DIRECTOR ORIENTATION AND CONTINUING EDUCATION

Management, working with the Board, provides an orientation process for new directors and coordinates director continuing education programs. The orientation programs are designed to familiarize new directors with the Company’s businesses, strategies and challenges and to assist new directors in developing and maintaining skills necessary or appropriate for the performance of their responsibilities. As part of the onboarding process, new directors meet individually with members of senior management and visit our facilities.

As appropriate, management prepares additional educational sessions for directors on matters relevant to the Company and its business, such as with respect to the global economy, acquisition practices, activism, artificial intelligence, and cybersecurity. Directors are also encouraged to participate in educational programs relevant to their responsibilities, including programs conducted by universities and other educational institutions, such as the National Association of Corporate Directors.

TRANSACTIONS WITH RELATED PERSONS

Our Board of Directors has adopted a written policy regarding transactions with related persons, which we refer to as our “related person transaction policy.” Our related person transaction policy requires that (i) any “related person transaction” (defined as any transaction, consistent with Item 404(a) of Regulation S-K, in which we were or are to be a participant and the amount involved exceeds $120,000 and in which any related person had or will have a direct or indirect material interest) be approved by an approving body comprised of the disinterested members of our Board of Directors or any committee of the Board of Directors (provided that a majority of the members of the Board of Directors or such committee, respectively, are disinterested) and (ii) any employment relationship or transaction involving an executive officer and any related compensation be approved by the Compensation Committee or recommended by the Compensation Committee to the Board of Directors for its approval. It is our policy that directors interested in a related person transaction will recuse themselves from any vote on a related person transaction in which they have an interest.

FMR LLC (“Fidelity”) filed a Schedule 13G/A with the SEC on May 5, 2025 stating that it holds approximately 10.0% of the Company’s stock. An affiliate of Fidelity provides investment management and record keeping services to the Company’s 401(k) Plan. The participants in the 401(k) Plan paid $905,940 for record keeping services and $1,240,309 for investment management services to Fidelity in fiscal 2025. The investment management agreement was entered into on an arm’s-length basis.

Everett Holm, brother of George Holm, our Chairman and CEO, was employed by the Company as Vice President, Regional Operations during fiscal 2025. He retired on January 4, 2025. In fiscal 2025, he received total compensation of approximately $228,570, including salary, equity awards and customary employee benefits.

Benjamin Hoskins, son of Craig Hoskins, our Executive Vice President and Chief Development Officer, is employed by the Company as Vice President, Sales (Vistar). In fiscal 2025, he received total compensation of approximately $246,422, including salary, bonus, and customary employee benefits.

Jake Hoskins, son of Craig Hoskins, our Executive Vice President and Chief Development Officer, is employed by the Company as Manager, National Accounts. In fiscal 2025, he received total compensation of approximately $120,000, including salary, bonus, and customary employee benefits.

The compensation for each of Messrs. Holm and Benjamin and Jake Hoskins is commensurate with their peers’ compensation and established in accordance with the Company’s compensation practices applicable to employees with equivalent qualifications, experience, and responsibilities.

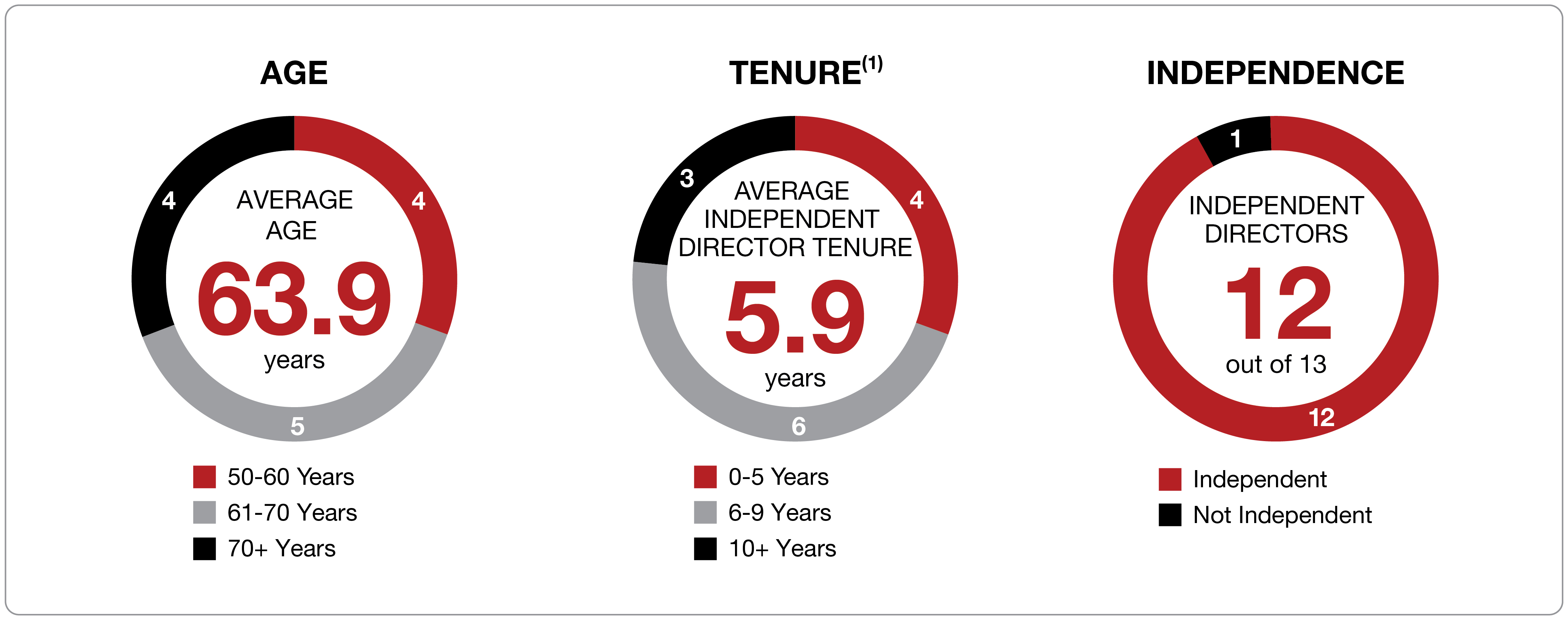

Cooperation Agreement with Sachem Head

On September 23, 2025, the Company entered into a cooperation agreement (the “Cooperation Agreement”) with Sachem Head Capital Management LP, Sachem Head LP and certain of their affiliates (collectively, “Sachem Head”).

Concurrently with the execution of the Cooperation Agreement, Sachem Head irrevocably withdrew its notice of nomination of candidates for election to the Board and business proposal intended to be presented at the Annual Meeting.

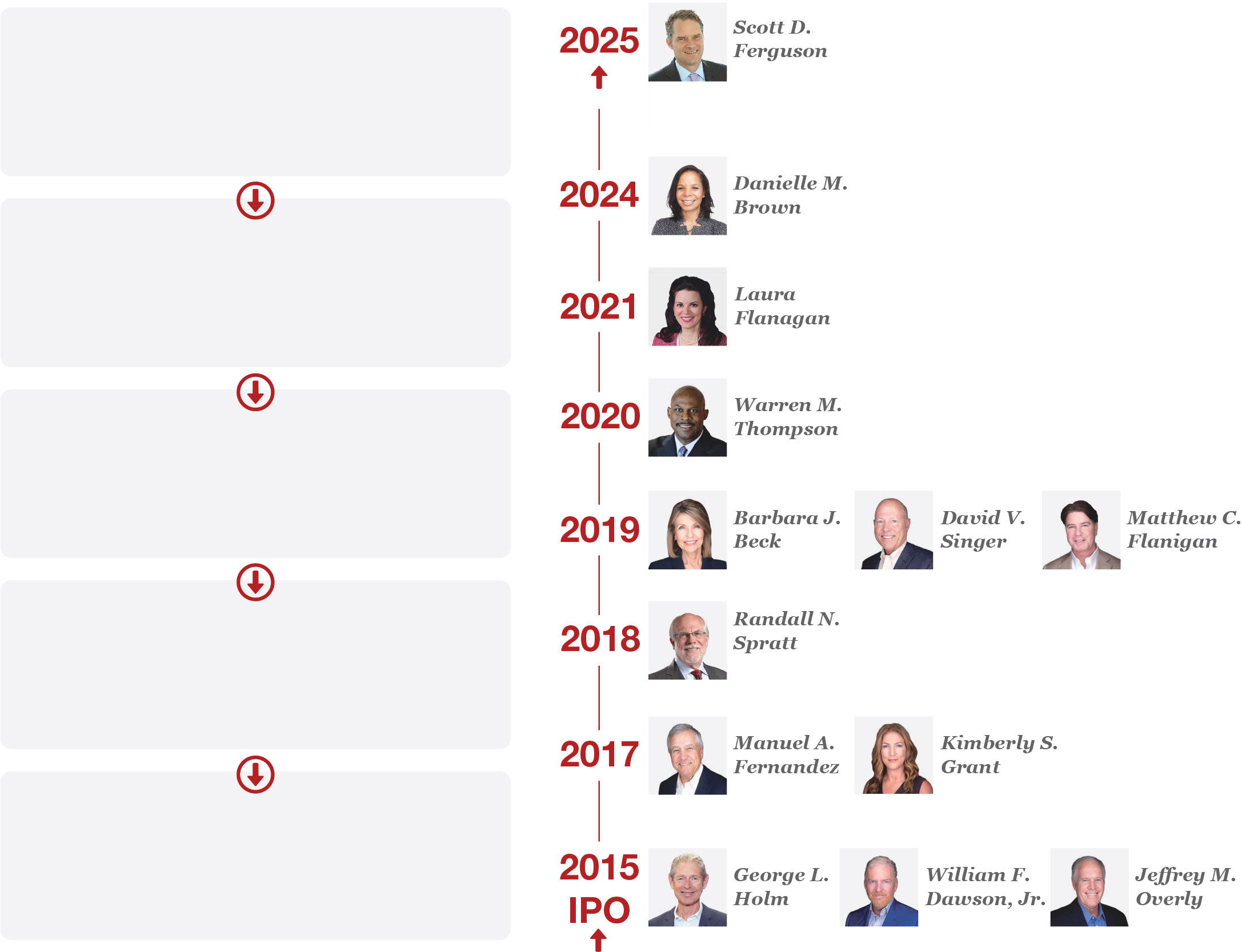

Pursuant to the Cooperation Agreement, the Board (i) increased the size of the Board from twelve (12) to thirteen (13) directors, (ii) appointed Scott D. Ferguson, a principal of Sachem Head, to the Board, with a term expiring at the Annual Meeting, and (iii) appointed Mr. Ferguson to the Audit and Finance Committee. The Company also agreed to include Mr. Ferguson on its slate of director nominees recommended by the Board for election at the Annual Meeting, subject to specified conditions.