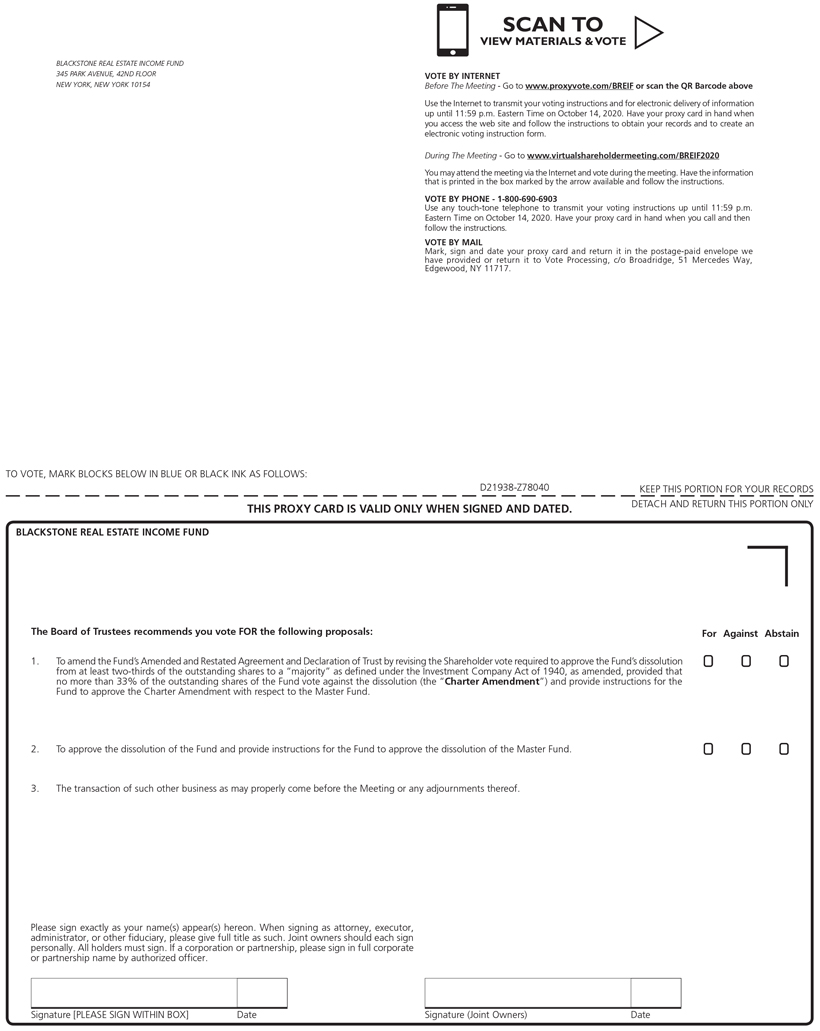

BLACKSTONE REAL ESTATE INCOME FUND

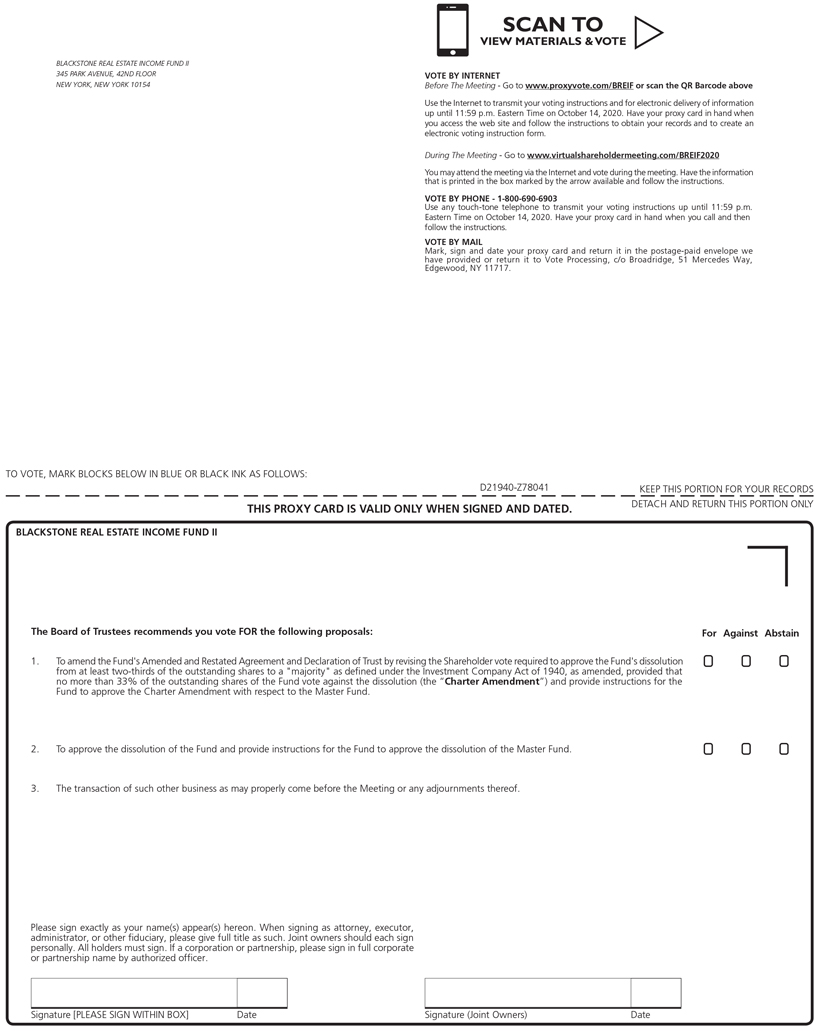

BLACKSTONE REAL ESTATE INCOME FUND II

BLACKSTONE REAL ESTATE INCOME MASTER FUND

345 Park Avenue, 42nd Floor | New York, New York 10154

August 14, 2020

Dear Shareholder:

After careful consideration and as disclosed in each Fund’s Prospectus Supplement dated July 13, 2020, Blackstone Real Estate Income Advisors L.L.C., the investment manager (the “Investment Manager”) of Blackstone Real Estate Income Fund, Blackstone Real Estate Income Fund II and Blackstone Real Estate Income Master Fund (each, a “Fund” and collectively, the “Funds”), recommended to the Boards of Trustees of the Funds (the “Board”) that an orderly liquidation of the Funds would be in the best interest of the shareholders (“Shareholders”) of each Fund. In order to have the best opportunity to maximize the underlying value of the Funds’ investments, the Board has approved the Investment Manager’s proposal and the enclosed proxy statement seeks your approval to implement the liquidation.

Blackstone supports the plan and believes the approach provides Shareholders with the best opportunity to maximize the underlying value of the Funds’ investments.

The Funds currently have significant cash holdings and are starting to see a recovery in the pricing of the Funds’ portfolio holdings since the recent trough related to market reaction to the outbreak of COVID-19. Our proposal would replace quarterly tender offers with an orderly liquidation, allowing us to seek to maximize portfolio recovery while providing equal access to liquidity to all Shareholders.

A few important things to note:

| ∎ | As part of its commitment to the best interests of shareholders, the Investment Manager will waive its management and incentive fees starting the first month after approval of the liquidation. |

| ∎ | The Funds would seek to return your capital by mid-2021, but the final date of liquidation could shift based on market conditions. |

| ∎ | Although not guaranteed, the Funds intend to declare a regular dividend in the third quarter of 2020 and then make distributions on a quarterly basis until the Funds have been completely liquidated. |

| ∎ | The Funds will be actively managed during this period and will continue to access the resources and relationships of the broader Blackstone Real Estate Debt Strategies team, which remains in place. |

Your approval is needed to enact this liquidation and begin to return capital back to investors. We encourage you to vote “YES” on both proposals. The first proposal seeks to amend each Fund’s governing document to change the Shareholder voting thresholds needed to approve a dissolution and the second proposal is to approve the dissolution of each Fund.

On behalf of the Board of each Fund, we are pleased to invite you to a joint Special Meeting of Shareholders (the “Meeting”) of the Funds to be held virtually via audio webcast on October 15, 2020 at 8:00 a.m. (Eastern time), at the following website: www.virtualshareholdermeeting.com/BREIF2020. We are asking Shareholders to sign and approve the proxy and return by no later than October 14, 2020.

To participate in the Meeting, you must have your sixteen-digit control number that is shown on your proxy card. Because the Funds are hosting a virtual meeting, you will not be able to attend the Meeting in person.

For more information about the matters requiring your vote, please refer to the accompanying Proxy Statement.

Thank you for your continued support of Blackstone. We believe this plan will produce the best outcome for Shareholders, which is our top priority.

Sincerely,

/s/ Jonathan Pollack

Jonathan Pollack

Chief Executive Officer and President