Strategic Bolt-On Combination California’s Leading Energy Platform

Forward-Looking / Cautionary Statements – Certain Terms Additional Information and Where to Find It In connection with the transaction, California Resources Corporation (“CRC”) will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 (the “registration statement”), which will include a proxy statement of Berry Corporation (“BRY”) (“Berry”) that also constitutes a prospectus of CRC, and any other documents in connection with the transaction. The definitive proxy statement/prospectus will be sent to the holders of common stock of Berry. INVESTORS AND STOCKHOLDERS OF CRC AND BERRY ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRC, BERRY, THE TRANSACTION AND RELATED MATTERS. The registration statement and proxy statement/prospectus and other documents filed by CRC or Berry with the SEC, when filed, will be available free of charge at the SEC’s website at https://www.sec.gov. Alternatively, investors and stockholders may obtain free copies of documents that are filed or will be filed with the SEC by CRC, including the registration statement and the proxy statement/prospectus, on CRC’s website at https://www.crc.com/investor-relations, and may obtain free copies of documents that are filed or will be filed with the SEC by Berry, including the proxy statement/prospectus, on Berry’s website at https://ir.bry.com/reports-resources. The information included on, or accessible through, CRC’s or Berry’s website is not incorporated by reference into this communication. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in Solicitation CRC and certain of its directors, executive officers and other employees, and Berry and its directors and certain of Berry’s executive officers and other employees, may be deemed to be participants in the solicitation of proxies from Berry’s stockholders in connection with the transaction. A description of participants’ direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus relating to the transaction when it is filed with the SEC. Information regarding CRC’s directors and executive officers is contained in the “Board of Directors and Corporate Governance,” “Compensation Discussion and Analysis,” “Executive Compensation Tables,” “Director Compensation,” “Stock Ownership Information,” and “Proposals Requiring Your Vote – Proposal 1: Election of Directors” sections of CRC’s definitive proxy statement for CRC’s 2025 Annual Meeting of Stockholders, filed with the SEC on March 19, 2025; under the heading “Directors, Executive Officers and Corporate Governance” in Part III, Item 10 of CRC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on March 3, 2025; in Item 5.07 of CRC’s Current Report on Form 8-K filed with the SEC on May 6, 2025; in CRC’s Current Reports on Form 8-K filed with the SEC on June 23, 2025 and November 25, 2024; and under “Our Team” accessed through the “Our Business” link on CRC’s website at https://www.crc.com/our-business/our-team. Information regarding Berry’s directors and executive officers is contained in the “Proposal No. 1—Election of Directors,” “Corporate Governance,” “Executive Officers,” “Executive Compensation – Compensation Discussion and Analysis,” “Director Compensation,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Party Transactions” sections of Berry’s definitive proxy statement for its 2025 annual meeting of stockholders, filed with the SEC on April 7, 2025; under the heading “Directors, Executive Officers and Corporate Governance” in Part III, Item 10 of Berry’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on March 13, 2025; in Item 5.07 of Berry’s Current Report on Form 8-K filed with the SEC on May 22, 2025; in Berry’s Current Reports on Form 8-K filed with the SEC on January 22, 2025 and October 25, 2024; and under “Leadership” accessed through the “About” link on Berry’s website at https://bry.com/about/management/. Additional information regarding ownership of Berry’s securities by its directors and executive officers and of CRC’s securities by its directors and executive officers is included in such persons’ SEC filings on Forms 3, 4 or 5, which are available at https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001705873 and https://www.sec.gov/cgi- bin/own-disp?action=getissuer&CIK=0001609253, respectively. These documents and the other SEC filings described in this paragraph may be obtained free of charge as described above under the heading “Additional Information and Where to Find It.” Cautionary Note Regarding Forward-Looking Statements Information set forth in this communication, including financial estimates and statements as to the effects of the transaction, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other securities laws. All statements other than historical facts are forward-looking statements, and include statements regarding the benefits of the transaction, future financial position and operating results of CRC and Berry, business strategy, projected revenues, earnings, costs, capital expenditures and plans, objectives and intentions of management for the future. Words such as “expect,” “could,” “may,” “anticipate,” “intend,” “plan,” “ability,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “guidance,” “outlook,” “opportunity” or “strategy” or similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements are based upon the current beliefs and expectations of the management of CRC and Berry and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, projected in, or implied by, such statements. The expectations and forecasts reflected in these forward-looking statements are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond CRC’s and Berry’s control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause CRC’s and/or Berry’s actual results to be materially different from those described in the forward-looking statements include: 2

i. transaction costs, ii. unknown liabilities, iii. the risk that any announcements relating to the transaction could have adverse effects on the market price of CRC’s common stock or Berry’s common stock, iv. the ability to successfully integrate the businesses, v. the ability to achieve projected synergies or it may take longer than expected to achieve those synergies, vi. risks related to financial community and rating agency perceptions of CRC and Berry or their respective businesses, operations, financial condition and the industry in which they operate, vii. risks related to the potential impact of general economic, political and market factors on CRC or Berry or the transaction, viii. those expressed in CRC’s other forward-looking statements including those factors discussed in Part I, Item 1A – Risk Factors in CRC’s Annual Report on Form 10-K and its other SEC filings available at www.crc.com, ix. those expressed in Berry’s other forward-looking statements including those factors discussed in Part I, Item 1A – Risk Factors in Berry’s Annual Report on Form 10-K and its other SEC filings available at https://ir.bry.com/, x. the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction, xi. the risk that stockholders of Berry may not approve the transaction, xii. the risk that any of the other closing conditions to the transaction may not be satisfied in a timely manner, including the risk that all necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated, xiii. risks related to disruption of management time from ongoing business operations due to the transaction, and xiv. effects of the announcement, pendency or completion of the transaction on the ability of CRC and Berry to retain customers and retain and hire key personnel and maintain relationships with their respective suppliers and customers. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of CRC’s registration statement on Form S-4 that will contain a proxy statement/prospectus discussed above, when it becomes available, and other documents filed by CRC or Berry from time to time with the SEC. You are cautioned not to place undue reliance on forward-looking statements contained in this communication, which speak only as of the date hereof, and each of CRC and Berry is under no obligation, and expressly disclaims any obligation to update, alter or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise. This communication may also contain information from third-party sources. This data may involve a number of assumptions and limitations, and neither CRC nor Berry has independently verified them and do not warrant the accuracy or completeness of such third-party information. Non-GAAP Financial Measures: This presentation contains certain financial measures that are not prepared in accordance with generally accepted accounting principles (“GAAP”). These measures are identified with an “*” and include but are not limited to adjusted EBITDAX, PV-10, Leverage Ratio, Net Debt, Liquidity, Net Cash Provided by Operating Activities Before Net Changes in Operating Assets and Liabilities, Free Cash Flow Before Net Changes in Operating Assets and Liabilities and Free Cash Flow. CRC is unable to provide a reconciliation of non-GAAP financial measures contained in this presentation that are presented on a forward- looking basis for the described transaction because CRC is unable, without reasonable efforts, to estimate and quantify the most directly comparable GAAP components, largely because predicting future operating results is subject to many factors outside of CRC's control and not readily predictable and that are not part of CRC's routine operating activities, including various economic, regulatory, political and legal factors. For all historical non-GAAP financial measures please see the Earning Releases or Investor Relations pages at www.crc.com and www.bry.com for a reconciliation to the nearest GAAP equivalent and other additional information. Industry and Market Data: This presentation has been prepared by CRC and includes market data and other statistical information from sources it believes to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from CRC’s review of internal sources as well as the independent sources described above. Although CRC believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. CRC owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. CRC’s use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with CRC or an endorsement or sponsorship by or of CRC. Forward-Looking / Cautionary Statements – Certain Terms (Continued) 3

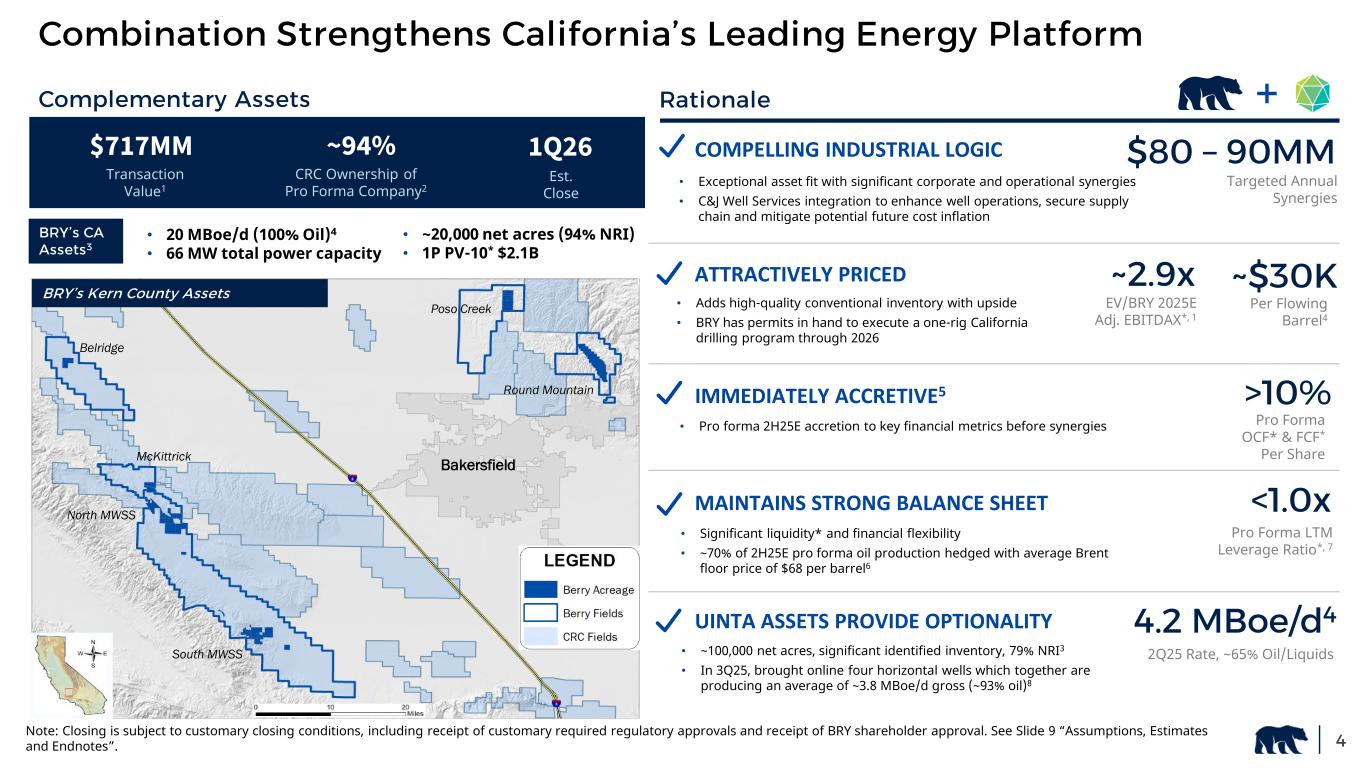

RationaleComplementary Assets $717MM Transaction Value1 ~94% Est. Close 1Q26 CRC Ownership of Pro Forma Company2 Poso Creek Bakersfield Round Mountain South MWSS North MWSS McKittrick Belridge BRY’s Kern County Assets • 20 MBoe/d (100% Oil)4 • 66 MW total power capacity BRY’s CA Assets3 • ~20,000 net acres (94% NRI) • 1P PV-10* $2.1B COMPELLING INDUSTRIAL LOGIC $80 – 90MM Targeted Annual Synergies • Exceptional asset fit with significant corporate and operational synergies • C&J Well Services integration to enhance well operations, secure supply chain and mitigate potential future cost inflation ATTRACTIVELY PRICED ~2.9x • Adds high-quality conventional inventory with upside • BRY has permits in hand to execute a one-rig California drilling program through 2026 EV/BRY 2025E Adj. EBITDAX*, 1 ~$30K Per Flowing Barrel4 >10%IMMEDIATELY ACCRETIVE5 • Pro forma 2H25E accretion to key financial metrics before synergies Pro Forma OCF* & FCF* Per Share MAINTAINS STRONG BALANCE SHEET <1.0x • Significant liquidity* and financial flexibility • ~70% of 2H25E pro forma oil production hedged with average Brent floor price of $68 per barrel6 Pro Forma LTM Leverage Ratio*, 7 UINTA ASSETS PROVIDE OPTIONALITY 4.2 MBoe/d4 2Q25 Rate, ~65% Oil/Liquids• ~100,000 net acres, significant identified inventory, 79% NRI3 • In 3Q25, brought online four horizontal wells which together are producing an average of ~3.8 MBoe/d gross (~93% oil)8 + Note: Closing is subject to customary closing conditions, including receipt of customary required regulatory approvals and receipt of BRY shareholder approval. See Slide 9 “Assumptions, Estimates and Endnotes”. 4 Combination Strengthens California’s Leading Energy Platform

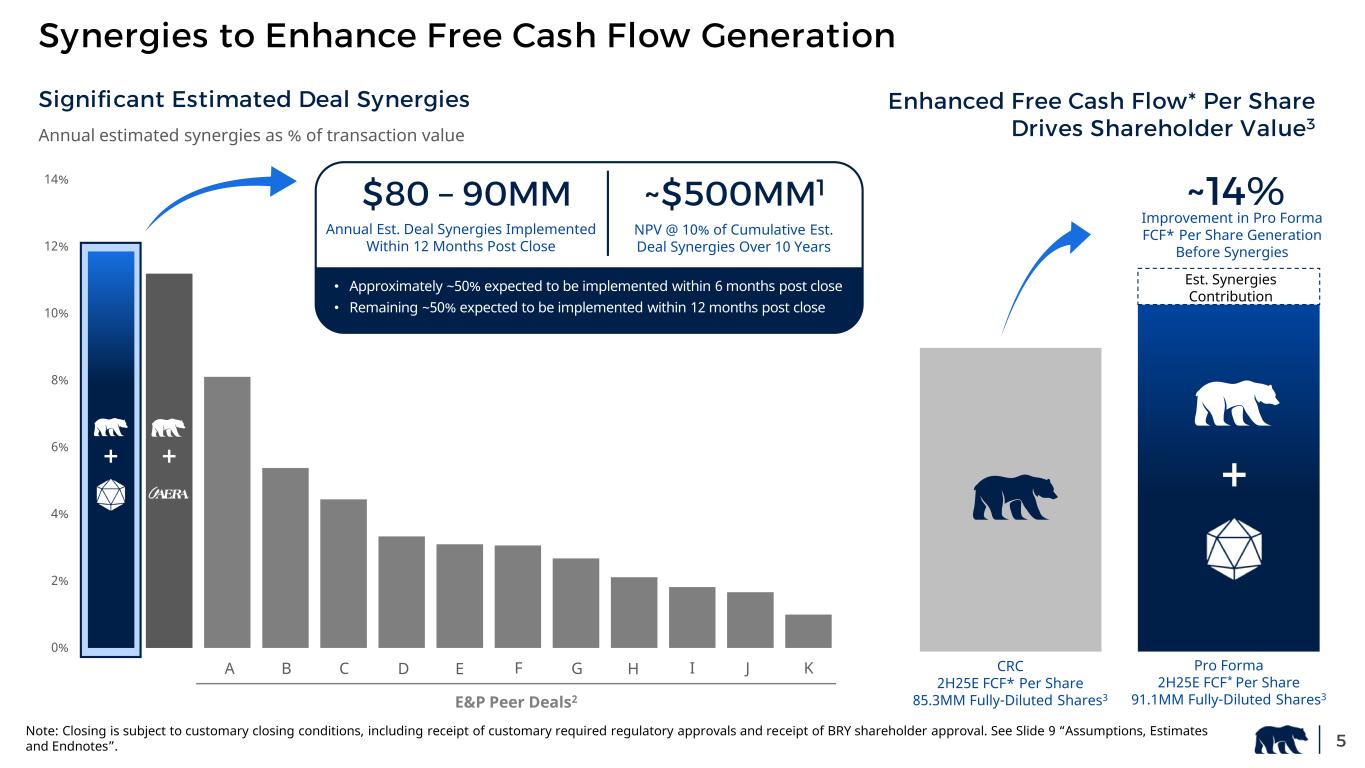

0% 2% 4% 6% 8% 10% 12% 14% $80 – 90MM Annual Est. Deal Synergies Implemented Within 12 Months Post Close NPV @ 10% of Cumulative Est. Deal Synergies Over 10 Years ~$500MM1 5 Annual estimated synergies as % of transaction value E&P Peer Deals2 A B C D E F G H I J K Enhanced Free Cash Flow* Per Share Drives Shareholder Value3 ~14% CRC 2H25E FCF* Per Share 85.3MM Fully-Diluted Shares3 + Pro Forma 2H25E FCF* Per Share 91.1MM Fully-Diluted Shares3 Improvement in Pro Forma FCF* Per Share Generation Before Synergies + + • Approximately ~50% expected to be implemented within 6 months post close • Remaining ~50% expected to be implemented within 12 months post close Est. Synergies Contribution Note: Closing is subject to customary closing conditions, including receipt of customary required regulatory approvals and receipt of BRY shareholder approval. See Slide 9 “Assumptions, Estimates and Endnotes”. 5 Synergies to Enhance Free Cash Flow Generation Significant Estimated Deal Synergies

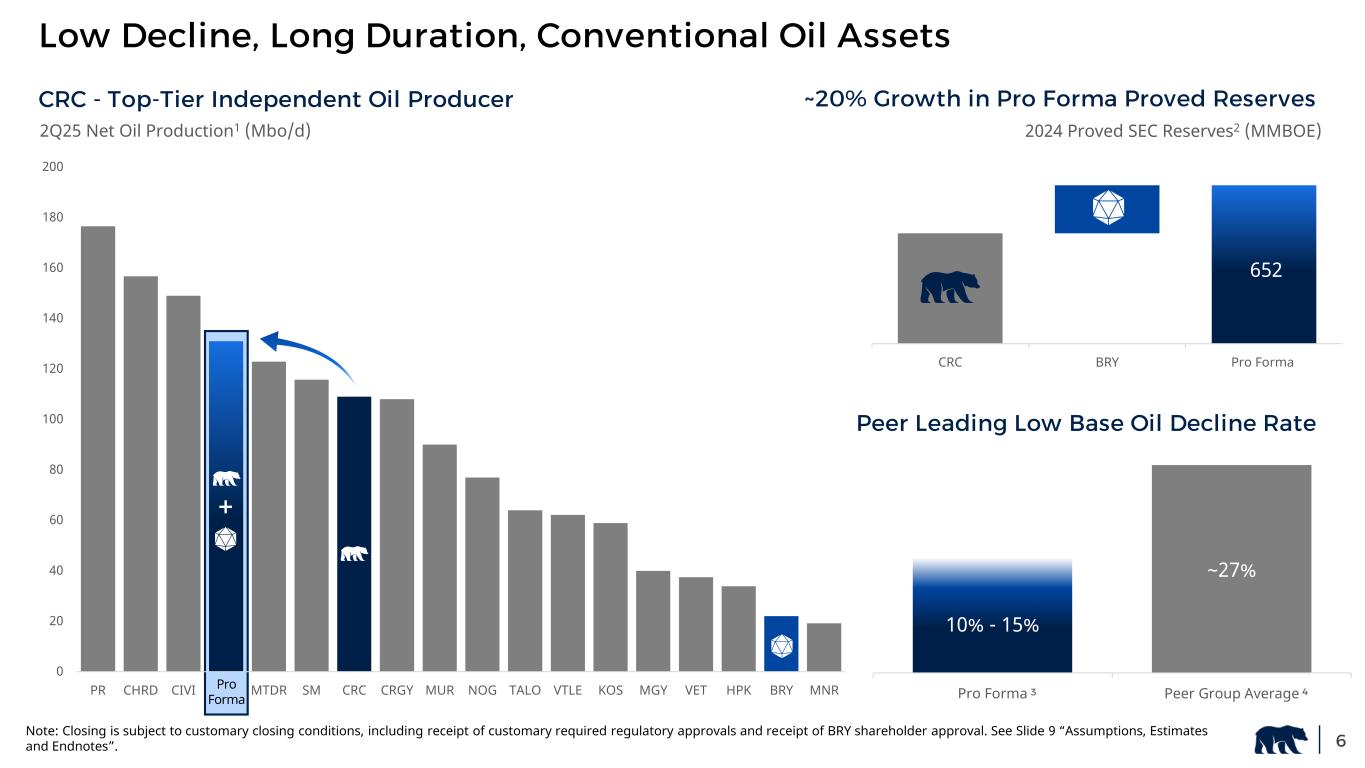

0 20 40 60 80 100 120 140 160 180 200 PR CHRD CIVI MTDR SM CRC CRGY MUR NOG TALO VTLE KOS MGY VET HPK BRY MNR 66 CRC BRY Pro Forma 2024 Proved SEC Reserves2 (MMBOE) 652 10% - 15% ~27% Pro Forma Peer Group Average Peer Leading Low Base Oil Decline Rate 4 Pro Forma 3 ~20% Growth in Pro Forma Proved Reserves 2Q25 Net Oil Production1 (Mbo/d) + Low Decline, Long Duration, Conventional Oil Assets Note: Closing is subject to customary closing conditions, including receipt of customary required regulatory approvals and receipt of BRY shareholder approval. See Slide 9 “Assumptions, Estimates and Endnotes”. CRC - Top-Tier Independent Oil Producer

STRONG BALANCE SHEET WITH SOLID FREE CASH FLOW GENERATION TRACK RECORD OF ROBUST SHAREHOLDER RETURNS DISCIPLINED CAPITAL ALLOCATION LEADING CARBON MANAGEMENT BUSINESS California’s Leading Energy Platform 7

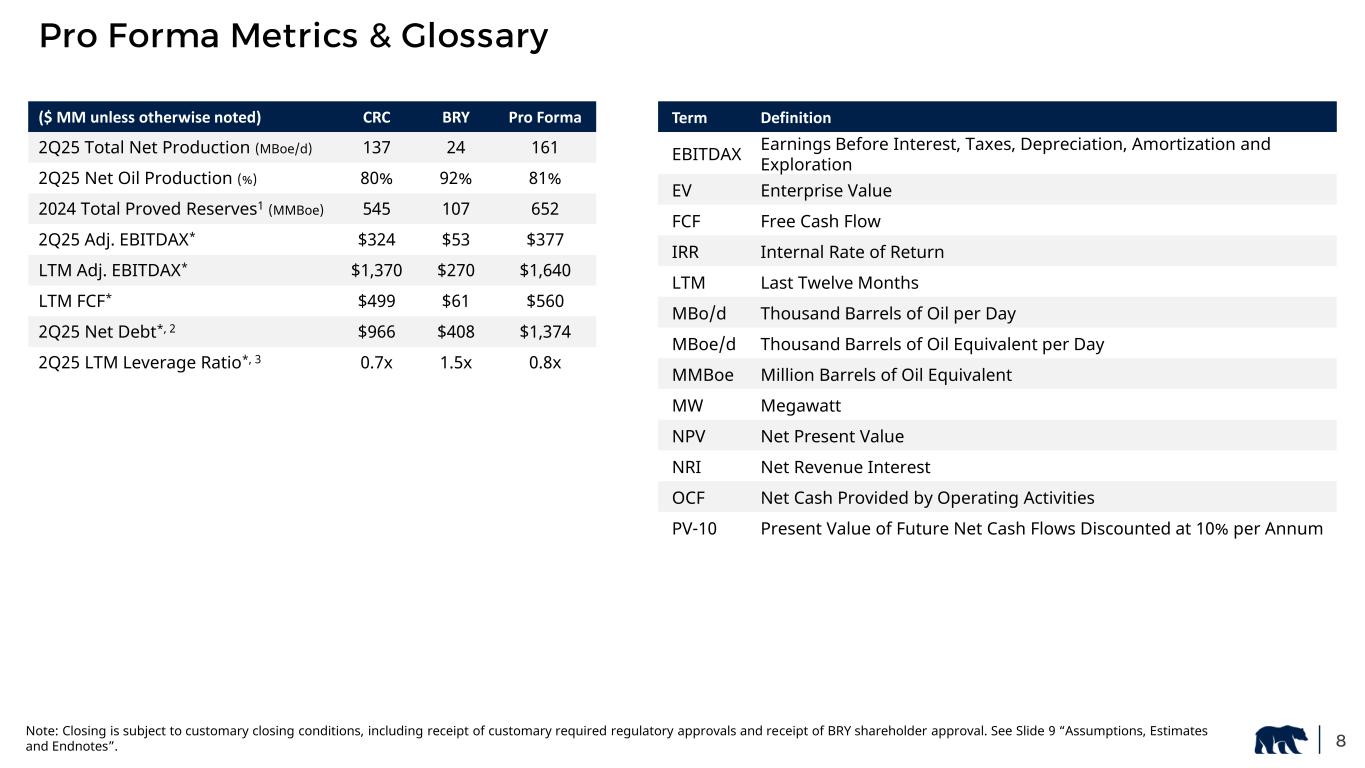

88 Pro Forma Metrics & Glossary Note: Closing is subject to customary closing conditions, including receipt of customary required regulatory approvals and receipt of BRY shareholder approval. See Slide 9 “Assumptions, Estimates and Endnotes”. Term Definition EBITDAX Earnings Before Interest, Taxes, Depreciation, Amortization and Exploration EV Enterprise Value FCF Free Cash Flow IRR Internal Rate of Return LTM Last Twelve Months MBo/d Thousand Barrels of Oil per Day MBoe/d Thousand Barrels of Oil Equivalent per Day MMBoe Million Barrels of Oil Equivalent MW Megawatt NPV Net Present Value NRI Net Revenue Interest OCF Net Cash Provided by Operating Activities PV-10 Present Value of Future Net Cash Flows Discounted at 10% per Annum ($ MM unless otherwise noted) CRC BRY Pro Forma 2Q25 Total Net Production (MBoe/d) 137 24 161 2Q25 Net Oil Production (%) 80% 92% 81% 2024 Total Proved Reserves1 (MMBoe) 545 107 652 2Q25 Adj. EBITDAX* $324 $53 $377 LTM Adj. EBITDAX* $1,370 $270 $1,640 LTM FCF* $499 $61 $560 2Q25 Net Debt*, 2 $966 $408 $1,374 2Q25 LTM Leverage Ratio*, 3 0.7x 1.5x 0.8x

Assumptions, Estimates and Endnotes Pro forma 2025 estimates. This presentation includes certain forward-looking estimates of pro forma combined operating and financial results for the six months ended December 31, 2025. Unless otherwise noted, pro forma 2025 estimates are based on management estimates and/or FactSet consensus estimates as of September 12, 2025, and exclude estimated annualized synergies. All future quarterly dividends and share repurchases are subject to changes in commodity prices, restrictions under credit agreement covenants and the approval of CRC's Board (in the case of CRC) and Berry’s Board (in the case of Berry). Pro forma 2025 estimates are forward-looking statements and actual results could differ materially. Slide 4: (1) Berry’s enterprise value was calculated as $717 million assuming 5.8 million of shares of CRC common stock are issued as consideration in the combination based on a per CRC share price of $53.01 as of September 12, 2025, plus $408 million of assumed net debt as of June 30, 2025. Based on internal management expectations and consensus estimates from FactSet as of September 12, 2025. (2) Reflects CRC shareholder ownership in the pro forma combined company, based on exchange ratio calculations using shares outstanding as of August 31, 2025. (3) For more information, including information on Berry’s proved reserves and the calculation of PV-10, please see Berry’s Form 10-K for the fiscal year ended December 31, 2024. PV-10 is a non-GAAP measure. (4) Based on 2Q25 actuals. Please see Berry’s Form 10-Q for the period ended June 30, 2025 for additional information. (5) Based on internal management expectations and consensus estimates from FactSet as of September 12, 2025. Operating cash flow and free cash flow are both before net changes in operating assets and liabilities and exclude targeted synergies, transaction costs, debt issuance costs and other expenses related to the transaction. Assumes 85.3 million fully-diluted shares outstanding for CRC standalone and 91.1 million fully-diluted shares outstanding for pro forma. Fully-diluted shares has been calculated as if all outstanding equity awards were accelerated upon a change in control and settled in shares. (6) Based on internal management expectations and consensus estimates from FactSet as of September 12, 2025. (7) Please see slide 8 for additional information. (8) Represents the 7-day average gross production for the period from September 7, 2025 to September 14, 2025 with peak production expected in late September to early October. Slide 5: (1) NPV at 10% reflects the net present value of the midpoint of the targeted synergies range, discounted at a 10% rate. The calculation assumes all realized synergies are sustainable over a 10-year period and excludes both costs to achieve the savings and taxes. (2) Source: Company reports and internal estimates. Peer deals include Crescent Energy Co. & Vital Energy, Inc. (2025), EOG Resources, Inc. & Encino Acquisition Partners (2025), APA Corp. & Callon Petroleum Co. (2024), Chesapeake Energy Corp. & Southwestern Energy Co. (2024), Chord Energy Corp. & Enerplus Corp. (2024), ConocoPhillips & Marathon Petroleum Corp. (2024), Crescent Energy Co. & SilverBow Resources, Inc. (2024), Devon Energy & Grayson Mill Energy (2024), Diamondback Energy, Inc. & Endeavor Energy Resources, LP (2024), Chevron Corp. & Hess Corp. (2023) and Exxon Mobil Corp. & Pioneer Natural Resources (2023). (3) Based on internal management expectations and consensus estimates from FactSet as of September 12, 2025. Free cash flow is before net changes in operating assets and liabilities and excludes targeted synergies, transaction costs, debt issuance costs and other expenses related to the transaction. Assumes 85.3 million fully-diluted shares outstanding for CRC standalone and 91.1 million fully- diluted shares outstanding for pro forma. Fully-diluted shares has been calculated as if all outstanding equity awards were accelerated upon a change in control and settled in shares. Slide 6: (1) Source: FactSet as of September 12, 2025 for all companies other than CRC. CRC’s net production is based on 2Q25 actuals. CRC pro forma for the transaction is based on internal management expectations. (2) Proved reserves estimated as of December 31, 2024 using SEC Prices of $80.42 per barrel for oil and $2.13 per MMbtu for natural gas. For more information on Berry’s proved reserves, including a reconciliation to the most comparable GAAP measure, please see Berry’s Form 10-K for the fiscal year ended December 31, 2024. (3) Based on internal management expectations. Data represents the pro forma estimated next twelve-month base oil production decline rates as of 1Q25. (4) Source: Enverus, “1Q25 Oil NAV Compass | Long WCP, MTDR, MEG – Mispriced Quality and Catalysts” June 20, 2025. Data represents the peer average estimated next twelve-month base oil production decline rates as of 1Q25. Peer group includes BRY, CHRD, CIVI, CRGY, HPK, KOS, MGY, MNR, MTDR, MUR, NOG, PR, SM, TALO, VET and VTLE. Slide 8: (1) Proved reserves estimated as of December 31, 2024 using SEC Prices of $80.42 per barrel for oil and $2.13 per MMbtu for natural gas. For more information on Berry’s proved reserves, including a reconciliation to the most comparable GAAP measure, please see Berry’s Form 10-K for the fiscal year ended December 31, 2024. (2) Pro forma excludes transaction costs. CRC net debt excludes $16MM of restricted cash and transaction costs. Berry had an insignificant amount of restricted cash. (3) Leverage ratio is calculated as 2Q25 net debt divided by LTM adjusted EBITDAX. 9

Joanna Park VP, Investor Relations & Treasurer 818-661-3731 Joanna.Park@crc.com Daniel Juck Sr. Director, Investor Relations 818-661-6045 Daniel.Juck@crc.com Hailey Bonus Sr. Director, Communications 562-999-8363 Hailey.Bonus@crc.com