Feb. 10, 2026 Dear Shareholders, Zillow’s Q4 and full-year 2025 performance reflect excellent execution and meaningful progress on our long-term strategy to make moving easier. We delivered strong results across the business and achieved all of our reported financial targets for the full year — including full-year profitability — and we’re carrying that momentum into 2026.1 This week marks 20 years since Zillow.com launched with a simple idea: to give consumers access to clear information in a process that often lacked it. What started as a way to see what homes were worth, then evolved into the place to search and discover listings for sale and for rent, is now an integrated ecosystem spanning the entire experience of buying, selling, renting, and financing. Zillow’s evolution — and our brand strength today — reflect two decades of relentless product innovation, grounded in consumer advocacy and strong industry partnerships. Roughly 80% of our traffic comes directly to our apps and sites,2 we have more than twice as many daily app users as our largest competitor,3 and consumers are increasingly choosing Zillow to help them move from discovery to transacting. Residential real estate is a unique category: highly regulated, deeply local, and centered on licensed professionals in hundreds of distinct markets. Transactions are high-dollar, high-stakes, and infrequent for most people. This combination makes it especially difficult for general-purpose AI to disrupt. We see significant opportunity to lead residential real estate into an AI-powered future. We don’t just optimize for leads; our products facilitate the entire transaction. This means supporting everyone involved — buyers, sellers, agents, loan officers, renters, property managers — and enabling essential workflows at every step. What differentiates Zillow is the combination of assets we bring together at scale. We have a trusted brand and a deeply engaged 3Sensor Tower data as of Dec. 31, 2025. 2Zillow internal data and estimates, 2025. 1Adjusted EBITDA is a non-GAAP financial measure; it is not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about our presentation of Adjusted EBITDA, including a reconciliation to the most directly comparable GAAP financial measure for the relevant period. 1 | Q4 2025

consumer audience. We also provide best-in-class software that professionals rely on daily to run and grow their businesses. Agents who use at least one of our products touch an estimated 80%4 of residential real estate transactions. This puts Zillow in a unique position to improve outcomes for consumers and partners. We are rapidly executing on an ambitious multi-year strategy to integrate and digitize the many disparate pieces of the real estate transaction. Our software is deeply embedded in daily workflows and helps agents manage tours, financing, listing strategy, and communication more effectively. That includes broadly used industry platforms such as ShowingTime,5 which enables 90% of all tours of homes for sale in the U.S.,4 and Follow Up Boss,6 our customer relationship management software that powers daily activity for more than 80% of the highest-volume teams in the country.4 These capabilities reflect years of thoughtful execution — building technology that works across hundreds of markets, millions of consumers, and a wide range of professional needs. Zillow has been applying advanced technology in this category for 20 years, from natural language search7 and the neural Zestimate powered by machine learning, to personalized discovery, to rich media in virtual touring, to workflow automation and coordination and now generative AI. Our focus is on building what matters most: improving consumer experiences, boosting productivity for real estate professionals, and strengthening transaction outcomes for them and for Zillow. FOR SALE Our For Sale performance continues to outpace industry transaction trends and reflects our ability to convert more high-intent movers already in our funnel and to improve outcomes for agents and loan officers through a more integrated experience. We continue to expand existing products, broaden our reach, convert more customers already in our funnel, and integrate the experience more deeply. This strategy is clearly working, and why we believe we 7https://investors.zillowgroup.com/investors/news-and-events/news/news-details/2023/Zillows-new-AI-powered-natural-language-search-is-a -first-in-real-estate/default.aspx 6https://www.followupboss.com/ 5https://showingtime.com/ 4Zillow internal data and estimates, 2025. 2 | Q4 2025

are well on our way to achieving our one-billion-dollar incremental revenue target in For Sale.8 Our success in For Sale is largely driven by improving customer experiences and growth in our Enhanced Markets, where the integrated experience comes to life. In Q4, 44% of our connections came through Enhanced Markets, up from 21% a year ago and well on our way to our intermediate target of at least 75%. Across these markets, Zillow Home Loans9 has averaged double-digit adoption as consumers see value in our offerings, including affordability guidance, a fast and convenient application, free appraisals for eligible buyers, free access to credit monitoring, and competitive rates. In 2025, Zillow Home Loans saw an 11% increase in loan officer productivity — even as we added 40% more loan officers, who take time to ramp up — and total purchase loan origination volume grew 53% year over year. We also improved transaction conversion among Zillow Preferred10 agents on a year-over-year basis in 2025 while expanding the integrated Enhanced Market experience. Throughout 2025, we not only rolled out more Enhanced Markets, but also rapidly innovated on our products along the way — with a focus on improving connection quality, engagement, and productivity. BuyAbilitySM,11 a Zillow Home Loans tool that helps buyers determine what they can afford before touring or making an offer, has enrolled 3.6 million users to date, up from 2.9 million at the end of Q3. We’ve more tightly integrated BuyAbility with Zillow Home Loans and with Follow Up Boss. We recently rolled out custom pre-approval letters for Zillow Home Loans directly within Follow Up Boss, allowing agents to generate offer-specific updates and collaborate faster and more seamlessly within our systems. 11https://www.zillow.com/homeloans/buyability/ 10https://www.zillow.com/preferred/ 9https://www.zillow.com/homeloans/ 8Please see slide 25 of our February 2026 Investor Deck for more information about this revenue target. 3 | Q4 2025

Zillow’s in-app messaging12 is boosting engagement between customers and agent partners, which we believe will translate to better conversion and more transactions. In 2025, agents sent more than 7 million AI-powered Follow Up Boss smart messages as the feature scaled nationwide. These software improvements build on other unique assets that already put Zillow at the center of so many real estate workflows. Zillow Showcase,13 with enhancements like SkyTour14 and virtual staging,15 is attracting more agents and sellers by offering what we believe is a superior way to market homes as well as a better buying experience. Showcase was on 3.7% of new listings in Q4, up from 1.7% a year ago, and we see significant room to expand from here. Also in Q4, we announced Zillow Pro,16 a comprehensive suite of offerings that helps agents manage all clients — including those from outside Zillow — in one connected system. Over time, we expect Zillow Pro to reinforce our role as a long-term partner helping real estate professionals operate more effectively and grow their businesses. We are currently beta testing Zillow Pro and plan to expand nationwide over the second half of the year. While it’s in its early stages, we’re encouraged by initial feedback from agents and believe Zillow Pro creates exciting future growth potential for the company. All of these efforts reflect a consistent theme: integration improves outcomes. RENTALS In Rentals, we’re executing against a significant opportunity and seeing some of our strongest growth as we deliver clear value for both renters and property managers. In Q4, Zillow had 2.5 million average monthly active rental listings, ranging from single-family homes to large apartment buildings. In 16https://investors.zillowgroup.com/investors/news-and-events/news/news-details/2025/Zillow-announces-Zillow-Pro-A-suite-of-products-desig ned-to-transform-how-agents-capture-business-and-meet-consumer-needs/default.aspx 15https://investors.zillowgroup.com/investors/news-and-events/news/news-details/2025/Zillow-brin gs-AI-powered-Virtual-Staging-to-Showcase-listings/default.aspx 14https://www.zillow.com/news/take-home-listings-to-new-heights-with-skytour/ 13https://www.zillow.com/agents/showcase/ 12https://investors.zillowgroup.com/investors/news-and-events/news/news-details/2025/Zillow-laun ches-messaging-a-new-way-for-home-shoppers-to-collaborate-within-the-Zillow-app/default.a spx 4 | Q4 2025

2025, we estimate our share of rental listings increased to 63%, up from 54% in 2024. Zillow Rentals attracted 31 million average monthly unique visitors in Q4,17 and because of our relentless focus on the consumer experience, renters rate Zillow as their #1 preferred platform.18 High-quality audience engagement translates into strong outcomes for our partners. As a result, Rentals revenue grew 45% year over year in Q4 and 39% for full-year 2025. Multifamily rentals revenue continues to be a key driver — we’re adding more properties as we expand packaged offerings for property managers and encourage broader adoption across their portfolios.19 As we keep scaling Rentals, we’re coupling revenue growth with thoughtful investment, and we see a clear path to a billion-dollar-plus annual revenue opportunity.20 We’re improving the renter experience — with clearer pricing, streamlined applications and more transparency — while delivering the highest return on marketing investment in our category for property managers.21 This winning combination has helped Rentals revenue grow at an average of 32% annually since 2022, far outpacing the estimated 14% growth rate in broader rental advertising demand. IN CLOSING Before we wrap up, we want to briefly address the legal matters that have been in the headlines recently. We are confident in our positions and approach, and we do not expect these matters to have a material impact on our financial position or long-term strategy. We believe deeply in our strategy, which is guided by a few core tenets: Consumers want an easier, more transparent way to rent, buy, sell, and finance their homes. Industry professionals want to scale their businesses, serve their clients more effectively and help them get the broadest possible exposure. Our business decisions consistently focus on delivering products and experiences that do both. 21Zillow internal data and estimates, 2025. 20Please see slide 28 of our February 2026 Investor Deck for more information about this revenue target. 19Zillow Rentals defines “multifamily” properties as those with 25 or more units. 18Zillow internal data and estimates, 2025. 17Average monthly rentals unique visitors for Q4 2025, estimated using Comscore data. 5 | Q4 2025

That focus doesn’t change based on market conditions or other external factors. We believe Zillow will continue to thrive by innovating and delivering what consumers and industry professionals want and need. We expect to continue growing across our business and further enhance the comprehensive marketplaces that consumers and the broader industry rely on. Our audience and engagement are strong, and consumers and partners keep choosing Zillow because of the scale, transparency, and experiences we offer. You can see the impact of our steady focus and consistent execution in the results we’ve reported today. Our multi-year strategy is designed to perform across market conditions, and the momentum we carried through 2025 has set us up well for 2026. As we mark Zillow’s 20 years of building in this category, we continue to shape what’s next. We’ve earned consumer trust and delivered sustained value to partners by investing in technology that brings transparency and efficiency to a complex process. That foundation positions us to lead in the current era and define the next one. Sincerely, Jeremy Wacksman Jeremy Hofmann CEO CFO 6 | Q4 2025

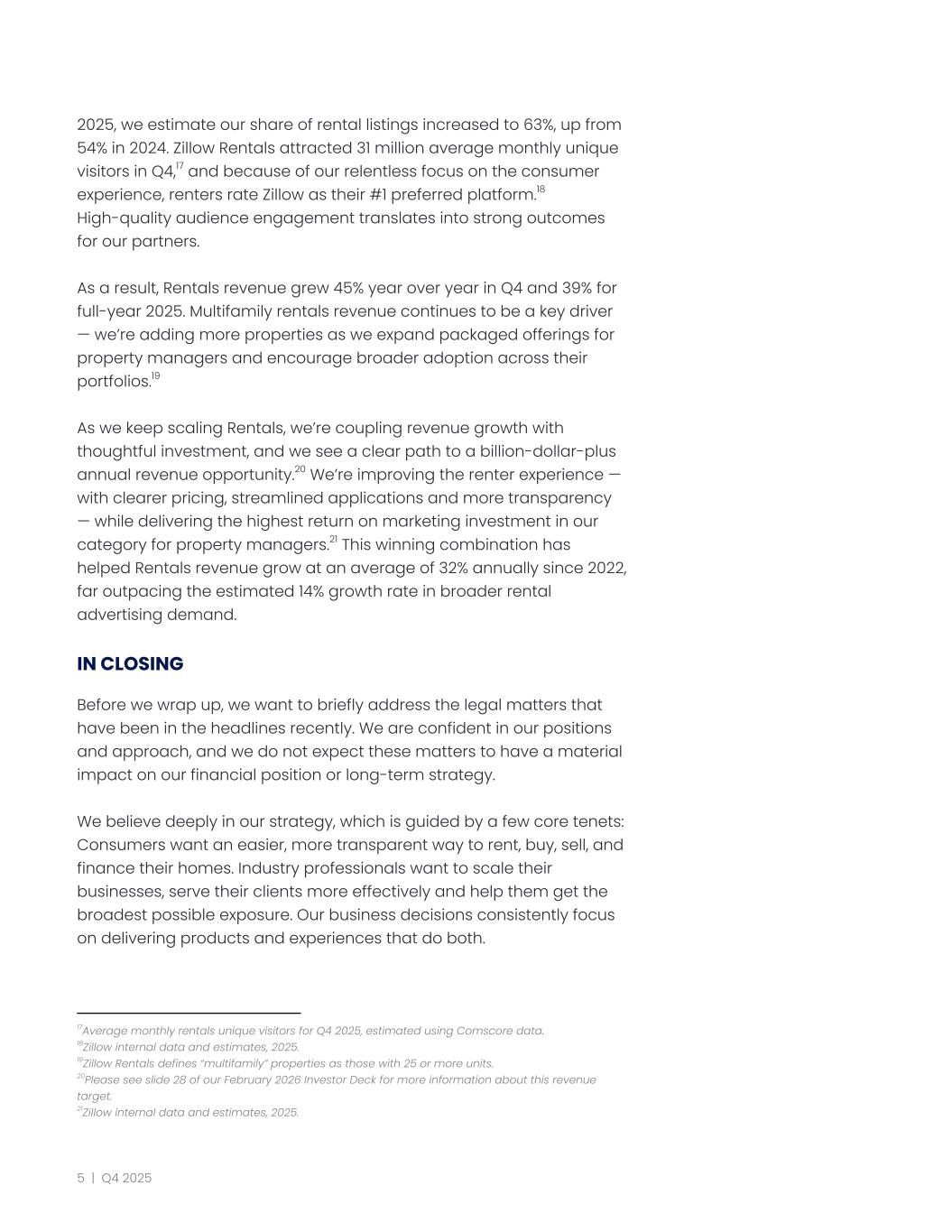

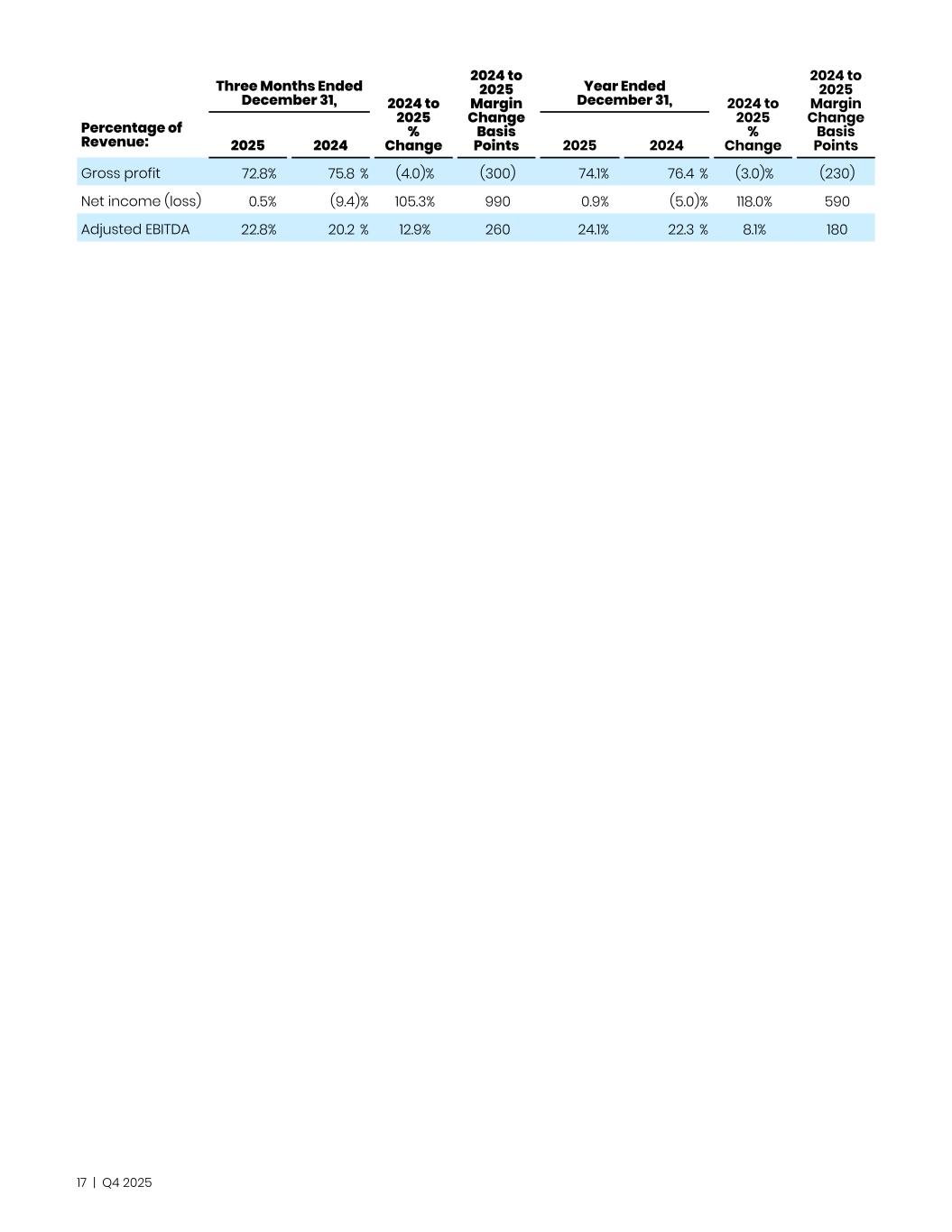

Fourth-Quarter and Full-Year 2025 Highlights Zillow Group reported strong fourth-quarter results. ● Q4 revenue was up 18% year over year to $654 million, near the high end of our outlook range. Full-year 2025 revenue of $2.6 billion was up 16% year over year. The residential real estate industry grew by 3% in Q4 and 3% for full-year 2025, according to the National Association of REALTORS®, meaning we outperformed the industry by 1,500 basis points in Q4 and 1,300 basis points for full-year 2025. We estimate Q4 and full-year 2025 purchase mortgage origination volume for the industry was roughly flat year over year. ○ For Sale revenue was up 11% year over year to $475 million in Q4. ■ Residential revenue was up 8% year over year in Q4 to $418 million, benefiting from growth in our agent and software offerings and in our New Construction marketplace. ■ Mortgages revenue increased 39% year over year to $57 million in Q4, primarily due to a 67% increase in purchase loan origination volume to $1.5 billion. ○ Rentals revenue increased 45% year over year to $168 million in Q4, primarily driven by multifamily revenue growing 63% year over year. ● On a GAAP basis, net income was $3 million in Q4, and net income margin was 0%, a 990-basis-point increase year over year. GAAP net income was $23 million for full-year 2025, and net income margin was 1%, a 590-basis-point increase year over year. ● Q4 Adjusted EBITDA was $149 million, and Adjusted EBITDA margin22 was 23%, a 260-basis-point increase year over year, driven by revenue growth and cost management. Adjusted EBITDA was $622 million for full-year 2025, and Adjusted EBITDA margin was 24%, a 180-basis-point increase year over year. ● Cash and investments at the end of Q4 were $1.3 billion, down from $1.4 billion at the end of Q3. During Q4, we repurchased 3.4 million shares for $232 million. ● Traffic to Zillow Group’s apps and sites in Q4 was up 8% year over year to 221 million average monthly unique users. Visits during Q4 were up 2% year over year at 2.1 billion. 22Adjusted EBITDA margin is a non-GAAP financial measure; it is not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about the presentation and calculation of Adjusted EBITDA margin. 7 | Q4 2025

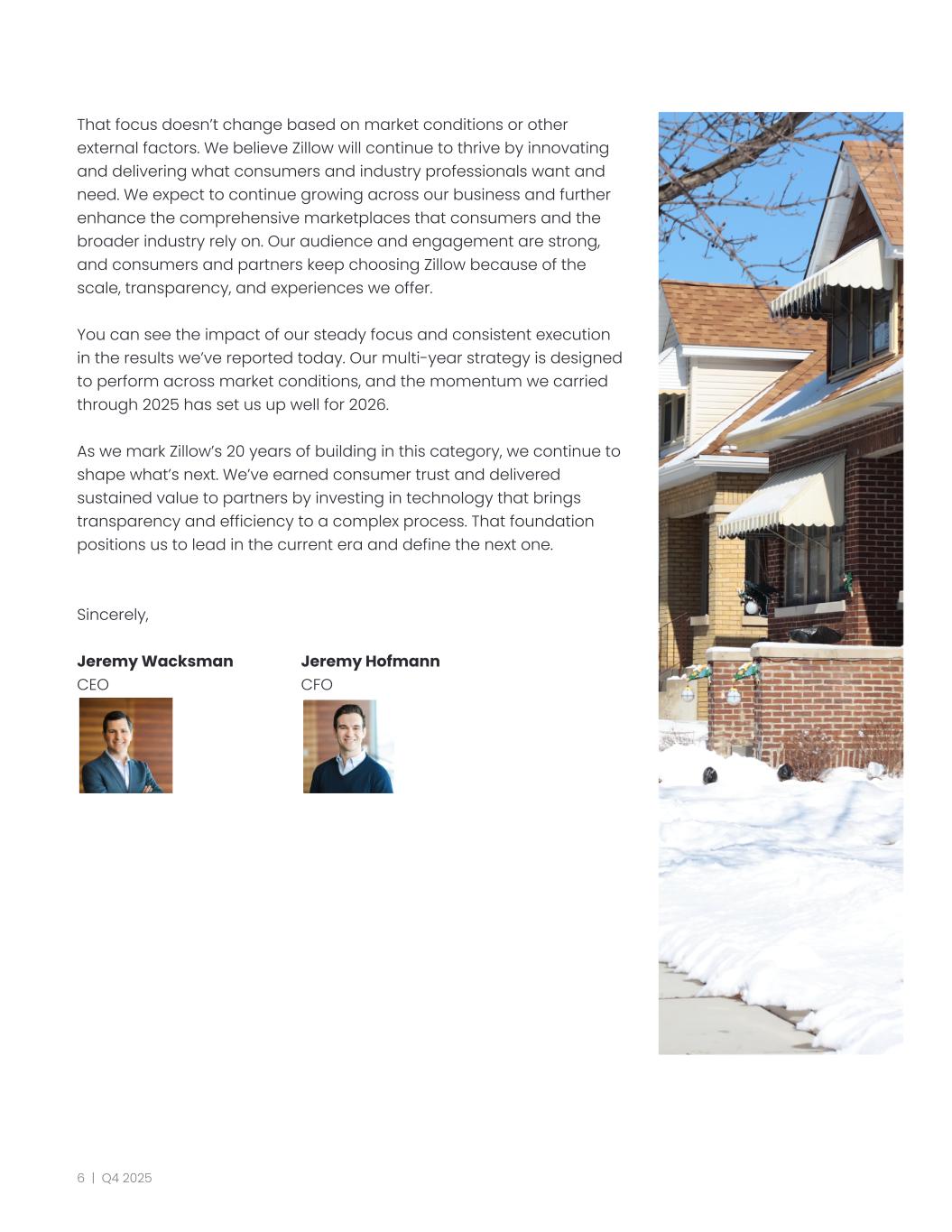

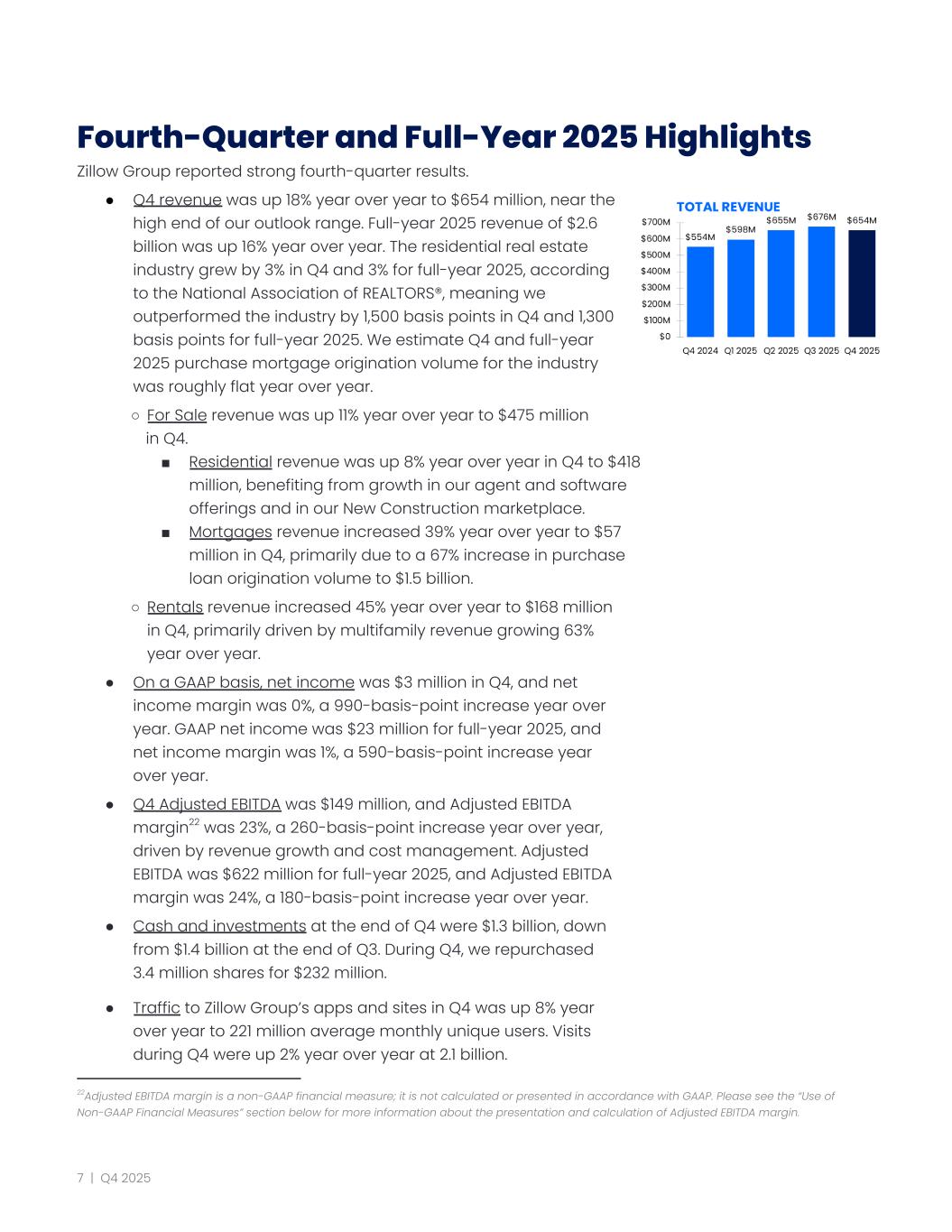

Select Q4 and Full-Year 2025 Results FOR SALE For Sale revenue grew 11% year over year to $475 million in Q4. Full-year 2025 For Sale revenue was up 9% year over year to $1.9 billion. RESIDENTIAL Residential revenue increased 8% year over year to $418 million in Q4. Residential revenue benefited from growth in our agent and software offerings and in our New Construction marketplace. Agent offerings include Zillow Preferred, Market-Based Pricing, and Zillow Showcase. Software offerings primarily include Follow Up Boss, dotloop, and ShowingTime. Full-year 2025 Residential revenue was up 7% year over year to $1.7 billion. MORTGAGES Mortgages revenue for Q4 was up 39% year over year to $57 million, driven by a 67% increase in purchase loan origination volume to $1.5 billion. Full-year 2025 Mortgages revenue was up 37% year over year to $199 million. We accelerated growth in purchase loan origination volume throughout 2025, ending the year originating a total of $4.7 billion of purchase mortgage loans, up 53% year over year. Our mortgage strategy delivers an attractive value proposition that is designed to make it easier for more buyers to choose financing through Zillow Home Loans, the primary growth driver of our overall Mortgages revenue. 8 | Q4 2025

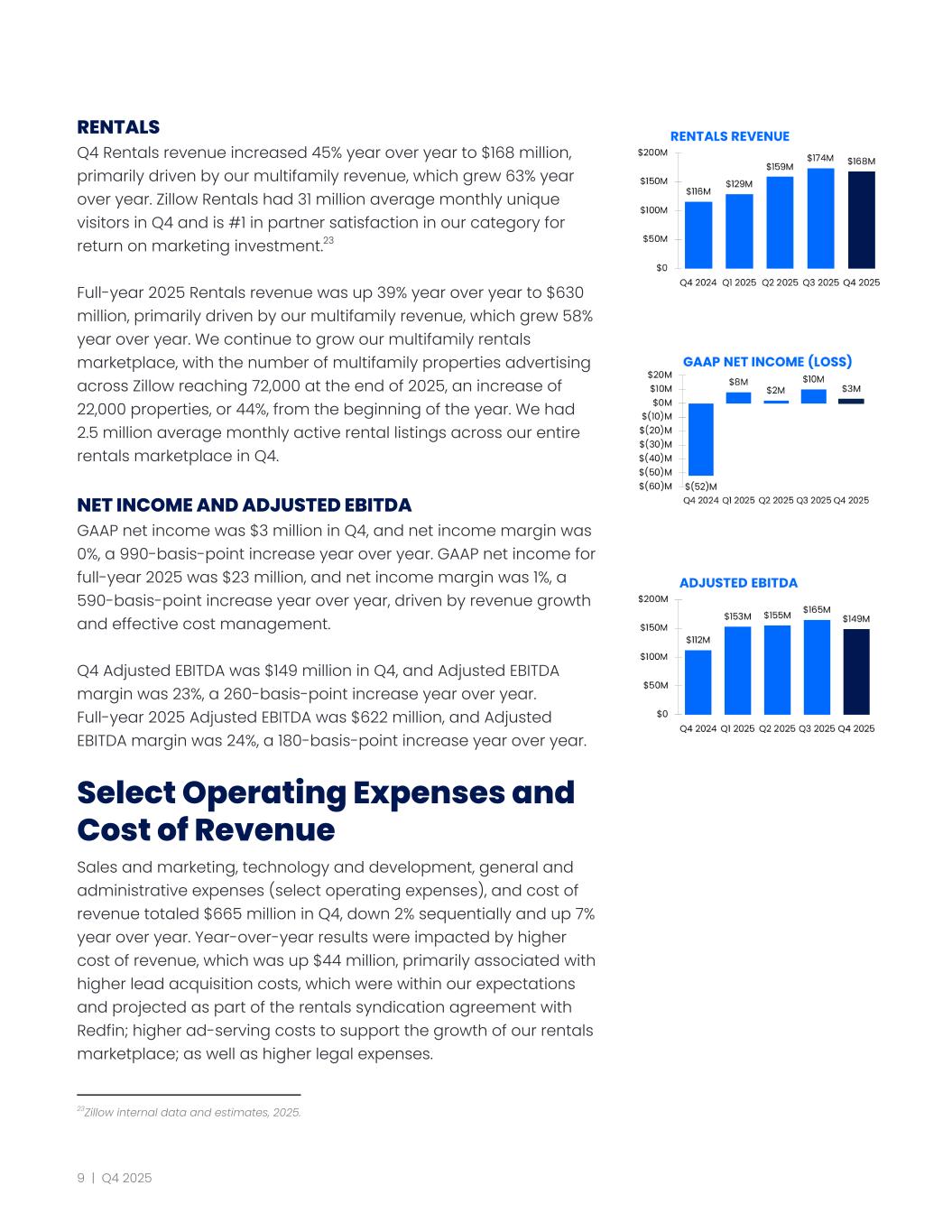

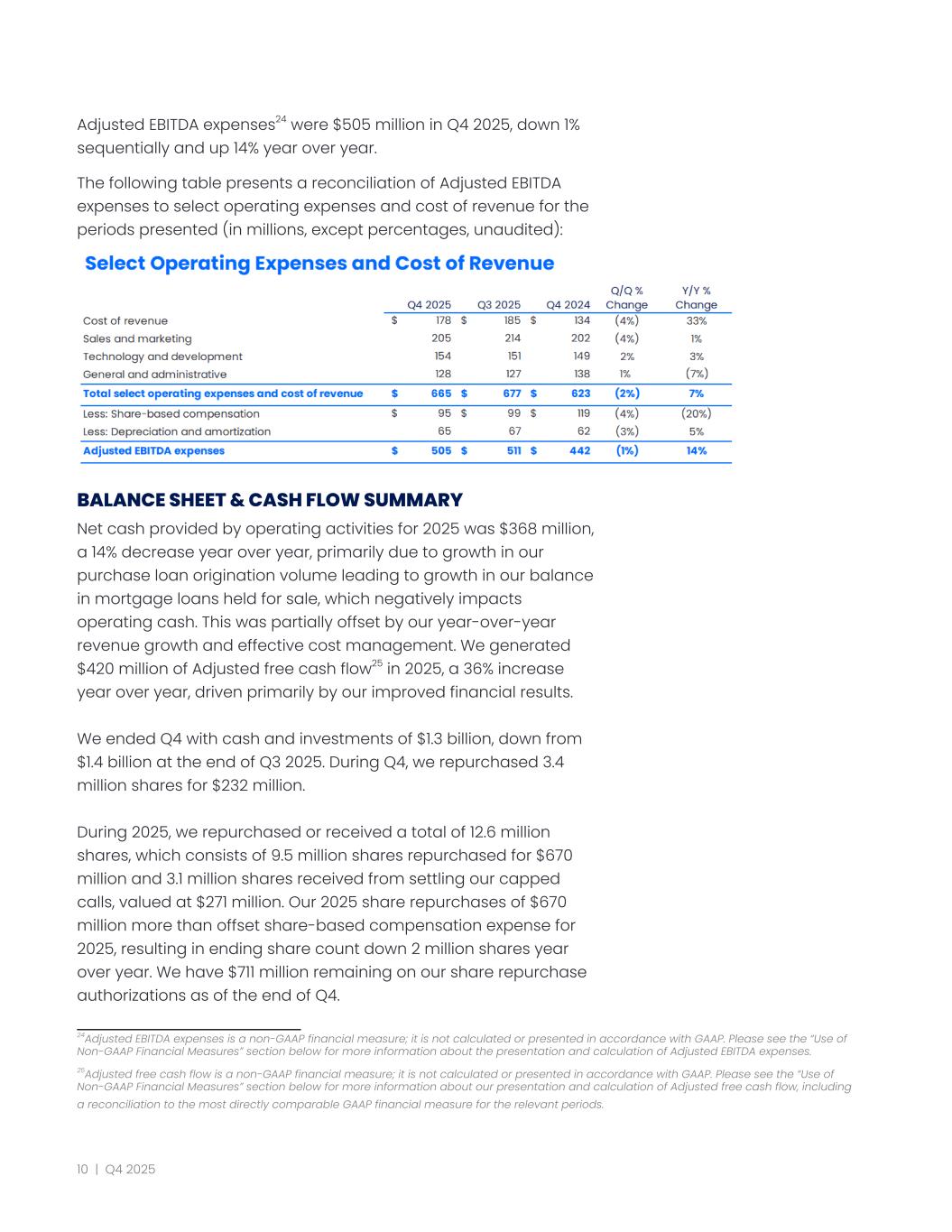

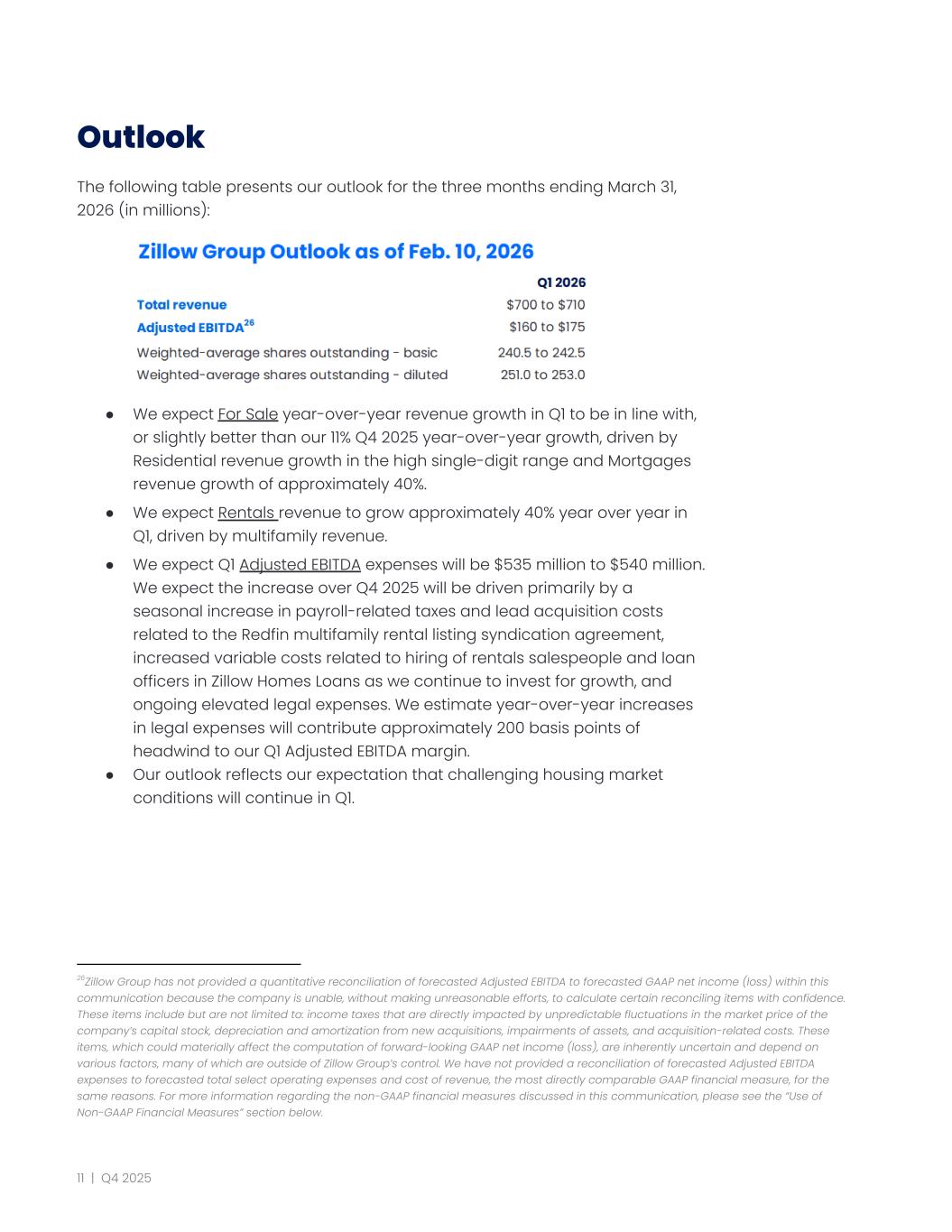

RENTALS Q4 Rentals revenue increased 45% year over year to $168 million, primarily driven by our multifamily revenue, which grew 63% year over year. Zillow Rentals had 31 million average monthly unique visitors in Q4 and is #1 in partner satisfaction in our category for return on marketing investment.23 Full-year 2025 Rentals revenue was up 39% year over year to $630 million, primarily driven by our multifamily revenue, which grew 58% year over year. We continue to grow our multifamily rentals marketplace, with the number of multifamily properties advertising across Zillow reaching 72,000 at the end of 2025, an increase of 22,000 properties, or 44%, from the beginning of the year. We had 2.5 million average monthly active rental listings across our entire rentals marketplace in Q4. NET INCOME AND ADJUSTED EBITDA GAAP net income was $3 million in Q4, and net income margin was 0%, a 990-basis-point increase year over year. GAAP net income for full-year 2025 was $23 million, and net income margin was 1%, a 590-basis-point increase year over year, driven by revenue growth and effective cost management. Q4 Adjusted EBITDA was $149 million in Q4, and Adjusted EBITDA margin was 23%, a 260-basis-point increase year over year. Full-year 2025 Adjusted EBITDA was $622 million, and Adjusted EBITDA margin was 24%, a 180-basis-point increase year over year. Select Operating Expenses and Cost of Revenue Sales and marketing, technology and development, general and administrative expenses (select operating expenses), and cost of revenue totaled $665 million in Q4, down 2% sequentially and up 7% year over year. Year-over-year results were impacted by higher cost of revenue, which was up $44 million, primarily associated with higher lead acquisition costs, which were within our expectations and projected as part of the rentals syndication agreement with Redfin; higher ad-serving costs to support the growth of our rentals marketplace; as well as higher legal expenses. 23Zillow internal data and estimates, 2025. 9 | Q4 2025

Adjusted EBITDA expenses24 were $505 million in Q4 2025, down 1% sequentially and up 14% year over year. The following table presents a reconciliation of Adjusted EBITDA expenses to select operating expenses and cost of revenue for the periods presented (in millions, except percentages, unaudited): BALANCE SHEET & CASH FLOW SUMMARY Net cash provided by operating activities for 2025 was $368 million, a 14% decrease year over year, primarily due to growth in our purchase loan origination volume leading to growth in our balance in mortgage loans held for sale, which negatively impacts operating cash. This was partially offset by our year-over-year revenue growth and effective cost management. We generated $420 million of Adjusted free cash flow25 in 2025, a 36% increase year over year, driven primarily by our improved financial results. We ended Q4 with cash and investments of $1.3 billion, down from $1.4 billion at the end of Q3 2025. During Q4, we repurchased 3.4 million shares for $232 million. During 2025, we repurchased or received a total of 12.6 million shares, which consists of 9.5 million shares repurchased for $670 million and 3.1 million shares received from settling our capped calls, valued at $271 million. Our 2025 share repurchases of $670 million more than offset share-based compensation expense for 2025, resulting in ending share count down 2 million shares year over year. We have $711 million remaining on our share repurchase authorizations as of the end of Q4. 24Adjusted EBITDA expenses is a non-GAAP financial measure; it is not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about the presentation and calculation of Adjusted EBITDA expenses. 25Adjusted free cash flow is a non-GAAP financial measure; it is not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about our presentation and calculation of Adjusted free cash flow, including a reconciliation to the most directly comparable GAAP financial measure for the relevant periods. 10 | Q4 2025

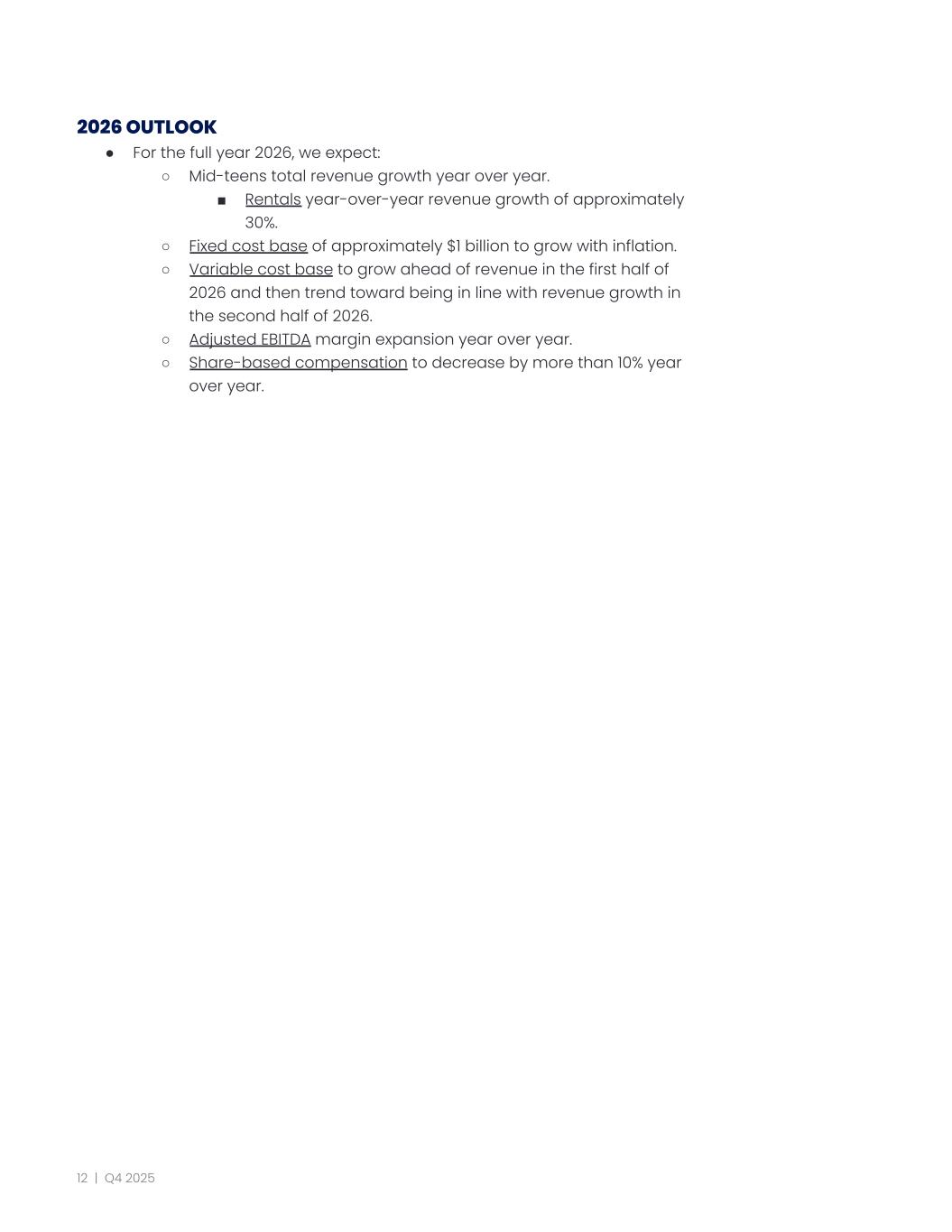

Outlook The following table presents our outlook for the three months ending March 31, 2026 (in millions): 26 ● We expect For Sale year-over-year revenue growth in Q1 to be in line with, or slightly better than our 11% Q4 2025 year-over-year growth, driven by Residential revenue growth in the high single-digit range and Mortgages revenue growth of approximately 40%. ● We expect Rentals revenue to grow approximately 40% year over year in Q1, driven by multifamily revenue. ● We expect Q1 Adjusted EBITDA expenses will be $535 million to $540 million. We expect the increase over Q4 2025 will be driven primarily by a seasonal increase in payroll-related taxes and lead acquisition costs related to the Redfin multifamily rental listing syndication agreement, increased variable costs related to hiring of rentals salespeople and loan officers in Zillow Homes Loans as we continue to invest for growth, and ongoing elevated legal expenses. We estimate year-over-year increases in legal expenses will contribute approximately 200 basis points of headwind to our Q1 Adjusted EBITDA margin. ● Our outlook reflects our expectation that challenging housing market conditions will continue in Q1. 26Zillow Group has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this communication because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to: income taxes that are directly impacted by unpredictable fluctuations in the market price of the company’s capital stock, depreciation and amortization from new acquisitions, impairments of assets, and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss), are inherently uncertain and depend on various factors, many of which are outside of Zillow Group’s control. We have not provided a reconciliation of forecasted Adjusted EBITDA expenses to forecasted total select operating expenses and cost of revenue, the most directly comparable GAAP financial measure, for the same reasons. For more information regarding the non-GAAP financial measures discussed in this communication, please see the “Use of Non-GAAP Financial Measures” section below. 11 | Q4 2025

2026 OUTLOOK ● For the full year 2026, we expect: ○ Mid-teens total revenue growth year over year. ■ Rentals year-over-year revenue growth of approximately 30%. ○ Fixed cost base of approximately $1 billion to grow with inflation. ○ Variable cost base to grow ahead of revenue in the first half of 2026 and then trend toward being in line with revenue growth in the second half of 2026. ○ Adjusted EBITDA margin expansion year over year. ○ Share-based compensation to decrease by more than 10% year over year. 12 | Q4 2025

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding our future targets and opportunities; the future growth, performance and operation of our business; our business strategies and ability to translate such strategies into financial performance; and the health of, and our impact on, the residential real estate industry. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “opportunity,” “guidance,” “would,” “could,” “strive,” “path,” “positioned,” “on track,” “target,” “goal,” or similar expressions constitute forward-looking statements. Forward-looking statements are made based on assumptions as of February 10, 2026, and although we believe the expectations reflected in the forward- looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to: the health and stability of the economy and United States residential real estate industry, including changes in inflationary conditions, interest rates, housing availability and affordability, labor shortages and supply chain issues; our ability to manage advertising, product inventory and pricing, and to maintain relationships with our real estate partners; our ability to establish or maintain relationships with listing and data providers, which affects traffic to our mobile apps and websites; or changes to our rights to use or timely access listing data, or to the quality or quantity of such listing data; our ability to comply with current and future rules and requirements promulgated by National Association of REALTORS®, multiple listing services, or other real estate industry groups or governing bodies, or decisions to repeal, amend or not enforce such rules and requirements; our ability to navigate industry changes, including as a result of past, pending or future lawsuits, settlements or government investigations, which may include lawsuits, settlements or investigations in which we are not a named party; uncertainties related to policy changes, enforcement priorities, or government shutdowns at the federal and state levels; our ability to continue to innovate and compete to attract customers and real estate partners; our ability to effectively invest resources to pursue new strategies, develop new products and services and expand existing products and services into new markets; our ability to operate and grow Zillow Home Loans’ mortgage operations, including the ability to obtain or maintain sufficient financing to fund the origination of mortgages, meet customers’ financing needs with product offerings, continue to grow origination operations and resell originated mortgages on the secondary market; the duration and impact of natural disasters, climate change, geopolitical events, and other catastrophic events (including public health crises) on our ability to operate, demand for our products or services, or general economic conditions; our public statements, disclosures, targets, and product features related to sustainability matters; our ability to maintain adequate security controls or technology systems, or those of third parties on which we rely, to protect data integrity and the information and privacy of our customers and other third parties; our ability to navigate any significant disruption in service on our mobile apps or websites or in our network; the impact of past, pending or future litigation and other disputes or enforcement actions, which may include lawsuits or investigations to which we are not a party; our ability to attract, engage, and retain a highly skilled workforce; mergers, acquisitions, investments, strategic partnerships, capital-raising activities, or other corporate transactions or commitments by us or our competitors; our ability to continue relying on third-party services to support critical functions of our business; our ability to protect and continue using our intellectual property and prevent others from copying, infringing upon, or developing similar intellectual property, including as a result of artificial intelligence; our ability to comply with domestic and international laws, regulations, rules, contractual obligations, policies and other obligations, or to obtain or maintain required licenses to support our business and operations; our ability to pay our debt or to raise additional capital or refinance our indebtedness on acceptable terms, or at all; actual or anticipated fluctuations in quarterly and annual results of operations and financial position; actual or perceived inaccuracies in the assumptions, estimates and internal or third-party data that we use to calculate business, performance and operating metrics; and volatility of our Class A common stock and Class C capital stock prices. The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk 13 | Q4 2025

Factors” described in Zillow Group’s publicly available filings with the United States Securities and Exchange Commission (“SEC”). Except as may be required by law, Zillow Group does not intend and undertakes no duty to update this information to reflect future events or circumstances. No Incorporation by Reference This communication includes website addresses and references to additional materials found on those websites, including Zillow Group’s websites. These websites and materials are not incorporated by reference herein or in our other filings with the SEC. Use of Estimates and Statistical Data This communication includes estimates and other statistical data made by independent third parties and by Zillow Group relating to the housing market, the mortgage-rate environment, connections, conversion, engagement, growth, rental listings and other data about Zillow Group’s audience and performance and the residential real estate industry and purchase loan origination industry. These data involve a number of assumptions and limitations, which may significantly impair their accuracy, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of future performance are necessarily subject to a high degree of uncertainty and risk. Use of Non-GAAP Financial Measures To provide investors with additional information regarding our financial results, this communication includes references to Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA expenses, and Adjusted free cash flow, all of which are non-GAAP financial measures not calculated or presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We have provided a reconciliation below of each non-GAAP financial measure to the most directly comparable GAAP financial measure. Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA expenses These non-GAAP measures are key metrics used by our management and board of directors to measure operating performance and trends and to prepare and approve our annual budget. In particular, we believe the exclusion of certain expenses in calculating these measures facilitates operating performance comparisons on a period-to-period basis. Our use of these non-GAAP financial measures has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include, but are not limited to, the fact that such non-GAAP measures: • Do not reflect changes in, or cash requirements for, our working capital needs; • Do not consider the potentially dilutive impact of share-based compensation; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and these non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or contractual commitments; • Do not reflect impairment costs; • Do not reflect interest expense or other income, net; • Do not reflect income taxes; and • May be calculated differently by other companies, including companies in our own industry, from the way we do, limiting their usefulness as comparative measures. Because of these limitations, you should consider these measures alongside other financial performance measures, including various cash-flow metrics, net income (loss), and our other GAAP results. 14 | Q4 2025

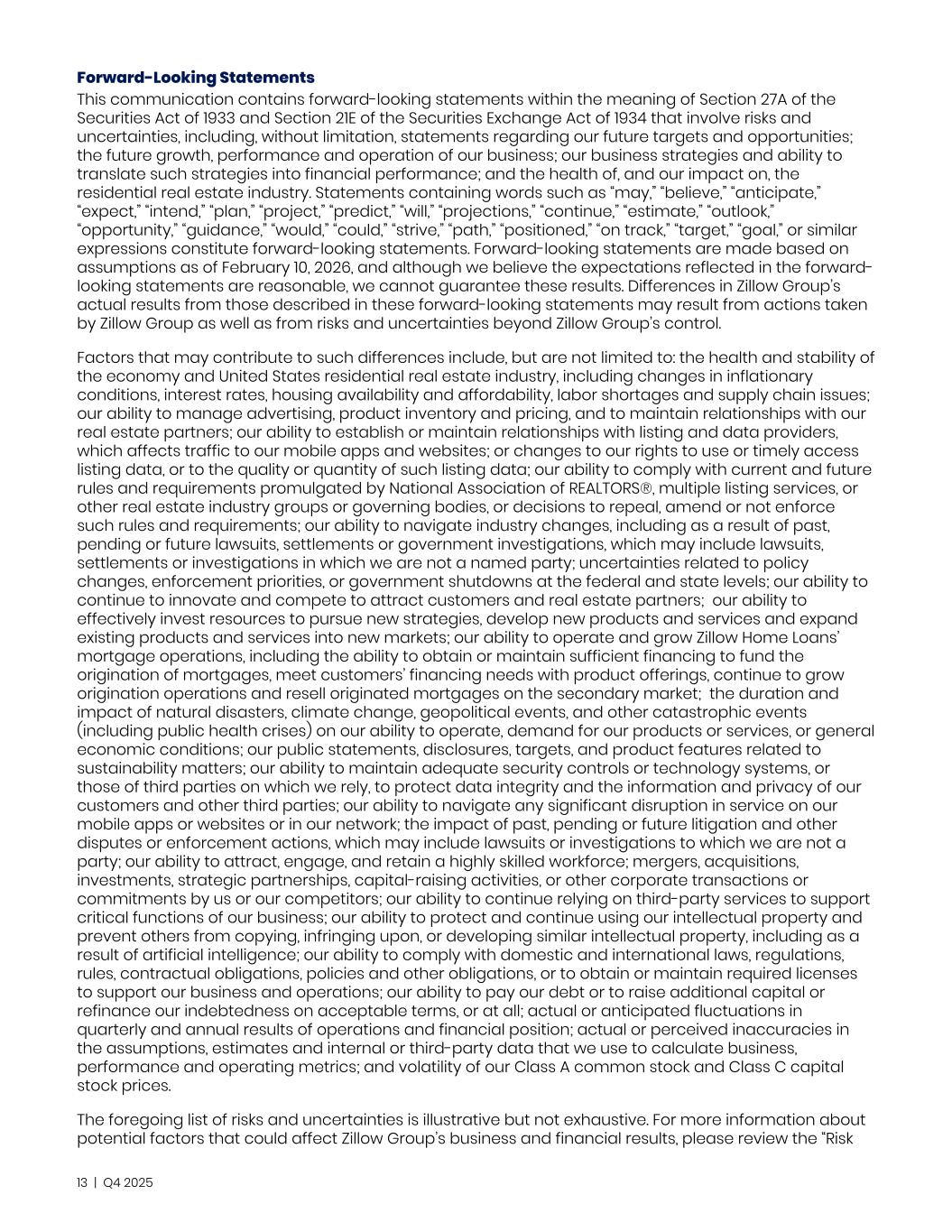

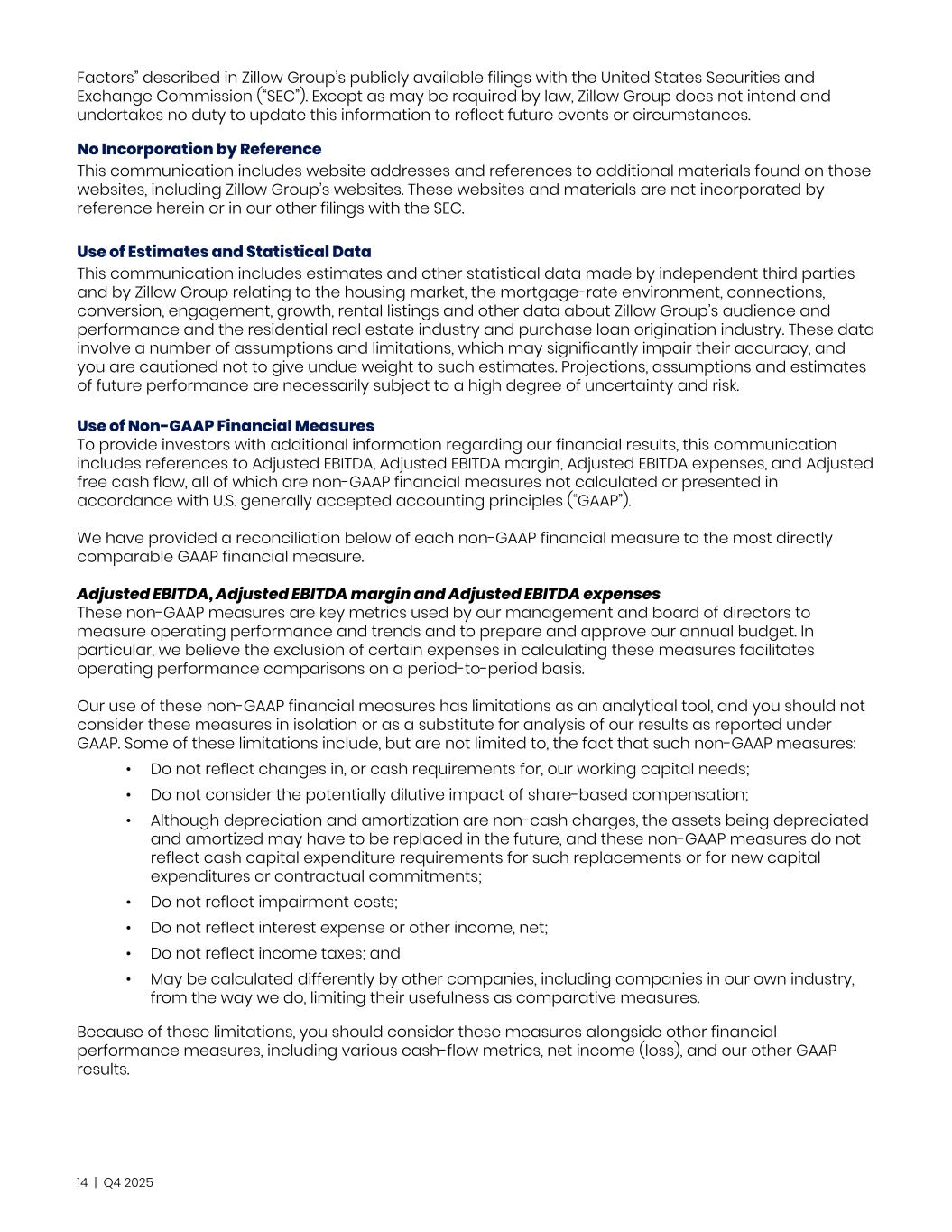

Adjusted Free Cash Flow We define Adjusted free cash flow as net cash provided by operating activities adjusted for purchases of property and equipment, purchases of intangible assets, net borrowings (repayments) on repurchase agreements and the initial payment in connection with the Redfin rentals partnership. Borrowings (repayments) on repurchase agreements are used to fund Zillow Home Loans mortgage loan originations, and we consider them part of our ongoing liquidity management. The initial payment in connection with the Redfin rentals partnership was considered a one-time and nonrecurring cash flow, and we exclude it from our calculation as we believe it impacts the ability to evaluate the liquidity of our business operations on a period-to-period basis. We have included Adjusted free cash flow in this communication as it is a key metric used by our management to evaluate the effectiveness of our business strategies and execution and our ability to consistently generate cash from our core operations on a period-to-period basis. Our use of Adjusted free cash flow has limitations as an analytical tool and you should not consider this measure in isolation or as a substitute for analysis of our results as reported under GAAP. Adjusted free cash flow does not represent the residual cash flow available for discretionary expenditures. Other companies, including companies in our own industry, may calculate Adjusted free cash flow differently from the way we do, limiting its usefulness as a comparative measure. We have provided a reconciliation above of Adjusted EBITDA expenses to total select operating expenses and cost of revenue, the most directly comparable GAAP financial measure. The following tables present a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, and a calculation of Adjusted EBITDA expenses for each of the periods presented (in millions, unaudited): Three Months Ended December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Net income (loss) $ 3 $ 10 $ 2 $ 8 $ (52) Income taxes — 2 — — 1 Other income, net (19) (18) (18) (22) (26) Depreciation and amortization 65 67 67 65 62 Share-based compensation 95 99 99 97 119 Impairment costs — 2 — — — Interest expense 5 3 5 5 8 Adjusted EBITDA $ 149 $ 165 $ 155 $ 153 $ 112 Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Calculation of Adjusted EBITDA Expenses: Revenue $ 654 $ 676 $ 554 Less: Adjusted EBITDA (149) (165) (112) Adjusted EBITDA expenses $ 505 $ 511 $ 442 15 | Q4 2025

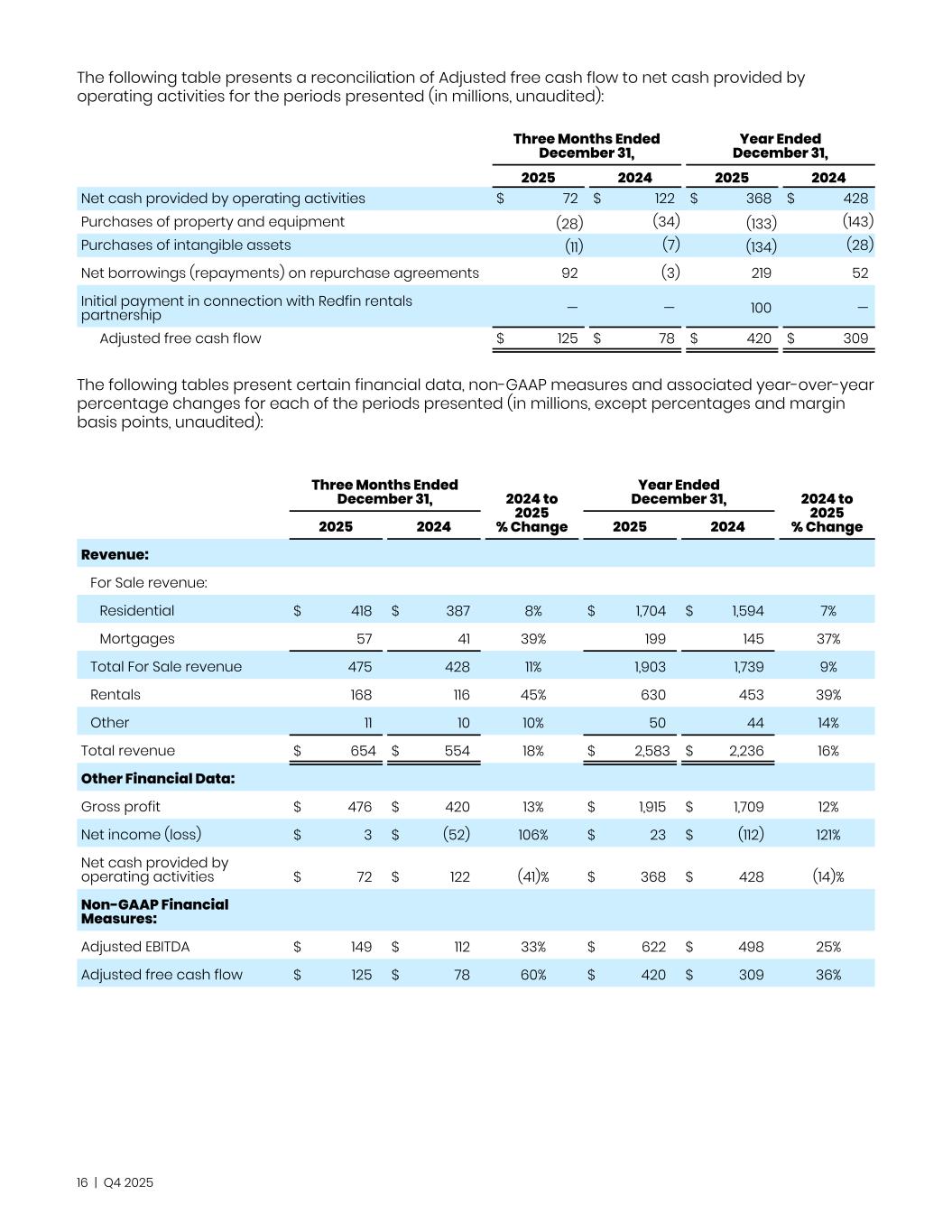

The following table presents a reconciliation of Adjusted free cash flow to net cash provided by operating activities for the periods presented (in millions, unaudited): Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net cash provided by operating activities $ 72 $ 122 $ 368 $ 428 Purchases of property and equipment (28) (34) (133) (143) Purchases of intangible assets (11) (7) (134) (28) Net borrowings (repayments) on repurchase agreements 92 (3) 219 52 Initial payment in connection with Redfin rentals partnership — — 100 — Adjusted free cash flow $ 125 $ 78 $ 420 $ 309 The following tables present certain financial data, non-GAAP measures and associated year-over-year percentage changes for each of the periods presented (in millions, except percentages and margin basis points, unaudited): Three Months Ended December 31, 2024 to 2025 % Change Year Ended December 31, 2024 to 2025 % Change2025 2024 2025 2024 Revenue: For Sale revenue: Residential $ 418 $ 387 8% $ 1,704 $ 1,594 7% Mortgages 57 41 39% 199 145 37% Total For Sale revenue 475 428 11% 1,903 1,739 9% Rentals 168 116 45% 630 453 39% Other 11 10 10% 50 44 14% Total revenue $ 654 $ 554 18% $ 2,583 $ 2,236 16% Other Financial Data: Gross profit $ 476 $ 420 13% $ 1,915 $ 1,709 12% Net income (loss) $ 3 $ (52) 106% $ 23 $ (112) 121% Net cash provided by operating activities $ 72 $ 122 (41)% $ 368 $ 428 (14)% Non-GAAP Financial Measures: Adjusted EBITDA $ 149 $ 112 33% $ 622 $ 498 25% Adjusted free cash flow $ 125 $ 78 60% $ 420 $ 309 36% 16 | Q4 2025

Three Months Ended December 31, 2024 to 2025 % Change 2024 to 2025 Margin Change Basis Points Year Ended December 31, 2024 to 2025 % Change 2024 to 2025 Margin Change Basis Points Percentage of Revenue: 2025 2024 2025 2024 Gross profit 72.8 % 75.8 % (4.0)% (300) 74.1 % 76.4 % (3.0)% (230) Net income (loss) 0.5 % (9.4) % 105.3% 990 0.9 % (5.0) % 118.0% 590 Adjusted EBITDA 22.8 % 20.2 % 12.9% 260 24.1 % 22.3 % 8.1% 180 17 | Q4 2025

https://investors.zillowgroup.com