Page 1 of 624235 (05/25) NY *2423501* 1. PRODUCT Product Name: Athene Amplify 2.0 NF - a Single Purchase Payment Index-Linked Deferred Separate Account Annuity Withdrawal Charge Period (in years): 6 Years 2. OWNER Individual or Trustee First Name M.I. Last Name Suffix Trust or Company Name Social Security Number/Tax ID Date of Birth (MM/DD/YY) Gender M F Relationship to Proposed Annuitant: Self Spouse Other: Street Address (Required - No PO Box) City State Zip Country Mailing Address (Optional) City State Zip Country US Citizen Yes No Country of Citizenship E-mail Telephone (Required) Type of gov’t issued photo ID: Driver’s license Passport Other__________ State or Country of issue _______ Note: If the proposed Owner is a non-natural entity (i.e. Trust, Corporation, Association, etc.), additional documentation will be required to establish the entity’s legal identity and who has authority to legally act on behalf of the entity. 3. JOINT OWNER Not applicable to qualified contracts or those owned by non-natural entities Individual or Trustee First Name M.I. Last Name Suffix Social Security Number/Tax ID Date of Birth (MM/DD/YY) Gender M F Relationship to Proposed Owner: Spouse Other: Street Address (Required - No PO Box) City State Zip Country Mailing Address (Optional) City State Zip Country US Citizen Yes No Country of Citizenship E-mail Telephone (Required, if applicable) Type of gov’t issued photo ID: Driver’s license Passport Other__________ State or Country of issue ______ Athene.com Athene Annuity & Life Assurance Company of New York Home Office Address: Pearl River, NY Mailing Address: PO Box 1555, Des Moines, IA 50306-1555 Overnight Address: 7700 Mills Civic Parkway West Des Moines, IA 50266-3862 Customer Contact Center - Tel: 888-266-8489 Fax: 866-709-3922 FINANCIAL PROFESSIONAL CODE & NAME: APP SIGNED STATE: DISTRIBUTOR ACCOUNT ID#: Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

Athene.com 4. REPLACEMENT This section MUST be completed 1. Yes No Do you have an existing life insurance policy or annuity contract? 2. Yes No Do you intend for this annuity to change or replace any existing life insurance policy or annuity contract? 5. ANNUITANT (Complete if different from Owner) First Name M.I. Last Name Suffix Social Security Number/Tax ID Date of Birth (MM/DD/YY) Gender M F Telephone (Required) Relationship to Proposed Owner: Self Spouse Other: Street Address (Required - No PO Box) City State Zip Country Mailing Address (Optional) City State Zip Country 6. JOINT ANNUITANT Not applicable to non-spouse or qualified contracts First Name M.I. Last Name Suffix Social Security Number/Tax ID Date of Birth (MM/DD/YY) Gender M F Telephone (Required, if applicable) Relationship to Proposed Annuitant: Spouse Other: Street Address (Required - No PO Box) City State Zip Country Mailing Address (Optional) City State Zip Country Page 2 of 624235 (05/25) NY *2423502* Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

7. BENEFICIARIES • Proceeds will be divided equally if no percentages are listed. All beneficiaries must be living/existing at the time of application. The sum of the percentages for primary and contingent beneficiaries, respectively, must total 100%. A contingent beneficiary will receive the death benefit if the primary beneficiary dies before the death benefit becomes due. • If the beneficiary is a trust, include the name and trust creation date on the Beneficiary name line. • Please provide Social Security/Tax Identification Numbers to expedite future death claim processing. • List additional beneficiaries on a separate page. Owner must sign, date and include required information. Individual, Trust or Company Name Primary Contingent Percentage % Telephone (Recommended) E-mail Social Security Number/Tax ID Date of Birth(MM/DD/YY) Gender M F Relationship to Proposed Owner: Relationship to Proposed Annuitant: Address City State Zip Country Individual, Trust or Company Name Primary Contingent Percentage % Telephone (Recommended if applicable) E-mail Social Security Number/Tax ID Date of Birth(MM/DD/YY) Gender M F Relationship to Proposed Owner: Relationship to Proposed Annuitant: Address City State Zip Country Individual, Trust or Company Name Primary Contingent Percentage % Telephone (Recommended if applicable) E-mail Social Security Number/Tax ID Date of Birth(MM/DD/YY) Gender M F Relationship to Proposed Owner: Relationship to Proposed Annuitant: Address City State Zip Country Individual, Trust or Company Name Primary Contingent Percentage % Telephone (Recommended if applicable) E-mail Social Security Number/Tax ID Date of Birth(MM/DD/YY) Gender M F Relationship to Proposed Owner: Relationship to Proposed Annuitant: Address City State Zip Country Page 3 of 624235 (05/25) NY Athene.com *2423503* Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

8. ANNUITY TYPE Select one option to indicate how this contract should be issued Non-Qualified IRA (Select only one): Traditional Roth SEP Inherited IRA1 (Select only one): Traditional Roth For Qualified options, select all that apply: Contribution Year _______ Direct Transfer/Rollover2 Rollover within 60 Days3 If Inherited IRA selected above, complete for Decedent: Decedent Name: Relationship to Proposed Annuitant: Spouse Other: Date of Birth (MM/DD/YY) Date of Death (MM/DD/YY) 9. PREMIUMS Make all checks payable to Athene Annuity & Life Assurance Company of New York; estimate total transfer amounts New Purchase $ Transfer/Rollover $ Internal Transfer Existing Athene Contract Number(s) _______________________________ $ TOTAL ANTICIPATED PREMIUM $ 1 Athene will accept applications for a spouse Inherited IRA and trust owned Inherited IRA for trusts that qualify as see- through trust where the sole beneficiary of the trust is the spouse. Athene does not accept applications for non-spouse Inherited IRAs. 2 Please complete and submit the applicable Request for Funds Form or ACORD 951 form, for each account to be transferred into this contract. 3 I understand that, except in the case of a Roth Conversion, I can make only one rollover from an IRA (including a Traditional IRA, Roth IRA, or SEP IRA) to an IRA in any 1-year period, regardless of the number of IRAs I own. 24235 (05/25) NY Page 4 of 6 Athene.com *2423504* Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

10. AGREEMENTS AND SIGNATURES I agree that all statements and answers to questions on this application are true to the best of my knowledge and belief. This application will be attached to and made part of the entire contract. I have received a copy of the prospectus. This application does not constitute a contract. A contract is not formed until the application is accepted by the Company and the contract is issued and delivered to and accepted by the owner while both the proposed owner and annuitant are alive. If this application is rejected for any reason, or cancelled prior to issue by the proposed owner, the Company will return the purchase payment paid. Payment must be made payable to Athene Annuity & Life Assurance Company of New York. IRS CERTIFICATION Under penalties of perjury, I certify that: 1. The Social Security Number or Taxpayer Identification Number shown on this form is correct (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (as defined in the General Instructions of IRS Form W-9), and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Exemption from FATCA reporting code (if any):______. (FATCA reporting codes can be found in the General Instructions on IRS Form W-9.) If you are only submitting this form for an account you hold in the United States, you may leave this field blank. Certification Instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. The Internal Revenue Service does not require your consent to any provisions of this document other than the certifications required to avoid backup withholding. All statements made by, or by the authority of, the applicant for the issuance of the applied for contract, are deemed representations and not warranties. Signed at City State Date Signed Owner Signature X Joint Owner Signature (if applicable) X Annuitant Signature (if other than Owner) X Joint Annuitant Signature (if applicable) X Page 5 of 624235 (05/25) NY Athene.com *2423505* Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

Athene.com 11. FINANCIAL PROFESSIONAL USE ONLY 1. Yes No Does the applicant have an existing life insurance policy or annuity contract? 2. Yes No Does the applicant intend for this annuity to replace or change an existing life insurance policy or annuity contract? If (Yes) to either question, and if required by state regulation, replacement forms must accompany this application. 3. Yes No Is any participant on this contract or a dependent family member of a participant on this contract an active duty (full-time) service member (officer or enlisted) of the United States Armed Forces (Army, Navy, Air Force, Marine Corps, or Coast Guard)? If Yes, please complete Military Disclosure Form 18257. In accordance with Athene’s Customer Information Program and the Know Your Customer requirements of the USA PATRIOT Act, I have reviewed a non-expired government issued ID of the owner. By signing below, I certify I have truly and accurately recorded on this application the information provided by the applicant. I certify that only company approved sales materials were used and that copies of such materials were 1) left with the client and 2) retained in my files. I certify any required disclosure material has been presented to the applicant. I have not made any statements which differ from this material nor have I made any promises about the future expected values of this contract. Please complete the section below. Writing Financial Professional Signature X Writing Financial Professional Name (Please print) Date Signed Financial Professional Phone Number Financial Professional E-mail If splitting commissions, please provide the following details: Financial Professional Name Financial Professional Code Financial Professional Telephone/E-mail Address Split % - MUST Equal 100% Commission Option 1 Commission Option 2 Commission Option 3 Page 6 of 624235 (05/25) NY *2423506* Application for Single Purchase Payment Index- Linked Deferred Separate Account Annuity

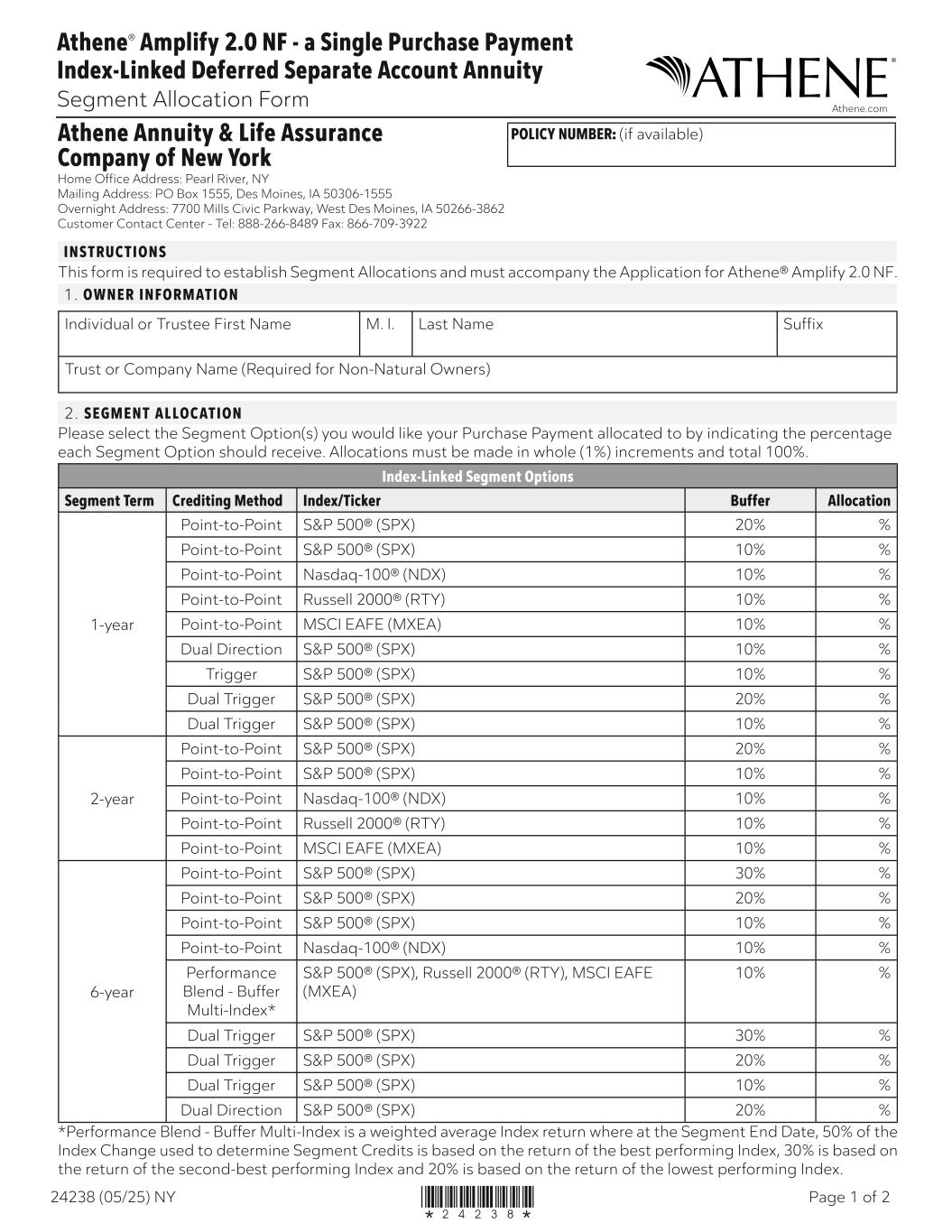

Athene.com Athene Annuity & Life Assurance Company of New York Home Office Address: Pearl River, NY Mailing Address: PO Box 1555, Des Moines, IA 50306-1555 Overnight Address: 7700 Mills Civic Parkway, West Des Moines, IA 50266-3862 Customer Contact Center - Tel: 888-266-8489 Fax: 866-709-3922 POLICY NUMBER: (if available) Athene® Amplify 2.0 NF - a Single Purchase Payment Index-Linked Deferred Separate Account Annuity Segment Allocation Form Page 1 of 224238 (05/25) NY *24238* INSTRUCTIONS This form is required to establish Segment Allocations and must accompany the Application for Athene® Amplify 2.0 NF. 1. OWNER INFORMATION Individual or Trustee First Name M. I. Last Name Suffix Trust or Company Name (Required for Non-Natural Owners) 2. SEGMENT ALLOCATION Please select the Segment Option(s) you would like your Purchase Payment allocated to by indicating the percentage each Segment Option should receive. Allocations must be made in whole (1%) increments and total 100%. Index-Linked Segment Options Segment Term Crediting Method Index/Ticker Buffer Allocation 1-year Point-to-Point S&P 500® (SPX) 20% % Point-to-Point S&P 500® (SPX) 10% % Point-to-Point Nasdaq-100® (NDX) 10% % Point-to-Point Russell 2000® (RTY) 10% % Point-to-Point MSCI EAFE (MXEA) 10% % Dual Direction S&P 500® (SPX) 10% % Trigger S&P 500® (SPX) 10% % Dual Trigger S&P 500® (SPX) 20% % Dual Trigger S&P 500® (SPX) 10% % 2-year Point-to-Point S&P 500® (SPX) 20% % Point-to-Point S&P 500® (SPX) 10% % Point-to-Point Nasdaq-100® (NDX) 10% % Point-to-Point Russell 2000® (RTY) 10% % Point-to-Point MSCI EAFE (MXEA) 10% % 6-year Point-to-Point S&P 500® (SPX) 30% % Point-to-Point S&P 500® (SPX) 20% % Point-to-Point S&P 500® (SPX) 10% % Point-to-Point Nasdaq-100® (NDX) 10% % Performance Blend - Buffer Multi-Index* S&P 500® (SPX), Russell 2000® (RTY), MSCI EAFE (MXEA) 10% % Dual Trigger S&P 500® (SPX) 30% % Dual Trigger S&P 500® (SPX) 20% % Dual Trigger S&P 500® (SPX) 10% % Dual Direction S&P 500® (SPX) 20% % *Performance Blend - Buffer Multi-Index is a weighted average Index return where at the Segment End Date, 50% of the Index Change used to determine Segment Credits is based on the return of the best performing Index, 30% is based on the return of the second-best performing Index and 20% is based on the return of the lowest performing Index.

Athene.com Fixed Segment Options Segment Term Crediting Method Index/Ticker Buffer Allocation 1-year Fixed N/A N/A % TOTAL (must equal 100%): % 3. SIGNATURE(S) Owner Signature X Date Joint Owner Signature (if applicable) X Date Page 2 of 224238 (05/25) NY *24238* Athene® Amplify 2.0 NF - a Single Purchase Payment Index-Linked Deferred Separate Account Annuity Segment Allocation Form