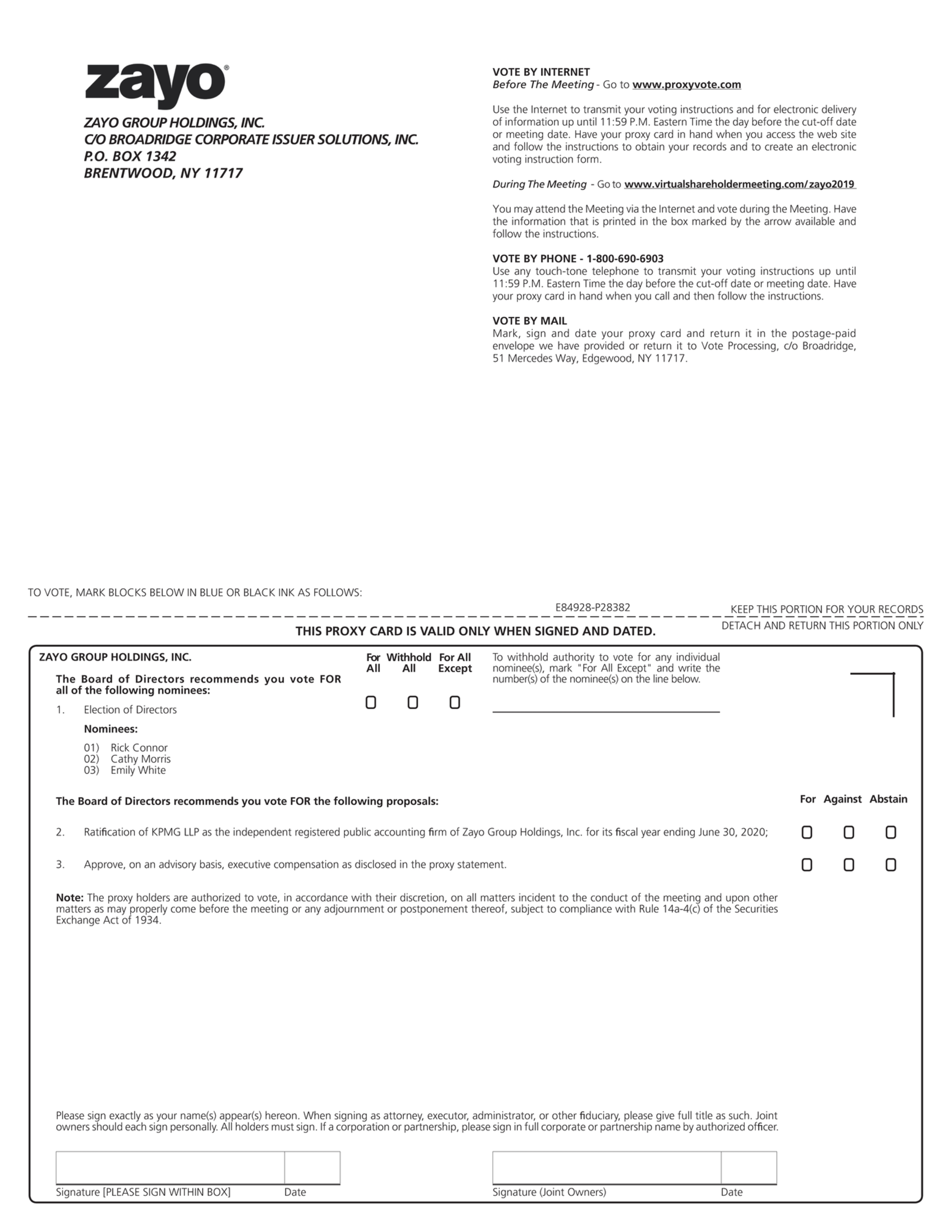

Notice of Annual Meeting of Stockholders

|

November 5, 2019

7:30 a.m. (Mountain Time) |

ZAYO GROUP HOLDINGS, INC.

1821 30th Street, Unit A Boulder, CO 80301 |

Items of Business

| 1. | Election of the three directors named in the proxy statement; |

| 2. | Ratification of KPMG LLP as our independent registered public accounting firm; |

| 3. | Advisory vote approving executive compensation; and |

| 4. | Transact such other business as may properly come before the meeting or any adjournment thereof. |

Notice is hereby given that the 2019 Annual Meeting of Stockholders of Zayo Group Holdings, Inc. will be held virtually via live webcast on Tuesday, November 5, 2019, at 7:30 a.m. (Mountain Time). The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/zayo2019, where you will be able to listen to the meeting live, submit questions and vote online. To participate in the Annual Meeting, you will need the 16 digit control number included on your notice of Internet availability of the proxy materials.

Only stockholders of record at the close of business on September 9, 2019 are entitled to notice of, and to vote at, the virtual meeting and any adjournments thereof. For ten days prior to the meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the meeting during ordinary business hours at our headquarters in Boulder, Colorado and such list will be made available during our virtual meeting at www.virtualshareholdermeeting.com/zayo2019.

Your vote is important. Voting over the Internet or by telephone, written proxy or voting instruction card will ensure your representation at the Annual Meeting regardless of whether you attend the virtual meeting.

By Order of the Board of Directors,

|

|

|

|

/s/ MATT STEINFORT

|

September 23, 2019

|

|

|

|

|

Matt Steinfort

Chief Financial Officer |

|

|

Internet

|

Telephone

|

Mail

|

Virtual Meeting

|

|

|

|

|

|

Visit the Website noted on your proxy card to vote via the Internet.

|

Use the toll free telephone number on your proxy card to vote by telephone.

|

Sign, date and return your proxy card in the enclosed envelope to vote by mail.

|

Attend the virtual meeting.

|