Please wait

0001590877falseDEF 14A0001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:KennethTMillsMemberecd:PeoMember2024-01-012024-12-3100015908772021-01-012021-12-310001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:KennethTMillsMemberecd:PeoMember2021-01-012021-12-310001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:KennethTMillsMemberecd:PeoMember2023-01-012023-12-310001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:CurranSimpsonMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001590877ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2024-01-012024-12-310001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:KennethTMillsMemberecd:PeoMember2020-01-012020-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-01-012024-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:KennethTMillsMemberecd:PeoMember2023-01-012023-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:KennethTMillsMemberecd:PeoMember2021-01-012021-12-310001590877rgnx:KennethTMillsMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-3100015908772022-01-012022-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001590877rgnx:CurranSimpsonMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001590877ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001590877rgnx:KennethTMillsMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001590877ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2024-01-012024-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:KennethTMillsMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001590877rgnx:KennethTMillsMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001590877rgnx:CurranSimpsonMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMember2022-01-012022-12-310001590877rgnx:KennethTMillsMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001590877rgnx:KennethTMillsMember2024-01-012024-12-310001590877ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001590877ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-31000159087722024-01-012024-12-31000159087732024-01-012024-12-310001590877rgnx:CurranSimpsonMember2024-01-012024-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:KennethTMillsMemberecd:PeoMember2022-01-012022-12-310001590877ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberrgnx:KennethTMillsMemberecd:PeoMember2022-01-012022-12-310001590877ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-012021-12-310001590877rgnx:KennethTMillsMember2020-01-012020-12-310001590877ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-3100015908772024-01-012024-12-310001590877rgnx:KennethTMillsMember2023-01-012023-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:KennethTMillsMemberecd:PeoMember2020-01-012020-12-310001590877ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-01-012024-12-31000159087712024-01-012024-12-310001590877ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001590877ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrgnx:CurranSimpsonMemberecd:PeoMember2024-01-012024-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-3100015908772023-01-012023-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-3100015908772020-01-012020-12-310001590877rgnx:KennethTMillsMember2021-01-012021-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001590877ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310001590877rgnx:KennethTMillsMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001590877rgnx:KennethTMillsMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-3100015908772024-07-012024-12-310001590877ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-01-012020-12-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

REGENXBIO Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 14a-6(i)(1) and 0-11

REGENXBIO Inc.

9804 Medical Center Drive

Rockville, MD 20850

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

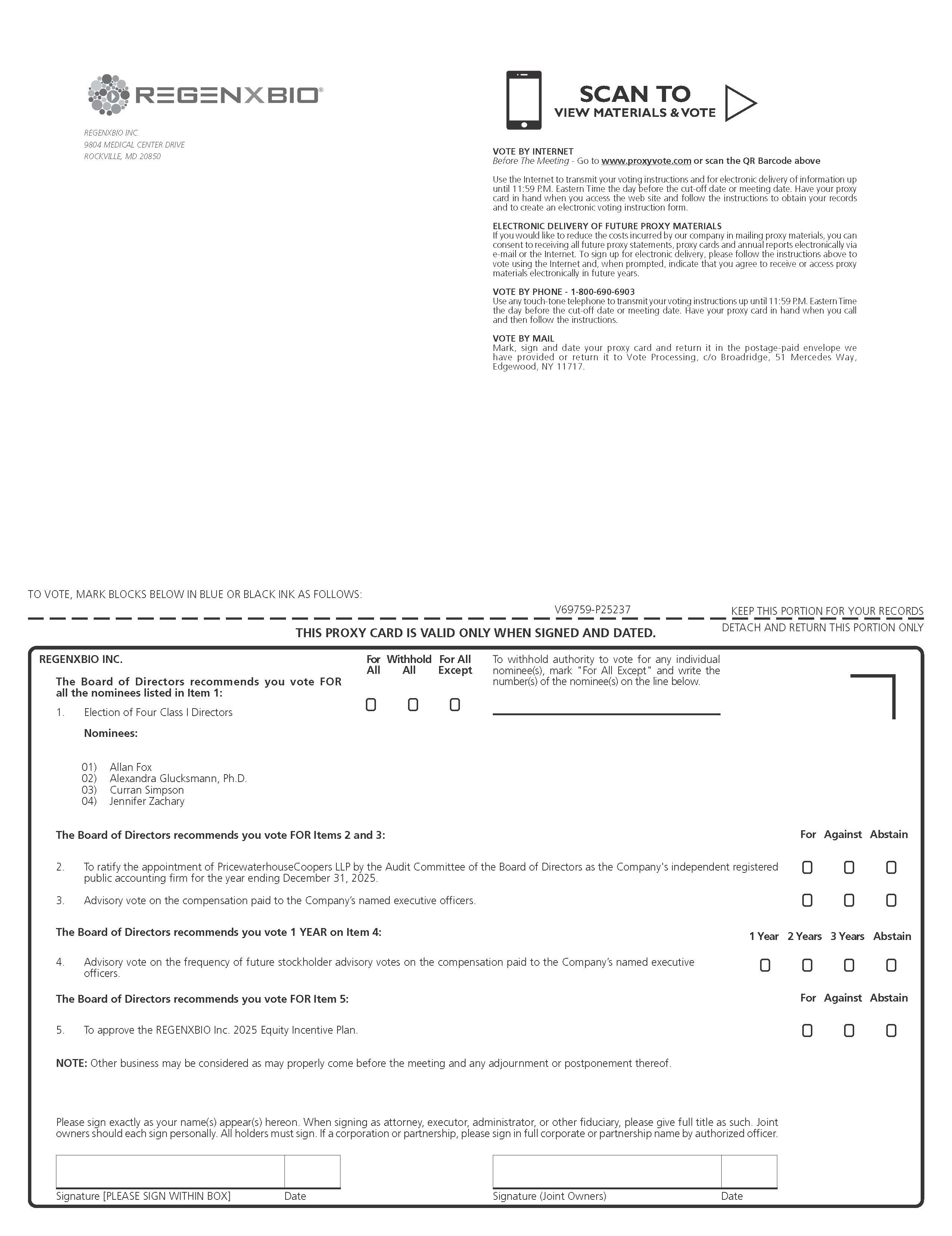

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of REGENXBIO Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held on May 30, 2025, at 9:00 a.m. local time at the Company’s offices located at 9804 Medical Center Drive, Rockville, Maryland 20850 for the following purposes:

1.To elect Allan Fox, Alexandra Glucksmann, Ph.D., Curran Simpson and Jennifer Zachary, to serve as Class I directors until the 2028 annual meeting of stockholders;

2.To ratify the selection of PricewaterhouseCoopers LLP by the Audit Committee of the Board of Directors as the independent registered public accounting firm of the Company for the year ending December 31, 2025;

3.To hold an advisory vote on the compensation paid to the Company’s named executive officers;

4.To hold an advisory vote to determine the frequency of future stockholder advisory votes on the compensation paid to the Company’s named executive officers;

5.To approve the REGENXBIO Inc. 2025 Equity Incentive Plan; and

6.To transact any other business properly brought before the Annual Meeting and any adjournments or postponements thereof.

Only stockholders of record at the close of business on April 1, 2025 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. A complete list of such stockholders will be available for inspection at the Company’s offices in Rockville, Maryland at the Annual Meeting and during normal business hours for a period of 10 days prior to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, please submit your proxy by telephone or over the internet, or by completing, signing, dating and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting. Instructions for voting are described in the Company’s proxy statement for the Annual Meeting, Notice of Internet Availability of Proxy Materials and proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 30, 2025:

The Company’s Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10‑K for the fiscal year ended December 31, 2024 are available at www.proxyvote.com.

|

|

By Order of the Board of Directors, |

|

|

Curran Simpson President and Chief Executive Officer |

|

Rockville, Maryland April 8, 2025 |

This Proxy Statement is first being mailed to the stockholders of the Company on or about April 8, 2025.

REGENXBIO Inc.

9804 Medical Center Drive

Rockville, MD 20850

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies to be voted at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of REGENXBIO Inc., which will be held on May 30, 2025, at 9:00 a.m. local time at the Company’s offices located at 9804 Medical Center Drive, Rockville, Maryland 20850.

When this Proxy Statement refers to “REGENXBIO,” the “Company,” “we,” “us” or “our,” it is referring to REGENXBIO Inc.

We are making this Proxy Statement and our Annual Report on Form 10‑K for the fiscal year ended December 31, 2024 (the “Annual Report”) available to stockholders at www.proxyvote.com. On or about April 8, 2025, we will begin mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access and review this Proxy Statement and the Annual Report. The Notice also instructs you how you may submit your proxy over the internet or via telephone. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice.

PROXY STATEMENT EXECUTIVE SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

Voting Overview and Vote Recommendations of the Board - Items of Business

Election of Directors: Please vote “For” each nominee (page 6)

•Director nominees have the right mix of experience, qualifications and skills and represent a mix of diverse experience, background and thought to contribute to our strategy and to the Board’s ability to perform its duties.

•All of our directors are independent, except for Curran Simpson, our President and CEO, Kenneth T. Mills, the Chairman of the Board, and Allan M. Fox.

Ratification of Appointment of Independent Registered Public Accounting Firm: Please vote “For” (page 20)

•PricewaterhouseCoopers LLP (“PwC”) is an independent accounting firm with the breadth of expertise and knowledge necessary to effectively audit our business.

•PwC has served as our independent registered public accounting firm since 2015.

Advisory Vote on Executive Compensation: Please vote “For” (page 23)

•Independent oversight by the Compensation Committee with the assistance of an independent external consultant.

•Executive compensation targets are determined based on an annual peer group review and annual analysis of all elements of executive compensation for each executive.

Advisory Vote on the Frequency of Executive Compensation: Please vote “One Year” (page 50)

•On an advisory basis, to determine how often stockholders prefer to have an advisory vote on the compensation of executives (every year, every two years, or every three years).

•An annual vote offers direct and immediate feedback on the Company’s compensation programs.

•We have held advisory votes on executive officer compensation on an annual basis since 2019 based on our stockholders’ expressed preference for an annual say on pay at the 2019 annual meeting.

Approve the REGENXBIO Inc. 2025 Equity Incentive Plan: Please vote “For” (page 51)

•The Company has put forth an appropriately balanced equity incentive plan designed to attract and retain top talent and align their interests with the Company's long-term goals.

•The proposed equity incentive plan was crafted to align with current executive compensation trends and recommended best practices.

About REGENXBIO

We are a biotechnology company on a mission to improve lives through the curative potential of gene therapy. Since its founding in 2009, REGENXBIO has pioneered the field of AAV gene therapy. REGENXBIO is advancing a late-stage pipeline of one-time treatments for rare and retinal diseases, including RGX-202 for the treatment of Duchenne; clemidsogene lanparvovec (RGX-121) for the treatment of MPS II and RGX-111 for the treatment of MPS I, both in partnership with Nippon Shinyaku; and surabgene lomparvovec (ABBV-RGX-314) for the treatment of wet AMD and diabetic retinopathy, in collaboration with AbbVie. REGENXBIO's investigational gene therapies have the potential to change the way healthcare is delivered for millions of people.

Business Highlights

In 2024, we made significant progress toward our clinical development and business objectives, including the following achievements:

|

|

|

ABBV-RGX-314 for the Treatment of wet AMD and DR under the eyecare collaboration with AbbVie |

We achieved key enrollment milestones with ABBV-RGX-314 ATMOSPHERE® and ASCENT™ pivotal clinical trials evaluating the efficacy and safety of ABBV-RGX-314 in patients with wet AMD using the subretinal delivery approach. We announced positive new data from multiple trials in the ABBV-RGX-314 program, including from the Phase II bridging study evaluating the clinical performance using the NAVXpress™ manufacturing platform process and the phase II AAVIATE® trial for the treatment of wet AMD using suprachoroidal delivery and the phase II ALTITUDE® trial using in-office suprachoroidal delivery for the treatment of DR without center-involved diabetic macular edema (DME). We completed a successful End-of-Phase II meeting with the FDA for our Phase II ALTITUDE trial and expanded enrollment into a new cohort of patients with center-involved DME. |

RGX-202 for the Treatment of Duchenne Muscular Dystrophy (“Duchenne”) |

We delivered on RGX-202 milestones, including a successful End-of-Phase II meeting with the FDA, initiating a pivotal (Phase III) trial of AFFINITY DUCHENNE®, approval for trial initiation in Canada, and announcing first strength and functional assessment data for both dose levels. |

RGX-121 for the Treatment of Mucopolysaccharidosis Type II (“MPS II”) |

We announced that the pivotal phase of the CAMPSIITE® trial of RGX-121 for the treatment of patients up to 5 years old diagnosed with MPS II achieved its primary endpoint in addition to reporting positive long-term safety and tolerability data. We also announced a successful pre-Biologics License Application (BLA) meeting for RGX-121, where we finalized details of our BLA with the FDA. Then in alignment with the FDA we completed filing of the first two sections of the rolling BLA for RGX-121. |

Pipeline Prioritization and Corporate Restructuring |

We successfully implemented and completed our strategic pipeline prioritization and corporate restructuring announced in late 2023, which was designed to prioritize the development of ABBV-RGX-314, RGX-202 and RGX-121, while seeking strategic alternatives for our other clinical stage programs. We achieved our stated goal of strategic alternatives for our other clinical stage product candidates. We completed out-licensing agreements for RGX-181 for the treatment of late-infantile neuronal ceroid lipofuscinosis type 2 (CLN2) disease, and RGX-381 for the treatment of the ocular manifestations of CLN2 disease. In January 2025, we announced a strategic partnership to develop and commercialize RGX-121 and RGX-111 for the treatment of MPS II and MPS I, respectively, in the United States and Asia. We achieved our corporate objective of targeted cost reductions in excess of $50.0 million in 2024 stemming from the corporate restructuring plan implemented in late 2023. |

Corporate Development and Pipeline Advancement |

We successfully transitioned senior leadership roles with the internal elevation of a newly appointed CEO and a new external hire of a CFO. Looking towards early portfolio plans, we continued to invest in our pre-clinical pipeline. |

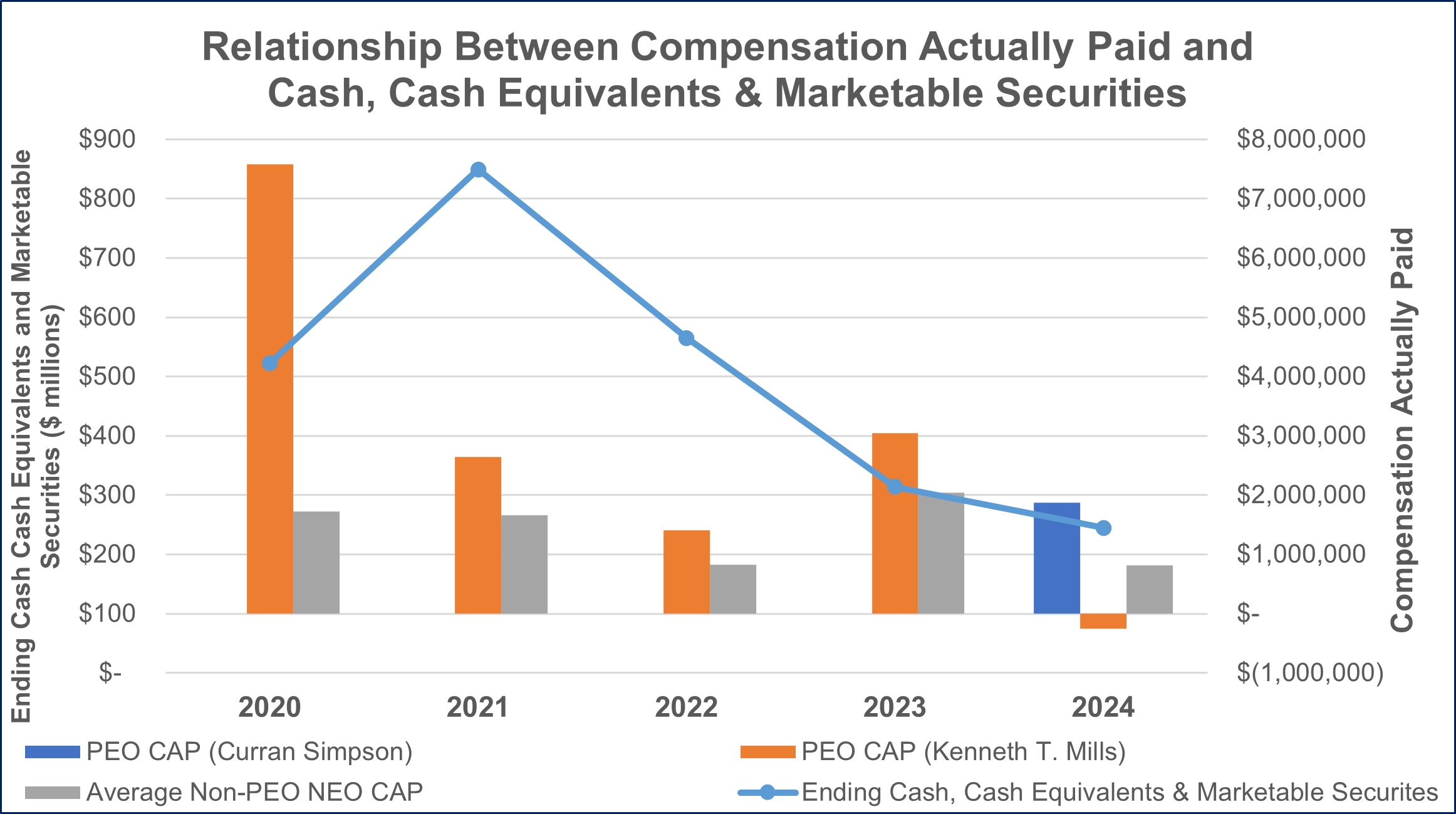

Financial Strength |

We ended 2024 with $244.9 million in cash, cash equivalents and marketable securities. In the first quarter of 2025, the Company announced a strategic partnership with Nippon Shinyaku to develop and commercialize RGX-121 and RGX-111, with a $110.0 million upfront payment received under the collaboration in March 2025. |

Corporate Governance Highlights

Our commitment to effective corporate governance is illustrated by the following practices:

•Our Board actively oversees and approves our corporate strategy.

•Our Board and board committee agendas are structured to engage our directors in informed reviews of strategic and forward-looking issues.

•Our Board reviews our enterprise-level risks and risk management practices.

•The charters of the Board committees clearly establish the committees’ respective roles and responsibilities.

•Our Board committees are fully independent.

•We have a strong, independent, clearly defined lead independent director role with meaningful governance duties.

•Our independent directors actively engage in board meetings, have direct access to management, and have discretion to hire independent advisors at the Company’s expense.

Sustainability Highlights

•Our Board has a long-standing commitment to corporate responsibility.

•We are committed to remaining cognizant of our impact on the wider environment in which we operate including Company initiatives designed to improve manufacturing yields and measuring baseline emissions to identify opportunities reduce waste.

•We are committed to providing equal opportunity in all aspects of employment.

•Our Board believes that gender, racial and ethnic diversity are important in providing diverse viewpoints. Our commitment to that belief is reflected in the composition of our Board, which includes three women among its five most recent additions.

Investor Engagement in 2024

Throughout 2024, including following our 2024 annual meeting, our leadership team consistently engaged with our top 25 shareholders representing approximately 68% of our outstanding common stock to discuss the progress of our clinical trials, our business strategy, our financial performance and strategic initiatives and our corporate guidance. We also provided stockholders an overview of the overall state of the gene therapy industry.

PROPOSAL 1:

ELECTION OF DIRECTORS

Under our Restated Certificate of Incorporation (the “Certificate of Incorporation”) and Amended and Restated Bylaws ("the Bylaws"), the Board is divided into three classes of roughly equal size. The members of each class are elected to serve a three-year term with the term of office of each of the three classes ending in successive years. Pursuant to our Bylaws, the Board has fixed the current number of directors at ten. Allan Fox, Alexandra Glucksmann, Ph.D., Curran Simpson and Jennifer Zachary, are the four Class I directors whose terms expire at this Annual Meeting. The Board has nominated Messrs. Fox and Simpson, Dr. Glucksmann and Ms. Zachary (collectively, the “nominees” and each, a “nominee”) to serve until the 2028 annual meeting of stockholders or until their successors are duly elected and qualified, or until their earlier death, resignation, retirement, disqualification or other removal. Each of the nominees was recommended for election by the Nominating and Corporate Governance Committee, and each such recommendation was approved unanimously by the Board.

Shares represented by signed proxy cards will be voted on Proposal 1 “For” the election of the nominees to the Board at the Annual Meeting, unless otherwise marked on the card. If any of the nominees becomes unavailable for election as a result of an unexpected occurrence, shares represented by proxy will be voted for the election of a substitute nominee designated by the current Board, unless otherwise marked on the card. The nominees have each agreed to serve as a director if elected. We have no reason to believe that any of the nominees will be unable to serve if elected.

Certain information about each of the nominees is furnished below, including their business experience, public company director positions held currently or at any time during the last five years and the experience, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the nominees should continue to serve as directors.

Our directors have a diverse set of skills and experience on the board, including:

•all of our directors have life sciences experience, including with respect to gene therapy;

•all of our directors have deep public company or executive leadership experience;

•five of our directors have experience in medicine, science, academia or research;

•three of our directors have finance, accounting or IT experience;

•two of our directors have regulatory, public policy or legal experience;

•three of our directors have commercial experience and;

•four of our directors have international experience.

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Positions and Offices Held

with Company |

|

Director Since |

Allan M. Fox |

|

77 |

|

Director |

|

2009 |

Alexandra Glucksmann, Ph.D. |

|

66 |

|

Director |

|

2018 |

Curran Simpson |

|

63 |

|

Director, President and Chief Executive Officer |

|

2024 |

Jennifer Zachary |

|

47 |

|

Director |

|

2022 |

Allan M. Fox has been a Director since February 2009 and served as Chairman from June 2020 until June 2024. Mr. Fox is the founding partner of FOXKISER, a firm committed to the strategic development of transformative innovations from biomedical research, which was formed in September 1986. Mr. Fox specializes in identifying business opportunities and improving competitive market positions. Through FOXKISER, he has participated in the formation and development of numerous ventures in the public and private sectors, including the founding of REGENXBIO and Dimension Therapeutics, Inc. Before forming FOXKISER, Mr. Fox co-led the establishment of the Washington office of the law firm of Kaye Scholer. While in the public sector, Mr. Fox served as Chief of Staff and Chief Legislative Assistant to U.S. Senator Jacob K. Javits of New York. He also served as Chief Counsel to the United States Senate Health and Scientific Research Subcommittee, chaired by Senator Edward M. Kennedy. Mr. Fox was a Fellow in Law, Science and Medicine at Yale Law School where he received an LL.M. degree. Mr. Fox also holds a J.D. and B.A. from Temple University. Mr. Fox has specific attributes that qualify him to continue to serve as a member of the Board, including his broad

experience in providing strategic advice to and investing in biotechnology companies throughout their life cycles, his expertise in identifying business opportunities, his deep experience with REGENXBIO since the time of its founding and his current and prior service on boards of directors.

Alexandra Glucksmann, Ph.D., has been a Director since May 2018. Dr. Glucksmann currently serves as President and CEO of Sensorium Therapeutics, a privately held biotechnology company, as a Senior Advisor at Scenic Biotech BV, a privately held biotechnology company, and on the Supervisory Board of TME Pharma NV, a biotechnology company focused on the treatment of aggressive cancers. From April 2018 to November 2022, Dr. Glucksmann served as the President and Chief Executive Officer and a director at Cedilla Therapeutics, Inc., a privately held biotechnology company, and from October 2017 to March 2018, Dr. Glucksmann was an Entrepreneur-in-Residence at Third Rock Ventures, LLC, a privately held healthcare venture firm, where she focused on company formation. She was also a founding employee of Editas Medicine, Inc., a publicly held biotechnology company, and served as its Chief Operating Officer from October 2013 to March 2017. Prior to that, Dr. Glucksmann was a founding employee of Cerulean Pharma Inc., a publicly held biotechnology company, and served as its Senior Vice President of research and business operations from September 2006 to June 2013. From August 2006 to May 2015, she served as a director at Taconic Biosciences, Inc. Dr. Glucksmann received a B.S. in Bacteriology from the University of Wisconsin-Madison and a Ph.D. in Molecular Genetics and Cell Biology from the University of Chicago, and she completed her postdoctoral fellowship at the Massachusetts Institute of Technology. Dr. Glucksmann’s qualifications to continue to serve as a member of the Board include her extensive experience in senior management positions at biotechnology companies, particularly her experience in the formation and development of biotechnology companies.

Curran Simpson became Company President, Chief Executive Officer and Director in July 2024. Mr. Simpson previously served as our EVP, Chief Operating Officer and has been on our senior management team since August 2015. Prior to joining us, from December 2012 until August 2015, Mr. Simpson was the Regional Supply Chain Head for North America and Interim Chief Operating Officer at GlaxoSmithKline plc (“GSK”). Mr. Simpson was the Senior Vice President, Operations at the Human Genome Sciences division of GSK (“HGS”) from July 2006 to December 2012, as well as the Vice President, Manufacturing Operations at HGS from January 2003 to June 2006 and served as interim CEO of HGS, where he led the integration of HGS into GSK. Prior to HGS, Mr. Simpson held various positions with Biogen, Inc., Covance Biotechnology Services Inc., Novo-Nordisk Biochem Inc., Genentech, Inc. and Genencor, Inc. Mr. Simpson is a member of the Board of Directors of the Alliance for Regenerative Medicine, an international advocacy organization for cell therapies and genetic medicines. Mr. Simpson received an M.S. in Surface and Colloid Science (Physical Chemistry) from Clarkson University and a B.S. in Chemistry/Chemical Engineering from Clarkson College of Technology. Mr. Simpson’s qualifications to serve as a member of the Board include his extensive experience as an executive in the biotechnology and life sciences industries, including as former EVP, Chief Operating Officer of our Company along with his prior service as a senior-level executive with biotechnology companies and his demonstrated business judgment.

Jennifer Zachary has been a Director since June 2022. Ms. Zachary currently serves as the Executive Vice President and General Counsel of Merck & Co., Inc. In this role, she serves as a legal advisor to Merck’s directors and executives, leads the company’s office of general counsel and sets the company’s global legal strategy. She is also responsible for the company’s compliance, global safety and environment, and global security functions. Prior to joining Merck, Ms. Zachary was a partner at the international law firm Covington & Burling, LLP. She practiced in the area of pharmaceutical and medical device regulatory law and advised a wide range of manufacturers and trade associations on compliance with government requirements for the development, manufacture and sale of their products. Prior to that, Ms. Zachary served as an Associate Chief Counsel for enforcement at the FDA and as a Special Assistant U.S. Attorney in the Civil Division of the U.S. Attorney’s Office for the District of Columbia. Ms. Zachary holds a B.S./B.A. in biology and chemistry from Arizona State University and a J.D. from Harvard Law School. Ms. Zachary has specific attributes that qualify her to continue to serve as a member of the Board, including her government service related to health care and regulatory compliance, experience in senior management positions at a large biopharmaceutical company and a global law firm, and her strong knowledge of strategic, legal and regulatory issues.

Vote Required

Directors are elected by a plurality of the votes cast at the Annual Meeting. The four nominees receiving the highest number of “For” votes will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of directors at the Annual Meeting.

Recommendation of the Board

The Board unanimously recommends a vote “For” each director nominee.

Continuing Directors Not Standing for Election

Certain information about those directors whose terms do not expire at the Annual Meeting is furnished below, including their business experience, public company director positions held currently or at any time during the last five years and the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the directors should serve as one of our directors. The term of the Class II directors will expire at the 2026 annual meeting of stockholders, and the term of the Class III directors will expire at the 2027 annual meeting of stockholders.

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Positions and Offices Held

with Company |

|

Director Since |

Jean Bennett, M.D., Ph.D. |

|

70 |

|

Director |

|

2021 |

George Migausky |

|

70 |

|

Director |

|

2021 |

A.N. “Jerry” Karabelas, Ph.D. |

|

72 |

|

Director |

|

2015 |

Kenneth T. Mills |

|

50 |

|

Chairman of the Board |

|

2009 |

David Stump, M.D. |

|

75 |

|

Director |

|

2015 |

Daniel Tassé |

|

65 |

|

Lead Independent Director |

|

2016 |

Class II Directors (Terms Expire in 2026)

Jean Bennett, M.D., Ph.D., has been a Director since September 2021. Dr. Bennett has been the F.M. Kirby Emeritus Professor of Ophthalmology at the Perelman School of Medicine at the University of Pennsylvania since July 2021, where she was previously a professor for 17 years. She also served as director of the Center for Advanced Retinal and Ocular Therapeutics at the University of Pennsylvania from July 2014 to June 2023. In addition to Dr. Bennett’s positions at the University of Pennsylvania, she has been an Investigator at the Center for Cellular and Molecular Therapeutics at The Children’s Hospital of Philadelphia for more than a decade. She also co-founded life science companies Spark Therapeutics (acquired by Roche), GenSight Biologics, Limelight Bio and Opus Genetics. Dr. Bennett has published or contributed to more than 175 peer-reviewed publications on gene therapy, including her pioneering work on gene therapy delivery of RPE65, which was foundational to the approval of Luxturna, the first gene therapy product approved by the U.S. Food and Drug Administration (the “FDA”). Dr. Bennett received a B.S. in Biology from Yale University, a Ph.D. in Zoology and Cell Biology from the University of California, Berkeley and an M.D. from Harvard University. She also completed postdoctoral fellowships in Radiobiology and Environmental Health at the University of California, San Francisco, Human Genetics at Yale School of Medicine and Development Genetics at The Johns Hopkins University School of Medicine. She is a member of the National Academy of Science, The National Academy of Medicine and the American Academy of Arts and Sciences. Dr. Bennett’s work as a leading molecular genetics researcher and her past experience in drug development, provides her with deep medical and scientific experience and with life sciences expertise, particularly in the field of retinal gene therapy.

A.N. “Jerry” Karabelas, Ph.D., has been a Director since May 2015 and served as Lead Independent Director from June 2020 until June 2024. Dr. Karabelas has been a Venture Partner at Apple Tree Partners, a life sciences venture capital firm, since January 2021, prior to which he was a Partner at Care Capital, LLC (“Care Capital”), a life sciences venture capital firm, from December 2001 to December 2020. Before joining Care Capital, Dr. Karabelas was Chairman at Novartis BioVentures Fund, which is owned by Novartis AG (“Novartis”), a provider of capital for life sciences companies across the biotech, medical devices and diagnostics industries, prior to which he was the Chief Executive Officer of Novartis Pharma AG, which is also owned by Novartis. Before joining Novartis, Dr. Karabelas was Executive Vice President, Worldwide Pharmaceuticals of SmithKline Beecham, where he was responsible for U.S. and European operations, regulatory and strategic marketing. Dr. Karabelas also serves as a director at Braeburn Pharmaceuticals, Inc., a privately held pharmaceutical company, since September 2015. He previously served as director at Bausch Health Companies from 2016 until 2023, Chairman at Polyphor AG, a pharmaceutical company, from June 2013 to November 2019 and Inotek Pharmaceuticals Corporation from July 2012 to June 2016. In connection with his work at Care Capital, Dr. Karabelas previously served on numerous boards of directors of pharmaceutical and therapeutics companies, including Renovo, plc, Vanda Pharmaceuticals, Inc. and NitroMed, Inc. Dr. Karabelas also previously served as Chairman at SkyePharma, plc and Human Genome Sciences. Dr. Karabelas received a B.S. from the University of New Hampshire and a Ph.D. from the Massachusetts College of Pharmacy. Dr. Karabelas's senior management positions at commercial and development-stage biopharmaceutical companies, strong knowledge of strategic and regulatory issues, his insight into international operations and his international perspective on the life sciences industry and healthcare related issues provides him with deep executive leadership, medical, life sciences, regulatory, international and commercial expertise.

Daniel Tassé has been a Director since August 2016 and began serving as Lead Independent Director in July 2024. Mr. Tassé has served as the Chief Executive Officer and a director of DBV Technologies SA, a publicly held biopharmaceutical company, since November 2018. From March 2016 to March 2019, he was the Chairman of Alcresta Therapeutics, Inc. (“Alcresta”), a privately held biopharmaceutical company, and from March 2016 to November 2018, he was the Chairman and Chief Executive Officer of

Alcresta. Mr. Tassé previously served as a director at Indivior PLC, from August 2014 to May 2021, Bellerophon Therapeutics, Inc. from December 2013 to May 2019 and HLS Therapeutics Inc. from March 2018 to March 2019. Prior to the acquisition of Ikaria Inc. (“Ikaria”) by Mallinckrodt Pharmaceuticals in April 2015, Mr. Tassé was President, Chief Executive Officer and Chairman of Ikaria and served as the Interim Chief Executive Officer and President of Bellerophon from February 2014 to June 2014. Previously, Mr. Tassé was the General Manager of the Pharmaceuticals and Technologies Business Unit of Baxter International, Inc. and Vice President and Regional Director for Australasia at GlaxoSmithKline plc. Mr. Tassé was a member of the Health Section Governing Board of the Biotechnology Industry Organization, where he participated on the bioethics, regulatory environment and reimbursement committees. Additionally, Mr. Tassé was a member of the board of directors of the Pharmaceutical Research and Manufacturers of America, where he participated on the FDA and biomedical research committee. Mr. Tassé received a B.Sc. in Biochemistry from the University of Montreal. Mr. Tassé has an extensive track record of business building in the healthcare industry, a strong background in commercial operations, global management experience and a detailed knowledge of the life sciences industry, which provides him with a breadth of executive leadership, life sciences and international experience.

Class III Directors (Terms Expire in 2027)

George Migausky has been a Director since September 2021. Mr. Migausky has more than 30 years of experience in the life sciences industry, having served as Chief Financial Officer for several public biopharmaceutical and clinical diagnostic companies. From April 2017 to September 2017, Mr. Migausky served as interim Chief Financial Officer for Ocular Therapeutix, Inc., a biopharmaceutical company. Prior to that, he served as Chief Financial Officer of Dyax Corp., a biopharmaceutical company, from August 2008 through the company’s acquisition by Shire plc in January 2016. Prior to that, Mr. Migausky served as Chief Financial Officer of Wellstat Management Company, a biotechnology company, from 2007 to 2008, and Chief Financial Officer of IGEN International, Inc., a biotechnology company, and BioVeris Corporation, a diagnostics company, from 1986 through their acquisitions by F. Hoffman LaRoche in 2004 and 2007, respectively. Mr. Migausky has served as a director at Immunovant, Inc., a publicly held biopharmaceutical company, since December 2019. He has also served as a trustee at the Massachusetts Eye and Ear Institute since 2015. Mr. Migausky previously served as a director at Dimension Therapeutics, Inc. from June 2015 through the company’s acquisition by Ultragenyx Pharmaceutical Inc. in November 2017, and at Abeona Therapeutics Inc. from June 2020 to September 2020 and at Hyperion Catalysis International, a privately held electrical manufacturing company, from 2008 to August 2022. He received a B.S. from Boston College and an M.B.A. from Babson College. Mr. Migausky has specific attributes that qualify him to continue to serve as a member of the Board, including his significant experience in executive leadership positions in the life sciences industry and serving on the boards of directors and audit committees of publicly traded biopharmaceutical companies.

Kenneth T. Mills has been a Director since March 2009, and served as our President and Chief Executive Officer until July 2024 when he was appointed Chairman of the Board. Mr. Mills was appointed as President, Chief Executive Officer, and Director of Tagworks Pharmaceuticals BV, a privately-held precision oncology company, in July 2024. Mr. Mills was with FOXKISER LLP (“FOXKISER”), most recently as a Partner, from January 2007 to January 2015 and was previously the Chief Financial Officer and Vice President of Business Development at Meso Scale Diagnostics, a life sciences company, from January 2004 to December 2006 and was part of the original management team that established the company’s operations and financing strategy. From March 1997 to December 2003, Mr. Mills was employed at IGEN International, Inc., a biotechnology company, where he served as Director of Business Development up through the company’s acquisition by Roche. Mr. Mills received an S.B. in Chemistry from the Massachusetts Institute of Technology. Mr. Mills’ qualifications to continue to serve as a member of the Board include his extensive experience as an executive in the gene therapy and biotechnology industries, including as former President and Chief Executive Officer of our Company, his prior service as a senior-level executive in both early stage and mature biotechnology companies and his demonstrated business judgment.

David C. Stump, M.D., has been a Director since October 2015. From November 1999 to December 2012, Dr. Stump was with Human Genome Sciences, Inc., a biopharmaceutical company, as Executive Vice President, Research and Development from May 2007 to December 2012, Executive Vice President, Drug Development from December 2003 to May 2007 and Senior Vice President, Drug Development from November 1999 to December 2003. Prior to joining Human Genome Sciences, Dr. Stump held roles of increasing responsibility at Genentech, Inc., a biopharmaceutical company, from 1989 to 1999, including Vice President, Clinical Research and Genentech Fellow. Prior to joining Genentech, Dr. Stump was an Associate Professor of Medicine and Biochemistry at the University of Vermont. Dr. Stump has served as a director at MacroGenics, Inc., a publicly held biopharmaceutical company, since September 2013. He also currently serves on the board of trustees of Earlham College. Dr. Stump previously served as a director at Sunesis Pharmaceuticals, Inc. from June 2006 to February 2021, Portola Pharmaceuticals, Inc. from September 2015 to July 2020 and Dendreon Corporation, a biotechnology company, from June 2010 to June 2015. Dr. Stump holds an A.B. from Earlham College and an M.D. from Indiana University and completed his residency and fellowship training in internal medicine, hematology, oncology and biochemistry at the University of Iowa. Dr. Stump has specific attributes that qualify him to continue to serve as a member of the Board, including his substantial medical and scientific background and expertise, his extensive experience in research and development and operations in the biotechnology industry and his prior service on public company boards.

CORPORATE GOVERNANCE

Our Board is responsible for oversight of the management of the Company. In carrying out its responsibilities, the Board selects and monitors our management team, provides oversight of our financial reporting processes and determines and oversees the implementation of our corporate governance policies.

Corporate Responsibility

The Company seeks to enhance stockholder value while embodying its core values of Trust, Accountability, Perseverance and Innovation (our “Core Values”). As part of our Core Values the Company engages in the following areas to further our environmental, social and governance strategy:

Environmental Footprint

The Company is cognizant of its impact on the wider environment. In recognition of that impact, the Company's Rockville, Maryland headquarters is Leadership in Energy and Environmental Design Gold certified. Furthermore, the Company engages in multiple initiatives that are designed to improve manufacturing yields and is measuring waste generation and emissions to identify opportunities to reduce those levels. The Company has previously been locally recognized for its waste reduction and recycling programs.

Equal Opportunity

The Company believes that a merit-based, diverse, equitable and inclusive culture fosters innovation, which is integral to our mission. Our commitment to equal opportunity is also reflected in our diverse workforce population. We have also emphasized equal opportunity as part of our company culture, as set out in our Code of Business Conduct and Ethics.

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines, which, along with our Certificate of Incorporation and Bylaws, and the charters of the committees of the Board, provide the framework for our corporate governance. Our current corporate governance guidelines can be found, together with other corporate governance information, in the “Investors + Newsroom – Corporate Governance” section of our website at www.regenxbio.com. The Board also evaluates the charters of its committees from time to time, as appropriate.

Code of Business Conduct and Ethics

We maintain a code of business conduct and ethics that qualifies as a “code of ethics” under Item 406 of the Securities and Exchange Commission’s (the “SEC”) Regulation S-K and applies to each of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The code of business conduct and ethics addresses various topics, including: (1) compliance with applicable laws, rules and regulations; (2) conflicts of interest; (3) public disclosure of information; (4) insider trading; (5) corporate opportunities; (6) competition and fair dealing; (7) gifts; (8) discrimination, harassment and retaliation; (9) health and safety; (10) record keeping; (11) confidentiality; (12) protection and proper use of company assets; (13) prevention of corruption; and (14) the reporting of illegal and unethical behavior.

The code of business conduct and ethics is available in the corporate governance section of our website at www.regenxbio.com. Any amendment or waiver of the “code of ethics” provisions of the code of business conduct and ethics for an executive officer or director may be granted only by the Board or a committee thereof and must be timely disclosed as required by applicable law. We intend to satisfy the disclosure requirements regarding any such amendment or waiver applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, in a current report filed with the SEC on Form 8-K or on our website at www.regenxbio.com.

Director Independence

As required under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Consistent with these regulations, after review of all relevant transactions or relationships between each director, or any of such director’s family members, and the Company, its senior management and its independent registered public accounting firm, the Board has determined that all of our current directors are independent directors within the meaning of applicable Nasdaq listing standards, except for Curran Simpson, our President and CEO, Kenneth T. Mills our Chairman and Allan M. Fox.

Information Regarding the Board of Directors and its Committees

As required under Nasdaq listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for each of the Board committees during 2024:

|

|

|

|

|

Committee |

Chair |

Non-Chair Members |

Number of Meetings in 2024 |

Audit Committee |

George Migausky |

Jennifer Zachary

David C. Stump, M.D. |

5 |

Compensation Committee |

Daniel Tassé |

A.N. “Jerry” Karabelas, Ph.D.

Alexandra Glucksmann, Ph.D. |

8 |

Nominating and Corporate Governance Committee |

David C. Stump, M.D. |

Jean Bennett, M.D., Ph.D. |

4 |

Below is a description of each committee of the Board. The Board has determined that each member of the Audit, Compensation and Nominating and Corporate Governance Committees meets applicable rules and regulations regarding “independence” and that each such member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board oversees the quality and integrity of the Company’s financial statements and other financial information provided to the Company’s stockholders, the retention and performance of the Company’s independent accountants, the effectiveness of the Company’s internal controls and disclosure controls, and the Company’s compliance with ethics policies and SEC and related regulatory requirements. Pursuant to the Audit Committee charter, the functions of the Audit Committee include, among other things:

1.appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

2.overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm;

3.reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures;

4.monitoring our internal control over financial reporting and our disclosure controls and procedures;

5.meeting independently with our registered public accounting firm and management;

6.furnishing the Audit Committee Report required by SEC rules;

7.reviewing and approving or ratifying any related person transactions; and

8.overseeing our risk assessment and risk management policies.

Our Audit Committee charter can be found in the “Investors + Newsroom – Corporate Governance” section of our website at www.regenxbio.com.

Three directors currently comprise the Audit Committee: Mr. Migausky (the Chair of the Audit Committee), Ms. Zachary and Dr. Stump. The Audit Committee met five times during 2024.

All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq. The Board has determined that Mr. Migausky is an “audit committee financial expert,” as defined by applicable SEC rules, and has the requisite financial sophistication as defined under the applicable Nasdaq listing standards.

The Board annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent (as independence is currently defined in applicable Nasdaq listing standards and Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act")).

Compensation Committee

The Compensation Committee of the Board reviews and approves the design and philosophy of, assesses the effectiveness of, and administers executive compensation programs for officers and employees, including our equity incentive plans. Pursuant to the Compensation Committee charter, the functions of the Compensation Committee include, among other things:

1.evaluating the performance of our Chief Executive Officer ("CEO") and determining the CEO’s salary and contingent compensation based on his or her performance and other relevant criteria;

2.identifying the corporate and individual objectives governing the CEO’s compensation;

3.approving the compensation of our other executive officers;

4.making recommendations to the Board with respect to non-employee director compensation;

5.reviewing and approving the terms of material agreements between us and our executive officers;

6.overseeing and administering our equity incentive plans and employee benefit plans;

7.reviewing and approving policies and procedures relating to the perquisites and expense accounts of our executive officers;

8.approving the Company’s annual Compensation Discussion and Analysis to be included in the Company’s annual proxy statement and preparing the annual Compensation Committee report required by SEC rules;

9.reviewing and selecting the companies in the Company’s peer group for purposes of assessing the compensation paid to the Company’s executive officers;

10.conducting an annual assessment of material risk exposures associated with the Company’s compensation policies and practices and the mitigation thereof;

11.considering the results of stockholder advisory votes on executive compensation and the frequency of such votes, among other factors, in determining compensation policies and practices; and

12.conducting a review of executive officer succession planning periodically, reporting its findings and recommendations to the Board, and working with the Board in evaluating potential successors to executive officer positions.

In accordance with Nasdaq listing standards and our Compensation Committee charter, the Board has granted our Compensation Committee the authority and responsibility to retain or obtain the advice of compensation consultants, legal counsel and other compensation advisers, the authority to fund such advisers, and the responsibility to consider the independence factors specified under applicable law and any additional factors the Compensation Committee deems relevant. Our Compensation

Committee charter can be found in the “Investors + Newsroom – Corporate Governance” section of our website at www.regenxbio.com.

Three directors currently comprise the Compensation Committee: Mr. Tassé (the Chair of the Compensation Committee) and Drs. Glucksmann and Karabelas. The Compensation Committee met eight times during 2024.

The Board has determined that all members of the Compensation Committee are independent (as independence is currently defined in the Nasdaq listing standards). In addition, each of our directors serving on our Compensation Committee satisfies the heightened independence standards for members of a compensation committee under Nasdaq listing standards, and is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act.

Our President and CEO often participates in the Compensation Committee’s meetings. He does not participate in the determination of his own compensation or the compensation of directors. Our President and CEO makes recommendations to the Compensation Committee regarding the amount and form of the compensation of the other executive officers and key employees, and he often participates in the Compensation Committee’s deliberations about the compensation of such individuals. Our Executive Vice President ("EVP"), Chief Communications and People Officer and our EVP, Chief Strategy and Legal Officer also regularly participate in the Compensation Committee’s meetings, but they do not participate in the determination of the amount or form of the compensation of executive officers or directors.

The Compensation Committee has retained Willis Towers Watson as its independent compensation consultant since April 2019. In connection with the 2024 compensation paid by the Company, Willis Towers Watson provided the Compensation Committee with data about the compensation paid by our peer group of companies, as described below, and other employers who compete with the Company for executives, updated the Compensation Committee on new developments in areas that fall within the Compensation Committee’s remit and was available to advise the Compensation Committee regarding its responsibilities. The compensation consultant serves at the pleasure of the Compensation Committee rather than the Company, and the consultant’s fees are approved by the Compensation Committee. The Compensation Committee assessed the independence of Willis Towers Watson pursuant to applicable SEC rules and Nasdaq listing standards and concluded that Willis Towers Watson was independent under such standards and that their work did not raise any conflict of interest.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board identifies, evaluates and recommends nominees to the Board and committees of the Board, conducts searches for appropriate directors, and evaluates the performance of the Board, its committees and management against their duties and responsibilities relating to corporate governance. Pursuant to the Nominating and Corporate Governance Committee charter, the functions of the Nominating and Corporate Governance Committee include, among other things:

1.reviewing the criteria for selecting directors set forth in the Company’s corporate governance guidelines and any additional factors deemed appropriate given the needs of the Board and the Company;

2.identifying, evaluating and making recommendations to the Board and our stockholders concerning nominees for election to the Board, to each of the Board’s committees and as committee chairs;

3.annually reviewing the performance and effectiveness of the Board, its committees and each individual director, and developing and overseeing a performance evaluation process;

4.annually evaluating the performance of management, the Board and each Board committee against their duties and responsibilities relating to corporate governance;

5.annually evaluating adequacy of our corporate governance structure, policies and procedures; and

6.providing reports to the Board regarding the Nominating and Corporate Governance Committee’s nominations for election to the Board and its committees.

Our Nominating and Corporate Governance Committee charter can be found in the “Investors + Newsroom – Corporate Governance” section of our website at www.regenxbio.com.

Two directors currently comprise the Nominating and Corporate Governance Committee: Dr. Stump (the Chair of the Nominating and Corporate Governance Committee) and Dr. Bennett. The Nominating and Corporate Governance Committee met four times during 2024.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements and having a general understanding of the Company’s industry. The Nominating and Corporate Governance Committee also considers other factors it deems appropriate, including, but not limited to:

•the candidate’s relevant expertise and experience upon which to offer advice and guidance to management;

•the candidate having sufficient time to devote to the affairs of the Company;

•the candidate having a proven track record in his or her field;

•the candidate’s ability to exercise sound business judgment;

•the candidate’s commitment to vigorously represent the long-term interests of our stockholders;

•whether or not a conflict of interest exists between the candidate and our business;

•whether the candidate would be considered independent under applicable Nasdaq and SEC standards;

•the current composition of the Board; and

•the operating requirements of the Company.

In conducting this assessment, the Nominating and Corporate Governance Committee also considers diversity, age, skills, and such other factors as it deems appropriate given the then-current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence.

We believe that each of our directors brings a strong background and set of skills to our Board, giving the Board, as a whole, an appropriate balance of diversity, knowledge, experience, attributes, skills and expertise. In addition, seven of our ten directors are independent under Nasdaq standards (Mr. Simpson, our President and CEO, Mr. Mills and Mr. Fox being the exceptions) and our Nominating and Corporate Governance Committee believes that all ten directors are independent of the influence of any particular stockholder or group of stockholders whose interests may diverge from the interests of our stockholders as a whole. We believe that our directors have a broad range of personal characteristics including leadership, management, pharmaceutical, gene therapy business, marketing and financial experience and abilities to act with ethics and integrity, with sound judgment and collegially, to consider strategic proposals, to assist with the development of our strategic plan and oversee its implementation, to oversee our risk management efforts and executive compensation and to provide leadership, to commit the requisite time for preparation and attendance at Board and committee meetings and to provide required expertise on Board committees.

In evaluating director candidates, our Nominating and Corporate Governance Committee has reviewed the experience, qualifications, attributes and skills of our directors and nominees, including those identified in the biographical information set forth above in the section entitled “Election of Directors.” The Nominating and Corporate Governance Committee believes that the members of the Board offer insightful and creative views and solutions with respect to issues facing the Company. In addition, the Nominating and Corporate Governance Committee also believes that the members of the Board function well together as a group. The Nominating and Corporate Governance Committee believes that the above-mentioned attributes and qualifications, along with the leadership skills and other experiences of the members of the Board described in further detail above under the section entitled “Election of Directors,” provide the Company with the perspectives and judgment necessary to guide the Company’s strategies and monitor their execution.

When there is a vacancy on the Board, the Nominating and Corporate Governance Committee uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems it appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

Director Qualifications and Diversity

The Board believes that it is important that its members represent diverse viewpoints, with a broad array of experiences, professions, skills and backgrounds that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to the long-term interests of our stockholders. The attributes required of Board members, as a whole, may include (i) various and relevant career experience, (ii) relevant skills, such as an understanding of our business and industry, (iii) financial expertise, including the ability to read and understand basic financial statements, (iv) diversity and (v) local and community ties.

Board Renewal

The Board believes it is important to have experienced directors with a deep understanding of the Company’s business as well as newer directors who bring fresh perspectives to the Board. In its efforts to identify potential director candidates, the Board and the Nominating and Corporate Governance Committee consider the input from the directors’ self-evaluation process to identify the backgrounds and expertise that are desired and the future needs of the Board in light of anticipated director retirements or resignations. The Board’s ongoing assessment of its collective skills, experience and expertise resulted in the recruitment of four new independent directors within the past seven years.

Our recruiting process typically involves either engaging a search firm or having a member of the Board or the Nominating and Corporate Governance Committee contact a prospect to gauge the prospect’s interest and availability. A candidate will then meet with several members of the Board and then meet with members of the Company’s management as appropriate. At the same time, the Board or the Nominating and Corporate Governance Committee and the search firm will contact references for the prospect. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

Meetings of the Board

The Board met eight times during 2024. Each director attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he or she served, held during the period for which he or she was a director or committee member.

Directors are encouraged, but not required, to attend our annual meetings of stockholders. All of the then-continuing directors attended our 2024 annual meeting of stockholders.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has ever been an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or our Compensation Committee.

Performance Evaluations of the Board of Directors and its Committees

In accordance with our corporate governance guidelines and the Nominating and Corporate Governance Committee charter, the Board, with the assistance of the Nominating and Corporate Governance Committee, evaluates the performance of the Board, its committees and each individual director on an annual basis. Each member of the Board conducts an annual self-evaluation for the purpose of determining whether the Board and its committees are functioning optimally. As part of this process, each director considers the effectiveness of the Board and each committee on which the director serves. The results of the evaluations are discussed at subsequent meetings of the Board and its committees.

Director Nominations

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders and evaluate them using the same criteria as candidates identified by the Board or the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee may also take into consideration the number of shares of the Company’s common stock held by the recommending stockholder and the length of time that those shares have been held. To recommend a director candidate for consideration by the Nominating and Corporate Governance Committee, a stockholder must submit the recommendation in writing to the Company, including the following information:

•the name of the stockholder and evidence of the stockholder’s ownership of the Company’s common stock, including the number of shares owned and the length of time the shares have been owned; and

•the name of the director candidate, a description of the candidate’s qualifications to be a director of the Company, and the candidate’s consent to be named as a director nominee if recommended by the Nominating and Corporate Governance Committee and nominated by the Board.

Recommendations and the information described above should be sent to our Corporate Secretary at REGENXBIO Inc., 9804 Medical Center Drive, Rockville, Maryland 20850, Attention: Corporate Secretary.

Once a person has been identified by the Nominating and Corporate Governance Committee as a potential director candidate, the Nominating and Corporate Governance Committee may: collect and review publicly available information regarding the person to assess whether the person should be considered further; request additional information from the candidate and the proposing stockholder; contact references or other persons to assess the candidate; and conduct one or more interviews with the candidate. The Nominating and Corporate Governance Committee may consider that candidate in light of information regarding any other candidates that the Nominating and Corporate Governance Committee may be evaluating at that time, as well as any relevant director search criteria. The evaluation process generally does not vary based on whether or not a candidate is recommended by a stockholder; however, as stated above, the Nominating and Corporate Governance Committee may take into consideration the number of shares held by the recommending stockholder and the length of time that those shares have been held.

In addition to recommending director candidates to the Nominating and Corporate Governance Committee, stockholders may also nominate candidates for election to the Board at an annual meeting of stockholders. For more information, see “Questions and Answers About the Proxy Materials and Voting—May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors?”

Separation of Chairman of the Board and Chief Executive Officer Roles

The Board separates the positions of Chairman of the Board and CEO. Separating these positions allows our CEO to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board recognizes the time, effort, and energy that the CEO is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman of the Board, particularly as the Board’s oversight responsibilities continue to grow. We believe that having separate positions and having an outside director serve as Chairman of the Board is the appropriate leadership structure for the Company at this time.

Lead Independent Director

As the Chairman of the Board is not an independent director, the Board has appointed a Lead Independent Director to provide leadership for our independent directors. The Lead Independent Director has a clearly defined set of responsibilities and provides significant independent Board leadership. Mr. Tassé was appointed as our Lead Independent Director on July 1, 2024. During Mr. Tassé’s nearly nine years of service on our Board, he has consistently demonstrated strong leadership skills in addition to his strong knowledge of commercial operations, strategic management and the life sciences industry. The independent directors of the Board are confident in Mr. Tassé’s ability to serve as Lead Independent Director.

The position of Lead Independent Director has a clear mandate, significant authority and well-defined responsibilities under our corporate governance guidelines. These responsibilities include:

1.presiding at executive sessions of the independent directors and at any other meeting when the Chairman of the Board is not present;

2.determining an agenda for executive sessions of the independent directors;

3.serving as a liaison between the Chairman of the Board, the CEO and the independent directors and advising the Chairman of the Board and the CEO, as appropriate, on the issues discussed at executive sessions of independent directors;

4.calling special meetings of the independent directors; and

5.performing other duties specified in the corporate governance guidelines or assigned from time to time by the Board.

Risk Oversight

The Board has responsibility for the oversight of the Company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes the Board receiving regular reports from Board committees and members of senior management to enable the Board to understand and evaluate the Company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, reputational, information and cyber security, human capital, environmental and social risk. The oversight of risk within the Company is an evolving process requiring the Company to continually look for opportunities to further embed systematic enterprise risk management into ongoing business processes within the Company.

The Board is responsible for overseeing information security risk, and management reports to the Board regarding our assessment of information security risk, among other risks we face, on a periodic basis. Management monitors our information security systems to identify and mitigate any related risks, and we do not believe we have experienced any material cyber breaches. We maintain cybersecurity insurance coverage and we continue to invest in data protection and information technology, including providing an information security training and compliance program to our employees. Periodically, the Audit Committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. The Audit Committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Oversight by the Audit Committee includes direct communication with our external auditor, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The Compensation Committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking and conducts a compensation risk assessment on an annual basis. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board, corporate governance practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by the Board as a whole.

Insider Trading Policy

We have adopted insider trading policies and procedures applicable to our directors, officers, and employees, and have implemented processes for the Company that we believe are reasonably designed to promote compliance with insider trading laws, rules, and regulations, and the Nasdaq listing standards. Our Insider Trading Policy prohibits our employees and related persons and entities from trading in our stock while in possession of material, nonpublic information. Our trading black-out period requires that certain officers of the Company and other designated employees only transact in our stock during an open window period, subject to limited exceptions. In addition, certain officers and directors of the Company are required to obtain approval in advance of transactions in our stock. The foregoing summary of our insider trading policies and procedures does not purport to be complete and is qualified by reference to our Insider Trading Policy, a copy of which can be found as Exhibit 19.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Communications with the Board

The Board is interested in receiving communications from stockholders and other interested parties. These parties may contact any member of the Board or any committee of the Board, the non-employee directors as a group or the chairperson of any committee. In addition, the Audit Committee is interested in receiving communications from employees and other interested parties regarding accounting, internal controls or auditing matters. Any such correspondence should be addressed to the appropriate person or persons, either by name or title, and sent to our Corporate Secretary at REGENXBIO Inc., 9804 Medical Center Drive, Rockville, Maryland 20850, Attention: Corporate Secretary. The Corporate Secretary will review all such communications, but may, in his or her sole discretion, disregard any communication that he or she believes is not related to the duties and responsibilities of the Board. If deemed an appropriate communication, the Corporate Secretary will share the communication with the applicable director or directors.

DIRECTOR COMPENSATION

Our Board determines the compensation of our non-employee directors in conjunction with recommendations made by the Compensation Committee. We use a combination of cash and share-based compensation to attract and retain qualified candidates to serve on the Board. Kenneth T. Mills, who served as our President and CEO until July 1, 2024 and remained a member of the Board, did not receive any compensation from us during the first half of fiscal year ended December 31, 2024 for his service as a director and is only partially included in the 2024 Director Compensation Table below. Curran Simpson became our President and CEO and member of the Board effective July 1, 2024; he did not receive any compensation from us during our fiscal year ended December 31, 2024 for his service as a director and is not included in the 2024 Director Compensation Table below.

Fees Earned or Paid in Cash

In 2024, pursuant to our compensation program for non-employee directors, each member of the Board who was not an employee received the following annual cash compensation for Board services, as applicable, paid in quarterly installments in arrears:

|

|

|

|

Description of Service |

|

Cash

Compensation

($) |

Chairman of the Board |

|

35,000 |

Lead Independent Director |

|

25,000 |

Member of the Board

(including the Chairman of the Board and the Lead Independent Director) |

|

45,000 |

In addition to the cash compensation described above, each member of the Board who served on the Audit Committee, Compensation Committee or Nominating and Corporate Governance Committee received additional cash compensation as follows, paid in quarterly installments in arrears:

|

|

|

|

|

|

Committee |

|

Role |

|

Cash

Compensation

($) |

Audit Committee |

|

Committee Chair |

|

20,000 |

|

|

Committee Member |

|

10,000 |

Compensation Committee |

|

Committee Chair |

|

15,000 |

|

|

Committee Member |

|

7,500 |

Nominating and Corporate Governance Committee |

|

Committee Chair |

|

10,000 |

|

|