2

3

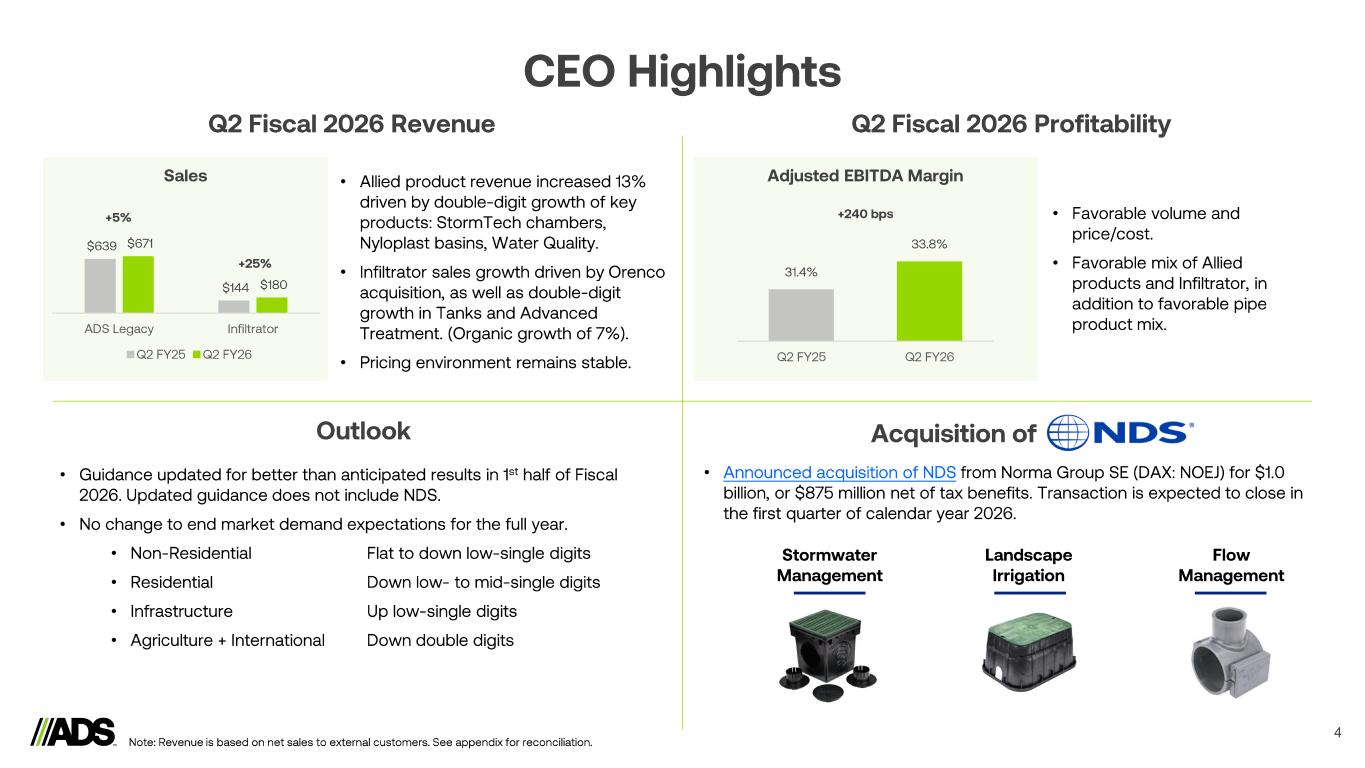

4 • • • • • • • • • • • •

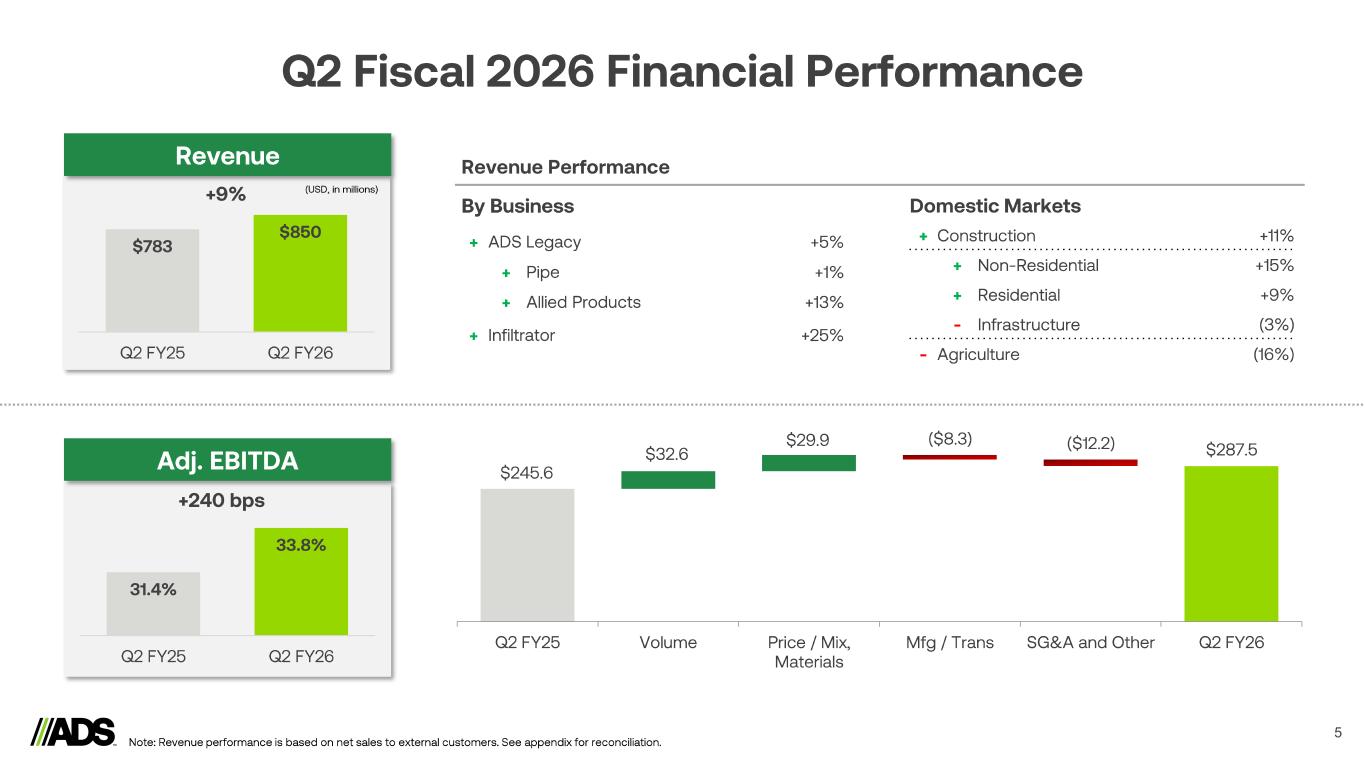

5

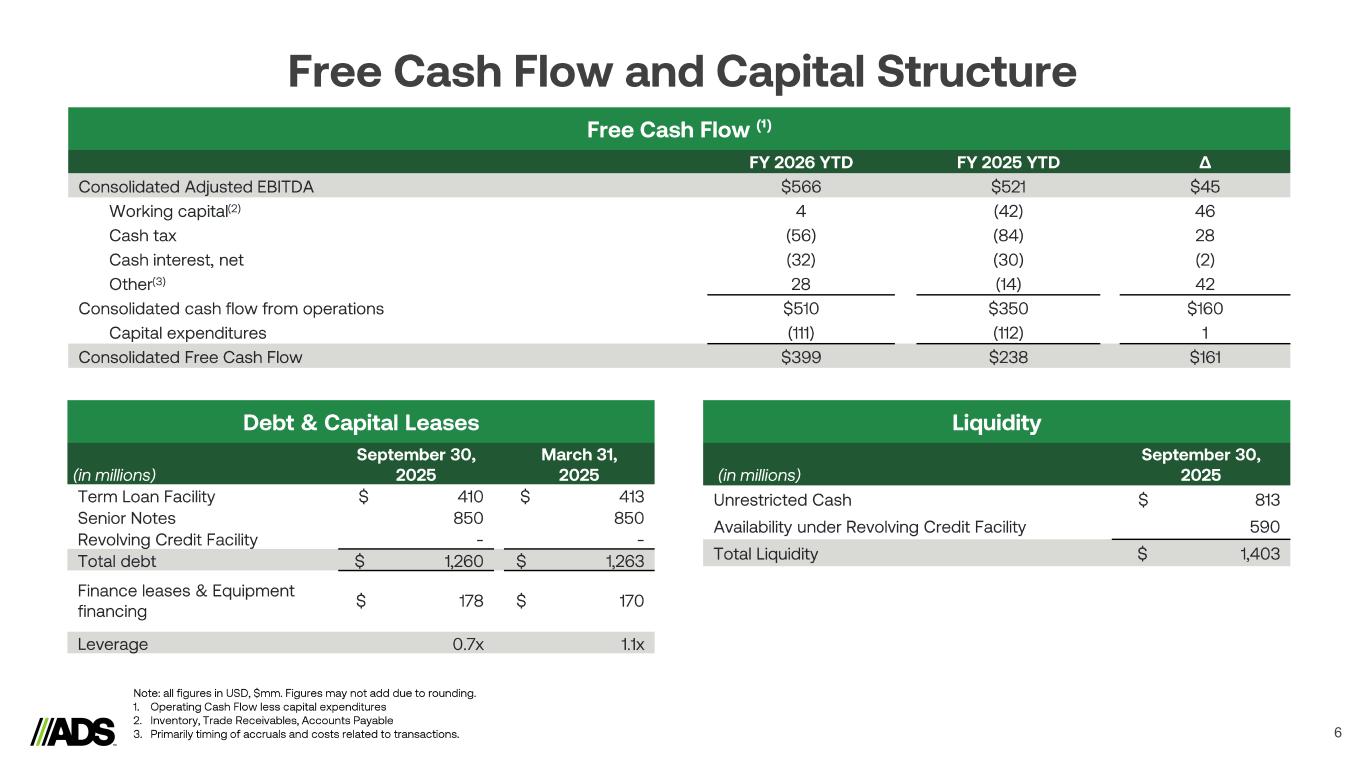

6

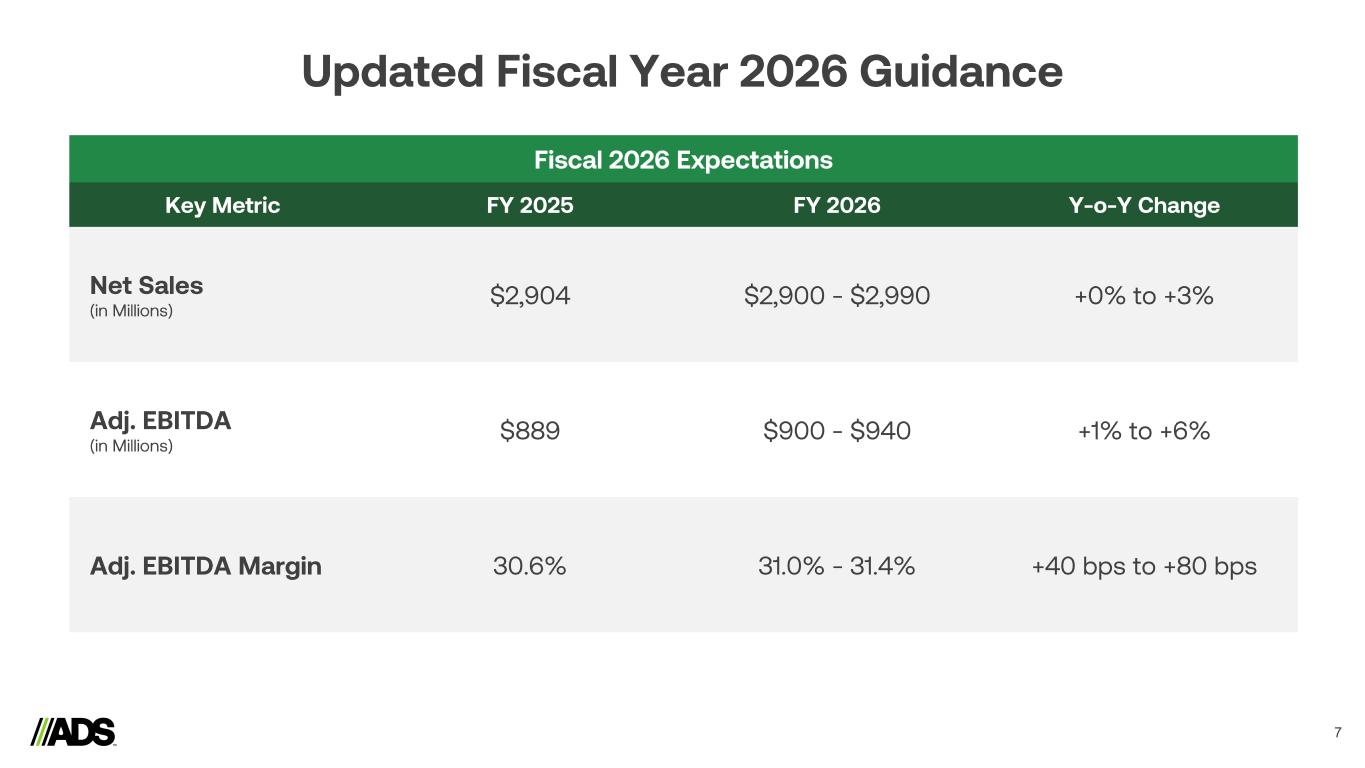

7

9

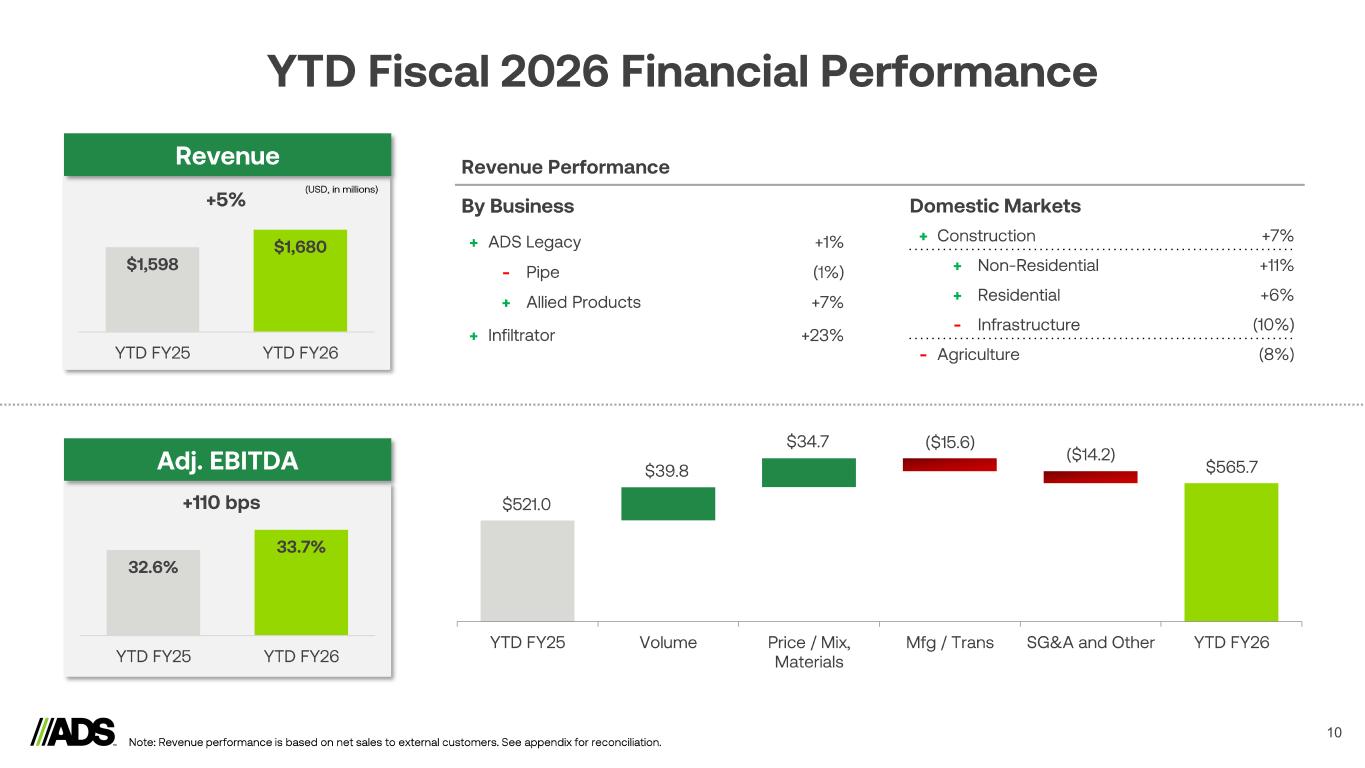

10

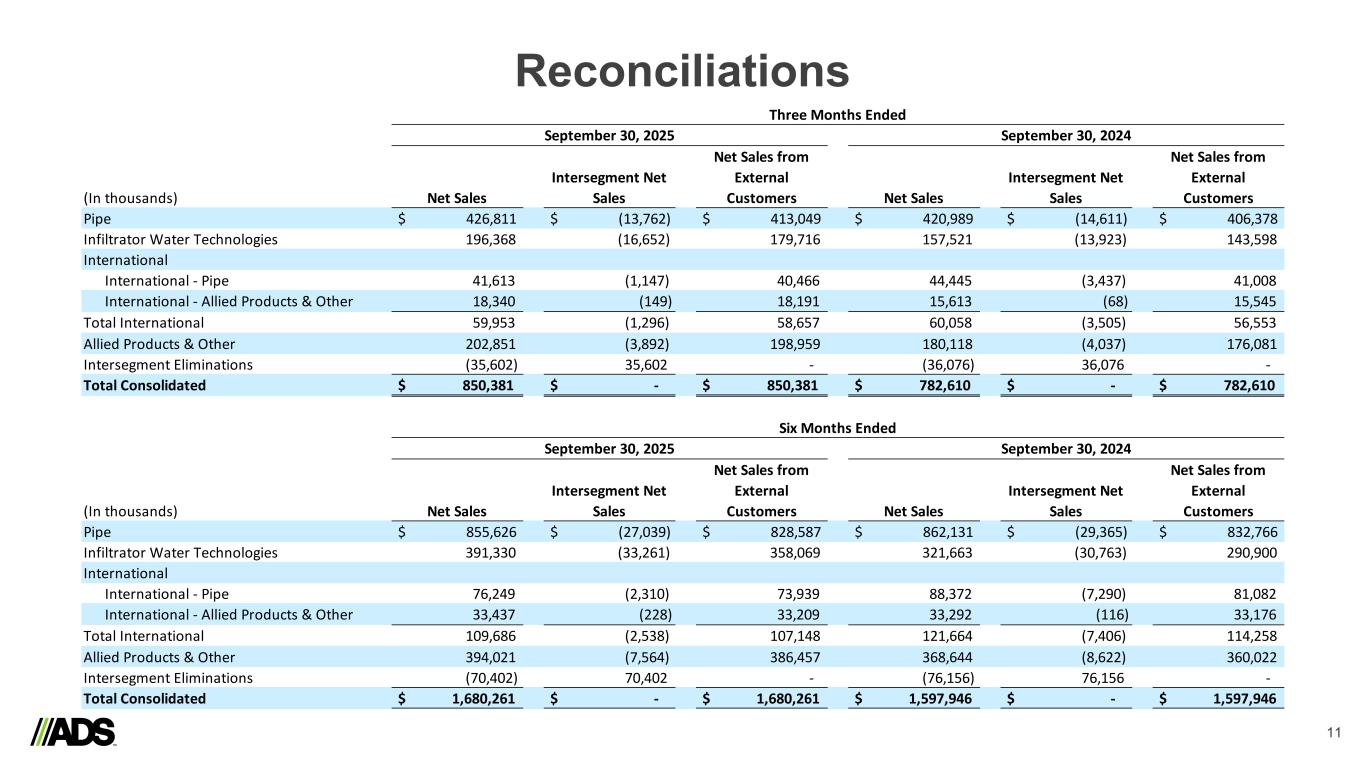

Reconciliations 11 (In thousands) Net Sales Intersegment Net Sales Net Sales from External Customers Net Sales Intersegment Net Sales Net Sales from External Customers Pipe $ 426,811 $ (13,762) $ 413,049 $ 420,989 $ (14,611) $ 406,378 Infiltrator Water Technologies 196,368 (16,652) 179,716 157,521 (13,923) 143,598 International International - Pipe 41,613 (1,147) 40,466 44,445 (3,437) 41,008 International - Allied Products & Other 18,340 (149) 18,191 15,613 (68) 15,545 Total International 59,953 (1,296) 58,657 60,058 (3,505) 56,553 Allied Products & Other 202,851 (3,892) 198,959 180,118 (4,037) 176,081 Intersegment Eliminations (35,602) 35,602 - (36,076) 36,076 - Total Consolidated $ 850,381 $ - $ 850,381 $ 782,610 $ - $ 782,610 (In thousands) Net Sales Intersegment Net Sales Net Sales from External Customers Net Sales Intersegment Net Sales Net Sales from External Customers Pipe $ 855,626 $ (27,039) $ 828,587 $ 862,131 $ (29,365) $ 832,766 Infiltrator Water Technologies 391,330 (33,261) 358,069 321,663 (30,763) 290,900 International International - Pipe 76,249 (2,310) 73,939 88,372 (7,290) 81,082 International - Allied Products & Other 33,437 (228) 33,209 33,292 (116) 33,176 Total International 109,686 (2,538) 107,148 121,664 (7,406) 114,258 Allied Products & Other 394,021 (7,564) 386,457 368,644 (8,622) 360,022 Intersegment Eliminations (70,402) 70,402 - (76,156) 76,156 - Total Consolidated $ 1,680,261 $ - $ 1,680,261 $ 1,597,946 $ - $ 1,597,946 Three Months Ended September 30, 2025 September 30, 2024 Six Months Ended September 30, 2025 September 30, 2024

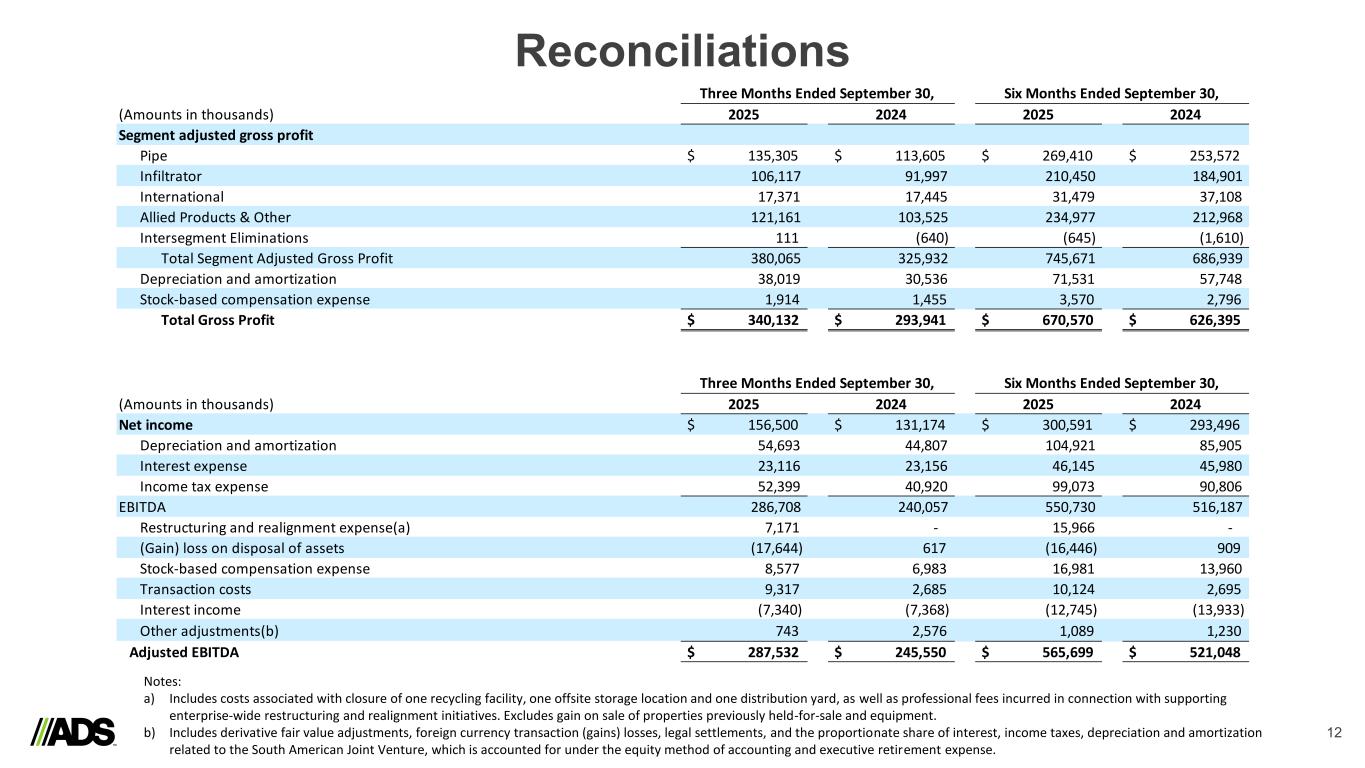

Reconciliations 12 Notes: a) Includes costs associated with closure of one recycling facility, one offsite storage location and one distribution yard, as well as professional fees incurred in connection with supporting enterprise-wide restructuring and realignment initiatives. Excludes gain on sale of properties previously held-for-sale and equipment. b) Includes derivative fair value adjustments, foreign currency transaction (gains) losses, legal settlements, and the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense. (Amounts in thousands) 2025 2024 2025 2024 Segment adjusted gross profit Pipe $ 135,305 $ 113,605 $ 269,410 $ 253,572 Infiltrator 106,117 91,997 210,450 184,901 International 17,371 17,445 31,479 37,108 Allied Products & Other 121,161 103,525 234,977 212,968 Intersegment Eliminations 111 (640) (645) (1,610) Total Segment Adjusted Gross Profit 380,065 325,932 745,671 686,939 Depreciation and amortization 38,019 30,536 71,531 57,748 Stock-based compensation expense 1,914 1,455 3,570 2,796 Total Gross Profit $ 340,132 $ 293,941 $ 670,570 $ 626,395 (Amounts in thousands) 2025 2024 2025 2024 Net income $ 156,500 $ 131,174 $ 300,591 $ 293,496 Depreciation and amortization 54,693 44,807 104,921 85,905 Interest expense 23,116 23,156 46,145 45,980 Income tax expense 52,399 40,920 99,073 90,806 EBITDA 286,708 240,057 550,730 516,187 Restructuring and realignment expense(a) 7,171 - 15,966 - (Gain) loss on disposal of assets (17,644) 617 (16,446) 909 Stock-based compensation expense 8,577 6,983 16,981 13,960 Transaction costs 9,317 2,685 10,124 2,695 Interest income (7,340) (7,368) (12,745) (13,933) Other adjustments(b) 743 2,576 1,089 1,230 Adjusted EBITDA $ 287,532 $ 245,550 $ 565,699 $ 521,048 Three Months Ended September 30, Six Months Ended September 30, Three Months Ended September 30, Six Months Ended September 30,