1 Phase 2 Strategy Update November 19, 2025 v v v v

Forward-Looking Statements and Non-GAAP Financial Measures This presentation

contains “forward-looking statements,” within the meaning of the federal securities law, as well as forward-looking projections about our business, prospects and other information, as well as hypothetical business models, which are based on

management’s current expectations as of the date of this presentation. Statements that are not historical facts, including statements about our beliefs, opinions, projections or expectations and statements that assume or are dependent upon

future events, are forward-looking statements and often contain words such as “expect,” “anticipate,” “assume,” “intend,” “plan,” “project,” “estimate,” “forecast,” “believe,” “seek,” “see,” “will,” “would,” “may,” “could,” “should,” “goals,”

“target,” and similar expressions. Such statements involve many risks and uncertainties that could cause our actual results to dier materially from those expressed or implied in our forward-looking statements. For Navient, these factors

include, among other things: general economic conditions, including the potential impact of inflation and interest rates on Navient and its clients and customers and on the creditworthiness of third parties; increased defaults on loans held

by us; unanticipated repayment trends on education loans, including prepayments or deferrals resulting from new interpretations or the timing of the execution and implementation of current laws, rules or regulations or future laws,

executive orders or other policy initiatives that operate to encourage or require consolidation, abolish existing or create additional income-based repayment or debt forgiveness programs or establish other policies and programs or extensions

of previously announced deadlines which may increase or decrease the prepayment rates on education loans and accelerate or slow down the repayment of the bonds in our securitization trusts; a reduction in our credit ratings; changes to

applicable laws, rules, regulations and government policies and expanded regulatory and governmental oversight; changes in the general interest rate environment, including the availability of any relevant money-market index rate or the

relationship between the relevant money market index rate and the rate at which our assets are priced; the interest rate characteristics of our assets do not always match those of our funding arrangements; adverse market conditions or an

inability to manage eectively our liquidity risk or access liquidity; the cost and availability of funding in the capital markets; our ability to earn Floor Income and our ability to enter into hedges relative to that Floor Income are

dependent on the future interest rate environment and therefore is variable; our use of derivatives exposes us to credit and market risk; our ability to align continually and eectively our cost structure with our business operations; our

ability to implement our strategic initiatives and realize the projected synergies, cost savings and other benefits of those initiatives; a failure or breach of our operating systems, infrastructure or information technology systems; failure

by any third party providing us material services or products or a breach or violation of law by one of these third parties; additional risks inherent in the government contracting environment from our current or previous work with

government clients; acquisitions, strategic initiatives and investments or divestitures that we pursue; shareholder activism; reputational risk and social factors; and the other factors that are described in the “Risk Factors” section of

Navient’s Annual Report on Form 10-K for the year ended December 31, 2024, and in our other reports filed with the SEC. The preparation of our consolidated financial statements also requires management to make certain estimates and assumptions

including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect and actual results could dier materially. All forward-looking statements contained in this presentation are qualified by these

cautionary statements and are made only as of the date of this release. The company does not undertake any obligation to update or revise these forward-looking statements except as required by law. Navient reports financial results on a GAAP

basis and also provides certain non-GAAP performance measures, including Core Earnings, Adjusted Tangible Equity Ratio, and various other non-GAAP financial measures derived from Core Earnings. When compared to GAAP results, Core Earnings

exclude the impact of: (1) mark-to-market gains/losses on derivatives; and (2) goodwill and acquired intangible asset amortization and impairment. Navient provides Core Earnings measures because this is what management uses when making

management decisions regarding Navient’s performance and the allocation of corporate resources. Navient Core Earnings are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. For

certain forward-looking non-GAAP measures, Navient is unable to provide a reconciliation because it is unable to estimate with reasonable certainty the ultimate timing or amount of certain significant items without unreasonable eorts. For

more information on the assumptions underlying the financial snapshots set forth in this presentation, see the Appendix hereto. 2

Ma Palese Ed Bramson Dave Yowan Navient Phase 2 Strategy Update Present on

Today’s Call Chief Executive Oicer SVP, Earnest Chairman of the Board of Directors 2

Phase 1: Restructuring Navient Navient restructuring program has increased

future cash flows → Anticipate further expense reductions 1. Estimated pre-tax savings of $119 million for 17 year remaining life of legacy portfolio. Does not include additional benefits from reduction in variable outsourced loan servicing

expense as legacy portfolio shrinks in future years. ✔• ✔• Adds another ~$2 billion to existing net cash flow for growth investments or distributions1 2

Phase 2: Growing Earnest •1 Align product lines, disclosures, and metrics with

relevant peers and sectors → Education Lending: Navient (FFELP, Legacy Private, In-School1) Peers: Specialty Finance Sector → Digital Financial Services: Earnest (Student Loan Refinancing (“SLR”), Personal Loans, future financial services or

products) Peers: Fintech Sector •2 Adopt Earnest-specific shareholder value metrics → Significantly higher growth rates → Reduced capital intensity → Increased proportion of recurring fee income → Higher return on equity 3• Achieve

overall Earnest eiciency equal to or greater than peers at lower breakeven volumes 2 1. Includes undergraduate and graduate In-School student lending.

Company Overview 2

Earnest Overview Division of Navient using “Earnest” brand since

acquisition Originates and services all new loans Develops all new customer facing software Migrating to completely standalone operations by integrating capital markets capability from Navient Generating relationships with high lifetime

value customers 2

>375k1 Unique customer relationships; with >40k expected to be added in

2026 29 yrs2 Average age at origination $198k3 Average Annual Income 7723 Average FICO 2 Earnest’s Customer Set up for financial success, but starting their professional life with debt At September 30, 2025. At loan origination for

SLR loans during the period of January 2023 - September 2025. At loan origination for SLR loans during the latest 12 months ending September 30, 2025; represents current underwriting standards.

Earnest’s People 10 3301 Total Employees 3 Hubs Oakland, Austin, and Salt

Lake City 33 Average Employee Age 44 Average Exec Team Age 1. At September 30, 2025; includes contractors.

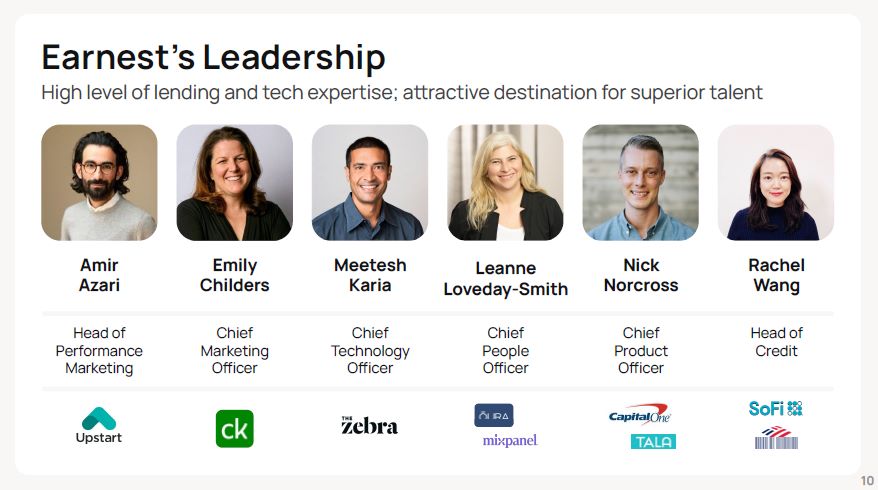

Emily Childers Meetesh Karia Nick Norcross Leanne Loveday-Smith Rachel

Wang Amir Azari Earnest’s Leadership High level of lending and tech expertise; aractive destination for superior talent Head of Performance Marketing Chief Marketing Oicer Chief Technology Oicer Chief People Oicer Chief Product

Oicer Head of Credit 10

Financial Snapshot 10

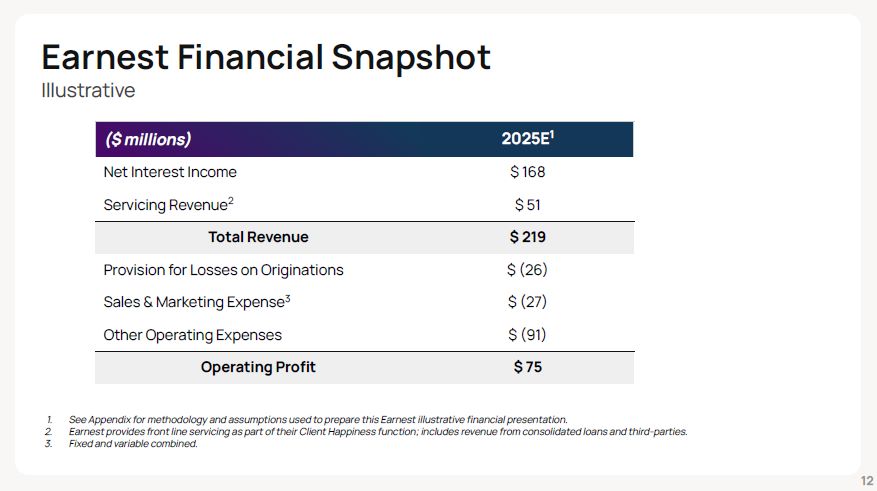

($ millions) 10 2025E1 Net Interest Income Servicing Revenue2 $ 168 $

51 Total Revenue $ 219 Provision for Losses on Originations Sales & Marketing Expense3 Other Operating Expenses $ (26) $ (27) $ (91) Operating Profit $ 75 See Appendix for methodology and assumptions used to prepare this Earnest

illustrative financial presentation. Earnest provides front line servicing as part of their Client Happiness function; includes revenue from consolidated loans and third-parties. Fixed and variable combined. Earnest Financial

Snapshot Illustrative

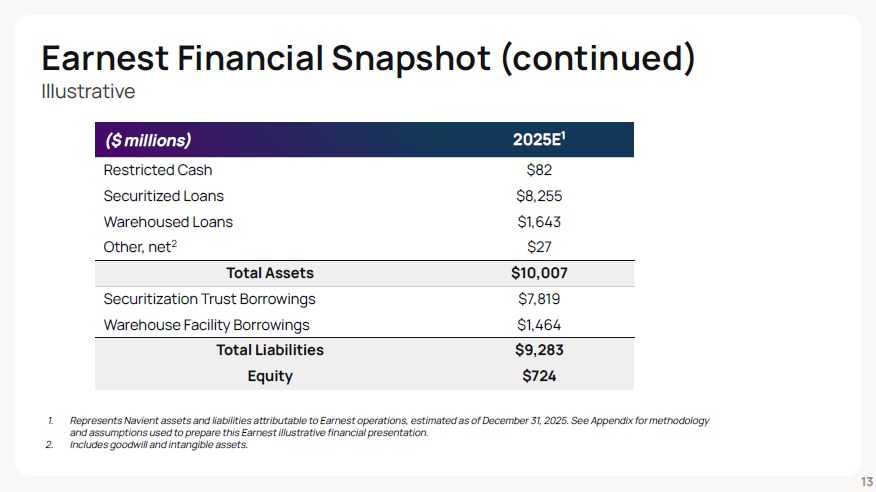

($ millions) 2025E1 Restricted Cash $82 Securitized

Loans $8,255 Warehoused Loans $1,643 Other, net2 $27 Total Assets $10,007 Securitization Trust Borrowings $7,819 Warehouse Facility Borrowings $1,464 Total Liabilities $9,283 Equity $724 17 Represents Navient assets and

liabilities aributable to Earnest operations, estimated as of December 31, 2025. See Appendix for methodology and assumptions used to prepare this Earnest illustrative financial presentation. Includes goodwill and intangible assets. Earnest

Financial Snapshot (continued) Illustrative

Foundation for Growth 17

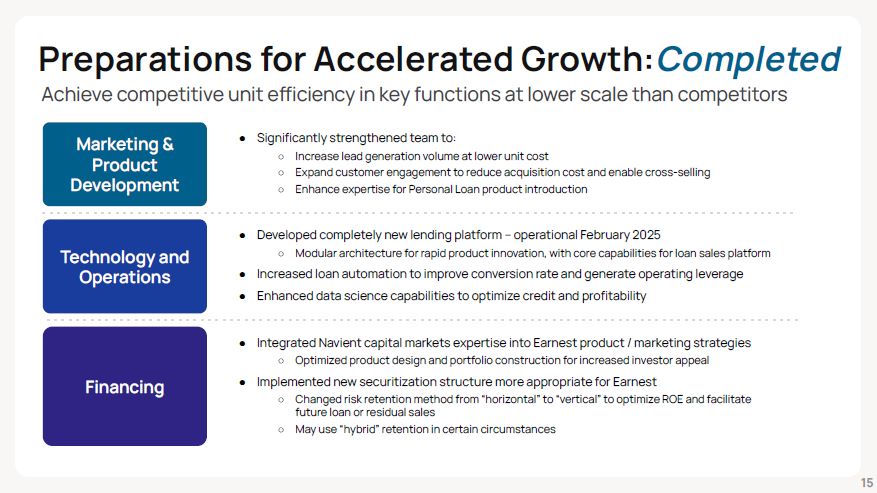

Preparations for Accelerated Growth:Completed Achieve competitive unit

eiciency in key functions at lower scale than competitors Marketing & Product Development Technology and Operations Financing Integrated Navient capital markets expertise into Earnest product / marketing strategies Optimized product

design and portfolio construction for increased investor appeal Implemented new securitization structure more appropriate for Earnest Changed risk retention method from “horizontal” to “vertical” to optimize ROE and facilitate future loan

or residual sales May use “hybrid” retention in certain circumstances Developed completely new lending platform – operational February 2025 Modular architecture for rapid product innovation, with core capabilities for loan sales

platform Increased loan automation to improve conversion rate and generate operating leverage Enhanced data science capabilities to optimize credit and profitability Significantly strengthened team to: Increase lead generation volume at

lower unit cost Expand customer engagement to reduce acquisition cost and enable cross-selling Enhance expertise for Personal Loan product introduction 17

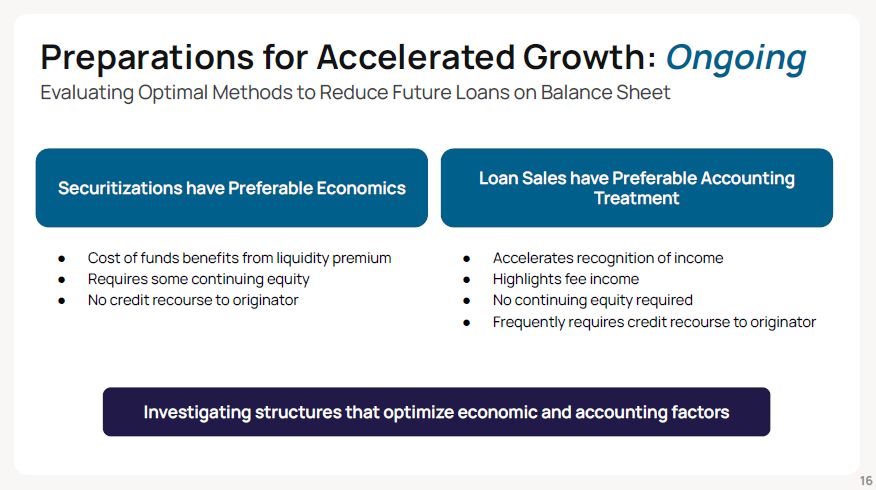

Securitizations have Preferable Economics Loan Sales have Preferable Accounting

Treatment Investigating structures that optimize economic and accounting factors 17 Cost of funds benefits from liquidity premium Requires some continuing equity No credit recourse to originator Accelerates recognition of

income Highlights fee income No continuing equity required Frequently requires credit recourse to originator Preparations for Accelerated Growth: Ongoing Evaluating Optimal Methods to Reduce Future Loans on Balance Sheet

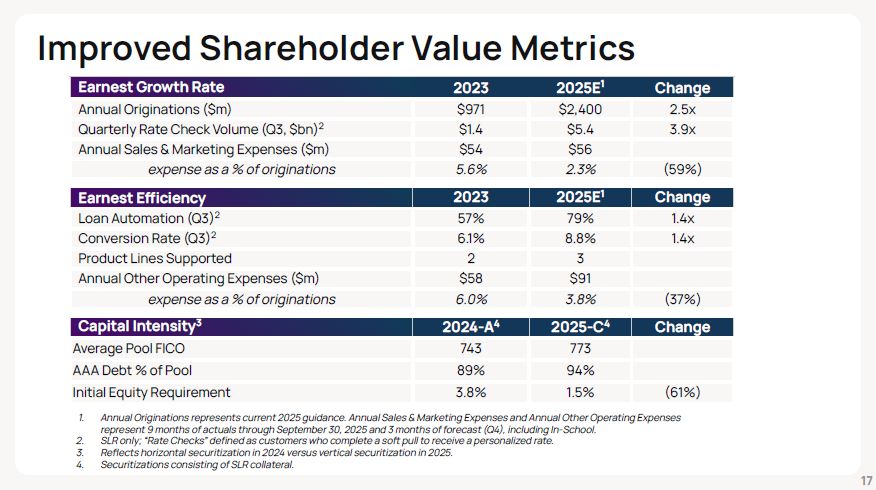

Improved Shareholder Value Metrics Annual Originations represents current 2025

guidance. Annual Sales & Marketing Expenses and Annual Other Operating Expenses represent 9 months of actuals through September 30, 2025 and 3 months of forecast (Q4), including In-School. SLR only; “Rate Checks” defined as customers who

complete a soft pull to receive a personalized rate. Reflects horizontal securitization in 2024 versus vertical securitization in 2025. Securitizations consisting of SLR collateral. Earnest Growth Rate 2023 2025E1 Change Annual

Originations ($m) $971 $2,400 2.5x Quarterly Rate Check Volume (Q3, $bn)2 $1.4 $5.4 3.9x Annual Sales & Marketing Expenses ($m) $54 $56 expense as a % of originations 5.6% 2.3% (59%) Earnest

Eiciency 2023 2025E1 Change Loan Automation (Q3)2 57% 79% 1.4x Conversion Rate (Q3)2 6.1% 8.8% 1.4x Product Lines Supported 2 3 Annual Other Operating Expenses ($m) $58 $91 expense as a % of

originations 6.0% 3.8% (37%) Capital Intensity3 2024-A4 2025-C4 Change Average Pool FICO 743 773 AAA Debt % of Pool 89% 94% Initial Equity Requirement 3.8% 1.5% (61%) 17

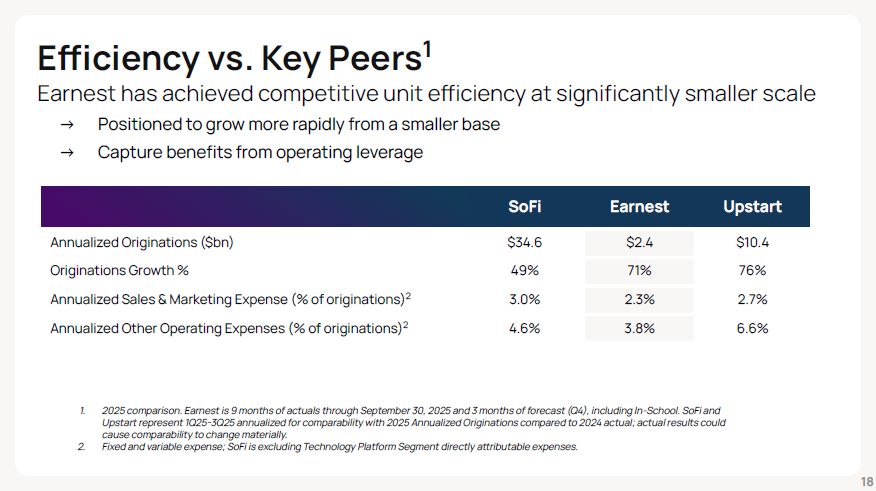

Eiciency vs. Key Peers1 Earnest has achieved competitive unit eiciency at

significantly smaller scale → Positioned to grow more rapidly from a smaller base → Capture benefits from operating leverage 2025 comparison. Earnest is 9 months of actuals through September 30, 2025 and 3 months of forecast (Q4), including

In-School. SoFi and Upstart represent 1Q25-3Q25 annualized for comparability with 2025 Annualized Originations compared to 2024 actual; actual results could cause comparability to change materially. Fixed and variable expense; SoFi is

excluding Technology Platform Segment directly aributable expenses. SoFi Earnest Upstart Annualized Originations ($bn) $34.6 $2.4 $10.4 Originations Growth % 49% 71% 76% Annualized Sales & Marketing Expense (% of

originations)2 3.0% 2.3% 2.7% Annualized Other Operating Expenses (% of originations)2 4.6% 3.8% 6.6% 17

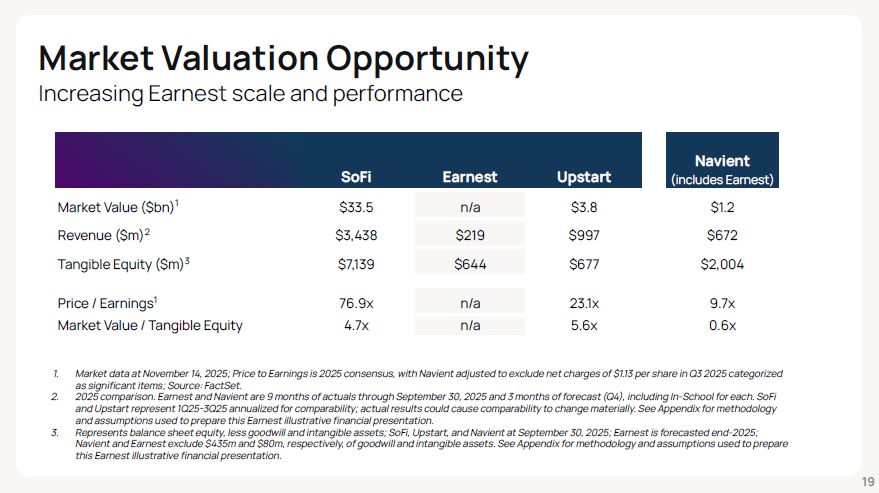

Market Valuation Opportunity Increasing Earnest scale and performance Market

data at November 14, 2025; Price to Earnings is 2025 consensus, with Navient adjusted to exclude net charges of $1.13 per share in Q3 2025 categorized as significant items; Source: FactSet. 2025 comparison. Earnest and Navient are 9 months of

actuals through September 30, 2025 and 3 months of forecast (Q4), including In-School for each. SoFi and Upstart represent 1Q25-3Q25 annualized for comparability; actual results could cause comparability to change materially. See Appendix for

methodology and assumptions used to prepare this Earnest illustrative financial presentation. Represents balance sheet equity, less goodwill and intangible assets; SoFi, Upstart, and Navient at September 30, 2025; Earnest is forecasted

end-2025; Navient and Earnest exclude $435m and $80m, respectively, of goodwill and intangible assets. See Appendix for methodology and assumptions used to prepare this Earnest illustrative financial presentation. SoFi Earnest

Upstart Navient (includes Earnest) Market Value ($bn)1 $33.5 n/a $3.8 $1.2 Revenue ($m)2 $3,438 $219 $997 $672 Tangible Equity ($m)3 $7,139 $644 $677 $2,004 Price / Earnings1 76.9x n/a 23.1x 9.7x Market Value / Tangible

Equity 4.7x n/a 5.6x 0.6x 17

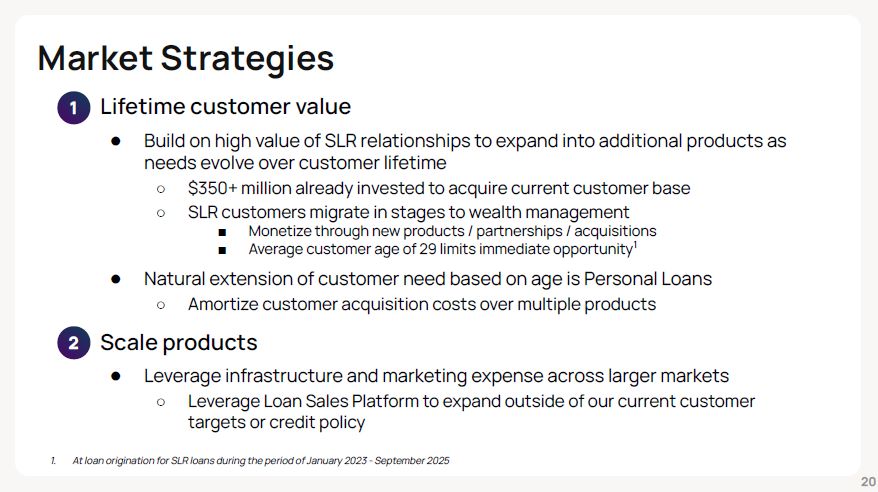

Market Strategies Lifetime customer value Build on high value of SLR

relationships to expand into additional products as needs evolve over customer lifetime $350+ million already invested to acquire current customer base SLR customers migrate in stages to wealth management Monetize through new products /

partnerships / acquisitions Average customer age of 29 limits immediate opportunity1 Natural extension of customer need based on age is Personal Loans Amortize customer acquisition costs over multiple products Scale products Leverage

infrastructure and marketing expense across larger markets Leverage Loan Sales Platform to expand outside of our current customer targets or credit policy 1. At loan origination for SLR loans during the period of January 2023 - September

2025 20

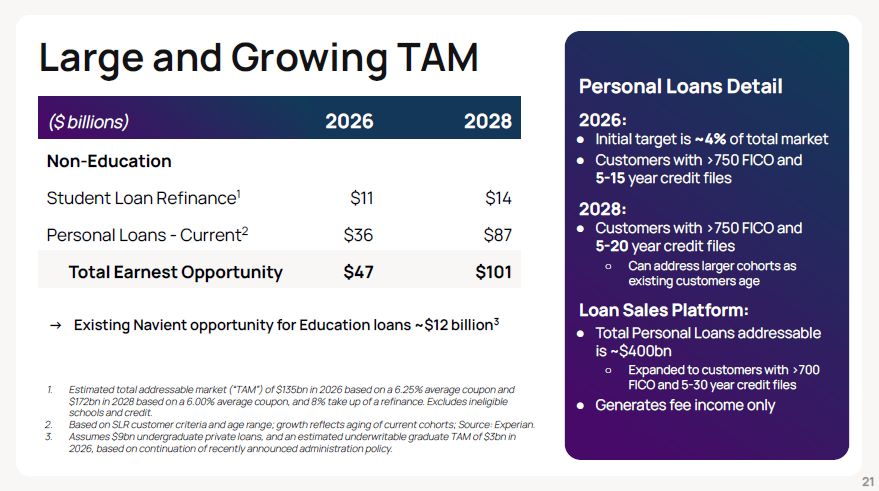

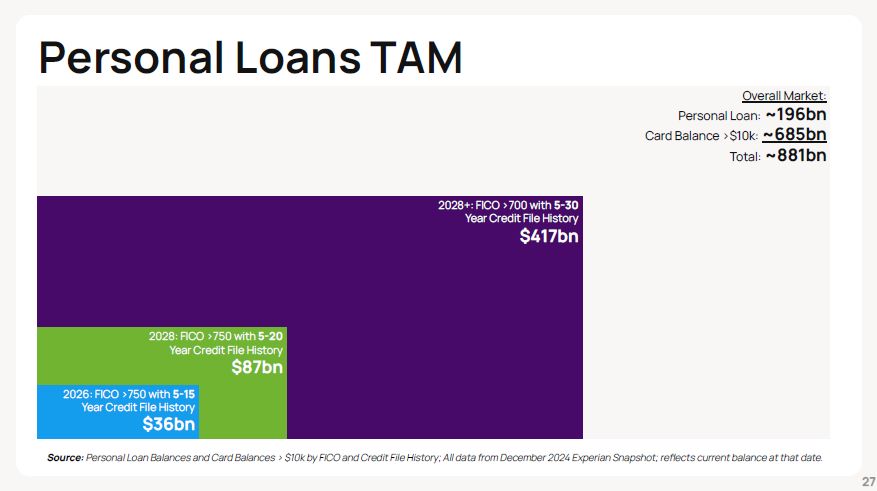

Large and Growing TAM Estimated total addressable market (“TAM”) of $135bn in

2026 based on a 6.25% average coupon and $172bn in 2028 based on a 6.00% average coupon, and 8% take up of a refinance. Excludes ineligible schools and credit. Based on SLR customer criteria and age range; growth reflects aging of current

cohorts; Source: Experian. Assumes $9bn undergraduate private loans, and an estimated underwritable graduate TAM of $3bn in 2026, based on continuation of recently announced administration policy. Personal Loans Detail 2026: Initial

target is ~4% of total market Customers with >750 FICO and 5-15 year credit files 2028: Customers with >750 FICO and 5-20 year credit files Can address larger cohorts as existing customers age Loan Sales Platform: Total Personal

Loans addressable is ~$400bn Expanded to customers with >700 FICO and 5-30 year credit files Generates fee income only ($ billions) 2026 2028 Non-Education Student Loan Refinance1 $11 $14 Personal Loans - Current2 $36 $87 Total

Earnest Opportunity $47 $101 20 → Existing Navient opportunity for Education loans ~$12 billion3

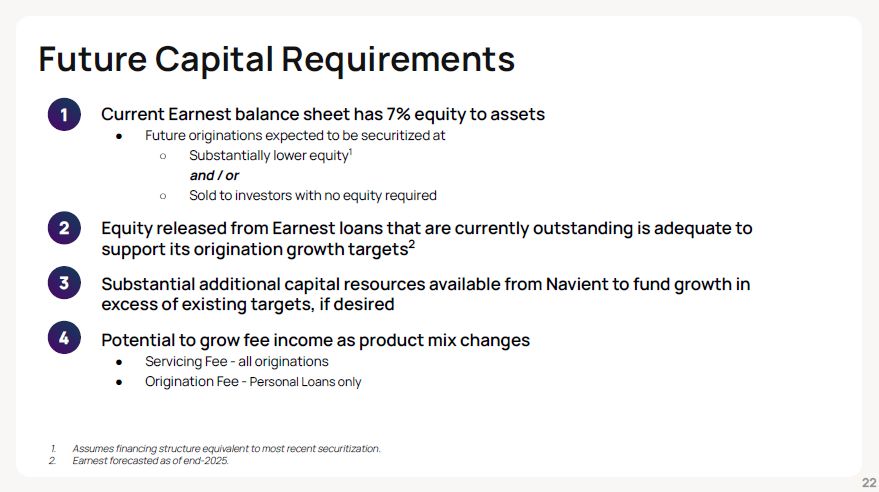

Future Capital Requirements Assumes financing structure equivalent to most

recent securitization. Earnest forecasted as of end-2025. 1 Current Earnest balance sheet has 7% equity to assets Future originations expected to be securitized at Substantially lower equity1 and / or Sold to investors with no equity

required Equity released from Earnest loans that are currently outstanding is adequate to support its origination growth targets2 Substantial additional capital resources available from Navient to fund growth in excess of existing targets,

if desired Potential to grow fee income as product mix changes Servicing Fee - all originations Origination Fee - Personal Loans only 4 20

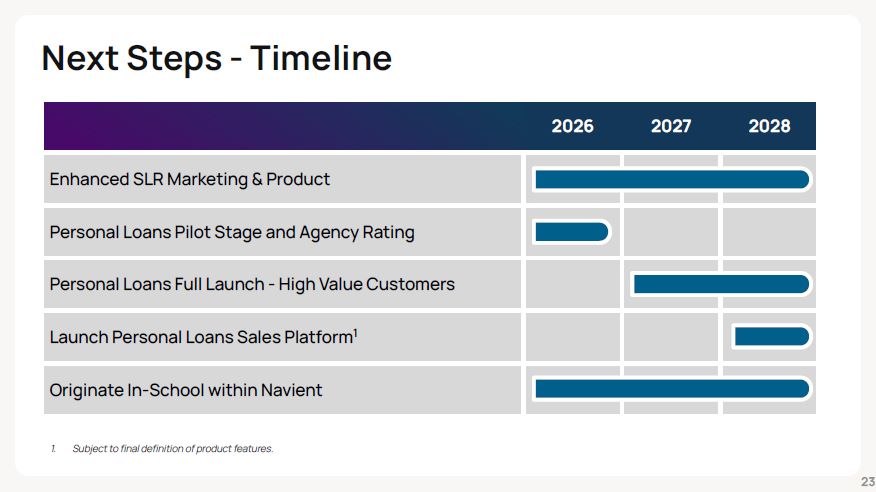

Next Steps - Timeline 2026 2027 2028 Enhanced SLR Marketing &

Product Personal Loans Pilot Stage and Agency Rating Personal Loans Full Launch - High Value Customers Launch Personal Loans Sales Platform1 Originate In-School within Navient 1. Subject to final definition of product features. 23

Summary 1● 2 years of investment have transformed Earnest’s competitive

eiciency and ability to compete in current and expanded markets 2● Improved product alignment and disclosure in 2026 enables more meaningful comparison with peers and information for investors Education Lending aligns Navient with

Specialty Finance sector Digital Financial Services aligns Earnest with Fintech sector 3● Origination momentum into 2026 Increasing SLR rate check volume provides support for increased origination growth Additional growth drivers in

Graduate In-School and Personal Loans 23

Appendix v v v 25

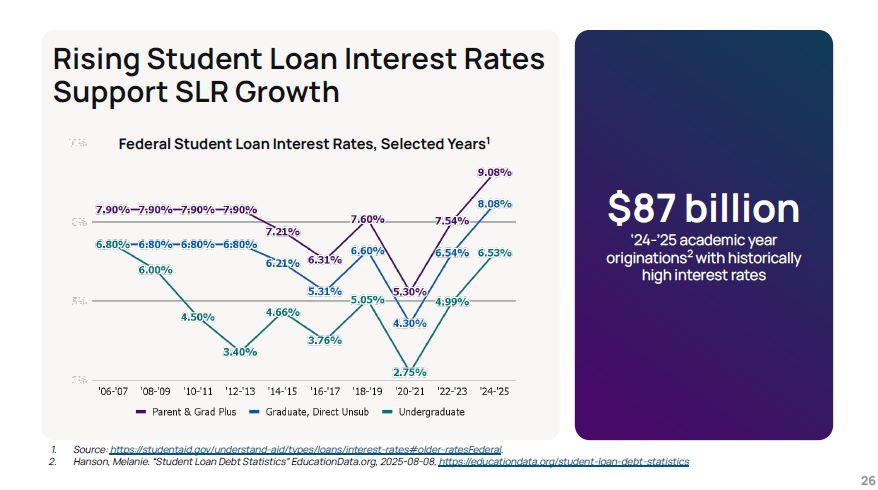

Rising Student Loan Interest Rates Support SLR Growth Source: hps:

/studentaid.gov/understand-aid/types/loans/interest-rates#older-ratesFederal. Hanson, Melanie. “Student Loan Debt Statistics” EducationData.org, 2025-08-08, hps: /educationdata.org/student-loan-debt-statistics $87 billion ‘24-’25 academic

year originations2 with historically high interest rates Federal Student Loan Interest Rates, Selected Years1 26

Personal Loans TAM Source: Personal Loan Balances and Card Balances > $10k

by FICO and Credit File History; All data from December 2024 Experian Snapshot; reflects current balance at that date. 2028+: FICO >700 with 5-30 Year Credit File History $417bn Overall Market: Personal Loan: ~196bn Card Balance

>$10k: ~685bn Total: ~881bn 2028: FICO >750 with 5-20 Year Credit File History $87bn 2026: FICO >750 with 5-15 Year Credit File History $36bn 26

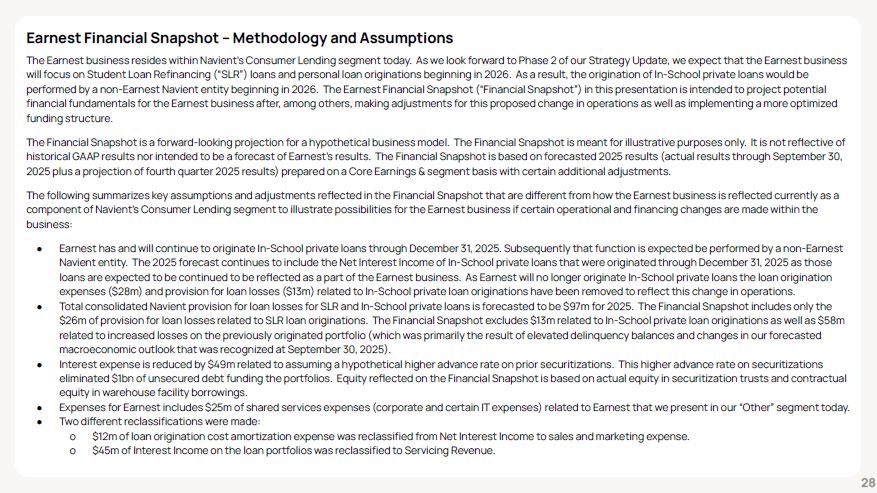

Earnest Financial Snapshot – Methodology and Assumptions 26 The Earnest

business resides within Navient’s Consumer Lending segment today. As we look forward to Phase 2 of our Strategy Update, we expect that the Earnest business will focus on Student Loan Refinancing (“SLR”) loans and personal loan originations

beginning in 2026. As a result, the origination of In-School private loans would be performed by a non-Earnest Navient entity beginning in 2026. The Earnest Financial Snapshot (“Financial Snapshot”) in this presentation is intended to project

potential financial fundamentals for the Earnest business after, among others, making adjustments for this proposed change in operations as well as implementing a more optimized funding structure. The Financial Snapshot is a forward-looking

projection for a hypothetical business model. The Financial Snapshot is meant for illustrative purposes only. It is not reflective of historical GAAP results nor intended to be a forecast of Earnest’s results. The Financial Snapshot is based

on forecasted 2025 results (actual results through September 30, 2025 plus a projection of fourth quarter 2025 results) prepared on a Core Earnings & segment basis with certain additional adjustments. The following summarizes key

assumptions and adjustments reflected in the Financial Snapshot that are dierent from how the Earnest business is reflected currently as a component of Navient’s Consumer Lending segment to illustrate possibilities for the Earnest business if

certain operational and financing changes are made within the business: Earnest has and will continue to originate In-School private loans through December 31, 2025. Subsequently that function is expected be performed by a non-Earnest Navient

entity. The 2025 forecast continues to include the Net Interest Income of In-School private loans that were originated through December 31, 2025 as those loans are expected to be continued to be reflected as a part of the Earnest business. As

Earnest will no longer originate In-School private loans the loan origination expenses ($28m) and provision for loan losses ($13m) related to In-School private loan originations have been removed to reflect this change in operations. Total

consolidated Navient provision for loan losses for SLR and In-School private loans is forecasted to be $97m for 2025. The Financial Snapshot includes only the $26m of provision for loan losses related to SLR loan originations. The Financial

Snapshot excludes $13m related to In-School private loan originations as well as $58m related to increased losses on the previously originated portfolio (which was primarily the result of elevated delinquency balances and changes in our

forecasted macroeconomic outlook that was recognized at September 30, 2025). Interest expense is reduced by $49m related to assuming a hypothetical higher advance rate on prior securitizations. This higher advance rate on securitizations

eliminated $1bn of unsecured debt funding the portfolios. Equity reflected on the Financial Snapshot is based on actual equity in securitization trusts and contractual equity in warehouse facility borrowings. Expenses for Earnest includes

$25m of shared services expenses (corporate and certain IT expenses) related to Earnest that we present in our “Other” segment today. Two dierent reclassifications were made: $12m of loan origination cost amortization expense was

reclassified from Net Interest Income to sales and marketing expense. $45m of Interest Income on the loan portfolios was reclassified to Servicing Revenue.