Supplemental Information Third Quarter 2025 1

2 Cautionary Statement Regarding Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, including statements relating to the future divestment of office properties and growth of our industrial outdoor storage (“IOS”) platform. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this document reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: general economic and financial conditions; political uncertainty in the U.S.; the impact of tariffs and global trade disruptions on us and our tenants; market volatility; inflation; any potential recession or threat of recession; interest rates; disruption in the debt and banking markets; concentration in asset type; tenant concentration, geographic concentration, and the financial condition of our tenants; whether we are able to monitor the credit quality of our tenants and/or their parent companies and guarantors; competition for tenants and competition with sellers of similar properties if we elect to dispose of our properties; our access to, and the availability of capital; whether we will be able to refinance or repay debt; whether work-from-home trends or other factors will impact the attractiveness of industrial and/or office assets; whether we will be successful in renewing leases or selling an applicable property, as leases expire; whether we will re-lease available space above or at current market rental rates; future financial and operating results; our ability to manage cash flows; our ability to manage expenses, including as a result of tenant failure to maintain our net-leased properties; dilution resulting from equity issuances; expected sources of financing, including the ability to maintain the commitments under our revolving credit facility, and the availability and attractiveness of the terms of any such financing; legislative and regulatory changes that could adversely affect our business; changes in zoning, occupancy and land use regulations and/or changes in their applicability to our properties; cybersecurity incidents or disruptions to our or our third party information technology systems; our ability to maintain our status as a real estate investment trust (a "REIT") within the meaning of Section 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”) and our Operating Partnership as a partnership for U.S. federal income tax purposes; our future capital expenditures, operating expenses, net income or loss, operating income, cash flow and developments and trends of the real estate industry; whether we will be successful in the pursuit of our business plans, objectives, expectations and intentions, including any acquisitions, investments, or dispositions, including our acquisition of industrial outdoor storage assets; our intention to sell all of our remaining office properties and the anticipated timing of, and the impact on our business (including our leverage) from, such divestment; our ability to meet budgeted or stabilized returns on our redevelopment projects within expected time frames, or at all; whether we will succeed in our investment objectives; any fluctuation and/or volatility of the trading price of our common shares; risks associated with our dependence on key personnel whose continued service is not guaranteed; and other factors, including those risks disclosed in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q, our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. The forward-looking statements speak only as of the date of this document. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this document, except as required by applicable law. We caution investors not to place undue reliance on any forward-looking statements, which are based only on information currently available to us. Notice Regarding Non-GAAP Financial Measures In addition to U.S. GAAP financial measures, this document contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this document.

3 Table of Contents Page Portfolio Overview 4 Financial Information 8 Debt & Capitalization 20 Components of Net Asset Value 24 Portfolio Characteristics: Industrial Segment 26 Redevelopment Properties 32 Capital Expenditures 34 Portfolio Characteristics: Office Discontinued Operations Properties 36 Notes & Definitions 40

Portfolio Overview 4

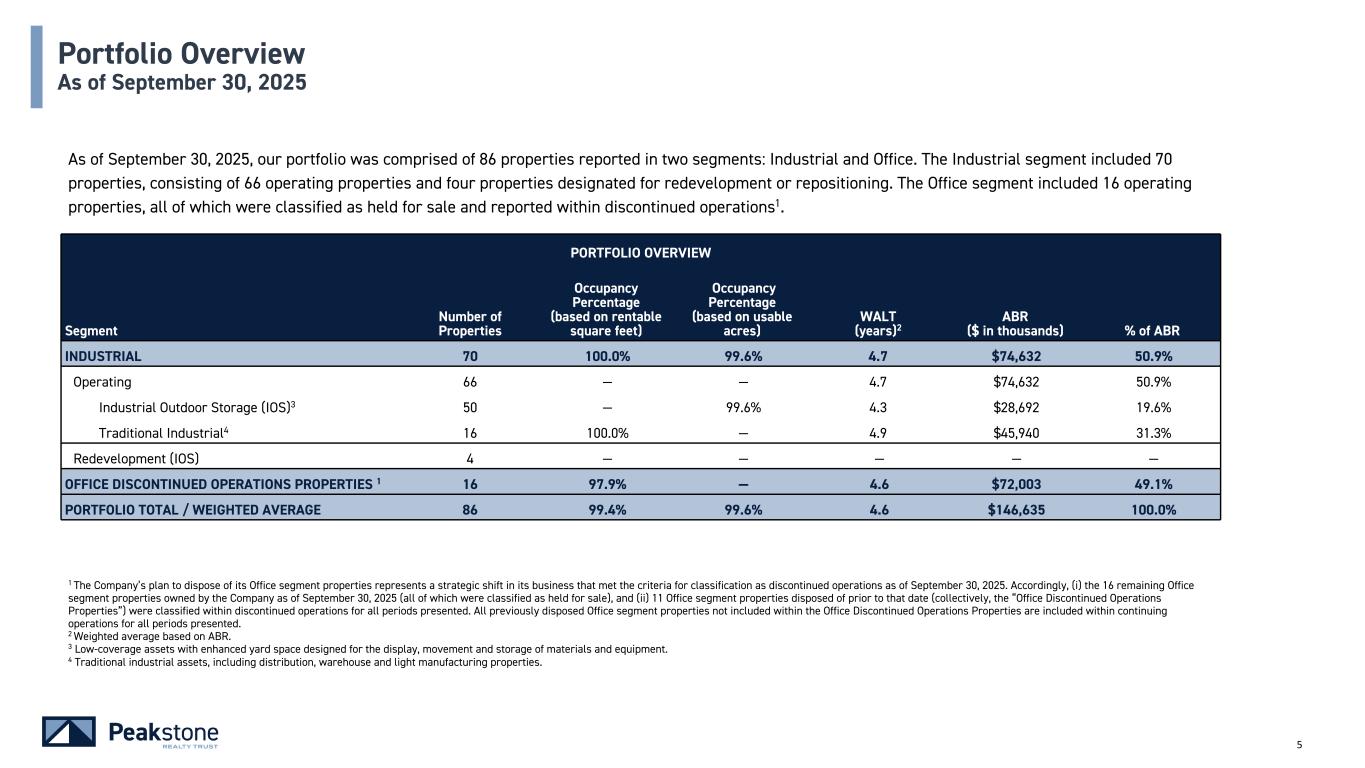

5 PORTFOLIO OVERVIEW Segment Number of Properties Occupancy Percentage (based on rentable square feet) Occupancy Percentage (based on usable acres) WALT (years)2 ABR ($ in thousands) % of ABR INDUSTRIAL 70 100.0% 99.6% 4.7 $74,632 50.9% Operating 66 — — 4.7 $74,632 50.9% Industrial Outdoor Storage (IOS)3 50 — 99.6% 4.3 $28,692 19.6% Traditional Industrial4 16 100.0% — 4.9 $45,940 31.3% Redevelopment (IOS) 4 — — — — — OFFICE DISCONTINUED OPERATIONS PROPERTIES 1 16 97.9% — 4.6 $72,003 49.1% PORTFOLIO TOTAL / WEIGHTED AVERAGE 86 99.4% 99.6% 4.6 $146,635 100.0% Portfolio Overview As of September 30, 2025 1 The Company’s plan to dispose of its Office segment properties represents a strategic shift in its business that met the criteria for classification as discontinued operations as of September 30, 2025. Accordingly, (i) the 16 remaining Office segment properties owned by the Company as of September 30, 2025 (all of which were classified as held for sale), and (ii) 11 Office segment properties disposed of prior to that date (collectively, the “Office Discontinued Operations Properties”) were classified within discontinued operations for all periods presented. All previously disposed Office segment properties not included within the Office Discontinued Operations Properties are included within continuing operations for all periods presented. 2 Weighted average based on ABR. 3 Low-coverage assets with enhanced yard space designed for the display, movement and storage of materials and equipment. 4 Traditional industrial assets, including distribution, warehouse and light manufacturing properties. As of September 30, 2025, our portfolio was comprised of 86 properties reported in two segments: Industrial and Office. The Industrial segment included 70 properties, consisting of 66 operating properties and four properties designated for redevelopment or repositioning. The Office segment included 16 operating properties, all of which were classified as held for sale and reported within discontinued operations1.

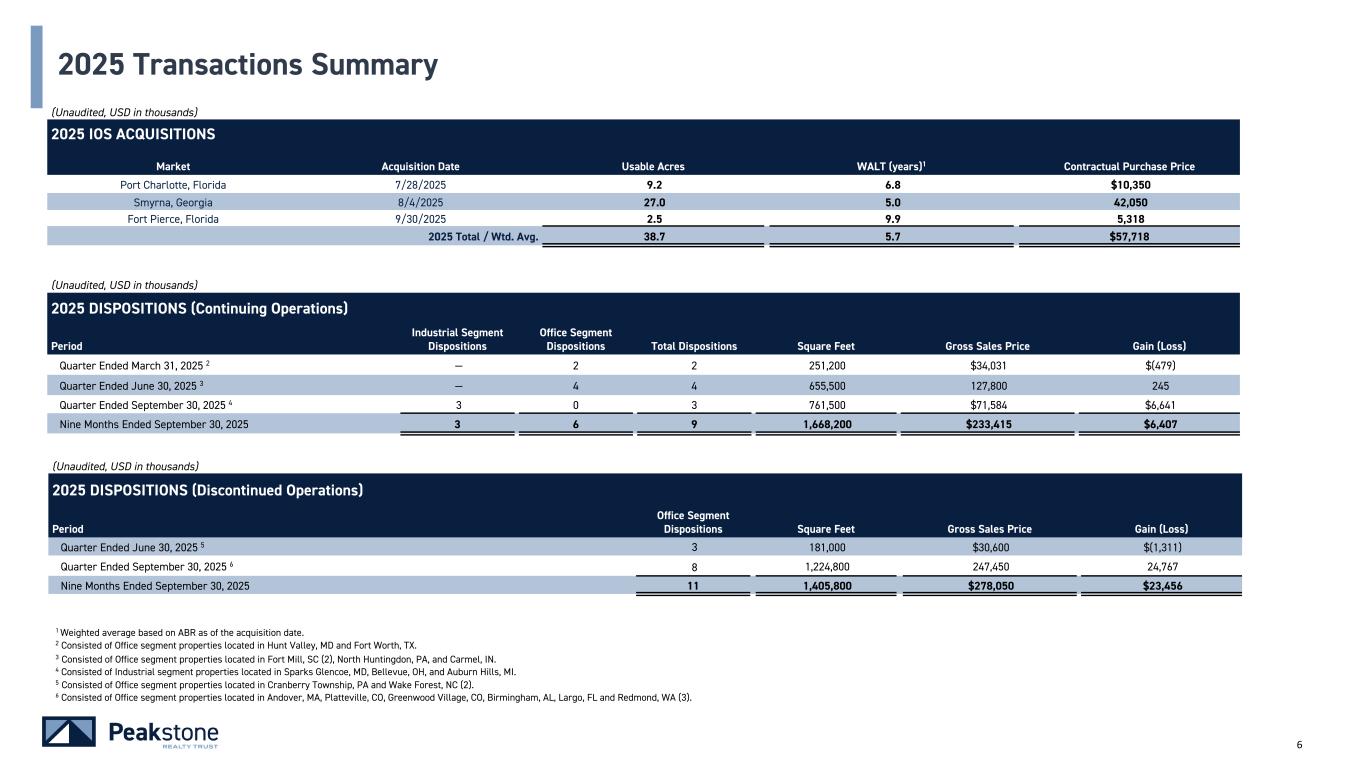

6 2025 Transactions Summary (Unaudited, USD in thousands) 2025 DISPOSITIONS (Continuing Operations) Period Industrial Segment Dispositions Office Segment Dispositions Total Dispositions Square Feet Gross Sales Price Gain (Loss) Quarter Ended March 31, 2025 2 — 2 2 251,200 $34,031 $(479) Quarter Ended June 30, 2025 3 — 4 4 655,500 127,800 245 Quarter Ended September 30, 2025 4 3 0 3 761,500 $71,584 $6,641 Nine Months Ended September 30, 2025 3 6 9 1,668,200 $233,415 $6,407 1 Weighted average based on ABR as of the acquisition date. 2 Consisted of Office segment properties located in Hunt Valley, MD and Fort Worth, TX. 3 Consisted of Office segment properties located in Fort Mill, SC (2), North Huntingdon, PA, and Carmel, IN. 4 Consisted of Industrial segment properties located in Sparks Glencoe, MD, Bellevue, OH, and Auburn Hills, MI. 5 Consisted of Office segment properties located in Cranberry Township, PA and Wake Forest, NC (2). 6 Consisted of Office segment properties located in Andover, MA, Platteville, CO, Greenwood Village, CO, Birmingham, AL, Largo, FL and Redmond, WA (3). (Unaudited, USD in thousands) 2025 IOS ACQUISITIONS Market Acquisition Date Usable Acres WALT (years)1 Contractual Purchase Price Port Charlotte, Florida 7/28/2025 9.2 6.8 $10,350 Smyrna, Georgia 8/4/2025 27.0 5.0 42,050 Fort Pierce, Florida 9/30/2025 2.5 9.9 5,318 2025 Total / Wtd. Avg. 38.7 5.7 $57,718 (Unaudited, USD in thousands) 2025 DISPOSITIONS (Discontinued Operations) Period Office Segment Dispositions Square Feet Gross Sales Price Gain (Loss) Quarter Ended June 30, 2025 5 3 181,000 $30,600 $(1,311) Quarter Ended September 30, 2025 6 8 1,224,800 247,450 24,767 Nine Months Ended September 30, 2025 11 1,405,800 $278,050 $23,456

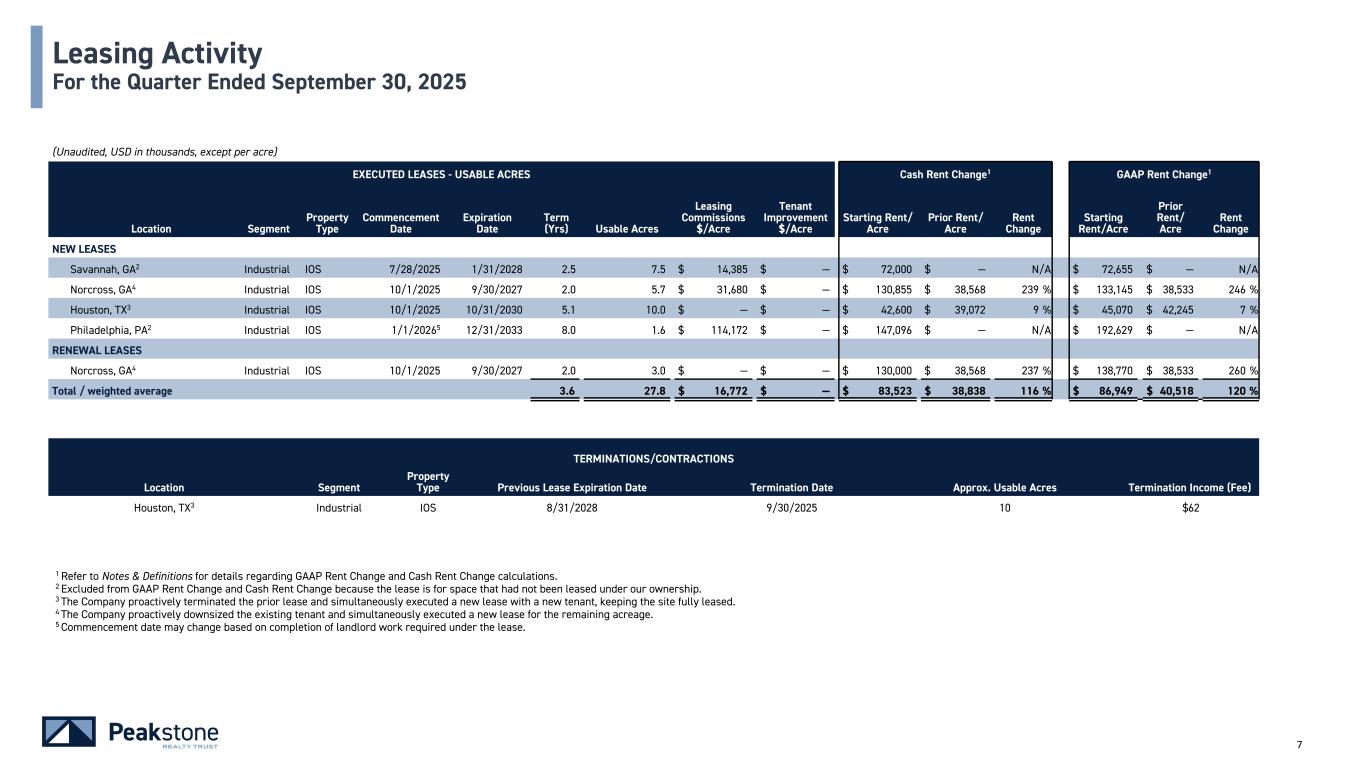

7 Leasing Activity For the Quarter Ended September 30, 2025 TERMINATIONS/CONTRACTIONS Location Segment Property Type Previous Lease Expiration Date Termination Date Approx. Usable Acres Termination Income (Fee) Houston, TX3 Industrial IOS 8/31/2028 9/30/2025 10 $62 (Unaudited, USD in thousands, except per acre) EXECUTED LEASES - USABLE ACRES Cash Rent Change1 GAAP Rent Change1 Location Segment Property Type Commencement Date Expiration Date Term (Yrs) Usable Acres Leasing Commissions $/Acre Tenant Improvement $/Acre Starting Rent/ Acre Prior Rent/ Acre Rent Change Starting Rent/Acre Prior Rent/ Acre Rent Change NEW LEASES Savannah, GA2 Industrial IOS 7/28/2025 1/31/2028 2.5 7.5 $ 14,385 $ — $ 72,000 $ — N/A $ 72,655 $ — N/A Norcross, GA4 Industrial IOS 10/1/2025 9/30/2027 2.0 5.7 $ 31,680 $ — $ 130,855 $ 38,568 239 % $ 133,145 $ 38,533 246 % Houston, TX3 Industrial IOS 10/1/2025 10/31/2030 5.1 10.0 $ — $ — $ 42,600 $ 39,072 9 % $ 45,070 $ 42,245 7 % Philadelphia, PA2 Industrial IOS 1/1/20265 12/31/2033 8.0 1.6 $ 114,172 $ — $ 147,096 $ — N/A $ 192,629 $ — N/A RENEWAL LEASES Norcross, GA4 Industrial IOS 10/1/2025 9/30/2027 2.0 3.0 $ — $ — $ 130,000 $ 38,568 237 % $ 138,770 $ 38,533 260 % Total / weighted average 3.6 27.8 $ 16,772 $ — $ 83,523 $ 38,838 116 % $ 86,949 $ 40,518 120 % 1 Refer to Notes & Definitions for details regarding GAAP Rent Change and Cash Rent Change calculations. 2 Excluded from GAAP Rent Change and Cash Rent Change because the lease is for space that had not been leased under our ownership. 3 The Company proactively terminated the prior lease and simultaneously executed a new lease with a new tenant, keeping the site fully leased. 4 The Company proactively downsized the existing tenant and simultaneously executed a new lease for the remaining acreage. 5 Commencement date may change based on completion of landlord work required under the lease.

Financial Information 8

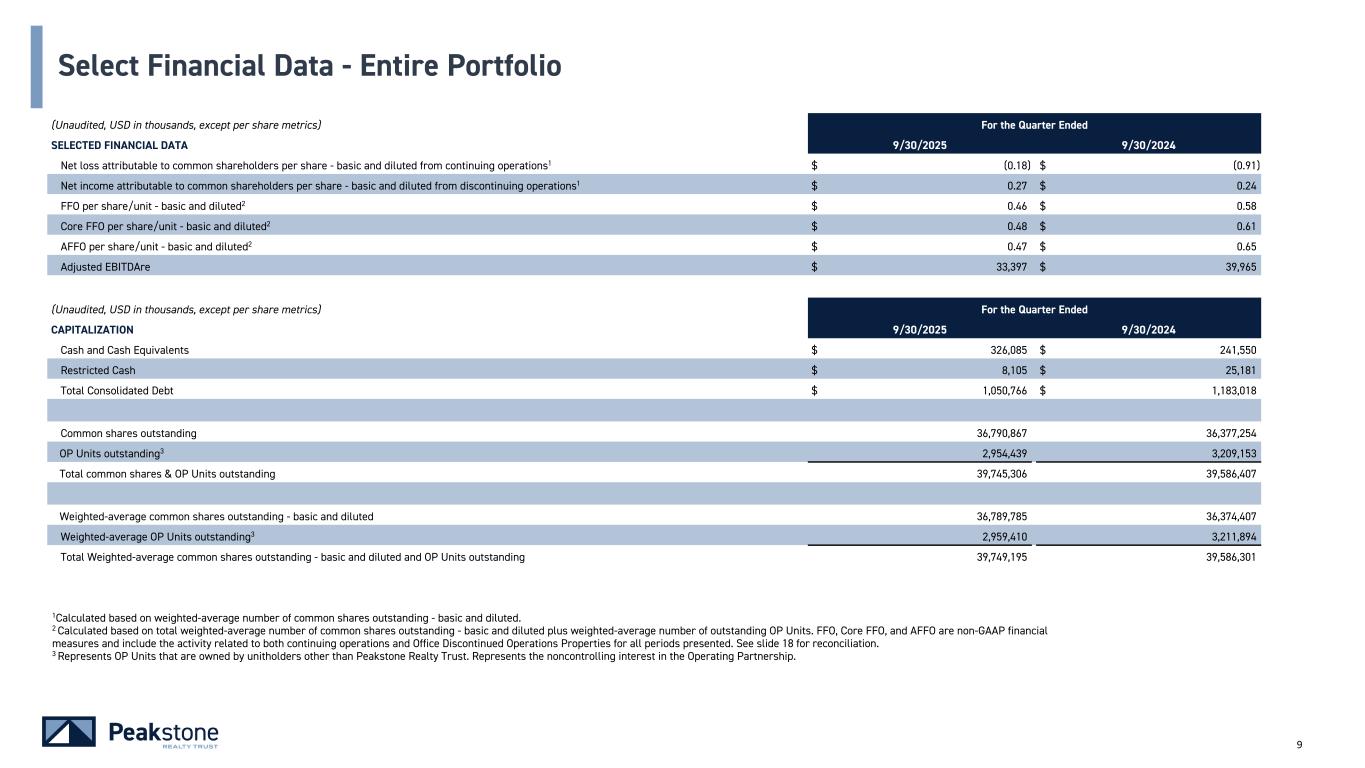

9 1Calculated based on weighted-average number of common shares outstanding - basic and diluted. 2 Calculated based on total weighted-average number of common shares outstanding - basic and diluted plus weighted-average number of outstanding OP Units. FFO, Core FFO, and AFFO are non-GAAP financial measures and include the activity related to both continuing operations and Office Discontinued Operations Properties for all periods presented. See slide 18 for reconciliation. 3 Represents OP Units that are owned by unitholders other than Peakstone Realty Trust. Represents the noncontrolling interest in the Operating Partnership. (Unaudited, USD in thousands, except per share metrics) For the Quarter Ended SELECTED FINANCIAL DATA 9/30/2025 9/30/2024 Net loss attributable to common shareholders per share - basic and diluted from continuing operations1 $ (0.18) $ (0.91) Net income attributable to common shareholders per share - basic and diluted from discontinuing operations1 $ 0.27 $ 0.24 FFO per share/unit - basic and diluted2 $ 0.46 $ 0.58 Core FFO per share/unit - basic and diluted2 $ 0.48 $ 0.61 AFFO per share/unit - basic and diluted2 $ 0.47 $ 0.65 Adjusted EBITDAre $ 33,397 $ 39,965 (Unaudited, USD in thousands, except per share metrics) For the Quarter Ended CAPITALIZATION 9/30/2025 9/30/2024 Cash and Cash Equivalents $ 326,085 $ 241,550 Restricted Cash $ 8,105 $ 25,181 Total Consolidated Debt $ 1,050,766 $ 1,183,018 Common shares outstanding 36,790,867 36,377,254 OP Units outstanding3 2,954,439 3,209,153 Total common shares & OP Units outstanding 39,745,306 39,586,407 Weighted-average common shares outstanding - basic and diluted 36,789,785 36,374,407 Weighted-average OP Units outstanding3 2,959,410 3,211,894 Total Weighted-average common shares outstanding - basic and diluted and OP Units outstanding 39,749,195 39,586,301 Select Financial Data - Entire Portfolio

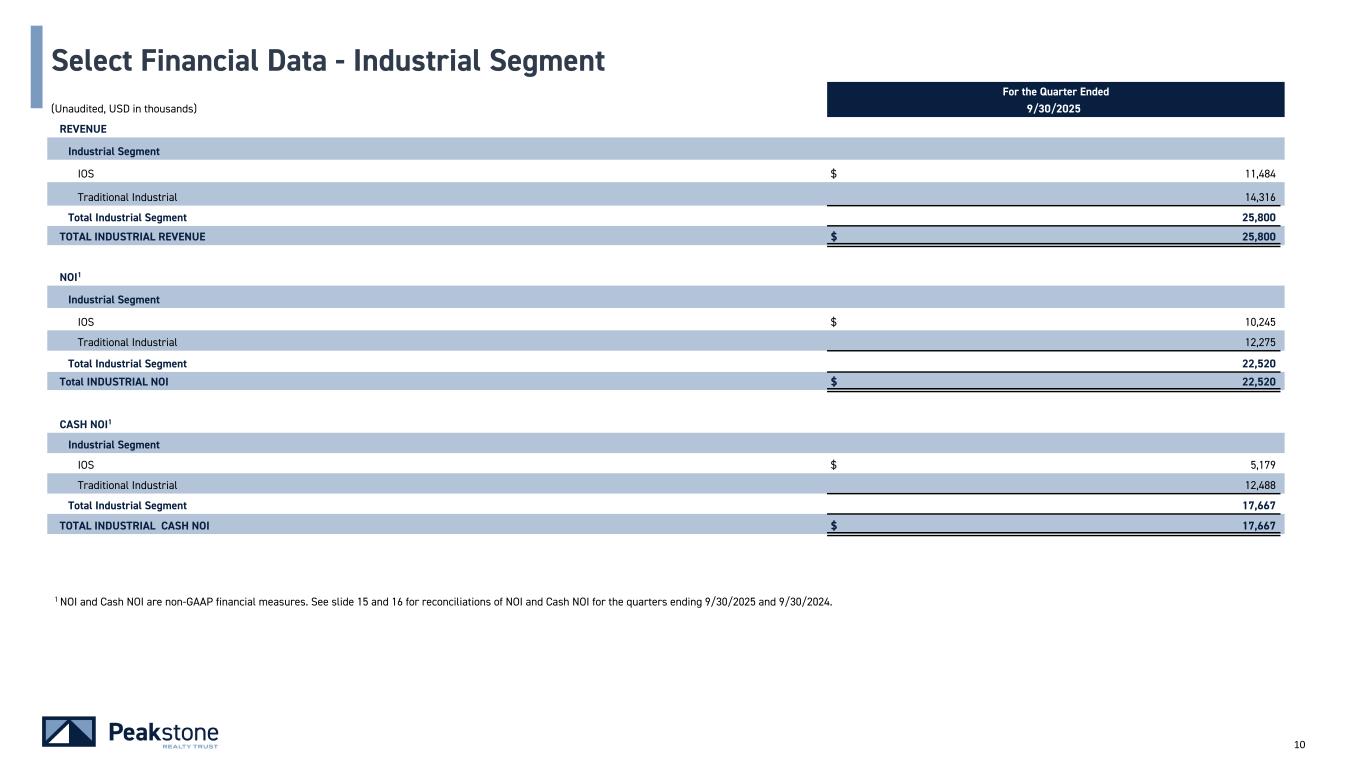

10 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2025 REVENUE Industrial Segment IOS $ 11,484 Traditional Industrial 14,316 Total Industrial Segment 25,800 TOTAL INDUSTRIAL REVENUE $ 25,800 NOI1 Industrial Segment IOS $ 10,245 Traditional Industrial 12,275 Total Industrial Segment 22,520 Total INDUSTRIAL NOI $ 22,520 CASH NOI1 Industrial Segment IOS $ 5,179 Traditional Industrial 12,488 Total Industrial Segment 17,667 TOTAL INDUSTRIAL CASH NOI $ 17,667 1 NOI and Cash NOI are non-GAAP financial measures. See slide 15 and 16 for reconciliations of NOI and Cash NOI for the quarters ending 9/30/2025 and 9/30/2024. Select Financial Data - Industrial Segment

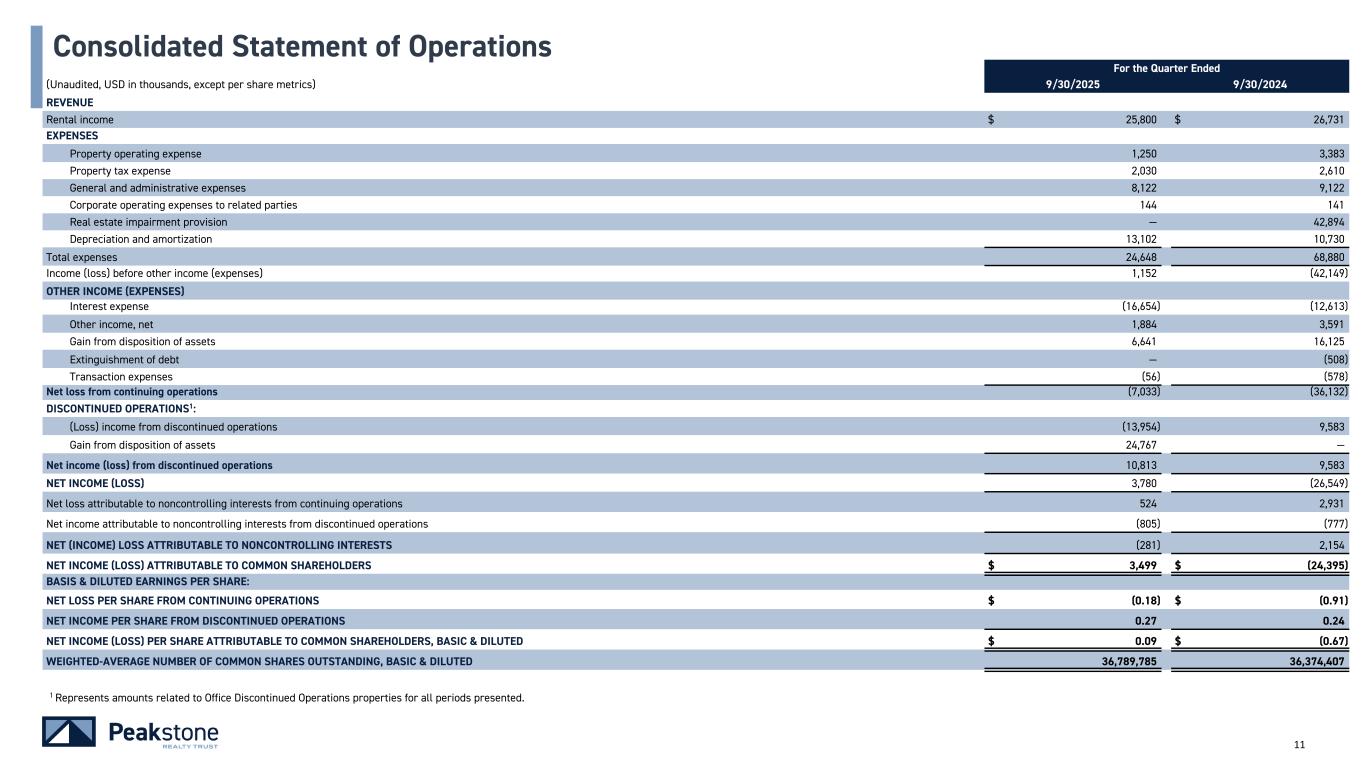

11 For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 9/30/2025 9/30/2024 REVENUE Rental income $ 25,800 $ 26,731 EXPENSES Property operating expense 1,250 3,383 Property tax expense 2,030 2,610 General and administrative expenses 8,122 9,122 Corporate operating expenses to related parties 144 141 Real estate impairment provision — 42,894 Depreciation and amortization 13,102 10,730 Total expenses 24,648 68,880 Income (loss) before other income (expenses) 1,152 (42,149) OTHER INCOME (EXPENSES) Interest expense (16,654) (12,613) Other income, net 1,884 3,591 Gain from disposition of assets 6,641 16,125 Extinguishment of debt — (508) Transaction expenses (56) (578) Net loss from continuing operations (7,033) (36,132) DISCONTINUED OPERATIONS1: (Loss) income from discontinued operations (13,954) 9,583 Gain from disposition of assets 24,767 — Net income (loss) from discontinued operations 10,813 9,583 NET INCOME (LOSS) 3,780 (26,549) Net loss attributable to noncontrolling interests from continuing operations 524 2,931 Net income attributable to noncontrolling interests from discontinued operations (805) (777) NET (INCOME) LOSS ATTRIBUTABLE TO NONCONTROLLING INTERESTS (281) 2,154 NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS $ 3,499 $ (24,395) BASIS & DILUTED EARNINGS PER SHARE: NET LOSS PER SHARE FROM CONTINUING OPERATIONS $ (0.18) $ (0.91) NET INCOME PER SHARE FROM DISCONTINUED OPERATIONS 0.27 0.24 NET INCOME (LOSS) PER SHARE ATTRIBUTABLE TO COMMON SHAREHOLDERS, BASIC & DILUTED $ 0.09 $ (0.67) WEIGHTED-AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC & DILUTED 36,789,785 36,374,407 Consolidated Statement of Operations 1 Represents amounts related to Office Discontinued Operations properties for all periods presented.

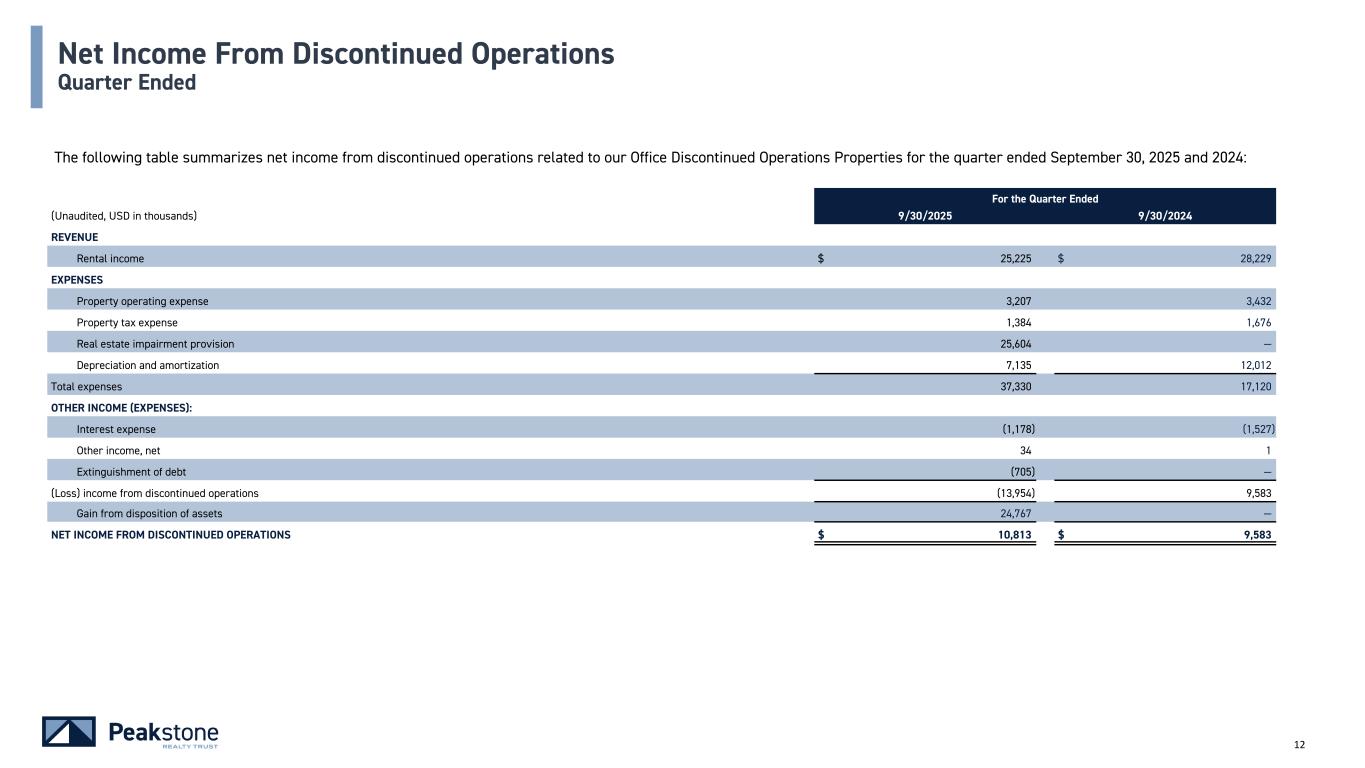

12 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2025 9/30/2024 REVENUE Rental income $ 25,225 $ 28,229 EXPENSES Property operating expense 3,207 3,432 Property tax expense 1,384 1,676 Real estate impairment provision 25,604 — Depreciation and amortization 7,135 12,012 Total expenses 37,330 17,120 OTHER INCOME (EXPENSES): Interest expense (1,178) (1,527) Other income, net 34 1 Extinguishment of debt (705) — (Loss) income from discontinued operations (13,954) 9,583 Gain from disposition of assets 24,767 — NET INCOME FROM DISCONTINUED OPERATIONS $ 10,813 $ 9,583 Net Income From Discontinued Operations Quarter Ended The following table summarizes net income from discontinued operations related to our Office Discontinued Operations Properties for the quarter ended September 30, 2025 and 2024:

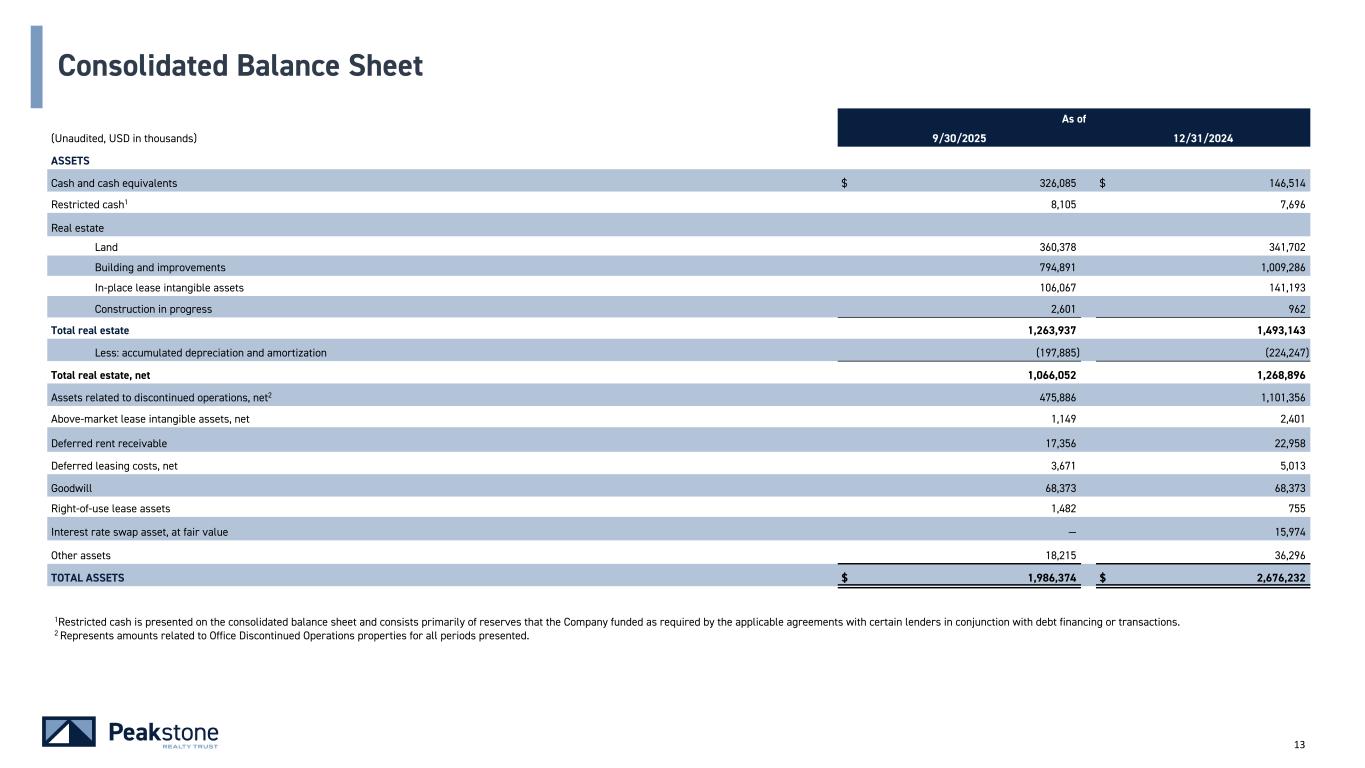

13 As of (Unaudited, USD in thousands) 9/30/2025 12/31/2024 ASSETS Cash and cash equivalents $ 326,085 $ 146,514 Restricted cash1 8,105 7,696 Real estate Land 360,378 341,702 Building and improvements 794,891 1,009,286 In-place lease intangible assets 106,067 141,193 Construction in progress 2,601 962 Total real estate 1,263,937 1,493,143 Less: accumulated depreciation and amortization (197,885) (224,247) Total real estate, net 1,066,052 1,268,896 Assets related to discontinued operations, net2 475,886 1,101,356 Above-market lease intangible assets, net 1,149 2,401 Deferred rent receivable 17,356 22,958 Deferred leasing costs, net 3,671 5,013 Goodwill 68,373 68,373 Right-of-use lease assets 1,482 755 Interest rate swap asset, at fair value — 15,974 Other assets 18,215 36,296 TOTAL ASSETS $ 1,986,374 $ 2,676,232 Consolidated Balance Sheet 1Restricted cash is presented on the consolidated balance sheet and consists primarily of reserves that the Company funded as required by the applicable agreements with certain lenders in conjunction with debt financing or transactions. 2 Represents amounts related to Office Discontinued Operations properties for all periods presented.

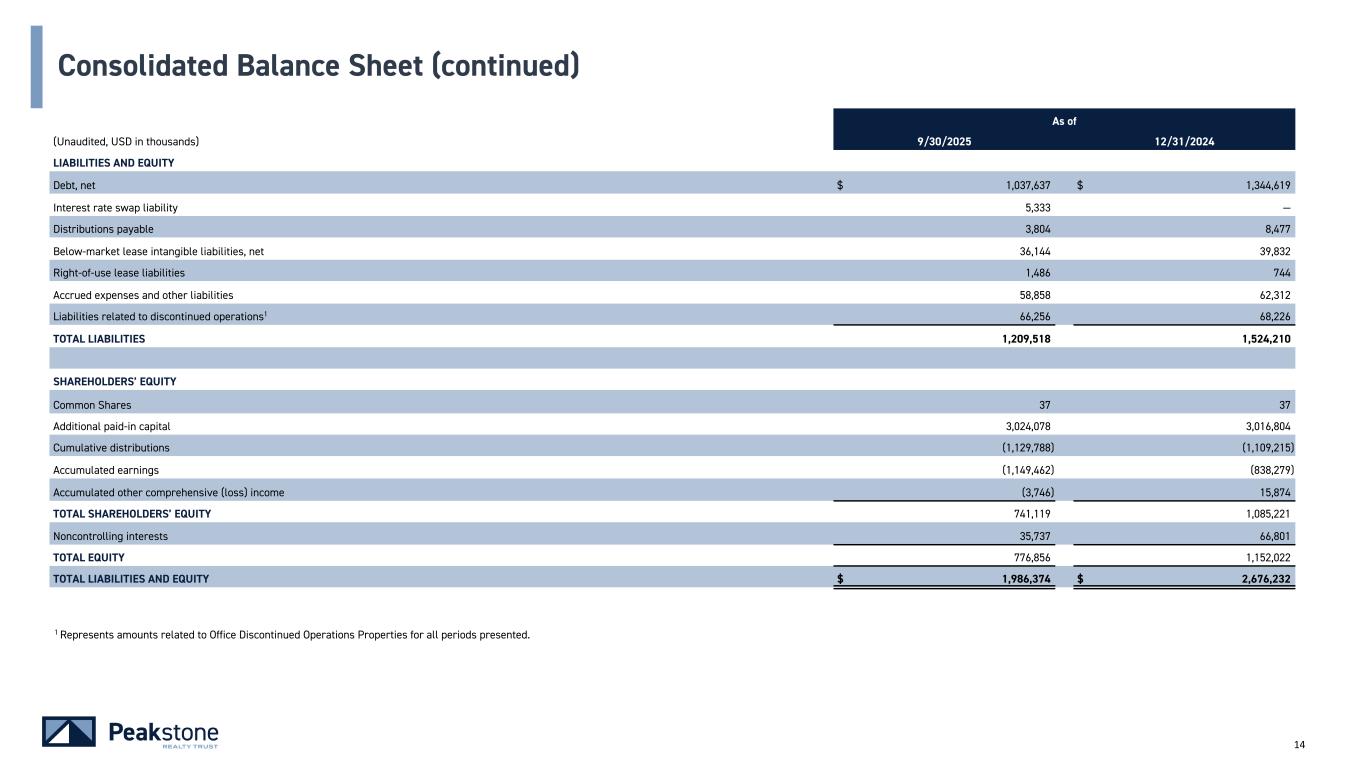

14 As of (Unaudited, USD in thousands) 9/30/2025 12/31/2024 LIABILITIES AND EQUITY Debt, net $ 1,037,637 $ 1,344,619 Interest rate swap liability 5,333 — Distributions payable 3,804 8,477 Below-market lease intangible liabilities, net 36,144 39,832 Right-of-use lease liabilities 1,486 744 Accrued expenses and other liabilities 58,858 62,312 Liabilities related to discontinued operations1 66,256 68,226 TOTAL LIABILITIES 1,209,518 1,524,210 SHAREHOLDERS’ EQUITY Common Shares 37 37 Additional paid-in capital 3,024,078 3,016,804 Cumulative distributions (1,129,788) (1,109,215) Accumulated earnings (1,149,462) (838,279) Accumulated other comprehensive (loss) income (3,746) 15,874 TOTAL SHAREHOLDERS’ EQUITY 741,119 1,085,221 Noncontrolling interests 35,737 66,801 TOTAL EQUITY 776,856 1,152,022 TOTAL LIABILITIES AND EQUITY $ 1,986,374 $ 2,676,232 Consolidated Balance Sheet (continued) 1 Represents amounts related to Office Discontinued Operations Properties for all periods presented.

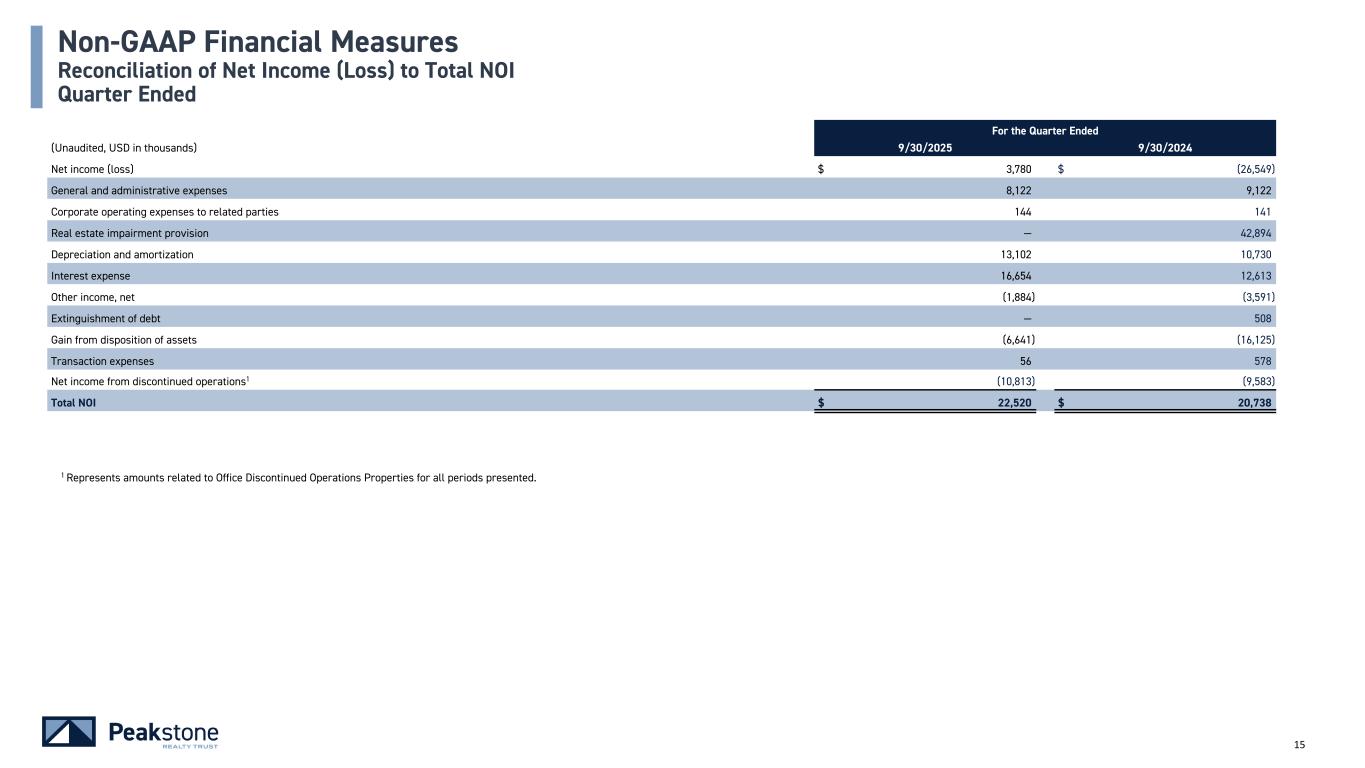

15 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2025 9/30/2024 Net income (loss) $ 3,780 $ (26,549) General and administrative expenses 8,122 9,122 Corporate operating expenses to related parties 144 141 Real estate impairment provision — 42,894 Depreciation and amortization 13,102 10,730 Interest expense 16,654 12,613 Other income, net (1,884) (3,591) Extinguishment of debt — 508 Gain from disposition of assets (6,641) (16,125) Transaction expenses 56 578 Net income from discontinued operations1 (10,813) (9,583) Total NOI $ 22,520 $ 20,738 Non-GAAP Financial Measures Reconciliation of Net Income (Loss) to Total NOI Quarter Ended 1 Represents amounts related to Office Discontinued Operations Properties for all periods presented.

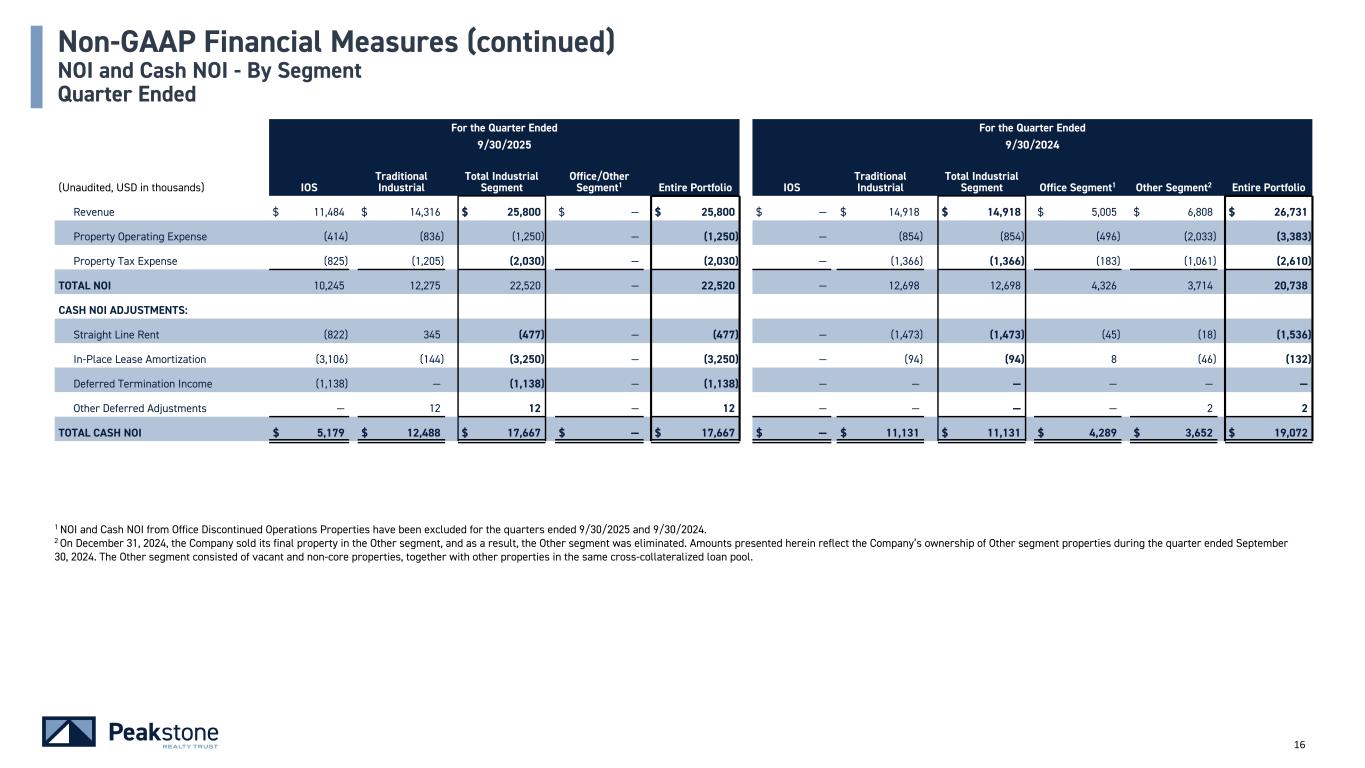

16 For the Quarter Ended For the Quarter Ended 9/30/2025 9/30/2024 (Unaudited, USD in thousands) IOS Traditional Industrial Total Industrial Segment Office/Other Segment1 Entire Portfolio IOS Traditional Industrial Total Industrial Segment Office Segment1 Other Segment2 Entire Portfolio Revenue $ 11,484 $ 14,316 $ 25,800 $ — $ 25,800 $ — $ 14,918 $ 14,918 $ 5,005 $ 6,808 $ 26,731 Property Operating Expense (414) (836) (1,250) — (1,250) — (854) (854) (496) (2,033) (3,383) Property Tax Expense (825) (1,205) (2,030) — (2,030) — (1,366) (1,366) (183) (1,061) (2,610) TOTAL NOI 10,245 12,275 22,520 — 22,520 — 12,698 12,698 4,326 3,714 20,738 CASH NOI ADJUSTMENTS: Straight Line Rent (822) 345 (477) — (477) — (1,473) (1,473) (45) (18) (1,536) In-Place Lease Amortization (3,106) (144) (3,250) — (3,250) — (94) (94) 8 (46) (132) Deferred Termination Income (1,138) — (1,138) — (1,138) — — — — — — Other Deferred Adjustments — 12 12 — 12 — — — — 2 2 TOTAL CASH NOI $ 5,179 $ 12,488 $ 17,667 $ — $ 17,667 $ — $ 11,131 $ 11,131 $ 4,289 $ 3,652 $ 19,072 Non-GAAP Financial Measures (continued) NOI and Cash NOI - By Segment Quarter Ended 1 NOI and Cash NOI from Office Discontinued Operations Properties have been excluded for the quarters ended 9/30/2025 and 9/30/2024. 2 On December 31, 2024, the Company sold its final property in the Other segment, and as a result, the Other segment was eliminated. Amounts presented herein reflect the Company’s ownership of Other segment properties during the quarter ended September 30, 2024. The Other segment consisted of vacant and non-core properties, together with other properties in the same cross-collateralized loan pool.

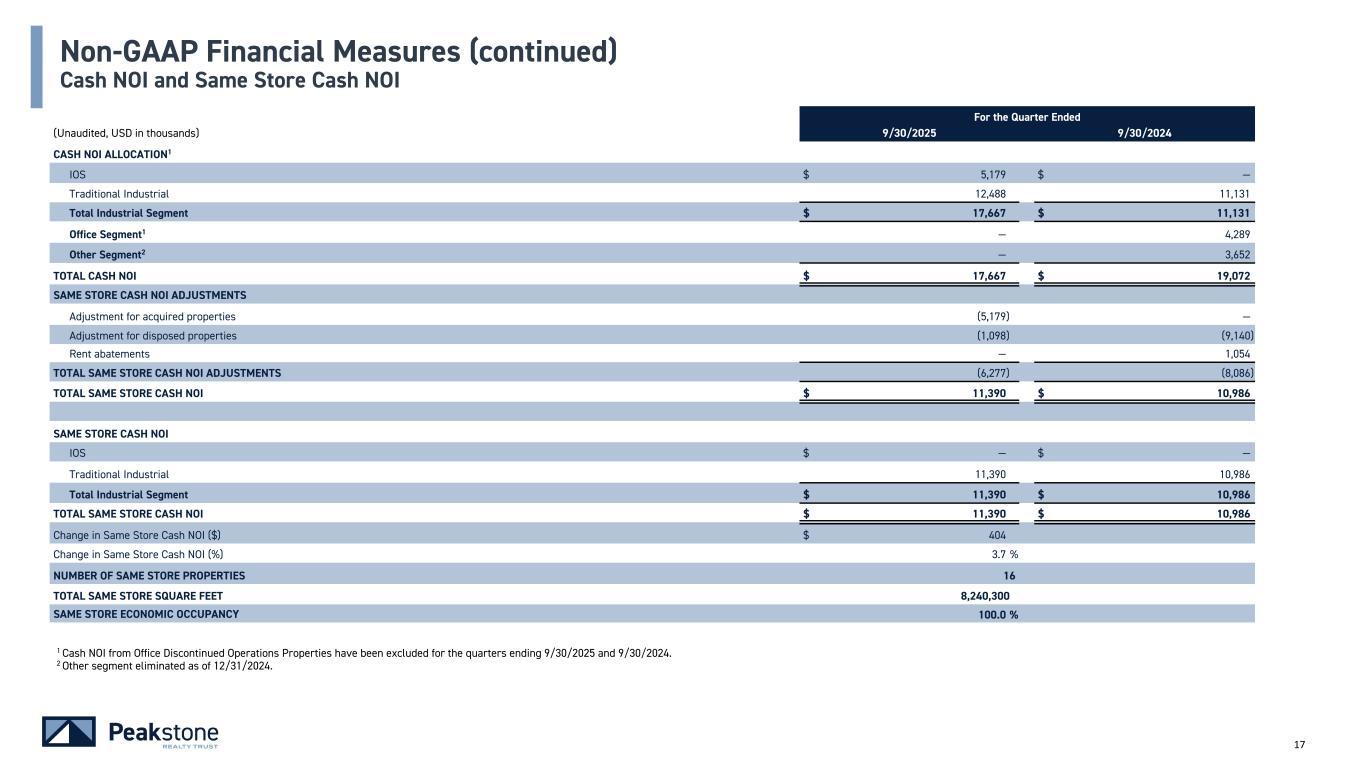

17 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2025 9/30/2024 CASH NOI ALLOCATION1 IOS $ 5,179 $ — Traditional Industrial 12,488 11,131 Total Industrial Segment $ 17,667 $ 11,131 Office Segment1 — 4,289 Other Segment2 — 3,652 TOTAL CASH NOI $ 17,667 $ 19,072 SAME STORE CASH NOI ADJUSTMENTS � � Adjustment for acquired properties (5,179) — Adjustment for disposed properties (1,098) (9,140) Rent abatements — 1,054 TOTAL SAME STORE CASH NOI ADJUSTMENTS (6,277) (8,086) TOTAL SAME STORE CASH NOI $ 11,390 $ 10,986 SAME STORE CASH NOI IOS $ — $ — Traditional Industrial 11,390 10,986 Total Industrial Segment $ 11,390 $ 10,986 TOTAL SAME STORE CASH NOI $ 11,390 $ 10,986 Change in Same Store Cash NOI ($) $ 404 Change in Same Store Cash NOI (%) 3.7 % NUMBER OF SAME STORE PROPERTIES 16 TOTAL SAME STORE SQUARE FEET 8,240,300 SAME STORE ECONOMIC OCCUPANCY 100.0 % Non-GAAP Financial Measures (continued) Cash NOI and Same Store Cash NOI 1 Cash NOI from Office Discontinued Operations Properties have been excluded for the quarters ending 9/30/2025 and 9/30/2024. 2 Other segment eliminated as of 12/31/2024.

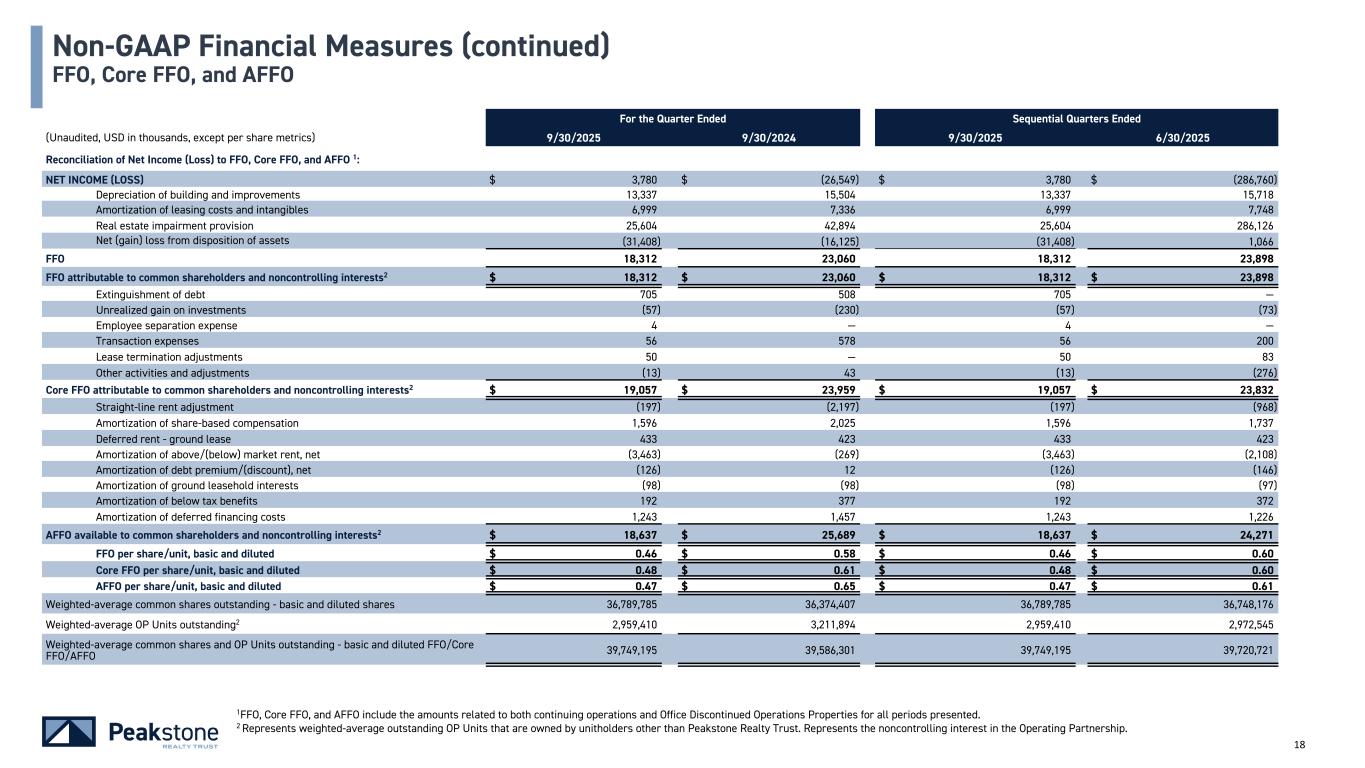

18 For the Quarter Ended Sequential Quarters Ended (Unaudited, USD in thousands, except per share metrics) 9/30/2025 9/30/2024 9/30/2025 6/30/2025 Reconciliation of Net Income (Loss) to FFO, Core FFO, and AFFO 1: NET INCOME (LOSS) $ 3,780 $ (26,549) $ 3,780 $ (286,760) Depreciation of building and improvements 13,337 15,504 13,337 15,718 Amortization of leasing costs and intangibles 6,999 7,336 6,999 7,748 Real estate impairment provision 25,604 42,894 25,604 286,126 Net (gain) loss from disposition of assets (31,408) (16,125) (31,408) 1,066 FFO 18,312 23,060 18,312 23,898 FFO attributable to common shareholders and noncontrolling interests2 $ 18,312 $ 23,060 $ 18,312 $ 23,898 Extinguishment of debt 705 508 705 — Unrealized gain on investments (57) (230) (57) (73) Employee separation expense 4 — 4 — Transaction expenses 56 578 56 200 Lease termination adjustments 50 — 50 83 Other activities and adjustments (13) 43 (13) (276) Core FFO attributable to common shareholders and noncontrolling interests2 $ 19,057 $ 23,959 $ 19,057 $ 23,832 Straight-line rent adjustment (197) (2,197) (197) (968) Amortization of share-based compensation 1,596 2,025 1,596 1,737 Deferred rent - ground lease 433 423 433 423 Amortization of above/(below) market rent, net (3,463) (269) (3,463) (2,108) Amortization of debt premium/(discount), net (126) 12 (126) (146) Amortization of ground leasehold interests (98) (98) (98) (97) Amortization of below tax benefits 192 377 192 372 Amortization of deferred financing costs 1,243 1,457 1,243 1,226 AFFO available to common shareholders and noncontrolling interests2 $ 18,637 $ 25,689 $ 18,637 $ 24,271 FFO per share/unit, basic and diluted $ 0.46 $ 0.58 $ 0.46 $ 0.60 Core FFO per share/unit, basic and diluted $ 0.48 $ 0.61 $ 0.48 $ 0.60 AFFO per share/unit, basic and diluted $ 0.47 $ 0.65 $ 0.47 $ 0.61 Weighted-average common shares outstanding - basic and diluted shares 36,789,785 36,374,407 36,789,785 36,748,176 Weighted-average OP Units outstanding2 2,959,410 3,211,894 2,959,410 2,972,545 Weighted-average common shares and OP Units outstanding - basic and diluted FFO/Core FFO/AFFO 39,749,195 39,586,301 39,749,195 39,720,721 Non-GAAP Financial Measures (continued) FFO, Core FFO, and AFFO 1FFO, Core FFO, and AFFO include the amounts related to both continuing operations and Office Discontinued Operations Properties for all periods presented. 2 Represents weighted-average outstanding OP Units that are owned by unitholders other than Peakstone Realty Trust. Represents the noncontrolling interest in the Operating Partnership.

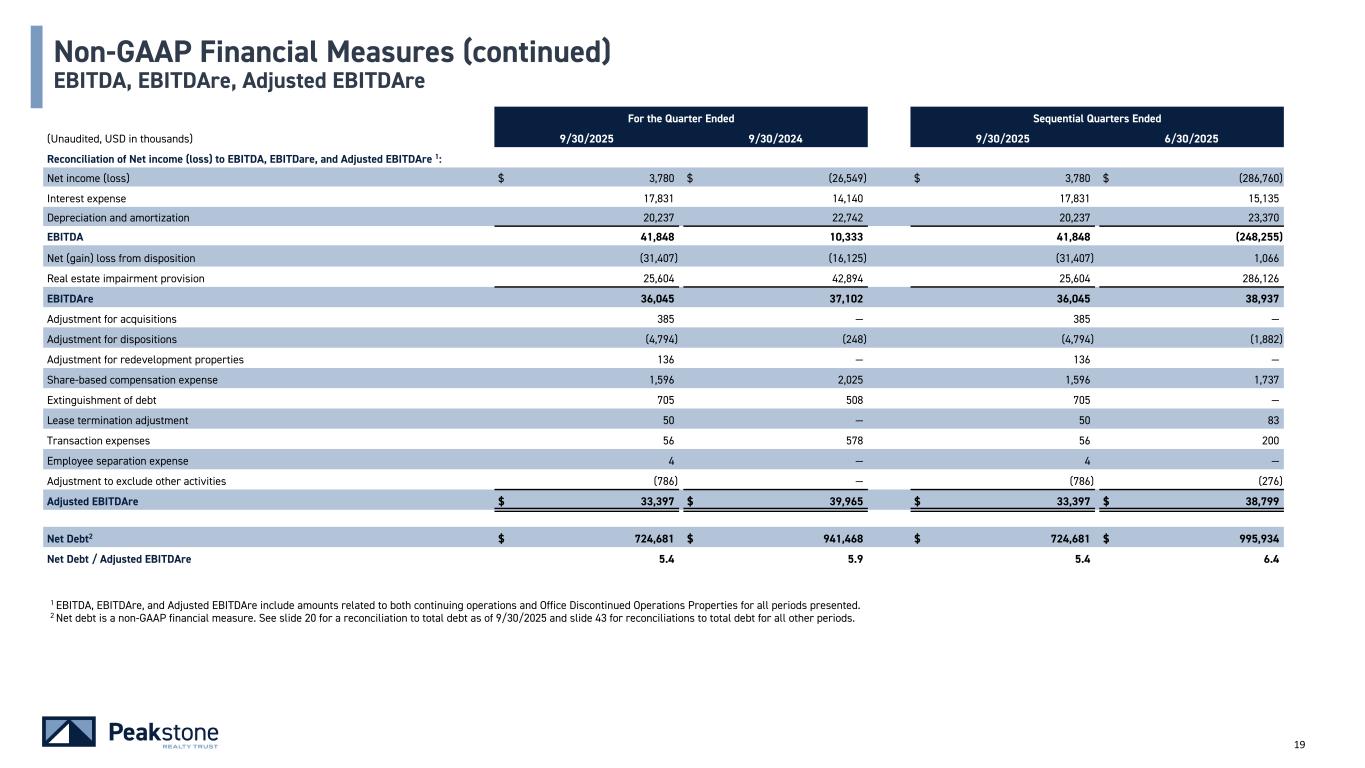

19 For the Quarter Ended Sequential Quarters Ended (Unaudited, USD in thousands) 9/30/2025 9/30/2024 9/30/2025 6/30/2025 Reconciliation of Net income (loss) to EBITDA, EBITDare, and Adjusted EBITDAre 1: Net income (loss) $ 3,780 $ (26,549) $ 3,780 $ (286,760) Interest expense 17,831 14,140 17,831 15,135 Depreciation and amortization 20,237 22,742 20,237 23,370 EBITDA 41,848 10,333 41,848 (248,255) Net (gain) loss from disposition (31,407) (16,125) (31,407) 1,066 Real estate impairment provision 25,604 42,894 25,604 286,126 EBITDAre 36,045 37,102 36,045 38,937 Adjustment for acquisitions 385 — 385 — Adjustment for dispositions (4,794) (248) (4,794) (1,882) Adjustment for redevelopment properties 136 — 136 — Share-based compensation expense 1,596 2,025 1,596 1,737 Extinguishment of debt 705 508 705 — Lease termination adjustment 50 — 50 83 Transaction expenses 56 578 56 200 Employee separation expense 4 — 4 — Adjustment to exclude other activities (786) — (786) (276) Adjusted EBITDAre $ 33,397 $ 39,965 $ 33,397 $ 38,799 Net Debt2 $ 724,681 $ 941,468 $ 724,681 $ 995,934 Net Debt / Adjusted EBITDAre 5.4 5.9 5.4 6.4 Non-GAAP Financial Measures (continued) EBITDA, EBITDAre, Adjusted EBITDAre 1 EBITDA, EBITDAre, and Adjusted EBITDAre include amounts related to both continuing operations and Office Discontinued Operations Properties for all periods presented. 2 Net debt is a non-GAAP financial measure. See slide 20 for a reconciliation to total debt as of 9/30/2025 and slide 43 for reconciliations to total debt for all other periods.

Debt & Capitalization 20

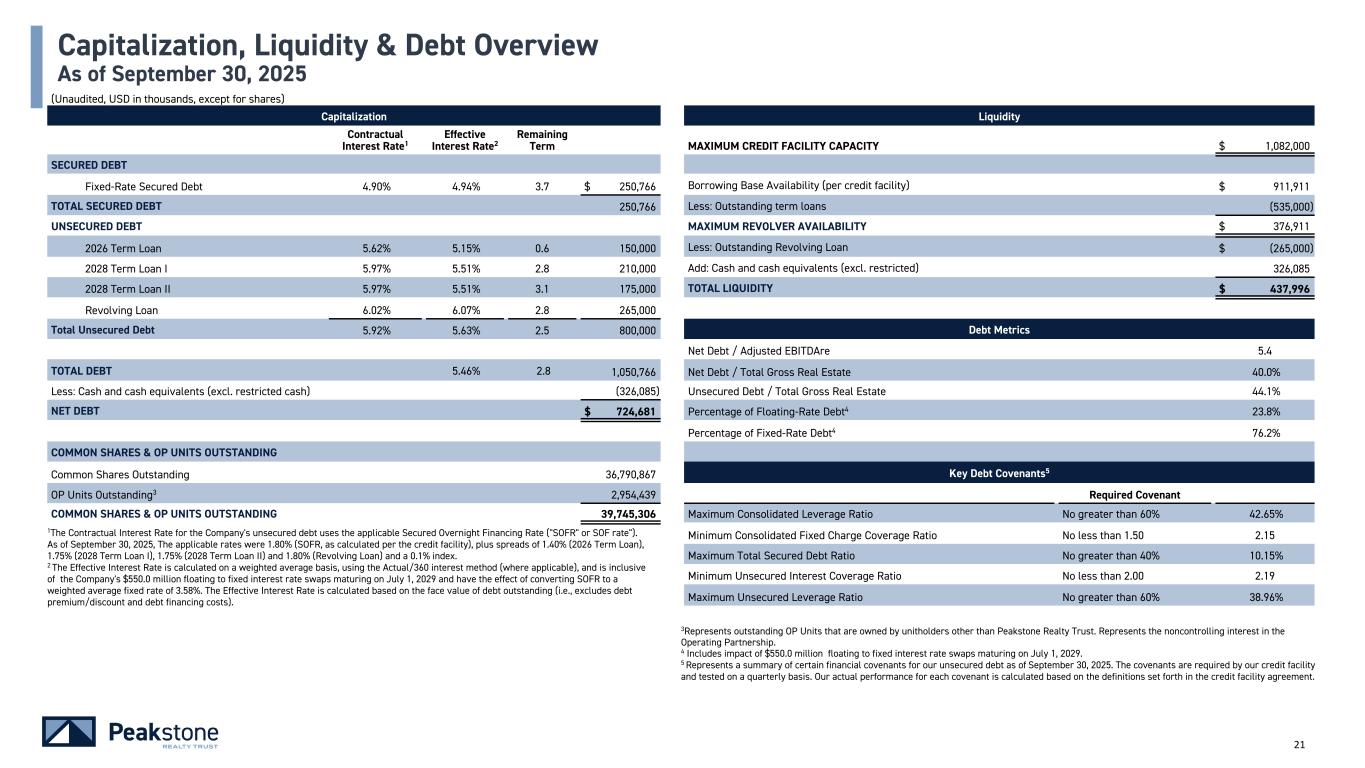

21 (Unaudited, USD in thousands, except for shares) Capitalization Liquidity Contractual Interest Rate1 Effective Interest Rate2 Remaining Term MAXIMUM CREDIT FACILITY CAPACITY $ 1,082,000 SECURED DEBT Fixed-Rate Secured Debt 4.90% 4.94% 3.7 $ 250,766 Borrowing Base Availability (per credit facility) $ 911,911 TOTAL SECURED DEBT 250,766 Less: Outstanding term loans (535,000) UNSECURED DEBT MAXIMUM REVOLVER AVAILABILITY $ 376,911 2026 Term Loan 5.62% 5.15% 0.6 150,000 Less: Outstanding Revolving Loan $ (265,000) 2028 Term Loan I 5.97% 5.51% 2.8 210,000 Add: Cash and cash equivalents (excl. restricted) 326,085 2028 Term Loan II 5.97% 5.51% 3.1 175,000 TOTAL LIQUIDITY $ 437,996 Revolving Loan 6.02% 6.07% 2.8 265,000 Total Unsecured Debt 5.92% 5.63% 2.5 800,000 Debt Metrics Net Debt / Adjusted EBITDAre 5.4 TOTAL DEBT 5.46% 2.8 1,050,766 Net Debt / Total Gross Real Estate 40.0% Less: Cash and cash equivalents (excl. restricted cash) (326,085) Unsecured Debt / Total Gross Real Estate 44.1% NET DEBT $ 724,681 Percentage of Floating-Rate Debt4 23.8% Percentage of Fixed-Rate Debt4 76.2% COMMON SHARES & OP UNITS OUTSTANDING Common Shares Outstanding 36,790,867 Key Debt Covenants5 OP Units Outstanding3 2,954,439 Required Covenant COMMON SHARES & OP UNITS OUTSTANDING 39,745,306 Maximum Consolidated Leverage Ratio No greater than 60% 42.65% Minimum Consolidated Fixed Charge Coverage Ratio No less than 1.50 2.15 Maximum Total Secured Debt Ratio No greater than 40% 10.15% Minimum Unsecured Interest Coverage Ratio No less than 2.00 2.19 Maximum Unsecured Leverage Ratio No greater than 60% 38.96% Capitalization, Liquidity & Debt Overview As of September 30, 2025 3Represents outstanding OP Units that are owned by unitholders other than Peakstone Realty Trust. Represents the noncontrolling interest in the Operating Partnership. 4 Includes impact of $550.0 million floating to fixed interest rate swaps maturing on July 1, 2029. 5 Represents a summary of certain financial covenants for our unsecured debt as of September 30, 2025. The covenants are required by our credit facility and tested on a quarterly basis. Our actual performance for each covenant is calculated based on the definitions set forth in the credit facility agreement. 1The Contractual Interest Rate for the Company's unsecured debt uses the applicable Secured Overnight Financing Rate ("SOFR" or SOF rate"). As of September 30, 2025, The applicable rates were 1.80% (SOFR, as calculated per the credit facility), plus spreads of 1.40% (2026 Term Loan), 1.75% (2028 Term Loan I), 1.75% (2028 Term Loan II) and 1.80% (Revolving Loan) and a 0.1% index. 2 The Effective Interest Rate is calculated on a weighted average basis, using the Actual/360 interest method (where applicable), and is inclusive of the Company's $550.0 million floating to fixed interest rate swaps maturing on July 1, 2029 and have the effect of converting SOFR to a weighted average fixed rate of 3.58%. The Effective Interest Rate is calculated based on the face value of debt outstanding (i.e., excludes debt premium/discount and debt financing costs).

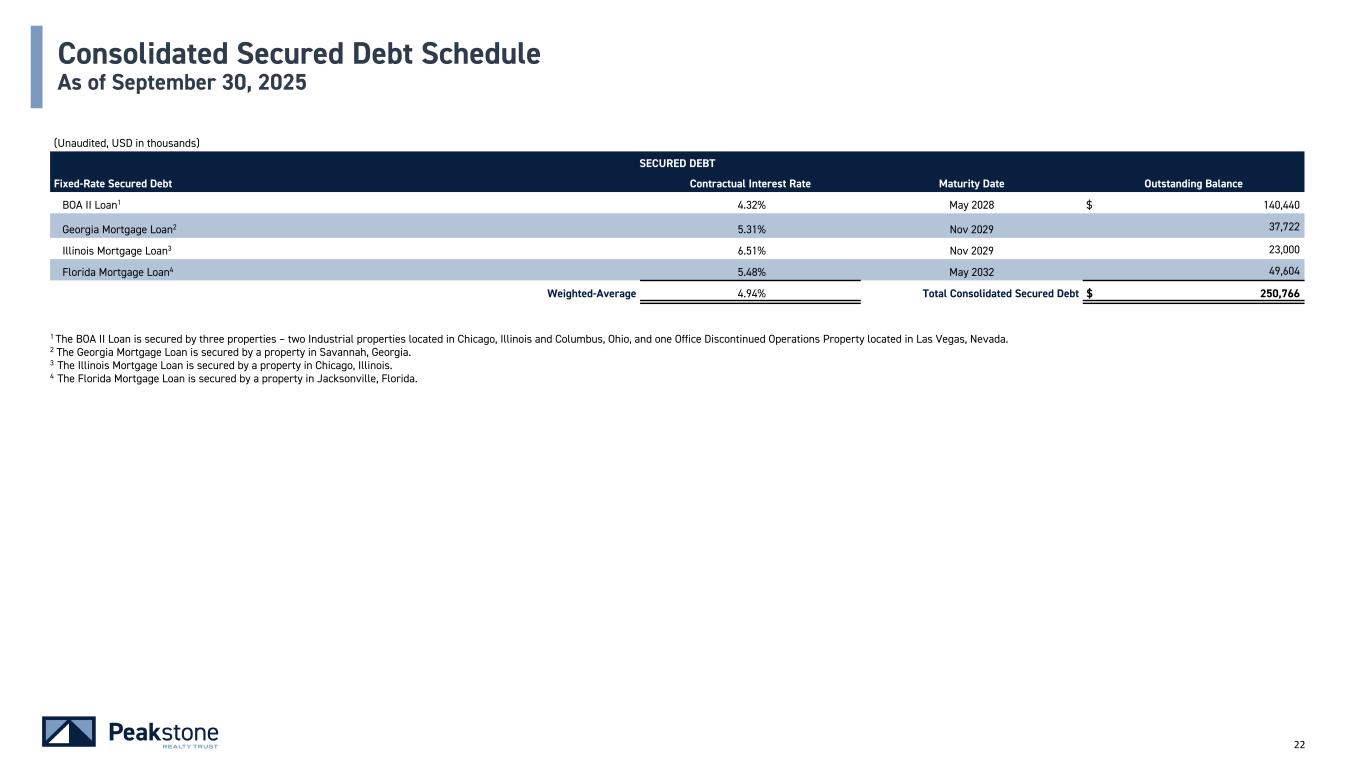

22 (Unaudited, USD in thousands) SECURED DEBT Fixed-Rate Secured Debt Contractual Interest Rate Maturity Date Outstanding Balance BOA II Loan1 4.32% May 2028 $ 140,440 Georgia Mortgage Loan2 5.31% Nov 2029 37,722 Illinois Mortgage Loan3 6.51% Nov 2029 23,000 Florida Mortgage Loan4 5.48% May 2032 49,604 Weighted-Average 4.94% Total Consolidated Secured Debt $ 250,766 Consolidated Secured Debt Schedule As of September 30, 2025 1 The BOA II Loan is secured by three properties – two Industrial properties located in Chicago, Illinois and Columbus, Ohio, and one Office Discontinued Operations Property located in Las Vegas, Nevada. 2 The Georgia Mortgage Loan is secured by a property in Savannah, Georgia. 3 The Illinois Mortgage Loan is secured by a property in Chicago, Illinois. 4 The Florida Mortgage Loan is secured by a property in Jacksonville, Florida.

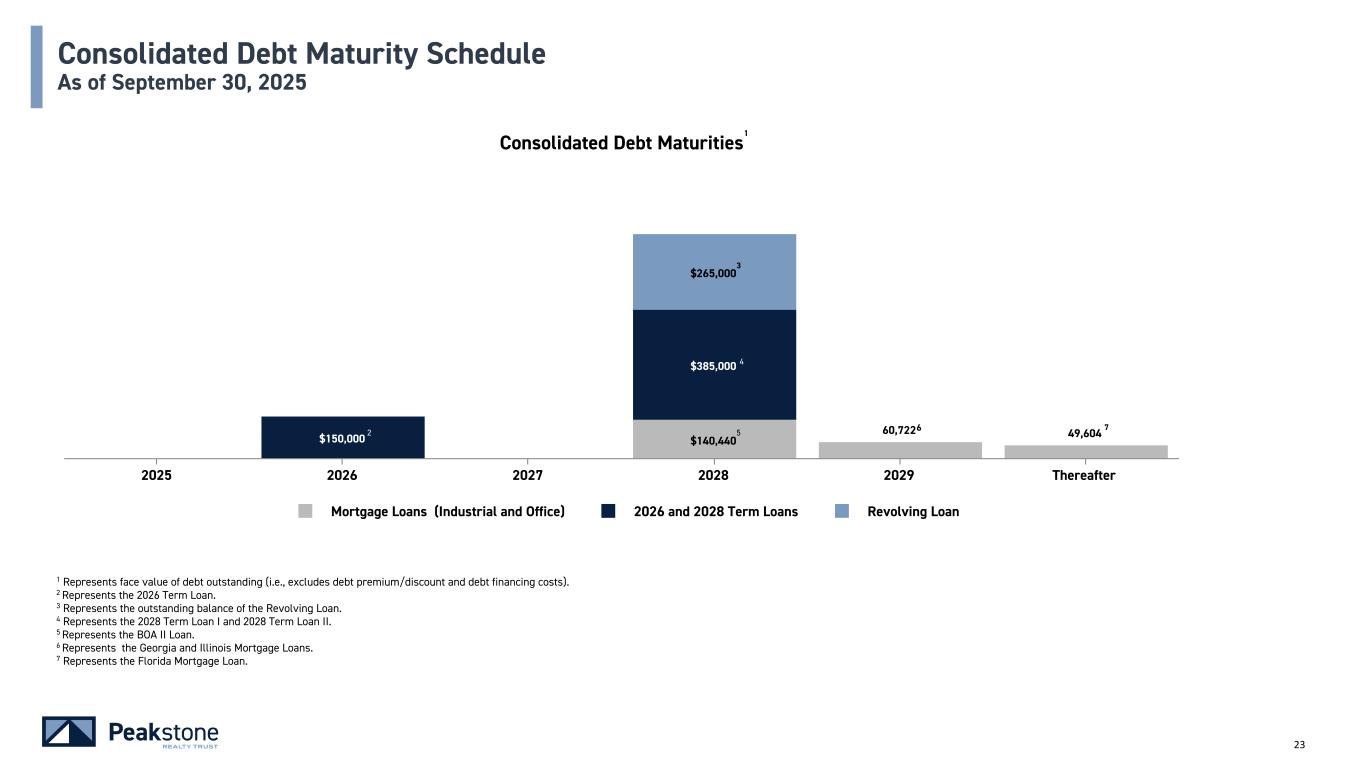

23 1 Represents face value of debt outstanding (i.e., excludes debt premium/discount and debt financing costs). 2 Represents the 2026 Term Loan. 3 Represents the outstanding balance of the Revolving Loan. 4 Represents the 2028 Term Loan I and 2028 Term Loan II. 5 Represents the BOA II Loan. 6 Represents the Georgia and Illinois Mortgage Loans. 7 Represents the Florida Mortgage Loan. $141,194(1) $200,000(3) $400,000(5) Consolidated Debt Maturities 60,722 49,604 $140,440$150,000 $385,000 $265,000 Mortgage Loans (Industrial and Office) 2026 and 2028 Term Loans Revolving Loan 2025 2026 2027 2028 2029 Thereafter (1) $250,000 4 2 Consolidated Debt Maturity Schedule As of September 30, 2025 $210,0005 1 65 4 3 7

Components of Net Asset Value 24

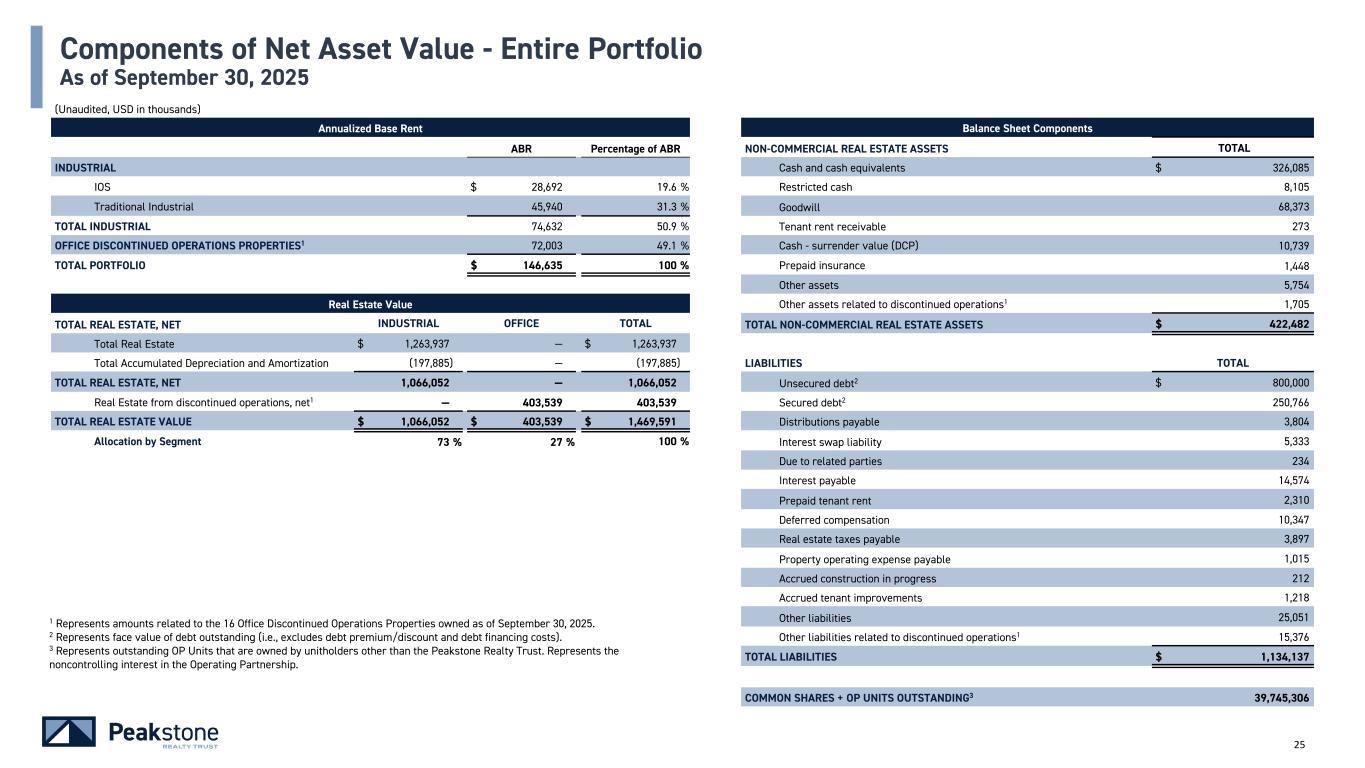

25 (Unaudited, USD in thousands) Annualized Base Rent Balance Sheet Components ABR Percentage of ABR NON-COMMERCIAL REAL ESTATE ASSETS TOTAL INDUSTRIAL � � Cash and cash equivalents $ 326,085 IOS $ 28,692 19.6 % Restricted cash 8,105 Traditional Industrial 45,940 31.3 % Goodwill 68,373 TOTAL INDUSTRIAL 74,632 50.9 % Tenant rent receivable 273 OFFICE DISCONTINUED OPERATIONS PROPERTIES1 72,003 49.1 % Cash - surrender value (DCP) 10,739 TOTAL PORTFOLIO $ 146,635 100 % Prepaid insurance 1,448 Other assets 5,754 Real Estate Value Other assets related to discontinued operations1 1,705 TOTAL REAL ESTATE, NET INDUSTRIAL OFFICE TOTAL TOTAL NON-COMMERCIAL REAL ESTATE ASSETS $ 422,482 Total Real Estate $ 1,263,937 — $ 1,263,937 Total Accumulated Depreciation and Amortization (197,885) — (197,885) LIABILITIES TOTAL TOTAL REAL ESTATE, NET 1,066,052 — 1,066,052 Unsecured debt2 $ 800,000 Real Estate from discontinued operations, net1 — 403,539 403,539 Secured debt2 250,766 TOTAL REAL ESTATE VALUE $ 1,066,052 $ 403,539 $ 1,469,591 Distributions payable 3,804 Allocation by Segment 73 % 27 % 100 % Interest swap liability 5,333 Due to related parties 234 Interest payable 14,574 Prepaid tenant rent 2,310 Deferred compensation 10,347 Real estate taxes payable 3,897 Property operating expense payable 1,015 Accrued construction in progress 212 Accrued tenant improvements 1,218 Other liabilities 25,051 Other liabilities related to discontinued operations1 15,376 TOTAL LIABILITIES $ 1,134,137 COMMON SHARES + OP UNITS OUTSTANDING3 39,745,306 Components of Net Asset Value - Entire Portfolio As of September 30, 2025 1 Represents amounts related to the 16 Office Discontinued Operations Properties owned as of September 30, 2025. 2 Represents face value of debt outstanding (i.e., excludes debt premium/discount and debt financing costs). 3 Represents outstanding OP Units that are owned by unitholders other than the Peakstone Realty Trust. Represents the noncontrolling interest in the Operating Partnership.

26 Portfolio Characteristics: Industrial Segment

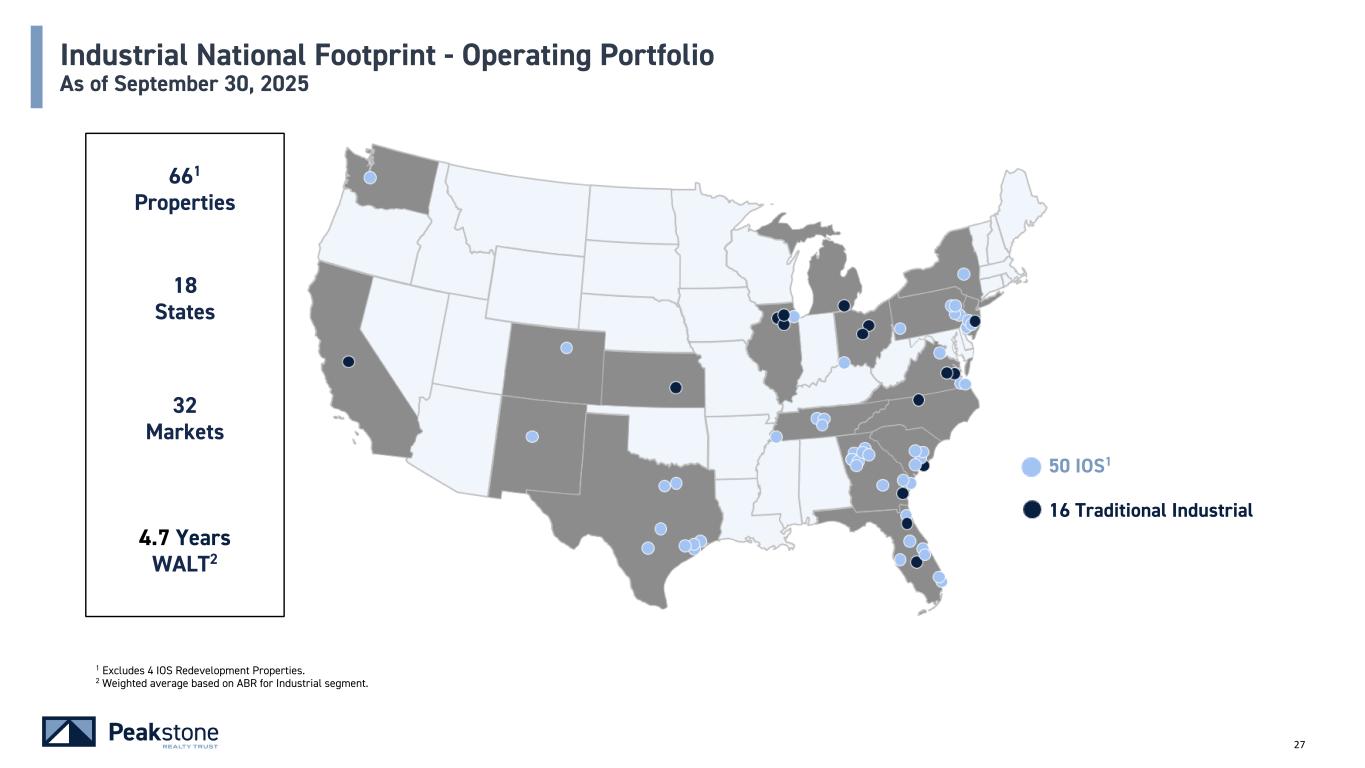

27 661 Properties 18 States 32 Markets 4.7 Years WALT2 1 Excludes 4 IOS Redevelopment Properties. 2 Weighted average based on ABR for Industrial segment. Industrial National Footprint - Operating Portfolio As of September 30, 2025 50 IOS1 16 Traditional Industrial

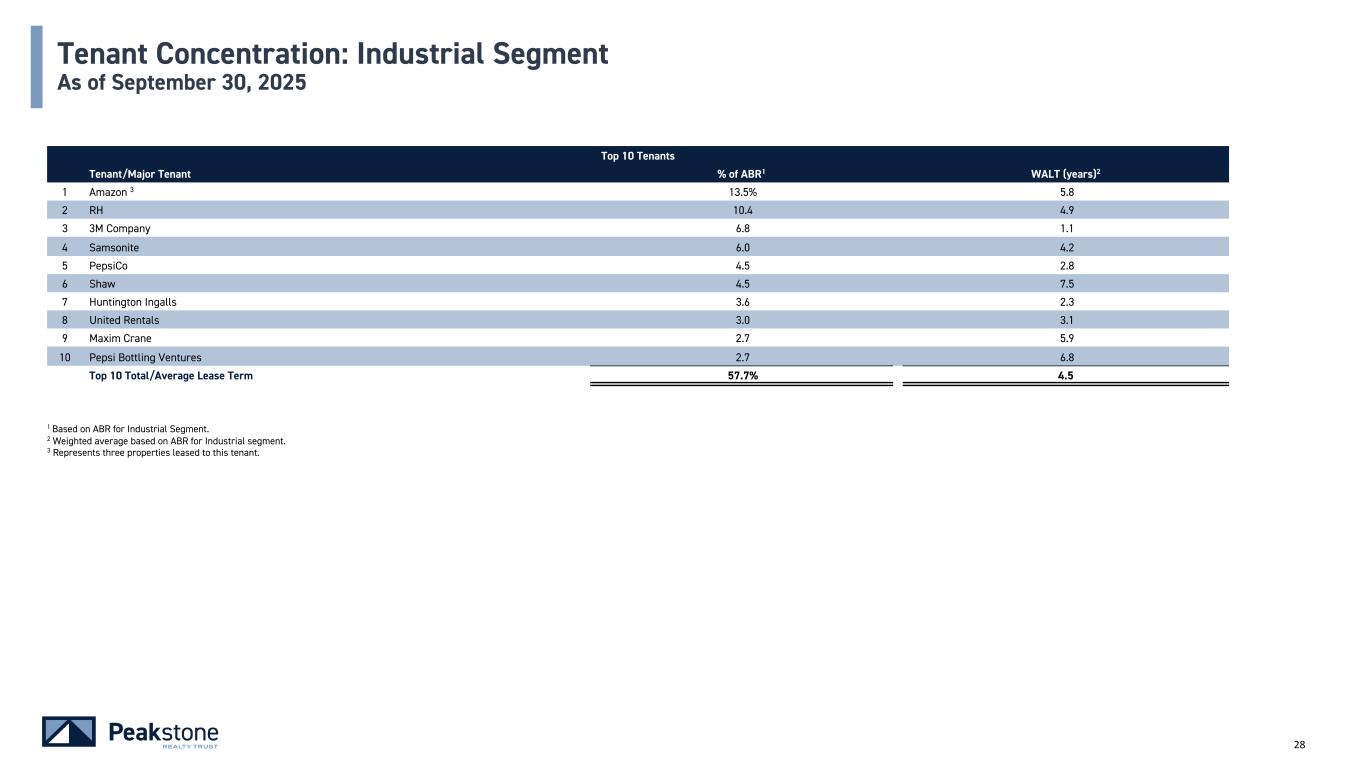

28 Top 10 Tenants Tenant/Major Tenant % of ABR1 WALT (years)2 1 Amazon 3 13.5% 5.8 2 RH 10.4 4.9 3 3M Company 6.8 1.1 4 Samsonite 6.0 4.2 5 PepsiCo 4.5 2.8 6 Shaw 4.5 7.5 7 Huntington Ingalls 3.6 2.3 8 United Rentals 3.0 3.1 9 Maxim Crane 2.7 5.9 10 Pepsi Bottling Ventures 2.7 6.8 Top 10 Total/Average Lease Term 57.7% 4.5 Tenant Concentration: Industrial Segment As of September 30, 2025 1 Based on ABR for Industrial Segment. 2 Weighted average based on ABR for Industrial segment. 3 Represents three properties leased to this tenant.

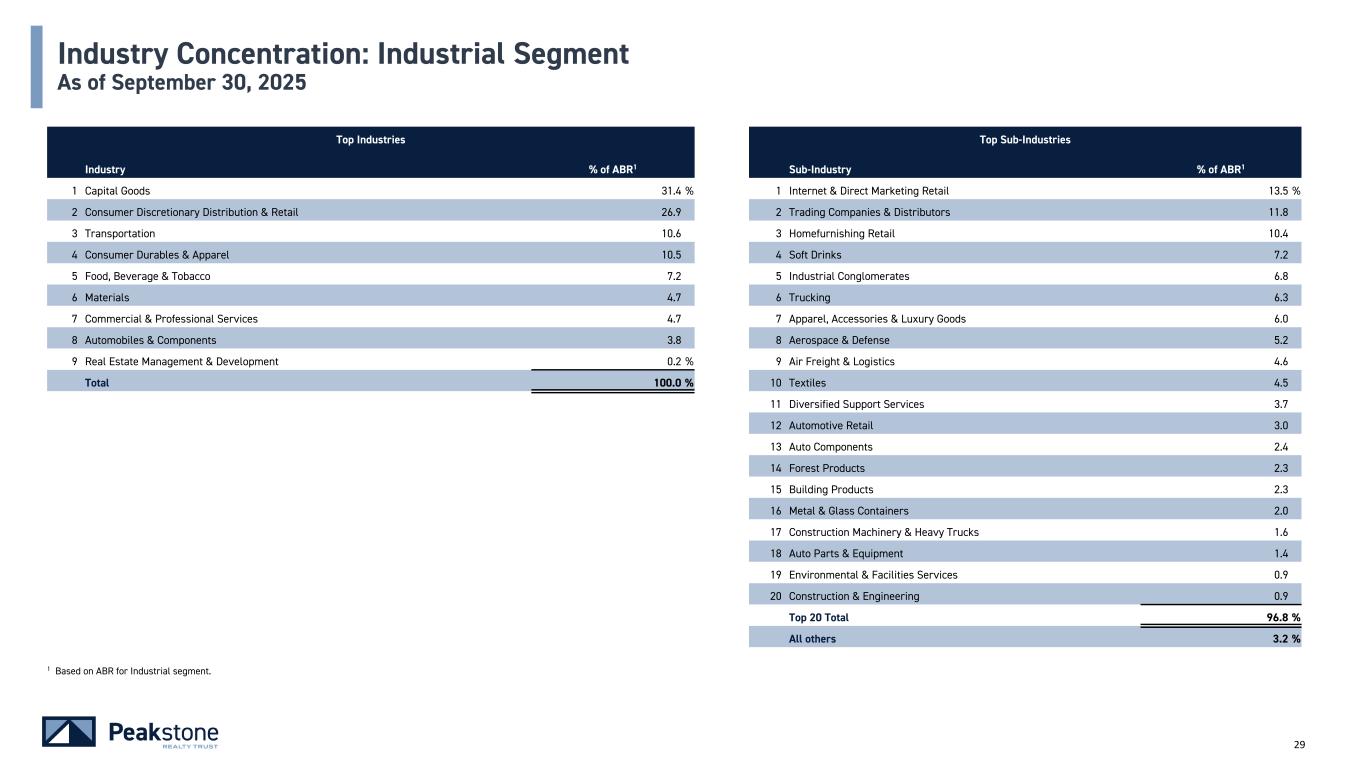

29 Industry Concentration: Industrial Segment As of September 30, 2025 Top Industries Top Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 31.4 % 1 Internet & Direct Marketing Retail 13.5 % 2 Consumer Discretionary Distribution & Retail 26.9 2 Trading Companies & Distributors 11.8 3 Transportation 10.6 3 Homefurnishing Retail 10.4 4 Consumer Durables & Apparel 10.5 4 Soft Drinks 7.2 5 Food, Beverage & Tobacco 7.2 5 Industrial Conglomerates 6.8 6 Materials 4.7 6 Trucking 6.3 7 Commercial & Professional Services 4.7 7 Apparel, Accessories & Luxury Goods 6.0 8 Automobiles & Components 3.8 8 Aerospace & Defense 5.2 9 Real Estate Management & Development 0.2 % 9 Air Freight & Logistics 4.6 � Total 100.0 % 10 Textiles 4.5 � � � 11 Diversified Support Services 3.7 12 Automotive Retail 3.0 � � � 13 Auto Components 2.4 14 Forest Products 2.3 15 Building Products 2.3 16 Metal & Glass Containers 2.0 17 Construction Machinery & Heavy Trucks 1.6 18 Auto Parts & Equipment 1.4 19 Environmental & Facilities Services 0.9 20 Construction & Engineering 0.9 Top 20 Total 96.8 % All others 3.2 % 1 Based on ABR for Industrial segment.

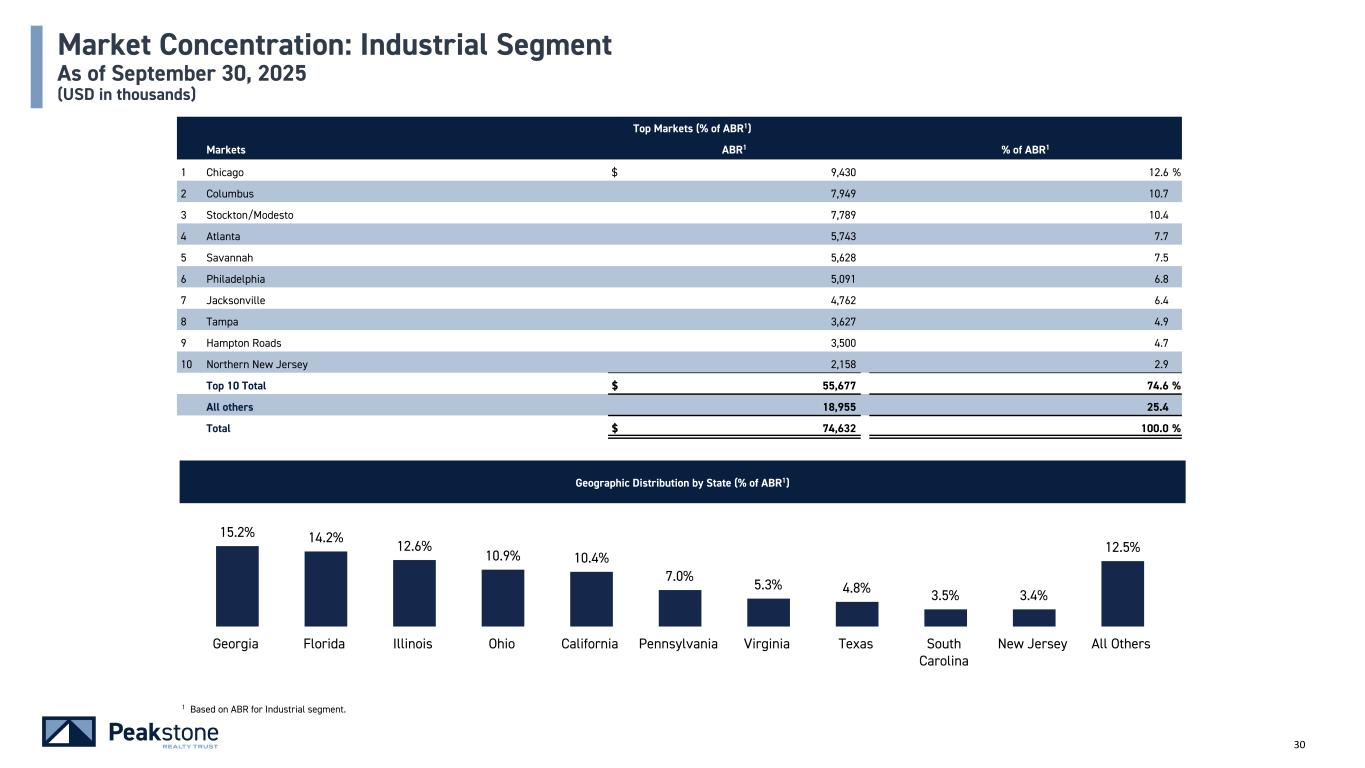

30 Geographic Distribution by State (% of ABR1) Market Concentration: Industrial Segment As of September 30, 2025 (USD in thousands) Top Markets (% of ABR1) Markets ABR1 % of ABR1 1 Chicago $ 9,430 12.6 % 2 Columbus 7,949 10.7 3 Stockton/Modesto 7,789 10.4 4 Atlanta 5,743 7.7 5 Savannah 5,628 7.5 6 Philadelphia 5,091 6.8 7 Jacksonville 4,762 6.4 8 Tampa 3,627 4.9 9 Hampton Roads 3,500 4.7 10 Northern New Jersey 2,158 2.9 Top 10 Total $ 55,677 74.6 % All others 18,955 25.4 Total $ 74,632 100.0 % 15.2% 14.2% 12.6% 10.9% 10.4% 7.0% 5.3% 4.8% 3.5% 3.4% 12.5% Georgia Florida Illinois Ohio California Pennsylvania Virginia Texas South Carolina New Jersey All Others 1 Based on ABR for Industrial segment.

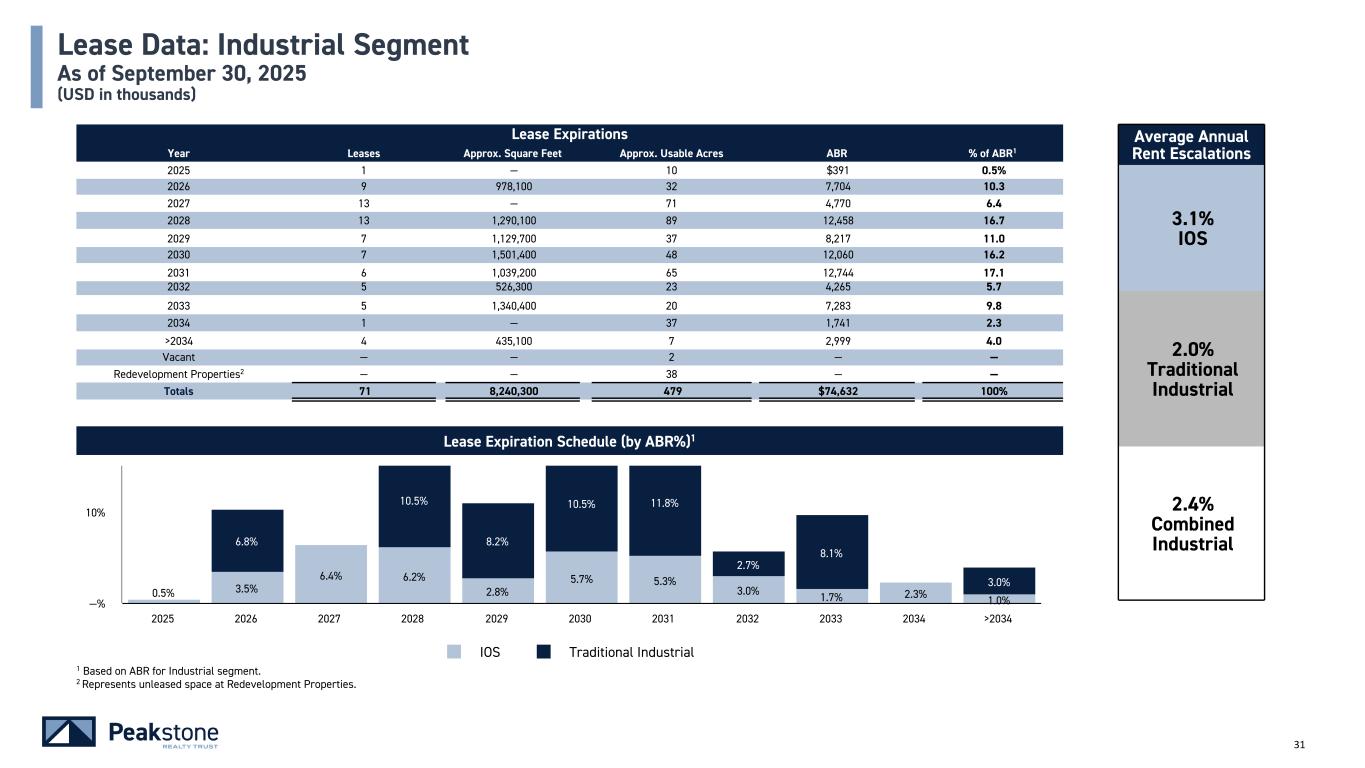

31 Lease Data: Industrial Segment As of September 30, 2025 (USD in thousands) Lease Expiration Schedule (by ABR%)1 0.5% 3.5% 6.4% 6.2% 2.8% 5.7% 5.3% 3.0% 1.7% 2.3% 1.0% 6.8% 10.5% 8.2% 10.5% 11.8% 2.7% 8.1% 3.0% IOS Traditional Industrial 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 >2034 —% 10% Lease Expirations Year Leases Approx. Square Feet Approx. Usable Acres ABR % of ABR1 2025 1 — 10 $391 0.5% 2026 9 978,100 32 7,704 10.3 2027 13 — 71 4,770 6.4 2028 13 1,290,100 89 12,458 16.7 2029 7 1,129,700 37 8,217 11.0 2030 7 1,501,400 48 12,060 16.2 2031 6 1,039,200 65 12,744 17.1 2032 5 526,300 23 4,265 5.7 2033 5 1,340,400 20 7,283 9.8 2034 1 — 37 1,741 2.3 >2034 4 435,100 7 2,999 4.0 Vacant — — 2 — — Redevelopment Properties2 — — 38 — — Totals 71 8,240,300 479 $74,632 100% 1 Based on ABR for Industrial segment. 2 Represents unleased space at Redevelopment Properties. Average Annual Rent Escalations 3.1% IOS 2.0% Traditional Industrial 2.4% Combined Industrial

Redevelopment Properties 32

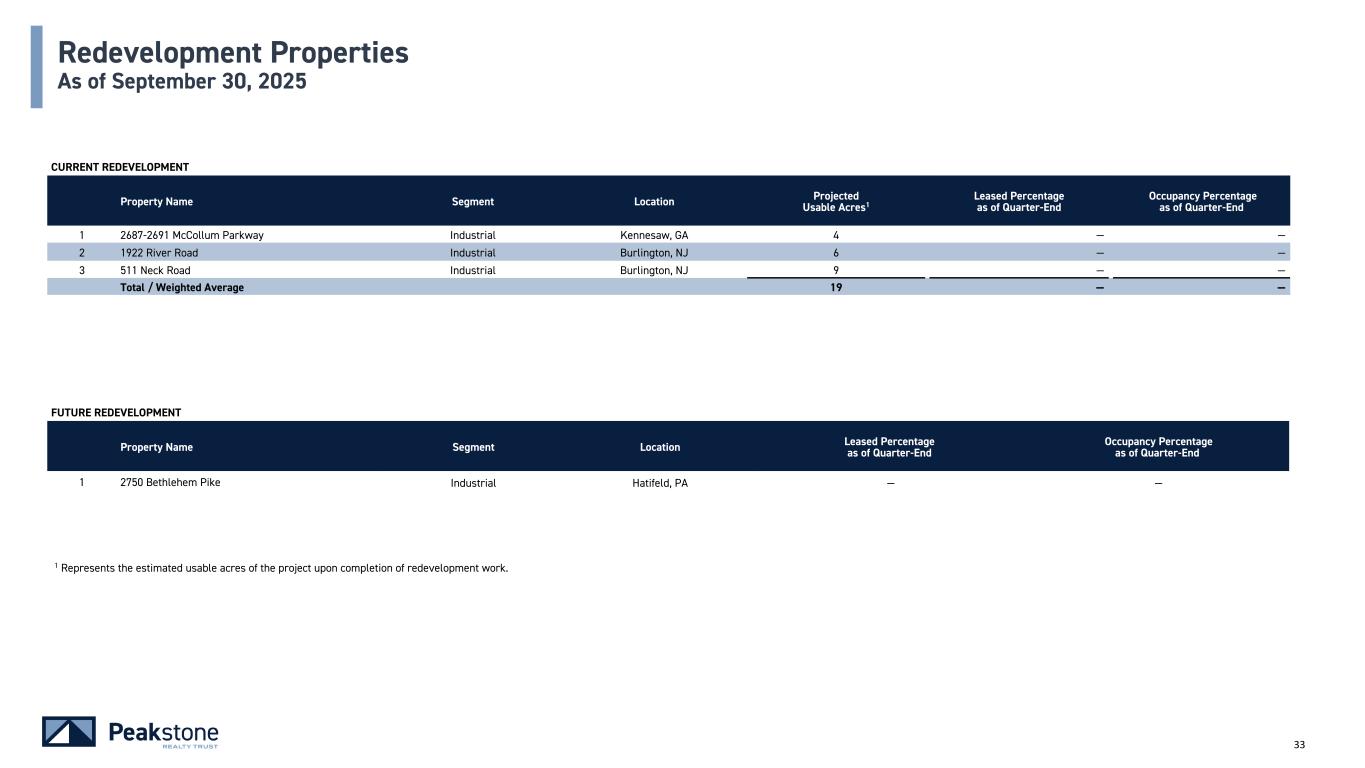

33 Redevelopment Properties As of September 30, 2025 CURRENT REDEVELOPMENT Property Name Segment Location Projected Usable Acres1 Leased Percentage as of Quarter-End Occupancy Percentage as of Quarter-End 1 2687-2691 McCollum Parkway Industrial Kennesaw, GA 4 — — 2 1922 River Road Industrial Burlington, NJ 6 — — 3 511 Neck Road Industrial Burlington, NJ 9 — — Total / Weighted Average 19 — — 1 Represents the estimated usable acres of the project upon completion of redevelopment work. FUTURE REDEVELOPMENT Property Name Segment Location Leased Percentage as of Quarter-End Occupancy Percentage as of Quarter-End 1 2750 Bethlehem Pike Industrial Hatifeld, PA — —

Capital Expenditures 34

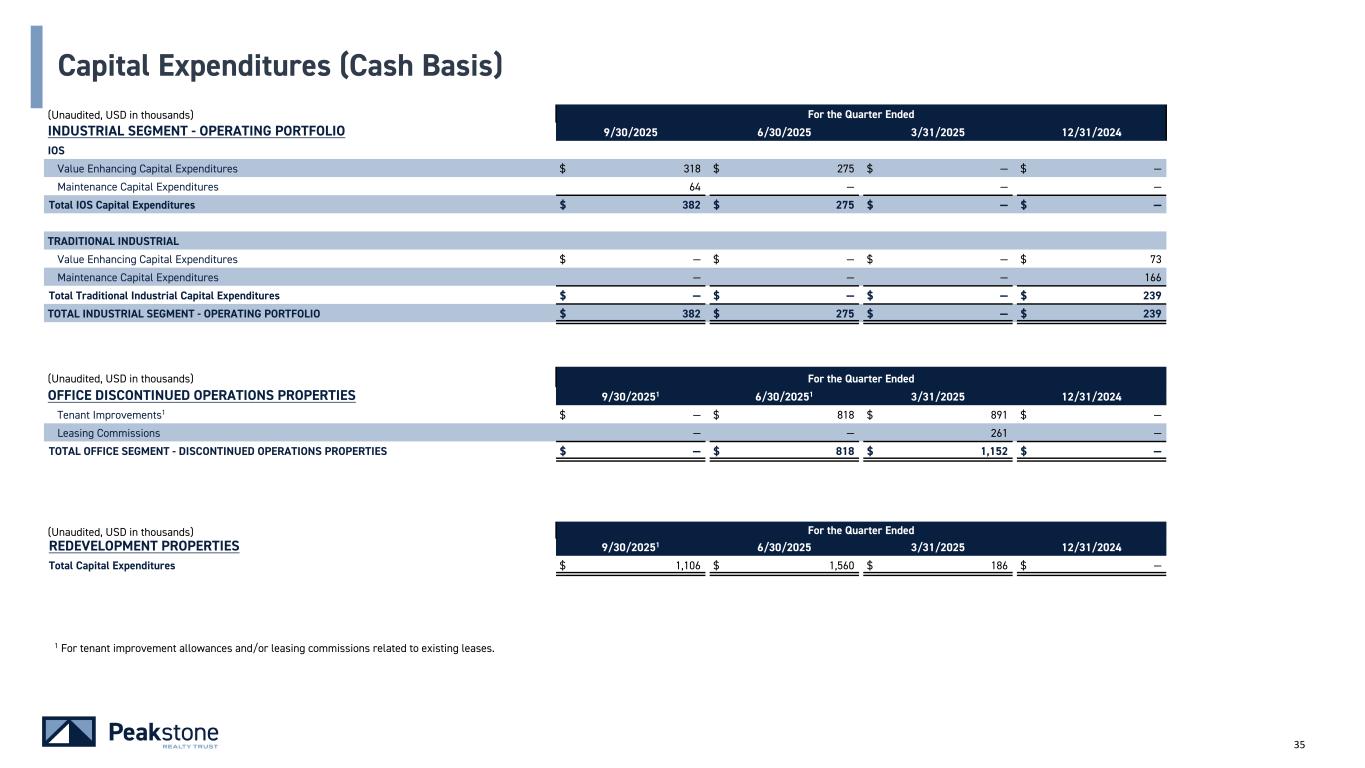

35 (Unaudited, USD in thousands) For the Quarter Ended INDUSTRIAL SEGMENT - OPERATING PORTFOLIO 9/30/2025 6/30/2025 3/31/2025 12/31/2024 IOS Value Enhancing Capital Expenditures $ 318 $ 275 $ — $ — Maintenance Capital Expenditures 64 — — — Total IOS Capital Expenditures $ 382 $ 275 $ — $ — TRADITIONAL INDUSTRIAL Value Enhancing Capital Expenditures $ — $ — $ — $ 73 Maintenance Capital Expenditures — — — 166 Total Traditional Industrial Capital Expenditures $ — $ — $ — $ 239 TOTAL INDUSTRIAL SEGMENT - OPERATING PORTFOLIO $ 382 $ 275 $ — $ 239 Capital Expenditures (Cash Basis) 1 For tenant improvement allowances and/or leasing commissions related to existing leases. (Unaudited, USD in thousands) For the Quarter Ended REDEVELOPMENT PROPERTIES 9/30/20251 6/30/2025 3/31/2025 12/31/2024 Total Capital Expenditures $ 1,106 $ 1,560 $ 186 $ — (Unaudited, USD in thousands) For the Quarter Ended OFFICE DISCONTINUED OPERATIONS PROPERTIES 9/30/20251 6/30/20251 3/31/2025 12/31/2024 Tenant Improvements1 $ — $ 818 $ 891 $ — Leasing Commissions — — 261 — TOTAL OFFICE SEGMENT - DISCONTINUED OPERATIONS PROPERTIES $ — $ 818 $ 1,152 $ —

36 Portfolio Characteristics: Office Discontinued Operations Properties

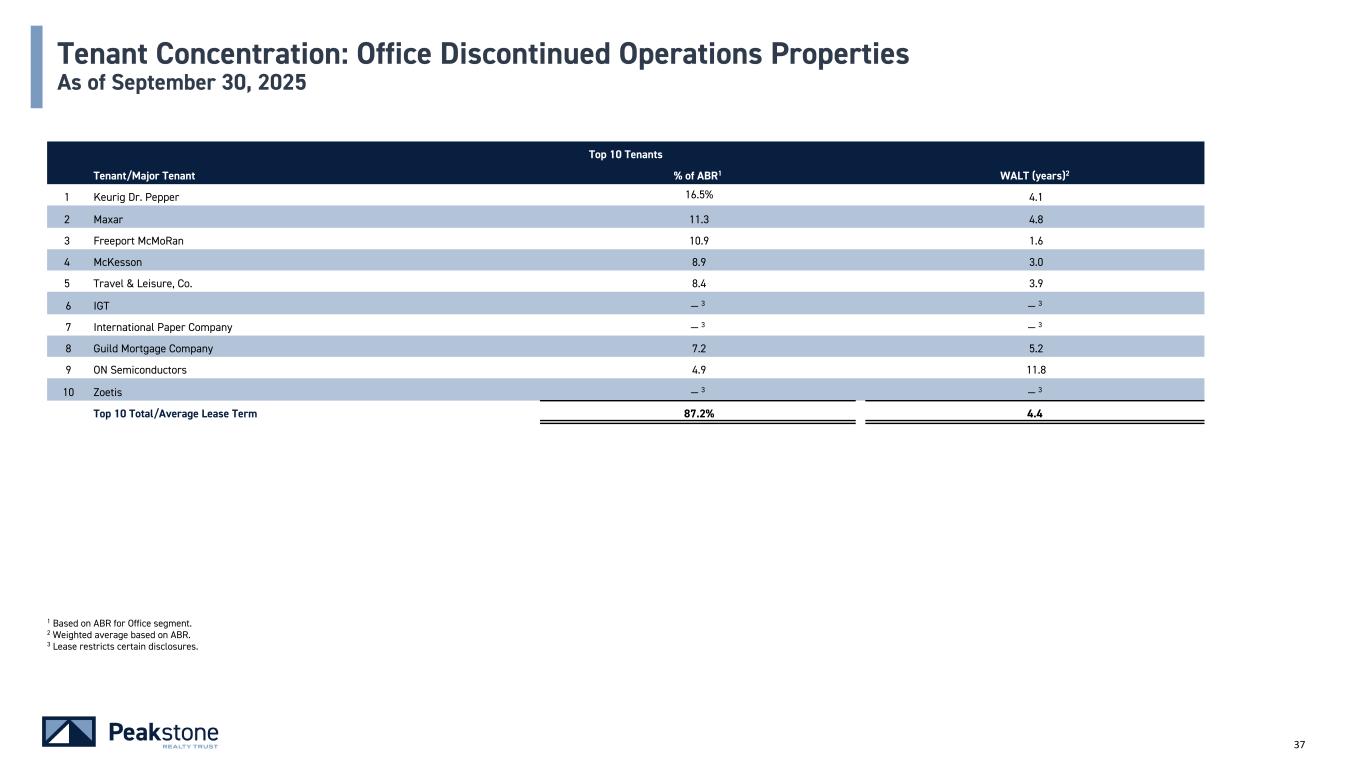

37 Top 10 Tenants Tenant/Major Tenant % of ABR1 WALT (years)2 1 Keurig Dr. Pepper 16.5% 4.1 2 Maxar 11.3 4.8 3 Freeport McMoRan 10.9 1.6 4 McKesson 8.9 3.0 5 Travel & Leisure, Co. 8.4 3.9 6 IGT — 3 — 3 7 International Paper Company — 3 — 3 8 Guild Mortgage Company 7.2 5.2 9 ON Semiconductors 4.9 11.8 10 Zoetis — 3 — 3 Top 10 Total/Average Lease Term 87.2% 4.4 Tenant Concentration: Office Discontinued Operations Properties As of September 30, 2025 1 Based on ABR for Office segment. 2 Weighted average based on ABR. 3 Lease restricts certain disclosures.

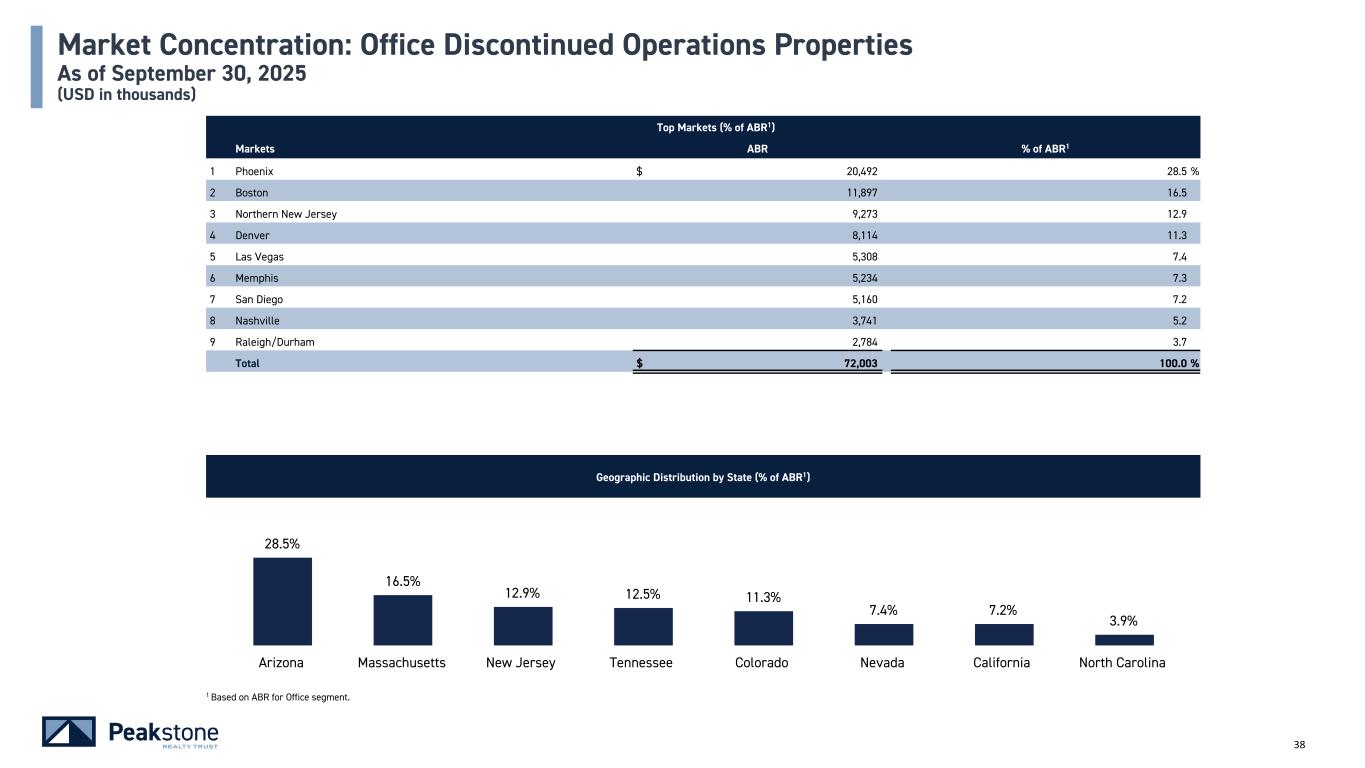

38 Geographic Distribution by State (% of ABR1) Market Concentration: Office Discontinued Operations Properties As of September 30, 2025 (USD in thousands) Top Markets (% of ABR1) Markets ABR % of ABR1 1 Phoenix $ 20,492 28.5 % 2 Boston 11,897 16.5 3 Northern New Jersey 9,273 12.9 4 Denver 8,114 11.3 5 Las Vegas 5,308 7.4 6 Memphis 5,234 7.3 7 San Diego 5,160 7.2 8 Nashville 3,741 5.2 9 Raleigh/Durham 2,784 3.7 Total $ 72,003 100.0 % 28.5% 16.5% 12.9% 12.5% 11.3% 7.4% 7.2% 3.9% Arizona Massachusetts New Jersey Tennessee Colorado Nevada California North Carolina 1 Based on ABR for Office segment.

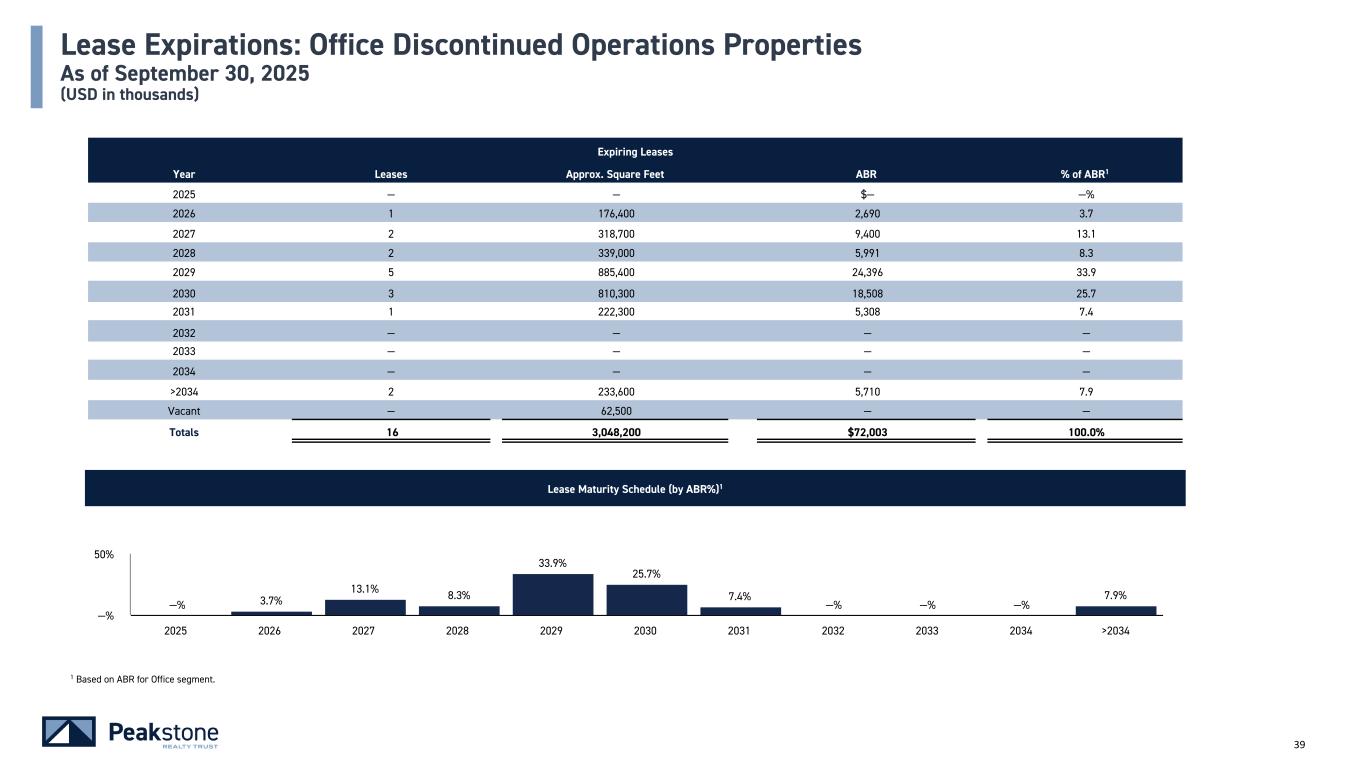

39 Lease Expirations: Office Discontinued Operations Properties As of September 30, 2025 (USD in thousands) Lease Maturity Schedule (by ABR%)1 —% 3.7% 13.1% 8.3% 33.9% 25.7% 7.4% —% —% —% 7.9% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 >2034 —% 50% Expiring Leases Year Leases Approx. Square Feet ABR % of ABR1 2025 — — $— —% 2026 1 176,400 2,690 3.7 2027 2 318,700 9,400 13.1 2028 2 339,000 5,991 8.3 2029 5 885,400 24,396 33.9 2030 3 810,300 18,508 25.7 2031 1 222,300 5,308 7.4 2032 — — — — 2033 — — — — 2034 — — — — >2034 2 233,600 5,710 7.9 Vacant — 62,500 — — Totals 16 3,048,200 $72,003 100.0% 1 Based on ABR for Office segment.

Notes & Definitions 40

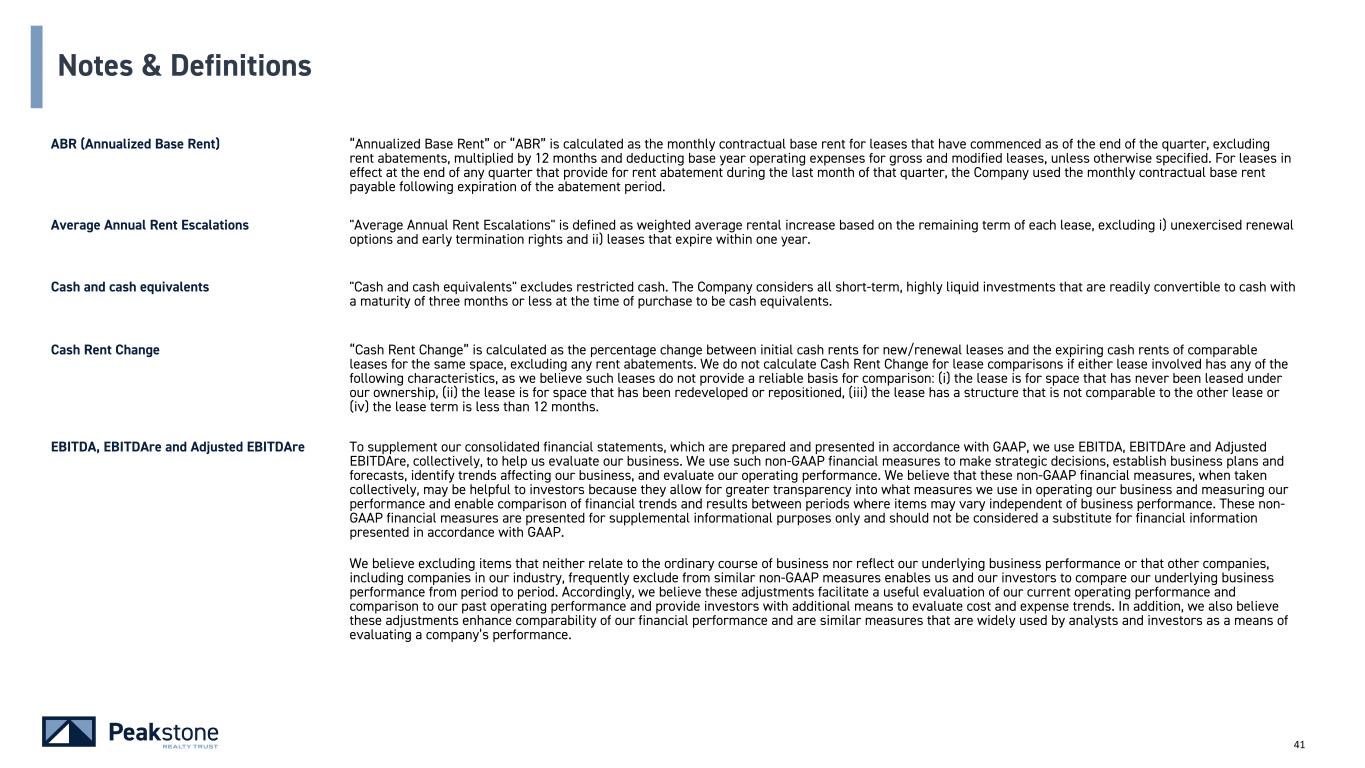

41 Notes & Definitions ABR (Annualized Base Rent) “Annualized Base Rent” or “ABR” is calculated as the monthly contractual base rent for leases that have commenced as of the end of the quarter, excluding rent abatements, multiplied by 12 months and deducting base year operating expenses for gross and modified leases, unless otherwise specified. For leases in effect at the end of any quarter that provide for rent abatement during the last month of that quarter, the Company used the monthly contractual base rent payable following expiration of the abatement period. Average Annual Rent Escalations "Average Annual Rent Escalations" is defined as weighted average rental increase based on the remaining term of each lease, excluding i) unexercised renewal options and early termination rights and ii) leases that expire within one year. Cash and cash equivalents "Cash and cash equivalents" excludes restricted cash. The Company considers all short-term, highly liquid investments that are readily convertible to cash with a maturity of three months or less at the time of purchase to be cash equivalents. Cash Rent Change “Cash Rent Change” is calculated as the percentage change between initial cash rents for new/renewal leases and the expiring cash rents of comparable leases for the same space, excluding any rent abatements. We do not calculate Cash Rent Change for lease comparisons if either lease involved has any of the following characteristics, as we believe such leases do not provide a reliable basis for comparison: (i) the lease is for space that has never been leased under our ownership, (ii) the lease is for space that has been redeveloped or repositioned, (iii) the lease has a structure that is not comparable to the other lease or (iv) the lease term is less than 12 months. EBITDA, EBITDAre and Adjusted EBITDAre To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use EBITDA, EBITDAre and Adjusted EBITDAre, collectively, to help us evaluate our business. We use such non-GAAP financial measures to make strategic decisions, establish business plans and forecasts, identify trends affecting our business, and evaluate our operating performance. We believe that these non-GAAP financial measures, when taken collectively, may be helpful to investors because they allow for greater transparency into what measures we use in operating our business and measuring our performance and enable comparison of financial trends and results between periods where items may vary independent of business performance. These non- GAAP financial measures are presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. We believe excluding items that neither relate to the ordinary course of business nor reflect our underlying business performance or that other companies, including companies in our industry, frequently exclude from similar non-GAAP measures enables us and our investors to compare our underlying business performance from period to period. Accordingly, we believe these adjustments facilitate a useful evaluation of our current operating performance and comparison to our past operating performance and provide investors with additional means to evaluate cost and expense trends. In addition, we also believe these adjustments enhance comparability of our financial performance and are similar measures that are widely used by analysts and investors as a means of evaluating a company’s performance.

42 Notes & Definitions (continued) EBITDA, EBITDAre and Adjusted EBITDAre (Cont.) There are a number of limitations related to our non-GAAP measures. Some of these limitations are that these measures, to the extent applicable, exclude: (i) historical or future cash requirements for maintenance capital expenditures or growth and expansion capital expenditures; (ii) depreciation and amortization, a non-cash expense, where the assets being depreciated and amortized may have to be replaced in the future and these measures do not reflect cash capital expenditure requirements for such replacements; (iii) interest expense, net, or the cash requirements necessary to service interest or principal payments on our indebtedness, which reduces cash available to us; (iv) share-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy; (v) provision for income taxes, which may represent a reduction in cash available to us; and (vi) certain other items that we believe are not indicative of the performance of our portfolio. In addition, other companies, including companies in our industry, may calculate these non-GAAP measures or similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our disclosure of non-GAAP measures as a tool for comparison. Because of these and other limitations, these non-GAAP measures should be considered along with other financial performance measures, including our financial results prepared in accordance with GAAP. EBITDA EBITDA is defined as earnings before interest, tax, depreciation and amortization. EBITDAre EBITDAre is defined by The National Association of Real Estate Investment Trusts (“NAREIT”) as follows: (a) GAAP net income or loss, plus (b) interest expense, plus (c) income tax expense, plus (d) depreciation and amortization plus/minus (e) losses and gains on the disposition of depreciated property, including losses/ gains on change of control, plus (f) impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, plus (g) adjustments to reflect the entity’s share of EBITDAre of consolidated affiliates. Adjusted EBITDAre Adjusted EBITDAre is defined as EBITDAre modified to exclude items such as stock-based compensation expenses, lease terminations, debt extinguishments, transaction expenses, employee separation expenses and other items that we believe are not indicative of the performance of our portfolio. We also include an adjustment to reflect a full period of net operating income for i) operating properties acquired during the quarter, ii) operating properties disposed of during the quarter, and iii) redevelopment properties that were re-classified to operating properties during the quarter (in each case, as if such property, as applicable, had occurred on the first day of the quarter). The adjustments for acquisitions and redevelopment properties are based on our estimate of the net operating income we would have received from such property if it had been owned or operating for the full quarter; however, the net operating income we actually receive from such properties in future quarters may differ based on our experience owning or operating such properties subsequent to the closing of the acquisition or re- classification from redevelopment.

43 Notes & Definitions (continued) Funds from Operations ("FFO"), Core Funds from Operations ("Core FFO"), and Adjusted Funds from Operations ("AFFO") We use Funds from Operations (“FFO”), Core Funds from Operation (“Core FFO”) and Adjusted Funds from Operations (“AFFO”) as supplemental financial measures of our performance. These measures are used by management as supplemental financial measures of operating performance. We do not use these measures as, nor should they be considered to be, alternatives to net earnings computed under GAAP, as indicators of our operating performance, as alternatives to cash from operating activities computed under GAAP or as indicators of our ability to fund our cash needs. The summary below describes the way we use these measures, provides information regarding why we believe these measures are meaningful supplemental measures of performance and reconciles these measures from net income or loss, the most directly comparable GAAP measures. FFO We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). FFO is defined as net income or loss computed in accordance with GAAP, excluding real estate related depreciation and amortization, impairment losses of depreciable real estate assets, gains (losses) from sales of depreciable real estate assets and after adjustments for unconsolidated joint ventures. FFO is used to facilitate meaningful comparisons of operating performance between periods and among other REITs, primarily because it excludes the effect of real estate depreciation and amortization and net gains (losses) from real estate sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, FFO can help facilitate comparisons of operating performance between periods and among other REITs. It should be noted, however, that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than we do, making comparisons less meaningful. Core FFO We compute Core FFO by adjusting FFO, as defined by NAREIT, to exclude certain items such as gain or loss from the extinguishment of debt, goodwill impairment, unrealized gains or losses on derivative instruments, employee separation expense, transaction expenses, lease termination fees, and other items not related to ongoing operating performance of our properties. We believe that Core FFO is a useful supplemental measure in addition to FFO because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our core business operations. As with FFO, our reported Core FFO may not be comparable to Core FFO as defined by other REITs. AFFO AFFO is presented in addition to Core FFO. AFFO further adjusts Core FFO for certain other non-cash items, including straight-line rent adjustment, amortization of share-based compensation, deferred rent – ground lease, non-cash amortization items (e.g., amortization of above- and below-market rent, net, debt premium and discount, net, ground lease interests, tax benefits and deferred financing costs) and other non-cash transactions. We believe AFFO provides a useful supplemental measure of our operating performance and is useful in comparing our operating performance with other REITs that may not be involved in similar transactions or activities. As with Core FFO, our reported AFFO may not be comparable to AFFO as defined by other REITs.

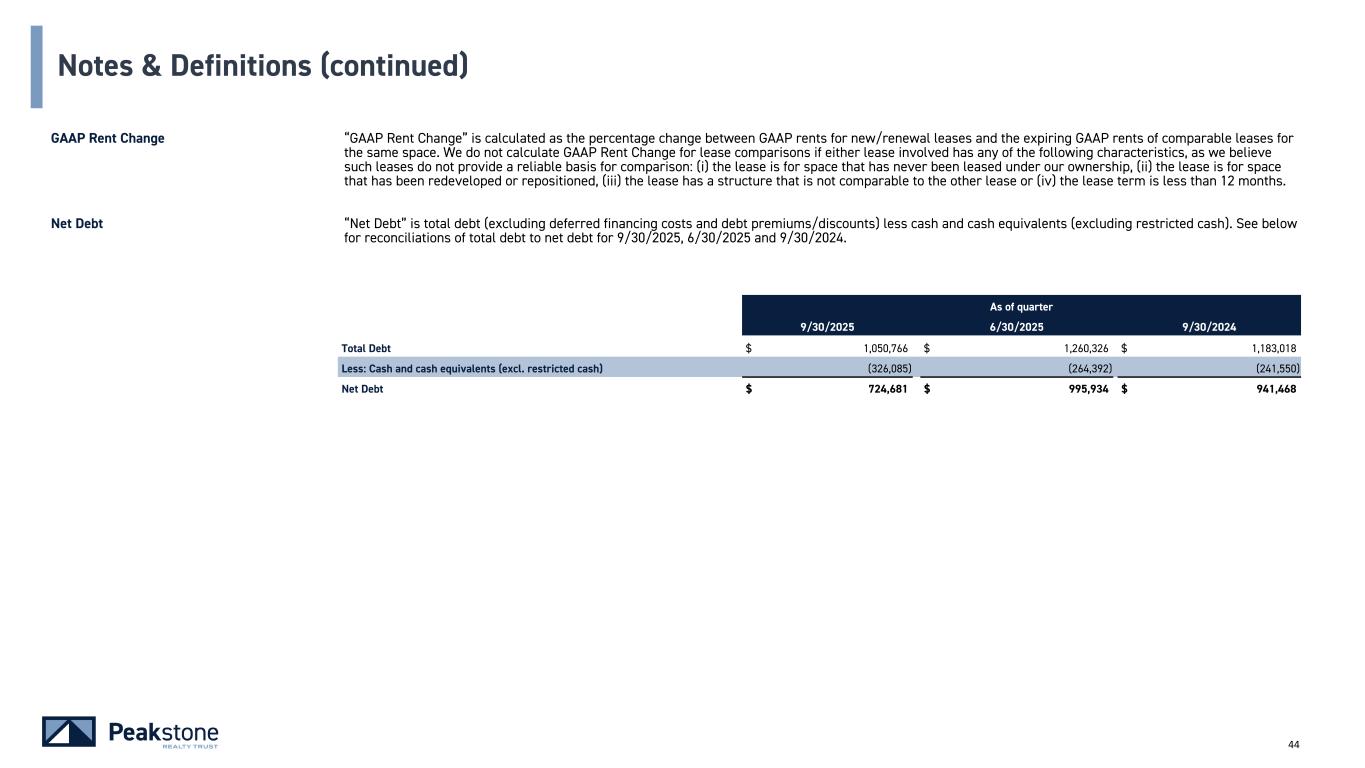

44 Notes & Definitions (continued) GAAP Rent Change “GAAP Rent Change” is calculated as the percentage change between GAAP rents for new/renewal leases and the expiring GAAP rents of comparable leases for the same space. We do not calculate GAAP Rent Change for lease comparisons if either lease involved has any of the following characteristics, as we believe such leases do not provide a reliable basis for comparison: (i) the lease is for space that has never been leased under our ownership, (ii) the lease is for space that has been redeveloped or repositioned, (iii) the lease has a structure that is not comparable to the other lease or (iv) the lease term is less than 12 months. Net Debt “Net Debt” is total debt (excluding deferred financing costs and debt premiums/discounts) less cash and cash equivalents (excluding restricted cash). See below for reconciliations of total debt to net debt for 9/30/2025, 6/30/2025 and 9/30/2024. As of quarter 9/30/2025 6/30/2025 9/30/2024 Total Debt $ 1,050,766 $ 1,260,326 $ 1,183,018 Less: Cash and cash equivalents (excl. restricted cash) (326,085) (264,392) (241,550) Net Debt $ 724,681 $ 995,934 $ 941,468

45 Notes & Definitions (continued) Net Operating Income (NOI), Cash NOI, and Same Store Cash NOI Net operating income (“NOI”) is a non-GAAP financial measure calculated as net income or loss, the most directly comparable financial measure calculated and presented in accordance with GAAP, excluding (to the extent applicable during the periods presented) general and administrative expenses, corporate operating expenses to related parties, impairment of real estate, depreciation and amortization, interest expense, other income, net, gains or losses on early extinguishment of debt, gains or losses on sales of real estate, impairment of goodwill, investment income or loss, transaction expense and net income or loss from discontinued operations and equity in earnings of unconsolidated real estate joint ventures. NOI on a cash basis (“Cash NOI”) is NOI adjusted to exclude the effect of straight- line rent, amortization of acquired above- and below-market lease intangibles, deferred termination income, other deferred adjustments and amortization of other intangibles. Cash NOI for our Same Store portfolio (“Same Store Cash NOI”) is Cash NOI for properties held for the entirety of all periods presented, with adjustments for lease termination fees and rent abatements (to the extent applicable during the periods presented). We believe that NOI, Cash NOI and Same-Store Cash NOI are helpful to investors as additional measures of operating performance because we believe they help both investors and management to understand the core operations of our properties excluding corporate and financing-related costs and non-cash depreciation and amortization. NOI, Cash NOI and Same Store Cash NOI are unlevered operating performance metrics of our properties and allow for a useful comparison of the operating performance of individual assets or groups of assets. These measures thereby provide an operating perspective not immediately apparent from GAAP income from operations or net income (loss). In addition, NOI, Cash NOI and Same Store Cash NOI are considered by many in the real estate industry to be useful starting points for determining the value of a real estate asset or group of assets. Because NOI, Cash NOI and Same Store Cash NOI exclude depreciation and amortization and capture neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our results from operations, the utility of NOI, Cash NOI and Same Store Cash NOI as measures of our performance is limited. Therefore, NOI, Cash NOI and Same Store Cash NOI should not be considered as alternatives to net income or loss, as computed in accordance with GAAP. NOI, Cash NOI and Same Store Cash NOI may not be comparable to similarly titled measures of other companies.

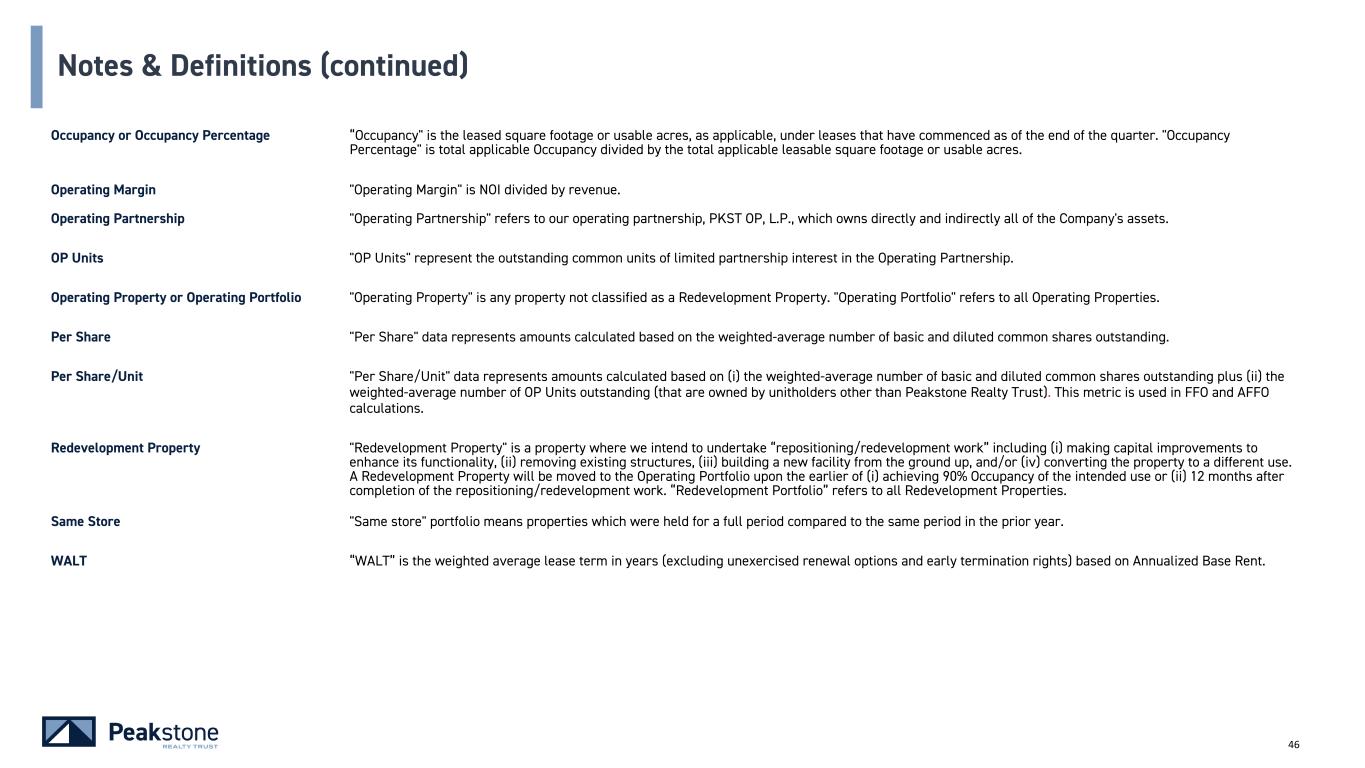

46 Notes & Definitions (continued) Occupancy or Occupancy Percentage “Occupancy" is the leased square footage or usable acres, as applicable, under leases that have commenced as of the end of the quarter. "Occupancy Percentage" is total applicable Occupancy divided by the total applicable leasable square footage or usable acres. Operating Margin "Operating Margin" is NOI divided by revenue. Operating Partnership "Operating Partnership" refers to our operating partnership, PKST OP, L.P., which owns directly and indirectly all of the Company's assets. OP Units "OP Units" represent the outstanding common units of limited partnership interest in the Operating Partnership. Operating Property or Operating Portfolio "Operating Property" is any property not classified as a Redevelopment Property. "Operating Portfolio" refers to all Operating Properties. Per Share "Per Share" data represents amounts calculated based on the weighted-average number of basic and diluted common shares outstanding. Per Share/Unit "Per Share/Unit" data represents amounts calculated based on (i) the weighted-average number of basic and diluted common shares outstanding plus (ii) the weighted-average number of OP Units outstanding (that are owned by unitholders other than Peakstone Realty Trust). This metric is used in FFO and AFFO calculations. Redevelopment Property "Redevelopment Property" is a property where we intend to undertake “repositioning/redevelopment work” including (i) making capital improvements to enhance its functionality, (ii) removing existing structures, (iii) building a new facility from the ground up, and/or (iv) converting the property to a different use. A Redevelopment Property will be moved to the Operating Portfolio upon the earlier of (i) achieving 90% Occupancy of the intended use or (ii) 12 months after completion of the repositioning/redevelopment work. “Redevelopment Portfolio” refers to all Redevelopment Properties. Same Store "Same store" portfolio means properties which were held for a full period compared to the same period in the prior year. WALT “WALT” is the weighted average lease term in years (excluding unexercised renewal options and early termination rights) based on Annualized Base Rent.