PROCEPT BIOROBOTICS CORPORATION 2021 EQUITY INCENTIVE AWARD PLAN PERFORMANCE STOCK UNIT AWARD GRANT NOTICE PROCEPT BioRobotics Corporation, a Delaware corporation (the “Company”), pursuant to its 2021 Equity Incentive Award Plan (as amended from time to time, the “Plan”), has granted to the participant listed below (“Participant”) an award of performance stock units (“Performance Stock Units” or “PSUs”) described in this Performance Stock Unit Award Grant Notice (this “Grant Notice”). Each vested PSU represents the contingent right to receive, in accordance with the Performance Stock Unit Award Agreement attached hereto as Exhibit A and the Performance Conditions attached hereto as Exhibit B (together, the “Agreement”), up to two shares of the Company’s common stock (each, a “Share”). This award of PSUs is subject to the terms and conditions set forth in the Agreement and the Plan, both of which are incorporated into this Grant Notice by reference. Capitalized terms not specifically defined in this Grant Notice or the Agreement have the meanings given to them in the Plan. Participant: [To be specified] Grant Date: [To be specified] Vesting Commencement Date: [To be specified] Number of PSUs: [To be specified] Vesting Schedule and Settlement: 75% of the PSUs shall vest (each, a “Vesting Date”) on the second annual anniversary of the Vesting Commencement Date following the end of the Cumulative Revenue Performance Period (as defined in Exhibit B) and the remaining 25% of the PSUs shall vest on the third annual anniversary of the Vesting Commencement Date following the end of the Relative TSR Performance Period (as defined in Exhibit B) in the event the Participant does not incur a Termination of Service prior to the applicable Vesting Date and subject to the additional terms and conditions set forth in this Agreement. On the Determination Date, the Administrator shall determine the applicable Achievement Factor in accordance with Exhibit B. On each Vesting Date, a number of Shares determined by multiplying the number of PSUs vesting as of such date times the applicable Achievement Factor shall be earned by the Participant. For the avoidance of doubt, in the event the Achievement Factor equals zero, no Shares will be issued in respect of the PSUs tied to such Achievement Factor and all such PSUs shall terminate for no consideration on the Determination Date.

2 The maximum number of Shares that may be issued in settlement of the PSUs is two times of the number of PSUs listed above. By accepting (whether in writing, electronically or otherwise) the PSUs, Participant agrees to be bound by the terms of this Grant Notice, the Plan and the Agreement. Participant has reviewed the Plan, this Grant Notice and the Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Grant Notice and fully understands all provisions of the Plan, this Grant Notice and the Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Administrator upon any questions arising under the Plan, this Grant Notice or the Agreement. PROCEPT BIOROBOTICS CORPORATION PARTICIPANT By: Name: [Participant Name] Title:

EXHIBIT A TO PERFORMANCE STOCK UNIT AWARD GRANT NOTICE PERFORMANCE STOCK UNIT AWARD AGREEMENT Capitalized terms not specifically defined in this Performance Stock Unit Award Agreement (this “Agreement”) shall have the meanings specified in the Grant Notice or, if not defined in the Grant Notice, in the Plan. ARTICLE I. GENERAL 1.1 Award of PSUs. The Company has granted the PSUs to Participant effective as of the Grant Date set forth in the Grant Notice (the “Grant Date”). Each PSU represents the right to receive up to two Shares as set forth in this Agreement. Participant will have no right to the distribution of any Shares until the time (if ever) the PSUs have vested. 1.2 Incorporation of Terms of Plan. The PSUs are subject to the terms and conditions set forth in this Agreement and the Plan, which is incorporated herein by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan will control. 1.3 Unsecured Promise. The PSUs will at all times prior to settlement represent an unsecured Company obligation payable only from the Company’s general assets. ARTICLE II. VESTING; FORFEITURE AND SETTLEMENT 2.1 Vesting; Forfeiture. The PSUs will vest according to the vesting schedule in the Grant Notice. In addition, upon Participant’s Termination of Service due to Participant’s death or Disability, in either case, on or after the first anniversary of Participant’s employment or service commencement date, the then-unvested PSUs will vest based on an Achievement Factor of 1. In the event of Participant’s Termination of Service for any other reason, all unvested PSUs will immediately and automatically be terminated for no consideration, except as otherwise determined by the Administrator or provided in a binding written agreement between Participant and the Company. 2.2 Settlement. (a) The PSUs will be paid in Shares as soon as administratively practicable after the vesting of the applicable PSU, but in no event later than forty-five (45) days following the Vesting Date. (b) Notwithstanding the foregoing, the Company may delay any payment under this Agreement that the Company reasonably determines would violate Applicable Law until the earliest date the Company reasonably determines the making of the payment will not cause such a violation (in accordance with Treasury Regulation Section 1.409A-2(b)(7)(ii)); provided the Company reasonably believes the delay will not result in the imposition of excise taxes under Section 409A. ARTICLE III. TAXATION AND TAX WITHHOLDING 3.1 Representation. Participant represents to the Company that Participant has reviewed with Participant’s own tax advisors the tax consequences of this award of PSUs (the “Award”) and the

2 transactions contemplated by the Grant Notice and this Agreement. Participant is relying solely on such advisors and not on any statements or representations of the Company or any of its agents. 3.2 Tax Withholding. (a) Subject to Section 3.2(b), payment of the withholding tax obligations with respect to the Award may be made by any of the following, or a combination thereof, as determined by [the Company in its sole discretion / Participant or the Administrator]1: (i) Cash or check; (ii) In whole or in part by delivery of Shares, including Shares delivered by attestation and Shares retained from the Award creating the tax obligation, valued at their Fair Market Value on the date of delivery; or (iii) In whole or in part by the Company withholding of Shares otherwise vesting or issuable under this Award in satisfaction of any applicable withholding tax obligations. (b) Unless [the Company / Participant or the Administrator] otherwise determines, and subject to Section 10.17 of the Plan, payment of the withholding tax obligations with respect to the Award shall be by [delivery (including electronically or telephonically to the extent permitted by the Company) of an irrevocable and unconditional undertaking by a broker acceptable to the Company to deliver promptly to the Company sufficient funds to satisfy the applicable tax withholding obligations] / [delivery (including electronically or telephonically to the extent permitted by the Company) by Participant to the Company of a copy of irrevocable and unconditional instructions to a broker acceptable to the Company that Participant has placed a market sell order with such broker with respect to Shares then-issuable upon settlement of the Award, and that the broker has been directed to deliver promptly to the Company funds sufficient to satisfy the applicable tax withholding obligations; provided, that payment of such proceeds is then made to the Company at such time as may be required by the Administrator]2. (c) Subject to Section 9.5 of the Plan, the applicable tax withholding obligation will be determined based on Participant’s Applicable Withholding Rate. Participant’s “Applicable Withholding Rate” shall mean (i) if Participant is subject to Section 16 of the Exchange Act, the greater of (A) the minimum applicable statutory tax withholding rate or (B) with Participant’s consent, the maximum individual tax withholding rate permitted under the rules of the applicable taxing authority for tax withholding attributable to the underlying transaction, or (ii) if Participant is not subject to Section 16 of the Exchange Act, the minimum applicable statutory tax withholding rate or such other higher rate approved by the Company; provided, however, that (i) in no event shall Participant’s Applicable Withholding Rate exceed the maximum individual statutory tax rate in the applicable jurisdiction at the time of such withholding (or such other rate as may be required to avoid the liability classification of the applicable award under generally accepted accounting principles in the United States of America); and (ii) the number of Shares tendered or withheld, if applicable, shall be rounded up to the nearest whole Share sufficient to cover the applicable tax withholding obligation, to the extent rounding up to the nearest whole Share does not result in the liability classification of the PSUs under generally accepted accounting principles. 1 NTD: “Participant or the Administrator” for Section 16 individuals. “The Company” for non-Section 16 individuals. 2 NTD: Use second bracketed language for Section 16 individuals.

3 (d) Participant acknowledges that Participant is ultimately liable and responsible for all taxes owed in connection with the PSUs, regardless of any action the Company or any Subsidiary takes with respect to any tax withholding obligations that arise in connection with the PSUs. Neither the Company nor any Subsidiary makes any representation or undertaking regarding the treatment of any tax withholding in connection with the awarding, vesting or payment of the PSUs or the subsequent sale of Shares. The Company and its Subsidiaries do not commit and are under no obligation to structure the PSUs to reduce or eliminate Participant’s tax liability. ARTICLE IV. OTHER PROVISIONS 4.1 Adjustments. Participant acknowledges that the PSUs and the Shares subject to the PSUs are subject to adjustment, modification and termination in certain events as provided in this Agreement and the Plan. 4.2 Clawback. The Award and the Shares issuable hereunder shall be subject to any clawback or recoupment policy in effect on the Grant Date or as may be adopted or maintained by the Company following the Grant Date, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and any rules or regulations promulgated thereunder. 4.3 Notices. Any notice to be given under the terms of this Agreement to the Company must be in writing and addressed to the Company in care of the Company’s General Counsel at the Company’s principal office or the General Counsel’s then-current email address or facsimile number. Any notice to be given under the terms of this Agreement to Participant must be in writing and addressed to Participant (or, if Participant is then deceased, to the Designated Beneficiary) at Participant’s last known mailing address, email address or facsimile number in the Company’s personnel files. By a notice given pursuant to this Section, either party may designate a different address for notices to be given to that party. Any notice will be deemed duly given when actually received, when sent by email, when sent by certified mail (return receipt requested) and deposited with postage prepaid in a post office or branch post office regularly maintained by the United States Postal Service, when delivered by a nationally recognized express shipping company or upon receipt of a facsimile transmission confirmation. 4.4 Titles. Titles are provided herein for convenience only and are not to serve as a basis for interpretation or construction of this Agreement. 4.5 Conformity to Securities Laws. Participant acknowledges that the Plan, the Grant Notice and this Agreement are intended to conform to the extent necessary with all Applicable Laws and, to the extent Applicable Laws permit, will be deemed amended as necessary to conform to Applicable Laws. 4.6 Successors and Assigns. The Company may assign any of its rights under this Agreement to a single or multiple assignees, and this Agreement will inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth in this Agreement or the Plan, this Agreement will be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the parties hereto. 4.7 Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if Participant is subject to Section 16 of the Exchange Act, the Plan, the Grant Notice, this Agreement and the PSUs will be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3) that are requirements for the application of such exemptive rule. To the extent Applicable Laws permit, this Agreement will be deemed amended as necessary to conform to such applicable exemptive rule.

4 4.8 Entire Agreement; Amendment. The Plan, the Grant Notice and this Agreement (including any exhibit hereto) constitute the entire agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect to the subject matter hereof. To the extent permitted by the Plan, this Agreement may be wholly or partially amended or otherwise modified, suspended or terminated at any time or from time to time by the Administrator or the Board; provided, however, that except as may otherwise be provided by the Plan, no amendment, modification, suspension or termination of this Agreement shall materially and adversely affect the PSUs without the prior written consent of Participant. 4.9 Agreement Severable. In the event that any provision of the Grant Notice or this Agreement is held illegal or invalid, the provision will be severable from, and the illegality or invalidity of the provision will not be construed to have any effect on, the remaining provisions of the Grant Notice or this Agreement. 4.10 Limitation on Participant’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. Participant will have only the rights of a general unsecured creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the PSUs, and rights no greater than the right to receive cash or the Shares as a general unsecured creditor with respect to the PSUs, as and when settled pursuant to the terms of this Agreement. 4.11 Not a Contract of Service Relationship. Nothing in the Plan, the Grant Notice or this Agreement confers upon Participant any right to continue in the employ or service of the Company or any Subsidiary or interferes with or restricts in any way the rights of the Company and its Subsidiaries, which rights are hereby expressly reserved, to discharge or terminate the services of Participant at any time for any reason whatsoever, with or without cause. 4.12 Section 409A. This Award is not intended to constitute “nonqualified deferred compensation” within the meaning of Section 409A of the Code (together with any Department of Treasury regulations and other interpretive guidance issued thereunder, including without limitation any such regulations or other guidance that may be issued after the date hereof, “Section 409A”). However, notwithstanding any other provision of the Plan, the Grant Notice or this Agreement, if at any time the Administrator determines that this Award (or any portion thereof) may be subject to Section 409A, the Administrator shall have the right in its sole discretion (without any obligation to do so or to indemnify the Participant or any other person for failure to do so) to adopt such amendments to the Plan, the Grant Notice or this Agreement, or adopt other policies and procedures (including amendments, policies and procedures with retroactive effect), or take any other actions, as the Administrator determines are necessary or appropriate for this Award either to be exempt from the application of Section 409A or to comply with the requirements of Section 409A. 4.13 Counterparts. The Grant Notice may be executed in one or more counterparts, including by way of any electronic signature, subject to Applicable Law, each of which will be deemed an original and all of which together will constitute one instrument.

5 EXHIBIT B TO PERFORMANCE STOCK UNIT AWARD GRANT NOTICE PERFORMANCE CONDITIONS 1. Definitions. “Average Market Value” means the average closing trading price of a company’s shares on the principal exchange on which such shares are then traded, during the thirty consecutive calendar days ending on a specified date for which such closing trading price is reported by the applicable exchange or such other authoritative source as the Administrator may reasonably determine. “Cumulative Revenue” means the sum of the Company’s gross revenue for each of fiscal year 2024 and fiscal year 2025, as determined in accordance with GAAP. “Cumulative Revenue Target” means the sum of the budgeted gross revenue pursuant to the annual operating plan of the Company for each of fiscal year 2024, as set forth in the table below, and fiscal year 2025 as approved by the Administrator during the first quarter of fiscal year 2025. In addition: i. The Administrator may adjust the Cumulative Revenue Target as it determines appropriate in its discretion including such adjustments to reflect the effect of business results from significant acquisitions not contemplated in the Company’s annual operating plan; and ii. In the event the Cumulative Revenue Performance Period ends upon the consummation of a Change in Control, the Cumulative Revenue Target shall be prorated in a manner determined by the Administrator. “GAAP” means Generally Accepted Accounting Principles. “Index” means the Russell 2000 Index. “Performance Period” means for the purposes of determining (a) Cumulative Revenue, the period commencing on January 1, 2024 and ending on the earlier of (i) December 31, 2025 or (ii) the consummation of a Change in Control (the “Cumulative Revenue Performance Period”) and (b) Relative TSR, the period commencing on December 31, 2023 and ending on the earlier of (i) December 31, 2026 or (ii) the consummation of a Change in Control (the “Relative TSR Performance Period”). “Relative TSR” means the Company’s TSR relative to the TSR of the companies that comprise the Index as of the first day of the Relative TSR Performance Period (and remains fixed through the Relative TSR Performance Period), provided that: i. In the event a bankruptcy proceeding is commenced during the Relative TSR Performance Period with respect to any peer company, such peer company shall be treated as having a TSR of negative one hundred percent (-100%) for the Relative TSR Performance Period and will remain as a member of the peer group for purposes of the payout calculation; ii. In the event of a merger, acquisition or business combination of any peer company during the Relative TSR Performance Period, then the entity that survives as a result of such merger, acquisition, or business combination will remain as a member of the peer group for purposes of the payout calculation; and iii. In the event of a merger, acquisition or business combination of any peer company during the Relative TSR Performance Period and such peer company is not the entity that survives as a result of such merger, acquisition, or business combination, then such peer company

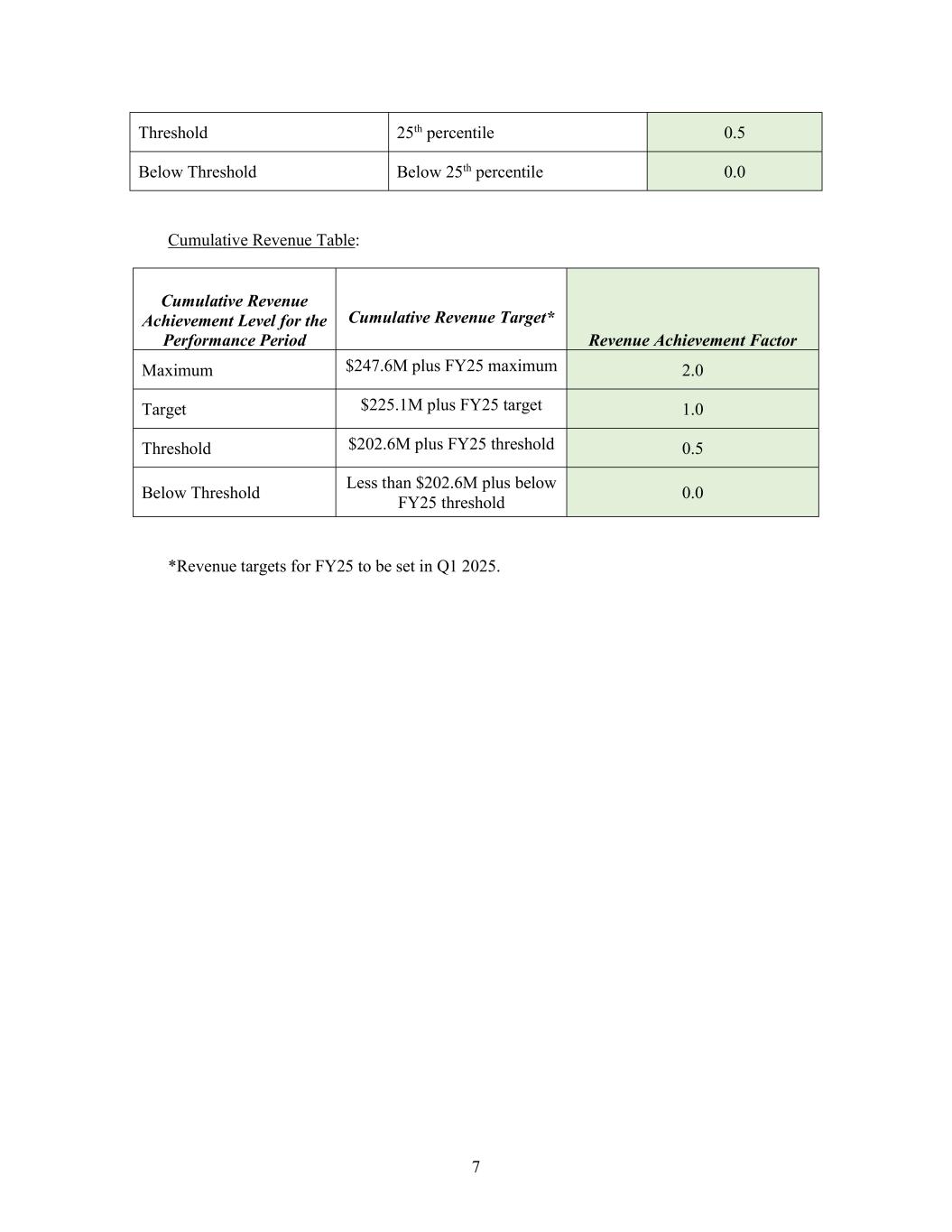

6 shall be removed and treated as if it had never been a peer company for the Relative TSR Performance Period. “TSR” means the compound annual total shareholder return of the Company (or of a company in the Index, as applicable), as measured by the change in the price of a Share (or the publicly traded securities of a company in the Index, as applicable) over the Relative TSR Performance Period (positive or negative), calculated based on the Average Market Value ending on the first day of the Relative TSR Performance Period as the beginning stock price, and the Average Market Value ending on the last day of the Relative TSR Performance Period as the ending stock price, and assuming dividends (if any) are reinvested based on the price of a Share (or the publicly traded securities of a company in the Index, as applicable) in accordance with the “gross” or “total” return methodology as defined by S&P Dow Jones; provided, that in the case of a Change in Control, the Average Market Value ending on the last day of the Relative TSR Performance Period shall be based on the five (rather than thirty) consecutive calendar days ending immediately prior to the consummation of a Change in Control. 2. Achievement Factor. As soon as administratively practicable (but in no event later than the first regularly scheduled meeting of the Administrator following the completion of a Performance Period, or in the event a Performance Period ends on the date of a Change in Control, no later than the latest date that permits the issuance of Shares before the consummation of the Change in Control), the Administrator shall determine and certify the Relative TSR or the Cumulative Revenue for the Performance Period, as applicable, and calculate the applicable Achievement Factor (such date of determination, the “Determination Date”). For the purposes hereof, “Achievement Factor” means (a) with respect of the Relative TSR Performance Period, the TSR Achievement Factor determined using the Relative TSR Table below and (b) with respect of the Cumulative Revenue Performance Period, the Revenue Achievement Factor determined using the Cumulative Revenue Table below, provided, that in the event a Performance Period ends on the date of a Change in Control, the Achievement Factor with respect to each Performance Period will be the greater of that factor determined in accordance with this sentence and 1. If the Relative TSR or Cumulative Revenue achieved during the applicable Performance Period is between the threshold and maximum achievement levels set forth in the tables below, the TSR Achievement Factor and/or Revenue Achievement Factor shall be determined using straight-line linear interpolation between the adjacent performance levels. For the avoidance of doubt, (a) in no event shall the Achievement Factor exceed two, and (b) if TSR for the Relative TSR Performance Period is negative, the TSR Achievement Factor will not exceed 1. Relative TSR Table: Relative TSR Achievement Level for the Performance Period Relative TSR for the Performance Period TSR Achievement Factor Maximum Above 90th percentile 2.0 Above Target 75th percentile 1.5 Target 50th percentile 1.0

7 Threshold 25th percentile 0.5 Below Threshold Below 25th percentile 0.0 Cumulative Revenue Table: Cumulative Revenue Achievement Level for the Performance Period Cumulative Revenue Target* Revenue Achievement Factor Maximum $247.6M plus FY25 maximum 2.0 Target $225.1M plus FY25 target 1.0 Threshold $202.6M plus FY25 threshold 0.5 Below Threshold Less than $202.6M plus below FY25 threshold 0.0 *Revenue targets for FY25 to be set in Q1 2025.