EXPLANATORY NOTE REGARDING PROXY SUPPLEMENT

This proxy statement supplement (the “Supplement”) supplements and amends the definitive proxy statement on Schedule 14A (the “Proxy Statement”) filed by Seres Therapeutics, Inc. (the “Company”) with the Securities and Exchange Commission on March 13, 2025 in relation to the Company’s 2025 annual meeting of stockholders (the “Annual Meeting”).

Following the filing of the Proxy Statement, it was determined that the disclosure in the Proxy Statement under the section “Executive Compensation–Pay Versus Performance,” inadvertently calculated total shareholder return (“TSR”) based on a measurement period commencing on December 31, 2019, which would have been the correct measurement period if the Company were a larger reporting company and included five completed fiscal years in the Pay Versus Performance table, rather than based on a measurement period commencing on December 31, 2021, the last trading day before the Company’s earliest fiscal year in the Pay Versus Performance table. The Company is a smaller reporting company and included three completed fiscal years in the Pay Versus Performance table.

This Supplement is being filed to correct this error by reproducing in full the Pay Versus Performance disclosure, which was originally set forth on pages

55-57

of the Proxy Statement. The corrected Pay Versus Performance information is provided below and replaces the information originally included in the Proxy Statement in its entirety. Except as specifically discussed in this Explanatory Note, this Supplement does not otherwise modify or update any other disclosures presented in the Proxy Statement. This Supplement should be read with the Proxy Statement, and, from and after the date of this Supplement, any references to the “Proxy Statement” shall be deemed to include the Proxy Statement as amended by this Supplement. The Company encourages any eligible stockholder that has not yet voted their shares or provided voting instructions to their broker to do so promptly. It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting webcast, we urge you to vote your shares via the Internet, as described in the Proxy Statement. If you have received a printed copy of your proxy card by mail, you may alternatively sign, date and mail the proxy card in the provided return envelope.

Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

Stockholders do not need to take any action if they have already voted their shares for the Annual Meeting and do not wish to change their votes. The form of proxy card included with the Proxy Statement remains valid, and no new proxy cards are being distributed. If you have already voted and wish to change your vote based on any of the information contained in this Supplement or otherwise, you may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting. Proxies already returned by stockholders (via Internet, telephone or mail) will remain valid and will be voted at the Annual Meeting unless revoked. Important information regarding how to vote your shares of common stock and how to revoke or change a proxy already given is described under the section titled “Questions and Answers about the 2025 Annual Meeting of Stockholders–Can I change my vote after I submit my proxy?” in the Proxy Statement.

PAY VERSUS PERFORMANCE

In accordance with the SEC’s disclosure requirements regarding pay versus performance, this section presents the

SEC-defined

“Compensation Actually Paid,” or CAP. Also required by the SEC, this section compares CAP to various measures used to gauge our performance. CAP is a supplemental measure to be viewed alongside performance measures as an addition to the philosophy and strategy of compensation-setting discussed elsewhere in this proxy statement, not in replacement. Pay Versus Performance Table

The following table sets forth information concerning the compensation of our NEOs for each of the fiscal years ended December 31, 2022, 2023 and 2024, and our financial performance for each such fiscal year:

| Year | Summary Compensation Table Total for PEO ($) |

Compensation Actually Paid to PEO ($)(1)(2) |

Average Summary Compensation Table Total for Non-PEO NEOs ($) |

Average Compensation Actually Paid to Non-PEO NEOs ($)(1)(2) |

Value of Initial Fixed $100 Investment Based on Total Shareholder Return ($) |

Net Income ($) | ||||||||||||||||||

2024 |

||||||||||||||||||||||||

2023 |

( |

) | ( |

) | ||||||||||||||||||||

2022 |

( |

) | ||||||||||||||||||||||

| (1) | Amounts represent compensation actually paid to our PEO and the average compensation actually paid to our remaining NEOs for the relevant fiscal year, as determined under SEC rules (and described below), which includes the individuals indicated in the table below for each fiscal year: |

Year |

PEO | Non-PEO NEOs | ||

| 2024 | Lisa von Moltke, M.D., and Thomas J. DesRosier | |||

| 2023 | Teresa L. Young, Ph.D. and Lisa von Moltke, M.D. | |||

| 2022 | David Arkowitz, Lisa von Moltke, M.D., Matthew Henn, Ph.D., and Paula A. Cloghessy |

Compensation actually paid to our NEOs represents the “Total” compensation reported in the Summary Compensation Table for the applicable fiscal year, as adjusted as follows:

2024 |

||||||||

Adjustments |

PEO |

Average Non- PEO NEOs |

||||||

Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Columns in the Summary Compensation Table for Applicable FY |

( |

) | ( |

) | ||||

Increase Based on ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, Determined as of Applicable FY End |

||||||||

Increase Based on ASC 718 Fair Value of Awards Granted during Applicable FY that Vested during Applicable FY, Determined as of Vesting Date |

||||||||

Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, Determined Based on Change in ASC 718 Fair Value from Prior FY End to Applicable FY End |

( |

) | ( |

) | ||||

Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, Determined Based on Change in ASC 718 Fair Value from Prior FY End to Vesting Date |

( |

) | ( |

) | ||||

Deduction of ASC 718 Fair Value of Awards Granted during Prior FY that were Forfeited during Applicable FY, Determined as of Prior FY End |

||||||||

Increase Based on Dividends or Other Earnings Paid during Applicable FY prior to Vesting Date |

||||||||

Increase Based on Incremental Fair Value of Options/SARs Modified during Applicable FY |

||||||||

Deduction for Change in the Actuarial Present Values Reported under the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” Column of the Summary Compensation Table for Applicable FY |

||||||||

Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans |

||||||||

TOTAL ADJUSTMENTS |

( |

) | ( |

) | ||||

| (2) | Fair value or change in fair value, as applicable, of equity awards in the “Compensation Actually Paid” columns was determined by reference to (i) for solely service-vesting RSU awards, the closing price per share on the applicable year-end date(s) or, in the case of vesting dates, the closing price per share on the applicable vesting date(s); (ii) for performance-based RSU awards, the same valuation methodology as RSU awards above except that the year-end values are multiplied by the probability of achievement of the applicable performance objective as of the applicable date; and (iii) for stock options, a Black Scholes value as of the applicable year-end or vesting date(s), determined based on the same methodology as used to determine grant date fair value but using the closing stock price on the applicable revaluation date as the current market price and with an expected life set equal to the original expected life determined at grant, reduced by the amount of time elapsed from the grant date to the revaluation date, and adjusted based on relevant factors, including taking into account the stock price on the applicable revaluation date relative to the option’s strike price determined at grant, and in all cases based on volatility and risk free rates determined as of the revaluation date based on the expected life period and based on an expected dividend rate of 0%. For additional information on the assumptions used to calculate the valuation of the awards, see the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and prior fiscal years. |

Narrative Disclosure to Pay Versus Performance Table

Relationship Between Financial Performance Measures

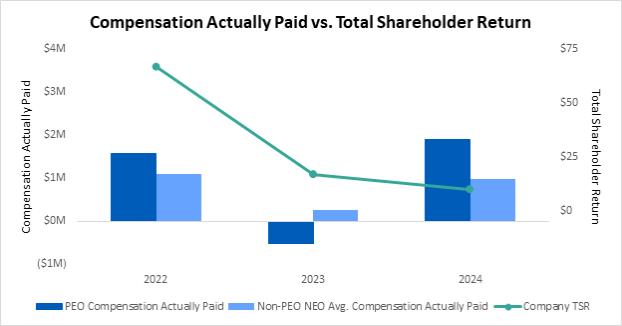

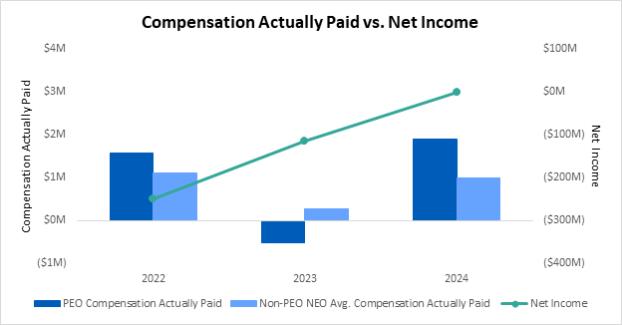

The graphs below compares the compensation actually paid to our PEO and the average of the compensation actually paid to our remaining NEOs,

with

(i) our cumulative TSR, and (ii) our net income, in each case, for the fiscal years ended December 31, 2022, 2023 and 2024. TSR amounts reported in the graph assume an initial fixed investment of $100.