Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box: |

☐Preliminary Proxy Statement |

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒Definitive Proxy Statement |

☐Definitive Additional Materials |

☐Soliciting Material under §240.14a-12 |

Payment of Filing Fee (Check all boxes that apply): |

☒No fee required. |

☐Fee paid previously with preliminary materials. |

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| March 12, 2025 |  | ||

| NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS |

¾ |  |  | ||||

Date and Time Friday, April 25, 2025 at 8:00 a.m. (Eastern Time) | Location 1775 Tysons Blvd. Tysons, VA 22102 | Who Can Vote Stockholders of record as of the close of business on March 3, 2025 will be entitled to notice of and to vote at the 2025 annual meeting of stockholders and any adjournment or postponement of the annual meeting | ||||

Proposals That Require Your Vote | Board Recommendation | |||

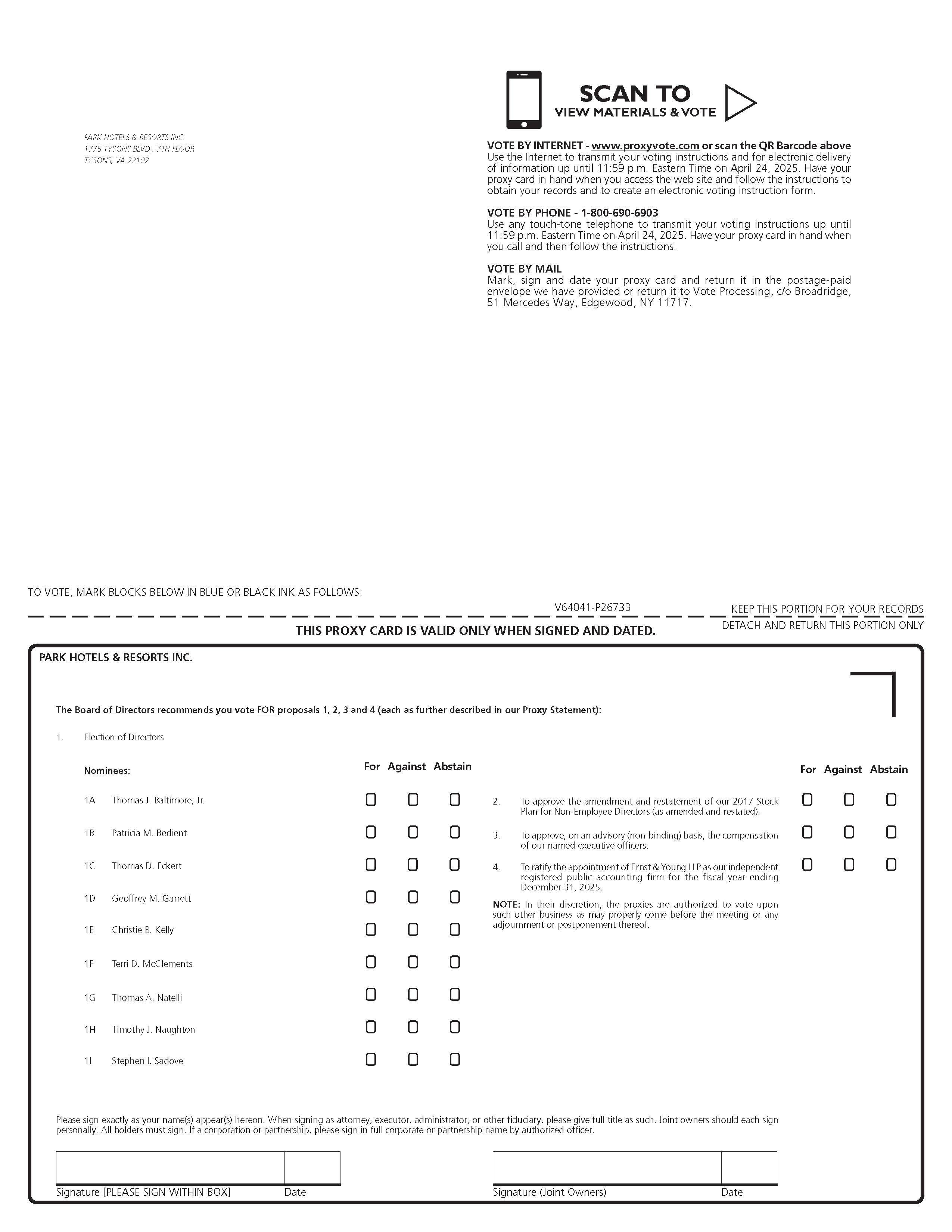

1 | Elect nine director nominees named in this Proxy Statement | FOR each nominee | ||

2 | Approve the amendment and restatement of our 2017 Stock Plan for Non-Employee Directors (as amended and restated) | FOR | ||

3 | Approve, on an advisory (non-binding) basis, our named executive officer compensation | FOR | ||

4 | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025 | FOR | ||

- | Mail If you received printed proxy materials, mark, sign, date and return the enclosed Proxy Card or Voting Instruction Form in the postage-paid envelope | ( | Telephone 1-800-690-6903 | : | Internet https://www.proxyvote.com | ||||||

| Nancy M. Vu Executive Vice President, General Counsel and Secretary March 12, 2025 |

Page | |

Page | |

Page | |

| 2025 PROXY STATEMENT | 1 |

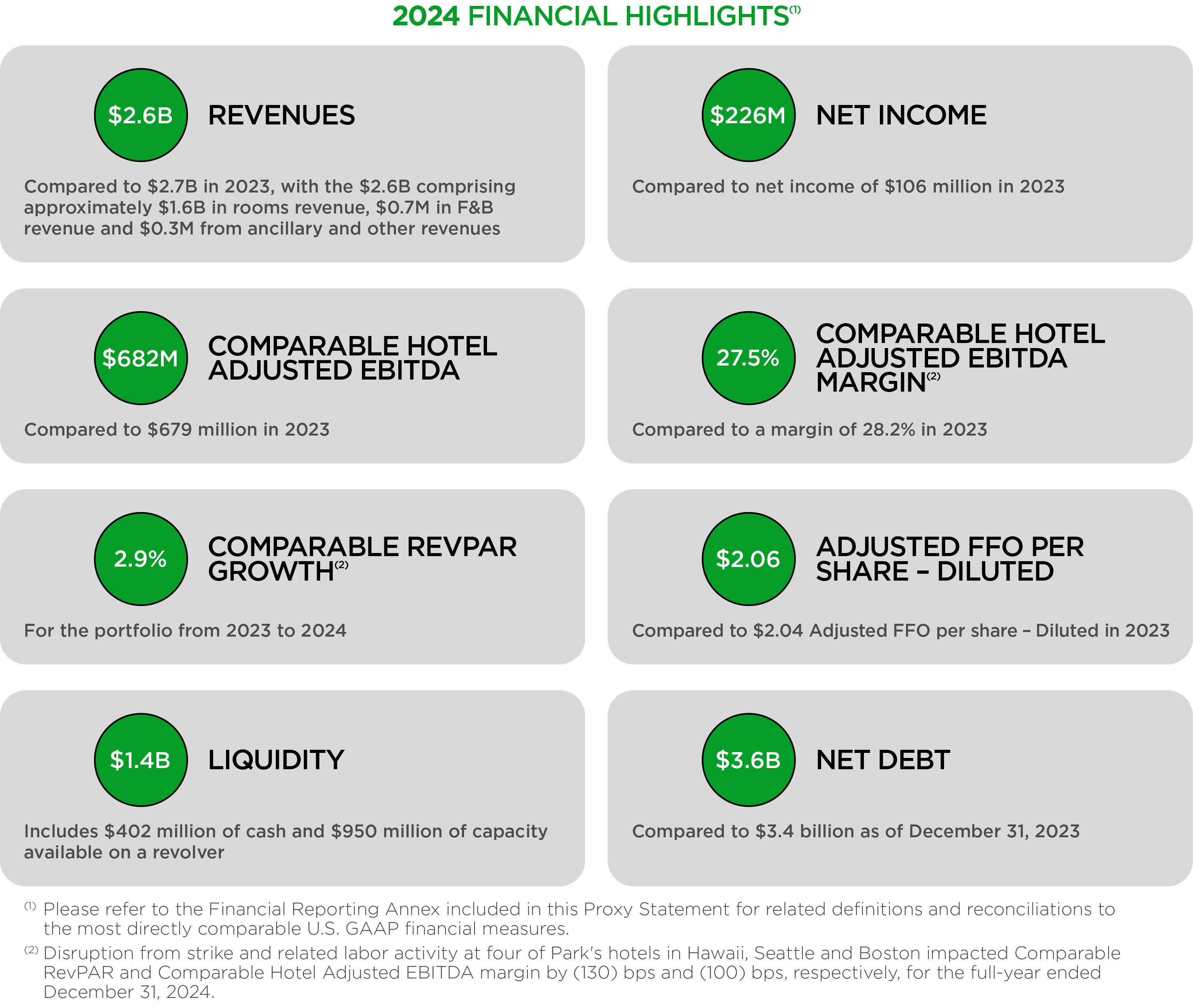

OPERATIONAL EXCELLENCE THROUGH ACTIVE ASSET MANAGEMENT | We collaborate with our third-party managers to improve property-level operating performance and profitability through our proactive asset management efforts. We continue to identify revenue-enhancement opportunities and drive cost efficiencies to maximize the operating performance, cash flow and value of each property. | |

PRUDENT CAPITAL ALLOCATION | We intend to leverage our scale, liquidity and transaction expertise to create value throughout all phases of the lodging cycle through opportunistic acquisitions, dispositions and/or corporate transactions, in addition to value enhancing return on investment projects, which we believe will enable us to further diversify our portfolio. | |

STRONG AND FLEXIBLE BALANCE SHEET | We intend to maintain a strong and flexible balance sheet that will enable us to navigate the various seasons of the lodging cycle. We expect to maintain sufficient liquidity across the lodging cycle and access to multiple types of financing, including corporate bonds and credit facilities. | |

2 | 2025 PROXY STATEMENT |  |

Reshaping the Park Portfolio | Reinvesting in the Portfolio | Strengthening our Balance Sheet | Returns to Stockholders | |||||

Disposed of three non-core assets in 2024, including the sale of two joint venture hotels for a combined $200 million. Since 2017, in an effort to reshape the portfolio, Park has disposed of 45 hotels* for over $3 billion. | During fiscal year 2024, Park invested nearly $230 million on capital improvements in its portfolio. | Well-positioned to continue executing on our strategic initiatives with approximately $1.4 billion of liquidity at the end of fiscal year 2024. | In fiscal year 2024, Park returned over $400 million to stockholders through $116 million in stock repurchases, as well as another $287 million in dividends. | |||||

| 2025 PROXY STATEMENT | 3 |

4 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 5 |

6 | 2025 PROXY STATEMENT |  |

Special Offerings & Initiatives | ||||||

•All associates provided hybrid- working option where associates may work from home one day per week | •“Wellness Wednesdays” sessions provided to all associates, targeted at improving the physical, social, mental and spiritual well-being of our associates through regular company-wide virtual and in-person events | •Created opportunity for connection between associates and Park leadership through Executive Fireside Chats, in which associates learn about our executives’ backgrounds, journeys and personal stories | ||||

•Conducted annual compensation analysis by position for both gender and ethnicity - 2024 results revealed no pay disparities | •In 2024, our Engagement Survey reported that 95% of our associates believe people of all cultures and backgrounds are valued and appreciated at Park as demonstrated by Park’s commitment to fair treatment and full participation of people from all backgrounds | •Conducted mandatory training on various topics including our Code of Conduct, ethical business practices, anti- harassment policies, unconscious bias, respect and fair treatment for all | ||||

•Recognize the cultural, religious and secular holidays which may impact our associates by granting a Floating Holiday, reflecting Park’s commitment to being inclusive of the different customs, traditions and needs of our associates | •CEO and Executive Committee members led small-group sessions, providing associates with a direct means of communication and an opportunity for open dialogue with senior leadership | •Introduced an Associate Recognition Program to encourage and reinforce retention among associates | ||||

•Continued to fully pay health insurance premiums for all Park associates and eligible dependents | •Provided Paid Parental Leave with equal time off for male and female associates | •Conducted Annual Associate Engagement Survey and an ad hoc additional pulse survey in 2024 | ||||

•Continued to support our local community by engaging/supporting local charitable activities, such as the Salvation Army’s Angel Tree program and Arlington’s True Ground Housing Partnership’s School Supply Drive | •Participated in Don Bosco Work Study Program, providing work study internships for high-school students from underprivileged areas in the Washington D.C. community | •Wellness Day provided to associates, in which the corporate office was closed in order to encourage each associate to take the day to focus on their overall well-being | ||||

| 2025 PROXY STATEMENT | 7 |

8 | 2025 PROXY STATEMENT |  |

Date and Time | Record Date | |

April 25, 2025 at 8:00 a.m. (Eastern Time) | March 3, 2025 | |

Location | Number of Shares of Common Stock Outstanding and Eligible to Vote at the Meeting as of the Record Date | |

1775 Tysons Blvd., Tysons, Virginia 22102 | 201,864,175 shares of common stock | |

Proposal 1 | Election of Directors The Board, acting upon the recommendation of the Governance Committee, has nominated all nine of the directors currently serving on the Board for re-election. Through their experience, skills and perspectives, which span various industries and organizations, these director nominees represent a Board that is diverse and possesses the appropriate collective qualifications, skills, knowledge and attributes to provide effective oversight of the Company’s business and quality advice and counsel to the Company’s management. | ||||

Proposal 2 | Approve the Amendment and Restatement of our 2017 Stock Plan for Non-Employee Directors (as Amended and Restated) We believe that the amendment and restatement of the 2017 Stock Plan for Non-Employee Directors (as amended and restated) to, among other changes, increase the number of shares of the Company’s common stock available for issuance under such plan and extend the term of such plan for another ten years will enable the Company to continue to attract and retain experienced and sophisticated directors to guide the Company’s future growth. | ||||

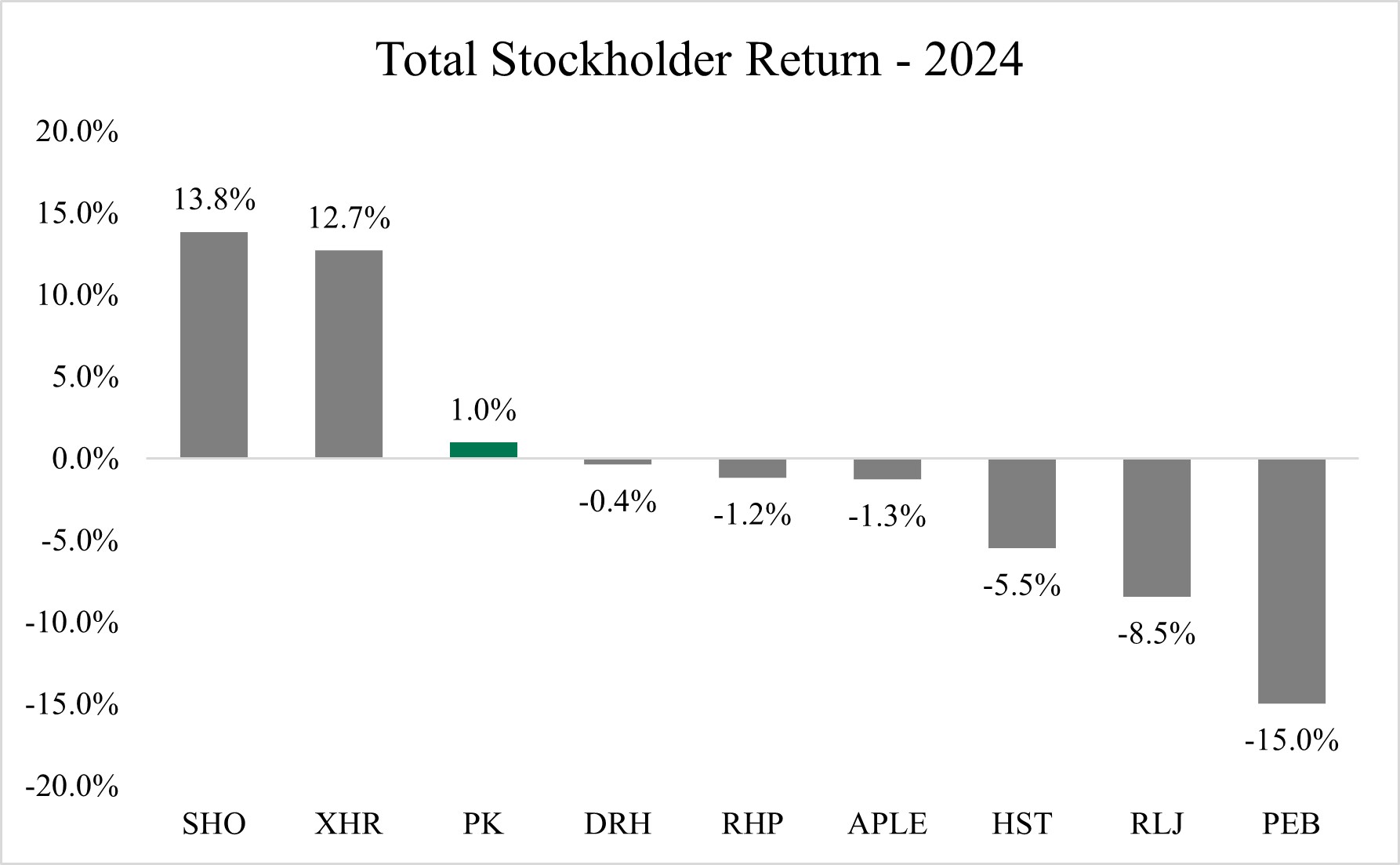

Proposal 3 | Advisory Vote on Executive Compensation (Say-on-Pay Vote) We believe our compensation program provides the appropriate mix of fixed and at-risk compensation. Both the executive short- and long-term incentive programs reward achievement of financial and operational goals, relative TSR and encourage individual performance that is in line with our long-term strategy, are aligned with stockholder interests and remain competitive with our industry peers. | ||||

Proposal 4 | Ratification of the Appointment of Ernst & Young LLP The Audit Committee has appointed Ernst & Young LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2025. This appointment is being submitted to stockholders for ratification. | ||||

| 2025 PROXY STATEMENT | 9 |

Committee Memberships | |||||||||||||

Name | Independent | Director Since | AC | CC | GC | Other Public Company Boards | |||||||

Thomas J. Baltimore, Jr. (Chairman) | -- | 2016 | 2 | ||||||||||

Patricia M. Bedient | ✓ | 2017 |  |  | 2 | ||||||||

Thomas D. Eckert | ✓ | 2019 |  |  | 1 | ||||||||

Geoffrey M. Garrett | ✓ | 2017 |  |  | -- | ||||||||

Christie B. Kelly | ✓ | 2016 |  |  | 1 | ||||||||

Terri D. McClements | ✓ | 2024 |  | -- | |||||||||

Thomas A. Natelli | ✓ | 2019 |  |  | -- | ||||||||

Timothy J. Naughton | ✓ | 2017 |  |  | 2 | ||||||||

Stephen I. Sadove (Lead Independent Director) | ✓ | 2017 |  |  | 2 | ||||||||

AC | Audit Committee | CC | Compensation & Human Capital Committee | |||

GC | Nominating, Governance & Corporate Responsibility Committee |  | Chair of the Committee | |||

10 | 2025 PROXY STATEMENT |  |

4 out of 9 Accounting/ Financial Expertise | 9 out of 9 Accounting/ Financial Literacy | 9 out of 9 Board of Directors Experience | 9 out of 9 Business Operations Experience | 9 out of 9 Executive Experience | ||||||||||||||

8 out of 9 Financial/ Capital Markets Experience | 3 out of 9 Lodging Industry Knowledge | 9 out of 9 Management Experience | 9 out of 9 Real Estate Experience | 8 out of 9 Prior REIT Experience | ||||||||||||||

6 out of 9 Retail Experience | 9 out of 9 Risk Management Experience | 4 out of 9 Technology/ Cyber Systems Knowledge |

Our Practices and Policies | ||||

•Annual election of all directors with majority voting standard in uncontested elections and director resignation policy | •Robust annual Board and committee evaluation process | •One class of common stock, with each share carrying equal voting rights - a one share, one vote standard | ||

•100% independent Board committees | •Active stockholder outreach and engagement, with feedback provided to the Board | •44% of our directors are either female (3 directors) or represent ethnic/racial diversity (1 director) | ||

•25% threshold for stockholders to request a special meeting | •Regular executive sessions, where independent directors meet without management present | •Board approved Policy Regarding Diversity as a Consideration for Board Nominations, confirming the Board’s commitment to actively seeking out diverse candidates | ||

•8 out of our 9 director nominees are independent | •Opted-out of Delaware’s anti-takeover protections | •Adopted proxy access right for director nominees | ||

•Strong Lead Independent Director position, elected by the independent directors | •Stockholders holding 50% or more of our outstanding shares have right to amend our by-laws (no super- majority vote requirements) | •No stockholder rights plan (“Poison Pill”) |

| 2025 PROXY STATEMENT | 11 |

Board Independence | Board & Committee Meetings in Fiscal Year 2024 | Director Elections | ||

Lead Independent Director with Expansive Duties Stephen I. Sadove | Audit Committee Meetings 4 Compensation & Human Capital Committee Meetings 7 Nominating, Governance & Corporate Responsibility Committee Meetings 2 | Proxy Access for Director Nominations Ownership Threshold: 3% Holding Period: 3 Years Nominees: Greater of 2 or 20% of Board Group Formation: Up to 20 stockholders | ||

12 | 2025 PROXY STATEMENT |  |

Engagement in 2024 | Participants | Response to Stockholder Feedback in Recent Years | |||

As part of our regular stockholder outreach in 2024, we reached out to stockholders representing approximately 52% of our outstanding shares of common stock to invite them to participate in calls with members of the Company’s senior management team. However, as we had recently spoken to a significant number of our larger stockholders over the last few years and in light of our favorable say-on-pay results over the last few years, many of our investors declined our invitation to speak. | Outreach was conducted by a cross-functional team including our: •EVP & General Counsel •SVP, Corporate Strategy and Investor Relations •EVP, Design and Construction •VP & Assistant General Counsel – Corporate Stockholder feedback was communicated to our Board. | We have received valuable feedback from our stockholders over the last few years during our stockholder outreach. In response to the stockholder feedback received, the Compensation Committee and the Board have taken certain actions, including: | |||

•APPOINTMENT OF NEW DIRECTOR. In January 2024 and in response to stockholder feedback received over the proceeding few years, the Board demonstrated its firm commitment to enhancing the female representation on our Board by successfully identifying and appointing an additional well- qualified and experienced woman director to the Board. | |||||

•CONTINUE TO PAY FOR PERFORMANCE. In response to stockholder feedback received in 2021, the Compensation Committee increased the performance-based portion for executive’s target annual equity award and the Committee has continued to award a significant portion of each executive’s target annual equity award in the form of performance stock unit (“PSUs”) awards as follows: ◦65% of the annual award in PSUs for our Chief Executive Officer ◦60% of the annual award in PSUs for our other named executive officers Additionally, the Compensation Committee continues the practice of using a PSU award modifier, resulting in a limitation on the payout of certain officers’ PSUs in the event of a negative TSR during the applicable performance period. | |||||

•CONTINUE RIGOR OF TARGETS. In recent years, the Compensation Committee has confirmed a return to Park’s traditional executive compensation framework and provided enhanced disclosure outlining the rigor of the corporate objectives that affect compensation. | |||||

•MAINTAINING STRONG CORPORATE GOVERNANCE. Stockholders have continued to express the importance of strong corporate governance practices. The Board continually evaluates and updates corporate policies (as appropriate) to maintain strong corporate governance practices. In recent years, corporate policies that have been updated include the Company’s incentive compensation clawback policy that was updated in order to provide for the mandatory recovery from current and former officers of incentive-based compensation that was erroneously awarded during the three years preceding the date that the Company is required to prepare an accounting restatement. |

| 2025 PROXY STATEMENT | 13 |

2024 ANNUAL CASH BONUS OPPORTUNITY for the Chief Executive Officer that is: | |||

90% DEPENDENT on achievement of predetermined and measurable corporate performance objectives | |||

10% DEPENDENT on Compensation Committee’s assessment of individual contributions toward achievement of measurable goals tied to the Company’s strategic priorities | |||

2024 ANNUAL EQUITY AWARD for the Chief Executive Officer | |||

14 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 15 |

Director Nominee Gender & Ethnic/Racial Diversity | Director Nominee Independence | Board Committees Chaired by Women | Director Nominees with Prior Public Company CEO/CFO Experience | Director Nominees with Prior REIT Experience |

44% | 89% | 67% | 67% | 89% |

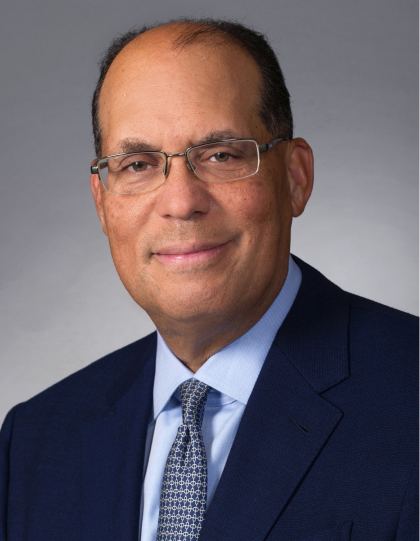

Thomas J. Baltimore, Jr. Chairman of the Board, President and Chief Executive Officer of Park Hotels & Resorts Inc. | |||

Director since: 2016 Age: 61 Other Current Public Company Boards: ➣American Express Company ➣Comcast Corporation | Professional Experience Mr. Baltimore joined the Company in May 2016 and has served as our President and Chief Executive Officer and as a director and the Chairman of the Board since December 2016. Prior to joining the Company, Mr. Baltimore served most recently as the President and Chief Executive Officer of RLJ Lodging Trust (NYSE: RLJ) (“RLJ”), a lodging REIT, and as a member of its board of trustees from RLJ’s formation on January 31, 2011 until May 11, 2016. Prior to that, Mr. Baltimore co-founded RLJ Development and served as its president from 2000 to 2011. During this time period, RLJ Development and affiliates raised and invested more than $2.2 billion in equity. Previously, Mr. Baltimore served as vice president of gaming acquisitions of Hilton Hotels Corporation from 1997 until 1998 and later as vice president of development and finance from 1999 until 2000. He also served in various management positions with Marriott Corporation and Host Marriott Services Corporation, including vice president of business development. Mr. Baltimore currently serves on the board of directors of American Express Company (NYSE: AXP) and Comcast Corporation (Nasdaq: CMCSA). Previously, Mr. Baltimore served on the board of directors of Prudential Financial, Inc. (NYSE: PRU) until March 2023, the board of directors of AutoNation, Inc. (NYSE: AN) until January 2021, the board of directors of Duke Realty Corporation (NYSE: DRE) until April 2017, the board of trustees of RLJ until May 2016 and the board of directors of Integra Life Sciences Company (NASDAQ: IART) until August 2012. Mr. Baltimore is a past chair (2018) of the National Association of Real Estate Investment Trusts’ (“Nareit”) Executive Board. Mr. Baltimore received his Bachelor of Science degree from the McIntire School of Commerce, University of Virginia and his Master of Business Administration degree from the Colgate Darden School of Business, University of Virginia. Key Qualifications and Experience Mr. Baltimore’s knowledge of and extensive experience in various senior leadership roles in the lodging real estate industry provides the Board valuable industry-specific knowledge and expertise. In addition, Mr. Baltimore’s role as our President and Chief Executive Officer brings management perspective to Board deliberations and provides beneficial information about the status of our day- to-day operations. | ||

16 | 2025 PROXY STATEMENT |  |

Patricia M. Bedient Former Executive Vice President and Chief Financial Officer of Weyerhaeuser Company | |||

INDEPENDENT Director since: 2017 Committees: Governance (Chair); Audit Age: 71 Other Current Public Company Boards: ➣Alaska Air Group, Inc. ➣Suncor Energy Inc. | Professional Experience Ms. Bedient has served as a director on the Board since January 2017. Ms. Bedient most recently served as Executive Vice President for Weyerhaeuser Company (NYSE: WY), one of the world’s largest integrated forest products companies, from 2007 until her retirement in July 2016. Ms. Bedient also served Weyerhaeuser as Chief Financial Officer from 2007 until February 2016. Prior to that, Ms. Bedient served as Senior Vice President, Finance and Strategic Planning of Weyerhaeuser from 2006 until 2007 and as Vice President, Strategic Planning from 2003, when Ms. Bedient joined Weyerhaeuser, until 2006. A certified public accountant (“CPA”) since 1978, Ms. Bedient served as managing partner of the Seattle office of Arthur Andersen LLP prior to joining Weyerhaeuser. Ms. Bedient also worked at Arthur Andersen’s Portland and Boise offices as a partner and as a CPA during her 27-year career with that firm. Ms. Bedient currently serves on the board of directors of Alaska Air Group, Inc. (NYSE: ALK), where she serves as the Non-executive Board Chair, and Suncor Energy Inc. (NYSE: SU), where she serves as the Chair of the Audit Committee. Ms. Bedient received her Bachelor of Science degree in Business Administration with concentrations in Finance and Accounting from Oregon State University. She is a member of the American Institute of CPAs. Ms. Bedient holds a Certificate in cyber-risk oversight from the National Association of Corporate Directors. Key Qualifications and Experience Ms. Bedient brings to the Board her extensive financial, management and cyber-risk oversight experience, including service as a REIT chief financial officer. In addition, Ms. Bedient brings to the Board her public company directorship experience. | ||

Thomas D. Eckert Former Chairman of the Board, Chief Executive Officer and President of Capital Automotive Real Estate Services, Inc. | |||

INDEPENDENT Director since: 2019 Committees: Audit; Compensation (Chair) Age: 77 Other Current Public Company Boards: ➣NVR, Inc. | Professional Experience Mr. Eckert has served as a director on the Board since September 2019. Mr. Eckert previously served at Capital Automotive Real Estate Services, Inc., a privately owned real estate company that owns and manages net-leased real estate for automotive retailers, as President and Chief Executive Officer from 2005 until 2011 and as Chairman of the board of directors from 2011 until 2014. Prior to that, Mr. Eckert served as President, Chief Executive Officer and a trustee of Capital Automotive REIT (Nasdaq: CARS) from its founding in 1997 until it was taken private in 2005. Prior to his tenure at Capital Automotive, Mr. Eckert served at Pulte Home Corporation, a U.S. homebuilder company, from 1983 until 1997. Prior to working at Pulte, Mr. Eckert spent over seven years with the public accounting firm of Arthur Andersen LLP. Mr. Eckert currently serves on the board of directors of NVR, Inc. (NYSE: NVR) and since December 2024, Mr. Eckert has been a trustee of BIGI REIT, a private industrial income trust and affiliate of Bridge Investment Group Holdings Inc. (NYSE: BRDG), an alternative investment manager. In addition, Mr. Eckert formerly served on the board of trustees of Chesapeake Lodging Trust (“Chesapeake”) (NYSE: CHSP) from 2010 until Park’s acquisition of Chesapeake in 2019; on the board of directors of Dupont-Fabros Technologies, Inc. (NYSE: DFT) from 2007 until 2017; as the Chairman on the board of directors of The Munder Funds, a $10 billion mutual fund group, from 2006 until 2014; on the board of trustees of The Victory Funds, a $20 billion mutual fund group, from 2014 until 2015; and on the board of trustees of Gramercy Property Trust from 2015 until 2018. Additionally, Mr. Eckert is currently an Emeritus Trustee of The College Foundation at the University of Virginia. Mr. Eckert received a Bachelor degree in Business Administration from the University of Michigan. Key Qualifications and Experience Mr. Eckert brings to the Board his extensive financial and leadership experience, including service as a chief executive officer of a publicly-traded REIT. In addition, Mr. Eckert brings to the Board his public company directorship experience. | ||

| 2025 PROXY STATEMENT | 17 |

Geoffrey M. Garrett Dean of Marshall School of Business of the University of Southern California | |||

INDEPENDENT Director since: 2017 Committee: Audit; Compensation Age: 66 Other Current Public Company Boards: None | Professional Experience Mr. Garrett has served as a director of the Board since June 2017. Mr. Garrett currently serves as dean of the University of Southern California’s Marshall School of Business (“Marshall”). Prior to his appointment as dean of Marshall in July 2020, Mr. Garrett served as the dean of the Wharton School of Business at the University of Pennsylvania from 2014 to 2020, the dean of the business school at University of New South Wales in Australia from January 2013 until June 2014 and the dean of the business school at the University of Sydney, Australia from January 2013 until December 2013. From 2008 until 2012, Mr. Garrett served as the Founding Chief Executive Officer and a Professor of Political Science at the United States Studies Centre in Sydney, Australia. Prior to that, Mr. Garrett served as President of the Pacific Council of International Policy in Los Angeles from 2005 until 2009 and the dean of the UCLA International Institute from 2001 until 2005. Mr. Garrett previously served as a professor at Oxford University, Stanford University, Yale University and as a member of the faculty in the Management Department at Wharton. Mr. Garrett received a Bachelor of Arts degree with Honors from the Australian National University and a Master of Arts and Doctor of Philosophy degrees from Duke University where he was a Fulbright Scholar. Key Qualifications and Experience Mr. Garrett brings to the Board his extensive leadership and management experience, as well as a diverse perspective gained from serving as the dean of one of the most prominent business schools in the United States. | ||

Christie B. Kelly Former Executive Vice President, Chief Financial Officer and Treasurer of Realty Income Corporation | |||

INDEPENDENT Director since: 2016 Committees: Audit (Chair); Compensation Age: 63 Other Current Public Company Boards: ➣Kite Realty Group Trust | Professional Experience Ms. Kelly has served as a director on the Board since December 2016. Ms. Kelly most recently served as the Executive Vice President, Chief Financial Officer and Treasurer of Realty Income Corporation (NYSE: O), a REIT focused on investing in free-standing, single-tenant commercial properties that are subject to triple-net leases, from January 2021 until December 2023. Prior to her appointment as Chief Financial Officer of Realty Income in January 2021, Ms. Kelly served as Executive Vice President and Chief Financial Officer of Jones Lang LaSalle Incorporated (NYSE: JLL) (“JLL”), a publicly traded financial and professional services firm specializing in real estate, from July 2013 until September 2018. Prior to her tenure at JLL, Ms. Kelly served as Executive Vice President and Chief Financial Officer of Duke Realty Corporation (NYSE: DRE) (“Duke”) from 2009 until June 2013. From 2007 until she joined Duke in 2009, Ms. Kelly served as Senior Vice President, Global Real Estate at Lehman Brothers, where she led real estate equity syndication in the United States and Canada. Prior to that, Ms. Kelly served at General Electric Company (NYSE: GE) from 1983 to 2007 in numerous finance and operational financial management positions in the United States, Europe and Asia that included responsibility for mergers and acquisitions, process improvements, internal audit and enterprise risk management. Ms. Kelly currently serves on the board of directors of Kite Realty Group Trust (NYSE: KRG) and Gilbane, Inc., a private global development company. Ms. Kelly served on the board of directors of Realty Income Corporation from November 2019 until January 2021. Ms. Kelly received her Bachelor of Arts degree in Economics from Bucknell University. She has been recognized as one of the Women of Influence by the Indianapolis Business Journal. Key Qualifications and Experience Ms. Kelly brings to the Board financial and industry-specific expertise, including as chief financial officer of a REIT, as well as her public company directorship experience. Additionally, the Board values Ms. Kelly’s extensive network in the REIT-industry. The Board believes that the combination of Ms. Kelly’s experience, network and dedication, which she has consistently demonstrated by, among other things, her exemplary engagement and attendance at Board meetings since joining the Board, is a valuable asset to our Company. | ||

18 | 2025 PROXY STATEMENT |  |

Terri D. McClements Former Partner at PricewaterhouseCoopers | |||

INDEPENDENT Director since: 2024 Committees: Governance Age: 62 Other Current Public Company Boards: None | Professional Experience Ms. McClements has served as a director on the Board since January 2024. Ms. McClements most recently served as a partner in the Washington, D.C. office at PricewaterhouseCoopers (“PwC”), a multinational professional service firm that is considered one of the “Big Four” accounting firms, from 1997 until her retirement in June 2023. While at PwC, Ms. McClements served as an advisor to Fortune 100 and 500 multinational companies and their boards of directors on organizational change, digital/cloud transformations, human capital, DE&I, financial/accounting and securities reporting matters and was appointed to manage PwC’s project management office responses to both the Ukraine and COVID-19 crises. Ms. McClements was also charged with leading PwC’s DE&I practice and managed the firm’s partner candidate leadership development experience from 2020 until June 2023. Between 2017 and 2020, Ms. McClements was the Mid-Atlantic Market Managing Partner for PwC, overseeing over 6,000 professionals across all lines of service for the mid-atlantic region of the country. Ms. McClements currently serves on the board of directors of the American Cancer Society and Inova Health System. Ms. McClements received her Bachelor of Science degree in Accounting from California University of Pennsylvania. She is a licensed CPA in Maryland, Virginia, and Washington, D.C. She has been recognized as one of the 100 Most Powerful Women in Washington by the Washingtonian Magazine (2017, 2019 and 2021), as one of the 50 Most Influential Virginians by Virginia Business (2018-2021) and was inducted into the Washington Business Hall of Fame in December of 2023. Key Qualifications and Experience Ms. McClements brings to the Board her record of achievement during a 38 year career that provided her with extensive financial and management experience, including service as a Senior Partner and Mid-Atlantic Market Managing Partner at a large multinational professional service firm. In addition, Ms. McClements brings to the Board her human capital and DE&I management experience. | ||

Thomas A. Natelli President and Chief Executive Officer of Natelli Communities | |||

INDEPENDENT Director since: 2019 Committees: Audit; Governance Age: 64 Other Current Public Company Boards: None | Professional Experience Mr. Natelli has served as a director on the Board since September 2019. Mr. Natelli has served as President and Chief Executive Officer of Natelli Communities, a privately held real estate investment and development company, since 1987. Mr. Natelli is the past chairman and has served on the board of the School of Engineering at Duke University since 2006. He has served on the President’s Council of Catholic Charities of Washington DC since 2014. Previously, Mr. Natelli served on the board of directors of Quantum Loophole, Inc., a privately held developer of data center campuses, from 2021 until 2024; on the board of directors of Chesapeake Lodging Trust (NYSE: CHSP) from 2010 until Park’s acquisition of Chesapeake in 2019; on the board of directors of Highland Hospitality Corporation (NYSE: HIH) from 2003 until 2007; on the board of trustees of Suburban Hospital Healthcare System from 1993 until 2006; and on the board of directors of FBR National Bank and Trust, a wholly-owned affiliate of Friedman, Billings, Ramsey Group, Inc. (NYSE: FBR) from 2001 until 2005. Mr. Natelli served as President of the Board of the Montgomery County Chamber of Commerce in 1993, and played a central role in creating the Montgomery Housing Partnership in 1989, a non-profit organization created to preserve and expand the supply of affordable housing in Montgomery County, Maryland. Mr. Natelli received his Bachelor of Science degree in Mechanical Engineering from Duke University in 1982. Key Qualifications and Experience Mr. Natelli brings to the Board industry-specific experience in the real estate sector, as well as his public company directorship experience. | ||

| 2025 PROXY STATEMENT | 19 |

Timothy J. Naughton Non-Executive Chairman of the Board and Former Chief Executive Officer of AvalonBay | |||

INDEPENDENT Director since: 2017 Committees: Compensation; Governance Age: 63 Other Current Public Company Boards: ➣AvalonBay Communities, Inc. ➣BXP, Inc. | Professional Experience Mr. Naughton has served as a director on the Board since January 2017. Mr. Naughton currently serves as the Non-Executive Chairman of the Board of Directors of AvalonBay Communities, Inc. (NYSE: AVB) (“AvalonBay”), a REIT focused on multifamily communities. Joining AvalonBay’s predecessor entity in 1989, Mr. Naughton served as Chairman of the board of directors for AvalonBay from May 2013 until January 2022, as Chief Executive Officer from January 2012 until January 2022, as President from February 2005 until February 2021, as Chief Operating Officer from 2001 until 2005, as Senior Vice President, Chief Investment Officer from 2000 until 2001 and as Senior Vice President and Vice President, Development and Acquisitions from 1993 until 2000. Since May 2024, Mr. Naughton has served on the board of directors of BXP, Inc. (NYSE: BXP), the largest publicly traded developer, owner and manager of workplaces in the United States. Mr. Naughton served on the board of directors of Welltower Inc. (NYSE: WELL) from 2013 until 2019, previously served on the executive board of Nareit, is a member of The Real Estate Round Table, is a member and past Chairman of the Multifamily Council of the Urban Land Institute and is a member of the Real Estate Forum. Mr. Naughton sits on the board of the Jefferson Scholars Foundation at the University of Virginia. Mr. Naughton received his Master of Business Administration from Harvard Business School and received his Bachelor of Arts degree in Economics with High Distinction from the University of Virginia, where he was elected to Phi Beta Kappa. Key Qualifications and Experience Mr. Naughton brings to the Board industry-specific experience in the real estate sector, including as chief executive officer of a REIT, as well as his extensive public company directorship experience. | ||

Stephen I. Sadove Founding Partner of JW Levin Management Partners LLC and Former Chairman of the Board and Chief Executive Officer of Saks Inc. | |||

INDEPENDENT Director since: 2017 Committees: Compensation; Governance Age: 73 Other Current Public Company Boards: ➣Aramark ➣Movado Group, Inc. | Professional Experience Mr. Sadove has served as a director on the Board since January 2017 and as the Board’s lead independent director since April 2022. Mr. Sadove has served as a founding partner of JW Levin Management Partners LLC, a private management and investment firm, since 2015. Mr. Sadove has also served as principal of Stephen Sadove and Associates, which provides consulting services to the retail industry, since 2014. From 2007 until 2013, Mr. Sadove served as Chairman and Chief Executive Officer of Saks Incorporated (“Saks”), an owner and operator of high-end department stores in the United States. Prior to that, Mr. Sadove served Saks as Vice Chairman from January 2002 until March 2004, as Chief Operating Officer from March 2004 until January 2006 and was named Chief Executive Officer in 2006. Prior to his tenure with Saks, Mr. Sadove served Bristol-Myers Squibb Company (NYSE: BMY) from 1991 until 2001, as President, Clairol from 1991 until 1996, as President, Worldwide Beauty Care from 1996 until 1997, as President, Worldwide Beauty Care and Nutritionals from 1997 until 1998 and as Senior Vice President of Bristol-Myers Squibb and President, Worldwide Beauty Care from 1997 until 2001. Mr. Sadove currently serves on the board of directors of Aramark (NYSE: ARMK), where he is also Non-Executive Chairman of the Board, Movado Group, Inc. (NYSE: MOV) and Waterloo Sparkling Water, a privately-held sparkling water producer, where he serves as Non-Executive Chairman of the Board. Mr. Sadove served on the board of directors of J.C. Penney Company, Inc. (NYSE: JCP) until May 2016, Ruby Tuesday, Inc. (NYSE: RT) until December 2017 and Colgate-Palmolive Company (NYSE: CL), until May 2024. Mr. Sadove received his Master of Business Administration degree with Distinction from Harvard Business School and received his Bachelor’s degree in Government from Hamilton College. He currently is a life trustee of Hamilton College. Key Qualifications and Experience Mr. Sadove brings to the Board extensive operations and management experience, including as chief executive officer of a large, national retailer, as well as his extensive public company directorship experience. | ||

20 | 2025 PROXY STATEMENT |  |

Baltimore, Thomas J., Jr. | Bedient, Patricia M. | Eckert, Thomas D. | Garrett, Geoffrey M. | Kelly, Christie B. | McClements, Terri D. | Natelli, Thomas A. | Naughton, Timothy J. | Sadove, Stephen I. | ||

SKILLS AND EXPERIENCE | ||||||||||

ACCOUNTING / FINANCIAL EXPERTISE enables an in-depth understanding of our financial reporting and internal controls, ensuring transparency and accuracy | • | • | • | • | ||||||

ACCOUNTING / FINANCIAL LITERACY enables a general understanding of our financial reporting and internal controls, ensuring transparency and accuracy | • | • | • | • | • | • | • | • | • | |

BOARD OF DIRECTORS experience in serving on public sector, private sector or non-profit boards | • | • | • | • | • | • | • | • | • | |

BUSINESS OPERATIONS experience provides directors with a practical understanding of developing, implementing and evaluating our operating plans and strategies | • | • | • | • | • | • | • | • | • | |

EXECUTIVE experience in leadership role as a company executive officer or head of a government or academic organization | • | • | • | • | • | • | • | • | • | |

FINANCIAL / CAPITAL MARKETS experience is important to raising the capital needed to fund our business | • | • | • | • | • | • | • | • | ||

LODGING knowledge of the lodging industry and the issues facing hotels, brands and owners | • | • | • | |||||||

MANAGEMENT experience provides directors a practical understanding of developing, implementing and assessing our operating plan and business strategy | • | • | • | • | • | • | • | • | • | |

REAL ESTATE experience is important to understanding the business and strategy of a real estate company | • | • | • | • | • | • | • | • | • | |

REITS prior knowledge of the issues facing real estate investment trusts including taxation and public markets | • | • | • | • | • | • | • | • | ||

RETAIL experience is important in understanding hospitality as a retail platform and also the retail that exists in many hotels within the Company’s portfolio | • | • | • | • | • | • | ||||

RISK MANAGEMENT experience is critical to the Board’s role in overseeing the risks facing the Company | • | • | • | • | • | • | • | • | • | |

TECHNOLOGY / CYBER SYSTEMS relevant to the Company as it looks to enhance internal operations and assess cyber issues | • | • | • | • | ||||||

DEMOGRAPHICS | ||||||||||

RACIAL / ETHNICITY / OTHER FORMS OF DIVERSITY | ||||||||||

AFRICAN AMERICAN / BLACK | • | |||||||||

ALASKAN NATIVE / NATIVE AMERICAN | ||||||||||

ASIAN / PACIFIC ISLANDER | ||||||||||

HISPANIC | ||||||||||

TWO OR MORE RACES OR ETHNICITIES | ||||||||||

WHITE / CAUCASIAN | • | • | • | • | • | • | • | • | ||

LGBTQ+ | ||||||||||

GENDER | ||||||||||

FEMALE | • | • | • | |||||||

MALE | • | • | • | • | • | • | ||||

INDEPENDENCE | ||||||||||

INDEPENDENT DIRECTOR | • | • | • | • | • | • | • | • |

| 2025 PROXY STATEMENT | 21 |

CORPORATE GOVERNANCE HIGHLIGHTS | |||

Annual election of directors | All of our directors are elected annually. | ||

Majority voting/director resignation policy | Each director nominee must be elected by a majority of votes cast in uncontested elections. This majority voting standard complements our policy that requires any director nominee in an uncontested election who fails to receive a majority of the votes cast to promptly tender his or her resignation to the Board for the Board’s consideration. | ||

Independent Board | All of our directors are independent except for our Chief Executive Officer. | ||

100% independent Board committees | Each of our three Board committees consists solely of independent directors. Each standing committee operates under a written charter, that has been approved by the Board and which is reviewed annually. | ||

Strong Lead Independent Director, elected by the independent directors | We have a Lead Independent Director of the Board who has comprehensive duties, including leading regular executive sessions of the Board. | ||

Annual Board and committee evaluation process | The Governance Committee conducts an anonymous survey of the Board and its committees each year. | ||

“Opted out” of certain Delaware anti-takeover protections | We have expressly elected that the Company not be governed by the anti-takeover protections provided by Section 203 of the Delaware General Corporation Law. | ||

Director selection process | Our Board has a rigorous director selection process resulting in a diverse Board in terms of gender, experience, perspectives, skills and tenure. Additionally, our Board has approved a Policy Regarding Diversity as a Consideration for Board Nominations demonstrating its commitment to actively seeking out diverse candidates. | ||

Authority to call special meetings | Stockholders holding 25% or more of our outstanding share capital have the right to convene a special meeting. | ||

No stockholder rights plan (“Poison Pill”) | The Company does not have a poison pill. | ||

Proxy access right | Eligible stockholders can (subject to certain requirements) include their own qualified director nominees in our proxy materials. | ||

Active stockholder engagement | We regularly engage with our stockholders to better understand their perspectives and provide received feedback to the Board. | ||

Authority to amend by-laws | Stockholders consisting of at least a majority of the outstanding share capital are entitled to amend the Company’s by-laws. | ||

Clawback policy | We maintain a clawback policy applicable to our senior leaders, which provides for the mandatory recoupment of annual and/or long-term incentive compensation under specified circumstances as further described under “Compensation Discussion and Analysis—Other Compensation Program Elements.” | ||

Director and executive officer equity ownership requirements | Each Park officer is required to hold Park equity with a value equal to six times his compensation for our Chief Executive Officer and three times his/her compensation for Executive Committee members by the fifth anniversary of becoming subject to such policy. Each director is required to hold Park equity having a fair market value equal to five times the value of his or her annual cash retainer within five years of joining the Board. | ||

Prohibition on hedging or pledging of company stock | Our directors and executive officers are prohibited from entering into hedging and pledging transactions. | ||

22 | 2025 PROXY STATEMENT |  |

2024 Stockholder Outreach |  |

| 2025 PROXY STATEMENT | 23 |

LEAD INDEPENDENT DIRECTOR’S ROLE | |||

BOARD LEADERSHIP. Provides leadership to the Board in any situation where the Chairman’s role may be perceived to be in conflict | LEADERSHIP OF INDEPENDENT DIRECTOR MEETINGS. Presides at all independent director meetings at which the Chairman is not present, including executive sessions of the independent directors | ||

BOARD AGENDA, SCHEDULE & INFORMATION. Approves the agenda (with the ability to add agenda items), schedule and information sent to directors and calls additional meetings as needed | CHAIRMAN / DIRECTOR LIAISON. Regularly meets with the Chairman and serves as liaison between the Chairman and the independent directors (although every director has direct access to the Chairman) | ||

STOCKHOLDER COMMUNICATIONS. Makes himself/herself available, if requested, by stockholders for consultation and direct communication | |||

24 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 25 |

Audit Committee | ||||||||||

MEMBERS All Independent | Christie B. Kelly, CHAIR Patricia M. Bedient Thomas D. Eckert | Geoffrey M. Garret Thomas A. Natelli | ||||||||

ATTENDANCE | 100% | MEETINGS IN 2024 4 Executive Sessions 4 | ||||||||

The Audit Committee’s duties and responsibilities include (without limitation) the following: ➣Oversee the Company’s financial reporting, audit process and internal controls ➣Appoint the Company’s independent registered public accounting firm, approve its services and fees and establish and review the scope and timing of its audits ➣Review and discuss the Company’s financial statements with management and the independent registered public accounting firm, including critical accounting policies and practices, material alternative financial treatments within GAAP and any disagreements with management and other material written communications between the independent registered public accounting firm and management ➣Oversee the Company’s compliance with applicable laws and regulations, including REIT rules and regulations, and with the Company’s Code of Conduct ➣Review and oversee the Company’s data privacy, information technology and security and cybersecurity risk exposures and the guidelines, programs and steps implemented by management to assess, manage and mitigate any such exposures ➣Discuss the Company’s major enterprise and financial risk exposures and the steps management takes to monitor and control such exposures The Board has determined that each of the members of the Audit Committee is independent as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors generally and audit committees in particular. The Board has also determined that each of the members of the Audit Committee is financially literate within the meaning of the NYSE listing standards and that Mmes. Bedient and Kelly and Mr. Eckert qualify as “audit committee financial experts” as defined under applicable SEC rules and regulations. | ||||||||||

26 | 2025 PROXY STATEMENT |  |

Compensation & Human Capital Committee (“Compensation Committee”) | ||||||||||

MEMBERS All Independent | Thomas D. Eckert CHAIR Geoffrey M. Garrett Christie B. Kelly | Timothy J. Naughton Stephen I. Sadove | ||||||||

ATTENDANCE | 97% | MEETINGS IN 2024 7 Executive Sessions 4 | ||||||||

The Compensation Committee’s duties and responsibilities include (without limitation) the following: ➣Oversee, review and approve the goals, objectives, compensation and benefits of our Chief Executive Officer and other executive officers ➣Evaluate the performance of our Chief Executive Officer and other executive officers at least annually ➣Review and approve compensation plans and programs, including performance-based compensation, equity-based compensation programs and perquisites ➣Review and make recommendations to the Board with respect to director compensation ➣Coordinate succession planning as it relates to the Chief Executive Officer ➣Review and assess the incentives and the risks arising from the Company’s compensation policies, particularly performance- based compensation, as it relates to risk management practices and/or risk-taking incentives ➣Review and discuss with management the Compensation Discussion and Analysis in the Company’s proxy statement ➣Review reports from management related to the Company’s demographics, pay equity, personnel appointments and practices, and the Company’s employee engagement and retention, and workplace environment, safety and culture initiatives The Board has determined that each of the members of the Compensation Committee is independent as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors generally and compensation committees in particular. Pursuant to its Charter, and subject to compliance with applicable laws of our state of jurisdiction, the Compensation Committee may not delegate its authority to approve executive compensation or grant equity awards to directors or executive officers of the Company, except to subcommittees comprised solely of Committee members. The Compensation Committee also has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. A more detailed discussion of the Compensation Committee’s use of outside advisors with respect to 2024 compensation matters is provided under the caption “Compensation Discussion and Analysis—Role of Compensation Consultant.” | ||||||||||

Nominating, Governance & Corporate Responsibility Committee (“Governance Committee”) | ||||||||||

MEMBERS All Independent | Patricia M. Bedient, CHAIR Terri D. McClements Thomas A. Natelli | Timothy J. Naughton Stephen I. Sadove | ||||||||

ATTENDANCE | 100% | MEETINGS IN 2024 2 Executive Sessions 2 | ||||||||

The Governance Committee’s duties and responsibilities include (without limitation) the following: ➣Recommend Board size and membership criteria and identify, evaluate and recommend qualified candidates to serve on the Board ➣Review and make recommendations regarding Board and committee composition ➣Oversee the Company’s corporate governance programs, policies and practices ➣Review and recommend updates to the Corporate Governance Guidelines ➣Oversee annual evaluation of the Board and its committees ➣Review all “related party transactions” ➣Oversee, review and discuss with management the Company’s activities related to corporate responsibility matters The Board has determined that each of the members of the Governance Committee is independent as defined by our Corporate Governance Guidelines and the NYSE listing standards. | ||||||||||

| 2025 PROXY STATEMENT | 27 |

28 | 2025 PROXY STATEMENT |  |

Board of Directors | ||||||||||

The Board has overall responsibility for risk oversight. A fundamental part of this risk oversight is not only understanding the material risks that Park faces and the steps management is taking to manage those risks, but also understanding what level of risk is appropriate for Park. While the full Board has overall responsibility for risk oversight, it is supported in this function by the Audit Committee, the Compensation Committee and the Governance Committee. Throughout the year, the Board and the relevant Committees receive updates from management with respect to various enterprise risk management issues and dedicate a portion of their meetings to reviewing and discussing specific risk topics in greater detail, including risks related to capital allocation, transaction execution, environmental/climate events, tax/REIT compliance, cybersecurity, human capital management, workplace culture, and business continuity and disaster recovery. The Board also receives updates from management on various operational risks faced by the Company’s third-party hotel operators, such as disruption from labor activity, that may impact the Company’s assets or financial results. | ||||||||||

Audit Committee | Compensation & Human Capital Committee | Nominating, Governance & Corporate Responsibility Committee | ||||||||

•Responsible for reviewing the Company’s accounting reporting and financial practices, including the integrity of its financial statements and the surveillance of administrative and financial controls •Responsible for reviewing the Company’s major enterprise and financial risk exposures, including business continuity and operational risks and cybersecurity, and the steps management takes to monitor and control such exposures •Oversees the Company’s risk assessment, risk management and risk mitigation policies and programs, including with respect to enterprise risk management, data privacy and cybersecurity risk exposures •Receives and reviews periodic compliance reports from management regarding the Company’s compliance with applicable laws and regulations, including REIT rules and regulations, and with the Company’s Code of Conduct | •Responsible for reviewing and overseeing the management of any potential material risks related to Park’s compensation structure and compensation programs, including the formulation, administration and regulatory compliance with respect to compensation matters •Oversees the development, implementation and effectiveness of the Company’s practices, policies and strategies relating to human capital and talent management and matters relating to the Company’s demographics, pay equity, personnel appointments and practices and the Company’s employee engagement and retention, inclusion and workplace environment, safety and culture initiatives •Oversees Chief Executive Officer succession planning | •Oversees risks associated with the Company’s corporate governance programs, policies and practices •Oversees and reviews the Company’s activities related to corporate responsibility matters, including Park’s overall corporate responsibility and sustainability strategies, policies, practices, goals and programs | ||||||||

| 2025 PROXY STATEMENT | 29 |

30 | 2025 PROXY STATEMENT |  |

1 | DETERMINE FORMAT The Governance Committee oversees the annual self-evaluation process on behalf of the Board, which involves the completion of a written questionnaire by each director. Each year, the Governance Committee reviews and updates the tailored assessment focusing on various topics, including Board and committee composition, processes, dynamic, performance, effectiveness and contributions to the Company. | ||||||

2 | CONDUCT BOARD AND COMMITTEE EVALUATIONS Members of the Board and each committee participate in the formal evaluation process by anonymously completing the approved written questionnaire. | ||||||

3 | REVIEW FEEDBACK IN EXECUTIVE SESSION The Lead Independent Director receives a memo summarizing and tabulating the results of the questionnaires in order to ensure that responses remain anonymous. The Lead Independent Director leads a discussion in executive session with the full Board to review the results of the self-evaluation and identify follow up items. The committee self-evaluation process involves a review and discussion for each committee. The process is led by the chair of each committee and is conducted in executive session. | ||||||

4 | RESPOND TO DIRECTOR INPUT In response to feedback from the evaluation process, the Board and committees work with management to consider adjustments or enhancements to further Board and committee effectiveness. | ||||||

| 2025 PROXY STATEMENT | 31 |

32 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 33 |

ADDITIONAL ANNUAL CASH COMPENSATION | |

Lead Independent Director: $35,000 | |

Audit Committee | Compensation Committee |

Chair: $25,000 | Chair: $20,000 |

Member: $7,500 | Member: $7,500 |

Governance Committee | |

Chair: $20,000 | |

Member: $7,500 | |

34 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 35 |

Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||

Patricia M. Bedient | 103,757 | 139,988 | — | 243,745 | ||||||

Thomas D. Eckert | 107,500 | 139,988 | — | 247,488 | ||||||

Geoffrey M. Garrett | 95,000 | 139,988 | 475 | 235,463 | ||||||

Christie B. Kelly | 112,467 | 139,988 | — | 252,455 | ||||||

Sen. Joseph I. Lieberman(4) | 23,620 | — | — | 23,620 | ||||||

Terri D. McClements(5) | 82,849 | 178,476 | — | 261,325 | ||||||

Thomas A. Natelli | 94,965 | 139,988 | — | 234,953 | ||||||

Timothy J. Naughton | 98,692 | 139,988 | — | 238,680 | ||||||

Stephen I. Sadove | 129,972 | 139,988 | 1,320 | 271,280 |

36 | 2025 PROXY STATEMENT |  |

Sean M. Dell’Orto Executive Vice President, Chief Financial Officer and Treasurer Age 50 | |||

Professional Experience Mr. Dell’Orto has served as our Executive Vice President and Chief Financial Officer since December 2016 and also as our Treasurer from December 2016 until February 2020 and then again starting in January 2022. Prior to joining the Company, Mr. Dell’Orto served as Senior Vice President, Treasurer of Hilton Worldwide Holdings Inc. (NYSE: HLT), a global hospitality company, from September 2012 until December 2016. Prior to that, Mr. Dell’Orto served as Vice President, Corporate Finance of Hilton from February 2010 to September 2012, leading corporate forecasting and capital markets activities including debt fundraising and refinancing, loan workouts and modifications, strategic planning and debt compliance. Prior to his tenure at Hilton, Mr. Dell’Orto held similar management roles at Barceló Crestline Corporation and Highland Hospitality Corporation. Mr. Dell’Orto received his Bachelor of Science degree from University of Virginia and his Master of Business Administration degree from the Wharton School, University of Pennsylvania. Mr. Dell’Orto served on the pre-Spin-off Board of the Company from December 2016 until January 3, 2017. Mr. Dell’Orto currently serves on the board of directors for the University of Virginia Foundation, serving on its Audit & Finance and Hospitality Committees. | |||

Carl A. Mayfield Executive Vice President, Design and Construction Age 61 | |||

Professional Experience Mr. Mayfield has served as our Executive Vice President, Design and Construction since September 2018. Prior to joining the Company, Mr. Mayfield served most recently as the Senior Vice President of Design & Construction at RLJ Lodging Trust (NYSE: RLJ), a lodging REIT, and RLJ Development, LLC from February 2004 to September 2018. Prior to his tenure at RLJ, Mr. Mayfield served as the Project Executive for Georgetown University’s $300 million, mixed-use campus expansion project and held senior positions representing Washington Sports and Entertainment and The World Bank. Mr. Mayfield received his Bachelor of Science degree in Civil Engineering from University of Delaware and his Master of Science degree in Real Estate Development from Johns Hopkins University. Mr. Mayfield currently serves on the board of directors of the American Red Cross of the National Capital Region and the Montgomery County Boys and Girls Club. He is also an executive mentor to graduate students at the Georgetown University McDonough School of Business. | |||

| 2025 PROXY STATEMENT | 37 |

Thomas C. Morey Executive Vice President and Chief Investment Officer Age 53 | |||

Professional Experience Mr. Morey joined the Company in August 2016 and has served as our Executive Vice President and Chief Investment Officer since January 2020. From December 2016 until February 2018, he served as our Senior Vice President and General Counsel. From February 2018 until January 2020, he served as our Executive Vice President and General Counsel (and he continued to serve as our General Counsel on an interim basis from January 2020 until October 2020 when his successor was appointed). Prior to joining the Company, Mr. Morey served as Senior Vice President and General Counsel of Washington Real Estate Investment Trust, a multifamily, office and retail REIT, from October 2008 until July 2016. Prior to that, he served in a business role as Chief Operating Officer of Medical Funding Services, Inc., a provider of financial and administrative services to healthcare companies, from February 2006 to September 2008. Previously, Mr. Morey was a corporate partner with Hogan & Hartson LLP, a multi-national law firm (now known as Hogan Lovells US LLP), where he focused on capital market transactions, mergers and acquisitions, strategic investments and general business matters for national and regional lodging, residential, office, retail and other REITs. From 1997 to 1998, Mr. Morey was a corporate attorney with Jones Day. Mr. Morey is a former member of the board of directors of the Maryland Chamber of Commerce and also previously served on the Executive Committee of the Maryland Chamber of Commerce. Mr. Morey received his Bachelor of Arts degree from Princeton University and his Juris Doctor degree from Duke Law School. Mr. Morey served on the pre Spin-off Board of the Company from December 2016 until January 3, 2017. | |||

Jill C. Olander Executive Vice President, Human Resources Age 51 | |||

Professional Experience Ms. Olander has served as our Executive Vice President, Human Resources since February 2018 and, prior to that, as our Senior Vice President, Human Resources from January 2017 until February 2018. Prior to joining the Company, Ms. Olander served as Vice President, Human Resources Consulting with Hilton (NYSE: HLT), a global hospitality company, from July 2013 until December 2016. Prior to that, Ms. Olander served as Senior Director of Human Resources Consulting with Hilton from April 2010 to July 2013. Prior to that, she served as Vice President of Human Resources for Allied Capital (acquired by Ares Capital Management in 2010), a private equity investment firm and mezzanine capital lender, from April 2006 to January 2010. Previously, Ms. Olander also held various Human Resources management roles at Chevy Chase Bank (now Capital One Bank), Deloitte & Touche and Capital One Financial. Ms. Olander received her Bachelor of Science degree from Vanderbilt University. | |||

38 | 2025 PROXY STATEMENT |  |

Joseph M. Piantedosi Executive Vice President, Asset Management Age 44 | |||

Professional Experience Mr. Piantedosi joined the Company in April 2017 and has served as our Executive Vice President, Asset Management since December 2023. From April 2017 until September 2021, he served the Company as a Vice President, Asset Management and from September 2021 until December 2023, he served as our Senior Vice President, Asset Management. Prior to joining the Company, Mr. Piantedosi served as Vice President, Asset Management at DiamondRock Hospitality (NYSE: DRH), a lodging REIT, from October 2014 until April 2017. Prior to joining DiamondRock, Mr. Piantedosi spent 14 years in various finance and hotel operations roles with The Ritz-Carlton Hotel Company and Hilton Worldwide Holdings Inc. (NYSE: HLT), both global hospitality companies. Mr. Piantedosi received his Bachelor of Science degree from the McDonough School of Business at Georgetown University. | |||

Nancy M. Vu Executive Vice President, General Counsel and Secretary Age 49 | |||

Professional Experience Ms. Vu joined the Company in October 2016 and has served as our Executive Vice President, General Counsel and Secretary since October 2022. From October 2016 until January 2020, she served as our Assistant General Counsel – Real Estate, from January 2020 until October 2020, she served as Senior Vice President and Deputy General Counsel and from October 2020 until October 2022, she served as our Senior Vice President, General Counsel and Secretary. Prior to joining the Company, Ms. Vu served as Senior Director, Asset Management at Choice Hotels International (NYSE: CHH) from 2014 to 2016, leading and managing real estate, joint venture and capital transactions and investments for her assigned portfolio of assets. Ms. Vu previously served as Senior Counsel at RLJ Lodging Trust (NYSE: RLJ) from 2013 to 2014 and as Senior Counsel at Choice Hotels International from 2010 to 2013. Ms. Vu received her Bachelor of Science degree from Georgetown University and her Juris Doctor degree from the University of San Diego. | |||

| 2025 PROXY STATEMENT | 39 |

40 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 41 |

42 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 43 |

44 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 45 |

46 | 2025 PROXY STATEMENT |  |

Thomas J. Baltimore, Jr. | Chairman of the Board, President and Chief Executive Officer | |

Sean M. Dell’Orto | Executive Vice President, Chief Financial Officer and Treasurer | |

Carl A. Mayfield | Executive Vice President, Design and Construction | |

Thomas C. Morey | Executive Vice President and Chief Investment Officer | |

Nancy M. Vu | Executive Vice President, General Counsel and Secretary | |

| 2025 PROXY STATEMENT | 47 |

48 | 2025 PROXY STATEMENT |  |

| 2025 PROXY STATEMENT | 49 |

What We Heard | What We Did | |||||

Board Composition – Over the last few years, stockholders have communicated a strong preference for additional gender diversity on the Board | In January 2024, ahead of our anticipated schedule, the Board appointed Ms. McClements to the Board, bringing female representation on the Board currently to 33%. | |||||

Pay for Performance Alignment – During our stockholder outreach efforts in 2021 and 2022, stockholders expressed that executive compensation should have a more correlated linkage of pay for performance. Stockholder outreach sessions following our compensation program changes in 2022 have highlighted stockholder support for the current design of our executive compensation program to continue and maintain this strong pay for performance alignment. | In February 2022, in response to stockholder feedback, the Committee amended the LTIP (as defined below) to increase the performance-based portion for an executive’s target annual equity award: –from 60% to 65% for CEO; and –from 50% to 60% for Executive Committee members and/or Section 16 officers (other than CEO). Furthermore, the Committee maintained the use of the modifier to the NEO’s PSU awards that adjusts PSU payout in the event that the Company’s TSR is negative for the applicable PSU award’s performance period. | |||||

Rigor of Targets – Stockholders continue to request STIP (as defined below) corporate objectives to be set at rigorous levels and for individual performance objectives to continue to be clearly defined. Stockholders have communicated understanding of the Company’s rationale for splitting the determination of the performance levels for the corporate performance objectives into two phases. | We continue to undergo a detailed process of analyzing and reviewing a number of factors including, but not limited to our short and long-term financial plan; investor expectations; industry and peer performance; industry benchmarking; overall attainability; and stockholder value creation. Following that analysis, rigorous corporate objectives with measurable targets are set. Disclosure detailing the corporate objectives is provided in this CD&A under the discussion “—Compensation Framework – Short-Term Incentive.” | |||||

Maintaining Strong Corporate Governance – Stockholders have expressed the importance of good corporate governance polices and practices and have acknowledged that they view the Company’s corporate governance policies to be what they consider “best in class.” | The Board continually evaluates and updates corporate governance policies (as appropriate) in order to maintain strong corporate governance practices. For example, in October 2023, the Board adopted an updated incentive compensation clawback policy that provides for the mandatory recovery from current and former officers of incentive-based compensation that was erroneously awarded during the three years preceding the date that the Company is required to prepare an accounting restatement. | |||||

50 | 2025 PROXY STATEMENT |  |

What We Do | What We Don’t Do | |||||

✓Maintain a short-term incentive program that is performance oriented and is based on rigorous and measurable Company performance metrics and individual performance objectives | ×No guaranteed minimum short-term incentive or long- term incentive payouts or annual salary increases | |||||

✓Use total stockholder return as the sole performance metric for our performance stock units that are tied to multi-year performance | ×No tax gross-ups upon a change in control | |||||

✓Maintain meaningful executive and independent director stock ownership policy •6x for our Chief Executive Officer •3x for other executive officers •5x annual cash retainer for directors | ×No employment agreements with executives (other than our Chief Executive Officer, whose employment agreement was required in order to bring him to our Company from another chief executive officer position) | |||||

✓Engage an independent compensation consultant | ×No pledging or hedging activities permitted by our executives and directors | |||||

✓Conduct an annual peer group review to ensure total compensation is properly benchmarked | ×No plan design features that encourage excessive or imprudent risk taking | |||||

✓Offer limited perquisites | ×No dividends on unearned performance stock units | |||||

✓Maintain an incentive compensation clawback policy that complies with the requirements imposed pursuant to Exchange Act Rule 10D-1 and provides for clawback of excess incentive-based compensation in the event of an accounting restatement | ×No uncapped short-term incentive or long-term incentive payouts | |||||

| 2025 PROXY STATEMENT | 51 |

Peer | Industry | Total Capitalization ($MM) as of December 31, 2024 | |||

Host Hotels & Resorts, Inc. | Hotel | $17,494 | |||

Hyatt Hotels Corporation | Hotel | $17,380 | |||

Federal Realty Investment Trust | Shopping Center | $14,469 | |||

Wyndham Hotels & Resorts, Inc. | Hotel | $10,277 | |||

Hilton Grand Vacations Inc. | Hotel, Resorts and Cruise Lines | $10,074 | |||

Ryman Hospitality Properties, Inc. | Hotel | $9,486 | |||

Park Hotels & Resorts Inc. | Hotel | $7,079 | |||

Apple Hospitality REIT, Inc. | Hotel | $5,255 | |||

JBG SMITH Properties | Diversified | $4,258 | |||

Pebblebrook Hotel Trust | Hotel | $4,145 | |||

RLJ Lodging Trust | Hotel | $3,860 | |||

Sunstone Hotel Investors, Inc. | Hotel | $3,294 | |||

DiamondRock Hospitality Company | Hotel | $2,975 | |||

Xenia Hotels & Resorts, Inc. | Hotel | $2,730 | |||

Apartment Income REIT Corp. | Multifamily | N/A | |||

Source: S&P Capital IQ as of December 31, 2024. | |||||

52 | 2025 PROXY STATEMENT |  |

Element | Form | Primary Objective | Key Features | ||||

Base Salary | Cash | Recognize the performance of job responsibilities | Adjustments are considered annually based on competitive market analysis and individual performance | ||||

Attract and retain the best executive talent to drive our success | |||||||

Short-Term Incentive | Cash | Promote short-term business objectives and growth strategies | Annual awards are made with respect to achievement of Company performance objectives and individual performance | ||||

Align pay with performance | |||||||

Long-Term Incentive | Restricted stock awards (RSAs) | Promote long-term value creation and growth strategies | 35% of CEO’s annual award and 40% of our other NEO’s annual award is delivered in RSAs that vest over 3 years | ||||

Encourage maximization of stockholder value | |||||||

Performance stock units (PSUs) | Remaining 65% of CEO’s annual award and 60% of our other NEO’s annual award is delivered in PSUs with a 3 year performance period based solely on relative total stockholder return | ||||||

Promote retention and provide ongoing incentives by encouraging long-term stock ownership | |||||||

| 2025 PROXY STATEMENT | 53 |

Base Salary(1) ($) | ||||||||

Name | 2024(2)(3) | 2023 | % Change | |||||

Thomas J. Baltimore, Jr. | 1,100,000 | 1,000,000 | 10 % | |||||

Sean M. Dell’Orto | 600,600 | 572,000 | 5 % | |||||

Carl A. Mayfield | 570,570 | 543,400 | 5 % | |||||

Thomas C. Morey | 600,600 | 572,000 | 5 % | |||||

Nancy M. Vu | 518,700 | 494,000 | 5 % | |||||

54 | 2025 PROXY STATEMENT |  |

Participant Level | Target Bonus(1) | ||

Chief Executive Officer | 175% of base salary | ||

Executive Vice President | Up to 100% of base salary | ||

Senior Vice President | Up to 75% of base salary |

Target Bonus | |||||

Participant Level | Company Performance Objective | Individual Performance Objective | |||

Chief Executive Officer | 90% | 10% | |||

Executive Vice President | 80% | 20% | |||

Senior Vice President | 75% | 25% | |||

| 2025 PROXY STATEMENT | 55 |

Name | Target STIP Opportunity (as a % of base salary) | STIP Bonus Opportunity ($) | ||||||||

Threshold ($) | Target ($) | High ($) | ||||||||

Thomas J. Baltimore, Jr. | 175% | 962,500 | 1,925,000 | 3,850,000 | ||||||

Sean M. Dell’Orto | 100% | 300,300 | 600,600 | 1,201,200 | ||||||

Carl A. Mayfield | 100% | 285,285 | 570,570 | 1,141,140 | ||||||

Thomas C. Morey | 100% | 300,300 | 600,600 | 1,201,200 | ||||||

Nancy M. Vu | 100% | 259,350 | 518,700 | 1,037,400 | ||||||

Phase I Corporate Objective (50%) | Measurement | ||||||||||||

Allocation | Description | Threshold | Target | High | Achievement | ||||||||

Consolidated Portfolio RevPAR | 20% | Focuses on revenue within our portfolio—one of the Company’s core pillars of aggressive asset management | $178.75 | $185.62 | $192.25 | $185.28 | |||||||

Consolidated Hotel Adjusted EBITDA Margin | 30% | Focuses on “margin improvement”—as expense reduction is another of our core pillars of aggressive asset management | 26.1% | 27.4% | 28.6% | 28.6% | |||||||

Adjusted EBITDA | 30% | Focuses on the Company’s overall earnings profile, which is affected by both asset management and acquisition and disposition activity | $308.1M | $338.1M | $368.1M | $355.4M | |||||||

Net Debt / TTM Adjusted EBITDA | 20% | Focuses on our overall net leverage position to align with maintaining a strong, conservative balance sheet | 5.77x | 5.38x | 5.00x | 5.25x | |||||||

56 | 2025 PROXY STATEMENT |  |

Phase II Corporate Objective (50%) | Allocation | Description | Measurement | ||||||||||

Threshold | Target | High | Achievement | ||||||||||

Comparable Portfolio RevPAR | 20% | Focuses on revenue within our portfolio—one of the Company’s core pillars of aggressive asset management | $174.07 | $181.07 | $188.07 | $183.38 | |||||||

Comparable Hotel Adjusted EBITDA Margin | 30% | Focuses on “margin improvement”—as expense reduction is another of our core pillars of aggressive asset management | 25.2% | 26.2% | 27.2% | 26.1% | |||||||

Adjusted EBITDA | 30% | Focuses on the Company’s overall earnings profile, which is affected by both asset management and acquisition and disposition activity | $240.3M | $270.3M | $300.3M | $279.6M | |||||||

Net Debt / TTM Adjusted EBITDA | 20% | Focuses on our overall net leverage position to align with maintaining a strong, conservative balance sheet | 6.26x | 5.91x | 5.56x | 5.67x | |||||||

Named Executive Officer | Individual Performance Highlights | ||

Thomas J. Baltimore, Jr. | •Successfully led the Company in evaluating and reshaping the Company’s portfolio and recycling proceeds from non-core asset sales into the stock repurchase program and debt reduction •Oversaw the increase in the Company’s quarterly dividend payment •Aggressively led the Company to evaluate opportunities and implement plans to activate real estate within the portfolio, including the development of adjacent parcels of land at Hilton Hawaiian Village and return on investment project at Royal Palm South Beach Miami •Continued working with Park’s third-party management companies to deliver value through strengthening communications and effectiveness to improve operating performance •Actively engaged and communicated with associates to inspire and motivate them and ensure that Park creates the right environment for their success in delivering the Company’s mission, values and goals to achieve long-term stockholder value •Successfully managed and maintained high quality relationships with the investment community by achieving credibility, clear and achievable expectations and transparency •Continued to assess and update enterprise risk management framework (including cybersecurity risk assessment and mitigation activities) |

| 2025 PROXY STATEMENT | 57 |

Named Executive Officer | Individual Performance Highlights | ||

Sean M. Dell’Orto | •Led the update of the Company’s strategic plan and assessment of the full potential of the portfolio based on cost efficiencies, revenue opportunities and return on investment projects in planning •Continued to strengthen the balance sheet and the Company’s liquidity position, including (i) by structuring the issuance of $550 million of 7.0% senior notes due 2030 and amending the Company’s existing credit agreement to include a new $200 million senior unsecured term loan facility due 2027 and using proceeds from such transactions to repurchase or redeem all of the $650 million 7.5% senior notes due June 2025, as well as (ii) evaluating options to push out maturities, lower interest costs and provide for prepay flexibility in the capital stack •Oversaw the continued improvement and effectiveness of the Company’s financial reporting functions, including the refinement of internal processes, reports, analytics and tools •Led the renewal of the Company’s property insurance policies •Supported the Company’s Investment team with underwriting and funding plans for potential acquisitions, dispositions, ground lease workouts and joint venture related matters | ||

Carl A. Mayfield | •Oversaw the development and implementation of plans to activate the Company’s real estate, including the completion of renovation projects at the Casa Marina Key West, Curio Collection and the start of projects at the Hilton New Orleans Riverside and Royal Palm South Beach Miami •Executed on all approved risk and emergency capital projects within 3% of budget •Oversaw and updated the Company’s environmental, risk, energy and sustainability programs •Updated the Company’s First Responder’s Program and created a waste and diversion program •Completed retro commissioning studies to build out 2025 projects at various assets in the portfolio | ||

Thomas C. Morey | •Successfully led the negotiations and completion of the disposition of the Company’s joint venture interests in both the DoubleTree Hotel Spokane City Center and Hilton La Jolla Torrey Pines •Continued maintaining and refining an active “ready list” of potential acquisition opportunities in target markets •Maintained and continued to improve strong portfolio management program interconnected with the Company’s Asset Management and Design & Construction teams •Actively engaged and communicated with lodging investment community to ensure strengthening of relationships to ensure that the Company is well positioned for future growth and access to market opportunities | ||