Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF RIA II (05/25) NF NY Individual Single Purchase Payment Index-Linked Deferred Separate Account Annuity Contract • Periodic income commencing on Annuity Date. • The values of this contract may be affected by an external index; however, this contract does not directly participate in any stock or equity investments. • Option to change Annuity Date. • Non-Participating. • After the Withdrawal Charge Period, the Minimum Guaranteed Interest Rate for Fixed Segment Options is subject to redetermination on each Fixed Segment Start Date. • At least one Fixed Segment Option and one Buffer Segment Option will always be available. Athene Annuity & Life Assurance Company of New York will make the payments and provide the benefits described in this contract in consideration for the payment by the Owner of the Purchase Payment when due. The Company will pay the Death Benefit to the Beneficiary as provided in this contract if: (1) any Owner dies prior to the Annuity Date, or (2) any Owner is a non-natural person and any Annuitant dies prior to the Annuity Date. This is a legal contract between the Owner and Athene Annuity & Life Assurance Company of New York (the “Company”). The Company holds reserves for the Index-Linked Segment Options under this contract in a separate account. The assets in the Separate Account will not be chargeable with liabilities arising out of any other business that the Company may conduct. Contractual benefits and values for Index-Linked Segment Options are variable, may increase or decrease, and are not guaranteed as to a fixed dollar amount. THE INDEX RETURN FOR INDEX-LINKED SEGMENT OPTIONS MAY BE POSITIVE, NEGATIVE OR ZERO AND INVESTMENT IN THIS CONTRACT MAY RESULT IN A LOSS OF PRINCIPAL. IN SOME INSTANCES, THE POTENTIAL INVESTMENT LOSS FOR THIS PRODUCT MAY BE SIGNIFICANTLY GREATER THAN THE POTENTIAL INVESTMENT GAIN. Please read your contract carefully. It includes the provisions both on the pages within and on any riders or endorsements which are attached. If you (the Owner) are not satisfied with your contract, you may return it to the Company or to the financial professional from whom your contract was purchased within 20 days following its receipt, or 60 days in replacement situations, and the Contract Value plus the sum of all fees, taxes, and charges will be refunded, and your contract will be cancelled. This is referred to as the “Right to Cancel Period”. The Contract Value will be calculated as of the date the contract is actually mailed or actually delivered. Mike Downing Blaine T. Doerrfeld President Secretary Administrative Office: Home Office: Mail Processing Center 1 Blue Hill Plz Ste 1672 P.O. Box 1555 P.O. Box 1690 Des Moines, IA 50306-1555 Pearl River, New York 10965 888-266-8489 800-926-7599 /s/ Blaine T. Doerrfeld/s/ Mike Downing

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page i RIA II (05/25) NF NY Table of Contents Contract Schedule ............................................................................................................................ 1 Annuity Tables .................................................................................................................................. 2 1. Definitions ..................................................................................................................................... 4 Administrative Office ................................................................................................................ 4 Annuitant, Joint Annuitant ......................................................................................................... 4 Annuity Date ............................................................................................................................. 4 Beneficiary ............................................................................................................................... 4 Business Day ........................................................................................................................... 4 Company .................................................................................................................................. 4 Contract Anniversary ................................................................................................................ 4 Contract Date ........................................................................................................................... 4 Contract Year ........................................................................................................................... 4 Holding Account ....................................................................................................................... 4 Index or Indices ........................................................................................................................ 5 Index-Linked Segment Option .................................................................................................. 5 Owner, Joint Owners ................................................................................................................ 5 Segment Allocation Percentage ............................................................................................... 5 Segment Anniversary ............................................................................................................... 5 Segment Options ..................................................................................................................... 5 Segment End Date ................................................................................................................... 5 Segment Start Date .................................................................................................................. 5 Segment Term Period ............................................................................................................... 5 Segment Year ........................................................................................................................... 5 Separate Account ..................................................................................................................... 6 Strategy Endorsements ............................................................................................................ 6 Withdrawal ............................................................................................................................... 6 2. General Provisions ....................................................................................................................... 6 Annuity Payments .................................................................................................................... 6 Assignment .............................................................................................................................. 6 Change of Annuitant ................................................................................................................. 7 Change of Beneficiary .............................................................................................................. 7 Contract .................................................................................................................................... 7 Conformity with Applicable Laws .............................................................................................. 7 Incontestability ......................................................................................................................... 7

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page ii RIA II (05/25) NF NY Misstatement of Age or Gender ................................................................................................ 7 Ownership ................................................................................................................................ 7 Notices ..................................................................................................................................... 8 Statements ............................................................................................................................... 8 3. Purchase Payment and Contract Value ........................................................................................ 8 Purchase Payment ................................................................................................................... 8 Contract Value .......................................................................................................................... 8 Segment Value ......................................................................................................................... 8 Segment Credits ...................................................................................................................... 8 Segment Allocation................................................................................................................... 8 Segment Value Transfers ......................................................................................................... 8 4. Interim Value ................................................................................................................................. 9 Interim Value ............................................................................................................................ 9 Segment Interim Value ............................................................................................................. 9 Interest Adjustment................................................................................................................... 9 Interest Adjustment Factor ....................................................................................................... 9 Equity Adjustment .................................................................................................................. 10 Equity Adjustment Factor ....................................................................................................... 10 5. Cash Surrender Value and Withdrawals ..................................................................................... 10 Cash Surrender Value ............................................................................................................ 10 Withdrawal Charge ................................................................................................................. 11 Withdrawals, Free Withdrawals .............................................................................................. 11 Required Minimum Distribution Withdrawals .......................................................................... 12 6. Death Provisions ........................................................................................................................ 12 Death Benefit ......................................................................................................................... 12 Beneficiary ............................................................................................................................. 12 Death of an Annuitant prior to the Annuity Date ..................................................................... 13 Death of an Owner prior to the Annuity Date .......................................................................... 13 Death on or after the Annuity Date ......................................................................................... 13 7. Settlement Options ..................................................................................................................... 13 Election of Option ................................................................................................................... 13 Betterment of Rates ............................................................................................................... 14 Settlement Options ................................................................................................................. 14 Option 1: Life Annuity ......................................................................................................... 14 Option 2: Life Annuity with Guaranteed Period .................................................................. 14

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page iii RIA II (05/25) NF NY Option 3: Installment Refund Life Annuity .......................................................................... 14 Option 4: Joint and Last Survivor Annuity .......................................................................... 14 Option 5: Fixed Period Annuity ........................................................................................... 14 8. Termination ................................................................................................................................. 15 For information, or to make a complaint regarding your contract, call: [888-266-8489]

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 4 RIA II (05/25) NF NY 1. Definitions In addition to the terms defined throughout this contract, the following terms have the respective meanings described in this section: Administrative Office Our Administrative Office is shown on the front of this contract. We may change our Administrative Office by notifying you in writing. Annuitant, Joint Annuitant The Annuitant is the natural person named on the Contract Schedule. The Annuitant is the person whose life determines the annuity payments made under your contract. You may name two natural persons on the application to be Joint Annuitants. Annuity Date The Annuity Date is the date on which annuity payments will begin. The Maximum Annuity Date is the date shown on the Contract Schedule and is the Contract Anniversary on or first following the later of the Annuitant's age 95 and the 10th Contract Anniversary, unless modified by any rider or endorsement. In the case of Joint Annuitants, the Maximum Annuity Date will be based on the age of the older Joint Annuitant. You may select an earlier Annuity Date, which may be any time after the Contract Date, by notice provided to us. The revised Annuity Date must be at least 10 days after we receive your notice. Beneficiary The Beneficiary is one or more persons or entities named by the Owner to receive the Death Benefit. Business Day Business Day means any day of the week except for Saturday, Sunday and U.S. federal holidays where U.S. stock exchanges are closed. Company Company and “we,” “us,” and “our” refer to Athene Annuity & Life Assurance Company of New York. Contract Anniversary A Contract Anniversary is any 12-month anniversary of the Contract Date. For example, if the Contract Date is January 17, 2025, then the first Contract Anniversary is January 17, 2026. Contract Date The Contract Date is the date your contract is issued as shown on the Contract Schedule. Contract Year A Contract Year is the 12-month period that begins on the Contract Date and each Contract Anniversary. For example, if the Contract Date is January 17, 2025, then the first Contract Year is the 12-month period that includes January 17, 2025, through January 16, 2026. Holding Account The Holding Account is an account that holds the Purchase Payment until it is allocated to the applicable Segment Options according to the Segment Allocation Percentages selected by the Owner. Interest is credited daily to the Holding Account in accordance with the Holding Account Fixed Interest Rate. The Holding Account Fixed Interest Rate is an annual rate that is shown on the Segment Contract Schedule and is guaranteed not to change.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 5 RIA II (05/25) NF NY Index or Indices Index or Indices means the index or indices shown on the Segment Contract Schedule, which are used in the calculation of the Segment Credits for an Index-Linked Segment Option. Index-Linked Segment Option Index-Linked Segment Option means any Segment Option that calculates Segment Credits based on one or more underlying Indices (as opposed to a predetermined interest rate as with Fixed Segment Options). Owner, Joint Owners Owner means one or more persons or entities named as owner in the application or their successor. If no owner is named on the application, the Annuitant will be the Owner. If Joint Owners are named, all references to Owner shall mean the Joint Owners. Joint Owners must be spouses. References to “you” and “your” refer to the Owner. Segment Allocation Percentage A Segment Allocation Percentage is the percentage of the Purchase Payment applied to each Segment Option as elected by you. Segment Anniversary A Segment Anniversary is any 12-month anniversary of the Initial Segment Start Date (shown in the Segment Contract Schedule). For example, if the Initial Segment Start Date is January 22, 2025, then the first Segment Anniversary is January 22, 2026. Segment Options A Segment Option is a method for crediting funds to your contract. It includes a Segment Term Period and an Index, if applicable. There may be several Segments Options available within any Strategy Endorsement. The Segment Options available on the Initial Segment Start Date are shown on the Segment Contract Schedule. You may transfer funds across available Segment Options in accordance with the Segment Value Transfers provision of this contract. Segment End Date A Segment End Date is the last day of a Segment Term Period. The Segment Credit for Index-Linked Segment Options is calculated on the Segment End Date. The Segment End Date coincides with the next Segment Start Date. Segment Start Date The Segment Start Date is the first date of the Segment Term Period. The day and month on which any Segment Start Date falls will always be the same day and month as the Initial Segment Start Date shown in the Segment Contract Schedule. Segment Term Period The Segment Term Period for each Segment Option is shown on the Segment Contract Schedule. The Segment Term Period ends on the Segment End Date. Unless otherwise stated in a Strategy Endorsement, upon expiration of each Segment Term Period a new Segment Term Period will begin. Segment Year A Segment Year is the 12-month period that begins on the Initial Segment Start Date (shown on the Segment Contract Schedule) and each Segment Anniversary. For example, if the Initial Segment Start Date is January 22, 2025, then the first Segment Year is the 12-month period that includes January 22, 2025, through January 21, 2026.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 6 RIA II (05/25) NF NY Separate Account The Separate Account is the segregated account, established by the Company under New York law, in which we hold reserves for the Index-Linked Segment Options under the contract. The portion of the assets of the Separate Account equal to the reserves and other contract liabilities with respect to the Separate Account will not be chargeable with liabilities arising out of any other business of the Company, provided that the portion of assets of the Separate Account not chargeable with liabilities arising out of any other business of the Company shall not exceed the following: (1) the assets purchased with purchase payments allocated to the Separate Account by purchasers of this annuity product; minus (2) any benefits paid from such assets; minus (3) any charges taken from such assets under the terms of those contracts; minus (4) any contract holder initiated transfers of such assets out of the Separate Account; plus (5) the net investment returns earned on the net amount of such assets. You do not participate in the performance of assets held in the Separate Account and do not have any direct claim on them. The Separate Account is not registered under the Investment Company Act of 1940. Strategy Endorsements Strategy Endorsements are separate documents that include additional terms of your contract and are attached to and made part of this contract. Withdrawal Unless otherwise specified, a Withdrawal is the removal of funds from your contract, including a partial withdrawal, a surrender of your contract, payment of a Death Benefit, or the application of the Interim Value to a Settlement Option. A Withdrawal amount is the amount of Contract Value withdrawn for such benefits, before the application of Withdrawal Charges, Interest Adjustments, and Equity Adjustments, if applicable. 2. General Provisions Annuity Payments Unless the Death Benefit is owed or you have surrendered your contract for the Cash Surrender Value, annuity payments will commence on the Annuity Date. Annuity payments will be paid to you or a payee you designate in accordance with the terms and conditions of the Settlement Option elected by the Owner, or if no Settlement Option is elected, in accordance with the terms and conditions of this Annuity Payments provision. To receive annuity payments, an Annuitant must be living on the Annuity Date and on the date that each following payment is due, if applicable. The “Settlement Options” are the methods of distribution described in the Settlement Options section of your contract. We may require proof of the correct age and gender of an Annuitant before making annuity payments. An election of a Settlement Option must be made in writing by the Owner before the Annuity Date and is irrevocable as of the Annuity Date. If a Settlement Option has not been elected prior to the Annuity Date, one of the following two payment provisions will apply: • If there is one living Annuitant on the Annuity Date, the Interim Value will be applied to provide annuity payments for the longer of the lifetime of the Annuitant and five years; or • If there are two living Joint Annuitants on the Annuity Date, the Interim Value will be applied to provide annuity payments in the same monthly amount for the longer of the lifetimes of both Joint Annuitants and five years. Assignment We reserve the right to refuse our consent to any assignment at any time on a nondiscriminatory basis if the assignment would violate or result in noncompliance with any applicable state or federal law or regulation. Unless otherwise restricted for tax-qualification purposes, you may request to assign or transfer your rights under this contract by notifying us. We will not be bound by an assignment until we acknowledge it. If your contract is assigned, the assignment will take effect on the date the notice was signed, subject to any action taken by us before receipt of the notice. In addition, we shall not be liable for any tax consequences you may incur due to the assignment of your contract.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 7 RIA II (05/25) NF NY Change of Annuitant Before the Annuity Date, you may change the Annuitant by notifying us. A change will take effect as of the date you signed the notice. The Annuitant may not be changed if this contract is owned by a non-natural person, unless the contract is being continued by a surviving spouse as sole Beneficiary in which case the surviving spouse Beneficiary will become the Annuitant. The Annuitant cannot be changed on or after the Annuity Date. Change of Beneficiary Before the date the Death Benefit becomes payable, you may change a Beneficiary by notifying us. You may name one or more contingent Beneficiaries. The interest of any named irrevocable Beneficiary cannot be changed without the written consent of that Beneficiary. A change will take effect as of the date you signed the notice. Any change is subject to payment or other action taken by us before we received the notice. Contract This contract, including the Contract Schedule, the Segment Contract Schedule, the attached application, if any, and any attached endorsements, riders or amendments constitute the entire contract. No one except the President or Secretary of the Company may change or waive any of the terms of this contract. Any change must be in writing and signed by the President or the Secretary of the Company. The Company may not change the terms and conditions of the contract except where the change or amendment is required to conform to applicable New York or federal law. Any such change cannot be effective without prior approval of the New York Department of Financial Services. Prior written consent of the Owner is required if any such change diminishes the rights and/or benefits under this contract in any manner. Conformity with Applicable Laws The benefits and Cash Surrender Value available under your contract are not less than the minimum benefits required by New York law. If any provision of your contract is determined not to provide the minimum benefits, that provision will be deemed to be amended to conform or comply with New York law. Notwithstanding any provision in your contract to the contrary, all distributions under your contract must be made in accordance with the applicable requirements of section 72(s) of the Internal Revenue Code, as amended, or section 401(a)(9), as amended, as applicable, and all terms of your contract will be interpreted consistently with the requirements of section 72(s) or section 401(a)(9), as applicable. Incontestability All statements made in the application by, or under the authority of, the applicant are considered representations and not warranties. The validity of your contract will not be contestable. Misstatement of Age or Gender If the age or gender of an Annuitant has been misstated, the amount we will pay will be that which the Purchase Payment paid would have purchased if the correct age and gender had been stated. Age will be calculated as the age at the last birthday of that Annuitant. Any underpayments made by us due to a misstatement will be immediately paid in one sum with compounded interest. Any overpayments made by us will be charged against the next succeeding annuity payment or payments with compounded interest. Interest under this provision will be calculated based on the Misstatement Interest Rate shown on the Contract Schedule. Ownership All rights described in your contract may be exercised by you subject to the rights of any assignee on record with us and any irrevocably named Beneficiary. You may change the Owner by notifying us. A change will take effect as of the date you signed the notice. Any change is subject to payment or other action taken by us before we received the notice. We will not be liable for any tax consequences you may incur due to a change of the Owner designation.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 8 RIA II (05/25) NF NY Notices Unless stated otherwise, a valid notice or request from you to us must be in writing (or other form acceptable to us), reasonably clear and complete, signed by you, and received at our Administrative Office. Statements Each Contract Year, the Company will furnish a statement to the Owner reflecting the following information: (1) the beginning and ending dates of the statement period, (2) the Contract Value at the beginning and end of the statement period, (3) amounts credited and debited to the Contract Value, such as Withdrawals and Segment Credits, (4) the Cash Surrender Value at the end of the statement period, and (5) the Death Benefit at the end of the statement period. The Owner may request a statement reflecting current contract values at any time. 3. Purchase Payment and Contract Value Purchase Payment The “Purchase Payment” is the amount we receive for your contract. The Purchase Payment is due on the Contract Date. No Purchase Payment will be accepted after the Contract Date. Contract Value The “Contract Value” at any time is equal to the sum of the Segment Values. Segment Value The “Segment Value” of a Segment Option at any time is determined based on the provisions of the applicable Strategy Endorsement. Segment Credits The dollar amounts we credit to each Segment Option under this contract are called “Segment Credits.” Segment Credits may be positive, negative, or zero. Segment Credits will be calculated for a Segment Option based on the provisions of the applicable Strategy Endorsement. Segment Allocation On the Contract Date, the Purchase Payment will be credited to the Holding Account. The Holding Account will be transferred to the Segment Options on the Initial Segment Start Date (shown in the Segment Contract Schedule) based on the Segment Allocation Percentages selected by the Owner. The Segment Allocation Percentages selected for each Segment Option must be a whole percentage ranging from 0% to 100%. The sum of the Segment Allocation Percentages must equal 100%. Segment Value Transfers At each Segment End Date that occurs before the Annuity Date, you may elect to transfer some or all of the Segment Value from a Segment Option into one or more of your contract’s other Segment Options, subject to any transfer limitations specified in the Strategy Endorsements. Each Segment Option involved in a transfer must be at the end of a Segment Term Period. We will notify you at least 15 days before the Segment End Date of the Cap Rates, Participation Rates, Downside Participation Rates, Trigger Rates, and Annual Interest Rates applicable to available Segment Options for the next Segment Term Period. Cap Rates, Participation Rates, Downside Participation Rates, Trigger Rates, and Annual Interest Rates are defined in the applicable Strategy Endorsements. To elect a transfer, you must notify us at least two Business Days before the Segment End Date on which the transfer is to be made. Your notice must specify the Segment Options to which each transfer is to be made. You must also specify the amount that is to be transferred, either as a total dollar amount or as a whole percentage of the Segment Value of the Segment Option from which the funds are being transferred.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 9 RIA II (05/25) NF NY For any transfer request we receive where the amount to be transferred represents a percentage of a known or unknown value, we will use our best efforts to determine the amount that must be transferred from each Segment Option in order to satisfy the intent of your request. 4. Interim Value Interim Value The “Interim Value” at any time is equal to the sum of the Segment Interim Values. Segment Interim Value The “Segment Interim Value” for any Segment Option is calculated daily and is equal to A + B + C, where: A is the Segment Value on this date; B is any applicable Interest Adjustment on this date; and C is any applicable Equity Adjustment on this date. Interest Adjustment The “Interest Adjustment” is a positive or negative adjustment that approximates the change in the value of the fixed income assets purchased in support of the contract. The Interest Adjustment applies only during the Withdrawal Charge Period. On any day during the Withdrawal Charge Period, the Interest Adjustment for any Segment Option equals A x B, where: A is the portion of the Segment Value that is subject to a Withdrawal Charge on this date, immediately prior to any Withdrawal; and B is the Interest Adjustment Factor. Interest Adjustment Factor The “Interest Adjustment Factor” for any Index-Linked Segment Option equals (RN/12 – 1) x (1 – C), where: N is the number of complete months remaining before the Segment Term Period expires; R is equal to (1 + A) / (1 + B), where: A is the Beginning Interest Adjustment Index Value; B is the Closing Interest Adjustment Index Value; and C is equal to D x (1 – E), where: D is the value of certain derivative instruments on the Segment Start Date for the applicable Index-Linked Segment Option; and E is the number of days elapsed from the Segment Start Date to the day we calculate the Segment Interim Value, divided by the number of days in the Segment Term Period. On each Business Day, we calculate the value of the derivative instruments for each Index-Linked Segment Option based on the estimated market value of a set of put and call options as determined by an option pricing formula. Our method of estimating the current value of the derivative instruments is on file with the New York Department of Financial Services.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 10 RIA II (05/25) NF NY The “Interest Adjustment Factor” for any Fixed Segment Option equals the greater of (RN/12 - 1) and [- (10% - C)], where: N is the number of complete months remaining before the Segment Term Period expires; R is equal to (1 + A) / (1 + B), where: A is the Beginning Interest Adjustment Index Value; B is the Closing Interest Adjustment Index Value; and C is equal to the applicable Withdrawal Charge rate for that Contract Year. The “Beginning Interest Adjustment Index Value” is equal to the closing yield of the Interest Adjustment Index on the Segment Start Date. The “Closing Interest Adjustment Index Value” is equal to the closing yield of the Interest Adjustment Index on the day we calculate the Segment Interim Value. If a closing yield of the Interest Adjustment Index is not available on any day for which a closing yield is needed, then the closing yield as of the first preceding Business Day for which a closing yield is available will be used. The “Interest Adjustment Index” is shown on the Contract Schedule. You may obtain the daily yield of the Interest Adjustment Index by contacting us at the Administrative Office phone number noted on the cover page of your contract. If the Interest Adjustment Index is discontinued, we are unable for any reason to utilize it, or the calculation of the Interest Adjustment Index is changed substantially, we may substitute another method of determining the values that will be used in the above calculation and will inform you of that change at your last known address on file with us. Any substitute index will be submitted for prior approval to the New York Department of Financial Services. Equity Adjustment The “Equity Adjustment” is a positive or negative adjustment that approximates the change in the market value of the derivative instruments purchased in support of the contract. The Equity Adjustment does not apply to Fixed Segment Options. On any day, except the Segment End Date, the Equity Adjustment for any Index-Linked Segment Option equals A x B, where: A is the Segment Value on this date, immediately prior to any Withdrawal; and B is the Equity Adjustment Factor applicable to that Segment Option. The Equity Adjustment is equal to zero on the Segment End Date. Equity Adjustment Factor The “Equity Adjustment Factor” for an Index-Linked Segment Option is determined based on the provisions of the applicable Strategy Endorsement. 5. Cash Surrender Value and Withdrawals Cash Surrender Value The “Cash Surrender Value” is the Interim Value adjusted for any applicable Withdrawal Charges. On or before the Annuity Date and before the date the Death Benefit becomes payable under this contract, you may surrender your contract for the Cash Surrender Value by making a written request to our Administrative Office. The Company may defer payment upon surrender of this contract for up to six months.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 11 RIA II (05/25) NF NY Withdrawal Charge Withdrawals may incur a charge if made during the Contract Years with a corresponding positive rate as shown in the Withdrawal Charge Rate Schedule (that charge, a “Withdrawal Charge”; those Contract Years, the “Withdrawal Charge Period”). The amount of the Withdrawal Charge is the applicable rate from the Withdrawal Charge Rate Schedule multiplied by the Withdrawal amount. The Withdrawal Charge Rate Schedule is set forth in your Contract Schedule. The Withdrawal Charge does not apply to Free Withdrawals (defined in the following provision). Withdrawals, Free Withdrawals On or before the Annuity Date and before the date the Death Benefit becomes payable under this contract, you may request a Withdrawal from your contract. The Withdrawal amount, adjusted for any applicable Withdrawal Charges, Interest Adjustment, and Equity Adjustment, cannot be greater than the Cash Surrender Value. On or after the Initial Segment Start Date, an Interest Adjustment will be applied to any portion of a surrender or Withdrawal that is subject to a Withdrawal Charge and will be calculated as a separate adjustment that is in addition to any applicable Withdrawal Charge. An Interest Adjustment will not be applied to any portion of a surrender or Withdrawal that is not subject to a Withdrawal Charge. All Withdrawals, including Free Withdrawal amounts, will be subject to an Equity Adjustment. Unless you direct otherwise, all partial Withdrawals will be taken first from the Fixed Segment Options (shown on the Segment Contract Schedule), beginning with the Fixed Segment Option with the shortest Segment Term Period. To the extent there are not enough funds in the Fixed Segment Options to cover the entire Withdrawal, we will deduct the remaining balance from the other Segment Options in which you have funds, beginning with Segment Options that have the shortest Segment Term Period. If you have multiple Segment Options with the same Segment Term Period, we will deduct the remaining balance pro rata across those Segment Options. A “Free Withdrawal” is a Withdrawal amount on which no Withdrawal Charges or Interest Adjustment apply. Free Withdrawals are available beginning on the Initial Segment Start Date. The Free Withdrawal amount available to you in the first Segment Year will be equal to the Free Withdrawal Percentage for that Segment Year multiplied by the Contract Value on the Initial Segment Start Date. In subsequent Segment Years, the Free Withdrawal amount available to you will be equal to the Free Withdrawal Percentage for that Segment Year multiplied by the Contract Value as of the Segment Anniversary on the first day of that Segment Year. The Free Withdrawal Percentages are shown on the Contract Schedule. Any unused portion of the Free Withdrawal amount for a Segment Year cannot be carried over to the following Segment Year. If the amount of a Withdrawal in any Segment Year exceeds the Free Withdrawal amount for that Segment Year, the excess Withdrawal will be subject to any applicable Withdrawal Charge and Interest Adjustment. To take a Withdrawal from your contract, you must notify us. The minimum amount that you may request to be withdrawn from your contract at any time is $500. If you request a Withdrawal that causes the Contract Value to be less than $2,000, we will treat your request as a surrender of your contract. We reserve the right to pay Withdrawal amounts directly to you. We may defer payment of any Withdrawals of any type from your contract (except for the payment of Death Benefits, annuity payments, and required minimum distributions under Internal Revenue Code section 401(a)(9)) for up to six months. Interest will be paid on any amount deferred for ten days or more, from the date the documentation necessary to complete the transaction is received by us at a rate at least equal to the rate required by the state of New York.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 12 RIA II (05/25) NF NY Required Minimum Distribution Withdrawals This provision applies only if your contract is subject to the minimum distribution requirements under Internal Revenue Code section 401(a)(9), such as if this contract is a contract issued in connection with a qualified plan under section 401(a), a section 403(b) contract, an individual retirement annuity contract under section 408, or a Roth IRA under section 408A. Any Withdrawal of a required minimum distribution under section 401(a)(9) with respect to this contract, as calculated by us, will not be subject to a Withdrawal Charge or Interest Adjustment except as otherwise provided in this section. Any required minimum distribution Withdrawal amount includes and is not in addition to the contract's Free Withdrawal amount. Required minimum distributions will incur a Withdrawal Charge and Interest Adjustment if you previously took a Withdrawal in the same Segment Year to satisfy the required minimum distribution requirement. In this circumstance, you must wait until the next Segment Anniversary to take your required minimum distribution free of a Withdrawal Charge or Interest Adjustment. 6. Death Provisions Death Benefit The “Death Benefit” will be equal to the Interim Value. The Death Benefit will be calculated as of the date of death. Withdrawal Charges will not be applied in determining the Death Benefit payable to the Beneficiary. The Death Benefit must be paid in a manner that complies with the applicable requirements of section 72(s) of the Internal Revenue Code. Before we will pay the Death Benefit, we must receive the following claim information at our Administrative Office in a reasonably clear and complete manner: • proof of death while the contract was in effect; • our claim form properly completed from each Beneficiary, as applicable; and • any other documents required by law. Beneficiary The following rules apply unless otherwise permitted by us in accordance with applicable law: • No Beneficiary has any rights in your contract until they are entitled to the Death Benefit. If the Beneficiary, including an irrevocable Beneficiary, dies before that time, all rights of that Beneficiary will end at their death. • If no Beneficiary has been named or if no Beneficiary is alive at the time the Death Benefit is payable, then the Beneficiary is the estate of the deceased Owner or Annuitant whose death caused the Death Benefit to be payable. If the death of both Joint Annuitants or Joint Owners, if applicable, occurs simultaneously, the estates of both will be the Beneficiary in equal shares. This paragraph does not apply if there is a named Beneficiary and such Beneficiary is an entity. • If you have not designated how the Death Benefit is to be distributed and two or more Beneficiaries are entitled to the Death Benefit, the Death Benefit will be paid to the Beneficiaries in equal shares. • Unless you notify us otherwise, if you have designated how the Death Benefit is to be distributed and a Beneficiary dies prior to the time such Beneficiary is entitled to the Death Benefit, the portion of the Death Benefit designated to the deceased Beneficiary will be divided among the surviving Beneficiaries and Beneficiaries that are entities on a pro rata basis. In other words, each surviving Beneficiary's or each entity Beneficiary’s interest in the Death Benefit will be divided by the sum of the interests of all such surviving or entity Beneficiaries to determine the percentage each Beneficiary will receive of the deceased Beneficiary's original interest in the Death Benefit.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 13 RIA II (05/25) NF NY Death of an Annuitant prior to the Annuity Date If the Annuitant is not an Owner and dies prior to the Annuity Date, you may designate a new Annuitant, subject to our underwriting rules then in effect. If no designation is made within 30 days of death of the Annuitant, the younger of you or any Joint Owner will become the Annuitant. If the Owner is a non-natural person, the death of the Annuitant will be treated as the death of the Owner and a new Annuitant may not be designated. Death of an Owner prior to the Annuity Date If any Owner (or, if the Owner is a non-natural person, any Annuitant) dies prior to the Annuity Date, we will pay the Death Benefit to the Beneficiary. Upon the death of any Joint Owner, where the surviving spouse is the surviving Joint Owner, the surviving Joint Owner will become the sole designated Beneficiary to whom the Death Benefit will be paid, and any other Beneficiary designation on record at the time of the death will be treated as a contingent Beneficiary. If the Beneficiary is a natural person, that Beneficiary may elect for the Death Benefit to be distributed over the life of the Beneficiary, or over a period not extending beyond the life expectancy of the Beneficiary, provided the election is made in accordance with Internal Revenue Code section 72. If the sole Beneficiary is the deceased Owner’s surviving spouse (or, if the Owner is a non-natural person, the deceased Annuitant’s surviving spouse), the surviving spouse may elect to continue the contract as the sole Owner in lieu of receiving the Death Benefit. This provision relating to the surviving spouse can only apply once and cannot apply a second time if the surviving spouse elects to continue the contract, remarries, and then dies. All elections must be made by submitting the appropriate notice to us. Death on or after the Annuity Date If an Owner dies (or an Annuitant dies where the Owner is a non-natural person) on or after the Annuity Date and before the entire interest in this contract has been distributed, any remaining interest in this contract will be distributed under the method of distribution being used on the date of death. 7. Settlement Options Election of Option On the Annuity Date, the Interim Value will be applied to provide annuity payments to you or a payee you designate in accordance with the applicable Settlement Option elected by the Owner or, if no Settlement Option was elected, in accordance with the Annuity Payments provision. Withdrawal Charges will not be applied when you elect a Settlement Option and will not be applied to the resulting annuity payments. As stated in the Annuity Payments provision, an election of a Settlement Option must be made in writing by the Owner prior to the Annuity Date and is irrevocable as of the Annuity Date. Additionally, the Beneficiary may elect to receive the Death Benefit under one of the Settlement Options described below, subject to the satisfaction of section 72(s) of the Internal Revenue Code, as amended. Any election of a Settlement Option by a Beneficiary must be made in writing and is irrevocable as of the date payments begin. For purposes of the Settlement Options below, the Beneficiary will be the Annuitant. A lump sum along with a Settlement Option may be elected. The amount applied under the Settlement Option must be at least $5,000. If on the Annuity Date the Contract Value is less than $5,000, the full Contract Value will be paid to you in a lump sum.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 14 RIA II (05/25) NF NY If a Settlement Option with a Guaranteed Period is elected and provides for installment payments of the same amount at some ages for different guaranteed periods, we will deem an election to have been made for the longest guaranteed period which could have been elected for such age and amount. Payments made quarterly, semiannually, or annually may be elected in lieu of monthly payments. Payments less than $100 will only be made annually. Betterment of Rates On the Annuity Date, annuity payments will not be less than those that would be provided by the application of the Interim Value to purchase any single premium immediate annuity contract offered by us, of the same type as the settlement option elected, to the same class of annuitants. Settlement Options No future payments under any option except as provided by law may be assigned or transferred. In addition to the Settlement Options below, we may provide other options at our discretion: Option 1: Life Annuity Monthly payments will be made during the lifetime of the Annuitant. The monthly payments will cease on the death of the Annuitant. No payments will be due after the death of the Annuitant. Option 2: Life Annuity with Guaranteed Period Monthly payments will be made for the longer of the guaranteed period elected and the lifetime of the Annuitant. The guaranteed periods are 5, 10, 15 or 20 years, or any other period agreed upon in writing by us. After the guaranteed period, monthly payments will cease on the death of the Annuitant, and no payments will be due after the death of the Annuitant. If the Annuitant dies during the guaranteed period, no payments will be due after the guaranteed period. Option 3: Installment Refund Life Annuity Monthly payments will be made for the Installment Refund Period and thereafter for the lifetime of the Annuitant. The “Installment Refund Period” is the period required for the sum of the monthly payments to equal the total amount applied under this option. After the Installment Refund Period, monthly payments will cease on the death of the Annuitant, and no payments will be due after the death of the Annuitant. If the Annuitant dies during the Installment Refund Period, no payments will be due after the Installment Refund Period. Option 4: Joint and Last Survivor Annuity Monthly payments will be made for the joint lifetime of two Annuitants and in an equal amount during the remaining lifetime of the survivor. Payments will cease, and no further payments will be due, on the death of the last survivor. Payments may also be elected to be made to the survivor in an amount equal to two- thirds or one-half of the payment made during the joint lifetime of the two persons. We will furnish Annuity Settlement Option factors for Option 4 upon request. Option 5: Fixed Period Annuity Monthly payments will be made for the fixed period elected. Payments will cease at the end of the fixed period and no further payments will be due. The fixed period that may be elected is any period from 5 to 30 years. Fixed periods shorter than 10 years are only available as a Death Benefit Settlement Option. Annuity Settlement Option factors for Options 1, 2, 3, and 5 are shown on the Contract Schedule.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF Page 15 RIA II (05/25) NF NY 8. Termination Your contract will terminate on the date on which all amounts are paid as required by your contract.

Athene Annuity & Life Assurance Company of New York RIA II (05/25) NF RIA II (05/25) NF NY Individual Single Purchase Payment Index-Linked Deferred Separate Account Annuity Contract Subject to the terms and conditions of your contract, periodic income commencing on the Annuity Date with the option to change the type of Settlement Option payable prior to the Annuity Date. Non-Participating. Administrative Office: Home Office: Mail Processing Center 1 Blue Hill Plz Ste 1672 P.O. Box 1555 P.O. Box 1690 Des Moines, IA 50306-1555 Pearl River, New York 10965 888-266-8489 800-926-7599

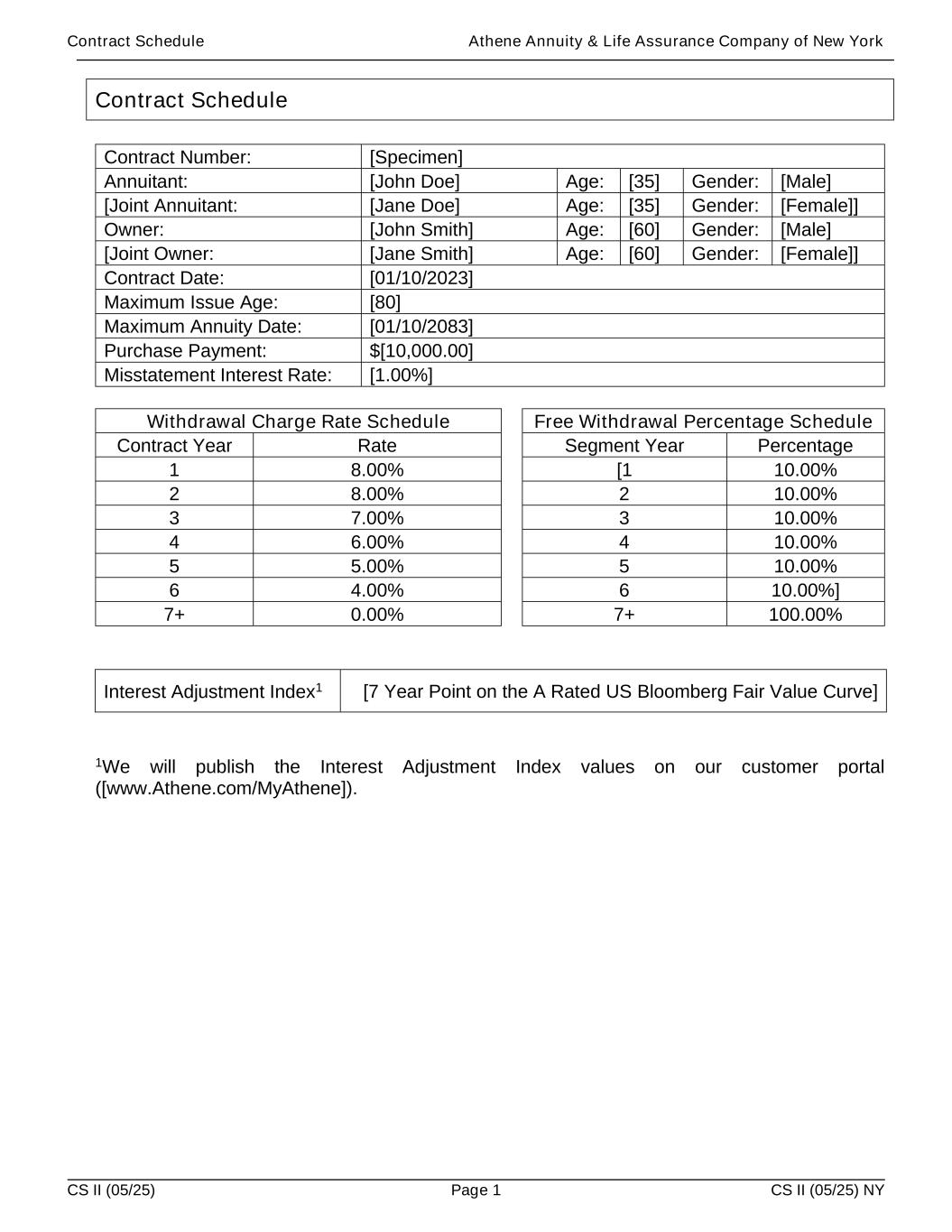

Contract Schedule Athene Annuity & Life Assurance Company of New York CS II (05/25) Page 1 CS II (05/25) NY Contract Schedule Contract Number: [Specimen] Annuitant: [John Doe] Age: [35] Gender: [Male] [Joint Annuitant: [Jane Doe] Age: [35] Gender: [Female]] Owner: [John Smith] Age: [60] Gender: [Male] [Joint Owner: [Jane Smith] Age: [60] Gender: [Female]] Contract Date: [01/10/2023] Maximum Issue Age: [80] Maximum Annuity Date: [01/10/2083] Purchase Payment: $[10,000.00] Misstatement Interest Rate: [1.00%] Withdrawal Charge Rate Schedule Free Withdrawal Percentage Schedule Contract Year Rate Segment Year Percentage 1 8.00% [1 10.00% 2 8.00% 2 10.00% 3 7.00% 3 10.00% 4 6.00% 4 10.00% 5 5.00% 5 10.00% 6 4.00% 6 10.00%] 7+ 0.00% 7+ 100.00% Interest Adjustment Index1 [7 Year Point on the A Rated US Bloomberg Fair Value Curve] 1We will publish the Interest Adjustment Index values on our customer portal ([www.Athene.com/MyAthene]).

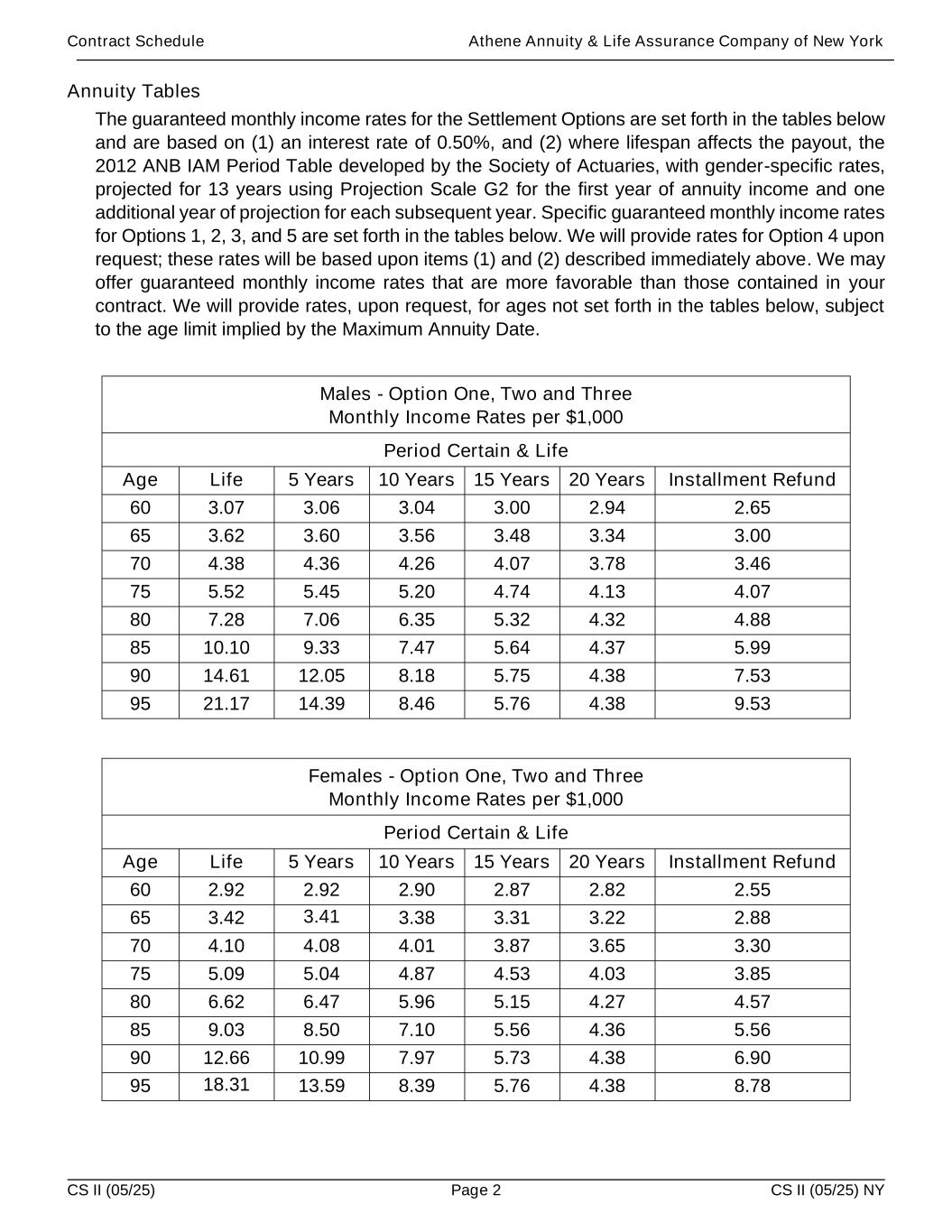

Contract Schedule Athene Annuity & Life Assurance Company of New York CS II (05/25) Page 2 CS II (05/25) NY Annuity Tables The guaranteed monthly income rates for the Settlement Options are set forth in the tables below and are based on (1) an interest rate of 0.50%, and (2) where lifespan affects the payout, the 2012 ANB IAM Period Table developed by the Society of Actuaries, with gender-specific rates, projected for 13 years using Projection Scale G2 for the first year of annuity income and one additional year of projection for each subsequent year. Specific guaranteed monthly income rates for Options 1, 2, 3, and 5 are set forth in the tables below. We will provide rates for Option 4 upon request; these rates will be based upon items (1) and (2) described immediately above. We may offer guaranteed monthly income rates that are more favorable than those contained in your contract. We will provide rates, upon request, for ages not set forth in the tables below, subject to the age limit implied by the Maximum Annuity Date. Males - Option One, Two and Three Monthly Income Rates per $1,000 Period Certain & Life Age Life 5 Years 10 Years 15 Years 20 Years Installment Refund 60 3.07 3.06 3.04 3.00 2.94 2.65 65 3.62 3.60 3.56 3.48 3.34 3.00 70 4.38 4.36 4.26 4.07 3.78 3.46 75 5.52 5.45 5.20 4.74 4.13 4.07 80 7.28 7.06 6.35 5.32 4.32 4.88 85 10.10 9.33 7.47 5.64 4.37 5.99 90 14.61 12.05 8.18 5.75 4.38 7.53 95 21.17 14.39 8.46 5.76 4.38 9.53 Females - Option One, Two and Three Monthly Income Rates per $1,000 Period Certain & Life Age Life 5 Years 10 Years 15 Years 20 Years Installment Refund 60 2.92 2.92 2.90 2.87 2.82 2.55 65 3.42 3.41 3.38 3.31 3.22 2.88 70 4.10 4.08 4.01 3.87 3.65 3.30 75 5.09 5.04 4.87 4.53 4.03 3.85 80 6.62 6.47 5.96 5.15 4.27 4.57 85 9.03 8.50 7.10 5.56 4.36 5.56 90 12.66 10.99 7.97 5.73 4.38 6.90 95 18.31 13.59 8.39 5.76 4.38 8.78

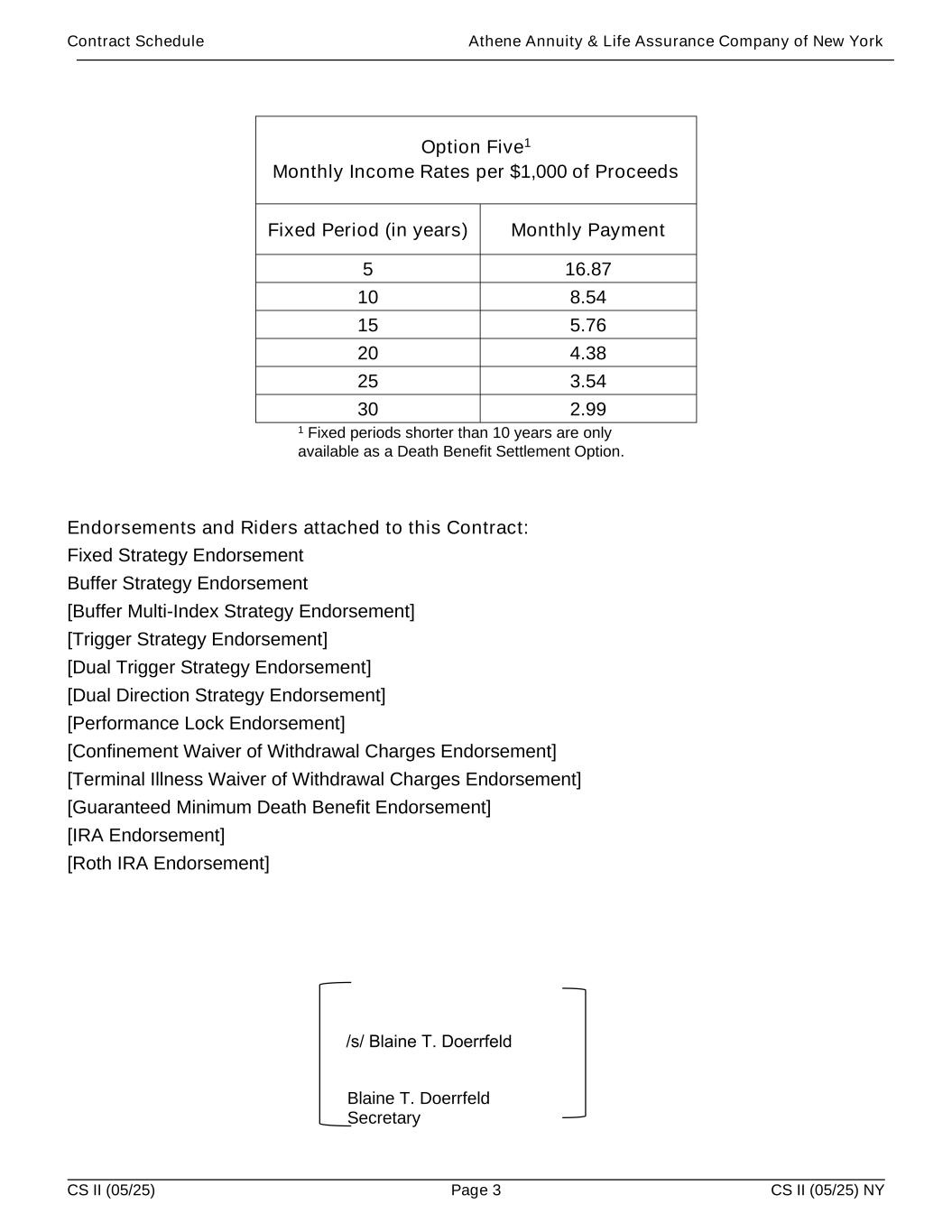

Contract Schedule Athene Annuity & Life Assurance Company of New York CS II (05/25) Page 3 CS II (05/25) NY Option Five1 Monthly Income Rates per $1,000 of Proceeds Fixed Period (in years) Monthly Payment 5 16.87 10 8.54 15 5.76 20 4.38 25 3.54 30 2.99 1 Fixed periods shorter than 10 years are only available as a Death Benefit Settlement Option. Endorsements and Riders attached to this Contract: Fixed Strategy Endorsement Buffer Strategy Endorsement [Buffer Multi-Index Strategy Endorsement] [Trigger Strategy Endorsement] [Dual Trigger Strategy Endorsement] [Dual Direction Strategy Endorsement] [Performance Lock Endorsement] [Confinement Waiver of Withdrawal Charges Endorsement] [Terminal Illness Waiver of Withdrawal Charges Endorsement] [Guaranteed Minimum Death Benefit Endorsement] [IRA Endorsement] [Roth IRA Endorsement] Blaine T. Doerrfeld Secretary /s/ Blaine T. Doerrfeld

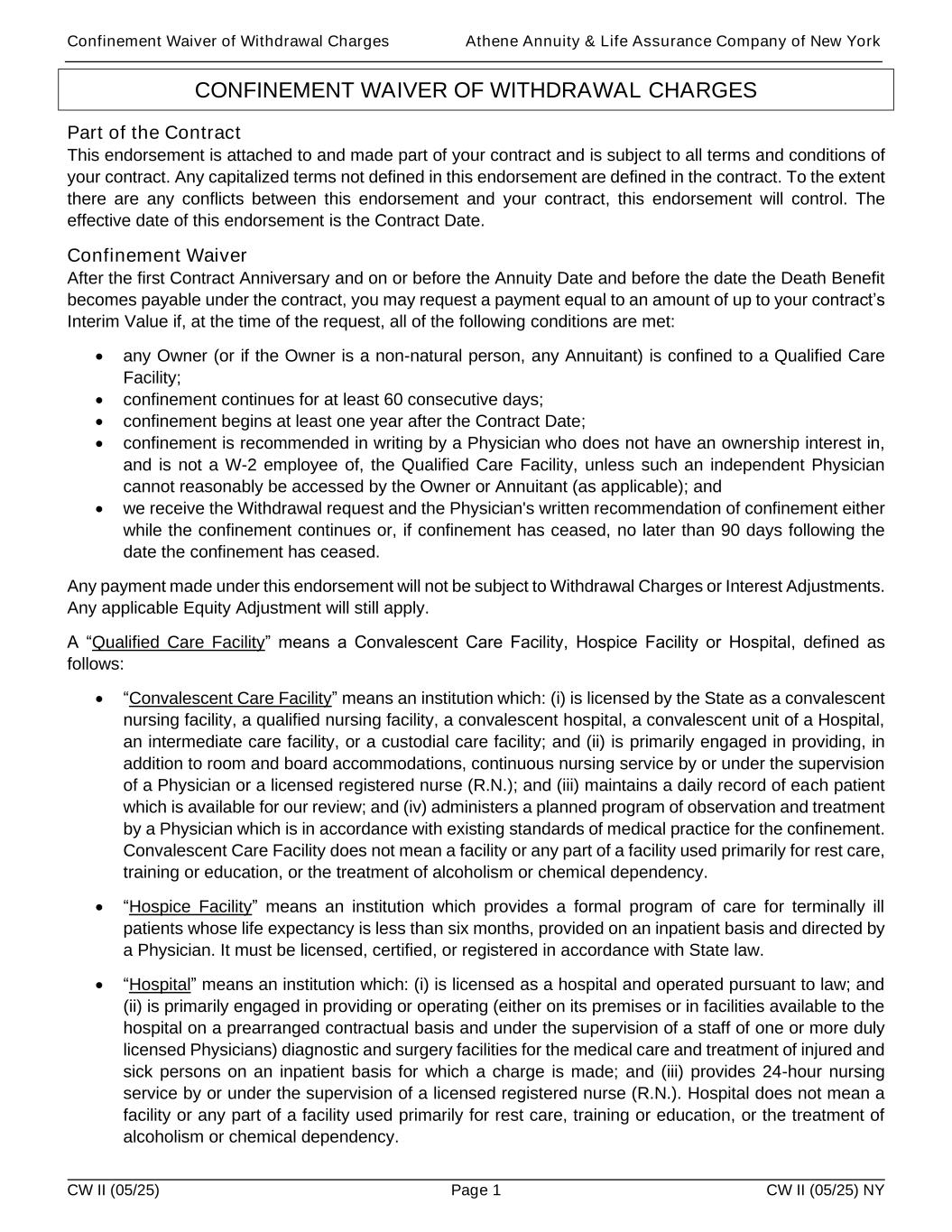

Confinement Waiver of Withdrawal Charges Athene Annuity & Life Assurance Company of New York CW II (05/25) Page 1 CW II (05/25) NY CONFINEMENT WAIVER OF WITHDRAWAL CHARGES Part of the Contract This endorsement is attached to and made part of your contract and is subject to all terms and conditions of your contract. Any capitalized terms not defined in this endorsement are defined in the contract. To the extent there are any conflicts between this endorsement and your contract, this endorsement will control. The effective date of this endorsement is the Contract Date. Confinement Waiver After the first Contract Anniversary and on or before the Annuity Date and before the date the Death Benefit becomes payable under the contract, you may request a payment equal to an amount of up to your contract’s Interim Value if, at the time of the request, all of the following conditions are met: • any Owner (or if the Owner is a non-natural person, any Annuitant) is confined to a Qualified Care Facility; • confinement continues for at least 60 consecutive days; • confinement begins at least one year after the Contract Date; • confinement is recommended in writing by a Physician who does not have an ownership interest in, and is not a W-2 employee of, the Qualified Care Facility, unless such an independent Physician cannot reasonably be accessed by the Owner or Annuitant (as applicable); and • we receive the Withdrawal request and the Physician's written recommendation of confinement either while the confinement continues or, if confinement has ceased, no later than 90 days following the date the confinement has ceased. Any payment made under this endorsement will not be subject to Withdrawal Charges or Interest Adjustments. Any applicable Equity Adjustment will still apply. A “Qualified Care Facility” means a Convalescent Care Facility, Hospice Facility or Hospital, defined as follows: • “Convalescent Care Facility” means an institution which: (i) is licensed by the State as a convalescent nursing facility, a qualified nursing facility, a convalescent hospital, a convalescent unit of a Hospital, an intermediate care facility, or a custodial care facility; and (ii) is primarily engaged in providing, in addition to room and board accommodations, continuous nursing service by or under the supervision of a Physician or a licensed registered nurse (R.N.); and (iii) maintains a daily record of each patient which is available for our review; and (iv) administers a planned program of observation and treatment by a Physician which is in accordance with existing standards of medical practice for the confinement. Convalescent Care Facility does not mean a facility or any part of a facility used primarily for rest care, training or education, or the treatment of alcoholism or chemical dependency. • “Hospice Facility” means an institution which provides a formal program of care for terminally ill patients whose life expectancy is less than six months, provided on an inpatient basis and directed by a Physician. It must be licensed, certified, or registered in accordance with State law. • “Hospital” means an institution which: (i) is licensed as a hospital and operated pursuant to law; and (ii) is primarily engaged in providing or operating (either on its premises or in facilities available to the hospital on a prearranged contractual basis and under the supervision of a staff of one or more duly licensed Physicians) diagnostic and surgery facilities for the medical care and treatment of injured and sick persons on an inpatient basis for which a charge is made; and (iii) provides 24-hour nursing service by or under the supervision of a licensed registered nurse (R.N.). Hospital does not mean a facility or any part of a facility used primarily for rest care, training or education, or the treatment of alcoholism or chemical dependency.

Confinement Waiver of Withdrawal Charges Athene Annuity & Life Assurance Company of New York CW II (05/25) Page 2 CW II (05/25) NY “Physician” means a doctor of medicine or osteopathy practicing in a State in which he or she is legally authorized to practice medicine. The Physician cannot be you, an Annuitant, a Beneficiary, or a member of your, an Annuitant’s, or a Beneficiary’s immediate family, including a husband, wife, domestic partner, civil union partner, child, sibling, parent, grandparent, grandchild, cousin, aunt, uncle, niece, nephew, or any of their spouses, domestic partners, or civil union partners. “State” means each state of the United States of America, as well as the District of Columbia, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, Guam, and American Samoa. Denial of Waiver If we deny a confinement waiver claim, the Withdrawal will not be disbursed until the Owner is notified of the denial and provided the opportunity to accept or reject the Withdrawal proceeds after any Withdrawal Charge and any applicable Interest Adjustment. Termination This endorsement will terminate upon the change or addition of an Owner (or if the Owner is a non-natural person, upon the change or addition of an Annuitant), except through continuation of the contract by the surviving spouse. Termination of this contract shall not prejudice the waiver of any Withdrawal Charges and Interest Adjustments while this Confinement Waiver was in force. Blaine T. Doerrfeld Secretary /s/ Blaine T. Doerrfeld

Terminal Illness Waiver of Withdrawal Charges Athene Annuity & Life Assurance Company of New York TIW II (05/25) Page 1 TIW II (05/25) NY TERMINAL ILLNESS WAIVER OF WITHDRAWAL CHARGES Part of the Contract This endorsement is attached to and made part of your contract and is subject to all terms and conditions of your contract. Any capitalized terms not defined in this endorsement are defined in the contract. To the extent there are any conflicts between this endorsement and your contract, this endorsement will control. The effective date of this endorsement is the Contract Date. Terminal Illness Waiver After the first Contract Anniversary and on or before the Annuity Date and before the date the Death Benefit becomes payable under this contract, you may request a payment equal to an amount of up to your contract’s Interim Value if, at the time of the request, all of the following conditions are met: • any Owner (or if the Owner is a non-natural person, any Annuitant), is diagnosed with a Terminal Illness; • the initial diagnosis occurs at least one year after the Contract Date; and • the Withdrawal request is accompanied by a certification of Terminal Illness prepared by a Physician who has examined the ill Owner or Annuitant (as applicable) and is qualified to provide the certification. Any payment made under this endorsement will not be subject to Withdrawal Charges or Interest Adjustments. Any applicable Equity Adjustment will still apply. “Terminal Illness” means an illness or injury that is expected to cause death within 12 months. “Physician” means a doctor of medicine or osteopathy practicing in a State in which he or she is legally authorized to practice medicine. The Physician cannot be you, an Annuitant, a Beneficiary, or a member of your, an Annuitant’s, or a Beneficiary’s immediate family, including a husband, wife, domestic partner, civil union partner, child, sibling, parent, grandparent, grandchild, cousin, aunt, uncle, niece, nephew, or any of their spouses, domestic partners, or civil union partners. “State” means each state of the United States of America, as well as the District of Columbia, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, Guam, and American Samoa. Denial of Waiver If we deny a Terminal Illness waiver claim, the Withdrawal will not be disbursed until the Owner is notified of the denial and provided the opportunity to accept or reject the Withdrawal proceeds after any Withdrawal Charge and any applicable Interest Adjustment. Termination This endorsement will terminate upon the change or addition of an Owner (or if the Owner is a non-natural person, upon the change or addition of an Annuitant), except through continuation of the contract by the surviving spouse. Termination of this contract shall not prejudice the waiver of any Withdrawal Charges and Interest Adjustments while this Terminal Illness Waiver was in force. Blaine T. Doerrfeld Secretary /s/ Blaine T. Doerrfeld

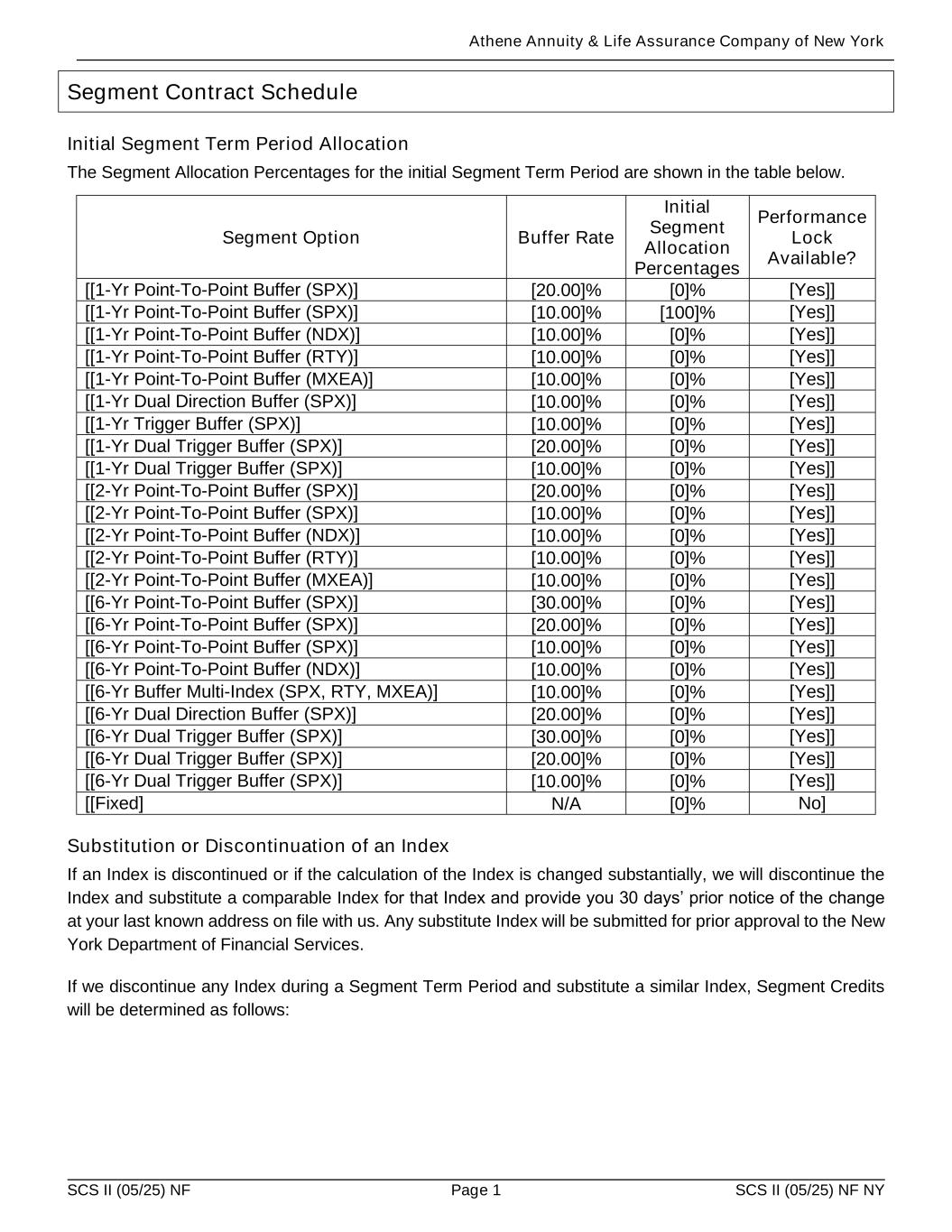

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 1 SCS II (05/25) NF NY Segment Contract Schedule Initial Segment Term Period Allocation The Segment Allocation Percentages for the initial Segment Term Period are shown in the table below. Segment Option Buffer Rate Initial Segment Allocation Percentages Performance Lock Available? [[1-Yr Point-To-Point Buffer (SPX)] [20.00]% [0]% [Yes]] [[1-Yr Point-To-Point Buffer (SPX)] [10.00]% [100]% [Yes]] [[1-Yr Point-To-Point Buffer (NDX)] [10.00]% [0]% [Yes]] [[1-Yr Point-To-Point Buffer (RTY)] [10.00]% [0]% [Yes]] [[1-Yr Point-To-Point Buffer (MXEA)] [10.00]% [0]% [Yes]] [[1-Yr Dual Direction Buffer (SPX)] [10.00]% [0]% [Yes]] [[1-Yr Trigger Buffer (SPX)] [10.00]% [0]% [Yes]] [[1-Yr Dual Trigger Buffer (SPX)] [20.00]% [0]% [Yes]] [[1-Yr Dual Trigger Buffer (SPX)] [10.00]% [0]% [Yes]] [[2-Yr Point-To-Point Buffer (SPX)] [20.00]% [0]% [Yes]] [[2-Yr Point-To-Point Buffer (SPX)] [10.00]% [0]% [Yes]] [[2-Yr Point-To-Point Buffer (NDX)] [10.00]% [0]% [Yes]] [[2-Yr Point-To-Point Buffer (RTY)] [10.00]% [0]% [Yes]] [[2-Yr Point-To-Point Buffer (MXEA)] [10.00]% [0]% [Yes]] [[6-Yr Point-To-Point Buffer (SPX)] [30.00]% [0]% [Yes]] [[6-Yr Point-To-Point Buffer (SPX)] [20.00]% [0]% [Yes]] [[6-Yr Point-To-Point Buffer (SPX)] [10.00]% [0]% [Yes]] [[6-Yr Point-To-Point Buffer (NDX)] [10.00]% [0]% [Yes]] [[6-Yr Buffer Multi-Index (SPX, RTY, MXEA)] [10.00]% [0]% [Yes]] [[6-Yr Dual Direction Buffer (SPX)] [20.00]% [0]% [Yes]] [[6-Yr Dual Trigger Buffer (SPX)] [30.00]% [0]% [Yes]] [[6-Yr Dual Trigger Buffer (SPX)] [20.00]% [0]% [Yes]] [[6-Yr Dual Trigger Buffer (SPX)] [10.00]% [0]% [Yes]] [[Fixed] N/A [0]% No] Substitution or Discontinuation of an Index If an Index is discontinued or if the calculation of the Index is changed substantially, we will discontinue the Index and substitute a comparable Index for that Index and provide you 30 days’ prior notice of the change at your last known address on file with us. Any substitute Index will be submitted for prior approval to the New York Department of Financial Services. If we discontinue any Index during a Segment Term Period and substitute a similar Index, Segment Credits will be determined as follows:

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 2 SCS II (05/25) NF NY (1) We will determine the Index Change for the Segment Term Period by (i) multiplying together one plus the percentage change in the Index Price of the original Index from the Segment Start Date until the date of the substitution and one plus the percentage change in the Index Price of the substituted Index from the date of the substitution until the Segment End Date, (ii) subtracting one from the result, and then (iii) applying any applicable Cap Rate, Participation Rate, Downside Participation Rate, Trigger Rate, and Buffer Rate. The substituted Index will be incorporated in the Buffer Multi-Index Segment Option, if applicable. (2) The resulting Segment Credit will be added to your Segment Value on the scheduled Segment End Date. Addition, Discontinuation, or Suspension of a Segment Option We may add, discontinue, or temporarily suspend the availability of any Index-Linked Segment Option at our discretion. When a change is made to an Index-Linked Segment Option, we will send you a notice describing the change. This change will take effect upon your contract as of the next available Segment Start Date for any allowable transfers into the affected Index-Linked Segment Options. If you have Segment Value in an Index-Linked Segment Option that is discontinued or suspended, the Segment Value will remain in that Index- Linked Segment Option until the end of that option’s Segment Term Period. After that, that Index-Linked Segment Option will no longer be available. If a Segment Option is no longer available, the Segment Value in that option will be automatically transferred to the Fixed Segment Option on the scheduled Segment End Date, unless you elect to have the Segment Value transferred to one or more of the available Segment Options by providing us notice as provided for in the Segment Value Transfers provision of the contract. At least one Index-Linked Segment Option will always be available. Holding Account Fixed Interest Rate: [3.00%] Initial Segment Start Date: [January] [22], [2025] Fixed Segment Option[s] Segment Term Period Initial Minimum Guaranteed Interest Rate Initial Annual Interest Rate [[1] Year[s] [2.30%] [3.00]%]

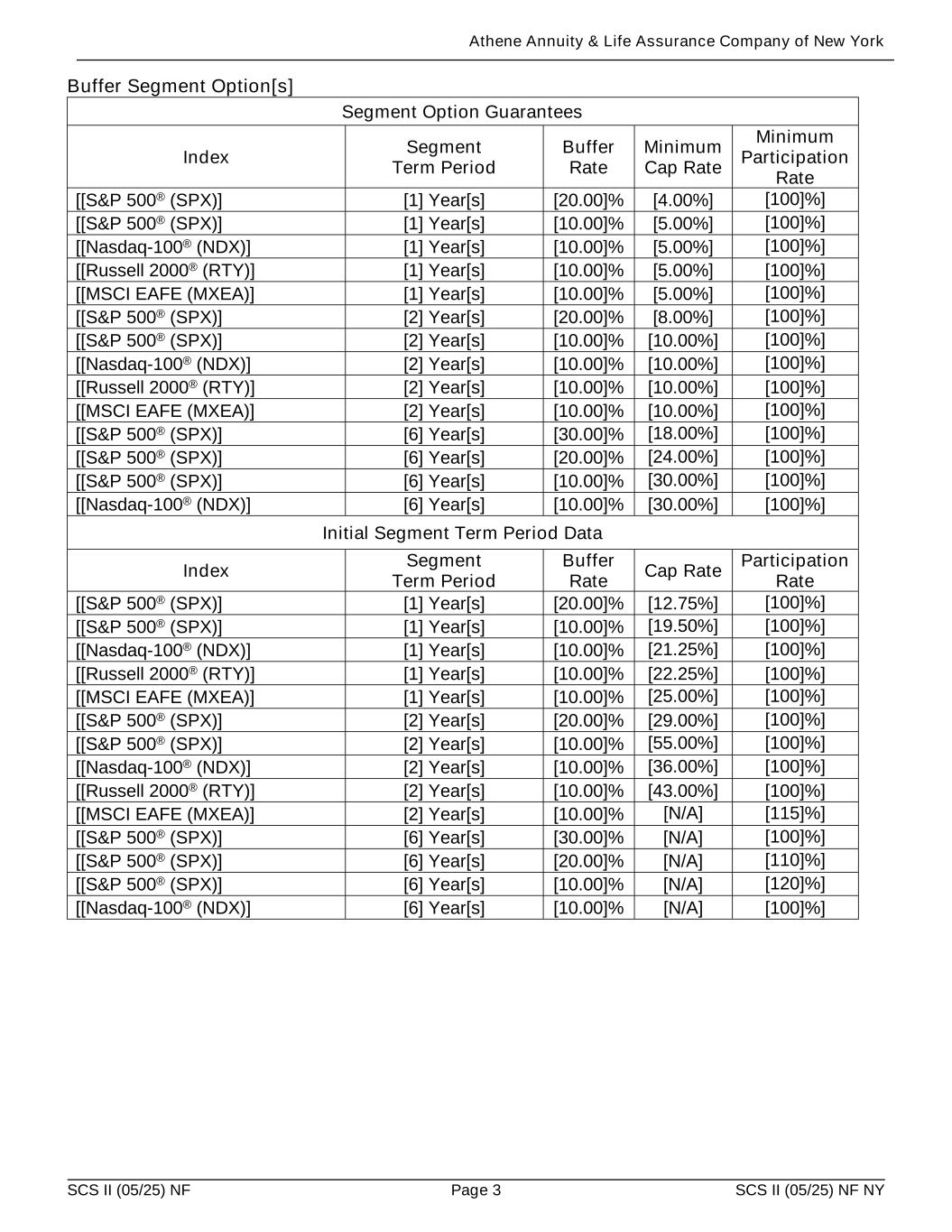

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 3 SCS II (05/25) NF NY Buffer Segment Option[s] Segment Option Guarantees Index Segment Term Period Buffer Rate Minimum Cap Rate Minimum Participation Rate [[S&P 500® (SPX)] [1] Year[s] [20.00]% [4.00%] [100]%] [[S&P 500® (SPX)] [1] Year[s] [10.00]% [5.00%] [100]%] [[Nasdaq-100® (NDX)] [1] Year[s] [10.00]% [5.00%] [100]%] [[Russell 2000® (RTY)] [1] Year[s] [10.00]% [5.00%] [100]%] [[MSCI EAFE (MXEA)] [1] Year[s] [10.00]% [5.00%] [100]%] [[S&P 500® (SPX)] [2] Year[s] [20.00]% [8.00%] [100]%] [[S&P 500® (SPX)] [2] Year[s] [10.00]% [10.00%] [100]%] [[Nasdaq-100® (NDX)] [2] Year[s] [10.00]% [10.00%] [100]%] [[Russell 2000® (RTY)] [2] Year[s] [10.00]% [10.00%] [100]%] [[MSCI EAFE (MXEA)] [2] Year[s] [10.00]% [10.00%] [100]%] [[S&P 500® (SPX)] [6] Year[s] [30.00]% [18.00%] [100]%] [[S&P 500® (SPX)] [6] Year[s] [20.00]% [24.00%] [100]%] [[S&P 500® (SPX)] [6] Year[s] [10.00]% [30.00%] [100]%] [[Nasdaq-100® (NDX)] [6] Year[s] [10.00]% [30.00%] [100]%] Initial Segment Term Period Data Index Segment Term Period Buffer Rate Cap Rate Participation Rate [[S&P 500® (SPX)] [1] Year[s] [20.00]% [12.75%] [100]%] [[S&P 500® (SPX)] [1] Year[s] [10.00]% [19.50%] [100]%] [[Nasdaq-100® (NDX)] [1] Year[s] [10.00]% [21.25%] [100]%] [[Russell 2000® (RTY)] [1] Year[s] [10.00]% [22.25%] [100]%] [[MSCI EAFE (MXEA)] [1] Year[s] [10.00]% [25.00%] [100]%] [[S&P 500® (SPX)] [2] Year[s] [20.00]% [29.00%] [100]%] [[S&P 500® (SPX)] [2] Year[s] [10.00]% [55.00%] [100]%] [[Nasdaq-100® (NDX)] [2] Year[s] [10.00]% [36.00%] [100]%] [[Russell 2000® (RTY)] [2] Year[s] [10.00]% [43.00%] [100]%] [[MSCI EAFE (MXEA)] [2] Year[s] [10.00]% [N/A] [115]%] [[S&P 500® (SPX)] [6] Year[s] [30.00]% [N/A] [100]%] [[S&P 500® (SPX)] [6] Year[s] [20.00]% [N/A] [110]%] [[S&P 500® (SPX)] [6] Year[s] [10.00]% [N/A] [120]%] [[Nasdaq-100® (NDX)] [6] Year[s] [10.00]% [N/A] [100]%]

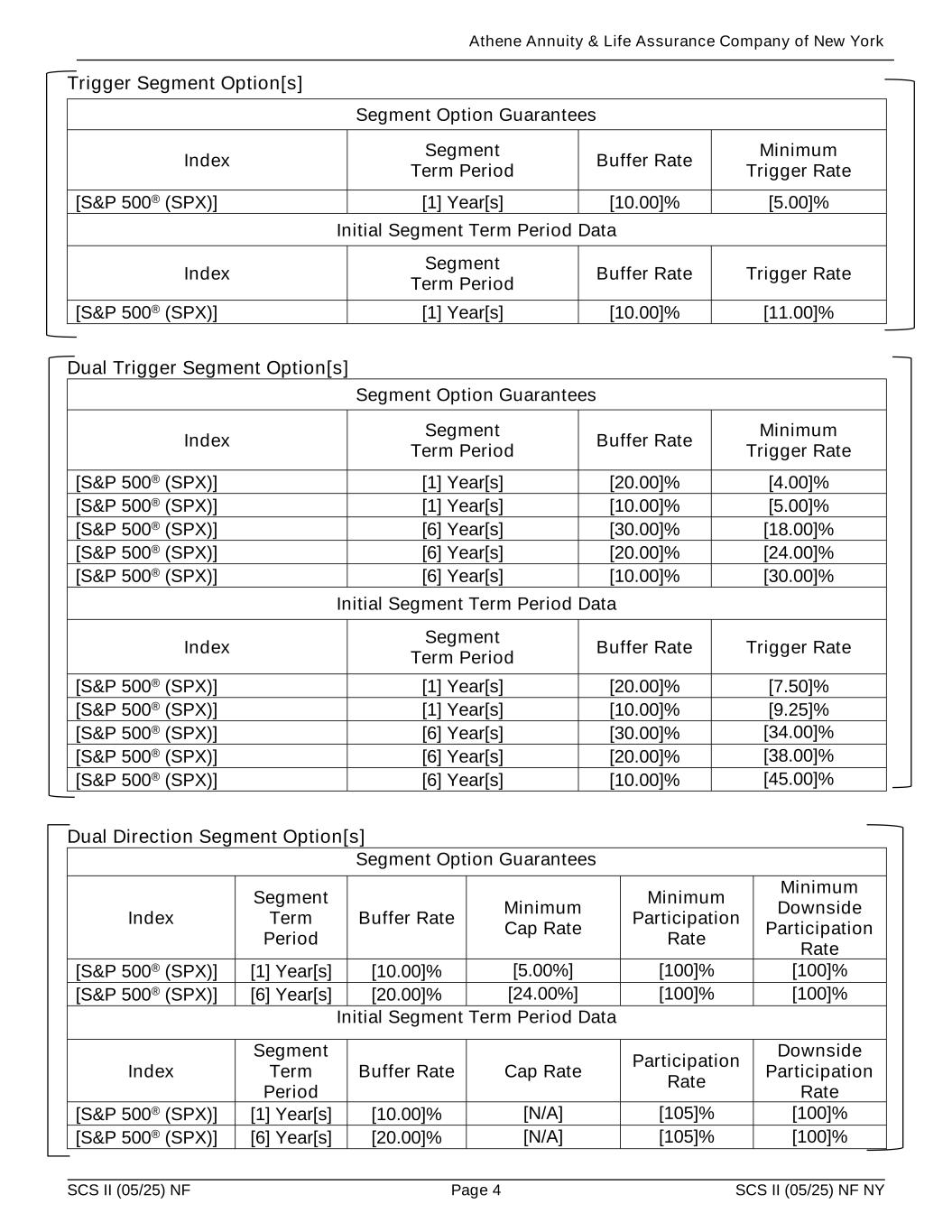

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 4 SCS II (05/25) NF NY Trigger Segment Option[s] Segment Option Guarantees Index Segment Term Period Buffer Rate Minimum Trigger Rate [S&P 500® (SPX)] [1] Year[s] [10.00]% [5.00]% Initial Segment Term Period Data Index Segment Term Period Buffer Rate Trigger Rate [S&P 500® (SPX)] [1] Year[s] [10.00]% [11.00]% Dual Trigger Segment Option[s] Segment Option Guarantees Index Segment Term Period Buffer Rate Minimum Trigger Rate [S&P 500® (SPX)] [1] Year[s] [20.00]% [4.00]% [S&P 500® (SPX)] [1] Year[s] [10.00]% [5.00]% [S&P 500® (SPX)] [6] Year[s] [30.00]% [18.00]% [S&P 500® (SPX)] [6] Year[s] [20.00]% [24.00]% [S&P 500® (SPX)] [6] Year[s] [10.00]% [30.00]% Initial Segment Term Period Data Index Segment Term Period Buffer Rate Trigger Rate [S&P 500® (SPX)] [1] Year[s] [20.00]% [7.50]% [S&P 500® (SPX)] [1] Year[s] [10.00]% [9.25]% [S&P 500® (SPX)] [6] Year[s] [30.00]% [34.00]% [S&P 500® (SPX)] [6] Year[s] [20.00]% [38.00]% [S&P 500® (SPX)] [6] Year[s] [10.00]% [45.00]% Dual Direction Segment Option[s] Segment Option Guarantees Index Segment Term Period Buffer Rate Minimum Cap Rate Minimum Participation Rate Minimum Downside Participation Rate [S&P 500® (SPX)] [1] Year[s] [10.00]% [5.00%] [100]% [100]% [S&P 500® (SPX)] [6] Year[s] [20.00]% [24.00%] [100]% [100]% Initial Segment Term Period Data Index Segment Term Period Buffer Rate Cap Rate Participation Rate Downside Participation Rate [S&P 500® (SPX)] [1] Year[s] [10.00]% [N/A] [105]% [100]% [S&P 500® (SPX)] [6] Year[s] [20.00]% [N/A] [105]% [100]%

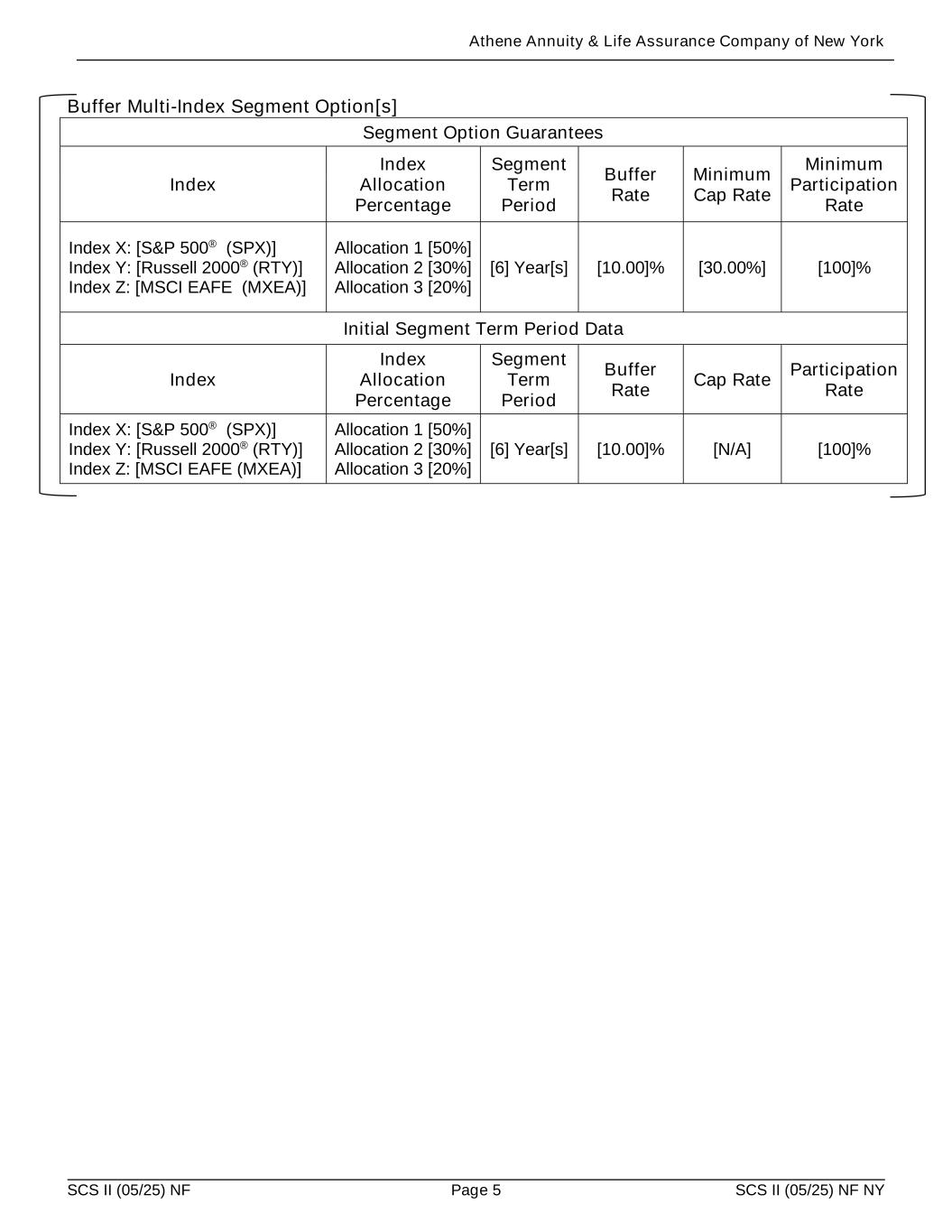

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 5 SCS II (05/25) NF NY Buffer Multi-Index Segment Option[s] Segment Option Guarantees Index Index Allocation Percentage Segment Term Period Buffer Rate Minimum Cap Rate Minimum Participation Rate Index X: [S&P 500® (SPX)] Index Y: [Russell 2000® (RTY)] Index Z: [MSCI EAFE (MXEA)] Allocation 1 [50%] Allocation 2 [30%] Allocation 3 [20%] [6] Year[s] [10.00]% [30.00%] [100]% Initial Segment Term Period Data Index Index Allocation Percentage Segment Term Period Buffer Rate Cap Rate Participation Rate Index X: [S&P 500® (SPX)] Index Y: [Russell 2000® (RTY)] Index Z: [MSCI EAFE (MXEA)] Allocation 1 [50%] Allocation 2 [30%] Allocation 3 [20%] [6] Year[s] [10.00]% [N/A] [100]%

Athene Annuity & Life Assurance Company of New York SCS II (05/25) NF Page 6 SCS II (05/25) NF NY [S&P 500® Price Return Index The S&P 500® Index (the “Index") is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and has been licensed for use by Athene Annuity & Life Assurance Company of New York (“Athene”). S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). It is not possible to invest directly in an index. Athene’s products are not regulated, sponsored, operated, issued, endorsed, sold, guaranteed or promoted by S&P DJI, Dow Jones, S&P, or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices does not make any representation or warranty, express or implied, to the owners of Athene’s products or any member of the public regarding the advisability of investing in securities generally or in Athene’s products particularly or the ability of the Index to track general market performance. Past performance of an index is not an indication or guarantee of future results. S&P Dow Jones Indices’ only relationship to Athene with respect to the Index is the licensing of the Index and/or sub-licensing certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The Index is determined, composed and calculated by S&P Dow Jones Indices without regard to Athene or Athene’s products. S&P Dow Jones Indices has no obligation to take the needs of Athene or the owners of Athene’s products into consideration in determining, composing or calculating the Index. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing or trading of Athene’s products. There is no assurance that investment products based on the Index will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment adviser, commodity trading advisor, commodity pool operator, broker dealer, fiduciary, “promoter” (as defined in the Investment Company Act of 1940, as amended), “expert” as enumerated within 15 U.S.C. § 77k(a) or tax advisor. Inclusion of a security, commodity, crypto currency or other asset within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, commodity, crypto currency or other asset, nor is it considered to be investment advice or commodity trading advice. S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY ATHENE, OWNERS OF ATHENE’S PRODUCTS, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. S&P DOW JONES INDICES HAS NOT REVIEWED, PREPARED AND/OR CERTIFIED ANY PORTION OF, NOR DOES S&P DOW JONES INDICES HAVE ANY CONTROL OVER, THE ATHENE PRODUCT REGISTRATION STATEMENT, PROSPECTUS OR OTHER OFFERING MATERIALS. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND ATHENE, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.]