Dear Shareholders,

Metallus Inc. invites you to attend its 2025 annual meeting of shareholders at 10 a.m. EDT on May 7, 2025. We will consider matters that are important to our company and to you, our investors.

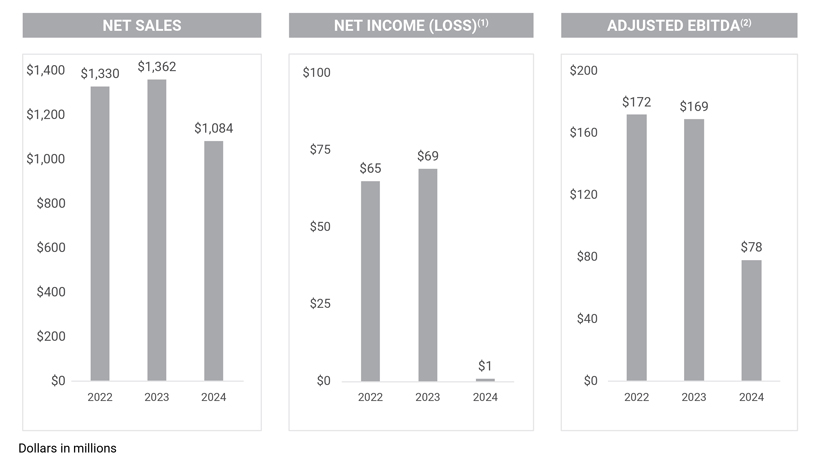

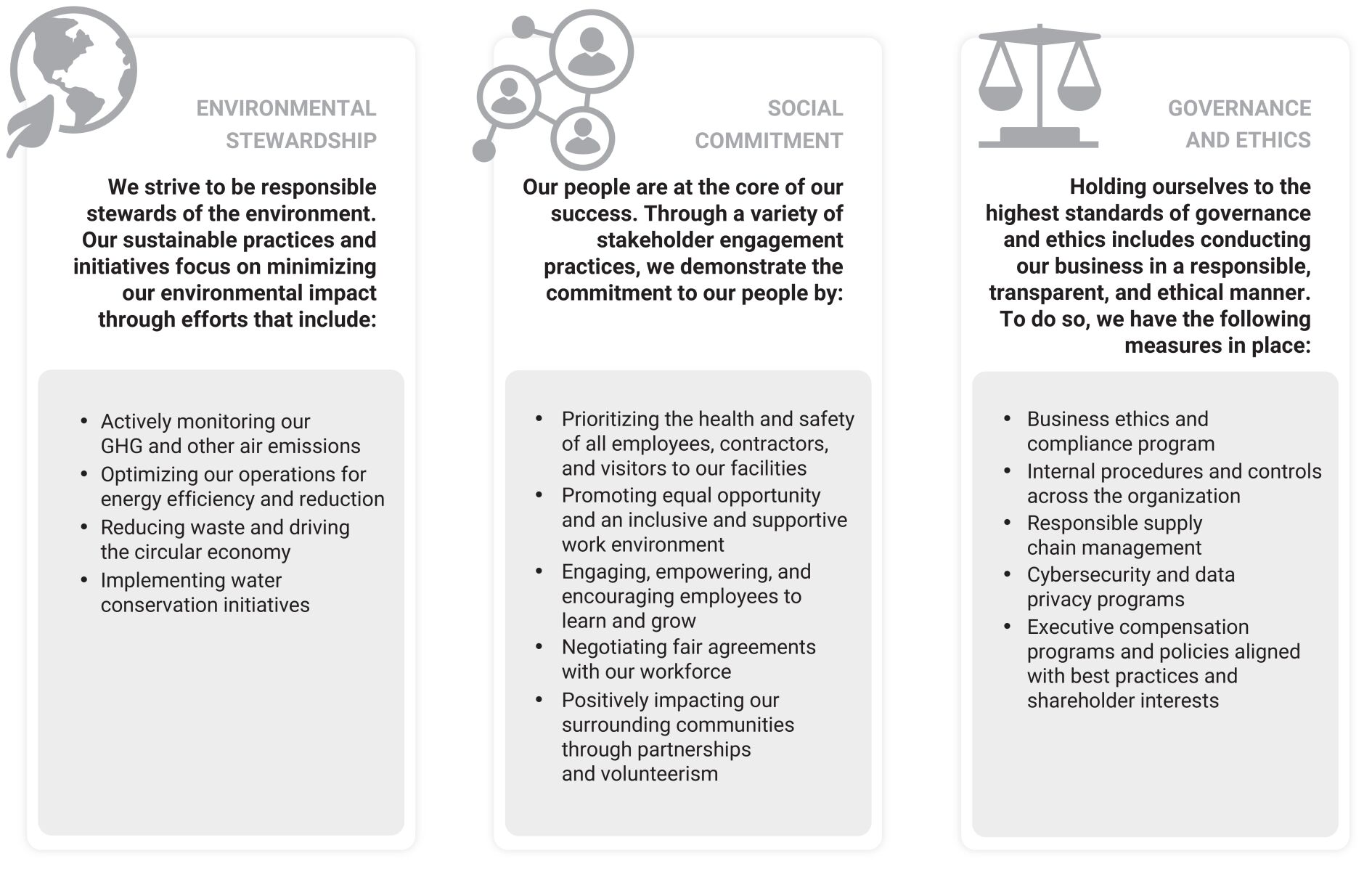

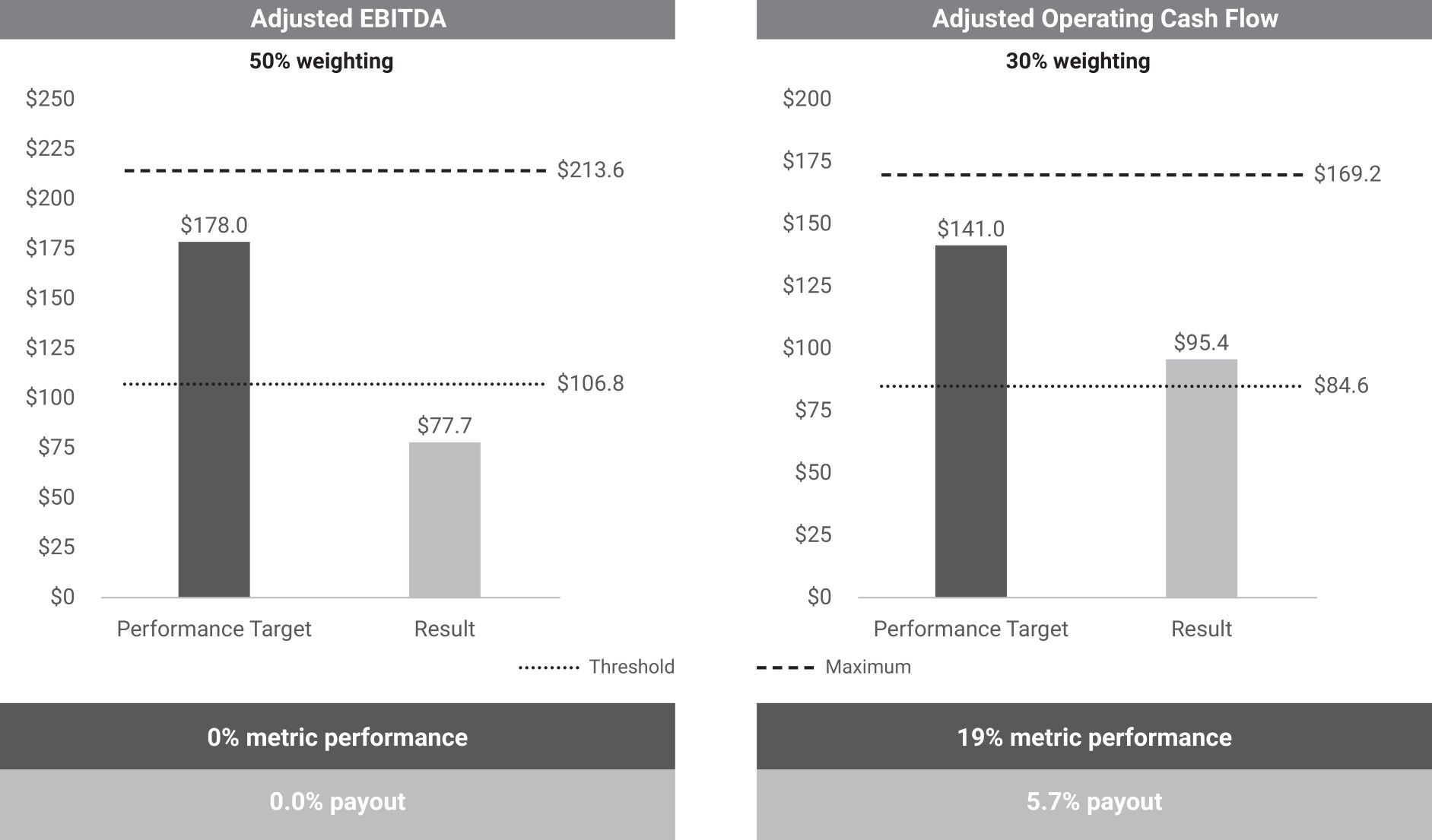

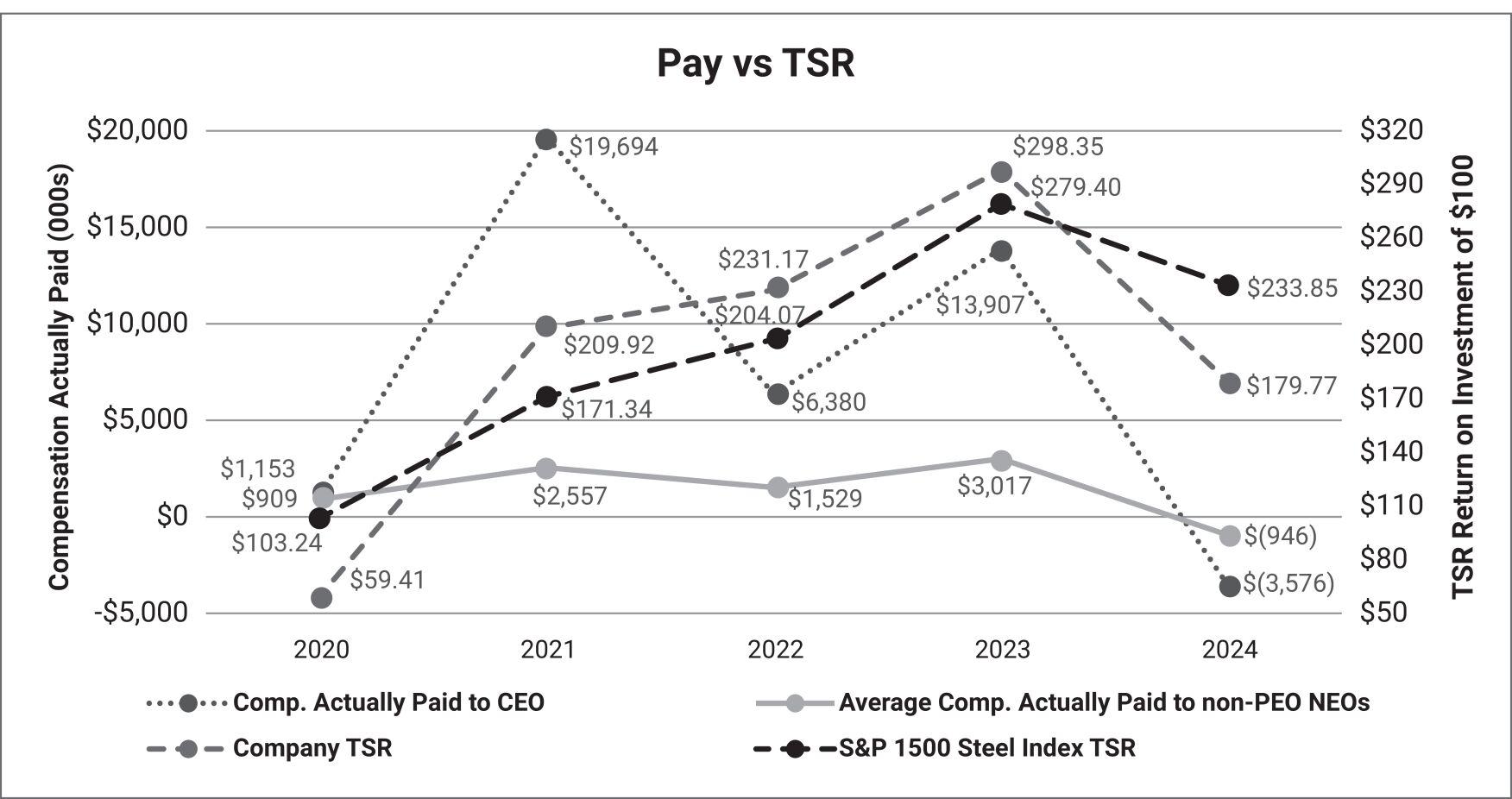

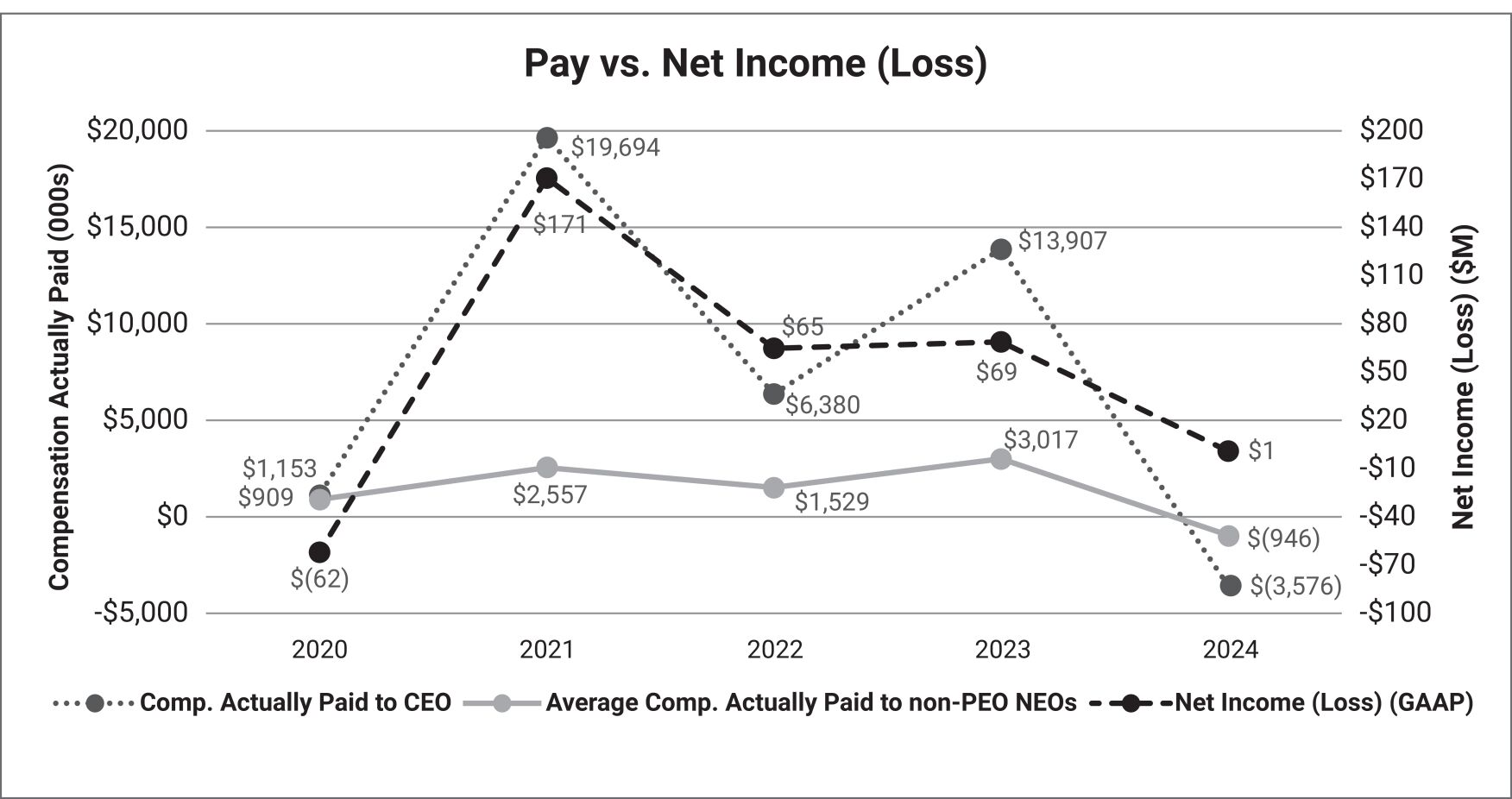

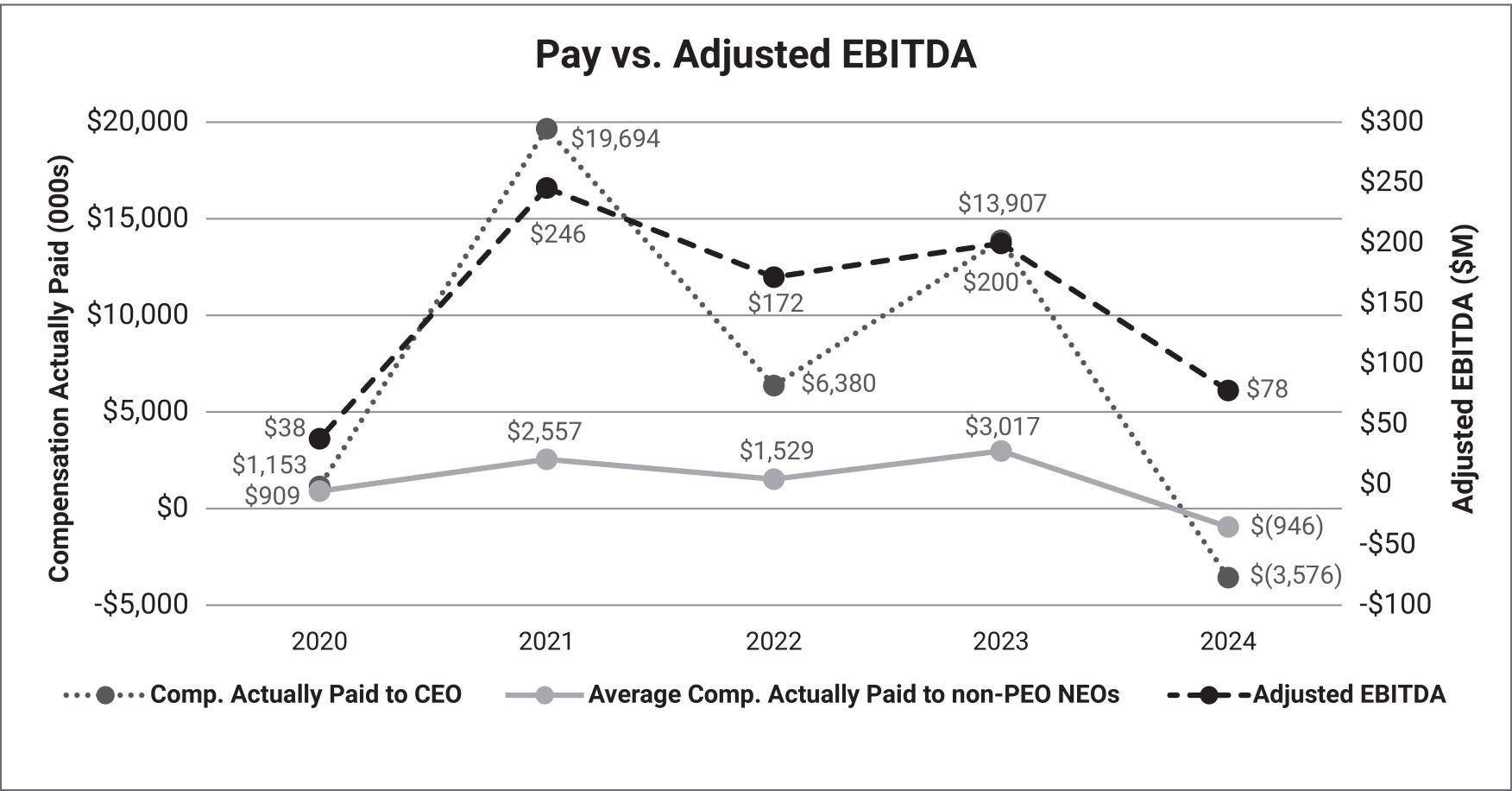

Weak market demand across many of our end markets in 2024 drove lower ship tons and utilization rates, resulting in financial results well below expectations for 2024. Over the past few years and with a focus on continuous improvement, we have structurally enhanced our business to be more resilient against economic downturns such as those experienced in 2024. As a result, despite challenging market conditions, we delivered positive net income and operating cash flow in 2024 while maintaining a strong balance sheet and returning capital to shareholders through our share repurchase program.

This year underscored the importance of focusing on what we can control – namely investing in our people and our assets and nurturing our valued partnerships with our customers and suppliers. Throughout the year, our team remained focused on maintaining and investing in our world-class assets aimed at improving safety, quality and efficiency. In addition, we continued to provide training and development opportunities for our employees. We believe these actions are not only critical for our long-term growth but will help us emerge from the current downturn stronger and ready to capitalize on opportunities as market conditions improve.

In 2024, Metallus entered into an agreement with the U.S. Army for $99.75 million in funding to support their mission of increasing munitions production for national security in the upcoming years, as well as an agreement for $3.5 million in grants from JobsOhio. The agreements support the commissioning of two major assets: a continuous bloom reheat furnace and a roller hearth heat treat furnace. These assets are expected to enhance production capacity, improve processing efficiencies, increase first-time quality, and reduce yield loss, benefiting all our customers. The company received $53.5 million of the funding in 2024, with additional funding expected throughout 2025 and into early 2026 as mutually agreed upon milestones are achieved. The confidence placed in us by the U.S. Department of Defense has proudly established Metallus as a key materials supplier.

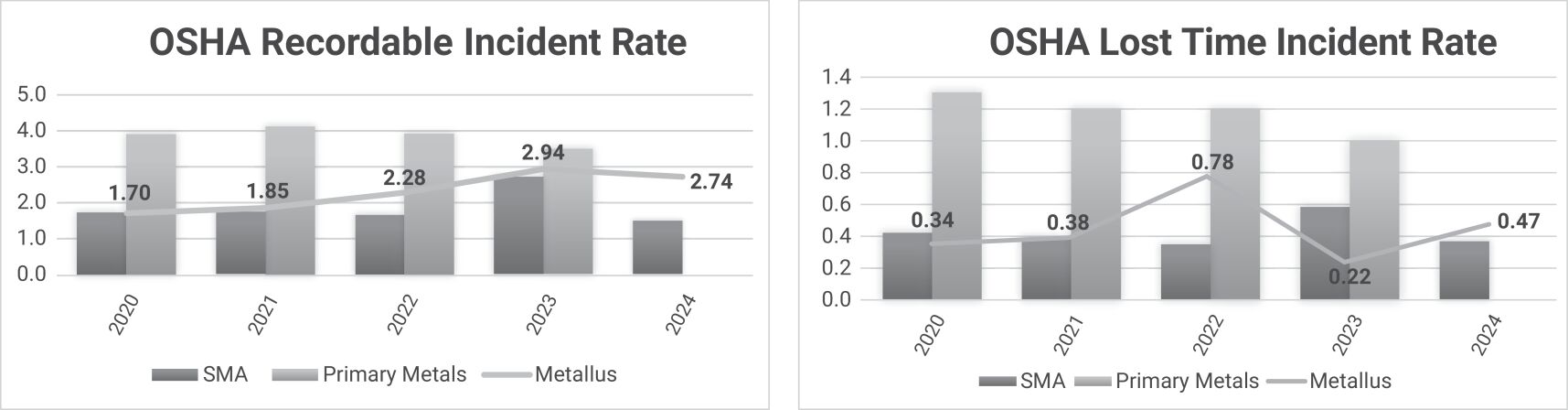

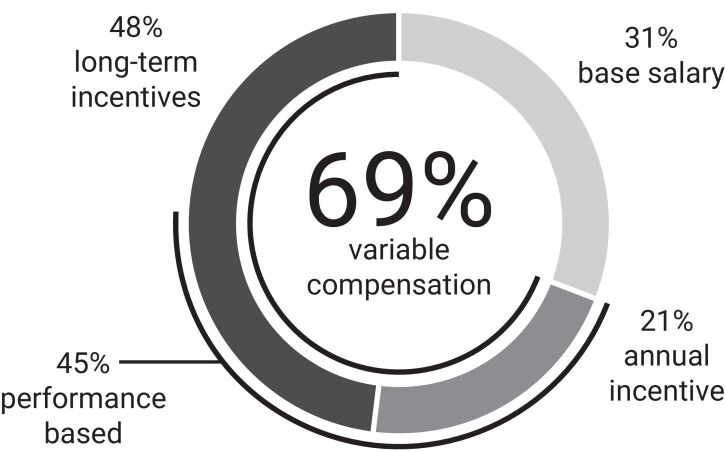

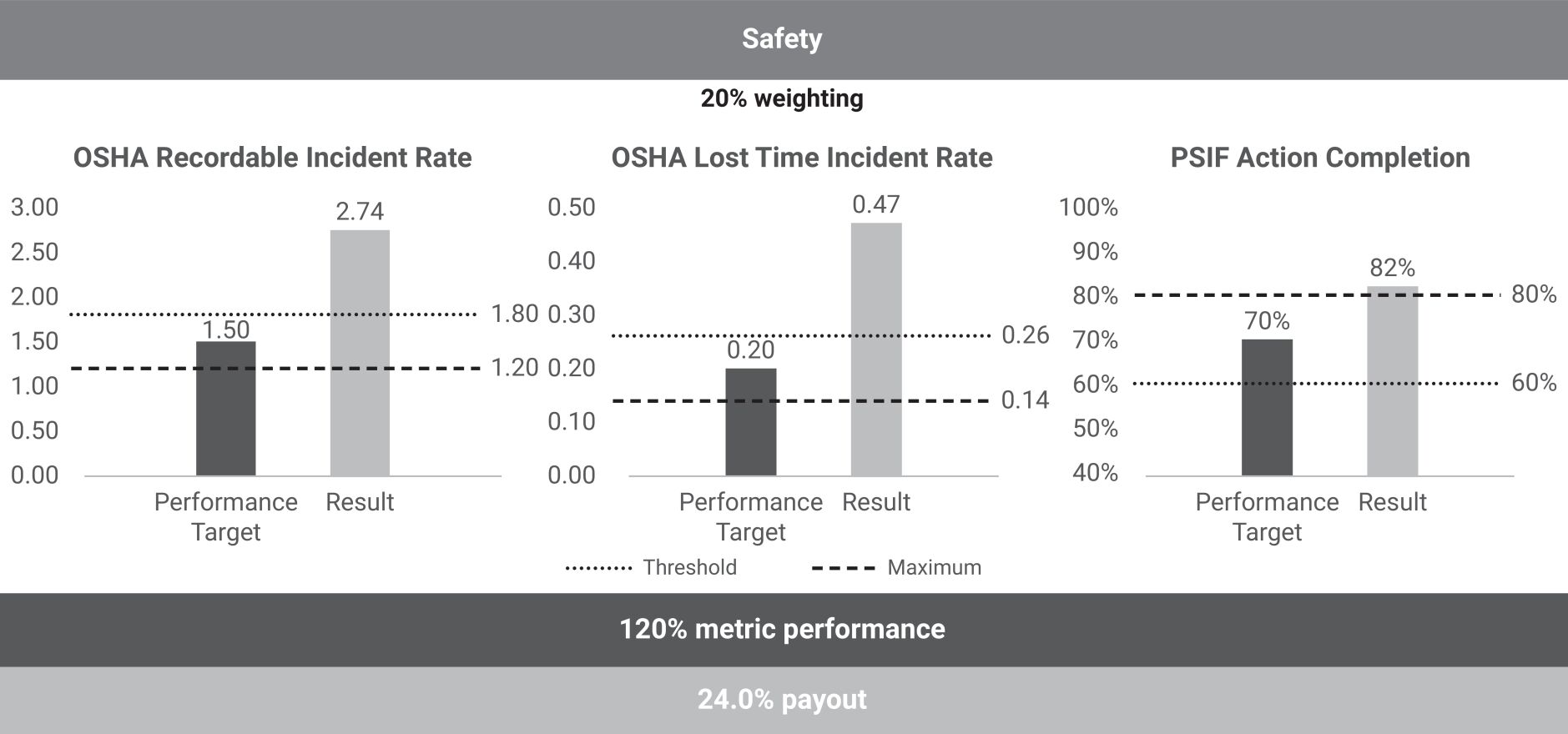

As we conduct our business, we consistently prioritize safety, which remains a core value at Metallus. In 2024, we spent approximately $8 million on safety equipment and comprehensive training programs company-wide, covering critical areas such as machine guarding upgrades, hand safety practices and training to prevent serious injuries or fatalities. Our goal is to ensure that our employees end each day injury and incident free. As a reminder, a significant portion of the annual incentive for each leader in our organization is tied directly to achieving specific safety targets.

In 2024, our teams made significant strides not only in safety but in other areas that we believe will drive long-term shareholder value, including:

| • | broadening our value-added processing services in multi-metals, including stainless steel and other high-alloy steels; |

| • | installing new camera technologies, in-line gauging to improve first-time quality, and an automated grinding line to improve operational efficiency and achieve significant cost reductions; |

| • | enhancing our manufacturing training and cross-training to develop our employees’ capabilities; |

| • | expanding our successful apprentice program to include our facility in Eaton, Ohio; and |

| • | focusing on leadership development and introducing a new cultural framework (Care, Communicate, Collaborate, Follow-Through, and Follow-Up) to support our company’s ongoing transformation. |

FOR ALL

FOR ALL

Please fold and detach card at perforation before mailing.

Please fold and detach card at perforation before mailing.