REVOLVING CREDIT AGREEMENT As of January 1, 2023 1. FOR VALUE RECEIVED, the undersigned, ATHENE ANNUITY & LIFE ASSURANCE COMPANY OF NEW YORK, a New York corporation (the “Maker”), HEREBY promises to pay, in lawful money of the United States, to ATHENE USA CORPORATION (together with its registered successors and assigns, the “Holder”), on the earlier of January 1, 2024, or such later date as approved by the Makers’ insurance regulator on an annual basis, and the date of demand for such repayment made by Holder to Maker (such earlier date, the “Final Payment Date”), the “Maximum Principal Amount” (as defined below) or, if less, the aggregated unpaid principal amount of all advances made hereunder (the “Principal Balance”), together with interest on the unpaid Principal Balance at the rate or rates provided below until payment in full thereof. This revolving credit agreement (the “Agreement”) evidences and sets forth repayment terms related to the Principal Balance. This Note shall be approved by the Maker’s board of directors annually and submitted to the Maker’s insurance regulator annually for review, including a history of amounts borrowed, reasons for the borrowings, dates of the borrowings, and interest paid for the previous year. 2. The Holder may at any time and from time to time until the Final Payment Date, in its sole discretion following the request of the Maker make advances to or on behalf of the Maker in lawful money of the United States in an aggregate amount outstanding at any time not to exceed the lesser of (a) $100,000,000 or (b) 5% of Maker’s admitted assets as of year-end of the preceding year (such amount as may be in effect at any time, the “Maximum Principal Amount”). In addition, the Maker may at any time and from time to time, without premium or penalty, prepay all or a portion of its Principal Balance, along with all interest accrued and unpaid with respect to the amount of the Principal Balance so prepaid. Until the Final Payment Date, the Maker may borrow, repay and reborrow under this Section 2. 3. Interest shall accrue on the Principal Balance from time to time outstanding at a rate per annum equal to 2.085%. Maker shall pay such interest in arrears quarterly on the last day of each March, June, September and December (each, an “Interest Payment Date”), on any day any portion of the Principal Balance is repaid or prepaid and on the Final Payment Date. In addition, such interest rate will increase on a compound basis by five percent (5%) per annum from and after the Final Payment Date or any earlier default in Maker’s obligations hereunder, and such increased rate shall remain in effect until the indebtedness of Maker evidenced hereby is satisfied in full. The obligation of the Maker to pay interest on the Principal balance following the Final Payment Date shall not be construed as an agreement to extend the date that payment is due, nor as a waiver of any other right or remedy available to the Holder. Notwithstanding any provision of this Agreement to the contrary, the maximum rate of interest to be paid hereunder shall not exceed the maximum rate of interest permissible under applicable law. Any amount paid in excess of such rate shall be considered to have been payments in reduction of principal. 4. Interest on the Principal Balance shall be computed on the basis of a 360-day year and the actual days elapsed. In addition to interest on the Principal Balance as aforesaid, the Maker shall also pay (a) upon the request of the Holder in its discretion, all taxes assessed against the Holder on this Agreement or the debt evidenced hereby in respect of the Maker, except for income or other similar taxes on income derived by the Holder from this Agreement, and (b) all costs, attorneys’ and professionals’ fees incurred by Holder in respect of the Maker in (i) any action to collect this Agreement, or (ii) in any controversy relating to this Agreement.

5. Notwithstanding anything herein to the contrary, if the date on which any payment hereunder is due is a Saturday, Sunday or legal holiday, such payment will not be delinquent if paid on the first day following such payment date which is not a Saturday, Sunday or legal holiday. 6. Both principal and interest hereunder are payable in lawful money of the United States of America to the depositary bank of the Holder in the United States as designated by the Holder from time to time for deposit in the depositary account of the Holder, in immediately available funds no later than 2:00 p.m. (New York City time) on the date such payments are due. Each advance made by the Holder to the Maker and all payments made on account of principal hereof, shall be recorded by the Maker in the “Register” referred to below in Section 14 and, prior to any transfer hereof, endorsed on the grid attached hereto which is as part of this Agreement; provided, however, that the failure to make a notation of any advance under or payment on the grid attached to this Revolving Agreement or in the Register shall not limit or otherwise affect the respective obligations of the Maker hereunder. 7. If the Maker shall fail to make payment of principal or interest when due hereunder, the obligations evidenced by this Agreement shall, at the option of the Holder, and without notice or demand by the Holder, be immediately due and payable, and the Holder may pursue any and all other rights and remedies with respect to such Maker under this Agreement or any instrument related thereto and at law or in equity. 8. Any delay by Holder to exercise its rights and remedies hereunder, or partial exercise by Holder of such rights and remedies, shall not be construed as a waiver of any other right or remedy available to Holder. 9. This Agreement may be amended or modified, and any term of this Agreement may be waived, only by an agreement in writing signed by the Maker and the Holder and prior approval received from the New York Department of Financial Services. Whenever possible each provision of this Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement. 10. This Agreement may be freely assigned by the Holder, pursuant to the transfer provisions set forth in Section 14 hereof provided the New York State Department of Financial Services provides prior approval of such assignment. 11. The Maker and all others who may become liable for the payment of all or any part of this Agreement severally waive presentment and demand for payment, notice of dishonor, protest and notice of protest and nonpayment. 12. THIS AGREEMENT SHALL BE GOVERNED, CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK. 13. Notwithstanding anything to the contrary contained herein, this Agreement constitutes a general and unsecured obligation of the Maker. The Holder’s right to payment under this Agreement shall be senior in right of payment to the shareholders of the Maker and in the event of liquidation of the Maker, full payment from Maker hereunder shall be made before the holders of common or preferred stock shall become entitled to any distribution of the remaining assets of the Maker. 14. The Maker shall maintain or cause to be maintained a register (the “Register”) on which the Maker enters the name and address of the Holder as the registered owner of this Agreement, the principal

amount thereof and the stated interest thereon; provided, however, that the failure to make a notation of any advance under or payment in the Register shall not limit or otherwise affect the obligation of the Maker hereunder. The Maker hereby acknowledges and makes this Agreement a registered obligation for federal income tax purposes. This Agreement may be assigned or sold in whole or in part only by registration of such assignment or sale on the Register or by the surrender of this Agreement duly endorsed by (or accompanied by a written instrument of assignment or sale duly executed by) the Holder, whereupon one or more new registered Agreements in the same aggregate principal amount shall be issued to the designated assignee(s) or transferee(s). Upon its receipt of an assignment and acceptance agreement executed by the Holder and an assignee, the Maker shall record the information contained therein in the Register. Prior to the registration of assignment or sale of this Agreement, the Maker shall treat the person in whose name this Agreement is registered as the owner thereof for the purpose of receiving all payments thereon and for all other purposes, notwithstanding notice to the contrary. The Register shall be available for inspection by the Maker and the Holder, at any reasonable time and from time to time upon reasonable prior notice. This Agreement may not at any time be endorsed to bearer. The Maker shall also retain all relevant documentation of borrowings made, dates of borrowings, interest rates and interest paid, and any other documentation necessary for the annual submission to the Maker’s regulator described in Section 1 of this Agreement. 15. The address of the Holder for notices received hereunder shall be: Athene USA Corporation, 7700 Mills Civic Parkway, West Des Moines, IA 50266, telephone: (515)-342-5157, Attention: Tyler Goode, or such other office as may be notified to the Makers from time to time. 16. The address of the Maker for notices received hereunder shall be: Athene Annuity & Life Assurance Company of New York, 7700 Mills Civic Parkway, West Des Moines, IA 50266, telephone: (515)-342-2376, Attention: Blaine Doerrfeld, or such other office as may be notified to the Holder from time to time. 17. The Holder shall provide notice to the New York Department of Financial Services upon the termination of this Agreement. {Signature Page Follows}

The Maker have executed this Agreement on the day and year first written above. MAKER ATHENE ANNUITY & LIFE ASSURANCE COMPANY OF NEW YORK By: _________________________________________ Name: Blaine T. Doerrfeld Title: Senior Vice President, Senior Counsel & Secretary Accepted by HOLDER: ATHENE USA CORPORATION By: _________________________________ Tyler Goode, VP, Controller & Treasurer

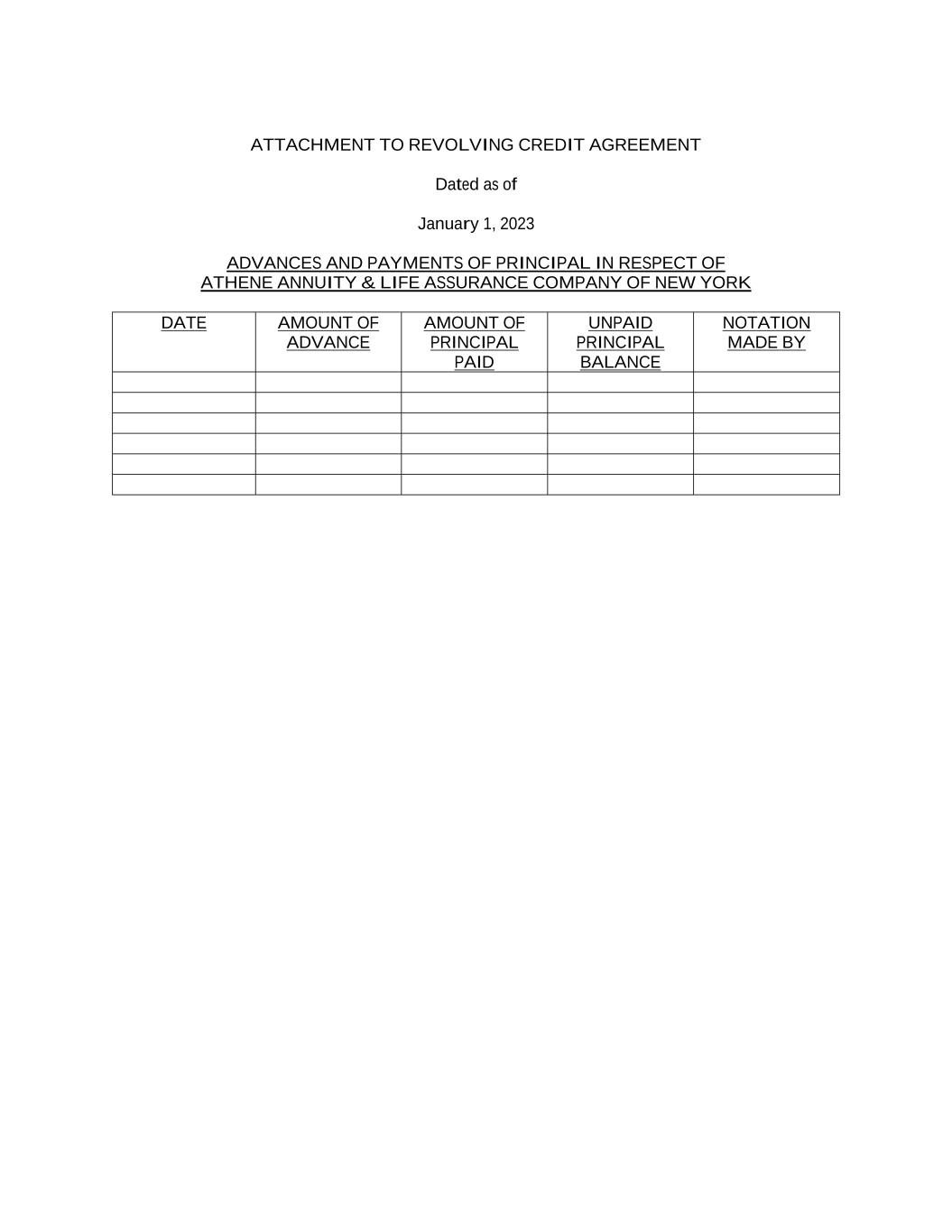

ATTACHMENT TO REVOLVING CREDIT AGREEMENT Dated as of January 1, 2023 ADVANCES AND PAYMENTS OF PRINCIPAL IN RESPECT OF ATHENE ANNUITY & LIFE ASSURANCE COMPANY OF NEW YORK DATE AMOUNT OF ADVANCE AMOUNT OF PRINCIPAL PAID UNPAID PRINCIPAL BALANCE NOTATION MADE BY