Please wait

| | | | | |

| KIMBALL ELECTRONICS REPORTS Q2 RESULTS; WITH STRONG SALES GROWTH IN THE MEDICAL VERTICAL; COMPANY RAISES ITS GUIDANCE FOR FISCAL 2026 |

JASPER, Ind., February 4, 2026 -- (BUSINESS WIRE) -- Kimball Electronics, Inc. (Nasdaq: KE) today announced financial results for the second quarter ended December 31, 2025. | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| “I’m pleased with the results for the second quarter and our updated guidance for fiscal 2026. Sales in Q2 were in line with expectations, highlighted by another quarter of strong double-digit year-over-year growth in the medical vertical, margins improved compared to the same period last year, and cash from operations was positive for the eighth consecutive quarter.

Our focus as a medical CMO continues to gain momentum as we leverage our unique capabilities in the industry. We expect top-line growth in medical to outpace our other two verticals as we balance our portfolio across the markets we serve. Our recent announcement to rebrand as Kimball Solutions, and the grand opening of the new medical manufacturing facility in Indianapolis, reflects this strategy and our expanded offering of capabilities and services.”

Richard D. Phillips Chief Executive Officer | | | | Second Quarter 2026 Highlights •Revenue of $341.3 million, a 5% decrease compared to Q2 of fiscal 2025 •Sales in the medical vertical increased 15% year-over-year •Operating income of $10.8 million, or 3.2% of net sales •Adjusted operating income of 4.5%, up 80 bps year-over-year •Cash from operations of $6.9 million, the eighth consecutive quarter of positive operating cash generation •Debt of $154.2 million and borrowing capacity of $285.1 million •Cash Conversion Days of 91, a 16-day improvement compared to the same period last year •Invested $4.3 million to repurchase 149,000 shares of common stock •Company increases guidance for fiscal 2026 sales and adjusted operating income | |

| | | | | | | | |

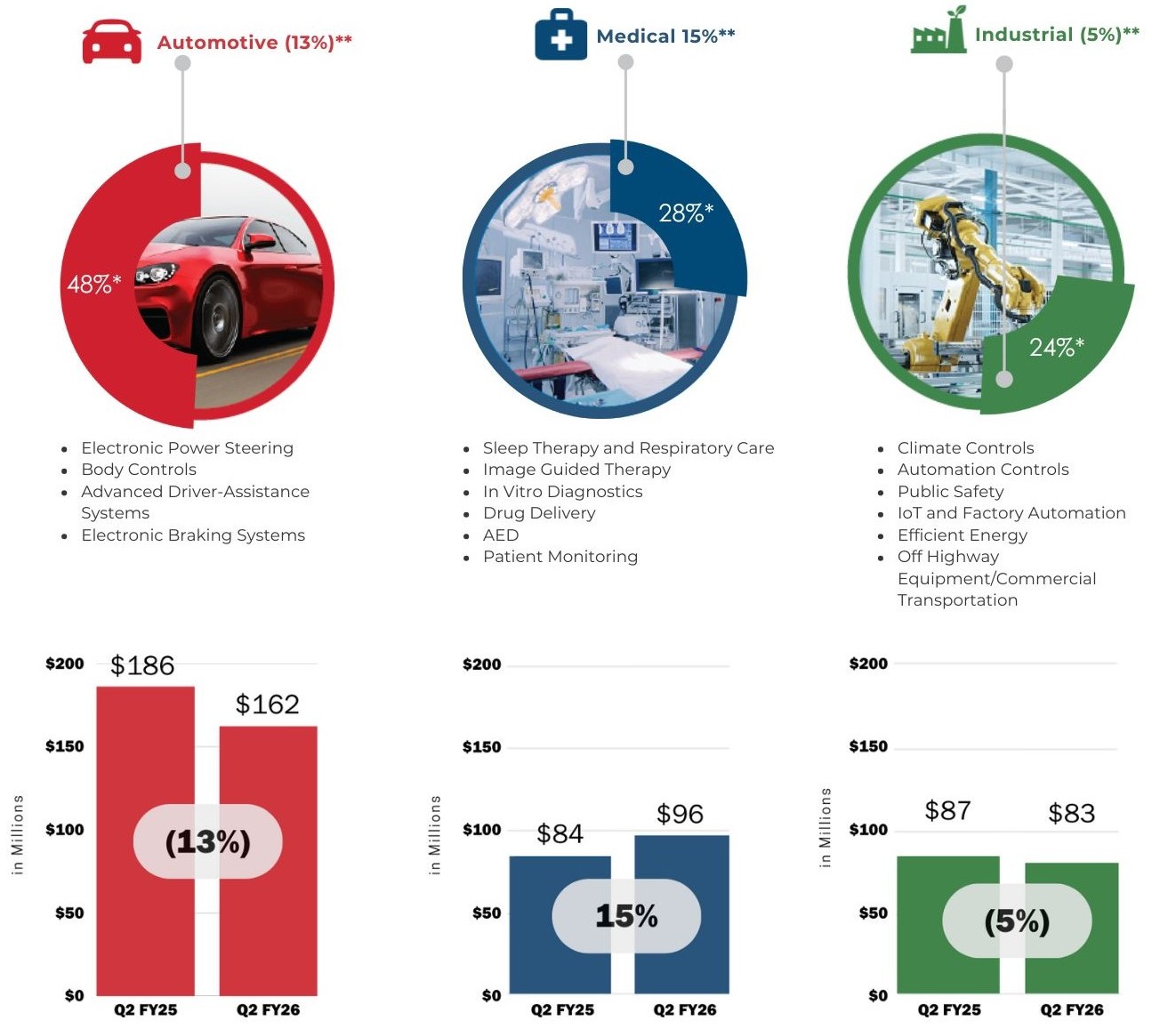

Net Sales by Vertical Market For Q2 Fiscal 2026 |

Sales in the medical vertical market increased 15% compared to the second quarter of fiscal 2025, while sales in automotive decreased 13% and industrial decreased 5%. |

|

| | | | | | | | |

*Percentage of net sales. |

| ** | Percentage changes compared to Q2 of fiscal 2025. |

| AT&M excluded from all amounts, percentages, and periods. |

FISCAL YEAR 2026 GUIDANCE

As part of today’s announcement, the Company increased its guidance for net sales and adjusted operating income in fiscal year 2026:

•Net sales are now expected to be in the range of $1,400 - $1,460 million, compared to the previous guidance of $1,350 - $1,450 million

•Adjusted operating income is estimated to be 4.2% - 4.5% of net sales versus the prior estimate of 4.0% - 4.25%

•The guidance for capital expenditures did not change with a range of $50 - $60 million

| | | | | |

| Conference Call / Webcast |

Thursday, February 5, 2026

Live Webcast: investors.kimballelectronics.com/events-and-presentations/events

For those unable to participate in the live webcast, the call will be archived at investors.kimballelectronics.com. |

| | |

Forward-Looking Statements |

Certain statements contained within this release are considered forward-looking, including our guidance, under the Private Securities Litigation Reform Act of 1995. The statements may be identified by the use of words such as “expect,” “should,” “goal,” “predict,” “will,” “future,” “optimistic,” “confident,” and “believe.” Undue reliance should not be placed on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from our expectations and projections. These forward-looking statements are subject to risks and uncertainties including, without limitation, global economic conditions, geopolitical environment and conflicts such as the war in Ukraine, global health emergencies, availability or cost of raw materials and components, tariffs and other trade barriers, foreign exchange rate fluctuations, and our ability to convert new business opportunities into customers and revenue. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of the company are contained in its Annual Report on Form 10-K for the year ended June 30, 2025.

| | |

Non-GAAP Financial Measures |

This press release contains non-GAAP financial measures. The non-GAAP financial measures contained herein include constant currency growth, net sales excluding Automation, Test & Measurement, adjusted selling and administrative expenses, adjusted operating income, adjusted net income, adjusted diluted EPS, and ROIC. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included in the Reconciliation of Non-GAAP Financial Measures section below. Management believes these measures are useful and allow investors to meaningfully trend, analyze, and benchmark the performance of the company’s core operations. The company’s non-GAAP financial measures are not necessarily comparable to non-GAAP information used by other companies.

| | |

| About Kimball Electronics, Inc. |

Kimball Electronics is a global, multifaceted manufacturer offering Electronics Manufacturing Services (EMS) and Contract Manufacturing Organization (CMO) solutions to customers around the world. From our operations in the United States, China, Mexico, Poland, Romania, and Thailand, our teams are proud to provide manufacturing services for a variety of industries. Recognized for a reputation of excellence, we are committed to a high-performance culture that values quality, reliability, value, speed, and ethical behavior. Kimball Electronics, Inc. (Nasdaq: KE) is headquartered in Jasper, Indiana.

To learn more about Kimball Electronics, visit www.kimballelectronics.com.

Lasting relationships. Global success.

| | | | | | | | |

| Contact: Andrew D. Regrut Vice President, Investor Relations, Strategic Development, and Treasurer 812.827.4151 Investor.Relations@kimballelectronics.com | |

Financial highlights for the second quarter and year-to-date period ended December 31, 2025 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| December 31, | | December 31, |

| (Amounts in Thousands, except EPS) | 2025 | | 2024 | | 2025 | | 2024 |

| Net Sales | $ | 341,280 | | | $ | 357,392 | | | $ | 706,883 | | | $ | 731,648 | |

Operating Income | $ | 10,767 | | | $ | 8,230 | | | $ | 25,221 | | | $ | 17,345 | |

Adjusted Operating Income (non-GAAP) | $ | 15,308 | | | $ | 13,333 | | | $ | 32,842 | | | $ | 25,923 | |

| Operating Income % | 3.2 | % | | 2.3 | % | | 3.6 | % | | 2.4 | % |

| Adjusted Operating Income (non-GAAP) % | 4.5 | % | | 3.7 | % | | 4.6 | % | | 3.5 | % |

| Net Income | $ | 3,637 | | | $ | 3,432 | | | $ | 13,723 | | | $ | 6,586 | |

Adjusted Net Income (non-GAAP) | $ | 6,925 | | | $ | 7,354 | | | $ | 19,175 | | | $ | 12,881 | |

Diluted EPS | $ | 0.15 | | | $ | 0.14 | | | $ | 0.55 | | | $ | 0.26 | |

Adjusted Diluted EPS (non-GAAP) | $ | 0.28 | | | $ | 0.29 | | | $ | 0.77 | | | $ | 0.51 | |

Net Sales by Vertical Market for Q2 Fiscal 2026:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Six Months Ended | | |

| December 31, | | | | December 31, | | |

| (Amounts in Millions) | 2025 | | * | | 2024 (2) | | * | | Percent

Change | | 2025 | | * | | 2024 (2) | | * | | Percent Change |

| | | | | | | | | | | | | | | | | | | |

Automotive | $ | 162.3 | | | 48 | % | | $ | 186.3 | | | 52 | % | | (13) | % | | $ | 326.7 | | | 46 | % | | $ | 368.0 | | | 50 | % | | (11) | % |

Medical | 96.3 | | | 28 | % | | 84.0 | | | 23 | % | | 15 | % | | 197.9 | | | 28 | % | | 173.8 | | | 24 | % | | 14 | % |

Industrial excluding AT&M (1) | 82.7 | | | 24 | % | | 87.1 | | | 25 | % | | (5) | % | | 182.3 | | | 26 | % | | 187.7 | | | 26 | % | | (3) | % |

Net Sales excluding AT&M (1) | $ | 341.3 | | | 100 | % | | $ | 357.4 | | | 100 | % | | (5) | % | | $ | 706.9 | | | 100 | % | | $ | 729.5 | | | 100 | % | | (3) | % |

AT&M (1) | — | | | — | % | | — | | | — | % | | — | % | | — | | | — | % | | 2.1 | | | — | % | | (100) | % |

| | | | | | | | | | | | | | | | | | | |

| Total Net Sales | $ | 341.3 | | | 100 | % | | $ | 357.4 | | | 100 | % | | (5) | % | | $ | 706.9 | | | 100 | % | | $ | 731.6 | | | 100 | % | | (3) | % |

| | | | | | | | | | | | | | | | | | | |

*As a percent of Total Net Sales | | | | | | | | | | | | |

(1)Sales from our Automation, Test, and Measurement business (AT&M), which was divested effective July 31, 2024, were previously included in the industrial vertical |

(2)Beginning in the first quarter of fiscal year 2026, sales to customers related to commercial transportation, previously included in the automotive vertical, are now reflected in the industrial vertical; prior periods have been recast to conform to current period presentation |

–Automotive includes electronic power steering, body controls, advanced driver-assistance systems, and electronic braking systems |

–Medical includes sleep therapy and respiratory care, image guided therapy, in vitro diagnostics, drug delivery, AED, and patient monitoring |

–Industrial includes climate controls, automation controls, public safety, IoT and factory automation, efficient energy, off highway equipment, and commercial transportation |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income | | | | | | |

| (Unaudited) | Three Months Ended |

| (Amounts in Thousands, except Per Share Data) | December 31, 2025 | | December 31, 2024 |

| Net Sales | $ | 341,280 | | | 100.0 | % | | $ | 357,392 | | | 100.0 | % |

| Cost of Sales | 313,412 | | | 91.8 | % | | 333,965 | | | 93.4 | % |

| Gross Profit | 27,868 | | | 8.2 | % | | 23,427 | | | 6.6 | % |

| Selling and Administrative Expenses | 14,862 | | | 4.4 | % | | 10,526 | | | 3.0 | % |

| | | | | | | |

| Restructuring Expense | 1,817 | | | 0.5 | % | | 4,671 | | | 1.3 | % |

| | | | | | | |

Asset Impairment | 422 | | | 0.1 | % | | — | | | — | % |

Operating Income | 10,767 | | | 3.2 | % | | 8,230 | | | 2.3 | % |

| Interest Income | 375 | | | 0.1 | % | | 253 | | | 0.1 | % |

| Interest Expense | (2,095) | | | (0.6) | % | | (4,241) | | | (1.2) | % |

| Non-Operating Income (Expense), net | (2,063) | | | (0.7) | % | | (768) | | | (0.2) | % |

| Other Income (Expense), net | (3,783) | | | (1.2) | % | | (4,756) | | | (1.3) | % |

| Income Before Taxes on Income | 6,984 | | | 2.0 | % | | 3,474 | | | 1.0 | % |

| Provision (Benefit) for Income Taxes | 3,347 | | | 0.9 | % | | 42 | | | — | % |

Net Income | $ | 3,637 | | | 1.1 | % | | $ | 3,432 | | | 1.0 | % |

| | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | |

| Basic | $ | 0.15 | | | | | $ | 0.14 | | | |

| Diluted | $ | 0.15 | | | | | $ | 0.14 | | | |

| | | | | | | |

| Average Number of Shares Outstanding: | | | | | | | |

| Basic | 24,606 | | | | | 24,870 | | | |

| Diluted | 24,823 | | | | | 24,968 | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (Unaudited) | Six Months Ended |

| (Amounts in Thousands, except Per Share Data) | December 31, 2025 | | December 31, 2024 |

| Net Sales | $ | 706,883 | | | 100.0 | % | | $ | 731,648 | | | 100.0 | % |

| Cost of Sales | 650,179 | | | 92.0 | % | | 684,621 | | | 93.6 | % |

| Gross Profit | 56,704 | | | 8.0 | % | | 47,027 | | | 6.4 | % |

| Selling and Administrative Expenses | 27,952 | | | 3.9 | % | | 23,953 | | | 3.2 | % |

| | | | | | | |

| Restructuring Expense | 3,233 | | | 0.5 | % | | 6,993 | | | 1.0 | % |

| | | | | | | |

| Asset Impairment (Gain on Disposal) | 298 | | | — | % | | (1,264) | | | (0.2) | % |

| Operating Income | 25,221 | | | 3.6 | % | | 17,345 | | | 2.4 | % |

| Interest Income | 514 | | | 0.1 | % | | 475 | | | 0.1 | % |

| Interest Expense | (4,448) | | | (0.6) | % | | (9,033) | | | (1.2) | % |

| Non-Operating Income (Expense), net | (3,304) | | | (0.6) | % | | (2,429) | | | (0.4) | % |

| Other Income (Expense), net | (7,238) | | | (1.1) | % | | (10,987) | | | (1.5) | % |

| Income Before Taxes on Income | 17,983 | | | 2.5 | % | | 6,358 | | | 0.9 | % |

Provision (Benefit) for Income Taxes | 4,260 | | | 0.6 | % | | (228) | | | — | % |

| Net Income | $ | 13,723 | | | 1.9 | % | | $ | 6,586 | | | 0.9 | % |

| | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | |

| Basic | $ | 0.56 | | | | | $ | 0.26 | | | |

| Diluted | $ | 0.55 | | | | | $ | 0.26 | | | |

| | | | | | | |

| Average Number of Shares Outstanding: | | | | | | | |

| Basic | 24,603 | | | | | 24,924 | | | |

| Diluted | 24,878 | | | | | 25,098 | | | |

| | | | | | | | | | | |

| Condensed Consolidated Statements of Cash Flows | Six Months Ended |

| (Unaudited) | December 31, |

| (Amounts in Thousands) | 2025 | | 2024 |

| Net Cash Flow provided by Operating Activities | $ | 14,943 | | | $ | 74,932 | |

Net Cash Flow used for Investing Activities | (24,368) | | | (1,214) | |

Net Cash Flow used for Financing Activities | (2,142) | | | (97,255) | |

| Effect of Exchange Rate Change on Cash, Cash Equivalents, and Restricted Cash | 623 | | | (722) | |

Net Decrease in Cash, Cash Equivalents, and Restricted Cash | (10,944) | | | (24,259) | |

| Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 89,467 | | | 78,779 | |

| Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 78,523 | | | $ | 54,520 | |

| | | | | | | | | | | |

| (Unaudited) | | |

| Condensed Consolidated Balance Sheets | December 31,

2025 | | June 30,

2025 |

| (Amounts in Thousands) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 77,853 | | | $ | 88,781 | |

| Receivables, net | 213,994 | | | 222,623 | |

| Contract assets | 79,521 | | | 71,812 | |

| Inventories | 281,699 | | | 273,500 | |

| Prepaid expenses and other current assets | 32,214 | | | 36,027 | |

| Assets held for sale | 6,610 | | | 6,861 | |

| Property and Equipment, net | 276,433 | | | 264,804 | |

| Goodwill | 6,191 | | | 6,191 | |

| Other Intangible Assets, net | 2,182 | | | 2,427 | |

Other Assets, net | 106,774 | | | 104,286 | |

| Total Assets | $ | 1,083,471 | | | $ | 1,077,312 | |

| | | |

LIABILITIES AND SHARE OWNERS’ EQUITY | | | |

| | | |

| | | |

| Current portion of long-term debt | $ | 24,112 | | | $ | 17,400 | |

| Accounts payable | 218,830 | | | 218,805 | |

| Advances from customers | 28,439 | | | 35,867 | |

| | | |

| Accrued expenses | 41,995 | | | 46,489 | |

| | | |

| Long-term debt, less current portion | 129,700 | | | 129,650 | |

| | | |

| Other long-term liabilities | 61,233 | | | 59,217 | |

| Share Owners’ Equity | 579,162 | | | 569,884 | |

| Total Liabilities and Share Owners’ Equity | $ | 1,083,471 | | | $ | 1,077,312 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Financial Metrics | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| (Amounts in Millions, except CCD) | | | | | | | | | |

| At or For the | | | | |

| Three Months Ended | | |

| December 31, | | September 30, | | December 31, | | |

| 2025 | | 2025 | | 2024 | | | | |

| Depreciation and Amortization | $ | 9.3 | | | $ | 9.1 | | | $ | 9.1 | | | | | |

| | | | | | | | | |

Cash Conversion Days (CCD) (1) | 91 | | | 83 | | | 107 | | | | | |

Open Orders (2) | $ | 557 | | | $ | 593 | | | $ | 564 | | | | | |

| | | | | | | | | |

(1)Cash Conversion Days (“CCD”) are calculated as the sum of Days Sales Outstanding plus Contract Asset Days plus Production Days Supply on Hand less Accounts Payable Days and less Advances from Customers Days. CCD, or a similar metric, is used in our industry and by our management to measure the efficiency of managing working capital.

(2)Open Orders are the aggregate sales price of production pursuant to unfulfilled customer orders.

| | | | | | | | | | | | | | | | | | | | | | | |

Select Financial Results of Automation, Test and Measurement | | | | |

| (Unaudited) | | | | | | | |

(Amounts in Millions) | | | | | | | |

| Three Months Ended | | Six Months Ended |

| December 31, | | December 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Net Sales | $ | — | | | $ | — | | | $ | — | | | $ | 2.1 | |

Operating Income (Loss) (1) | $ | (0.4) | | | $ | — | | | $ | (0.4) | | | $ | 0.8 | |

| | | | | | | |

(1)Amounts include gain (loss) on sale adjustments following the close of the sale on July 31, 2024: ($0.4 million) in the three and six months ended December 31, 2025 and $1.3 million for the six months ended December 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures | | | | | | | | | | | |

| | | | | | | | | | | |

| (Unaudited, Amounts in Thousands, except Per Share Data) | | | | | | | | | | | |

| | | | | | | | | | | |

|

| Three Months Ended | | Six Months Ended | | |

| December 31, | | December 31, | | |

| 2025 | | 2024 | | 2025 | | 2024 | | | | |

| Net Sales Growth (vs. same period in prior year) | (5) | % | | (15) | % | | (3) | % | | (15) | % | | | | |

| Foreign Currency Exchange Impact | 2 | % | | — | % | | 2 | % | | — | % | | | | |

| Constant Currency Growth | (7) | % | | (15) | % | | (5) | % | | (15) | % | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Selling and Administrative Expenses, as reported | $ | 14,862 | | | $ | 10,526 | | | $ | 27,952 | | | $ | 23,953 | | | | | |

| Stock Compensation Expense | (2,217) | | | (501) | | | (3,780) | | | (2,573) | | | | | |

| SERP | (85) | | | 69 | | | (310) | | | (276) | | | | | |

| Adjusted Selling and Administrative Expenses | $ | 12,560 | | | $ | 10,094 | | | $ | 23,862 | | | $ | 21,104 | | | | | |

| | | | | | | | | | | |

Operating Income, as reported | $ | 10,767 | | | $ | 8,230 | | | $ | 25,221 | | | $ | 17,345 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock Compensation Expense | 2,217 | | | 501 | | | 3,780 | | | 2,573 | | | | | |

| SERP | 85 | | | (69) | | | 310 | | | 276 | | | | | |

| | | | | | | | | | | |

| Restructuring Expense | 1,817 | | | 4,671 | | | 3,233 | | | 6,993 | | | | | |

| | | | | | | | | | | |

| Asset Impairment (Gain on Disposal) | 422 | | | — | | | 298 | | | (1,264) | | | | | |

| Adjusted Operating Income | $ | 15,308 | | | $ | 13,333 | | | $ | 32,842 | | | $ | 25,923 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

|

| | | | | |

| | | | | |

| | | | | | | | | | | |

Net Income, as reported | $ | 3,637 | | | $ | 3,432 | | | $ | 13,723 | | | $ | 6,586 | | | | | |

| Stock Compensation Expense, After-Tax | 1,681 | | | 380 | | | 2,866 | | | 1,951 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restructuring Expense, After-Tax | 1,287 | | | 3,542 | | | 2,360 | | | 5,303 | | | | | |

| | | | | | | | | | | |

| Asset Impairment (Gain on Disposal), After-Tax | 320 | | | — | | | 226 | | | (959) | | | | | |

| Adjusted Net Income | $ | 6,925 | | | $ | 7,354 | | | $ | 19,175 | | | $ | 12,881 | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | |

|

| | | | | |

| | | | | |

| | | | | | | | | | | |

| Diluted Earnings per Share, as reported | $ | 0.15 | | | $ | 0.14 | | | $ | 0.55 | | | $ | 0.26 | | | | | |

| | | | | | | | | | | |

| Stock Compensation Expense | 0.07 | | | 0.01 | | | 0.12 | | | 0.07 | | | | | |

| | | | | | | | | | | |

| Restructuring Expense | 0.05 | | | 0.14 | | | 0.09 | | | 0.21 | | | | | |

| | | | | | | | | | | |

| Asset Impairment (Gain on Disposal) | 0.01 | | | — | | | 0.01 | | | (0.03) | | | | | |

| Adjusted Diluted Earnings per Share | $ | 0.28 | | | $ | 0.29 | | | $ | 0.77 | | | $ | 0.51 | | | | | |

| | | | | | | | | | | |

| Twelve Months Ended | | | | | | | | |

| December 31, | | | | | | | | |

| 2025 | | 2024 | | | | | | | | |

Operating Income, as reported | $ | 53,411 | | | $ | 30,522 | | | | | | | | | |

| Goodwill Impairment | — | | | 5,820 | | | | | | | | | |

| SERP | 648 | | | 649 | | | | | | | | | |

| Restructuring Expense | 7,230 | | | 9,379 | | | | | | | | | |

| Asset Impairment (Gain on Disposal) | (829) | | | 15,776 | | | | | | | | | |

| Legal Settlements (Recovery) | — | | | (892) | | | | | | | | | |

| Stock Compensation Expense | 7,726 | | | 6,096 | | | | | | | | | |

Adjusted Operating Income | $ | 68,186 | | | $ | 67,350 | | | | | | | | | |

| Tax Effect | 23,836 | | | 17,019 | | | | | | | | | |

| After-tax Adjusted Operating Income | $ | 44,350 | | | $ | 50,331 | | | | | | | | | |

Average Invested Capital (1) | $ | 657,074 | | | $ | 756,966 | | | | | | | | | |

| ROIC | 6.7 | % | | 6.6 | % | | | | | | | | |

(1) Average invested capital is computed using Share Owners’ equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters.