HRBeauty LLC Consolidated Financial Statements December 31, 2024

TABLE OF CONTENTS Page No. Independent Auditor's Report 1 - 2 Consolidated Balance Sheet 3 Consolidated Statement of Income 4 Consolidated Statement of Changes in Members' Equity 5 Consolidated Statement of Cash Flows 6 Notes to Consolidated Financial Statements 7 - 20

INDEPENDENT AUDITOR'S REPORT Board of Directors HRBeauty LLC Opinion We have audited the accompanying consolidated financial statements of HRBeauty LLC (a Delaware limited liability company) (the ''Company''), which comprise the consolidated balance sheet as of December 31, 2024, and the related consolidated statements of income, changes in members' equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of HRBeauty LLC as of December 31, 2024, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of HRBeauty LLC and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Correction of Error As discussed in Note 3 to the consolidated financial statements, certain errors resulting in an understatement of amounts related to equity-based compensation for the year ended December 31, 2023, were discovered by management of the Company during the current year. The correction had no impact on total members’ equity as of January 1, 2024. Our opinion is not modified with respect to that matter. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about HRBeauty LLC's ability to continue as a going concern within one year after the date that the financial statements are available to be issued. 1

Auditor's Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with auditing standards generally accepted in the United States of America will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with auditing standards generally accepted in the United States of America, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of HRBeauty LLC's internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about HRBeauty LLC's ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Woodland Hills, California October 10, 2025 2

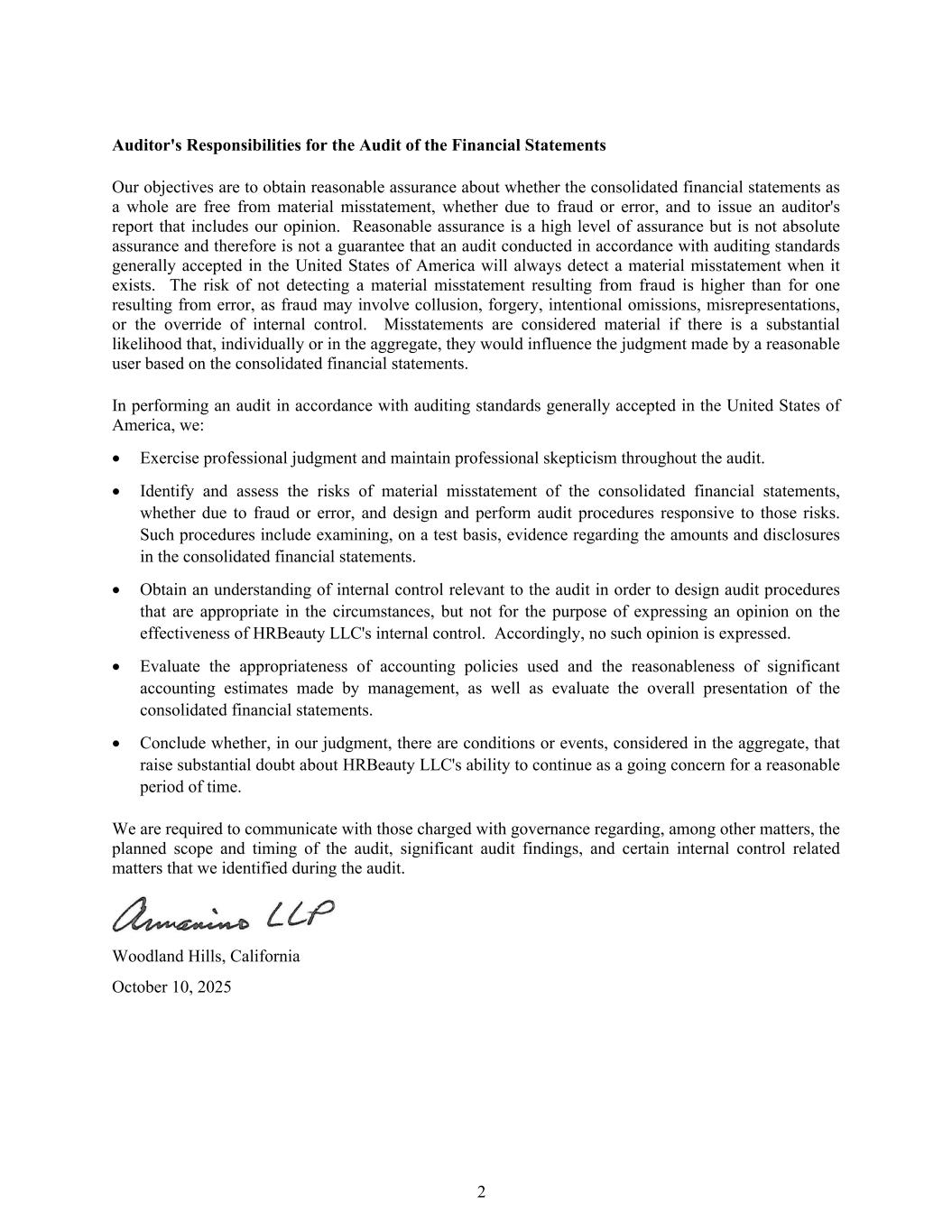

HRBeauty LLC Consolidated Balance Sheet December 31, 2024 ASSETS Current assets Cash and cash equivalents $ 58,850,158 Accounts receivable, net 242,120 Inventory 15,814,183 Prepaid expenses 1,327,350 Total current assets 76,233,811 Property and equipment, net 890,654 Operating lease right-of-use asset 1,237,029 Intangible assets, net 1,869,866 Other assets 276,119 Total assets $ 80,507,479 LIABILITIES AND MEMBERS' EQUITY Current liabilities Accounts payable $ 18,318,991 Accrued expenses 6,616,744 Deferred revenue 508,715 Current portion of operating lease liability 582,689 Total current liabilities 26,027,139 Operating lease liability, net of current portion 871,094 Total liabilities 26,898,233 Members' equity 53,609,246 Total liabilities and members' equity $ 80,507,479 The accompanying notes are an integral part of these consolidated financial statements. 3

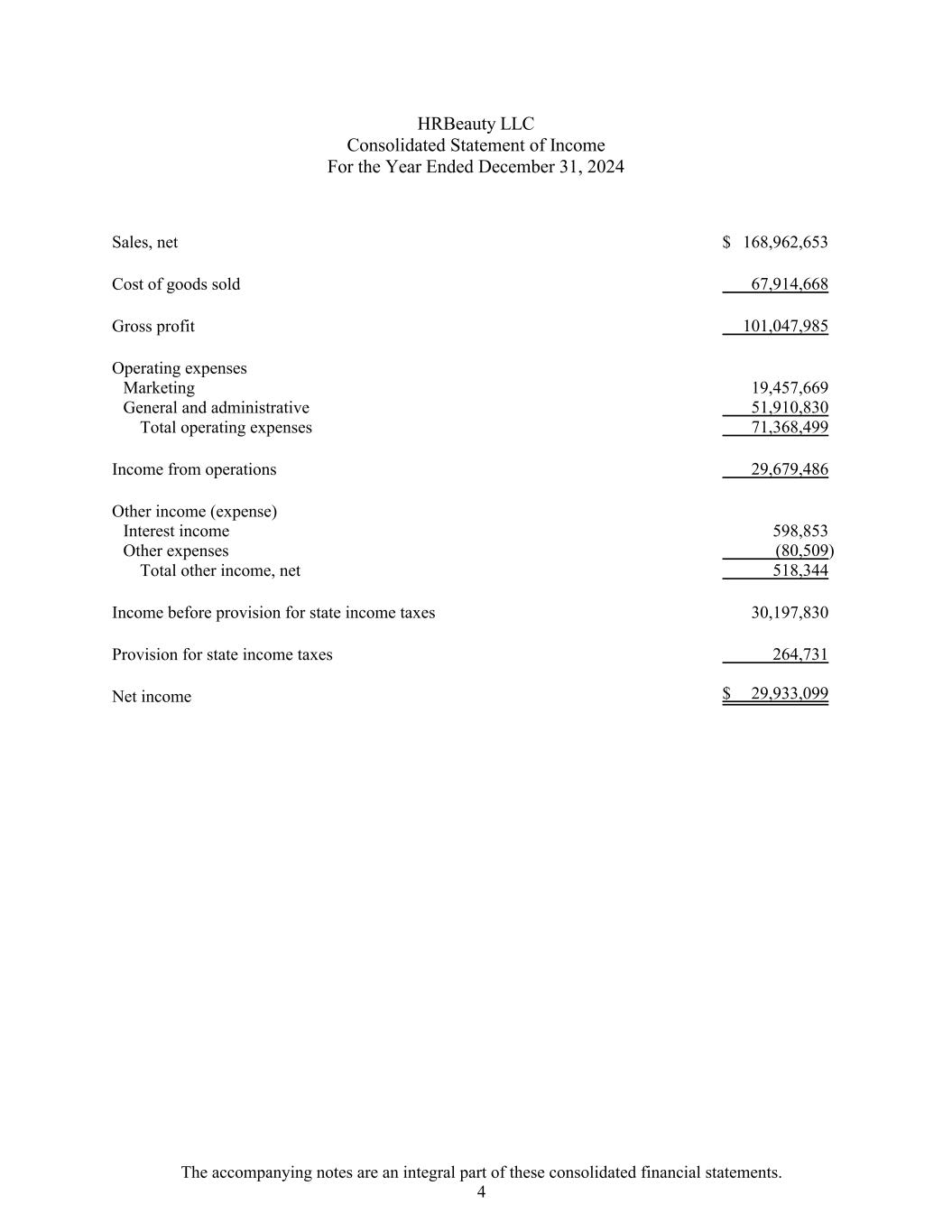

HRBeauty LLC Consolidated Statement of Income For the Year Ended December 31, 2024 Sales, net $ 168,962,653 Cost of goods sold 67,914,668 Gross profit 101,047,985 Operating expenses Marketing 19,457,669 General and administrative 51,910,830 Total operating expenses 71,368,499 Income from operations 29,679,486 Other income (expense) Interest income 598,853 Other expenses (80,509) Total other income, net 518,344 Income before provision for state income taxes 30,197,830 Provision for state income taxes 264,731 Net income $ 29,933,099 The accompanying notes are an integral part of these consolidated financial statements. 4

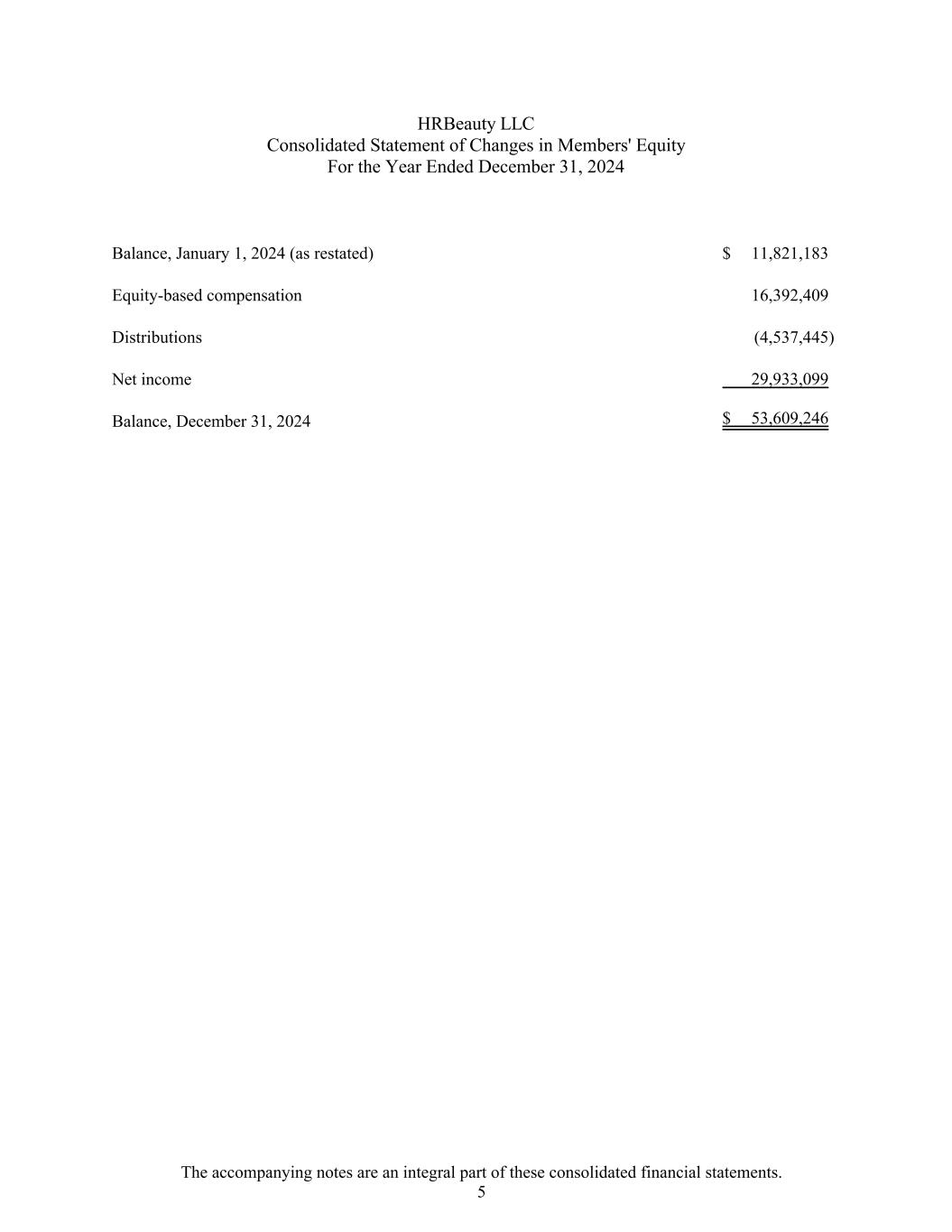

HRBeauty LLC Consolidated Statement of Changes in Members' Equity For the Year Ended December 31, 2024 Balance, January 1, 2024 (as restated) $ 11,821,183 Equity-based compensation 16,392,409 Distributions (4,537,445) Net income 29,933,099 Balance, December 31, 2024 $ 53,609,246 The accompanying notes are an integral part of these consolidated financial statements. 5

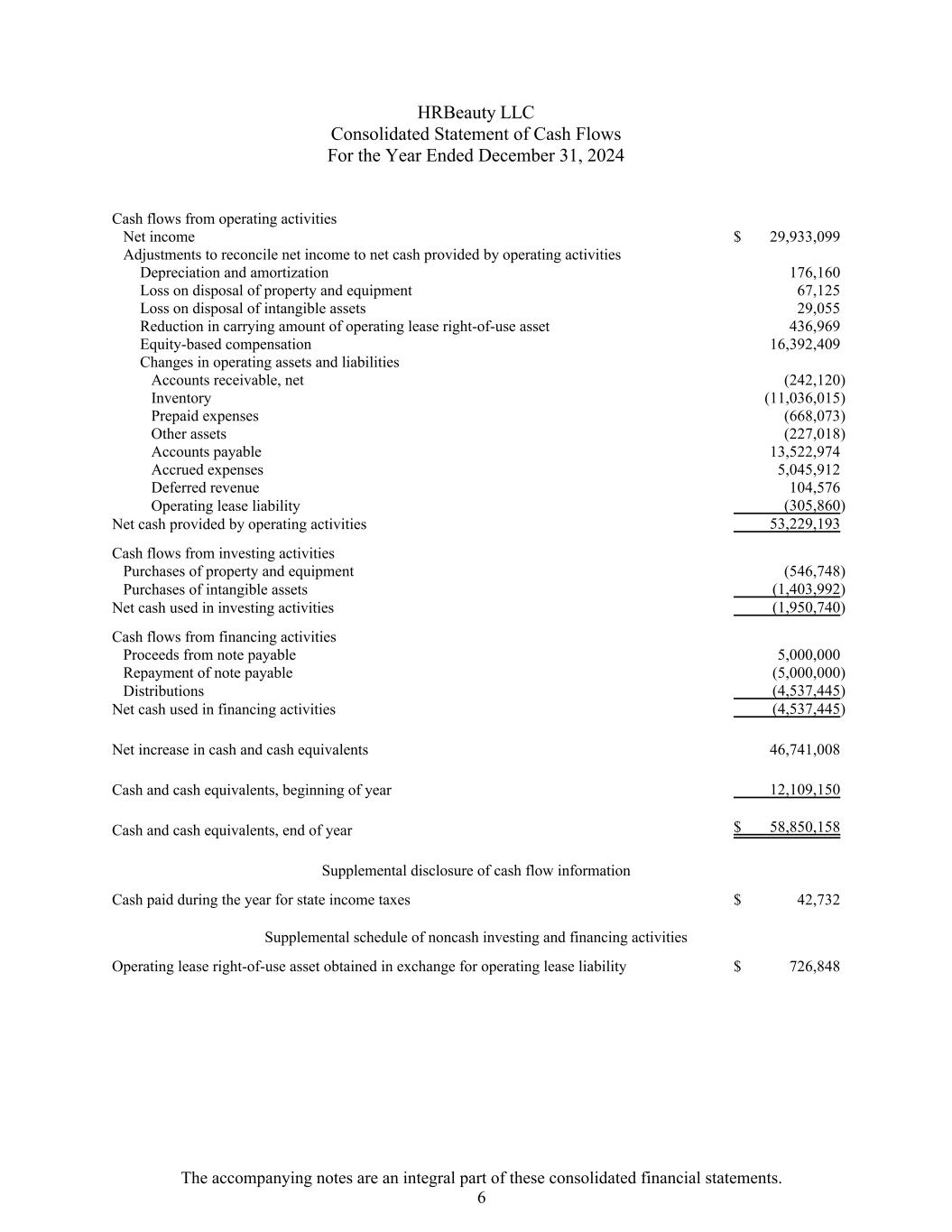

HRBeauty LLC Consolidated Statement of Cash Flows For the Year Ended December 31, 2024 Cash flows from operating activities Net income $ 29,933,099 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 176,160 Loss on disposal of property and equipment 67,125 Loss on disposal of intangible assets 29,055 Reduction in carrying amount of operating lease right-of-use asset 436,969 Equity-based compensation 16,392,409 Changes in operating assets and liabilities Accounts receivable, net (242,120) Inventory (11,036,015) Prepaid expenses (668,073) Other assets (227,018) Accounts payable 13,522,974 Accrued expenses 5,045,912 Deferred revenue 104,576 Operating lease liability (305,860) Net cash provided by operating activities 53,229,193 Cash flows from investing activities Purchases of property and equipment (546,748) Purchases of intangible assets (1,403,992) Net cash used in investing activities (1,950,740) Cash flows from financing activities Proceeds from note payable 5,000,000 Repayment of note payable (5,000,000) Distributions (4,537,445) Net cash used in financing activities (4,537,445) Net increase in cash and cash equivalents 46,741,008 Cash and cash equivalents, beginning of year 12,109,150 Cash and cash equivalents, end of year $ 58,850,158 Supplemental disclosure of cash flow information Cash paid during the year for state income taxes $ 42,732 Supplemental schedule of noncash investing and financing activities Operating lease right-of-use asset obtained in exchange for operating lease liability $ 726,848 The accompanying notes are an integral part of these consolidated financial statements. 6

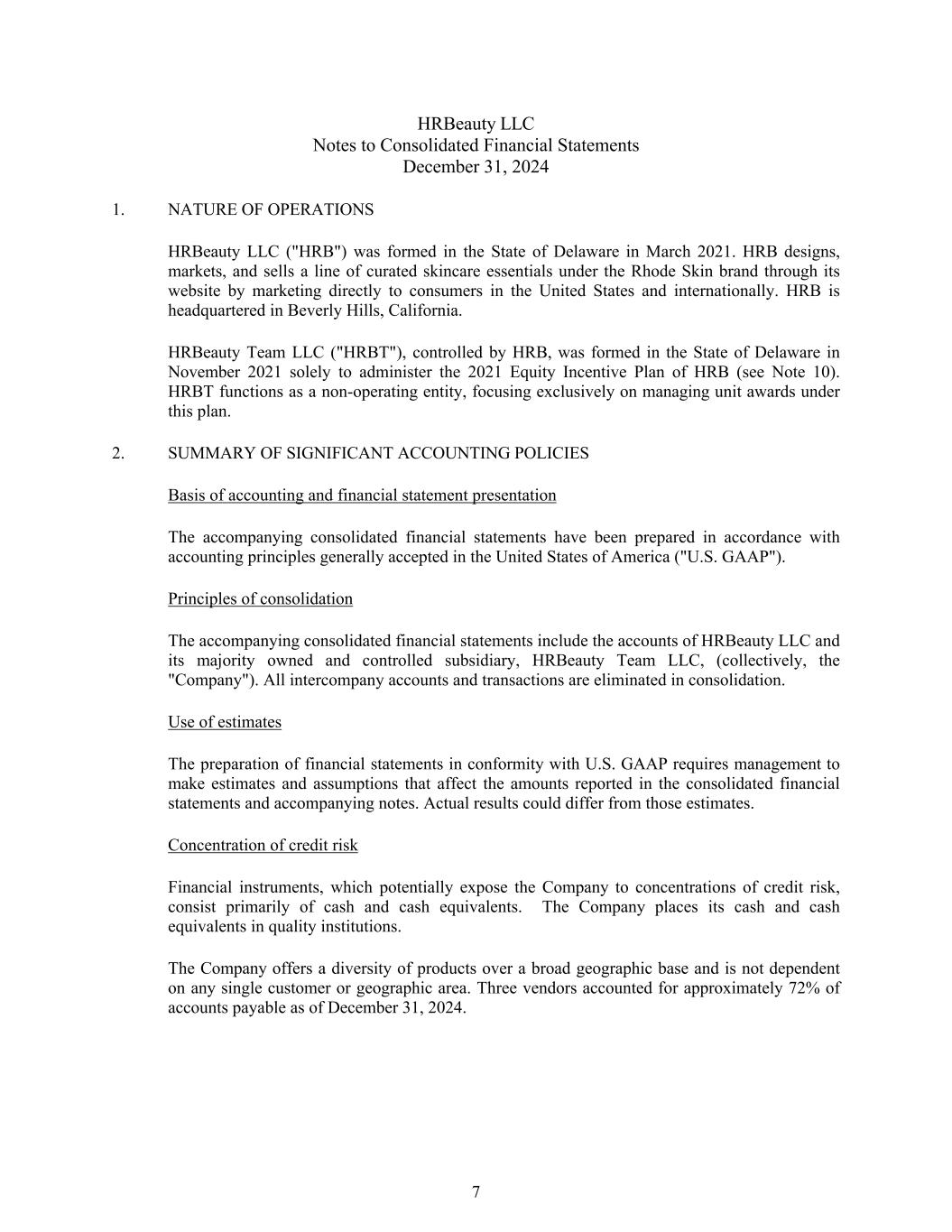

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 1. NATURE OF OPERATIONS HRBeauty LLC ("HRB") was formed in the State of Delaware in March 2021. HRB designs, markets, and sells a line of curated skincare essentials under the Rhode Skin brand through its website by marketing directly to consumers in the United States and internationally. HRB is headquartered in Beverly Hills, California. HRBeauty Team LLC ("HRBT"), controlled by HRB, was formed in the State of Delaware in November 2021 solely to administer the 2021 Equity Incentive Plan of HRB (see Note 10). HRBT functions as a non-operating entity, focusing exclusively on managing unit awards under this plan. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of accounting and financial statement presentation The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). Principles of consolidation The accompanying consolidated financial statements include the accounts of HRBeauty LLC and its majority owned and controlled subsidiary, HRBeauty Team LLC, (collectively, the "Company"). All intercompany accounts and transactions are eliminated in consolidation. Use of estimates The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates. Concentration of credit risk Financial instruments, which potentially expose the Company to concentrations of credit risk, consist primarily of cash and cash equivalents. The Company places its cash and cash equivalents in quality institutions. The Company offers a diversity of products over a broad geographic base and is not dependent on any single customer or geographic area. Three vendors accounted for approximately 72% of accounts payable as of December 31, 2024. 7

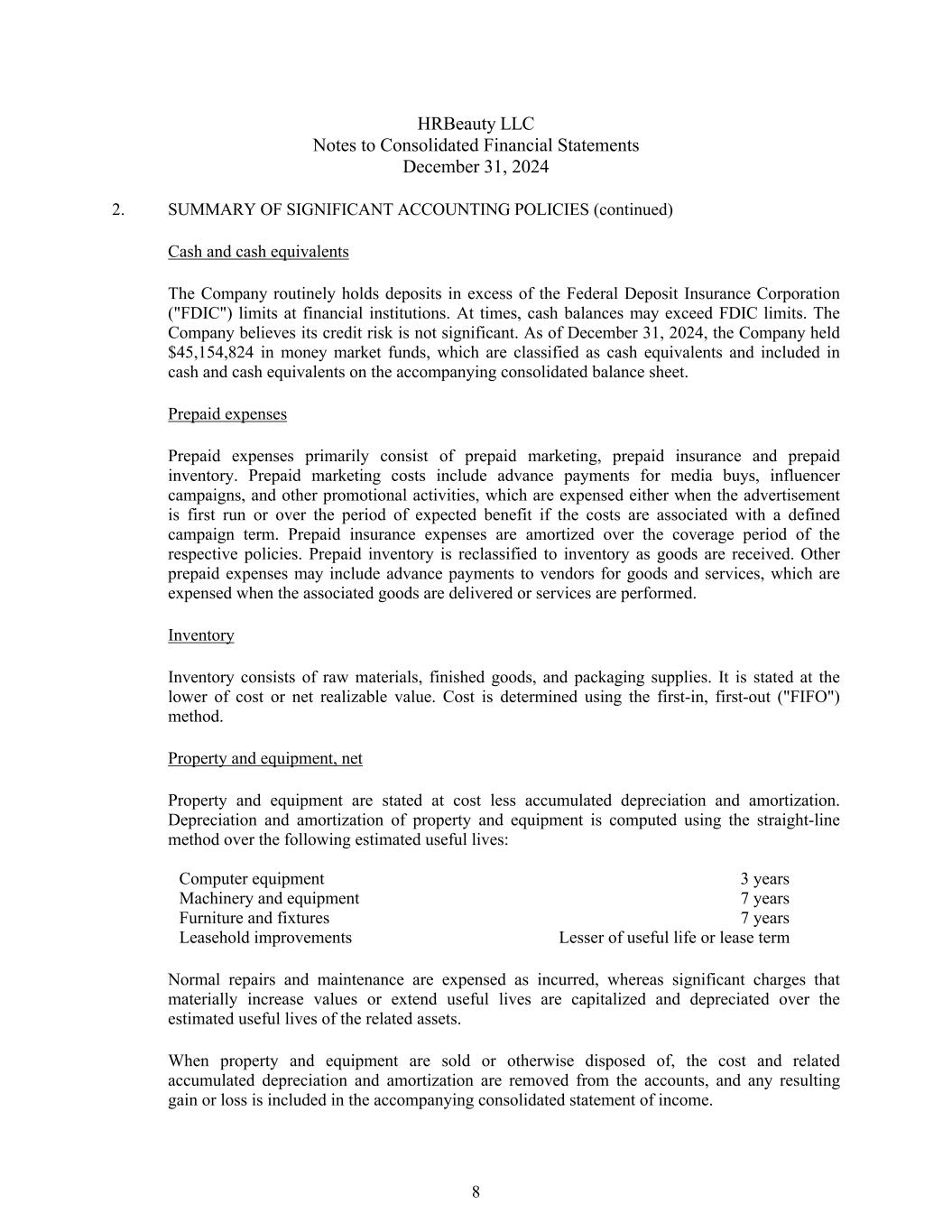

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Cash and cash equivalents The Company routinely holds deposits in excess of the Federal Deposit Insurance Corporation ("FDIC") limits at financial institutions. At times, cash balances may exceed FDIC limits. The Company believes its credit risk is not significant. As of December 31, 2024, the Company held $45,154,824 in money market funds, which are classified as cash equivalents and included in cash and cash equivalents on the accompanying consolidated balance sheet. Prepaid expenses Prepaid expenses primarily consist of prepaid marketing, prepaid insurance and prepaid inventory. Prepaid marketing costs include advance payments for media buys, influencer campaigns, and other promotional activities, which are expensed either when the advertisement is first run or over the period of expected benefit if the costs are associated with a defined campaign term. Prepaid insurance expenses are amortized over the coverage period of the respective policies. Prepaid inventory is reclassified to inventory as goods are received. Other prepaid expenses may include advance payments to vendors for goods and services, which are expensed when the associated goods are delivered or services are performed. Inventory Inventory consists of raw materials, finished goods, and packaging supplies. It is stated at the lower of cost or net realizable value. Cost is determined using the first-in, first-out ("FIFO") method. Property and equipment, net Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation and amortization of property and equipment is computed using the straight-line method over the following estimated useful lives: Computer equipment 3 years Machinery and equipment 7 years Furniture and fixtures 7 years Leasehold improvements Lesser of useful life or lease term Normal repairs and maintenance are expensed as incurred, whereas significant charges that materially increase values or extend useful lives are capitalized and depreciated over the estimated useful lives of the related assets. When property and equipment are sold or otherwise disposed of, the cost and related accumulated depreciation and amortization are removed from the accounts, and any resulting gain or loss is included in the accompanying consolidated statement of income. 8

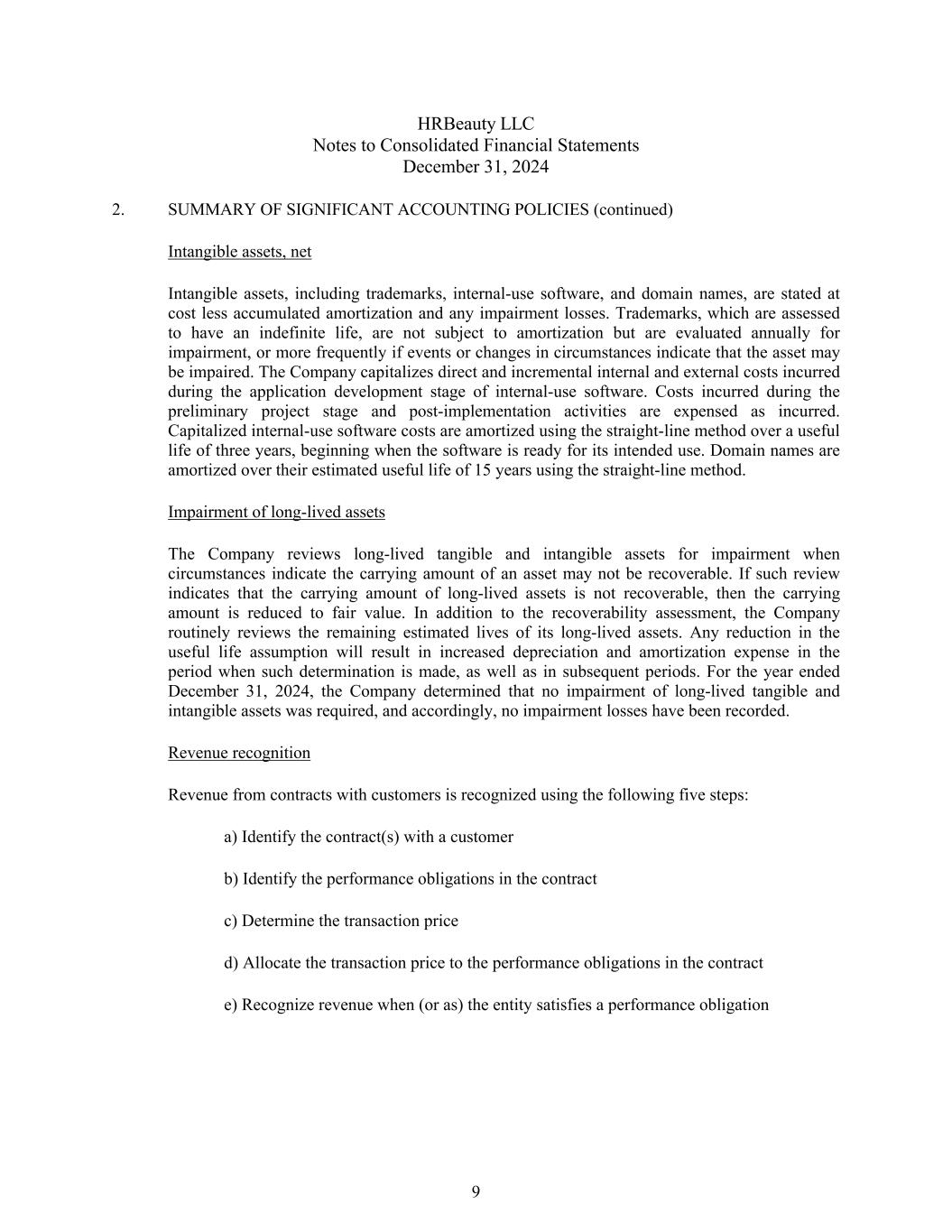

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Intangible assets, net Intangible assets, including trademarks, internal-use software, and domain names, are stated at cost less accumulated amortization and any impairment losses. Trademarks, which are assessed to have an indefinite life, are not subject to amortization but are evaluated annually for impairment, or more frequently if events or changes in circumstances indicate that the asset may be impaired. The Company capitalizes direct and incremental internal and external costs incurred during the application development stage of internal-use software. Costs incurred during the preliminary project stage and post-implementation activities are expensed as incurred. Capitalized internal-use software costs are amortized using the straight-line method over a useful life of three years, beginning when the software is ready for its intended use. Domain names are amortized over their estimated useful life of 15 years using the straight-line method. Impairment of long-lived assets The Company reviews long-lived tangible and intangible assets for impairment when circumstances indicate the carrying amount of an asset may not be recoverable. If such review indicates that the carrying amount of long-lived assets is not recoverable, then the carrying amount is reduced to fair value. In addition to the recoverability assessment, the Company routinely reviews the remaining estimated lives of its long-lived assets. Any reduction in the useful life assumption will result in increased depreciation and amortization expense in the period when such determination is made, as well as in subsequent periods. For the year ended December 31, 2024, the Company determined that no impairment of long-lived tangible and intangible assets was required, and accordingly, no impairment losses have been recorded. Revenue recognition Revenue from contracts with customers is recognized using the following five steps: a) Identify the contract(s) with a customer b) Identify the performance obligations in the contract c) Determine the transaction price d) Allocate the transaction price to the performance obligations in the contract e) Recognize revenue when (or as) the entity satisfies a performance obligation 9

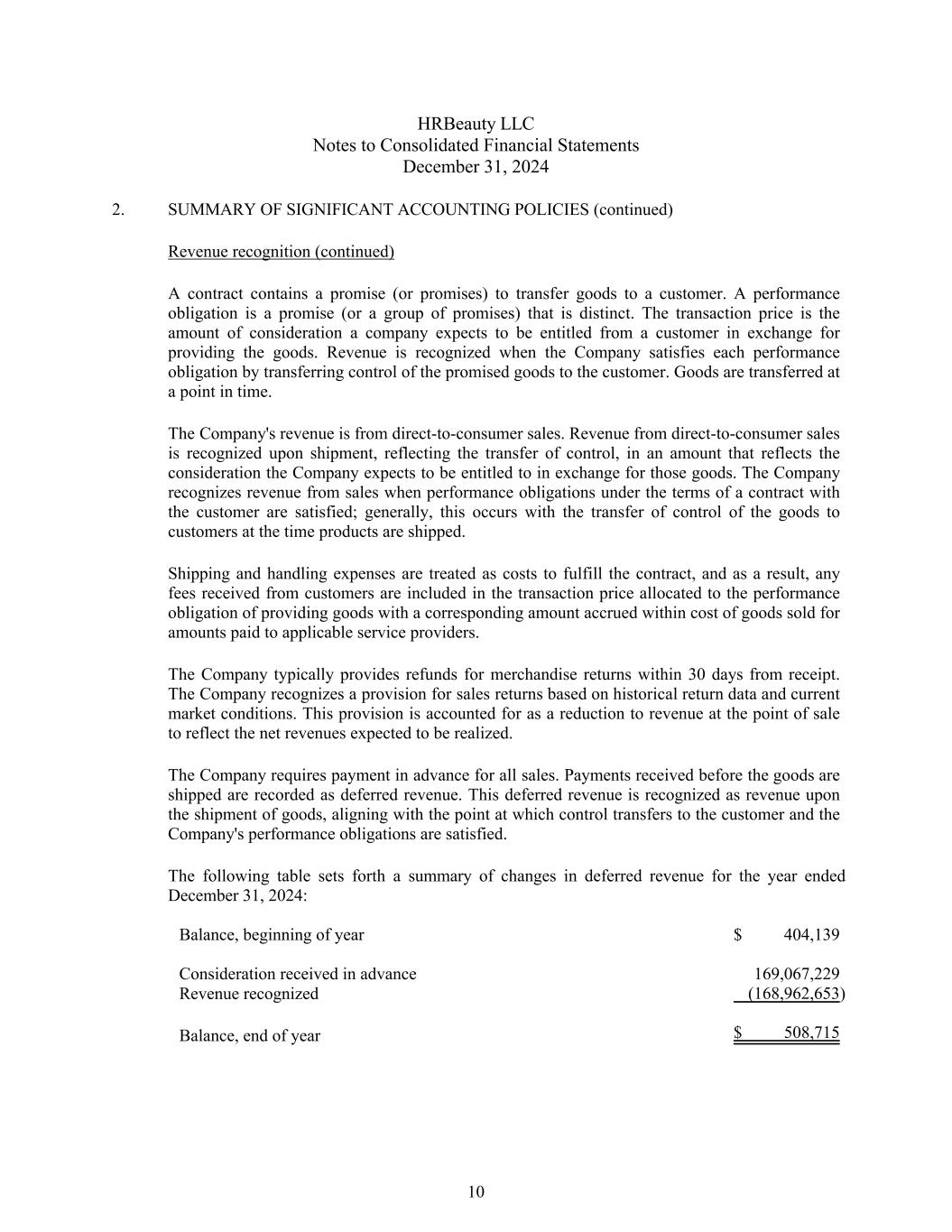

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Revenue recognition (continued) A contract contains a promise (or promises) to transfer goods to a customer. A performance obligation is a promise (or a group of promises) that is distinct. The transaction price is the amount of consideration a company expects to be entitled from a customer in exchange for providing the goods. Revenue is recognized when the Company satisfies each performance obligation by transferring control of the promised goods to the customer. Goods are transferred at a point in time. The Company's revenue is from direct-to-consumer sales. Revenue from direct-to-consumer sales is recognized upon shipment, reflecting the transfer of control, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods. The Company recognizes revenue from sales when performance obligations under the terms of a contract with the customer are satisfied; generally, this occurs with the transfer of control of the goods to customers at the time products are shipped. Shipping and handling expenses are treated as costs to fulfill the contract, and as a result, any fees received from customers are included in the transaction price allocated to the performance obligation of providing goods with a corresponding amount accrued within cost of goods sold for amounts paid to applicable service providers. The Company typically provides refunds for merchandise returns within 30 days from receipt. The Company recognizes a provision for sales returns based on historical return data and current market conditions. This provision is accounted for as a reduction to revenue at the point of sale to reflect the net revenues expected to be realized. The Company requires payment in advance for all sales. Payments received before the goods are shipped are recorded as deferred revenue. This deferred revenue is recognized as revenue upon the shipment of goods, aligning with the point at which control transfers to the customer and the Company's performance obligations are satisfied. The following table sets forth a summary of changes in deferred revenue for the year ended December 31, 2024: Balance, beginning of year $ 404,139 Consideration received in advance 169,067,229 Revenue recognized (168,962,653) Balance, end of year $ 508,715 10

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Income taxes The Company is a limited liability company that has elected to be taxed as a partnership under the Internal Revenue Code. Under those provisions, the Company does not pay federal taxes on its taxable income. Instead, the members report their respective share of the Company's taxable income. The Company is subject to various state income or gross-receipts based taxes in states which the Company has established nexus. U.S. GAAP requires management to evaluate tax positions taken by the Company and recognize a tax liability (or asset) if the Company has taken an uncertain tax position that more likely than not would not be sustained upon examination by the Internal Revenue Service. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. There were no uncertain tax positions for the year ended December 31, 2024. Sales taxes The Company files sales tax returns in all required jurisdictions in the United States of America. The Company is required to collect sales taxes and fees from customers on behalf of government agencies and remit the amounts collected to the applicable governmental agencies on a periodic basis. These taxes and fees are legal assessments on the customer, and the Company has a legal obligation to act as a collection agent. Because the Company does not retain these taxes and fees, the Company does not include such amounts in revenue. The Company records a liability when the amounts are collected and relieves the liability when payments are made to the applicable governmental agencies. Cost of goods sold Cost of goods sold includes the costs incurred to acquire materials, assemble, and sell the Company's finished products. Such costs include product costs held at the lower of cost and net realizable value and inclusive of inventory reserves, freight and import costs, outbound shipping and handling expenses, and warehouse labor costs. Shipping and handling costs Shipping and handling costs, included in cost of goods sold in the accompanying consolidated statement of income amounted to $17,038,957 for the year ended December 31, 2024. 11

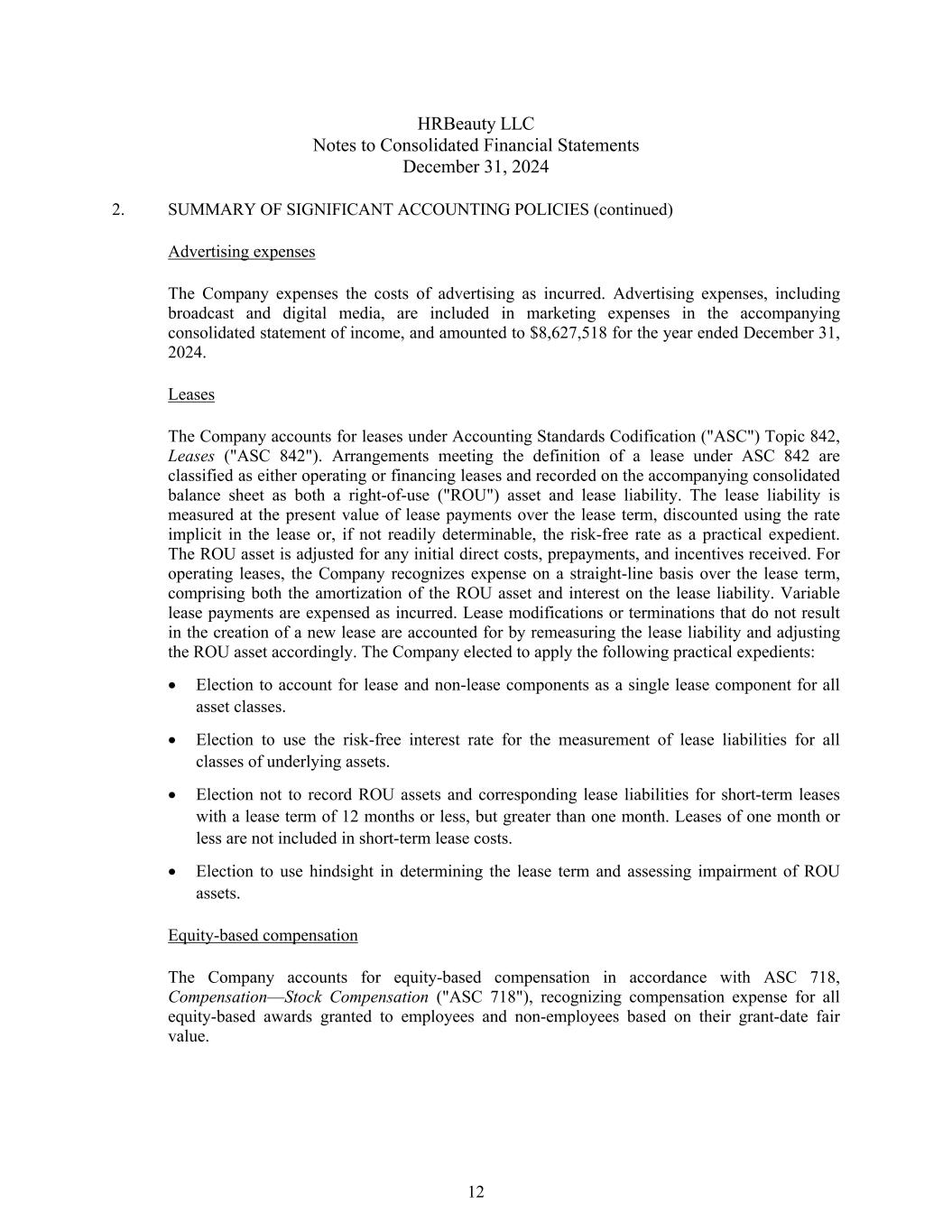

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Advertising expenses The Company expenses the costs of advertising as incurred. Advertising expenses, including broadcast and digital media, are included in marketing expenses in the accompanying consolidated statement of income, and amounted to $8,627,518 for the year ended December 31, 2024. Leases The Company accounts for leases under Accounting Standards Codification ("ASC") Topic 842, Leases ("ASC 842"). Arrangements meeting the definition of a lease under ASC 842 are classified as either operating or financing leases and recorded on the accompanying consolidated balance sheet as both a right-of-use ("ROU") asset and lease liability. The lease liability is measured at the present value of lease payments over the lease term, discounted using the rate implicit in the lease or, if not readily determinable, the risk-free rate as a practical expedient. The ROU asset is adjusted for any initial direct costs, prepayments, and incentives received. For operating leases, the Company recognizes expense on a straight-line basis over the lease term, comprising both the amortization of the ROU asset and interest on the lease liability. Variable lease payments are expensed as incurred. Lease modifications or terminations that do not result in the creation of a new lease are accounted for by remeasuring the lease liability and adjusting the ROU asset accordingly. The Company elected to apply the following practical expedients: Election to account for lease and non-lease components as a single lease component for all asset classes. Election to use the risk-free interest rate for the measurement of lease liabilities for all classes of underlying assets. Election not to record ROU assets and corresponding lease liabilities for short-term leases with a lease term of 12 months or less, but greater than one month. Leases of one month or less are not included in short-term lease costs. Election to use hindsight in determining the lease term and assessing impairment of ROU assets. Equity-based compensation The Company accounts for equity-based compensation in accordance with ASC 718, Compensation—Stock Compensation ("ASC 718"), recognizing compensation expense for all equity-based awards granted to employees and non-employees based on their grant-date fair value. 12

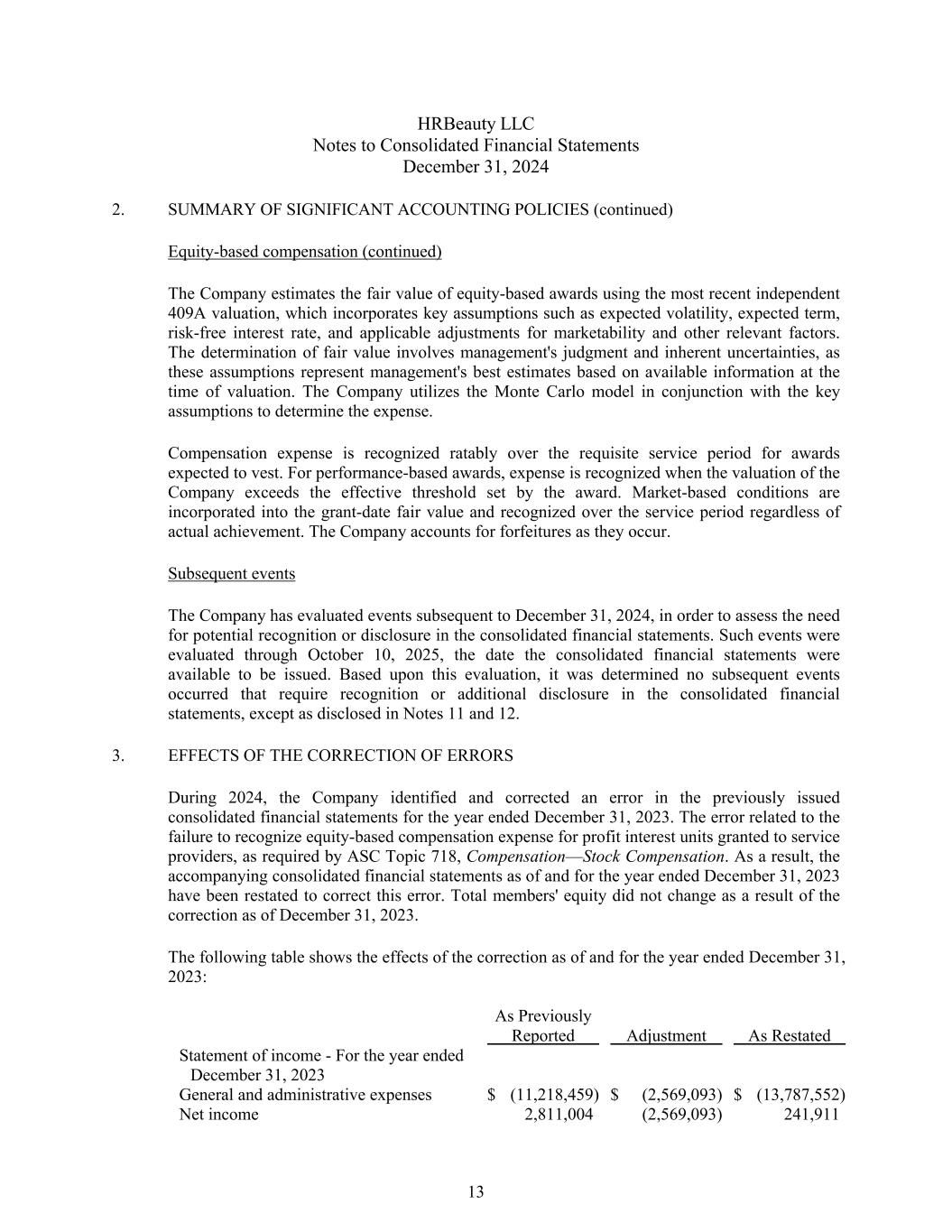

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Equity-based compensation (continued) The Company estimates the fair value of equity-based awards using the most recent independent 409A valuation, which incorporates key assumptions such as expected volatility, expected term, risk-free interest rate, and applicable adjustments for marketability and other relevant factors. The determination of fair value involves management's judgment and inherent uncertainties, as these assumptions represent management's best estimates based on available information at the time of valuation. The Company utilizes the Monte Carlo model in conjunction with the key assumptions to determine the expense. Compensation expense is recognized ratably over the requisite service period for awards expected to vest. For performance-based awards, expense is recognized when the valuation of the Company exceeds the effective threshold set by the award. Market-based conditions are incorporated into the grant-date fair value and recognized over the service period regardless of actual achievement. The Company accounts for forfeitures as they occur. Subsequent events The Company has evaluated events subsequent to December 31, 2024, in order to assess the need for potential recognition or disclosure in the consolidated financial statements. Such events were evaluated through October 10, 2025, the date the consolidated financial statements were available to be issued. Based upon this evaluation, it was determined no subsequent events occurred that require recognition or additional disclosure in the consolidated financial statements, except as disclosed in Notes 11 and 12. 3. EFFECTS OF THE CORRECTION OF ERRORS During 2024, the Company identified and corrected an error in the previously issued consolidated financial statements for the year ended December 31, 2023. The error related to the failure to recognize equity-based compensation expense for profit interest units granted to service providers, as required by ASC Topic 718, Compensation—Stock Compensation. As a result, the accompanying consolidated financial statements as of and for the year ended December 31, 2023 have been restated to correct this error. Total members' equity did not change as a result of the correction as of December 31, 2023. The following table shows the effects of the correction as of and for the year ended December 31, 2023: As Previously Reported Adjustment As Restated Statement of income - For the year ended December 31, 2023 General and administrative expenses $ (11,218,459) $ (2,569,093) $ (13,787,552) Net income 2,811,004 (2,569,093) 241,911 13

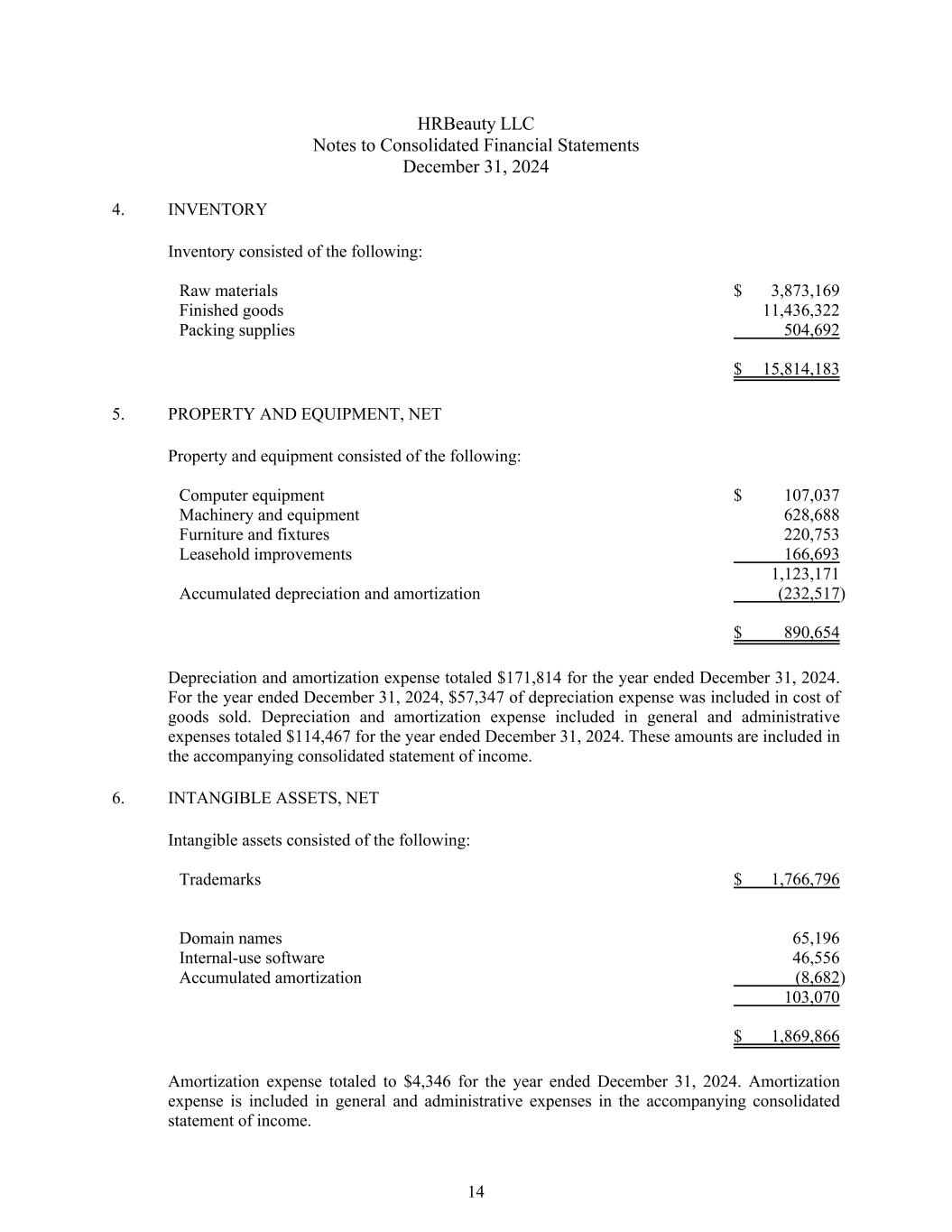

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 4. INVENTORY Inventory consisted of the following: Raw materials $ 3,873,169 Finished goods 11,436,322 Packing supplies 504,692 $ 15,814,183 5. PROPERTY AND EQUIPMENT, NET Property and equipment consisted of the following: Computer equipment $ 107,037 Machinery and equipment 628,688 Furniture and fixtures 220,753 Leasehold improvements 166,693 1,123,171 Accumulated depreciation and amortization (232,517) $ 890,654 Depreciation and amortization expense totaled $171,814 for the year ended December 31, 2024. For the year ended December 31, 2024, $57,347 of depreciation expense was included in cost of goods sold. Depreciation and amortization expense included in general and administrative expenses totaled $114,467 for the year ended December 31, 2024. These amounts are included in the accompanying consolidated statement of income. 6. INTANGIBLE ASSETS, NET Intangible assets consisted of the following: Trademarks $ 1,766,796 Domain names 65,196 Internal-use software 46,556 Accumulated amortization (8,682) 103,070 $ 1,869,866 Amortization expense totaled to $4,346 for the year ended December 31, 2024. Amortization expense is included in general and administrative expenses in the accompanying consolidated statement of income. 14

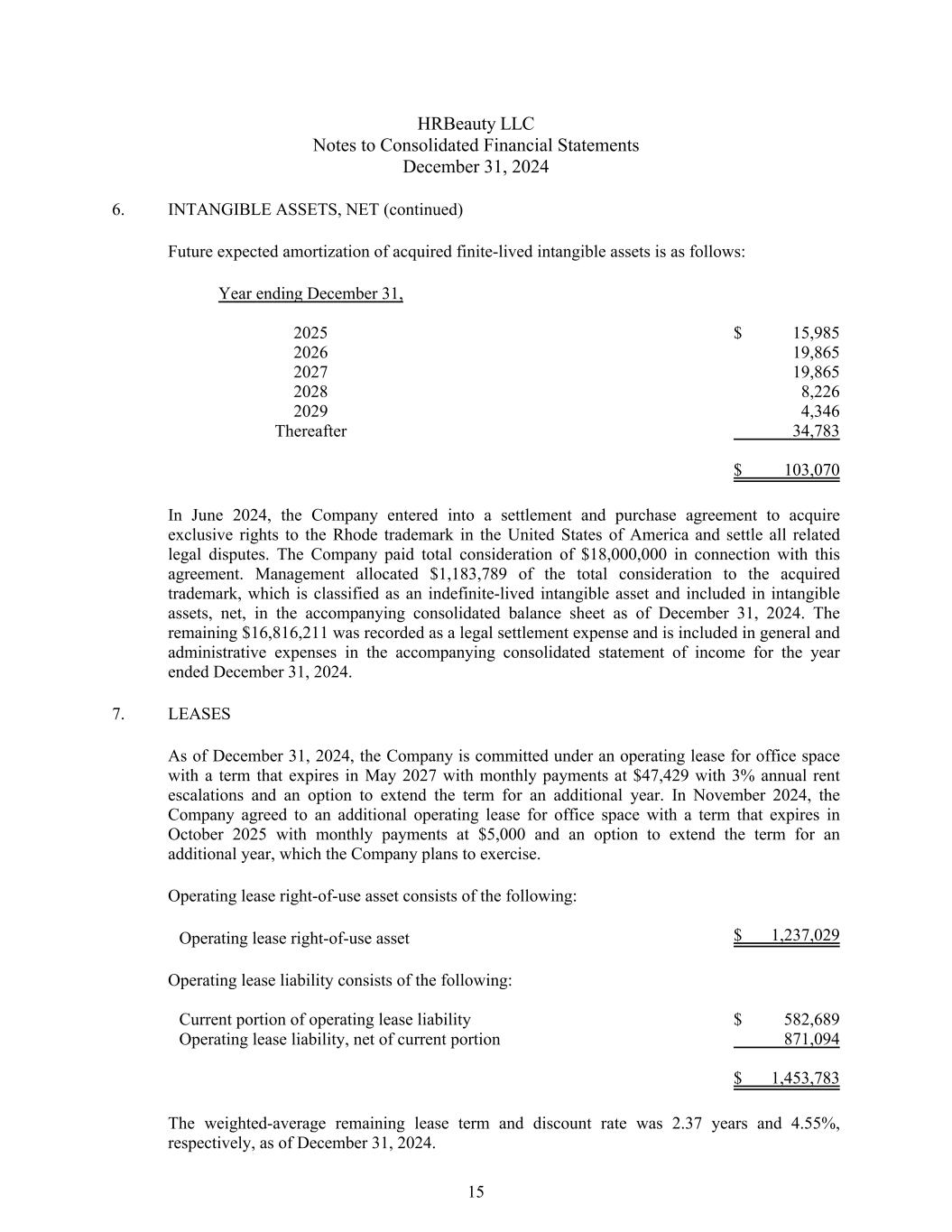

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 6. INTANGIBLE ASSETS, NET (continued) Future expected amortization of acquired finite-lived intangible assets is as follows: Year ending December 31, 2025 $ 15,985 2026 19,865 2027 19,865 2028 8,226 2029 4,346 Thereafter 34,783 $ 103,070 In June 2024, the Company entered into a settlement and purchase agreement to acquire exclusive rights to the Rhode trademark in the United States of America and settle all related legal disputes. The Company paid total consideration of $18,000,000 in connection with this agreement. Management allocated $1,183,789 of the total consideration to the acquired trademark, which is classified as an indefinite-lived intangible asset and included in intangible assets, net, in the accompanying consolidated balance sheet as of December 31, 2024. The remaining $16,816,211 was recorded as a legal settlement expense and is included in general and administrative expenses in the accompanying consolidated statement of income for the year ended December 31, 2024. 7. LEASES As of December 31, 2024, the Company is committed under an operating lease for office space with a term that expires in May 2027 with monthly payments at $47,429 with 3% annual rent escalations and an option to extend the term for an additional year. In November 2024, the Company agreed to an additional operating lease for office space with a term that expires in October 2025 with monthly payments at $5,000 and an option to extend the term for an additional year, which the Company plans to exercise. Operating lease right-of-use asset consists of the following: Operating lease right-of-use asset $ 1,237,029 Operating lease liability consists of the following: Current portion of operating lease liability $ 582,689 Operating lease liability, net of current portion 871,094 $ 1,453,783 The weighted-average remaining lease term and discount rate was 2.37 years and 4.55%, respectively, as of December 31, 2024. 15

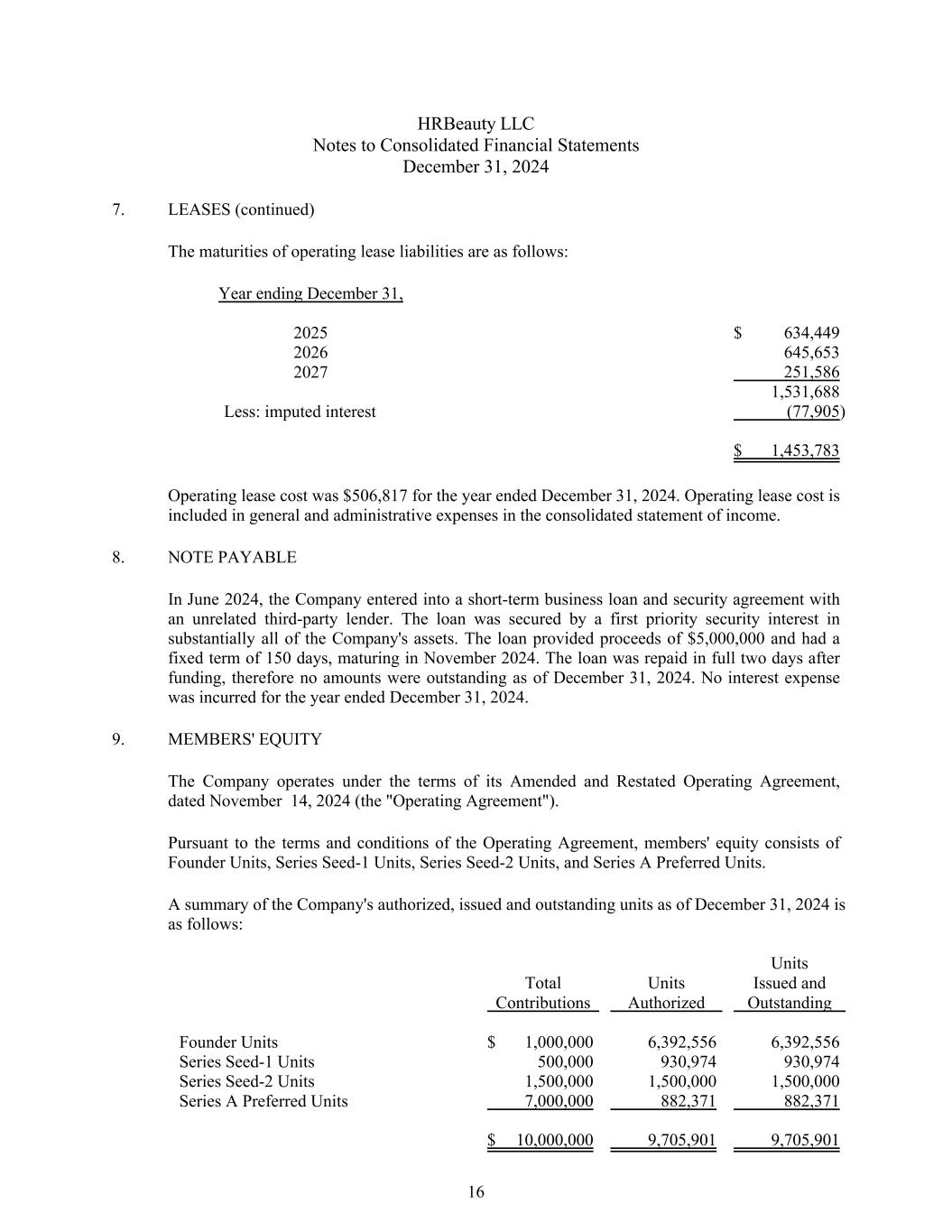

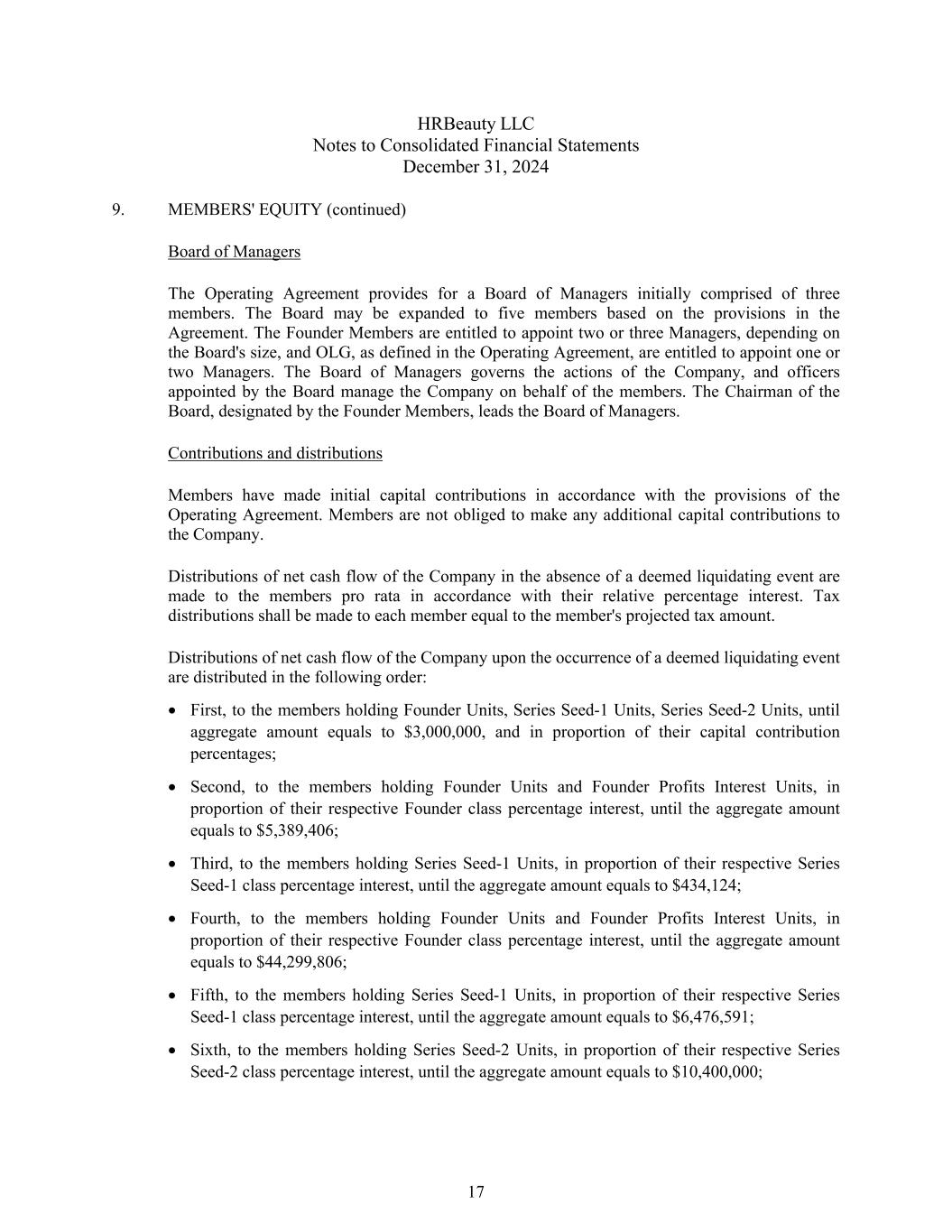

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 7. LEASES (continued) The maturities of operating lease liabilities are as follows: Year ending December 31, 2025 $ 634,449 2026 645,653 2027 251,586 1,531,688 Less: imputed interest (77,905) $ 1,453,783 Operating lease cost was $506,817 for the year ended December 31, 2024. Operating lease cost is included in general and administrative expenses in the consolidated statement of income. 8. NOTE PAYABLE In June 2024, the Company entered into a short-term business loan and security agreement with an unrelated third-party lender. The loan was secured by a first priority security interest in substantially all of the Company's assets. The loan provided proceeds of $5,000,000 and had a fixed term of 150 days, maturing in November 2024. The loan was repaid in full two days after funding, therefore no amounts were outstanding as of December 31, 2024. No interest expense was incurred for the year ended December 31, 2024. 9. MEMBERS' EQUITY The Company operates under the terms of its Amended and Restated Operating Agreement, dated November 14, 2024 (the "Operating Agreement"). Pursuant to the terms and conditions of the Operating Agreement, members' equity consists of Founder Units, Series Seed-1 Units, Series Seed-2 Units, and Series A Preferred Units. A summary of the Company's authorized, issued and outstanding units as of December 31, 2024 is as follows: Total Contributions Units Authorized Units Issued and Outstanding Founder Units $ 1,000,000 6,392,556 6,392,556 Series Seed-1 Units 500,000 930,974 930,974 Series Seed-2 Units 1,500,000 1,500,000 1,500,000 Series A Preferred Units 7,000,000 882,371 882,371 $ 10,000,000 9,705,901 9,705,901 16

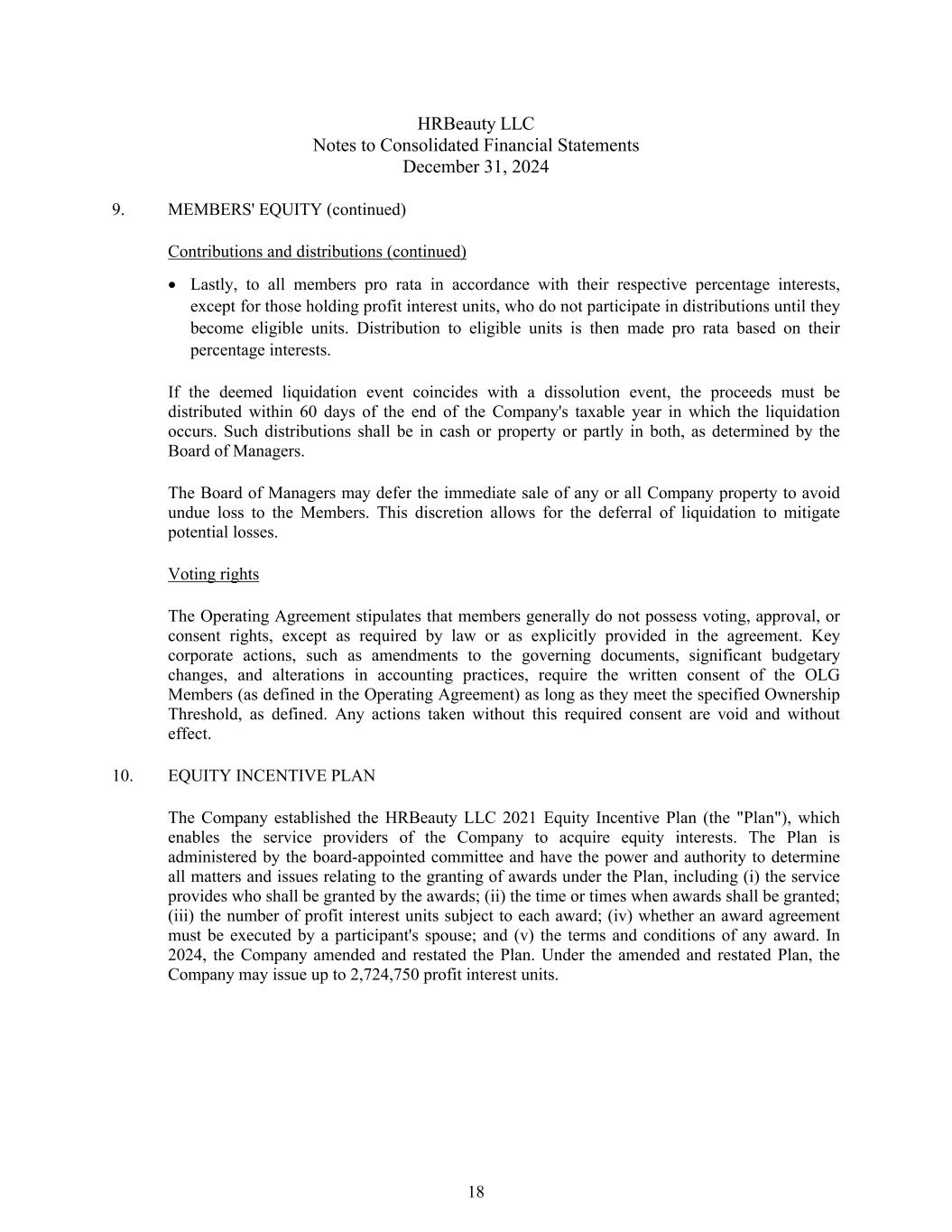

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 9. MEMBERS' EQUITY (continued) Board of Managers The Operating Agreement provides for a Board of Managers initially comprised of three members. The Board may be expanded to five members based on the provisions in the Agreement. The Founder Members are entitled to appoint two or three Managers, depending on the Board's size, and OLG, as defined in the Operating Agreement, are entitled to appoint one or two Managers. The Board of Managers governs the actions of the Company, and officers appointed by the Board manage the Company on behalf of the members. The Chairman of the Board, designated by the Founder Members, leads the Board of Managers. Contributions and distributions Members have made initial capital contributions in accordance with the provisions of the Operating Agreement. Members are not obliged to make any additional capital contributions to the Company. Distributions of net cash flow of the Company in the absence of a deemed liquidating event are made to the members pro rata in accordance with their relative percentage interest. Tax distributions shall be made to each member equal to the member's projected tax amount. Distributions of net cash flow of the Company upon the occurrence of a deemed liquidating event are distributed in the following order: First, to the members holding Founder Units, Series Seed-1 Units, Series Seed-2 Units, until aggregate amount equals to $3,000,000, and in proportion of their capital contribution percentages; Second, to the members holding Founder Units and Founder Profits Interest Units, in proportion of their respective Founder class percentage interest, until the aggregate amount equals to $5,389,406; Third, to the members holding Series Seed-1 Units, in proportion of their respective Series Seed-1 class percentage interest, until the aggregate amount equals to $434,124; Fourth, to the members holding Founder Units and Founder Profits Interest Units, in proportion of their respective Founder class percentage interest, until the aggregate amount equals to $44,299,806; Fifth, to the members holding Series Seed-1 Units, in proportion of their respective Series Seed-1 class percentage interest, until the aggregate amount equals to $6,476,591; Sixth, to the members holding Series Seed-2 Units, in proportion of their respective Series Seed-2 class percentage interest, until the aggregate amount equals to $10,400,000; 17

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 9. MEMBERS' EQUITY (continued) Contributions and distributions (continued) Lastly, to all members pro rata in accordance with their respective percentage interests, except for those holding profit interest units, who do not participate in distributions until they become eligible units. Distribution to eligible units is then made pro rata based on their percentage interests. If the deemed liquidation event coincides with a dissolution event, the proceeds must be distributed within 60 days of the end of the Company's taxable year in which the liquidation occurs. Such distributions shall be in cash or property or partly in both, as determined by the Board of Managers. The Board of Managers may defer the immediate sale of any or all Company property to avoid undue loss to the Members. This discretion allows for the deferral of liquidation to mitigate potential losses. Voting rights The Operating Agreement stipulates that members generally do not possess voting, approval, or consent rights, except as required by law or as explicitly provided in the agreement. Key corporate actions, such as amendments to the governing documents, significant budgetary changes, and alterations in accounting practices, require the written consent of the OLG Members (as defined in the Operating Agreement) as long as they meet the specified Ownership Threshold, as defined. Any actions taken without this required consent are void and without effect. 10. EQUITY INCENTIVE PLAN The Company established the HRBeauty LLC 2021 Equity Incentive Plan (the "Plan"), which enables the service providers of the Company to acquire equity interests. The Plan is administered by the board-appointed committee and have the power and authority to determine all matters and issues relating to the granting of awards under the Plan, including (i) the service provides who shall be granted by the awards; (ii) the time or times when awards shall be granted; (iii) the number of profit interest units subject to each award; (iv) whether an award agreement must be executed by a participant's spouse; and (v) the terms and conditions of any award. In 2024, the Company amended and restated the Plan. Under the amended and restated Plan, the Company may issue up to 2,724,750 profit interest units. 18

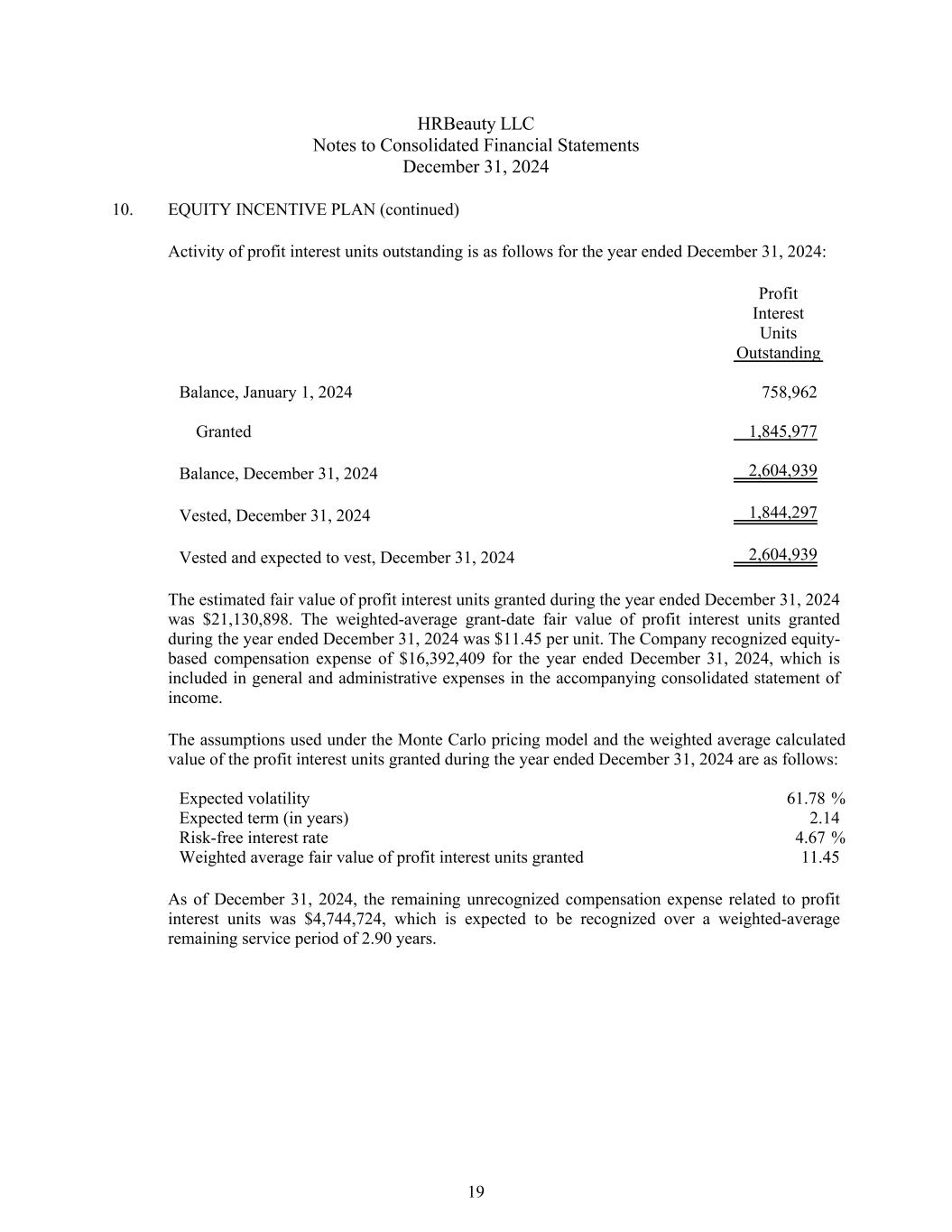

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 10. EQUITY INCENTIVE PLAN (continued) Activity of profit interest units outstanding is as follows for the year ended December 31, 2024: Profit Interest Units Outstanding Balance, January 1, 2024 758,962 Granted 1,845,977 Balance, December 31, 2024 2,604,939 Vested, December 31, 2024 1,844,297 Vested and expected to vest, December 31, 2024 2,604,939 The estimated fair value of profit interest units granted during the year ended December 31, 2024 was $21,130,898. The weighted-average grant-date fair value of profit interest units granted during the year ended December 31, 2024 was $11.45 per unit. The Company recognized equity- based compensation expense of $16,392,409 for the year ended December 31, 2024, which is included in general and administrative expenses in the accompanying consolidated statement of income. The assumptions used under the Monte Carlo pricing model and the weighted average calculated value of the profit interest units granted during the year ended December 31, 2024 are as follows: Expected volatility %61.78 Expected term (in years) 2.14 Risk-free interest rate %4.67 Weighted average fair value of profit interest units granted 11.45 As of December 31, 2024, the remaining unrecognized compensation expense related to profit interest units was $4,744,724, which is expected to be recognized over a weighted-average remaining service period of 2.90 years. 19

HRBeauty LLC Notes to Consolidated Financial Statements December 31, 2024 11. SUBSEQUENT EVENT - REVOLVING LINE OF CREDIT In April 2025, the Company entered into a credit agreement with JPMorgan Chase Bank (the "Credit Agreement") that provided for a revolving facility of up to $10,000,000, subject to a borrowing base. As of April 2025, the borrowing base was $7,681,247. The Credit Agreement included financial and reporting covenants, and was secured by substantially all of the Company's assets. The Credit Agreement bore interest at variable rates based on either (a) the greater of 2.5% or the prime rate, plus 2.25%, or (b) the secured overnight financing rate plus 3.35%. The agreement was scheduled to mature in April 2027, but was repaid in full and terminated in August 2025. 12. SUBSEQUENT EVENT - ACQUISITION In May 2025, the Company entered into an agreement and plan of merger with e.l.f. Beauty, Inc. ("e.l.f. Beauty"), a publicly traded company listed on the New York Stock Exchange. On August 5, 2025, the transaction pursuant to the agreement and plan of merger between the Company and e.l.f. Beauty was completed, and e.l.f. Beauty acquired the Company. Under the terms of the agreement and plan of merger, e.l.f. Beauty acquired the Company for $800,000,000 at closing, subject to customary adjustments, inclusive of $600,000,000 of cash and $200,000,000 of stock of e.l.f. Beauty, and potential earnout consideration of up to $200,000,000 based on the future growth of the brand over a three-year timeframe. 20