of large manufacturer = Agility and innovation Competitive Advantage MEDTECH DEFENSE INDUSTRIAL ELECTRIFICATION High Perf rmance Capacitors & RF/Microwave Filters Hearing Health Solutions

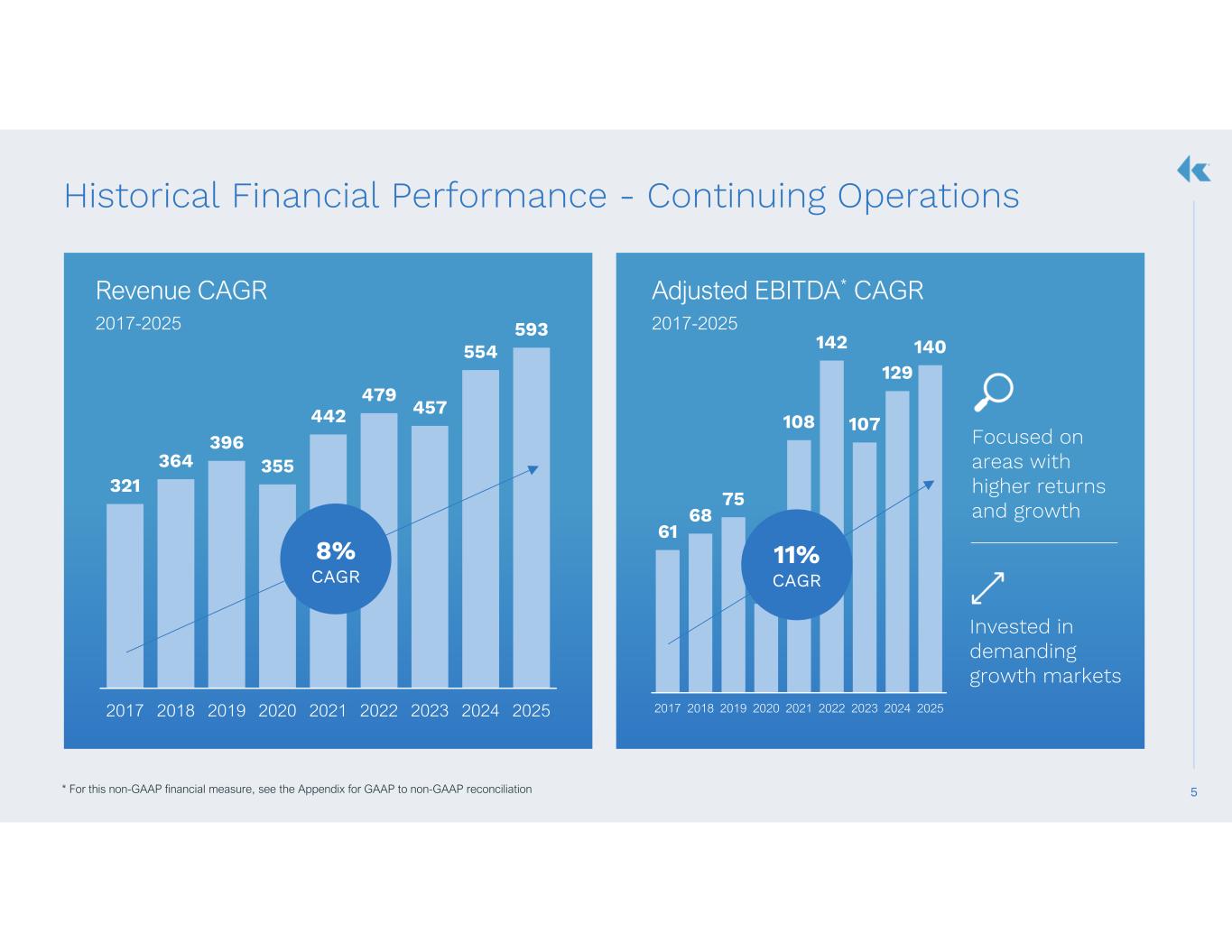

5 61 68 75 38 108 142 107 129 140 2017 2018 2019 2020 2021 2022 2023 2024 2025 * For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation Adjusted EBITDA* CAGR 2017-2025 Historical Financial Performance - Continuing Operations 321 364 396 355 442 479 457 554 593 2017 2018 2019 2020 2021 2022 2023 2024 2025 11% CAGR Focused on areas with higher returns and growth Invested in demanding growth markets 8% CAGR Revenue CAGR 2017-2025

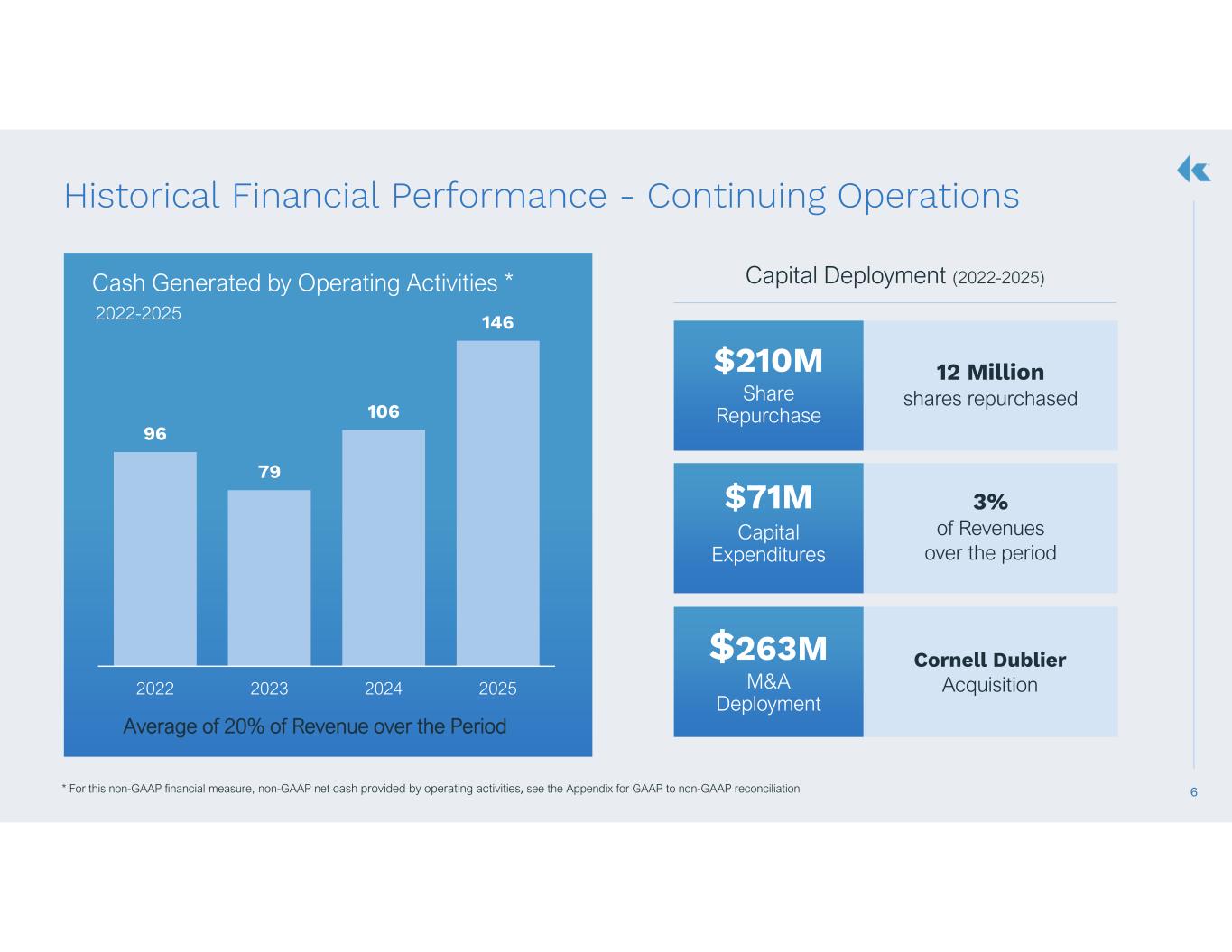

6 Historical Financial Performance - Continuing Operations 96 79 106 146 2022 2023 2024 2025 Cash Generated by Operating Activities * 2022-2025 Share Repurchase $210M Capital Expenditures $71M M&A Deployment $263M Capital Deployment (2022-2025) Average of 20% of Revenue over the Period 12 Million shares repurchased 3% of Revenues over the period Cornell Dublier Acquisition * For this non-GAAP financial measure, non-GAAP net cash provided by operating activities, see the Appendix for GAAP to non-GAAP reconciliation

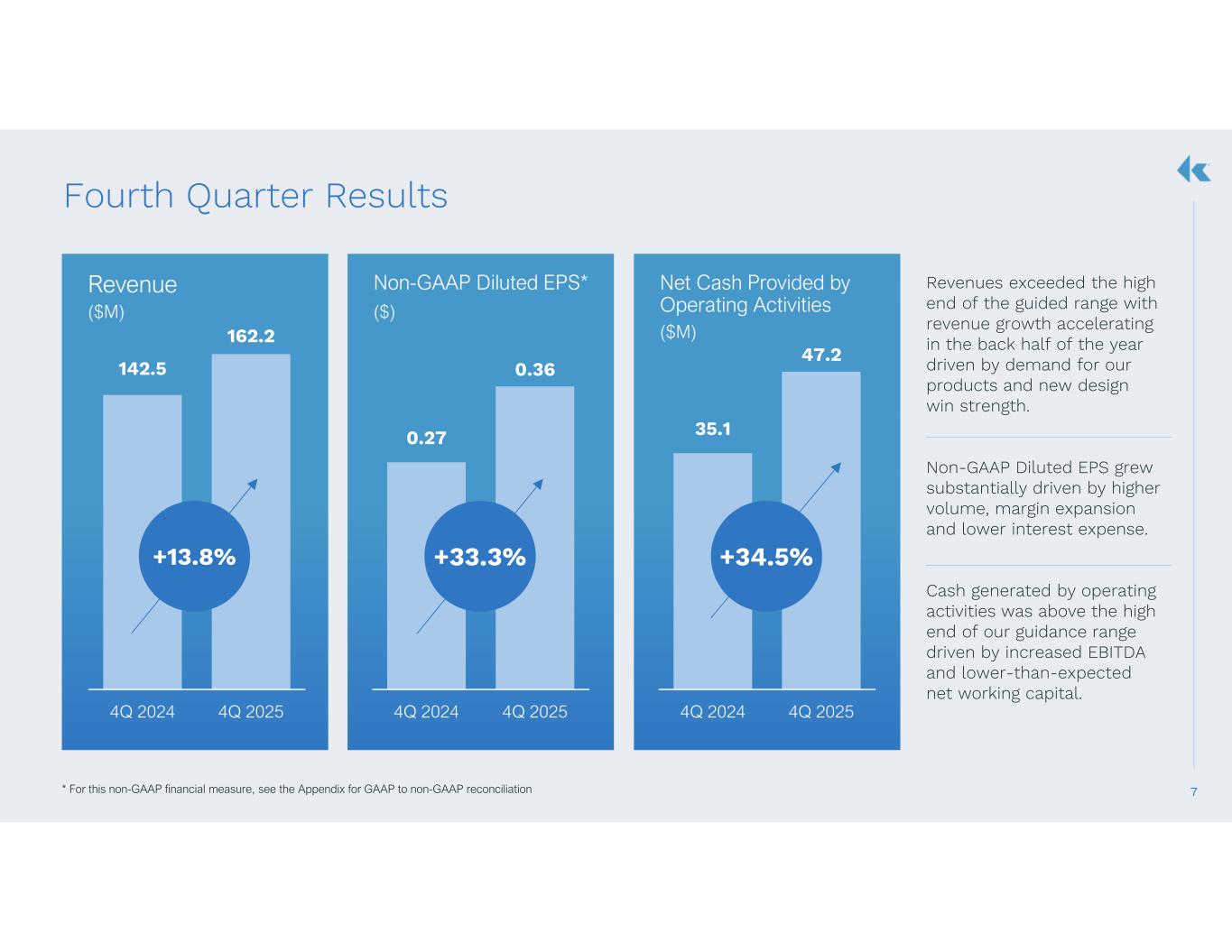

7 142.5 162.2 4Q 2024 4Q 2025 * For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation Revenue ($M) Revenues exceeded the high end of the guided range with revenue growth accelerating in the back half of the year driven by demand for our products and new design win strength. Non-GAAP Diluted EPS grew substantially driven by higher volume, margin expansion and lower interest expense. Cash generated by operating activities was above the high end of our guidance range driven by increased EBITDA and lower-than-expected net working capital. +13.8% Fourth Quarter Results 0.27 0.36 4Q 2024 4Q 2025 Non-GAAP Diluted EPS* ($) +33.3% 35.1 47.2 4Q 2024 4Q 2025 Net Cash Provided by Operating Activities ($M) +34.5%

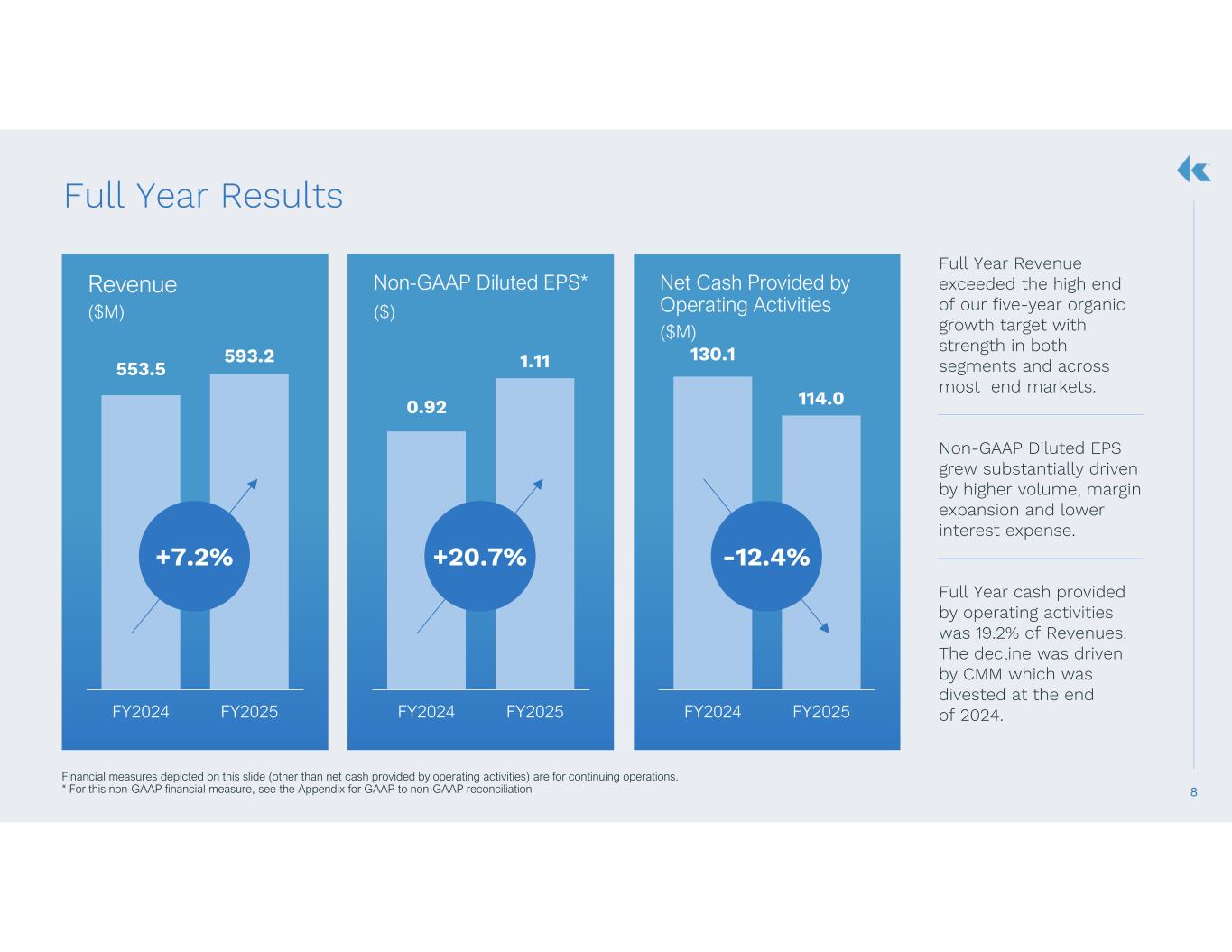

8 553.5 593.2 FY2024 FY2025 Financial measures depicted on this slide (other than net cash provided by operating activities) are for continuing operations. * For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation Revenue ($M) +7.2% Full Year Results 0.92 1.11 FY2024 FY2025 Non-GAAP Diluted EPS* ($) +20.7% 130.1 114.0 FY2024 FY2025 Net Cash Provided by Operating Activities ($M) -12.4% Full Year Revenue exceeded the high end of our five-year organic growth target with strength in both segments and across most end markets. Non-GAAP Diluted EPS grew substantially driven by higher volume, margin expansion and lower interest expense. Full Year cash provided by operating activities was 19.2% of Revenues. The decline was driven by CMM which was divested at the end of 2024.

9* For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation Fourth Quarter and Full Year revenue grew at the high end of the organic growth target driven by increased shipment volumes. Adjusted EBITDA margins were down slightly in 2025 based on product mix. 69.7 72.5 4Q 2024 4Q 2025 Revenue ($) +4.0% 42.5 42.6 4Q 2024 4Q 2025 Adjusted EBITDA Margin* (%) MedTech & Specialty Audio SEGMENT PERFORMANCE 253.5 264.3 FY2024 FY2025 Revenue ($) +4.3% 43.6 42.0 FY2024 FY2025 Adjusted EBITDA Margin* (%) -160 bps

10* For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation 72.8 89.7 4Q 2024 4Q 2025 Revenue ($) +23.2% 20.5 23.4 4Q 2024 4Q 2025 Adjusted EBITDA Margin* (%) Precision Devices SEGMENT PERFORMANCE 300.0 328.9 FY2024 FY2025 Revenue ($) +9.6% 20.2 22.3 FY2024 FY2025 Adjusted EBITDA Margin* (%) +210 bps Revenue grew significantly in the fourth quarter as growth accelerated in the back half of the year with inventory levels normalizing with our distribution partners. Adjusted EBITDA margins increased both in Q4 and on a full year basis as higher end market demand and increased factory capacity utilization. +290 bps

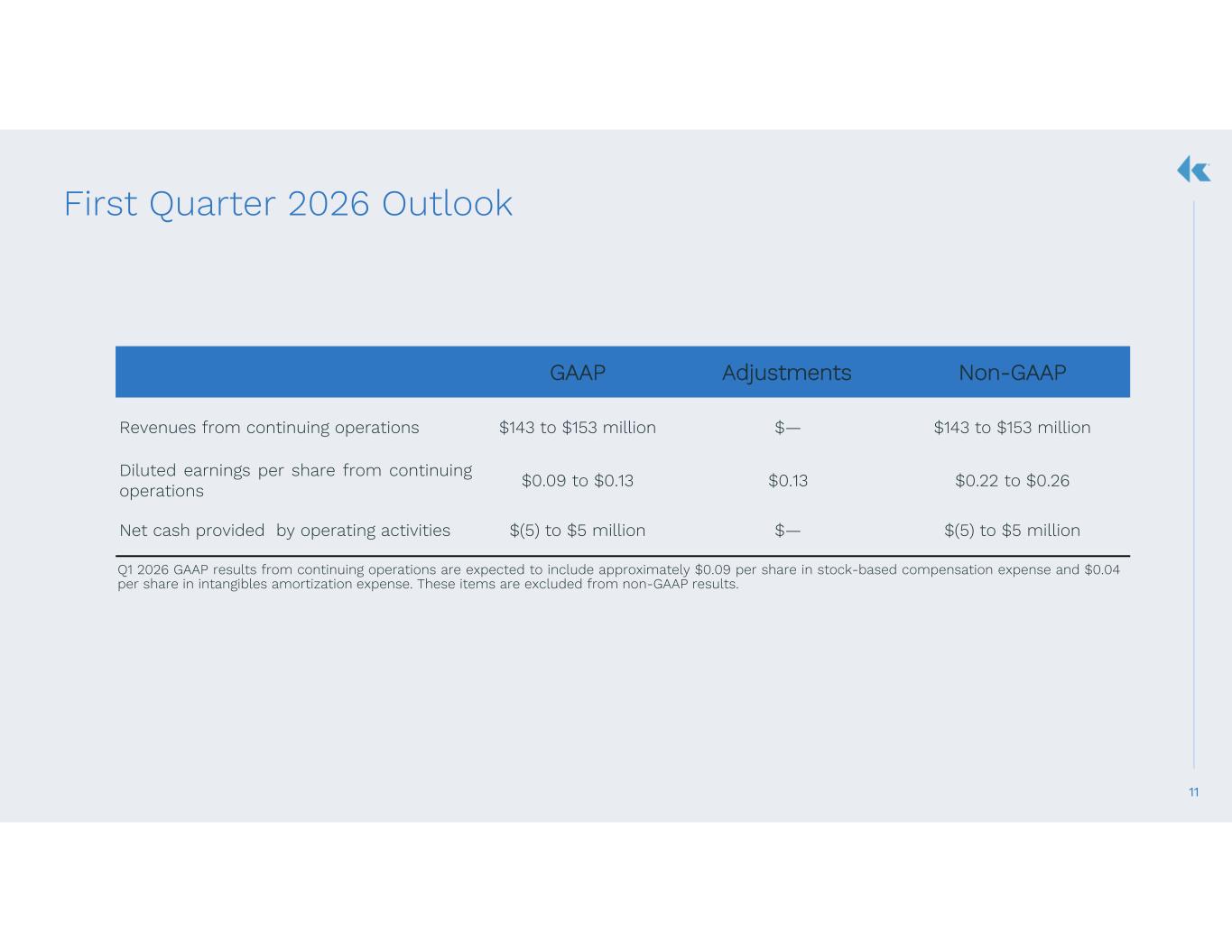

11 First Quarter 2026 Outlook Non-GAAPAdjustments GAAP $143 to $153 million$—$143 to $153 millionRevenues from continuing operations $0.22 to $0.26$0.13$0.09 to $0.13Diluted earnings per share from continuing operations $(5) to $5 million $—$(5) to $5 millionNet cash provided by operating activities Q1 2026 GAAP results from continuing operations are expected to include approximately $0.09 per share in stock-based compensation expense and $0.04 per share in intangibles amortization expense. These items are excluded from non-GAAP results.

12 2 0 2 6 - 2 0 2 9 8-10% Revenue CAGR 10-14% Adjusted EBITDA† CAGR Creating value for our organization, customers and shareholders — today and in the future. * For this non-GAAP financial measure, see the Appendix for GAAP to non-GAAP reconciliation † Reconciliation of this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure is not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort. 8% Revenue CAGR 11% Adjusted EBITDA* CAGR 2 0 1 7 - 2 0 2 5 CONTINUING OPERATIONS 16-20% Cash from Operations as a % of Revenue

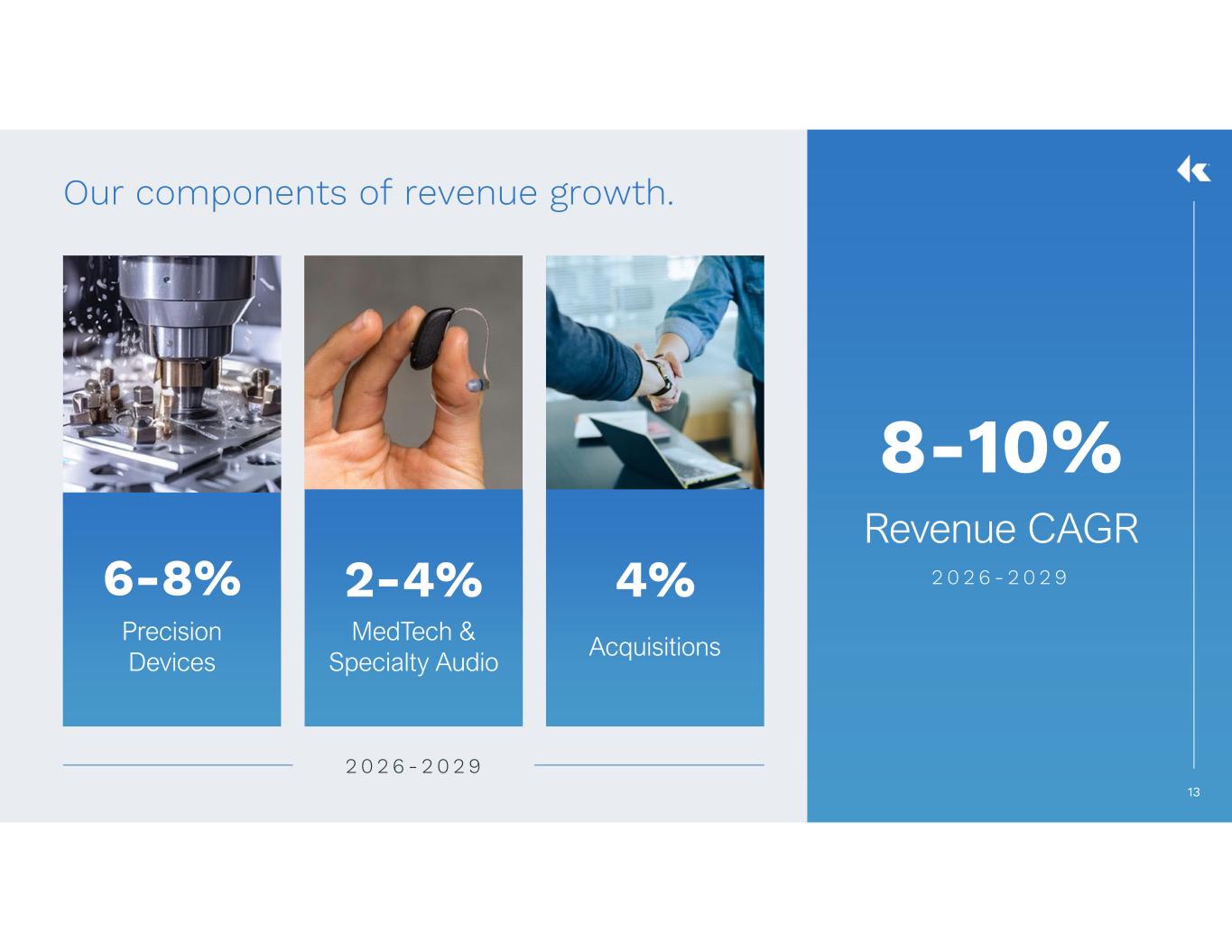

13 8-10% Revenue CAGR Our components of revenue growth. 6-8% Precision Devices 2-4% MedTech & Specialty Audio 4% Acquisitions 2 0 2 6 - 2 0 2 9 2 0 2 6 - 2 0 2 9

14 Pricing / Higher Value Products Factory Productivity Initiatives Capacity Utilization Continuing to drive value with strong earnings growth. Margin Expansion Operating Expenses Accretive Acquisitions Continued disciplined approach to SG&A Accretive in first 12 months Organic Revenue Growth EBITDA drop through 10-14% Adjusted EBITDA CAGR † 2 0 2 6 - 2 0 2 9 † Reconciliation of this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure is not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort

15 Consolidation in existing products and technologies Extensions to product lines which serve our existing markets and customers Adjacencies to expand our technology and customer base Consumer MEMS Microphones Strategically focused on expanding from our strong core. ACQUISITIONS DIVESTITURES

16 Deploy capital with targeted return of 200-300 bps above cost of capital. Capital Allocation Organic Investment • Capital investments of 4-5% of revenues over a cycle to support new business and product innovation M&A • Focal point of our capital allocation strategy • Supported by robust pipeline focused on high-growth end markets • Demonstrated capabilities to acquire and integrate • Existing liquidity of $340M+ supports acquisition growth • Limit net leverage ratio to 2.75x Share Repurchase • $271M executed on existing $400M program through Q4 2025 • Taking an opportunistic and efficient approach to future share repurchases Net Leverage represents Debt less Cash over EBITDA

1 2 3 4 5 17 Strategic transformation into industrial technology leader completed with focus on attractive MedTech, Defense, Industrial, and Energy markets Historical financial performance demonstrates ability of portfolio to deliver future growth with strong margin expansion over a cycle Differentiation through customization at scale creating distinct competitive advantage Proven M&A strategy to supplement organic growth Strong balance sheet and cash generation with capital allocation strategy to drive shareholder returns Summary

Appendix 18

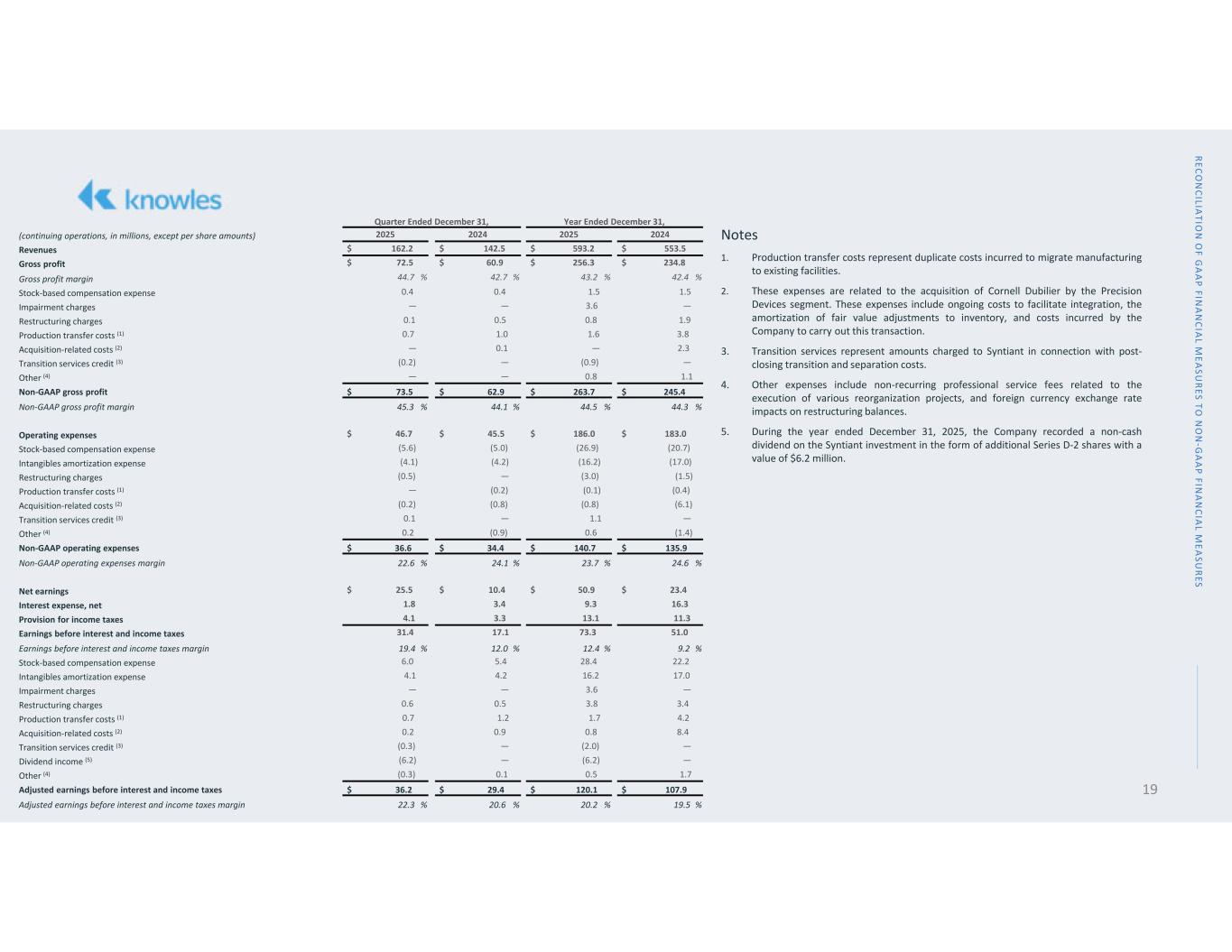

Notes 1. Production transfer costs represent duplicate costs incurred to migrate manufacturing to existing facilities. 2. These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses include ongoing costs to facilitate integration, the amortization of fair value adjustments to inventory, and costs incurred by the Company to carry out this transaction. 3. Transition services represent amounts charged to Syntiant in connection with post- closing transition and separation costs. 4. Other expenses include non-recurring professional service fees related to the execution of various reorganization projects, and foreign currency exchange rate impacts on restructuring balances. 5. During the year ended December 31, 2025, the Company recorded a non-cash dividend on the Syntiant investment in the form of additional Series D-2 shares with a value of $6.2 million. RECO N CILIATIO N O F G A A P FIN A N CIA L M EA SU RES TO N O N -G A A P FIN A N CIA L M EA SU RES Year Ended December 31,Quarter Ended December 31, 2024202520242025(continuing operations, in millions, except per share amounts) $ 553.5$ 593.2$ 142.5$ 162.2Revenues $ 234.8$ 256.3$ 60.9$ 72.5Gross profit 42.4 %43.2 %42.7 %44.7 %Gross profit margin 1.51.50.40.4Stock-based compensation expense —3.6——Impairment charges 1.90.80.50.1Restructuring charges 3.81.61.00.7Production transfer costs (1) 2.3—0.1—Acquisition-related costs (2) —(0.9)—(0.2)Transition services credit (3) 1.10.8——Other (4) $ 245.4$ 263.7$ 62.9$ 73.5Non-GAAP gross profit 44.3 %44.5 %44.1 %45.3 %Non-GAAP gross profit margin $ 183.0$ 186.0$ 45.5$ 46.7Operating expenses (20.7)(26.9)(5.0)(5.6)Stock-based compensation expense (17.0)(16.2)(4.2)(4.1)Intangibles amortization expense (1.5)(3.0)—(0.5)Restructuring charges (0.4)(0.1)(0.2)—Production transfer costs (1) (6.1)(0.8)(0.8)(0.2)Acquisition-related costs (2) —1.1—0.1Transition services credit (3) (1.4)0.6(0.9)0.2Other (4) $ 135.9$ 140.7$ 34.4$ 36.6Non-GAAP operating expenses 24.6 %23.7 %24.1 %22.6 %Non-GAAP operating expenses margin $ 23.4$ 50.9$ 10.4$ 25.5Net earnings 16.39.33.41.8Interest expense, net 11.313.13.34.1Provision for income taxes 51.073.317.131.4Earnings before interest and income taxes 9.2 %12.4 %12.0 %19.4 %Earnings before interest and income taxes margin 22.228.45.46.0Stock-based compensation expense 17.016.24.24.1Intangibles amortization expense —3.6——Impairment charges 3.43.80.50.6Restructuring charges 4.21.71.20.7Production transfer costs (1) 8.40.80.90.2Acquisition-related costs (2) —(2.0)—(0.3)Transition services credit (3) —(6.2)—(6.2)Dividend income (5) 1.70.50.1(0.3)Other (4) $ 107.9$ 120.1$ 29.4$ 36.2Adjusted earnings before interest and income taxes 19.5 %20.2 %20.6 %22.3 %Adjusted earnings before interest and income taxes margin 19

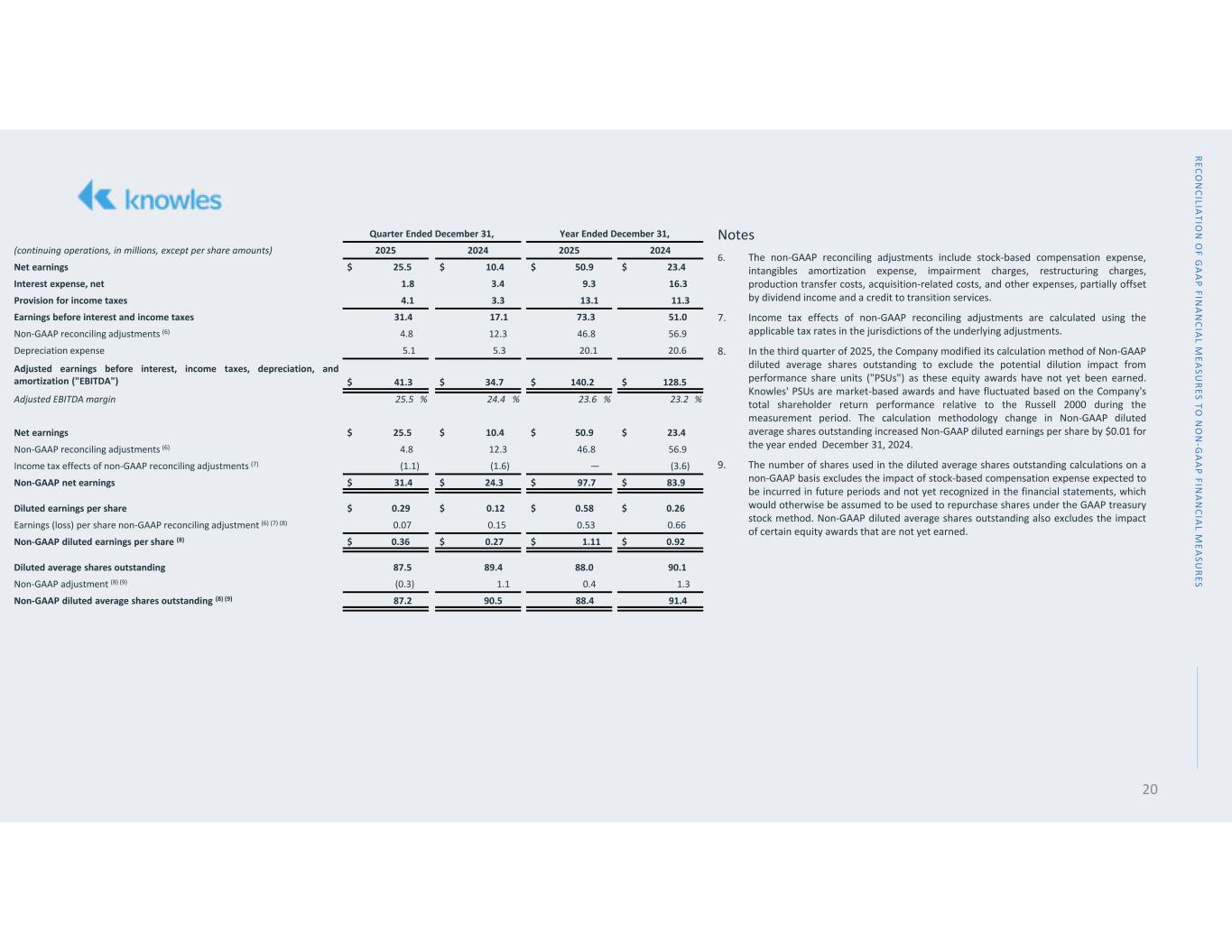

RECO N CILIATIO N O F G A A P FIN A N CIA L M EA SU RES TO N O N -G A A P FIN A N CIA L M EA SU RES Notes 6. The non-GAAP reconciling adjustments include stock-based compensation expense, intangibles amortization expense, impairment charges, restructuring charges, production transfer costs, acquisition-related costs, and other expenses, partially offset by dividend income and a credit to transition services. 7. Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. 8. In the third quarter of 2025, the Company modified its calculation method of Non-GAAP diluted average shares outstanding to exclude the potential dilution impact from performance share units ("PSUs") as these equity awards have not yet been earned. Knowles' PSUs are market-based awards and have fluctuated based on the Company's total shareholder return performance relative to the Russell 2000 during the measurement period. The calculation methodology change in Non-GAAP diluted average shares outstanding increased Non-GAAP diluted earnings per share by $0.01 for the year ended December 31, 2024. 9. The number of shares used in the diluted average shares outstanding calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. Non-GAAP diluted average shares outstanding also excludes the impact of certain equity awards that are not yet earned. Year Ended December 31,Quarter Ended December 31, 2024202520242025(continuing operations, in millions, except per share amounts) $ 23.4$ 50.9$ 10.4$ 25.5Net earnings 16.39.33.41.8Interest expense, net 11.313.13.34.1Provision for income taxes 51.073.317.131.4Earnings before interest and income taxes 56.946.812.34.8Non-GAAP reconciling adjustments (6) 20.620.15.35.1Depreciation expense $ 128.5$ 140.2$ 34.7$ 41.3 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") 23.2 %23.6 %24.4 %25.5 %Adjusted EBITDA margin $ 23.4$ 50.9$ 10.4$ 25.5Net earnings 56.946.812.34.8Non-GAAP reconciling adjustments (6) (3.6)—(1.6)(1.1)Income tax effects of non-GAAP reconciling adjustments (7) $ 83.9$ 97.7$ 24.3$ 31.4Non-GAAP net earnings $ 0.26$ 0.58$ 0.12$ 0.29Diluted earnings per share 0.660.530.150.07Earnings (loss) per share non-GAAP reconciling adjustment (6) (7) (8) $ 0.92$ 1.11$ 0.27$ 0.36Non-GAAP diluted earnings per share (8) 90.188.089.487.5Diluted average shares outstanding 1.30.41.1(0.3)Non-GAAP adjustment (8) (9) 91.488.490.587.2Non-GAAP diluted average shares outstanding (8) (9) 20

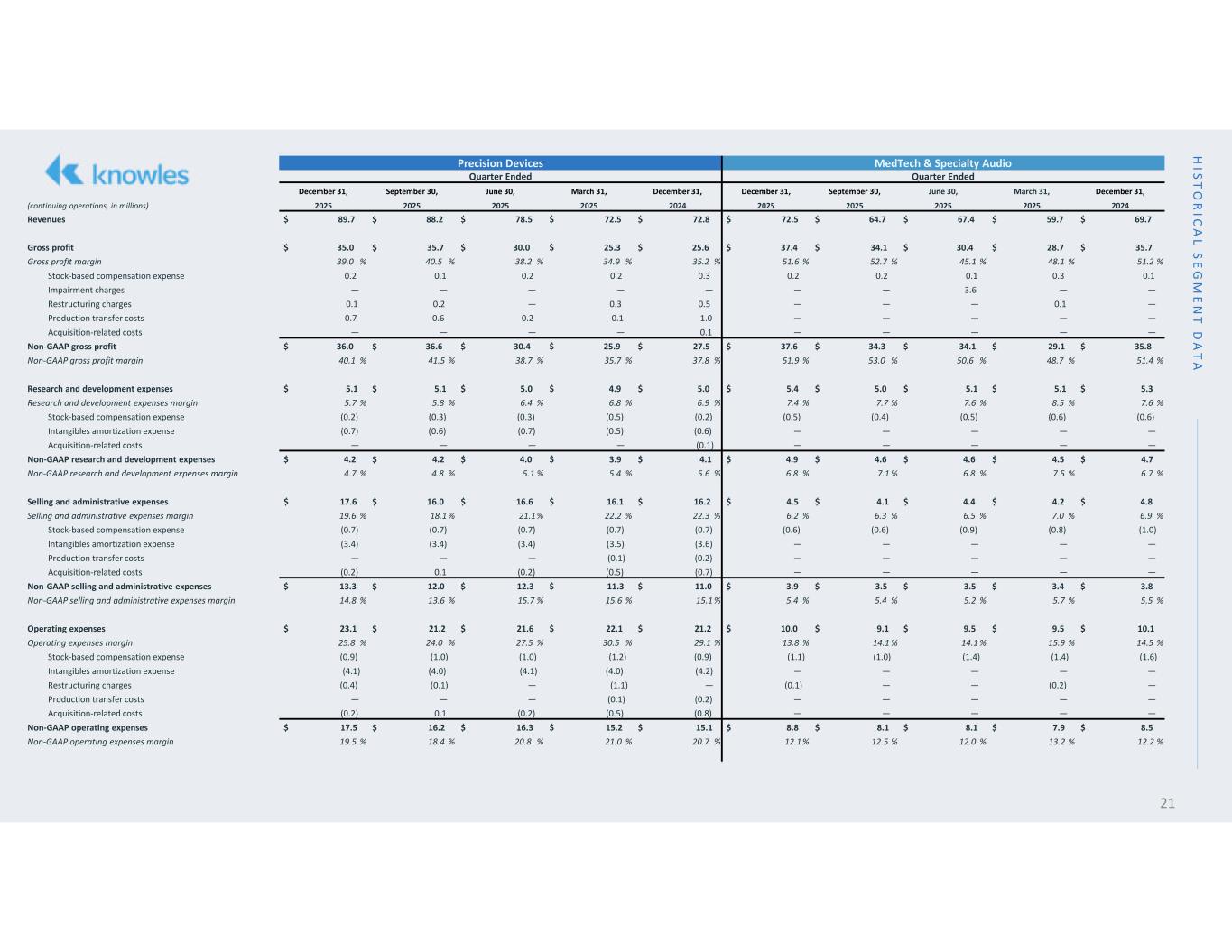

H IST O R IC A L SE G M E N T D A T A MedTech & Specialty AudioPrecision Devices Quarter EndedQuarter Ended December 31,March 31,June 30,September 30,December 31,December 31,March 31,June 30,September 30,December 31, 2024202520252025202520242025202520252025(continuing operations, in millions) $ 69.7$ 59.7$ 67.4$ 64.7$ 72.5$ 72.8$ 72.5$ 78.5$ 88.2$ 89.7Revenues $ 35.7$ 28.7$ 30.4$ 34.1$ 37.4$ 25.6$ 25.3$ 30.0$ 35.7$ 35.0Gross profit 51.2 %48.1 %45.1 %52.7 %51.6 %35.2 %34.9 %38.2 %40.5 %39.0 %Gross profit margin 0.10.30.10.20.20.30.20.20.10.2Stock-based compensation expense ——3.6———————Impairment charges —0.1———0.50.3—0.20.1Restructuring charges —————1.00.10.20.60.7Production transfer costs —————0.1————Acquisition-related costs $ 35.8$ 29.1$ 34.1$ 34.3$ 37.6$ 27.5$ 25.9$ 30.4$ 36.6$ 36.0Non-GAAP gross profit 51.4 %48.7 %50.6 %53.0 %51.9 %37.8 %35.7 %38.7 %41.5 %40.1 %Non-GAAP gross profit margin $ 5.3$ 5.1$ 5.1$ 5.0$ 5.4$ 5.0$ 4.9$ 5.0$ 5.1$ 5.1Research and development expenses 7.6 %8.5 %7.6 %7.7 %7.4 %6.9 %6.8 %6.4 %5.8 %5.7 %Research and development expenses margin (0.6)(0.6)(0.5)(0.4)(0.5)(0.2)(0.5)(0.3)(0.3)(0.2)Stock-based compensation expense —————(0.6)(0.5)(0.7)(0.6)(0.7)Intangibles amortization expense —————(0.1)————Acquisition-related costs $ 4.7$ 4.5$ 4.6$ 4.6$ 4.9$ 4.1$ 3.9$ 4.0$ 4.2$ 4.2Non-GAAP research and development expenses 6.7 %7.5 %6.8 %7.1 %6.8 %5.6 %5.4 %5.1 %4.8 %4.7 %Non-GAAP research and development expenses margin $ 4.8$ 4.2$ 4.4$ 4.1$ 4.5$ 16.2$ 16.1$ 16.6$ 16.0$ 17.6Selling and administrative expenses 6.9 %7.0 %6.5 %6.3 %6.2 %22.3 %22.2 %21.1%18.1 %19.6 %Selling and administrative expenses margin (1.0)(0.8)(0.9)(0.6)(0.6)(0.7)(0.7)(0.7)(0.7)(0.7)Stock-based compensation expense —————(3.6)(3.5)(3.4)(3.4)(3.4)Intangibles amortization expense —————(0.2)(0.1)———Production transfer costs —————(0.7)(0.5)(0.2)0.1(0.2)Acquisition-related costs $ 3.8$ 3.4$ 3.5$ 3.5$ 3.9$ 11.0$ 11.3$ 12.3$ 12.0$ 13.3Non-GAAP selling and administrative expenses 5.5 %5.7 %5.2 %5.4 %5.4 %15.1 %15.6 %15.7 %13.6 %14.8 %Non-GAAP selling and administrative expenses margin $ 10.1$ 9.5$ 9.5$ 9.1$ 10.0$ 21.2$ 22.1$ 21.6$ 21.2$ 23.1Operating expenses 14.5 %15.9 %14.1 %14.1 %13.8 %29.1 %30.5 %27.5 %24.0 %25.8 %Operating expenses margin (1.6)(1.4)(1.4)(1.0)(1.1)(0.9)(1.2)(1.0)(1.0)(0.9)Stock-based compensation expense —————(4.2)(4.0)(4.1)(4.0)(4.1)Intangibles amortization expense —(0.2)——(0.1)—(1.1)—(0.1)(0.4)Restructuring charges —————(0.2)(0.1)———Production transfer costs —————(0.8)(0.5)(0.2)0.1(0.2)Acquisition-related costs $ 8.5$ 7.9$ 8.1$ 8.1$ 8.8$ 15.1$ 15.2$ 16.3$ 16.2$ 17.5Non-GAAP operating expenses 12.2 %13.2 %12.0 %12.5 %12.1%20.7 %21.0 %20.8 %18.4 %19.5 %Non-GAAP operating expenses margin 21

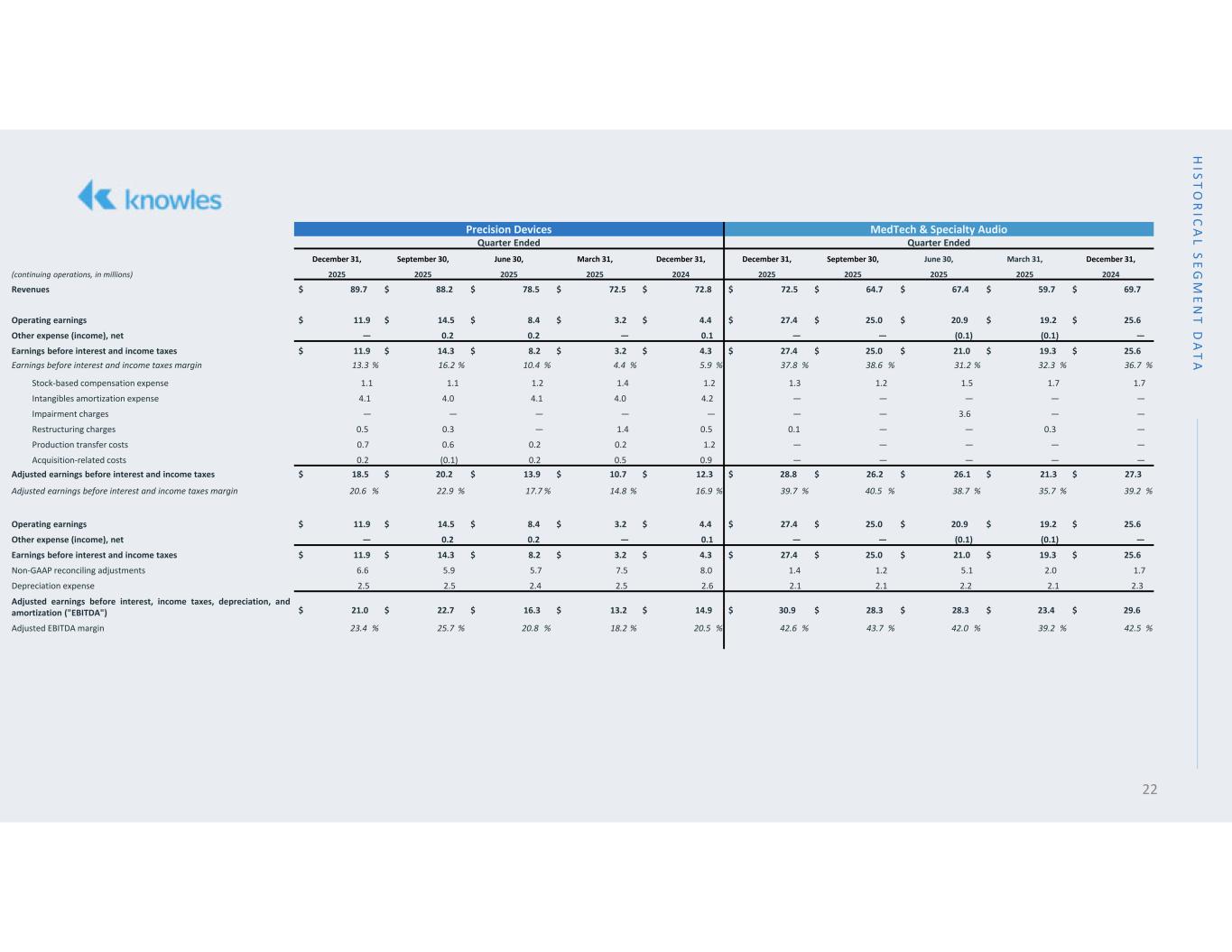

H IST O R IC A L SE G M E N T D A T A MedTech & Specialty AudioPrecision Devices Quarter EndedQuarter Ended December 31,March 31,June 30,September 30,December 31,December 31,March 31,June 30,September 30,December 31, 2024202520252025202520242025202520252025(continuing operations, in millions) $ 69.7$ 59.7$ 67.4$ 64.7$ 72.5$ 72.8$ 72.5$ 78.5$ 88.2$ 89.7Revenues $ 25.6$ 19.2$ 20.9$ 25.0$ 27.4$ 4.4$ 3.2$ 8.4$ 14.5$ 11.9Operating earnings —(0.1)(0.1)——0.1—0.20.2—Other expense (income), net $ 25.6$ 19.3$ 21.0$ 25.0$ 27.4$ 4.3$ 3.2$ 8.2$ 14.3$ 11.9Earnings before interest and income taxes 36.7 %32.3 %31.2 %38.6 %37.8 %5.9 %4.4 %10.4 %16.2 %13.3 %Earnings before interest and income taxes margin 1.71.71.51.21.31.21.41.21.11.1Stock-based compensation expense —————4.24.04.14.04.1Intangibles amortization expense ——3.6———————Impairment charges —0.3——0.10.51.4—0.30.5Restructuring charges —————1.20.20.20.60.7Production transfer costs —————0.90.50.2(0.1)0.2Acquisition-related costs $ 27.3$ 21.3$ 26.1$ 26.2$ 28.8$ 12.3$ 10.7$ 13.9$ 20.2$ 18.5Adjusted earnings before interest and income taxes 39.2 %35.7 %38.7 %40.5 %39.7 %16.9 %14.8 %17.7 %22.9 %20.6 %Adjusted earnings before interest and income taxes margin $ 25.6$ 19.2$ 20.9$ 25.0$ 27.4$ 4.4$ 3.2$ 8.4$ 14.5$ 11.9Operating earnings —(0.1)(0.1)——0.1—0.20.2—Other expense (income), net $ 25.6$ 19.3$ 21.0$ 25.0$ 27.4$ 4.3$ 3.2$ 8.2$ 14.3$ 11.9Earnings before interest and income taxes 1.72.05.11.21.48.07.55.75.96.6Non-GAAP reconciling adjustments 2.32.12.22.12.12.62.52.42.52.5Depreciation expense $ 29.6$ 23.4$ 28.3$ 28.3$ 30.9$ 14.9$ 13.2$ 16.3$ 22.7$ 21.0 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") 42.5 %39.2 %42.0 %43.7 %42.6 %20.5 %18.2 %20.8 %25.7 %23.4 %Adjusted EBITDA margin 22

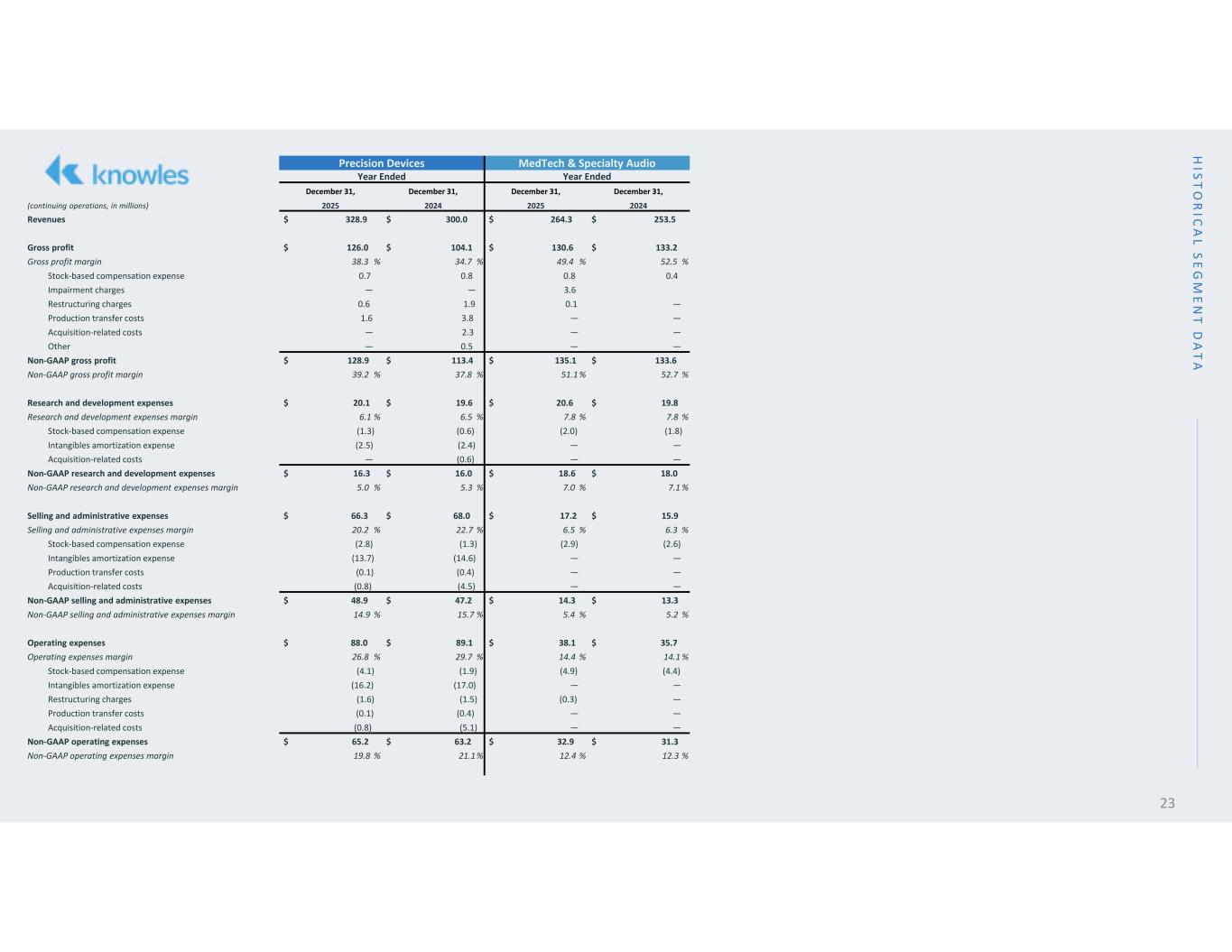

H IST O R IC A L SE G M E N T D A T A MedTech & Specialty AudioPrecision Devices Year EndedYear Ended December 31,December 31,December 31,December 31, 2024202520242025(continuing operations, in millions) $ 253.5$ 264.3$ 300.0$ 328.9Revenues $ 133.2$ 130.6$ 104.1$ 126.0Gross profit 52.5 %49.4 %34.7 %38.3 %Gross profit margin 0.40.80.80.7Stock-based compensation expense 3.6——Impairment charges —0.11.90.6Restructuring charges ——3.81.6Production transfer costs ——2.3—Acquisition-related costs ——0.5—Other $ 133.6$ 135.1$ 113.4$ 128.9Non-GAAP gross profit 52.7 %51.1 %37.8 %39.2 %Non-GAAP gross profit margin $ 19.8$ 20.6$ 19.6$ 20.1Research and development expenses 7.8 %7.8 %6.5 %6.1 %Research and development expenses margin (1.8)(2.0)(0.6)(1.3)Stock-based compensation expense ——(2.4)(2.5)Intangibles amortization expense ——(0.6)—Acquisition-related costs $ 18.0$ 18.6$ 16.0$ 16.3Non-GAAP research and development expenses 7.1 %7.0 %5.3 %5.0 %Non-GAAP research and development expenses margin $ 15.9$ 17.2$ 68.0$ 66.3Selling and administrative expenses 6.3 %6.5 %22.7 %20.2 %Selling and administrative expenses margin (2.6)(2.9)(1.3)(2.8)Stock-based compensation expense ——(14.6)(13.7)Intangibles amortization expense ——(0.4)(0.1)Production transfer costs ——(4.5)(0.8)Acquisition-related costs $ 13.3$ 14.3$ 47.2$ 48.9Non-GAAP selling and administrative expenses 5.2 %5.4 %15.7 %14.9 %Non-GAAP selling and administrative expenses margin $ 35.7$ 38.1$ 89.1$ 88.0Operating expenses 14.1 %14.4 %29.7 %26.8 %Operating expenses margin (4.4)(4.9)(1.9)(4.1)Stock-based compensation expense ——(17.0)(16.2)Intangibles amortization expense —(0.3)(1.5)(1.6)Restructuring charges ——(0.4)(0.1)Production transfer costs ——(5.1)(0.8)Acquisition-related costs $ 31.3$ 32.9$ 63.2$ 65.2Non-GAAP operating expenses 12.3 %12.4 %21.1%19.8 %Non-GAAP operating expenses margin 23

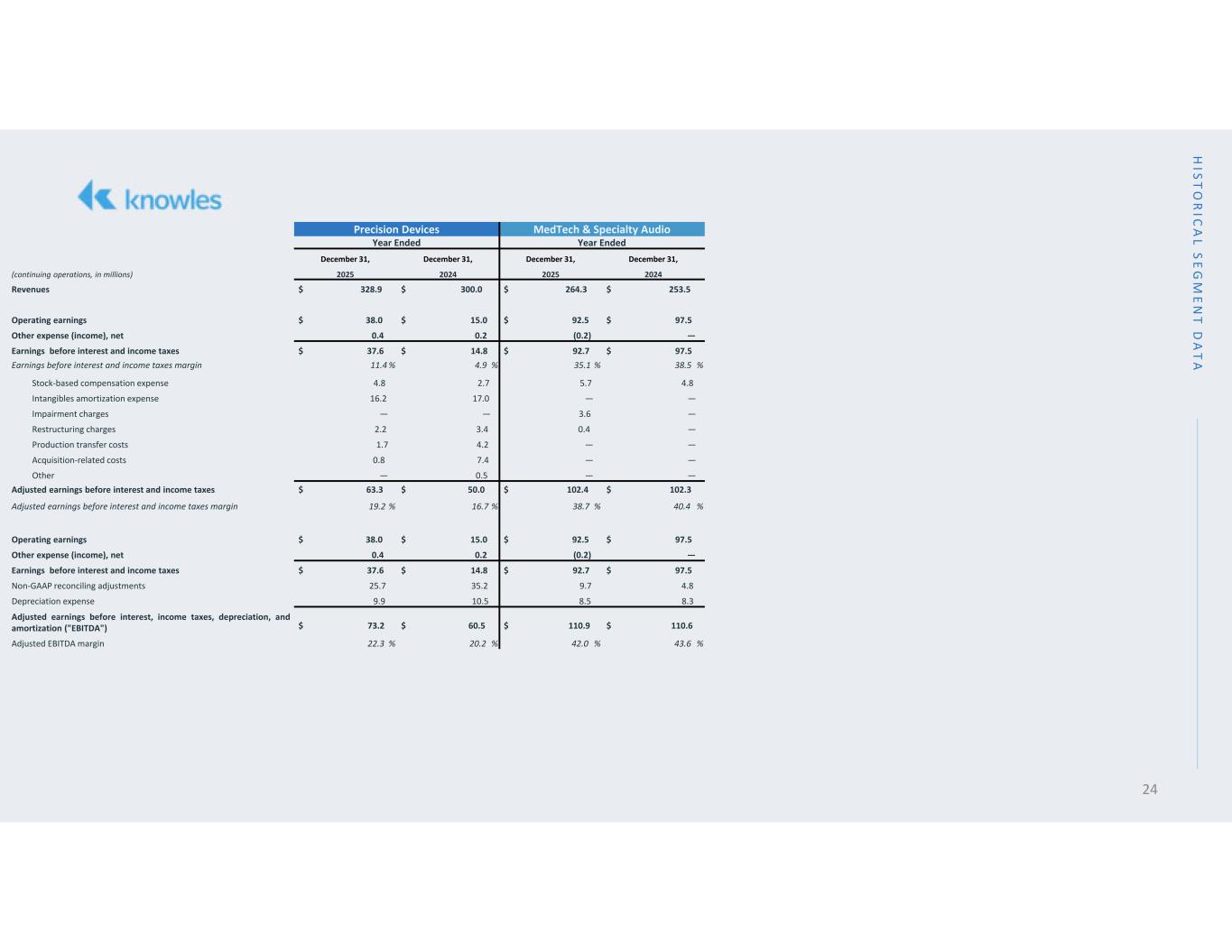

H IST O R IC A L SE G M E N T D A T A MedTech & Specialty AudioPrecision Devices Year EndedYear Ended December 31,December 31,December 31,December 31, 2024202520242025(continuing operations, in millions) $ 253.5$ 264.3$ 300.0$ 328.9Revenues $ 97.5$ 92.5$ 15.0$ 38.0Operating earnings —(0.2)0.20.4Other expense (income), net $ 97.5$ 92.7$ 14.8$ 37.6Earnings before interest and income taxes 38.5 %35.1 %4.9 %11.4 %Earnings before interest and income taxes margin 4.85.72.74.8Stock-based compensation expense ——17.016.2Intangibles amortization expense —3.6——Impairment charges —0.43.42.2Restructuring charges ——4.21.7Production transfer costs ——7.40.8Acquisition-related costs ——0.5—Other $ 102.3$ 102.4$ 50.0$ 63.3Adjusted earnings before interest and income taxes 40.4 %38.7 %16.7 %19.2 %Adjusted earnings before interest and income taxes margin $ 97.5$ 92.5$ 15.0$ 38.0Operating earnings —(0.2)0.20.4Other expense (income), net $ 97.5$ 92.7$ 14.8$ 37.6Earnings before interest and income taxes 4.89.735.225.7Non-GAAP reconciling adjustments 8.38.510.59.9Depreciation expense $ 110.6$ 110.9$ 60.5$ 73.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") 43.6 %42.0 %20.2 %22.3 %Adjusted EBITDA margin 24

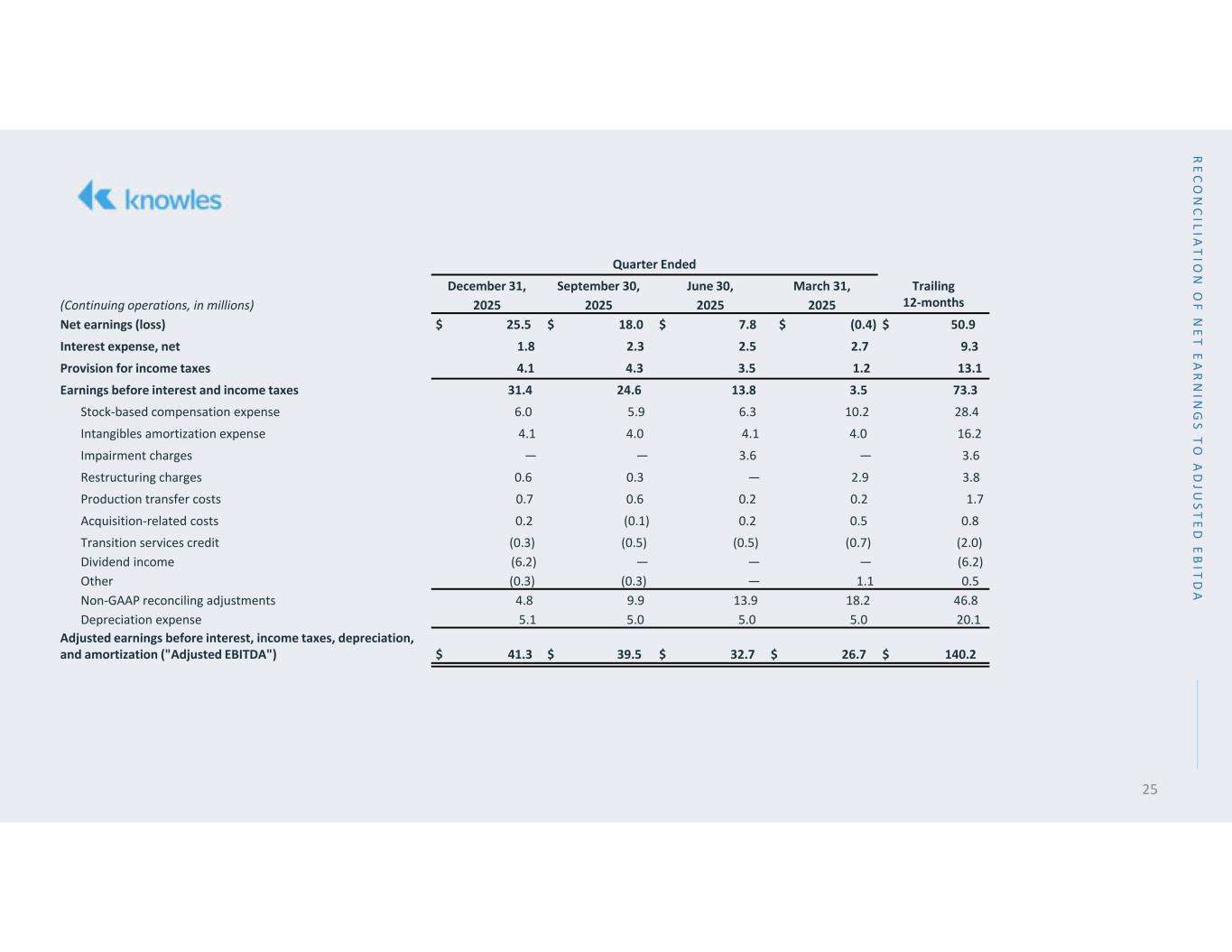

Quarter Ended Trailing 12-months March 31,June 30,September 30,December 31, 2025202520252025(Continuing operations, in millions) $ 50.9$ (0.4)$ 7.8$ 18.0$ 25.5Net earnings (loss) 9.32.72.52.31.8Interest expense, net 13.11.23.54.34.1Provision for income taxes 73.33.513.824.631.4Earnings before interest and income taxes 28.410.26.35.96.0Stock-based compensation expense 16.24.04.14.04.1Intangibles amortization expense 3.6—3.6——Impairment charges 3.82.9—0.30.6Restructuring charges 1.70.20.20.60.7Production transfer costs 0.80.50.2(0.1)0.2Acquisition-related costs (2.0)(0.7)(0.5)(0.5)(0.3)Transition services credit (6.2)———(6.2)Dividend income 0.51.1—(0.3)(0.3)Other 46.818.213.99.94.8Non-GAAP reconciling adjustments 20.15.05.05.05.1Depreciation expense $ 140.2$ 26.7$ 32.7$ 39.5$ 41.3 Adjusted earnings before interest, income taxes, depreciation, and amortization ("Adjusted EBITDA") 25 R E C O N C ILIA T IO N O F N E T E A R N IN G S T O A D JU ST E D E B IT D A

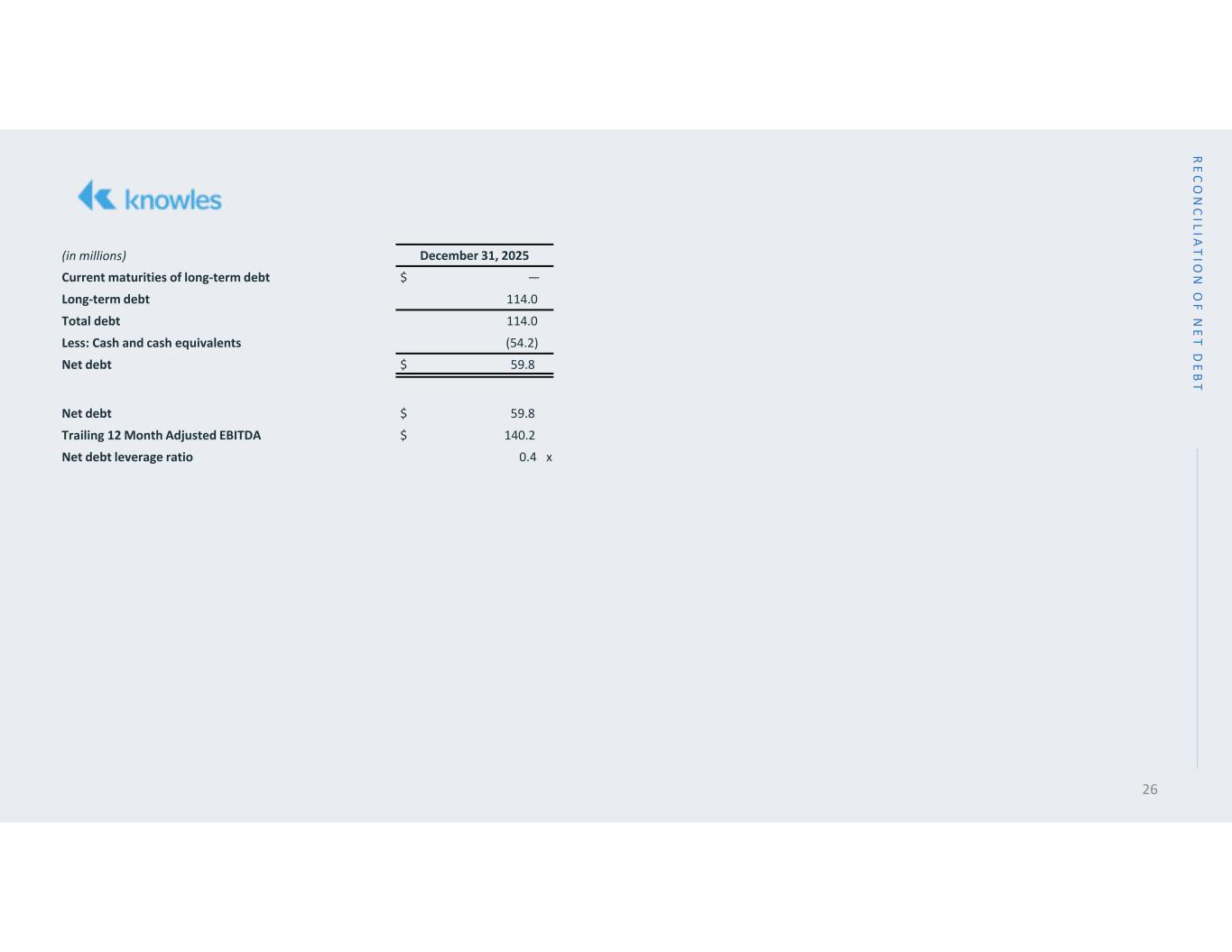

R E C O N C ILIA T IO N O F N E T D E B T December 31, 2025(in millions) $ —Current maturities of long-term debt 114.0Long-term debt 114.0Total debt (54.2)Less: Cash and cash equivalents $ 59.8Net debt $ 59.8Net debt $ 140.2Trailing 12 Month Adjusted EBITDA 0.4 xNet debt leverage ratio 26

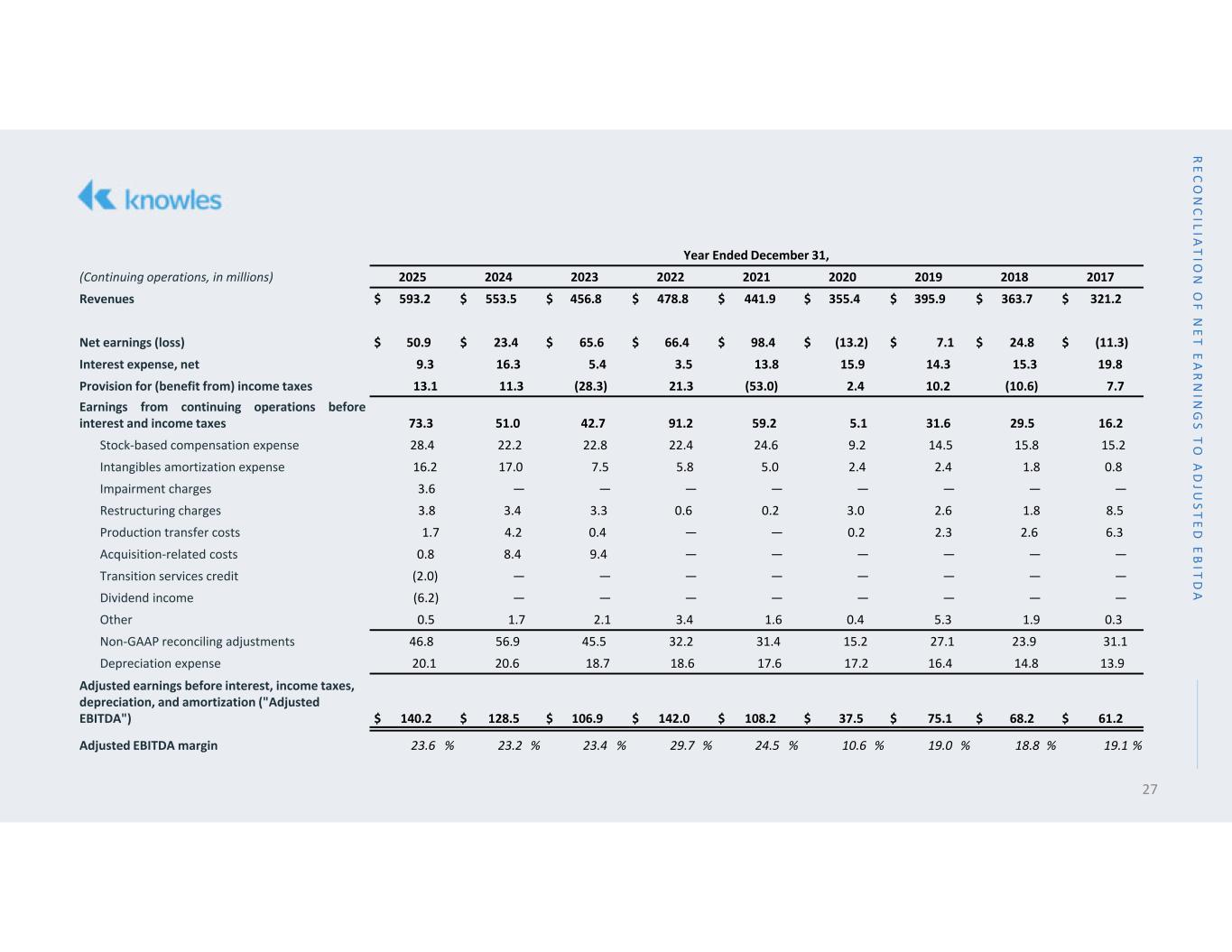

R E C O N C ILIA T IO N O F N E T E A R N IN G S T O A D JU ST E D E B IT D A 27 Year Ended December 31, 201720182019202020212022202320242025(Continuing operations, in millions) $ 321.2$ 363.7$ 395.9$ 355.4$ 441.9$ 478.8$ 456.8$ 553.5$ 593.2Revenues $ (11.3)$ 24.8$ 7.1$ (13.2)$ 98.4$ 66.4$ 65.6$ 23.4$ 50.9Net earnings (loss) 19.815.314.315.913.83.55.416.39.3Interest expense, net 7.7(10.6)10.22.4(53.0)21.3(28.3)11.313.1Provision for (benefit from) income taxes 16.229.531.65.159.291.242.751.073.3 Earnings from continuing operations before interest and income taxes 15.215.814.59.224.622.422.822.228.4Stock-based compensation expense 0.81.82.42.45.05.87.517.016.2Intangibles amortization expense ————————3.6Impairment charges 8.51.82.63.00.20.63.33.43.8Restructuring charges 6.32.62.30.2——0.44.21.7Production transfer costs ——————9.48.40.8Acquisition-related costs ————————(2.0)Transition services credit ————————(6.2)Dividend income 0.31.95.30.41.63.42.11.70.5Other 31.123.927.115.231.432.245.556.946.8Non-GAAP reconciling adjustments 13.914.816.417.217.618.618.720.620.1Depreciation expense $ 61.2$ 68.2$ 75.1$ 37.5$ 108.2$ 142.0$ 106.9$ 128.5$ 140.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("Adjusted EBITDA") 19.1 %18.8 %19.0 %10.6 %24.5 %29.7 %23.4 %23.2 %23.6 %Adjusted EBITDA margin

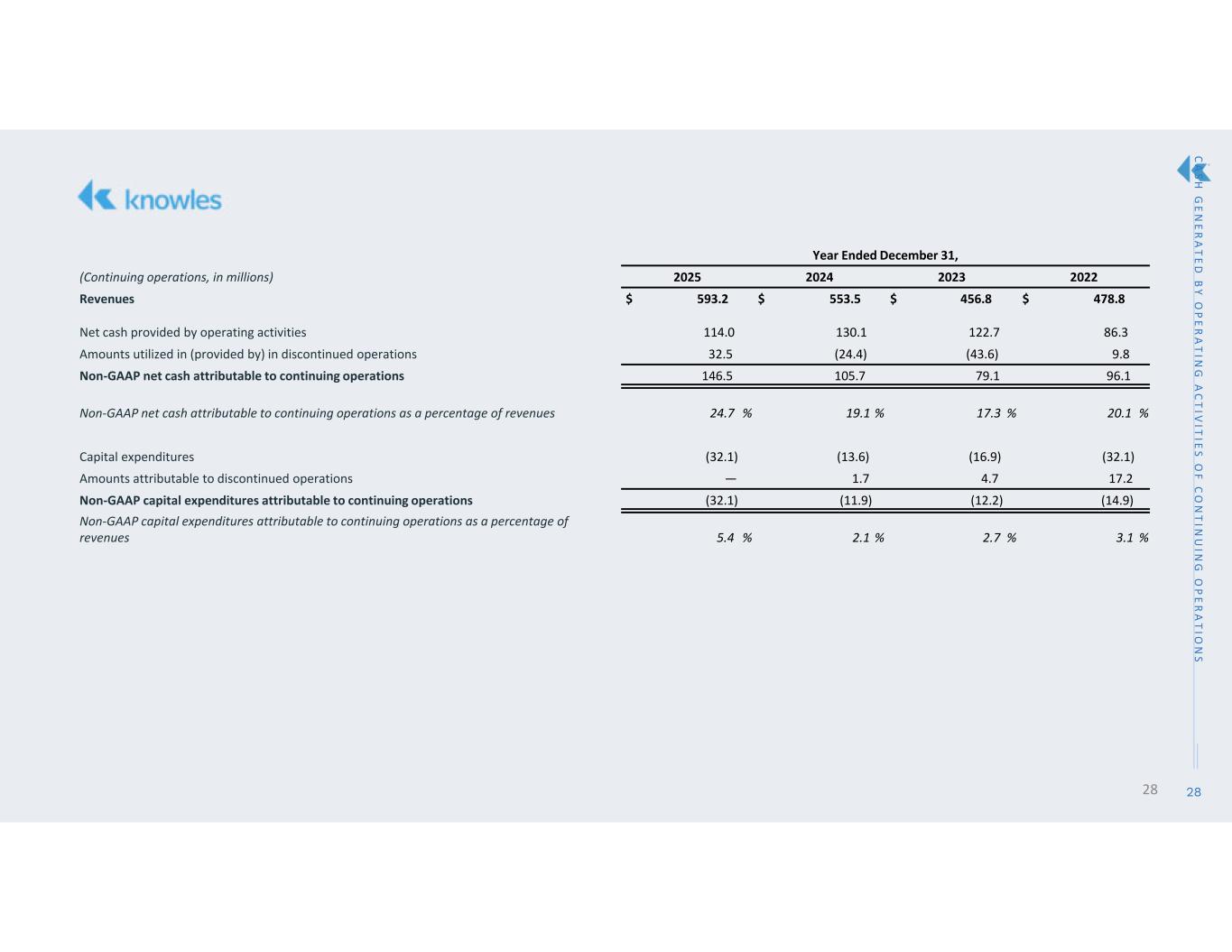

28 C A SH G E N E R A T E D B Y O P E R A T IN G A C T IV IT IE S O F C O N T IN U IN G O P E R A T IO N S 28 Year Ended December 31, 2022202320242025(Continuing operations, in millions) $ 478.8$ 456.8$ 553.5$ 593.2Revenues 86.3122.7130.1114.0Net cash provided by operating activities 9.8(43.6)(24.4)32.5Amounts utilized in (provided by) in discontinued operations 96.179.1105.7146.5Non-GAAP net cash attributable to continuing operations 20.1 %17.3 %19.1 %24.7 %Non-GAAP net cash attributable to continuing operations as a percentage of revenues (32.1)(16.9)(13.6)(32.1)Capital expenditures 17.24.71.7—Amounts attributable to discontinued operations (14.9)(12.2)(11.9)(32.1)Non-GAAP capital expenditures attributable to continuing operations 3.1 %2.7 %2.1 %5.4 % Non-GAAP capital expenditures attributable to continuing operations as a percentage of revenues

T h a n k y o u .