Financial Supplement Fourth Quarter 2025

This supplement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding the following: future financial and financing plans; strategies related to the Company's business and its portfolio, including acquisition opportunities and disposition plans; growth prospects, operating and financial performance, expectations regarding the making of distributions, payment of dividends, and the performance of our operators and their respective properties. Words such as “anticipate,” “believe,” “could,” "expect,” “estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,” “would,” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements, though not all forward-looking statements contain these identifying words. Our forward-looking statements are based on our current expectations and beliefs, and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying these forward-looking statements are reasonable, they are not guarantees and we can give no assurance that our expectations will be attained. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from expectations include, but are not limited to: (i) the ability of our tenants, managers, and borrowers to successfully operate our properties and to meet and/or perform their obligations under the agreements we have entered into with them, including without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (ii) the impact of unstable market and economic conditions;(iii) the impact of healthcare reform legislation, including reimbursement rates and potential minimum staffing level requirements, on the operating results and financial conditions of our tenants, managers, and borrowers; (iv) the consequences of bankruptcy, insolvency or financial deterioration of our tenants, managers and borrowers;(v) the ability and willingness of our tenants, managers and borrowers to renew their agreements with us, and our ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant or manager; (vi) the risk that we may have to incur additional impairment charges related to our assets held for sale if we are unable to sell such assets at the prices we expect; (vii) the impact of public health crises; (viii) the availability of and the ability to identify (a) tenants and managers who meet our credit and operating standards, and (b) suitable acquisition opportunities and the ability to acquire and lease the respective properties to such tenants and managers on favorable terms; (ix) the intended benefits of our acquisition of Care REIT plc (“Care REIT”) may not be realized, and the additional risks we will be subject to from our investment in Care REIT and any other international investments; (x) the additional operational and legal risks associated with our properties managed in a RIDEA structure; (xi) the impact of the unfavorable resolution of litigation or disputes and rising liability and insurance costs as a result thereof or other market factors; (xii) the ability to retain our key management personnel; (xiii) the ability to maintain our status as a real estate investment trust (“REIT”); (xiv) changes in the U.S. and U.K. tax law and other state, federal or local laws, whether or not specific to REITs; (xv) the ability to generate sufficient cash flows to service our outstanding indebtedness; (xvi) access to debt and equity capital markets; (xvii) fluctuating interest and currency rates; and (xviii) any additional factors included under Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2025, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission (the “SEC”). This supplement contains certain non-GAAP financial information relating to CareTrust REIT including EBITDA, Normalized EBITDA, FFO, Normalized FFO, FAD, Normalized FAD, and certain related ratios. Explanatory footnotes and a glossary explaining this non-GAAP information are included in this supplement. Reconciliations of these non-GAAP measures are also included in this supplement or on our website. See “Financials and Filings – Quarterly Results” on the Investors section of our website at investor.caretrustreit.com. Non-GAAP financial information does not represent financial performance under GAAP and should not be considered in isolation, as a measure of liquidity, as an alternative to net income, or as an indicator of any other performance measure determined in accordance with GAAP. You should not rely on non-GAAP financial information as a substitute for GAAP financial information, and should recognize that non-GAAP information presented herein may not compare to similarly-termed non-GAAP information of other companies (i.e., because they do not use the same definitions for determining any such non-GAAP information). This supplement also includes certain information regarding operators of our properties (such as EBITDARM Coverage, EBITDAR Coverage, and Occupancy), most of which are not subject to audit or SEC reporting requirements. The operator information provided in this supplement has been provided by the operators. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. We are providing this information for informational purposes only. The Ensign Group, Inc. ("Ensign"), The Pennant Group, Inc. ("Pennant") and PACS Group, Inc. ("PACS") are subject to the registration and reporting requirements of the SEC and are required to file with the SEC annual reports containing audited financial information and quarterly reports containing unaudited financial information. Ensign’s, Pennant's and PACS' financial statements, as filed with the SEC, can be found at the SEC's website at www.sec.gov. This supplement provides information about our financial results as of and for the quarter ended December 31, 2025 and is provided as of the date hereof, unless specifically stated otherwise. We expressly disclaim any obligation to update or revise any information in this supplement (including forward-looking statements), whether to reflect any change in our expectations, any change in events, conditions or circumstances, or otherwise. As used in this supplement, unless the context requires otherwise, references to “CTRE,” “CareTrust,” “CareTrust REIT” or the “Company” refer to CareTrust REIT, Inc. and its consolidated subsidiaries. GAAP refers to generally accepted accounting principles in the United States of America. Disclaimers 2

Table of Contents CONTACT INFORMATION CareTrust REIT, Inc. 24901 Dana Point Harbor Dr, Suite A200 Dana Point, CA 92629 (949) 542-3130 ir@caretrustreit.com www.caretrustreit.com Transfer Agent Broadridge Corporate Issuer Solutions 51 Mercedes Way Edgewood, NY 11717 (800) 733-1121 shareholder@broadridge.com COMPANY SNAPSHOT 04 INVESTMENTS 05 PORTFOLIO OVERVIEW 07 Net-Leased Rent Coverage Rent Diversification Revenue Maturity & Purchase Options on Net-Leased Assets FINANCIAL OVERVIEW 10 Debt Summary Key Debt Metrics Capital Market Transactions Guidance APPENDIX 14 Consolidated Income Statements Reconciliations of EBITDA, FFO and FAD Consolidated Balance Sheets Enterprise Value Property Detail GLOSSARY 22 EXECUTIVE OFFICERS Dave Sedgwick, Chief Executive Officer Derek Bunker, Chief Financial Officer James Callister, Chief Investment Officer Lauren Beale, Chief Accounting Officer BOARD MEMBERS Diana Laing, Board Chair Dave Sedgwick Spencer Plumb Anne Olson Careina Williams Greg Stapley 3

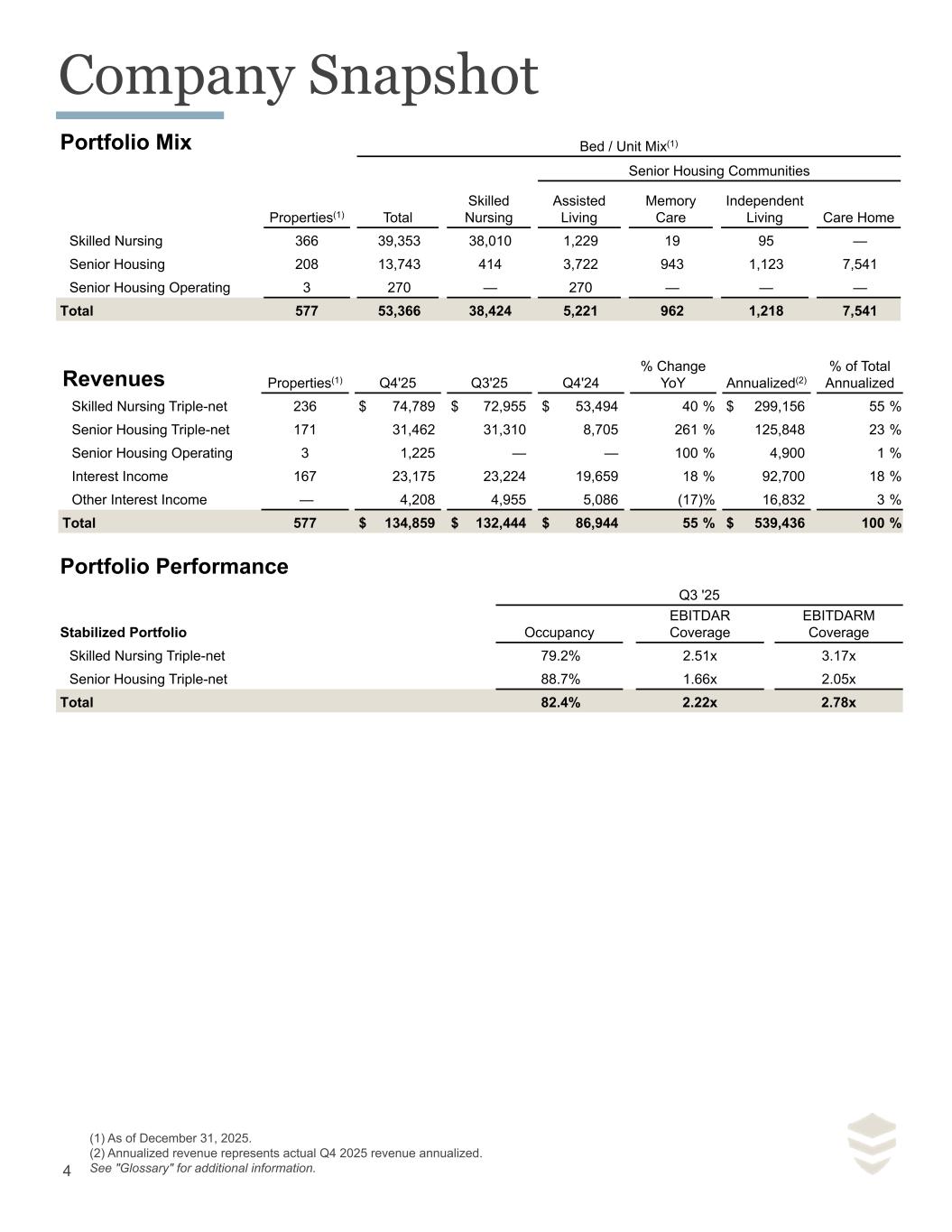

Company Snapshot Portfolio Mix Bed / Unit Mix(1) Senior Housing Communities Properties(1) Total Skilled Nursing Assisted Living Memory Care Independent Living Care Home Skilled Nursing 366 39,353 38,010 1,229 19 95 — Senior Housing 208 13,743 414 3,722 943 1,123 7,541 Senior Housing Operating 3 270 — 270 — — — Total 577 53,366 38,424 5,221 962 1,218 7,541 Revenues Properties(1) Q4'25 Q3'25 Q4'24 % Change YoY Annualized(2) % of Total Annualized Skilled Nursing Triple-net 236 $ 74,789 $ 72,955 $ 53,494 40 % $ 299,156 55 % Senior Housing Triple-net 171 31,462 31,310 8,705 261 % 125,848 23 % Senior Housing Operating 3 1,225 — — 100 % 4,900 1 % Interest Income 167 23,175 23,224 19,659 18 % 92,700 18 % Other Interest Income — 4,208 4,955 5,086 (17) % 16,832 3 % Total 577 $ 134,859 $ 132,444 $ 86,944 55 % $ 539,436 100 % 4 (1) As of December 31, 2025. (2) Annualized revenue represents actual Q4 2025 revenue annualized. See "Glossary" for additional information. Portfolio Performance Q3 '25 Stabilized Portfolio Occupancy EBITDAR Coverage EBITDARM Coverage Skilled Nursing Triple-net 79.2% 2.51x 3.17x Senior Housing Triple-net 88.7% 1.66x 2.05x Total 82.4% 2.22x 2.78x

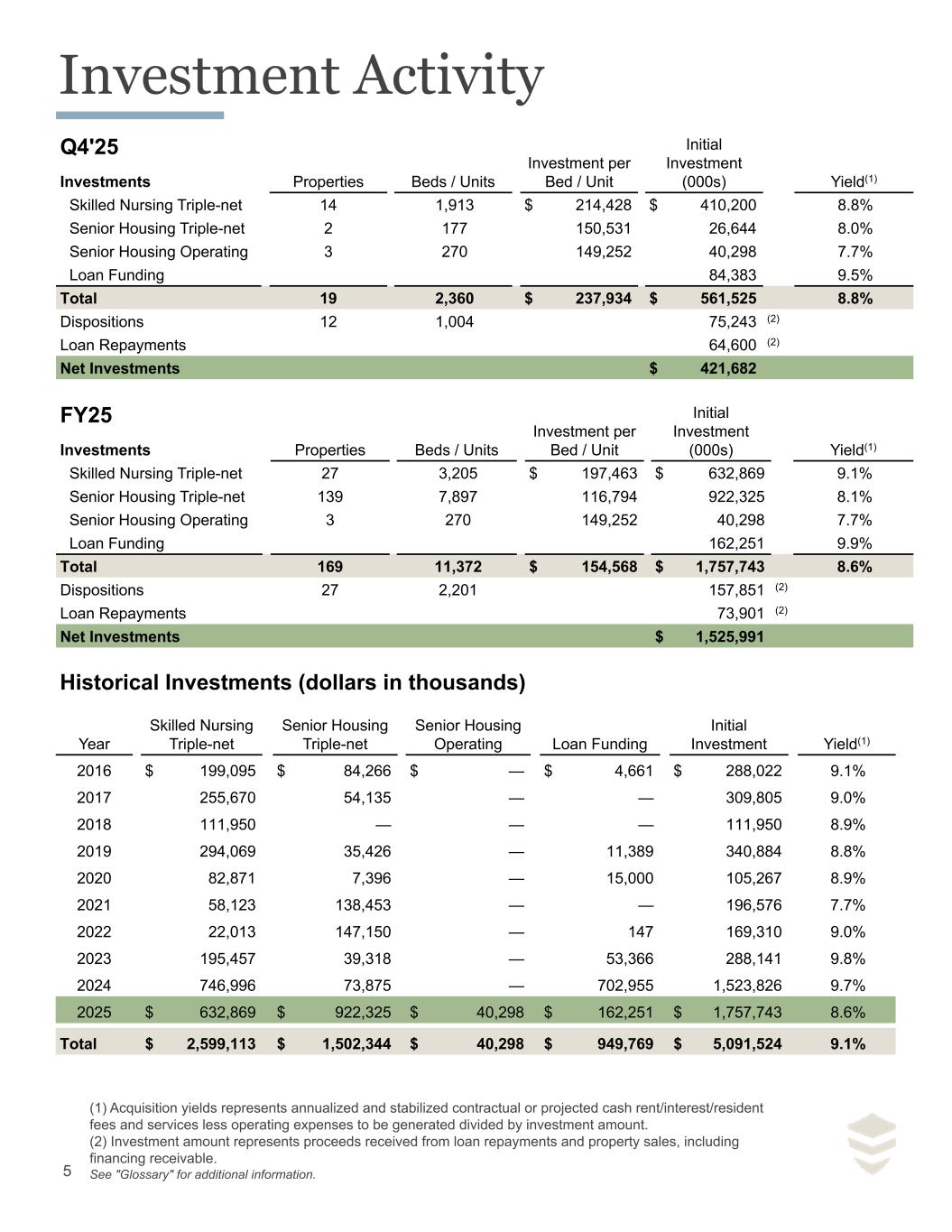

Investment Activity Q4'25 Investment per Bed / Unit Initial Investment (000s)Investments Properties Beds / Units Yield(1) Skilled Nursing Triple-net 14 1,913 $ 214,428 $ 410,200 8.8% Senior Housing Triple-net 2 177 150,531 26,644 8.0% Senior Housing Operating 3 270 149,252 40,298 7.7% Loan Funding 84,383 9.5% Total 19 2,360 $ 237,934 $ 561,525 8.8% Dispositions 12 1,004 75,243 (2) Loan Repayments 64,600 (2) Net Investments $ 421,682 Historical Investments (dollars in thousands) Year Skilled Nursing Triple-net Senior Housing Triple-net Senior Housing Operating Loan Funding Initial Investment Yield(1) 2016 $ 199,095 $ 84,266 $ — $ 4,661 $ 288,022 9.1% 2017 255,670 54,135 — — 309,805 9.0% 2018 111,950 — — — 111,950 8.9% 2019 294,069 35,426 — 11,389 340,884 8.8% 2020 82,871 7,396 — 15,000 105,267 8.9% 2021 58,123 138,453 — — 196,576 7.7% 2022 22,013 147,150 — 147 169,310 9.0% 2023 195,457 39,318 — 53,366 288,141 9.8% 2024 746,996 73,875 — 702,955 1,523,826 9.7% 2025 $ 632,869 $ 922,325 $ 40,298 $ 162,251 $ 1,757,743 8.6% Total $ 2,599,113 $ 1,502,344 $ 40,298 $ 949,769 $ 5,091,524 9.1% FY25 Investment per Bed / Unit Initial Investment (000s)Investments Properties Beds / Units Yield(1) Skilled Nursing Triple-net 27 3,205 $ 197,463 $ 632,869 9.1% Senior Housing Triple-net 139 7,897 116,794 922,325 8.1% Senior Housing Operating 3 270 149,252 40,298 7.7% Loan Funding 162,251 9.9% Total 169 11,372 $ 154,568 $ 1,757,743 8.6% Dispositions 27 2,201 157,851 (2) Loan Repayments 73,901 (2) Net Investments $ 1,525,991 5 (1) Acquisition yields represents annualized and stabilized contractual or projected cash rent/interest/resident fees and services less operating expenses to be generated divided by investment amount. (2) Investment amount represents proceeds received from loan repayments and property sales, including financing receivable. See "Glossary" for additional information.

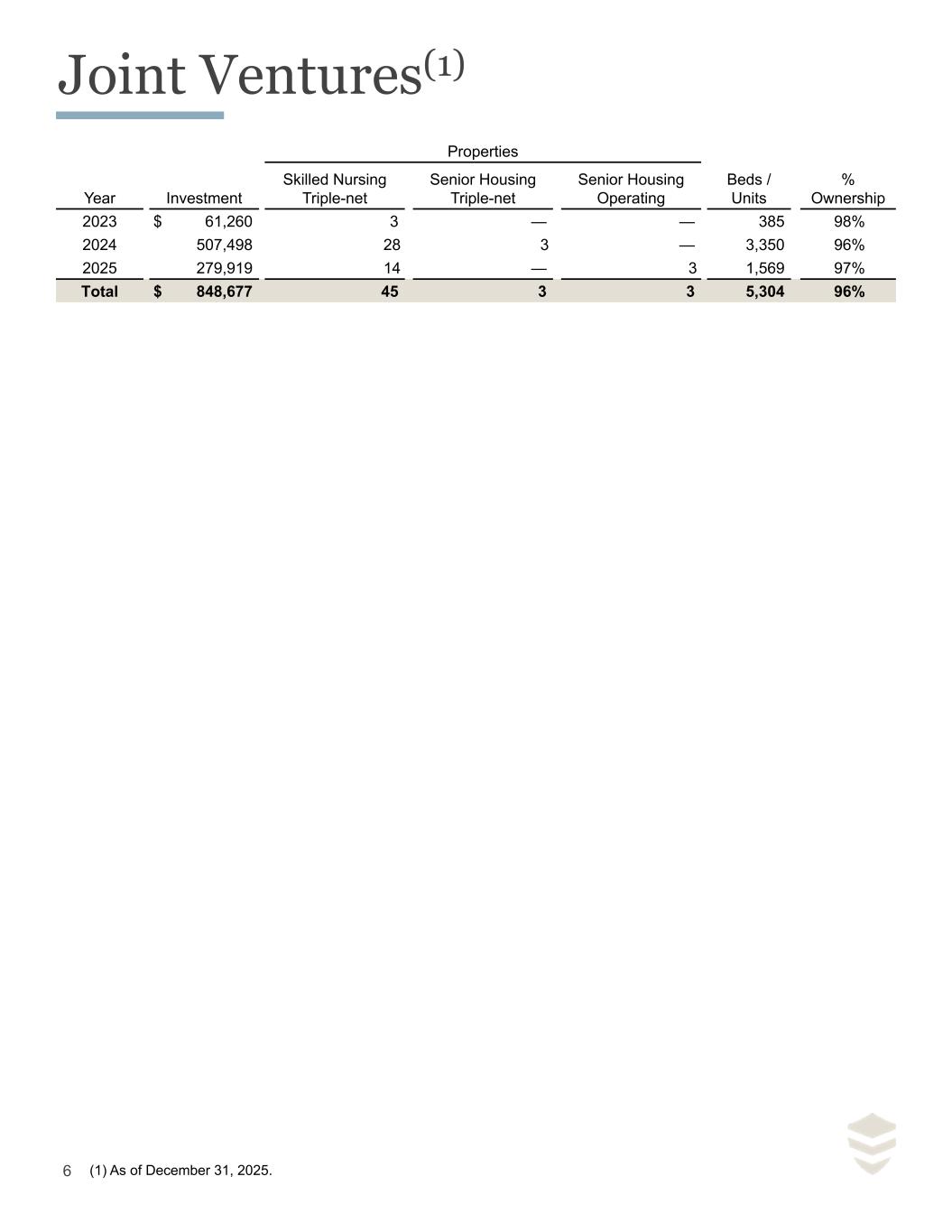

Joint Ventures(1) 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 Properties Year Investment Skilled Nursing Triple-net Senior Housing Triple-net Senior Housing Operating Beds / Units % Ownership 2023 $ 61,260 3 — — 385 98% 2024 507,498 28 3 — 3,350 96% 2025 279,919 14 — 3 1,569 97% Total $ 848,677 45 3 3 5,304 96% 6 (1) As of December 31, 2025.

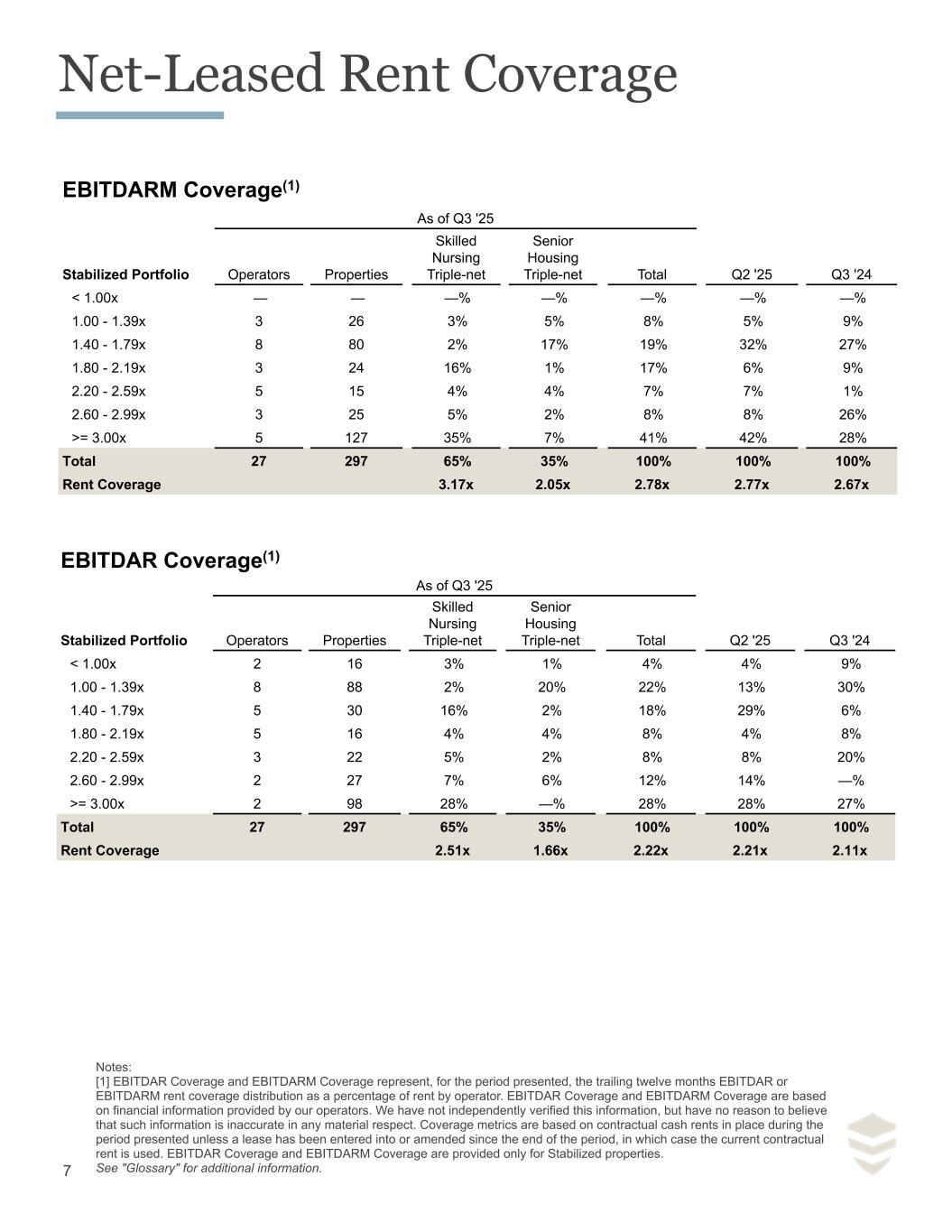

Net-Leased Rent Coverage 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 7 EBITDARM Coverage(1) As of Q3 '25 Stabilized Portfolio Operators Properties Skilled Nursing Triple-net Senior Housing Triple-net Total Q2 '25 Q3 '24 < 1.00x — — —% —% —% —% —% 1.00 - 1.39x 3 26 3% 5% 8% 5% 9% 1.40 - 1.79x 8 80 2% 17% 19% 32% 27% 1.80 - 2.19x 3 24 16% 1% 17% 6% 9% 2.20 - 2.59x 5 15 4% 4% 7% 7% 1% 2.60 - 2.99x 3 25 5% 2% 8% 8% 26% >= 3.00x 5 127 35% 7% 41% 42% 28% Total 27 297 65% 35% 100% 100% 100% Rent Coverage 3.17x 2.05x 2.78x 2.77x 2.67x EBITDAR Coverage(1) As of Q3 '25 Stabilized Portfolio Operators Properties Skilled Nursing Triple-net Senior Housing Triple-net Total Q2 '25 Q3 '24 < 1.00x 2 16 3% 1% 4% 4% 9% 1.00 - 1.39x 8 88 2% 20% 22% 13% 30% 1.40 - 1.79x 5 30 16% 2% 18% 29% 6% 1.80 - 2.19x 5 16 4% 4% 8% 4% 8% 2.20 - 2.59x 3 22 5% 2% 8% 8% 20% 2.60 - 2.99x 2 27 7% 6% 12% 14% —% >= 3.00x 2 98 28% —% 28% 28% 27% Total 27 297 65% 35% 100% 100% 100% Rent Coverage 2.51x 1.66x 2.22x 2.21x 2.11x Notes: [1] EBITDAR Coverage and EBITDARM Coverage represent, for the period presented, the trailing twelve months EBITDAR or EBITDARM rent coverage distribution as a percentage of rent by operator. EBITDAR Coverage and EBITDARM Coverage are based on financial information provided by our operators. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. Coverage metrics are based on contractual cash rents in place during the period presented unless a lease has been entered into or amended since the end of the period, in which case the current contractual rent is used. EBITDAR Coverage and EBITDARM Coverage are provided only for Stabilized properties. See "Glossary" for additional information.

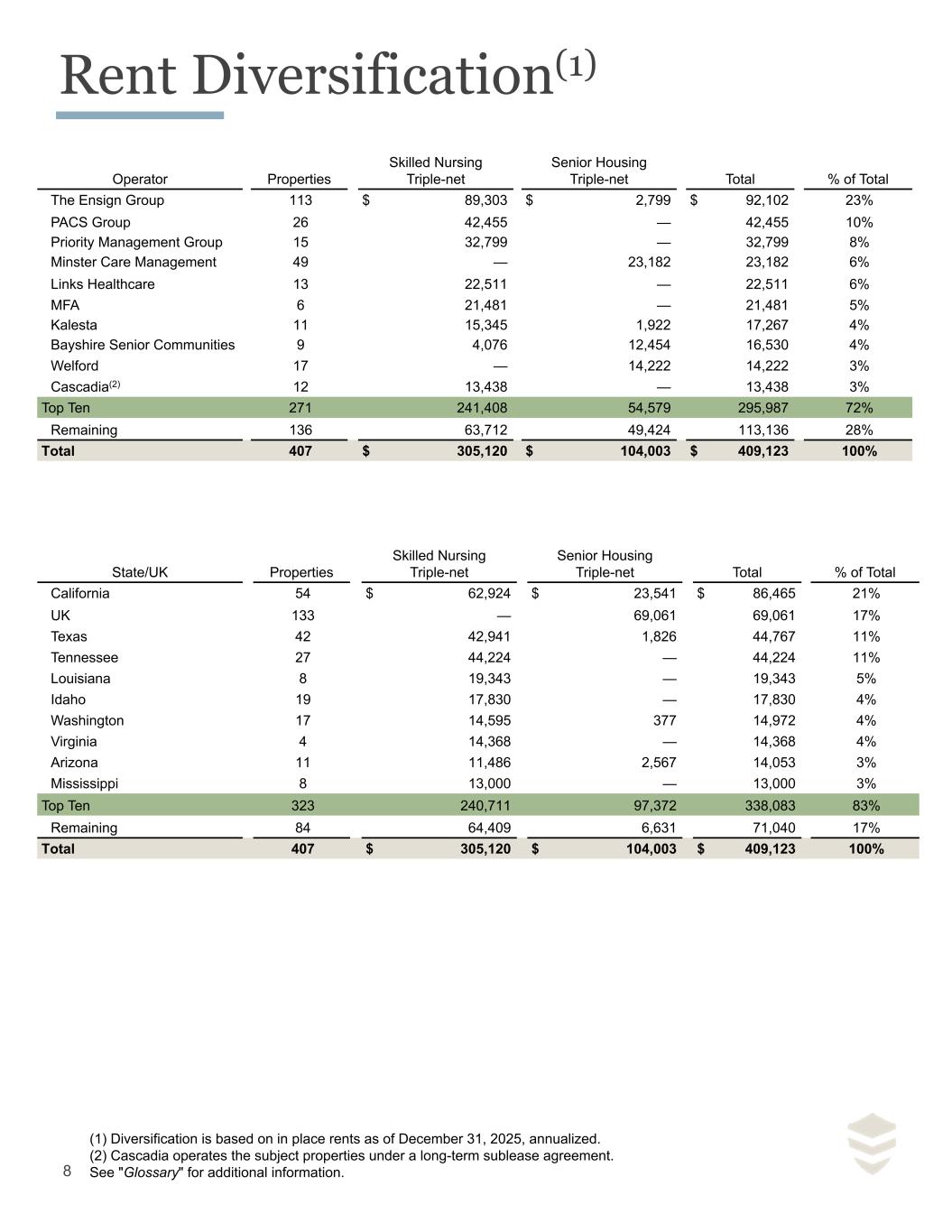

Rent Diversification(1) Operator Properties Skilled Nursing Triple-net Senior Housing Triple-net Total % of Total The Ensign Group 113 $ 89,303 $ 2,799 $ 92,102 23% PACS Group 26 42,455 — 42,455 10% Priority Management Group 15 32,799 — 32,799 8% Minster Care Management 49 — 23,182 23,182 6% Links Healthcare 13 22,511 — 22,511 6% MFA 6 21,481 — 21,481 5% Kalesta 11 15,345 1,922 17,267 4% Bayshire Senior Communities 9 4,076 12,454 16,530 4% Welford 17 — 14,222 14,222 3% Cascadia(2) 12 13,438 — 13,438 3% Top Ten 271 241,408 54,579 295,987 72% Remaining 136 63,712 49,424 113,136 28% Total 407 $ 305,120 $ 104,003 $ 409,123 100% State/UK Properties Skilled Nursing Triple-net Senior Housing Triple-net Total % of Total California 54 $ 62,924 $ 23,541 $ 86,465 21% UK 133 — 69,061 69,061 17% Texas 42 42,941 1,826 44,767 11% Tennessee 27 44,224 — 44,224 11% Louisiana 8 19,343 — 19,343 5% Idaho 19 17,830 — 17,830 4% Washington 17 14,595 377 14,972 4% Virginia 4 14,368 — 14,368 4% Arizona 11 11,486 2,567 14,053 3% Mississippi 8 13,000 — 13,000 3% Top Ten 323 240,711 97,372 338,083 83% Remaining 84 64,409 6,631 71,040 17% Total 407 $ 305,120 $ 104,003 $ 409,123 100% 8 (1) Diversification is based on in place rents as of December 31, 2025, annualized. (2) Cascadia operates the subject properties under a long-term sublease agreement. See "Glossary" for additional information.

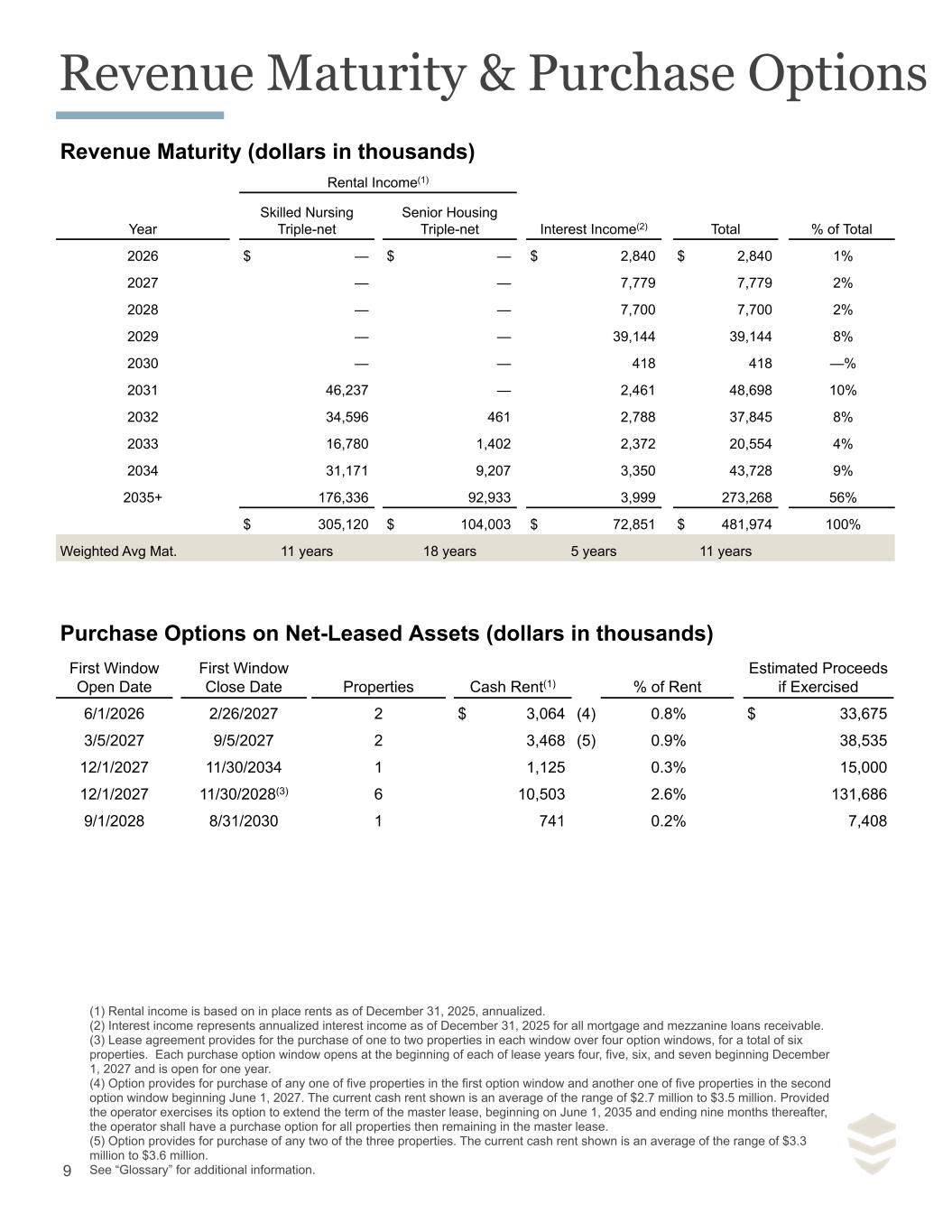

Revenue Maturity & Purchase Options 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 Revenue Maturity (dollars in thousands) Rental Income(1) Interest Income(2) TotalYear Skilled Nursing Triple-net Senior Housing Triple-net % of Total 2026 $ — $ — $ 2,840 $ 2,840 1% 2027 — — 7,779 7,779 2% 2028 — — 7,700 7,700 2% 2029 — — 39,144 39,144 8% 2030 — — 418 418 —% 2031 46,237 — 2,461 48,698 10% 2032 34,596 461 2,788 37,845 8% 2033 16,780 1,402 2,372 20,554 4% 2034 31,171 9,207 3,350 43,728 9% 2035+ 176,336 92,933 3,999 273,268 56% $ 305,120 $ 104,003 $ 72,851 $ 481,974 100% Weighted Avg Mat. 11 years 18 years 5 years 11 years Purchase Options on Net-Leased Assets (dollars in thousands) First Window Open Date First Window Close Date Properties Cash Rent(1) % of Rent Estimated Proceeds if Exercised 6/1/2026 2/26/2027 2 $ 3,064 (4) 0.8% $ 33,675 3/5/2027 9/5/2027 2 3,468 (5) 0.9% 38,535 12/1/2027 11/30/2034 1 1,125 0.3% 15,000 12/1/2027 11/30/2028(3) 6 10,503 2.6% 131,686 9/1/2028 8/31/2030 1 741 0.2% 7,408 9 (1) Rental income is based on in place rents as of December 31, 2025, annualized. (2) Interest income represents annualized interest income as of December 31, 2025 for all mortgage and mezzanine loans receivable. (3) Lease agreement provides for the purchase of one to two properties in each window over four option windows, for a total of six properties. Each purchase option window opens at the beginning of each of lease years four, five, six, and seven beginning December 1, 2027 and is open for one year. (4) Option provides for purchase of any one of five properties in the first option window and another one of five properties in the second option window beginning June 1, 2027. The current cash rent shown is an average of the range of $2.7 million to $3.5 million. Provided the operator exercises its option to extend the term of the master lease, beginning on June 1, 2035 and ending nine months thereafter, the operator shall have a purchase option for all properties then remaining in the master lease. (5) Option provides for purchase of any two of the three properties. The current cash rent shown is an average of the range of $3.3 million to $3.6 million. See “Glossary” for additional information.

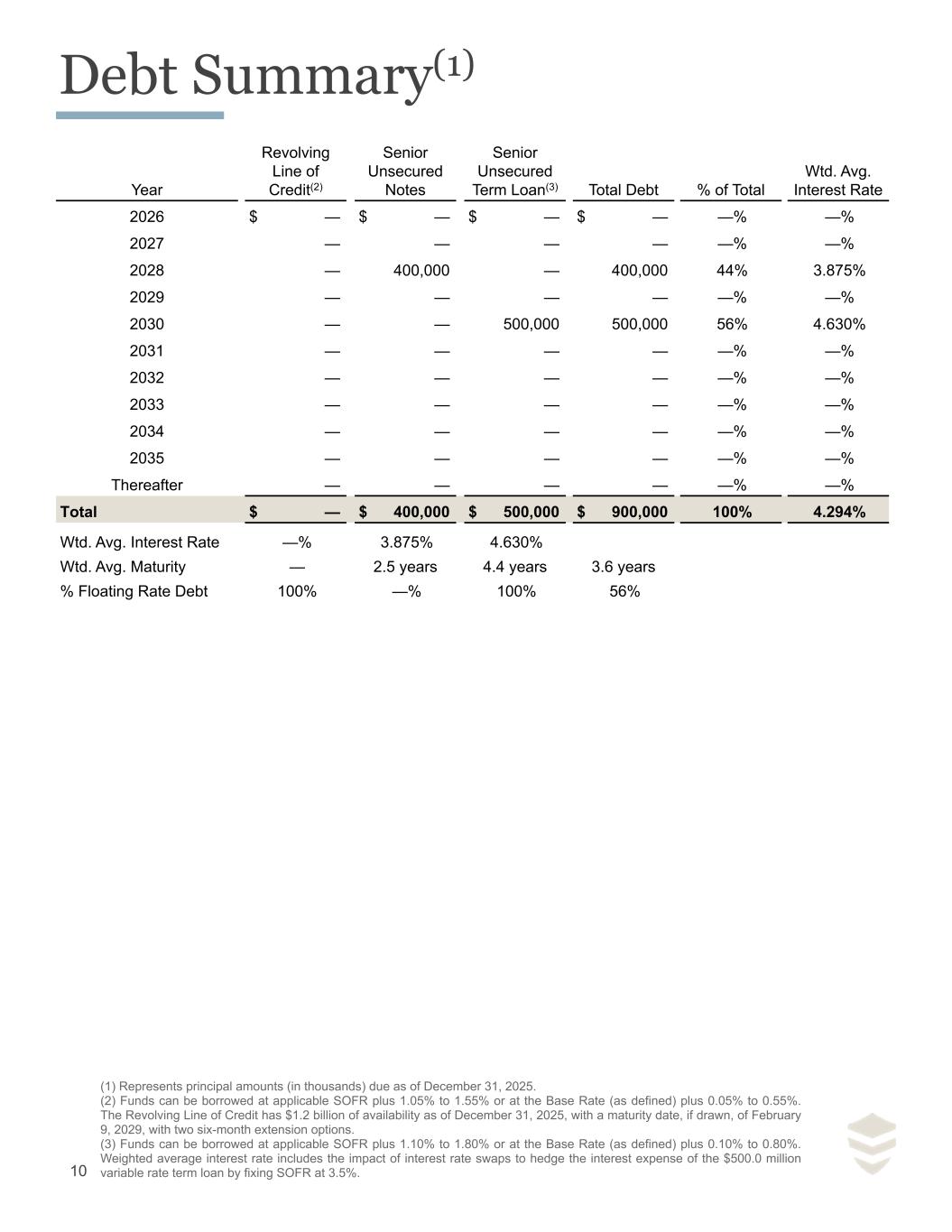

Debt Summary(1) Year Revolving Line of Credit(2) Senior Unsecured Notes Senior Unsecured Term Loan(3) Total Debt % of Total Wtd. Avg. Interest Rate 2026 $ — $ — $ — $ — —% —% 2027 — — — — —% —% 2028 — 400,000 — 400,000 44% 3.875% 2029 — — — — —% —% 2030 — — 500,000 500,000 56% 4.630% 2031 — — — — —% —% 2032 — — — — —% —% 2033 — — — — —% —% 2034 — — — — —% —% 2035 — — — — —% —% Thereafter — — — — —% —% Total $ — $ 400,000 $ 500,000 $ 900,000 100% 4.294% Wtd. Avg. Interest Rate —% 3.875% 4.630% Wtd. Avg. Maturity — 2.5 years 4.4 years 3.6 years % Floating Rate Debt 100% —% 100% 56% 10 (1) Represents principal amounts (in thousands) due as of December 31, 2025. (2) Funds can be borrowed at applicable SOFR plus 1.05% to 1.55% or at the Base Rate (as defined) plus 0.05% to 0.55%. The Revolving Line of Credit has $1.2 billion of availability as of December 31, 2025, with a maturity date, if drawn, of February 9, 2029, with two six-month extension options. (3) Funds can be borrowed at applicable SOFR plus 1.10% to 1.80% or at the Base Rate (as defined) plus 0.10% to 0.80%. Weighted average interest rate includes the impact of interest rate swaps to hedge the interest expense of the $500.0 million variable rate term loan by fixing SOFR at 3.5%.

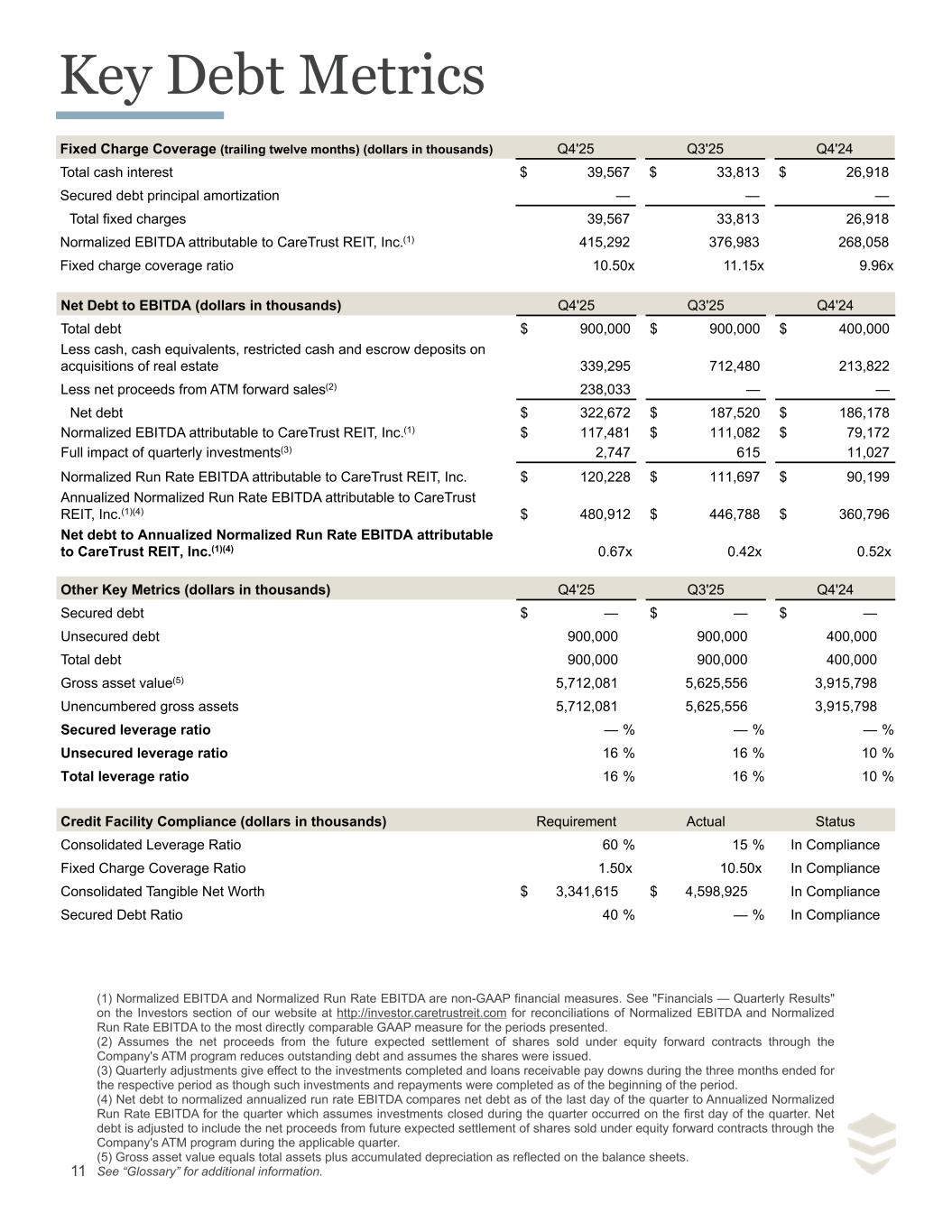

Key Debt Metrics 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 Fixed Charge Coverage (trailing twelve months) (dollars in thousands) Q4'25 Q3'25 Q4'24 Total cash interest $ 39,567 $ 33,813 $ 26,918 Secured debt principal amortization — — — Total fixed charges 39,567 33,813 26,918 Normalized EBITDA attributable to CareTrust REIT, Inc.(1) 415,292 376,983 268,058 Fixed charge coverage ratio 10.50x 11.15x 9.96x Net Debt to EBITDA (dollars in thousands) Q4'25 Q3'25 Q4'24 Total debt $ 900,000 $ 900,000 $ 400,000 Less cash, cash equivalents, restricted cash and escrow deposits on acquisitions of real estate 339,295 712,480 213,822 Less net proceeds from ATM forward sales(2) 238,033 — — Net debt $ 322,672 $ 187,520 $ 186,178 Normalized EBITDA attributable to CareTrust REIT, Inc.(1) $ 117,481 $ 111,082 $ 79,172 Full impact of quarterly investments(3) 2,747 615 11,027 Normalized Run Rate EBITDA attributable to CareTrust REIT, Inc. $ 120,228 $ 111,697 $ 90,199 Annualized Normalized Run Rate EBITDA attributable to CareTrust REIT, Inc.(1)(4) $ 480,912 $ 446,788 $ 360,796 Net debt to Annualized Normalized Run Rate EBITDA attributable to CareTrust REIT, Inc.(1)(4) 0.67x 0.42x 0.52x Other Key Metrics (dollars in thousands) Q4'25 Q3'25 Q4'24 Secured debt $ — $ — $ — Unsecured debt 900,000 900,000 400,000 Total debt 900,000 900,000 400,000 Gross asset value(5) 5,712,081 5,625,556 3,915,798 Unencumbered gross assets 5,712,081 5,625,556 3,915,798 Secured leverage ratio — % — % — % Unsecured leverage ratio 16 % 16 % 10 % Total leverage ratio 16 % 16 % 10 % Credit Facility Compliance (dollars in thousands) Requirement Actual Status Consolidated Leverage Ratio 60 % 15 % In Compliance Fixed Charge Coverage Ratio 1.50x 10.50x In Compliance Consolidated Tangible Net Worth $ 3,341,615 $ 4,598,925 In Compliance Secured Debt Ratio 40 % — % In Compliance 11 (1) Normalized EBITDA and Normalized Run Rate EBITDA are non-GAAP financial measures. See "Financials — Quarterly Results" on the Investors section of our website at http://investor.caretrustreit.com for reconciliations of Normalized EBITDA and Normalized Run Rate EBITDA to the most directly comparable GAAP measure for the periods presented. (2) Assumes the net proceeds from the future expected settlement of shares sold under equity forward contracts through the Company's ATM program reduces outstanding debt and assumes the shares were issued. (3) Quarterly adjustments give effect to the investments completed and loans receivable pay downs during the three months ended for the respective period as though such investments and repayments were completed as of the beginning of the period. (4) Net debt to normalized annualized run rate EBITDA compares net debt as of the last day of the quarter to Annualized Normalized Run Rate EBITDA for the quarter which assumes investments closed during the quarter occurred on the first day of the quarter. Net debt is adjusted to include the net proceeds from future expected settlement of shares sold under equity forward contracts through the Company's ATM program during the applicable quarter. (5) Gross asset value equals total assets plus accumulated depreciation as reflected on the balance sheets. See “Glossary” for additional information.

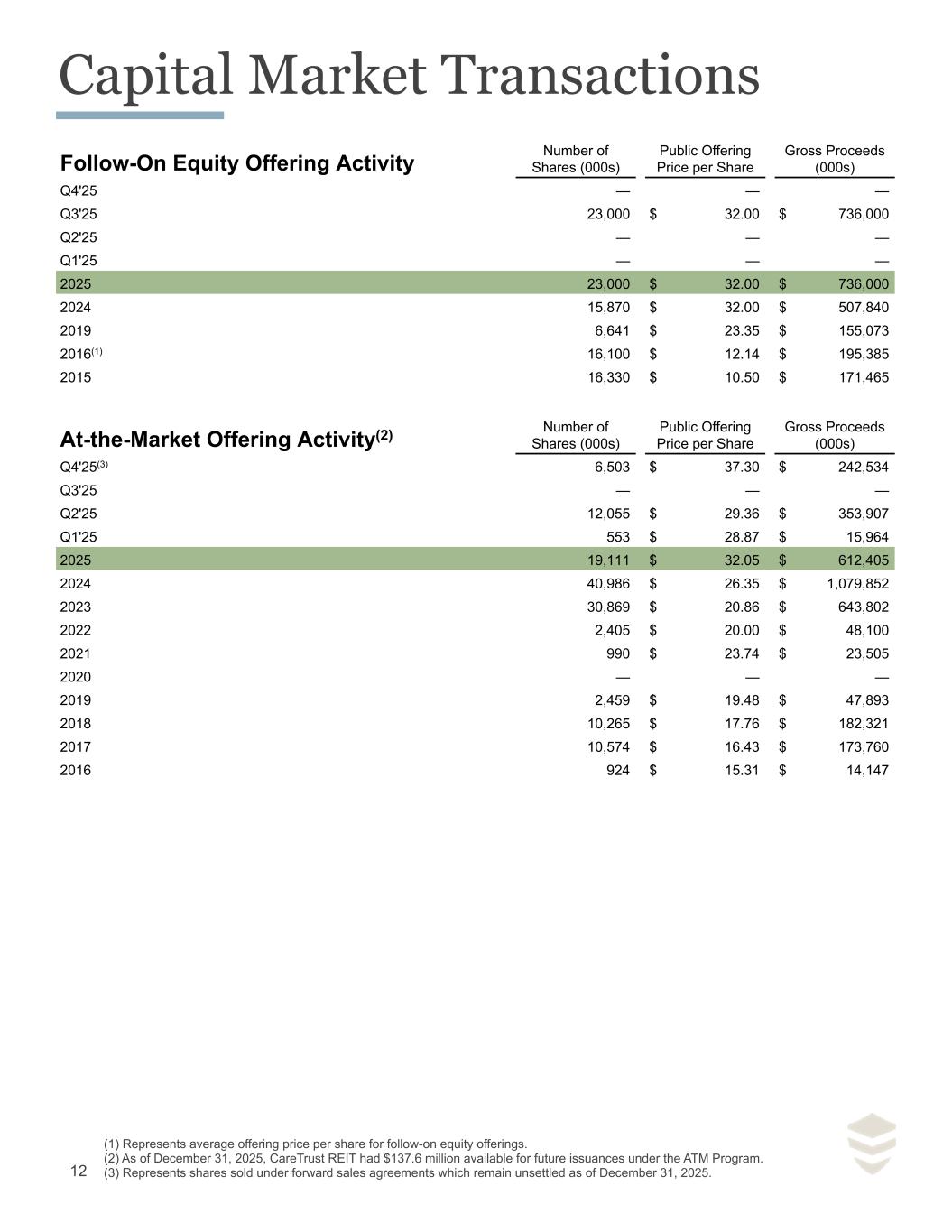

Capital Market Transactions Follow-On Equity Offering Activity Number of Shares (000s) Public Offering Price per Share Gross Proceeds (000s) Q4'25 — — — Q3'25 23,000 $ 32.00 $ 736,000 Q2'25 — — — Q1'25 — — — 2025 23,000 $ 32.00 $ 736,000 2024 15,870 $ 32.00 $ 507,840 2019 6,641 $ 23.35 $ 155,073 2016(1) 16,100 $ 12.14 $ 195,385 2015 16,330 $ 10.50 $ 171,465 12 At-the-Market Offering Activity(2) Number of Shares (000s) Public Offering Price per Share Gross Proceeds (000s) Q4'25(3) 6,503 $ 37.30 $ 242,534 Q3'25 — — — Q2'25 12,055 $ 29.36 $ 353,907 Q1'25 553 $ 28.87 $ 15,964 2025 19,111 $ 32.05 $ 612,405 2024 40,986 $ 26.35 $ 1,079,852 2023 30,869 $ 20.86 $ 643,802 2022 2,405 $ 20.00 $ 48,100 2021 990 $ 23.74 $ 23,505 2020 — — — 2019 2,459 $ 19.48 $ 47,893 2018 10,265 $ 17.76 $ 182,321 2017 10,574 $ 16.43 $ 173,760 2016 924 $ 15.31 $ 14,147 (1) Represents average offering price per share for follow-on equity offerings. (2) As of December 31, 2025, CareTrust REIT had $137.6 million available for future issuances under the ATM Program. (3) Represents shares sold under forward sales agreements which remain unsettled as of December 31, 2025.

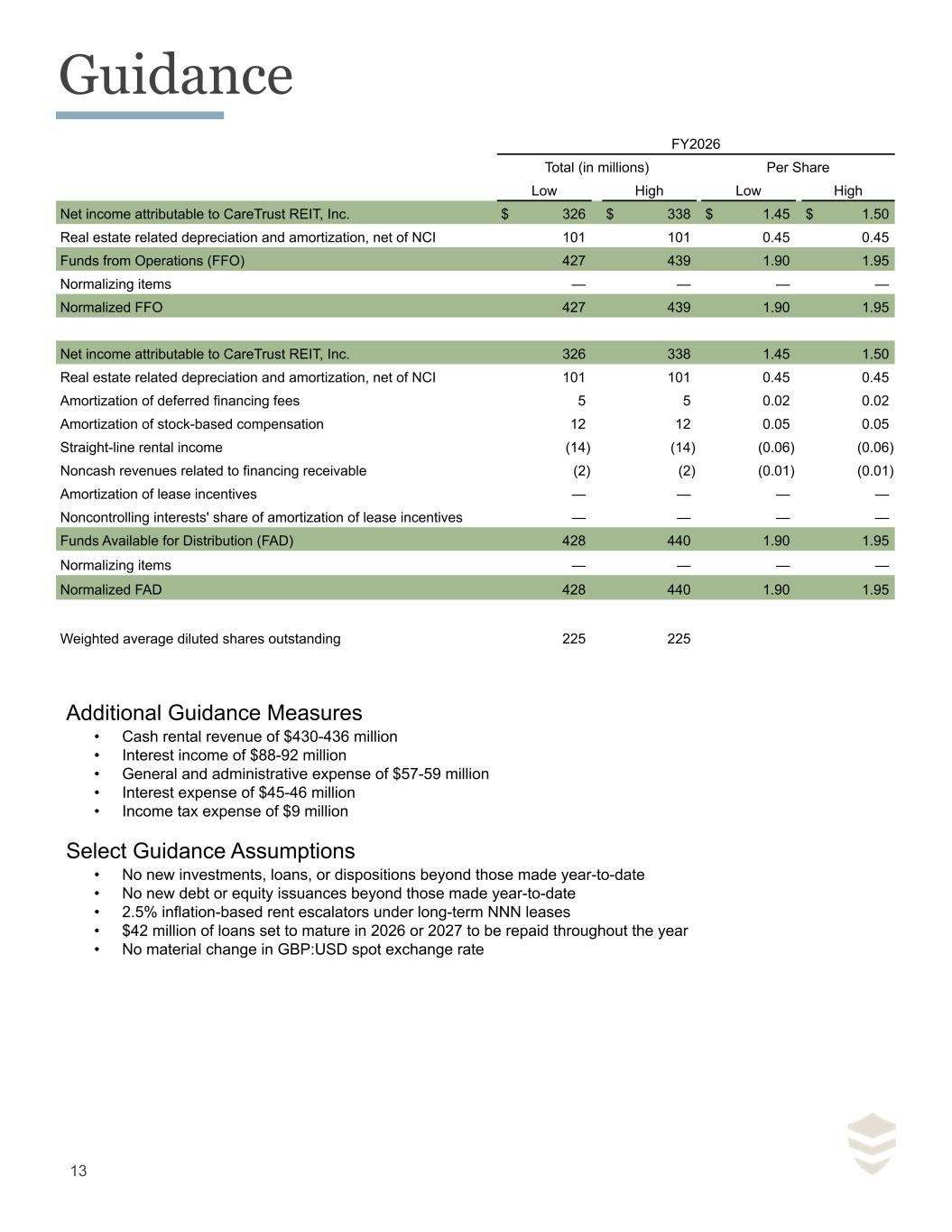

Guidance FY2026 Total (in millions) Per Share Low High Low High Net income attributable to CareTrust REIT, Inc. $ 326 $ 338 $ 1.45 $ 1.50 Real estate related depreciation and amortization, net of NCI 101 101 0.45 0.45 Funds from Operations (FFO) 427 439 1.90 1.95 Normalizing items — — — — Normalized FFO 427 439 1.90 1.95 Net income attributable to CareTrust REIT, Inc. 326 338 1.45 1.50 Real estate related depreciation and amortization, net of NCI 101 101 0.45 0.45 Amortization of deferred financing fees 5 5 0.02 0.02 Amortization of stock-based compensation 12 12 0.05 0.05 Straight-line rental income (14) (14) (0.06) (0.06) Noncash revenues related to financing receivable (2) (2) (0.01) (0.01) Amortization of lease incentives — — — — Noncontrolling interests' share of amortization of lease incentives — — — — Funds Available for Distribution (FAD) 428 440 1.90 1.95 Normalizing items — — — — Normalized FAD 428 440 1.90 1.95 Weighted average diluted shares outstanding 225 225 13 Additional Guidance Measures • Cash rental revenue of $430-436 million • Interest income of $88-92 million • General and administrative expense of $57-59 million • Interest expense of $45-46 million • Income tax expense of $9 million Select Guidance Assumptions • No new investments, loans, or dispositions beyond those made year-to-date • No new debt or equity issuances beyond those made year-to-date • 2.5% inflation-based rent escalators under long-term NNN leases • $42 million of loans set to mature in 2026 or 2027 to be repaid throughout the year • No material change in GBP:USD spot exchange rate

Appendix

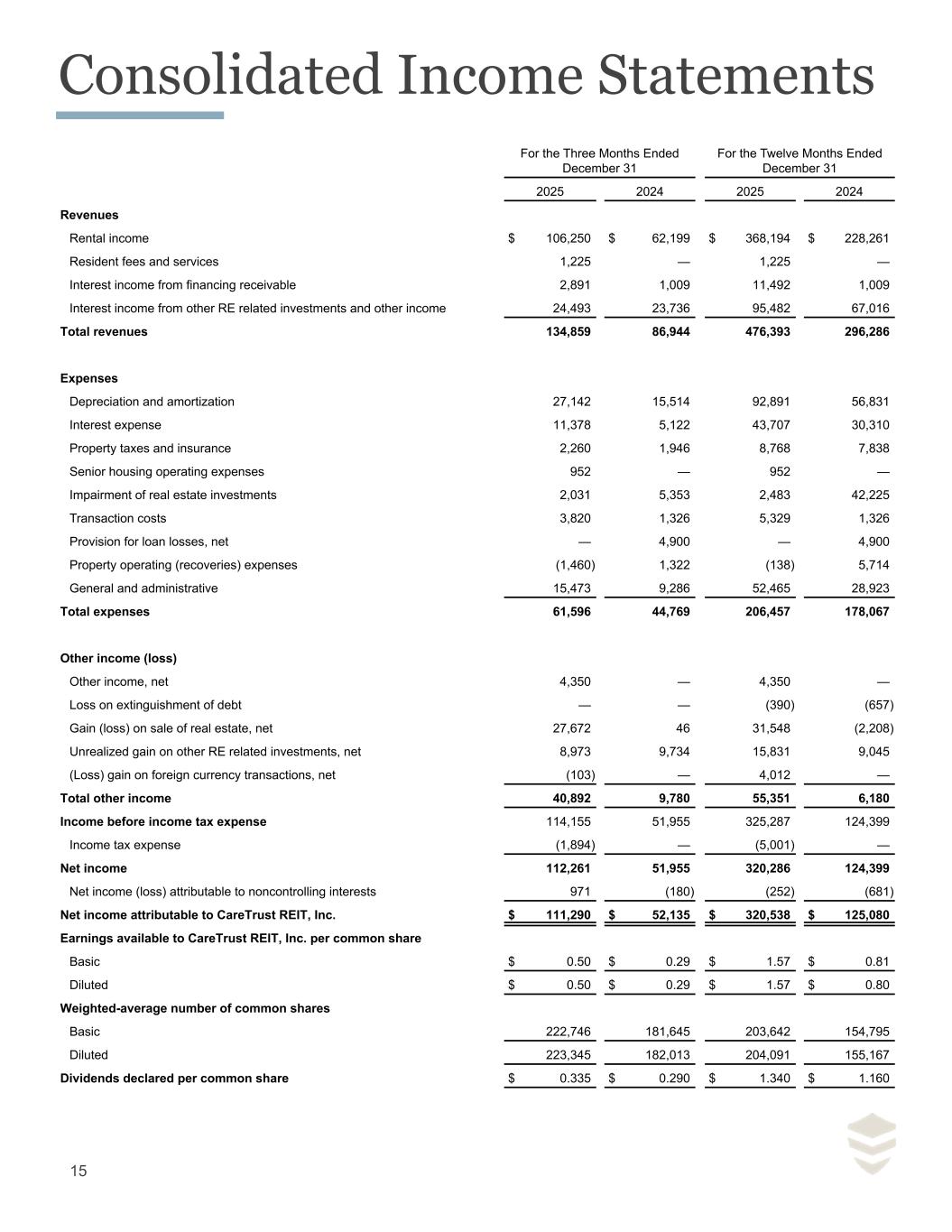

Consolidated Income Statements 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 For the Three Months Ended December 31 For the Twelve Months Ended December 31 2025 2024 2025 2024 Revenues Rental income $ 106,250 $ 62,199 $ 368,194 $ 228,261 Resident fees and services 1,225 — 1,225 — Interest income from financing receivable 2,891 1,009 11,492 1,009 Interest income from other RE related investments and other income 24,493 23,736 95,482 67,016 Total revenues 134,859 86,944 476,393 296,286 Expenses Depreciation and amortization 27,142 15,514 92,891 56,831 Interest expense 11,378 5,122 43,707 30,310 Property taxes and insurance 2,260 1,946 8,768 7,838 Senior housing operating expenses 952 — 952 — Impairment of real estate investments 2,031 5,353 2,483 42,225 Transaction costs 3,820 1,326 5,329 1,326 Provision for loan losses, net — 4,900 — 4,900 Property operating (recoveries) expenses (1,460) 1,322 (138) 5,714 General and administrative 15,473 9,286 52,465 28,923 Total expenses 61,596 44,769 206,457 178,067 Other income (loss) Other income, net 4,350 — 4,350 — Loss on extinguishment of debt — — (390) (657) Gain (loss) on sale of real estate, net 27,672 46 31,548 (2,208) Unrealized gain on other RE related investments, net 8,973 9,734 15,831 9,045 (Loss) gain on foreign currency transactions, net (103) — 4,012 — Total other income 40,892 9,780 55,351 6,180 Income before income tax expense 114,155 51,955 325,287 124,399 Income tax expense (1,894) — (5,001) — Net income 112,261 51,955 320,286 124,399 Net income (loss) attributable to noncontrolling interests 971 (180) (252) (681) Net income attributable to CareTrust REIT, Inc. $ 111,290 $ 52,135 $ 320,538 $ 125,080 Earnings available to CareTrust REIT, Inc. per common share Basic $ 0.50 $ 0.29 $ 1.57 $ 0.81 Diluted $ 0.50 $ 0.29 $ 1.57 $ 0.80 Weighted-average number of common shares Basic 222,746 181,645 203,642 154,795 Diluted 223,345 182,013 204,091 155,167 Dividends declared per common share $ 0.335 $ 0.290 $ 1.340 $ 1.160 15

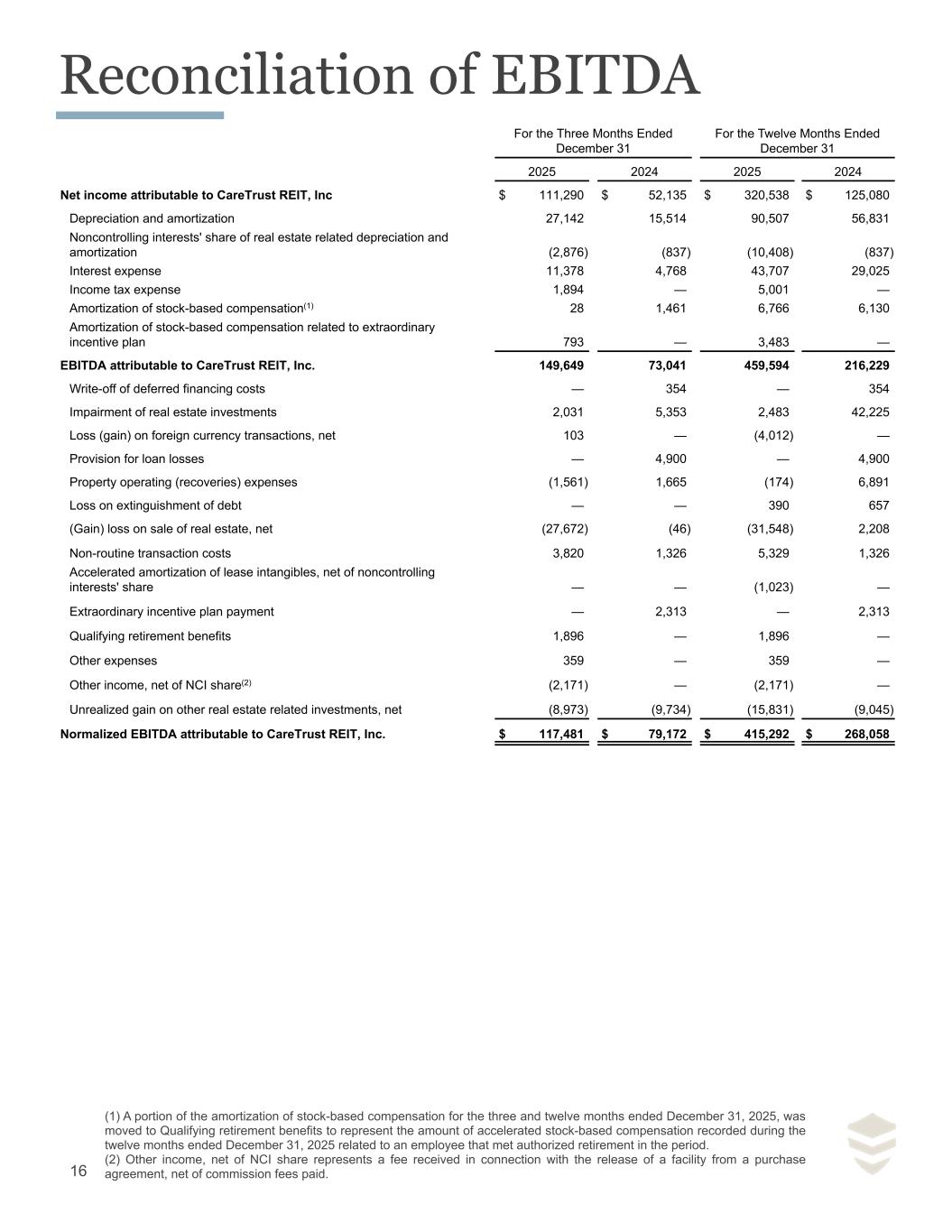

Reconciliation of EBITDA 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 For the Three Months Ended December 31 For the Twelve Months Ended December 31 2025 2024 2025 2024 Net income attributable to CareTrust REIT, Inc $ 111,290 $ 52,135 $ 320,538 $ 125,080 Depreciation and amortization 27,142 15,514 90,507 56,831 Noncontrolling interests' share of real estate related depreciation and amortization (2,876) (837) (10,408) (837) Interest expense 11,378 4,768 43,707 29,025 Income tax expense 1,894 — 5,001 — Amortization of stock-based compensation(1) 28 1,461 6,766 6,130 Amortization of stock-based compensation related to extraordinary incentive plan 793 — 3,483 — EBITDA attributable to CareTrust REIT, Inc. 149,649 73,041 459,594 216,229 Write-off of deferred financing costs — 354 — 354 Impairment of real estate investments 2,031 5,353 2,483 42,225 Loss (gain) on foreign currency transactions, net 103 — (4,012) — Provision for loan losses — 4,900 — 4,900 Property operating (recoveries) expenses (1,561) 1,665 (174) 6,891 Loss on extinguishment of debt — — 390 657 (Gain) loss on sale of real estate, net (27,672) (46) (31,548) 2,208 Non-routine transaction costs 3,820 1,326 5,329 1,326 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — (1,023) — Extraordinary incentive plan payment — 2,313 — 2,313 Qualifying retirement benefits 1,896 — 1,896 — Other expenses 359 — 359 — Other income, net of NCI share(2) (2,171) — (2,171) — Unrealized gain on other real estate related investments, net (8,973) (9,734) (15,831) (9,045) Normalized EBITDA attributable to CareTrust REIT, Inc. $ 117,481 $ 79,172 $ 415,292 $ 268,058 16 (1) A portion of the amortization of stock-based compensation for the three and twelve months ended December 31, 2025, was moved to Qualifying retirement benefits to represent the amount of accelerated stock-based compensation recorded during the twelve months ended December 31, 2025 related to an employee that met authorized retirement in the period. (2) Other income, net of NCI share represents a fee received in connection with the release of a facility from a purchase agreement, net of commission fees paid.

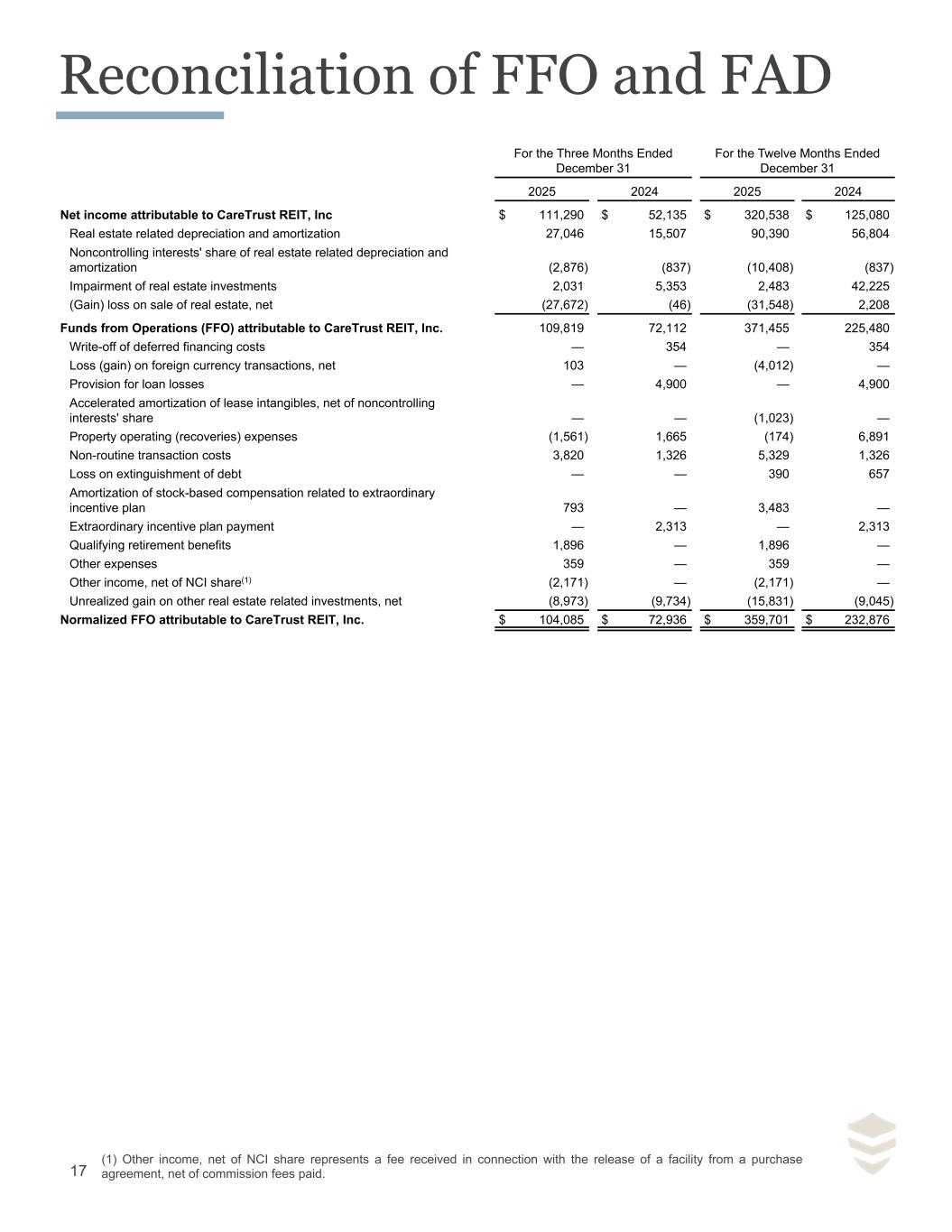

Reconciliation of FFO and FAD 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 For the Three Months Ended December 31 For the Twelve Months Ended December 31 2025 2024 2025 2024 Net income attributable to CareTrust REIT, Inc $ 111,290 $ 52,135 $ 320,538 $ 125,080 Real estate related depreciation and amortization 27,046 15,507 90,390 56,804 Noncontrolling interests' share of real estate related depreciation and amortization (2,876) (837) (10,408) (837) Impairment of real estate investments 2,031 5,353 2,483 42,225 (Gain) loss on sale of real estate, net (27,672) (46) (31,548) 2,208 Funds from Operations (FFO) attributable to CareTrust REIT, Inc. 109,819 72,112 371,455 225,480 Write-off of deferred financing costs — 354 — 354 Loss (gain) on foreign currency transactions, net 103 — (4,012) — Provision for loan losses — 4,900 — 4,900 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — (1,023) — Property operating (recoveries) expenses (1,561) 1,665 (174) 6,891 Non-routine transaction costs 3,820 1,326 5,329 1,326 Loss on extinguishment of debt — — 390 657 Amortization of stock-based compensation related to extraordinary incentive plan 793 — 3,483 — Extraordinary incentive plan payment — 2,313 — 2,313 Qualifying retirement benefits 1,896 — 1,896 — Other expenses 359 — 359 — Other income, net of NCI share(1) (2,171) — (2,171) — Unrealized gain on other real estate related investments, net (8,973) (9,734) (15,831) (9,045) Normalized FFO attributable to CareTrust REIT, Inc. $ 104,085 $ 72,936 $ 359,701 $ 232,876 17 (1) Other income, net of NCI share represents a fee received in connection with the release of a facility from a purchase agreement, net of commission fees paid.

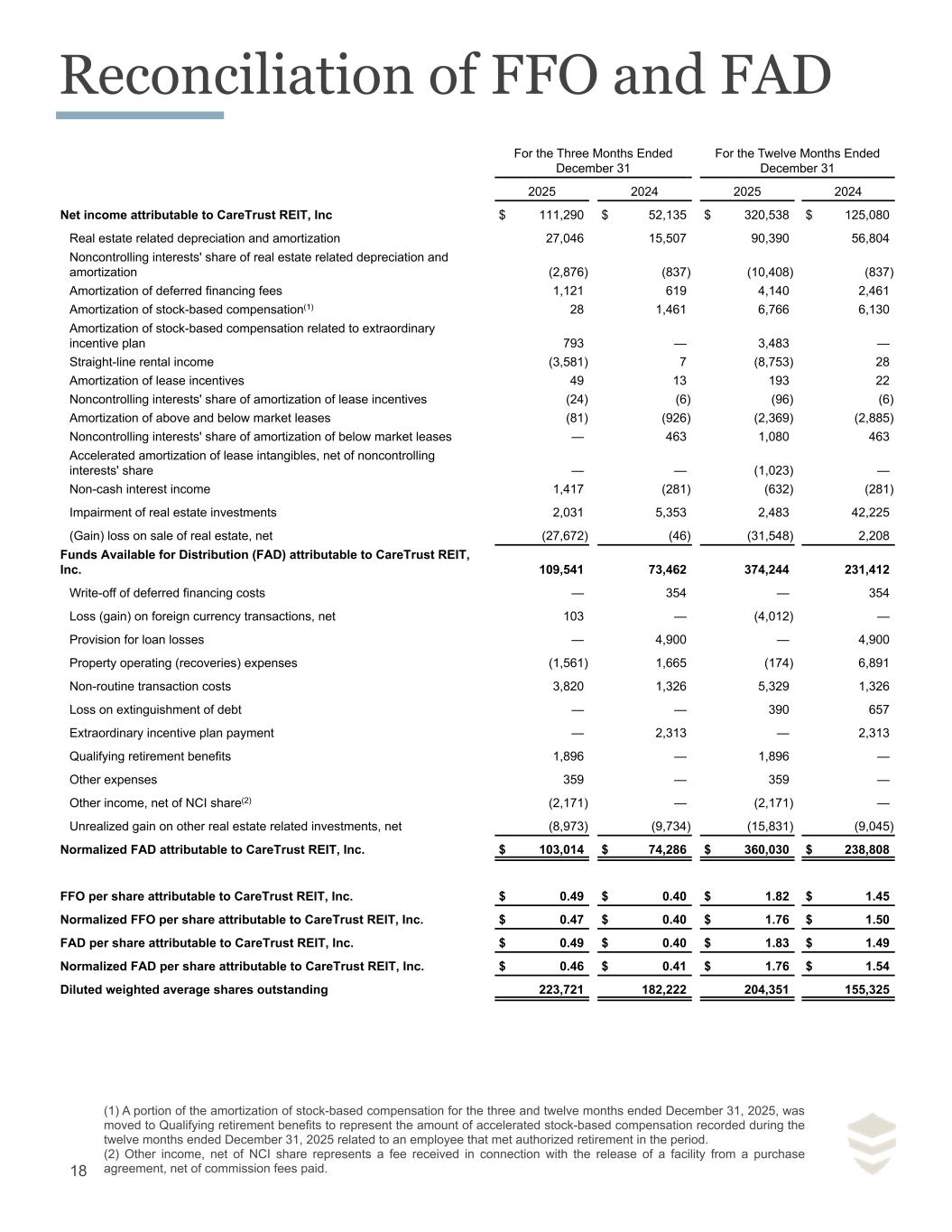

Reconciliation of FFO and FAD 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 For the Three Months Ended December 31 For the Twelve Months Ended December 31 2025 2024 2025 2024 Net income attributable to CareTrust REIT, Inc $ 111,290 $ 52,135 $ 320,538 $ 125,080 Real estate related depreciation and amortization 27,046 15,507 90,390 56,804 Noncontrolling interests' share of real estate related depreciation and amortization (2,876) (837) (10,408) (837) Amortization of deferred financing fees 1,121 619 4,140 2,461 Amortization of stock-based compensation(1) 28 1,461 6,766 6,130 Amortization of stock-based compensation related to extraordinary incentive plan 793 — 3,483 — Straight-line rental income (3,581) 7 (8,753) 28 Amortization of lease incentives 49 13 193 22 Noncontrolling interests' share of amortization of lease incentives (24) (6) (96) (6) Amortization of above and below market leases (81) (926) (2,369) (2,885) Noncontrolling interests' share of amortization of below market leases — 463 1,080 463 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — (1,023) — Non-cash interest income 1,417 (281) (632) (281) Impairment of real estate investments 2,031 5,353 2,483 42,225 (Gain) loss on sale of real estate, net (27,672) (46) (31,548) 2,208 Funds Available for Distribution (FAD) attributable to CareTrust REIT, Inc. 109,541 73,462 374,244 231,412 Write-off of deferred financing costs — 354 — 354 Loss (gain) on foreign currency transactions, net 103 — (4,012) — Provision for loan losses — 4,900 — 4,900 Property operating (recoveries) expenses (1,561) 1,665 (174) 6,891 Non-routine transaction costs 3,820 1,326 5,329 1,326 Loss on extinguishment of debt — — 390 657 Extraordinary incentive plan payment — 2,313 — 2,313 Qualifying retirement benefits 1,896 — 1,896 — Other expenses 359 — 359 — Other income, net of NCI share(2) (2,171) — (2,171) — Unrealized gain on other real estate related investments, net (8,973) (9,734) (15,831) (9,045) Normalized FAD attributable to CareTrust REIT, Inc. $ 103,014 $ 74,286 $ 360,030 $ 238,808 FFO per share attributable to CareTrust REIT, Inc. $ 0.49 $ 0.40 $ 1.82 $ 1.45 Normalized FFO per share attributable to CareTrust REIT, Inc. $ 0.47 $ 0.40 $ 1.76 $ 1.50 FAD per share attributable to CareTrust REIT, Inc. $ 0.49 $ 0.40 $ 1.83 $ 1.49 Normalized FAD per share attributable to CareTrust REIT, Inc. $ 0.46 $ 0.41 $ 1.76 $ 1.54 Diluted weighted average shares outstanding 223,721 182,222 204,351 155,325 18 (1) A portion of the amortization of stock-based compensation for the three and twelve months ended December 31, 2025, was moved to Qualifying retirement benefits to represent the amount of accelerated stock-based compensation recorded during the twelve months ended December 31, 2025 related to an employee that met authorized retirement in the period. (2) Other income, net of NCI share represents a fee received in connection with the release of a facility from a purchase agreement, net of commission fees paid.

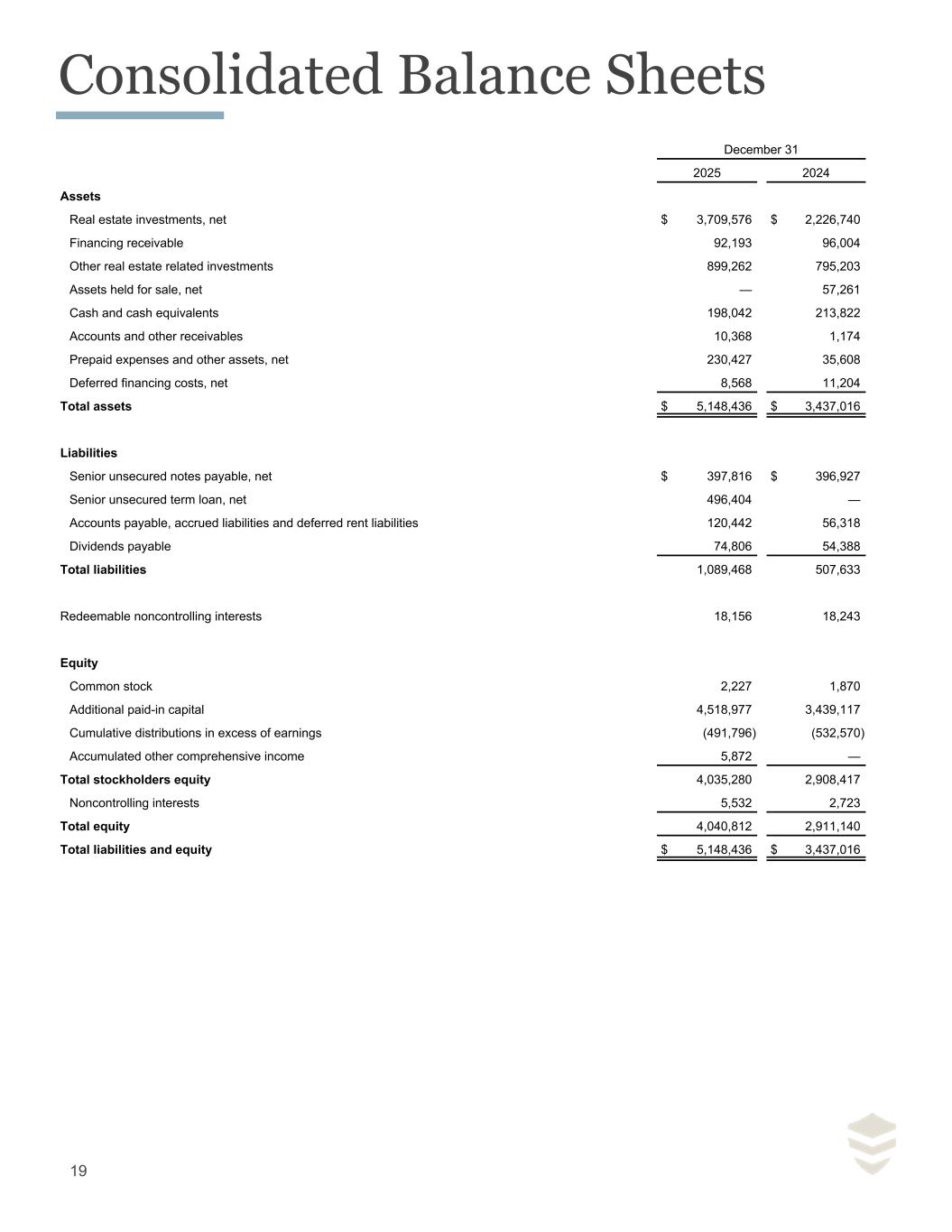

Consolidated Balance Sheets 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 December 31 2025 2024 Assets Real estate investments, net $ 3,709,576 $ 2,226,740 Financing receivable 92,193 96,004 Other real estate related investments 899,262 795,203 Assets held for sale, net — 57,261 Cash and cash equivalents 198,042 213,822 Accounts and other receivables 10,368 1,174 Prepaid expenses and other assets, net 230,427 35,608 Deferred financing costs, net 8,568 11,204 Total assets $ 5,148,436 $ 3,437,016 Liabilities Senior unsecured notes payable, net $ 397,816 $ 396,927 Senior unsecured term loan, net 496,404 — Accounts payable, accrued liabilities and deferred rent liabilities 120,442 56,318 Dividends payable 74,806 54,388 Total liabilities 1,089,468 507,633 Redeemable noncontrolling interests 18,156 18,243 Equity Common stock 2,227 1,870 Additional paid-in capital 4,518,977 3,439,117 Cumulative distributions in excess of earnings (491,796) (532,570) Accumulated other comprehensive income 5,872 — Total stockholders equity 4,035,280 2,908,417 Noncontrolling interests 5,532 2,723 Total equity 4,040,812 2,911,140 Total liabilities and equity $ 5,148,436 $ 3,437,016 19

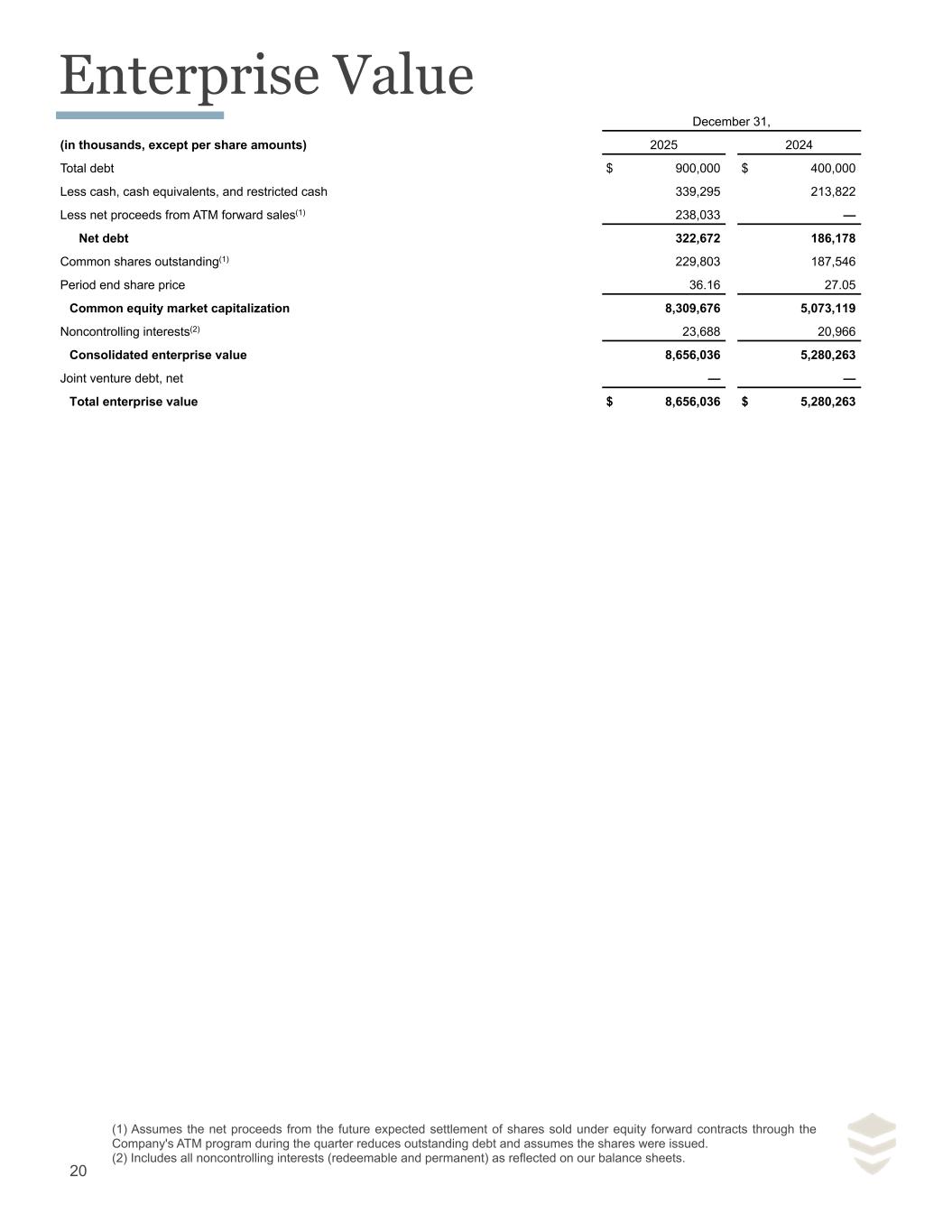

Enterprise Value 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 December 31, (in thousands, except per share amounts) 2025 2024 Total debt $ 900,000 $ 400,000 Less cash, cash equivalents, and restricted cash 339,295 213,822 Less net proceeds from ATM forward sales(1) 238,033 — Net debt 322,672 186,178 Common shares outstanding(1) 229,803 187,546 Period end share price 36.16 27.05 Common equity market capitalization 8,309,676 5,073,119 Noncontrolling interests(2) 23,688 20,966 Consolidated enterprise value 8,656,036 5,280,263 Joint venture debt, net — — Total enterprise value $ 8,656,036 $ 5,280,263 20 (1) Assumes the net proceeds from the future expected settlement of shares sold under equity forward contracts through the Company's ATM program during the quarter reduces outstanding debt and assumes the shares were issued. (2) Includes all noncontrolling interests (redeemable and permanent) as reflected on our balance sheets.

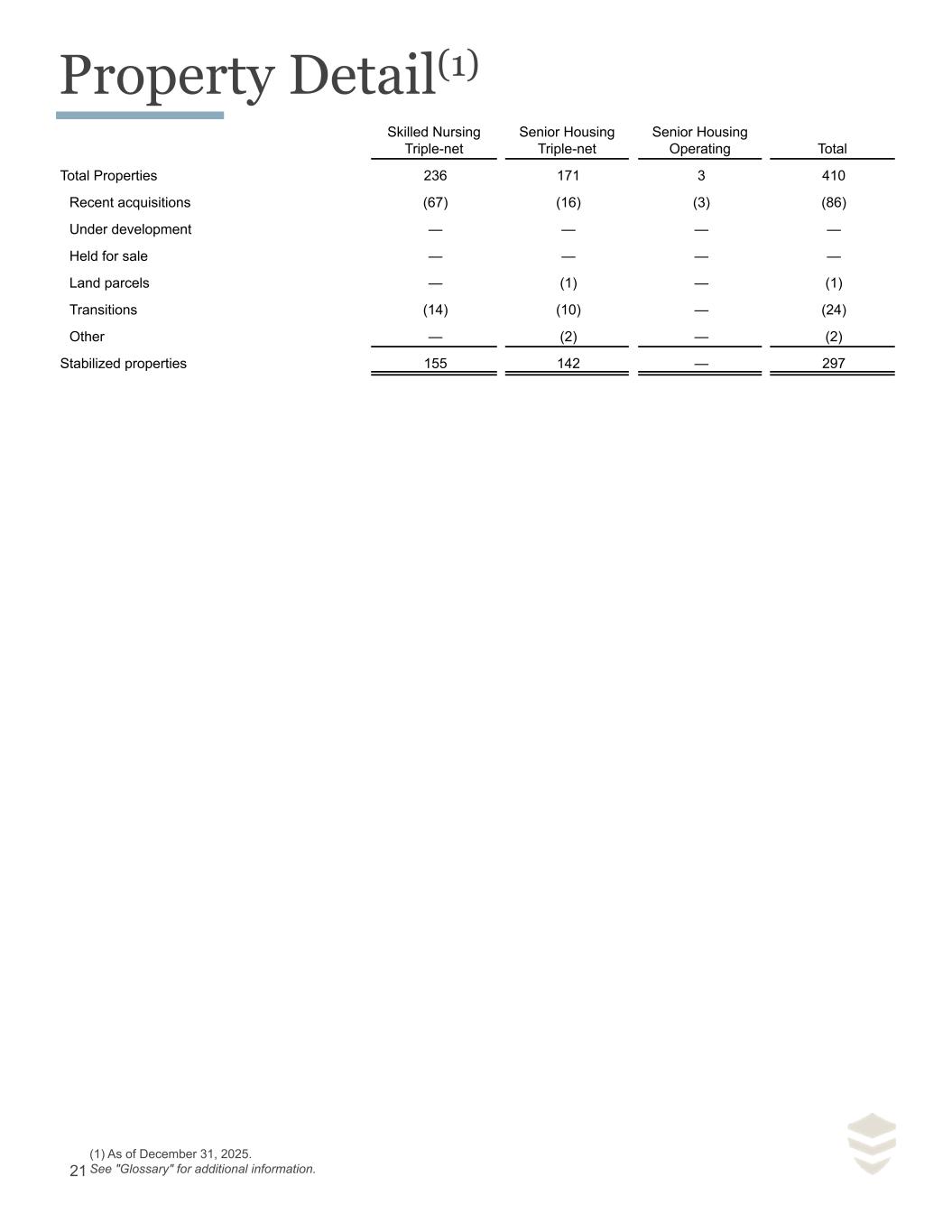

Property Detail(1) 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 Skilled Nursing Triple-net Senior Housing Triple-net Senior Housing Operating Total Total Properties 236 171 3 410 Recent acquisitions (67) (16) (3) (86) Under development — — — — Held for sale — — — — Land parcels — (1) — (1) Transitions (14) (10) — (24) Other — (2) — (2) Stabilized properties 155 142 — 297 21 (1) As of December 31, 2025. See "Glossary" for additional information.

Glossary 22 EBITDA Net income attributable to CareTrust REIT, Inc. before interest expense, income tax, depreciation and amortization and amortization of stock-based compensation.[1] EBITDAR Net income before interest expense, income tax, depreciation, amortization and cash rent, after applying a standardized management fee (5% of facility operating revenues). EBITDAR Coverage Aggregate EBITDAR produced by all properties under a master lease (or other grouping) for the trailing twelve-months ending on the period presented divided by the base rent payable to CareTrust REIT under such master lease (or other grouping) for the same period; provided that if the master lease has been amended to change the base rent during or since such period, then the aggregate EBITDAR for such period is divided by the annualized monthly base rent currently in effect. "Rent" refers to the total monthly rent due under the Company's lease agreements. EBITDAR reflects the application of a standard 5% management fee. EBITDARM Earnings before interest expense, income tax, depreciation, amortization, cash rent, and a standardized management fee (5% of facility operating revenues). EBITDARM Coverage Aggregate EBITDARM produced by all properties under a master lease (or other grouping) for the trailing twelve-months ending on the period presented divided by the base rent payable to CareTrust REIT under such master lease (or other grouping) for the same period; provided that if the master lease has been amended to change the base rent during or since such period, then the aggregate EBITDARM for such period is divided by the annualized monthly base rent currently in effect. Enterprise Value Share price multiplied by the number of outstanding shares, including assumed shares issued from the ATM program, plus total outstanding debt minus cash and assumed net proceeds from the ATM program, each as of a specified date. Property Counts Property counts exclude land under development, properties classified as held for sale or non-operational. Funds Available for Distribution (“FAD”) FFO attributable to CareTrust REIT, Inc, excluding straight-line rental income adjustments, amortization of deferred financing fees, lease incentives, above and below market lease intangibles, stock-based compensation expense, non-cash interest income and adjustments for joint ventures. Adjustments for joint ventures are calculated to reflect our pro rata share of our consolidated joint ventures.[2] Funds from Operations (“FFO”) Net income attributable to CareTrust REIT, Inc, excluding gains and losses from dispositions of real estate or other real estate, before real estate depreciation, amortization and real estate impairment charges and adjustments for joint ventures. Adjustments for joint ventures are calculated to reflect our pro rata share of our consolidated joint ventures. CareTrust REIT calculates and reports FFO attributable to CareTrust REIT, Inc in accordance with the definition and interpretive guidelines issued by the National Association of Real Estate Investment Trusts.[2] Initial Investment Initial Investment for properties acquired in connection with the Company becoming public represents Ensign's and Pennant's gross book value. Initial Investment for properties acquired since inception as a public company represents CareTrust REIT’s purchase price and transaction costs and includes commitments for capital expenditures that are not rent producing and impairment charges (on all portfolio slides except the Investments slide). Normalized EBITDA EBITDA attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as write-off of deferred financing costs, real estate impairment charges, provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, property operating expenses, non-routine transaction costs, loss on extinguishment of debt, unrealized gains or losses on other real estate related investments, gains or losses from dispositions of real estate or other real estate, accelerated amortization of lease intangibles, net of noncontrolling interests' share, extraordinary incentive plan payment, qualifying retirement benefits, other income and expenses, and gains or losses on foreign currency transactions.[1] Normalized FAD FAD attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, non-routine transaction costs, write-off of deferred financing fees, loss on extinguishment of debt, extraordinary incentive plan payment, unrealized gains or losses on other real estate related investments, gains or losses on foreign currency transactions, qualifying retirement benefits, other income and expenses, and property operating expenses.[2] Normalized FFO FFO attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as write-off of deferred financing costs, accelerated amortization of lease intangibles, net of noncontrolling interests' share, provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, amortization of stock-based compensation related to extraordinary incentive plan, extraordinary incentive plan payment, qualifying retirement benefits, other income and expenses, non-routine transaction costs, loss on extinguishment of debt, unrealized gains or losses on other real estate related investments, gains or losses on foreign currency transactions and property operating expenses.[2]

Revenues Revenues represents the respective period's contractual cash rent or interest income, annualized, and presented at 100% share for consolidated entities, and excludes ground lease income and the impact of any rent abatement for recent acquisitions, if applicable. Rent denominated in GBP is translated to USD using the spot rate at the balance sheet date. Interest income includes annualized interest from other real estate related loans and preferred equity investments. Additionally, if a lease or loan agreement was entered into, amended or restructured subsequent to the period, but prior to our filing date for the respective period the initial or amended contractual cash rent or interest is used. Senior Housing ("SH") Includes licensed healthcare facilities that provide personal care services, support and housing for those who need help with daily living activities, such as bathing, eating and dressing, yet require limited medical care. The programs and services may include transportation, social activities, exercise and fitness programs, beauty or barber shop access, hobby and craft activities, community excursions, meals in a dining room setting and other activities sought by residents. These facilities are often in apartment-like buildings with private residences ranging from single rooms to large apartments. Certain senior housing properties may offer higher levels of personal assistance for residents requiring memory care as a result of Alzheimer’s disease or other forms of dementia. Levels of personal assistance are based in part on local regulations. Senior Housing also includes retirement communities or senior apartments, which are not healthcare facilities. These communities typically consist of entirely self-contained apartments, complete with their own kitchens, baths and individual living spaces, as well as parking for tenant vehicles. They are most often rented unfurnished, and generally can be personalized by the tenants, typically an individual or a couple over the age of 55. These facilities offer various services and amenities such as laundry, housekeeping, dining options/meal plans, exercise and wellness programs, transportation, social, cultural and recreational activities, and on-site security. Skilled Nursing or Skilled Nursing Facilities (“SNFs”) Licensed healthcare facilities that provide restorative, rehabilitative and nursing care for people not requiring the more extensive and sophisticated treatment available at an acute care hospital or long-term acute care hospital. Treatment programs include physical, occupational, speech, respiratory, ventilator, and wound therapy. Stabilized A property is considered stabilized unless it (i) is held for sale or disposed of during the reporting period, (ii) temporarily on Special Focus Facility status, (iii) slated to be transitioned to a new operator, or (iv) has recently undergone significant renovations or was recently repositioned or transitioned to a new operator and has not achieved underwritten stabilization within 12 months following its stabilization target date. Notes: [1] EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc do not purport to be indicative of cash available to fund future cash requirements, including the Company’s ability to fund capital expenditures or make payments on its indebtedness. Further, the Company’s computation of EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc may not be comparable to EBITDA and Normalized EBITDA reported by other REITs. [2] CareTrust REIT believes FAD attributable to CareTrust REIT, Inc, FFO attributable to CareTrust REIT, Inc, Normalized FAD attributable to CareTrust REIT, Inc, and Normalized FFO attributable to CareTrust REIT, Inc (and their related per-share amounts) are important non-GAAP supplemental measures of its operating performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time, even though real estate values have historically risen or fallen with market and other conditions. Moreover, by excluding items not indicative of ongoing results, Normalized FAD attributable to CareTrust REIT, Inc and Normalized FFO attributable to CareTrust REIT, Inc can facilitate meaningful comparisons of operating performance between periods and between other companies. However, FAD attributable to CareTrust REIT, Inc, FFO attributable to CareTrust REIT, Inc, Normalized FAD attributable to CareTrust REIT, Inc, and Normalized FFO attributable to CareTrust REIT, Inc (and their related per-share amounts) do not represent cash flows from operations or net income attributable to shareholders as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. The Company believes that net income attributable to CareTrust REIT, Inc., as defined by GAAP, is the most appropriate earnings measure. The Company also believes that the use of EBITDA, Normalized EBITDA, FFO, Normalized FFO, FAD and Normalized FAD, combined with the required GAAP presentations, improves the understanding of operating results of REITs among investors and makes comparisons of operating results among such companies more meaningful. The Company considers EBITDA and Normalized EBITDA, in each case attributable to CareTrust REIT, Inc., useful in understanding the Company’s operating results independent of its capital structure, indebtedness and other charges that are not indicative of its ongoing results, thereby allowing for a more meaningful comparison of operating performance between periods and against other REITs. The Company considers FFO, Normalized FFO, FAD and Normalized FAD, in each case attributable to CareTrust REIT, Inc., to be useful measures for reviewing comparative operating and financial performance because, by excluding gains or losses from real estate dispositions, impairment charges and real estate related depreciation and amortization, and, for FAD and Normalized FAD, by excluding noncash income and expenses such as amortization of stock-based compensation, amortization of deferred financing fees, and the effects of straight-line rent, FFO, Normalized FFO, FAD and Normalized FAD can help investors compare the Company’s operating performance between periods and to other REITs. The Company believes that the disclosure of Net Debt to Annualized Normalized Run Rate EBITDA provides a useful measure to investors to evaluate the credit strength of the Company and its ability to service its debt obligations and to compare the Company’s credit strength to prior reporting periods and to other companies without the effect of charges that are not indicative of the Company’s ongoing performance or that could obscure the Company’s actual credit quality and after considering the effect of investments occurring during the period. Glossary (continued) 23