| 0 Supplemental Financial Presentation February 2026 Offering everyone a piece of the American spirit—one handshake at a time. |

| 1 Important Information Forward-Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements refer to Boot Barn Holdings, Inc.’s (the “Company,” “Boot Barn,” “BOOT,” “we,” “us,” and “our,”) current expectations and projections relating to, by way of example and without limitation, the Company’s financial condition, liquidity, profitability, results of operations, margins, plans, objectives, strategies, future performance, business, and industry. You can identify forward-looking statements by the fact that they generally do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan“, “intend”, “believe”, “may”, “might”, “will”, “could”, “should”, “can have”, “likely”, “outlook”, and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events, but not all forward-looking statements contain these identifying words. These forward-looking statements are based on assumptions that the Company’s management has made in light of their industry experience and on their perceptions of historical trends, current conditions, expected future developments and other factors that they believe are appropriate under the circumstances. As you consider this presentation, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond the Company’s control), and assumptions. These risks, uncertainties, and assumptions include, but are not limited to, the following: decreases in consumer spending due to declines in consumer confidence, local economic conditions, or changes in consumer preferences; the impact that import tariffs and other trade restrictions imposed by the U.S., China, or other countries have had, and may continue to have, on our product costs and changes to U.S. or other countries’ trade policies and tariff and import/export regulations; the Company’s ability to effectively execute on its growth strategy; and the Company’s failure to maintain and enhance its strong brand image, to compete effectively, to maintain good relationships with its key suppliers, and to improve and expand its exclusive product offerings. The Company discusses the foregoing risks and other risks in greater detail under the heading “Risk factors” in the periodic reports filed by the Company with the Securities and Exchange Commission. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect the Company’s actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. Because of these factors, the Company cautions that you should not place undue reliance on any of these forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for the Company to predict those events or how they may affect the Company. Further, any forward-looking statement speaks only as of the date on which it is made. Except as required by law, the Company does not intend to update or revise the forward-looking statements in this presentation after the date of this presentation. Industry and Market Information Statements in this presentation concerning our industry and the markets in which we operate, including our general expectations and competitive position, business opportunity and market size, growth and share, are based on information from independent industry organizations and other third-party sources, data from our internal research, and management estimates. Management estimates are derived from publicly available information and the information and data referred to above and are based on assumptions and calculations made by us based upon our interpretation of such information and data. The information and data referred to above are imprecise and may prove to be inaccurate because the information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties. As a result, please be aware that the data and statistical information in this presentation may differ from information provided by our competitors or from information found in current or future studies conducted by market research institutes, consultancy firms, or independent sources. Recent Developments Our business and opportunities for growth depend on consumer discretionary spending, and as such, our results are particularly sensitive to economic conditions and consumer confidence. Inflation, changes to U.S. or other countries’ trade policies and tariff and import/export regulations, and other challenges affecting the global economy could impact our operations and will depend on future developments, which are uncertain. These and other effects make it more challenging for us to estimate the future performance of our business, particularly over the near-to-medium term. For further discussion of the uncertainties and business risks affecting the Company, see the sections captioned “Risk factors” in our periodic reports filed with the Securities and Exchange Commission. |

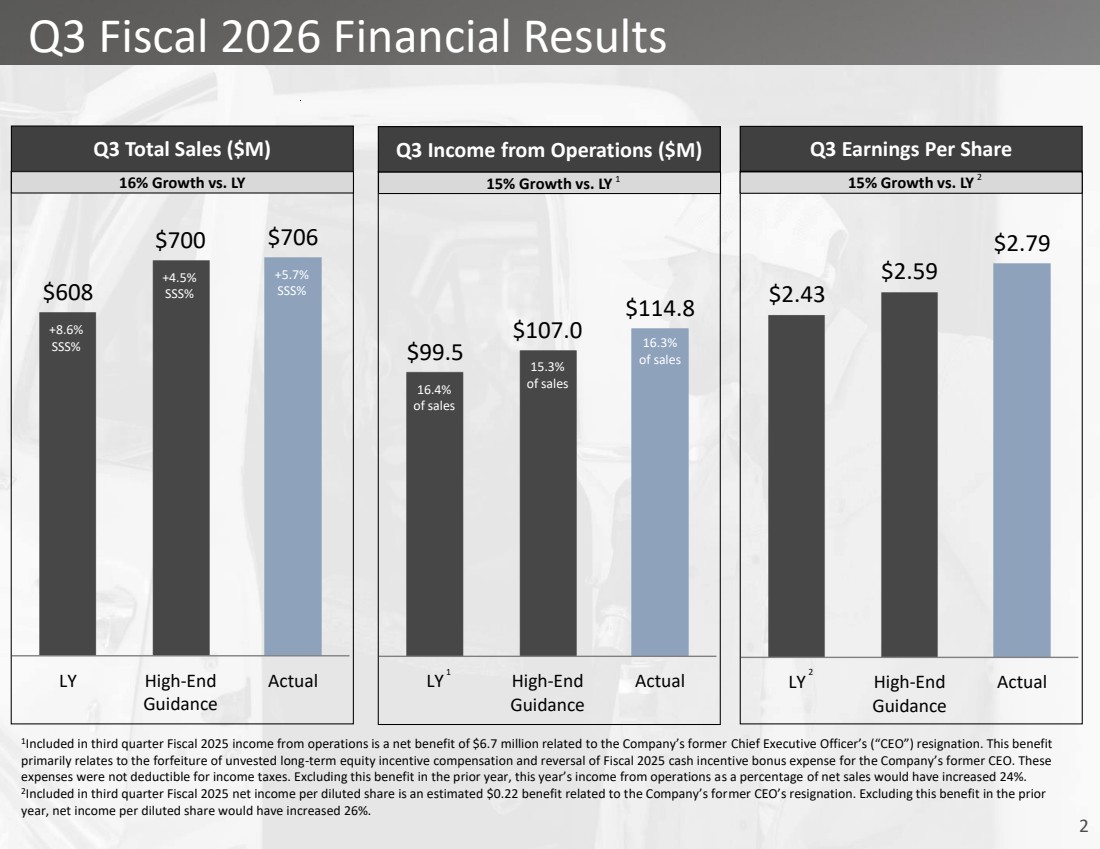

| 2 Q3 Fiscal 2026 Financial Results 1 Included in third quarter Fiscal 2025 income from operations is a net benefit of $6.7 million related to the Company’s former Chief Executive Officer’s (“CEO”) resignation. This benefit primarily relates to the forfeiture of unvested long-term equity incentive compensation and reversal of Fiscal 2025 cash incentive bonus expense for the Company’s former CEO. These expenses were not deductible for income taxes. Excluding this benefit in the prior year, this year’s income from operations as a percentage of net sales would have increased 24%. 2 Included in third quarter Fiscal 2025 net income per diluted share is an estimated $0.22 benefit related to the Company’s former CEO’s resignation. Excluding this benefit in the prior year, net income per diluted share would have increased 26%. $608 $700 $706 LY High-End Guidance Actual Q3 Total Sales ($M) Q3 Earnings Per Share $2.43 $2.59 $2.79 LY High-End Guidance Actual $99.5 $107.0 $114.8 LY High-End Guidance Actual Q3 Income from Operations ($M) 16% Growth vs. LY 15% Growth vs. LY 15% Growth vs. LY 16.4% of sales 15.3% of sales 16.3% of sales +8.6% SSS% +4.5% SSS% +5.7% SSS% 1 2 1 2 |

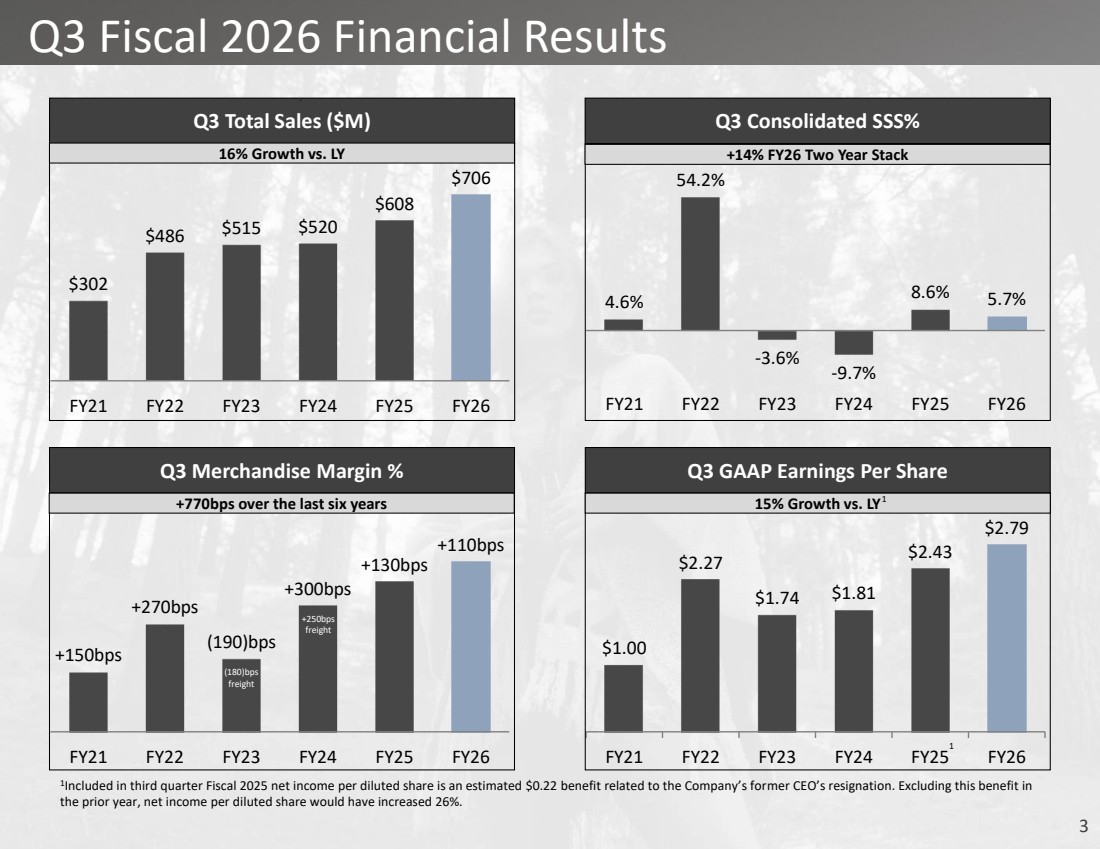

| 3 Q3 Fiscal 2026 Financial Results $302 $486 $515 $520 $608 $706 FY21 FY22 FY23 FY24 FY25 FY26 Q3 Total Sales ($M) 4.6% 54.2% -3.6% -9.7% 8.6% 5.7% FY21 FY22 FY23 FY24 FY25 FY26 Q3 Consolidated SSS% +150bps +270bps (190)bps +300bps +130bps +110bps FY21 FY22 FY23 FY24 FY25 FY26 Q3 Merchandise Margin % $1.00 $2.27 $1.74 $1.81 $2.43 $2.79 FY21 FY22 FY23 FY24 FY25 FY26 Q3 GAAP Earnings Per Share 1 Included in third quarter Fiscal 2025 net income per diluted share is an estimated $0.22 benefit related to the Company’s former CEO’s resignation. Excluding this benefit in the prior year, net income per diluted share would have increased 26%. (180)bps freight +250bps freight 1 +770bps over the last six years 16% Growth vs. LY 15% Growth vs. LY1 +14% FY26 Two Year Stack |

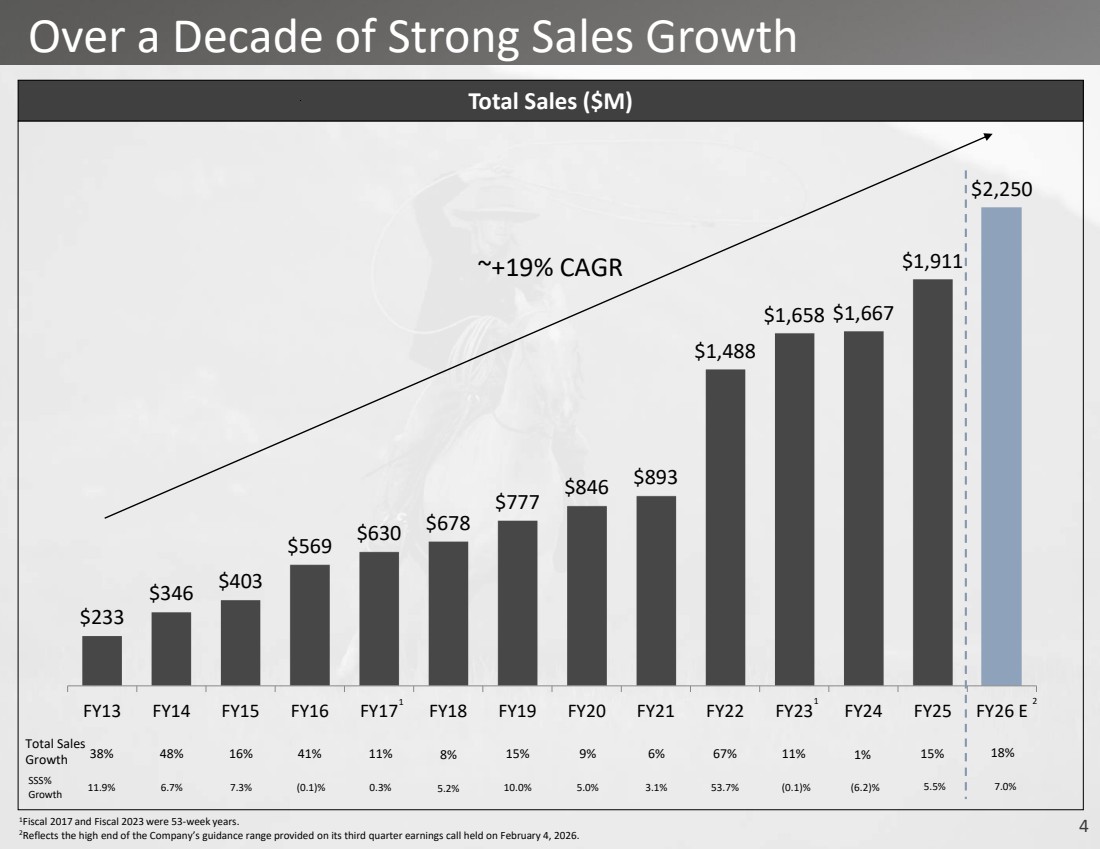

| 4 $233 $346 $403 $569 $630 $678 $777 $846 $893 $1,488 $1,658 $1,667 $1,911 $2,250 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 E Total Sales ($M) Total Sales Growth 38% 48% 16% 41% 11% 8% 15% 9% 6% 67% 11% Over a Decade of Strong Sales Growth 1 1 1Fiscal 2017 and Fiscal 2023 were 53-week years. 2Reflects the high end of the Company’s guidance range provided on its third quarter earnings call held on February 4, 2026. 1% ~+19% CAGR SSS% Growth 11.9% 6.7% 7.3% (0.1)% 0.3% 5.2% 10.0% 5.0% 3.1% 53.7% (0.1)% (6.2)% 15% 5.5% 18% 7.0% 2 |

| 5 Strategic Initiatives Update 1 2 3 4 New Stores Same Store Sales Omni-Channel Merchandise Margin & Exclusive Brands |

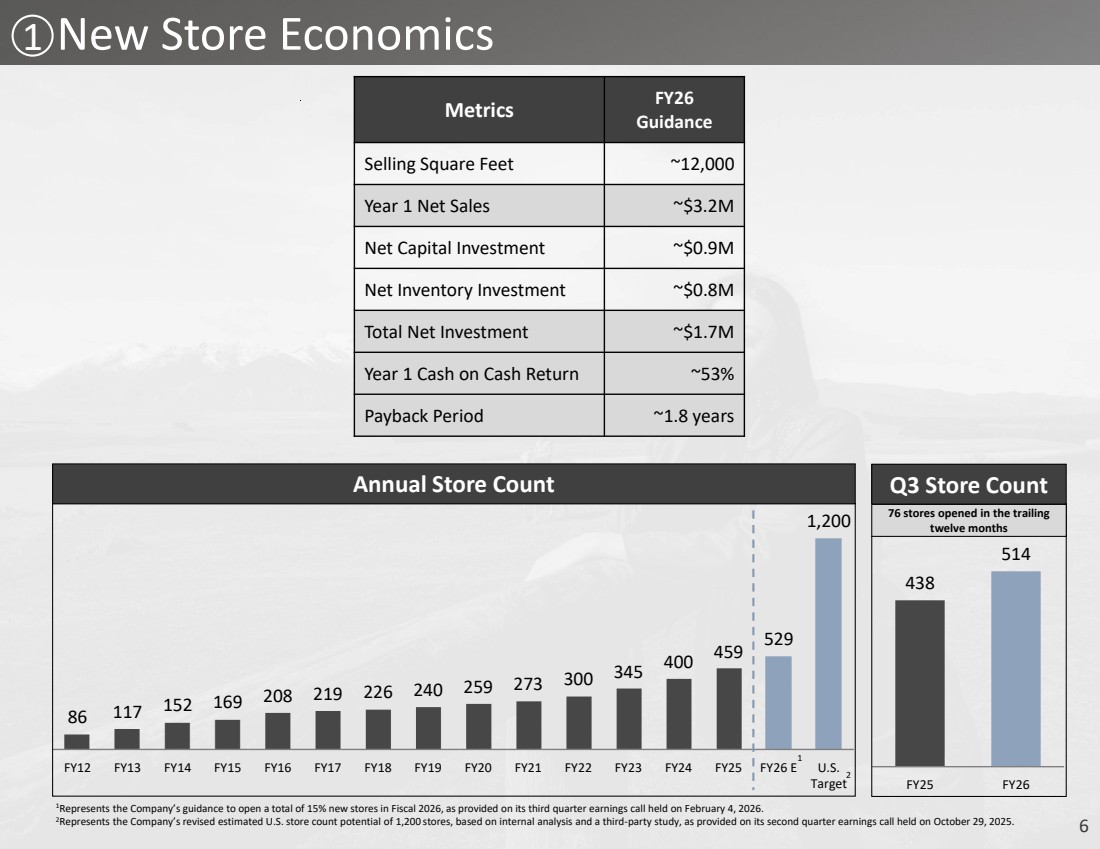

| 6 1 New Store Economics 1Represents the Company’s guidance to open a total of 15% new stores in Fiscal 2026, as provided on its third quarter earnings call held on February 4, 2026. 2Represents the Company’s revised estimated U.S. store count potential of 1,200 stores, based on internal analysis and a third-party study, as provided on its second quarter earnings call held on October 29, 2025. 86 117 152 169 208 219 226 240 259 273 300 345 400 459 529 1,200 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 E U.S. Target Annual Store Count 1 Metrics FY26 Guidance Selling Square Feet ~12,000 Year 1 Net Sales ~$3.2M Net Capital Investment ~$0.9M Net Inventory Investment ~$0.8M Total Net Investment ~$1.7M Year 1 Cash on Cash Return ~53% Payback Period ~1.8 years 438 514 FY25 FY26 Q3 Store Count 76 stores opened in the trailing twelve months 2 |

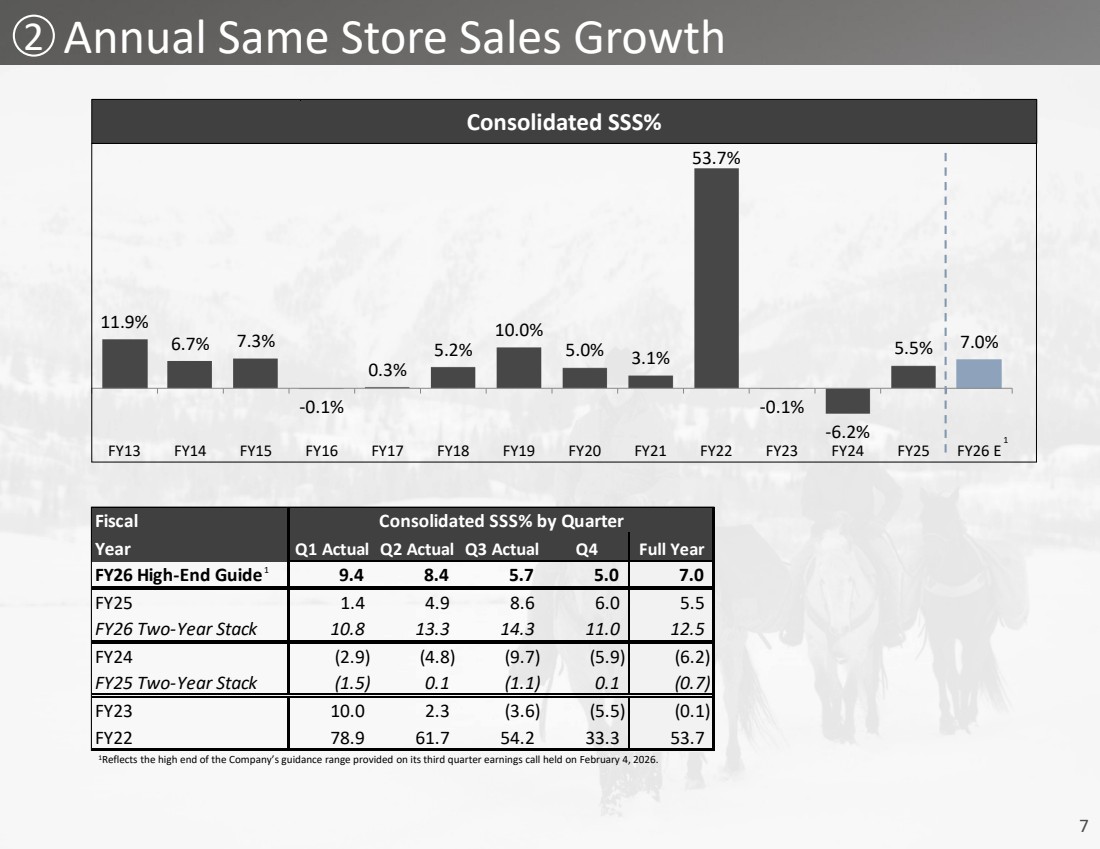

| 7 2 Annual Same Store Sales Growth 11.9% 6.7% 7.3% -0.1% 0.3% 5.2% 10.0% 5.0% 3.1% 53.7% -0.1% -6.2% 5.5% 7.0% FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 E Consolidated SSS% 1 1Reflects the high end of the Company’s guidance range provided on its third quarter earnings call held on February 4, 2026. 1 Fiscal Consolidated SSS% by Quarter Year Q1 Actual Q2 Actual Q3 Actual Q 4 Full Year FY26 High-End Guide 9.4 8.4 5.7 5.0 7.0 FY25 1.4 4.9 8.6 6.0 5.5 FY26 Two-Year Stack 10.8 13.3 14.3 11.0 12.5 FY24 (2.9) (4.8) (9.7) (5.9) (6.2) FY25 Two-Year Stack (1.5) 0.1 (1.1) 0.1 (0.7) FY23 10.0 2.3 (3.6) (5.5) (0.1) FY22 78.9 61.7 54.2 33.3 53.7 |

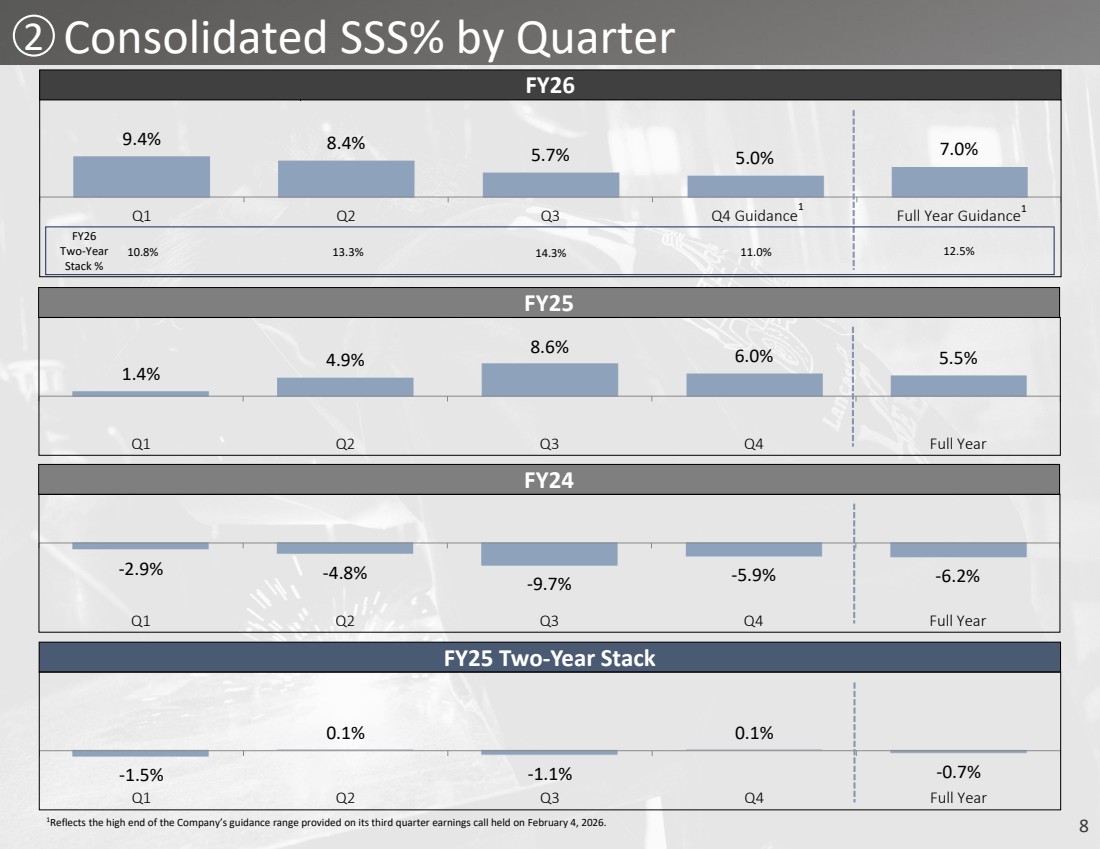

| 8 2 Consolidated SSS% by Quarter 9.4% 8.4% 5.7% 5.0% 7.0% Q1 Q2 Q3 Q4 Guidance Full Year Guidance FY26 FY25 Two-Year Stack 1 FY25 FY24 1.4% 4.9% 8.6% 6.0% 5.5% Q1 Q2 Q3 Q4 Full Year -2.9% -4.8% -9.7% -5.9% -6.2% Q1 Q2 Q3 Q4 Full Year -1.5% 0.1% -1.1% 0.1% -0.7% Q1 Q2 Q3 Q4 Full Year 1 FY26 Two-Year Stack % 10.8% 13.3% 14.3% 11.0% 12.5% 1Reflects the high end of the Company’s guidance range provided on its third quarter earnings call held on February 4, 2026. |

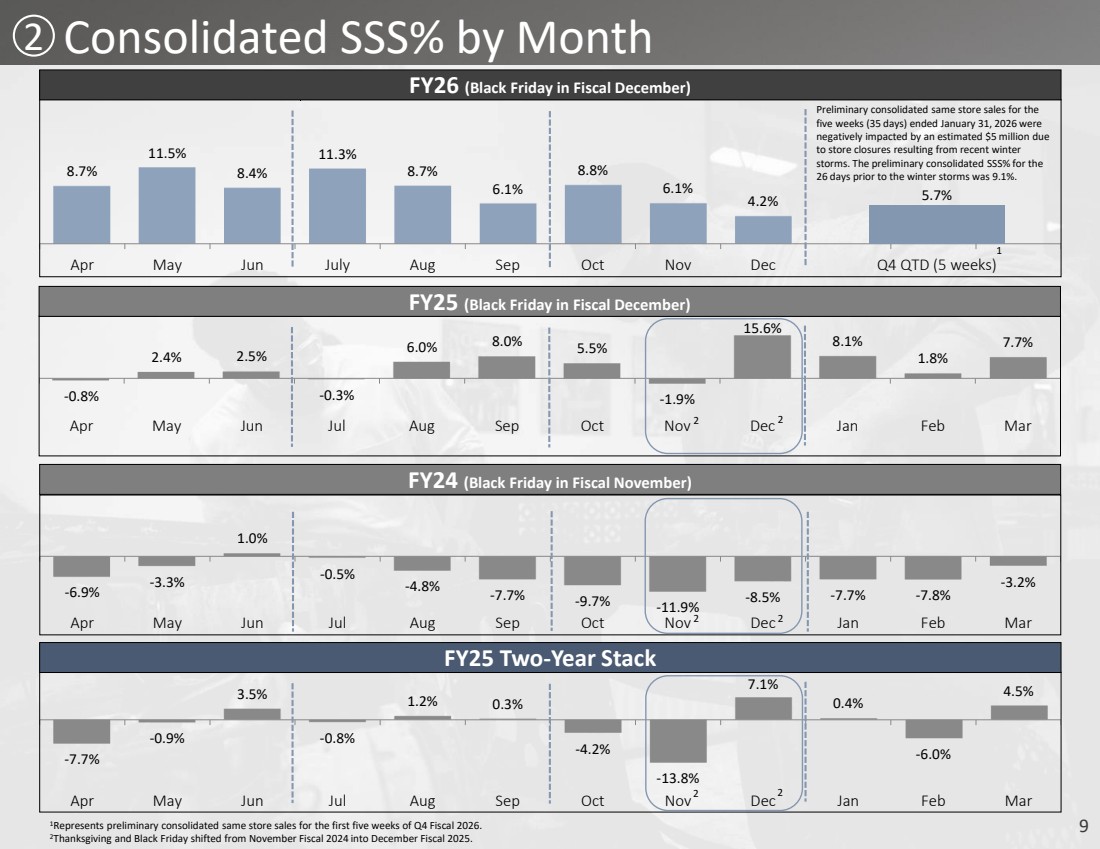

| 9 2 Consolidated SSS% by Month 1Represents preliminary consolidated same store sales for the first five weeks of Q4 Fiscal 2026. 2Thanksgiving and Black Friday shifted from November Fiscal 2024 into December Fiscal 2025. 8.7% 11.5% 8.4% 11.3% 8.7% 6.1% 8.8% 6.1% 4.2% Apr May Jun July Aug Sep Oct Nov Dec FY26 (Black Friday in Fiscal December) -7.7% -0.9% 3.5% -0.8% 1.2% 0.3% -4.2% -13.8% 7.1% 0.4% -6.0% 4.5% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 Two-Year Stack -0.8% 2.4% 2.5% -0.3% 6.0% 8.0% 5.5% -1.9% 15.6% 8.1% 1.8% 7.7% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 (Black Friday in Fiscal December) FY24 (Black Friday in Fiscal November) -6.9% -3.3% 1.0% -0.5% -4.8% -7.7% -9.7% -11.9% -8.5% -7.7% -7.8% -3.2% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 1 2 2 2 2 2 2 5.7% Q4 QTD (5 weeks) Preliminary consolidated same store sales for the five weeks (35 days) ended January 31, 2026 were negatively impacted by an estimated $5 million due to store closures resulting from recent winter storms. The preliminary consolidated SSS% for the 26 days prior to the winter storms was 9.1%. |

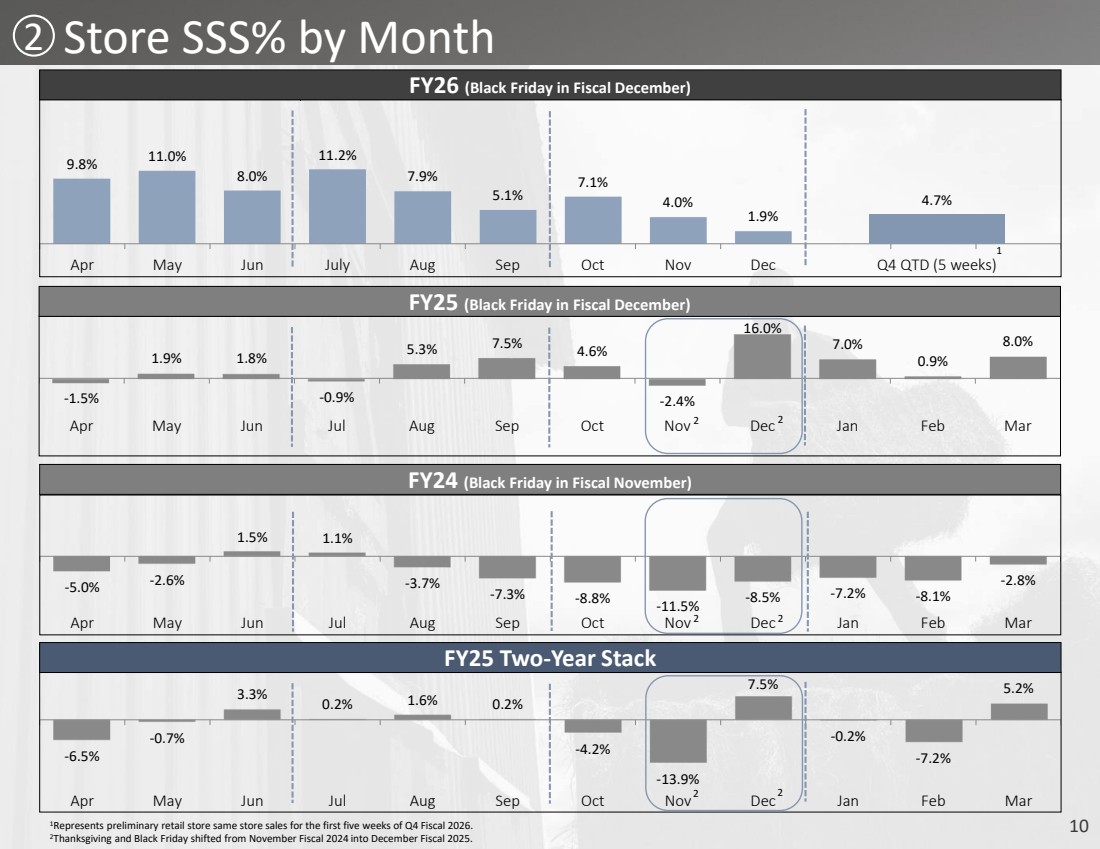

| 10 2 Store SSS% by Month 1Represents preliminary retail store same store sales for the first five weeks of Q4 Fiscal 2026. 2Thanksgiving and Black Friday shifted from November Fiscal 2024 into December Fiscal 2025. 9.8% 11.0% 8.0% 11.2% 7.9% 5.1% 7.1% 4.0% 1.9% Apr May Jun July Aug Sep Oct Nov Dec FY26 (Black Friday in Fiscal December) -6.5% -0.7% 3.3% 0.2% 1.6% 0.2% -4.2% -13.9% 7.5% -0.2% -7.2% 5.2% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 Two-Year Stack -1.5% 1.9% 1.8% -0.9% 5.3% 7.5% 4.6% -2.4% 16.0% 7.0% 0.9% 8.0% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 (Black Friday in Fiscal December) FY24 (Black Friday in Fiscal November) -5.0% -2.6% 1.5% 1.1% -3.7% -7.3% -8.8% -11.5% -8.5% -7.2% -8.1% -2.8% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 1 2 2 2 2 2 2 4.7% Q4 QTD (5 weeks) |

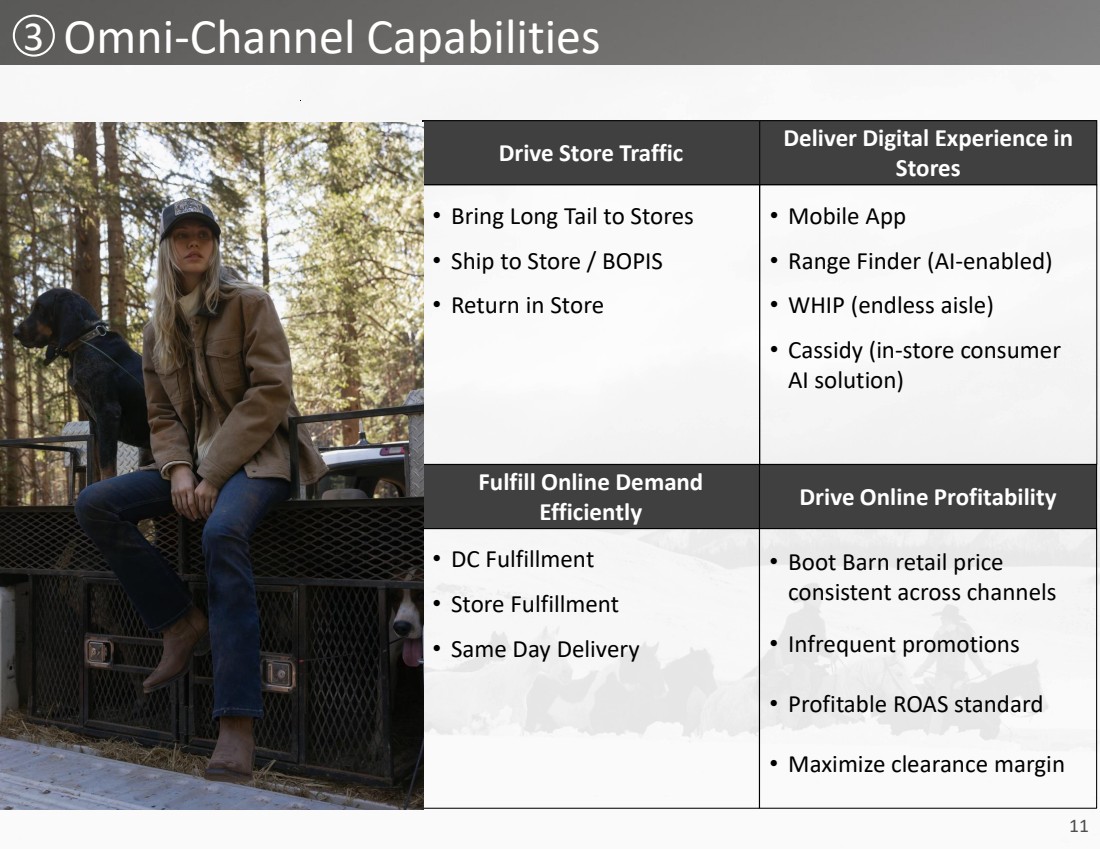

| 11 3 Omni-Channel Capabilities Drive Store Traffic • Bring Long Tail to Stores • Ship to Store / BOPIS • Return in Store Deliver Digital Experience in Stores • Mobile App • Range Finder (AI-enabled) • WHIP (endless aisle) • Cassidy (in-store consumer AI solution) Fulfill Online Demand Efficiently • DC Fulfillment • Store Fulfillment • Same Day Delivery Drive Online Profitability • Boot Barn retail price consistent across channels • Infrequent promotions • Profitable ROAS standard • Maximize clearance margin |

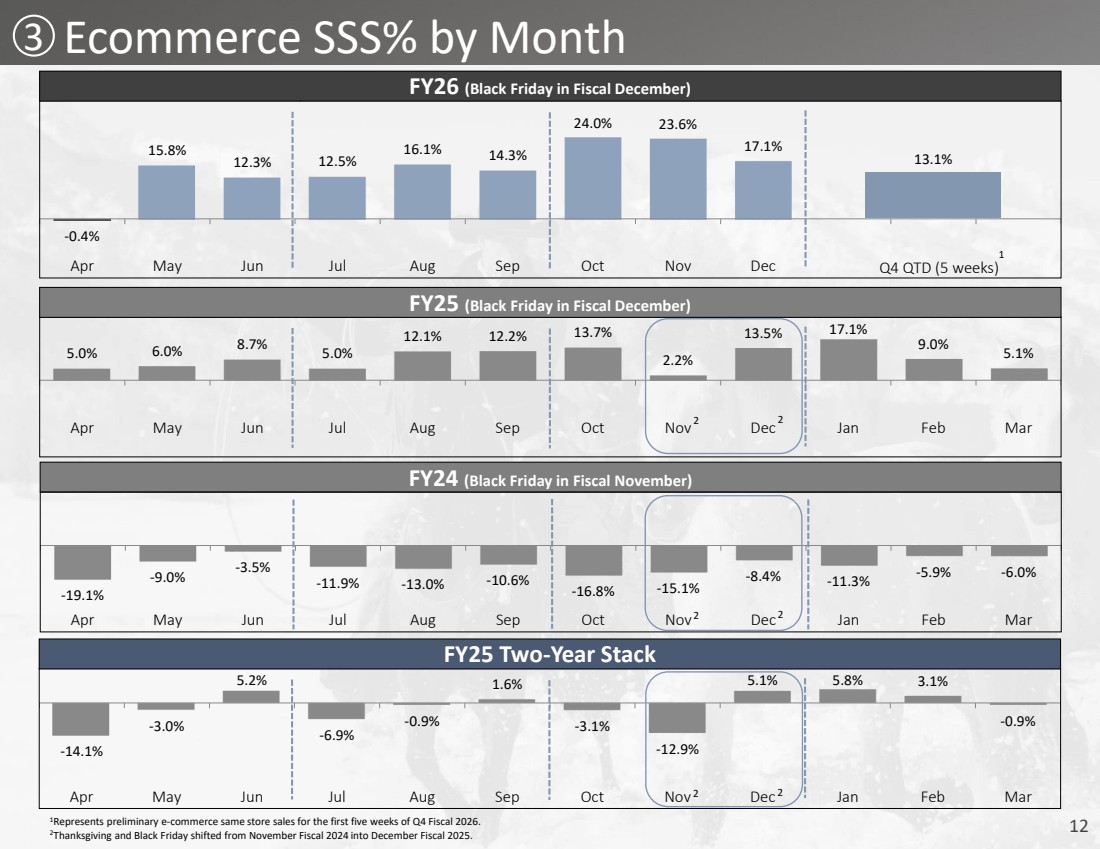

| 12 3 Ecommerce SSS% by Month -0.4% 15.8% 12.3% 12.5% 16.1% 14.3% 24.0% 23.6% 17.1% Apr May Jun Jul Aug Sep Oct Nov Dec FY26 (Black Friday in Fiscal December) -14.1% -3.0% 5.2% -6.9% -0.9% 1.6% -3.1% -12.9% 5.1% 5.8% 3.1% -0.9% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 Two-Year Stack 5.0% 6.0% 8.7% 5.0% 12.1% 12.2% 13.7% 2.2% 13.5% 17.1% 9.0% 5.1% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar FY25 (Black Friday in Fiscal December) FY24 (Black Friday in Fiscal November) -19.1% -9.0% -3.5% -11.9% -13.0% -10.6% -16.8% -15.1% -8.4% -11.3% -5.9% -6.0% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 1Represents preliminary e-commerce same store sales for the first five weeks of Q4 Fiscal 2026. 2Thanksgiving and Black Friday shifted from November Fiscal 2024 into December Fiscal 2025. 2 2 2 2 2 2 1 13.1% Q4 QTD (5 weeks) |

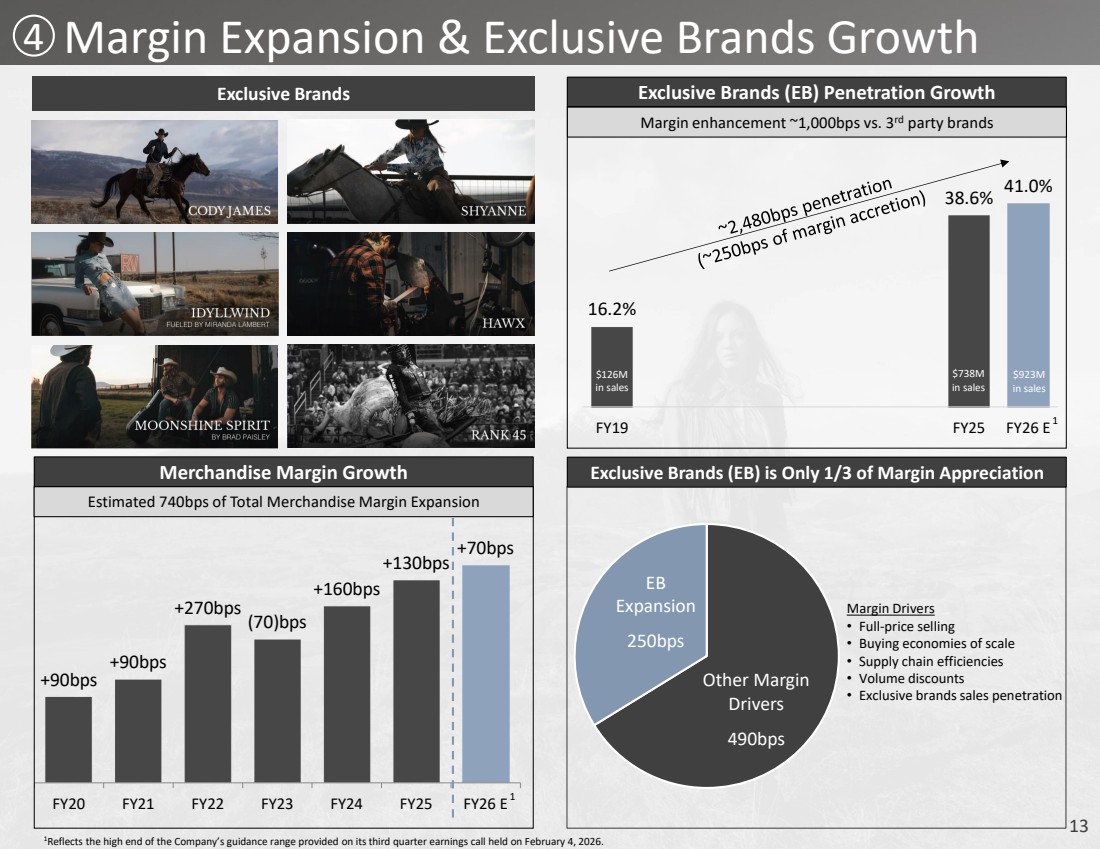

| 13 4 Margin Expansion & Exclusive Brands Growth Margin Drivers • Full-price selling • Buying economies of scale • Supply chain efficiencies • Volume discounts • Exclusive brands sales penetration Exclusive Brands (EB) Penetration Growth 16.2% 38.6% 41.0% FY19 FY25 FY26 E Exclusive Brands (EB) is Only 1/3 of Margin Appreciation EB Expansion 250bps Other Margin Drivers 490bps +90bps +90bps +270bps (70)bps +160bps +130bps +70bps FY20 FY21 FY22 FY23 FY24 FY25 FY26 E Merchandise Margin Growth Estimated 740bps of Total Merchandise Margin Expansion Exclusive Brands Margin enhancement ~1,000bps vs. 3rd party brands 1 1 1Reflects the high end of the Company’s guidance range provided on its third quarter earnings call held on February 4, 2026. $923M in sales $738M in sales $126M in sales |

| 14 FY26 Guidance |

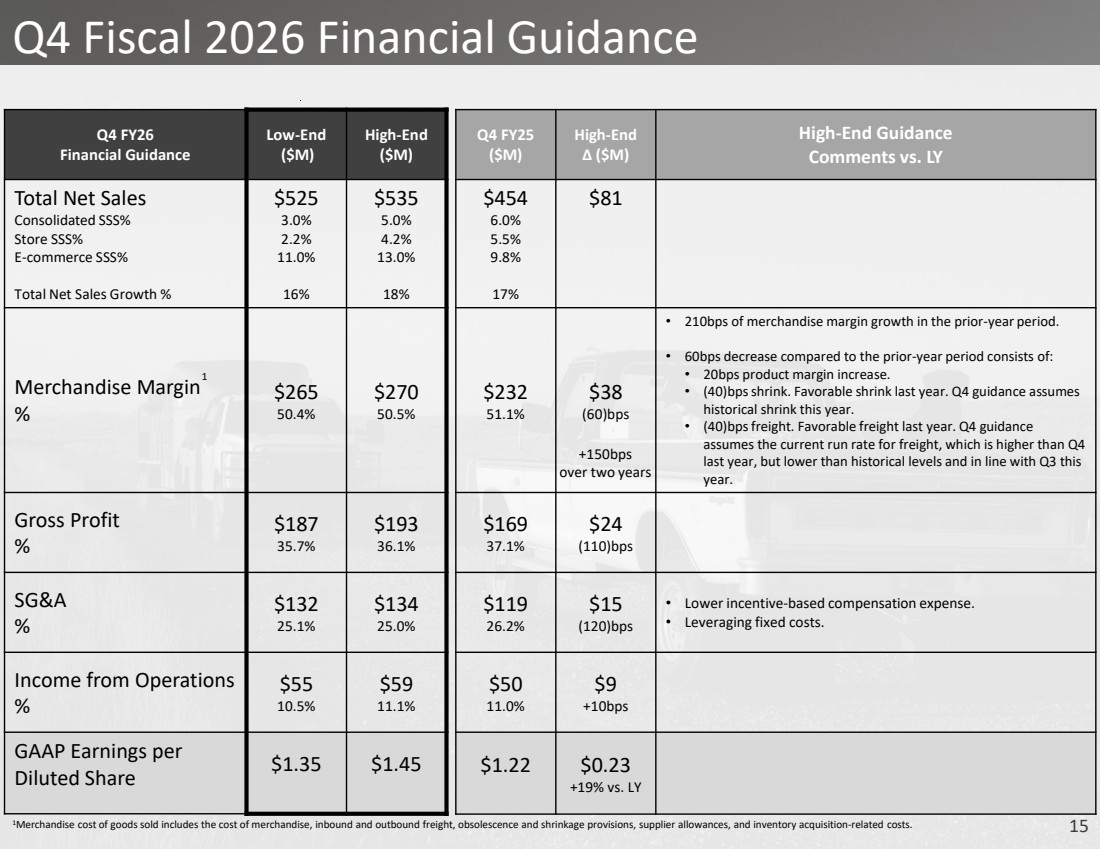

| 15 Q4 Fiscal 2026 Financial Guidance Q4 FY26 Financial Guidance Low-End ($M) High-End ($M) Total Net Sales Consolidated SSS% Store SSS% E-commerce SSS% Total Net Sales Growth % $525 3.0% 2.2% 11.0% 16% $535 5.0% 4.2% 13.0% 18% Merchandise Margin % $265 50.4% $270 50.5% Gross Profit % $187 35.7% $193 36.1% SG&A % $132 25.1% $134 25.0% Income from Operations % $55 10.5% $59 11.1% GAAP Earnings per Diluted Share $1.35 $1.45 1 1Merchandise cost of goods sold includes the cost of merchandise, inbound and outbound freight, obsolescence and shrinkage provisions, supplier allowances, and inventory acquisition-related costs. Q4 FY25 ($M) High-End Δ ($M) High-End Guidance Comments vs. LY $454 6.0% 5.5% 9.8% 17% $81 $232 51.1% $38 (60)bps • 210bps of merchandise margin growth in the prior-year period. • 60bps decrease compared to the prior-year period consists of: • 20bps product margin increase. • (40)bps shrink. Favorable shrink last year. Q4 guidance assumes historical shrink this year. • (40)bps freight. Favorable freight last year. Q4 guidance assumes the current run rate for freight, which is higher than Q4 last year, but lower than historical levels and in line with Q3 this year. $169 37.1% $24 (110)bps $119 26.2% $15 (120)bps • Lower incentive-based compensation expense. • Leveraging fixed costs. $50 11.0% $9 +10bps $1.22 $0.23 +19% vs. LY +150bps over two years |

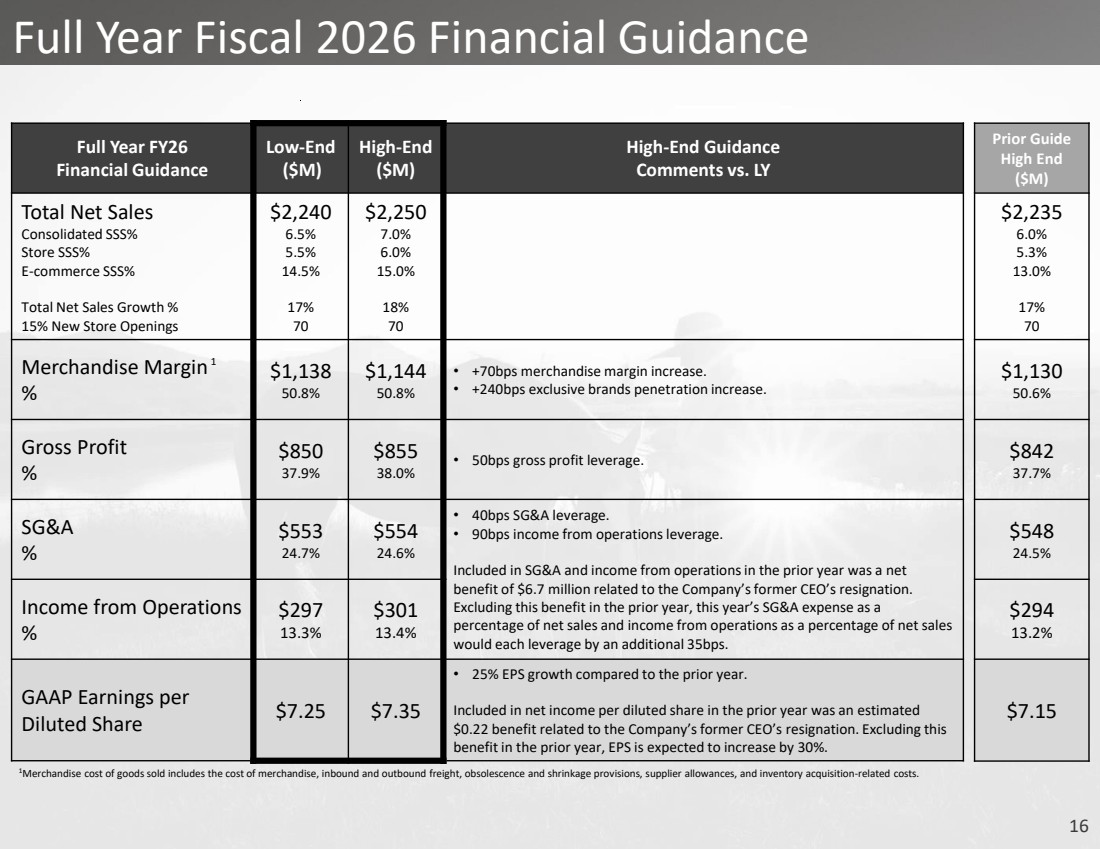

| 16 Full Year Fiscal 2026 Financial Guidance Full Year FY26 Financial Guidance Low-End ($M) High-End ($M) High-End Guidance Comments vs. LY Total Net Sales Consolidated SSS% Store SSS% E-commerce SSS% Total Net Sales Growth % 15% New Store Openings $2,240 6.5% 5.5% 14.5% 17% 70 $2,250 7.0% 6.0% 15.0% 18% 70 Merchandise Margin % $1,138 50.8% $1,144 50.8% • +70bps merchandise margin increase. • +240bps exclusive brands penetration increase. Gross Profit % $850 37.9% $855 38.0% • 50bps gross profit leverage. SG&A % $553 24.7% $554 24.6% • 40bps SG&A leverage. • 90bps income from operations leverage. Included in SG&A and income from operations in the prior year was a net benefit of $6.7 million related to the Company’s former CEO’s resignation. Excluding this benefit in the prior year, this year’s SG&A expense as a percentage of net sales and income from operations as a percentage of net sales would each leverage by an additional 35bps. Income from Operations % $297 13.3% $301 13.4% GAAP Earnings per Diluted Share $7.25 $7.35 • 25% EPS growth compared to the prior year. Included in net income per diluted share in the prior year was an estimated $0.22 benefit related to the Company’s former CEO’s resignation. Excluding this benefit in the prior year, EPS is expected to increase by 30%. 1 1Merchandise cost of goods sold includes the cost of merchandise, inbound and outbound freight, obsolescence and shrinkage provisions, supplier allowances, and inventory acquisition-related costs. Prior Guide High End ($M) $2,235 6.0% 5.3% 13.0% 17% 70 $1,130 50.6% $842 37.7% $548 24.5% $294 13.2% $7.15 |

| 17 investor.bootbarn.com |