Ethylene Sales Agreement Renewal

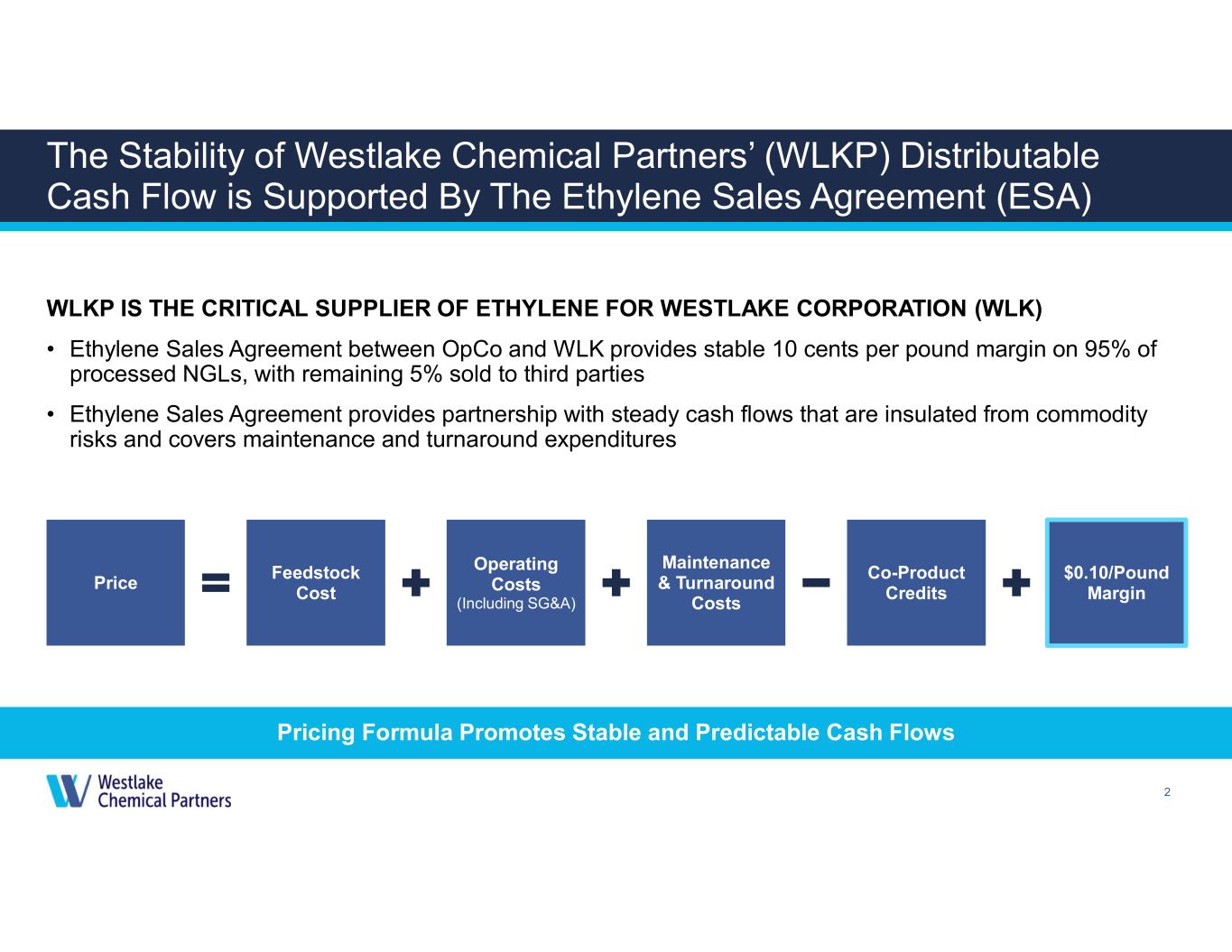

2 The Stability of Westlake Chemical Partners’ (WLKP) Distributable Cash Flow is Supported By The Ethylene Sales Agreement (ESA) WLKP IS THE CRITICAL SUPPLIER OF ETHYLENE FOR WESTLAKE CORPORATION (WLK) • Ethylene Sales Agreement between OpCo and WLK provides stable 10 cents per pound margin on 95% of processed NGLs, with remaining 5% sold to third parties • Ethylene Sales Agreement provides partnership with steady cash flows that are insulated from commodity risks and covers maintenance and turnaround expenditures Pricing Formula Promotes Stable and Predictable Cash Flows Price Feedstock Cost Operating Costs (Including SG&A) Maintenance & Turnaround Costs Co-Product Credits $0.10/Pound Margin

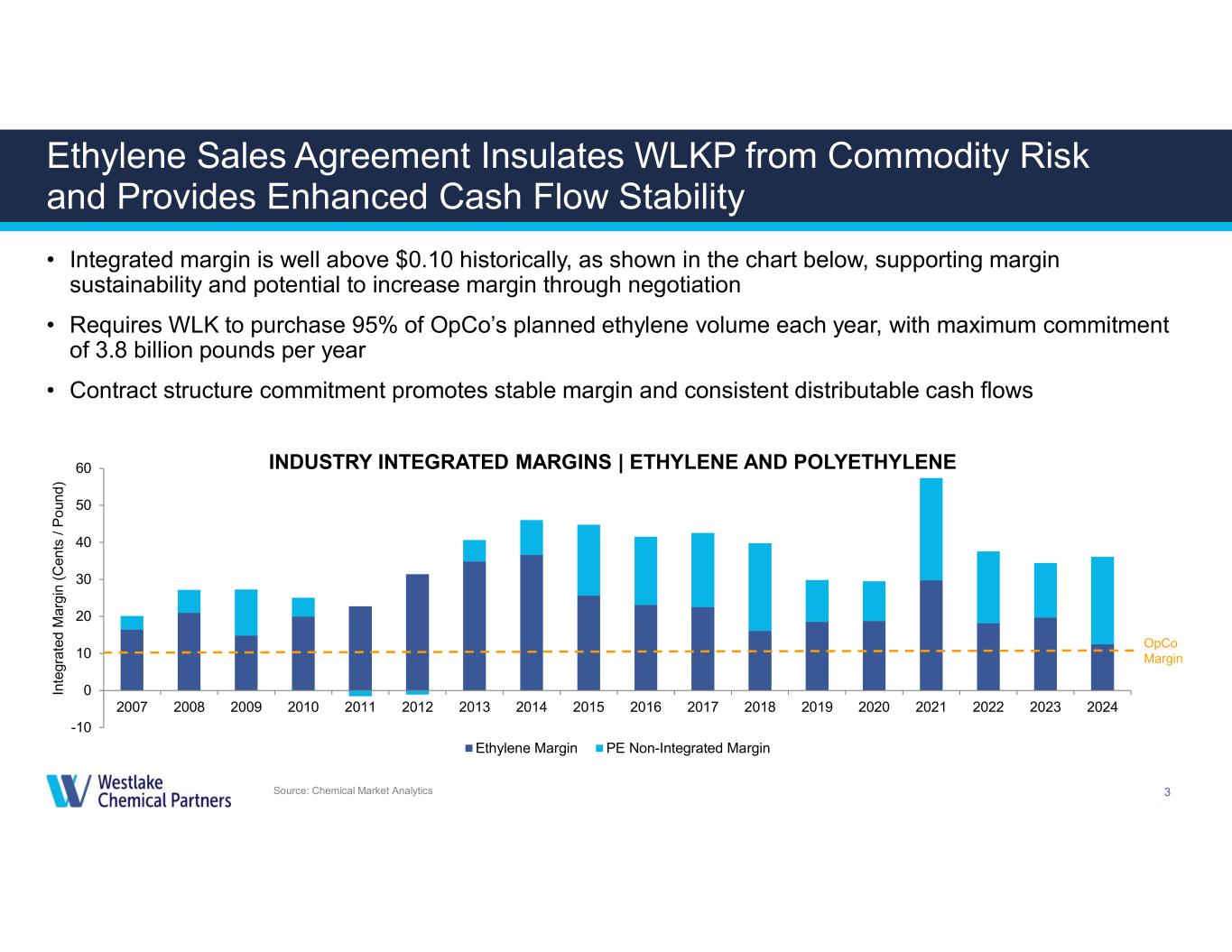

3 Ethylene Sales Agreement Insulates WLKP from Commodity Risk and Provides Enhanced Cash Flow Stability • Integrated margin is well above $0.10 historically, as shown in the chart below, supporting margin sustainability and potential to increase margin through negotiation • Requires WLK to purchase 95% of OpCo’s planned ethylene volume each year, with maximum commitment of 3.8 billion pounds per year • Contract structure commitment promotes stable margin and consistent distributable cash flows Source: Chemical Market Analytics -10 0 10 20 30 40 50 60 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 In te gr at ed M ar g in ( C en ts / P o un d) Ethylene Margin PE Non-Integrated Margin OpCo Margin INDUSTRY INTEGRATED MARGINS | ETHYLENE AND POLYETHYLENE

4 OpCo and WLK Agree to Renew The ESA Through 2027 THE ESA IS A CRITICAL DRIVER OF STABLE, CONSISTENT DISTRIBUTABLE CASH FLOW FOR WLKP • OpCo and WLK have agreed to renew the ESA, as the original contract provided for, through the end of 2027, providing continued offtake on attractive terms for 95% of the ethylene produced by OpCo • The ESA renewal maintains the same pricing formula and sales volume protections that have provided WLKP with the distributable cash flow to make 45 consecutive quarterly distributions to unitholders since its IPO • The renewal of the ESA through the end of 2027 provides increased visibility and confidence in the stability of WLKP’s distributable cash flow and coverage ratio • The ESA continues to provide for automatic renewal annually with existing terms and conditions • WLK’s decision to renew the ESA under the same terms that have been in place since its origination demonstrates the critical nature of OpCo’s supply of ethylene to their operations and their commitment to support OpCo’s continued safe, reliable operations through stable, predictable cash flows The ESA Renewal Demonstrates That WLK Continues To Value And Support Its Relationship With WLKP

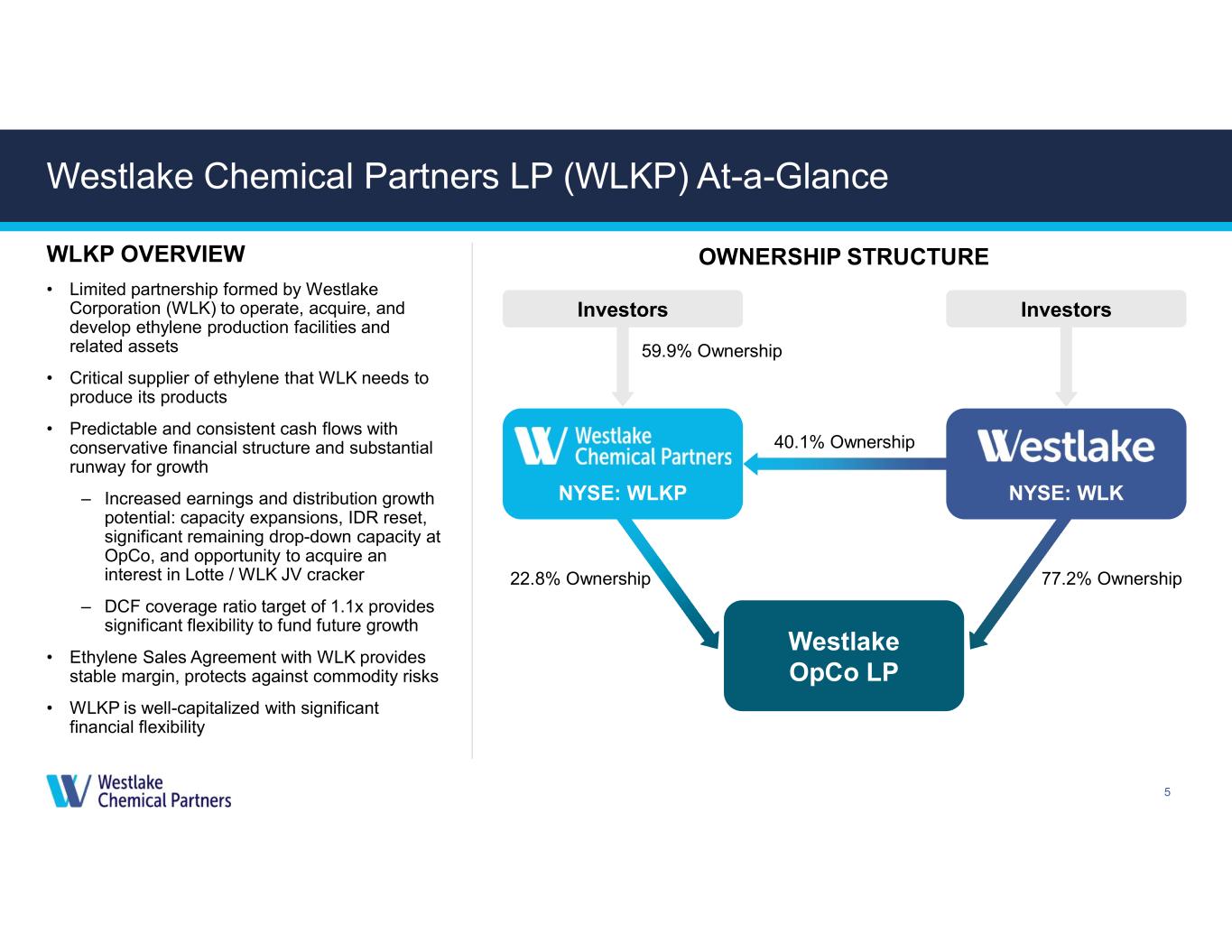

5 Westlake Chemical Partners LP (WLKP) At-a-Glance WLKP OVERVIEW • Limited partnership formed by Westlake Corporation (WLK) to operate, acquire, and develop ethylene production facilities and related assets • Critical supplier of ethylene that WLK needs to produce its products • Predictable and consistent cash flows with conservative financial structure and substantial runway for growth – Increased earnings and distribution growth potential: capacity expansions, IDR reset, significant remaining drop-down capacity at OpCo, and opportunity to acquire an interest in Lotte / WLK JV cracker – DCF coverage ratio target of 1.1x provides significant flexibility to fund future growth • Ethylene Sales Agreement with WLK provides stable margin, protects against commodity risks • WLKP is well-capitalized with significant financial flexibility OWNERSHIP STRUCTURE NYSE: WLKP NYSE: WLK 59.9% Ownership Investors Investors Westlake OpCo LP 40.1% Ownership 22.8% Ownership 77.2% Ownership

6 Compelling Investment Opportunity ► 95% of sales at fixed margin to investment-grade parent, WLK, insulates WLKP from commodity risks ► Conservative financial and leverage metrics Stable, Predictable Cash Flows and Strong Balance Sheet ► Globally cost advantaged feedstock with operating rates that exceed North American industry averages Long History of Predictable Operation from Strategically Located Assets ► Q3 2018 IDR reset with no compensation paid illustrates parent company commitment to WLKP Excellent Governance and Strategic Alignment with Investment-Grade Parent, WLK ► Negotiate higher ethylene margin • acquisition opportunities • periodic drop downs from OpCo • expansion opportunities Four Levers of Continued Growth

7 OpCo Supplies Vital Ethylene to WLK LAKE CHARLES, LOUISIANA • Two ethane-based processing facilities at WLK’s complex • Combined ethylene capacity of 3 billion pounds – Primarily consumed by WLK for chemical production, including polyethylene and PVC CALVERT CITY, KENTUCKY • One ethane-based processing facility • Ethylene capacity of 730 million pounds per year – Primarily consumed by WLK to produce higher value-added chemicals, including PVC LONGVIEW, TEXAS • 200-mile common carrier ethylene pipeline in Texas – Runs from Mont Belvieu, Texas to Longview chemical complex, which includes WLK’s Longview polyethylene production facility WLK Depends on OpCo to Supply the Ethylene Used to Produce All Its Key End Products

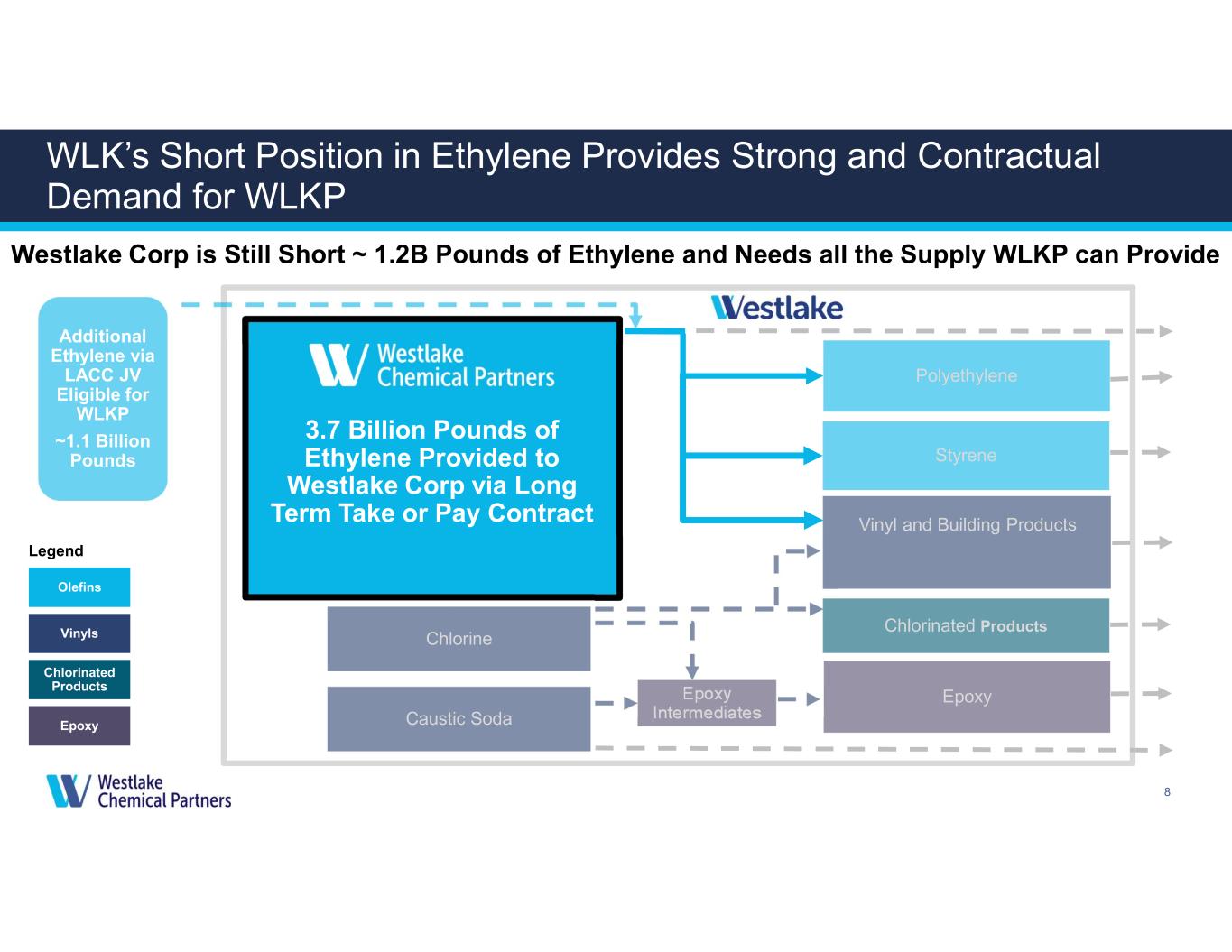

8 WLK’s Short Position in Ethylene Provides Strong and Contractual Demand for WLKP Westlake Corp is Still Short ~ 1.2B Pounds of Ethylene and Needs all the Supply WLKP can Provide Additional Ethylene via LACC JV Eligible for WLKP ~1.1 Billion Pounds Chlorine Caustic Soda Epoxy Intermediates Polyethylene Styrene Chlorinated Products Epoxy Olefins Vinyls Chlorinated Products Epoxy Legend Vinyl and Building Products 3.7 Billion Pounds of Ethylene Provided to Westlake Corp via Long Term Take or Pay Contract

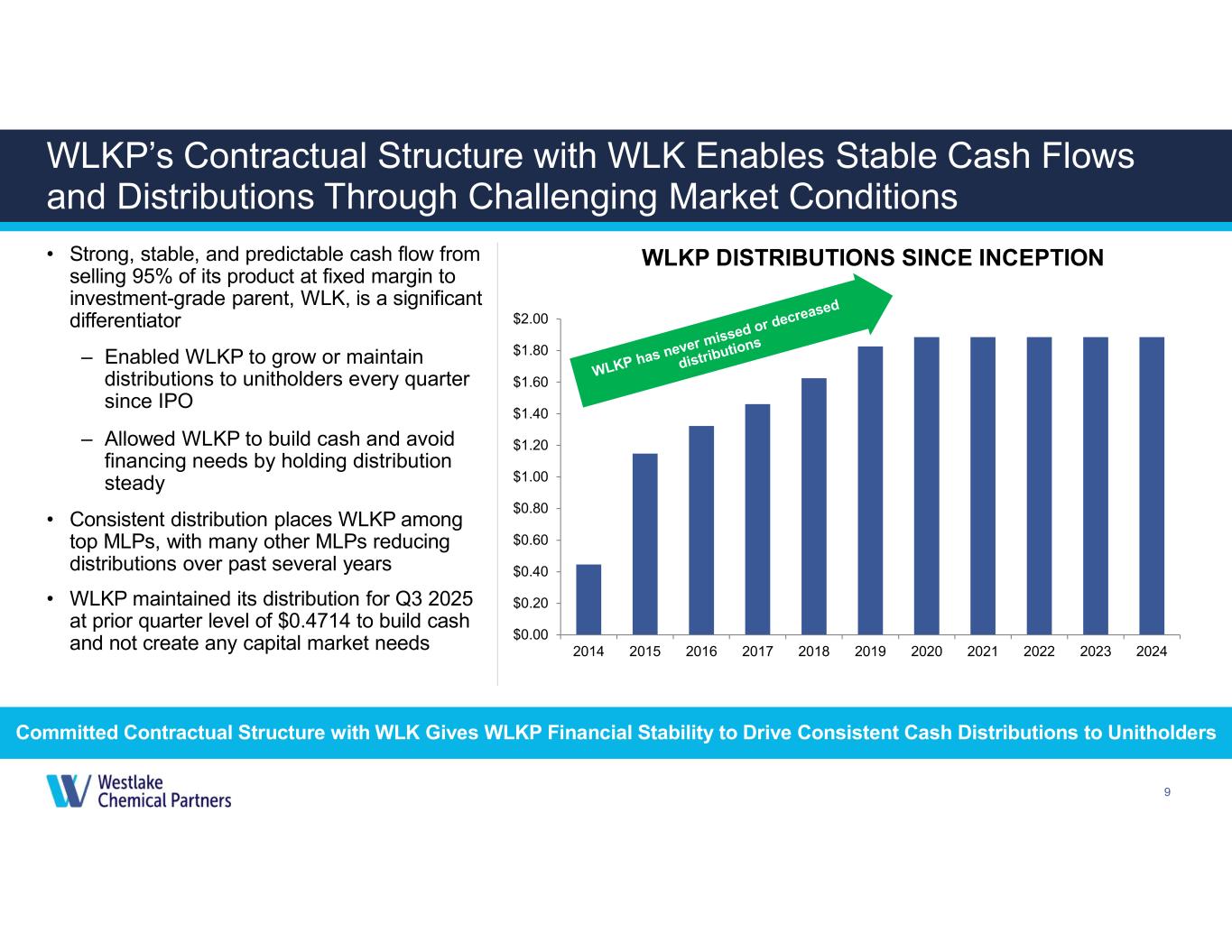

9 WLKP’s Contractual Structure with WLK Enables Stable Cash Flows and Distributions Through Challenging Market Conditions • Strong, stable, and predictable cash flow from selling 95% of its product at fixed margin to investment-grade parent, WLK, is a significant differentiator – Enabled WLKP to grow or maintain distributions to unitholders every quarter since IPO – Allowed WLKP to build cash and avoid financing needs by holding distribution steady • Consistent distribution places WLKP among top MLPs, with many other MLPs reducing distributions over past several years • WLKP maintained its distribution for Q3 2025 at prior quarter level of $0.4714 to build cash and not create any capital market needs Committed Contractual Structure with WLK Gives WLKP Financial Stability to Drive Consistent Cash Distributions to Unitholders WLKP DISTRIBUTIONS SINCE INCEPTION $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

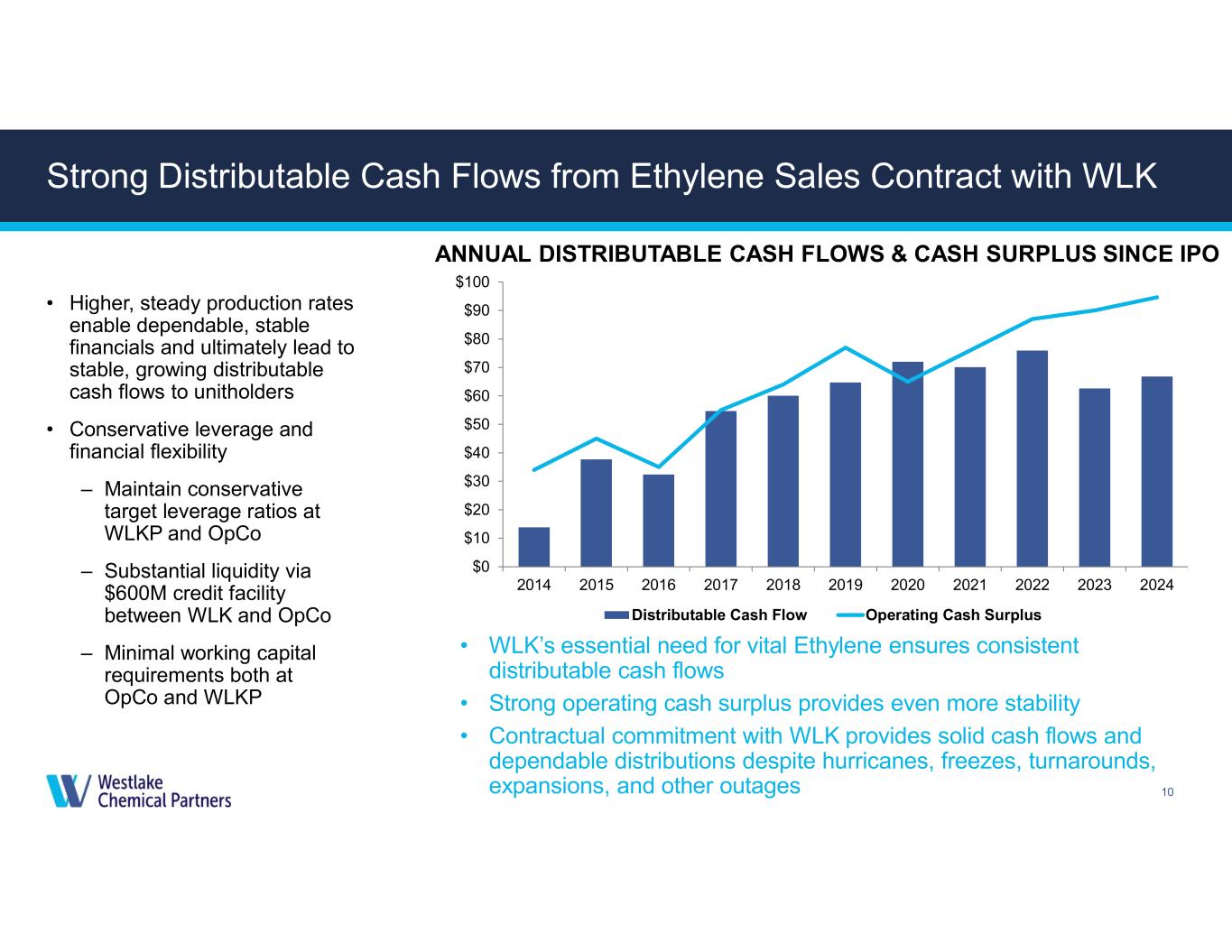

10 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Distributable Cash Flow Operating Cash Surplus Strong Distributable Cash Flows from Ethylene Sales Contract with WLK ANNUAL DISTRIBUTABLE CASH FLOWS & CASH SURPLUS SINCE IPO • Higher, steady production rates enable dependable, stable financials and ultimately lead to stable, growing distributable cash flows to unitholders • Conservative leverage and financial flexibility – Maintain conservative target leverage ratios at WLKP and OpCo – Substantial liquidity via $600M credit facility between WLK and OpCo – Minimal working capital requirements both at OpCo and WLKP • WLK’s essential need for vital Ethylene ensures consistent distributable cash flows • Strong operating cash surplus provides even more stability • Contractual commitment with WLK provides solid cash flows and dependable distributions despite hurricanes, freezes, turnarounds, expansions, and other outages

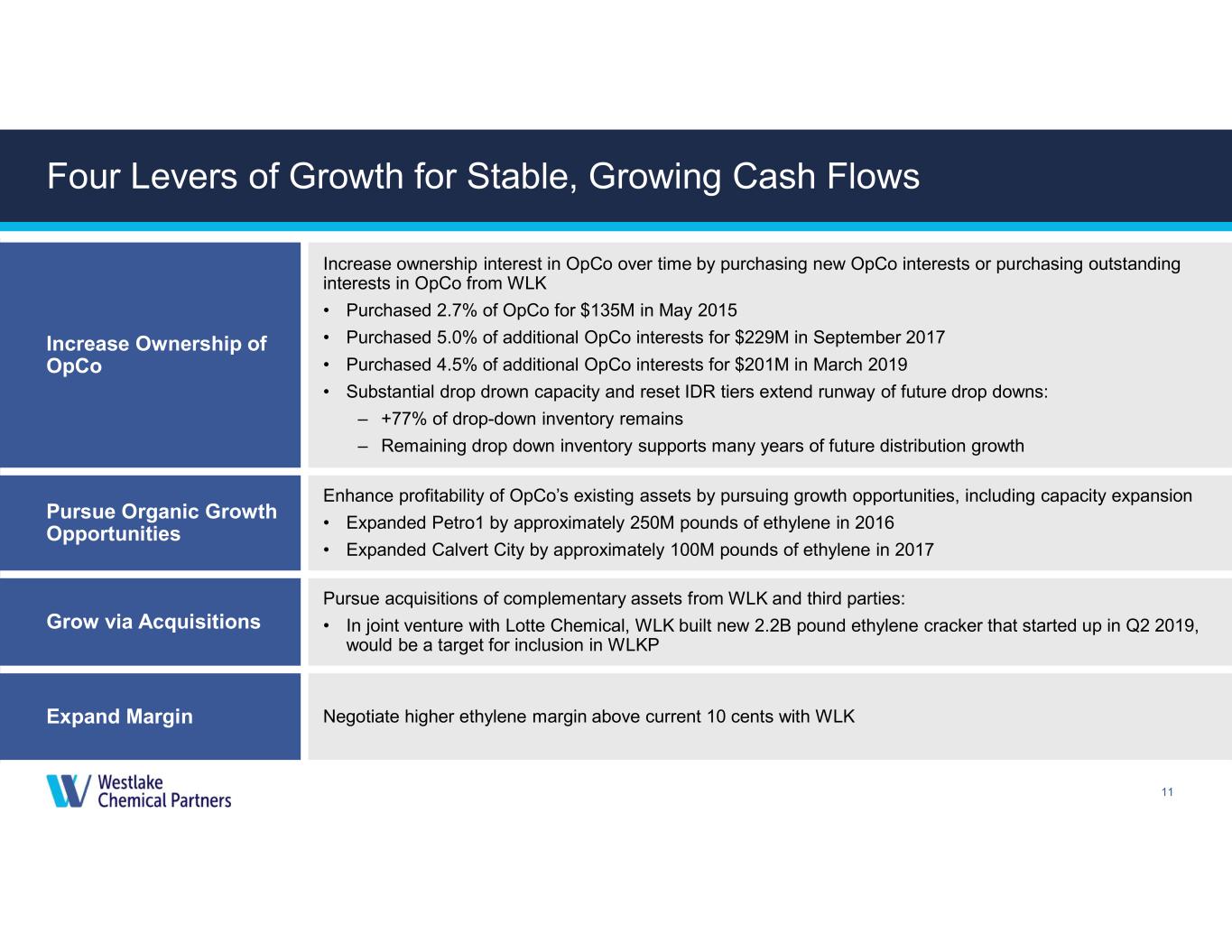

11 Four Levers of Growth for Stable, Growing Cash Flows Increase ownership interest in OpCo over time by purchasing new OpCo interests or purchasing outstanding interests in OpCo from WLK • Purchased 2.7% of OpCo for $135M in May 2015 • Purchased 5.0% of additional OpCo interests for $229M in September 2017 • Purchased 4.5% of additional OpCo interests for $201M in March 2019 • Substantial drop drown capacity and reset IDR tiers extend runway of future drop downs: – +77% of drop-down inventory remains – Remaining drop down inventory supports many years of future distribution growth Increase Ownership of OpCo Enhance profitability of OpCo’s existing assets by pursuing growth opportunities, including capacity expansion • Expanded Petro1 by approximately 250M pounds of ethylene in 2016 • Expanded Calvert City by approximately 100M pounds of ethylene in 2017 Pursue Organic Growth Opportunities Pursue acquisitions of complementary assets from WLK and third parties: • In joint venture with Lotte Chemical, WLK built new 2.2B pound ethylene cracker that started up in Q2 2019, would be a target for inclusion in WLKP Grow via Acquisitions Negotiate higher ethylene margin above current 10 cents with WLKExpand Margin

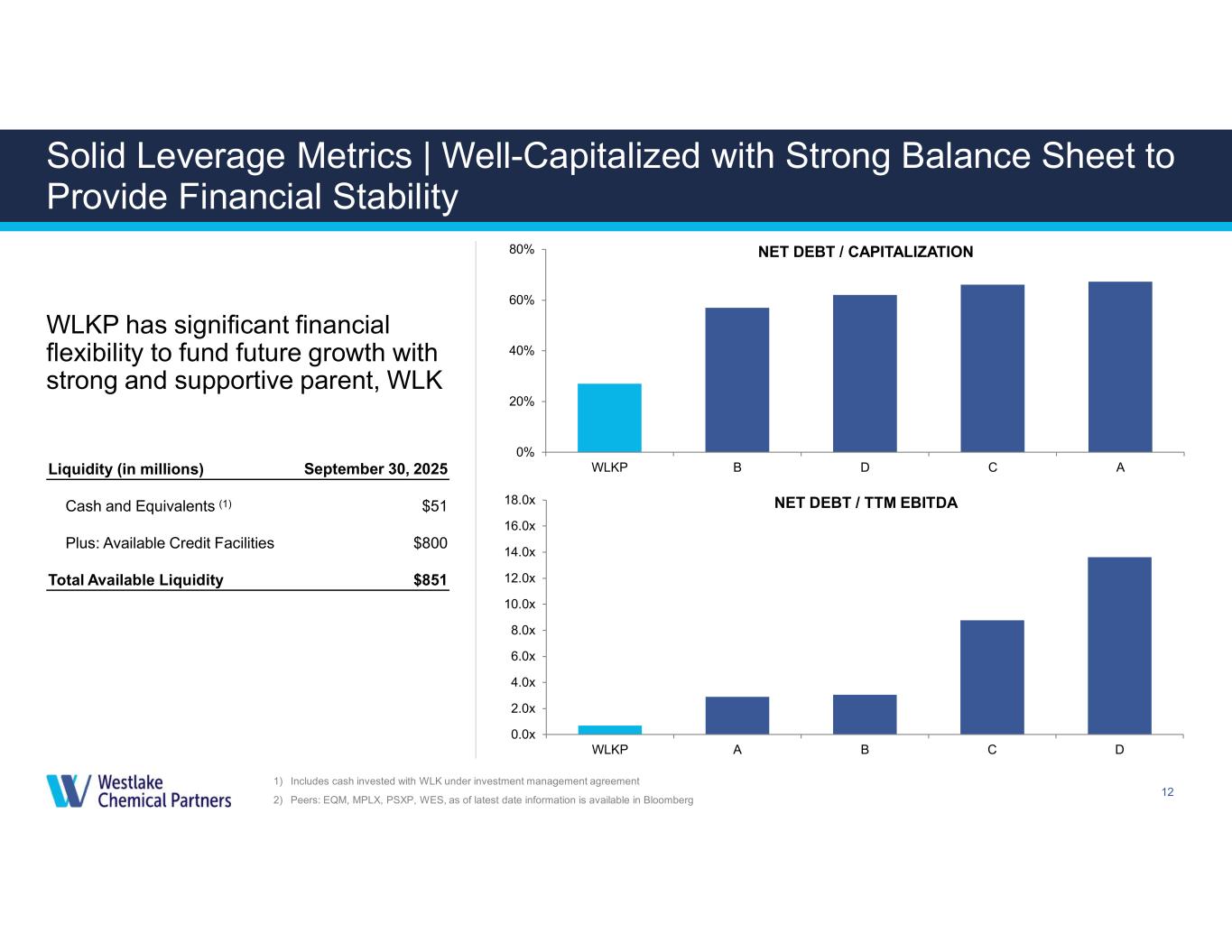

12 Solid Leverage Metrics | Well-Capitalized with Strong Balance Sheet to Provide Financial Stability 1) Includes cash invested with WLK under investment management agreement 2) Peers: EQM, MPLX, PSXP, WES, as of latest date information is available in Bloomberg 0% 20% 40% 60% 80% WLKP B D C A 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x WLKP A B C D NET DEBT / CAPITALIZATION NET DEBT / TTM EBITDA WLKP has significant financial flexibility to fund future growth with strong and supportive parent, WLK September 30, 2025Liquidity (in millions) $51Cash and Equivalents (1) $800Plus: Available Credit Facilities $851Total Available Liquidity

13 Sustainable Commitments Embedded Across Westlake Through Investments, Goals, and Products Reducing Scope 1 and 2 Emissions per Tons of Production by 20% by 20301 • To further reduce our carbon footprint, we are allocating capital to both proven and emerging technologies, including product and operational innovations – Energy-efficiency projects – Increasing use of less carbon- intensive energy providers – Adding more hydrogen as fuel gas – Other continuous operational improvements • Leading practice alignments Expanding Portfolio of Environmentally Safe Products • Incorporating recycled and bio-derived materials while maintaining product quality Efforts Recognized Through Awards and Industry Memberships • Rewards from EcoVadis, the leading provider of business sustainability ratings https://wlkpartners.com/content/sustainability 1) From a 2016 baseline Pivotal (One Pellet Solution) Efficient polyethylene solution that incorporates post-consumer resin (PCR) and maintains strength of plastic materials Epoxy Used in coatings and composites to fabricate wind turbine blades and light-weight aerospace and automotive components Molecular-Oriented (PVC-O) Pipe Engineering solution for lighter-weight, more durable PVC pipe; manufactured with lower-carbon footprint than any other water main pipe materials; used in housing and infrastructure Vinnolit WLK Epoxy • Selected solution-oriented industry memberships

14 Key Investment Drivers WLKP is Well-Positioned to Continue Delivering Value to Unitholders ► Experienced and incentivized management team ► Strategically located assets ► Stable, predictable cash flows not encumbered by IDRs ► Strategic relationship with WLK ► WLK’s increasing demand for ethylene ► Access to operational and industry expertise ► Competitive market position and asset integrity, with a commitment to social responsibility ► Ethylene sales agreement, plus IDR reset ► Expanded capacity and significant dropdown inventory ► Global cost advantage for ethylene production

Appendix

16 Commitment to the Environment Through Both Company Action and Dedicated Industry Organizations PARTICIPATING IN MULTI-INDUSTRY ASSOCIATIONS FOR ENVIRONMENTAL PROTECTION Westlake is a proud partner with the following organizations to drive sustainable action to eliminate plastic waste, capture more flexible food packaging waste for recycling, and support the sustainable impact vinyl has in the world, along with many other initiatives Westlake Associations and Alliances WLKP Sustainability Report https://wlkpartners.com/content/sustainability

17 Disclaimer This presentation contains certain forward-looking statements, including statements with respect to the ability to resume distribution growth, potential levers for growth, remaining drop-down opportunities, potential increases in margin, avoiding the creation of any capital market needs, accretive M&A as a source of future drop down opportunities for Westlake Chemical Partners and demand for the ethylene we produce. Actual results may differ materially depending on factors such as general economic and business conditions; the cyclical nature of the chemical industry; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, Europe and worldwide economies, including those due to political tensions in the Middle East, Ukraine and elsewhere; current and potential governmental regulatory actions in the United States and Europe and regulatory actions and political unrest in other countries; industry production capacity and operating rates; the supply/ demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions (including leaks, explosions, fires, weather-related incidents, mechanical failure, unscheduled downtime, labor difficulties, transportation interruptions, spills and releases and other environmental risks); changes in laws or regulations; technological developments; our ability to implement our business strategies; creditworthiness of our customers; the results of potential negotiations between Westlake Corporation and Westlake Chemical Partners, world health events, such as the COVID-19 pandemic, and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of these factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward looking statements. Management cautions against putting undue reliance on forward- looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. Investor Relations Contacts Westlake Chemical Partners LP 2801 Post Oak Boulevard, Suite 600 Houston, Texas 77056 (713) 960-9111 Steve Bender Executive Vice President & Chief Financial Officer Jeff Holy Vice President & Chief Accounting Officer