Q3 Fiscal 2026 Financial Results February 5, 2026

Management Presenters 2 Scott Barbour President and Chief Executive Officer Scott Cottrill Executive Vice President, Chief Financial Officer Craig Taylor President, Infiltrator Mike Higgins Vice President, Corporate Strategy & Investor Relations

Forward Looking Statements and Non - GAAP Financial Metrics 3 Forward Looking Statements Certain statements in this press release may be deemed to be forward - looking statements. These statements are not historical fac ts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward - looking statements. Factors that could cause actual results to differ from those reflected in forward - looking statements relating to our operations and business include: fluctuations in the price and ava ilability of resins and other raw materials, new tariff and international trade policies, and our ability to pass any increased costs of raw materials and tariffs on to our customers; disruption or volatil ity in general business, political and economic conditions in the markets in which we operate; cyclicality and seasonality of the non - residential and residential construction markets and infrastructure spending; th e risks of increasing competition in our existing and future markets; uncertainties surrounding the integration and realization of anticipated benefits of acquisitions or doing so within the intended timeframe , including our ability to successfully integrate NDS into our business; risks that the acquisition of NDS may involve unexpected costs, liabilities, risks that the cost savings and synergies from the acquisition of NDS may not be fully realized; the effect of any claims, litigation, investigations or proceedings; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; the risk associated with manufacturing processes; the effects of global climate change and any related regulatory responses; our ability to protect against cybersecurity incidents and disruptions or failures of our IT systems; our ability to assess and m onitor the effects of artificial intelligence, machine learning, robotics and blockchain or other new approaches to data mining on our business and operations; our ability to manage our supply purchasing and customer cre dit policies; our ability to control labor costs and to attract, train and retain highly qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and re gulations, including environmental laws and regulations; our ability to appropriately address any environmental, social or governance concerns that may arise from our activities; the risks associated with our cu rrent levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; and other risks and uncertainties described in the Co mpa ny’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward - look ing statements contained in this press release. In light of the significant uncertainties inherent in the forward - looking information included herein, the inclusion of such information should not be regar ded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward - looking statements and the Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new informa tion, future events or otherwise, except as required by law. Non - GAAP Financial Measures This presentation includes references to Adjusted EBITDA and Free Cash Flow, non - GAAP financial measures. These non - GAAP financi al measures are used in addition to and in conjunction with results presented in accordance with GAAP. These measures are not intended to be substitutes for those reported in accordance with GA AP. Adjusted EBITDA and Free Cash Flow may be different from non - GAAP financial measures used by other companies, even when similar terms are used to identify such measures. EBITDA and Adjusted EBITDA are non - GAAP financial measures that comprise net income before interest, income taxes, depreciation and amortization, stock - based compensation, non - cash charges and certain other expenses. The Company’s definition of Adjusted EBITDA may differ from similar measures used by other companies, even when similar terms are used to identify such measures. Adjusted EBITDA is a key metric used by management and the Company’s board of directors to assess financial performance and evaluate t he effectiveness of the Company’s business strategies. Accordingly, management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as the Company’s management and board of directors. In order to provide investors with a meaningful reconciliation, the Company has provided reconciliations of Adjusted EBITDA to net income. Free Cash Flow is a non - GAAP financial measure that comprises cash flow from operating activities less capital expenditures. Fre e Cash Flow is a measure used by management and the Company’s board of directors to assess the Company’s ability to generate cash. Accordingly, management believes that Free Cash Flow provides us efu l information to investors and others in understanding and evaluating our ability to generate cash flow from operations after capital expenditures.

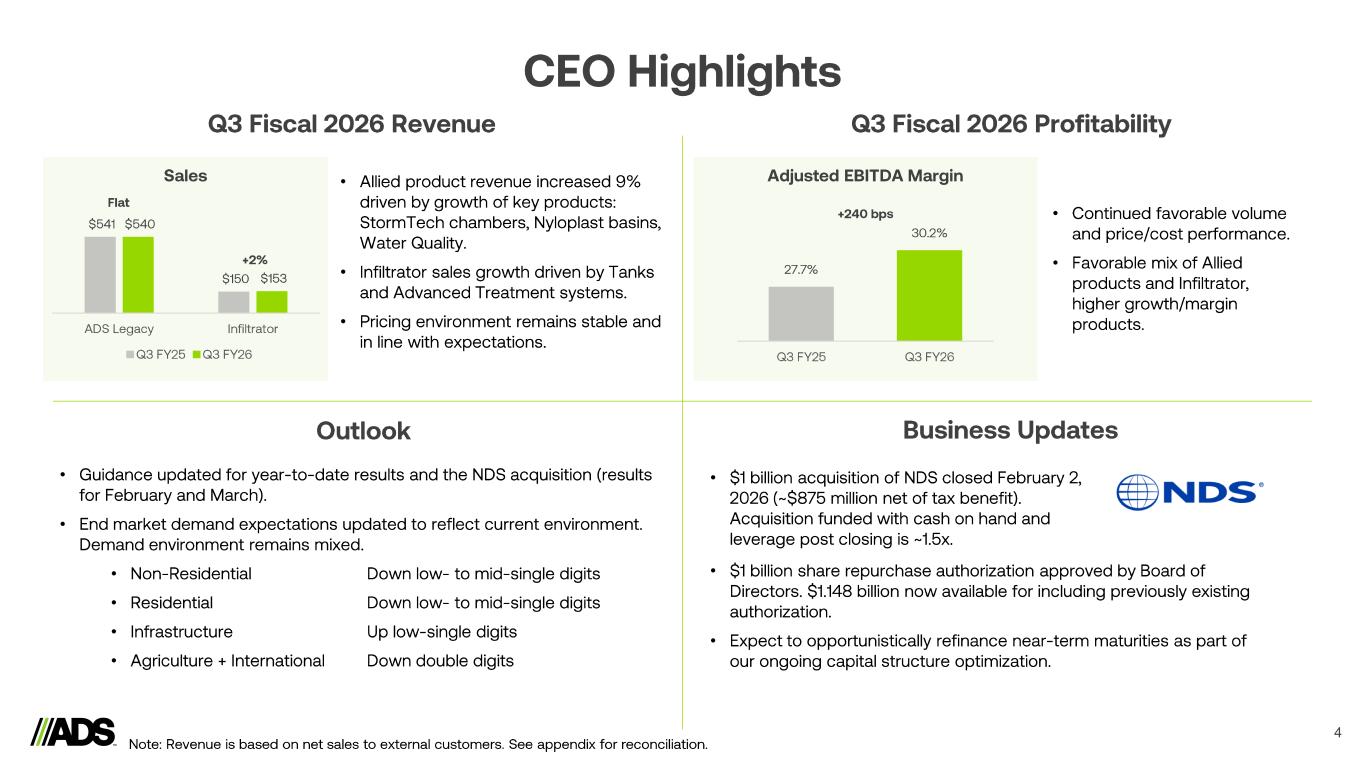

CEO Highlights 4 $541 $150 $540 $153 ADS Legacy Infiltrator Q3 FY25 Q3 FY26 Sales Flat +2% • Allied product revenue increased 9% driven by growth of key products: StormTech chambers, Nyloplast basins, Water Quality. • Infiltrator sales growth driven by Tanks and Advanced Treatment systems. • Pricing environment remains stable and in line with expectations. Q3 Fiscal 2026 Revenue Outlook Q3 Fiscal 2026 Profitability 27.7% 30.2% Q3 FY25 Q3 FY26 Adjusted EBITDA Margin +240 bps • Continued favorable volume and price/cost performance. • Favorable mix of Allied products and Infiltrator, higher growth/margin products. • Guidance updated for year - to- date results and the NDS acquisition (results for February and March). • End market demand expectations updated to reflect current environment. Demand environment remains mixed. • Non - Residential Down low - to mid - single digits • Residential Down low - to mid - single digits • Infrastructure Up low - single digits • Agriculture + International Down double digits Note: Revenue is based on net sales to external customers. See appendix for reconciliation. Business Updates • $1 billion acquisition of NDS closed February 2, 2026 (~$875 million net of tax benefit). Acquisition funded with cash on hand and leverage post closing is ~1.5x. • $1 billion share repurchase authorization approved by Board of Directors. $1.148 billion now available for including previously existing authorization. • Expect to opportunistically refinance near - term maturities as part of our ongoing capital structure optimization.

5 Advanced Drainage Systems Investor Day June 18, 2026 ADS Engineering and Technology Center Hilliard, OH Save the Date

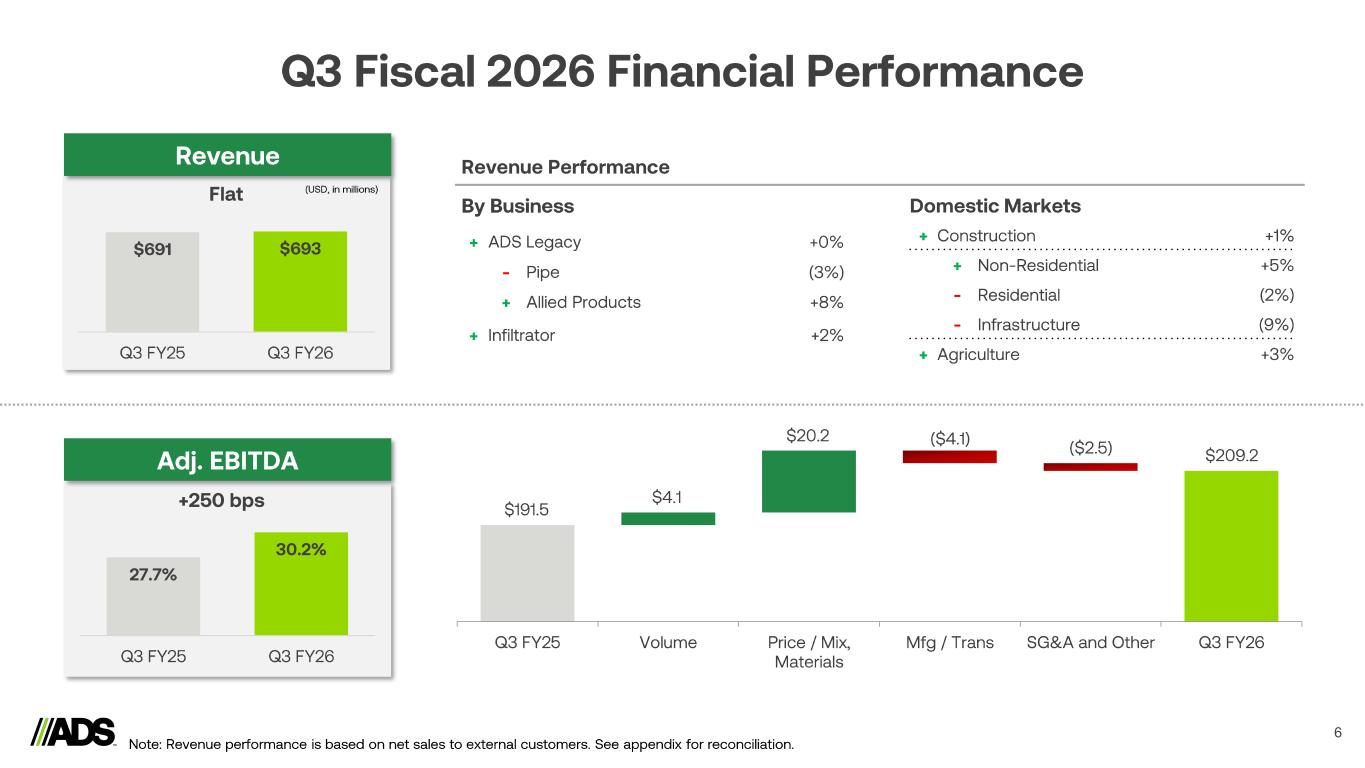

Q3 FY25 Volume Price / Mix, Materials Mfg / Trans SG&A and Other Q3 FY26 Q3 Fiscal 2026 Financial Performance 6 27.7% 30.2% Q3 FY25 Q3 FY26 $691 $693 Q3 FY25 Q3 FY26 +250 bps (USD, in millions)Flat Domestic Markets + Construction +1% + Non - Residential +5% - Residential (2%) - Infrastructure (9%) + Agriculture +3% Revenue Performance By Business + ADS Legacy +0% - Pipe (3%) + Allied Products +8% + Infiltrator +2% $191.5 $4.1 $20.2 ($2.5) $209.2 Revenue Adj. EBITDA ($4.1) Note: Revenue performance is based on net sales to external customers. See appendix for reconciliation.

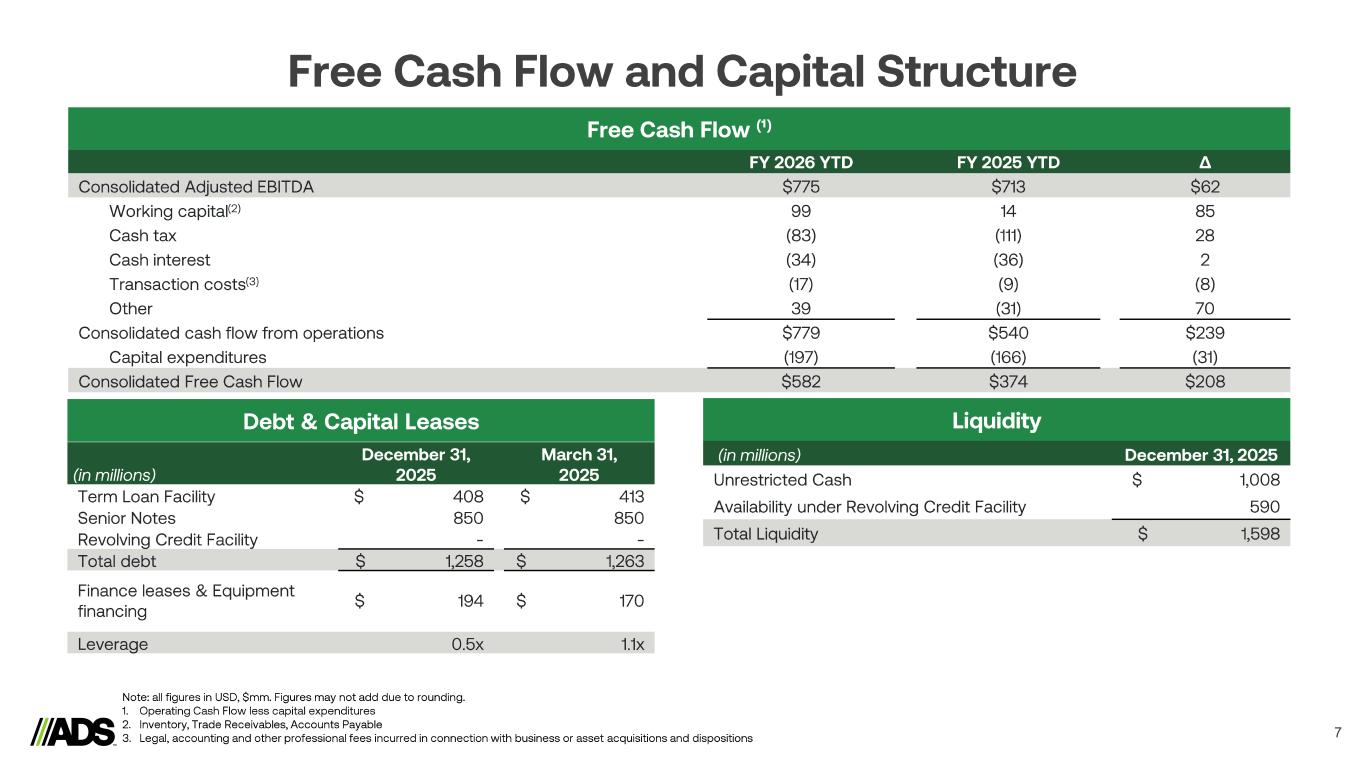

Free Cash Flow and Capital Structure 7 FY 2026 YTD FY 2025 YTD ∆ Consolidated Adjusted EBITDA $775 $713 $62 Working capital (2) 99 14 85 Cash tax (83) (111) 28 Cash interest (34) (36) 2 Transaction costs (3) (17) (9) (8) Other 39 (31) 70 Consolidated cash flow from operations $779 $540 $239 Capital expenditures (197) (166) (31) Consolidated Free Cash Flow $582 $374 $208 Free Cash Flow (¹) Note: all figures in USD, $mm. Figures may not add due to rounding. 1. Operating Cash Flow less capital expenditures 2. Inventory, Trade Receivables, Accounts Payable 3. Legal, accounting and other professional fees incurred in connection with business or asset acquisitions and dispositions (in millions) December 31, 2025 March 31, 2025 Term Loan Facility $ 408 $ 413 Senior Notes 850 850 Revolving Credit Facility - - Total debt $ 1,258 $ 1,263 Finance leases & Equipment financing $ 194 $ 170 Leverage 0.5x 1.1x Debt & Capital Leases (in millions) December 31, 2025 Unrestricted Cash $ 1,008 Availability under Revolving Credit Facility 590 Total Liquidity $ 1,598 Liquidity

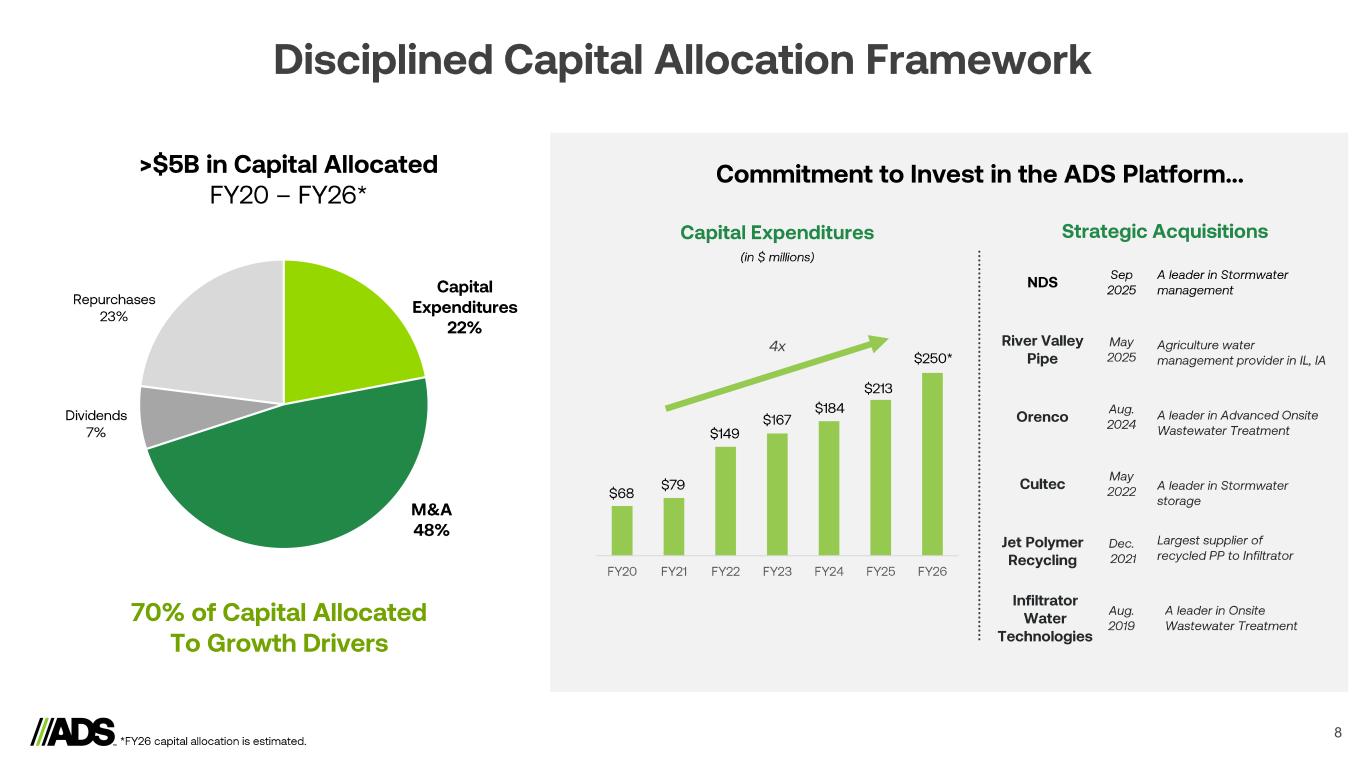

8 Disciplined Capital Allocation Framework 70% of Capital Allocated To Growth Drivers M&A 48% Capital Expenditures 22% Dividends 7% Repurchases 23% >$5B in Capital Allocated FY20 – FY26* Commitment to Invest in the ADS Platform… Capital Expenditures Strategic Acquisitions Infiltrator Water Technologies Aug. 2019 A leader in Onsite Wastewater Treatment Cultec May 2022 A leader in Stormwater storage Jet Polymer Recycling Dec. 2021 Largest supplier of recycled PP to Infiltrator Orenco Aug. 2024 A leader in Advanced Onsite Wastewater Treatment FY20 FY21 FY22 FY23 FY24 FY25 FY26 $68 $79 $149 $167 $184 $213 May 2025 Agriculture water management provider in IL, IA River Valley Pipe NDS Sep 2025 A leader in Stormwater management *FY26 capital allocation is estimated. 4x (in $ millions) $250*

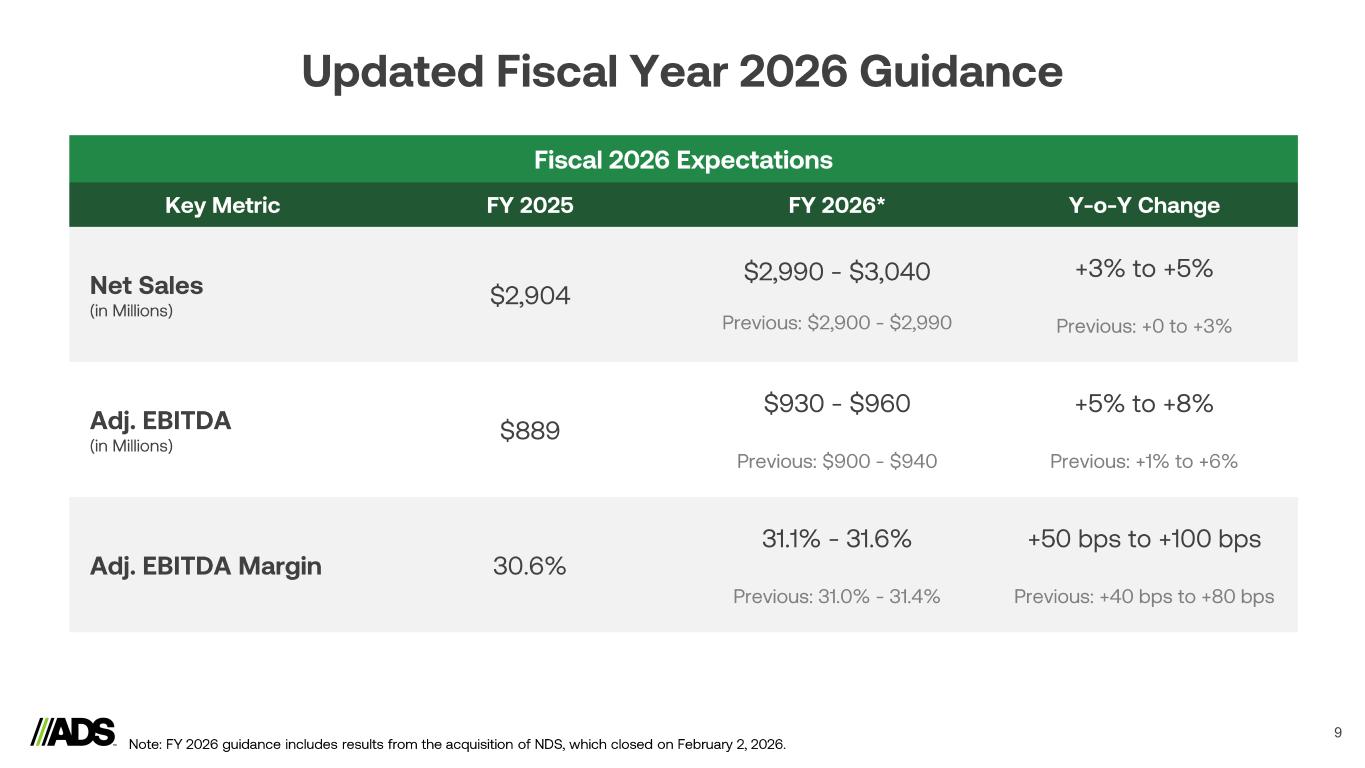

Updated Fiscal Year 2026 Guidance 9 Key Metric FY 2025 FY 2026* Y - o- Y Change Net Sales (in Millions) $2,904 $2,990 - $3,040 Previous: $2,900 - $2,990 +3% to +5% Previous: +0 to +3% Adj. EBITDA (in Millions) $889 $930 - $960 Previous: $900 - $940 +5% to +8% Previous: +1% to +6% Adj. EBITDA Margin 30.6% 31.1% - 31.6% Previous: 31.0% - 31.4% +50 bps to +100 bps Previous: +40 bps to +80 bps Fiscal 2026 Expectations Note: FY 2026 guidance includes results from the acquisition of NDS, which closed on February 2, 2026.

Q&A

Appendix 11

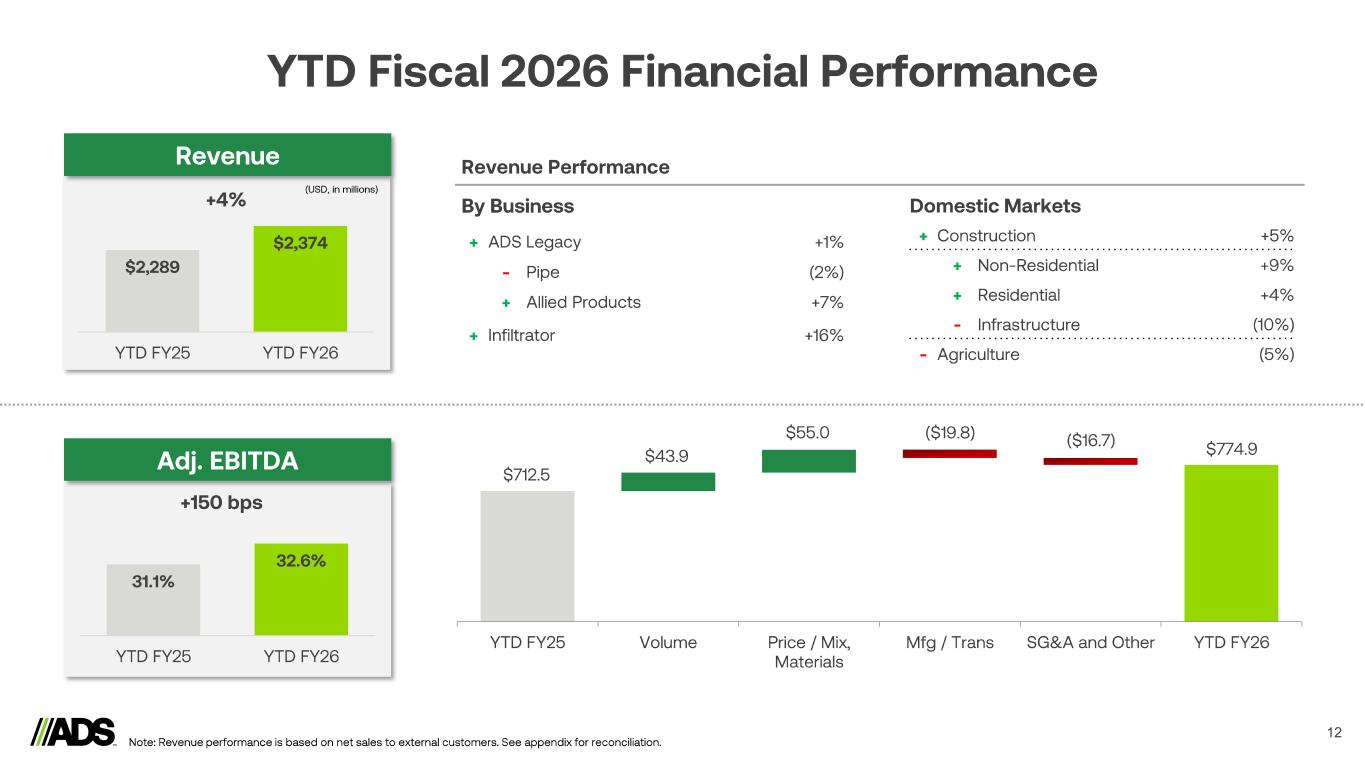

YTD FY25 Volume Price / Mix, Materials Mfg / Trans SG&A and Other YTD FY26 YTD Fiscal 2026 Financial Performance 12 31.1% 32.6% YTD FY25 YTD FY26 $2,289 $2,374 YTD FY25 YTD FY26 +150 bps (USD, in millions) +4% Domestic Markets + Construction +5% + Non - Residential +9% + Residential +4% - Infrastructure (10%) - Agriculture (5%) Revenue Performance By Business + ADS Legacy +1% - Pipe (2%) + Allied Products +7% + Infiltrator +16% $712.5 $43.9 $55.0 ($16.7) $774.9 Revenue Adj. EBITDA ($19.8) Note: Revenue performance is based on net sales to external customers. See appendix for reconciliation.

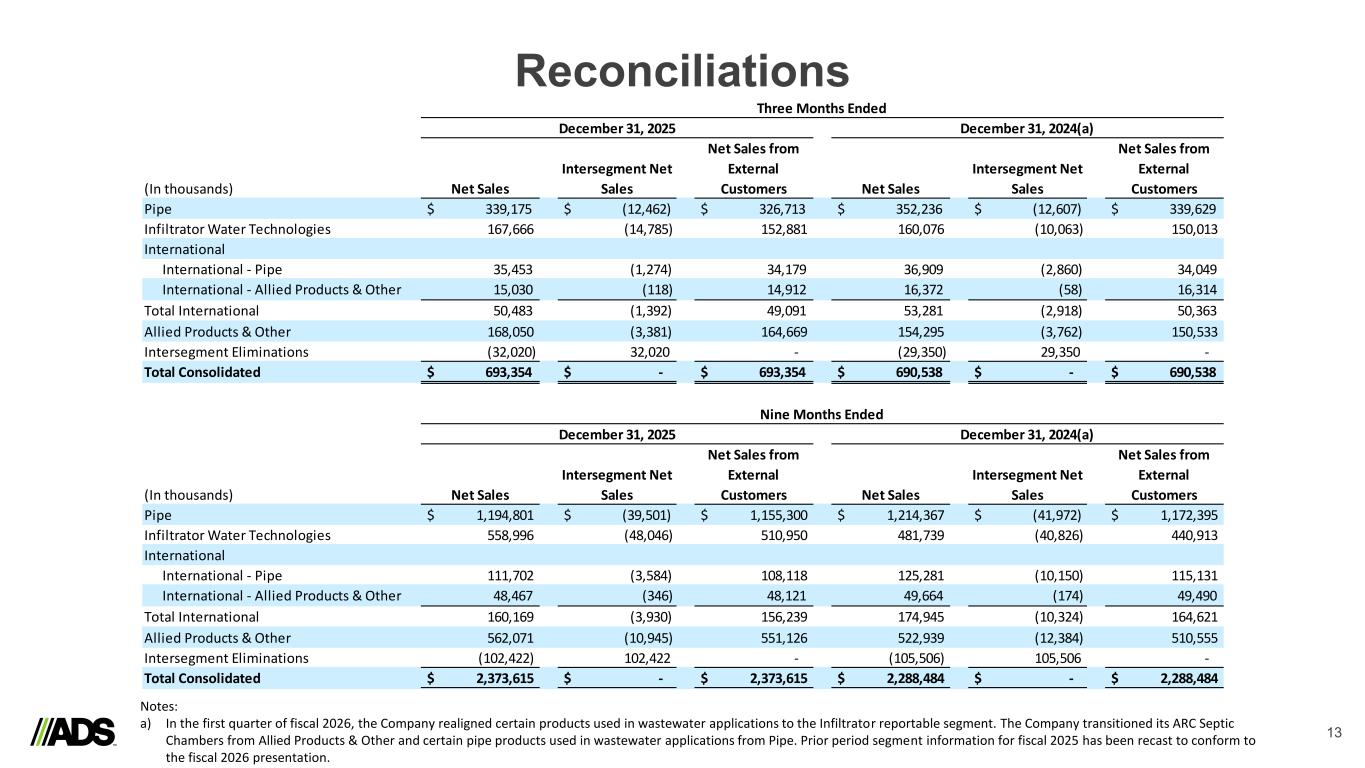

Reconciliations 13 (In thousands) Net Sales Intersegment Net Sales Net Sales from External Customers Net Sales Intersegment Net Sales Net Sales from External Customers Pipe $ 339,175 $ (12,462) $ 326,713 $ 352,236 $ (12,607) $ 339,629 Infiltrator Water Technologies 167,666 (14,785) 152,881 160,076 (10,063) 150,013 International International - Pipe 35,453 (1,274) 34,179 36,909 (2,860) 34,049 International - Allied Products & Other 15,030 (118) 14,912 16,372 (58) 16,314 Total International 50,483 (1,392) 49,091 53,281 (2,918) 50,363 Allied Products & Other 168,050 (3,381) 164,669 154,295 (3,762) 150,533 Intersegment Eliminations (32,020) 32,020 - (29,350) 29,350 - Total Consolidated $ 693,354 $ - $ 693,354 $ 690,538 $ - $ 690,538 (In thousands) Net Sales Intersegment Net Sales Net Sales from External Customers Net Sales Intersegment Net Sales Net Sales from External Customers Pipe $ 1,194,801 $ (39,501) $ 1,155,300 $ 1,214,367 $ (41,972) $ 1,172,395 Infiltrator Water Technologies 558,996 (48,046) 510,950 481,739 (40,826) 440,913 International International - Pipe 111,702 (3,584) 108,118 125,281 (10,150) 115,131 International - Allied Products & Other 48,467 (346) 48,121 49,664 (174) 49,490 Total International 160,169 (3,930) 156,239 174,945 (10,324) 164,621 Allied Products & Other 562,071 (10,945) 551,126 522,939 (12,384) 510,555 Intersegment Eliminations (102,422) 102,422 - (105,506) 105,506 - Total Consolidated $ 2,373,615 $ - $ 2,373,615 $ 2,288,484 $ - $ 2,288,484 Three Months Ended December 31, 2025 December 31, 2024(a) Nine Months Ended December 31, 2025 December 31, 2024(a) Notes: a) In the first quarter of fiscal 2026, the Company realigned certain products used in wastewater applications to the Infiltrator reportable segment. The Company transitioned its ARC Septic Chambers from Allied Products & Other and certain pipe products used in wastewater applications from Pipe. Prior period segment information for fiscal 2025 has been recast to conform to the fiscal 2026 presentation.

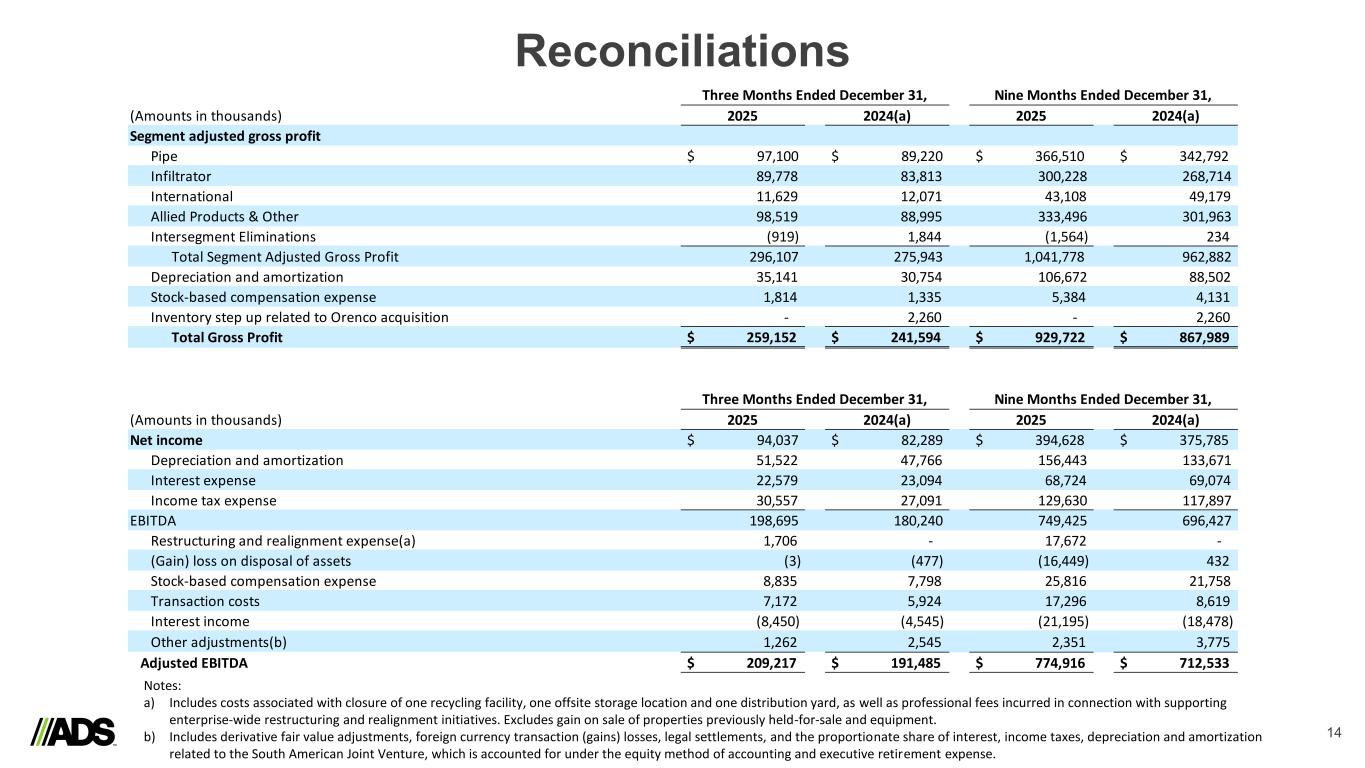

Reconciliations 14 Notes: a) Includes costs associated with closure of one recycling facility, one offsite storage location and one distribution yard, as well as professional fees incurred in connection with supporting enterprise-wide restructuring and realignment initiatives. Excludes gain on sale of properties previously held-for-sale and equipment. b) Includes derivative fair value adjustments, foreign currency transaction (gains) losses, legal settlements, and the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense. (Amounts in thousands) 2025 2024(a) 2025 2024(a) Segment adjusted gross profit Pipe $ 97,100 $ 89,220 $ 366,510 $ 342,792 Infiltrator 89,778 83,813 300,228 268,714 International 11,629 12,071 43,108 49,179 Allied Products & Other 98,519 88,995 333,496 301,963 Intersegment Eliminations (919) 1,844 (1,564) 234 Total Segment Adjusted Gross Profit 296,107 275,943 1,041,778 962,882 Depreciation and amortization 35,141 30,754 106,672 88,502 Stock-based compensation expense 1,814 1,335 5,384 4,131 Inventory step up related to Orenco acquisition - 2,260 - 2,260 Total Gross Profit $ 259,152 $ 241,594 $ 929,722 $ 867,989 (Amounts in thousands) 2025 2024(a) 2025 2024(a) Net income $ 94,037 $ 82,289 $ 394,628 $ 375,785 Depreciation and amortization 51,522 47,766 156,443 133,671 Interest expense 22,579 23,094 68,724 69,074 Income tax expense 30,557 27,091 129,630 117,897 EBITDA 198,695 180,240 749,425 696,427 Restructuring and realignment expense(a) 1,706 - 17,672 - (Gain) loss on disposal of assets (3) (477) (16,449) 432 Stock-based compensation expense 8,835 7,798 25,816 21,758 Transaction costs 7,172 5,924 17,296 8,619 Interest income (8,450) (4,545) (21,195) (18,478) Other adjustments(b) 1,262 2,545 2,351 3,775 Adjusted EBITDA $ 209,217 $ 191,485 $ 774,916 $ 712,533 Three Months Ended December 31, Nine Months Ended December 31, Three Months Ended December 31, Nine Months Ended December 31,